From Bartering To Banknotes To Bitcoin

.The History of Money

From Bartering To Banknotes To Bitcoin

By Andrew Beattie Updated March 24, 2022 Reviewed By Robert C. Kelly

Money, whether it's represented by a seashell, a metal coin, a piece of paper, or a string of code electronically mined by computer, doesn't always have value. Its total global value—currently estimated to be around $420 trillion1—depends on the importance that people place on it as a medium of exchange, a unit of measurement, and a storehouse for wealth.

Money allows people to trade goods and services indirectly; it helps communicate the price of goods (prices written in dollar and cents correspond to a numerical amount in your possession—e.g., in your pocket, purse, or wallet); and it provides individuals with a way to store their wealth.

The History of Money

From Bartering To Banknotes To Bitcoin

By Andrew Beattie Updated March 24, 2022 Reviewed By Robert C. Kelly

Money, whether it's represented by a seashell, a metal coin, a piece of paper, or a string of code electronically mined by computer, doesn't always have value. Its total global value—currently estimated to be around $420 trillion1—depends on the importance that people place on it as a medium of exchange, a unit of measurement, and a storehouse for wealth.

Money allows people to trade goods and services indirectly; it helps communicate the price of goods (prices written in dollar and cents correspond to a numerical amount in your possession—e.g., in your pocket, purse, or wallet); and it provides individuals with a way to store their wealth.

KEY TAKEAWAYS

Money conveys the importance that people place on it; it allows trading of goods and services indirectly, communicates the price of goods, and provides a way to store wealth.

All of the money in the world is estimated to total around $420 trillion.1

Before money, people acquired and exchanged goods through bartering.

The world’s oldest known, securely dated coin minting site was located in Guanzhuang in Henan Province, China, which began striking spade coins sometime around 640 BCE, likely the first standardized metal coinage.

Money is valuable as a unit of account—a socially accepted standard by which things are priced and with which payment is accepted. However, throughout history, both the usage and form of money have evolved.

Though the terms "money" and "currency" are often used interchangeably, several theories suggest that they are not identical. According to some theories, money is inherently an intangible concept, while currency is the physical (tangible) manifestation of the intangible concept of money.

By extension, according to this theory, money cannot be touched or smelled. Currency is the coin, note, object, etc. that is presented in the form of money. The basic form of money is numbers; currently, the basic form of currency is paper notes, coins, or plastic cards (e.g., credit or debit cards). Though this distinction between money and currency is important in some contexts, for the purposes of this article, the terms are used interchangeably.

Understanding the History of Money

The Transition From Bartering to Currency

Money—in some form or another—has been part of human history for at least the past 5,000 years.2 Before that time, historians generally agree that a system of bartering was likely used.

Bartering is a direct trade of goods and services; for example, a farmer may exchange a bushel of wheat for a pair of shoes from a shoemaker. However, these arrangements take time. If you are exchanging an ax as part of an agreement in which the other party is supposed to kill a woolly mammoth, you have to find someone who thinks an ax is a fair trade for having to face down the 12-foot tusks of a mammoth. If this doesn't work, you would have to alter the deal until someone agreed to the terms.

To continue reading, please go to the original article here:

No Such Thing as Enough Money

.No Such Thing as Enough Money

Jacob Schroeder Oct 27, 2021

How much money is enough? It’s a philosophical money question that often arises out of discontent. We see someone of substantial means, like a celebrity, live a troubled life. Or, we ourselves experience great fortune yet feel unhappy. It makes us wonder where the finish line is, the point when you can stop striving for more and settle into a life of satisfaction.

There are some great financial blogs that provide good answers, such as here and here. And then there are a variety of books that tackle this question in their own ways: Ego Is the Enemy, The Last Lecture, the Bible, to name a few. Another book that resonates with me, perhaps because of its instructive format, is How Will You Measure Your Life? by the late Clayton Christensen.

No Such Thing as Enough Money

Jacob Schroeder Oct 27, 2021

How much money is enough? It’s a philosophical money question that often arises out of discontent. We see someone of substantial means, like a celebrity, live a troubled life. Or, we ourselves experience great fortune yet feel unhappy. It makes us wonder where the finish line is, the point when you can stop striving for more and settle into a life of satisfaction.

