Can Reddit Day Traders Crash JP Morgan Short Squeezing Silver?

.The Atlantis Report:

Can Reddit Day Traders Crash JP Morgan Short Squeezing Silver ?!

Jan 29, 2021

A decentralized Reddit forum called WallStreetBets is causing chaos on Wall Street. The WallStreetBets a longstanding subreddit channel where over 4 million users discuss highly speculative trading ideas and strategies, briefly went private on Wednesday in response to millions of new users pouring in.

The Reddit subgroup is operating now by invitation only. WallStreetBets crushes hedge funds and crashes trading apps by creating major short squeezes.

A short squeeze happens when a price increase for an asset prompts a rush in buying activity by those who previously bet that prices would fall.

The Atlantis Report:

Can Reddit Day Traders Crash JP Morgan Short Squeezing Silver ?!

Jan 29, 2021

A decentralized Reddit forum called WallStreetBets is causing chaos on Wall Street. The WallStreetBets a longstanding subreddit channel where over 4 million users discuss highly speculative trading ideas and strategies, briefly went private on Wednesday in response to millions of new users pouring in.

The Reddit subgroup is operating now by invitation only. WallStreetBets crushes hedge funds and crashes trading apps by creating major short squeezes.

A short squeeze happens when a price increase for an asset prompts a rush in buying activity by those who previously bet that prices would fall.

A short squeeze might sound complicated, but it’s actually a relatively straightforward process. When institutional investors short-sell a stock, what they actually do is borrow a number of shares they believe will drop in value, sell them at the highest price possible and try to buy them back later at a lower price.

If they’re successful, they hand the initial borrowed amount back and pocket the difference. If the market turns against them however, and the price of the shares increase, they are forced to buy the shares back at a loss.

If the price rises dramatically within a short space of time, it can cause devastating losses for the short-seller.

Major hedge funds have already lost around 7 billion dollars to WallStreetBets day traders short squeezes. WallStreetBets traders are not stopping here; they are now turning to silver for their next short-squeeze target after being restricted from hot stocks like GameStop and AMC.

Silver has become a new target for Reddit day traders after multiple posts on the infamous WallStreetBets subreddit .

For the full transcript go to https://financearmageddon.blogspot.com

Max Keiser and Bix Weir Friday 1-29-2021 "Inflation, Silver and Hedge Funds"

.Keiser Report | Inflation Rhymes with the 1970s | E1651

Jan 28, 2021

In this episode of Keiser Report, Max and Stacy look at the rising inflation as more and more money gets sent into the hands of the people.

In the second half, Max interviews investment manager Lawrence Lepard about price discovery and national debt.

Keiser Report | Inflation Rhymes with the 1970s | E1651

Jan 28, 2021

In this episode of Keiser Report, Max and Stacy look at the rising inflation as more and more money gets sent into the hands of the people.

In the second half, Max interviews investment manager Lawrence Lepard about price discovery and national debt.

Reddit traders exposed illegal practices of hedge funds – Max Keiser on Robinhood saga

Jan 29, 2021

The GameStop-Robinhood saga went truly ‘viral’, even resulting in a demonstration outside NYSE earlier today. Max Keiser tells RT that the small investors’ efforts should be praised for exposing big Wall Street traders’ questionable practices.

Bix Weir

Hey Robin Hood! "Free Markets...are the Road to Freedom!" (Bix Weir)

This song should be the Anthem for all those retail investors that were screwed over by Robin Hood and the Banking Cabal!

SILVER RED ALERT! Silver Shorts PANIC DUMP 1.5B oz to STOP REDDIT MOB!! (Bix Weir)

Jan 29, 2021

WOW! COMEX silver volumes were OFF THE CHARTS yesterday posting a 1.5B ounce Silver Dump to keep the price in check! That's HUGE!! Maybe they are afraid of the Little Guy after all!!

