Bix Weir and Michael Pento Monday PM 11-29-2021

.Bix Weir

SILVER ALERT! Silver Slam is an Early Christmas Present for SILVER STACKERS!!

Nov 29, 2021

The Criminal Market riggers are desperate to get out of their MASSIVE Silver short position so they are once again SLAMMING the price down!!

Consider this an early Xmas present to Silver Stackers!!

Bix Weir

SILVER ALERT! Silver Slam is an Early Christmas Present for SILVER STACKERS!!

Nov 29, 2021

The Criminal Market riggers are desperate to get out of their MASSIVE Silver short position so they are once again SLAMMING the price down!!

Consider this an early Xmas present to Silver Stackers!!

Most Overvalued & Dangerous Market In History | Michael Pento

Liberty and Finance: Nov 29, 2021

“We have the most overvalued and dangerous market there has ever been,” says money manager Michael Pento, “and there’s a whole heck of a lot of things that have to go right to keep it afloat.”

0:00 Intro

2:19 Market update

8:20 Catalysts

10:17 Fed taper

14:00 Rate hike

16:15 Debt collapse

19:43 Monetary control

23:22 Foreign inflation

29:27 Gold position

News, Rumors and Opinions Saturday Morning 11-27-2021

Wolverine Saturday Update

All indications are saying that the RV is very close to get launch.

Lots of movement in Reno for the last two weeks and momentum is moving every day . Yesterday they have all been told to stay put as any day the gates are about to be open

All paymasters and redemption centres are on hold to get this started and they have all been told to stay put.

All paymasters have been paid in full. Bonds are starting to be paid off but there is no liquidity as of yet.

The UST have called most whales and have told them to stay put as any day they are going to have the gates open.

Everything is ready to go and we are just waiting for them to lock in the codes. As soon as the codes are locked in we can all open a bottle of champagne and celebrate and I can sing my opera.

Wolverine Saturday Update

All indications are saying that the RV is very close to get launch.

Lots of movement in Reno for the last two weeks and momentum is moving every day . Yesterday they have all been told to stay put as any day the gates are about to be open

All paymasters and redemption centres are on hold to get this started and they have all been told to stay put.

All paymasters have been paid in full. Bonds are starting to be paid off but there is no liquidity as of yet.

The UST have called most whales and have told them to stay put as any day they are going to have the gates open.

Everything is ready to go and we are just waiting for them to lock in the codes. As soon as the codes are locked in we can all open a bottle of champagne and celebrate and I can sing my opera.

Let’s all keep our vibrations high and not start posting negative comments as later on it spreads like COVID.

God bless everyone

The Wolverine

Holly Saturday Update

Good morning roomies!

Life without liberty is like a body without spirit! Kahlil Gibron

I’m driving home today. So will be out of the rooms. All sources say we are there, this is done. So why have we not seen it at our level? My thoughts:

1. There is still something going on behind the scenes we are not being told.

2. We are waiting for an event to trigger this as it is event driven.

3. We need everyone to maintain the vibration high enough to match the RV vibration. What we can do is, Hold our vibration high and stay at that level.

Do not fall down in doubt, despair and giving up. See it, feel it and be it!

Holly

************

Courtesy of Dinar Guru

Frank26 THE CENTRAL BANK HAS ALL IT'S DUCKS IN A ROW INTERNATIONALLY... ARTICLE 8 THEY'RE FOLLOWING ALL THE RULES, LAWS AND REGULATIONS OF THE IMF!!!

MilitiaMan ...There is far to much information out that supports Iraq is about to go international with a new exchange rate with the real value to go with it...There is proof that the WTO suggests that there is imminence to ascension and there is more on that matter to come out, as early as next week...the positive effects in play now have made the environment today what it is so that the investors and private sector can flourish once the exchange rate with real value is exposed...imo...

************

X22 Spotlight Report Today’s Guest: Bob Kudla

November 24, 2021

Bob is the created and owner of Trade Genius Academy. Bob begins the conversation talking about inflation and fuel prices.

The release of the strategic oil supply will only last 2.5 days and will not fix the problem, it will make it worse. The [DS] will push the people to the edge and the people will push back and when they do it will destroy their system.

It’s going to get worse before it gets better, but there is light and the end of the tunnel.

Catherine Austin Fitts

What can we expect as the “Financial Reset” arrives by Catherine Austin Fitts

Rafi Farber: Is there REALLY a big silver short position?

Arcadia Economics: Nov. 26, 2021

In this week’s End Game Investor Silver Report, Rafi Farber discusses whether there’s really a big silver short on the COMEX, and what even the bankers might not have considered.