There are some great financial blogs that provide good answers, such as here and here. And then there are a variety of books that tackle this question in their own ways: Ego Is the Enemy, The Last Lecture, the Bible, to name a few. Another book that resonates with me, perhaps because of its instructive format, is How Will You Measure Your Life? by the late Clayton Christensen.

He comes to the startling realization:

“I had thought the destination was what was important, but it turned out it was the journey.”

That to me is the answer to the question. Though it is, in a way, a non-answer. As with many of life’s mysteries, there is no definitive conclusion.

There is never enough money.

Don’t get me wrong. I don’t mean that you can always use more money to achieve a perfect life. Rather, I mean the exact opposite.

No amount of money will insulate you from suffering.

This week Elon Musk’s wealth jumped by $36 billion in a single day, bringing his net worth close to $300 billion. Yet, even he has experienced some very public setbacks, including the tragedy of losing his first child.

“The race is not to the swift or the battle to the strong, nor does food come to the wise or wealth to the brilliant or favor to the learned; but time and chance happen to them all.” (Eccles. 9:11)

There is no such thing as enough money, as there is no destination of absolute happiness. It’s all about simply having the capacity to notice the truly joyful things along the journey.

Pay attention to the wrong things, and life starts to feel empty. As Christensen writes:

“In your life, there are going to be constant demands for your time and attention. How are you going to decide which of those demands gets resources? The trap many people fall into is to allocate their time to whoever screams loudest, and their talent to whatever offers them the fastest reward.”

His solution is to focus on what provides lasting happiness:

“Intimate, loving, and enduring relationships with our family and close friends will be among the sources of the deepest joy in our lives.”

To continue reading, please go to the original article here:

https://rootofall.substack.com/p/no-such-thing-as-enough-money?s=r

Money Lessons From Famous Artists

.Money Lessons From Famous Artists

Here are some words of advice from artists that could double as insight for turning financial success into a creative pursuit.

M.C. ESCHER // “Are you really sure that a floor can’t also be a ceiling?” → Financial success is a matter of perception and deception.

M.C. Escher is known for images that play with perception and dimension to form mind-bending illusions. In a sense, they represent how we see the world. When faced with uncertainty and incomplete information, our brains like to take mental shortcuts that can distort reality.

These biases can have profound effects on our financial decisions. For instance, we may spend rather than save because we perceive our future selves as someone else. Or, we may buy an investment based on what we want to believe, despite all the contrary evidence. It is why the right financial steps often feel counterintuitive.

Money Lessons From Famous Artists

Here are some words of advice from artists that could double as insight for turning financial success into a creative pursuit.

M.C. ESCHER // “Are you really sure that a floor can’t also be a ceiling?” → Financial success is a matter of perception and deception.

M.C. Escher is known for images that play with perception and dimension to form mind-bending illusions. In a sense, they represent how we see the world. When faced with uncertainty and incomplete information, our brains like to take mental shortcuts that can distort reality.

These biases can have profound effects on our financial decisions. For instance, we may spend rather than save because we perceive our future selves as someone else. Or, we may buy an investment based on what we want to believe, despite all the contrary evidence. It is why the right financial steps often feel counterintuitive.

Take investing. In Winning the Loser’s Game, Charley Ellis flips the perception that it’s all about picking winners:

“Even though most investors see their work as active, assertive, and on the offensive, the reality is… stock and bond investing alike are primarily a defensive process. The great secret for success in long-term investing is to avoid serious losses.”

An awareness and understanding of the financial Jedi mind tricks we play on ourselves can help us make better financial decisions. Question your perceptions to avoid self-made deceptions. In art and money, it helps to ask: Is how I see the world, how the world really is?

FRANCISCO GOYA // “The sleep of reason brings forth monsters.” → Financial mistakes arise when emotion silences reason.

Many of Francisco Goya’s paintings shed light on humanity’s dark side; especially, times of war, when reason is overrun by our primitive instincts. Accordingly, there is a reason for every object, movement and shade of color in his work. Without it, they would just look grotesque.

Similarly, it’s important to remember your reason for every financial decision – where you park your money, what you invest in, how much you save, etc. – because there are times when everything feels unreasonable – loss of a job, stock market booms and busts, financial windfalls, etc. Those are times ripe for the monsters of fear and greed.

