.Mis-Focus

.Mis-Focus

By Anna Von Reitz Thursday, January 30, 2020

While everyone's attention is focused on the Circus Maxima taking place in Washington, DC, complete with the pot calling the kettle black, and all sorts of "investigation" intrigue taking place all over the world --- it turns out that the "Russian Collusion" was actually about Joe Biden, Nancy Pelosi, John Kerry, and Mitt Romney, all four, very gainfully employing their children in what used to be called Russia -- the Ukraine.

Name games, again.

Apparently, leaders in BOTH political parties are compromised for the same sins and likely to be painted with the same brush of corruption once the dust settles, so that's why Romney and his RINO buddies are trying to justify impeaching Trump with no credible evidence of wrong-doing on his part at all.

Mis-Focus

By Anna Von Reitz Thursday, January 30, 2020

While everyone's attention is focused on the Circus Maxima taking place in Washington, DC, complete with the pot calling the kettle black, and all sorts of "investigation" intrigue taking place all over the world --- it turns out that the "Russian Collusion" was actually about Joe Biden, Nancy Pelosi, John Kerry, and Mitt Romney, all four, very gainfully employing their children in what used to be called Russia -- the Ukraine.

Name games, again.

Apparently, leaders in BOTH political parties are compromised for the same sins and likely to be painted with the same brush of corruption once the dust settles, so that's why Romney and his RINO buddies are trying to justify impeaching Trump with no credible evidence of wrong-doing on his part at all.

Ukraine was just such a honey pot, they couldn't resist.

And now, they are scared.

With the lowest unemployment rate in 50 years and lower and middle income families gaining net income for the first time in a decade and average life expectancy in this country on the rise, and many other indicators of Trump's success physically hitting home throughout America, all their lies sound increasingly hollow.

So, what do they do? They unleash the deadly and naturally occurring Nipah virus and the Corona virus engineered by Bill Gates, at the same exact time, in China, to signal their displeasure with the China-Trump Trade Deal.

Reminds me of little kids getting mad because they can't win a softball game, and taking their bat and ball and going home. If they can't bilk China, and extort racketeering and protection money from China, then nobody else is going to be able to do business with China, either.

Unfortunately, their home is here, in America---- and we have the responsibility of dealing with these Infant Terribles. Sooner or later, it's going to come down to dragging them out of the halls of Congress, out of St. Peter's., and out of the banks and military as well.

We have to do it, and there is nobody here but us chickens.

So, we need to wise up our Democrat friends who are still in a daze from decades of glutting at the trough and assure them that, yes, the dirty laundry is in full view. The Unions, the Mob, the Oil Companies, Blackwater, Vanguard, Homeland Security, both the RNC and DNC, the FED, the "Marshal Plan", the banks ---- all of it.

Turns out that Wells Fargo was Crime Central in the time period between the Twin Towers and the 2008 Meltdown.

To continue reading, please go to the original article here:

http://www.paulstramer.net/2020/01/mis-focus.html

See this article and over 2200 others on Anna's website here: www.annavonreitz.com

.Ideas For Those Who Have More Money Than They Can Spend

.Ideas For Those Who Have More Money Than They Can Spend

A Few Ideas for Those Rich People Who Have More Money Than They Can Spend

What should you do if the only asset you lack is imagination?

By Harry Cheadle

From Left: Bobby Murphy, Evan Spiegel, Rupert Murdoch, And David H. Koch At Some Time 100 Thing In 2014. Photo Illustration Based On A Photo By Larry Busacca/Getty Images For Time

Axios reported on Thursday that "wealthy people and corporations have so much money they literally don't know what to do with it." According to the outlet, a combination of low interest rates (making it easy to borrow from banks) and globalization (driving down labor costs) have fueled a Scrooge McDuck-style rise in corporate profits since the 2008 financial crisis.

Ideas For Those Who Have More Money Than They Can Spend

A Few Ideas for Those Rich People Who Have More Money Than They Can Spend

What should you do if the only asset you lack is imagination?

By Harry Cheadle

From Left: Bobby Murphy, Evan Spiegel, Rupert Murdoch, And David H. Koch At Some Time 100 Thing In 2014. Photo Illustration Based On A Photo By Larry Busacca/Getty Images For Time

Axios reported on Thursday that "wealthy people and corporations have so much money they literally don't know what to do with it." According to the outlet, a combination of low interest rates (making it easy to borrow from banks) and globalization (driving down labor costs) have fueled a Scrooge McDuck-style rise in corporate profits since the 2008 financial crisis.

At the same time, in a story familiar to generations of Americans, economic gains have disproportionately gone to the world's ultra-rich, who have also recently benefited from policies like Donald Trump's tax cut last year, which rewarded the wealthy and corporations.

