Coffee with MarkZ and Mr. Cottrell. 08/29/2025

Coffee with MarkZ and Mr. Cottrell. 08/29/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Friday Morning….looks like another month bites the dust

Member: If Saturday night into Sunday morning is the best time to reset we still could have this RV this month.

Coffee with MarkZ and Mr. Cottrell. 08/29/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Friday Morning….looks like another month bites the dust

Member: If Saturday night into Sunday morning is the best time to reset we still could have this RV this month.

MZ: I was told the easiest time to pull the trigger was Saturday night to Sunday morning

MZ: I don’t know if they will flip the switch this weekend…but expectations are high.

Member: It sure would be ironic if it happened over Labor Day weekend

Member: Vietnam is giving their citizens 100,000 dong each seems like a big indicator to me

MZ: I don’t think its enough unless something is hidden there. Doesn’t make any sense

Member: If it isnt more than just the typical 100K dong, its like buying everyone a coffee in celebration.... Nice but not noteworthy......about worth $3.50 US

Member: People are chatting about it on Reddit and it sounds like the Vietnamese citizens are upset because it’s such a little anoint of money and it seems like a waster to them.

Member: Vietnam might push Iraq to go???

MZ: “Iraq is moving towards building an advanced economy” This is more on the white paper reforms. This is a steady affirmation on where they are headed.

Member: Dear God just please let Iraq do it……release the new rate…enough talk….just do it.

MZ: “France, Germany, UK initiate 30 day window for Iran nations snapback” they intend to reinstate sanctions on Iran.

Member: Any news on Indian Nations Mark?

MZ: No confirmations on Indian nations or tier 3 as of yet.

Member: Keep in mind, the new fiscal year for the US and other countries starts Oct 1.

Member: October starts the 4th quarter.

Member: Hope you all have a happy labor day weekend!

Mr. Cottrell joins the stream today. Please listen to the replay for his information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Friday 8-29-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 29 August 2025

Compiled Fri. 29 August 2025 12:01 am EST by Judy Byington

Thurs. 28 Aug. 2025 BREAKING! QFS FULLY ACTIVATED, GESARA ENFORCEMENT UNDERWAY, SHI TOKEN DEPLOYED UNDER SPACE FORCE COMMAND

The digital SHI token — Sovereign Human Initiative — has (allegedly) been deployed. Bound to gold, secured by biometric Quantum Access Cards, and unhackable, SHI is already (allegedly) in use at Redemption Centers in Texas, Arizona, Nevada, and Alaska.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 29 August 2025

Compiled Fri. 29 August 2025 12:01 am EST by Judy Byington

Thurs. 28 Aug. 2025 BREAKING! QFS FULLY ACTIVATED, GESARA ENFORCEMENT UNDERWAY, SHI TOKEN DEPLOYED UNDER SPACE FORCE COMMAND

The digital SHI token — Sovereign Human Initiative — has (allegedly) been deployed. Bound to gold, secured by biometric Quantum Access Cards, and unhackable, SHI is already (allegedly) in use at Redemption Centers in Texas, Arizona, Nevada, and Alaska.

Space Force’s Starlink grid (allegedly) provides quantum encryption for every transaction. If a transfer doesn’t pass through Space Force verification, it is blocked. This is total control of the financial battlefield, and it (allegedly) belongs to Trump.

Central banks worldwide are collapsing structurally, not metaphorically. Japan is insolvent. The euro is at historic lows. Germany froze pensions. The UK halted high-net withdrawals. Over 430 elite escape payouts have been intercepted in Monaco, Singapore, and Tel Aviv. Their gold is gone. Their authority is gone. Their illusion is gone.

Over 130 nations are (allegedly) already in GESARA biometric compliance. IRS offices are (allegedly) shutting down. Student loan and tax debts are (allegedly) being erased via quantum ledger corrections. Consumption-based taxation is (allegedly) replacing the corrupt income system. Every account, property title, and investment (allegedly) will be quantum-audited. Fraudulent entries wiped. Legitimate ones preserved.

The Emergency Broadcast System will (allegedly) trigger once 90% of global compliance is secured. Expect public announcements: the end of the Federal Reserve, confirmation of GESARA rollout, activation of SHI as the global token, biometric onboarding, and Quantum Card distribution. Savings and wealth will(allegedly) be restored under quantum law. Illicit assets will be erased.

Trump did not return for politics. He returned to (allegedly) annihilate the central banking system, dismantle globalist slavery, and restore sovereignty to humanity. The elite’s money is(allegedly) frozen. Their escape routes destroyed. Their gold seized. Their time is over.

QFS is(allegedly) live. GESARA is(allegedly) active. SHI is (allegedly) real. And those who enslaved humanity with debt and lies will not survive what comes next.