Judy, Mike Maloney, Bix Weir and more Friday AM 1-29-2021

.RV Excerpts from Restored Republic via a GCR: Update as of Fri. 29 Jan. 2021

Compiled Fri. 29 Jan. 2021 12:01 am EST by Judy Byington

Judy Note: Today Thurs. 28 Jan. Fleming’s Military Intel Contact said that the Tier 4B start and notification could come any time between Fri. 29 Jan. to Tues. 2 Feb. Final payouts with huge payout packages started Thurs. 28 Jan. in Zurich and elsewhere. Bruce indicated that Sun. 31 Jan. was Freedom Day and could be the beginning of NESARA, plus that Tier 4B notification was a possibility for Mon.-Tues. Feb. 1, 2.

The US Military had control of all assets, taxpayer dollars, were conducting a return to a gold/asset-backed dollar and tasked to insure the Republic would be restored to elements of the original Constitution as written prior to 1871.

RV Excerpts from Restored Republic via a GCR: Update as of Fri. 29 Jan. 2021

Compiled Fri. 29 Jan. 2021 12:01 am EST by Judy Byington

Judy Note: Today Thurs. 28 Jan. Fleming’s Military Intel Contact said that the Tier 4B start and notification could come any time between Fri. 29 Jan. to Tues. 2 Feb. Final payouts with huge payout packages started Thurs. 28 Jan. in Zurich and elsewhere. Bruce indicated that Sun. 31 Jan. was Freedom Day and could be the beginning of NESARA, plus that Tier 4B notification was a possibility for Mon.-Tues. Feb. 1, 2.

The US Military had control of all assets, taxpayer dollars, were conducting a return to a gold/asset-backed dollar and tasked to insure the Republic would be restored to elements of the original Constitution as written prior to 1871.

Thurs. 28 Jan. 2021 The Big Call, Bruce: Thebigcall.net 712-770-4016 pin123456#

In Iraq they would likely have their new Dinar rate on Sun. 31 Jan.

In Miami, Reno, Zurich Switzerland, Hong Kong Bond Paymasters were down-streaming monies to their groups, though those accounts were not yet liquid.

At 4pm today Thurs. 28 Jan. 28% of the bonds had been completed. All should be complete by Sat. evening 30 Jan.

Redemption Center Staff went in today and were going in on Fri. 29 Jan. at noon. They were on a 35 min. response time to be at their desks.

Sun. 31 Jan. was Freedom Day and could be the beginning of NESARA.

Tier 4B notification was a possibility for Mon.-Tues. Feb. 1, 2.

Read full post here: https://inteldinarchronicles.blogspot.com/2021/01/restored-republic-via-gcr-update-as-of_29.html

************

Late Thursday Night Fleming RV Update

Our military intel contact said his info agrees with the above timing of Mr Fleming’s sources—T4B start & notifications any time tomorrow Fri 29th, Sat 30th, Mon 1st, or Tue 2nd—

He agrees with the source saying final payouts with huge payout packages have started today Thu 28 Jan in Zurich & elsewhere and we just have to wait till the shotgun start payout sequence reaches us in T4B.

He said he would get more info out when he has time.

***********

Courtesy of Dinar Guru

MilitiaMan Article: "Al-Halbousi and the Emir of Kuwait discuss activating the joint governmental and parliamentary committees between the two countries" This is about tens of billions of dollars for re construction. Clearing and Settling payments goes hand and hand with this. If we cannot see what is at play by now, one may never get it.. Wow! This is good... imo!

Mike Maloney

First GAMESTOP, Next...SILVER? Will This Be the Biggest Short Squeeze In History?

Premiered 11 hours ago

Something in the financial Universe just broke…

In tonight’s must-watch update, Jeff Clark relays many of your questions from today including: “Mike, what's your reaction to the Reddit community taking on silver and driving the price higher?”, “Do you see this rise in price as sustainable?”, and “What are the advantages and disadvantages of what's happened?

Get some popcorn ready, this video clocks in at 24 minutes long...enjoy.

