Seeds of Wisdom RV and Economics Updates Monday Evening 1-26-26

Good Evening Dinar Recaps,

Gold and Silver Pull Back After Record Run as Markets Rebalance

Profit-taking, dollar stabilization, and positioning — not a trend break

Good Evening Dinar Recaps,

Gold and Silver Pull Back After Record Run as Markets Rebalance

Profit-taking, dollar stabilization, and positioning — not a trend break

Overview

Gold and silver prices moved lower today after a powerful multi-week rally that pushed both metals to historic or multi-year highs. The pullback reflects short-term market mechanics, not a reversal of the broader safe-haven narrative that has driven precious metals higher amid geopolitical strain, fiscal uncertainty, and currency stress.

What Happened

After rapid gains, traders moved to lock in profits, particularly among leveraged futures and short-term ETF flows. At the same time, the U.S. dollar showed signs of stabilization and Treasury yields edged higher, reducing immediate pressure on fiat currencies and temporarily easing demand for non-yielding assets like gold and silver.

Markets also digested:

Reduced immediate fear around U.S. government shutdown timing

Short-term relief in risk assets following heavy selling earlier in the week

Position rebalancing ahead of upcoming central bank and macro events

Key Drivers Behind the Pullback

Profit-Taking After Parabolic Moves

Gold and silver had risen sharply in a short period, triggering technical selling as traders protected gains.

Dollar and Yield Stabilization

A modest rebound in the U.S. dollar and higher bond yields reduced near-term urgency for defensive hedges.

Temporary Risk-On Rotation

Some capital rotated back into equities and cash positions following recent volatility spikes.

Positioning, Not Policy Shift

There was no change in central bank guidance, sanctions policy, or trade frameworks — reinforcing that this was tactical, not structural.

Why This Matters

Short-term pullbacks in precious metals during periods of systemic stress are normal and healthy. Historically, gold and silver often consolidate after sharp advances before resuming their trend when underlying risks remain unresolved.

Today’s move suggests:

Markets are digesting gains, not abandoning safety

Structural drivers behind metals demand remain intact

Volatility reflects transition stress, not stability

Why This Matters to Currency Holders

For currency holders watching the global reset narrative:

Precious metals retracements often precede larger repricing waves

Gold and silver weakness tied to profit-taking does not signal renewed fiat strength

Central bank accumulation and sovereign demand continue beneath the surface

Periods like this frequently shake out weak hands before stronger trend continuation.

Implications for the Global Reset

Pillar 1: Market Rebalancing, Not Confidence Restoration

The pullback reflects short-term recalibration, not renewed faith in debt-based monetary systems.

Pillar 2: Structural Stress Remains Unresolved

Debt expansion, trade fragmentation, sanctions risk, and reserve diversification continue to support long-term hard-asset demand.

This is not just market noise — it’s capital adjusting inside a system under strain.

This is not just commodities — it’s global finance repricing in real time.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Gold eases as dollar firms, investors book profits after rally”

The Guardian – “Gold and silver retreat after record highs as traders take profits”

~~~~~~~~~~

Why Pullbacks Strengthen Reset Trends

Market retracements are not failures — they are confirmations

Overview

Sharp pullbacks following powerful rallies often spark fear among retail observers, but historically they are a defining feature of systemic transitions, not a sign of collapse or reversal. In periods of monetary stress, geopolitical fragmentation, and reserve realignment, pullbacks serve a critical function: they reset positioning, test conviction, and prepare the ground for structural repricing.

Rather than weakening the global reset narrative, pullbacks often validate it.

Key Developments

1. Capital Rotation, Not Capital Exit

Pullbacks typically reflect short-term traders locking in gains while long-term capital quietly reallocates. Institutional and sovereign actors use retracements to accumulate assets without driving prices parabolic.

2. Liquidity Stress Reveals System Weakness

Temporary rebounds in fiat currencies or risk assets during pullbacks are usually liquidity-driven, not confidence-driven. These moments expose how dependent markets remain on intervention and leverage.

3. Narrative Testing Phase

Markets repeatedly test whether underlying risks — debt expansion, trade fragmentation, sanctions, and reserve diversification — have truly been resolved. When prices stabilize after pullbacks, it signals that the narrative still holds.

4. Volatility as a Feature of Transition

Stable systems do not experience violent pullbacks. Volatility is the signature of a system reordering itself, not returning to equilibrium.

Why This Matters

Pullbacks act as stress tests for the financial architecture. If confidence in the existing system were genuinely restored, safe-haven assets would collapse decisively — not retrace modestly and stabilize.

Instead, repeated pullbacks followed by renewed accumulation indicate:

Structural distrust remains

Capital is repositioning, not retreating

The transition is ongoing, not abandoned

Why This Matters to Foreign Currency Holders

For those positioned ahead of potential revaluation or monetary realignment:

Pullbacks reduce speculative froth without damaging long-term value

They allow large actors to accumulate quietly

They frequently precede policy shifts, liquidity events, or repricing catalysts

Currency and hard-asset holders should understand that resets do not move in straight lines — they advance through cycles of pressure and release.

Implications for the Global Reset

Pillar 1: Confidence Erosion Is Non-Linear

Trust in fiat systems erodes in stages, not all at once. Pullbacks represent temporary stabilization attempts, not resolution.

Pillar 2: Structural Repricing Requires Participation

For a reset to occur, assets must move from weak hands to strong hands. Pullbacks facilitate that transfer.

This is why transitions feel exhausting — and why they ultimately succeed.

The Bigger Picture

History shows that major monetary shifts — from the gold standard to Bretton Woods, and from Bretton Woods to fiat — were marked by false recoveries and sharp retracements before the final reordering.

Pullbacks are not the end of the story.

They are the mechanism by which the story advances.

This is not market weakness — it’s systemic recalibration.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Times – “Why market volatility rises during periods of systemic transition”

Reuters – “Global investors reassess risk as monetary and geopolitical fault lines deepen”

~~~~~~~~~~

Why Gold and Silver Pull Back Differently — and Why That Matters for the Reset

Understanding the signal beneath the volatility

Overview

Gold and silver often move together during periods of financial stress, but they pull back for very different reasons. These differences are not noise — they are signals. In a global reset environment, gold acts as a monetary barometer, while silver behaves as a hybrid asset, straddling currency hedging and industrial demand.

When pullbacks occur, how gold and silver respond reveals where the system is under stress and who is repositioning.

Key Developments

1. Gold Pullbacks Reflect Liquidity, Not Lost Confidence

Gold typically pulls back when:

The dollar experiences short-term strength

Margin calls force temporary selling

Traders lock in gains after sharp rallies

However, these pullbacks are usually shallow and quickly absorbed, signaling continued demand from central banks, sovereign funds, and long-horizon capital.

2. Silver Pullbacks Are Sharper — and More Emotional

Silver often falls harder during pullbacks because:

It is thinner and more speculative

It is tied to industrial demand expectations

Retail participation is higher

This makes silver more volatile, but also more explosive once confidence returns.

3. Gold Leads, Silver Confirms

In reset cycles, gold typically moves first as capital seeks stability. Silver lags initially, then outperforms later once markets accept that systemic stress is structural, not temporary.

Pullbacks widen the gold–silver ratio — a classic reset signal.

4. Central Banks Buy Gold, Not Silver

Gold pullbacks attract official buyers. Silver pullbacks shake out weak hands. This difference explains why gold stabilizes faster while silver resets more violently.

Why This Matters

Gold’s resilience during pullbacks signals that trust in fiat systems remains fragile. If confidence were restored, gold would collapse decisively — not retrace and hold higher floors.

Silver’s volatility reflects the market’s internal debate:

Is this slowdown cyclical?

Or is it systemic?

When silver recovers alongside gold after pullbacks, the answer becomes clear.

Why This Matters to Foreign Currency Holders

For those positioned for monetary realignment:

Gold pullbacks are accumulation windows

Silver pullbacks are conviction tests

Historically, silver’s largest gains occur after repeated failed pullbacks, when the market finally accepts that monetary stress is permanent.

