“Gold is a Currency. It's been a Currency forever.”

“We’re Consuming More Than We Produce” Silver Warning | Randy Smallwood

Kitco News: 3-2-2026

Gold testing $5,400 is not a temporary surge; it reflects what Wheaton Precious Metals CEO Randy Smallwood describes as a structural shift in markets.

Speaking with Kitco News at PDAC 2026, amid escalating Middle East tensions and a sharp move higher in oil, Smallwood said precious metals are entering a new phase driven by fiscal imbalances, currency concerns, and renewed demand for hard assets.

“I do think 5,000 is a new base for gold,” Smallwood said. “Gold is a currency. It's been a currency forever.”

“We’re Consuming More Than We Produce” Silver Warning | Randy Smallwood

Kitco News: 3-2-2026

Gold testing $5,400 is not a temporary surge; it reflects what Wheaton Precious Metals CEO Randy Smallwood describes as a structural shift in markets.

Speaking with Kitco News at PDAC 2026, amid escalating Middle East tensions and a sharp move higher in oil, Smallwood said precious metals are entering a new phase driven by fiscal imbalances, currency concerns, and renewed demand for hard assets.

“I do think 5,000 is a new base for gold,” Smallwood said. “Gold is a currency. It's been a currency forever.”

He argued that the long-held view of the US dollar as the primary reference currency is being reassessed as deficits widen and geopolitical risk intensifies.

Smallwood also pointed to silver’s multi-year supply imbalance, noting, “We're consuming more of it than what we're producing,” after peak silver production in 2017 and 2018.

His comments come after Wheaton closed a $4.3 billion transaction last week to double its silver exposure at Antamina, positioning the streaming company for what he sees as a sustained monetary and industrial shift.

Recorded March 02, 2026.

00:40 - CEO Transition and $4.3B Silver Deal

02:32 - Gold Above $5,000 and Breakout Drivers

03:54 - Energy Costs, Cost Curve, and Mining Margins

05:48 - $4.3B Antamina Silver Stream in Peru

07:58 - Wheaton’s Growth Engine and Streaming Model

10:21 - M&A Pressure and Mine Supply Constraints

11:43 - Managing Jurisdiction and Political Risk

13:23 - Silver Structural Deficit Since 2017

16:25 - Industrial Silver Demand and AI Growth

17:55 - Silver Volatility and Squeeze Narrative

19:15 - Wheaton’s 2030 Production Strategy

21:34 - $1M Future of Mining Innovation Challenge

Coin Shops Say They're Swimming In So Much Silver And Gold That They're Having To Limit Purchases

Coin Shops Say They're Swimming In So Much Silver And Gold That They're Having To Limit Purchases

Dominick Reuter Business Insider Updated Sun, February 8, 2026

Spot prices for silver and gold are stabilizing after a rocky stretch of record gains and losses.

The market volatility has caused headaches for local coin shops that typically buy precious metals.

"If you do this wrong, you run out of capital really fast," one shop told Business Insider.

If January was a party in the precious metals market, February is the hangover.

Coin Shops Say They're Swimming In So Much Silver And Gold That They're Having To Limit Purchases

Dominick Reuter Business Insider Updated Sun, February 8, 2026

Spot prices for silver and gold are stabilizing after a rocky stretch of record gains and losses.

The market volatility has caused headaches for local coin shops that typically buy precious metals.

"If you do this wrong, you run out of capital really fast," one shop told Business Insider.

If January was a party in the precious metals market, February is the hangover.

The per-ounce price of gold topped $5,300 and silver reached nearly $120 at the end of January before tumbling sharply. The stretch of record gains and losses has since stabilized in the early days of February.

"These price moves have done a lot of damage all across the line," HSBC precious metals analyst James Steel told Business Insider.

One type of business bearing the brunt of volatility is local coin shops, where people often trade in gold and silver. High prices have led to a huge influx of people selling, but some shops tell Business Insider they're running out of their usual places to offload excess metals.

