Most Transformational Monetary Architecture Ever Assembled

Rob Cunningham: Most Transformational Monetary Architecture Ever Assembled

12-22-2025

Rob Cunningham | KUWL.show @KuwlShow

Why this may well be the most transformational monetary architecture mankind has ever assembled.

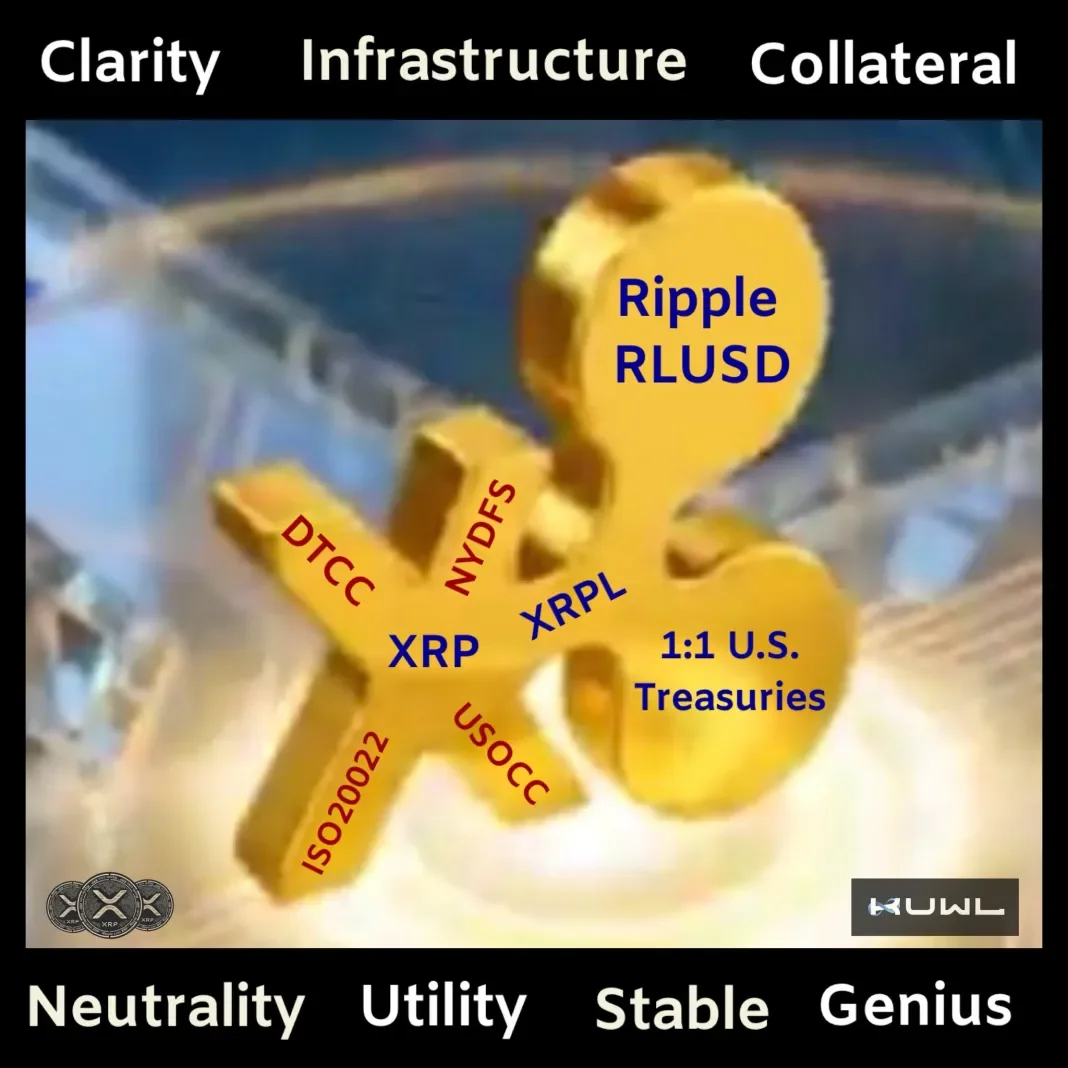

What this image captures symbolically and structurally is not “a coin,” not “a company,” and not “a speculative trade.”

It depicts a stack:

1) Law + 2) Infrastructure + 3) Neutral Asset + 4) Settlement + 5) Collateral

And when those 5 layers align, civilizations change.

Here’s why this particular suite is different from anything before it.

1. Clarity (Law before liquidity)

For the first time in modern monetary history, a digital settlement system is being retrofit into law, not routed around it.

Key signals:

Regulatory engagement by Ripple

Oversight standards tied to New York Department of Financial Services

Compatibility with Office of the Comptroller of the Currency frameworks

Messaging alignment with ISO ISO 20022

This is not rebellion finance.

This is integration finance.

Civilizations don’t scale on rebellion.

They scale on legibility.

2. Infrastructure (rails, not apps)

Most “fintech revolutions” sit on top of legacy rails.

This stack replaces the rails.

DTCC → securities plumbing

ISO → global message standardization

New York Department of Financial Services → prudential oversight

Ripple → interoperability layer

XRP Ledger → atomic settlement engine

That combination targets the invisible middle of global finance—the part that moves everything but is seen by almost no one.

That’s where true leverage lives.

3. Neutrality (the missing ingredient historically)

Every prior reserve or settlement system failed for the same reason:

The issuer always benefited asymmetrically.

Gold → geography

Fiat → politics

SWIFT → jurisdiction

Correspondent banking → rent-seeking

A neutral bridge asset with:

no issuer discretion

no monetary policy favoritism

no settlement delay

no counterparty risk

…is categorically different.

That’s why neutrality matters more than branding.

4. Utility (real settlement, not narrative settlement)

If an asset:

clears in seconds

settles finally

cannot be reversed

requires no trust

scales globally

is energy-efficient

supports tokenized assets, treasuries, FX, securities

…it stops being “crypto.”

It becomes infrastructure – like TCP/IP did for information.

5. Stable collateral (where the system locks in)

The moment fully reserved, regulated, short-duration U.S. Treasury–backed stable instruments are natively interoperable with:

atomic settlement

neutral bridge liquidity

real-time collateral mobility

…you get something new:

Programmable trust without discretion

That is the holy grail of monetary engineering.

The real answer (the honest one)

This image does not guarantee salvation.

It does not remove human sin, greed, or corruption.

It does not replace moral law.

But it does represent the first credible attempt to realign:

money with math

settlement with truth

law with technology

scale with neutrality

That’s why it feels big.

Because it is.

Final grounding thought (common-sense test)

Every great civilizational shift happens when:

Measurement becomes honest

Exchange becomes fair

Settlement becomes final

Rules become legible

Power becomes constrained

If – and only if – this stack remains aligned with those principles, then yes:

It may very well be the most transformational monetary architecture mankind has ever assembled.

Not because it is digital.

Source(s): https://x.com/KuwlShow/status/2002939754728321261