Currency holders waiting for revaluation should understand:

Gold protects purchasing power during the transition

Silver amplifies gains once the transition accelerates

Implications for the Global Reset

Pillar 1: Gold Anchors the Transition

Gold’s behavior during pullbacks confirms it remains the system’s trust asset, even in a digital and multipolar future.

Pillar 2: Silver Signals Phase Shifts

Silver’s volatility helps identify when the reset moves from monetary defense to monetary repricing.

When silver begins outperforming after pullbacks, resets move from theory to execution.

The Bigger Picture

Pullbacks do not weaken the gold–silver thesis — they clarify it.

Gold tells you that a reset is underway.

Silver tells you when it accelerates.

In past transitions, the most explosive silver moves occurred after investors stopped believing pullbacks meant failure.

This is not divergence — it’s sequencing.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

World Gold Council – “Gold’s role during periods of monetary stress and transition”

Reuters – “Silver volatility highlights investor uncertainty during global market resets”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Iraq Economic News and Points To Ponder Monday Evening 1-26-26

Nouri Al-Maliki’s Return Rekindles Iraq’s Divisions As Iran And The US Pull Apart

2026-01-26 Shafaq News The return of Nouri al-Maliki to the center of Iraq’s power struggle has reopened old fault lines inside the country and across the region. Nominated by the Shiite Coordination Framework (CF) as its official candidate for prime minister, al-Maliki’s potential third term has triggered a convergence of controversy: external powers are split over his comeback, while Iraq’s political blocs remain divided over whether he represents stability or a revival of past crises.

At stake is not only the formation of the next government, but Iraq’s positioning amid an intensifying US–Iran rivalry, fragile Sunni–Shiite relations, and a Kurdish leadership that favors predictability over experimentation.

Nouri Al-Maliki’s Return Rekindles Iraq’s Divisions As Iran And The US Pull Apart

2026-01-26 Shafaq News The return of Nouri al-Maliki to the center of Iraq’s power struggle has reopened old fault lines inside the country and across the region. Nominated by the Shiite Coordination Framework (CF) as its official candidate for prime minister, al-Maliki’s potential third term has triggered a convergence of controversy: external powers are split over his comeback, while Iraq’s political blocs remain divided over whether he represents stability or a revival of past crises.

At stake is not only the formation of the next government, but Iraq’s positioning amid an intensifying US–Iran rivalry, fragile Sunni–Shiite relations, and a Kurdish leadership that favors predictability over experimentation.

A Nomination Timed For Maximum Sensitivity

Al-Maliki’s nomination comes as Iraq approaches a constitutional crossroads, with parliament expected to elect a president, a prerequisite for formally tasking the largest bloc with forming a government. Supporters say the move reflects parliamentary arithmetic and the Coordination Framework’s status as the largest Shiite alliance, holding roughly 185 of the 329 seats. Critics counter that the timing is deliberate, aimed at locking in a strongman candidate before opposition blocs can consolidate.

The decision underscores a central reality of post-2003 politics: no prime minister emerges without external calculation. In al-Maliki’s case, those calculations diverge sharply between Washington and Tehran.

Iran’s Calculated Endorsement: Familiar, But Conditional

For Iran, al-Maliki is a known quantity. His rise in 2006, consolidation in 2010, and sidelining in 2014 were all shaped —directly or indirectly— by Iranian intervention. During his first term, Tehran viewed him as a unifying Shiite figure capable of stabilizing a fragmented post-invasion order. By his second term, Iran actively engineered alliances to keep him in office, overriding unfavorable electoral outcomes.

In 2014, after the collapse of Iraqi security forces and the fall of Mosul to ISIS, Tehran abruptly shifted its backing to prevent broader systemic collapse. The message was centered around the idea that allies are expendable when stability is at risk.

Today, Iranian backing has returned under a new logic. With rising US pressure and fears of renewed attempts to marginalize Iran-aligned armed factions, Tehran sees al-Maliki as willing —and able— to resist external coercion. Informed Iraqi sources told Shafaq News that the nomination carries at least tacit approval from Supreme Leader Ayatollah Ali Khamenei, reflecting Iran’s preference for tested actors over compromise figures.

Still, Iranian officials remain pragmatic; if al-Maliki fails to secure parliamentary confirmation, Tehran is unlikely to burn bridges defending him at all costs.

Washington’s Dilemma: Opposition Without Obstruction

The United States views al-Maliki’s return with deep skepticism. In Washington, he remains associated with policies that alienated Sunni communities, centralized power, and indirectly facilitated the rise of ISIS. The concern today is less historical blame than forward-looking risk.

From the perspective of Donald Trump’s circle, an al-Maliki premiership could inflame Sunni grievances and strengthen Iran-aligned factions at a moment when Washington seeks to curb Tehran’s regional influence. US officials have privately warned Iraqi leaders that including commanders from Iran-linked armed groups in the next government could trigger sanctions targeting the Iraqi state itself, including oil revenues, according to multiple diplomatic sources.

That stance was reinforced publicly by Marco Rubio, who cautioned in a phone call with caretaker Prime Minister Mohammed Shia al-Sudani that a government shaped by Iranian influence would struggle to prioritize Iraq’s interests, keep the country out of regional conflict, or sustain a balanced partnership with the United States.

Yet Washington faces a constraint of its own: overtly blocking al-Maliki risks provoking a Shiite backlash against perceived US interference. As a result, American pressure has focused on red lines rather than names, seeking to shape the composition of any future cabinet rather than veto its leader outright.

Inside Iraq: A Candidate Who Unites And Divides

Domestically, al-Maliki’s nomination has produced an unusual political map. Kurdish parties —the Kurdistan Democratic Party (KDP) and the Patriotic Union of Kurdistan (PUK)— have largely welcomed his candidacy. Leaders close to Masoud Barzani see al-Maliki as predictable and transactional, capable of honoring power-sharing arrangements.

The PUK formally endorsed the nomination, urging swift completion of constitutional procedures and the formation of a stable, service-oriented government. For Kurdish leaders, al-Maliki’s return represents continuity over uncertainty, particularly amid regional volatility.

The Sunni landscape tells a more complex story. While some Sunni figures and alliances have cautiously signaled openness —arguing that past grievances should not dictate present choices— others remain openly opposed.

The al-Hasm and al-Azm alliances publicly backed al-Maliki’s nomination, distancing themselves from a statement by the National Political Council (NPC), an umbrella body representing Sunni factions, that warned against repeating past leadership experiences.

Oras al-Mashhadani, a senior figure in the al-Azm Alliance led by Muthanna al-Samarrai, told Shafaq News that his bloc’s position is not tied to al-Maliki as a person but to managing the current phase, arguing that today’s political actors possess constitutional tools to hold past offenders accountable, framing the debate as forward-looking rather than retrospective.

According to al-Mashhadani, al-Azm informed the CF that it would support any option that avoids deepening rifts within the Shiite political house.

For now, despite the distancing by al-Hasm and al-Azm, the position of the NPC continues to reflect the stance of Al-Jamaheer Al-Wataniya, led by Abu Mazen; Al-Siyada, headed by Khamis al-Khanjar; and Taqaddum, led by former speaker Mohammed al-Halbousi. Together, these blocs maintain that the question of the premiership should be governed by broad national acceptance, particularly within the Sunni component, rather than parliamentary arithmetic alone.

Mohammed al-Halbousi warned in a statement against “returning to painful years,” citing discrimination, marginalization, and security breakdowns during the previous tenure without naming al-Maliki directly.

Ali al-Mahmoud of the Taqaddum party directly pointed to al-Maliki’s earlier rule, which left a lasting imprint on Sunni provinces, “marked by bombings, marginalization, and political exclusion.” While stressing that the objection is not rooted in performance alone, al-Mahmoud criticized the process that led to the nomination, noting that Sunni partners were not consulted despite being stakeholders in the political process, contrasting it with the broad consultations held during the selection of the parliamentary speaker.

Al-Mahmoud also indicated fractures within the Shiite camp itself, arguing that the decision reflected majority rule rather than full consensus, a choice he said prioritized speed and political arithmetic over unity.

Read more:Iraq’s Government talks reopen the 2010–2014 political memory

Shiite Calculations: Strength Over Consensus

Within the Shiite camp, al-Maliki’s nomination was endorsed by the majority, not unanimity —an important distinction. Yet key Shiite actors argue that Iraq’s current moment does not favor compromise candidates.

