25 Things To Sell When You’re Ready To Retire

.25 Things To Sell When You’re Ready To Retire

Gabrielle Olya Sat, April 16, 2022 GOBankingRates

Many people downsize in retirement as a way to cut back on expenses and make their lives simpler. For some, this means relocating to a smaller home or a retirement community. For others, this can just mean getting rid of stuff they no longer use anymore.

If your retirement planning includes downsizing, there are numerous things you can sell to clear out clutter and add some extra funds to your retirement nest egg.

25 Things To Sell When You’re Ready To Retire

Gabrielle Olya Sat, April 16, 2022 GOBankingRates

Many people downsize in retirement as a way to cut back on expenses and make their lives simpler. For some, this means relocating to a smaller home or a retirement community. For others, this can just mean getting rid of stuff they no longer use anymore.

If your retirement planning includes downsizing, there are numerous things you can sell to clear out clutter and add some extra funds to your retirement nest egg.

Your Home

One of the key things you need to figure out when planning for retirement is where you want to live. This might entail selling your current home, which for most people is their most valuable asset. You can use the funds to buy a smaller place or put the money toward rent and deposit any leftover money into savings. Downsizing your home can not only save you money, but it also can save time and effort because you have a smaller property to maintain.

Work Clothes

When you're out of the working world, you no longer need to wear business attire in your everyday life. Hold onto one suit for weddings and other special occasions and sell the rest. You can sell your clothes online on sites like Poshmark and thredUP, or sell them at your local consignment shop.

Exercise Equipment

If you downsize your home, you might no longer have room for exercise equipment. But even if you plan to stay at your current house, you might consider selling your treadmill or stationary bike because of other exercise options available to you. For example, you might have the SilverSneakers senior fitness program included in your Medicare Advantage Plan, which lets you visit select gyms and take fitness classes for free. In this case, there's no need to hold onto equipment that you can turn into cash instead.

Your Car

Even if you're done paying off your car, it can still be a major expense between gas, insurance, maintenance and repairs. If you and your partner each own a car, consider selling one of them. Even if you only have one car, it might be cheaper to sell it and get around using rideshare services or public transportation.

Furniture

If you plan to move to a smaller home, it's a good idea to sell off bulkier furniture pieces that you'll no longer have room for. You can sell furniture through Craigslist or Facebook Marketplace, or to a consignment shop or used furniture store.

Decorative Items

Holiday decorations and other decor items might be taking up space you won't have if you downsize to a smaller home. Consider holding a yard sale to get rid of any miscellaneous decor items that you no longer want or need.

To continue reading, please go to the original article here:

https://www.yahoo.com/finance/news/25-things-sell-ready-retire-190001511.html

Warren Buffett's 12 Best Quotes In a New Interview

.Warren Buffett's 12 Best Quotes In a New Interview

Theron Mohamed Fri, April 15, 2022,

Warren Buffett applauded Elon Musk, MacKenzie Scott, and Jerome Powell in a new interview. The Berkshire Hathaway CEO reflected on his age, his legacy, and the main drivers of his success. Buffett commended Bill Gates and Melinda French Gates for devoting time and money to philanthropy. Warren Buffett praised Tesla CEO Elon Musk, billionaire philanthropist MacKenzie Scott, and Federal Reserve Chair Jerome Powell during a Charlie Rose interview released on Thursday.

The 91-year-old investor and Berkshire Hathaway CEO also discussed his legacy, how old age has affected him, and why he admires Bill Gates and Melinda French Gates.

Warren Buffett's 12 Best Quotes In a New Interview

Theron Mohamed Fri, April 15, 2022,

Warren Buffett applauded Elon Musk, MacKenzie Scott, and Jerome Powell in a new interview. The Berkshire Hathaway CEO reflected on his age, his legacy, and the main drivers of his success. Buffett commended Bill Gates and Melinda French Gates for devoting time and money to philanthropy. Warren Buffett praised Tesla CEO Elon Musk, billionaire philanthropist MacKenzie Scott, and Federal Reserve Chair Jerome Powell during a Charlie Rose interview released on Thursday.

The 91-year-old investor and Berkshire Hathaway CEO also discussed his legacy, how old age has affected him, and why he admires Bill Gates and Melinda French Gates.

Here are Buffett's 12 best quotes from the interview, lightly edited for length and clarity:

1. "You don't need to be a genius in what I do, that's the good thing about it. I'm a bright guy who's terribly interested in what he does, so I've spent a lifetime doing it, and I've surrounded myself with people that bring out the best in me."

2. "I know I'll win over time. That doesn't mean I'll beat everybody else, or anything like that. But the game is very, very, very easy if you have the right lessons in your mind about what you're buying." (Buffett emphasized that stocks are pieces of businesses, not wagers to be monitored day by day.)

