Iraq Economic News and Points To Ponder Saturday Morning 2-21-26

Shocking Figures: The Total Amount Of Gold In Human History Reveals Astonishing Numbers.

Money and Business Economy News - Follow-up Did you know that all the gold ever mined by humankind, from the beginning of history to the present day, could fit into a single cube measuring just 22 meters? Yes, gold is much smaller than you might imagine, but its value governs the global economy, according to a report by the World Gold Council.

By the end of 2024, humans had extracted 219,000 tons of gold, with the majority of this precious metal produced after 1950, meaning that the modern era produced most of the world's gold.

Shocking Figures: The Total Amount Of Gold In Human History Reveals Astonishing Numbers.

Money and Business Economy News - Follow-up Did you know that all the gold ever mined by humankind, from the beginning of history to the present day, could fit into a single cube measuring just 22 meters? Yes, gold is much smaller than you might imagine, but its value governs the global economy, according to a report by the World Gold Council.

By the end of 2024, humans had extracted 219,000 tons of gold, with the majority of this precious metal produced after 1950, meaning that the modern era produced most of the world's gold.

Most importantly, gold does not deteriorate, which means that almost all the gold that was extracted still exists today, and perhaps the gold of the pharaohs is stored in the vaults of modern banks.

Read also Why are gold and silver prices jumping again?

When studying the global distribution of gold, we find that:

44% converted to jewelry

23% in bullion, coins, and investment funds

18% is owned by central banks

The remainder is used in industry and technology.

But the question for investors and economists remains: Will gold run out?

The globally known and recoverable reserves are estimated at only 55,000 tons, while the potential resources amount to 132,000 tons, but not all of them are mineable.

Therefore, gold remains a rare metal, which is the real reason why its value is pivotal in the global economy. https://economy-news.net/content.php?id=65862

Trump's Tariffs Will Take Effect On February 24 Despite The Supreme Court Ruling.

Money and Business Economy News - Follow-up The White House announced on Saturday that the new tariffs imposed by US President Donald Trump will take effect on February 24 and will remain in place for 150 days.

The White House said in a statement: "The decree imposes, for a period of 150 days, import duties of 10 percent on goods imported into the United States, and the temporary tariffs will take effect on February 24 at 12:01 a.m. Eastern Time."

Trump had previously announced that he had signed an executive order imposing a 10 percent trade tariff on all countries.

The U.S. Supreme Court ruled on Friday, by a vote of 6 to 3, that President Donald Trump is not authorized to impose global tariffs under the International Emergency Economic Powers Act (IEPA).

Trump described the ruling as "very disappointing," accusing the court of being subservient to "foreign interests," and asserting that "all tariffs related to national security remain in effect."https://economy-news.net/content.php?id=65889

1.085 Million Dinars For 21-Karat Gold… A New Rise In Gold Prices In Local Markets

Money and Business Economy News – Baghdad The markets of the capital Baghdad and Erbil witnessed a rise in the prices of foreign and Iraqi gold on Saturday, coinciding with the start of the weekly trading.

In Baghdad, gold prices in the wholesale markets on Al-Nahr Street recorded a significant increase, as the selling price of one mithqal of 21-karat Gulf, Turkish and European gold reached about 1.085 million dinars, while the buying price reached 1.081 million dinars, after it had recorded 1.073 million dinars at the end of last week.

As for Iraqi gold, 21 karat, the selling price reached 1,055,000 dinars per mithqal, and the buying price was 1,051,000 dinars.

In goldsmith shops, the selling price of a mithqal of 21-karat Gulf gold ranged between 1,085,000 and 1,095,000 dinars, while the selling price of a mithqal of Iraqi gold ranged between 1,055,000 and 1,065,000 dinars, according to the difference in crafting and manufacturing fees.

In Erbil, gold prices also rose, with the selling price of 22-karat gold reaching about 1,163,000 dinars, 21-karat gold reaching about 1,110,000 dinars, while the price of 18-karat gold reached about 952,000 dinars.

Goldsmiths rely on a formula that includes the price of an ounce in global markets and the dollar exchange rate in the local market to determine prices, which makes prices subject to change according to the movement of international markets and the price of the currency.

It is worth noting that gold prices had exceeded the one million dinar mark per mithqal last January, in a precedent that is the first of its kind in the local Iraqi markets . https://economy-news.net/content.php?id=65896

Russia Sells 300,000 Ounces Of Gold As Prices Hit A Record High

Money and Business Economy News - Follow-up Russia’s central bank sold about 300,000 ounces of gold from its reserves during January, taking advantage of prices reaching record levels.

Data published on Friday showed that Russia’s total gold holdings fell to 74.5 million ounces, the first decline since last October, according to Bloomberg.

Gold prices hit a record high last month, averaging nearly $4,700 an ounce, meaning the sale could have generated around $1.4 billion if executed at prevailing market prices.

According to the Russian Central Bank, the move comes within the framework of what is known as "mirror" operations, which are related to the Ministry of Finance selling assets of the National Welfare Fund, to compensate for the decline in oil and gas revenues amid a widening budget deficit.

During the first two months of 2025, the ministry spent about 419 billion rubles ($5.5 billion) from the fund through the sale of gold and foreign currency.

Despite the reduction in quantities, the total value of Russia’s gold reserves rose by 23% in January to $402.7 billion, driven by higher global prices.

Since the start of the war on Ukraine in 2022, rising gold prices have provided significant financial support to Moscow, given that a large portion of its foreign currency assets in Europe are frozen. https://economy-news.net/content.php?id=65893

New Rise In Dollar Prices In Local Markets

Money and Business Economy News – Baghdad The exchange rate of the US dollar rose this morning, Saturday, in the markets of the capital, Baghdad and Erbil, coinciding with the opening of weekly trading.