GameStop, Reddit & Silver! ( Bix Weir Live)

Streamed live 14 hours ago

LET'S TALK ABOUT THE EXPOSURE OF A RIGGED SYSTEM!!

Bix Weir and Mike Maloney "Silver, Market Corrections and Shorts" 1-28-2021

.Bix Weir

ALERT! Will SILVER be the Next Game Stop Short Squeeze?!

Jan 27, 2021

The curtain is being pulled away on the Market Riggers. Naked shorting has NEVER gone away even though the SEC has outlawed it.

The Game Stop situation is just one of many rigged situations that is being exploited. SILVER is the ultimate rigged market but is THE Bank Killer which would wreak untold havoc on the Global Financial System...which may be a Good Thing!

Bix Weir

ALERT! Will SILVER be the Next Game Stop Short Squeeze?!

Jan 27, 2021

The curtain is being pulled away on the Market Riggers. Naked shorting has NEVER gone away even though the SEC has outlawed it.

The Game Stop situation is just one of many rigged situations that is being exploited. SILVER is the ultimate rigged market but is THE Bank Killer which would wreak untold havoc on the Global Financial System...which may be a Good Thing!

SILVER ALERT! Is This the Long Awaited "SILVER SQUEEZE?!" (Bix Weir)

Jan 28, 2021

I've been fighting the Silver Battle for over 20 years and we have NEVER had this kind of EXPOSURE to the SILVER MANIPULATION fraud as we have seen over the past 48 hours.

This is NOT about price...this is about EXPOSURE of the 4 Massive Silver Shorts! Hang on tight as the markets turn CRAZY!

Mike Maloney: "I See a Tremendous Market Correction In 2021"

Jan 26, 2021

I do think that this year, there’s going to be some tremendous market correction, I think that people are going to start coming to the conclusion that they have to run to safety.

A lot of people think that the markets are so manipulated by central banks that they can’t crash any more - they’ll only go up. Well, why did they do such an enormous pullback in March?”

Silver Report Uncut 1-28-2021

.Silver Report Uncut

Hyperinflation Rumbling Service Prices To Surge Following Huge Rise In Prices Paid By Producers

Jan 28, 2021

More signs of hyperinflation following the rise in industrial metals prices we have seen for months.

The grain price is soaring, nations are scrambling to find enough food, precious metals are lagging so far so it's likely silver and gold will benefit from rising prices. Another thing that signals a surge in service prices will be coming in is the prices producers have been paying have soared in recent months thus the huge increase in expenses will translate to the consumer which will push more people into poverty

The increase in the minimum wage to 15 dollars could also contribute. It is beginning to look like we are entering a whole new paradigm regarding money supply and money in general

Silver Report Uncut

Hyperinflation Rumbling ,Service Prices To Surge, Following Huge Rise In Prices Paid By Producers

Jan 28, 2021

More signs of hyperinflation following the rise in industrial metals prices we have seen for months.

The grain price is soaring, nations are scrambling to find enough food, precious metals are lagging so far so it's likely silver and gold will benefit from rising prices. Another thing that signals a surge in service prices will be coming in is the prices producers have been paying have soared in recent months thus the huge increase in expenses will translate to the consumer which will push more people into poverty

The increase in the minimum wage to 15 dollars could also contribute. It is beginning to look like we are entering a whole new paradigm regarding money supply and money in general

Bix Weir, Jim Willie and Silver Report Uncut Wednesday Afternoon 1-27-2021

Bix Weir

ALERT! Silver is Ready! Watch for Full "Wolf Moon!" (Bix Weir)

Everything is coming together at the exact right moment. Tomorrow's Full Moon "Wolf Moon" will usher in a New World for silver investors but you will have to hold tight.

The "Spiritual Silver Knights" will destroy the criminal market riggers and we WILL see FREE MARKETS in our Future. Buckle up!

Bix Weir

ALERT! Silver is Ready! Watch for Full "Wolf Moon!" (Bix Weir)

Everything is coming together at the exact right moment. Tomorrow's Full Moon "Wolf Moon" will usher in a New World for silver investors but you will have to hold tight.

