Why the US Still Controls Iraq’s Dollar Pipeline

Why the US Still Controls Iraq’s Dollar Pipeline

Edu Matrix: 2-20-2026

In a recent Edu Matrix video, Sandy Ingram sheds light on a complex and critical issue that has significant implications for Iraq’s economy and sovereignty.

The United States has maintained control over Iraq’s oil revenue since the 2003 Iraq War, a situation that has far-reaching consequences for the country’s financial independence.

Why the US Still Controls Iraq’s Dollar Pipeline

Edu Matrix: 2-20-2026

In a recent Edu Matrix video, Sandy Ingram sheds light on a complex and critical issue that has significant implications for Iraq’s economy and sovereignty.

The United States has maintained control over Iraq’s oil revenue since the 2003 Iraq War, a situation that has far-reaching consequences for the country’s financial independence.

In this blog post, we’ll delve into the intricacies of this arrangement and explore its historical context, implications, and the tensions it has created.

Iraq is a wealthy nation thanks to its vast oil reserves. However, the country’s oil sales are conducted internationally in US dollars, and these funds are not deposited directly into Iraqi banks. Instead, they are held in an account at the Federal Reserve Bank of New York.

Although this account belongs to Iraq, it is subject to stringent US oversight and regulatory controls. This arrangement was initially designed to ensure transparency, prevent corruption, and reassure international creditors after Ssdaam Hussein’s regime.

The US control over Iraq’s oil revenue has significant implications for the country’s economy.

The arrangement effectively gives the US leverage over Iraq’s financial flows and economic sovereignty. Iraq cannot freely use its oil revenue without passing through US financial scrutiny, as the US system enforces compliance with sanctions, anti-money laundering, and counterterrorism regulations.

This control has real consequences, affecting Iraq’s ability to conduct dollar transactions and forcing it to tighten its banking and currency auction practices under US pressure.

The US control over Iraq’s oil revenue has also caused tension with neighboring Iran, which views Iraq as lacking full financial independence.

To understand the historical context of this arrangement, we need to look back at Iraq’s invasion of Kuwait and subsequent conflicts, which led to international intervention and coalition forces demanding financial safeguards.

The US decision to hold Iraq’s oil revenues in New York was partly to protect Iraq from lawsuits and financial claims by other nations that participated in the coalition.

Despite being controversial, this system remains a cornerstone of Iraq’s economic framework, demonstrating the ongoing influence of the US over Iraq’s financial sovereignty.

The arrangement has been in place for nearly two decades, and its implications continue to be felt today. As Sandy Ingram’s video highlights, this is a complex issue with multiple stakeholders and interests at play.

The US control over Iraq’s oil revenue is a complex and multifaceted issue that has significant implications for Iraq’s economy and sovereignty. While the arrangement was initially designed to ensure transparency and prevent corruption, it has effectively given the US leverage over Iraq’s financial flows and economic sovereignty.

As we continue to navigate the intricacies of global politics and economies, it’s essential to understand the historical context and ongoing implications of this arrangement. For further insights and information, watch the full Edu Matrix video featuring Sandy Ingram.

https://dinarchronicles.com/2026/02/20/edu-matrix-why-the-us-still-controls-iraqs-dollar-pipeline/

Seeds of Wisdom RV and Economics Updates Friday Afternoon 2-20-26

Good Afternoon Dinar Recaps,

Oil Spike Signals Volatility: Markets Reprice Middle East Risk

Energy, gold, and the dollar surge as geopolitical tensions ripple across global markets.

Good Afternoon Dinar Recaps,

Oil Spike Signals Volatility: Markets Reprice Middle East Risk

Energy, gold, and the dollar surge as geopolitical tensions ripple across global markets.

Overview

Global markets reacted sharply to escalating tensions in the Middle East amid rising fears of potential U.S. military action involving Iran. Brent crude surged to multi-month highs, gold climbed on safe-haven demand, and equities retreated as investors shifted toward defensive positioning.

The U.S. dollar strengthened on capital inflows seeking stability, reflecting how quickly geopolitical risk can reshape asset flows.

As volatility widens, markets are repricing energy exposure, inflation expectations, and central bank policy paths.

Key Developments

1. Oil Prices Climb on Supply Risk

Brent crude rallied as traders priced in the possibility of supply disruption through key transit routes. Even the perception of instability in the region can tighten global energy markets.

2. Gold Attracts Defensive Flows

Gold rose alongside oil, signaling classic risk-off behavior as investors sought protection against uncertainty and potential inflation shocks.

3. Equities Pull Back

Global stock markets declined as risk appetite weakened. Energy-sensitive sectors faced volatility while defense and commodity-linked assets outperformed.

4. U.S. Dollar Strengthens

The dollar benefited from safe-haven flows, reinforcing its role as the primary liquidity refuge during geopolitical turbulence.

Why It Matters

Energy markets sit at the core of global inflation dynamics. A sustained oil rally could:

• Reignite inflation pressures in major economies

• Complicate central bank rate-cut timelines

• Increase transportation and manufacturing costs

• Raise geopolitical risk premiums across asset classes

Energy shocks historically ripple across currency markets, sovereign debt yields, and commodity pricing structures.

Volatility in oil is rarely isolated — it is systemic.

Why It Matters to Foreign Currency Holders

For currency and asset observers, geopolitical escalation introduces structural considerations:

• Safe-haven demand reinforces dollar dominance — short term

• Elevated energy prices strain import-dependent currencies

• Commodity exporters may see temporary FX support

• Central banks could delay easing cycles due to inflation risk

Geopolitics Hits the Tape: Oil and Gold Surge

If energy inflation persists, it may accelerate reserve diversification conversations and strategic asset reallocation — particularly among countries seeking insulation from volatility tied to geopolitical flashpoints.

Implications for the Global Reset

Pillar 1: Inflation as a Structural Force

Energy price spikes can reignite inflation, limiting monetary flexibility. Central banks may be forced into defensive policy stances, slowing economic momentum.

Pillar 2: Asset Rotation and Reserve Strategy

Heightened geopolitical risk increases demand for tangible assets and alternative stores of value. While the dollar strengthens during crisis moments, prolonged instability can also fuel long-term diversification efforts.

The market reaction underscores how quickly geopolitical risk can reshape financial architecture — not gradually, but abruptly.

This is not just market volatility — it is geopolitical risk translating directly into monetary consequences.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Guardian -- "Oil prices rise amid fears of US strikes on Iran"