In Baghdad, the price of the dollar in the main exchanges reached 152,700 Iraqi dinars per 100 dollars, compared to 152,300 dinars per 100 dollars at the close of trading last Thursday.

Selling prices in local market exchange shops reached 153,250 dinars for every 100 dollars, while the buying price reached 152,250 dinars for 100 dollars.

In Erbil, the selling price was recorded at 152,900 dinars per 100 dollars, while the buying price was 152,800 dinars per 100 dollars. https://economy-news.net/content.php?id=65892

The United Nations Circulates Iraq's Maritime Coordinates Following Their Deposit In Accordance With The Law Of The Sea Convention.

Money and Business Economy News – Baghdad The United Nations published a map of Iraqi maritime areas following its official deposit by the Republic of Iraq, based on the provisions of the 1982 United Nations Convention on the Law of the Sea.

According to a notification issued by the United Nations bearing the reference (MZN172.2026.LOS) and dated 18 February 2026, Iraq, on 19 January and 9 February 2026, deposited lists of the geographical coordinates of the points, accompanied by an explanatory map, in accordance with Article 16, Paragraph 2, Article 75, Paragraph 2, and Article 84, Paragraph 2 of the Convention.

The deposit relates to determining the straight baselines and the baselines emanating from the heights of the islands to measure the breadth of the territorial sea, in addition to determining the territorial sea, the contiguous zone, the exclusive economic zone and the continental shelf of the Republic of Iraq, with the adoption of the 1984 World Geodetic System (WGS-84) as a reference for the adopted coordinates.

The document explained that the new filing replaces previous filings dating back to 2021 and 2011, while the lists of coordinates and the explanatory map were published on the website of the United Nations Division for Ocean Affairs and the Law of the Sea, in accordance with the approved procedures.

For its part, the Iraqi Ministry of Foreign Affairs confirmed that the deposit came in implementation of Cabinet Resolution No. (266) of 2025, which approved the map of Iraqi maritime areas prepared by a specialized technical and legal team, based on technical studies, hydrographic measurements and relevant international agreements.

The ministry stressed that the step comes within the framework of establishing Iraq’s maritime rights in accordance with international law, while respecting the rights of the countries of the region, and in a way that enhances security, stability and freedom of navigation in the region. https://economy-news.net/content.php?id=65903

Iraqis Ranked Fifth Among Nationalities Who Bought The Most Real Estate In Türkiye During The Month.

Money and Business Economy News - Follow-up The Turkish Statistical Institute announced on Saturday that Iraqis ranked fifth among the nationalities that purchased the most real estate in Türkiye during the month of January.

The agency stated that total home sales in Türkiye decreased by 2.1% during January compared to the same month of the previous year, recording 34,069 homes.

She added that home sales to foreigners also declined by 20.8% compared to the same period last year, reaching 1,306 homes, representing 1.2% of total home sales in the country during the month in question.

The agency noted that Russians topped the list of nationalities buying real estate in Turkey during January with 219 homes, followed by Iran in second place with 118 homes, and then Ukraine in third place with 77 homes.

The United Kingdom came in fourth with 75 homes purchased, followed by Iraq in fifth place with 74 homes, China in sixth with 73 homes, and Azerbaijan in seventh with 54 homes. Palestine ranked eighth with 40 homes, Afghanistan ninth with 38 homes, and Kazakhstan tenth with 29 homes.

It is worth noting that Iraqis topped the list of nationalities that bought the most homes in Turkey since 2015, before their ranking dropped to second place after Iran at the beginning of 2021, then to third place since April 2022 after the Russians topped the list of buyers, before settling later in fifth place according to the latest data.https://economy-news.net/content.php?id=65899

The Iraqi Trade Bank Announces The Granting Of Loans For The Solar Energy Initiative.

Banks The Trade Bank of Iraq (TBI) announced on Friday that it has begun granting solar energy loans to employees who receive their salaries through the bank, while also confirming its continued financing of industrial projects and investment power plants.

TBI Chairman Bilal Al-Hamdani stated, "The bank has granted solar energy loans to employees who receive their salaries through the bank as part of its commitment to supporting alternative energy projects and reducing pressure on the electrical grid."

He explained that the bank's branch network is limited, as it primarily deals with institutions and business owners, in addition to employees who receive their salaries through the bank. He noted that the bank finances most investment power plants for investors and will continue to do so.

He added that the bank is committed to supporting industrial business owners, particularly those with existing industrial projects within Iraq and those in the food and pharmaceutical security sectors. He clarified that this support is provided through loans based on technical and economic feasibility studies.

He emphasized that the bank finances up to 75% of the value of an industrial project, provided that the approved terms and conditions are met. He pointed out that the lending mechanisms are clear and implemented in all branches, and that the bank has already financed a significant number of industrial projects in the recent period.https://economy-news.net/content.php?id=65875

The Next Black Swan, Expert Warns of Market ‘Time Bomb’

The Next Black Swan, Expert Warns of Market ‘Time Bomb’

David Lin: 2-8-2026

In a recent in-depth discussion with David Lin, Matthew Piepenburg, a partner at Von Greer’s AG, shared his expert analysis on the current and future state of global financial markets, the role of gold and silver investments, and the geopolitical shifts that are reshaping the world economy.

The conversation provided a sobering look at the challenges facing fiat currencies and the increasing preference for hard assets among central banks and major financial institutions.

The Next Black Swan, Expert Warns of Market ‘Time Bomb’

David Lin: 2-8-2026

In a recent in-depth discussion with David Lin, Matthew Piepenburg, a partner at Von Greer’s AG, shared his expert analysis on the current and future state of global financial markets, the role of gold and silver investments, and the geopolitical shifts that are reshaping the world economy.