He also talked about why coin and junk silver premiums have been rising, the looming December delivery numbers (they’re currently large), and why the LBMA and the banks have a glaring achilles in their interpretation of what happened during the first #silversqueeze.

All in this week’s End Game Investor Silver Report!

Central Banks and Global Reset 101- Lynette Zang 11-24-2021

.Lynette Zang

CENTRAL BANKS & GLOBAL RESET 101: [Pt.1] Banks Buying Gold Before the Currency "Resets"

Nov 24, 2021

In the beginning, there was gold………….

In this video I will highlight my insights over the last few years on Central Banks and what is now moving into the Global Reset.

I'll break down these subjects in the simplest way possible so you can not only understand what's happening, but also exactly what you can do about it.

How many times can you be lied to if you do not know the truth? My passion is in showing you the facts and data so you can protect yourself while you still can.

Lynette Zang

CENTRAL BANKS & GLOBAL RESET 101: [Pt.1] Banks Buying Gold Before the Currency "Resets"

Nov 24, 2021

In the beginning, there was gold………….

In this video I will highlight my insights over the last few years on Central Banks and what is now moving into the Global Reset.

I'll break down these subjects in the simplest way possible so you can not only understand what's happening, but also exactly what you can do about it.

How many times can you be lied to if you do not know the truth? My passion is in showing you the facts and data so you can protect yourself while you still can.

Because when it comes to your money, if you don't hold it, you don't own it.

Tangible assets are key and so is the right strategy for navigating both the pre and post-reset economy. This is what I've been studying for over 50 years and I'm here to show you the truth behind the curtain...

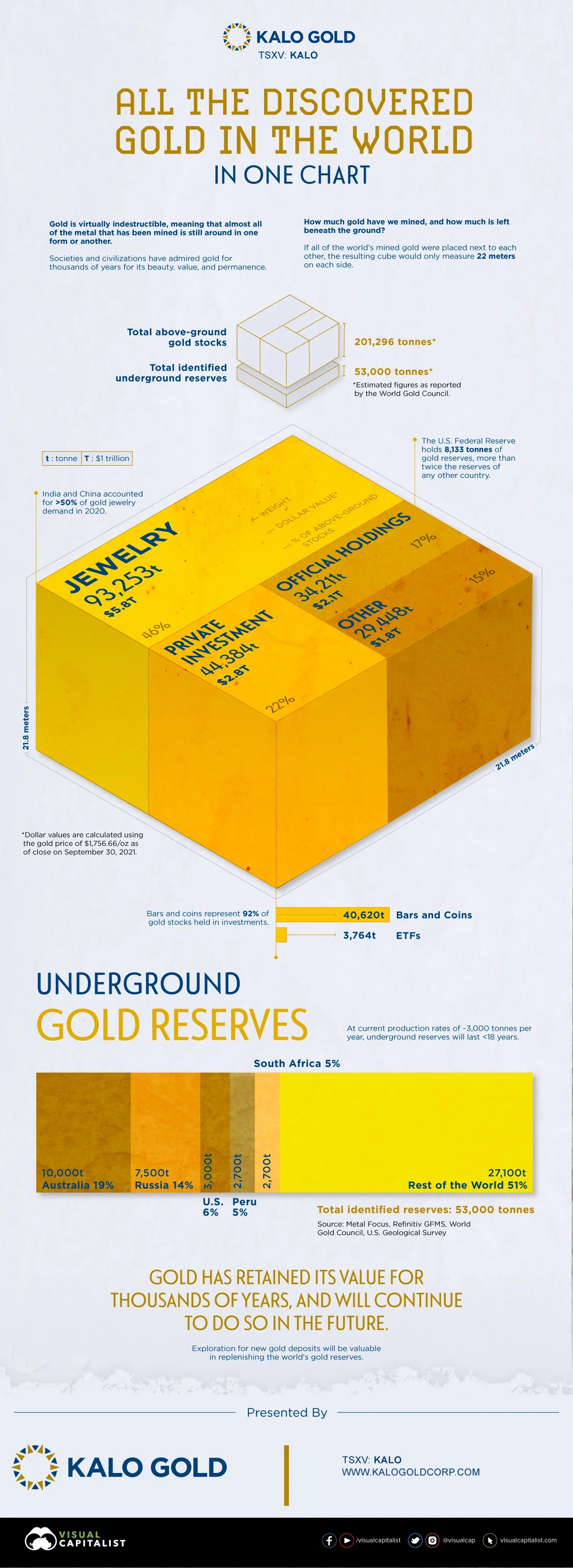

How Much Gold is in the World?