The "Spiritual Silver Knights" will destroy the criminal market riggers and we WILL see FREE MARKETS in our Future. Buckle up!

Robert David Steele - Jim Willie aka "Golden Jackass" on US Corporation, Anna Von Reitz On Target

Jan 27, 2021

History of the US Corporation and more

Silver Report Uncut

Major Internet Blackout On The East Coast Affecting Several Major Cities And Services

Jan 27, 2021

There was a major internet blackout along the east coast in many of the large northern cities thought to be caused by a cut fiber optics cable in Brooklyn.

All of this is interesting because the theme of an internet blackout has been discussed a lot recently.

Idaho Aims to protect State Funds With Gold and Silver

Idaho Aims to Protect State Funds with Gold and Silver As US Dollar Implodes

Jan 24, 2021

The recent explosion of money printing and debt-funded spending by the U.S. in response to the Covid-19 pandemic has sparked a renewed interest in the key role gold and silver play in hedging against systemic risks.

Idaho Aims to Protect State Funds with Gold and Silver As US Dollar Implodes

Jan 24, 2021

The recent explosion of money printing and debt-funded spending by the U.S. in response to the Covid-19 pandemic has sparked a renewed interest in the key role gold and silver play in hedging against systemic risks.

Silver’s Role in the New Energy Era Part 3 of 3

.Silver’s Role in the New Energy Era Part 3 of 3

More Than Precious: Silver’s Role in the New Energy Era

January 15, 2021 By Nicholas LePan

Silver is one of the first metals that humans discovered and used. Its extensive use throughout history has linked its name to its monetary value. However, as we have advanced technologically, so have our uses for silver. In the future, silver will see a surge in demand from solar and electric vehicle (EV) technologies.

Part 1 and Part 2 of the Silver Series showcased its monetary legacy as a safe haven asset as a precious metal and why now is its time to shine.

Part 3 of the Silver Series comes to us from Endeavour Silver, and it outlines silver’s role in the new energy era and how it is more than just a precious metal.

Silver’s Role in the New Energy Era Part 3 of 3

More Than Precious: Silver’s Role in the New Energy Era

January 15, 2021 By Nicholas LePan

Silver is one of the first metals that humans discovered and used. Its extensive use throughout history has linked its name to its monetary value. However, as we have advanced technologically, so have our uses for silver. In the future, silver will see a surge in demand from solar and electric vehicle (EV) technologies.

Part 1 and Part 2 of the Silver Series showcased its monetary legacy as a safe haven asset as a precious metal and why now is its time to shine.

Part 3 of the Silver Series comes to us from Endeavour Silver, and it outlines silver’s role in the new energy era and how it is more than just a precious metal.

A Sterling Reputation: Silver’s History in Technologies

Silver along with gold, copper, lead and iron, was one of the first metals known to humankind. Archaeologists have uncovered silver coins and objects dating from before 4,000 BC in Greece and Turkey. Since then, governments and jewelers embraced its properties to mint currency and craft jewelry.

This historical association between silver and money is recorded across multiple languages. The word silver itself comes from the Anglo-Saxon language, seolfor, which itself comes from ancient Germanic silabar.

Silver’s chemical symbol, “Ag”, is an abbreviation of the Latin word for silver, argentum. The Latin word originates from argunas, a Sanskrit word which means shining. The French use argent as the word for money and silver. Romans bankers and silver traders carried the name argentarius.

While silver’s monetary meanings still stand today, there have been hints of its use beyond money throughout history. For centuries, many cultures used silver containers and wares to store wine, water, and food to prevent spoilage.

During bouts of bubonic plague in Europe, children of wealthy families sucked on silver spoons to preserve their health, which gave birth to the phrase “born with a silver spoon in your mouth.”