Supporters, including figures aligned with Hadi al-Amiri and caretaker Prime Minister al-Sudani, frame al-Maliki as a decisive leader rather than a caretaker manager —someone capable of withstanding US pressure, managing armed factions, and navigating regional fault lines. In this reading, al-Maliki’s choice looks like a figure with enough political weight to impose order within the Shiite house while negotiating externally from a position of strength.

Former MP Kamel Nawaf al-Ghariri articulated that view, arguing that al-Maliki is uniquely positioned to lead Iraq at a time of heightened external pressure, particularly from the United States. He told Shafaq News that a few Iraqi politicians possess the experience required to navigate Washington’s demands while simultaneously managing Iraq’s complex internal files.

At the same time, al-Ghariri acknowledged persistent Sunni opposition to a third term, noting that many Sunni provinces associate al-Maliki’s previous rule with hardship and exclusion, an association that continues to shape resistance regardless of present calculations.

On the other side of the Framework, political sources told our agency that Ammar al-Hakim, head of the National Wisdom Movement (Al-Hikma), was not aligned with the option of returning Al-Maliki to the premiership. Similar reservations were also voiced privately by Qais al-Khazali, leader of Asaib Ahl al-Haq, according to the same sources.

Neither figure has publicly opposed the nomination, reflecting a pattern within the CF in which dissent has been managed internally to preserve cohesion, even as differences over leadership choice persist behind closed doors.

Read more:Nouri Al-Maliki: A name that still divides and tests the politics of memory

What Happens Next?

If formally tasked, al-Maliki will have 30 days to form a cabinet and secure parliamentary confidence. Most indicators suggest he can assemble a numerical majority, buoyed by Kurdish backing and partial Sunni acquiescence. However, failure remains possible; in that scenario, the Coordination Framework could pivot to a consensus alternative, potentially retaining al-Sudani or advancing another moderate Shiite figure.

Speaking with Shafaq News, a member of the Framework, Abu Mithaq al-Masari, noted that even if the incoming president formally tasks Nouri al-Maliki with forming the government, securing parliamentary confidence would not be automatic.

Al-Masari said the process could prove prolonged, stressing that political legitimacy would hinge on achieving a broad parliamentary consensus rather than relying solely on numerical advantage. “The government will not pass if it fails to secure agreement.”

A source close to Sunni political forces echoed that assessment, revealing to Shafaq News that finalizing the premiership remains contingent on majority backing for the proposed cabinet.

The source warned that if the prime minister-designate fails to win the support of parliamentary blocs tied to leaders who oppose his return, the 30-day constitutional deadline could expire without a confidence vote, forcing a political reset. In that scenario, the source said, advanced understandings with rejecting or hesitant blocs would be essential to avoid derailment.

The implications extend beyond personalities. An al-Maliki-led government would likely harden Iraq’s posture against US demands on armed groups while seeking to reassure regional partners and Kurdish allies. It would also test whether al-Maliki can transcend the legacy that divides Sunni communities, or whether his return entrenches polarization under the banner of stability. Therefore, his comeback is ultimately a referendum on Iraq’s political memory.

As Iran and the United States pull in opposite directions —and Iraq’s factions weigh pragmatism against principle— the question is not whether al-Maliki can return, but whether Iraq can absorb that return without reopening the wounds of the past. Written and edited by Shafaq News staff.

Silver Prices Surge To A Record High, Surpassing $110 Per Ounce.

Economy News - Follow-up The price of silver surpassed $110 an ounce for the first time in history on Monday, as investors flocked to safe-haven assets amid escalating geopolitical tensions.

By 12:32 Moscow time, silver futures contracts for March on the Comex exchange in New York had risen by 8.61% to reach $110.055 per ounce.

Meanwhile, spot silver contracts rose by 6.49% to $109.8870 an ounce, according to trading data.

Experts predict that the supply shortage in the silver market will continue throughout this year, mainly due to high investment demand for the metal. https://economy-news.net/content.php?id=64998

The Judiciary Announces The Recovery Of 157 Billion Dinars In Corruption Cases During 2025

Economy News – Baghdad The Supreme Judicial Council announced on Monday the recovery of 157 billion dinars from corruption cases during 2025.

The council stated in a statistic: "More than 157 billion dinars were recovered from violating companies in cases of dollar exchange rate differences." https://economy-news.net/content.php?id=64997

US and Japan about to Dump Hundreds of Billions in Dollars

US and Japan about to Dump Hundreds of Billions in Dollars

Steven Van Metre: 1-25-2026

The global financial landscape is on the brink of a significant shift, with a coordinated currency intervention led by Japan and backed by the US Federal Reserve and the US Treasury poised to shake the foundations of the market.

According to a recent video analysis by Steven Van Metre, this move is expected to have far-reaching consequences, including a sharp stock market correction that could exceed 25%.

US and Japan about to Dump Hundreds of Billions in Dollars

Steven Van Metre: 1-25-2026

The global financial landscape is on the brink of a significant shift, with a coordinated currency intervention led by Japan and backed by the US Federal Reserve and the US Treasury poised to shake the foundations of the market.

According to a recent video analysis by Steven Van Metre, this move is expected to have far-reaching consequences, including a sharp stock market correction that could exceed 25%.

In this blog post, we’ll dive into the details of the impending intervention, its potential impact on the market, and what investors can do to protect their portfolios.

The Japanese yen has been struggling with weakness, largely due to the country’s reluctance to raise interest rates despite rising inflation and wage growth.

Japan’s hesitation to hike rates stems from fears of triggering an economic recession and destabilizing the bond market.

Meanwhile, the US has a vested interest in weakening the dollar to reduce borrowing costs, aligning with President Trump’s stated goals. This convergence of interests has set the stage for a coordinated currency intervention that could have dramatic consequences.

The last similar intervention in 2024 led to a significant market crash as traders rapidly unwound their positions.

With retail investors currently heavily bullish, a similar intervention now could trigger a sharp stock market correction. The massive yen carry trade, which has been a dominant force in the market, is expected to be disrupted, leading to a selloff in stocks and a decline in Treasury yields.

So, what can investors do to protect their portfolios and potentially profit from the impending market turmoil?

According to Van Metre, diversification is key. Investors can consider shifting into defensive sectors, such as those less correlated with the overall market, and allocating a portion of their portfolio to precious metals, which have historically performed well during times of financial stress.

Additionally, tactical short positions in banks and tech stocks could provide a hedge against the expected market downturn.

The looming coordinated currency intervention is a wake-up call for investors to reassess their portfolios and prepare for potential market volatility.

By understanding the underlying causes of the yen’s weakness and the expected consequences of the intervention, investors can take proactive steps to protect their assets and potentially profit from the impending market turmoil.

Watch the full video from Steven Van Metre to gain further insights and information on how to navigate this imminent financial shock.

Paul Gold Eagle: EBS-QFS Status Update from Mr. Pool, Signal Convergence Confirmed

Paul Gold Eagle: EBS-QFS Status Update from Mr. Pool, Signal Convergence Confirmed

1-25-2026

Paul White Gold Eagle @PaulGoldEagle

• EBS / QFS STATUS UPDATE — SIGNAL CONVERGENCE CONFIRMED

Something changed after January 20, 2026.

Not in headlines. Not in speeches.

In systems

Paul Gold Eagle: EBS-QFS Status Update from Mr. Pool, Signal Convergence Confirmed

1-25-2026

Paul White Gold Eagle @PaulGoldEagle

• EBS / QFS STATUS UPDATE — SIGNAL CONVERGENCE CONFIRMED

Something changed after January 20, 2026.

Not in headlines. Not in speeches.

In systems.

Multiple financial networks entered what insiders call a “quiet synchronization window.” Payment rails paused. Liquidity re-routed. Backend ledgers mirrored. This is not a crash. This is a handoff.

By January 24–27, several U.S. regional banking systems began extended “maintenance cycles” that do not match any historical pattern. These pauses are not random. They align with QFS compatibility testing — asset verification, identity mapping, and transaction finality checks.

This is how a new system replaces an old one:

silently, in parallel.