The conversation provided a sobering look at the challenges facing fiat currencies and the increasing preference for hard assets among central banks and major financial institutions.

Piepenburg emphasized that the ongoing bull market in gold and silver is not driven by speculative fervor but by a more fundamental reality: the erosion of fiat currency values.

Unprecedented global debt levels and expansive monetary policies have led to a deep-seated mistrust in the sustainability of the global monetary system.

As a result, central banks and major financial institutions are increasingly favoring gold over US treasuries, signaling a significant shift in the global financial landscape.

The discussion also touched on the stock market’s outlook for 2026, highlighting the complex interplay of factors such as Federal Reserve policies, tax-driven inflows, and the shifting of capital from tech growth to global value and hard assets. Piepenburg’s insights underscored the challenges of predicting market movements in a landscape marked by unprecedented monetary policies and geopolitical tensions.

One of the most striking aspects of the conversation was Piepenburg’s warning about the systemic risks embedded in derivatives markets and commodity exchanges.

He highlighted the potential for “black swan” events, such as delivery failures in silver, which could have a cascading effect on other metal markets. This risk, coupled with the unsustainable global debt crisis, underscores the need for honesty and austerity in economic policymaking.

Piepenburg stressed that the current debt crisis cannot be solved by more debt or monetary stimulus but will require painful structural adjustments—a reality that is politically unpalatable but economically inevitable.

The discussion also explored the motivations behind gold and silver investments. Piepenburg characterized gold as a preservation asset against currency debasement, rather than a speculative instrument.

In contrast, silver was described as more volatile, influenced significantly by industrial demand and supply constraints. The recent disruptions in major exchange markets have further complicated the silver market, making it a more challenging investment landscape.

Piepenburg’s critique of the global political and economic order painted a picture of a world where the old order is irreversibly broken.

The current geopolitical tensions and policy responses are symptomatic of deeper systemic failures, indicating a need for a fundamental rethink of the global economic architecture.

The generational wealth transfer caused by inflation and monetary debasement has resulted in younger generations facing diminished purchasing power and fewer opportunities compared to their predecessors.

In light of these challenges, Piepenburg offered pragmatic advice for young investors: to prepare for a tougher economic future by focusing on risk assets like junior mining companies and hard assets. While acknowledging the significant challenges ahead, he emphasized that opportunities exist for those with a long-term perspective and the conviction to navigate the heightened risks.

FIRST BANK FAILURE OF 2026: This Is How It Starts

FIRST BANK FAILURE OF 2026: This Is How It Starts

Taylor Kenny: 2-4-2026

The first bank failure of 2026 is here and it could be just the beginning.

Chicago's Metropolitan Capital Bank & Trust was shuttered by regulators this past weekend. The reason? "Unsafe and unsound conditions" and an "impaired capital position."

Translation: they were broke.

If you think this is an isolated incident, think again. The failure of Metropolitan Capital Bank isn't just a blip — it's a red flag waving from the crumbling foundations of our financial system. And it has direct implications for your deposits, retirement, and financial future.

FIRST BANK FAILURE OF 2026: This Is How It Starts

Taylor Kenny: 2-4-2026

The first bank failure of 2026 is here and it could be just the beginning.

Chicago's Metropolitan Capital Bank & Trust was shuttered by regulators this past weekend. The reason? "Unsafe and unsound conditions" and an "impaired capital position."

Translation: they were broke.

If you think this is an isolated incident, think again. The failure of Metropolitan Capital Bank isn't just a blip — it's a red flag waving from the crumbling foundations of our financial system. And it has direct implications for your deposits, retirement, and financial future.

Seeds of Wisdom RV and Economics Updates Friday Afternoon 1-23-26

Good Afternoon Dinar Recaps,

First Trilateral Peace Talks Set for UAE as Ukraine, US, and Russia Prepare to Meet

High-stakes diplomacy begins amid war and unresolved territorial tensions

Good Afternoon Dinar Recaps,

First Trilateral Peace Talks Set for UAE as Ukraine, US, and Russia Prepare to Meet

High-stakes diplomacy begins amid war and unresolved territorial tensions

Overview

Ukraine, the United States, and Russia are preparing for a first-ever trilateral meeting in the United Arab Emirates (UAE), Ukrainian President Volodymyr Zelenskyy announced. The talks are scheduled to take place in Abu Dhabi across two days, with discussions expected to focus on the ongoing war in Ukraine, security guarantees, and the contentious Donbas territorial dispute. There is no detailed public agenda yet, and outcomes remain unconfirmed, but the development marks a rare direct diplomatic engagement between the three parties since the war began in 2022.

Key Developments

Zelenskyy confirmed the trilateral talks will be held in Abu Dhabi on January 23–24 at a technical negotiation level with U.S. and Russian delegations.

The discussions are described as the first of their kind in the UAE, with representatives from military and security sectors expected to participate.

While Zelenskyy emphasized that the Donbas issue will be “key” to talks, no official agenda or diplomatic text has been released.

Russia, Ukraine, and U.S. envoys have stated they are willing to talk about territorial modalities and security frameworks, but full agreement remains distant.

Why It Matters

Direct engagement between Kyiv, Washington, and Moscow is rare and represents a significant diplomatic step in efforts to end the war.

The territorial dispute over Donbas is central to the conflict and remains a core sticking point that could determine whether negotiations progress.

No agenda or confirmed outcomes indicate that these talks are exploratory and may or may not yield concrete agreements.

The UAE’s role as host reflects its growing position as a mediator in complex international conflicts.

Why It Matters to Foreign Currency Holders

Geopolitical conflict — especially one involving major powers — can shift investor confidence and safe-haven demand quickly, influencing currency valuations.

Progress or breakdown in talks could affect risk sentiment, with implications for the U.S. dollar, euro, Russian ruble, and Ukrainian currency stability.