How we react during our most perilous financial situations will have a greater effect on long-term wealth than every small, $5-latte decision. Unchecked emotions often lead to bad decisions, from which some people take advantage, as immortalized in Warren Buffett’s famous advice to “be fearful when others are greedy and greedy only when others are fearful.”

Controlling emotions is an art, whether on a canvas or in a portfolio. The goal is to “do the average thing when everyone is losing their heads,” as Napoleon said.

HENRI MATISSE // “Don’t wait for inspiration. It comes while one is working.” → The right conditions for financial success are created by working on your finances.

To continue reading, please go to the original article here:

How to check the Authenticity of the New Iraqi Dinar

.Reposted by request, from a Recaps post from 2011.

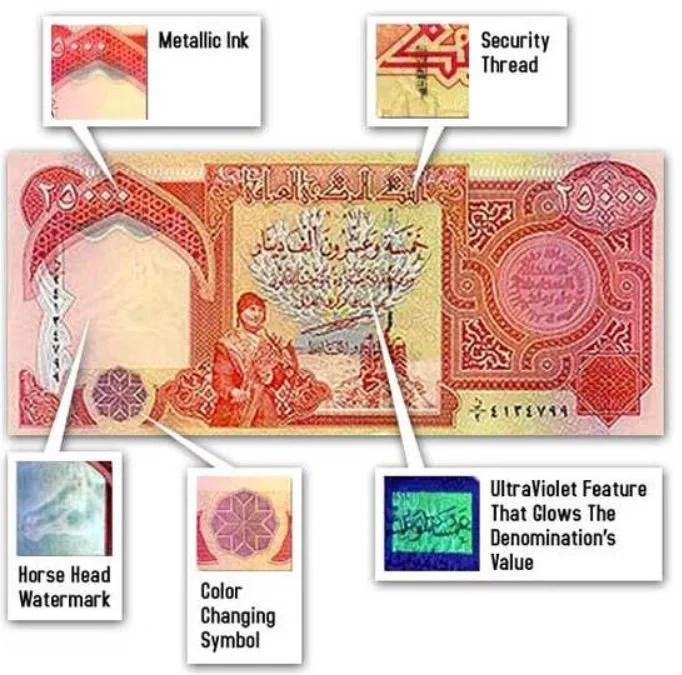

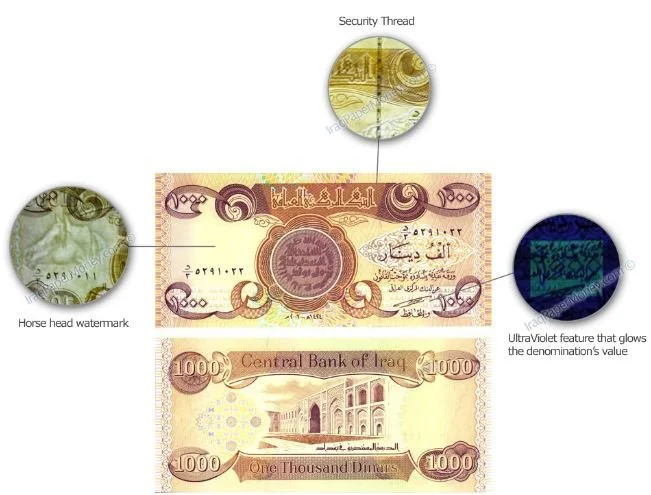

How to check the Authenticity of the New Iraqi Dinar (25,000 note)

The New Iraqi Dinar was printed by the De La Rue Corporation, the world’s largest integrated commercial security printer and papermaker and the printer of over 150 world currencies. The dinar is available in 50, 250, 1000, 5000, 10000, and 25000 notes (information from 2011).

De La Rue incorporates a number of nearly foolproof countermeasures into the New Iraqi Dinar, including:

Reposted by request…from a Recaps post from 2011.

How to check the Authenticity of the New Iraqi Dinar (25,000 note)

The New Iraqi Dinar was printed by the De La Rue Corporation, the world’s largest integrated commercial security printer and papermaker and the printer of over 150 world currencies. The dinar is available in 50, 250, 1000, 5000, 10000, and 25000 notes (information from 2011).

De La Rue incorporates a number of nearly foolproof countermeasures into the New Iraqi Dinar, including:

• Metallic ink (25K note): The image of a dove is printed in metallic ink on the top left hand corner of the back of the dinar.