3. "We have a successor in place, but he's not warming up. I'm in overtime but I'm out there."

4. "Jay Powell matched Paul Volcker in terms of doing things that needed to be done that day." (Buffett was referring to the Fed chair moving quickly to save the US financial system when the pandemic took it to the "brink of chaos" in March 2020.)

5. "It isn't like the 50 richest guys in the country can say, 'I'm just going to eat everything.'" (Buffett argued that while Henry Ford, Thomas Edison, and Steve Jobs amassed large fortunes, they also shared their inventions, improving the lives of millions of people).

6. "Elon is taking on General Motors and Ford and Toyota, and all these people who've got all this stuff, and he's got an idea and he's winning. That's America. You can't dream it up. It's astounding."

7. "I am a decaying machine that still feels wonderful. I can't add a group of numbers remotely as fast as I used to be able to. I can't remember sometimes why the hell I walked up the stairs. I forget names so easily. I can't read as fast as I used to read. I can't hear as well, I can't see as well, my balance isn't as good. But it doesn't interfere with my happiness, my work, anything."

To continue reading, please go to the original article here:

https://finance.yahoo.com/news/warren-buffett-praises-elon-musk-092324460.html

7 Money Skills It’s Never Too Late To Learn

.7 Money Skills It’s Never Too Late To Learn

Heather Taylor Wed, April 13, 2022,

No matter what age you are, there are basic money skills that will always be beneficial in your life. From spending less than what you make to determining the best way to pay off your debt, these skills can increase your overall financial literacy and create a healthy relationship with money.

Budgeting

Budgeting is often considered the cornerstone of personal finance advice. Amy Maliga, financial educator at Take Charge America, said it's never too late to get in the habit of planning and following a budget.

7 Money Skills It’s Never Too Late To Learn

Heather Taylor Wed, April 13, 2022,

No matter what age you are, there are basic money skills that will always be beneficial in your life. From spending less than what you make to determining the best way to pay off your debt, these skills can increase your overall financial literacy and create a healthy relationship with money.

Budgeting

Budgeting is often considered the cornerstone of personal finance advice. Amy Maliga, financial educator at Take Charge America, said it's never too late to get in the habit of planning and following a budget.

Creating a budget allows you to figure out how much money you have coming in every month and the source of this income. Once you know how much money is coming in, you can start tracking and figuring out your expenses. Keep an eye out for fixed expenses (expenses that stay the same every month like rent or a mortgage), variable expenses (expenses that change each month such as groceries or utilities) and periodic expenses (expenses that happen once a year like back-to-school shopping).

Tracking expenses through a budget allows you to see the areas where you may be spending too much money and where there may be opportunities for saving or investing your money. You may also strategize how you can live within your means and plan for the future with the help of a budget. Maliga said that understanding exactly how much money you have coming in, going out and where it's going is the cornerstone of effective money management.

Wise Spending Habits

It's never too late to learn about spending. From reducing everyday expenditures to embracing a passive saving mindset, wise spending habits are a key component of financial literacy.

Britt Williams Baker, co-founder of Dow Janes, said a money skill many underestimate is the importance of learning to spend less than what you make.

"Whether you're 25 or 55, if you still spend more than you make each month, you'll never be able to save. And until you start to save, you can't do anything else -- like invest, buy a house, or build wealth," Williams Baker said.

The best way to learn how to spend less than what you make is by tracking expenses. (This shares similarities with creating and keeping a budget.) Williams Baker recommends paying attention to every dollar that comes in and out of your life. Write down your paycheck and every expense. Then, tally it up at the end of the month. Was it negative or positive?

"If you're going into debt every month, you have to find a way to eliminate your expenses or increase your income. That's the first step to being able to save and that's a lesson that you need to learn at any age," Williams Baker said.

Strategic Credit Card Usage

To continue reading, please go to the original article here:

https://www.yahoo.com/finance/news/7-money-skills-never-too-120022076.html

Yes, It Is Possible To Fix This. But Don’t Hold Your Breath

.Yes, It Is Possible To Fix This. But Don’t Hold Your Breath

Notes From The Field By Simon Black April 11, 2022

On the morning of September 2, 1715, Philippe d’Orleans prepared for an impossible task. King Louis XIV had just died the day before after a painful struggle with gangrene, leaving his five-year old great grandson to inherit the throne. Philippe had been appointed regent the week prior, meaning that he would rule France until the boy king came of age and could take the throne.

But Philippe knew the situation in France was grim.