A breakthrough could ease military spending pressures and reduce volatility in energy markets, which historically tie closely to currency flows.

The Global Reset narrative often accelerates when major geopolitical disputes enter substantive diplomacy, even if early meetings produce limited outcomes.

Implications for the Global Reset

Pillar 1: Geopolitical Realignment

The trilateral talks signal a new phase of direct engagement, potentially reshaping alliances and diplomatic power balances in a world where traditional multilateral systems have struggled to halt conflict.

Pillar 2: Monetary and Risk Sentiment Dynamics

Conflict negotiations involving superpowers can rapidly influence currency reserve behaviors, safe-haven flows, and cross-border capital movement, especially if markets perceive shifts in geopolitical risk profiles.

This is not just a meeting — it’s a structural test of whether diplomacy can alter entrenched conflict dynamics.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

BRICS Central Banks Overtake U.S. Treasuries With Gold Holdings

Gold quietly replaces bonds as the world’s preferred reserve anchor

Overview

Foreign central banks — led by BRICS nations — now hold more gold by value than U.S. Treasuries for the first time since 1996, marking a historic shift in global reserve strategy. Accelerated gold accumulation reflects rising concern over dollar exposure, sanctions risk, and long-term fiat credibility, even as Treasuries remain in use for liquidity management.

Key Developments

Central bank gold holdings reached approximately $4 trillion in January 2026, surpassing $3.9 trillion in U.S. Treasury holdings

BRICS nations purchased over 1,000 tonnes of gold since 2022, bringing collective holdings above 6,000 tonnes

Gold prices surged to record highs, nearly doubling in value since 2022

Reserve diversification is driven by geopolitical risk, trade conflict, and sanctions exposure, not yield considerations

U.S. Treasuries remain widely used, but no longer dominate reserve growth trends

Why It Matters

Gold overtaking Treasuries signals a structural shift in how safety is defined

Reserve managers are prioritizing sovereign neutrality over yield

The dollar’s role is being hedged, not abandoned, through parallel reserve strategies

This transition weakens the U.S. advantage of financing deficits through foreign bond demand

Why It Matters to Foreign Currency Holders

Reserve diversification historically precedes currency realignment

Reduced Treasury reliance increases demand for non-USD settlement currencies

Gold-backed confidence strengthens currencies linked to commodity exporters

Foreign currency holders benefit as multipolar reserve structures emerge

These shifts align directly with Global Reset timing mechanics

Implications for the Global Reset

Pillar 1: Reserve Asset Realignment

Gold’s rise above Treasuries reflects a measurable move away from debt-based reserve dominance toward tangible asset anchoring, a core reset mechanism.

Pillar 2: Monetary Sovereignty Defense

By holding gold instead of bonds, central banks reduce exposure to foreign political leverage, reinforcing national control over monetary stability.

This is not speculation — it is institutional repositioning.

When bonds wobble, gold remembers its job

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS: Foreign Central Banks Hold More Gold Than US Treasuries”

World Gold Council – “Central Bank Gold Reserves and Global Trends”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Trump Treasury & Fed Will Run it Hot in 2026 – Craig Hemke

Trump Treasury & Fed Will Run it Hot in 2026 – Craig Hemke

By Greg Hunter’s USAWatchdog.com

Financial writer, market analyst and precious metals expert Craig Hemke predicted at the beginning of 2024 that the US would add a whopping $2 trillion in debt. It did.

At the beginning of 2025, Hemke predicted the US dollar would take a big hit. It did, and record high gold and silver prices score Hemke another bullseye.

At the beginning of 2026, Hemke is predicting the Trump Treasury and Fed are going to put the pedal to the metal in running the economy.

Trump Treasury & Fed Will Run it Hot in 2026 – Craig Hemke

By Greg Hunter’s USAWatchdog.com

Financial writer, market analyst and precious metals expert Craig Hemke predicted at the beginning of 2024 that the US would add a whopping $2 trillion in debt. It did.

At the beginning of 2025, Hemke predicted the US dollar would take a big hit. It did, and record high gold and silver prices score Hemke another bullseye.

At the beginning of 2026, Hemke is predicting the Trump Treasury and Fed are going to put the pedal to the metal in running the economy.

Hemke explains, “Japan had yield curve control for years. They have taken it off, and interest rates have skyrocketed. This is where we are heading in the US.

In May, Trump is going to appoint a ‘yes man’ to the Fed. He’s going to replace (Jay) Powell, who will work with Scott Bessent (Treasury Secretary) and do his bidding and meld operations together.

Why would they need to do that? Because they are going to run it hot.

Remember, it was austerity a year ago. DOGE was going to cut $2 trillion in spending. They were going to balance the budget and all that kind of stuff. They quickly figured out that dog was not going to hunt.

Now, it’s all about growing our way out of this. Scott Bessent was on TV this weekend saying we are going to grow fast enough that the interest expense, which is around 6% of GDP, is going back down to 3% of GDP.

They think they can grow GDP that fast. They are going to grow GDP that fast by Trump’s ‘yes man’ cutting the short end, and if interest rates on the long end start going higher because of the inflation that it’s going to cause, they are going to come back in with yield curve control here in the US.

They have done this before after World War II, and they are going to do it again as soon as this year. That is the most bullish thing that can happen for gold and silver. This is also why gold and silver have been rallying so strongly in the last 24 months.”

Hemke predicts gold will hit at least $6,000 per ounce, and silver will easily hit $130 per ounce in 2026. The industrial demand for silver is not going to let up anytime soon.

Also, central bank demand is going to continue. Hemke contends, “Two weeks after the start of the Ukraine war, the US kicked Russia out of the SWIFT system and froze its foreign currency reserves. That sparked, at the same time, global central bank gold demand that has run record buying for four years in a row.