• Embedded security thread (25 K note): There should be a metallic security thread embedded into the stock of the Iraqi dinar paper. Note: the security thread is metallic only on the 25,000 dinar note.

• Horse head watermark embedded into each note (all notes): This is one of the easiest security features to check for. Hold the Iraqi dinar up to a bright light source and the image of a horse head should clearly appear. This pattern is embedded, not printed, into the paper.

• Raised lettering

• Denomination’s value glows under Ultra Violet (UV) light. UV lights can be found on Amazon and some hardware stores. In a dimly lit area, hold the UV lamp over the Iraqi dinar. You should clearly see a UV box with writing inside on the back side of the dinar.

• The eight-sided symbol in the bottom left hand corner should change color from purple to green when viewed at different angles.

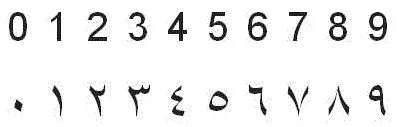

• Unique Arabic serial numbers: Every dinar has a unique number in East-Arabic script. See conversion chart below to western numerals. Notice the similarities between the 2 and 3 numerals.

The Art of Money

.The Art of Money

Turning financial success into a creative pursuit

Jacob Schroeder Mar 15

What do you consider the act of ‘making money’? Is it an act of accounting and measuring? Or, is it an act of imagining and contemplating? Our finances involve numbers and data, but they’re intractably tied to our personal ideas, experiences, feelings and behaviors – intangible things you can’t formulate in a spreadsheet. Therefore, to manage the human side of money, it’s better to think more like an artist than a scientist.

It’s a shame many famous artists had financial troubles.

The Art of Money

Turning financial success into a creative pursuit

Jacob Schroeder Mar 15

What do you consider the act of ‘making money’? Is it an act of accounting and measuring? Or, is it an act of imagining and contemplating? Our finances involve numbers and data, but they’re intractably tied to our personal ideas, experiences, feelings and behaviors – intangible things you can’t formulate in a spreadsheet. Therefore, to manage the human side of money, it’s better to think more like an artist than a scientist. It’s a shame many famous artists had financial troubles.

Johannes Vermeer is said to have left behind 10 young children, a house full of paintings no one wanted and enormous debts, causing his wife to declare bankruptcy. Mozart wracked up massive amounts of debt, too, to feed an extravagant lifestyle. Not to be out done, Oscar Wilde lived far beyond his means, until he eventually fell into poverty and supposedly spent his last bit of money on booze. When he took his own life, Vincent van Gogh was poor and destitute.

It’s a shame, because some principles great artists follow to make art could also apply to making money.

Art and money share more similarities than we like to think. Money, like art, is a means of self-expression; it helps you turn the life you imagine into reality. They’re both deeply personal. There is no one right way to sculpt a Greek goddess or invest in stocks. Most of all, money offers a lot of insights into human behaviors and sensations.

It is often those human elements that lead to financial problems, but that also give our financial decisions meaning. Therefore, when trying to create a financially successful future, we may need a little more right-brain than left-brain thinking.

Take it from Andy Warhol, an artist who loved to blur the lines of commerce and culture, who declared:

“Making money is art and working is art and good business is the best art.” Andy Warhol

Why It Helps To Think Of Money As More Art Than Science

Is personal finance an art or a science?

The juncture of art and money has gotten most attention as it relates to investing. Investor Howard Marks said: “Investing, like economics, is more art than science.”

Why?

To continue reading, please go to the original article here:

What Is a Silver Certificate Dollar Bill Worth Today?

.What Is a Silver Certificate Dollar Bill Worth Today?

By David Gorton Updated March 10, 2022 Reviewed By Chip Stapleton Fact Checked By Jiwon Ma

What Is a Silver Certificate Dollar Bill Worth Today?

A silver certificate dollar bill represents a unique time in American history. It was a type of legal tender that was issued by the federal government in the late 1800s. As the name suggests, the holder of a certificate could redeem it for a certain amount of silver. One certificate allowed investors to hold silver without having to buy the precious metal itself.1

These certificates no longer carry monetary value as an exchange for silver, yet they are still legal tender at their face value. In the market, silver certificates are often worth more than their face value (e.g., $1) as collectors still seek out these prints.

