Why the US Still Controls Iraq’s Dollar Pipeline

Why the US Still Controls Iraq’s Dollar Pipeline

Edu Matrix: 2-20-2026

In a recent Edu Matrix video, Sandy Ingram sheds light on a complex and critical issue that has significant implications for Iraq’s economy and sovereignty.

The United States has maintained control over Iraq’s oil revenue since the 2003 Iraq War, a situation that has far-reaching consequences for the country’s financial independence.

Why the US Still Controls Iraq’s Dollar Pipeline

Edu Matrix: 2-20-2026

In a recent Edu Matrix video, Sandy Ingram sheds light on a complex and critical issue that has significant implications for Iraq’s economy and sovereignty.

The United States has maintained control over Iraq’s oil revenue since the 2003 Iraq War, a situation that has far-reaching consequences for the country’s financial independence.

In this blog post, we’ll delve into the intricacies of this arrangement and explore its historical context, implications, and the tensions it has created.

Iraq is a wealthy nation thanks to its vast oil reserves. However, the country’s oil sales are conducted internationally in US dollars, and these funds are not deposited directly into Iraqi banks. Instead, they are held in an account at the Federal Reserve Bank of New York.

Although this account belongs to Iraq, it is subject to stringent US oversight and regulatory controls. This arrangement was initially designed to ensure transparency, prevent corruption, and reassure international creditors after Ssdaam Hussein’s regime.

The US control over Iraq’s oil revenue has significant implications for the country’s economy.

The arrangement effectively gives the US leverage over Iraq’s financial flows and economic sovereignty. Iraq cannot freely use its oil revenue without passing through US financial scrutiny, as the US system enforces compliance with sanctions, anti-money laundering, and counterterrorism regulations.

This control has real consequences, affecting Iraq’s ability to conduct dollar transactions and forcing it to tighten its banking and currency auction practices under US pressure.

The US control over Iraq’s oil revenue has also caused tension with neighboring Iran, which views Iraq as lacking full financial independence.

To understand the historical context of this arrangement, we need to look back at Iraq’s invasion of Kuwait and subsequent conflicts, which led to international intervention and coalition forces demanding financial safeguards.

The US decision to hold Iraq’s oil revenues in New York was partly to protect Iraq from lawsuits and financial claims by other nations that participated in the coalition.

Despite being controversial, this system remains a cornerstone of Iraq’s economic framework, demonstrating the ongoing influence of the US over Iraq’s financial sovereignty.

The arrangement has been in place for nearly two decades, and its implications continue to be felt today. As Sandy Ingram’s video highlights, this is a complex issue with multiple stakeholders and interests at play.

The US control over Iraq’s oil revenue is a complex and multifaceted issue that has significant implications for Iraq’s economy and sovereignty. While the arrangement was initially designed to ensure transparency and prevent corruption, it has effectively given the US leverage over Iraq’s financial flows and economic sovereignty.

As we continue to navigate the intricacies of global politics and economies, it’s essential to understand the historical context and ongoing implications of this arrangement. For further insights and information, watch the full Edu Matrix video featuring Sandy Ingram.

https://dinarchronicles.com/2026/02/20/edu-matrix-why-the-us-still-controls-iraqs-dollar-pipeline/

Accountant Breaks Down (Possible) Taxes After the Dinar RV

Accountant Breaks Down Taxes After the Dinar RV

Dinar For Dummies: 2-20-2026

The Iraqi dinar investment community has been a topic of interest among investors for several years, with many people drawn to its potential for significant financial returns.

However, what sets this community apart is not just the potential for profit, but the strong spiritual undercurrent that drives many of its members.

Accountant Breaks Down Taxes After the Dinar RV

Dinar For Dummies: 2-20-2026

The Iraqi dinar investment community has been a topic of interest among investors for several years, with many people drawn to its potential for significant financial returns.

However, what sets this community apart is not just the potential for profit, but the strong spiritual undercurrent that drives many of its members.

In a recent video discussion between two experienced investors, the spiritual guidance behind the investment, the supportive community that has formed around it, and the critical tax implications for investors were explored in depth.

At the heart of the conversation was Heather North, co-founder of Kingdom Economic Builders, who shared her personal journey into the dinar investment. Heather’s entry into this investment arena began in 2020, guided by spiritual direction.

Her experience is not unique; many investors in the dinar community report receiving divine confirmations, dreams, or visions that have encouraged their investment decisions. This shared spiritual experience has fostered a unique bond among community members, creating a supportive network that goes beyond a typical investment group.

Heather’s background in accounting and business management brings a valuable perspective to the discussion, particularly when it comes to the tax implications of investing in the Iraqi dinar.

A crucial point highlighted in the conversation is the tax treatment of profits from foreign currency investments like the dinar.

According to Heather’s research into tax codes and relevant court cases, gains from such investments are generally considered ordinary income rather than capital gains under IRC Section 988.

This distinction has significant tax implications for investors, as it means that higher tax rates may apply, and the benefits typically associated with capital gains will not be available. This could result in substantial tax liabilities for investors who are not prepared.

The discussion also touched on the potential for future changes in tax law, particularly in the context of political shifts and the anticipated revaluation of the Iraqi dinar.

Heather stressed the importance of understanding tax obligations and seeking knowledgeable advice to navigate these complexities and avoid costly mistakes or audits.

The conversation speculated on broader themes, including the role of government and the IRS, and the possibility of tax system restructuring. While Heather remains skeptical about the abolition of the IRS, she is open to the idea of reforms that could impact how investments like the dinar are taxed.

As the discussion drew to a close, both participants shared their perspectives on the timeline for the Iraqi dinar’s revaluation.

While they sense a growing spiritual and geopolitical momentum, particularly around March, they acknowledge the uncertainty surrounding the exact timing of the event. Heather emphasized the value of the community and collaboration among investors, highlighting the importance of sharing insights and supporting one another through what is seen as a long but promising journey.

In conclusion, the Iraqi dinar investment is more than just a financial opportunity; it’s a community driven by shared spiritual experiences and a commitment to mutual support.

As with any investment, understanding the tax implications is crucial, and the dinar investment is no exception.

With the potential for significant returns comes the need for careful planning and informed decision-making. For those looking to dive deeper into this topic, watching the full video discussion on Dinar For Dummies is a valuable next step.

Bruce’s Big Call Dinar Intel Thursday Night 2-19-26

Bruce’s Big Call Dinar Intel Thursday Night 2-19-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight - it is Thursday, February 19th, and you're listening to the big call. Thanks for tuning in everybody

All right, there are a couple things I want to talk about tonight before we get into the specifics of our timeline. And that is, there's been a lot of discussion about is there a difference between what we call redemption centers?

Excuse me. Get all choked up here, redemption centers and exchange centers. I usually call them exchange locations and banks. So let me go through that so you guys understand it, but there might be a little question out there about it.

Bruce’s Big Call Dinar Intel Thursday Night 2-19-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight - it is Thursday, February 19th, and you're listening to the big call. Thanks for tuning in everybody

All right, there are a couple things I want to talk about tonight before we get into the specifics of our timeline. And that is, there's been a lot of discussion about is there a difference between what we call redemption centers?

Excuse me. Get all choked up here, redemption centers and exchange centers. I usually call them exchange locations and banks. So let me go through that so you guys understand it, but there might be a little question out there about it.

Now banks, we talk about bank branches. What I'm encouraging big call universe to do is to go to redemption centers, and what is the difference?