And rather than using those windfalls to raise salaries for workers (lol) or even just spend on consumer goods, these entities are either buying back their own stock, sitting Smaug-like on piles of cash, or blowing it on dubious investments. From Axios:

Wealthy households and individuals are pouring money into asset managers, betting on companies that lose $1 billion a year, bonds from little-known Middle Eastern republics, and giving hot Silicon Valley start-ups more venture capital than they can handle…

But even that hasn't been enough to account for all the new money. The top 1 percent of U.S. households are holding a record $303.9 billion of cash, a quantum leap from the under $15 billion they held just before the financial crisis.

So what should the imagination-poor rich people do with all of those commas? A few suggestions:

To continue reading, please go to the original article at

A Few Ideas for Those Rich People Who Have More Money Than They Can Spend

.How to Get Through Tough Times When You Are in Despair

.How to Get Through Tough Times When You Are in Despair

From Lifehack By Daniel Matthews, CPRP November 5, 2018

A Certified Psychosocial Rehabilitation Practitioner with an extensive background working with clients on community-based rehabilitation. Read full profile

Suddenly, a class 5 hurricane comes out of nowhere and literally wrecks your life; you discover your health is failing; your best friend commits suicide. These aren’t scenarios from a TV show or movie — they’re tough times that many people face all over the world, and even if you’re not dealing with something so major, you’re still in a state of utter despair.

Step back for a second. You’re still able to read this, or you have someone reading it to you. To realize the fact of your existence and what that realization means right now is part of the journey not just to recovery, but to bliss.

How to Get Through Tough Times When You Are in Despair

From Lifehack By Daniel Matthews, CPRP November 5, 2018

A Certified Psychosocial Rehabilitation Practitioner with an extensive background working with clients on community-based rehabilitation. Read full profile

Suddenly, a class 5 hurricane comes out of nowhere and literally wrecks your life; you discover your health is failing; your best friend commits suicide. These aren’t scenarios from a TV show or movie — they’re tough times that many people face all over the world, and even if you’re not dealing with something so major, you’re still in a state of utter despair.

Step back for a second. You’re still able to read this, or you have someone reading it to you. To realize the fact of your existence and what that realization means right now is part of the journey not just to recovery, but to bliss.

When you’re in a state of bliss, what does that look like? Where are you, is there anyone with you, are you relaxed, is there an incredible scent hanging in the air?

Even if the advice I’m about to give you doesn’t put you in a state of bliss, it will help you get closer to a place where bliss is possible.

Below, you’ll discover the initial steps towards recovery — those first essential actions you must take to recover from being in a state of despair. Next, you’ll get tips on maintaining psychological stability once there’s some distance between yourself and whatever is causing you to despair. Finally, you’ll grasp a philosophical standpoint that will help you help others when they are in a state of despair like yours.

Ready to get through this tough moment in your life and emerge a better person? Let’s do this.

1. You Are Not Alone — Cry out for Help

First, know this: Isolation is dangerous while you’re in despair.

If you break down and do something you can’t take back, there’s a good chance no one is helping you think differently.

Some 70 percent of people who commit suicide are not undergoing mental health treatment, and suicide rates for people between the ages of 34 and 65 have increased by 33 percent since the year 2000.[1] If those individuals who killed themselves had been able to get treatment, it could have saved their lives.

Find a counselor. If you don’t have health insurance and it’s going to cost too much, search for free counseling options in your community. Try the SAMHSA Treatment Referral Helpline, 1-877-SAMHSA7 (1-877-726-4727), if you’re at a loss.

Or call a family member or friend if you simply need someone to talk to. Even if you can’t completely unburden yourself, talking to someone is better than the alternative of carrying such a heavy burden.

A caveat: Do not try to substitute your friends and family for an actual therapist. It’s unhealthy for both you and them, because there’s too much emotional attachment.

In short, you’ll be burdening them too much, and they may give you biased advice. A counselor will give you objective advice that can help immensely.

2. Search Yourself and Be Honest About Absolutely Everything

Now that you’ve identified someone to talk to, it’s time to take these important steps:

Take a look at your life and ask whether there are any ongoing physical, external issues in your environment making things worse.

Examine your diet and lifestyle for factors affecting your wellness (more on this soon).

Examine your thoughts and look for the types of thoughts, or the very specific thoughts, that are causing you to despair.

At this point, it will help to go to the doctor and get a physical exam. Find out where you’re at biologically. Maybe you’re not getting enough vitamins or nutrients, or you’re getting too much of something. You may not be getting enough exercise. Be honest with the doctor.

To continue reading, please go to the original article here:

.How the 2010’s Taught Us to Hate the Rich

.How the 2010’s Taught Us to Hate the Rich

By Matt Taylor, and Maxwell Strachan; illustrated by Hunter French Nov 26 2019,

From the gig economy to supervillains like Martin Shkreli to the college cheating scandal, this is the story of "late capitalism" coming to life.