It started in 2022. Countries looked around and said, ‘Wow, if we get sideways with the US, they will do the same thing to us.’ So, they started selling their Treasuries and dollar reserves and started buying gold.

There were record amounts in 2022, 2023, 2024 and another big year in 2025 for physical gold buying by central banks.

We just got news today that the Polish central bank is buying another 150 metric tons of gold. They are building their gold holding to 700 metric tons. So, this global central bank demand is underpinning gold.”

In closing, Hemke says, “The Fed is saying they are going to cap interest rates. The Fed is going to be a buyer of 10-year Treasury notes at let’s say 4%. . .. With locking in rates while inflation is up there, you will have negative real interest rates.

The most bullish factor for gold prices are negative real interest rates. That’s the path, and that’s where the US is headed. It will be yield curve control.”

There is much more in the 39-minute interview.

Join Greg Hunter of USAWatchdog as he goes One-on-One with Craig Hemke of the popular website TFMetalsReport.com for 1.20.26.

https://usawatchdog.com/trump-treasury-fed-will-run-it-hot-in-2026-craig-hemke/

Major Currencies are Headed for a Reckoning

Major Currencies are Headed for a Reckoning

WTFinance: 1-21-2026

The global financial landscape is undergoing a significant transformation, driven by a complex interplay of fiscal dominance, geopolitical volatility, monetary policy, and demographic shifts.

In a recent episode of the WTFinance podcast, host Anthony Fatseas sat down with macro strategist Lyn Alden to explore these changes and their far-reaching implications. .

Lyn explains that the market environment has transitioned from a liquidity-driven, relatively predictable phase in 2023-2024 to a more volatile, headline-driven phase in 2025 and beyond.

Major Currencies are Headed for a Reckoning

WTFinance: 1-21-2026

The global financial landscape is undergoing a significant transformation, driven by a complex interplay of fiscal dominance, geopolitical volatility, monetary policy, and demographic shifts.

In a recent episode of the WTFinance podcast, host Anthony Fatseas sat down with macro strategist Lyn Alden to explore these changes and their far-reaching implications. .

Lyn explains that the market environment has transitioned from a liquidity-driven, relatively predictable phase in 2023-2024 to a more volatile, headline-driven phase in 2025 and beyond.

This shift is not simply the natural end of a bull market but a reflection of broader systemic tensions, including fiscal dominance, where government debt and deficits heavily influence central bank policies.

As a result, markets are becoming increasingly sensitive to political and geopolitical uncertainties, making it essential for investors and individuals to be prepared for a more unpredictable future.

The conversation between Anthony and Lyn delves into the intricate relationship between the U.S. Federal Reserve and political pressures, particularly under the Trump Administration.

The ongoing debates about Fed independence and the potential implications of leadership changes have significant implications for monetary policy.

While the Fed may begin to increase its balance sheet again, the approach is expected to be gradual and cautious, aiming to maintain financial system stability without triggering a bond market crisis. This delicate balancing act will be crucial in navigating the challenges ahead.

The persistent fiscal deficits and monetary expansion have significant socio-economic consequences, including rising inequality between older and younger generations and the emergence of a “K-shaped” economy.

Lyn emphasizes the challenges posed by demographic shifts, particularly aging populations, and the role of technological advancements like AI, which while boosting productivity, also disrupt labor markets and potentially exacerbate wage pressures. As the global economy continues to evolve, understanding these dynamics will be essential for developing effective strategies to mitigate their impact.

Geopolitical risks, such as the strategic importance of Greenland and the transition from a unipolar to a multipolar world, are framed within the broader theme of fiscal dominance and systemic instability.

Lyn warns that this era of fiscal dominance tends to breed populism, social unrest, and conflict, often culminating in currency and debt crises that force significant economic restructuring. As the global landscape becomes increasingly complex, it is crucial to be aware of these risks and their potential consequences.

Despite the bleak outlook, Lyn recommends practical strategies for individuals, emphasizing diversification, preparedness for unlikely but impactful events, and maintaining personal and community resilience. By focusing on productive efforts, financial prudence, and supporting social cohesion, individuals can navigate the ongoing uncertainty and build a more secure future.

The evolving global financial landscape presents significant challenges, but also opportunities for growth and adaptation.

By understanding the complex interplay of fiscal dominance, geopolitical volatility, monetary policy, and demographic shifts, we can develop effective strategies to navigate the uncertain terrain ahead. As Lyn Alden’s insights make clear, being prepared, diversified, and resilient will be essential for weathering the storms ahead.

For further insights and information, be sure to watch the full video from WTFinance.

“Tidbits From TNT” Saturday 1-17-2026

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

Trump had appointed Savaya as special envoy for Iraq affairs on October 19, 2025. He is an American businessman of Iraqi origin.

In his latest remarks, attributed to him ahead of the visit, he said he would deal with the "appropriate decision-makers" in Iraq, and had previously hinted that "big changes are coming" with a focus on "actions, not words." link

Tishwash: Sudanese advisor: The government has achieved economic success, and the International Monetary Fund is witnessing it.

Despite talk of a severe financial crisis in Iraq and the decline of the dinar against the dollar, the Prime Minister's financial advisor, Mazhar Muhammad Salih, says that the country recorded a low inflation rate of about 1.5% by the end of 2025. He pointed out that inflation in Iraq is the lowest in the Arab world, noting that the government's monetary policy succeeded in maintaining price and exchange rate stability and protecting the purchasing power of the dinar.

Regarding the recent cabinet measures, Salih explained that their aim is to address what is known as "job inflation" as a step to support social stability and improve income levels, as he put it.