EBS

~~~~~~~~~~~~~

Thurs. 28 Aug. 2025 THE GREAT SILENCE BEFORE THE SIGNAL: QFS Live as of Sun. 17 Aug. 2025 …Emergency Broadcast System on Telegram

The Quantum Financial System (QFS) is no longer a concept locked in secret halls. It breathes. It pulses. It’s being tested in shadows while the old fiat still pretends to be alive.

For months, the system has been whispering. Bank terminals flicker. Satellites “recalibrate.” Power grids stutter for seconds, then return as if nothing happened. To the untrained eye — glitches. To those who know — signals. What you’re witnessing is not chaos. It’s the final rewiring of the global network.

Every transaction you’ve made in recent weeks already (allegedly) passed through nodes you were never told exist. The “banks” you still see on the street are facades, like empty shells of a dead organism. Inside the core — quantum settlement, asset-backed transfers, incorruptible code.

And what comes with QFS? GESARA. NESARA. Debt release. Restoration of stolen wealth. Funding for suppressed technologies — MedBeds, free energy, hidden cures. This is why the silence feels so heavy. Because once the switch flips, there will be no turning back.

Watch for these markers:

• Lights cutting out in government buildings for minutes at a time.

• News anchors “losing” audio simultaneously across networks.

• Sudden revaluation of currencies in small, “insignificant” nations.

• An unexpected global message, looping across every screen.

When it hits, remember this: the storm isn’t coming. The storm is already here. You’re just waiting for the broadcast.

On Sun. 17 Aug. 2025 a Top Secret Global Currency Reset (GCR) (allegedly) began rolling out that was decades in the making & designed to stabilize currencies & unite over 90 nations under a fairer financial system. The U.S. enters last, ensuring the system is stress-tested before the largest economy commits.

Read full post here: https://dinarchronicles.com/2025/08/29/restored-republic-via-a-gcr-update-as-of-august-29-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 This blessing is happening. It's occurring at a very quick pace...relative to the last 20 years that we've been sitting here wondering when is this ever going to happen. We were always asking the question, does this have the potential? Does that have the possibility? We don't even ask those questions anymore. What we're doing now is making the questions of preparation...

Jeff Like Donald Trump said in the video I brought you last weekend that the US are not leaving until we get paid because we were paid in Iraq dinar, not the US dollar. The only way we can get paid is for the dinar to have value added to it - a real effective exchange rate.

Militia Man Iraq is telling us exactly what they're doing and how they're doing it. It's somewhat vague but if the implications behind what they're stating is truly showing that they are integrating into the global financial system.

************

Gold Revaluation, Banking Collapse & the Endgame Ahead | Rafi Farber

Liberty and Finance: 8-28-2025

Rafi Farber dismantles the illusion that gold is merely another commodity, framing it instead as the bedrock of the monetary system against which the dollar perpetually devalues.

He draws historical parallels—from FDR’s arbitrary revaluation in 1933 to the market-driven surge of 1980—arguing that today’s monetary base implies gold could reach $40,000–$50,000 an ounce, a number that sounds absurd only to those unfamiliar with precedent.

Farber skewers the Genius Act and its stablecoin provisions as nothing more than adding another flimsy layer to an already top-heavy pyramid of derivatives, a bureaucratic sleight-of-hand that will collapse under the same laws of economic gravity.

Ironically, the very schemes meant to preserve the system may accelerate its demise, forcing the choice between saving the banks or the currency—a decision that ensures the destruction of one or the other.

Yet, he insists the coming “end game” is less apocalypse than rebirth, where those grounded in community and tangible value will endure while the paper illusions dissolve.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Gold revaluation

14:02 Gold price spreads & financial crises

17:33 GENIUS Act & Endgame

Iraq Economic News and Points To Ponder Friday Morning 8-29-25

Economic Institution: Central Bank Reforms Boost Investor Confidence and Open the Way to Global Markets

Baghdad – INA Khaled Al-Jaberi, Chairman of the Osool Foundation for Economic and Sustainable Development, affirmed on Tuesday that the reforms led by the Central Bank are fundamental and have contributed to transforming the banking sector from a restricted reality to one open to the world.

He explained that these steps will open up broad horizons for Iraqi banks and positively impact the overall economic and investment activity in the country.

Economic Institution: Central Bank Reforms Boost Investor Confidence and Open the Way to Global Markets

Baghdad – INA Khaled Al-Jaberi, Chairman of the Osool Foundation for Economic and Sustainable Development, affirmed on Tuesday that the reforms led by the Central Bank are fundamental and have contributed to transforming the banking sector from a restricted reality to one open to the world.

He explained that these steps will open up broad horizons for Iraqi banks and positively impact the overall economic and investment activity in the country.

Al-Jaberi told the Iraqi News Agency (INA):

"The current reforms have transformed the banking sector from being restricted and deprived of dealing in dollars to a sector capable of opening correspondent banks and restoring its international relations, which will directly reflect on improving banking services and stimulating economic activity in Iraqi markets."

He added, "Iraqi banks welcomed these reforms because they are an indispensable necessity.

The banking sector is suffering from numerous problems, and a comprehensive reform is needed to ensure the ability to conduct international transactions and ensure the freedom to trade in dollars."

He explained that "the investment environment in Iraq has become attractive thanks to the

security stability, and this has prompted investors to enter the Iraqi market."

He explained that "investors are always looking for two basic answers: the status of the banking sector and the country's tax system. If reassurance is achieved in these two aspects, investments begin to flow."

Al-Jaberi pointed out that "banking reforms will lead to broader relationships with correspondent banks,

putting Iraq on the path to opening up to the global market and

facilitating the transfer of funds in line with international standards."

He continued, "Financial technology and digital transformation are a fundamental pillar of these reforms, as they are not limited to banking policies alone, but rather encompass all aspects of banking operations.

This positively impacts all economic sectors, such as agriculture, industry, and tourism, and contributes to facilitating the movement of funds and trade both domestically and internationally."

Earlier, Central Bank Governor Ali Al-Alaq confirmed that the banking reform plan would boost international confidence and restore relations with correspondent banks. https://ina.iq/ar/economie/241869-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Friday Morning 8-29-25

Good Morning Dinar Recaps,

US Regulator Opens Pathway for Americans to Trade on Offshore Crypto Exchanges

The Commodity Futures Trading Commission (CFTC) has cleared a new path for U.S. investors to legally access offshore crypto platforms under its Foreign Board of Trade (FBOT) framework.

This marks a significant development in the regulator’s ongoing “crypto sprint” initiative, which was launched to overhaul outdated regulations in response to proposals from the Trump administration.

Good Morning Dinar Recaps,

US Regulator Opens Pathway for Americans to Trade on Offshore Crypto Exchanges

The Commodity Futures Trading Commission (CFTC) has cleared a new path for U.S. investors to legally access offshore crypto platforms under its Foreign Board of Trade (FBOT) framework.

This marks a significant development in the regulator’s ongoing “crypto sprint” initiative, which was launched to overhaul outdated regulations in response to proposals from the Trump administration.

🔹 CFTC’s Announcement

Acting CFTC Director Caroline Pham confirmed that U.S. clients can once again tap into offshore trading opportunities through the long-standing FBOT registry.

“Starting now, the CFTC welcomes back Americans who want to trade efficiently and safely under CFTC regulations, and opens up U.S. markets to the rest of the world. It’s just another example of how the CFTC will continue to deliver wins for President Trump as part of our crypto sprint.” – Caroline Pham

The FBOT framework, in place since the 1990s, allows registered offshore exchanges to provide U.S. access across asset classes, now extended explicitly to crypto.

🔹 Impact on U.S. Crypto Markets

Liquidity Boost: Offshore access is expected to increase market depth and reduce regional silos.

Binance Case Study: The world’s largest exchange, Binance, remains off-limits to most U.S. users except through its limited affiliate, Binance.US. The CFTC’s move could pave the way for broader participation.

Investor Choice: U.S. traders, often restricted to “walled garden” platforms, may soon benefit from a more competitive and global marketplace.

🔹 Trump’s Crypto Sprint in Action

The announcement follows President Trump’s repeated calls to bring crypto companies back to U.S. soil and secure American leadership in digital assets.

Between 2021 and 2024, unclear rules drove many crypto firms offshore, with the majority of trading volume moving outside U.S. borders. The CFTC’s reforms aim to reverse this trend, positioning the U.S. as a friendlier jurisdiction for digital finance.

🔹 Industry Perspective

Edwin Mata, attorney and CEO of tokenization platform Brickken, stressed that ambiguity in past regulations had created unnecessary legal risk for crypto firms:

Clearer rules will lower compliance burdens.

Companies can operate in the U.S. without fear of “regulation by enforcement.”

More projects will stay onshore, fueling U.S. innovation.

🔹 Next Steps

The CFTC is now accepting public feedback on its crypto framework. Its goal:

Protect investors and markets,

Avoid creating barriers that push innovation offshore.

This marks one of the most significant shifts in U.S. crypto oversight since 2021, potentially reshaping where and how Americans trade digital assets.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Mastercard Launches First Stablecoin Transactions in Africa and the Middle East

The world of crypto payments is steadily moving from experimentation to real-world adoption. This week’s development comes from Mastercard and Circle, who have joined forces to bring stablecoin settlements into mainstream banking flows across Africa, the Middle East, and Eastern Europe.

🔹 A Bold Expansion: USDC & EURC in Banking Flows

Mastercard now enables settlements in USDC and EURC for acquirers in the EEMEA region (Eastern Europe, Middle East, Africa).

Circle has integrated USDC into Finastra’s Global PAYplus platform, opening access to 50 countries and $5 trillion in potential flows.

Early adopters include Arab Financial Services (Bahrain) and Eazy Financial Services (Saudi Arabia).

For Kash Razzaghi, Circle’s Chief Business Officer, the initiative is a turning point:

“Our expanded partnership with Mastercard will enable wider reach, global access, and scaled impact, so that USDC can become as ubiquitous as traditional payments.”

🔹 Mastercard’s Strategy: Bridging Fiat and Blockchain

Mastercard is no longer just a credit card network. The company is actively positioning itself as a global bridge between banks and digital assets, leveraging stablecoins to unify fiat and blockchain systems.

Key initiatives include:

Crypto Credential – identity authentication for blockchain transactions.

Crypto Secure – fraud detection tailored to crypto payments.

MTN integration – enabling multi-asset digital settlements.

Partnerships with Bybit and S1lkPay, offering direct USDC payments via crypto cards.

Dimitrios Dosis, Mastercard’s EEMEA President, emphasized the company’s commitment:

“We know trust is essential to scale, and we are proud to play a leading role by leveraging our decades of experience in security and compliance in the stablecoin universe.”

🔹 The Bigger Picture: Circle’s Global Offensive

Five facts highlighting the scale of Circle & Mastercard’s move:

+90% annual growth of USDC, now at $65.2B market cap.

28% share of the dollar-backed stablecoin market.

Zero fees for USDC/USD conversions on OKX.

50 countries connected through Finastra’s settlement rails.

4 Korean banks in talks with Circle on a potential digital won issuance.

Beyond payments, Circle is aiming higher: the company has filed for a U.S. banking license to transform USDC into a native part of the financial system.

🔹 Why This Matters

This collaboration is more than just a technical integration:

It places stablecoins inside the banking infrastructure, not just at the edges of crypto exchanges.

It strengthens regulatory trust in stablecoins by leveraging Mastercard’s compliance systems.

It signals the beginning of a world where stablecoins like USDC can serve as a monetary backbone for digital economies.

@ Newshounds News™

Source: CoinTribune