What Is a Silver Certificate Dollar Bill Worth Today?

By David Gorton Updated March 10, 2022 Reviewed By Chip Stapleton Fact Checked By Jiwon Ma

What Is a Silver Certificate Dollar Bill Worth Today?

A silver certificate dollar bill represents a unique time in American history. It was a type of legal tender that was issued by the federal government in the late 1800s. As the name suggests, the holder of a certificate could redeem it for a certain amount of silver. One certificate allowed investors to hold silver without having to buy the precious metal itself.1

These certificates no longer carry monetary value as an exchange for silver, yet they are still legal tender at their face value. In the market, silver certificates are often worth more than their face value (e.g., $1) as collectors still seek out these prints.

Their history dates to the 1860s, when the United States rapidly developed into one of the top producers of silver in the world. This ushered in a new monetary structure in the U.S., of which the silver certificate is a unique historical artifact.2 In this article, we look at the history of this form of currency and how much they're worth today.

KEY TAKEAWAYS

A silver certificate dollar bill was a legal tender issued by the United States government.

When they were first issued, certificate holders could redeem them for a certain amount of silver.

Certificates are no longer redeemable in exchange for physical silver.

Although collectors still seek out many of the uncommon prints, many certificates are only worth their face value.

Understanding Silver Certificate Dollar Bills

It was for this reason that provisions in the Coinage Act of 1873 went little noticed. The act ended free coinage for silver, effectively ending bimetallism and placing the United States on the gold standard. Though silver coins could still be used as legal tender, few were in circulation.3

The U.S. government began issuing certificates in 1878 under the Bland-Allison Act. Under the act, people could deposit silver coins at the U.S. Treasury in exchange for certificates, which were easier to carry.4 This representative money could also be redeemed for silver equal to the certificate’s face value. In the past, other countries like China, Colombia, Costa Rica, Ethiopia, Morocco, Panama, and the Netherlands have issued silver certificates.5

Silver

Congress adopted a bimetallic standard of money in 1792, making gold and silver the mediums of exchange. Under a free coinage policy, raw gold or silver could be taken to the U.S. mint and converted into coins.6 However, few silver coins were minted between 1793 and 1873, as the raw silver required to make a coin was worth more than their gold dollar and greenback counterparts.78

A year later, Section 3568 of the Revised Statutes further diminished silver's status by prohibiting the use of silver coins as legal tender for amounts exceeding five dollars.9

Old Silver Dollar Certificates

Silver's importance became apparent with the development of the Comstock lode and other deposits. This happened as Congress looked for ways to grow the monetary base. The U.S. went from producing less than 1% of the world's silver to nearly 20% by the 1860s and 40% by the 1870s.10

To continue reading, please go to the original article here:

Why Poor People Can't Afford To Save Money

.Understanding the 'Boots Theory' of Socioeconomic Unfairness

This is why poor people can't afford to save money.

By Tom Huffman Dec. 01, 2021

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

Terry Pratchett was an English fantasy writer, best known for his Discworld series of 41 novels. If you’re familiar with Pratchett's novels, you may recognize the "boots theory." If not, you better write off the next few months of your life as you're about to undertake some serious binge-reading.

What is the 'boots theory'?

Understanding the 'Boots Theory' of Socioeconomic Unfairness

This is why poor people can't afford to save money.

By Tom Huffman Dec. 01, 2021

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

Terry Pratchett was an English fantasy writer, best known for his Discworld series of 41 novels. If you’re familiar with Pratchett's novels, you may recognize the "boots theory." If not, you better write off the next few months of your life as you're about to undertake some serious binge-reading.

What is the 'boots theory'?

The "boots theory" comes from a simple piece of dialogue in Pratchett’s 1993 novel Men at Arms. The book features a City Watch commander named Capt. Samuel Vimes. The captain is set to marry one of the richest women in the world, and he often opines about the differences between low-status and high-status spending habits.

At one point in the story, the captain ruminates:

The reason that the rich were so rich...was because they managed to spend less money.

In reference to the captain, the quote continues:

"Take boots, for example. He earned $38 a month plus allowances. A really good pair of leather boots cost $50. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about $10.

"Those were the kind of boots Vimes always bought, and wore until the soles were so thin that he could tell where he was in Ankh-Morpork on a foggy night by the feel of the cobbles.