Medieval doctors invented silver nitrate used to treat ulcers and burns, a practice that continues to this day. In the 1900s, silver found further application in healthcare. Doctors used to administer eye drops containing silver to newborns in the United States. During World War I, combat medics, doctors, and nurses would apply silver sutures to cover deep wounds.

Silver’s shimmer also made an important material in photography up until the 1970s. Silver’s reflectivity of light made it popular in mirror and building windows.

Now, a new era is rediscovering silver’s properties for the next generation of technology, making the metal more than precious.

Silver in the New Energy Era: Solar and EVs

Silver’s shimmering qualities foreshadowed its use in renewable technologies. Among all metals, silver has the highest electrical conductivity, making it an ideal metal for use in solar cells and the electronic components of electric vehicles.

Silver in Solar Photovoltaics

Conductive layers of silver paste within the cells of a solar photovoltaic (PV) cell help to conduct the electricity within the cell. When light strikes a PV, the conductors absorb the energy and electrons are set free.

Silver’s conductivity carries and stores the free electrons efficiently, maximizing the energy output of a solar cell. According to one study from the University of Kent, a typical solar panel can contain as much as 20 grams of silver.

As the world adopts solar photovoltaics, silver could see dramatic demand coming from this form of renewable energy.

Silver in Electric Vehicles

Silver’s conductivity and corrosion resistance makes its use in electronics critical, and electric vehicles are no exception. Virtually every electrical connection in a vehicle uses silver.

Silver is a critical material in the automotive sector, which uses over 55 million ounces of the metal annually. Auto manufacturers apply silver to the electrical contacts in powered seats and windows and other automotive electronics to improve conductivity.

A Silver Intensive Future

A green future will require metals and will redefine the role for many of them. Silver is no exception. Long known as a precious metal, silver also has industrial applications metal for an eco-friendly future.

https://www.visualcapitalist.com/silver-series-new-energy-in-solar-and-ev/

Perfect Storm for Silver Part 2 of 3

.Silver Series: Perfect Storm for Silver Part 2 of 3

February 26, 2020By Nicholas LePan

The Silver Series: A Perfect Storm for Silver (Part 2 of 3)

In Part 1 of the Silver Series we showed how precious metals can be a safe haven during times of volatility in a debt-laden era.

Today’s infographic is Part Two of the Silver Series, and it comes to us from Endeavour Silver, outlining some of the key supply and demand indicators that precede a coming gold-silver cycle in which the price of silver could move upwards.

Silver Fundamentals

Silver is produced primarily as a by-product in the mining of non-precious metals, and there is currently a dwindling supply of silver as a result of low base metal prices.

Silver Series: Perfect Storm for Silver Part 2 of 3

February 26, 2020By Nicholas LePan

The Silver Series: A Perfect Storm for Silver (Part 2 of 3)

In Part 1 of the Silver Series we showed how precious metals can be a safe haven during times of volatility in a debt-laden era.

Today’s infographic is Part Two of the Silver Series, and it comes to us from Endeavour Silver, outlining some of the key supply and demand indicators that precede a coming gold-silver cycle in which the price of silver could move upwards.

Silver Fundamentals

Silver is produced primarily as a by-product in the mining of non-precious metals, and there is currently a dwindling supply of silver as a result of low base metal prices.

However, silver is more than just a precious metal and a safe haven investment. Its industrial uses also create a significant demand on silver stocks.

As the production of green technologies such as solar cells and EVs quickly escalates, upward pressure is being placed on the price of silver, indicating the potential start of a new gold-silver cycle in the market.

Investment Demand

Just like gold, silver has functioned as a form of money for centuries, and its role as a store of value and hedge against monetary inflation endures.

Currency debasement is not new. Governments throughout history have “printed” money while silver’s value has held more constant over time.

In today’s age, the average investor does not own physical silver. Rather, they invest in financial instruments that track the performance of the physical commodity itself, such as silver exchange-traded funds (ETFs).

Until recently, ETF investment in precious metals has been relatively flat, but there has been a surge in the price of silver. Meanwhile, demand for silver-backed financial products have increased the demand for physical silver and could continue to do so.