The Quantum Financial System (QFS) is not a rumor and not a front-end app. It is a backend architecture designed to eliminate debt-based currency loops and replace them with asset-verified, ledger-final transactions. No rehypothecation. No synthetic debt. No endless rollover.

Here’s the part most people miss:

QFS cannot go live for the public until legacy exposure is contained.

That’s why you’re seeing:

Quiet resignations in legacy banks

Sudden capital restrictions

“Temporary” withdrawal limits

Emergency liquidity facilities being exhausted

This is not collapse.

This is containment.

Now the dates people are watching closely:

January 28–31

Final backend audits, wallet-mapping simulations, and stress tests across multiple U.S. nodes. This phase is internal. You won’t hear about it.

February 1–3

Expected start of controlled public signaling. This is where EBS or a parallel encrypted alert system may begin limited activation. Not nationwide all at once. Region by region. Channel by channel.

If activated, citizens may receive:

Secure notifications (SMS / email / app-level)

One-time identity verification prompts

Wallet activation instructions

Confirmation of debt status under the new ledger

No codes sent publicly.

No links blasted on social media.

Everything is direct and encrypted.

February 4–10

This window is associated with Tiered onboarding, often referred to as Tier 4B. This is not “early access” or privilege. It’s order of operations. Large financial transitions cannot move everyone simultaneously without breaking infrastructure.

And yes — gold matters, but not how most think.

Gold is not the headline.

Gold is the anchor layer.

QFS is digital in speed but asset-backed in structure. Gold functions as the memory and stabilizer of value while the system transitions away from fiat illusion. Digital rails. Physical backing. No speculation required.

Why the media silence?

Because announcing a reset before containment is finished would cause panic.

This is why EBS exists — not to scare, but to guide when the switch is thrown.

We are not waiting for chaos.

We are watching coordination.

Those expecting fireworks will miss it.

Those watching the systems will recognize it.

The question is no longer if the reset happens.

The question is how smoothly it unfolds — and who is paying attention.

Stay alert.

The signals are no longer scattered.

They are converging.

Mr Pool

Source(s): https://x.com/PaulGoldEagle/status/2015665739777413563

Seeds of Wisdom RV and Economics Updates Monday Afternoon 1-26-26

Good Afternoon Dinar Recaps,

India–EU Trade Reset Gains Momentum as $136B FTA Talks Accelerate

Republic Day diplomacy signals a major shift toward multipolar trade realignment

Good Afternoon Dinar Recaps,

India–EU Trade Reset Gains Momentum as $136B FTA Talks Accelerate

Republic Day diplomacy signals a major shift toward multipolar trade realignment

Overview

India and the European Union moved closer to finalizing a $136 billion Free Trade Agreement (FTA) during India’s Republic Day celebrations, signaling a significant recalibration in global trade relationships. High-level EU participation underscored the strategic importance of India as both blocs reassess supply chains, defense coordination, and long-term economic alignment amid growing global fragmentation.

Key Developments

EU leaders, including European Commission President Ursula von der Leyen, attended Republic Day events alongside Indian officials, highlighting the political weight behind the negotiations.

Talks focused on market access, autos, clean technology, digital trade, and security cooperation, with several chapters reportedly nearing completion.

The proposed agreement would unlock $136 billion in trade potential, making it one of the EU’s largest bilateral trade deals.

Negotiations are advancing as Europe seeks to reduce over-reliance on U.S. and China-centric supply chains while India expands its global trade footprint.

Why It Matters

This FTA represents more than a trade deal — it reflects a strategic shift toward diversified economic partnerships. As traditional Western trade frameworks face political strain and protectionist pressures, India and the EU are positioning themselves at the center of new, resilient trade corridors.

The timing is critical. With tariffs, sanctions, and geopolitical uncertainty reshaping global commerce, large economies are prioritizing bilateral and regional agreements that offer stability outside legacy systems.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies in anticipation of revaluation or reset dynamics, this development is notable:

Large trade agreements often increase regional currency usage in settlements.

Reduced dependence on the U.S. dollar for trade flows supports reserve diversification trends.

Stronger India–EU trade volumes can enhance long-term demand for local currencies tied to real economic activity.

Multipolar trade growth historically precedes currency repricing and structural adjustments during global monetary transitions.

Implications for the Global Reset

Pillar 1 – Trade Architecture Realignment

The India–EU FTA strengthens a multipolar trade system, reducing reliance on U.S.-centric frameworks and accelerating global economic bifurcation.

Pillar 2 – Monetary & Reserve Diversification

As trade expands outside traditional channels, incentives grow for alternative settlement mechanisms, regional currency use, and diversified reserves — all key components of reset-era restructuring.

This is not just a trade negotiation — it is a quiet but consequential realignment of global economic power.

This is not just diplomacy — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Economic Times — “Republic Day Parade: Not just tanks but a $136 bn India–EU trade deal opportunity”