Redemption centers can be located in conjunction with a bank branch, meaning connected to physically connected to a bank branch. It can be a completely separate building, not connected to a bank.

And then, of course, you have regular bank branches that you do your normal retail banking in.

There are, as you guys know, Wells Fargo used to call their wealth management offices just that, and those were offices maybe where they didn't even have bank branches, which is the case in my state. They don't have any retail banking in the state, they only have wealth management, and our newest term that Wells’ is using for wealth management is premier banking. Premier banking.

Now, what is the difference in all of that?

Redemption centers are termed to that. Because not only do you do currency exchange in them, but you also do the redemption of bonds and redemption of Zimbabwe notes - and the Zimbabwe currency which we have are also a form of bond.

They're like a bearer bond. The reason is because, on the currency itself, it says payable to the bearer of so in that sense, the Zimbabwe currency we have is, designed to be used and transacted like a bearer bond

Now, the redemption centers, as I mentioned, can be completely separate buildings can be standalone buildings can be in strip centers. It can be so many different and we have so many of those in North America, specifically in the contiguous 48 states. We had 26,900 Now they have moved a few they've changed a few locations. They've modified a few locations. All of this has been ongoing for the last several months.

Even in the last few weeks, there have been some changes. But the concept of these redemption centers is that they're for redemption of Zim, which cannot be done at a bank branch.

Okay, so there's a distinction, right there? Banks on Zim, no -- redemption centers? Yes.

Remember, some redemption centers are connected to the bank itself. It could be in separate offices, even within the same building as the bank. Some have separate entrances. Some don't, but you'll figure that out based on the location that is close to your zip code when you call to set your appointment.

All right, what else are there? Any other distinctions why redemption centers, the Iraqi dinar, has a screen rate at the bank, a screen rate at the redemption center, and they have a sort of a back screen rate at the redemption center that is a contracted rate. We use the term contract rate,

it's not, it's not at the bank. It's only at the redemption center, at a much, much higher rate than the redemption center front screen would be, as well as it's way higher than the than the bank screen rate would be on the dinar.

The point is, if you have Iraqi Dinar and you have Zim, there's no question that you absolutely need to go to a redemption center, you'll get the rate that we've talked about on the zim for the last several years, and you'll get a very high rate that, seemingly in the last couple of days, has changed again, and it is tied again to the per barrel price of oil that we understand that is selling from Iraq, meaning the oil that they have the sale price of their oil per barrel.

Okay, so it has gone up. It's gone down. It's all but it'll be quite a bit higher, quite a bit higher than screen rate at the bank. Okay, so when we say exchange centers or redemption centers, it's for both - currency and Zim and what about sheet bonds? Let’s say you have not transacted your bonds, but you have a box of bonds. These are sheet length bonds.

It could be yellow Dragon, Red Dragon, gold dragon. Bonds, it could be German bonds, they could be Peruvian, gold bonds. It could be anything. It could be any number. There's so many kinds of bonds. Well, the redemption centers have a person that is skilled and knows how to transact sheet bonds as well.

So when you set up your appointment, when you talk real live person, which should be at the redemption center, zip code indicates you'll be going, when you connect with that person, you'll let them know, by the way, in addition to currency, I also have sheet bonds, if you do, obviously, if you don't, you know, but if you do, say, I have a box, or have two boxes, or whatever you have, sheet bonds, and just tell them what kind they are,

tell them if they're railroad bonds, whether they're Germans, whether they're, you know, gold Dragon, Yellow Dragon, Red Dragon, whatever type of bonds they are, just let them know the kind of bond – and that way they'll be prepared for you, and they'll allow additional time for you at the redemption center, because it'll take a while to process those bonds and make sure that they are legitimate. Make sure you're legitimate. All of that - if you don't have them don't worry about it. You've got Zim no problem - That's all what they're involved in.

So I wanted to make that distinction so everybody understands that these redemption centers are where we exchange our currency and redeem our Zim as well.

All right, and we don't know how many currencies there'll be that will be going up in value. It was we had 24 at one time. We had 28 we had 33 and it might be as many as 40 or 41, currencies that will actually be going up in value. That will be, I mean, there's a few out there that you want. I wonder if that's one of them. I wonder if the Indian rupee is one of them. Yep, I think so.

So we'll see there are a lot of mainly the five or six or seven - ones that we know about, that we've been talking about for years are definitely there and probably a few others that we hadn't talked about the Philippine Peso. So thought about so many other currencies, right? I mean, I can't even list them all. Whatever you have, bring it

Now. What about ? This is interesting. What about our new USN - our new asset backed dollar?

It should be up and out there, whether it's discussed openly, publicly or not, yet -- we expect that to be out and useable starting Monday, Monday,-- today is Thursday, not too far away -- Friday, Saturday, Sunday. It's only four days away right

Now -- We have talked about NESARA the use of the EBS, nobody's telling us right now, when EBS will get activated -when some disclosure will come out using the EBS, what will be disclosed? What will be brought out? What about NESARA? How much of NESARA will be brought out in the first week or two?

What about debt forgiveness ? Are we going to see that coming in the way of zeroed out credit cards, zeroed out mortgages, I would say yes and yes, but we don't know if it's going to still be this month, or whether that happened a little bit later in March. We don't know yet. We believe that a lot of this is going to initiate still in the month of February, this month, all right, so what else is out there?

There is a substantial claim that is taking place and should be complete over the weekend that's really going to be important.

We know that we've got peace processes going on in Gaza, in the Gaza strip between, obviously, between Israel and Hamas. Hopefully they're coming to the party and agreeing to the terms of the peace accord.

We have other things happening with Russia and Ukraine, supposedly have reached an agreement. We'll see if that gets signed or is signed already,

And we know that Iran is like a thorn in our side, and that thorn needs to be removed, I would look for them to come to party and make and come to an agreement. If not, they'll have -- they'll have some action that will take place.

So I think everything we are wanting to wrap up should wrap up pretty much by the weekend. So the next three or four or five days should be wrapped up. That's what our hope is.

Because do we need Cuba to come to the party? We need Iran? I have heard Yes, so we'll see how that goes progressing over the next few days, we have heard that in talking with our very, very top sources, that if everything gets done as we anticipate by Sunday, the end of the Olympics, the end of the closing ceremonies, we could be looking at being notified Monday or Tuesday of this coming week

So everything should occur for us. As a kickoff of the emails, we would include the 800 numbers Monday or Tuesday of this coming week -- Bondholders were supposed to have been paid today, where they could see the money in their accounts. We have not verified that that has been the case today, but I think they probably will get to see the funds in their accounts over the weekend. I do believe they will not get access to those funds until we get notified with our 800 numbers. It's supposed to be a modified shotgun start over a three day period and those days could very well be Sunday, Monday and Tuesday.

That's the very latest information that we've received, and we thought it could go sooner, as in this week, but it looks much more like this week, with Sunday, Monday, Tuesday being very much in play, still in the month of February.

So I think that's good. We should see that should see some mention or some activation of the USN currency, our new asset backed currency, they're not going to call it gold backed, even though gold is one of the assets that is backing the value of our new USN dollar and USTN, physical folding money is already in bank and redemption centers has been for a year or more.

So that's all knocked out ready knocked out for us that when we go in for our redemption and exchanges of currency.