Yes, It Is Possible To Fix This. But Don’t Hold Your Breath

Notes From The Field By Simon Black April 11, 2022

On the morning of September 2, 1715, Philippe d’Orleans prepared for an impossible task. King Louis XIV had just died the day before after a painful struggle with gangrene, leaving his five-year old great grandson to inherit the throne. Philippe had been appointed regent the week prior, meaning that he would rule France until the boy king came of age and could take the throne.

But Philippe knew the situation in France was grim.

Louis XIV’s lavish spending and penchant for endless warfare had left the kingdom completely bankrupt; the French national debt was so large that its interest payments alone exceeded the government’s annual tax revenue.

Taxes were already high, stifling economic development. Inflation was rising. Food was in short supply. Corruption was rampant. Social divisions were raging.

Most of all, people were angry. The King that had ruled over them for seven decades had ruined their lives, and there was hardly a single household in France that hadn’t lost a loved one to one of Louis XIV’s wars.

They hated him for it. Most French peasants celebrated his death, and some spat at his coffin as the funeral procession passed.

Philippe wasted no time, and he began making widespread reforms immediately.

He started with dramatic cuts in government spending, including pruning the new King’s personal budget to almost nothing. He vastly reduced the size of the French army, and he scaled back public welfare.

He also eliminated many taxes, cut the ones that remained, and greatly simplified the process of paying them.

Philippe fired thousands of government bureaucrats who were getting rich by clogging up the system, and he took steps to stamp out corruption.

He sought peace with France’s former adversaries, traded with everyone, and established new relations with rising powers (like the Russian Empire).

He reversed Louis XIV’s policies of censorship, and he advocated for national unity and tolerance.

It wasn’t just empty words; Philippe released prisoners from the Bastille who had been arrested of political crimes. And he even set a personal example by graciously smiling when he was occasionally lampooned in the press-- something that would have been unthinkable only a few years before.

Philippe’s reforms were far from perfect, and there were a number of terrible ideas (like the ill-fated Mississippi Company bubble of 1720).

But overall the reforms worked. And he didn’t even need to do anything complicated. Rather, his primary strategy was to remove as much government as possible, avoid conflict, and let freedom prevail.

Sadly, though, the prosperity didn’t last. Philippe died in 1723, just a few months after the boy king was crowned Louis XV.

At first the new ministers kept up Philippe’s policies. But in time, France returned to the old ways of corruption, intolerance, persecution, and war… all of which ultimately resulted in a bloody revolution in 1789.

Philippe’s story does show, however, that it’s possible to fix even the worst economic and public finance disasters, as long as the government gets out of the way and stops making the problem worse.

It would be nice to see that approach today in the West, and especially the US. But leadership can’t seem to stop making things worse.

First off, they’re addicted to deficits; even though the US national debt rocketed past $30 TRILLION this year, the government still hasn’t found the motivation to balance the budget and live within its means.

The White House’s most recent budget proposal for next year shows a deficit of “only” $1.8 trillion. And they’re actually bragging about this like it’s a major accomplishment.

And it was only a few months ago that the most senior officials in the federal government, including the Speaker of the House and the President himself, insisted that their multi-trillion dollar ‘Build Back Better’ bill would “cost nothing”.

They even went on TV multiple times to make this ridiculous assertion, almost as if they wanted to leave no doubt of their economic illiteracy.

They clearly have zero understanding of the problems; they blame inflation, for example on “corporate greed”, and have decided to ‘fix’ inflation by having powerful government agencies harass the private sector.

They actually believe they’re fixing high oil prices by depleting the Strategic Petroleum Reserve, as if dipping into your emergency savings is a credible alternative to new production.

And they see every problem as an opportunity to create more regulations.

So, contrary to Philippe d’Orleans, they clearly have no intention of getting out of the way. Quite the opposite-- they’re taking a bad situation and making it much worse. And it’s time to get rational about this.

For starters, inflation will likely continue to rise.

After all, we cannot expect them to fix a problem that (a) they do not understand, and (b) they keep making worse.

And most likely it’s only a matter of time before inflation, along with global supply chain madness, pushes much of the world into recession.

They’re not going to be able to fix that either. They don’t have the tools.

They’re already $30 trillion in debt with a $1.8 trillion deficit in their supposedly ‘scaled-back’ budget. Fighting a recession would mean the government dumps trillions more into the economy-- money they clearly don’t have.

The Federal Reserve, meanwhile, has few options. Interest rates are already near zero, so they don’t have much room to fight a recession by cutting rates. Besides, any interest rate cut would only risk making inflation worse.

It’s not a great situation. But it is fixable; Philippe d’Orleans showed what could happen if you get out of the way and let freedom prevail. It’s not rocket science:

Stop creating disincentives to work, produce, and trade. Stop creating fanatical regulations. Stop dismantling capitalism in the name of social justice. Stop fomenting conflict. Stop trying to invent new taxes.