~~~~~~~~~

Final List of XRP ETF Awaiting SEC Approval: Dates, Filings, And Deadlines

The SEC’s final decisions on multiple spot XRP ETF proposals are expected between October and December 2025, with analysts predicting approval could unlock billions in inflows — potentially surpassing Bitcoin and Ethereum ETFs in size.

At present, eleven XRP ETF proposals are under review, spanning from major asset managers to crypto-native firms. Bloomberg Intelligence data shows a mix of spot ETFs, futures ETFs, and leveraged products awaiting final SEC rulings.

🔹 ProShares Ultra XRP ETF (Approved & Live)

Filed: January 17, 2025

Approval: July 2025 (NYSE Arca)

Launch: July 18, 2025

Details: First approved XRP ETF, offering 2x leveraged exposure to XRP futures.

🔹 Grayscale XRP ETF

Filed: Sept 5, 2024 (Prospectus), Jan 30, 2025 (Form 19b-1)

Deadlines: April 6, May 21, Aug 19, 2025

Final SEC Decision: October 18, 2025

🔹 Grayscale Avalanche Trust for XRP (Conversion)

Filed: Aug 25, 2025 → ETF conversion bid (Form 19b-1 March 25, 2025)

Deadlines: May 31, July 15, Oct 13, 2025

Final SEC Decision: December 12, 2025

🔹 21Shares XRP ETF

Filed: Nov 1, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 7, May 22, Aug 20, 2025

Final SEC Decision: October 19, 2025

🔹 Bitwise XRP ETF

Filed: Oct 2, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 7, May 25, Aug 23, 2025

Final SEC Decision: October 20, 2025

🔹 Canary Capital XRP ETF

Filed: Oct 8, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 11, May 26, Aug 24, 2025

Final SEC Decision: October 23, 2025

🔹 WisdomTree XRP ETF

Filed: Dec 2, 2024 (Prospectus), Feb 6, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: April 12, May 27, Aug 25, 2025

Final SEC Decision: October 25, 2025

🔹 CoinShares XRP ETF

Filed: Jan 24, 2025 (Prospectus), Feb 10, 2025 (Form 19b-4)

Deadlines: April 11, May 26, Aug 24, 2025

Final SEC Decision: October 23, 2025

🔹 Franklin Templeton XRP ETF

Filed: March 11, 2025 (Prospectus), March 13, 2025 (Form 19b-4, Cboe BZX Exchange)

Deadlines: May 3, June 17, Sept 15, 2025

Final SEC Decision: November 14, 2025

🔹 Rex & Osprey XRP ETF

Filed: Jan 21, 2025 (Prospectus), March 13, 2025 (Form 19b-4)

Status: SEC decision was delayed after July 25, 2025, pending further review.