So is there anything else to bring up right now? I think I've covered I wanted to cover tonight. I'm going to say Thank you Sue and thank you Bob for making your time available to join us, and big call universe for being out there and listening to the big call for we're in our 15th year now and thank you for that - and I think what we've had since tonight's Thursday night -- Tuesday night could be very interesting for us -

We plan to have a call Tuesday, but we also think at this point, I hope it should be a celebration call, so we'll see, we'll see what happens between now and Tuesday, it's five days. There's a lot of things that can happen and hopefully we will get everything that we're looking to receive right there toward the end, we're getting toward the end of the month these things are / we're supposed to fall into and have in the month of February. So that's the good news.

We're getting closer and closer every day, and I think we're almost I would think, So let’s do this. Let's pray out the call, and then we'll look forward to seeing what happens between now and Tuesday, because the way it looks right now, everything's going to happen between now and the weekend that opens up Monday abd Tuesday for us to be notified , and we'll see how that comes together.

Well, good night everybody, and have a great weekend. Pay attention. Watch the closing ceremonies, and we will on Sunday, and we'll look forward to seeing what happens for us this week. Alrighty, so thanks so much everybody for listening, and we will. We'll talk to you on Tuesday, and God bless you have a great weekend.

Bruce’s Big Call Dinar Intel Thursday Night 2-19-26 REPLAY LINK Intel Begins 57:47

Bruce’s Big Call Dinar Intel Tuesday Night 2-17-26 REPLAY LINK Intel 59:49

Bruce’s Big Call Dinar Intel Thursday Night 2-12-26 REPLAY LINK Intel Begins 1:04:50

Bruce’s Big Call Dinar Intel Tuesday Night 2-10-26 REPLAY LINK Intel Begins 1:23:13

Bruce’s Big Call Dinar Intel Thursday Night 2-5-26 REPLAY LINK Intel Begins 1:30:40

Bruce’s Big Call Dinar Intel Tuesday Night 2-3-26 REPLAY LINK Intel Begins 1:06:46

Bruce’s Big Call Dinar Intel Thursday Night 1-27-26 REPLAY LINK Intel Begins 1:26:36

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26 REPLAY LINK Intel Begins 1:23:23

Bruce’s Big Call Dinar Intel Thursday Night 1-22-26 REPLAY LINK Intel Begins 1:19:00

Bruce’s Big Call Dinar Intel Tuesday Night 1-20-26 REPLAY LINK Intel Begins 1:07:15

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26 REPLAY LINK Intel Begins 1:05:30

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Seeds of Wisdom RV and Economics Updates Friday Afternoon 2-20-26

Good Afternoon Dinar Recaps,

Oil Spike Signals Volatility: Markets Reprice Middle East Risk

Energy, gold, and the dollar surge as geopolitical tensions ripple across global markets.

Good Afternoon Dinar Recaps,

Oil Spike Signals Volatility: Markets Reprice Middle East Risk

Energy, gold, and the dollar surge as geopolitical tensions ripple across global markets.

Overview

Global markets reacted sharply to escalating tensions in the Middle East amid rising fears of potential U.S. military action involving Iran. Brent crude surged to multi-month highs, gold climbed on safe-haven demand, and equities retreated as investors shifted toward defensive positioning.

The U.S. dollar strengthened on capital inflows seeking stability, reflecting how quickly geopolitical risk can reshape asset flows.

As volatility widens, markets are repricing energy exposure, inflation expectations, and central bank policy paths.

Key Developments

1. Oil Prices Climb on Supply Risk

Brent crude rallied as traders priced in the possibility of supply disruption through key transit routes. Even the perception of instability in the region can tighten global energy markets.

2. Gold Attracts Defensive Flows

Gold rose alongside oil, signaling classic risk-off behavior as investors sought protection against uncertainty and potential inflation shocks.

3. Equities Pull Back

Global stock markets declined as risk appetite weakened. Energy-sensitive sectors faced volatility while defense and commodity-linked assets outperformed.

4. U.S. Dollar Strengthens

The dollar benefited from safe-haven flows, reinforcing its role as the primary liquidity refuge during geopolitical turbulence.

Why It Matters

Energy markets sit at the core of global inflation dynamics. A sustained oil rally could:

• Reignite inflation pressures in major economies

• Complicate central bank rate-cut timelines

• Increase transportation and manufacturing costs

• Raise geopolitical risk premiums across asset classes

Energy shocks historically ripple across currency markets, sovereign debt yields, and commodity pricing structures.

Volatility in oil is rarely isolated — it is systemic.

Why It Matters to Foreign Currency Holders

For currency and asset observers, geopolitical escalation introduces structural considerations:

• Safe-haven demand reinforces dollar dominance — short term

• Elevated energy prices strain import-dependent currencies

• Commodity exporters may see temporary FX support

• Central banks could delay easing cycles due to inflation risk

Geopolitics Hits the Tape: Oil and Gold Surge

If energy inflation persists, it may accelerate reserve diversification conversations and strategic asset reallocation — particularly among countries seeking insulation from volatility tied to geopolitical flashpoints.

Implications for the Global Reset

Pillar 1: Inflation as a Structural Force

Energy price spikes can reignite inflation, limiting monetary flexibility. Central banks may be forced into defensive policy stances, slowing economic momentum.

Pillar 2: Asset Rotation and Reserve Strategy

Heightened geopolitical risk increases demand for tangible assets and alternative stores of value. While the dollar strengthens during crisis moments, prolonged instability can also fuel long-term diversification efforts.

The market reaction underscores how quickly geopolitical risk can reshape financial architecture — not gradually, but abruptly.

This is not just market volatility — it is geopolitical risk translating directly into monetary consequences.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Guardian -- "Oil prices rise amid fears of US strikes on Iran"

Reuters -- "Oil and gold rally as Middle East tensions escalate"

~~~~~~~~~~

Indo-Pacific Pivot: U.S.–Indonesia Trade Pact Nears Breakthrough

Strategic minerals, semiconductors, and supply chains move to the center of global economic realignment.

Overview

The United States and Indonesia are moving closer to a broader trade agreement after cementing a series of strategic economic partnerships focused on critical minerals, semiconductor investment, and supply chain cooperation.

The developing framework positions Indonesia as a rising Indo-Pacific economic power while strengthening U.S. engagement in Southeast Asia amid intensifying global trade competition.

As rival economic blocs expand influence, this partnership signals a deliberate recalibration of supply chains and geopolitical alignment.

Key Developments

1. Critical Minerals Cooperation Expands

Indonesia — rich in nickel and other battery inputs — is deepening collaboration with the U.S. to support electric vehicle and advanced manufacturing supply chains.

2. Semiconductor Investment Push

The agreement outlines expanded cooperation in semiconductor development and technology infrastructure, a sector at the heart of modern industrial policy.

3. Strategic Indo-Pacific Engagement

The U.S. is reinforcing economic ties with Jakarta as part of a broader Indo-Pacific strategy designed to balance regional trade dynamics and reduce concentration risks.

4. Balanced Foreign Policy Positioning

Indonesia continues to maintain diplomatic and trade relations across multiple global partners, positioning itself as a bridge economy rather than a bloc-aligned state.

Why It Matters

This partnership extends beyond bilateral trade — it is part of a structural shift in global economic architecture.

• Diversifies supply chains away from single-country dependency

• Strengthens U.S. access to critical mineral inputs

• Expands semiconductor production networks

• Reinforces Southeast Asia as a manufacturing and trade hub

As global trade corridors evolve, Indonesia’s role in energy transition materials and industrial supply chains is becoming strategically central.

Trade alignment is now as much about resilience as it is about growth.

Why It Matters to Foreign Currency Holders

For currency and asset observers, the U.S.–Indonesia partnership reflects deeper monetary and trade currents:

• Increased local currency settlement opportunities

• Diversified capital flows into emerging Southeast Asia

• Reduced exposure to concentrated trade corridors

• Greater geopolitical hedging within supply chain finance

As supply chains realign, capital follows infrastructure. This dynamic influences FX demand, commodity pricing, and long-term reserve diversification strategies.

Trade Realignment Signals the Next Phase of Global Restructuring

Implications for the Global Reset

Pillar 1: Supply Chain Multipolarity

Global production networks are no longer concentrated within a single corridor. Expanding partnerships with Indonesia reduces systemic bottlenecks and supports diversified manufacturing nodes.

Pillar 2: Resource-Backed Trade Influence

Control and access to critical minerals increasingly shape geopolitical leverage. Indonesia’s position in nickel and battery inputs places it at the heart of energy-transition economics.

The U.S.–Indonesia framework reflects an era where trade agreements are strategic architecture — not just tariff negotiations.

This is not just diplomacy — it’s supply chain sovereignty in motion.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Australian -- "Indonesia, US lock in deals as trade agreement nears"

Reuters -- "US and Indonesia strengthen strategic economic ties in Indo-Pacific"

