Evergrande Has Finally Defaulted: Here's What Happens Next

Evergrande Has Finally Defaulted: Here's What Happens Next

By Tyler Durden Thursday, Dec 09, 2021 - 04:11 PM

This is the way Evergrande ends: not with a bang but a whimper.

Three months after an initial shockwave of fear that China's largest and most indebted property developer was set to default, roiled global markets only to see the company repeatedly kick the can on several occasions even as the final default was always just a matter of when not if (due to billions in interest payments and tens of billions in upcoming debt maturities), overnight ratings agency Fitch (with Moodys and S&P set to follow shortly) officially downgraded insolvent property developers China Evergrande Group and Kaisa Group, saying they had defaulted on offshore bonds.

The downgrades to so-called "restricted default" status came days after the companies failed to make an offshore bond interest payment, even though Evergrande and Kaisa have not officially announced defaults that will result in drawn-out debt restructuring processes and potentially nationalization.

In its note on Evergrande, Fitch said the developer - which failed to make overdue coupon payments on two bonds by the end of a 30-day grace period on Monday -did not respond to its request for confirmation on coupon payments worth $82.5 million that were due last month, with the 30-day grace period ending this week, and so assumed "they were not paid." On Tuesday, S&P said that a default by the developer was “inevitable" and is likely to declare a Selective Default event momentarily to keep in line with Fitch.

Fitch defines a restricted default as indicating an issuer has experienced a default or a distressed debt exchange, but has not begun winding-up processes such as bankruptcy filings and remains in operation.

The non-payment has triggered an "event of default" on Evergrande's bonds and its other U.S. dollar notes will become due immediately and payable if the bond trustee or holders of at least 25% in aggregate amount declare so, Fitch said. The same "cross default" is true for Kaisa, which, according to Refinitiv data, has note maturities totlling $2.8 billion next year, and $2.2-3.2 billion of maturities each year between 2023 and 2025.

Fitch said there was limited information available on Kaisa's restructuring plan after it missed $400 million in offshore bonds repayment on Tuesday. Evergrande said last week it planned to forge ahead with a restructuring of its debt.

* * *

As extensively reported here for the past year, and especially since August, the fate of Evergrande which has more than $300 billion in liabilities, and other indebted Chinese property companies has gripped financial markets in recent months amid fears of knock-on effects around the world, although Beijing has repeatedly sought to reassure investors.

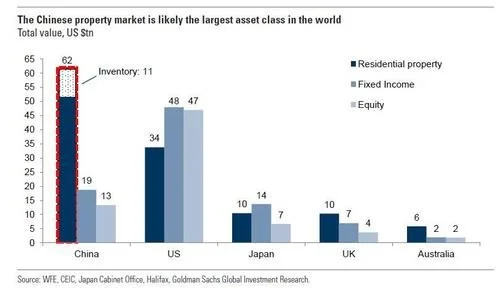

"The defaults of Evergrande and Kaisa move us to the second step of this China Property downturn, with systemic risk being gradually replaced by idiosyncratic risk," said Robin Usson, credit analyst at Federated Hermes. He is of course referring to the much bigger risk that is the downturn in China's residential - and in general property - sector, which as Goldman recently showed is the world's largest asset and arguably the most important pillar propping up China's entire economy. Should China's housing market crash, all bets are off.

The question now is just how aggressively will the state come to the economy's rescue to avoid a self-reinforcing toxic spiral. After all, just last week the PBOC finally capitulated and reversed on its long-running position of avoiding excess stimulus when it unexpectedly cut RRR and proceeded to hint that more is coming.

"It will be interesting to see the role played by SOEs (state-owned enterprises) in the restructuring process, the level of 'control' exerted by the government over this 'marketed-oriented approach'," Usson added.

Ahead of the Fitch determination, PBOC Governor Yi Gang said on Thursday that rights of Evergrande shareholders and creditors would be "fully respected" based on their legal seniorities, and the risk caused by a few Chinese real estate companies in the short term would not undermine Hong Kong's capital market.