"But the thing was that good boots lasted for years and years. A man who could afford $50 had a pair of boots that'd still be keeping his feet dry in 10 years' time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet."

This was Capt. Samuel Vimes' boots theory of socioeconomic unfairness.

The Boots Theory In Action

Pair of boots next to a desk on a carpeted floor.

The boots theory may seem obvious, but many people fall victim to its trap.

The wealthy, who have access to capital and disposable income, can make decisions with their money that leave them richer and better off.

To continue reading, please go to the original article here:

https://moneywise.com/managing-money/budgeting/boots-theory-of-socioeconomic-unfairness

5 Wise Money Moves Before The Fed Starts Raising Interest Rates Again

.5 Wise Money Moves Before The Fed Starts Raising Interest Rates Again

Time's almost up on ultralow rates, so don't be caught off guard. Federal Reserve Chairman Jerome Powell arrives for a Senate Banking Committee meeting in Washington, Sept. 28, 2021.

By Sigrid Forberg Jan. 27, 2022

Word just came down that you’ll soon pay more in interest for many loans. And your credit card balance with a variable interest rate? It’s about to cost you more too.

Federal Reserve Chairman Jerome Powell and the other policymakers at the central bank said this week that they’ll raise rates “soon,” likely at their next meeting in March, to try to slow inflation that’s rising faster than it has in almost 40 years.

5 Wise Money Moves Before The Fed Starts Raising Interest Rates Again

Time's almost up on ultralow rates, so don't be caught off guard.

Federal Reserve Chairman Jerome Powell arrives for a Senate Banking Committee meeting in Washington, Sept. 28, 2021.

By Sigrid Forberg Jan. 27, 2022

Word just came down that you’ll soon pay more in interest for many loans. And your credit card balance with a variable interest rate? It’s about to cost you more too.

Federal Reserve Chairman Jerome Powell and the other policymakers at the central bank said this week that they’ll raise rates “soon,” likely at their next meeting in March, to try to slow inflation that’s rising faster than it has in almost 40 years.

But regulators held a key interest rate near zero for now. You’ll need to act quickly to take advantage of today’s lower rates for a large purchase or for a loan for a necessity, like a new car to replace an old pile of junk that needs too many repairs.

Here are five money moves to jump on before rates rise.

1. Refinance Your Home Loan

Mortgage rates are going up from historically low levels in the pandemic, but they’re still a good deal for many people. The Fed’s expected rate increases this year will affect variable-rate loans, and its changing pandemic-related policies could create a climate for higher fixed-rate mortgages as well.

But take a look at your rates anyway because nearly 6 million homeowners could still save $1.6 billion monthly by refinancing now, the mortgage data and technology firm Black Knight tells MoneyWise.

The average interest rate on a 30-year fixed-rate mortgage hit 3.56% last week, up from 3.45%, government-sponsored mortgage buyer Freddie Mac reports. But remember that rates for shorter mortgages, while also trending upward, typically run lower than 30-year rates, so refinancing for a quicker payoff might still save you money in the end.

Plus, 3.56% is an average — lenders will offer you lower and higher rates. That’s one reason you shouldn’t skip the step of comparing rate quotes from multiple companies.

2. Consolidate Your Debt

The pandemic made it difficult for Americans to travel, eat in restaurants and shop at retailers, and many used the money they didn't spend on those activities to increase their savings and pay down debt.

To continue reading, please go to the original article here:

https://moneywise.com/managing-money/budgeting/money-moves-before-fed-raises-rates

Why Gold Matters: Everything You Need To Know

.Why Gold Matters: Everything You Need To Know

By Adam Hayes Updated March 09, 2022 Reviewed By Michael J Boyle Fact Checked By Diane Costagliola

Gold. It's shiny, metallic, and melts easily into bars, coins, or jewelry. It doesn't rust, corrode, or decay. Gold is...well, golden. But why is gold so valuable, both in our mind's eye and in reality as a global store of value and medium of exchange? Why is silver relegated to a distant second place, and what about poor old copper, which shares many of the same physical attributes as gold? Join us as we try to figure out the answers to these questions, and much more.

KEY TAKEAWAYS

In the articles that follow, we will take a look at gold's place in our economy and try to uncover just why it's valuable and what role gold can play today in investor's portfolios.