.How Much Gold is in the World?

Gold has retained its value throughout history, partly due to the fact that it is indestructible.

That means that virtually all the gold in the world that has been mined is still around in one form or another. Some of it may have turned into jewelry, while some might be sitting inside vaults as bullion. So, just how much gold have we mined, and how much of it is left beneath the ground?

This infographic from our sponsor Kalo Gold visualizes all the gold in the world that’s above ground and the identified reserves that we have yet to mine.

How Much Gold is in the World?

Published November 16, 2021 By Sponsored Content

Article/Editing: Govind Bhutada Graphics/Design: Pernia Jamshed

The following content is sponsored by Kalo Gold.

How Much Gold is in the World?

Gold has retained its value throughout history, partly due to the fact that it is indestructible.

That means that virtually all the gold in the world that has been mined is still around in one form or another. Some of it may have turned into jewelry, while some might be sitting inside vaults as bullion. So, just how much gold have we mined, and how much of it is left beneath the ground?

This infographic from our sponsor Kalo Gold visualizes all the gold in the world that’s above ground and the identified reserves that we have yet to mine.

Where is All the Gold?

The World Gold Council estimates that miners have historically extracted a total of 201,296 tonnes of gold, leaving another 53,000 tonnes left in identified underground reserves.

If all of the above-ground gold were stacked beside each other, the resulting cube would only measure 22 meters on each side, which is a testament to the metal’s rarity. But where exactly is all of this mined gold?

Nearly half of all the gold ever mined is held in the form of jewelry. India and China have been the largest markets for gold jewelry consumption, combining for more than 50% of global jewelry demand in 2020.

Category Gold stocks held (tonnes) % of above-ground stocks Dollar value* (US$, trillions)

Jewelry 93,253 46% $5.8T

Private investment 44,384 22% $2.8T

Official holdings/Central banks 34,211 17% $2.1T

Other 29,448 15% $1.8T

Total 201,296 100% $12.5T

*Dollar values are based on gold’s price of $1756.66/oz as of close on Sept. 30, 2021.

Investors across the globe buy gold because of its ability to deliver value, and when inflationary pressures are high, gold often acts as a flight to safety. Consequently, investment is one of gold’s biggest end-uses, with over 44,000 tonnes of gold held as bars, coins, or bullion for gold-backed exchange-traded funds (ETFs).

Besides investors, central banks are also among the biggest holders of gold. Unlike foreign currency reserves, equities, and debt-backed securities, gold’s value largely depends on supply and demand. Therefore, central banks often use gold to diversify their assets and hedge against fiat currency depreciation. Central banks’ gold holdings account for almost one-fifth of all above-ground gold; as of 2021, official holdings exceed 35,000 tonnes.

Although gold is widely coveted as a precious metal, it also has various industrial uses, with applications in electronics, dentistry, and space. In fact, it’s estimated that a typical iPhone contains about 0.034 grams of gold, in addition to other precious metals. It is these industrial uses that account for 29,448 tonnes or roughly 15% of all above-ground gold.

Underground Gold Reserves

Before it turns into jewelry and bullion, gold goes through several stages in the supply chain, beginning with mineral exploration and mining of underground reserves. As of 2020, the world had 53,000 tonnes of gold in identified reserves. Here’s where all this gold lies:

Country Gold reserves (tonnes) % of total

Australia 🇦🇺 10,000 19%

Russia 🇷🇺 7,500 14%

U.S. 🇺🇸 3,000 6%

Peru 🇵🇪 2,700 5%

South Africa 🇿🇦 2,700 5%

Rest of the World 🌎 27,100 51%

Total 53,000 100%

Given their availability of reserves, it’s no surprise that Australia, Russia, U.S., and Peru are among the world’s largest gold producers, with only China having produced more in 2020. These reserves not only help determine current production but can also provide an idea of where gold mining could occur in the future.

In 2020, miners produced just over 3,000 tonnes of gold, and at this rate, underground reserves will last less than 18 years without new discoveries. However, it’s important to note that reserves can change and grow as explorers find gold in different parts of the world.

A Golden Future

Gold has been around for thousands of years, and it will likely remain that way in the future.

With rising concerns over the growth in money supply and inflation, gold will continue to deliver value and protect investors in times of volatility while preserving wealth for the long term.