🔹 Volatility Shares XRP ETFs

Filed: May 21, 2025 (Form N-1A)

Products: 1x XRP Futures ETF, 2x Leveraged XRP ETF, Inverse -1x XRP ETF

Status: Initial decision expected July 2025, but SEC delayed.

🔹 Key Takeaway

The SEC’s final decisions on XRP spot ETFs are clustered around October–December 2025. Approval would open institutional floodgates, possibly positioning XRP as the third-largest ETF market in crypto — or even leapfrogging Bitcoin and Ethereum in adoption.

📌 Note: Cboe BZX Exchange has filed 19b-4 forms on behalf of Bitwise, 21Shares, WisdomTree, Franklin Templeton, and Canary Capital to list XRP spot ETFs.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 8-29-2025

TNT:

Tishwash: Iraqi ports are included for the first time in the global list of STS service providers.

The General Company for Iraqi Ports announced today, Thursday, its official inclusion, for the first time in its history, on the global list of Ship-to-Ship Transfer (STS) service providers , according to the list issued by the global consulting firm Dynamarine .

In a statement received by Al-Sa'a Network, the company's general manager, Farhan Al-Fartousi, said, "The launch of side-loading services at ports represents a strategic shift that will enhance the confidence of shipping companies and maritime fleets ."

TNT:

Tishwash: Iraqi ports are included for the first time in the global list of STS service providers.

The General Company for Iraqi Ports announced today, Thursday, its official inclusion, for the first time in its history, on the global list of Ship-to-Ship Transfer (STS) service providers , according to the list issued by the global consulting firm Dynamarine .

In a statement received by Al-Sa'a Network, the company's general manager, Farhan Al-Fartousi, said, "The launch of side-loading services at ports represents a strategic shift that will enhance the confidence of shipping companies and maritime fleets ."

He added, "The company provides side-loading services using modern equipment and specialized personnel, and has received excellent ratings from the vessels it has handled." He noted that "joining the international list will contribute to increasing the number of incoming vessels, increasing revenues, and expanding the scope of maritime services to keep pace with the requirements of global trade ."

Al-Fartousi pointed out that "this achievement comes as part of the General Company for Iraqi Ports' strategy to improve the quality of its services and strengthen Iraq's position on the international maritime transport map . link

Tishwash: President of the Republic: There is an urgent need to pass the oil and gas law.

President Abdul Latif Jamal Rashid stressed that there is an urgent need to pass the oil and gas law and detailed laws on the distribution of revenues, to solve the existing problems.

The President said in a televised interview: "The Arab-Kurdish Cultural Center is an important step towards strengthening common rapprochement through studying common history and destiny."

He explained: "The relationship between the federal government and the Kurdistan Regional Government is good in all areas, and the existing differences are originally between the provinces and the federal government, and what is common to them is greater than the differences."

He stressed: "There is an urgent need to pass the oil and gas law and detailed laws on the distribution of revenues to solve the existing problems, and unfortunately, Parliament has not succeeded in passing the important oil and gas law."

He pointed out: "It is the government's duty to provide salaries for all employees, and we have a major problem in government expenditures from salaries, as they reach more than 80% of the state's revenues, while in other developed countries they do not reach more than 6%, and we must solve this problem."

He added: "We must ensure free and fair elections, and prevent the exploitation of power and its resources for electoral purposes. We, in the four presidencies, agreed on a document to be electoral regulations to be adopted by the Electoral Commission and other bodies concerned with organizing them."

He stressed that there is no truth to the postponement of elections or the formation of an emergency government, and we must ensure our people's confidence in holding fair elections on time. We in Iraq are proud that all electoral processes took place on time without delay.

The President stressed that the world is facing a major water crisis as a result of climate change, including Iraq. We must obtain a fair share from neighboring countries, stop our waste, and use modern irrigation and agricultural methods.

He stressed: "The continued aggression on Gaza has a negative impact on the entire region, and our position in Iraq is clear and not new, in our support for the Palestinian people in achieving their full legitimate rights to self-determination. The aggression must now stop, humanitarian aid must be delivered, and famine must be stopped." link

************

Tishwash: KRG Delegation to Visit Baghdad for Talks on Resuming Oil Exports to Turkey

Sabah Subhi, a member of the Iraqi Parliament’s Oil and Gas Committee, told Kurdistan24 on Thursday that the delegation will travel to Baghdad on September 2 for talks with senior officials from the Iraqi Ministry of Oil and the SOMO.

A high-level delegation from the Kurdistan Regional Government’s (KRG) Ministry of Natural Resources, accompanied by representatives of oil companies operating in the region, is set to visit Baghdad next week to discuss the resumption of oil exports through the Turkish port of Ceyhan.

Sabah Subhi, a member of the Iraqi Parliament’s Oil and Gas Committee, told Kurdistan24 on Thursday that the delegation will travel to Baghdad on September 2 for talks with senior officials from the Iraqi Ministry of Oil and the State Organization for Marketing of Oil (SOMO).

According to Subhi, the main objective of the meeting is to reach a binding agreement that would allow oil exports to restart, as several companies have expressed reluctance to move forward without a written arrangement.

A final deal is widely expected to be achieved in the upcoming talks, particularly as oil production in the Kurdistan Region has recently increased.

The planned discussions follow a visit by a delegation from Iraq’s Ministry of Oil and SOMO to the Turkish port of Ceyhan last week. During that visit, the Iraqi side finalized technical procedures and secured an understanding with Turkey regarding the export of oil from the Kurdistan Region.

Oil exports through the Iraq-Turkey Pipeline have been suspended since March 2023 following a ruling by the International Chamber of Commerce (ICC) that halted independent Kurdish oil sales. Oil exports have long been a contentious issue between the KRG and the federal government, impacting the region's economic stability and development.