Saleh told the official agency, as reported by 964 Network , that “the Iraqi economy is witnessing a remarkable phase of monetary stability, as it recorded a low inflation rate of about 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region.” He explained that “this achievement is attributed to the monetary policy that succeeded in maintaining price and exchange rate stability, and protecting the purchasing power of the dinar, which strengthened confidence in the national currency and provided a more favorable environment for investment.”

He added that “the recent Cabinet decisions aim to address what is known as ‘job inflation’ as a step to support social stability and improve income levels,” noting that “these measures achieve positive short-term returns by stimulating domestic demand and enhancing economic confidence, especially if they are financed within the limits of financial sustainability and do not exceed the absorptive capacity of the economy.”

He explained that “the biggest challenge remains in transforming this monetary stability into sustainable productive economic growth, since government employment, if not linked to productivity, may create a gap between public spending and real output, and increase the economy’s vulnerability to fluctuations in oil prices.”

He added that “the solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, as well as diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy.”

He stressed that “Iraq today has a rare dual opportunity represented by low inflation and monetary stability,” adding that “this opportunity can turn into a long-term gain if it is invested in building a solid productive base, which will ensure the continuity of financial and monetary stability in the medium and long term, and move the economy from the cycle of rentier dependency to the path of sustainable growth.” link

************

Tishwash: Government advisor: Tourism investment is a gateway to stimulating the private sector and diversifying national income.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that Iraq has more than 12,000 archaeological sites that form the basis for a comprehensive tourism launch, explaining that tourism investment is a gateway to stimulating the private sector and diversifying national income.

Saleh told the Iraqi News Agency (INA): “Tourism in Iraq is more than just a recreational activity; it is a strategic tool for wealth creation, achieving balanced development, and diversifying national income sources, provided that investment in it is done seriously and with a clear institutional approach.”

He explained that “this sector has the potential to become a major economic pillar, capable of restoring Iraq to its natural civilizational position and contributing to building a more stable and sustainable economic future.”

He added that “tourism in Iraq represents a strategic economic lever capable of reducing the single dependence on oil, opening up broad prospects for diversifying national income, creating direct and indirect job opportunities, revitalizing the service and commercial sectors, as well as providing the economy with important revenues from foreign currency.”

He pointed out that "tourism leads to an increase in demand for local products and services, especially handicrafts, food products, and national cuisine, which strengthens local value chains. At the employment level, it is estimated that a single tourism event in the hotel accommodation sector alone is capable of generating more than 25 job opportunities at once, which highlights the multiplier effect of this sector on the labor market."

He pointed out that "tourism investment contributes to stimulating private sector trends by supporting the growth of small and medium enterprises, such as transport companies, restaurants and shops, and it also has a positive impact on the macroeconomy through the development of infrastructure by investing in roads, airports, hotels and public facilities, which enhances the investment attractiveness of the country as a whole."

Saleh emphasized that “Iraq has more than 12,000 archaeological sites stretching from Babylon, Ur and Nineveh to Baghdad and Samarra, as well as holy religious shrines. These are unique cultural treasures, some of which have been included in UNESCO’s World Heritage List, and they form a solid foundation for a comprehensive tourism initiative with economic, cultural and civilizational dimensions. link

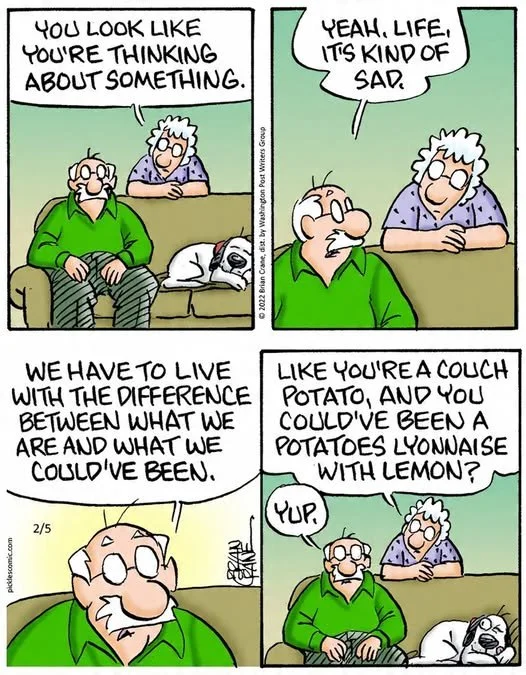

Mot: Simply Can't Win !!! -- Can He!!!???

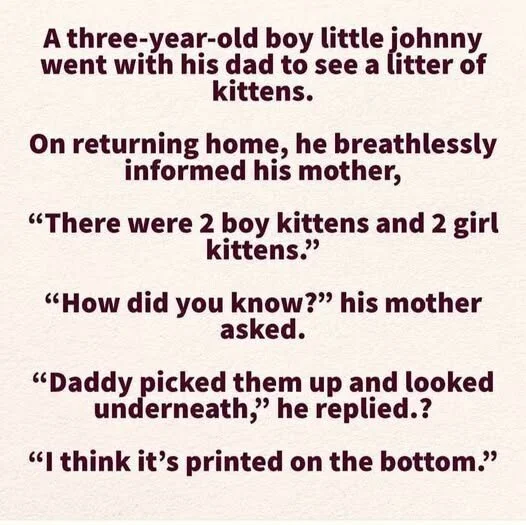

Mot: Love the Wisdom of the ""Wee Folks""!!!

MilitiaMan and Crew: IQD News Update-"Iraq Dinar: REER & Global Integration 2026"

MilitiaMan and Crew: IQD News Update-"Iraq Dinar: REER & Global Integration 2026"

1-11-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-"Iraq Dinar: REER & Global Integration 2026"

1-11-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 12-17-25

Good Afternoon Dinar Recaps,

U.S. Begins Venezuela Blockade as Trump Assembles “Largest Armada”: Escalation in Oil and Military Pressure

Naval blockade of Venezuelan oil tankers intensifies U.S.–Caracas conflict, with rising geopolitical and economic fallout.