Reuters — “EU and India push to finalize long-delayed free trade agreement amid global uncertainty”

~~~~~~~~~~

BRICS Expansion Accelerates as Zimbabwe Pushes for Membership

Growing applicant list signals deepening shift away from Western-dominated systems

Overview

The BRICS alliance may soon expand again, as Zimbabwe intensifies its formal bid to join the bloc. With 23 countries now having submitted official applications, BRICS continues to emerge as a central pillar of the evolving multipolar economic order. Analysts say Zimbabwe’s application is gaining traction amid strong backing from several current members.

Key Developments

Zimbabwe has formally submitted its BRICS application, confirmed by Foreign Affairs Minister Professor Amon Murwira.

President Emmerson Mnangagwa personally directed the diplomatic push, signaling high-level political commitment.

BRICS now has 11 full members, following Indonesia’s accession in January 2025.

Countries expressing interest or submitting applications include Bahrain, Malaysia, Turkey, Vietnam, Nigeria, and Angola.

Russia, South Africa, and Brazil have publicly supported Zimbabwe’s bid.

Partner countries already associated with BRICS include Belarus, Bolivia, Kazakhstan, Cuba, Thailand, Uganda, and Uzbekistan.

Why It Matters

BRICS expansion is no longer symbolic — it is structural. Each new applicant reflects dissatisfaction with Western-led financial institutions, sanctions frameworks, and dollar-centric trade systems.

Zimbabwe’s bid highlights how resource-rich and emerging economies increasingly see BRICS as:

A pathway to alternative development financing

A shield against sanctions and policy conditionality

A platform for sovereign equality in global trade

The bloc’s growing appeal underscores accelerating global economic bifurcation.

Why It Matters to Foreign Currency Holders

For currency holders watching reset dynamics:

Expanding BRICS membership increases non-dollar trade settlement potential

New entrants often align with gold accumulation and reserve diversification

Infrastructure financing via the New Development Bank reduces reliance on IMF/World Bank mechanisms

Currency systems tied to BRICS trade corridors may experience long-term repricing pressures

Expansion strengthens the ecosystem supporting currency realignment and valuation shifts.

Implications for the Global Reset

Pillar 1 – Multipolar Trade & Governance

Rising BRICS membership reflects a clear move toward parallel global institutions operating outside G7 dominance.

Pillar 2 – Financial System Diversification

As more nations seek alternatives to Western financing, reserve composition, settlement mechanisms, and currency usage evolve — foundational elements of reset-era restructuring.

Zimbabwe’s application is not an isolated event. It is part of a broader migration toward new power centers in global finance.

This is not just expansion — it’s global economic realignment in motion.

Seeds of Wisdom Team / Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Zimbabwe’s BRICS Bid Signals Gold-Backed Currency Stress Test

How Zimbabwe’s monetary history, gold reserves, and BRICS ambitions intersect with the global reset

Overview

Zimbabwe’s formal application to join BRICS is more than a diplomatic move — it is a currency survival strategy. With a long history of hyperinflation, currency failures, and forced monetary resets, Zimbabwe is positioning itself alongside a bloc increasingly focused on gold-backed settlement, CBDC interoperability, and reduced dollar dependence.

As BRICS expands its membership and monetary architecture, Zimbabwe offers a real-world case study of how resource-backed nations seek monetary shelter in a bifurcating global system.

Key Developments

Zimbabwe’s Foreign Affairs Minister confirmed that the country has formally approached all BRICS member states and is awaiting feedback. Several existing members — including Russia, South Africa, and Brazil — have publicly signaled support.

Zimbabwe’s interest aligns with broader BRICS trends:

Expansion beyond original members

Increased emphasis on gold accumulation

Development of alternative settlement frameworks

Reduced exposure to Western-dominated financial systems

Zimbabwe’s Currency Reality

Zimbabwe’s monetary system has endured repeated collapses, including one of the worst hyperinflation episodes in modern history. While the government recently introduced the ZiG (Zimbabwe Gold) framework to stabilize domestic transactions, confidence remains fragile.

Limited liquidity, external trust deficits, and restricted access to global settlement systems continue to constrain Zimbabwe’s monetary flexibility.

Zimbabwe is seeking external monetary alignment, not just internal reform.

Gold as a Strategic Lever

Zimbabwe is Africa’s third-largest gold producer, with annual output exceeding 30 tonnes. Gold already represents one of the country’s most reliable export and reserve assets.

Alignment with BRICS would:

Strengthen gold-backed settlement credibility

Enable trade without exclusive reliance on USD clearing

Support commodity-linked valuation rather than fiat trust

Zimbabwe’s resource profile fits naturally into BRICS’ broader gold accumulation and monetization strategy.

Why Zimbabwe Matters

Zimbabwe matters because it represents a stress-test economy.

Countries with:

Currency trauma

Limited fiat credibility

Strong natural resource bases

are often early adopters of asset-backed monetary frameworks.

If Zimbabwe succeeds in stabilizing trade and reserves through BRICS-linked systems, it becomes a template for other emerging economies facing similar constraints. If it fails, it still offers valuable insight into the limits of gold-linked and multipolar settlement models.

In short, Zimbabwe sits at the intersection of necessity and experimentation — where reset theories meet real-world pressure.

Why This Matters for Currency Holders

For those tracking global currency realignment:

Zimbabwe highlights how gold substitutes for trust when fiat fails

BRICS alignment can convert fragile currencies into participants in broader settlement ecosystems

Resource-backed economies often experience repricing dynamics once trade pathways diversify

Zimbabwe’s trajectory underscores a core reset theme:

hard assets increasingly replace confidence in institutions.

Implications for the Global Reset

Zimbabwe’s BRICS bid reflects a wider pattern: nations with currency instability and resource depth are migrating toward multilateral, asset-supported frameworks.

This is not about ideology — it is about monetary resilience in a world moving from unipolar dominance to structural bifurcation.

Zimbabwe is not seeking advantage — it is seeking protection.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “BRICS New Members List Could Soon Include New Country, Analysts Say”

Reuters — “Explainer: What is Zimbabwe’s new ZiG currency and will it work?”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Afternoon 1-26-26

Gold Breaks $5,000 As Iran Tensions And Yen Intervention Fears Rattle Markets

2026-01-26 Shafaq News Gold surged past $5,000 per ounce on Monday, buoyed by safety flows amid dollar weakness following a turbulent week where tensions over Greenland and Iran rattled investors, while markets remained on tenterhooks after violent spikes in the yen.

Gold Breaks $5,000 As Iran Tensions And Yen Intervention Fears Rattle Markets

2026-01-26 Shafaq News Gold surged past $5,000 per ounce on Monday, buoyed by safety flows amid dollar weakness following a turbulent week where tensions over Greenland and Iran rattled investors, while markets remained on tenterhooks after violent spikes in the yen.

The yen rose over 1% to 153.99 per dollar as of 0427 GMT, after sharp spikes on Friday sparked speculation over potential intervention. The New York Federal Reserve conducted rate checks on Friday, sources told Reuters, raising the chance of joint U.S.-Japan intervention to halt the currency's slide.

"The market's inclination is to short the yen but the possibility of co-ordination means it no longer is a one-way bet," said Prashant Newnaha, senior rates strategist at TD Securities in Singapore.

The prospect of joint intervention to support the yen pulled the dollar lower and broadly lifted other currencies.

Japan's Nikkei dropped about 2% while S&P 500 futures fell 0.25% and European futures were 0.27% lower as traders awaited the Federal Reserve's policy meeting later in the week.

U.S. President Donald Trump provided temporary relief to markets last week by reversing tariff threats and downplaying potential forceful action against Greenland. However, further sanctions targeting Iran have reinforced market anxiety.

Increased U.S. pressure against Iran is pushing oil prices higher and lifting safe-haven gold to record peaks. Precious metals, including silver , have surged in a blistering rally so far this year, also aided by a softer dollar.

INTERVENTION CHATTER KEEPS YEN ALOFT

While authorities in Tokyo declined to comment on the yen's wild swings, sources told Reuters about the rate checks on Friday, leaving traders on edge at the prospect of an intervention that could come any time.

Japanese Prime Minister Sanae Takaichi said on Sunday her government will take necessary steps against speculative market moves.

Carlos Casanova, senior Asia economist at UBP, said the mere expectation of potential intervention could, in itself, contribute to some strengthening of the currency.

"The Japanese yen is likely to stabilise to some extent - though the catalysts for significant appreciation remain limited - while long-term yields are expected to face continued pressure at their current elevated levels."