Just stop. And let people live their lives.

But it’s doubtful they’ll ever take this approach. And that’s why it’s so critical to have a Plan B.

To your freedom, Simon Black, Founder, SovereignMan.com

https://www.sovereignman.com/trends/yes-it-is-possible-to-fix-this-but-dont-hold-your-breath-34865/

Here’s How Much Cash You Need Stashed if a National Emergency Happens

.Here’s How Much Cash You Need Stashed if a National Emergency Happens

Jaime Catmull Sun, April 10, 2022 GOBankingRates

You've probably heard time and again that it's important to have a rainy day fund set up "just in case" something unexpected were to happen. But we're now at a time when having an emergency fund is more vital than ever.

The coronavirus pandemic was a prime example of how something unexpected can have devastating effects on the economy at large and on an individual level, too. While we all hope the worst of it is over, here's how to be prepared in case it's not -- plus how to set up a fund for unexpected future national emergencies.

Here’s How Much Cash You Need Stashed if a National Emergency Happens

Jaime Catmull Sun, April 10, 2022 GOBankingRates

You've probably heard time and again that it's important to have a rainy day fund set up "just in case" something unexpected were to happen. But we're now at a time when having an emergency fund is more vital than ever.

The coronavirus pandemic was a prime example of how something unexpected can have devastating effects on the economy at large and on an individual level, too. While we all hope the worst of it is over, here's how to be prepared in case it's not -- plus how to set up a fund for unexpected future national emergencies.

Why You Need a National Emergency Fund

Part of being prepared for any contingency, big or small, is having a reserve of emergency cash at your disposal at all times. When you can't rely on accessing your funds electronically, you'll need some legal tender to buy food, gas or other necessities.

"Whether it's Mother Nature or some other disaster out of your control, you always want to be prepared by having some emergency cash on hand," said Annalee Leonard, an investment advisor representative and president of Mainstay Financial Group. "Banks and ATMs may not be up and running for days after a strong storm. I recommend my clients have three to five days' worth of spending money, just in case."

How To Decide How Much To Save

To decide how much to save for an emergency fund, you'll need to ask yourself a couple of questions:

How much will I need for an extreme catastrophic event?

How much can I afford to save?

"It's wise to have a small amount of physical cash at home for the truest of emergencies when banks are not operating," said Priyanka Prakash, managing editor at Fit Small Business, a company that finds the best small-business software, services and financing options.

Aim To Save $2,000

"Individuals should be prepared to pay for essential or non-discretionary expenses out-of-pocket," said Brett Tharp, CFP and financial planning education consultant at eMoney Advisor. "Temporary lodging or shelter, fuel, food, water and necessary medications fall into this category. This will differ for each person depending on their level of preparedness or perception of how likely a catastrophic event might be.

"Two-thousand dollars should cover those costs. "The rule of thumb I advise my clients is to keep $1,000 to $2,000 in cash in case banking operations are shut down due to a national emergency or catastrophe," said Gregory Brinkman, president of Brinkman Financial in Tulsa, Oklahoma.

There's No 'Magic Number' for How Much To Save in Your Emergency Fund

Despite these suggestions and what some other experts might advise, though, there's no magic amount you should have nestled away in your emergency fund. The answer for how much you should save for an emergency situation is that you should do what feels right to you.

No matter the amount, an emergency fund is absolutely necessary — so make it a priority to build one. Even if you can't afford to save much, it's better to save something rather than nothing, Prakash said. So if you can only afford to set aside $1,000 for an emergency fund, that's better than not saving at all.

The Cost of an Emergency Kit

To continue reading, please go to the original article here:

https://www.yahoo.com/finance/news/much-cash-stashed-national-emergency-190022760.html

From Bartering To Banknotes To Bitcoin

.The History of Money

From Bartering To Banknotes To Bitcoin

By Andrew Beattie Updated March 24, 2022 Reviewed By Robert C. Kelly

Money, whether it's represented by a seashell, a metal coin, a piece of paper, or a string of code electronically mined by computer, doesn't always have value. Its total global value—currently estimated to be around $420 trillion1—depends on the importance that people place on it as a medium of exchange, a unit of measurement, and a storehouse for wealth.

Money allows people to trade goods and services indirectly; it helps communicate the price of goods (prices written in dollar and cents correspond to a numerical amount in your possession—e.g., in your pocket, purse, or wallet); and it provides individuals with a way to store their wealth.

The History of Money

From Bartering To Banknotes To Bitcoin

By Andrew Beattie Updated March 24, 2022 Reviewed By Robert C. Kelly

Money, whether it's represented by a seashell, a metal coin, a piece of paper, or a string of code electronically mined by computer, doesn't always have value. Its total global value—currently estimated to be around $420 trillion1—depends on the importance that people place on it as a medium of exchange, a unit of measurement, and a storehouse for wealth.