Reuters -- "Oil and gold rally as Middle East tensions escalate"

~~~~~~~~~~

Indo-Pacific Pivot: U.S.–Indonesia Trade Pact Nears Breakthrough

Strategic minerals, semiconductors, and supply chains move to the center of global economic realignment.

Overview

The United States and Indonesia are moving closer to a broader trade agreement after cementing a series of strategic economic partnerships focused on critical minerals, semiconductor investment, and supply chain cooperation.

The developing framework positions Indonesia as a rising Indo-Pacific economic power while strengthening U.S. engagement in Southeast Asia amid intensifying global trade competition.

As rival economic blocs expand influence, this partnership signals a deliberate recalibration of supply chains and geopolitical alignment.

Key Developments

1. Critical Minerals Cooperation Expands

Indonesia — rich in nickel and other battery inputs — is deepening collaboration with the U.S. to support electric vehicle and advanced manufacturing supply chains.

2. Semiconductor Investment Push

The agreement outlines expanded cooperation in semiconductor development and technology infrastructure, a sector at the heart of modern industrial policy.

3. Strategic Indo-Pacific Engagement

The U.S. is reinforcing economic ties with Jakarta as part of a broader Indo-Pacific strategy designed to balance regional trade dynamics and reduce concentration risks.

4. Balanced Foreign Policy Positioning

Indonesia continues to maintain diplomatic and trade relations across multiple global partners, positioning itself as a bridge economy rather than a bloc-aligned state.

Why It Matters

This partnership extends beyond bilateral trade — it is part of a structural shift in global economic architecture.

• Diversifies supply chains away from single-country dependency

• Strengthens U.S. access to critical mineral inputs

• Expands semiconductor production networks

• Reinforces Southeast Asia as a manufacturing and trade hub

As global trade corridors evolve, Indonesia’s role in energy transition materials and industrial supply chains is becoming strategically central.

Trade alignment is now as much about resilience as it is about growth.

Why It Matters to Foreign Currency Holders

For currency and asset observers, the U.S.–Indonesia partnership reflects deeper monetary and trade currents:

• Increased local currency settlement opportunities

• Diversified capital flows into emerging Southeast Asia

• Reduced exposure to concentrated trade corridors

• Greater geopolitical hedging within supply chain finance

As supply chains realign, capital follows infrastructure. This dynamic influences FX demand, commodity pricing, and long-term reserve diversification strategies.

Trade Realignment Signals the Next Phase of Global Restructuring

Implications for the Global Reset

Pillar 1: Supply Chain Multipolarity

Global production networks are no longer concentrated within a single corridor. Expanding partnerships with Indonesia reduces systemic bottlenecks and supports diversified manufacturing nodes.

Pillar 2: Resource-Backed Trade Influence

Control and access to critical minerals increasingly shape geopolitical leverage. Indonesia’s position in nickel and battery inputs places it at the heart of energy-transition economics.

The U.S.–Indonesia framework reflects an era where trade agreements are strategic architecture — not just tariff negotiations.

This is not just diplomacy — it’s supply chain sovereignty in motion.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Australian -- "Indonesia, US lock in deals as trade agreement nears"

Reuters -- "US and Indonesia strengthen strategic economic ties in Indo-Pacific"

~~~~~~~~~~

BRICS Pay Faces Reality Test: Can the Alliance Challenge Dollar Dominance?

Ambition meets execution as the 11-member bloc attempts to build a parallel payment system.

Overview

The BRICS alliance is pursuing an independent cross-border payment system known as BRICS Pay, aimed at reducing reliance on the US dollar and promoting local currency trade among member nations.

Designed as an alternative to Western-dominated financial messaging networks like SWIFT, the initiative seeks to strengthen economic sovereignty and shield member states from sanctions and tariff pressures.

However, while the vision is ambitious, the execution faces structural, political, and economic hurdles that could determine whether BRICS Pay becomes transformational — or symbolic.

Key Developments

1. Strategic Objective: Reduce Dollar Dependency

BRICS Pay is envisioned as a cross-border settlement mechanism facilitating trade in local currencies, supporting the bloc’s broader de-dollarization narrative.

2. Alternative to Western Infrastructure

Unlike SWIFT — which serves as a messaging system backed by dollar liquidity and global banking networks — BRICS Pay aims to provide integrated settlement pathways independent of Western influence.

3. Multipolar Financial Ambition

The system aligns with the bloc’s push toward a multipolar economic order, where trade settlement mechanisms are diversified beyond dollar-centric channels.

Why It Matters

Building a payment system is not just about software — it requires liquidity depth, currency trust, political alignment, and trade scale.

BRICS Pay faces three immediate structural challenges:

Trade Volume Imbalance

China dominates intra-BRICS trade flows. If transaction volume is disproportionately concentrated in one economy, it could shift operational influence toward that nation — potentially undermining the bloc’s principle of multipolar balance.

Without sufficient trade flow among all members, liquidity pools could remain shallow and uneven.

Currency Trust and Liquidity

The US dollar remains the most trusted and liquid global currency. Even countries critical of US policy continue to settle trade in dollars due to stability, convertibility, and deep capital markets.

For BRICS Pay to succeed externally, counterparties must trust participating currencies — a hurdle that cannot be solved solely by political agreement.

Divergent Economic Priorities

Member economies vary significantly:

• China prioritizes export dominance

• India balances Western partnerships with domestic growth

• Russia and Iran seek sanctions insulation

• Other members hold mixed or evolving strategic goals

These divergent priorities complicate harmonized policy development and could slow implementation.

Why It Matters to Foreign Currency Holders

For global currency observers, BRICS Pay represents an experiment in financial system redesign.

• It tests the durability of dollar dominance

• It highlights global appetite for settlement diversification

• It underscores rising geopolitical fragmentation in finance

• It reveals structural limits of de-dollarization without liquidity parity

If successful, it would incrementally shift trade settlement patterns. If unsuccessful, it reinforces the entrenched power of dollar-based infrastructure.

Building a New System Is Harder Than Leaving the Old One

Implications for the Global Reset

Pillar 1: Infrastructure vs. Influence

Creating a payment system requires more than political alignment — it demands capital depth, credit markets, and currency stability. Without those, infrastructure alone cannot displace entrenched networks.

Pillar 2: De-Dollarization Realism

BRICS Pay reflects a broader shift toward financial multipolarity. However, replacing the dollar requires global trust — not just internal coordination.

The success or stagnation of BRICS Pay will serve as a real-world stress test of whether multipolar finance can match the scale and liquidity of the existing system.

This is not just about payments — it’s about the future architecture of global settlement power.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- "The Challenges That BRICS Pay Is Going To Face"

Reuters -- "BRICS nations explore alternatives to dollar-based payment systems"

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday 2-20-2026

TNT:

Tishwash: Except for Hamoudi, the coordinating framework withdraws its support from Maliki.

Iraqi sources reported on Thursday that some members of the Coordination Framework and Shiite blocs withdrew their support for Nouri al-Maliki’s candidacy, while only Humam Hamoudi, head of the “Abshir Ya Iraq ” bloc, remained in support of him.

Sources told Al-Araby TV, as reported by Al-Sa’a Network, that “some members of the coordinating framework and Shiite political blocs withdrew their support for Maliki’s candidacy, and only Humam Hamoudi, who heads the Abshir Ya Iraq bloc, which holds 4 seats in the Iraqi parliament, continues to support him .”

TNT:

Tishwash: Except for Hamoudi, the coordinating framework withdraws its support from Maliki.

Iraqi sources reported on Thursday that some members of the Coordination Framework and Shiite blocs withdrew their support for Nouri al-Maliki’s candidacy, while only Humam Hamoudi, head of the “Abshir Ya Iraq ” bloc, remained in support of him.

Sources told Al-Araby TV, as reported by Al-Sa’a Network, that “some members of the coordinating framework and Shiite political blocs withdrew their support for Maliki’s candidacy, and only Humam Hamoudi, who heads the Abshir Ya Iraq bloc, which holds 4 seats in the Iraqi parliament, continues to support him .”

The sources added that "the deadline given by the US Chargé d'Affaires, Joshua Harris, to the political leaders within the coordination framework ends today ."

She noted that "a meeting of the coordination framework was scheduled for last Monday, but it was postponed at the request of al-Maliki due to the expiration of the deadline, and it was postponed to Thursday ."

Against this backdrop, the coordinating framework may withdraw al-Maliki’s nomination or replace him with another candidate who does not face internal and external problems, and who is a figure acceptable to everyone .

US President Donald Trump had warned that Washington would not provide any assistance to Iraq if Maliki returned to power link

************

Tishwash: An Iraqi delegation will visit Iran soon... Gas supplies are completely cut off, and the heatwave will reveal the extent of demand.