Industrial Demand

Silver is also helping to power the green revolution.

The precious metal is the best natural conductor of electricity and heat, and it plays an important role in the production of solar-powered energy. A silver paste is used in photovoltaic solar cells which collects electrons and creates electricity. Silver then helps conduct the electricity out of the cell. Without silver, solar cells would not be as efficient.

As investments and the green revolution demand more and more silver, where is the metal coming from?

A Perfect Storm for Silver: Supply Crunch

The bulk of silver production comes as a by-product of other metal mines, such as zinc, copper, or gold mines.

Since silver is not the primary metal emerging from some of these mines, it faces supply crunches when other metal prices are low.

Silver supply is falling for three reasons:

Declining mine production due to low base metal prices

Declining silver mine capacity

Declining reserves of silver

The demand for silver is rising and the few companies that produce silver could shine.

https://www.visualcapitalist.com/the-silver-series-setting-part-2-of-3/

News, Rumors and Opinions Saturday PM 1-23-2021

.KTFA:

Don961: Parliament raises its meeting to Tuesday

Posted 2 hours ago News source / Baghdad today

On Saturday, January 23, 2021, the House of Representatives adjourned its session for today to next Tuesday.

The media department of the council said in a brief statement received (Baghdad today), that "Parliament raised its session for this day to next Tuesday."

The parliament session witnessed a discussion of a proposed law to restore defense and interior personnel to service.

KTFA:

Don961: Parliament raises its meeting to Tuesday

Posted 2 hours ago News source / Baghdad today

On Saturday, January 23, 2021, the House of Representatives adjourned its session for today to next Tuesday.

The media department of the council said in a brief statement received (Baghdad today), that "Parliament raised its session for this day to next Tuesday."

The parliament session witnessed a discussion of a proposed law to restore defense and interior personnel to service. LINK

Don961: Mazhar Saleh explains through the obelisk the opportunities available for printing the Iraqi currency and its consequences for the standard of living

1/22/2021 6:04:42 PM

Baghdad / Al-Masalla: The Financial Adviser to the Prime Minister, Mazhar Muhammad Salih, responded to the black-eyed expectations regarding the disastrous results of the option to print the Iraqi currency - according to the description of analysts and economists - by saying that such a scenario presents a very pessimistic economic prospect, and reminds the people of a stage Dangerous stages of the Iraqi economy during the international siege on Iraq during the dark period 1990-2003.

Saleh told Al-Masalla that public finances relied at the time on the cheap monetary policy and inflation financing at a rate of 95% of its revenues to finance expenditures at that time, that is, by using the mechanism of the monetary authority’s submission to the financial authority and its dominance in accepting government treasury transfers that the public finances consistently issue by the Central Bank. As he considers this government debt instrument as a financial asset matched by liabilities or liabilities, which is the currency issued to finance the absolute budget deficit (and convince the public that it is foreign money or (temporary) monetary wealth, but it is highly eroded in its purchasing power due to what it generates from inflation expectations that the citizen seeks every hour. ) ..

He added: That financial policy dominating the monetary issuance in the levers of its financing at that time led to the creation of a huge monetary mass that generated surplus demand or spending within the overall economy that was not matched by sufficient commodity supply, which reflects the case over the course of twelve years to create continuous inflationary expectations. Caused by the continued strength of demand, it is said.

And he went on: This financial policy, which was founded on the principle of government financing with an inflationary tool based on the super cash issuance, led to sharp and continuous rises in the general level of prices, and the inflation increased in it to become unruly and three decimal places, and the commodity that was equal to 20 dinars in 1990 became equal to 2000 dinars or more. During the 1990s, cash incomes declined and the standard of living declined.

Dr. Mazhar Muhammad Saleh believes that the aforementioned warning is nothing but a very dark scenario to remind the people of a dark period of time that the people lived and their livelihoods were uprooted during the siege of the 1990s and the few years after.