Why Gold Matters: Everything You Need To Know

By Adam Hayes Updated March 09, 2022 Reviewed By Michael J Boyle Fact Checked By Diane Costagliola

Gold. It's shiny, metallic, and melts easily into bars, coins, or jewelry. It doesn't rust, corrode, or decay. Gold is...well, golden. But why is gold so valuable, both in our mind's eye and in reality as a global store of value and medium of exchange? Why is silver relegated to a distant second place, and what about poor old copper, which shares many of the same physical attributes as gold? Join us as we try to figure out the answers to these questions, and much more.

KEY TAKEAWAYS

In the articles that follow, we will take a look at gold's place in our economy and try to uncover just why it's valuable and what role gold can play today in investor's portfolios.

In fact, by some accounts, gold has never been more fashionable as an alternative investment, able to weather financial crises and hedge against the inflationary pressures of fiat currency.

We will discuss the risks and opportunities of owning gold as an investment, how to try and make quick profits day trading it in the commodities market, what influences its price, and how to go about owning gold in your brokerage account.

Gold as an Investment

Before jumping on the gold bandwagon, let us first put a damper on the enthusiasm around gold and at the outset examine some reasons why investing in gold has some fundamental issues.

The main problem with gold is that, unlike other commodities such as oil or wheat, it does not get used up or consumed. Once gold is mined, it stays in the world. A barrel of oil, on the other hand, is turned into gas and other products that are expended in your car's gas tank or an airplane's jet engines. Grains are consumed in the food we and our animals eat. Gold, on the other hand, is turned into jewelry, used in art, stored in ingots locked away in vaults, and put to a variety of other uses. Regardless of gold's final destination, its chemical composition is such that the precious metal cannot be used up - it is permanent.

Because of this, the supply/demand argument that can be made for commodities like oil and grains, etc, doesn't hold so well for gold. In other words, the supply will only go up over time, even if demand for the metal dries up.

History Overcomes the Supply Problem

Like no other commodity, gold has held the fascination of human societies since the beginning of recorded time. Empires and kingdoms were built and destroyed over gold and mercantilism. As societies developed, gold was universally accepted as a satisfactory form of payment. In short, history has given gold a power surpassing that of any other commodity on the planet, and that power has never really disappeared. The U.S. monetary system was based on a gold standard until the 1970s.1 Proponents of this standard argue that such a monetary system effectively controls the expansion of credit and enforces discipline on lending standards, since the amount of credit created is linked to a physical supply of gold. It's hard to argue with that line of thinking after nearly three decades of a credit explosion in the U.S. led to the financial meltdown in the fall of 2008.

From a fundamental perspective, gold is generally viewed as a favorable hedge against inflation. Gold functions as a good store of value against a declining currency.

Investing in Gold

To continue reading, please go to the original article here:

https://www.investopedia.com/articles/economics/09/why-gold-matters.asp

What I Teach My Kids About Money

.What I Teach My Kids About Money

By Cameron Huddleston July 10, 2019

I’ve been a guest on a lot of podcasts lately talking about my new book, Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances.

As you can assume by the title, I’ve been sharing tips on how adult children can get their parents to open up about their finances so everyone can get on the same page if those children ever need to step in and help their parents.

Occasionally, though, the podcast hosts will turn the tables on me and ask what sort of money conversations I’ve had with my own children. I’ve been asked how I teach my kids about money, what sort of details I’ve given them about my finances, and what works and doesn’t work when it comes to teaching kids about personal finance.

What I Teach My Kids About Money

By Cameron Huddleston July 10, 2019

I’ve been a guest on a lot of podcasts lately talking about my new book, Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances.

As you can assume by the title, I’ve been sharing tips on how adult children can get their parents to open up about their finances so everyone can get on the same page if those children ever need to step in and help their parents.

Occasionally, though, the podcast hosts will turn the tables on me and ask what sort of money conversations I’ve had with my own children. I’ve been asked how I teach my kids about money, what sort of details I’ve given them about my finances, and what works and doesn’t work when it comes to teaching kids about personal finance.

I don’t claim to be an expert on kids and money. But as a mom of three kids ages 7 to 14, I’ve had plenty of experience teaching my own children money lessons. Here are five key things about money that I’ve tried to instill in my children.

