The 4 Most Important Pieces of Advice This Financial Advisor Gave to His 3 Daughters

.The 4 Most Important Pieces of Advice This Financial Advisor Gave to His 3 Daughters

Gabrielle Olya Mon, February 28, 2022,

In today’s “Financially Savvy Female” column, we chat with Urban Adams, an investment advisor at Dynamic Wealth Advisors and the father of three young adult daughters. Here, he shares the financial lessons he taught them, his advice for other parents who want to raise financially savvy females and how being the father of daughters affected how he advises others in his practice.

What are the most important financial lessons you taught your daughters?

There are quite a few I taught them, [but the most important were] 1) wants versus needs, 2) saving for larger purchases, 3) independence by having their own money, and 4) awareness of what was saved for college for them.

The 4 Most Important Pieces of Advice This Financial Advisor Gave to His 3 Daughters

Gabrielle Olya Mon, February 28, 2022,

In today’s “Financially Savvy Female” column, we chat with Urban Adams, an investment advisor at Dynamic Wealth Advisors and the father of three young adult daughters. Here, he shares the financial lessons he taught them, his advice for other parents who want to raise financially savvy females and how being the father of daughters affected how he advises others in his practice.

What are the most important financial lessons you taught your daughters?

There are quite a few I taught them, [but the most important were] 1) wants versus needs, 2) saving for larger purchases, 3) independence by having their own money, and 4) awareness of what was saved for college for them.

Whenever a financial lesson to be taught presented itself, I would discuss it with them individually or as a group. More specifically, one example was opening checking accounts for them at the local credit union when they each turned 13. This got them comfortable with using a debit card, managing the balance, spending, etc. When each got their first job with W-2 income, I helped them open a Roth IRA to begin saving for retirement.

As the father of daughters, it was important for me to set them on a path to being financially independent. I have told my daughters numerous times over the years (they are 18, 19 and 21 now) that I will teach them the tools to be financially independent — with the aim of not having to be dependent on a mate or partner.

More personally, I’ve told them many times over the years that the only male they would ever be financially dependent on was me — and I was teaching them the lessons that would help them avoid being dependent on anyone.

When should parents start talking to their daughters about money?

To continue reading, please go to the original article here:

https://finance.yahoo.com/news/4-most-important-pieces-advice-190012038.html

The Biggest Things People Get Wrong About Money

.The Biggest Things People Get Wrong About Money

Financial Literacy Zina Kumok

I’ve gotten to a point in my career where I’m commonly referred to as a financial “expert”. I’ve worked hard to broaden my knowledge and fill in the gaps, so I feel pretty comfortable in that role. When a friend or colleague asks me for advice, chances are I can help them in some way.

But the more I learn, the more I realize how ignorant I actually am. Money is such a diverse and dynamic topic that it’s impossible to know everything, and even the most basic fundamentals can change over time. The best you can do is keep an open mind and actively challenge your assumptions.

The Biggest Things People Get Wrong About Money

Financial Literacy Zina Kumok

I’ve gotten to a point in my career where I’m commonly referred to as a financial “expert”. I’ve worked hard to broaden my knowledge and fill in the gaps, so I feel pretty comfortable in that role. When a friend or colleague asks me for advice, chances are I can help them in some way.

But the more I learn, the more I realize how ignorant I actually am. Money is such a diverse and dynamic topic that it’s impossible to know everything, and even the most basic fundamentals can change over time. The best you can do is keep an open mind and actively challenge your assumptions.

We all get things wrong about money. Here are some of the most common – and most dangerous – misconceptions.

“Keep 30% Balance On Your Credit Cards.“

I’ll never forget this argument I had with my friend Chelsea. We were talking about credit card rewards programs and how awesome they are. “Of course, you should never hold a balance on them, no matter what kind of cash-back you’re getting,” I told her. She disagreed, saying that you should always carry a small balance on your card or you won’t build any credit.

In my opinion, this is probably the most persistent credit myth still making the rounds in 2019. It’s true that you need to have a balance on a card when the statement closes. That balance will then be reported to the credit card bureaus, but once the statement closes, you can pay off the entire amount without hurting your credit. If you pay off the balance before the statement closes then the card provider will report your balance as $0.

An easy way to set this up is to create automatic payments that will go in effect after the statement closes, but before your due date. Go to your credit card account and click on the payments section. Then, create automatic payments for the full statement balance and choose a withdrawal date on or before your due date.

“Investing is the same thing as gambling.”

When I was in middle school, the dot-com crash happened. I don’t remember much about it, except for the fact that a lot of people lost a lot of money. A year later, 9/11 happened and the market tanked again. When I was a freshman in college, the housing market crashed and the Great Recession began.