In the past ten years, we lost hope in American politics, realized we were being watched on the internet, and finally broke the gender binary (kind of). So many of the beliefs we held to be true at the beginning of the decade have since been proven false—or at least, much more complicated than they once seemed.

The Decade of Disillusion is a series that tracks how the hell we got here.

If you squint hard enough, you could theoretically be optimistic about capitalism in America right now. Technically speaking, the U.S. economy is currently in the midst of the longest expansion in its history—a record that started when the country dragged itself out of the Great Recession and back into something resembling growth in 2009. Middle-class incomes have shown (at least fleeting) signs of life after decades of stagnation, too.

How the 2010’s Taught Us to Hate the Rich

By Matt Taylor, and Maxwell Strachan; illustrated by Hunter French Nov 26 2019,

From the gig economy to supervillains like Martin Shkreli to the college cheating scandal, this is the story of "late capitalism" coming to life.

In the past ten years, we lost hope in American politics, realized we were being watched on the internet, and finally broke the gender binary (kind of). So many of the beliefs we held to be true at the beginning of the decade have since been proven false—or at least, much more complicated than they once seemed.

The Decade of Disillusion is a series that tracks how the hell we got here.

If you squint hard enough, you could theoretically be optimistic about capitalism in America right now. Technically speaking, the U.S. economy is currently in the midst of the longest expansion in its history—a record that started when the country dragged itself out of the Great Recession and back into something resembling growth in 2009. Middle-class incomes have shown (at least fleeting) signs of life after decades of stagnation, too.

But if the first decade of the 21st century was defined by the rise and fall of what George W. Bush described as the American "ownership society,” the second saw that myth permanently disintegrate, replaced by the realities of economic precariousness. Even as stock markets started booming again, politics shifted leftward and socialists gained clout—and hackneyed terms like "late capitalism" gained followings.

Along the way, the very idea of what counts as money—what wealth looks like and how it's represented, what people aspire to earn and how popular figures flaunt it—shifted radically.

This is the era of memes about the horrors of student loan debt and temp gig labor, about young people subsisting on GoFundMe campaigns and Seamless coupons, about plowing all your savings into brand-new digital currencies.

If the economy's capacity to atomize workers and conjure up wealth were part of the story of our unraveling confidence in capitalism, this decade also saw a surge in awareness of pay disparities, discrimination, and scams. The Women's National Soccer Team. Theranos. Fyre Festival.

This was the time when the spectacular display of wealth reached its zenith, and also when society started to turn up its collective nose at the ugly truth.

End of 2011: U.S. Student Debt Tops $1 Trillion

In late 2011, as the Occupy Wall Street movement communicated millions of people’s frustrations with the economic policies of the last decade, the country quietly eclipsed a statistical marker that would help to define the next one: $1 trillion in student loan debt.

Over the following years, the amount of student debt accrued by Americans would continue to steadily rise as the nation came to grips with the true extent of a college-affordability crisis that disproportionately affected lower-income families and people of color.

By 2018, total student debt would reach $1.5 trillion, leading to calls by Democratic presidential candidates Bernie Sanders and Elizabeth Warren to eradicate most (if not all) of the debt that continues to hamper an entire generation.

For a huge percentage of the millennial generation, the debt they took on in hopes of obtaining decent-paying jobs also became the reason they stayed at home with their parents, put off having children, and lost hope that they’d ever own a home of their own.

July 2012: Uber Launches UberX, Mainstreaming the Gig Economy

In the middle of 2012, a three-year-old tech company called Uber announced a new version of its service: Uber X. Until then, Uber had only offered rides in fancy black Town Cars. But Uber X allowed regular people to sign up to pick up customers in their regular cars. Riders would pay less—35 percent less to be exact, according to then-CEO Travis Kalanick at the time.

To continue reading, please go to the original article here:

https://www.vice.com/en_us/article/ne8xpd/2010s-decade-money-wealth-debt

.Rich People Agree That Life Is Unfair

.Rich People Agree That Life Is Unfair

By Harry Cheadle Jan 10 2020,

They are concerned about inequality, according to a new survey, but don't ask them to pay more in taxes.

Huge numbers of Americans understand that life in their country is fundamentally unfair. Even many of those in households making more than $500,000—the literal top 1 percent of earners—think that they are unfairly privileged in areas of life ranging from college admissions to housing, and believe the richest of the rich should pay more in taxes.

But when those high earners are asked if the merely rich, i.e. them, should have to chip in more, they balk. Oh, reducing inequality and making the world nicer means that I, personally, might have less stuff? No thank you.

Rich People Agree That Life Is Unfair

By Harry Cheadle Jan 10 2020,

They are concerned about inequality, according to a new survey, but don't ask them to pay more in taxes.

Huge numbers of Americans understand that life in their country is fundamentally unfair. Even many of those in households making more than $500,000—the literal top 1 percent of earners—think that they are unfairly privileged in areas of life ranging from college admissions to housing, and believe the richest of the rich should pay more in taxes.