The Ministry of Electricity announced the formation of an official delegation that will visit Iran soon to discuss the issue of gas supply in preparation for the summer season, given the existing need for it.

According to the ministry spokesman, Ahmed Moussa, "The gas supplies and quantities agreed upon with the Iranian side are still completely halted, which has led to the loss of more than 5,500 megawatts of generating capacity for the national grid."

He noted that "this stoppage directly affected a number of vital centers supplying the southern and central regions, in addition to the capital, Baghdad," explaining that "the current moderate temperatures have contributed to controlling the loads and providing relatively stable supply hours."

He stressed that “any fluctuation in temperatures will reveal the actual size of the demand, especially with the approach of summer, which requires full readiness of stations and an abundance of fuel,” noting that “the delegation that will leave for Iran will discuss the quantities that can be supplied to ensure the stability of the network during the peak of summer.”

Musa also said that "work is continuing on the liquefied gas platform project at Khor Al-Zubair port, and it is hoped that it will be completed by the beginning of next June," indicating that "the platform will secure about 500 million standard cubic feet per day, which will provide between 3,500 and 4,000 megawatts through combined and simple cycle power plants."

He spoke of "high-level coordination with the Ministry of Oil to supply some stations with national gas produced in the southern and central regions, especially the Basmaya station, as well as securing alternative fuel (gas oil) for stations capable of operating with it."

He added that "the demand for energy is witnessing a significant increase as a result of the expansion of electrical appliances, modern buildings and investment projects," stressing that "the growth of residential areas and the conversion of agricultural lands into residential areas, as well as the spread of slums, have become additional, rapidly increasing loads that put pressure on the electrical grid." link

Tishwash: Washington reduces its diplomatic presence in Iraq and Gulf states amid tensions with Iran

Two Iraqi and American officials said on Thursday that the United States has reduced the number of its diplomatic staff at its missions in Iraq and some Gulf states, taking precautionary measures against the backdrop of escalating regional tensions, without disclosing details about the size or nature of the reduction.

They added in an interview with Shafaq News Agency that the reduction included staff in a number of locations, while work continued in the remaining missions according to normal operational arrangements with a reduction in some staff and non-essential activities.

Meanwhile, an official at the US Embassy declined to comment on this news to Shafaq News Agency, saying only that "the US Embassy in Baghdad and the US Consulate General in Erbil are open, and our operations are proceeding as usual."

In response to questions about the status of the forces, an official at the US Central Command (CENTCOM), which is part of the US Department of Defense, told Shafaq News Agency that "the US military will not comment on personnel movements or troop status for reasons related to operational security and the safety of military personnel."

The moves come after US President Donald Trump posted on Truth Social on Wednesday, February 18, warning Britain against “giving away” the Diego Garcia base, saying the base could be needed in any military operation to deter a “potential attack” from Iran.

In parallel, several capitals escalated their warnings to their citizens against traveling to Iran and called on those already there to leave, with Polish Prime Minister Donald Tusk urging his citizens to leave Iran "immediately," warning of "an imminent risk of escalation."

The US State Department has also reiterated in recent security alerts its call for its citizens to "leave Iran now" in light of unrest and security risks.

This is happening while indirect nuclear talks continued in Geneva, mediated by Oman, without any announcement of a decisive breakthrough.

On the military front, Western reports said the US military is preparing for the possibility of operations that could last "for weeks" if Trump orders an attack, with official US expectations of an Iranian response and a shift in targeting beyond nuclear infrastructure.

In the same context, Axios quoted Israeli officials as saying that the government is preparing for the possibility of a large-scale confrontation that "could erupt within days," while informed sources spoke of different time estimates within the US administration. link

************

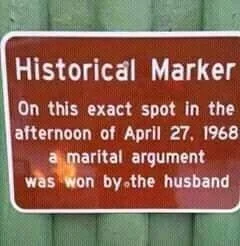

Mot: They ""Found that Spot"" again this Year!!!!

Seeds of Wisdom RV and Economics Updates Friday Morning 2-20-26

Good Morning Dinar Recaps,

Lagarde Holds the Line: ECB Independence Tested as Politics Swirl

ECB President Christine Lagarde shuts down resignation rumors, reinforcing central bank independence as European politics intensify ahead of France’s election cycle.

Good Morning Dinar Recaps,

Lagarde Holds the Line: ECB Independence Tested as Politics Swirl

ECB President Christine Lagarde shuts down resignation rumors, reinforcing central bank independence as European politics intensify ahead of France’s election cycle.

Overview

Christine Lagarde signals no early departure from the European Central Bank despite mounting speculation.

Rumors tied her potential exit to the upcoming French presidential election and succession politics.

ECB officials publicly reaffirm confidence in her leadership and long-term focus.

The episode highlights renewed tensions between central bank independence and political influence across major economies.

Key Developments

Lagarde Reassures ECB Governing Council

ECB President Christine Lagarde told colleagues she remains fully committed to completing her mandate and would inform them first if she ever intended to resign. The clarification followed media speculation suggesting she might step down early — potentially affecting France’s central banking leadership before its next presidential election.French Political Dynamics Add Sensitivity

Reports indicated that an early exit could allow outgoing President Emmanuel Macron to influence key central bank appointments. Meanwhile, the announced departure of Bank of France Governor François Villeroy de Galhau has already opened space for political maneuvering. The far-right Rassemblement National criticized developments as undermining democratic choice, increasing scrutiny over institutional neutrality.ECB Officials Emphasize Stability and Continuity

ECB Vice-President Luis de Guindos and board member Piero Cipollone underscored Lagarde’s focus on long-term institutional initiatives, signaling continuity in monetary strategy. Their coordinated messaging reflects concern that even rumors can destabilize perceptions of independence at a time when inflation and financial stability remain central priorities.Broader Context: Global Central Bank Pressure

The situation unfolds amid heightened debate over central bank independence globally, including in the United States. As fiscal pressures mount and elections approach in multiple economies, the line between political leadership and monetary authority is increasingly under scrutiny.

Why It Matters

Central bank independence is foundational to global financial credibility. When markets perceive that political leaders may influence monetary leadership transitions, bond markets, currencies, and sovereign risk pricing react swiftly. Lagarde’s reaffirmation seeks to anchor stability in the euro area at a moment when political cycles threaten to blur institutional boundaries.

Monetary credibility is currency credibility — and currency credibility is global power.

Why It Matters to Foreign Currency Holders

Readers holding foreign currencies in anticipation of a Global Reset should pay attention to governance stability within major reserve currency zones.

The euro’s international role depends heavily on ECB independence.

Political interference could weaken confidence in euro-denominated assets.

Stable leadership continuity strengthens the euro’s case as an alternative reserve asset to the U.S. dollar.

For foreign currency holders, the perception of institutional integrity may influence future reserve realignments.

When alliances expand, currencies realign and markets recalibrate.

Implications for the Global Reset

Pillar 1: Institutional Credibility and Reserve Status

The euro’s ability to expand its global role depends not just on economic scale but on trusted governance. Clear separation between politics and monetary policy reinforces its standing as a reserve alternative in a multipolar system.Pillar 2: Political Cycles vs. Monetary Stability

As elections approach in major economies, central banks face increased scrutiny. If political influence over appointments becomes normalized, markets may reassess risk premiums on sovereign debt and currencies — a potential catalyst in broader financial restructuring.