~~~~~~~~~~

BRICS Pay Faces Reality Test: Can the Alliance Challenge Dollar Dominance?

Ambition meets execution as the 11-member bloc attempts to build a parallel payment system.

Overview

The BRICS alliance is pursuing an independent cross-border payment system known as BRICS Pay, aimed at reducing reliance on the US dollar and promoting local currency trade among member nations.

Designed as an alternative to Western-dominated financial messaging networks like SWIFT, the initiative seeks to strengthen economic sovereignty and shield member states from sanctions and tariff pressures.

However, while the vision is ambitious, the execution faces structural, political, and economic hurdles that could determine whether BRICS Pay becomes transformational — or symbolic.

Key Developments

1. Strategic Objective: Reduce Dollar Dependency

BRICS Pay is envisioned as a cross-border settlement mechanism facilitating trade in local currencies, supporting the bloc’s broader de-dollarization narrative.

2. Alternative to Western Infrastructure

Unlike SWIFT — which serves as a messaging system backed by dollar liquidity and global banking networks — BRICS Pay aims to provide integrated settlement pathways independent of Western influence.

3. Multipolar Financial Ambition

The system aligns with the bloc’s push toward a multipolar economic order, where trade settlement mechanisms are diversified beyond dollar-centric channels.

Why It Matters

Building a payment system is not just about software — it requires liquidity depth, currency trust, political alignment, and trade scale.

BRICS Pay faces three immediate structural challenges:

Trade Volume Imbalance

China dominates intra-BRICS trade flows. If transaction volume is disproportionately concentrated in one economy, it could shift operational influence toward that nation — potentially undermining the bloc’s principle of multipolar balance.

Without sufficient trade flow among all members, liquidity pools could remain shallow and uneven.

Currency Trust and Liquidity

The US dollar remains the most trusted and liquid global currency. Even countries critical of US policy continue to settle trade in dollars due to stability, convertibility, and deep capital markets.

For BRICS Pay to succeed externally, counterparties must trust participating currencies — a hurdle that cannot be solved solely by political agreement.

Divergent Economic Priorities

Member economies vary significantly:

• China prioritizes export dominance

• India balances Western partnerships with domestic growth

• Russia and Iran seek sanctions insulation

• Other members hold mixed or evolving strategic goals

These divergent priorities complicate harmonized policy development and could slow implementation.

Why It Matters to Foreign Currency Holders

For global currency observers, BRICS Pay represents an experiment in financial system redesign.

• It tests the durability of dollar dominance

• It highlights global appetite for settlement diversification

• It underscores rising geopolitical fragmentation in finance

• It reveals structural limits of de-dollarization without liquidity parity

If successful, it would incrementally shift trade settlement patterns. If unsuccessful, it reinforces the entrenched power of dollar-based infrastructure.

Building a New System Is Harder Than Leaving the Old One

Implications for the Global Reset

Pillar 1: Infrastructure vs. Influence

Creating a payment system requires more than political alignment — it demands capital depth, credit markets, and currency stability. Without those, infrastructure alone cannot displace entrenched networks.

Pillar 2: De-Dollarization Realism

BRICS Pay reflects a broader shift toward financial multipolarity. However, replacing the dollar requires global trust — not just internal coordination.

The success or stagnation of BRICS Pay will serve as a real-world stress test of whether multipolar finance can match the scale and liquidity of the existing system.

This is not just about payments — it’s about the future architecture of global settlement power.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- "The Challenges That BRICS Pay Is Going To Face"

Reuters -- "BRICS nations explore alternatives to dollar-based payment systems"

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday 2-20-2026

TNT:

Tishwash: Except for Hamoudi, the coordinating framework withdraws its support from Maliki.

Iraqi sources reported on Thursday that some members of the Coordination Framework and Shiite blocs withdrew their support for Nouri al-Maliki’s candidacy, while only Humam Hamoudi, head of the “Abshir Ya Iraq ” bloc, remained in support of him.

Sources told Al-Araby TV, as reported by Al-Sa’a Network, that “some members of the coordinating framework and Shiite political blocs withdrew their support for Maliki’s candidacy, and only Humam Hamoudi, who heads the Abshir Ya Iraq bloc, which holds 4 seats in the Iraqi parliament, continues to support him .”

TNT:

Tishwash: Except for Hamoudi, the coordinating framework withdraws its support from Maliki.

Iraqi sources reported on Thursday that some members of the Coordination Framework and Shiite blocs withdrew their support for Nouri al-Maliki’s candidacy, while only Humam Hamoudi, head of the “Abshir Ya Iraq ” bloc, remained in support of him.

Sources told Al-Araby TV, as reported by Al-Sa’a Network, that “some members of the coordinating framework and Shiite political blocs withdrew their support for Maliki’s candidacy, and only Humam Hamoudi, who heads the Abshir Ya Iraq bloc, which holds 4 seats in the Iraqi parliament, continues to support him .”

The sources added that "the deadline given by the US Chargé d'Affaires, Joshua Harris, to the political leaders within the coordination framework ends today ."

She noted that "a meeting of the coordination framework was scheduled for last Monday, but it was postponed at the request of al-Maliki due to the expiration of the deadline, and it was postponed to Thursday ."

Against this backdrop, the coordinating framework may withdraw al-Maliki’s nomination or replace him with another candidate who does not face internal and external problems, and who is a figure acceptable to everyone .

US President Donald Trump had warned that Washington would not provide any assistance to Iraq if Maliki returned to power link

************

Tishwash: An Iraqi delegation will visit Iran soon... Gas supplies are completely cut off, and the heatwave will reveal the extent of demand.

The Ministry of Electricity announced the formation of an official delegation that will visit Iran soon to discuss the issue of gas supply in preparation for the summer season, given the existing need for it.

According to the ministry spokesman, Ahmed Moussa, "The gas supplies and quantities agreed upon with the Iranian side are still completely halted, which has led to the loss of more than 5,500 megawatts of generating capacity for the national grid."