Money allows people to trade goods and services indirectly; it helps communicate the price of goods (prices written in dollar and cents correspond to a numerical amount in your possession—e.g., in your pocket, purse, or wallet); and it provides individuals with a way to store their wealth.

KEY TAKEAWAYS

Money conveys the importance that people place on it; it allows trading of goods and services indirectly, communicates the price of goods, and provides a way to store wealth.

All of the money in the world is estimated to total around $420 trillion.1

Before money, people acquired and exchanged goods through bartering.

The world’s oldest known, securely dated coin minting site was located in Guanzhuang in Henan Province, China, which began striking spade coins sometime around 640 BCE, likely the first standardized metal coinage.

Money is valuable as a unit of account—a socially accepted standard by which things are priced and with which payment is accepted. However, throughout history, both the usage and form of money have evolved.

Though the terms "money" and "currency" are often used interchangeably, several theories suggest that they are not identical. According to some theories, money is inherently an intangible concept, while currency is the physical (tangible) manifestation of the intangible concept of money.

By extension, according to this theory, money cannot be touched or smelled. Currency is the coin, note, object, etc. that is presented in the form of money. The basic form of money is numbers; currently, the basic form of currency is paper notes, coins, or plastic cards (e.g., credit or debit cards). Though this distinction between money and currency is important in some contexts, for the purposes of this article, the terms are used interchangeably.

Understanding the History of Money

The Transition From Bartering to Currency

Money—in some form or another—has been part of human history for at least the past 5,000 years.2 Before that time, historians generally agree that a system of bartering was likely used.

Bartering is a direct trade of goods and services; for example, a farmer may exchange a bushel of wheat for a pair of shoes from a shoemaker. However, these arrangements take time. If you are exchanging an ax as part of an agreement in which the other party is supposed to kill a woolly mammoth, you have to find someone who thinks an ax is a fair trade for having to face down the 12-foot tusks of a mammoth. If this doesn't work, you would have to alter the deal until someone agreed to the terms.

To continue reading, please go to the original article here:

No Such Thing as Enough Money

.No Such Thing as Enough Money

Jacob Schroeder Oct 27, 2021

How much money is enough? It’s a philosophical money question that often arises out of discontent. We see someone of substantial means, like a celebrity, live a troubled life. Or, we ourselves experience great fortune yet feel unhappy. It makes us wonder where the finish line is, the point when you can stop striving for more and settle into a life of satisfaction.

There are some great financial blogs that provide good answers, such as here and here. And then there are a variety of books that tackle this question in their own ways: Ego Is the Enemy, The Last Lecture, the Bible, to name a few. Another book that resonates with me, perhaps because of its instructive format, is How Will You Measure Your Life? by the late Clayton Christensen.

No Such Thing as Enough Money

Jacob Schroeder Oct 27, 2021

How much money is enough? It’s a philosophical money question that often arises out of discontent. We see someone of substantial means, like a celebrity, live a troubled life. Or, we ourselves experience great fortune yet feel unhappy. It makes us wonder where the finish line is, the point when you can stop striving for more and settle into a life of satisfaction.

There are some great financial blogs that provide good answers, such as here and here. And then there are a variety of books that tackle this question in their own ways: Ego Is the Enemy, The Last Lecture, the Bible, to name a few. Another book that resonates with me, perhaps because of its instructive format, is How Will You Measure Your Life? by the late Clayton Christensen.

He comes to the startling realization:

“I had thought the destination was what was important, but it turned out it was the journey.”

That to me is the answer to the question. Though it is, in a way, a non-answer. As with many of life’s mysteries, there is no definitive conclusion.

There is never enough money.

Don’t get me wrong. I don’t mean that you can always use more money to achieve a perfect life. Rather, I mean the exact opposite.

No amount of money will insulate you from suffering.

This week Elon Musk’s wealth jumped by $36 billion in a single day, bringing his net worth close to $300 billion. Yet, even he has experienced some very public setbacks, including the tragedy of losing his first child.

“The race is not to the swift or the battle to the strong, nor does food come to the wise or wealth to the brilliant or favor to the learned; but time and chance happen to them all.” (Eccles. 9:11)

There is no such thing as enough money, as there is no destination of absolute happiness. It’s all about simply having the capacity to notice the truly joyful things along the journey.

Pay attention to the wrong things, and life starts to feel empty. As Christensen writes:

“In your life, there are going to be constant demands for your time and attention. How are you going to decide which of those demands gets resources? The trap many people fall into is to allocate their time to whoever screams loudest, and their talent to whatever offers them the fastest reward.”