To continue reading, please go to the original article here:

https://mint.intuit.com/blog/financial-literacy/the-biggest-things-people-get-wrong-about-money/

What You Need to Know to Get Through This Volatile Financial Time

.What You Need to Know to Get Through This Volatile Financial Time

February 8, 2022 (Last Modified: February 14, 2022) / Brittney Castro

As we’ve entered 2022 and the pandemic is still upon us, a lot of Minters are asking, “What do I need to know about what’s happening in the economy and stock market, and how does it all affect my finances?”

When investing, whether it is in real estate, the stock market, or crypto market, it is always important to remember your long-term game plan and investment philosophy. There are a lot of new investors on the scene and many have not yet experienced bear markets or extreme market volatility and don’t understand the principles of not reacting emotionally when they see their accounts down. If you are investing for the future, then focus on having the right allocation mix, understanding market volatility and risk, and don’t react emotionally when you see your accounts down. Remember, short-term fluctuation is not a long-term loss and you only lose money if you sell at a loss.

What You Need to Know to Get Through This Volatile Financial Time

February 8, 2022 (Last Modified: February 14, 2022) / Brittney Castro

As we’ve entered 2022 and the pandemic is still upon us, a lot of Minters are asking, “What do I need to know about what’s happening in the economy and stock market, and how does it all affect my finances?”

When investing, whether it is in real estate, the stock market, or crypto market, it is always important to remember your long-term game plan and investment philosophy. There are a lot of new investors on the scene and many have not yet experienced bear markets or extreme market volatility and don’t understand the principles of not reacting emotionally when they see their accounts down. If you are investing for the future, then focus on having the right allocation mix, understanding market volatility and risk, and don’t react emotionally when you see your accounts down. Remember, short-term fluctuation is not a long-term loss and you only lose money if you sell at a loss.

Spend time to learn, or remind yourself of, smart investing principles and never panic, sell, or get lost in your emotions when it comes to making financial decisions. The news will always (and I mean always) be a chicken little crying, “the sky is falling, the sky is falling,” but any successful investor will tell you to keep your investment philosophy front and center, and not react to market swings unless something major changes in your financial life and, therefore, changes your goals.

To help you review your finances and get an updated plan for 2022, here are 10 important things you can do right now with your money:

1. Don’t panic

Easier said than done, but during volatile times, it is important to remain calm and centered and not react from a place of fear. It is wise to express any emotions you may have about what is going on with a trusted family member, friend, or licensed therapist and use your network of professionals to help guide you during this time. Take advantage of this time to start meditating or doing other activities to keep you centered and calm.

2. Have a plan

You always need a solid budget and financial plan, and in times like these, you can then be more present and clear with what is happening. Most people who have a solid budget and financial plan that they’ve set up in Mint or have been working with a financial planner, will find that they don’t need to react much to the unforeseen circumstances and hopefully have been getting prepared for a market downturn.

3. Review your plan with your financial planner

You should review your plan often, but especially during times like this, you can review again to ensure you are doing everything properly with your money. If you don’t have a financial planner, now is the time to get one. Check out www.cfpboard.net for a planner who fits your needs.

4. Review your budget and cut out any unnecessary expenses

To continue reading, please go to the original article here:

What Does Being ‘Good with Money’ Actually Look Like?

.What Does Being ‘Good with Money’ Actually Look Like?

Personal Finance / Zina Kumok

People tend to talk about being financially savvy in a black and white way. You’re either good with money or you’re not. But as with most things related to your finances, it’s a little more complicated than that. You could be great at earning money and terrible at saving it – or vice versa. You could have an impressive net worth and a terrible credit score. You could be the world’s greatest budgeter and the world’s worst investor.

In other words, being “good with money” can mean a lot of things. Let’s take a look at some of the most important factors to consider.

What Does Being ‘Good with Money’ Actually Look Like?

Personal Finance / Zina Kumok

People tend to talk about being financially savvy in a black and white way. You’re either good with money or you’re not. But as with most things related to your finances, it’s a little more complicated than that. You could be great at earning money and terrible at saving it – or vice versa. You could have an impressive net worth and a terrible credit score. You could be the world’s greatest budgeter and the world’s worst investor.

In other words, being “good with money” can mean a lot of things. Let’s take a look at some of the most important factors to consider.

Metrics to Track

While there’s not a single figure that shows you’re good with money, there are some numbers you can track to see how you’re doing (Mint tracks these for you):

Net Worth

Your net worth is your total assets minus your liabilities. Assets include the money in your bank accounts, investment accounts, collectible items, home equity and more. Liabilities include what you owe, like your credit card balance, auto loans, student loans, mortgage balance and more.

To calculate your net worth, add up your assets and liabilities separately. Then, subtract the liabilities from the assets. Don’t be surprised if your net worth is negative. That means you owe more money than you currently have. Recent graduates and young adults often have a negative net worth, especially if they have a lot of student loans.

But as you get older, your net worth should increase as you pay down debt and start investing consistently. Try to track your net worth a couple times a year. You can create your own spreadsheet or use Mint’s net worth tracker.