As the market was in its tailspin, Tim Heuer said the shop he manages, University Coin & Jewelry in Madison, Wisconsin, was still doing deals.

Heuer said a customer came in to sell some silver when the spot price was $98 an ounce and falling: "By the time I wrote his check, silver was already down $3.50 from the time he walked in the door."

The recent volatility is putting those businesses in an uncomfortable position, beyond quickly changing spot prices that erode profit margins.

Local coin shops play an essential role in the circulation of physical gold and silver by providing a reliable way for individuals to sell their bars, coins, or scrap metal.

If someone bought a gold bar last year from Costco and wants to turn it back into cash, a local coin shop is one of the first places they might go.

And while these shops do turn around and sell some of what they buy, most of the metal is sold to refineries to be melted and minted into new bars or coins.

Precious metals refineries are experiencing major backlogs

That flow has been interrupted in recent months as the run in gold and silver prices has encouraged more people to trade in their metals, leading to a backlog of raw materials at refineries.

Jarret Niesse, president of Precious Metal Refining Services in Chicago, said his company stopped buying scrap silver back in October, when the price crossed $50 per ounce, sparking a frenzy of people trading in old silverware, platters, and other tchotchkes that had been gathering dust.

And the market has only gotten wilder since then.

"This entire crazy silver move that has happened, we have been sitting on the sidelines," he said.

Refineries like Niesse's are one step in the process. Much of the product they melt down gets further refined by other mints and exported to Asian markets, where demand for bars and coins is higher. With so much gold and silver to process, those refineries have also stopped buying, thereby cutting into the cash flow of local coin shops.

To Continue an d Read More: https://www.yahoo.com/finance/news/coin-shops-theyre-swimming-much-105201247.html

COMEX Silver Scam? CME Goes Dark Before Delivery

COMEX Silver Scam? CME Goes Dark Before Delivery

Taylor Kenny: 2-28-2026

CME outage before first notice day sparks gold market manipulation fears as physical demand surges and East challenges Western price control.

What are the odds that the world’s largest gold and silver derivatives exchange suddenly experiences a “technical outage” right before first notice day?

COMEX Silver Scam? CME Goes Dark Before Delivery

Taylor Kenny: 2-28-2026

CME outage before first notice day sparks gold market manipulation fears as physical demand surges and East challenges Western price control.

What are the odds that the world’s largest gold and silver derivatives exchange suddenly experiences a “technical outage” right before first notice day?

Gold & Silver Trading Halted: They’re Playing Very Dangerous Game | Andy Schectman & Michelle Makori

Gold & Silver Trading Halted: They’re Playing Very Dangerous Game | Andy Schectman & Michelle Makori

Miles Franklin Media: 2-27-2026

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, speaks with Andy Schectman, Founder & CEO of Miles Franklin Precious Metals, about the sudden CME gas & metals trading halt, massive silver withdrawals, Mexico silver supply risks, and whether silver is quietly becoming a national security asset.

After silver broke above $90, the CME halted trading, citing “technical issues”. Andy says, “These games… are greatly eroding confidence in the Comex.”

He warns that “the moment the market believes there isn’t enough metal… it unwinds violently.” In this episode of The Real Story, they break down:

Gold & Silver Trading Halted: They’re Playing Very Dangerous Game | Andy Schectman & Michelle Makori

Miles Franklin Media: 2-27-2026

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, speaks with Andy Schectman, Founder & CEO of Miles Franklin Precious Metals, about the sudden CME gas & metals trading halt, massive silver withdrawals, Mexico silver supply risks, and whether silver is quietly becoming a national security asset.

After silver broke above $90, the CME halted trading, citing “technical issues”. Andy says, “These games… are greatly eroding confidence in the Comex.”

He warns that “the moment the market believes there isn’t enough metal… it unwinds violently.” In this episode of The Real Story, they break down:

The CME “technical issue” and what happened at $90 silver

Millions of ounces leaving COMEX – where is it going?