His solution is to focus on what provides lasting happiness:

“Intimate, loving, and enduring relationships with our family and close friends will be among the sources of the deepest joy in our lives.”

To continue reading, please go to the original article here:

https://rootofall.substack.com/p/no-such-thing-as-enough-money?s=r

Money Lessons From Famous Artists

.Money Lessons From Famous Artists

Here are some words of advice from artists that could double as insight for turning financial success into a creative pursuit.

M.C. ESCHER // “Are you really sure that a floor can’t also be a ceiling?” → Financial success is a matter of perception and deception.

M.C. Escher is known for images that play with perception and dimension to form mind-bending illusions. In a sense, they represent how we see the world. When faced with uncertainty and incomplete information, our brains like to take mental shortcuts that can distort reality.

These biases can have profound effects on our financial decisions. For instance, we may spend rather than save because we perceive our future selves as someone else. Or, we may buy an investment based on what we want to believe, despite all the contrary evidence. It is why the right financial steps often feel counterintuitive.

Money Lessons From Famous Artists

Here are some words of advice from artists that could double as insight for turning financial success into a creative pursuit.

M.C. ESCHER // “Are you really sure that a floor can’t also be a ceiling?” → Financial success is a matter of perception and deception.

M.C. Escher is known for images that play with perception and dimension to form mind-bending illusions. In a sense, they represent how we see the world. When faced with uncertainty and incomplete information, our brains like to take mental shortcuts that can distort reality.

These biases can have profound effects on our financial decisions. For instance, we may spend rather than save because we perceive our future selves as someone else. Or, we may buy an investment based on what we want to believe, despite all the contrary evidence. It is why the right financial steps often feel counterintuitive.

Take investing. In Winning the Loser’s Game, Charley Ellis flips the perception that it’s all about picking winners:

“Even though most investors see their work as active, assertive, and on the offensive, the reality is… stock and bond investing alike are primarily a defensive process. The great secret for success in long-term investing is to avoid serious losses.”

An awareness and understanding of the financial Jedi mind tricks we play on ourselves can help us make better financial decisions. Question your perceptions to avoid self-made deceptions. In art and money, it helps to ask: Is how I see the world, how the world really is?

FRANCISCO GOYA // “The sleep of reason brings forth monsters.” → Financial mistakes arise when emotion silences reason.

Many of Francisco Goya’s paintings shed light on humanity’s dark side; especially, times of war, when reason is overrun by our primitive instincts. Accordingly, there is a reason for every object, movement and shade of color in his work. Without it, they would just look grotesque.

Similarly, it’s important to remember your reason for every financial decision – where you park your money, what you invest in, how much you save, etc. – because there are times when everything feels unreasonable – loss of a job, stock market booms and busts, financial windfalls, etc. Those are times ripe for the monsters of fear and greed.

How we react during our most perilous financial situations will have a greater effect on long-term wealth than every small, $5-latte decision. Unchecked emotions often lead to bad decisions, from which some people take advantage, as immortalized in Warren Buffett’s famous advice to “be fearful when others are greedy and greedy only when others are fearful.”

Controlling emotions is an art, whether on a canvas or in a portfolio. The goal is to “do the average thing when everyone is losing their heads,” as Napoleon said.

HENRI MATISSE // “Don’t wait for inspiration. It comes while one is working.” → The right conditions for financial success are created by working on your finances.

To continue reading, please go to the original article here:

How to check the Authenticity of the New Iraqi Dinar

.Reposted by request, from a Recaps post from 2011.