This is not just diplomacy — it’s monetary power being repositioned.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “ECB’s Lagarde signals no imminent exit as politics and central banks collide”

Reuters – “ECB policymakers defend central bank independence amid political scrutiny”

~~~~~~~~~~

U.S. Stablecoin Push Threatens BRICS De-Dollarization Strategy

Digital Dollarization Accelerates as Washington Advances Crypto Framework

Overview

The United States is moving closer to formalizing crypto regulation, and at the center of the debate is the expansion of USD-backed stablecoins. As Washington advances discussions around stablecoin yields and digital asset oversight, the ripple effects are being felt far beyond U.S. borders.

For BRICS nations, which have been actively pursuing de-dollarization strategies and alternative payment systems, the rapid growth of digital dollar instruments presents a new and potentially disruptive challenge.

Key Developments

White House Negotiations Continue

White House officials recently held a third round of talks with banking leaders and crypto policy experts regarding the Digital Asset Market Clarity Act. The central sticking point remains whether platforms such as Coinbase should be permitted to offer stablecoin yields.

Industry Divisions Deepen

Banks are pushing for a ban on stablecoin yield products, arguing that they threaten traditional deposit structures. Meanwhile, crypto industry leaders — including Crypto Council for Innovation CEO Ji Kim and Coinbase Chief Legal Officer Paul Grewal — described the discussions as constructive and cooperative.

Stablecoin Yields as a Global Magnet

If yields are approved under U.S. regulation, USD-backed stablecoins could become highly attractive to users in inflation-affected emerging markets. This would accelerate what analysts describe as “digital dollarization” — the migration of savings into dollar-denominated digital assets outside traditional banking channels.

BRICS De-Dollarization Faces New Headwinds

The BRICS bloc — led by major economies such as Russia, China, and India — has been building alternative financial rails, including central bank digital currencies (CBDCs), to reduce reliance on the U.S. dollar. A regulated and yield-bearing stablecoin market in the U.S. could undermine those efforts at the retail-user level.

Why It Matters

If the U.S. stablecoin push succeeds in locking in yield-bearing digital dollars, the shift won’t occur through government agreements — it will happen organically through consumer behavior. Individuals in unstable currency environments may simply choose higher-yielding, dollar-denominated digital assets.

That represents a bottom-up reinforcement of dollar dominance in the digital era.

The dollar may no longer need banks to expand — it now has blockchain rails.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching global monetary restructuring, this development highlights a critical reality: digital infrastructure may matter more than political alliances.

While BRICS nations pursue settlement systems and gold-backed frameworks, a yield-generating USD stablecoin ecosystem could quietly draw liquidity away from local currencies and into digital dollars.

This shifts the battlefield from trade agreements to wallet adoption.

Currency wars are no longer just about reserves — they’re about user adoption.

Implications for the Global Reset

Pillar 1: Monetary Sovereignty vs. Digital Market Forces

Governments may attempt to design alternatives to the dollar, but if individuals prefer USD-backed stablecoins for savings and yield, sovereignty strategies could weaken from within.

Pillar 2: Retail-Level Dollarization

Traditional dollarization often occurred through official banking channels. Stablecoins enable decentralized dollarization at scale, bypassing legacy systems and reshaping cross-border capital flows.

This dynamic complicates BRICS’ broader de-dollarization objectives and could slow momentum toward multipolar currency settlement systems.

The next phase of monetary power will be decided in digital wallets, not conference halls.

This is not just crypto regulation — it is global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru -- "US Stablecoin Push Threatens BRICS De-Dollarization Plans"

Reuters -- "White House holds talks with banks and crypto firms over stablecoin rules"

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Friday Morning 2-20-26

It's Not Just About Salaries... It's About "National Security": What Would Happen If Iraq Laid Off Its Employees?

Baghdad Today – Baghdad

Hardly a discussion takes place in Iraq without mentioning the "government employee"—their inflated numbers, their salaries that devour the budget, the growing talk of "zero productivity," and warnings of "economic collapse by 2030" if spending continues at this rate. In the background lies a rentier economy almost entirely dependent on oil, a fragile private sector, and a labor market where young people flee to government jobs as the only relatively safe haven.

It's Not Just About Salaries... It's About "National Security": What Would Happen If Iraq Laid Off Its Employees?

Baghdad Today – Baghdad

Hardly a discussion takes place in Iraq without mentioning the "government employee"—their inflated numbers, their salaries that devour the budget, the growing talk of "zero productivity," and warnings of "economic collapse by 2030" if spending continues at this rate. In the background lies a rentier economy almost entirely dependent on oil, a fragile private sector, and a labor market where young people flee to government jobs as the only relatively safe haven.

The simplistic idea is that the solution begins and ends with the employee: reduce their numbers, regulate their salaries, encourage some to take extended leave or early retirement, and public finances will automatically improve.

However, a deeper reading of the figures, along with the opinions of economic and legal experts, reveals that the picture is far more complex, and that the real question is not simply about the number of employees, but rather about the way the state is managed itself, and the intricate relationship between the public sector and the structure of the economy as a whole.

The Payroll Bill Grows With Every Budget... How Did We Get Here?

Over the course of nearly two decades, the Iraqi state has become the country's largest employer. Consistent official and local estimates indicate that more than 4,000,000 employees work today in various state institutions, including centrally funded ministries and departments, as well as institutions in the Kurdistan Region.

Meanwhile, the income of more than 10,000,000 citizens is directly or indirectly linked to the public treasury each month, through employee salaries, pensions, social safety nets, and various subsidies.

The imprint of this trend is clearly visible in successive budget figures. The wage bill and employee compensation consume a significant portion of operating expenditures, approaching half in some estimates when pensions and social security are included.

This means that the majority of public funds are allocated to current spending, while investment in infrastructure and essential services dwindles. With each increase in oil prices or revenue growth, the surplus is often reinvested in new appointments or salary increases, rather than in boosting the economy's productive capacity.

This trajectory was not accidental. After 2003, government employment was used more as a tool for social and political appeasement, a means to absorb the resentment of unemployment and buy stability, than as a tool for governance and development.

The widespread appointments often came in response to political and factional pressures, internal compromises, or electoral commitments, without any accompanying genuine restructuring of state functions or the establishment of a modern administrative apparatus.

The result was an overstaffed bureaucracy comprised of units with numbers exceeding their actual needs, and others suffering from staff shortages, particularly in health, education, and direct citizen services.

"Zero Productivity": A Simple Myth Masking Complex Problems

In this context, it has become easy to blame all economic crises on the government employee. "Estimated" tables proliferate on social media platforms, comparing the employee's salary with the output they are supposed to provide, then concluding with one catchy phrase: "The employee's productivity equals zero."

Economic expert Dirgham Muhammad urges caution in using this term. Speaking to Baghdad Today, he explains that employee productivity cannot be measured using the same metrics employed in factories and production lines, because a government employee, by the very nature of their work, provides a "public service," not a quantifiable commodity.

Attempting to reduce this service to a simple mathematical figure, he says, often leads to misleading conclusions.

Mohammed says that “the productivity of the Iraqi employee in state institutions cannot be measured by the traditional standards and measurements in circulation, because the government employee provides a public service and not a productive service in the commonly understood economic sense,” indicating that “what some people present in terms of numbers and measurements, especially the talk about the employee’s productivity being zero, is an unobjective and illogical proposition.”

He adds that employees are "tasked with managing state affairs, ensuring the continuity of work, and communicating with citizens, and there are no clear units of measurement by which the productivity of a government employee can be calculated," noting that "many employees of state departments work even during official holidays to accomplish their duties, which confirms that these proposals lack accuracy and responsibility and fall within the realm of merely stirring controversy."

This does not absolve the government apparatus of its inefficiency, but it shifts the discussion from condemning individual employees to critiquing the administrative structure itself.

The first problem lies in the unequal distribution of the workforce within the country, where thousands of positions are concentrated in offices and departments that do not require such a large number of staff, while health centers, schools, and service departments on the outskirts of cities and villages suffer from a severe shortage of doctors, teachers, engineers, and technicians.

The second problem is that the lack of digitalization and procedural modernization creates layers of paperwork that allow for a large number of employees trapped in a cycle of bureaucracy. If services were redesigned and automated, there would be a genuine need for fewer employees, but with more specialized and responsible roles.

In this sense, talk of "zero productivity" becomes more of an emotional description than an economic analysis. Yes, productivity is low in many areas, but the responsibility is distributed among job design, management style, work environment, and the monitoring and accountability system, and not solely on the employee as the weakest link in this structure.

2030: A Prophecy Of Collapse Or A Warning Of A Changeable Path?

Amidst soaring salaries and the state's near-total dependence on oil, a prophecy has circulated in recent years stating that "the Iraqi economy will collapse in 2030." Some treat this date as an inevitable fate, based on a linear reading of budget trends and financial deficits.

Dhirgham Muhammad describes this rhetoric as "irresponsible," pointing out that economic collapses don't occur according to fixed schedules, but rather as a result of a complex interplay of internal and external factors that cannot be confined to a single year.

He recalls that similar warnings were issued about ten years ago, and that talk of an "imminent collapse" was repeated frequently, yet the state remained able to pay salaries and finance part of its obligations, albeit at the cost of debt and increasing pressure on its fiscal flexibility.