Kalo Gold is discovering gold on the edges of the mineral-rich Pacific Ring of Fire with its Vatu Aurum project in Fiji.

https://www.visualcapitalist.com/chart-how-much-gold-is-in-the-world/

Bix Weir and Greg Mannarino Thursday Night 11-18-2021

.Bix Weir

ALERT! Silver Riggers BofA & Citibank Add 150Moz+ in Silver Derivative Shorts in 2021!!

Nov 18, 2021

he Great Silver Short has moved from JP Morgan to Bank of America & Citibank this year...so watch both of those banks CRUMBLE in the next Market Meltdown!!

The Silver Short is a hot potato that has gutted Drexal Burhnam, AIG, Bear Stearns, almost JPMorgan and now BofA & Citibank are in the grips of the ALL POWERFUL SILVER HOT POTATO!!

Hang on tight!

Bix Weir

ALERT! Silver Riggers BofA & Citibank Add 150Moz+ in Silver Derivative Shorts in 2021!!

Nov 18, 2021

he Great Silver Short has moved from JP Morgan to Bank of America & Citibank this year...so watch both of those banks CRUMBLE in the next Market Meltdown!!

The Silver Short is a hot potato that has gutted Drexal Burhnam, AIG, Bear Stearns, almost JPMorgan and now BofA & Citibank are in the grips of the ALL POWERFUL SILVER HOT POTATO!!

Hang on tight!

(Must Watch). PROOF: The MIDDLE CLASS WIPEOUT Is Accelerating With An Economy In FREEFALL.

Greg Mannarino: Nov 18, 2021

Economists Views on Digital Dollars, Inflation and Silver Derivatives 11-16-2021

.Mike Maloney

What They Aren't Admitting About the Digital Dollar...

Join Mike Maloney and Jeff Clark in today’s video update as they dive deep into the world of Central Bank Digital Currencies (CBDCs).

You’ll also get Mike and Jeff’s opinion on whether the ‘rich’ are paying their ‘fair share’.

Mike Maloney

What They Aren't Admitting About the Digital Dollar...

Join Mike Maloney and Jeff Clark in today’s video update as they dive deep into the world of Central Bank Digital Currencies (CBDCs).

You’ll also get Mike and Jeff’s opinion on whether the ‘rich’ are paying their ‘fair share’.

Inflation is going to kill the American Dream, prices are not done surging - E.B. Tucker

Kitco News: Nov 15, 2021

Inflation is now at the highest level since 1990, but it doesn't stop here said E.B. Tucker, director of Metalla Royalty and author of "Why Gold, Why Now?"

Bix Weir

SILVER ALERT! 750M oz of Silver Derivatives Dumped on Market Last Wednesday!!

On Wednesday Nov. 10th a group of colluding banks dumped 750M oz of Silver Derivatives on the COMEX to STOP the price of silver from moving above it's 200 day moving average.

On September 12, 1979 The U.S. Court of Appeals for the Seventh Circuit gave the Silver Regulator the power to not only IGNORE this illegal market action but to ASSIST and FACILITATE the market rigging trades.

Free Markets have been DEAD in the USA for over 40 Years!!

News, Rumors and Opinions Sunday AM 11-14-2021

.RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 14 Nov. 2021

Compiled Sun. 14 Nov. 2021 12:01 am EST by Judy Byington

Judy Note: What We Think We Know on the Global Currency Reset according to Intel from various credible sources as of Sun. 14 Nov. 2021:

On Mon. 8 Nov. Historic Bond payments started paying out. On Thurs. 11 Nov. 2,000 Bond Holders were paid, including Zimbabwe Sheet Bonds. Those Bond payouts would continue through the end of the month. Some CMKX folks have received spendable money. A Tier 3 Paymaster was told they would begin receiving funds on Sat. 13 Nov. that would be liquid on Tues. 16 Nov.

Tier 4 B Payout (Us, the Internet Group) was predicted to begin appointments on Wed. 24 Nov. 2021 – which on the Julian Calendar was Nov. 11 (11/11).

RV Excerpts from the Restored Republic via a GCR: Update as of Sun. 14 Nov. 2021

Compiled Sun. 14 Nov. 2021 12:01 am EST by Judy Byington

Judy Note: What We Think We Know on the Global Currency Reset according to Intel from various credible sources as of Sun. 14 Nov. 2021:

On Mon. 8 Nov. Historic Bond payments started paying out. On Thurs. 11 Nov. 2,000 Bond Holders were paid, including Zimbabwe Sheet Bonds. Those Bond payouts would continue through the end of the month. Some CMKX folks have received spendable money. A Tier 3 Paymaster was told they would begin receiving funds on Sat. 13 Nov. that would be liquid on Tues. 16 Nov.