But when those high earners are asked if the merely rich, i.e. them, should have to chip in more, they balk. Oh, reducing inequality and making the world nicer means that I, personally, might have less stuff? No thank you.

That's one of the takeaways of a new report from NPR, the Harvard T.H. Chan School of Public Health, and the Robert Wood Johnson Foundation, which jointly conducted a telephone survey of 1,885 adults.

In the most no-s* finding of all time, 1 percenters were found to have "near-universal life satisfaction," with 90 percent of that group saying they were "completely" or "very" satisfied with their lives, compared to just 44 percent of respondents in households earning less than $35,000.

Only 8 percent of those high earners reported having a serious problem paying for medical bills, while 57 percent of those making under $35,000 did. Even fewer of the rich said they had problems paying off debt, finding an affordable place to live, or paying for food or housing, which are routine and often crushing problems for those at the bottom of the income pyramid.

To continue reading, please go to the original article here:

https://www.vice.com/en_us/article/n7jb9m/the-1-percent-cares-about-inequality-but-not-taxes

.This is BIG News from the CBI

.This is BIG News from the CBI.

By Muhammad Ali

The post below was on Dinar Recaps and I attached the link and the full intel for everyone's reference. I was first alerted to this news by my friend, Mike The Dinarian. He's always on top of all the Iraq news and usually sends me anything that stands out. And this post definitely stands out. I will continue my perspective on it, below the post. https://dinarrecaps.com/our-blog/news-rumors-and-opinions-thursday-pm-1-9-2020

Walkingstick: the CBI has told us that all banks in Iraq are going to receive the 50,000 and the 100,000 freshly printed bills...The reason for it is because the CBI is now lessening the amount of 10k and 25k notes in the inventory of Iraqi banks. They want to get more of the three zeros...the CBI is sending 50k and 100k notes only to be used from bank to a bank. Each bank is getting a different specific amount.

Each bank must send to the CBI in return either 4 - 25K notes or 10 - 10K notes. We [Walkingstick's firm] have not received them yet. Some banks have. We believe we will be next. They are only to be used from bank to bank not for circulation. The 50k and 100K are not to be introduced to the citizens.

This is BIG News from the CBI.

By Muhammad Ali

The post below was on Dinar Recaps and I attached the link and the full intel for everyone's reference. I was first alerted to this news by my friend, Mike The Dinarian. He's always on top of all the Iraq news and usually sends me anything that stands out. And this post definitely stands out. I will continue my perspective on it, below the post.

https://dinarrecaps.com/our-blog/news-rumors-and-opinions-thursday-pm-1-9-2020

Walkingstick: the CBI has told us that all banks in Iraq are going to receive the 50,000 and the 100,000 freshly printed bills...The reason for it is because the CBI is now lessening the amount of 10k and 25k notes in the inventory of Iraqi banks. They want to get more of the three zeros...the CBI is sending 50k and 100k notes only to be used from bank to a bank. Each bank is getting a different specific amount.

Each bank must send to the CBI in return either 4 - 25K notes or 10 - 10K notes. We [Walkingstick's firm] have not received them yet. Some banks have. We believe we will be next. They are only to be used from bank to bank not for circulation. The 50k and 100K are not to be introduced to the citizens.

They are to introduce the small category notes when told on their schedule. This is being used to remove the three zeros notes from the banks not to draw them in - that was already done...

OK here we go. There are many aspects of this post but what particularly interests me is the 50,000 and 100,000 being used for Bank to Bank transactions.

Let me give you an example, here is a picture of a 1934 100,000 US Dollar Federal Reserve Gold Certificate bank note. For many, you probably didn't know the U.S. had a 100,000 bank note. Well they did.

The $100,000.00 Gold Certificate was used for bank to bank transactions, and was never intended to be held by the public nor was it legal for an individual to own one. This $100,000.00 is a Series 1934. All Series 1934 gold certificates were issued only to banks and were not available to the public.

The Series 1934 gold certificates are also distinguished from the previous gold certificates in their gold clause, which adds the phrase "as authorized by law" to denote that these notes cannot be legally held by private individuals.

The total print run for the original $100,000.00 Gold Certificate was 42,000 pieces, all but a few of them have been destroyed. Only a few specimens of these Series 1934 gold certificates survive today, in the Smithsonian and Federal Reserve Bank Museums.

I am a numismatist and collecting bank notes and coins has been a hobby of mine since 1995, so this is where I was first introduced to these large bank notes.

Alright so now let me explain why this is significant in relation to the above intel from Walkingstick.

These U.S. 100,000 notes were only used for transactions between banks. Today, transactions between bank to bank are generally settled digitally, so these large denomination notes are obsolete. However, in some countries transactions between banks are still being practiced using notes, as in our case, of Iraq.