However, this warning cannot be entirely ignored. The current trajectory indicates that continued inflation in current spending, coupled with revenues remaining dependent on oil prices, will gradually narrow the state's capacity to absorb shocks. Any sharp drop in oil prices could, at any moment, transform from a "passing crisis" into a direct threat to the stability of salaries and basic services if serious steps are not taken to alleviate the burden on the budget and diversify revenue sources.

The difference between propaganda and serious analysis is that the former transforms 2030 into a "doomsday date," while the latter places this date within a manageable trajectory. If policies continue as they are, fiscal space will shrink, our ability to cope with crises will weaken, and any shock in the oil market will become far more severe than it is today.

However, if genuine reform begins, this moment can be transformed from a "prophecy of collapse" into a "reform pressure" that compels the state to restructure its spending patterns and resources.

The Government Employee As A Social Refuge... When People Flee From The Market To The State

The bloated number of public employees cannot be understood solely from a public finance perspective. In Iraq, a government employee is not merely a number on a payroll, but rather the embodiment of a comprehensive social contract between the citizen and the state.

In a fragile labor market and a private sector that often fails to provide social security or job stability, a government job becomes the most viable option for those seeking a steady income, guaranteed retirement, and relatively adequate health insurance.

Labor market data indicates that a large proportion of the workforce is employed in the public sector, while the remainder are divided between largely informal private sector jobs, unregulated employment, and outright or disguised unemployment.

Meanwhile, the private sector's contribution to GDP remains far below the country's potential, and the business environment suffers from procedural complexities, bureaucracy, and corruption, making serious investment in industry, agriculture, and high-value services the exception rather than the rule.

Given these circumstances, talk of "restructuring the workforce" or "reducing staff numbers" without a comprehensive plan to revitalize the private sector and create decent jobs within it becomes akin to a gamble. Every employee pushed towards early retirement or extended leave means a family losing a portion of its financial security if there is no viable alternative in the job market. And every reduction in hiring without reforming the investment climate means a new wave of young people heading towards unemployment, emigration, or informal work.

Herein lies the stark contradiction: the state wants to alleviate the burden of salaries, while society still sees the state as its only refuge. The solution cannot be found in dismantling this refuge before building a new foundation upon which people can stand.

From "Government Economy" To "State Economy"... Where Does Reform Begin?

Economist Dirgham Muhammad succinctly summarizes the core of the problem in a striking statement: what is needed is a shift from a "government-run economy" to a "state-run economy." In a government-run economy, the government's role is reduced to that of a fund that receives oil revenues and distributes them as salaries and benefits, and the employee's function is reduced to receiving a salary at the end of the month and completing a minimum of transactions.

In a state-run economy, the government becomes the central authority that manages resources, formulates policies, and creates the legal and institutional environment for the growth of the private sector, without relinquishing its role in providing essential services and protecting vulnerable groups.

On a practical level, this transition means redefining the role of the public employee. In a state-run economy, the administrative apparatus becomes smaller in number but more specialized and efficient, operating in the areas of regulation, oversight, and planning, and providing services that the market cannot provide on its own.

Meanwhile, the private sector is left with greater scope to produce and create jobs. In return, private sector establishments are required to enroll their employees in social security, and fair competition rules are enforced to prevent the reduction in public sector employment from pushing people from "tiring but secure jobs" to "work without rights."

Reforming the payroll in this context cannot be reduced to isolated measures such as freezing hiring or tightening leave controls. Rather, it must be part of a comprehensive package that includes reforming the wage system, expanding the tax base, improving the collection of non-oil revenues, and increasing investment in infrastructure and services that encourage private sector expansion. Without this integrated vision, piecemeal measures remain merely temporary fixes that only exacerbate the problem instead of solving it.

A Test Of The Political System Before It Becomes A Financial Equation.

Legal expert Ali al-Saadawi places the issue within a broader context than just figures and tables. Speaking to Baghdad Today, he argues that what Iraq is experiencing today "cannot be viewed merely as a financial crisis, but rather as a true test of the political system's ability to redefine its priorities in resource management and achieving sustainable development."

Al-Saadawi says that crises "reveal structural flaws, but at the same time they open a window for serious reforms if the political will and courage to make decisions are present." He adds that the country now stands "at a crossroads," either the economic pressures will become an impetus for restructuring public spending, diversifying income sources, and strengthening transparency and good governance, or the current phase will continue to be managed "with a mindset of temporary patching," thus perpetuating stagnation and postponing reform requirements instead of confronting them.

Al-Saadawi emphasizes that what is required is "not just immediate measures, but a long-term strategic vision that places the Iraqi people at the heart of the development process and links economic stability with institutional reform," considering that this stage is "sensitive but could be a historic opportunity if it is properly utilized."

From Employee Condemnation To Holding The Entire Model Accountable

In conclusion, it seems easy to blame the government employee for the deficit and debts, and to hide behind the phrase “zero productivity” to justify everything. However, a deeper look reveals that the employee is merely the clearest mirror of an entire economic and political model that has been based for many years on oil rents and expanding employment in the state instead of enabling people to do productive work.

The current stage is not about the number of employees as much as it is about the nature of the state itself in the next decade; either the continuation of the distribution fund state that receives money from the sale of oil and converts it into salaries and allowances, or a gradual shift towards a management and development state that redefines its role in the economy, opens the way for a productive private sector, and involves society in bearing part of the responsibility for the future within clear and transparent rules.

Between these two paths, the position of the salary, the role of the employee, and the limits of the private sector’s contribution are redefined, and the features of a new contract between the citizen and the state are taking shape; a contract that can remain captive to the equation of “salary in exchange for loyalty and silence,” or, on the other hand, can develop into a broader partnership based on efficiency, justice, and sustainability, and make public work part of a long-term development project, not just a fixed item in the budget.

Seeds of Wisdom RV and Economics Updates Thursday Evening 2-19-26

Good Evening Dinar Recaps,

ECB Expands Euro Liquidity Backstop, Signaling Strategic Push Into Reserve Currency Territory

Europe moves to institutionalize the euro as a global alternative liquidity anchor

Good Evening Dinar Recaps,

ECB Expands Euro Liquidity Backstop, Signaling Strategic Push Into Reserve Currency Territory

Europe moves to institutionalize the euro as a global alternative liquidity anchor

Overview

• The European Central Bank announced an expansion of its permanent euro liquidity backstop facilities for global counterparties.

• The move strengthens swap and repo lines with key international central banks.

• Officials framed the step as enhancing financial stability amid geopolitical and trade fragmentation.

• The initiative reinforces the euro’s role as a credible reserve and settlement currency beyond Europe.

Key Developments

1. Permanent Liquidity Architecture Expanded

The ECB broadened access to its euro liquidity facilities, allowing foreign central banks greater ability to access euros during periods of stress. This institutionalizes euro swap lines as a long-term stability mechanism rather than a temporary crisis tool.

2. Strategic Autonomy Emphasized

European policymakers reiterated the importance of reducing reliance on external financial systems. The expansion reflects Europe’s desire to ensure euro funding markets remain resilient even amid sanctions regimes, trade conflicts, or dollar funding volatility.

3. Reinforcement of the Euro’s Global Role

By formalizing liquidity guarantees, the ECB is increasing confidence among sovereign reserve managers and global financial institutions. Access to reliable euro funding makes holding euro reserves structurally more attractive.

4. Quiet Structural Competition With the Dollar

While not positioned as anti-dollar policy, expanded euro liquidity lines create an alternative emergency funding channel outside the Federal Reserve’s dollar swap network — subtly diversifying global monetary dependence.

Why It Matters

Liquidity is power in global finance. By strengthening permanent euro backstops, the ECB is building the infrastructure required for a multipolar reserve system. Reserve status is not declared — it is built through trust, depth, and guaranteed access during crises.

Reserve currency strength is forged in moments of stress — not stability.

Why It Matters to Foreign Currency Holders

Readers holding foreign currencies anticipating Global Reset realignment should note:

• Expanded euro liquidity improves the euro’s resilience as a reserve asset.

• Structural diversification away from single-currency dependence increases multi-currency settlement potential.

• Central bank swap architecture often precedes long-term reserve allocation shifts.

If liquidity access is globalized, reserve concentration becomes optional — not automatic.

When liquidity networks expand, reserve hierarchies begin to shift.

Implications for the Global Reset

Pillar 1: Multipolar Liquidity Infrastructure

The euro’s strengthened backstop builds alternative plumbing for global funding markets. Reset dynamics depend heavily on which currencies offer reliable crisis liquidity.Pillar 2: Gradual Dollar Diversification

While the dollar remains dominant, expanding euro liquidity mechanisms reduce exclusive dependence on Federal Reserve swap lines. Over time, this lowers systemic concentration risk and supports reserve diversification.

This is not just monetary policy — it’s reserve architecture evolution in real time.

The Global Reset begins with who controls emergency liquidity.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “ECB expands euro liquidity lines to strengthen global financial stability”

Financial Times – “ECB moves to reinforce euro’s global role amid geopolitical fragmentation”