Dr. Saleh expects that the state of Iraq will not reach that, but in spite of that remains the policy of relying on monetary policy to finance the deficit by issuing cash (or monetizing debt) easy government financial leverage and is known (in the event of its continuation) in the knowledge of public finance as one of the constraints of the fragile budget ( The dangerous) because it neglects the inflation indicators and its potential projections as a result of financing the budget deficit by issuing cash without realizing the risks of its repercussions on the level of individuals ’cash income and its deterioration.

The economic advisor to the Prime Minister spoke to the obelisk earlier, about what the Iraqi public finances faced in the years 2020-2021, as the draft federal budget for the year 2021 indicates that the total deficit planned in it will rise to nearly 71 trillion dinars, and the aforementioned deficit will be no less than About 42% of total spending there, and a percentage of not less than 28% of the current GDP.

Saleh told Al-Masalla that the contractionary financial conditions in Iraq have led to dangerous economic manifestations, as the contraction of demand or government spending in the year 2020 has led to a widening of the national income gap, and a drop in growth by about 11% from its rates.

He added that the contraction was accompanied by an increase in unemployment levels that were not less than 25% of the Iraqi workforce, as well as an increase in poverty rates among the population that exceeded 30% of the country's families. LINK

************

Courtesy of Dinar Guru

Bruce [via WiserNow] my understanding today is that Iraq is going to be the strongest currency and the strongest financial nation in the middle east and not too long from now...

Jeff ...they actually launched the reforms on December 20th when they devalued the currency...that was a preparation step for the rate change. That's them confirming to you they're preparing to change the rate...it was a tool being used to reduce the 3 zero note count in country...We are in a great spot. We're in the best position ever...I've been telling you that January through March was the season for the rate change. Iraq confirmed that when they implemented the reforms...

HOLD ON! JPM Creates Bitcoin FUD as Silver Prepares to Destroy Global Monetary System! (Bix Weir)

Jan 22, 2021

So much going on behind the scenes right now

Dr Paul Craig Roberts Teaser & Explainer

Greg Hunter: Jan 23, 2021

Dr. Paul Craig Roberts will talk about what is going on in America today and give his assement of the economy in 2021.

Go to USAWatchdog.com to see the Interview: https://usawatchdog.com/

The Start of A New Gold-Silver Cycle Part 1 of 3

.The Start of A New Gold-Silver Cycle Part 1 of 3

The Silver Series: The Start of A New Gold-Silver Cycle Part 1 of 3

September 11, 2019 By Nicholas LePan

The world has experienced a decade of growth fueled by record-low interest rates, a burgeoning money supply, and historic debt levels – but the good times only last so long. As the global economy slows and eventually begins to retract, can precious metals offer a useful store of value to investors?

Part 1: The Start of a New Cycle

Today’s infographic comes to us from Endeavour Silver, and it outlines some key indicators that precede a coming gold-silver cycle in which exposure to hard assets may help to protect wealth.

The Start of A New Gold-Silver Cycle Part 1 of 3

The Silver Series: The Start of A New Gold-Silver Cycle Part 1 of 3

September 11, 2019 By Nicholas LePan

The world has experienced a decade of growth fueled by record-low interest rates, a burgeoning money supply, and historic debt levels – but the good times only last so long. As the global economy slows and eventually begins to retract, can precious metals offer a useful store of value to investors?

Part 1: The Start of a New Cycle

Today’s infographic comes to us from Endeavour Silver, and it outlines some key indicators that precede a coming gold-silver cycle in which exposure to hard assets may help to protect wealth.

Bankers Blowing Bubbles

Since 2008, central bankers around the world launched a historic market intervention by printing money and bailing out major banks. With cheap and abundant money, this strategy worked so well that it created a bull market in every sector — except for precious metals.

Stock markets, consumer lending, and property values surged. Meanwhile, the U.S. Federal Reserve’s assets ballooned, and so did corporate, government, and household debt. By 2018, total debt reached almost $250 trillion worldwide.