Good Afternoon Dinar Recaps,

U.S. Begins Venezuela Blockade as Trump Assembles “Largest Armada”: Escalation in Oil and Military Pressure

Naval blockade of Venezuelan oil tankers intensifies U.S.–Caracas conflict, with rising geopolitical and economic fallout.

Overview

President Trump orders a total naval blockade of all U.S.-sanctioned oil tankers going into and out of Venezuela.

U.S. military presence in the Caribbean surges, described as the largest armada in South American history.

Venezuela condemns the blockade as unlawful and vows to pursue action at the United Nations.

Oil markets react, with prices rising on geopolitical risk, while enforcement and legal questions persist.

Key Developments

Blockade officially announced

President Donald Trump declared a “total and complete blockade” of all U.S.-sanctioned oil tankers servicing Venezuela, citing allegations that the Maduro regime uses oil revenues to fund terrorism, drug trafficking, and human trafficking. He framed the directive as necessary to reclaim U.S. “stolen” oil, land, and assets and labelled the Venezuelan government a “foreign terrorist organization.”Largest armada deployed near Venezuela

Trump’s announcement emphasized that Venezuela was “completely surrounded by the largest Armada ever assembled in the history of South America,” with ongoing build-up of U.S. naval forces in the Caribbean.Venezuela condemns the action

Caracas, led by President Nicolás Maduro, denounced the blockade as a “grotesque threat” and violation of international law, characterizing it as an effort to seize national wealth. The Venezuelan government intends to raise the issue at the United Nations and appeal to the global community.Oil prices respond to disruption fears

Oil markets saw a rebound from multi-year lows following the blockade announcement, with Brent and WTI crude rising as energy stocks gained. Analysts caution that fundamentals may limit sustained price escalation absent broader supply shocks.

Why It Matters

The blockade marks a significant escalation in U.S.–Venezuelan tensions and reflects a broader Trump administration strategy of blending economic sanctions with military pressure. By targeting Venezuela’s critical oil exports, the policy places severe strain on the country’s already fragile economy and raises the specter of deeper conflict. Global markets and geopolitical alignments could shift as countries react to enforcement actions and diplomatic fallout.

Why It Matters to Global Energy Markets

Venezuela holds the world’s largest proven oil reserves. Disruptions to its crude exports under blockade pressure may reverberate through global oil supply chains, affecting prices, trade flows, and energy security strategies—particularly among major consumers and producers.

Implications for the Global Reset

Pillar 1: Militarized Economic Warfare

The Venezuela blockade illustrates a fusion of military force and economic policy to exert pressure on a sovereign state’s resource sector—redefining how sanctions and security strategies intertwine.

Pillar 2: Geopolitical Polarization and Legal Contention

Global institutions and foreign governments may be drawn into disputes over international law, freedom of navigation, and the legitimacy of naval blockades, potentially reshaping diplomatic alliances and norms.

This is not just geopolitics — it’s a reordering of power, resources, and legal frameworks in global affairs.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Venezuela Blockade Begins as Trump Assembles ‘Largest Armada’: Live Update”

ABC News – “Trump announces 'TOTAL AND COMPLETE BLOCKADE' of sanctioned Venezuelan oil tankers”

Al Jazeera – “Trump orders naval blockade of sanctioned Venezuelan oil tankers”