He noted that "this stoppage directly affected a number of vital centers supplying the southern and central regions, in addition to the capital, Baghdad," explaining that "the current moderate temperatures have contributed to controlling the loads and providing relatively stable supply hours."

He stressed that “any fluctuation in temperatures will reveal the actual size of the demand, especially with the approach of summer, which requires full readiness of stations and an abundance of fuel,” noting that “the delegation that will leave for Iran will discuss the quantities that can be supplied to ensure the stability of the network during the peak of summer.”

Musa also said that "work is continuing on the liquefied gas platform project at Khor Al-Zubair port, and it is hoped that it will be completed by the beginning of next June," indicating that "the platform will secure about 500 million standard cubic feet per day, which will provide between 3,500 and 4,000 megawatts through combined and simple cycle power plants."

He spoke of "high-level coordination with the Ministry of Oil to supply some stations with national gas produced in the southern and central regions, especially the Basmaya station, as well as securing alternative fuel (gas oil) for stations capable of operating with it."

He added that "the demand for energy is witnessing a significant increase as a result of the expansion of electrical appliances, modern buildings and investment projects," stressing that "the growth of residential areas and the conversion of agricultural lands into residential areas, as well as the spread of slums, have become additional, rapidly increasing loads that put pressure on the electrical grid." link

Tishwash: Washington reduces its diplomatic presence in Iraq and Gulf states amid tensions with Iran

Two Iraqi and American officials said on Thursday that the United States has reduced the number of its diplomatic staff at its missions in Iraq and some Gulf states, taking precautionary measures against the backdrop of escalating regional tensions, without disclosing details about the size or nature of the reduction.

They added in an interview with Shafaq News Agency that the reduction included staff in a number of locations, while work continued in the remaining missions according to normal operational arrangements with a reduction in some staff and non-essential activities.

Meanwhile, an official at the US Embassy declined to comment on this news to Shafaq News Agency, saying only that "the US Embassy in Baghdad and the US Consulate General in Erbil are open, and our operations are proceeding as usual."

In response to questions about the status of the forces, an official at the US Central Command (CENTCOM), which is part of the US Department of Defense, told Shafaq News Agency that "the US military will not comment on personnel movements or troop status for reasons related to operational security and the safety of military personnel."

The moves come after US President Donald Trump posted on Truth Social on Wednesday, February 18, warning Britain against “giving away” the Diego Garcia base, saying the base could be needed in any military operation to deter a “potential attack” from Iran.

In parallel, several capitals escalated their warnings to their citizens against traveling to Iran and called on those already there to leave, with Polish Prime Minister Donald Tusk urging his citizens to leave Iran "immediately," warning of "an imminent risk of escalation."

The US State Department has also reiterated in recent security alerts its call for its citizens to "leave Iran now" in light of unrest and security risks.

This is happening while indirect nuclear talks continued in Geneva, mediated by Oman, without any announcement of a decisive breakthrough.

On the military front, Western reports said the US military is preparing for the possibility of operations that could last "for weeks" if Trump orders an attack, with official US expectations of an Iranian response and a shift in targeting beyond nuclear infrastructure.

In the same context, Axios quoted Israeli officials as saying that the government is preparing for the possibility of a large-scale confrontation that "could erupt within days," while informed sources spoke of different time estimates within the US administration. link

************

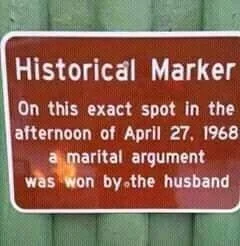

Mot: They ""Found that Spot"" again this Year!!!!

Coffee with MarkZ, joined by Mr. Cottrell. 02/20/2026

Coffee with MarkZ, joined by Mr. Cottrell. 02/20/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Good morning Mark and Mr. C and Mods!!!

Member: I say we rip out the words imminent and soon out of the dictionary post rv….lol

Member: Praying the RV is weeks or days instead of years

Coffee with MarkZ, joined by Mr. Cottrell. 02/20/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Good morning Mark and Mr. C and Mods!!!

Member: I say we rip out the words imminent and soon out of the dictionary post rv….lol

Member: Praying the RV is weeks or days instead of years

Member: IMO this is the quiet before the storm!

Member: Hi Mark, any update on the bonds sir? Thanks

MZ: No real bond news but I did hear something from the group side last night. I had a very good update from some folks in a very large group. I won’t deal in specifics to get anyone in trouble (including myself)

MZ: They made the comment that it is finally time and they are moving some key people that have not been moved in years…to start handling exchanges. Travel started today for a couple of key people….they are headed west. This is something I have been waiting to see….and I just saw it. I am exceptionally excited. Wait and see…..this is right now in the rumor category.

MZ: This is a “Currency Group” that comes at the same time as the sovereigns

MZ: No news on CMKX

Member: Were you surprised to hear that Andy (Schectman) doesn’t think we will have a gold backed currency?

MZ: It will be a gold backed Treasury that backs it. It will be kind of a hybrid system. We will get Andy to explain his thought process on that one.

Member: Judy Shelton says the US will have gold backed Treasuries by July 4th this year.

Member: Charlie Ward saying there are bank runs happening now???

Member: My Credit Union is closing 3/7 - 3/9/26. they say they are updating the system. Debit & Credit cards will work & ATMs, but the app won't work, & express 24 line won't work, no online banking. RV?

Member: If BRICS nations are abandoning the $ and using national currencies 1-1 then we are reverse issuing we're repoing the $ home, question is at what rate, bonds first currencies last

Member: Yesterday Dr Scott said that dinar will go at the same time as we reset to gold. Isn’t it possible that the currency will go first and then reset?

Member: I’m thinking the Clarity Act needs to be passed BEFORE we RV?

Member: Ramadan : Start Date: March 17, 1991 End Date: Approximately April 15/16, 1991

MZ: don’t worry…they have revalued during Ramadan before. I think Kuwait revalued during Ramadan

Member: Hey Mark, did I hear $59,300US per million Dong?

MZ: there are reports that someone is going to exchange for $59,300US per million Dong at the end of the month. This is the figure that the bank gave them. Their possible exchange is scheduled for the first of next week….so we will find out if this is true or not. I still think the rate will be way higher than that. There have been rates populating and disappearing on bank screens.

MZ: In Iraq: “11 members of the framework informed Maliki of their withdrawal of support for him to assume the Presidency of the new government” When the elect the President the next step will be Prime Minister.Maliki is expected to step down.

Member: What is HCL law in Iraq?

MZ: Its revenue sharing with the Kurdish region. Iraq is kinda 2 countries in one with the Kurdish region. We have been told for the last 20 years when we see HCL pass…within hours or days we would see the revaluation of the dinar.

Member: Oil Export Revenue sharing. Saudi Gives its citizens Funds based upon oil exports, HCL would do the same in iraq region. Hint: Oil belongs to the People. Kaziemi mentioned that when oil contract done

Member: Are your redemption center folks working this weekend?

MZ: They are on call this weekend. These folks also work in wealth management.

Member: Was told by a friend who works in banking from Venezuela. She asked if I still had my currency, she said I am about to be filthy rich.

Member: I'm betting we'll have a relatively quick resolution in Iran in less than 30 days. IMO Vietnam and Indonesia in are going to reval with Iraq. Venezuela is doing EVERYTHING wanted.

Member: Frank26 had some decent bank stories on YouTube shorts recently.