What is important to understand and realize is ONLY very large denomination size notes are used to settle bank to bank transactions.

Now getting back to Iraq, We know that the 50,000 Dinar note was introduced in 2015 and was introduced at the public level. Since then the CBI has been pulling these notes from the streets and what got me very excited in Walkingstick's intel is that these notes along with the 100,000 notes will be used for Bank to Bank ONLY transactions.

So if we apply a little logical reasoning. We can ask, how can the 50,000 note, used by the general public one moment and be used thru bank to bank transactions, the next moment?

Especially when I said, ONLY very large denomination size notes are used between Bank to Bank. Particularity when the value has not changed...YET.

At the present rate of 0.0008, Iraq would have to use even larger size notes, something like a 1,000,000 Dinar note but they are not, it was stated that they will use the 50,000 and 100,000 notes, so in order for this to happen they MUST raise the value of the Dinar by Re-instating it to $4.

So, let me just clarify my point, it is illogical that the 50,000 note at present value be used to handle banks very large settlements, there has to be a sizeable or substantial gap variation for it to make sense.

For example in the case of the 1934 $100,000 note used for bank to bank settlements, at that time the highest denomination for the public was $1,000 dollars. Therefore a note size of $100,000 worked well.

In the present case of Iraq the highest note size for the public is 50,000, so how can they use the same size to settle bank to bank transactions? This is where it is not logical. There is a missing factor here and that is the rate. The rate must be increased for it to be practical and by the sounds of it; it may be sooner than we think.

So I hope that starts to excite you. Now the other thing that got me very excited about this intel is that during the years, we have learnt that the Project to remove the 3 zeroes has been to remove the large notes from circulation or from the hands of the citizens.

And we have been told that 90% of the notes, inside Iraq, have been removed from circulation. This was confirmed again by Walkingstick when he said, "that was already done..."

So it seems that the remaining 10,000 and 25,000 notes are in the banks. So, again, applying my sense of logic to this, it would appear the CBI is trading the 50,000 and 100,000 notes for the banks 10,000 and 25,000 notes at the same value. Swap for Swap, a Dinar for a Dinar.

Therefore, in the bank's hands are 50,000 and 100,000 notes. But these notes are restricted for bank to bank settlements ONLY. You can see where this will start to become a problem, when the citizens come into the bank asking for withdrawals and banks say, sorry we have no money to give you.

Panics will start and a whole new wave of issues will give rise; the citizens will start accusing the banks of cheating and fraud, and the confidence level of the citizens to the banks will change in an instance.

The CBI will need to act quickly to raise the value of the Dinar so as to prevent a bad situation to get more worst.

I believe the CBI already has a time frame for collecting the remaining 10,000 and 25,000 notes from the banks and once the notes are back at the CBI, then PRESTO...the CBI will RI the Dinar and we will see the largest denomination size of the Iraq Dinar go to 1,000 Dinars, and the 50,000 and 100,000 notes will become the logical choice for bank to bank transactions.

Just an FYI side note here, as I am sure many people do not know this fact, but in Kuwait, did you know that the highest bank note size is 20 Dinar? That is one powerful currency.

So for Iraq and Iran, once they increase in value and things start to stabilize in country, in time they will follow suite to Kuwait and you'll see them start dropping the 1,000 notes, then 500, then the 100 and 50.

Now back to our logic flow and here's a new thought for you. We can conclude that at current the 50,000 IQD note can still be used for public transactions, since we have not seen any official announcements from the CBI that cancels the 50,000 note, from the public and that they will officially be used for bank to bank transactions. Once the value is raised, we may then see an announcement from the CBI.

From the standpoint of the CBI, they need to remove the last bit of 10k and 25k notes from the banks, because if they were to RI the Dinar now, before removing the notes, some of the bank employees thru temptation, may steal the notes and run over the border to exchange them.

Now, the 50,000 may become a question mark? How will the CBI handle this note? As it is now, the 50k notes are meant for public usage, and if these notes are still in the banks when they RI, then the same bank employees may try to steal them and run over the border for exchanging. So it means to me, that the employees will either steal the 10k, 25k or 50k notes.

If that's the case, then once the CBI does the RI to $4, they will immediately have to cancel the 50k notes, for public level, to prevent the bank employees from stealing the notes.

If the 50k is ONLY designated as Bank to Bank, then even if they were to steal the notes, they won't be able to exchange it in any country of the world but thru an Iraqi bank to an Iraqi bank. So it would be a futile thought on the bank employee to steal.

So what this means, is that, if anyone is holding the 50,000 IQD note now, do you need to be worried that you may not be able to get the chance to exchange it?

I think the CBI may do a 2nd scenario on the 50,000 note, and that is to make a new version of the note that would be intended for bank to bank transactions. Therefore, there would be 2 editions of the 50,000 note. The current one that was printed in 2015 and a new one for bank to bank.

If the CBI does this, then it'll be a sign of relief for anyone holding the current 50,000 note. I believe this would be the choice as most of the 50,000 notes the CBI printed in 2015 should have already been collected from local circulation.

Since Walkingstick said, "the CBI has told us that all banks in Iraq are going to receive the 50,000 and the 100,000 freshly printed bills". 'Freshly printed bills' are the keywords and this tells me that the CBI will in fact print, or have already printed, a new version of the 50,000 note.

This means the 10,000, 25,000 and current 50,000 notes will all be exchangeable, let's hope so, as I also have a few of the 50,000 IQD notes.

So aside from the matter on the 50,000 note. I believe that it's time to get our plans in order and be ready. It looks like the CBI will be ready to pull the trigger once they collect the remaining few of 10,000 and 25,000 notes which should not take long, as Walkingstick stated, "Some banks have [the 50k and 100k notes already]. "

If you still need help on your currency planning, please consider using my currency exchange planner. I remind you that 85% of the Kuwaiti RI millionaires were flat broke in 5 months. So if you wish to be part of the 15% then make sure your plans are solid.

I have a current promotion on my planner software and that is, buy the Desktop version and get the Mobile App version for FREE. This is a limited time offer as I may stop this promotion at any time.

So I hope my article has lifted your spirits after the stressful few days of the Iran-USA conflicts and I really believe that we are back on track and the RI is nearer to us now than ever before.

Just a shout out to The Dinarian, from The Dinarian YouTube Channel, for alerting me to this intel and thanks for Dinar Recaps for everything you guys are doing and a special thanks to Walkingstick, Frank and Delta for bringing us Iraq news in real-time.

Thank you Muhammad Ali www.CurrencyExchangePlanner.com

Sun Tzu’s Best Pieces of Leadership Advice

.Sun Tzu’s 31 Best Pieces of Leadership Advice

Eric Jackson , Contributor FORBES

‘If your opponent is temperamental, seek to irritate him.’ — Looks like the Trump playbook has borrowed from Sun Tz

There was no greater war leader and strategist than Chinese military general Sun Tzu. His philosophy on how to be a great leader and ensure you win in work, management, and life is summed up in these 33 pieces of advice. They can all be applied by you in your job when you go back to work next week:

A leader leads by example, not by force.

You have to believe in yourself.

Sun Tzu’s 31 Best Pieces of Leadership Advice

‘If your opponent is temperamental, seek to irritate him.’ — Looks like the Trump playbook has borrowed from Sun Tzu

Posted on November 27, 2017 by State of the Nation

Sun Tzu’s 31 Best Pieces Of Leadership Advice

Eric Jackson , Contributor FORBES

There was no greater war leader and strategist than Chinese military general Sun Tzu. His philosophy on how to be a great leader and ensure you win in work, management, and life is summed up in these 33 pieces of advice. They can all be applied by you in your job when you go back to work next week:

A leader leads by example, not by force.

You have to believe in yourself.

Appear weak when you are strong, and strong when you are weak.

If your enemy is secure at all points, be prepared for him. If he is in superior strength, evade him. If your opponent is temperamental, seek to irritate him.

Pretend to be weak, that he may grow arrogant. If he is taking his ease, give him no rest. If his forces are united, separate them. If sovereign and subject are in accord, put division between them. Attack him where he is unprepared, appear where you are not expected.

The supreme art of war is to subdue the enemy without fighting.

Supreme excellence consists of breaking the enemy’s resistance without fighting.

If the mind is willing, the flesh could go on and on without many things.

Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.

To know your Enemy, you must become your Enemy.

Keep your friends close, and your enemies closer.

Can you imagine what I would do if I could do all I can?

To continue reading, please go to the original article here:

.Where the World’s Banks Make the Most Money

.Where the World’s Banks Make the Most Money

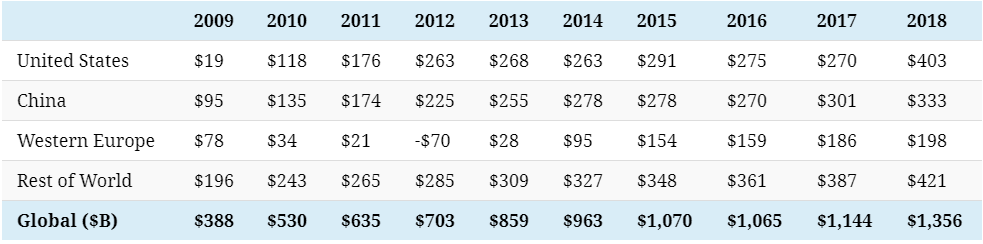

Profits in banking have been steadily on the rise since the financial crisis.

Just last year, the global banking industry cashed in an impressive $1.36 trillion in after-tax profits — the highest total in the sector seen in the last 20 years.

What are the drivers behind revenue and profits in the financial services sector, and where do the biggest opportunities exist in the future?

Following the Money

Today’s infographic comes to us from McKinsey & Company, and it leverages proprietary insights from their Panorama database.

Where the World’s Banks Make the Most Money

Profits in banking have been steadily on the rise since the financial crisis.

Just last year, the global banking industry cashed in an impressive $1.36 trillion in after-tax profits — the highest total in the sector seen in the last 20 years.

What are the drivers behind revenue and profits in the financial services sector, and where do the biggest opportunities exist in the future?

Following the Money

Today’s infographic comes to us from McKinsey & Company, and it leverages proprietary insights from their Panorama database.

Using data stemming from more than 60 countries, we’ve broken down historical banking profits by region, while also visualizing key ratios that help demonstrate why specific countries are more profitable for the industry.

Finally, we’ve also looked at the particular geographic regions that may present the biggest opportunities in the future, and why they are relevant today.

Banking Profits, by Region

Before we look at what’s driving banking profits, let’s start with a breakdown of annual after-tax profits by region over time.

In 2018, the United States accounted for $403 billion of after-tax profits in the banking sector — however, China sits in a very close second place, raking in $333 billion.

What’s Under the Hood?

To continue reading, please go to the original article here:

https://www.visualcapitalist.com/where-worlds-banks-make-money/

.42 Best Millionaire Statistics, Facts and Resources for 2019

.42 Best Millionaire Statistics, Facts and Resources for 2019

Here’s the new and latest 2019 millionaire statistics and facts on how many millionaires there are and their behaviors, all backed by credible sources.

There’s so much information that’s broadcast on millionaires, but much of it is inaccurate or poorly researched.

If you’re really interested in the best and most recent available data, it’s all right here. We’ve searched to find the best so that you don’t have to!

Below you’ll find statistics specifically on how many millionaires there are in the United States and the world, including the global cities with the highest population of millionaires.

42 Best Millionaire Statistics, Facts and Resources for 2019

Here’s the new and latest 2019 millionaire statistics and facts on how many millionaires there are and their behaviors, all backed by credible sources.

There’s so much information that’s broadcast on millionaires, but much of it is inaccurate or poorly researched.

If you’re really interested in the best and most recent available data, it’s all right here. We’ve searched to find the best so that you don’t have to!

Below you’ll find statistics specifically on how many millionaires there are in the United States and the world, including the global cities with the highest population of millionaires.

There’s also a summary of millionaire behaviors, supported by research, that reflect what they think, how they act, and what they believe.

The statistical data and the behavioral facts help provide a composite picture of where millionaires are and how they behave. Whether you’re a journalist, aspiring millionaire, or simply interested in learning about millionaires, the information below is sure to be useful.

Check back often as we continually update this page as new credible data are published.

There are several methodologies used to determine an answer to this simple question, resulting in many different answers. Be sure to understand how the calculations were made so that it’s consistent with how you want to use the data. After much of our own research, below are the sources and statistics that we believe are the best.

Credit Suisse’s latest global wealth report shows there are 42.2 million millionaires (measured in USD) worldwide, up 2.3 million over the last 12 months.

Of those, 41% or 17.3 million individuals are in the United States

This means that 7% of the U.S. adult population are millionaires

Which indicates that approximately 14% of U.S. households are in the millionaire club

With a median wealth of $63,100 for an adult across the globe, $1,000,000 represents 1585% of the median

The annual increase in global wealth per adult was 3.2%

To continue reading, please go to the original article here:

.Why We Fall For Cons

.Why We Fall For Cons

Tim Harford The Undercover Economist

There may be times and places where it’s a good idea to talk back to a military officer — but Germany in 1906 wasn’t one of them. So the young corporal didn’t. The corporal — let’s call him Muller — had been leading his squad of four privates down Sylterstrasse in Berlin, only to be challenged by a captain.

Captain Voigt was in his fifties, a slim fellow with sunken cheeks, the outline of his skull prominent above a large, white moustache. Truth be told, he looked strangely down on his luck — but Muller didn’t seem to take that in.

Like any man in uniform, Captain Voigt appeared taller and broader thanks to his boots, smart grey overcoat and Prussian-blue officer’s cap. His white-gloved hand rested casually on the hilt of his rapier.

“Where are you taking these men?” he barked.

“Back to barracks, sir,” replied Muller.

“Turn them around and follow me,” ordered Voigt. “I have an urgent mission from the “all-highest” command.”

Direct orders from the kaiser himself!

Why We Fall For Cons

Tim Harford The Undercover Economist

There may be times and places where it’s a good idea to talk back to a military officer — but Germany in 1906 wasn’t one of them. So the young corporal didn’t. The corporal — let’s call him Muller — had been leading his squad of four privates down Sylterstrasse in Berlin, only to be challenged by a captain.

Captain Voigt was in his fifties, a slim fellow with sunken cheeks, the outline of his skull prominent above a large, white moustache. Truth be told, he looked strangely down on his luck — but Muller didn’t seem to take that in.

Like any man in uniform, Captain Voigt appeared taller and broader thanks to his boots, smart grey overcoat and Prussian-blue officer’s cap. His white-gloved hand rested casually on the hilt of his rapier.

“Where are you taking these men?” he barked.

“Back to barracks, sir,” replied Muller.

“Turn them around and follow me,” ordered Voigt. “I have an urgent mission from the “all-highest” command.”

Direct orders from the kaiser himself!

As the small group marched towards Putlitzstrasse station, the charismatic Captain Voigt saw another squad and ordered them to fall in behind. He led his little army on a train ride towards Köpenick, a charming little town just south-east of the capital.

On arrival, the adventure continued: bayonets were to be fixed for inspection. It had been an extraordinary day for Corporal Muller and his men. But it was going to get a lot more extraordinary: what they were about to do would be the talk of newspapers around the world.

Captain Voigt’s impromptu strike force burst into Köpenick town hall and into the office of the mayor, a man named Georg Langerhans. Langerhans, a mild-looking fellow in his mid-thirties with pince-nez spectacles, a pointed goatee and a large, well-groomed moustache, stood up in astonishment and demanded an explanation. Voigt promptly placed him under arrest, by order of the kaiser.

“Where is your warrant?” stammered Langerhans.

“My warrant is the men I command!”

Voigt ordered the town treasurer to open the safe for inspection: fraud was suspected. The safe contained three thousand five hundred and fifty seven marks, forty-five pfennigs. Captain Voigt was punctilious about the count, confiscated the money, and handed over a receipt to be stamped.

It was nearly a quarter of a million dollars in today’s money.

To continue reading, please go to the original article here:

Absolute Value vs Relative Value:

Absolute Value vs Relative Value:

Doing Nothing Is Not the True Alternative

Post From the Finance Buff March 26 2019

I read a great comment on the blog Frugal Professor that I’d like to share. The business school professor there needed a new mattress. One model that came into consideration costs $3,500.

Someone commented that considering that you spend around 1/3 of your life on the mattress, it’s worth spending $3,500 on a good mattress. The professor replied:

These thoughts have gone through my mind as well. But I also spend around 95% of my life wearing socks and can’t justify paying $3500 on them. The tradeoff I’m making with this purchase, as with all purchases, is to maximize value by maximizing marginal benefit divided by the marginal cost.

Absolute Value vs Relative Value:

Doing Nothing Is Not the True Alternative

Post From the Finance Buff March 26 2019

I read a great comment on the blog Frugal Professor that I’d like to share. The business school professor there needed a new mattress. One model that came into consideration costs $3,500.

Someone commented that considering that you spend around 1/3 of your life on the mattress, it’s worth spending $3,500 on a good mattress. The professor replied:

These thoughts have gone through my mind as well. But I also spend around 95% of my life wearing socks and can’t justify paying $3500 on them. The tradeoff I’m making with this purchase, as with all purchases, is to maximize value by maximizing marginal benefit divided by the marginal cost.

In the case of the mattress, I’m trying to figure out what the marginal benefit is of a $3500 mattress relative to a $500 mattress (does the marginal benefit exceed the marginal cost of $3k). But, overall, I’m sympathetic to the idea of not cheaping out on a mattress given that it will affect the quality of my life in a non-trivial way for at least 10 years.

This highlighted the difference between what I call the absolute value and the relative value.

The absolute value is the value of having something over having nothing. If I must sleep on concrete for 10 years, I would spend $3,500 on a mattress. If I must walk 10 miles to work every day, I would pay $35,000 for a car.

The relative value is the value of something over its next acceptable alternative. When a $1,000 mattress does the job, a $3,500 mattress offers poor relative value. When a $5,000 car gets me to work just fine, a $35,000 car offers poor relative value.

Sellers like to use the absolute value to make the sale and justify to themselves they are providing value. Here are some examples:

“Before I sold you this whole life policy, you had no life insurance. You would’ve blown your money on unnecessary spending. You should be happy your family is protected now and the policy is worth something.”

“When you walked into the bank, your money was all in CDs. These mutual funds with 2% expense ratios still made more money for you than those CDs.”

“I talked you out of selling at the bottom when the market crashed. That’s worth a lot more than the 1% I’m charging you.”

“If I didn’t treat you after that bus accident, you would’ve bled to death. So pay me $27,000 for giving you stitches.”

In each case the sellers provided absolute value. However, buyers still received poor relative value. A whole life policy isn’t the only option to protect one’s family. You don’t have to blow away your money if you don’t buy a whole life policy.

To continue reading, please go to the original article here:

https://thefinancebuff.com/absolute-value-vs-relative-value-true-alternative.html