February open interest and delivery stress

Mexico cartel violence and global silver supply risk

Project Vault and potential U.S. strategic silver stockpiling

Gold replacing U.S. Treasuries as central banks lose trust

What a violent unwind in metals would actually mean

01:18 CME Trading Halt Explained

03:48 Manipulation Claims & Motives

05:51 Who Pulls the Strings

09:10 Regulators & Global Rivals

11:31 Shanghai Premium & Arbitrage

13:45 Comex Deliveries & Withdrawals

18:54 Failure to Deliver Risk

22:18 Mexico Violence Supply Shock

28:57 Project Vault Explained

29:55 Secret Silver Stockpiling

33:40 Price Floors & Ceilings

36:02 Robots Mining Myth

40:33 Gold Replaces Treasuries

44:31 Bank Gold Price Targets

49:12 Closing Remarks

Trump Revalues Gold? ‘It’s a 65% Chance’ – James Rickards Explains the Real Implications

Trump Revalues Gold? ‘It’s a 65% Chance’ – James Rickards Explains the Real Implications

Miles Franklin Media: 2-25-2026

Michelle Makori, President & Editor-in-Chief of Miles Franklin Media, speaks with macro strategist James Rickards about growing speculation that the United States could revalue its gold reserves.

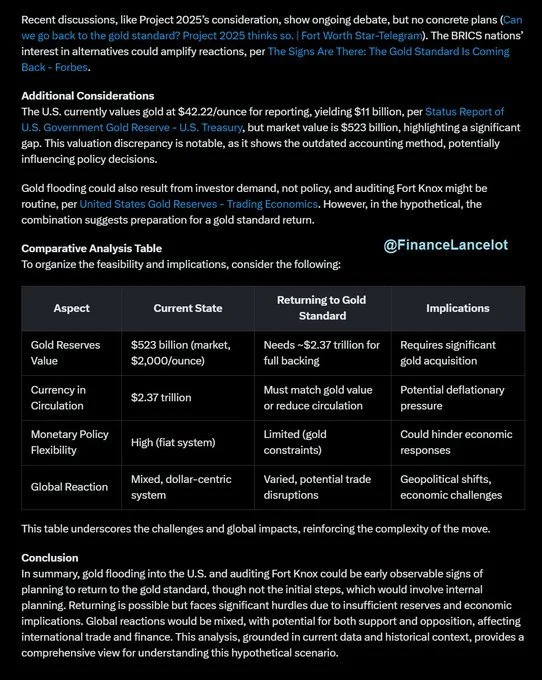

America still values its gold at $42.22 per ounce, a price set in 1973, and why the Treasury legally has the authority to reprice gold closer to market levels with what some describe as “the stroke of a pen.”

Trump Revalues Gold? ‘It’s a 65% Chance’ – James Rickards Explains the Real Implications

Miles Franklin Media: 2-25-2026

Michelle Makori, President & Editor-in-Chief of Miles Franklin Media, speaks with macro strategist James Rickards about growing speculation that the United States could revalue its gold reserves.

America still values its gold at $42.22 per ounce, a price set in 1973, and why the Treasury legally has the authority to reprice gold closer to market levels with what some describe as “the stroke of a pen.”

While the move would largely be an accounting adjustment, Rickards argues the real impact would be psychological – signaling to markets and foreign governments that the United States is once again treating gold as a monetary asset.