“Over time you will see your assets really starting to grow,” said Ryan C. Phillips, CFA, CFP, and founder of GuidePoint Financial Planning. “The success from this can be really motivating and many times will lead individuals to save and invest even more.”

Credit Score

Your credit score shows how responsible you are as a borrower. Potential lenders, utility companies, cell phone providers, car insurance companies and landlords will look at your credit score before approving you.

A credit score doesn’t take your savings rate or investment success into account, so it’s not a holistic number. But it does show if you’re good at borrowing money and paying it back. Even if you plan to avoid taking out loans, you may still need a good credit score.

Meeting Your Personal Goals

To continue reading, please go to the original article here:

https://mint.intuit.com/blog/personal-finance/what-does-being-good-with-money-actually-look-like/

Intellectual Freedom Started With The Elon Musk Of The 1600s

.Intellectual Freedom Started With The Elon Musk Of The 1600s

Simon Black Notes From The Field February 22, 2022

If Isaac Newton were alive today, he would almost certainly have over 100 million Twitter followers. He was something like the Elon Musk of his day– a bit controversial, incredibly innovative, and always the topic of conversation. People were obsessed with Newton’s every word and action. When news spread, for example, that Isaac Newton had invested in the famous South Sea Company, investors clamored to buy the stock… simply because Newton was in it. Sort of like Dogecoin.

The South Sea Company eventually collapsed after barely generating a penny in revenue; it still ranks as one of the biggest stock bubbles of all time, and Newton himself lost a fortune. But the obsession with Newton never stopped. People even paid attention to things that he didn’t say to infer what he might be thinking.

Intellectual Freedom Started With The Elon Musk Of The 1600s

Simon Black Notes From The Field February 22, 2022

If Isaac Newton were alive today, he would almost certainly have over 100 million Twitter followers. He was something like the Elon Musk of his day– a bit controversial, incredibly innovative, and always the topic of conversation. People were obsessed with Newton’s every word and action. When news spread, for example, that Isaac Newton had invested in the famous South Sea Company, investors clamored to buy the stock… simply because Newton was in it. Sort of like Dogecoin.

The South Sea Company eventually collapsed after barely generating a penny in revenue; it still ranks as one of the biggest stock bubbles of all time, and Newton himself lost a fortune. But the obsession with Newton never stopped. People even paid attention to things that he didn’t say to infer what he might be thinking.

In some of his earlier works, for example, Newton did not explicitly profess his faith in either the Catholic religion or the Church of England. Of course he didn’t explicitly state that the didn’t adhere to religious faith either. But people took the omission as a sign that Newton was an atheist. (He wasn’t.)

Bear in mind that England in the 1600s was a highly puritan society; “atheist” was one of the worst things you could call a human being back then.

Yet with so many people assuming that Newton was an atheist, there was a sudden surge of interest in alternative spirituality. It became cool to question mainstream religious beliefs. And a number of philosophers emerged from this new trend that Newton never intended to create.

One of those was Charles Blount, who argued in 1679 that organized religion was not the will of the divine, but the product of human beings seeking wealth and power over others.

Want to ensure you and your loved ones can survive and thrive, no matter what happens next? Download our FREE Ultimate Plan B Guide now to discover fully actionable strategies you can start putting in place right now...

He described clergymen as having a “vain opinion of their great knowledge” and that they “pretended to know all things which were done in Heaven and Earth.”

And he considered most stories of the Bible to be contrived works of men that were “irrational and repugnant”.

Primarily Blount was merely arguing for intellectual independence. He didn’t care what people believed, so long as they reached their own conclusions.

Blount himself was deeply spiritual. Yet he was instantly branded an atheist.

Blount pushed back. He argued that ‘atheist’ was just a word used to defame someone with different ideas.

He compared ‘atheist’ to how ancient Romans used the term ‘barbarian’ to describe Germanic tribes as feral savages, even though many of the barbarian kingdoms were extremely cultured and civilized.

But Blount was effectively canceled. His books were censored, and he was financially and socially ruined. He died by suicide in 1693.

Another writer named John Toland took on the fight for intellectual independence, and published his first book in 1696, three years after Blount’s death.

Toland argued that human beings should not have blind faith in anything without first engaging in discussion, exploration, and intellectual discourse.

Obviously this infuriated the authorities; Toland was immediately labeled an atheist, and his books were condemned.

In Dublin, the Irish parliament went so far as to hold a public burning of Toland’s works on the steps of the capital on September 18, 1697.

Several governments ordered Toland’s arrest. His ideas were simply too dangerous, and they couldn’t have an evil atheist on the loose.

Toland managed to escape to Hanover and remained in the protective care of the much more enlightened Queen of Prussia.

This is still the case today; if one society has totally lost its mind, there’s most likely another one where you can feel safe, free, and unconstrained. Hanover was Toland’s Plan B.

Toland continued his work while in Hanover, secure from all the crazies who wished him harm. He became a staunch advocate for freedom of thought, later writing:

“Let all men freely speak what they think, without being ever branded or punished. . . [only] then you are sure to hear the whole truth.”