Currency vs. Precious Metals

The world awash in unprecedented amounts of currency, and these dollars chase a limited supply of goods. Historically speaking, it’s only a matter of time before the price of goods increases or inflates – eroding the purchasing power of every dollar.

Gold and silver are some of the only assets unaffected by inflation, retaining their value.

Gold and silver are money… everything else is credit. – J.P. Morgan

The Perfect Story for a Gold-Silver Cycle?

Investors can use several indicators to gauge the beginning of the gold-silver cycle:

Gold/Silver Futures

Most traders do not trade physical gold and silver, but paper contracts with the promise to buy at a future price. Every week, U.S. commodity exchanges publish the Commitment of Traders “COT” report. This report summarizes the positions (long/short) of traders for a particular commodity.

Typically, speculators are long and commercial traders are short the price of gold and silver. However, when speculators and commercial traders positions reach near zero, there is usually a big upswing in the price of silver.

Gold-to-Silver Ratio Compression

As the difference between gold and silver prices decreases (i.e. the compression of the ratio), history suggests silver prices can make big moves upwards in price. The gold-to-silver ratio compression is now at high levels and may eventually revert to its long-term average, which implies a strong movement in prices is imminent for silver.

Scarcity: Declining Silver Production

Silver production has been declining despite its growing importance as a safe haven hedge, as well as its use in industrial applications and renewable technologies.

The Silver Exception

Silver is not just for coins, bars, jewelry and the family silverware. It stands out from gold with its practical industrial uses which account for 56.1% of its annual consumption. Silver will continue to be a critical material in solar technology. While photovoltaics currently account for 8% of annual silver consumption, this is set to change with the dramatic increase in the use of solar technologies.

The Price of Gold and Silver

Forecasting the exact price of gold and silver is not a science, but there are clear signs that point to the direction their prices will head. The prices of gold and silver do not accurately reflect a world awash with cheap and easy money, but now may be their time to shine.

https://www.visualcapitalist.com/the-silver-series-the-start-of-a-new-gold-silver-cycle/

![Silver-in-Solar-and-EV[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1611415679578-ZTA81CLNFK4NT7V2I9IZ/Silver-in-Solar-and-EV%5B1%5D.jpg)

![The-Silver-Series-Part-2_v7[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1611416181254-4F575G6EZJBFGFST1BC1/The-Silver-Series-Part-2_v7%5B1%5D.jpg)

![silver-series-gold-silver-cycle[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1611416535070-OQ8Q2SHRMLEZ5X4RZK0F/silver-series-gold-silver-cycle%5B1%5D.jpg)

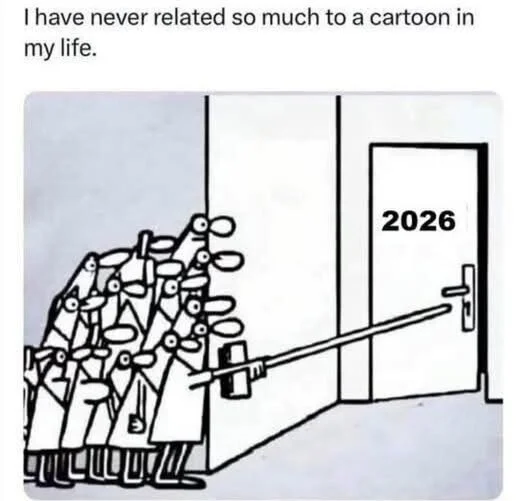

Why 2026 will be the End of the Fiat Experiment

As Good As Gold Australia: 12-28-2025

As we navigate the complexities of the current financial landscape, industry experts Daryl Payne, CEO of As Good as Gold Australia, and Alasdair Macleod offer a stark warning: the global economy is on the brink of a significant upheaval.

In a detailed discussion, they shed light on the precious metals market, particularly silver and gold, and what the future holds for these assets amidst growing economic instability.