Tier 4 B Payout (Us, the Internet Group) was predicted to begin appointments on Wed. 24 Nov. 2021 – which on the Julian Calendar was Nov. 11 (11/11). https://www.youtube.com/watch?v=1zRGlClb5fQ

Read full post here: https://dinarchronicles.com/2021/11/14/restored-republic-via-a-gcr-update-as-of-november-14-2021/

Courtesy of Dinar Guru

Frank26 [Firefly boots-on-the-ground Iraqi TV update] FIREFLY: All the previous rates again, they're talking about it...talking about time for Iraq to return to the glory days. This is a special report that they're showing to us again. FRANK ...they are talking to you from the 'old glory day' of your currency to prepare you for the new glory days with the new exchange rate, with the new small category notes although they call them lower notes...when a government or a central bank repeats itself over and over and over again it's for your education. They're trying to reprogram you from what you don't even know about back in 40's to introduce you to what you're about to receive now in the new millennium.

****************

KTFA:

Samson: Dubai will host the World Traders Conference on Financial Markets on November 17

25th October, 2021

The Emirates Association of Financial Markets Traders will host the ACI World Conference and the ICA Conference, November 17-20, at the Hilton Hotel’s La Perle Theater in Al Habtoor Village, with the participation of more than 800 people from around the world.

Including the Prime Minister of Ireland, Amid measures providing for the application of physical distancing and health services, to ensure the safety of all participants in light of “Covid 19” recovery procedures.

The two conferences will be attended by a group of official and legal personalities, international political leaders, central bank governors and CEOs, senior economists and senior bankers from around the world, specialists and workers in global financial markets trading and sales, representing foreign exchange, interest rate products, equities and fixed income, commodities, etc.

The conference will discuss a number of key and key themes presented by John Bruton, the former Irish Prime Minister, who helped transform the Irish economy into the “Celtic Tiger”, one of the fastest growing economies in the world, and David Mead, who works as a lecturer and researcher in international business and strategy at the University of Ulster.

Also participating are speaker Matthew Griffin, described as the “Advisor Behind Advisers”, Young Kurzweil, founder and CEO of the World Futures Forum and the 311 Institute, and Terence Morey, founder of Hack Future Lab, bestselling author and one of the world’s leading most sought-after thinkers, inspiring leaders to thrive in an age of turmoil.

The list of participants in the previous sessions included a selection of legal entities, led by former US President Bill Clinton, former French President Nicolas Sarkozy, Tony Blair, former British Prime Minister David Cameron, former British Prime Minister William Hague, James Baker, and Dr. Alan Greenspan, as well as a host of notable personalities.

The president of the association, Muhammad Al-Hashemi, stressed that the UAE’s hosting of the activities of the 59th Annual International Conference for Financial Market Traders and the 45th Annual Arab Conference is an important step in light of the repercussions that associated with “Covid 19” and its impact on the global economy, especially stock markets that witnessed a decline during the pandemic and prohibition.

Health, noting that the two conferences contain a package of key axes and issues that shed light on the characteristics of economic sectors, the strength and soundness of stock markets in times of crisis, and their ability to provide the economy with radical solutions that contribute to its growth.

He added: The association has become one of the strong arms of the economic sectors, due to its ability to anticipate the future, develop solutions and proactive plans, as well as its position, which has attracted a large number of partners and sponsors for this purpose. conference, including the Central Bank, the Dubai International Financial Center and the Dubai Tourism Department. Emirates Airlines and sponsors include Emirates NBD, Dubai Islamic Bank, YDS Security, Refinitiv, Murex, Finastra, GfI, TPICAP group and Dxm.

In turn, Ohood Al Ali, a member of the association’s board of directors, explained that during the pandemic, the emirate of Dubai has proven its rightful place on the map of the global economy due to the flexibility of its economic law, offering a safe economic environment full of investment opportunities, noting that the Emirates Association of Traders in Financial Markets, is keen to support economic momentum and movement, hosting an elite group of international figures impacting economic realities during this important conference.

Main axes

On its first day, the conference will shed light on the future prospects of the economy, which is in transition, through a package of axes encompassing life after “Covid 19”, and how economic, technological and demographic trends have been threatened, in addition to shaping of the global investment landscape in the coming years through the analysis of economic experts.

The first axis of the conference begins under the title “Global Economic Trends”: what to expect over the next four years and an assessment of the current legislative environment. This axis encompasses a number of issues and questions about the future characteristics of the economy, including starting to think about economic policy, and whether investors expect fundamentally different economic priorities from the United States over the next four years?