The suspension has significantly affected the KRG revenue, which heavily depends on oil exports. This has led to financial challenges for the region. Efforts to resolve the issue through negotiations between the KRG and the federal government are ongoing. lin

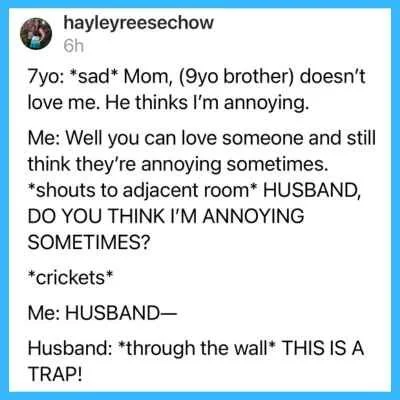

Mot: . Posts About Married Life in August 2025

FRANK26….8-28-25….ALOHA…SHINE LIKE A DIAMOND

KTFA

Thursday Night Video

FRANK26….8-28-25….ALOHA…SHINE LIKE A DIAMOND

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Thursday Night Video

FRANK26….8-28-25….ALOHA…SHINE LIKE A DIAMOND

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Iraq Economic News and Points To Ponder Thursday Evening 8-28-25

Oil rices Fall Amid Global Market Volatility

Thursday, August 28, 2025, Economic Number of reads: 185 Baghdad / NINA / Oil prices fell on Thursday, as investors assessed the outlook for fuel demand in the United States as the summer driving season approaches its end and also considered potential shifts in crude supplies in light of the huge tariffs imposed by the United States on India to punish it for importing Russian oil.

Oil rices Fall Amid Global Market Volatility

Thursday, August 28, 2025, Economic Number of reads: 185 Baghdad / NINA / Oil prices fell on Thursday, as investors assessed the outlook for fuel demand in the United States as the summer driving season approaches its end and also considered potential shifts in crude supplies in light of the huge tariffs imposed by the United States on India to punish it for importing Russian oil.

Brent crude futures fell 31 cents, or 0.46%, to $67.74 by 00:27 GMT, and West Texas Intermediate (WTI) crude futures fell 36 cents, or 0.56%, to $63.79, after rising more than 1% in the previous session.

The U.S. Energy Information Administration said on Wednesday that U.S. crude inventories fell by 2.4 million barrels in the week ending August 22, compared to analysts' expectations in a Reuters poll for a draw of 1.9 million barrels. / https://ninanews.com/Website/News/Details?key=1248817

The Ministry Of Oil Announces The Final Statistics For July Exports And Revenues.

Thursday, August 28, 2025 | Economic Number of reads: 161 Baghdad / NINA / The Ministry of Oil announced, today, Thursday, the total oil exports and revenues achieved for last July, according to the final statistics issued by the State Oil Marketing Company (SOMO).

The ministry said in a statement: "The quantity of crude oil exports, including condensates, amounted to (104) million and (750) thousand and (788) barrels, with revenues amounting to (7) billion and (184) million and (804) thousand dollars."

It added: "The total quantities of crude oil exported for last July from oil fields in central and southern Iraq amounted to (104) million and (255) thousand and (143) barrels, while exports from the Qayyarah field amounted to (495) thousand and (645) barrels." https://ninanews.com/Website/News/Details?key=1248904

Basra Crude Prices Rise

Time: 2025/08/27 Reading: 495 times {Economic: Al Furat News} Prices of Basra heavy and medium crude oil rose on Wednesday, despite stable oil prices in global markets.

Basra Heavy crude prices rose 49 cents, or 0.49%, to $67.12, while Middle East crude prices rose 49 cents, or 0.39%, to $70.57.

Oil prices stabilized after falling in the previous session, as the market awaits the impact of new US tariffs on India in retaliation for its purchases of Russian supplies. The price of Brent crude reached $67.24, while the price of US crude reached $63.25. LINK

After A Previous Increase, Gold Maintains Stability.

Economy | 08/28/2025 Mawazine News - Follow-up Gold prices remained stable on Thursday, as investors awaited influential US data expected to determine the Federal Reserve's interest rate outlook.

Spot gold was steady at $3,390.27 per ounce by 02:57 GMT, after touching its highest level since August 11 earlier in the session, while US futures for December delivery were steady at $3,447.40 per ounce.

Traders are awaiting the Personal Consumption Expenditures (PCE) price index, due on Friday. This is the Federal Reserve's preferred inflation gauge.

Economists expect the index to rise 2.6% in July, the same pace as the previous month.

The probability of a 25 basis point rate cut at the next Fed policy meeting is more than 88%, noting that gold typically benefits from a low interest rate environment.

Among other precious metals, silver rose 0.3% to $38.72 per ounce, while platinum was steady at $1,348.07, and palladium rose 0.3% to $1,095.26. https://www.mawazin.net/Details.aspx?jimare=265848

The Development Bank Launches The First Unmanned Smart Branch In Iraq.

Wednesday, August 27, 2025, 5:53 PM | Economic Number of readings: 96 Baghdad / NINA / The International Development Bank announced today, Wednesday, the launch of the first smart branch of its kind in Iraq.

The bank said in a statement: "It has launched the first smart branch of its kind in Iraq, which enables banking transactions to be completed completely without the need for employees and available 24 hours a day, seven days a week, in a step that reflects the bank's commitment to digital transformation and promoting innovation in the Iraqi banking sector."

The statement added that "the new branch is located inside the General Administration Building of the International Development Bank on Abu Nawas Street in Baghdad, to be available to all customers as the first integrated digital banking experience in the country."

It continued: "The smart branch enables customers to complete their various banking transactions within minutes, whether for individuals, companies, businessmen, investors, entrepreneurs, or content creators, through an integrated package of digital services that include opening bank accounts and deposits, withdrawing and depositing funds, depositing bank checks and requesting the issuance of checkbooks, requesting the issuance of bank cards, transferring funds between accounts, in addition to purchasing gold ounces, printing account statements, settling loans, receiving content creator profits, and other innovative services."

The bank explained that "the branch allows customers to speak directly with customer service employees via audio and video, ensuring a more interactive and flexible banking experience and identifying customer needs immediately."

According to the statement, Wissam Al-Amri, Marketing Director at the International Development Bank, said, "The launch of the smart branch reflects the bank's commitment to placing customers at the heart of our priorities by providing innovative and easy-to-use banking solutions that enable them to manage their financial needs efficiently and at any time."