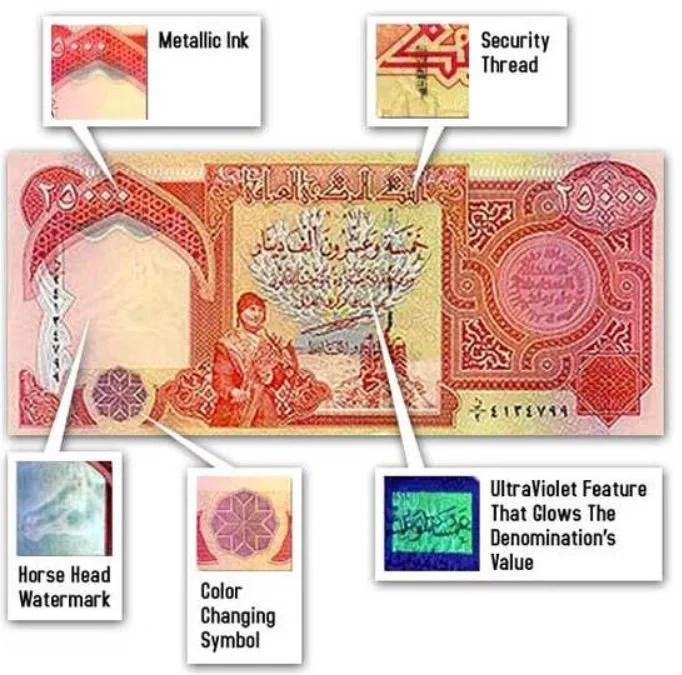

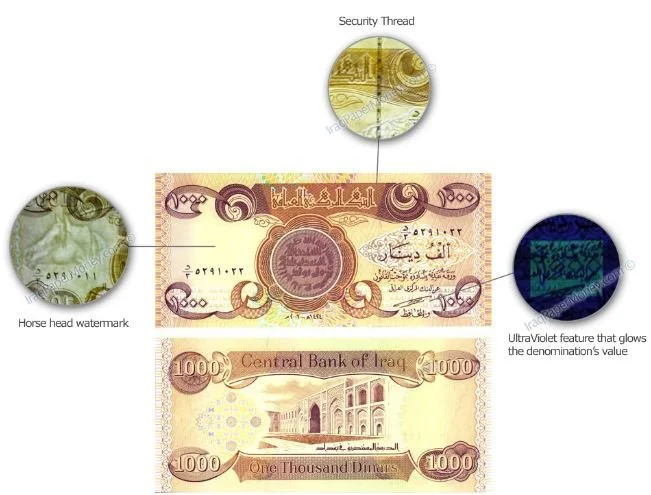

How to check the Authenticity of the New Iraqi Dinar (25,000 note)

The New Iraqi Dinar was printed by the De La Rue Corporation, the world’s largest integrated commercial security printer and papermaker and the printer of over 150 world currencies. The dinar is available in 50, 250, 1000, 5000, 10000, and 25000 notes (information from 2011).

De La Rue incorporates a number of nearly foolproof countermeasures into the New Iraqi Dinar, including:

Reposted by request…from a Recaps post from 2011.

How to check the Authenticity of the New Iraqi Dinar (25,000 note)

The New Iraqi Dinar was printed by the De La Rue Corporation, the world’s largest integrated commercial security printer and papermaker and the printer of over 150 world currencies. The dinar is available in 50, 250, 1000, 5000, 10000, and 25000 notes (information from 2011).

De La Rue incorporates a number of nearly foolproof countermeasures into the New Iraqi Dinar, including:

• Metallic ink (25K note): The image of a dove is printed in metallic ink on the top left hand corner of the back of the dinar.

• Embedded security thread (25 K note): There should be a metallic security thread embedded into the stock of the Iraqi dinar paper. Note: the security thread is metallic only on the 25,000 dinar note.

• Horse head watermark embedded into each note (all notes): This is one of the easiest security features to check for. Hold the Iraqi dinar up to a bright light source and the image of a horse head should clearly appear. This pattern is embedded, not printed, into the paper.

• Raised lettering

• Denomination’s value glows under Ultra Violet (UV) light. UV lights can be found on Amazon and some hardware stores. In a dimly lit area, hold the UV lamp over the Iraqi dinar. You should clearly see a UV box with writing inside on the back side of the dinar.

• The eight-sided symbol in the bottom left hand corner should change color from purple to green when viewed at different angles.

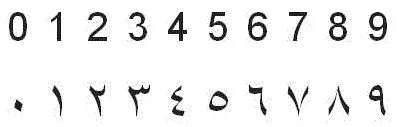

• Unique Arabic serial numbers: Every dinar has a unique number in East-Arabic script. See conversion chart below to western numerals. Notice the similarities between the 2 and 3 numerals.

The Art of Money

.The Art of Money

Turning financial success into a creative pursuit

Jacob Schroeder Mar 15

What do you consider the act of ‘making money’? Is it an act of accounting and measuring? Or, is it an act of imagining and contemplating? Our finances involve numbers and data, but they’re intractably tied to our personal ideas, experiences, feelings and behaviors – intangible things you can’t formulate in a spreadsheet. Therefore, to manage the human side of money, it’s better to think more like an artist than a scientist.

It’s a shame many famous artists had financial troubles.

The Art of Money

Turning financial success into a creative pursuit

Jacob Schroeder Mar 15

What do you consider the act of ‘making money’? Is it an act of accounting and measuring? Or, is it an act of imagining and contemplating? Our finances involve numbers and data, but they’re intractably tied to our personal ideas, experiences, feelings and behaviors – intangible things you can’t formulate in a spreadsheet. Therefore, to manage the human side of money, it’s better to think more like an artist than a scientist. It’s a shame many famous artists had financial troubles.