The theme also includes questions about the impact of the new government’s priorities on key business decisions and financial market expectations, and where should policymakers focus their energies to achieve the strongest results in the short term? Are investors satisfied with the structurally low interest rates, and how do we move towards a tighter monetary policy path?

The first axis and the development of beneficial solutions will be attended by Khadija Haqqi, Chief Economist and Head of Research at Emirates NBD, Charles-Henri Monschau, Head of Information at Syz Bank in Switzerland, and Dr. Adnan Chilwan, Group CEO of Dubai Islamic Bank, the conference will also witness other topics presented by prominent and influential figures, including John Bruton, former Prime Minister of Ireland, and Matthew Griffin, CEO of World Futures Forum and 311 Institute. LINK

Silver is the one metal 'that is going to play catch up' - Keith Neumeyer

Kitco News: Nov 13, 2021

The strong rally in precious metals was a bit of a surprise for First Majestic Silver (NYSE: AG) CEO Keith Neumeyer. Neumeyer spoke to Kitco on Friday at the Deutsche Goldmesse show in Frankfurt, Germany. Neumeyer commented on gold rallying strongly in November.

"The move surprised me a little bit, because the economy is still doing quite well and interest rates really haven't come down," said Neumeyer.

"The metal that surprised me the most is silver. You've got oil at 80-plus dollars. You've got copper at $4-plus. You've got natural gas north of $5--look at all the grains. Everything's been moving except silver," said Neumeyer. "That's the one that I think is going to play catch-up."

ALERT! EPIC Silver Battle is About to BUST LOOSE!! (Bix Weir)

Road To Roota: Nov 12, 2021

We are closer than we have EVER been to freeing Silver from the clutches of Silver Price Manipulation. Every day we inch forward by spreading INFORMATION about what a GREAT INVESTMENT physical silver is. Every day we are all smarter than the day before!

The Atlantis Report, Lynette Zang and Greg Mannarino Friday 11-12-2021

.The Atlantis Report

A Massive Stock Market Crash Is Coming: Prepare Your Self For A Catastrophic Bubble Burst!

Nov 11, 2021

Stocks, bonds, and real estate are at all-time highs. Household income is at an all-time high. Government spending is at an all-time high. Consumer demand is so strong the supply chains can't keep up. We're either in the greatest economic boom ever or the Mother Of All Bubbles.

A dangerous situation is brewing here. We have shortages of energy, shortages of labor (in certain sectors), shortages of all sorts of goods, shortages of housing (at least at the low end in what is supposed to be the affordable bracket), snarled supply chains, and political leadership hell-bent on making it worse.

The Atlantis Report

A Massive Stock Market Crash Is Coming: Prepare Your Self For A Catastrophic Bubble Burst!

Nov 11, 2021

Stocks, bonds, and real estate are at all-time highs. Household income is at an all-time high. Government spending is at an all-time high. Consumer demand is so strong the supply chains can't keep up. We're either in the greatest economic boom ever or the Mother Of All Bubbles.

A dangerous situation is brewing here. We have shortages of energy, shortages of labor (in certain sectors), shortages of all sorts of goods, shortages of housing (at least at the low end in what is supposed to be the affordable bracket), snarled supply chains, and political leadership hell-bent on making it worse.

We've had a very high standard of living for the past century or so. I suspect that's being challenged now. It can drop fairly significantly without feeling like a complete crash.

But our lifestyle depends on cheap energy, and lots of it. If we really get significant inflation in food and fertilizer prices (which looks quite possible) and farmers get squeezed on their margins (perhaps squeezed out of business), there could well be widespread starvation.

What has kept this world economy propped far longer than anyone thought it could be is a testament to the incredible level of modern productivity... We have been living off of that productivity for the past forty years and we are using it up...

When the crash comes it will be sudden... and it will be catastrophic...

The Fed and other central banks’ ability to manipulate markets will likely temper any crash. If markets were truly allowed to function then they would never have gotten to the levels they are at now. We have been in a Recession since the last Recession. Hyperinflation is inevitable. The US dollar is no longer a proper measuring stick. As it's being inflated away, stock values will continue to rise.

Moreover, since gold is valued in dollars, and stocks are measured in dollars. Gold is inevitable. Stocks can no longer find the appropriate price because of this endless Fed put.

Corrections in valuation are not allowed, so PEs keep expanding. If the kid down the street had a lemonade stand that earned $1 a year, would you buy the business from him for $45, $80, $100? That is what the market is doing.