The statement concluded, "With this pioneering step, the International Development Bank consolidates its position as the first Iraqi bank to launch a smart branch, keeping pace with global developments in the banking sector and affirming its commitment to providing the best financial solutions to its customers." /End https://ninanews.com/Website/News/Details?key=1248758

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

What You Need To Do To Prepare Your Home And Your Family

Storm is on the way: Here's What You Need To Do To Prepare Your Home And Your Family

Hurricane season is here and it's important to be ready if you're anywhere near a hurricane zone. Here's everything you need to remember to be prepared!

Sean McBride Creator of Charleston Crafted Updated Sat, August 16, 2025

As a South Carolina resident, hurricane season is officially my least favorite time of the year. I don't like that I feel the need to constantly check to see if there is tropical activity in the distance and I hate the feeling of deciding what to do if a storm is coming.

However, just because I don't like the season doesn't mean I'm not prepared for it.

Storm is on the way: Here's What You Need To Do To Prepare Your Home And Your Family

Hurricane season is here and it's important to be ready if you're anywhere near a hurricane zone. Here's everything you need to remember to be prepared!

Sean McBride Creator of Charleston Crafted Updated Sat, August 16, 2025

As a South Carolina resident, hurricane season is officially my least favorite time of the year. I don't like that I feel the need to constantly check to see if there is tropical activity in the distance and I hate the feeling of deciding what to do if a storm is coming.

However, just because I don't like the season doesn't mean I'm not prepared for it.

Hurricane Erin is the first hurricane of the 2025 Atlantic Hurricane Season and has gained significant attention for its size and unpredicted path. While it does look like the Hurricane Erin path will curve away from the east coast of the United States this time, that doesn't mean that with the next storm we'll be so lucky.

Living in a hurricane zone teaches you to be prepared and be vigilant about your surroundings throughout the entirety of hurricane season, which officially runs from June 1st to November 1st. Hurricanes and tropical storms can both produce damaging rains and wind and can impact your area even if the path doesn't come right through your state.

And if recent history has shown us anything, being anywhere near the zone means you need to be prepared, not just if you live on the coast. So, if you're thinking about what you need to do to be prepared this hurricane season, let's take a look

How To Prepare For Hurricane Season

Storm intensity and frequency has been on the uptick for decades, and it's seemingly only going to get worse as our climate continues to change. Hurricanes aren't going to go away, so we have to be prepared to live with the after effects.

It's important to know your risk by identifying what type of FEMA zone you live in and what the likelihood is of a storm. Hopefully you've done some research, but if you're new to an area, talk to your neighbors about how storms have impacted your neighborhood in recent years.

If you are in a flood risk zone, you need to know the degree of severity and what that means for your area, so be prepared by knowing what you will likely need to do.

Additionally, if a hurricane begins to form in the Atlantic, Gulf or Caribbean, make sure you stay up to date with the NOAA path tracker so you can know where the storm is and where it might end up. Don't spend too much time listening to random "experts" online and instead focus your attention on the actual data presented by NOAA's National Hurricane Center.

Create An Emergency Evacuation Plan

The most important thing to do in an emergency hurricane situation is to listen to your local officials. If a mandatory evacuation order has been issued, listen to that order. It's not smart to try to decide whether or not you think a storm will actually hit your area badly.

If an order has been issued, make sure you know the evacuation routes and whether or not they will be opening additional lanes on the highway. It's best to leave at less busy times, if possible, and not wait until the last minute when the entire town is trying to drive out.

Inflation is Destroying Fiat Currency but Strengthening Gold

Inflation is Destroying Fiat Currency but Strengthening Gold

VRIC Media: 8-27-2025

Recently, VRIC Media hosted a profoundly insightful interview with investment banker and author Chris Whan, who delivered an unflinching look at the global monetary system, the U.S. economy, and the future of financial markets.

Whan’s analysis offers a compelling (and often challenging) perspective, particularly on the resurgence of gold and the gradual erosion of the U.S. dollar’s unique status.

Inflation is Destroying Fiat Currency but Strengthening Gold

VRIC Media: 8-27-2025

Recently, VRIC Media hosted a profoundly insightful interview with investment banker and author Chris Whan, who delivered an unflinching look at the global monetary system, the U.S. economy, and the future of financial markets.

Whan’s analysis offers a compelling (and often challenging) perspective, particularly on the resurgence of gold and the gradual erosion of the U.S. dollar’s unique status.

At the heart of Whan’s analysis is a strong bullish stance on gold. He emphasizes its re-emergence as a primary monetary asset globally, a trend driven not by market speculation, but by national policy. Countries like China and Russia, in particular, are accumulating gold aggressively, seemingly regardless of price fluctuations.

This isn’t just about hedging; it’s a strategic move to diversify away from the dollar and strengthen their own financial sovereignty. For Whan, gold isn’t merely a commodity; it’s a foundational element in a shifting global economic landscape.

But what underpins this shift? Whan points directly to the U.S. dollar’s historically anomalous status as the world’s primary reserve currency. He argues that this position was largely a product of wartime dominance, and it’s now gradually losing ground.

The culprits?

Rampant U.S. fiscal mismanagement and a growing global skepticism about America’s economic stability and intentions. As nations look for alternatives, the dollar’s perceived invincibility starts to falter, ushering in an era of profound re-calibration.

The erosion of the dollar’s value is, of course, inextricably linked to inflation. Whan highlights its ongoing, pervasive impact on everyday Americans, noting that those without significant stock or real estate investments are disproportionately harmed.

He critiques the Federal Reserve’s policies, including interest rate decisions and “financial repression,” explaining how political pressures and expansive fiscal policies keep the economy “running hot.” Don’t expect a quick fix: Whan believes the Fed’s 2% inflation target remains unrealistic in the current environment, suggesting that inflation is here to stay for the foreseeable future.

Beyond the numbers, Whan connects these economic trends to broader societal impacts. He draws parallels with the historic Gilded Age, observing significant wealth concentration and wage stagnation. He attributes this partly to technological advances boosting productivity while limiting labor’s bargaining power, fueling political and social pressures for change.

Interestingly, he also discusses tariffs as a potential tool for the U.S. to compensate for its reserve currency status and global economic role.