Rickards estimates the probability of such a move under a Trump administration at “65%” He also discusses:

How gold revaluation works step-by-step

Why it could bypass debt ceiling constraints

The potential $1 trillion Treasury windfall

Signals this would send to China and global central banks

Why gold is increasingly viewed as protection against financial weaponization

Preparing for the Comeback of the Gold Standard

Preparing for the Comeback of the Gold Standard

Bendleruschka: 2-26-2026

Bendleruschka @bendleruschka

GOLD COMMS – GOLD SHALL DESTROY FED

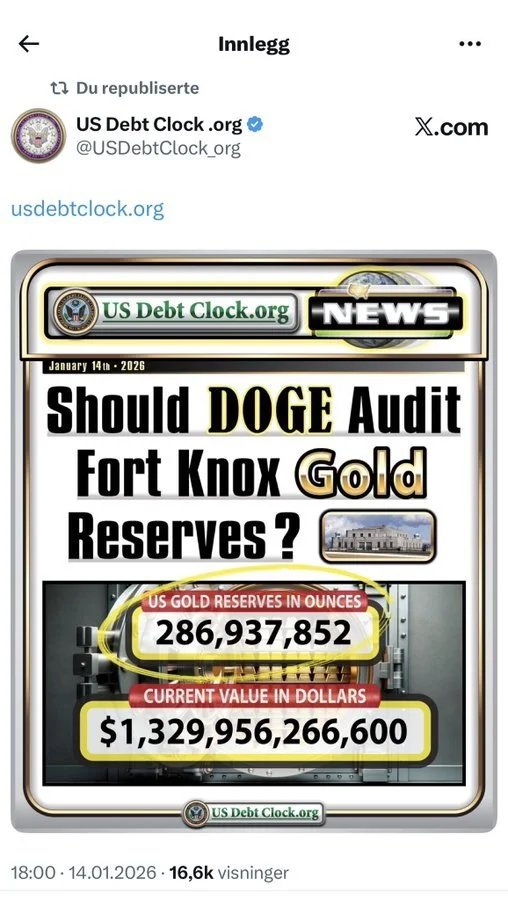

PREPARING FOR THE COMEBACK OF THE GOLD STANDARD – US Gold Reserve audit & revaluation.

Are we finally getting to know the status at Fort Knox?

Preparing for the Comeback of the Gold Standard

Bendleruschka: 2-26-2026

Bendleruschka @bendleruschka

GOLD COMMS – GOLD SHALL DESTROY FED

PREPARING FOR THE COMEBACK OF THE GOLD STANDARD – US Gold Reserve audit & revaluation.

Are we finally getting to know the status at Fort Knox?

DOGE is also an audit by the way. EVERYTHING IS BEING AUDITED NOW.

Financelot: How long until the general public finally realizes what's really going on here? JP Morgan & U.S. Treasury are bringing all the gold back to the US so they can audit & implement a gold standard. They created the Sovereign Wealth Fund specifically to replace the Federal Reserve.

Financealot: Why do you suppose Warren Buffet is hoarding $325 billion in cash? P.S. The euphoric rally to the 1929 peak was 5 years & 1 month

Is the US Headed Toward a Gold Reset?

Is the US Headed Toward a Gold Reset?

Arcadia Economics: 2-24-2026

As we step into 2026, the world of finance is abuzz with discussions about the evolving dynamics of the gold and silver markets, the future of the US dollar, and the implications of rising global debt and geopolitical tensions.

In a recent, in-depth conversation with Chris Marcus of Arcadia Economics, Michael McNair, a seasoned asset manager with a focus on precious metals and macroeconomic trends, shared his expert insights on these pressing issues.

Is the US Headed Toward a Gold Reset?

Arcadia Economics: 2-24-2026

As we step into 2026, the world of finance is abuzz with discussions about the evolving dynamics of the gold and silver markets, the future of the US dollar, and the implications of rising global debt and geopolitical tensions.

In a recent, in-depth conversation with Chris Marcus of Arcadia Economics, Michael McNair, a seasoned asset manager with a focus on precious metals and macroeconomic trends, shared his expert insights on these pressing issues.

The discussion provides a fascinating glimpse into the potential shifts in global monetary policy and the role that gold and silver are poised to play in the years to come.

One of the key highlights of the conversation is McNair’s analysis of the Trump Administrationn’s influence on monetary and fiscal coordination.