It’s notable that Toland is the first person to coin the term “free thinker”, and he lived during an era when being one was a terrible crime.

While in Hanover, Toland was subjected to endless scorn from “experts” back in England; more than FIFTY books were written criticizing his work and demeaning his character as an evil atheist.

Obviously Toland wasn’t an atheist either. Like Charles Blount before him, he simply had a different viewpoint and believed wholeheartedly in everyone’s right to intellectual freedom.

But that was more than enough for the ‘experts’ to censor him.

Another major development during this era was the authorities’ attempts to control information.

At this point in history, the printing press was having an extraordinary impact on social development; new ideas could be published and widely circulated at a speed that had never been imaginable.

Many politicians and religious leaders wanted to restrict this technology in order to prevent the spread of misinformation.

The Archdeacon of Canterbury complained in the late 1600s, for example, that the printing press was making it too easy for the “ignorant and unlearned… plebeians and mechanics… to demonstrate out of The Leviathan that there is no God.”

They didn’t like the ideas that were spreading… so their solution was to control the spread.

Now, if what I’ve written above sounds vaguely similar to our modern world, here’s the good news:

Freedom prevailed. Cancel culture lost.

It took time. But eventually the critics and the censors and ‘experts’ (who were always wrong about everything) faded into obscurity, paving the way for the Age of Enlightenment in which scientific achievement and freedom of thought flourished like never before.

This is true about all forms of totalitarianism, whether you’re talking about the Soviet Union or extreme ideological intolerance. They always fail. Freedom wins.

But it’s a bumpy road to get there… which is why it’s always worth having a Plan B.

PS: Alternative residency or citizenship generally forms the backbone of any robust Plan B. But there are WAY more things to consider. That’s why we created our 31-page Ultimate Plan B report to help you get to grips with this topic, and you can download the full, unabridged report here - 100% FREE.

Rich vs Wealthy: How Are They Different?

.Rich vs Wealthy: How Are They Different?

August 26, 2021 by Steve Cummings

Rich and Wealthy are two words people talk about interchangeably, but why?

Is being rich the same thing as being wealthy? “NO!!!”

Being rich and being wealthy are two different things. Yes, a wealthy person can be rich, and a rich person can be wealthy, but we have seen that high-priced athletes make vast sums of money but end up broke while a janitor makes a little bit of money and ends up super-wealthy.

How does all of this make sense? There are significant differences between being rich vs wealthy.

Rich vs Wealthy: How Are They Different?

August 26, 2021 by Steve Cummings

Rich and Wealthy are two words people talk about interchangeably, but why?

Is being rich the same thing as being wealthy? “NO!!!”

Being rich and being wealthy are two different things. Yes, a wealthy person can be rich, and a rich person can be wealthy, but we have seen that high-priced athletes make vast sums of money but end up broke while a janitor makes a little bit of money and ends up super-wealthy.

How does all of this make sense? There are significant differences between being rich vs wealthy.

What Does It Mean to be Rich?

Rich is an adjective we use to describe how much money you are bringing in via your income. In the dictionary, it says having a great deal of money or assets. An athlete making over a million dollars a year is considered rich. They would be regarded as some of the richest people in America. A teacher bringing in $50,000 a year is considered not rich at all. They would be regarded as middle income or middle class.

Being rich may also mean that you have high expenses. Your house is the biggest on the street. You drive fancy cars. Going out to eat at excellent restaurants is a norm for you. These things come with massive debt as well. If you are rich and spend the money as a rich person would, you will be poor once that job and income cease to exist. You will have high debts but no way to pay them off.

How is being rich different than being wealthy?

What Does Being Wealthy Mean?

Being wealthy is about having the money to cover your expenses and being able to have the freedom to do as you like. Wealthy people have accumulated assets that help produce a good flow of income.

In the book, Rich Dad Poor Dad Rober Kiyosaki talks about accumulating assets. It is not about how much you make it is about how much you keep. The wealthy people work on using their money to accumulate assets that can produce wealth for them. It is not about spending the money; it is about accumulating assets that will make income to hit financial freedom.

Most Wealthy people have a few traits that have:

Buy Income producing assets

Own their own time

Can do what they like

Spend less than they earn

To continue reading, please go to the original article here:

Advice for Everyone Who’s Confused About Money Right Now

.Advice for Everyone Who’s Confused About Money Right Now

MY TWO CENTS FEB. 10, 2022 By Charlotte Cowles

Ramit Sethi’s no-nonsense book, I Will Teach You to Be Rich, became a New York Times best seller in 2009 and spawned an eponymous podcast, newsletter, and range of personal finance courses that have made Sethi very, well, rich. It’s easy to be skeptical of what Sethi is selling, but dig under his bold promises and you’ll find approachable, empathetic advice on saving, spending, and organizing your money.