Taper is really a tenuous construct. If the stock market goes down 5%, they stop the taper. Down 10%, they restart QE. Everyone knows this. The question is how large does the bubble gets and how much inflation do we have before things get ugly.

Rates are what really matter and everyone knows they can't do much there or they can't pay the interest on the debt. They are painted into a corner.

They thought by creating a little inflation they could slowly manage the debt over time. All they really did was make politicians realize that they don’t have to stop spending money and can increase the debt massively because rates will never be allowed to rise and money will be printed to pay the debt...

BACK TO GOLD STANDARD: John Butler & Lynette Zang

Nov. 1, 2021

(Must Watch). SHOCK AND AWE: The US Dollar Value IS PLUMMETING! Get Out Of The Dollar NOW.

Greg Mannarino: Nov. 12, 2021

Gold is About to Enter iit's Next Leg-Up

.Michael Oliver: Gold is About to Enter it's Next Leg-Up

Palisades Gold Radio: Nov 10, 2021

Tom welcomes Michael Oliver back from Momentum Structural Analysis. Michael believes the movement in gold last week was just the start of another bull run.

Silver is in a similar pattern to gold but needs to reach $28 before it will move higher The thirty-year treasuries are the most illiquid and are behaving like gold.

These bonds are also the least influenced by the Feds' actions. There seems to be some money moving to safer assets. Eventually silver will outperform gold.

Michael Oliver: Gold is About to Enter it's Next Leg-Up

Palisades Gold Radio: Nov 10, 2021

Tom welcomes Michael Oliver back from Momentum Structural Analysis. Michael believes the movement in gold last week was just the start of another bull run.

Silver is in a similar pattern to gold but needs to reach $28 before it will move higher The thirty-year treasuries are the most illiquid and are behaving like gold.

These bonds are also the least influenced by the Feds' actions. There seems to be some money moving to safer assets. Eventually silver will outperform gold.

Michael feels we are in a topping pattern for the markets. He details some specific targets on the downside which if reached would break long-term structures.

The markets can't afford a drop beyond a few percent. These momentum structures are likely to be resolved next year. He questions what central banks will do the next time debt structures begin to break down. They are caught in a historic dilemma.

We are heading toward a 1970s style stagflation but this time there won't be a way out. At the end of the next crisis, we will have to start over.

Hopefully, we end up with a new period of stable currencies with a new gold backing.

This will be a traumatic period but also one of healing. He particularly likes natural gas and suggests that it can go as high as nine dollars this winter.

These high prices will affect everything that industry produces including fertilizer production. Live cattle prices are just now breaking upwards and this is going to impact meat prices.

We're going to see gyrations between inflation and deflation that will surprise most economists.

Time Stamp References:

0:00 - Intro

0:32 - Gold & Silver Upturn?

4:56 - Treasuries & Gold

8:10 - Markets & Topping

15:08 - Will Rates Rise?

17:02 - Bitcoin Vs. Gold

19:06 - 1970s Stagflation

21:42 - Currency Replacements

22:41 - Commodity Issues & Energy

26:37 - Energy & Recession

27:26 - Technicals & Time

31:25 - A Flawed Yardstick

34:44 - Momentum Structures

36:48 - Metal Proxies & GDX

39:08 - Wrap Up

Lior Gantz and Greg Mannarino Saturday 11-6-2021

.Lior Gantz: Silver's Time for a Substantial Rally has Come

Palisades Gold Radio: Nov 6, 2021

Lior discusses the Fed's policies on rates and the effect on gold. Inflation expectations are one reason we haven't seen the bottom yet for gold.

The market believes the Fed is under-estimating the impact of inflation. During 2020 we've seen many supply chain issues affecting commodities but silver has lagged.

Silver being an industrial metal seems overdue for a rally. This rally may need to happen fairly soon before logistics improve.

China is continuing to stockpile commodities. Powell has recently stressed that they have inflation under control. Lior believes these statements are indicative of serious concerns that they don't have inflation under control.

Lior Gantz: Silver's Time for a Substantial Rally has Come

Palisades Gold Radio: Nov 6, 2021

Lior discusses the Fed's policies on rates and the effect on gold. Inflation expectations are one reason we haven't seen the bottom yet for gold.

The market believes the Fed is under-estimating the impact of inflation. During 2020 we've seen many supply chain issues affecting commodities but silver has lagged.

Silver being an industrial metal seems overdue for a rally. This rally may need to happen fairly soon before logistics improve.