Member: big astrological alignment today. Saturn Neptune conjunction. every 36 years they come together. The Berlin Wall fell during the last one.

Member: I have been questioning my sanity...thinking I might be the most gullible person to exist some days...other days I am on top of the world thinking I am a genius. which is it? lol

Member: I wish everybody a great weekend!!

Member: Mark and Mods. Thank you all for keeping us sane!!

Mod: BREAKING NEWS: MarkZ's WEEKEND AND TRAVELING email address: Don't Write Me@NeverOnWEEKENDS.Com SERIOUSLY, MARK NEEDS A LITTLE TIME FOR HIMSELF FOR REST AND REC. THANK YOU!

Mr. Cottrell and CBD Guru’s join the stream today. Please listen to replay for their information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Friday 2-20-2026

KTFA:

Clare: Parliament summons Central Bank Governor to follow up on financial reforms

Independent/-

Member of Parliament, Jassim Al-Moussawi, revealed that there is a step to host the Governor of the Central Bank of Iraq inside Parliament, with the aim of following up on the bank’s position on the financial and economic reforms required in the country.

Al-Mousawi stressed, according to the official newspaper, that the purpose of hosting is not related to the weakness of the state’s financial balance, but rather comes as a precautionary measure to avoid any potential crisis and to ensure the sustainability of financial and monetary stability during the next stage.

KTFA:

Clare: Parliament summons Central Bank Governor to follow up on financial reforms

Independent/-

Member of Parliament, Jassim Al-Moussawi, revealed that there is a step to host the Governor of the Central Bank of Iraq inside Parliament, with the aim of following up on the bank’s position on the financial and economic reforms required in the country.

Al-Mousawi stressed, according to the official newspaper, that the purpose of hosting is not related to the weakness of the state’s financial balance, but rather comes as a precautionary measure to avoid any potential crisis and to ensure the sustainability of financial and monetary stability during the next stage.

He pointed out that through this step, Parliament seeks to review the progress of the reform procedures that were implemented in the previous government and are still being worked on at the present time, stressing that the MPs’ interest in the economic crisis does not necessarily mean a weak financial situation, but rather aims to strengthen reserves.

Al-Moussawi added that the parliamentary concern stems from the possibility of oil imports being subject to a future decrease or the region being affected by any tensions or conflicts that may negatively affect the economic situation, explaining that these measures are aimed at ensuring the continuation of the normal economic situation, providing the entitlements of employees, and the continuity of running public affairs without any problems.

This step reflects the parliament's keenness to monitor the state's financial performance and to ensure the central bank's readiness to deal with any potential economic changes, in order to maintain the stability of the local market and the sustainability of public services. LINK

***************

Clare: Fuad Hussein: War with Iran would be a disaster... and 3 million barrels of oil production are threatened with being halted.

2/18/2026

Foreign Minister Fuad Hussein warned on Wednesday (February 18, 2026) of the repercussions of any potential military confrontation in the region, stressing that the American military mobilization has clear objectives, and that the outbreak of war with Iran would lead to a “regional and global catastrophe.”

Hussein said in a televised interview followed by “Baghdad Today” that any military conflict would lead to the cessation of about three million barrels of oil exports, which would directly affect Iraq’s imports and financial revenues, given the country’s almost complete dependence on oil revenues as a primary source of hard currency.

He explained that if war were to occur, it would not be limited in its impact, but would cause global disturbances whose course is difficult to predict, noting that the Iranian reaction in such a scenario is unpredictable, which increases the magnitude of the risks.

The Foreign Minister pointed out that Iraq is not at war, and that pushing it into the throes of a regional conflict would pose a grave threat to its internal stability, calling on all parties to work hard to prevent the region from sliding into a comprehensive confrontation.

He explained that the American side played a direct role during the past two years in preventing Israel from targeting Iraqi armed factions, stressing that the Prime Minister succeeded in calming the factions and avoiding escalation.

On the economic front, Hussein stressed that any measure that would cut off the flow of dollars would create a major cash crisis within Iraq, explaining that the main source of dollars is oil export revenues, making regional stability a crucial condition for protecting the national economy. LINK

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man There's no hype...They've been really quiet about [the monetary reform items] but we know all about them because we've been studying all of these things. Reforms advance steadily and I believe the results are emerging quietly. Remember what Alaq said when they did exchange rate [change], he said it was effective immediately and that's what I would expect to happen again. No fanfare, no hype, just bottom line. We're just going to see it happen. I think that's by design.

Jeff Community Comment: "They're not going to do anything important during Ramadan." The country of Kuwait did perform their currency reinstatement during the religious celebratory period of Ramadan in 1991. Kuwait did their currency revaluation on March 24th during their Ramadan period which started on March 17, 1991...So your statement is completely incorrect...When people are incorrect, we will take the time to help you get correct. That's what this is about.

Jeff They're preparing to revalue. When we've looked at previous years budgets, they've never analyzed it at this level. They've never seen them bring the central bank governor in doing this type of analysis for a budget. They're about to go international, revalue the currency. That's why things are being studied carefully reviewed at this level, all the way to the level of having the central bank governor in there, the money man.

*****************

Jon Dowling & Prophet Randy Robinson Discuss Timing Of The Global Reset For The Wealth Transfer

2-20-2026

Randy and Jon warn of an imminent collapse of fiat currency systems, which could lead to a more controlled, technologically driven economy.

Seeds of Wisdom RV and Economics Updates Friday Morning 2-20-26

Good Morning Dinar Recaps,

Lagarde Holds the Line: ECB Independence Tested as Politics Swirl

ECB President Christine Lagarde shuts down resignation rumors, reinforcing central bank independence as European politics intensify ahead of France’s election cycle.

Good Morning Dinar Recaps,

Lagarde Holds the Line: ECB Independence Tested as Politics Swirl

ECB President Christine Lagarde shuts down resignation rumors, reinforcing central bank independence as European politics intensify ahead of France’s election cycle.

Overview

Christine Lagarde signals no early departure from the European Central Bank despite mounting speculation.

Rumors tied her potential exit to the upcoming French presidential election and succession politics.

ECB officials publicly reaffirm confidence in her leadership and long-term focus.

The episode highlights renewed tensions between central bank independence and political influence across major economies.

Key Developments

Lagarde Reassures ECB Governing Council

ECB President Christine Lagarde told colleagues she remains fully committed to completing her mandate and would inform them first if she ever intended to resign. The clarification followed media speculation suggesting she might step down early — potentially affecting France’s central banking leadership before its next presidential election.French Political Dynamics Add Sensitivity

Reports indicated that an early exit could allow outgoing President Emmanuel Macron to influence key central bank appointments. Meanwhile, the announced departure of Bank of France Governor François Villeroy de Galhau has already opened space for political maneuvering. The far-right Rassemblement National criticized developments as undermining democratic choice, increasing scrutiny over institutional neutrality.ECB Officials Emphasize Stability and Continuity

ECB Vice-President Luis de Guindos and board member Piero Cipollone underscored Lagarde’s focus on long-term institutional initiatives, signaling continuity in monetary strategy. Their coordinated messaging reflects concern that even rumors can destabilize perceptions of independence at a time when inflation and financial stability remain central priorities.Broader Context: Global Central Bank Pressure

The situation unfolds amid heightened debate over central bank independence globally, including in the United States. As fiscal pressures mount and elections approach in multiple economies, the line between political leadership and monetary authority is increasingly under scrutiny.