He’s also something of an anti-finance guru in that he eschews jargon and doesn’t lecture people about credit-card points and other minutiae. Instead, he has a talent for breaking down big-picture financial concepts into real-life steps. Which is why I wanted to talk to him right now, at a time when money seems especially complicated (Inflation! Interest rates! Crypto!). Here, we discussed why moments like this can be ideal for taking charge of your finances, and what that process can look like.

Advice for Everyone Who’s Confused About Money Right Now

MY TWO CENTS FEB. 10, 2022 By Charlotte Cowles

Ramit Sethi’s no-nonsense book, I Will Teach You to Be Rich, became a New York Times best seller in 2009 and spawned an eponymous podcast, newsletter, and range of personal finance courses that have made Sethi very, well, rich. It’s easy to be skeptical of what Sethi is selling, but dig under his bold promises and you’ll find approachable, empathetic advice on saving, spending, and organizing your money.

He’s also something of an anti-finance guru in that he eschews jargon and doesn’t lecture people about credit-card points and other minutiae. Instead, he has a talent for breaking down big-picture financial concepts into real-life steps. Which is why I wanted to talk to him right now, at a time when money seems especially complicated (Inflation! Interest rates! Crypto!). Here, we discussed why moments like this can be ideal for taking charge of your finances, and what that process can look like.

It’s a confusing time to be making decisions about money. The economy is all over the place, the pandemic is still happening — it just seems impossible to plan for the future. What’s your advice on how to make sense of this moment, financially?

I get over 2,000 messages a day, from people of different ages and different socioeconomic backgrounds. Over the past two years, I’ve heard from people who have lost jobs, had loved ones die, had to cancel their weddings — people have had a total disruption in their expectations for what they thought life was going to be like.

But there has also been this rare opportunity for people to take control of their money. I’ve seen a huge growth in interest in personal finance. Savings rates were at a historic high. People actually saw the value of things like an emergency fund. Especially back in March and April of 2020, they started to realize, “Oh my God, I know I should have saved, but I never actually did it. Now, I understand. What do I do?”

Right. It was a moment of reckoning.

There are several pivotal moments in somebody’s life when they decide to take control of their money — when they’re graduating from college, getting married, having children, getting divorced, getting a new job. There’s a few others. But usually it’s a time with high stakes, where there’s an external force that gets them to take stock.

It’s the rare person who just wakes up and goes, “I’m going to sit down and make a long-term plan with a low-cost investing strategy.” That almost never happens. Instead, something external causes us to say, “I’ve got to do this now.”

When that moment happens, what’s the best way to harness it? I think a lot of people try to dive in and then get overwhelmed and give up.

Well, you can read a book. I mean, the majority of people who complain about personal finance, who worry about personal finance, who feel guilty about personal finance, have never read a single book on personal finance. It’s pretty straightforward. A lot of people ask, how do I get confident with my money?

The way you get confident is through competence. In order to be competent, you have to learn the basic language of money. This is not complicated stuff. The words are a little unapproachable. If it were me, I would not have called it a 401(k). The reason most people do not engage with their money is simply that money is talked about in a restrictive and unappealing way.

I personally hold a lot of the financial media to account for this. They tell people all the things you can’t do with your money — “No, you can’t buy jeans. No, you can’t go on vacation.” No wonder people are turned off.

I want to use money to say yes. I want to tell people that they can spend extravagantly on the things they love if they cut costs mercilessly on the things they don’t. That gets into prioritizing, and designing and crafting what a rich life looks like to you, which is different for every person. As you start to dial in on this concept, it gets exciting and appealing, and it makes you want to read about IRAs and investments.

How do people actually go about determining what they actually want, though? It can be hard to figure that out — financially and otherwise. And it can change.

To continue reading, please go to the original article here:

https://www.thecut.com/2022/02/money-advice-confusing-times.html

A Halsted vs. Dwight Eisenhower Investor - Over Confident vs Healthy Confident - Risk vs Opportunity

.A Halsted vs. Dwight Eisenhower Investor - Over Confident vs Healthy Confident - Risk vs Opportunity

Write Two Letters Feb 22, 2022 by Ted Lamade Collaborative Fund

Guest post by Ted Lamade, Managing Director at The Carnegie Institution for Science

So, what differentiates someone with a healthy amount of confidence from someone with too much of it? In my experience, people with the right amount of confidence share the credit when they succeed, but more importantly, accept the responsibility when they fail. This combination translates into an ability to admit when they’re wrong and change direction if needed.

Overconfidence is everywhere in life. In finance, it is what caused John Merriweather, Dick Fuld, and Jeff Immelt to destroy billions in shareholder value. In sports, Barry Bonds, Roger Clemens, and Pete Rose are three of the greatest baseball players of all-time, yet none are in the Hall of Fame because of it. In entertainment, Martha Stewart, Michael Eisner in his last few years at Disney, and John Antico at Blockbuster all fell victim to it. In politics, the list is simply too long to get started.