China is continuing to stockpile commodities. Powell has recently stressed that they have inflation under control. Lior believes these statements are indicative of serious concerns that they don't have inflation under control.

Various transitory components of inflation are causing deeper structural issues. We see these issues in rents and wages. Individuals are choosing different career options, going back to school, or starting small businesses.

Vaccine mandates are also having a significant impact on the labor force. Wages are also rising due to the lack of employees willing to fill jobs. Lior explains the two different types of inflation today. We see asset inflation in sectors like housing and also real-world inflation in goods and services.

The global housing market is increasingly likely to remain expensive. He cautions that "We're at the lowest point for money velocity since they began measuring it."

The March 2020 crash postponed a blow-off top by several years. While some sectors like crypto may be experiencing euphoria, most investors are being cautious. People are investing in stocks since they appear safer than bonds and can provide reasonable returns.

Time Stamp References:

0:00 - Intro

0:29 - Gold & Higher Rates

8:16 - Silver Drivers

15:17 - Fed & Inflation

25:28 - Dual Inflation Concept

29:32 - Blow-Off Top?

33:50 - Comparing Crashes

39:18 - 2nd Term For Powell?

42:44 - Wrap Up

Talking Points From This Episode

- Fed's policies and the effect on the gold market.

- Silver's chance to rally but needs to do so soon.

- Powell and why inflation isn't under control.

- Investor sentiment and risk in this environment.

EPIC! This Market Is About To Do Something EXTRAORDINARY. Make Sure YOU Are On The Right Side Of It.

Greg Mannarino: Nov 5, 2021

The Gold Sector Can Turn Quickly 11-3-2021

.Killian Connolly: The Gold Sector can Turn Quickly

Palisades Gold Radio: Nov 3, 2021

Tom welcomes a new guest Killian Connolly from Price Value Partners to the show. Killian explains his views on growth versus value investing.

Most investors aren't paying much attention to value investments and are all focused on growth stocks. There is still compelling value out there and eventually, the value stocks will outperform. This is likely to occur once people realize that margin issues and inflation are not transitory.

He makes some comparisons of today's monetary problems with those of the past in Europe. The government of France chose to demonetize silver which resulted in periods of high inflation. Eventually, they reverted to the standard.

This seems like the inevitable outcome of today's monetary system. Killian describes the risks and cycles of inflation that are coming and why this may result in a new monetary system.

Killian Connolly: The Gold Sector can Turn Quickly

Palisades Gold Radio: Nov 3, 2021

Tom welcomes a new guest Killian Connolly from Price Value Partners to the show. Killian explains his views on growth versus value investing.

Most investors aren't paying much attention to value investments and are all focused on growth stocks. There is still compelling value out there and eventually, the value stocks will outperform. This is likely to occur once people realize that margin issues and inflation are not transitory.

He makes some comparisons of today's monetary problems with those of the past in Europe. The government of France chose to demonetize silver which resulted in periods of high inflation. Eventually, they reverted to the standard.

This seems like the inevitable outcome of today's monetary system. Killian describes the risks and cycles of inflation that are coming and why this may result in a new monetary system.

It's hard to know when such a new system will be built. What you can do however is stay away from economic assets that won't be revalued in the new system.

Investing is born out of mistakes and he explains their method of diversifying. They look for a well-operated business with little debt and work to fully understand these companies. In the short term the market is often a voting machine but in the medium to long value companies will show a profit on the chart. They prefer to invest in companies with a lot of cash flow.

If you're not in a rush and not focused on share prices you can make good returns. This requires patience and more patience. Killian explains how easy value investing can be and why it is overlooked by most investors.

He discusses some of the metrics they utilize from the public accounting data that companies release. Jurisdiction is key when it comes to investing in the mining sector. Currently, there is a lot of value in this sector.

He isn't overly concerned about the energy markets affecting the miners. He notes it's important to not chase the prevailing narrative for too long as often media attention signals a coming shift.

Time Stamp References:

0:00 - Introduction

0:31 - Growth Vs. Value

4:41 - Value Investing

8:44 - Macro History & Inflation

13:55 - Cycles of Inflation

19:20 - Confidence & Questioning

24:30 - Four Categories

28:24 - Seabord Value Example

35:07 - Simpler Investing

39:58 - Mining Sector & Value

44:00 - Energy Risks & Miners?

48:55 - Commodity Prices & Cycle

55:24 - Wrap Up

Talking Points From This Episode

- Value Investing compared with Growth Stocks

- Historical monetary parallels with today.

- Inflation and deflation cycles and a new monetary system.

- The Commodity Supercycle - Miners and Energy.