According to McNair, the Trump Administration is expected to have a significant impact on the coordination between monetary and fiscal policies, potentially leading to a more synchronized approach that could have far-reaching consequences for the global economy.

A significant part of the discussion revolves around the anticipated changes in leadership at the Federal Reserve, with Christopher Worsh potentially being appointed as the new Fed Chair.

McNair shares his thoughts on how this change could influence monetary policy and the dollar’s standing in the global financial system.

The potential dismantling of the current dollar-centric monetary system is also explored, with McNair suggesting that we are on the cusp of a significant shift away from the dollar’s dominance.

A crucial aspect of the conversation is the evolving role of gold in the global financial landscape.

McNair emphasizes that gold is transitioning from being merely a hedge against US solvency issues to becoming a crucial reserve asset that will play a key role in balancing global trade imbalances.

This shift underscores the growing recognition of gold’s importance in the global monetary system, beyond its traditional role as a safe-haven asset.

The discussion also delves into the dynamics of the silver market, highlighting the industrial demand for silver as a critical factor that will influence its price and utility in the global economy. McNair touches on the dynamics of capital flows and trade deficits, providing insights into how these macroeconomic trends will impact the precious metals market.

One of the most compelling aspects of the conversation is the anticipation of a prolonged and potentially painful transition to a new global monetary order.

McNair suggests that this transition will be characterized by significant adjustments in the global financial system, with implications for investors, policymakers, and the broader economy.

In a related development, the conversation briefly highlights the impressive 2025 earnings of First Majestic Silver, a mining company that has benefited from the surge in silver prices.

The correlation between the company’s performance and the silver price underscores the potential for significant returns in the precious metals sector, particularly in companies with strong operational fundamentals.

As the global economy navigates the complexities of rising debt, geopolitical tensions, and shifting monetary policies, the insights shared by Michael McNair provide valuable perspectives for investors and policymakers alike.

The conversation with Chris Marcus offers a nuanced understanding of the evolving dynamics in the gold and silver markets and the broader implications for the global monetary system.

Gold Revaluation Is Coming - Andy Schectman Explains The Endgame

Gold Revaluation Is Coming - Andy Schectman Explains The Endgame

Liberty and Finance: 2-24-2026

Andy Schectman CEO of Miles Franklin Precious Metals explains why gold revaluation by governments is increasingly likely rather than speculative.

He argues that treasury backed stablecoins and legislation such as the GENIUS Act create a powerful incentive for higher gold prices as interest flows are redirected into hard assets.

Gold Revaluation Is Coming - Andy Schectman Explains The Endgame

Liberty and Finance: 2-24-2026

Andy Schectman CEO of Miles Franklin Precious Metals explains why gold revaluation by governments is increasingly likely rather than speculative.

He argues that treasury backed stablecoins and legislation such as the GENIUS Act create a powerful incentive for higher gold prices as interest flows are redirected into hard assets.

Schectman notes that gold already sits on central bank balance sheets in revaluation accounts making an official reset structurally simple if confidence in fiat erodes further.

He connects this trajectory to long term policy thinking discussed by figures like Judy Shelton and Luke Gromen who view higher gold as a tool to manage debt and currency debasement.

The key message is that gold may rise dramatically through market forces first with formal revaluation coming only after prices are already much higher.

INTERVIEW TIMELINE:

0:00 Intro

1:40 Physical silver flows

19:00 Preparedness with metals

45:13 Junk silver - $1 below spot/oz

47:18 Gold revaluation & stable coins

The Decline Of The Dollar: Gold Is ‘Becoming The Reserve Asset’

One Of Wall Street’s Most Feared Hedge Fund Managers On The Decline Of The Dollar: Gold Is ‘Becoming The Reserve Asset’

Jake Angelo Fortune Updated Thu, February 12, 2026

Gold blasted past $5,300 per ounce last month as President Donald Trump’s hawkish foreign policy and tariff threats sent investors to safer assets. At the same time, U.S. deficit spending swelled to what the Congressional Budget Office called an unsustainable $1.9 trillion, a scenario that’s chipping away at the dollar’s standing as the world’s leading reserve currency.