A Halsted vs. Dwight Eisenhower Investor - Over Confident vs Healthy Confident - Risk vs Opportunity

Write Two Letters Feb 22, 2022 by Ted Lamade Collaborative Fund

Guest post by Ted Lamade, Managing Director at The Carnegie Institution for Science

So, what differentiates someone with a healthy amount of confidence from someone with too much of it? In my experience, people with the right amount of confidence share the credit when they succeed, but more importantly, accept the responsibility when they fail. This combination translates into an ability to admit when they’re wrong and change direction if needed.

Overconfidence is everywhere in life. In finance, it is what caused John Merriweather, Dick Fuld, and Jeff Immelt to destroy billions in shareholder value. In sports, Barry Bonds, Roger Clemens, and Pete Rose are three of the greatest baseball players of all-time, yet none are in the Hall of Fame because of it. In entertainment, Martha Stewart, Michael Eisner in his last few years at Disney, and John Antico at Blockbuster all fell victim to it. In politics, the list is simply too long to get started.

William Halsted is widely regarded as one of the “Fathers of Modern Surgery.” He is also known for being an extremely confident surgeon, co-founding Johns Hopkins Hospital, creating multiple surgical techniques, introducing sterilization procedures in the operating room, helping develop anesthesia, and creating the first formal surgical residency training program in the United States.

One of the notable surgical techniques Halsted pioneered was the “radical mastectomy”, which was a novel approach to treating breast cancer. Designed to go well beyond the breast tissue, the procedure would remove pectoral muscles, the mammary gland, lymph nodes under the armpit, and even extend down to the ribcage if necessary in an attempt to more effectively rid the patient of malignant cells.

The radical mastectomy quickly became the preferred method for treating breast cancer and would remain so for decades. There was just one problem. It didn’t work. Halsted was wrong.

Instead of curing breast cancer, the radical mastectomy was overly invasive, debilitating, and ineffective for most patients. Yet, Halsted failed to acknowledge this reality. In fact, he and countless other surgeons continued to perform it even as studies increasingly showed that the ultimate survival from breast cancer had more to do with how extensively the cancer had spread before surgery than how extensively a surgeon operated.

The logical question then is, why did Halsted continue performing and promoting the radical mastectomy in the face of disconfirming evidence?

As Siddhartha Mukherjee describes in his seminal book on Cancer, “The Emperor of all Maladies,”

The Gospel of the surgical profession was ideally arranged to resist change and to perpetuate an orthodoxy. Rather than address the real question raised by the data – did radical mastectomy truly extend lives? – they clutched to their theories even more adamantly. Where others might have seen reason for caution, Halsted only saw opportunity.

Halsted was blinded by what he wanted to believe. Instead of seeking the truth, he sought confirming evidence. When the results weren’t what he had hoped for, he would often make the case that he simply needed to go further.

To continue reading, please go to the original article here:

Saving Happiness

.Saving Happiness

Jiab Wasserman

RESEARCHERS HAVE spent decades probing the connection between money and happiness. For instance, a much-cited 2010 study by academics Daniel Kahneman and Angus Deaton found that folks tend to feel happier the more money they make—but only up to a point, which they estimated to be about $75,000 a year.

But using only income to measure the link between money and happiness is incomplete. Another study, entitled “How Your Bank Balance Buys Happiness,” analyzed the connection to people’s “cash on hand.” The researchers found that having more money in checking and savings accounts was associated with higher levels of life satisfaction. But similar to the income studies, so-called liquid wealth appeared to be subject to diminishing returns, with the impact on life satisfaction tapering off as folks have more.

Saving Happiness

Jiab Wasserman

RESEARCHERS HAVE spent decades probing the connection between money and happiness. For instance, a much-cited 2010 study by academics Daniel Kahneman and Angus Deaton found that folks tend to feel happier the more money they make—but only up to a point, which they estimated to be about $75,000 a year.

But using only income to measure the link between money and happiness is incomplete. Another study, entitled “How Your Bank Balance Buys Happiness,” analyzed the connection to people’s “cash on hand.” The researchers found that having more money in checking and savings accounts was associated with higher levels of life satisfaction. But similar to the income studies, so-called liquid wealth appeared to be subject to diminishing returns, with the impact on life satisfaction tapering off as folks have more.

Which brings me to tennis. We recently moved from Granada, Spain, to Alicante, which is about 220 miles to the east and right on the Mediterranean. Alicante has milder weather that’s conducive to outdoor sports all year round, so most apartment complexes have tennis courts. My husband Jim accused me of looking for our new apartment based on the condition of the tennis courts first and the apartment second. Yes, I love playing tennis.

I also have a fondness for tennis analogies. I think saving money is like playing good tennis defense, while making more money is like playing offense. There are plenty of YouTube videos of the best winning shots, but relatively few that focus on the defensive skill that’s needed to keep the ball in play. Playing defense isn’t flashy. Yet Novak Djokovic, arguably the world’s top player, is renowned for his defensive play and for his ability to turn defense into offense.