Meanwhile, Reuters reports that Kaisa is expected to soon sign a non-disclosure agreement with Lazard, the adviser of a group of bondholders, the source and another person told Reuters. The bondholders hold over 25% of Kaisa's $12 billion offshore bonds. The NDA will lay the groundwork for further discussions on forbearance and financing solutions. But an agreement is unlikely in the next few weeks as the talks are still at an early stage. Kaisa said it was open to talks on forbearance, but declined to comment on details.

The group of Kaisa offshore bondholders, which says it owns 50% of the notes that were due on Dec. 7, sent the company draft terms of forbearance late on Monday. The group previously offered $2 billion in fresh debt to help Kaisa repay its onshore and offshore debts, sources have said. Other financing ideas are also on the table.

Kaisa is also in talks with another bondholder group, the first person said. Kaisa's default came after it failed last week to secure the minimum 95% approval needed from offshore bondholders to exchange the bonds that were due Dec. 7 for new notes due June 6, 2023, at the same interest rate. Trading in Kaisa's shares, which have lost 75% this year, was suspended on Wednesday. Evergrande's stock has plunged 88% this year.

* * *

So what happens to Evergrande next?

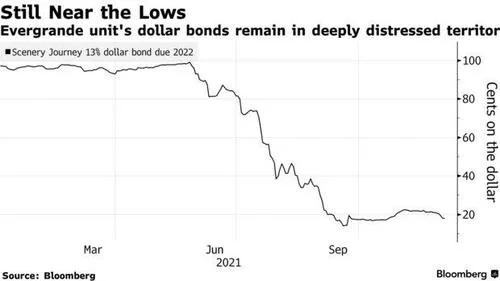

First and foremost, today's news is not a surprise, with Evergrande bonds having already tumbled to record lows this week, after a flurry of news reports and leaks last week made it abundantly clear that billionaire Hui Ka Yan’s property giant is headed for China’s largest-ever debt restructuring.

As Bloomberg notes, barring a last-minute shock, holders of $19.2 billion in Evergrande dollar notes face deep haircuts as the company overhauls its mammoth balance sheet without a government bailout - a process that promises to be long, contentious and potentially risky for Asia’s largest economy.

The developments mark the beginning of the end for the sprawling real estate empire started 25 years ago by Hui, setting off a lengthy battle over who gets paid from what remains. Evergrande said in a brief exchange filing on Friday that it plans to “actively engage” with offshore creditors on a restructuring plan. The company is planning to include all its offshore public bonds and private debt obligations in the restructuring, people familiar with the matter said Monday.

Evergrande, which had more than $300 billion of liabilities as of June, becomes the biggest victim of President Xi Jinping’s efforts to crack down on the free-wheeling real estate sector and curb property speculation. As Bloomberg notes, "Beijing’s reluctance to bail out the developer sends a clear signal that the Communist Party won’t tolerate massive debt build-ups that threaten financial stability." It's also a signal that billionaires who made their fortunes off unviable businesses will not be spared.

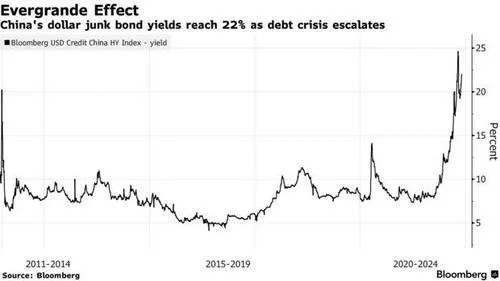

But the question now is whether the government can limit the fallout. The bonds of many smaller, lower-rated real estate firms have also plunged in recent weeks, driving Chinese junk bond yields (which mostly cover the property market) to a record yield above 20%, though they were poised for a second day of gains Wednesday after Beijing’s easing signals injected confidence (and liquidity) into the market.