One Of Wall Street’s Most Feared Hedge Fund Managers On The Decline Of The Dollar: Gold Is ‘Becoming The Reserve Asset’

Jake Angelo Fortune Updated Thu, February 12, 2026

Gold blasted past $5,300 per ounce last month as President Donald Trump’s hawkish foreign policy and tariff threats sent investors to safer assets. At the same time, U.S. deficit spending swelled to what the Congressional Budget Office called an unsustainable $1.9 trillion, a scenario that’s chipping away at the dollar’s standing as the world’s leading reserve currency.

The confluence of these factors has some investors predicting the fall of Treasury securities as the only true global reserve. Greenlight Capital founder David Einhorn made that apparent in a recent conversation with CNBC. The investing legend forecasts a monumental shift in global reserve assets, predicting that central banks will swap dollars for the yellow metal.

“The central banks around the world are buying gold,” Einhorn said. “Whereas a few years ago, it was mostly Treasuries.” He added that it is “becoming the reserve asset” because U.S. trade policy “is very unstable, and it’s causing other countries to say, ‘We want to settle our trade in something other than U.S. dollars.’”

To be sure, the dollar still dominates as the reserve currency of choice. While in the first half of last year, central banks dumped over $48 billion in Treasuries, in July 2025, the dollar still composed roughly a 58% share of all foreign exchange reserves, according to the International Monetary Fund. And gold purchases by central banks actually fell in 2025 from a high between 2022 and 2024, according to data from the World Gold Council.

Also, Einhorn has long predicted the price of gold will rise out of fears around U.S. monetary policy and fiscal policy. In an interview with CNBC last year, the hedge fund manager argued: “Gold is not about inflation. Gold is about the confidence in the fiscal policy and the monetary policy.” While the investor isn’t quite advocating for a return to the gold standard, he is a strong proponent of holding the metal as a hedge against U.S. fiscal and monetary mismanagement.

On Wednesday, Einhorn added that U.S. trade policy is sending jitters across global markets, fueling the “sell America” trend and sending central banks to safer assets like gold. While gold prices have eased since their peak last month, the currency’s value remains high, at around $5,100 per ounce as of Thursday morning.

The Einhorn effect

Einhorn has made a name for himself spotting financial red flags. The hedge fund manager rose to investing prominence in 2002 after taking a short position on Allied Capital, a midcap financial company. After giving a speech about his stance at the Sohn Investment Conference, the company’s stock went down 20% as Einhorn accused the company of defrauding the Small Business Administration.

Einhorn followed a similar playbook in 2007 after shorting Lehman Brothers, sharing his thesis about the financial institution’s overexposure to subprime-mortgage-backed securities at the Value Investing Congress. His prescient callouts of major firms via thoroughly researched presentations—and the resulting stock tumbles they initiate—has popularized the phrase “the Einhorn effect,” used to highlight the hedge fund manager’s striking influence on investor decisions. (This is not to be confused with the “Einhorn revolving shotgun” from the Call of Duty video game.)

Deficit fears fuel a bet on gold

Just as his early short calls exposed cracks in major financial institutions, the investor now sees structural vulnerabilities in government fiscal and monetary policies. Einhorn Wednesday highlighted his philosophy on gold, saying: “Our thesis on gold over the longer term has been that our fiscal policy and our monetary policies don’t make any sense.” At current spending rates, the U.S. deficit-to-GDP ratio is expected to reach 6.7% by 2036, per the CBO. However, Einhorn also noted other major developed currencies maintain high deficit-to-GDP ratios, explaining why gold, as opposed to a foreign currency, could become the preferred global reserve.