Why It Matters

Central bank independence is foundational to global financial credibility. When markets perceive that political leaders may influence monetary leadership transitions, bond markets, currencies, and sovereign risk pricing react swiftly. Lagarde’s reaffirmation seeks to anchor stability in the euro area at a moment when political cycles threaten to blur institutional boundaries.

Monetary credibility is currency credibility — and currency credibility is global power.

Why It Matters to Foreign Currency Holders

Readers holding foreign currencies in anticipation of a Global Reset should pay attention to governance stability within major reserve currency zones.

The euro’s international role depends heavily on ECB independence.

Political interference could weaken confidence in euro-denominated assets.

Stable leadership continuity strengthens the euro’s case as an alternative reserve asset to the U.S. dollar.

For foreign currency holders, the perception of institutional integrity may influence future reserve realignments.

When alliances expand, currencies realign and markets recalibrate.

Implications for the Global Reset

Pillar 1: Institutional Credibility and Reserve Status

The euro’s ability to expand its global role depends not just on economic scale but on trusted governance. Clear separation between politics and monetary policy reinforces its standing as a reserve alternative in a multipolar system.Pillar 2: Political Cycles vs. Monetary Stability

As elections approach in major economies, central banks face increased scrutiny. If political influence over appointments becomes normalized, markets may reassess risk premiums on sovereign debt and currencies — a potential catalyst in broader financial restructuring.

This is not just diplomacy — it’s monetary power being repositioned.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “ECB’s Lagarde signals no imminent exit as politics and central banks collide”