Barron’s – “Oil Prices Jump Off Multi-Year Lows as Trump Orders Venezuela Blockade”

~~~~~~~~~~

Asian Markets Rebound as Tech Leads Risk-On Shift Across the Region

Technology shares lift Asian equities as investors rotate toward growth amid global monetary recalibration.

Overview

Asian equity markets advanced broadly, led by gains in technology and semiconductor stocks.

Investor sentiment turned risk-on, signaling confidence despite global macro uncertainty.

Regional divergence remains, with some markets lagging due to domestic pressures.

Capital flows reflect global asset rotation, not economic normalization.

Key Developments

Tech stocks drive regional gains

Major Asian indices, including Japan’s Nikkei and Hong Kong’s Hang Seng, moved higher as technology and AI-linked shares rebounded. Semiconductor and chip-equipment firms led the advance, benefiting from renewed global demand expectations.China and Hong Kong stabilize cautiously

Chinese and Hong Kong markets showed modest improvement as investors weighed stimulus expectations against lingering structural concerns in property and debt markets. Gains were selective rather than broad-based.Mixed performance across Asia-Pacific

While Japan, South Korea, and China saw gains, markets such as Australia and parts of Southeast Asia underperformed due to commodity price sensitivity and domestic growth concerns.Global liquidity expectations influence flows

The rebound reflects anticipation that major central banks are nearing policy inflection points, encouraging investors to reposition into growth-oriented assets ahead of broader monetary shifts.

Why It Matters

Asian equity movements often act as an early signal of global capital reallocation trends. The renewed appetite for technology and growth assets suggests investors are positioning for structural changes in liquidity, productivity, and digital infrastructure rather than short-term economic relief. This behavior aligns with a world transitioning toward multipolar capital markets.

Why It Matters to Foreign Currency Holders

Currency holders should note that risk-on equity flows often weaken safe-haven currencies while strengthening regional and emerging-market currencies. As capital rotates into Asian assets, demand for local currencies can rise temporarily — but volatility increases if expectations reverse. This underscores the importance of diversification during global monetary transition phases.

Implications for the Global Reset

Pillar 1: Capital Rotation Over Economic Recovery

Markets are reallocating capital in anticipation of system change, not cyclical recovery — a hallmark of late-stage monetary restructuring.

Pillar 2: Asia’s Role in the Next Financial Order

Asia’s tech and manufacturing base continues to attract global liquidity, reinforcing its role as a cornerstone of the emerging multipolar financial system.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Asian stocks rise as tech shares rebound, risk appetite improves”

Reuters – “Global investors rotate toward growth as policy outlook shifts”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

"This Is Going To be Horrific" Mike Maloney Says USA Entering a Bust Unlike Any Other

"This Is Going To be Horrific" Mike Maloney Says USA Entering a Bust Unlike Any Other

SilverGold: 11-1-8-2025

WARNING: A crash unlike any other may be coming. In this video, financial educator and precious-metals proponent Mike Maloney joins Allan to walk us through why the U.S. may be entering “a bust unlike any other.”

From real-estate bubbles, to stock-market excess, to mounting credit-stress in households and businesses — we explore the data, the diverging signals, and the structural vulnerabilities that rarely get this much attention.

"This Is Going To be Horrific" Mike Maloney Says USA Entering a Bust Unlike Any Other

SilverGold: 11-1-8-2025

WARNING: A crash unlike any other may be coming. In this video, financial educator and precious-metals proponent Mike Maloney joins Allan to walk us through why the U.S. may be entering “a bust unlike any other.”

From real-estate bubbles, to stock-market excess, to mounting credit-stress in households and businesses — we explore the data, the diverging signals, and the structural vulnerabilities that rarely get this much attention.

What you’ll learn:

Why both housing and equities are flashing warning signs simultaneously.

How rising credit-card and auto-loan delinquencies may be just the beginning.

Why commercial real-estate could be the next domino to fall.

What the divergence between leading indicators and the stock market truly means.

Actionable strategies for when the reset happens (and yes — preparation beats surprise).

The U.S. is facing both a stock-market bubble and a real-estate bubble simultaneously — a scenario unlike past major downturns.

(Mike Maloney) Consumer credit-stress indicators are reaching levels not seen since the 2008 crisis: 90-day+ credit-card delinquencies above ~12 % and auto-loan delinquencies at record highs.

Commercial real-estate and commercial mortgage-backed securities are showing warning signs: delinquency rates in office‐CMBS have breached highs from past crises.

The divergence between leading economic indicators (LEI) and the stock market is historically a red flag: when the LEI drops sharply while the stock market remains elevated, a crash tends to follow.

According to Maloney, this is not just a cyclical downturn: he argues we’re in the midst of a “monetary reset” with structural risk, and the real crash hasn’t yet hit — it’s still building.

De-Dollarization is Reaching 100%, Russia and China Bypass the West Entirely

De-Dollarization is Reaching 100%, Russia and China Bypass the West Entirely

Lena Petrova: 11-8-2025

For nearly a century, the US dollar has reigned supreme, the undisputed king of global finance. It’s been the bedrock of international trade, the primary reserve currency, and the go-to for settling accounts across borders.

But beneath the surface of this perceived stability, a silent revolution is underway—a phenomenon known as “dellorization.”

De-Dollarization is Reaching 100%, Russia and China Bypass the West Entirely

Lena Petrova: 11-8-2025

For nearly a century, the US dollar has reigned supreme, the undisputed king of global finance. It’s been the bedrock of international trade, the primary reserve currency, and the go-to for settling accounts across borders.

But beneath the surface of this perceived stability, a silent revolution is underway—a phenomenon known as “dellorization.”

This isn’t a planned coup or a sudden uprising. Instead, it’s a gradual, market-driven adaptation, heavily accelerated by geopolitical shifts and, ironically, the very Western sanctions designed to assert financial power. We’re witnessing a fascinating transformation, particularly evident in the rapidly deepening financial partnership between Russia and China.

The catalyst for this accelerated shift was undeniably the extensive sanctions imposed on Russia following the 2022 UKraine conflict.

These severe restrictions, which saw Russia largely cut off from Western-dominated financial infrastructures like the US dollar and euro systems, forced a radical re-evaluation of its economic strategy.

The response has been swift and decisive: a strategic pivot eastward, with China emerging as Russia’s largest trading partner and primary buyer of its oil. The numbers speak volumes: Russia’s Finance Minister Anton Siluanov recently announced that a staggering 99.1% of trade settlements between Russia and China now occur in their local currencies—the ruble and yuan.

This isn’t just a statistic; it’s a powerful statement of financial independence, effectively bypassing the very systems that Western sanctions sought to control.

This trend isn’t confined to Moscow and Beijing. It’s part of a broader movement among nations worldwide—especially within the BRICS bloc (Brazil, Russia, India, China, South Africa) and other regional alliances like ASEAN and the Shanghai Cooperation Organization.

Their goal? To reduce dependence on the US dollar, insulate themselves from potential future sanctions, and mitigate financial shocks.

This shift represents more than just a tactical move; it’s a profound philosophical and practical change. Nations are prioritizing economic resilience and financial sovereignty, seeking to diversify away from traditional Western financial hubs like Washington, London, and Brussels.

While the momentum for dellorization is undeniable, the path to a truly multipolar financial world isn’t without its challenges.

The political and economic diversity among BRICS members, for instance, means not all nations share the same urgency or capability to decouple from Western economies. The US, naturally, has signaled its readiness to resist these efforts through sanctions and tariffs, aiming to protect the dollar’s dominance.

However, historical precedent suggests that currency dominance follows economic power shifts gradually. The Russia-China trade milestone is a key indication that we might be witnessing the early stages of a new era in global finance—one marked by complexity, multipolarity, and a strong emphasis on economic sovereignty.

The weaponization of the dollar, while powerful in the short term, may ultimately be accelerating its long-term decline by prompting viable alternatives to emerge. As more nations seek to control their own financial destinies, the global financial landscape is set for a fascinating and complex evolution.