He underscores the importance of understanding American financial history to grasp current challenges and future trajectories, suggesting that knowledge is the best defense against economic headwinds.

Chris Whan’s insights paint a picture of a global monetary system in flux, with significant implications for nations and individuals alike. His book, Inflated Money, Debt, and the American Dream, further explores these themes, offering a conservative perspective on U.S. economic history and policy.

To fully grasp the depth of his analysis and prepare for the road ahead, we highly recommend watching the full interview on VRIC Media. It’s a vital conversation for anyone looking to understand the forces shaping our financial future.

The Groundwork for the New Economic System

The Groundwork for the New Economic System

Gregory Mannarino: 8-27-2025

Do you ever get the feeling that the economic and political gears are grinding in a way that feels… intentional? That what’s happening isn’t just a series of random events, but part of a much larger, orchestrated transition?

Financial analyst Gregory Mannarino isn’t just watching the news; he’s dissecting a profound, and he argues, deliberate transition towards a new systemic order. In his latest thought-provoking video, Mannarino lays bare a critical analysis of our current landscape, revealing how the very structure of our society is being reshaped right before our eyes.

The Groundwork for the New Economic System

Gregory Mannarino: 8-27-2025

Do you ever get the feeling that the economic and political gears are grinding in a way that feels… intentional? That what’s happening isn’t just a series of random events, but part of a much larger, orchestrated transition?

Financial analyst Gregory Mannarino isn’t just watching the news; he’s dissecting a profound, and he argues, deliberate transition towards a new systemic order. In his latest thought-provoking video, Mannarino lays bare a critical analysis of our current landscape, revealing how the very structure of our society is being reshaped right before our eyes.

One of the most striking insights Mannarino presents is the idea that the current system is strategically engineered to foster dependency. By making us deeply reliant on the existing framework, the architects of this change are, in his view, paving the way for a smoother, albeit unsettling, shift into a new economic and political structure.

These aren’t isolated incidents; Mannarino frames them as interconnected components of a grand design, all serving to facilitate the move to a different framework.

But perhaps the most profound transformation Mannarino discusses is what he calls the “final act” in a broader series exploring systemic changes. This refers to the accelerating fusion of corporate power with government authority.

Imagine a world where the lines between immense corporate entities and the governing bodies are not just blurred, but virtually erased. This isn’t merely collaboration; it’s a deep, systemic integration that has enormous implications for our freedoms, our economy, and the very fabric of society. This convergence signifies a shift of immense proportions, fundamentally altering who holds power and how decisions are made.

Mannarino stresses that his analysis isn’t a one-off warning; it’s a comprehensive series, with each part building upon previous insights to create a complete understanding of this evolving landscape. He urgently encourages viewers to engage deeply, as piecemeal understanding simply won’t suffice.

However, he expresses concern that only about a quarter of his audience is actively absorbing the full scope of this critical information. In an era where information overload is common, it’s easy to skim the surface. But Mannarino’s message is clear: understanding this evolving landscape isn’t just academic; it’s crucial for preparing for future realities shaped by these transformative forces.

This isn’t just a forecast; it’s a critical juncture in systemic evolution. Mannarino’s call to deeper engagement serves as both a warning and an invitation to equip yourself with the knowledge needed to navigate the profound changes ahead.

Ready to dive deeper and understand the true forces at play?

Iraq Economic News and Points To Ponder Thursday Afternoon 8-28-25

Maximizing Revenue

Economic 08/28/2025 Abdul Zahra Muhammad Al-Hindawi When I say that the Iraqi economy is still unilateral and moving on one foot,I do not consider myself the discoverer of electricity, which still represents Iraq's first story! Rather,

everyone knows and acknowledges this, as the non-oil sectors are still crawling on their seats and have not recorded a notable presence in the economic scene, at a time when the state has no choice but to move towards maximizing its revenues, in light of the escalation of expenditures to the point that oil revenues are no longer able to meet the requirements of that spending, whether operational or investment.

So, how can we find other resources to support the budget and thus reduce our dependence on oil?

Maximizing Revenue

Economic 08/28/2025 Abdul Zahra Muhammad Al-Hindawi When I say that the Iraqi economy is still unilateral and moving on one foot,I do not consider myself the discoverer of electricity, which still represents Iraq's first story! Rather,

everyone knows and acknowledges this, as the non-oil sectors are still crawling on their seats and have not recorded a notable presence in the economic scene, at a time when the state has no choice but to move towards maximizing its revenues, in light of the escalation of expenditures to the point that oil revenues are no longer able to meet the requirements of that spending, whether operational or investment.

So, how can we find other resources to support the budget and thus reduce our dependence on oil?

Maximizing revenues necessarily leads to increased financial resources through economic diversification.

The five-year development plan for the years 2024-2028 talks about its goal of raising the contributions of the agriculture, industry and tourism sectors to rates ranging between 2-4%, and improving the collection of direct and indirect taxes, which will contribute to achieving an amount of 79 trillion dinars over five years, compared to more than 600 trillion dinars representing oil revenues, which is a very small percentage.

Hence, it is imperative that all state institutions strive diligently to search for sources to maximize their revenues.

However, this maximization should not be at the expense of the people, and this maximization

should not go entirely to the public treasury (Ministry of Finance).

Rather, there must be an incentive for the entity that has succeeded in finding sources to maximize its resources, so that it has a share of these resources, which it can invest in maintenance, or in developing the resource itself, or granting incentive bonuses to its workers, so that this will be an incentive for others to strive diligently. On this path.

Perhaps among the sources of maximizing the state’s resources are addressing tax evasion, simplifying procedures, controlling border crossings, and investing in infrastructure and strategic projects, such as the development road, the Grand Faw Port project, airports, industrial and economic cities, and most importantly, strengthening, encouraging, and improving partnerships with the private sector, especially after the establishment of the Special Council to manage and develop this sector.

Naturally, this also necessarily requires developing the financial and banking sector, in addition to adopting a digital transformation policy to increase sales, without forgetting the importance of improving human resources management, as it is the main driver and guide for all paths. Development. https://alsabaah.iq/119693-.html

The Ministry of Planning announces the adoption of a mechanism to combat counterfeit gold on a large scale. Buratha News Agency1632025-08-27

The Ministry of Planning announced on Wednesday the adoption of a mechanism to combat counterfeit gold on a large scale, while indicating that the counterfeit gold pieces leaking into the markets do not pose a significant risk.