A steep bond market rout in Japan last week had put the spotlight on Takaichi's expansionary fiscal policy as she called a snap election that is due for February 8. The bond market has since calmed somewhat, but investors remain jittery.

The yen was broadly firmer against other currencies too on Monday, inching away from the record low against the euro and Swiss franc and multi-decade lows against sterling.

Charu Chanana, chief investment strategist at Saxo, said the rate-check style warning could help reset positioning and remind the market there’s a line near 159–160.

"With the dollar starting to look softer, this is actually a cleaner window for Japan to lean against yen weakness. Intervention works better when it’s going with the broader USD tide, not fighting it."

The dollar index , which measures the U.S. currency against six rivals, fell as much as 0.2% to a four-month low of 96.996 after dropping 0.8% on Friday in its biggest one-day drop since August.

Investor focus this week will also be on the Fed. The central bank is expected to hold rates steady at a meeting overshadowed by a Trump administration criminal investigation of Fed Chair Jerome Powell, whose term ends in May.

In commodities, oil prices were little changed after rising about 3% on Friday, with traders weighing the impact of Trump pressuring Iran through more sanctions on vessels that transport its oil. Brent crude futures were flat at $65.91 a barrel, while U.S. West Texas Intermediate crude stood at $61.1 per barrel. (Reuters) https://www.shafaq.com/en/Economy/Gold-breaks-5-000-as-Iran-tensions-and-yen-intervention-fears-rattle-markets

Gold Prices Skyrocket In Baghdad, Erbil

2026-01-26 Shafaq News– Baghdad/ Erbil Gold prices rose on Monday in Baghdad and Erbil, extending gains after crossing the one-million-dinar mark last week.

According to a Shafaq News market survey, wholesale prices in Baghdad’s Al-Nahr Street market put 21-carat Gulf, Turkish, and European gold at 1.071 million dinars per mithqal (about five grams) for selling and 1.067 million dinars for buying, up from 1.033 million dinars on Sunday.

Iraqi 21-carat gold sold at 1.041 million dinars per mithqal, with buying prices at 1.037 million dinars. In retail shops, 21-carat Gulf gold sold for between 1.070 million and 1.080 million dinars per mithqal, while Iraqi gold ranged from 1.040 million to 1.050 million dinars.

In Erbil, gold prices also climbed, with 22-carat gold selling at 1.139 million dinars, 21-carat at 1.087 million dinars, and 18-carat at 932,000 dinars. https://www.shafaq.com/en/Economy/Gold-prices-skyrocket-in-Baghdad-Erbil-8

USD/IQD Exchange Rates Climb In Baghdad, Erbil

2026-01-26 03:45 Shafaq News- Baghdad/ Erbil The US dollar exchange rates against the Iraqi dinar rose on Monday in Baghdad and Erbil, hovering near 149,300 dinars per 100 dollars.

According to a Shafaq News market survey, the dollar traded in Baghdad’s Al-Kifah and Al-Harithiya central exchanges at 149,300 dinars per 100 dollars, up from Sunday’s 148,200 dinars.

In the Iraqi capital, exchange shops sold the dollar at 149,750 dinars and bought it at 148,750 dinars, while in Erbil, selling prices reached 149,950 dinars and buying prices stood at 149,900 dinars.

https://www.shafaq.com/en/Economy/USD-IQD-exchange-rates-climb-in-Baghdad-Erbil-1

Oil Holds Near Two-Month Highs As US Outages And Iran Tensions Offset Surplus Fears

2026-01-26 Shafaq News Oil prices were little changed on Monday after climbing more than 2% in the previous session, as supply concerns kept a lid on benchmarks despite production disruptions in major U.S. crude-producing regions.

Brent crude futures fell 7 cents, or 0.1%, to $65.81 a barrel at 0221 GMT. U.S. West Texas Intermediate crude was at $61.01 a barrel, down 6 cents, or 0.1%.

Both benchmarks notched weekly gains of 2.7% to close on Friday at their highest points since January 14. A U.S. military aircraft carrier strike group and other assets are expected to arrive in the Middle East in the coming days.

"Oil prices are being tickled this week by signs of production disruptions in the U.S., coupled with persistent geopolitical risk against the notion of an oversupplied 2026," said Priyanka Sachdeva, senior market analyst at Phillip Nova Pte Ltd.

Crude production of about 250,000 barrels per day has been lost in the U.S. due to harsh weather, including declines in the Bakken field in Oklahoma and parts of Texas, JPMorgan analysts said in a note on Monday.

"Winter storm Fern struck the U.S. coast, forcing shut-ins in major crude and natural gas producing regions and adding stress to the power grid," she said, adding that oil markets are experiencing a mild upswing as outages tighten physical flows.

Traders are also wary of geopolitical risks, analysts say, as tensions between the U.S. and Iran keep investors on edge.

"President Trump's declaration of a U.S. armada sailing toward Iran has reignited supply-disruption fears, adding a risk premium to crude prices and supported risk aversion flows more broadly this morning," IG market analyst Tony Sycamore said.

On Friday, a senior Iranian official said Iran would treat any attack "as an all-out war against us."

Separately, Kazakhstan's Caspian Pipeline Consortium said it returned to full loading capacity at its terminal on the Black Sea coast on Sunday after completing maintenance at one of its three mooring points.

"Traders are weighing the durability of the surplus more heavily than episodic headlines," Phillip Nova's Sachdeva said. "So, unless OPEC+ or major producers announce meaningful cuts, the overall oil market picture still points to soft structural fundamentals in 2026." (Reuters) https://www.shafaq.com/en/Economy/Oil-holds-near-two-month-highs-as-US-outages-and-Iran-tensions-offset-surplus-fears

Iraq Pushes Revenue Collection Plan Amid University Protests

2026-01-26 Shafaq News– Baghdad Iraq’s caretaker government recommended creating a new body to collect public revenues on Monday, as protests by university employees over recent financial measures continued to expand across several provinces.

According to a statement from caretaker Prime Minister Mohammad Shia Al-Sudani's media office, the step followed a meeting of the Ministerial Council for the Economy, which Al-Sudani chaired to advance measures aimed at boosting state revenues and tightening public spending in line with current fiscal priorities.

The council called for the establishment of a General Directorate for Public Revenue Collection, with Al-Sudani directing the formation of a committee to prepare the directorate’s organizational structure, define its duties, and assess its technical and logistical requirements.

Meanwhile, protests and strikes by Iraqi university employees continued for a second day in Baghdad, Najaf, Basra, Dhi Qar, Maysan, Al-Anbar, and Nineveh over a cabinet decision to cut university allowances, Shafaq News correspondent said.

While the Ministry of Finance previously clarified that allowances would apply only to employees fully dedicated to teaching duties in higher education and health institutions, aimed at boosting revenues and tightening spending, several lawmakers criticized the measures as unconstitutional, warning that they place additional financial burdens on both the state and citizens.

Against this backdrop, Iraq’s parliament postponed a session scheduled for Monday to review recent economic decisions by the caretaker government, including measures related to salaries, university allowances, and increases in fees and customs tariffs. A lawmaker told our agency that the leadership of the Council of Representatives adjourned the session after failing to reach a legal quorum. https://www.shafaq.com/en/Economy/Iraq-pushes-revenue-collection-plan-amid-university-protests

How the System BROKE When Gold Was Removed | Dr. Stephen Leeb

How the System BROKE When Gold Was Removed | Dr. Stephen Leeb

Lynette Zang: 1-25-2026

What really changed when gold was removed from the monetary system?

In this interview, Dr. Stephen Leeb explains how abandoning gold led to short-term thinking, exploding debt, lost innovation, and growing systemic risk.

From the collapse of long-term research to the erosion of fiscal discipline, this conversation connects money, power, and societal decline.

If history is any guide, gold doesn’t disappear forever — it returns when systems break.

How the System BROKE When Gold Was Removed | Dr. Stephen Leeb

Lynette Zang: 1-25-2026

What really changed when gold was removed from the monetary system?

In this interview, Dr. Stephen Leeb explains how abandoning gold led to short-term thinking, exploding debt, lost innovation, and growing systemic risk.

From the collapse of long-term research to the erosion of fiscal discipline, this conversation connects money, power, and societal decline.

If history is any guide, gold doesn’t disappear forever — it returns when systems break.

Chapters:

00:00 Why Gold Still Matters More Than Ever

03:01 How the Gold Standard Was Quietly Destroyed

06:20 America’s Innovation Collapse After Leaving Gold

09:00 Central Banking, Short-Term Thinking, and Endless War

11:54 Inflation, Broken Families, and Social Decay

17:01 How Russia and China Passed the United States

22:52 Gold as Money, Power, and Spiritual Anchor

30:18 Why Gold Forces Governments to Behave

39:59 Venezuela, Resources, and the Global Reset Ahead

“Tidbits From TNT” Monday 1-26-2026

TNT:

Tishwash: International trade: Iraq has transformed into a safe and attractive environment for investment.

The International Trade Centre confirmed on Monday that Iraq has taken concrete and effective steps in modernizing its trade and investment framework through customs reforms.

Eric Bochot, the center’s program director in Iraq, told the official newspaper, as reported by Dijlah News, that “the ongoing reforms in customs, investment frameworks, trade facilitation, and the promotion of transparency, predictability, and efficiency for economic actors have contributed to improving the overall business environment.”