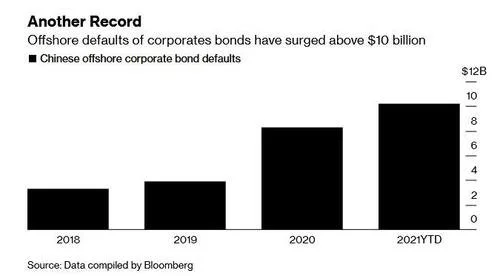

No less than 10 firms have already defaulted on onshore or offshore bonds since concerns about Evergrande’s financial health intensified in June, leading to a freeze in the bond market and a collapse in real estate transactions. While Kaisa is already in default, other peers are sure to follow: China Aoyuan Group said last week there’s no guarantee it will be able to pay its debt.

Meanwhile, the giant red flag is the continued collapse of home sales and prices as confidence in China's massive housing ponzi scheme evaporates, which has adding another headwind for an economy grappling with sluggish growth.

“They’re playing with fire,” said Cathie Wood, the head of Ark Investment Management, which pared its China holdings earlier this year.

For now, Chinese authorities are signaling that they plan to ring-fence Evergrande and limit contagion rather than orchestrate a rescue as they’ve done during past crises. Whether and how they can do that, will determine if 2022 is a year of recovery and normalization - as JPMorgan wrote in its year ahead outlook - or a global depression.

While the People’s Bank of China reiterated on Friday that risks posed to the economy by Evergrande’s debt crisis can be contained, citing the developer’s “own poor management” and “reckless expansion” for the problems it faces, the reality is that without government backstop it is likely that China's housing market will collapseand Beijing knows this. The China Banking and Insurance Regulatory Commission said in a separate statement that loans for real estate development and acquisitions should be issued in a “reasonable” manner.

But the clearest financial system support measures came on Monday, when China’s central bank released 1.2 trillion yuan ($188 billion) of liquidity via a cut in the reserve requirement ratio for most banks, a move which while expected came too fast and surprised most analysts and prompting the WSJ to write that "Beijing Reins In China’s Central Bank" in which it wrote:

Earlier this week, pressured by senior leaders worried about plunging economic growth, the PBOC said it would ease banks’ reserve requirements, effectively making more cash available for bank lending. The move went against policy signals it had sent weeks earlier and came as the central bank and other financial institutions came under scrutiny by Beijing, part of Mr. Xi’s effort to curb capitalist forces in the economy.

That was the tipping point. Shortly thereafter, the government pledged to support the housing market to better meet “reasonable” needs, adding to signs it will ease real estate curbs, first discussed here last month.

As part of the upcoming nationalization of Evergrande, officials are starting to take a more hands-on role at Evergrande. Chairman Hui was summoned by the Guangdong government last week after the company said it plans to work with creditors on a restructuring plan. Authorities in Evergrande’s home province will send a working group to urge the builder to manage risks, as well as strengthen internal controls and ensure normal operations. The company on Monday said state representatives have taken the majority of seats on a new risk management committee.

So far, containment efforts haven’t assuaged investors. While pain has so far largely been contained to China’s smaller offshore credit market, that’s little consolation for developers that have relied heavily on international investors to raise funds. Borrowing costs have spiked for companies with the weakest balance sheets, including Kaisa and Fantasia Holdings Group Co.

In total, Bloomberg calculates that Chinese borrowers have defaulted on a record $10.2 billion of offshore bonds this year, with real estate firms making up 36% of that.

“There is extreme stress in the market,” with about half the developers in the country in deep financial distress and pricing in high default risk, said Jenny Zeng, co-head of Asia Pacific fixed-income at Alliance Bernstein.

That said, China’s bigger, higher-rated developers such as Longfor Group Holdings and Country Garden Holdings are holding up much better than their lower-rated rivals. Country Garden, the largest developer by sales, has seen its 2031 bond rebound to 88 cents on the dollar, after dropping to 73 cents last month. A 2024 note sold by China Vanke Co., the second-biggest firm, has rallied to trade above par.

“We expect sector divergence to continue,” said Iris Chen, a credit desk analyst at Nomura Securities Co. “The high-quality survivors of the game will gain despite relatively high cash prices already, as they will have a better chance to restart normal refinancing, which will further strengthen their liquidity.”