~~~~~~~~~~

Trump Unveils $10B Board of Peace, Signals Oversight Role Over U.N.

Washington launches a U.S.-led reconstruction framework that could reshape global governance architecture

Overview

• President Trump presided over the inaugural Board of Peace meeting in Washington, convening representatives from more than 45 countries to coordinate Gaza reconstruction and broader conflict stabilization efforts.

• The United States pledged $10 billion toward reconstruction and global peace initiatives.

• Participating nations collectively pledged approximately $7 billion in additional funding commitments.

• Trump stated the Board would “almost be looking over the United Nations and making sure it runs properly,” suggesting a new supervisory dynamic in global governance.

Key Developments

1. $10 Billion U.S. Commitment

The United States positioned itself as the primary financial anchor of the initiative with a $10 billion pledge. The commitment signals Washington’s intention to lead reconstruction financing and shape the governance framework guiding its deployment.

2. Coalition Funding From Regional Powers

Several Middle Eastern and Eurasian nations pledged additional billions toward relief and stabilization. While significant, total commitments remain well below the estimated $70+ billion required for full Gaza reconstruction.

3. Structural Challenge to U.N. Authority

Trump’s remarks that the Board could “look over” the United Nations suggest a potential recalibration of multilateral power structures. If operationalized, this could alter the traditional diplomatic hierarchy centered around the U.N. Security Council.

4. Expansion Beyond Gaza

Officials indicated the Board’s mandate may extend beyond Gaza to address other global conflicts, creating a flexible coalition model outside conventional U.N.-driven frameworks.

Why It Matters

This initiative introduces a parallel diplomatic and financial structure that could redefine how post-conflict reconstruction and peace enforcement are organized. By combining large-scale funding with political oversight ambitions, the Board of Peace signals a possible

evolution in global governance — one centered more heavily around U.S.-led coalition finance than traditional multilateral institutions.

When funding meets authority, global governance begins to shift.

Why It Matters to Foreign Currency Holders

Readers holding foreign currencies in anticipation of Global Reset dynamics should monitor developments like this carefully:

• Large reconstruction funds influence sovereign debt issuance and liquidity flows.

• Shifts in institutional power affect long-term reserve currency confidence.

• Geopolitical restructuring alters safe-haven demand patterns and capital allocation behavior.

If the Board of Peace gains operational traction, it could subtly reinforce U.S. financial dominance — or accelerate counterbalancing responses from competing blocs.

Institutional power transitions often precede currency realignments.

Implications for the Global Reset

Pillar 1: Institutional Power Reconfiguration

A U.S.-led peace and reconstruction authority operating alongside — or above — the United Nations represents a structural shift in governance hierarchy. Control over reconstruction capital often translates into long-term geopolitical influence.

Pillar 2: Strategic Capital Deployment

Massive reconstruction funds are not simply humanitarian tools; they are instruments of influence that shape trade corridors, energy contracts, infrastructure ownership, and financial alignment for decades.

This is not just diplomacy — it’s global finance and governance restructuring before our eyes.

Whoever controls reconstruction controls the next economic chapter.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Thursday Evening 2-19-26

Kujer: Iraq's Gold And Currency Reserves Are "Good" And Ensure Economic Stability

Time: 2026/02/18 {Economic: Al-Furat News} MP Jamal Kojar confirmed that the fluctuation of gold prices towards an upward trend does not directly affect the government's economic and financial situation, noting that the impact falls directly on citizens.

Kujer told Al-Furat News Agency that the speculation carried out by traders who deal in gold directly affects the individual, indicating that the Iraqi bank's gold reserves are positive and can contribute to supporting economic stability.

Kujer: Iraq's Gold And Currency Reserves Are "Good" And Ensure Economic Stability

Time: 2026/02/18 {Economic: Al-Furat News} MP Jamal Kojar confirmed that the fluctuation of gold prices towards an upward trend does not directly affect the government's economic and financial situation, noting that the impact falls directly on citizens.

Kujer told Al-Furat News Agency that the speculation carried out by traders who deal in gold directly affects the individual, indicating that the Iraqi bank's gold reserves are positive and can contribute to supporting economic stability.

He added that "the bank's foreign currency reserves are very good, which puts the country's financial situation in safe hands from fluctuations."

Gold prices in Iraq have witnessed a significant increase over the past several months, particularly since the beginning of 2026, driven by a global surge that pushed the precious metal above one million dinars per mithqal in local markets. Despite some recent slight declines due to momentary fluctuations, the overall trend remains one of sustained upward movement, fueled by global and local economic and geopolitical factors.

According to economic experts, the main reasons for the rise are due to several factors, including global ones, where the rise is mainly due to increased demand for gold as a safe haven in light of economic uncertainty and global geopolitical tensions.