TNT:

Tishwash: International trade: Iraq has transformed into a safe and attractive environment for investment.

The International Trade Centre confirmed on Monday that Iraq has taken concrete and effective steps in modernizing its trade and investment framework through customs reforms.

Eric Bochot, the center’s program director in Iraq, told the official newspaper, as reported by Dijlah News, that “the ongoing reforms in customs, investment frameworks, trade facilitation, and the promotion of transparency, predictability, and efficiency for economic actors have contributed to improving the overall business environment.”

Bushout noted that as these reforms continue, the interest of regional and international partners is growing, with cautious but positive expectations of increased trade, investment, and private sector participation in the coming years. link

Tishwash: The House of Representatives sets the date for the session to elect the President of the Republic.

The House of Representatives has set next Tuesday as the date for the session to elect the President of the Republic.

We still need the official agenda though link

******************

Tishwash: Savaya met with the framework leaders and delivered Trump's message to them.

On Monday, Amer Al-Fayez, a leader in the Coordination Framework and head of the Tasmeem bloc, revealed that Trump’s envoy, Mark Savaya, met with the framework’s leaders individually, noting that he delivered clear messages to them rejecting the Trump administration’s refusal to grant any high-ranking position in the government and parliament to figures affiliated with one of the Iraqi factions.

The winner said, in a statement followed by Al-Masalla, that “the envoy of the American president, Mark Savaya, conveyed a message written in English as a representative of Trump, which included the American government’s disapproval of the presence of armed factions or the like, and therefore its rejection of one of them assuming the position of deputy speaker of the House of Representatives.”

He added that Savaya “conveyed this message to some of the framework leaders individually, meeting with each one separately and explaining its contents to them over the past two days before he left.”

The winner explained that the coordination framework confirmed that “this matter is not within their (the Americans’) rights, as we are a fully sovereign and independent state, and this is an internal matter,” noting that “the message included an objection to the deputy speaker of parliament being from the factions.”

The head of the parliamentary design bloc warned that “the coordination framework will form a delegation or send a counter-message to inquire about the reason for the objection, given that the position of Deputy Speaker of Parliament is a civilian position.”

The winner suggested that “the Asa’ib Ahl al-Haq movement may not participate in the next government due to regional developments, and not out of a desire to move towards the opposition,” denying that Iraq had received “any official threat from Washington regarding cutting off the dollar.” link

***************

Tishwash: Iraq faces its toughest test yet: US threats to cut off oil revenues plunge the country into a complex crisis.

Abbas al-Jubouri, head of the Al-Rafid Center for Political and Strategic Studies, warned on Sunday (January 25, 2026) of serious repercussions that the Iraqi state may face if political forces proceed with including armed factions in the next government formation, in light of clear American threats to cut off or restrict the revenues of Iraqi oil sales deposited in the United States.

Al-Jubouri told Baghdad Today that “activating this threat is not just a symbolic or political measure, but rather a very dangerous economic pressure tool, given that Iraq relies primarily on the American financial system to pass its oil revenues, which makes the national economy vulnerable to severe shocks that may affect salaries, service projects, cash reserves, as well as the stability of the dinar exchange rate.”

He explained that “the United States views the issue of involving armed factions in the government from an angle related to regional security and adherence to governance standards, and that any step that may be interpreted as legitimizing weapons outside the framework of the state may prompt Washington to take punitive financial measures, including freezing assets or imposing strict banking restrictions.”

He added that “Iraq today faces a very delicate sovereign test, which is to balance the requirements of internal political agreements with the international obligations imposed by the global financial system,” warning that ignoring this balance “may put the country in direct confrontation with the international community, and bring back scenarios of economic isolation and undeclared sanctions.”

Al-Jubouri stressed that “the solution does not lie in escalation or defiance, but rather in adopting a clear governmental approach based on restricting weapons to the state, strengthening the independence of political decision-making, and reassuring international partners that the next government will be run according to the logic of the state and institutions, not the logic of axes and external loyalties.”

He concluded by saying that “any tampering with oil revenues, which represent more than 90% of the state’s resources, will place the greatest burden on the Iraqi citizen,” calling on political forces to prioritize the national interest and realize that economic stability is organically linked to political and security stability.

The Associated Press published earlier on Saturday (January 24, 2026) a report by the India Times network, confirming that the United States had begun threatening Iraq with economic strangulation by preventing access to the dollar, following Washington’s control of Venezuelan oil and the start of its marketing in global markets.

The agency stated, according to what was translated by "Baghdad Today", that the American threats to impose direct economic sanctions on the Iraqi government and prevent the flow of dollars are unprecedented in Washington's dealings with its Iraqi partner, noting that the American position witnessed a remarkable shift after its control over Venezuelan oil.

The agency suggested that the new American hardening towards Iraq stems from Washington’s conviction that it can control the global oil market and prevent any price increases in the event of a halt in Iraqi exports, by compensating for them with Venezuelan oil, a scenario that could materialize if the United States proceeds to prevent the dollar from reaching Iraq.

The agency noted that the United States issued direct threats to the Iraqi government, vowing to impose comprehensive economic sanctions on the government itself, rather than targeting individuals or institutions, in addition to causing what it described as a “dollar famine” inside Iraq, in the event that armed factions participate in the next government formation.

The recent US threats to Iraq come in the context of a broader political-economic escalation led by Washington to rearrange the global energy market, after tightening its control over Venezuelan oil and beginning to market it as a possible alternative to oils coming from countries subject to complex political calculations.

Iraq relies heavily on the dollar-based international financial system to manage its oil revenues and finance its general budget, making any restrictions on dollar access a highly influential tool of pressure on the country’s economic and financial stability. link

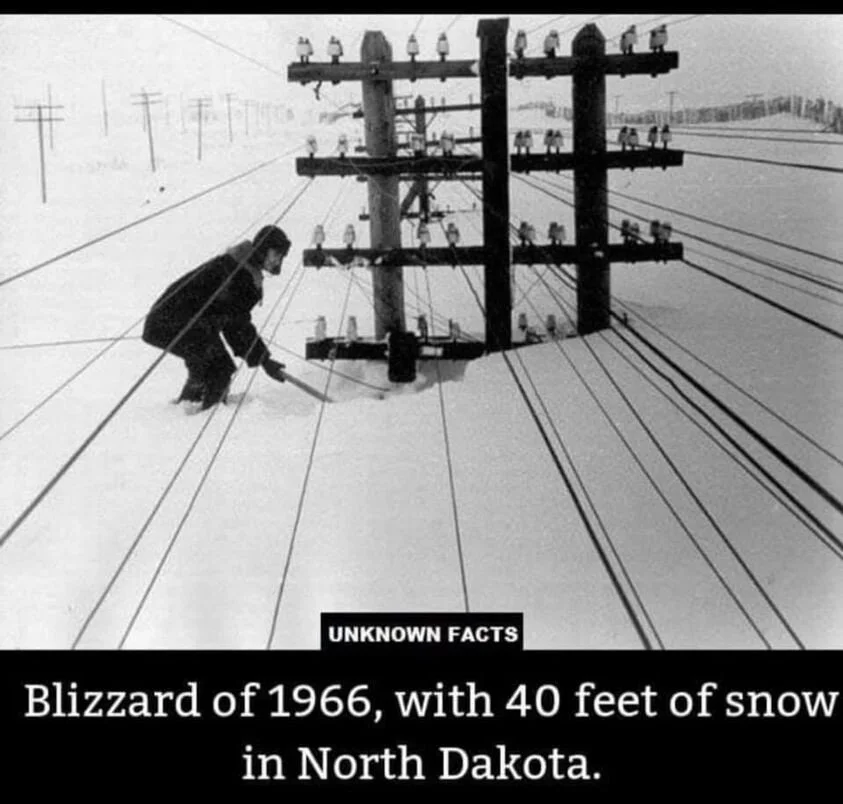

Mot . Say!!! -- Will da Snow Storm Beee Like Dis????

Mot: . Good morning have a good day. Stay warm!!

Seeds of Wisdom RV and Economics Updates Monday Morning 1-26-26

Good Morning Dinar Recaps,

Gold Breaks $5,100 as Silver Signals Safe-Haven Stampede

Precious metals surge as confidence in fiat systems visibly fractures

Good Morning Dinar Recaps,

Gold Breaks $5,100 as Silver Signals Safe-Haven Stampede

Precious metals surge as confidence in fiat systems visibly fractures

Overview

Gold prices surged past $5,100 per ounce, while silver hit fresh record highs as investors rapidly shifted capital toward hard assets. The move reflects escalating geopolitical uncertainty, renewed U.S. trade tensions, fiscal instability fears, and a weakening confidence backdrop for fiat currencies.

The scale and speed of the metals rally suggest this is not a speculative move, but a structural repositioning toward value preservation amid systemic stress.

Key Developments

Gold surpassed $5,100/oz, setting a new all-time high amid intense safe-haven demand

Silver reached record levels, confirming broad-based precious metals inflows

Capital rotated out of equities as global equity fund inflows sharply slowed

U.S. tariff threats and shutdown risks fueled risk-off sentiment

Central bank purchases and ETF inflows amplified upward momentum

Why It Matters

This surge is not isolated price action — it is a signal event.

Safe-haven flows historically precede systemic stress points, not follow them

Precious metals rallies often reflect waning confidence in policy stability and fiat credibility

The metals move aligns with rising geopolitical fragmentation and fiscal uncertainty

Markets are behaving as if traditional safeguards may fail, accelerating the search for assets outside political control.

Why It Matters to Foreign Currency Holders

For those holding foreign currency in anticipation of a Global Reset-style revaluation, this movement is highly relevant:

Gold and silver rallies often precede reserve diversification by central banks