Money Is Not a Taboo Topic

A couple of years ago, my middle child asked me out of the blue one day why people think it’s bad to talk about money. She couldn’t understand why the topic might be off limits because money is discussed so openly in our family.

Borrowing from the wisdom that my friend and financial psychologist Dr. Brad Klontz shared with me, I explained to my daughter that people avoid talking about money because they feel shame around it.

If the topic comes up in a conversation, they feel ashamed if they have less than the people they’re talking to – or if they have more money. They’re afraid they’ll be judged, I told her.

I remember my dad telling me when I was growing up that it wasn’t polite to talk about money. So he didn’t – which meant I didn’t have anyone teaching me about money. Once I got out into the real world, I had to figure out money matters on my own and made plenty of mistakes as a result.

I don’t want my kids to think that money is a taboo topic. That’s why I’ve been talking to them about it pretty much from the time they were able to talk. I want them to become financially responsible adults one day, so I consider it my job to teach them about being smart with their money.

After all, if I don’t teach them, who will? Only 17 states require high school students to take a course in personal finance, according to the Council for Economic Education. More importantly, I don’t want my kids to have negative associations with money. If I raise my children to believe that money is something you don’t talk about, they might develop an unhealthy relationship with it.

To continue reading, please go to the original article here:

https://cameronhuddleston.com/what-i-teach-my-kids-about-money/

How Gold Affects Currencies

.How Gold Affects Currencies 6

By Kalen Smith Updated January 26, 2022 Reviewed By Chip Stapleton

Ah, the enduring appeal—and influence—of gold. Even though it is no longer used as a primary form of currency in developed nations, the yellow metal continues to have a strong impact on the value of those currencies. Moreover, there is a strong correlation between its value and the strength of currencies trading on foreign exchanges.

To help illustrate this relationship between gold and foreign exchange trading, consider these five important features of the yellow stuff:

How Gold Affects Currencies

By Kalen Smith Updated January 26, 2022 Reviewed By Chip Stapleton

Ah, the enduring appeal—and influence—of gold. Even though it is no longer used as a primary form of currency in developed nations, the yellow metal continues to have a strong impact on the value of those currencies. Moreover, there is a strong correlation between its value and the strength of currencies trading on foreign exchanges.

To help illustrate this relationship between gold and foreign exchange trading, consider these five important features of the yellow stuff:

KEY TAKEAWAYS

*Throughout human history, gold has been used as a money form in one way or another.

*From gold coins to paper notes backed by the gold standard, only recently has money moved to a fiat system that is not backed by a physical commodity.

*Since then, inflation and a declining dollar have meant rising gold prices. By purchasing gold, people can also shelter themselves from times of global economic uncertainty.

*Gold levels may also influence national economies engaged in global trade and international finance.

Gold Was Once Used to Back up Currencies

As early as the Byzantine Empire, gold was used to support national currencies—that is, those considered legal tender in their nation of origin. Gold was also used as the world reserve currency up through most of the 20th century; the United States used the gold standard until 1971 when President Nixon discontinued it.

Until the gold standard was abandoned, countries couldn't simply print their fiat currencies ad nauseam. The paper money had to be backed up by an equal amount of gold in their reserves (then, as now, countries kept supplies of gold bullion on hand). Although the gold standard has long fallen out of in the developed world, some economists feel we should return to it due to the volatility of the U.S. dollar and other currencies; they like that it limited the amount of money nations were allowed to print.

Gold Used to Hedge Against Inflation

Investors typically buy large quantities of gold when their country is experiencing high levels of inflation. The demand for gold increases during inflationary times due to its inherent value and limited supply. As it cannot be diluted, gold is able to retain value much better than other forms of currency.

For example, in April 2011, investors feared declining values of fiat currency and drove the price of gold to a staggering $1,500 an ounce. This indicates there was little confidence in the currencies on the world market and that expectations of future economic stability were grim.

Note that economists are split over whether gold has proved to be as good of an inflation hedge as its promoters claim, since the data is inconsistent. Sometimes exceeding the inflation rate, and sometimes falling well short over periods of time. gold has been shown to be a much more effective hedge against economic downturns.1

The Price of Gold Affects Countries That Import and Export It

To continue reading, please go to the original article here:

https://www.investopedia.com/articles/forex/11/golds-effect-currencies.asp