Reuters – “ECB policymakers defend central bank independence amid political scrutiny”

~~~~~~~~~~

U.S. Stablecoin Push Threatens BRICS De-Dollarization Strategy

Digital Dollarization Accelerates as Washington Advances Crypto Framework

Overview

The United States is moving closer to formalizing crypto regulation, and at the center of the debate is the expansion of USD-backed stablecoins. As Washington advances discussions around stablecoin yields and digital asset oversight, the ripple effects are being felt far beyond U.S. borders.

For BRICS nations, which have been actively pursuing de-dollarization strategies and alternative payment systems, the rapid growth of digital dollar instruments presents a new and potentially disruptive challenge.

Key Developments

White House Negotiations Continue

White House officials recently held a third round of talks with banking leaders and crypto policy experts regarding the Digital Asset Market Clarity Act. The central sticking point remains whether platforms such as Coinbase should be permitted to offer stablecoin yields.

Industry Divisions Deepen

Banks are pushing for a ban on stablecoin yield products, arguing that they threaten traditional deposit structures. Meanwhile, crypto industry leaders — including Crypto Council for Innovation CEO Ji Kim and Coinbase Chief Legal Officer Paul Grewal — described the discussions as constructive and cooperative.

Stablecoin Yields as a Global Magnet

If yields are approved under U.S. regulation, USD-backed stablecoins could become highly attractive to users in inflation-affected emerging markets. This would accelerate what analysts describe as “digital dollarization” — the migration of savings into dollar-denominated digital assets outside traditional banking channels.

BRICS De-Dollarization Faces New Headwinds

The BRICS bloc — led by major economies such as Russia, China, and India — has been building alternative financial rails, including central bank digital currencies (CBDCs), to reduce reliance on the U.S. dollar. A regulated and yield-bearing stablecoin market in the U.S. could undermine those efforts at the retail-user level.

Why It Matters

If the U.S. stablecoin push succeeds in locking in yield-bearing digital dollars, the shift won’t occur through government agreements — it will happen organically through consumer behavior. Individuals in unstable currency environments may simply choose higher-yielding, dollar-denominated digital assets.

That represents a bottom-up reinforcement of dollar dominance in the digital era.

The dollar may no longer need banks to expand — it now has blockchain rails.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching global monetary restructuring, this development highlights a critical reality: digital infrastructure may matter more than political alliances.

While BRICS nations pursue settlement systems and gold-backed frameworks, a yield-generating USD stablecoin ecosystem could quietly draw liquidity away from local currencies and into digital dollars.

This shifts the battlefield from trade agreements to wallet adoption.

Currency wars are no longer just about reserves — they’re about user adoption.

Implications for the Global Reset

Pillar 1: Monetary Sovereignty vs. Digital Market Forces

Governments may attempt to design alternatives to the dollar, but if individuals prefer USD-backed stablecoins for savings and yield, sovereignty strategies could weaken from within.

Pillar 2: Retail-Level Dollarization

Traditional dollarization often occurred through official banking channels. Stablecoins enable decentralized dollarization at scale, bypassing legacy systems and reshaping cross-border capital flows.

This dynamic complicates BRICS’ broader de-dollarization objectives and could slow momentum toward multipolar currency settlement systems.

The next phase of monetary power will be decided in digital wallets, not conference halls.

This is not just crypto regulation — it is global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- "US Stablecoin Push Threatens BRICS De-Dollarization Plans"

Reuters -- "White House holds talks with banks and crypto firms over stablecoin rules"

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Friday Morning 2-20-26

It's Not Just About Salaries... It's About "National Security": What Would Happen If Iraq Laid Off Its Employees?

Baghdad Today – Baghdad

Hardly a discussion takes place in Iraq without mentioning the "government employee"—their inflated numbers, their salaries that devour the budget, the growing talk of "zero productivity," and warnings of "economic collapse by 2030" if spending continues at this rate. In the background lies a rentier economy almost entirely dependent on oil, a fragile private sector, and a labor market where young people flee to government jobs as the only relatively safe haven.

It's Not Just About Salaries... It's About "National Security": What Would Happen If Iraq Laid Off Its Employees?

Baghdad Today – Baghdad

Hardly a discussion takes place in Iraq without mentioning the "government employee"—their inflated numbers, their salaries that devour the budget, the growing talk of "zero productivity," and warnings of "economic collapse by 2030" if spending continues at this rate. In the background lies a rentier economy almost entirely dependent on oil, a fragile private sector, and a labor market where young people flee to government jobs as the only relatively safe haven.

The simplistic idea is that the solution begins and ends with the employee: reduce their numbers, regulate their salaries, encourage some to take extended leave or early retirement, and public finances will automatically improve.

However, a deeper reading of the figures, along with the opinions of economic and legal experts, reveals that the picture is far more complex, and that the real question is not simply about the number of employees, but rather about the way the state is managed itself, and the intricate relationship between the public sector and the structure of the economy as a whole.

The Payroll Bill Grows With Every Budget... How Did We Get Here?

Over the course of nearly two decades, the Iraqi state has become the country's largest employer. Consistent official and local estimates indicate that more than 4,000,000 employees work today in various state institutions, including centrally funded ministries and departments, as well as institutions in the Kurdistan Region.

Meanwhile, the income of more than 10,000,000 citizens is directly or indirectly linked to the public treasury each month, through employee salaries, pensions, social safety nets, and various subsidies.

The imprint of this trend is clearly visible in successive budget figures. The wage bill and employee compensation consume a significant portion of operating expenditures, approaching half in some estimates when pensions and social security are included.

This means that the majority of public funds are allocated to current spending, while investment in infrastructure and essential services dwindles. With each increase in oil prices or revenue growth, the surplus is often reinvested in new appointments or salary increases, rather than in boosting the economy's productive capacity.

This trajectory was not accidental. After 2003, government employment was used more as a tool for social and political appeasement, a means to absorb the resentment of unemployment and buy stability, than as a tool for governance and development.

The widespread appointments often came in response to political and factional pressures, internal compromises, or electoral commitments, without any accompanying genuine restructuring of state functions or the establishment of a modern administrative apparatus.

The result was an overstaffed bureaucracy comprised of units with numbers exceeding their actual needs, and others suffering from staff shortages, particularly in health, education, and direct citizen services.

"Zero Productivity": A Simple Myth Masking Complex Problems

In this context, it has become easy to blame all economic crises on the government employee. "Estimated" tables proliferate on social media platforms, comparing the employee's salary with the output they are supposed to provide, then concluding with one catchy phrase: "The employee's productivity equals zero."

Economic expert Dirgham Muhammad urges caution in using this term. Speaking to Baghdad Today, he explains that employee productivity cannot be measured using the same metrics employed in factories and production lines, because a government employee, by the very nature of their work, provides a "public service," not a quantifiable commodity.

Attempting to reduce this service to a simple mathematical figure, he says, often leads to misleading conclusions.

Mohammed says that “the productivity of the Iraqi employee in state institutions cannot be measured by the traditional standards and measurements in circulation, because the government employee provides a public service and not a productive service in the commonly understood economic sense,” indicating that “what some people present in terms of numbers and measurements, especially the talk about the employee’s productivity being zero, is an unobjective and illogical proposition.”

He adds that employees are "tasked with managing state affairs, ensuring the continuity of work, and communicating with citizens, and there are no clear units of measurement by which the productivity of a government employee can be calculated," noting that "many employees of state departments work even during official holidays to accomplish their duties, which confirms that these proposals lack accuracy and responsibility and fall within the realm of merely stirring controversy."

This does not absolve the government apparatus of its inefficiency, but it shifts the discussion from condemning individual employees to critiquing the administrative structure itself.

The first problem lies in the unequal distribution of the workforce within the country, where thousands of positions are concentrated in offices and departments that do not require such a large number of staff, while health centers, schools, and service departments on the outskirts of cities and villages suffer from a severe shortage of doctors, teachers, engineers, and technicians.

The second problem is that the lack of digitalization and procedural modernization creates layers of paperwork that allow for a large number of employees trapped in a cycle of bureaucracy. If services were redesigned and automated, there would be a genuine need for fewer employees, but with more specialized and responsible roles.

In this sense, talk of "zero productivity" becomes more of an emotional description than an economic analysis. Yes, productivity is low in many areas, but the responsibility is distributed among job design, management style, work environment, and the monitoring and accountability system, and not solely on the employee as the weakest link in this structure.

2030: A Prophecy Of Collapse Or A Warning Of A Changeable Path?

Amidst soaring salaries and the state's near-total dependence on oil, a prophecy has circulated in recent years stating that "the Iraqi economy will collapse in 2030." Some treat this date as an inevitable fate, based on a linear reading of budget trends and financial deficits.

Dhirgham Muhammad describes this rhetoric as "irresponsible," pointing out that economic collapses don't occur according to fixed schedules, but rather as a result of a complex interplay of internal and external factors that cannot be confined to a single year.

He recalls that similar warnings were issued about ten years ago, and that talk of an "imminent collapse" was repeated frequently, yet the state remained able to pay salaries and finance part of its obligations, albeit at the cost of debt and increasing pressure on its fiscal flexibility.

However, this warning cannot be entirely ignored. The current trajectory indicates that continued inflation in current spending, coupled with revenues remaining dependent on oil prices, will gradually narrow the state's capacity to absorb shocks. Any sharp drop in oil prices could, at any moment, transform from a "passing crisis" into a direct threat to the stability of salaries and basic services if serious steps are not taken to alleviate the burden on the budget and diversify revenue sources.

The difference between propaganda and serious analysis is that the former transforms 2030 into a "doomsday date," while the latter places this date within a manageable trajectory. If policies continue as they are, fiscal space will shrink, our ability to cope with crises will weaken, and any shock in the oil market will become far more severe than it is today.

However, if genuine reform begins, this moment can be transformed from a "prophecy of collapse" into a "reform pressure" that compels the state to restructure its spending patterns and resources.

The Government Employee As A Social Refuge... When People Flee From The Market To The State

The bloated number of public employees cannot be understood solely from a public finance perspective. In Iraq, a government employee is not merely a number on a payroll, but rather the embodiment of a comprehensive social contract between the citizen and the state.

In a fragile labor market and a private sector that often fails to provide social security or job stability, a government job becomes the most viable option for those seeking a steady income, guaranteed retirement, and relatively adequate health insurance.

Labor market data indicates that a large proportion of the workforce is employed in the public sector, while the remainder are divided between largely informal private sector jobs, unregulated employment, and outright or disguised unemployment.

Meanwhile, the private sector's contribution to GDP remains far below the country's potential, and the business environment suffers from procedural complexities, bureaucracy, and corruption, making serious investment in industry, agriculture, and high-value services the exception rather than the rule.

Given these circumstances, talk of "restructuring the workforce" or "reducing staff numbers" without a comprehensive plan to revitalize the private sector and create decent jobs within it becomes akin to a gamble. Every employee pushed towards early retirement or extended leave means a family losing a portion of its financial security if there is no viable alternative in the job market. And every reduction in hiring without reforming the investment climate means a new wave of young people heading towards unemployment, emigration, or informal work.

Herein lies the stark contradiction: the state wants to alleviate the burden of salaries, while society still sees the state as its only refuge. The solution cannot be found in dismantling this refuge before building a new foundation upon which people can stand.

From "Government Economy" To "State Economy"... Where Does Reform Begin?

Economist Dirgham Muhammad succinctly summarizes the core of the problem in a striking statement: what is needed is a shift from a "government-run economy" to a "state-run economy." In a government-run economy, the government's role is reduced to that of a fund that receives oil revenues and distributes them as salaries and benefits, and the employee's function is reduced to receiving a salary at the end of the month and completing a minimum of transactions.

In a state-run economy, the government becomes the central authority that manages resources, formulates policies, and creates the legal and institutional environment for the growth of the private sector, without relinquishing its role in providing essential services and protecting vulnerable groups.

On a practical level, this transition means redefining the role of the public employee. In a state-run economy, the administrative apparatus becomes smaller in number but more specialized and efficient, operating in the areas of regulation, oversight, and planning, and providing services that the market cannot provide on its own.

Meanwhile, the private sector is left with greater scope to produce and create jobs. In return, private sector establishments are required to enroll their employees in social security, and fair competition rules are enforced to prevent the reduction in public sector employment from pushing people from "tiring but secure jobs" to "work without rights."

Reforming the payroll in this context cannot be reduced to isolated measures such as freezing hiring or tightening leave controls. Rather, it must be part of a comprehensive package that includes reforming the wage system, expanding the tax base, improving the collection of non-oil revenues, and increasing investment in infrastructure and services that encourage private sector expansion. Without this integrated vision, piecemeal measures remain merely temporary fixes that only exacerbate the problem instead of solving it.

A Test Of The Political System Before It Becomes A Financial Equation.

Legal expert Ali al-Saadawi places the issue within a broader context than just figures and tables. Speaking to Baghdad Today, he argues that what Iraq is experiencing today "cannot be viewed merely as a financial crisis, but rather as a true test of the political system's ability to redefine its priorities in resource management and achieving sustainable development."