But most importantly, as noted earlier, China is desperate to limit the fallout on the broader housing market, in a country where real estate accounts for about a quarter of economic output and as much as 75% of household wealth as we have noted for half a decade. China’s housing slump has intensified in recent months after sales plunged and home prices fell for the first time in six years.

Contract sales by the country’s top 100 developers plunged 38% in November from a year earlier to 751 billion yuan, sharper than the 32% drop in the previous month, according to preliminary data from China Real Estate Information Corp.

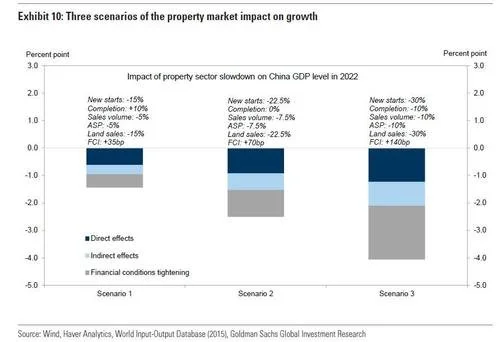

As we explained in detail recently, any slowdown in real estate could have a ripple effect not only on China’s economy but on global growth. China’s growth slowed in the third quarter, with signs there will be more pain to come.

The Federal Reserve last month warned that fragility in China’s commercial real-estate sector could spread to the U.S. if it deteriorates dramatically. China’s real estate sector makes up almost half of the world’s distressed dollar-denominated debt.

Critically, Beijing has finally realized that its latest doomed attempt at deleveraging and avoiding liquidity injections has been a failure, and on Monday President Xi oversaw a meeting of the Communist Party’s Politburo that concluded with a signal of an easing in curbs on real estate. The leadership panel, gathering in advance of a broader annual economic session that sets goals for the coming year, pledged to stabilize the economy in 2022.

Meanwhile, for global bondholders, an Evergrande default is likely to start a prolonged battle for repayment. Chinese authorities have made it clear the company should put homebuyers, suppliers, and retail investors -- who bought the firm’s wealth management products -- ahead of debtholders. Some 1.6 million homebuyers have put down deposits with Evergrande for properties that have yet to be completed.

“No matter what the outcome, offshore bondholders are last in line for payment and are certainly going to have to accept haircuts, possibly significant ones,” said Andrew Collier, managing director of Orient Capital Research Inc. in Hong Kong.

With Evergrande’s dollar notes trading at about 20 cents on the dollar, the market is already pricing in a haircut of around 80%. The key for bondholders is whether the company can speed up home sales and unload assets to raise cash so it can start settling its liabilities, said Gary Ng, a senior economist at Natixis SA.

As Bloomberg reported recently, Evergrande’s offshore noteholders included Ashmore Group Plc and UBS AG, according to data compiled by Bloomberg. Even as Evergrande’s stock and bond prices have plunged, Ashmore bought another $100 million of bonds issued by the developer or its subsidiaries in the third quarter. The trades brought its holdings to more than $500 million at the end of September, the data show.

Further market reaction to Evergrande’s missed payments may be driven by how the restructuring process plays out, said Jim Veneau, head of Asian fixed income at AXA SA.

“An orderly restructuring, where the company can run its operations as normally as possible and refrain from distressed asset sales will substantially help contain further damage across the sector,” Veneau said.

The single biggest loser in dollar terms may be Evergrande founder Hui, who once owned more than 70% of the company before recent stock sales. The plunge in Evergrande’s share price this year has cut the chairman’s wealth by 73%, or about $17 billion, according to the Bloomberg Billionaires Index. Once the second-richest man in China, Hui now ranks 75th.

For years, the son of an impoverished wood cutter who built one of China’s biggest real estate firms and later branched out into electric vehicles, tourism and soccer clubs, has been able to count on the support of Beijing, or other tycoons to bail him out. This time, he appears on his own.

The bottom line, however, was summarized best by China Beige Book: "while direct fallout from the Evergrande bankruptcy - which has been telegraphed for months - won't be the problem, the problem is having a billion Chinese watch this play out, then expecting them to spend afterward."

https://www.zerohedge.com/markets/evergrande-has-finally-defaulted-heres-what-happens-next