The continued strengthening of gold reserves by central banks, including the Central Bank of Iraq, as Iraq has repeatedly increased its holdings to support the stability of the national currency, in addition to the contribution of the weakness of the US dollar and expectations of interest rate cuts by the Federal Reserve, has increased the global attractiveness of gold, which has been directly reflected in the Iraqi market.

Locally, gold prices have been affected by the rising cost of living and the fluctuating exchange rate of the dollar against the dinar, which has prompted citizens to acquire gold as a financial hedge.

https://alforatnews.iq/news/كوجر-الاحتياطي-العراقي-من-الذهب-والعملة-جيد-ويؤمن-الاستقرار-الاقتصادي

US Scales Back Iraq Missions As Tensions With Iran Rise

2026-02-19 Shafaq News- Baghdad/ Washington/ Erbil The United States reduced diplomatic personnel at its missions in Iraq and parts of the Gulf as regional tensions intensify, Iraqi and American officials told Shafaq News on Thursday, declining to specify the size of the drawdown.

The reduction affected staff across several locations, while remaining facilities continue operating with leaner teams and suspended non-essential activities, the officials said.

A US Embassy official, speaking on background, said, “US Embassy Baghdad and US Consulate General Erbil are open and our operations remain normal.” A defense official at United States Central Command (CENTCOM) declined to comment on personnel movements or force posture, citing operational security and the safety of service members.

The adjustments come amid mounting warnings over Iran. Donald Trump said this week that the Diego Garcia base could be required in the event of a potential Iranian attack. Several governments have urged their citizens to leave Iran, while Washington reiterated its call for Americans to “leave Iran now.”

Indirect nuclear talks in Geneva, mediated by Oman, have ended without a breakthrough. Western reports indicate US forces are preparing contingency plans for operations that could extend for weeks if ordered, with officials anticipating a potential Iranian response.

Separately, Germany temporarily relocated dozens of its troops from Erbil. A spokesperson for the German Defense Ministry told AFP that only essential personnel remain to maintain operational capacity, and that the decision was coordinated with international partners. German forces are stationed in Erbil as part of an international mission training Iraqi security forces.

Read more: US, Israel, and Iran step up military readiness as regional tensions grow

https://www.shafaq.com/en/Iraq/US-scales-back-Iraq-missions-as-tensions-with-Iran-rise

Dollar Rates Climb In Baghdad And Erbil At Closure

2026-02-19 Shafaq News- Baghdad/ Erbil The US dollar closed Thursday’s trading higher in Iraq, recording 153,100 dinars per 100 dollars. According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 153,100 dinars per 100 dollars, up from the previous session’s 152,300 dinars.

In Baghdad, exchange shops sold the dollar at 153,500 dinars and bought it at 152,500 dinars, while in Erbil, selling prices stood at 153,000 dinars and buying prices at 152,900 dinars.

https://www.shafaq.com/en/Economy/Dollar-rates-climb-in-Baghdad-and-Erbil-at-closure

Controversial Ambassadors Expose Flaws In Appointment Criteria, Embarrassing Iraq’s Diplomacy

2026-02-19 Shafaq News Iraq’s criteria for appointing ambassadors continue to generate wide political and media debate, amid recurring objections to the selection process and the qualifications of candidates chosen to represent the country abroad.

The latest controversy centers on Iraq’s ambassador to Saudi Arabia, Safia Al-Suhail, after a video circulated online showing her receiving a Saudi delegation at the Iraqi embassy in Riyadh. The footage, which appeared to show members of the Iraqi delegation standing while a Saudi official remained seated during introductions, sparked criticism and prompted Iraq’s Parliament to request her summons for questioning.

Power-Sharing And Diplomatic Posts

Lawmakers and political experts told Shafaq News that the incident reflects deeper structural problems tied to Iraq’s post-2003 political system, which is based on sectarian and ethnic power-sharing.

They argue that al-Suhail’s conduct amounted to a protocol misstep toward an official delegation, but they stress that the episode goes beyond an individual error. They say the dominance of political quotas over professional standards means that personal mistakes can escalate into diplomatic incidents affecting Iraq’s international image.

For 23 years, ambassadorial appointment lists have repeatedly faced debate. Lawmakers often receive finalized lists from the government and vote on them quickly, sometimes without a full quorum or detailed review of candidates’ résumés.

Diplomatic positions, including ambassadorships, are often distributed among political blocs as part of informal agreements. Parties nominate individuals close to them, whether party members, relatives, or loyalists, as part of what critics describe as a “division of influence” across state institutions.

The number of Iraqi ambassadors has risen from 26 several years ago to more than 100 today. Positions carry substantial financial benefits, with overseas salaries reaching up to $12,000 per month, in addition to official vehicles, security protection, housing, and health coverage.

Repeated Diplomatic Controversies

Speaking to Shafaq News, MP Mukhtar al-Moussawi said the ambassadorial appointments are “based on quotas, not diplomacy,” claiming that some appointees are relatives of officials and lack formal diplomatic training. He added that the quota system extends beyond embassies to ministers and other government institutions.

“If previous appointees had five percent diplomatic experience, the new ones have none at all,” al-Moussawi noted.

On August 26, 2025, Iraq’s Parliament approved a list of new ambassadors submitted by caretaker Prime Minister Mohammed Shia al-Sudani after parliamentary debate. The list included several individuals identified as sons or close relatives of influential political figures, some in their early thirties, without notable diplomatic backgrounds.

The controversy surrounding al-Suhail is not isolated. On October 10, 2025, an official document from Iraq’s embassy in Jordan revealed a complaint filed by the Fairmont Amman hotel against Iraqi diplomat Zainab Akla Abd following an incident during her departure from the hotel.

According to the document, an alarm was triggered by two bags belonging to the diplomat, leading to a dispute and disruption inside the hotel. Iraq’s Foreign Ministry later formed a specialized investigative committee to examine allegations that a staff member at its mission in Jordan had taken hotel property.

On August 20, 2022, the Foreign Ministry said it had taken “appropriate measures” regarding Iraq’s ambassador to Jordan after photos of his wife circulated online. The images were published by Lebanese singer Ragheb Alama, showing him with the Iraqi ambassador to Jordan and his spouse in an “inappropriate situation.”

Structural Crisis

Political researcher Mujashaa al-Tamimi told our agency that recurring disputes involving Iraqi diplomatic missions cannot be separated from the structure of appointments. “The issue is not an isolated incident but a structural flaw,” he explained, adding, “The quota system prioritizes political loyalty over professionalism, and appointments from outside the diplomatic corps sometimes lack protocol and legal training.”

Al-Tamimi emphasized that managing embassies with a party-based mindset rather than a state-centered approach turns personal errors into national reputation crises. However, he cautioned against portraying the entire diplomatic corps as unqualified, noting that “many professional diplomats perform their duties effectively.”

The core problem, he said, lies in the absence of transparent selection criteria, weak accountability mechanisms, and politicization of sensitive positions, arguing that “reform would require strengthening the Foreign Ministry institutionally, implementing periodic performance evaluations, and linking appointments to experience rather than political balance.”

In an interview with Shafaq News, legal expert Mohammed Jomaa said that the ambassador's file consistently places Iraq in an “embarrassing position internationally.”

He criticized the “use of diplomatic posts as rewards for political figures or their relatives,” arguing that the position of ambassador should remain outside partisan and political consensus arrangements, since it represents Iraq’s reputation abroad.”

Written and edited by Shafaq News staff.