Johannes Vermeer is said to have left behind 10 young children, a house full of paintings no one wanted and enormous debts, causing his wife to declare bankruptcy. Mozart wracked up massive amounts of debt, too, to feed an extravagant lifestyle. Not to be out done, Oscar Wilde lived far beyond his means, until he eventually fell into poverty and supposedly spent his last bit of money on booze. When he took his own life, Vincent van Gogh was poor and destitute.

It’s a shame, because some principles great artists follow to make art could also apply to making money.

Art and money share more similarities than we like to think. Money, like art, is a means of self-expression; it helps you turn the life you imagine into reality. They’re both deeply personal. There is no one right way to sculpt a Greek goddess or invest in stocks. Most of all, money offers a lot of insights into human behaviors and sensations.

It is often those human elements that lead to financial problems, but that also give our financial decisions meaning. Therefore, when trying to create a financially successful future, we may need a little more right-brain than left-brain thinking.

Take it from Andy Warhol, an artist who loved to blur the lines of commerce and culture, who declared:

“Making money is art and working is art and good business is the best art.” Andy Warhol

Why It Helps To Think Of Money As More Art Than Science

Is personal finance an art or a science?

The juncture of art and money has gotten most attention as it relates to investing. Investor Howard Marks said: “Investing, like economics, is more art than science.”

Why?

To continue reading, please go to the original article here:

What Is a Silver Certificate Dollar Bill Worth Today?

.What Is a Silver Certificate Dollar Bill Worth Today?

By David Gorton Updated March 10, 2022 Reviewed By Chip Stapleton Fact Checked By Jiwon Ma

What Is a Silver Certificate Dollar Bill Worth Today?

A silver certificate dollar bill represents a unique time in American history. It was a type of legal tender that was issued by the federal government in the late 1800s. As the name suggests, the holder of a certificate could redeem it for a certain amount of silver. One certificate allowed investors to hold silver without having to buy the precious metal itself.1

These certificates no longer carry monetary value as an exchange for silver, yet they are still legal tender at their face value. In the market, silver certificates are often worth more than their face value (e.g., $1) as collectors still seek out these prints.

What Is a Silver Certificate Dollar Bill Worth Today?

By David Gorton Updated March 10, 2022 Reviewed By Chip Stapleton Fact Checked By Jiwon Ma

What Is a Silver Certificate Dollar Bill Worth Today?

A silver certificate dollar bill represents a unique time in American history. It was a type of legal tender that was issued by the federal government in the late 1800s. As the name suggests, the holder of a certificate could redeem it for a certain amount of silver. One certificate allowed investors to hold silver without having to buy the precious metal itself.1

These certificates no longer carry monetary value as an exchange for silver, yet they are still legal tender at their face value. In the market, silver certificates are often worth more than their face value (e.g., $1) as collectors still seek out these prints.

Their history dates to the 1860s, when the United States rapidly developed into one of the top producers of silver in the world. This ushered in a new monetary structure in the U.S., of which the silver certificate is a unique historical artifact.2 In this article, we look at the history of this form of currency and how much they're worth today.

KEY TAKEAWAYS

A silver certificate dollar bill was a legal tender issued by the United States government.

When they were first issued, certificate holders could redeem them for a certain amount of silver.

Certificates are no longer redeemable in exchange for physical silver.

Although collectors still seek out many of the uncommon prints, many certificates are only worth their face value.

Understanding Silver Certificate Dollar Bills

It was for this reason that provisions in the Coinage Act of 1873 went little noticed. The act ended free coinage for silver, effectively ending bimetallism and placing the United States on the gold standard. Though silver coins could still be used as legal tender, few were in circulation.3

The U.S. government began issuing certificates in 1878 under the Bland-Allison Act. Under the act, people could deposit silver coins at the U.S. Treasury in exchange for certificates, which were easier to carry.4 This representative money could also be redeemed for silver equal to the certificate’s face value. In the past, other countries like China, Colombia, Costa Rica, Ethiopia, Morocco, Panama, and the Netherlands have issued silver certificates.5

Silver

Congress adopted a bimetallic standard of money in 1792, making gold and silver the mediums of exchange. Under a free coinage policy, raw gold or silver could be taken to the U.S. mint and converted into coins.6 However, few silver coins were minted between 1793 and 1873, as the raw silver required to make a coin was worth more than their gold dollar and greenback counterparts.78

A year later, Section 3568 of the Revised Statutes further diminished silver's status by prohibiting the use of silver coins as legal tender for amounts exceeding five dollars.9

Old Silver Dollar Certificates

Silver's importance became apparent with the development of the Comstock lode and other deposits. This happened as Congress looked for ways to grow the monetary base. The U.S. went from producing less than 1% of the world's silver to nearly 20% by the 1860s and 40% by the 1870s.10

To continue reading, please go to the original article here: