Bix Weir and Gerald Celente Thursday 12-30-2021

.Bix Weir

ALERT! JP Morgan Violates Silver Rigging Settlement! Racketeering Charges Are BACK!!

Dec 30, 2021

JP Morgan has officially violated it's Deferred Prosecution Agreement (DPA) by hiding and destroying Whatsapp & Text messages DURING the 3 year DPA time-frame.

The DOJ can now continue with the PROSECUTION of JPM as it relates to Silver Manipulation and Racketeering!

Gonna be a Very Bad New Year for Jamie Dimon!!

Bix Weir

ALERT! JP Morgan Violates Silver Rigging Settlement! Racketeering Charges Are BACK!!

Dec 30, 2021

JP Morgan has officially violated it's Deferred Prosecution Agreement (DPA) by hiding and destroying Whatsapp & Text messages DURING the 3 year DPA time-frame.

The DOJ can now continue with the PROSECUTION of JPM as it relates to Silver Manipulation and Racketeering!

Gonna be a Very Bad New Year for Jamie Dimon!!

Prepare for Financial Disaster in 2022, Warns Forecaster Gerald Celente | Outlook 2022

Stansberry Research: Dec 28, 2021

"The real inflation rate is about 15%," cites Gerald Celente, Trends Journal Founder. When the Federal Reserve raises interest rates we will see, "the biggest crash in world history," Celente predicts in this edition of Outlook 2022: The Tipping Point.

Every day the bigs are getting bigger, and "look again at merger and acquisition activity," he tells our Daniela Cambone. He doubles down on previous remarks on government officials running a, "crime syndicate in front of everybody's eyes."

There will be a lot of entrepreneurial opportunities within the metaverse, Celente believes, saying "it's going to go to a whole other level."

Silver is one of the best conductors of electricity, and will be instrumental in powering solar panels to the metaverse, and "that's why I'm bullish on silver," he concludes.

Massive price Changes in gold and Silver /Potential New Gold Based Monetary System

.Massive Price Change In Gold And Silver | Andrew Maguire & Danielle DiMartino Gold & Silver Forecast

Investors Hub: Dec 10, 2021

Andrew Maguire is joined by former FED insider, bestselling author and the CEO of Quill Intelligence, Danielle DiMartino Booth, to thoroughly examine the source of the current nervousness in the market.

Distinguished by a career on both Wall Street and the Federal Reserve, Danielle offers her expert stance on the Fed’s fumbled attempts to fix the economy since 2008, and the potential transition into a new, gold-based monetary system.

Massive Price Change In Gold And Silver | Andrew Maguire & Danielle DiMartino Gold & Silver Forecast

Investors Hub: Dec 10, 2021

Andrew Maguire is joined by former FED insider, bestselling author and the CEO of Quill Intelligence, Danielle DiMartino Booth, to thoroughly examine the source of the current nervousness in the market.

Distinguished by a career on both Wall Street and the Federal Reserve, Danielle offers her expert stance on the Fed’s fumbled attempts to fix the economy since 2008, and the potential transition into a new, gold-based monetary system.

Wolverine, Holly, Frank and more...Saturday Morning 12-11-2021

.Wolverine:

Redemption centres have been working all day and are being trained for the start of the biggest transfer of wealth that has ever happened in this planet which will never happened again in our life time.

Behind the scenes there are huge meetings happening with very important people to get this started.

Everything is ready to go and just waiting for the codes to be locked in.

I wish I can tell you more but I’m sworn to secrecy.

The White Hats have won and are in control

Wolverine:

Redemption centres have been working all day and are being trained for the start of the biggest transfer of wealth that has ever happened in this planet which will never happened again in our life time.

Behind the scenes there are huge meetings happening with very important people to get this started.

Everything is ready to go and just waiting for the codes to be locked in.

I wish I can tell you more but I’m sworn to secrecy.

The White Hats have won and are in control

Holly Saturday Report

Good morning roomies!

We must remember that one determined person can make a significant difference, and a small group of determined people can change history.- Sonia Johnson

We are a very large group who has set out to change history! We are a global group who has come together for one cause, to free the world and ourselves, and then to heal the world. We are part of the biggest transfer of wealth in history.

We have dreamed the impossible dream! We have climbed the mountain and the journey has been long. We will have our dreams come true!

I heard great news from many yesterday that we are in the final sequence of events happening!

If all continues to go as it has, it should be a great Christmas!

Keep your vibrations high, and stay positive! We need to push this over the top and make it happen!

We can do this! High vibes everyone!

Holly

************

Frank26 Article: "Washington stops the automatic deductions from Iraq oil revenues to compensate Kuwait" That is so big...they need to make the official announcement they're Article VIII but look - Article quote: "Iraq should seek to get out of the provisions of Chapter VII of the UN Charter" ...there's only one banana peel left and Kuwait has just said that they have been compensated. It's time for you to catch up United Nations... Article: "The Central Bank of Iraq announces the suspension of the automatic deduction of Kuwait's compensation" Whoa wait a minute. They owe [Kuwait] money don't they? Not anymore... this is impressive because this is what's definitely considered the final countdown.

Petra Article: "Economist on the 2022 budget: It will address the fiscal deficit and debts owed by Iraq " Quote: "3% of Iraq's oil imports will be released as a result of the zeroing of Kuwait's debts, as well as the zeroing of the deficit during the past year, in addition to recycling part of the surplus for the next year," ...ZEROING of Kuwait 's debts as well as ALL DEFECITS of 2021 AND the budget will have extra that they will roll over to the next year! So you have to ask the question... Kuwait is paid...and ALL other deficits will be paid off this year! AND, they will have a surplus for next year? WHAT IN THE WORLD IS IN THIS BUDGET? ...SO, if they are "intentionally" leaking this information about the new budget and reflective of a new rate...this truly is...ANY DAY!!! IMO...

************

X22 Report

Ep. 2649a - Gold Will Destroy The Fed, In The End The [CB]s Will Not Survive

The fake news is now pushing the narrative that the economy is the best we the people have ever seen. The [CB] has no cover story they need to spin it all. This will fail. Jobs lowest we have seen, inflation hitting 6.8%, people see it all. The [CB] system will be destroyed by Gold when people truly see the real value of the [CB] currency.

Egon Von Greyerz: Get Ready For Gold Mania As Global Financial System Implodes

As Good as Gold Australia: Dec 11, 2021

Governments all around the world continue to recklessly print fiat money. The result and effect from this policy is always the same, leading to an economic disaster.

With the economy already in taters, a pledge has been made by the financial elites, who manage 40% of the world's financial assets to commit to $130 trillion to reach the goals of the Paris Agreement on Climate change. Are they serious?

And if so, where is the money coming from?

Why do Central Banks own gold? If Central Banks own gold then why shouldn't we?

Owning gold (real money) provides the holder with more options in a failing economy.

Now more than ever, one needs to protect their wealth against the real risk of a looming hyper-inflationary global phenomenon.

Holly, Fleming , Frank and more Friday AM 12-10-2021

.Holly Friday Update

Good morning roomies

We are on the cusp of culminating efforts of a global team to unleash the rv. It has been decades in the making.

All pieces are finalized and we await the final release codes. All say imminent.

Keep your vibrations high and your positive attitude.

We are the key to anchor the rv here on earth.

Never ever give up! Holly

Holly Friday Update

Good morning roomies

We are on the cusp of culminating efforts of a global team to unleash the rv. It has been decades in the making.

All pieces are finalized and we await the final release codes. All say imminent.

Keep your vibrations high and your positive attitude.

We are the key to anchor the rv here on earth.

Never ever give up! Holly

Fleming Late Thursday Night: **IRAQ HAS AN AGENDA**

The latest word from Iraq is that their in-country rate for the Iraq Dinar will be RV’d this coming Sunday Night, December 12, 2021. The new IQD value, in-country, is going to be 4.81

The international FOREX Rate will start at $11.90 and float from there.

We were under the assumption that this would be handled by today, and this is now explained. The IMF has been the problem with the delay of the IQD RV. Iraq has their agenda though and the IMF have agreed to the new plan.

Managing the BIG NOTES (10,000 - 25,000 IQD and up), has been the problem. Once we start exchange, we’ll only have a few weeks to get these notes in and out. CBI is getting rid of the big notes now and they want everyone to know that they don’t want people to sit and wait before bringing in these soon-to-be-obsolete bills.

After a very short period these bills won’t be any good. To exchange will require a visit to the Consulate in Iraq, after this big swap is done.

************

Courtesy of Dinar Guru

Frank26 IMO the education of the monetary reform to the Iraqi citizens is very close to completion...The completion of their education in 2021 is only for them to start in 2022 with a new value with purchasing power to their currency and with an explosion of their economic reform because their monetary reform was so successful...

Militiaman The [Central Bank of Iraq] satellite banks are getting geared here in the Untied States. Obviously they're not the only one - into the equation would be the World Trade Organization probably getting ready to be openly exposed.

************

KTFA:

Samson: Fitch confirms Chinese development giant Evergrande has stumbled for the first time

9th December, 2021

The credit rating agency, Fitch, announced Thursday that the giant Chinese real estate group Evergrande, which suffers from huge debts and worries financial markets, "defaulted" on its payment.

The group was supposed to pay $82.5 million on November 6, with an additional grace period that ended on Tuesday.

And Evergrande, which has debts of about $300 billion, is one of the largest real estate groups in China and employs two hundred thousand people, while its activity generates 3.8 million jobs in the country, according to the company. But the group, stifled by huge debts, has been struggling for several months to make interest payments and hand over apartments.

Observers have been following the group's situation with concern for months, because its possible collapse could hamper the growth of the Asian giant.

The rating downgrade reflects non-payment of obligations due on November 6 of the $645 million TNG bond, and other dues after the grace period expired on December 6.

The company, which has total liabilities of $300 billion, warned late Friday that it may not have enough funds to meet its financial obligations. "In light of the current liquidity situation, there is no guarantee that the group will have sufficient funds to continue to perform its financial obligations," Evergrande said in a statement to the stock exchange. "We plan to actively participate" with external creditors in the restructuring plan, she added.

Evergrande faced an immediate test of its ability to repay creditors last Monday, December 6, 2021, after a 30-day grace period on interest payments on its dollar-denominated bonds expired.

Regulators also repeated earlier accusations that the company had run into trouble through a combination of poor management and blind expansion.

In the filing, Evergrande also said it had received a request from creditors to honor its pledge to guarantee payment of $260 million, adding that creditors may demand expedited payment if the company is unable to meet its debt obligations. LINK

IRaQ To Pay Kuwait | Remove Chapter Vll

Rapid Updates: Dec 9, 2021

Iraq to Pay Kuwait Soon! Request to be removed from Chapter Vll. The Iraqi Government intends to pay the last batch of compensation for the Kuwait war, before the end of this year! Iraqi Dinar Update.

Keith Neumeyer: The Pricing System for Gold and Silver is Broken

Palisades Gold Radio: Dec 9, 2021

Tom welcomes back Keith Neumeyer, President & CEO of First Majestic Silver Corp. Keith explains why the world needs enormous amounts of metals for electrification and carbon objectives.

He says, "We will never be fully off oil and gas but we can reduce it given time." He is a fan of hydrogen and nuclear solutions for energy.

The mining industry continues to be held back and demonized. Mining methods are gradually improving. It takes time however to implement and build solutions in a capital-starved market. The creation of new mines takes years and sometimes decades.

Tech companies are too focused on the short-term and don't understand the complexity of resource development. The top five high tech companies have a market cap of five trillion. While the top fifty mining companies are worth a fraction of that industry.

There are no real substitutes for silver. Companies like Dupont have tried with limited success. By 2022 the world will need 140 million ounces of silver just for solar panels. This is a 30-40 percent YOY increase.

Keith discusses silver recycling and why supplies of similar seem limited. It will require considerably higher prices to recover silver and bring these metals to refiners and recyclers.

The recycling business is quite difficult and metals are hard to recover from e-waste. He is concerned about the pricing structures around metal and believes the Comex needs to go away.

Bix Weir and Michael Pento Monday PM 11-29-2021

.Bix Weir

SILVER ALERT! Silver Slam is an Early Christmas Present for SILVER STACKERS!!

Nov 29, 2021

The Criminal Market riggers are desperate to get out of their MASSIVE Silver short position so they are once again SLAMMING the price down!!

Consider this an early Xmas present to Silver Stackers!!

Bix Weir

SILVER ALERT! Silver Slam is an Early Christmas Present for SILVER STACKERS!!

Nov 29, 2021

The Criminal Market riggers are desperate to get out of their MASSIVE Silver short position so they are once again SLAMMING the price down!!

Consider this an early Xmas present to Silver Stackers!!

Most Overvalued & Dangerous Market In History | Michael Pento

Liberty and Finance: Nov 29, 2021

“We have the most overvalued and dangerous market there has ever been,” says money manager Michael Pento, “and there’s a whole heck of a lot of things that have to go right to keep it afloat.”

0:00 Intro

2:19 Market update

8:20 Catalysts

10:17 Fed taper

14:00 Rate hike

16:15 Debt collapse

19:43 Monetary control

23:22 Foreign inflation

29:27 Gold position

News, Rumors and Opinions Saturday Morning 11-27-2021

Wolverine Saturday Update

All indications are saying that the RV is very close to get launch.

Lots of movement in Reno for the last two weeks and momentum is moving every day . Yesterday they have all been told to stay put as any day the gates are about to be open

All paymasters and redemption centres are on hold to get this started and they have all been told to stay put.

All paymasters have been paid in full. Bonds are starting to be paid off but there is no liquidity as of yet.

The UST have called most whales and have told them to stay put as any day they are going to have the gates open.

Everything is ready to go and we are just waiting for them to lock in the codes. As soon as the codes are locked in we can all open a bottle of champagne and celebrate and I can sing my opera.

Wolverine Saturday Update

All indications are saying that the RV is very close to get launch.

Lots of movement in Reno for the last two weeks and momentum is moving every day . Yesterday they have all been told to stay put as any day the gates are about to be open

All paymasters and redemption centres are on hold to get this started and they have all been told to stay put.

All paymasters have been paid in full. Bonds are starting to be paid off but there is no liquidity as of yet.

The UST have called most whales and have told them to stay put as any day they are going to have the gates open.

Everything is ready to go and we are just waiting for them to lock in the codes. As soon as the codes are locked in we can all open a bottle of champagne and celebrate and I can sing my opera.

Let’s all keep our vibrations high and not start posting negative comments as later on it spreads like COVID.

God bless everyone

The Wolverine

Holly Saturday Update

Good morning roomies!

Life without liberty is like a body without spirit! Kahlil Gibron

I’m driving home today. So will be out of the rooms. All sources say we are there, this is done. So why have we not seen it at our level? My thoughts:

1. There is still something going on behind the scenes we are not being told.

2. We are waiting for an event to trigger this as it is event driven.

3. We need everyone to maintain the vibration high enough to match the RV vibration. What we can do is, Hold our vibration high and stay at that level.

Do not fall down in doubt, despair and giving up. See it, feel it and be it!

Holly

************

Courtesy of Dinar Guru

Frank26 THE CENTRAL BANK HAS ALL IT'S DUCKS IN A ROW INTERNATIONALLY... ARTICLE 8 THEY'RE FOLLOWING ALL THE RULES, LAWS AND REGULATIONS OF THE IMF!!!

MilitiaMan ...There is far to much information out that supports Iraq is about to go international with a new exchange rate with the real value to go with it...There is proof that the WTO suggests that there is imminence to ascension and there is more on that matter to come out, as early as next week...the positive effects in play now have made the environment today what it is so that the investors and private sector can flourish once the exchange rate with real value is exposed...imo...

************

X22 Spotlight Report Today’s Guest: Bob Kudla

November 24, 2021

Bob is the created and owner of Trade Genius Academy. Bob begins the conversation talking about inflation and fuel prices.

The release of the strategic oil supply will only last 2.5 days and will not fix the problem, it will make it worse. The [DS] will push the people to the edge and the people will push back and when they do it will destroy their system.

It’s going to get worse before it gets better, but there is light and the end of the tunnel.

Catherine Austin Fitts

What can we expect as the “Financial Reset” arrives by Catherine Austin Fitts

Rafi Farber: Is there REALLY a big silver short position?

Arcadia Economics: Nov. 26, 2021

In this week’s End Game Investor Silver Report, Rafi Farber discusses whether there’s really a big silver short on the COMEX, and what even the bankers might not have considered.

He also talked about why coin and junk silver premiums have been rising, the looming December delivery numbers (they’re currently large), and why the LBMA and the banks have a glaring achilles in their interpretation of what happened during the first #silversqueeze.

All in this week’s End Game Investor Silver Report!

Central Banks and Global Reset 101- Lynette Zang 11-24-2021

.Lynette Zang

CENTRAL BANKS & GLOBAL RESET 101: [Pt.1] Banks Buying Gold Before the Currency "Resets"

Nov 24, 2021

In the beginning, there was gold………….

In this video I will highlight my insights over the last few years on Central Banks and what is now moving into the Global Reset.

I'll break down these subjects in the simplest way possible so you can not only understand what's happening, but also exactly what you can do about it.

How many times can you be lied to if you do not know the truth? My passion is in showing you the facts and data so you can protect yourself while you still can.

Lynette Zang

CENTRAL BANKS & GLOBAL RESET 101: [Pt.1] Banks Buying Gold Before the Currency "Resets"

Nov 24, 2021

In the beginning, there was gold………….

In this video I will highlight my insights over the last few years on Central Banks and what is now moving into the Global Reset.

I'll break down these subjects in the simplest way possible so you can not only understand what's happening, but also exactly what you can do about it.

How many times can you be lied to if you do not know the truth? My passion is in showing you the facts and data so you can protect yourself while you still can.

Because when it comes to your money, if you don't hold it, you don't own it.

Tangible assets are key and so is the right strategy for navigating both the pre and post-reset economy. This is what I've been studying for over 50 years and I'm here to show you the truth behind the curtain...

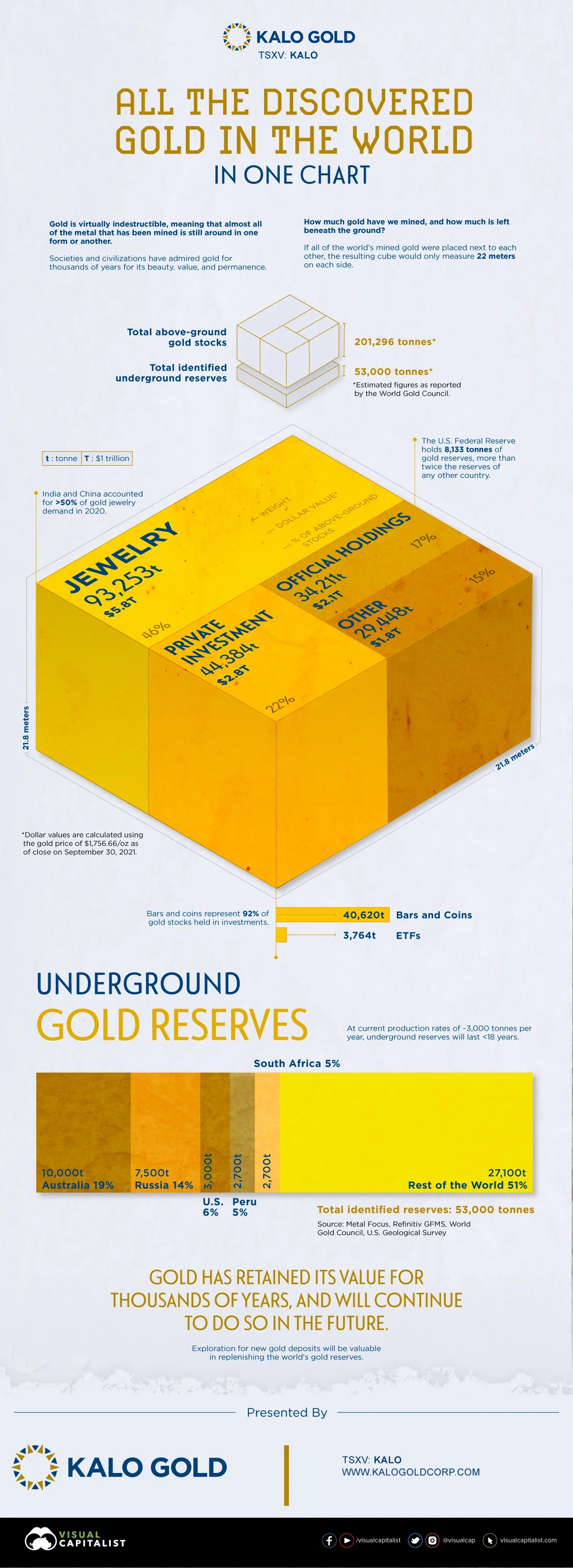

How Much Gold is in the World?

.How Much Gold is in the World?

Gold has retained its value throughout history, partly due to the fact that it is indestructible.

That means that virtually all the gold in the world that has been mined is still around in one form or another. Some of it may have turned into jewelry, while some might be sitting inside vaults as bullion. So, just how much gold have we mined, and how much of it is left beneath the ground?

This infographic from our sponsor Kalo Gold visualizes all the gold in the world that’s above ground and the identified reserves that we have yet to mine.

How Much Gold is in the World?

Published November 16, 2021 By Sponsored Content

Article/Editing: Govind Bhutada Graphics/Design: Pernia Jamshed

The following content is sponsored by Kalo Gold.

How Much Gold is in the World?

Gold has retained its value throughout history, partly due to the fact that it is indestructible.

That means that virtually all the gold in the world that has been mined is still around in one form or another. Some of it may have turned into jewelry, while some might be sitting inside vaults as bullion. So, just how much gold have we mined, and how much of it is left beneath the ground?

This infographic from our sponsor Kalo Gold visualizes all the gold in the world that’s above ground and the identified reserves that we have yet to mine.

Where is All the Gold?

The World Gold Council estimates that miners have historically extracted a total of 201,296 tonnes of gold, leaving another 53,000 tonnes left in identified underground reserves.

If all of the above-ground gold were stacked beside each other, the resulting cube would only measure 22 meters on each side, which is a testament to the metal’s rarity. But where exactly is all of this mined gold?

Nearly half of all the gold ever mined is held in the form of jewelry. India and China have been the largest markets for gold jewelry consumption, combining for more than 50% of global jewelry demand in 2020.

Category Gold stocks held (tonnes) % of above-ground stocks Dollar value* (US$, trillions)

Jewelry 93,253 46% $5.8T

Private investment 44,384 22% $2.8T

Official holdings/Central banks 34,211 17% $2.1T

Other 29,448 15% $1.8T

Total 201,296 100% $12.5T

*Dollar values are based on gold’s price of $1756.66/oz as of close on Sept. 30, 2021.

Investors across the globe buy gold because of its ability to deliver value, and when inflationary pressures are high, gold often acts as a flight to safety. Consequently, investment is one of gold’s biggest end-uses, with over 44,000 tonnes of gold held as bars, coins, or bullion for gold-backed exchange-traded funds (ETFs).

Besides investors, central banks are also among the biggest holders of gold. Unlike foreign currency reserves, equities, and debt-backed securities, gold’s value largely depends on supply and demand. Therefore, central banks often use gold to diversify their assets and hedge against fiat currency depreciation. Central banks’ gold holdings account for almost one-fifth of all above-ground gold; as of 2021, official holdings exceed 35,000 tonnes.

Although gold is widely coveted as a precious metal, it also has various industrial uses, with applications in electronics, dentistry, and space. In fact, it’s estimated that a typical iPhone contains about 0.034 grams of gold, in addition to other precious metals. It is these industrial uses that account for 29,448 tonnes or roughly 15% of all above-ground gold.

Underground Gold Reserves

Before it turns into jewelry and bullion, gold goes through several stages in the supply chain, beginning with mineral exploration and mining of underground reserves. As of 2020, the world had 53,000 tonnes of gold in identified reserves. Here’s where all this gold lies:

Country Gold reserves (tonnes) % of total

Australia 🇦🇺 10,000 19%

Russia 🇷🇺 7,500 14%

U.S. 🇺🇸 3,000 6%

Peru 🇵🇪 2,700 5%

South Africa 🇿🇦 2,700 5%

Rest of the World 🌎 27,100 51%

Total 53,000 100%

Given their availability of reserves, it’s no surprise that Australia, Russia, U.S., and Peru are among the world’s largest gold producers, with only China having produced more in 2020. These reserves not only help determine current production but can also provide an idea of where gold mining could occur in the future.

In 2020, miners produced just over 3,000 tonnes of gold, and at this rate, underground reserves will last less than 18 years without new discoveries. However, it’s important to note that reserves can change and grow as explorers find gold in different parts of the world.

A Golden Future

Gold has been around for thousands of years, and it will likely remain that way in the future.

With rising concerns over the growth in money supply and inflation, gold will continue to deliver value and protect investors in times of volatility while preserving wealth for the long term.

Kalo Gold is discovering gold on the edges of the mineral-rich Pacific Ring of Fire with its Vatu Aurum project in Fiji.

https://www.visualcapitalist.com/chart-how-much-gold-is-in-the-world/

Bix Weir and Greg Mannarino Thursday Night 11-18-2021

.Bix Weir

ALERT! Silver Riggers BofA & Citibank Add 150Moz+ in Silver Derivative Shorts in 2021!!

Nov 18, 2021

he Great Silver Short has moved from JP Morgan to Bank of America & Citibank this year...so watch both of those banks CRUMBLE in the next Market Meltdown!!

The Silver Short is a hot potato that has gutted Drexal Burhnam, AIG, Bear Stearns, almost JPMorgan and now BofA & Citibank are in the grips of the ALL POWERFUL SILVER HOT POTATO!!

Hang on tight!

Bix Weir

ALERT! Silver Riggers BofA & Citibank Add 150Moz+ in Silver Derivative Shorts in 2021!!

Nov 18, 2021

he Great Silver Short has moved from JP Morgan to Bank of America & Citibank this year...so watch both of those banks CRUMBLE in the next Market Meltdown!!

The Silver Short is a hot potato that has gutted Drexal Burhnam, AIG, Bear Stearns, almost JPMorgan and now BofA & Citibank are in the grips of the ALL POWERFUL SILVER HOT POTATO!!

Hang on tight!

(Must Watch). PROOF: The MIDDLE CLASS WIPEOUT Is Accelerating With An Economy In FREEFALL.

Greg Mannarino: Nov 18, 2021

Economists Views on Digital Dollars, Inflation and Silver Derivatives 11-16-2021

.Mike Maloney

What They Aren't Admitting About the Digital Dollar...

Join Mike Maloney and Jeff Clark in today’s video update as they dive deep into the world of Central Bank Digital Currencies (CBDCs).

You’ll also get Mike and Jeff’s opinion on whether the ‘rich’ are paying their ‘fair share’.

Mike Maloney

What They Aren't Admitting About the Digital Dollar...

Join Mike Maloney and Jeff Clark in today’s video update as they dive deep into the world of Central Bank Digital Currencies (CBDCs).

You’ll also get Mike and Jeff’s opinion on whether the ‘rich’ are paying their ‘fair share’.

Inflation is going to kill the American Dream, prices are not done surging - E.B. Tucker

Kitco News: Nov 15, 2021

Inflation is now at the highest level since 1990, but it doesn't stop here said E.B. Tucker, director of Metalla Royalty and author of "Why Gold, Why Now?"

Bix Weir

SILVER ALERT! 750M oz of Silver Derivatives Dumped on Market Last Wednesday!!

On Wednesday Nov. 10th a group of colluding banks dumped 750M oz of Silver Derivatives on the COMEX to STOP the price of silver from moving above it's 200 day moving average.

On September 12, 1979 The U.S. Court of Appeals for the Seventh Circuit gave the Silver Regulator the power to not only IGNORE this illegal market action but to ASSIST and FACILITATE the market rigging trades.

Free Markets have been DEAD in the USA for over 40 Years!!

News, Rumors and Opinions Sunday AM 11-14-2021

.RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 14 Nov. 2021

Compiled Sun. 14 Nov. 2021 12:01 am EST by Judy Byington

Judy Note: What We Think We Know on the Global Currency Reset according to Intel from various credible sources as of Sun. 14 Nov. 2021:

On Mon. 8 Nov. Historic Bond payments started paying out. On Thurs. 11 Nov. 2,000 Bond Holders were paid, including Zimbabwe Sheet Bonds. Those Bond payouts would continue through the end of the month. Some CMKX folks have received spendable money. A Tier 3 Paymaster was told they would begin receiving funds on Sat. 13 Nov. that would be liquid on Tues. 16 Nov.

Tier 4 B Payout (Us, the Internet Group) was predicted to begin appointments on Wed. 24 Nov. 2021 – which on the Julian Calendar was Nov. 11 (11/11).

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 14 Nov. 2021

Compiled Sun. 14 Nov. 2021 12:01 am EST by Judy Byington

Judy Note: What We Think We Know on the Global Currency Reset according to Intel from various credible sources as of Sun. 14 Nov. 2021:

On Mon. 8 Nov. Historic Bond payments started paying out. On Thurs. 11 Nov. 2,000 Bond Holders were paid, including Zimbabwe Sheet Bonds. Those Bond payouts would continue through the end of the month. Some CMKX folks have received spendable money. A Tier 3 Paymaster was told they would begin receiving funds on Sat. 13 Nov. that would be liquid on Tues. 16 Nov.

Tier 4 B Payout (Us, the Internet Group) was predicted to begin appointments on Wed. 24 Nov. 2021 – which on the Julian Calendar was Nov. 11 (11/11). https://www.youtube.com/watch?v=1zRGlClb5fQ

Read full post here: https://dinarchronicles.com/2021/11/14/restored-republic-via-a-gcr-update-as-of-november-14-2021/

Courtesy of Dinar Guru

Frank26 [Firefly boots-on-the-ground Iraqi TV update] FIREFLY: All the previous rates again, they're talking about it...talking about time for Iraq to return to the glory days. This is a special report that they're showing to us again. FRANK ...they are talking to you from the 'old glory day' of your currency to prepare you for the new glory days with the new exchange rate, with the new small category notes although they call them lower notes...when a government or a central bank repeats itself over and over and over again it's for your education. They're trying to reprogram you from what you don't even know about back in 40's to introduce you to what you're about to receive now in the new millennium.

****************

KTFA:

Samson: Dubai will host the World Traders Conference on Financial Markets on November 17

25th October, 2021

The Emirates Association of Financial Markets Traders will host the ACI World Conference and the ICA Conference, November 17-20, at the Hilton Hotel’s La Perle Theater in Al Habtoor Village, with the participation of more than 800 people from around the world.

Including the Prime Minister of Ireland, Amid measures providing for the application of physical distancing and health services, to ensure the safety of all participants in light of “Covid 19” recovery procedures.

The two conferences will be attended by a group of official and legal personalities, international political leaders, central bank governors and CEOs, senior economists and senior bankers from around the world, specialists and workers in global financial markets trading and sales, representing foreign exchange, interest rate products, equities and fixed income, commodities, etc.

The conference will discuss a number of key and key themes presented by John Bruton, the former Irish Prime Minister, who helped transform the Irish economy into the “Celtic Tiger”, one of the fastest growing economies in the world, and David Mead, who works as a lecturer and researcher in international business and strategy at the University of Ulster.

Also participating are speaker Matthew Griffin, described as the “Advisor Behind Advisers”, Young Kurzweil, founder and CEO of the World Futures Forum and the 311 Institute, and Terence Morey, founder of Hack Future Lab, bestselling author and one of the world’s leading most sought-after thinkers, inspiring leaders to thrive in an age of turmoil.

The list of participants in the previous sessions included a selection of legal entities, led by former US President Bill Clinton, former French President Nicolas Sarkozy, Tony Blair, former British Prime Minister David Cameron, former British Prime Minister William Hague, James Baker, and Dr. Alan Greenspan, as well as a host of notable personalities.

The president of the association, Muhammad Al-Hashemi, stressed that the UAE’s hosting of the activities of the 59th Annual International Conference for Financial Market Traders and the 45th Annual Arab Conference is an important step in light of the repercussions that associated with “Covid 19” and its impact on the global economy, especially stock markets that witnessed a decline during the pandemic and prohibition.

Health, noting that the two conferences contain a package of key axes and issues that shed light on the characteristics of economic sectors, the strength and soundness of stock markets in times of crisis, and their ability to provide the economy with radical solutions that contribute to its growth.

He added: The association has become one of the strong arms of the economic sectors, due to its ability to anticipate the future, develop solutions and proactive plans, as well as its position, which has attracted a large number of partners and sponsors for this purpose. conference, including the Central Bank, the Dubai International Financial Center and the Dubai Tourism Department. Emirates Airlines and sponsors include Emirates NBD, Dubai Islamic Bank, YDS Security, Refinitiv, Murex, Finastra, GfI, TPICAP group and Dxm.

In turn, Ohood Al Ali, a member of the association’s board of directors, explained that during the pandemic, the emirate of Dubai has proven its rightful place on the map of the global economy due to the flexibility of its economic law, offering a safe economic environment full of investment opportunities, noting that the Emirates Association of Traders in Financial Markets, is keen to support economic momentum and movement, hosting an elite group of international figures impacting economic realities during this important conference.

Main axes

On its first day, the conference will shed light on the future prospects of the economy, which is in transition, through a package of axes encompassing life after “Covid 19”, and how economic, technological and demographic trends have been threatened, in addition to shaping of the global investment landscape in the coming years through the analysis of economic experts.

The first axis of the conference begins under the title “Global Economic Trends”: what to expect over the next four years and an assessment of the current legislative environment. This axis encompasses a number of issues and questions about the future characteristics of the economy, including starting to think about economic policy, and whether investors expect fundamentally different economic priorities from the United States over the next four years?

The theme also includes questions about the impact of the new government’s priorities on key business decisions and financial market expectations, and where should policymakers focus their energies to achieve the strongest results in the short term? Are investors satisfied with the structurally low interest rates, and how do we move towards a tighter monetary policy path?

The first axis and the development of beneficial solutions will be attended by Khadija Haqqi, Chief Economist and Head of Research at Emirates NBD, Charles-Henri Monschau, Head of Information at Syz Bank in Switzerland, and Dr. Adnan Chilwan, Group CEO of Dubai Islamic Bank, the conference will also witness other topics presented by prominent and influential figures, including John Bruton, former Prime Minister of Ireland, and Matthew Griffin, CEO of World Futures Forum and 311 Institute. LINK

Silver is the one metal 'that is going to play catch up' - Keith Neumeyer

Kitco News: Nov 13, 2021

The strong rally in precious metals was a bit of a surprise for First Majestic Silver (NYSE: AG) CEO Keith Neumeyer. Neumeyer spoke to Kitco on Friday at the Deutsche Goldmesse show in Frankfurt, Germany. Neumeyer commented on gold rallying strongly in November.

"The move surprised me a little bit, because the economy is still doing quite well and interest rates really haven't come down," said Neumeyer.

"The metal that surprised me the most is silver. You've got oil at 80-plus dollars. You've got copper at $4-plus. You've got natural gas north of $5--look at all the grains. Everything's been moving except silver," said Neumeyer. "That's the one that I think is going to play catch-up."

ALERT! EPIC Silver Battle is About to BUST LOOSE!! (Bix Weir)

Road To Roota: Nov 12, 2021

We are closer than we have EVER been to freeing Silver from the clutches of Silver Price Manipulation. Every day we inch forward by spreading INFORMATION about what a GREAT INVESTMENT physical silver is. Every day we are all smarter than the day before!