Baghdad Confirms US Warning Of Sanctions Over Al-Maliki Premiership Bid

2026-02-19 Shafaq News- Baghdad Iraq’s Foreign Ministry confirmed on Thursday that an oral message conveyed by the United States included a “clear and explicit hint” at the possibility of sanctions if the Shiite Coordination Framework (CF), the country’s largest parliamentary bloc, proceeds with its nomination of Nouri al-Maliki for prime minister.

The clarification followed remarks by Deputy Prime Minister and Foreign Minister Fuad Hussein in an interview with Al-Sharqiya TV, after some media outlets reported that no reference to sanctions had been made.

In a formal statement, the ministry explained that the message was delivered by the US side in Washington and consisted of two main components: the first contained an indication that sanctions could target certain individuals and institutions, while the second set out standards governing the nature of cooperation and joint work with the United States, particularly in relation to the formation of the next government and its operating mechanisms.

tSeorpnosditi8mfcft41784ua51a619l47f4uc00tcc65036i2g9c7t4f1h ·

In the context of the interview conducted by the Deputy Prime Minister of the Cabinet and the Minister of Foreign Affairs, Mr. Fouad Hussein, with the Al-Sharqiya channel in the "Confrontation" program presented by the journalist Hisham Ali, some explanations and information circulated by the media out of context were received, especially regarding the absence of any wave of imposing sanctions on Iraq.

Meanwhile, the Ministry of Foreign Affairs would like to clarify what is coming:

First up: The oral letter received from the US side in Washington, in case the larger bloc holds its current candidate, included two major paragraphs:

1- The first paragraph included a clear and explicit hint at the possibility of imposing sanctions on some individuals and institutions.

2- The second paragraph included a set of criteria related to the nature of cooperation and joint work with the United States of America, namely with regard to the formation of any incoming government and its mechanisms of operation.

The Ministry confirms that the Minister's speech during the interview was based on the standards in the second paragraph, and did not touch the guarantor of the first paragraph on hinting at sanctions, which led to a malfunction in some media coverage.

Ministry of Foreign Affairs of the Republic of Iraq

February 18, 2026

The ministry stressed that Hussein’s televised remarks addressed only the criteria outlined in the second component and did not cover the portion referring to sanctions, describing this distinction as the source of confusion in some media coverage.

Under Iraq’s post-2003 power-sharing arrangement, the presidency is traditionally held by a Kurd, the premiership by a Shiite Muslim, and the speakership by a Sunni Arab.

On Wednesday, a US State Department spokesperson reaffirmed Washington’s opposition to al-Maliki’s return to office, warning that advancing the nomination could carry serious diplomatic consequences. He outlined three priorities guiding the US position: ending the alleged dominance of Iran-backed groups in Iraqi politics, reducing Tehran’s influence over state institutions, and strengthening economic partnerships aligned with US objectives.

Sources previously told Shafaq News that the nominee, who heads the State of Law Coalition and served as prime minister from 2006 to 2014, denied reports suggesting he might withdraw from the race, while the Coordination Framework continues to reassess the nomination in light of mounting domestic challenges, regional instability, and external pressure.

Read more: Nouri Al-Maliki’s new doctrine for power: Pragmatism over defiance?

Jon Dowling: Cryptos and Great Wealth Transfer Updates with Rob Cunningham, February 2026

Jon Dowling: Cryptos and Great Wealth Transfer Updates with Rob Cunningham, February 2026

2-18-2026

In a recent episode of the Jon Dowling podcast, Rob Cunningham, a military veteran and financial expert in the crypto space, shared his expertise on these developments and their potential impact on the global economy.

The traditional financial infrastructure, including legacy systems like SWIFT, is being gradually replaced by blockchain-based atomic settlement ledgers, such as the XRP ledger.

Jon Dowling: Cryptos and Great Wealth Transfer Updates with Rob Cunningham, February 2026

2-18-2026

In a recent episode of the Jon Dowling podcast, Rob Cunningham, a military veteran and financial expert in the crypto space, shared his expertise on these developments and their potential impact on the global economy.

The traditional financial infrastructure, including legacy systems like SWIFT, is being gradually replaced by blockchain-based atomic settlement ledgers, such as the XRP ledger.

This shift is expected to bring about significant improvements in efficiency and transparency.

According to Rob, XRP is poised to play a crucial role as a backbone in the future financial system, enabling verifiable and immutable transactions that eliminate traditional banking malpractices.

The XRP ledger, with its advanced blockchain technology, offers a more secure and reliable way to facilitate cross-border transactions, reducing the need for intermediaries and minimizing the risk of manipulation.

As the financial system transitions to this new infrastructure, we can expect to see increased transparency, accountability, and efficiency in global payment systems.

The conversation also touched on the issue of market manipulations in metals and cryptocurrencies, with large financial institutions often suppressing prices to cover shorts and buy dips.

Rob cautioned listeners against falling prey to misinformation and “redemption center” conspiracies, emphasizing that the transition to a blockchain-based system is about restoring justice and transparency to banking, not creating secretive underground exchanges.

To navigate this changing landscape, Rob advises patience and prudent behavior, encouraging listeners to wait and observe the system stabilize post-Clarity Act implementation rather than panic or fall prey to hype. By doing so, individuals can make informed decisions and avoid being caught up in speculative bubbles.

The Clarity Act, expected to be passed by April, is a significant legislative milestone that will legitimize crypto assets and dismantle central banking monopolies.

According to Rob and the host, this will unleash substantial global economic activity, bringing unparalleled transparency and accountability to government spending and banking.

The Clarity Act is seen as a crucial step towards creating a more decentralized and transparent financial system, with blockchain and AI technologies playing a key role in facilitating this transformation.

By providing a clear regulatory framework, the Act will help to unlock the potential of cryptocurrency and blockchain technology, driving innovation and growth in the financial sector.

The discussion also touched on the decentralization of U.S. federal agencies, with the Treasury and Federal Reserve functions moving away from Washington D.C.

This shift is expected to break up centralized corruption and bring government closer to the people it serves, promoting greater accountability and transparency.

In conclusion, the insights shared by Rob Cunningham on the Jon Dowling podcast offer a compelling glimpse into the evolving financial landscape.

As we move towards a more decentralized and transparent financial system, driven by advancements in cryptocurrency, blockchain technology, and legislative changes, it’s clear that the future of finance is set to be transformed.

As we navigate this changing landscape, it’s essential to remain informed, patient, and prudent, avoiding the pitfalls of misinformation and speculation. By doing so, we can position ourselves for success in a financial system that is set to be more transparent, efficient, and just.

Seeds of Wisdom RV and Economics Updates Thursday Afternoon 2-19-26

Good Afternoon Dinar Recaps,

Markets Pause as AI Optimism Meets Rising U.S.-Iran Tensions

Technology momentum collides with geopolitical uncertainty in fragile trading environment

Global equities entered a consolidation phase as corporate AI optimism offset growing geopolitical stress tied to U.S. troop deployments near Iran.

Good Afternoon Dinar Recaps,

Markets Pause as AI Optimism Meets Rising U.S.-Iran Tensions

Technology momentum collides with geopolitical uncertainty in fragile trading environment

Global equities entered a consolidation phase as corporate AI optimism offset growing geopolitical stress tied to U.S. troop deployments near Iran.

European stocks slipped from record highs, pressured by earnings misses from major industrial players, while U.S. futures remained largely unchanged. In Asia, trading volumes were thin due to Lunar New Year holidays across China, Hong Kong, and Taiwan.

Meanwhile, safe-haven assets advanced. Gold climbed and oil reached multi-week highs as markets priced in geopolitical contingency risk.