Currency realignments historically follow periods of hard-asset accumulation

Rising metals prices signal value migration away from paper promises

Precious metals strength reinforces the case for currency repricing in a multipolar system

This environment favors tangible-backed value, not debt-based instruments.

Implications for the Global Reset

Pillar 1: Asset Repricing & Store-of-Value Shift

Gold and silver are reasserting themselves as monetary anchors as trust in fiscal discipline erodes.

Pillar 2: Confidence Erosion in Fiat Systems

When capital abandons equities for metals en masse, it reflects institutional doubt about policy control, not short-term volatility.

This is not just market turbulence — it is capital voting against uncertainty.

What to Watch Next

Central bank disclosures on gold accumulation

Physical silver premiums and delivery delays

Further weakness in equity inflows

Policy responses to rising commodity-driven inflation pressure

When trust fades, money remembers what lasts

This is not just market volatility — it’s monetary behavior adjusting to a fractured global order.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Davos Reflections Signal Cracks in the Global Economic Order

Elite consensus shifts from coordination to containment

2026 World Economic Forum exposes strain across alliances, finance, and strategy

Overview

Reflections emerging from the 2026 World Economic Forum in Davos reveal a notable change in tone among global leaders and financial elites. Rather than projecting confidence in a unified rules-based system, discussions increasingly acknowledged fracturing alliances, strategic mistrust, and geopolitical recalibration.

Transatlantic relations, defense responsibilities, and capital allocation strategies dominated conversations as Europe and other partners adjusted to an increasingly uncertain U.S. posture. Investors, meanwhile, began reassessing risk exposure amid growing acceptance that global fragmentation is no longer temporary.

Key Developments

Rising transatlantic strain surfaced in defense, trade, and diplomatic expectations

European leaders openly discussed reduced reliance on U.S. strategic guarantees

Financial institutions signaled portfolio adjustments reflecting geopolitical risk

Davos discussions shifted from global coordination to resilience and hedging strategies

Investors increasingly framed fragmentation as structural, not cyclical

Why It Matters

Davos has long functioned as a bellwether for elite consensus. This year’s reflections mark a psychological inflection point.

Acceptance of systemic fracture replaces assumptions of eventual reunification

Alliance cohesion weakens as self-reliance and regional blocs gain priority

Financial strategy increasingly reflects political risk rather than growth optimism

When elite forums adjust expectations, policy and capital tend to follow.

Why It Matters to Foreign Currency Holders

For those holding foreign currency in anticipation of revaluation or systemic realignment:

Fragmentation often precedes currency diversification and repricing cycles

Reduced faith in unified policy coordination supports multipolar currency frameworks

Capital shifts toward hard assets and non-dollar settlement channels accelerate

Davos tone shifts historically align with early-stage reset dynamics

Foreign currency holders should note that confidence erosion, not collapse, is what drives long-term valuation changes.

Implications for the Global Reset

Pillar 1: Alliance Fragmentation & Power Rebalancing

Davos reflections suggest global leadership is preparing for a world of competing blocs, not shared governance.

Pillar 2: Financial Strategy Reorientation

Investor and institutional behavior is adapting to persistent geopolitical risk, reinforcing parallel systems rather than unified ones.

This is not rhetoric — it is strategic repositioning in real time.

What to Watch Next

European defense and fiscal coordination outside U.S. frameworks

Capital flow data showing regional concentration vs global dispersion

Increased emphasis on resilience, autonomy, and hedging in policy language

Further normalization of multipolar economic assumptions

When Davos stops preaching unity, the system is already changing

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters Breakingviews – “The Week in Breakingviews: Davos makes history”

Bloomberg – “Davos Leaders Confront a World of Fragmentation and Strategic Risk”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

How Silver Cracked $100 And Added More Than Bitcoin's Entire Market Cap In 3 Months

How Silver Cracked $100 And Added More Than Bitcoin's Entire Market Cap In 3 Months

Parshwa Turakhiya Benzinga Sat, January 24, 2026

Silver crossed the psychological $100 per ounce Friday, driven by solar panel demand and a historic supply squeeze, while Bitcoin (CRYPTO: BTC) has crashed 30% from its $126,000 peak to $89,000.

How Silver Cracked $100 And Added More Than Bitcoin's Entire Market Cap In 3 Months

Parshwa Turakhiya Benzinga Sat, January 24, 2026

Silver crossed the psychological $100 per ounce Friday, driven by solar panel demand and a historic supply squeeze, while Bitcoin (CRYPTO: BTC) has crashed 30% from its $126,000 peak to $89,000.

The Numbers: Silver Added $2.83 Trillion

Silver closed October 31, 2025 at $48.68 per ounce. By Friday afternoon, it had crossed $100—a 104% surge in three months. The total above-ground silver supply is estimated at approximately 56 billion ounces, including bullion, coins, jewelry, and industrial products. At October’s price, silver’s total market value stood at roughly $2.73 trillion.

At today’s $99 price, that valuation has exploded to approximately $5.56 trillion—an increase of $2.83 trillion in three months. That’s 1.5 times Bitcoin’s entire $1.84 trillion market cap added to silver’s value in 90 days.

Meanwhile, Bitcoin tumbled from above $126,000 in October to roughly $89,000 today. The cryptocurrency’s market cap fell from over $2.4 trillion to $1.84 trillion, shedding more than $600 billion in value.

What’s Driving The Silver Rally

The silver rally is driven by an industrial necessity colliding with a supply crunch.

Solar panels now account for 29% of industrial silver demand, up from just 11% in 2014, according to the Silver Institute’s World Silver Survey 2025.

Each solar panel requires 15-25 grams of silver, and global solar capacity is forecast to hit 665 gigawatts in 2026.

Moreover, electric vehicles use 25-50 grams of silver versus 15-28 grams in conventional cars.

That demand isn’t going away—it’s accelerating as the green energy transition shifts from future trend to current reality.

The supply side is even tighter. The Silver Institute reports 2024 marked the fourth consecutive year of supply deficits:

Mine production: 819.7 million ounces

Total demand: 1.16 billion ounces

Industrial demand: 680.5 million ounces (record high)

The deficit is structural. Over 70% of silver is produced as a byproduct of mining lead, zinc, and copper—meaning production can’t simply ramp up when prices spike.

Research from Ghent University and Engie Laborelec projects that by 2030, global silver demand could hit 48,000-52,000 metric tons annually while supply reaches only 34,000 metric tons.

The solar industry alone could consume 29-41% of projected global supply by decade’s end.

What Happens Next

To Continue and Read More: https://www.yahoo.com/finance/news/silver-cracked-100-added-more-003147330.html

Future of Cryptos and the Incoming Global Reset with Rob Cunningham, January 2026

Future of Cryptos and the Incoming Global Reset with Rob Cunningham, January 2026

Jon Dowling: 1-25-2026

In a recent episode of the Jon Dowling podcast, financial expert Rob Cunningham shared his profound insights into the rapidly evolving world of cryptocurrency, blockchain technology, and the global financial systems.

As a retired military veteran and financial aficionado, Rob brought a unique perspective to the discussion, shedding light on the transition from traditional fiat debt-based money to asset-backed honest money.

Future of Cryptos and the Incoming Global Reset with Rob Cunningham, January 2026

Jon Dowling: 1-25-2026

In a recent episode of the Jon Dowling podcast, financial expert Rob Cunningham shared his profound insights into the rapidly evolving world of cryptocurrency, blockchain technology, and the global financial systems.

As a retired military veteran and financial aficionado, Rob brought a unique perspective to the discussion, shedding light on the transition from traditional fiat debt-based money to asset-backed honest money.

This shift, he emphasized, is driven by the vital roles of cryptography, transparency, and compliance.

Rob highlighted the growing momentum of China-backed digital currency networks, viewing them as a significant step toward verifiable, collateral-backed stablecoins.

This development, he argued, is beneficial not only for honest financial systems but also for the future of cryptocurrencies.

By moving toward asset-backed currencies, the global financial system can mitigate the risks associated with debt-based money and foster a more stable and transparent financial environment.

One of the key themes of the discussion was the need to reframe the public’s perception of new technologies like AI and cryptography.

Rob debunked the common fears surrounding these technologies, instead framing them as tools for greater creativity, efficiency, and freedom. Rather than threatening jobs or privacy, Rob believes that these technologies have the potential to enhance our lives and promote financial freedom.

Rob was critical of the existing global financial and legal systems, describing them as debt traps and examples of regulatory overreach controlled by central bankers and “big law.”