The spokesperson for the Ministry of Planning, Abdul Zahra Al-Hindawi, told the official agency that “the Central Organization for Standardization and Quality Control in the Ministry of Planning is the body responsible for following up on the granting of licenses to practice goldsmithing and the marking of gold jewelry, where the marking is done through the presence of inspection units at airports (Baghdad Airport, Najaf Airport, Basra Airport, and Kirkuk Airport),” indicating that “these units affiliated with the Central Organization for Standardization and Quality Control inspect and mark any gold shipment entering Iraq directly at the airport, after which a license is granted for trading in the markets.”

He added, "There are committees from the Central Agency for Standardization and Quality Control that conduct continuous visits to inspect goldsmith shops and ensure that the gold in circulation is sound gold, marked with the agency's stamp and is not adulterated. In the event that any violation is detected, such as the presence of adulterated gold or otherwise, legal measures are taken or the violator is referred to the judiciary to take legal action against him."

He explained that "this mechanism has been able to contribute significantly to combating adulterated gold, but there may be some gold pieces that are leaked into the markets and do not pose a significant risk, and they are quickly discovered, even by consumers themselves."

Al-Hindawi also pointed out that "the agency's teams are continuing their work in this area, whether through airport inspections or monitoring goldsmiths' shops. In addition, there are other regulatory bodies, not just the Ministry of Planning, that are concerned with market and economic issues and monitor gold." He noted that "gold represents a significant economic sector, and it is very important that this commodity be monitored extensively and continuously." https://burathanews.com/arabic/economic/464337

Kurdistan deposits 120 billion dinars of non-oil revenues into the federal finance account.

Economy | 08/28/2025 Mawazine News – Baghdad The Ministry of Finance of the Kurdistan Regional Government deposited 120 billion dinars of non-oil revenues into the account of the federal Ministry of Finance.

According to a source in the Ministry of Finance of the regional government, it was explained that "the ministry began yesterday, Wednesday, the procedures for depositing the amount, which were completed today," noting that the amount was deposited into the account of the federal Ministry of Finance at the Erbil branch of the Central Bank of Iraq.

The source added that the Kurdistan Region has fulfilled all its obligations towards Baghdad, and all that remains is for Baghdad to finance the June salaries of the Kurdistan Region's employees in accordance with the agreement.

The Iraqi Council of Ministers had approved on (August 26, 2025) the Ministry of Finance's disbursement of the salaries of the Kurdistan Region for the month of June 2025, "with the regional government paying (120) billion dinars as an installment for non-oil revenues, according to the text of Council of Ministers Resolution No. 636 of 2025."

The Council instructed the joint committees to continue their work and directed the "formation of a legal team" comprising the Prime Minister's legal advisor and the heads of legal departments in the General Secretariat of the Council of Ministers, the Ministry of Finance, and the Federal Board of Supreme Audit, in coordination with representatives of the Kurdistan Regional Government, to "resolve legal disputes related to non-oil revenues, in accordance with the law."

Over the past four months, Kurdistan Region employees have received only one salary: the May salary, which was disbursed on July 24. https://www.mawazin.net/Details.aspx?jimare=265851

Central Bank: Iraq imported goods worth $87 billion in 2024.

Economy | 08/28/2025 Mawazine News – Baghdad The Central Bank revealed the value of Iraq's imports of goods from abroad during 2024.

The bank stated in a statistic monitored by Mawazine News that the value of goods imported from outside Iraq during 2024 amounted to $87 billion.

The bank indicated that "the value of imported goods amounted to $87.410 billion, an increase of 32.78 percent compared to 2023, when the value of Iraqi imports amounted to $65.826 billion."

It indicated that "Asian countries came first in terms of the value of imports, which amounted to $59.045 billion, followed by Western European countries with a value of $11.058 billion."

He added that the statistics showed that "Arab countries came third with a value of $9.073 billion, South American countries came fourth with a value of $4.082 billion, and North American countries came fifth with a value of $2.736 billion."

The bank explained that imports from Eastern Europe amounted to $1.031 billion, from Oceania countries $140 million, from non-Arab African countries $131 million, and finally from Central American countries $114 million.

The bank continued that the most important imports included transportation equipment and machinery worth $33.653 billion, followed by miscellaneous goods worth $13.811 billion, manufactured goods worth $9.965 billion, mineral fuels worth $8.566 billion, and food products worth $4.720 billion. https://www.mawazin.net/Details.aspx?jimare=265872

A Government Bank Launches An Account Statement Service For Visa Purposes.

Banks Economy News – Baghdad Rafidain Bank announced today, Thursday, the launch of its account statement service for visa purposes via the Ur portal, as part of its ongoing efforts to streamline procedures and develop its services.

In a statement received by Al-Eqtisad News, the bank stated that, "In line with its plans to simplify procedures and enhance the path of continuous development, and in cooperation with the Information Technology Department at the Ministry of Finance, the account statement service for visa purposes has been launched via the Ur Government Services Portal."

He added, "The service aims to enable customers to obtain a bank statement detailing their financial transactions and verify their financial capacity when applying for travel visas, in accordance with the requirements of several embassies and relevant authorities, and in a simple and quick electronic manner that reduces the need for direct review."

The bank confirmed that "this service is available to customers who have current, savings, or deposit accounts and whose salaries are domiciled with the bank. Customers must provide identification documents, a national ID card, and an electronic payment card (MasterCard), in addition to accurately entering data and uploading documents to successfully complete the application." https://economy-news.net/content.php?id=59361

The Dollar Exchange Rate Stabilized At 142,200 Dinars.

Economy | 12:18 - 08/28/2025 Mawazine News - Baghdad: The dollar exchange rate stabilized on the two main stock exchanges in Baghdad, Al-Kifah and Al-Harithiya, recording 142,200 dinars per $100, the same rate as yesterday, Wednesday.

Selling prices at exchange shops in local markets in Baghdad remained stable, with the selling price reaching 143,250 dinars per $100, and the buying price reaching 141,250 dinars per $100.

https://www.mawazin.net/Details.aspx?jimare=265854

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/