Along the same lines, making more money, moving up the corporate ladder and building your own business are all exciting. People love to talk about such successes and to show off what this money has bought them, whether it’s the new car or the bigger house. But they never pull out their latest portfolio statement and say, “Look at my balance.” There’s nothing showy about saving money. We often celebrate a pay raise, a promotion or a business success, but we seldom celebrate when we’ve maxed out our 401(k) plan or reached a financial milestone.

In tennis, playing defense is mostly about limiting your mistakes, while waiting for the opportunity to strike. In football, it’s said that “defense wins championships.” Isn’t it the same in life? Progress—and ultimate success—are typically achieved through hundreds of smart, boring, stay-the-course decisions, rather than through flashy gambles.

Indeed, for most people, financial success is more about limiting mistakes and less about striking it big. Limiting mistakes means minimizing expenses by investing in index funds, living within your means, making the most of your 401(k) and so on. Like the turtle, it’s slow and steady that wins the race.

Happiness – It’s a Rat Race Out There!!

32,260,804 views • Nov 24, 2017 • The story of a rodent's unrelenting quest for happiness and fulfillment.

https://www.youtube.com/watch?v=e9dZQelULDk&t=251s

To continue reading, please go to the original article here:

After The Fact

.After The Fact

Feb 8, 2022 by Morgan Housel

Let’s say you exercise an hour a day, seven days a week. Sweat, grunting, the real deal.

Exercising does two things: It makes you hungry and makes you proud. So let’s say after every workout you eat a huge dinner with extra dessert. You know that’s not ideal, but you just accomplished something hard, so it feels justified. After a year of this you haven’t lost any weight, which was your goal. You can’t figure it out. You’re exercising every day. You’re so frustrated.

The name for this is “food compensation,” and it’s wily foe. In his book The Body, Bill Bryson writes:

One study in America found that people overestimate the number of calories they burned in a workout by a factor of four. They also then consumed, on average, about twice as many calories as they had just burned off … the fact is, you can quickly undo a lot of exercise by eating a lot of food, and most of us do.

After The Fact

Feb 8, 2022 by Morgan Housel

Let’s say you exercise an hour a day, seven days a week. Sweat, grunting, the real deal.

Exercising does two things: It makes you hungry and makes you proud. So let’s say after every workout you eat a huge dinner with extra dessert. You know that’s not ideal, but you just accomplished something hard, so it feels justified. After a year of this you haven’t lost any weight, which was your goal. You can’t figure it out. You’re exercising every day. You’re so frustrated.

The name for this is “food compensation,” and it’s wily foe. In his book The Body, Bill Bryson writes:

One study in America found that people overestimate the number of calories they burned in a workout by a factor of four. They also then consumed, on average, about twice as many calories as they had just burned off … the fact is, you can quickly undo a lot of exercise by eating a lot of food, and most of us do.

You can’t measure the benefit of exercise just by tracking how much you work out. It’s the gap between your workout and avoiding offsetting its benefits after the fact that makes all the difference.

And isn’t building wealth the same?