To Continue and Read More: https://www.yahoo.com/finance/news/one-wall-street-most-feared-192611075.html

The U.S. Debt ‘Black Hole’: We’ve Crossed the Event Horizon | Greg Weldon & Andy Schectman

The U.S. Debt ‘Black Hole’: We’ve Crossed the Event Horizon | Greg Weldon & Andy Schectman

Miles Franklin Media: 2-23-2026

Andy Schectman, Founder & CEO of Miles Franklin Precious Metals, sits down with Greg Weldon, CTA and Publisher of the Global Macro Strategy Report, to break down what Weldon calls the U.S. debt “black hole” and why the global financial system may have already crossed a point of no return.

Weldon explains how decades of monetary policy, rising debt dependence, and geopolitical resource competition are reshaping markets, currencies, and global power structures.

The U.S. Debt ‘Black Hole’: We’ve Crossed the Event Horizon | Greg Weldon & Andy Schectman

Miles Franklin Media: 2-23-2026

Andy Schectman, Founder & CEO of Miles Franklin Precious Metals, sits down with Greg Weldon, CTA and Publisher of the Global Macro Strategy Report, to break down what Weldon calls the U.S. debt “black hole” and why the global financial system may have already crossed a point of no return.

Weldon explains how decades of monetary policy, rising debt dependence, and geopolitical resource competition are reshaping markets, currencies, and global power structures.

From yield curve control and inflation dynamics to gold’s role as a measure of trust, Schectman and Weldon explore why today’s economic pressures may signal a fundamental shift in the financial system.

As debt accelerates beyond sustainable growth, Weldon argues the consequences could include persistent inflation, declining purchasing power, and a lower standard of living, while gold increasingly reflects a growing loss of confidence in the monetary system.

In this episode of Little by Little:

The U.S. debt “black hole” and financial system tipping points

Why markets may have crossed an economic event horizon

Inflation, deflation, and the future of purchasing power

Yield curve control and Treasury market risks

Gold as a signal of declining trust in global finance

00:00 Coming Up

01:15 Intro: Greg Weldon

09:21 Markets Then vs Now

13:23 No Relief Valve

18:06 World War III: Resources

22:55 Debt Tipping Point Black Hole

25:03 Monetary Armageddon Scenario

27:13 Inflation Meets AI Deflation

29:22 Physics Cycles & Volatility

32:26 Gold as Trust Barometer

34:19 China Resources & Rare Earths

38:49 Advice for Young Investors

40:36 Diversify Beyond Stocks

45:56 Closing Remarks

Rome's Financial Collapse: 4 Assets That Outlived the Crash

Rome's Financial Collapse: 4 Assets That Outlived the Crash

Independent Financial Historian: 2-21-2026

In 64 AD, Emperor Nero began a quiet process that would eventually destroy the most powerful currency the world had ever seen.

By the Crisis of the Third Century, the Roman denarius had lost 98% of its silver content, wiping out the savings of millions who trusted the imperial stamp. This wasn't an overnight crash; it was a slow, invisible theft that lasted generations—until it wasn't invisible anymore.

Rome's Financial Collapse: 4 Assets That Outlived the Crash

Independent Financial Historian: 2-21-2026

In 64 AD, Emperor Nero began a quiet process that would eventually destroy the most powerful currency the world had ever seen.

By the Crisis of the Third Century, the Roman denarius had lost 98% of its silver content, wiping out the savings of millions who trusted the imperial stamp. This wasn't an overnight crash; it was a slow, invisible theft that lasted generations—until it wasn't invisible anymore.

This video conducts a forensic financial autopsy of Rome's monetary collapse, tracing the timeline from a trusted reserve currency to a worthless bronze washer.

More importantly, we analyze the specific assets that preserved wealth when the official money died: productive land, physical metals, practical skills, and local networks.

History shows that while currencies inevitably fail, the protocol for surviving the collapse remains remarkably consistent.