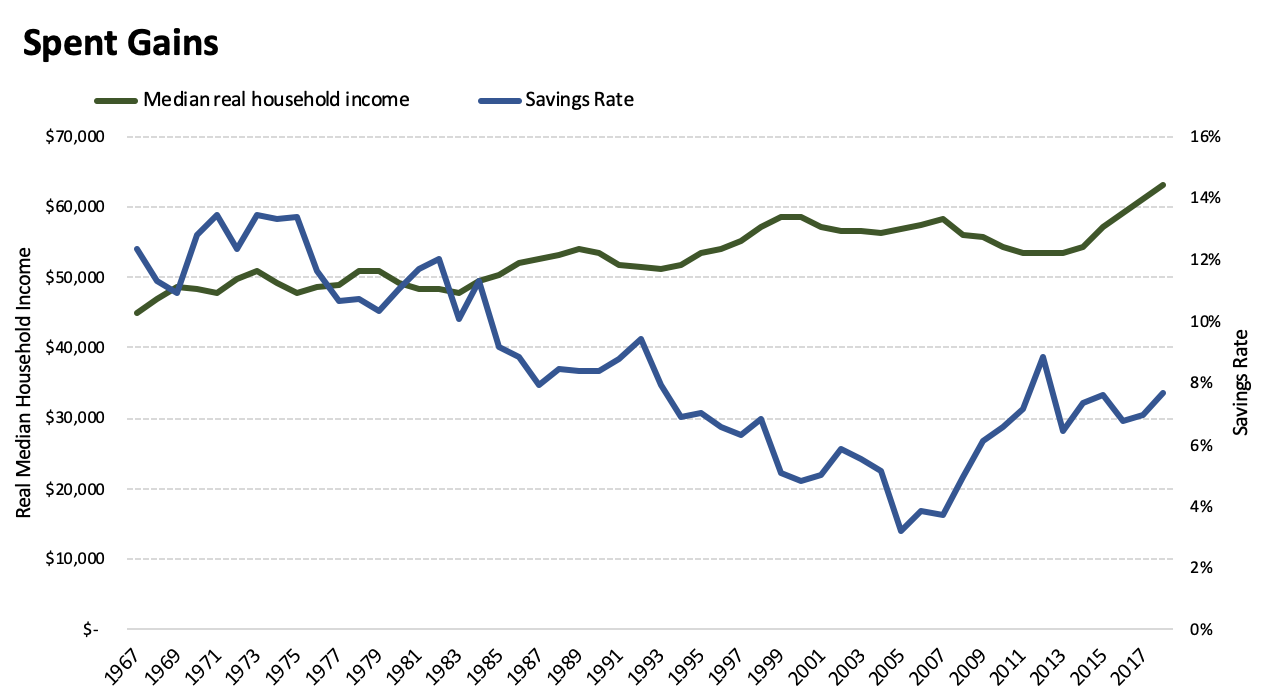

Here’s a short story of what happened over the last 50 years: Median inflation-adjusted incomes doubled and the savings rate was nearly cut in the half:

Source: Federal Reserve, Bureau of Labor Statistics.

The typical American family is earning more than ever before. But for many it probably doesn’t feel like that – at least as much as it should – because all of the income gains and then some have been offset with higher spending.

You could say higher spending is the goal. But all new luxuries become necessities in due time as expectations reset. I suspect part of the reason people don’t feel better off is because financial progress is better measured by wealth, not income. And wealth is just the accumulation of income you haven’t spent.

So a lot of people are the financial equivalent of the exerciser who burns 500 calories then immediately offsets it with dessert and is frustrated by the lack of progress despite working so hard.

To continue reading, please go to the original article here:

10 Mistakes That Deplete Your Wealth

.10 Mistakes That Deplete Your Wealth

Cynthia Measom Fri, February 18, 2022

Proper planning is crucial when it comes to your finances -- not only for the decisions that can affect your wealth now but also for those that will influence your bottom line long term. But knowing how to make the best financial decisions isn't innate. And if you don't fully understand how to manage your finances, you're likely to make mistakes that can take your net worth from well-cushioned to barely getting by -- or force yourself to stay stuck in a constant financial struggle.

The good news is that the longer you have until your target retirement date, the easier it will be to recover from financial blunders, but what if you could avoid money pitfalls altogether? Take a look at these 10 mistakes that deplete your wealth so you can sidestep them and achieve personal financial freedom.

10 Mistakes That Deplete Your Wealth

Cynthia Measom Fri, February 18, 2022

Proper planning is crucial when it comes to your finances -- not only for the decisions that can affect your wealth now but also for those that will influence your bottom line long term. But knowing how to make the best financial decisions isn't innate. And if you don't fully understand how to manage your finances, you're likely to make mistakes that can take your net worth from well-cushioned to barely getting by -- or force yourself to stay stuck in a constant financial struggle.

The good news is that the longer you have until your target retirement date, the easier it will be to recover from financial blunders, but what if you could avoid money pitfalls altogether? Take a look at these 10 mistakes that deplete your wealth so you can sidestep them and achieve personal financial freedom.

Proper planning is crucial when it comes to your finances -- not only for the decisions that can affect your wealth now but also for those that will influence your bottom line long term. But knowing how to make the best financial decisions isn't innate. And if you don't fully understand how to manage your finances, you're likely to make mistakes that can take your net worth from well-cushioned to barely getting by -- or force yourself to stay stuck in a constant financial struggle.

The good news is that the longer you have until your target retirement date, the easier it will be to recover from financial blunders, but what if you could avoid money pitfalls altogether? Take a look at these 10 mistakes that deplete your wealth so you can sidestep them and achieve personal financial freedom.

Investing Blindly

Brian Stivers, investment advisor and founder of Stivers Financial Services, said that one of the biggest mistakes that depletes wealth is investing in areas you have no experience in or don't truly understand.

"The media and internet are filled with fringe investments that promise great wealth with little risk," he said. "Yet, many of these are extremely aggressive and have a substantial downside. It is important for those who are accumulating wealth or have already accumulated wealth to make sure they fully understand the risk involved in any new investment and how that investment works. For most investors, it makes more sense to stay with traditional investment strategies that are easy to understand and have a long track record of success."

Making Investments Based on Emotion

"Investing is emotional given the fact that money is at stake, but investors must control those emotions and aim to act on reason and rationality," said Jason Dall'Acqua, CFP(r) and president of Crest Wealth Advisors.

"Unfortunately, people tend to make investment decisions that are against their own best interests strictly for emotional reasons. The most common example is chasing trends, which results in buying high or being panic-stricken during a market decline, which results in selling low. These decisions can have a significant negative impact on long-term investment returns."

To continue reading, please go to the original article here: