Coffee with MarkZ, joined by Dr. Scott Young. 01/29/2026

Coffee with MarkZ, joined by Dr. Scott Young. 01/29/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and RV’ers

Member: Only 2 days left in January. Wasn't GCR supposed to be easier at first of year due to balancing the books?

Coffee with MarkZ, joined by Dr. Scott Young. 01/29/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and RV’ers

Member: Only 2 days left in January. Wasn't GCR supposed to be easier at first of year due to balancing the books?

Member: Guess they have to do it the hard way.

Member: Iraq needs to step up or step out on the rv process !!

Member: IMO-Nothing happens without Iranian submission.. also clarity act must pass!!

MZ: I am not convinced we need clarity act to pass first…..but agree about Iran.

MZ: I have a bond contact that would not give me an update on their bonds this week. But he said what they were told the Iranian issue would come to a head and a determination this weekend and it would be an enormous weekend in the middle east

MZ: And CURRENCIES should start next week. That is what they were told. Many bond holders also hold currencies.

Member: Wow- great news. Hope its true.

MZ: Let us hope it is accurate, but we have heard some very grandiose things in the past. I found it interesting that they would not comment on their bond side…..(I always said bonds would go before currency-right?) So for them to say it looks like they will be exchanging currencies next week….makes me hopeful.

Member: Whoa sounds like they were keeping a possible NDA on bonds with potential movement for the rest of us

Member: Any CMKM info? Indian Claims farmer claims moving. Last we heard was 2 weeks ago on Indian Nations

Member: The Iranian currency opened trading this morning with another significant collapse and is traded at the following rate:1.67 million Iranian rials per one US dollar. The currency has lost about 16%

MZ: In Iraq the craziness continues: “ Framework MP-US interference in the selection of the PM is a blatent infringement on sovereignty” A lot of drama going on….do not let it panic you.

MZ: I believe we will see this come to a completion this week with something else coming to a completion over the weekend. We will see if I am right and my sources are right?

MZ: “Trump threatens to end Iraq support over Al Maliki comeback bid tied to Iranian influence” This even made Fox news. Iraq is under pressure. A lot is at stake.

MZ: “The end of corruption is approaching- Savaya opens forbidden documents” He says they will hold people accountable. They are releasing those documents to the public and we may see a lot of chaos happening and corrupt officials running.

Member: I find it humorous that the US politicians cry Iraq corruption when we are ate up with corruption.

MZ: “ Venezuela signals a Historic Energy Reset as oil laws open to foreign capital” On the ground reports are talking about the changes they are already seeing outside companies working on pipelines and infrastructure. This is great for Venezuela and the possibility of a value change.

Member: It sounds like the Venezuelan Bolivar just may be in the first basket after all!

Member: Silver just hit $111 an oz.!!!

Member: Possible US Government shut down this weekend. Maybe a reset would help bypass that?

Member: IMO- many events to happen soon be prepared

Member: We are one day closer to our Blessing. Stay strong. Keep the Faith.

Dr. Scott and StacieZ join the stream today. Please listen to the replay for thier information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Thursday 1-29-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 29 Jan. 2026

Compiled Thurs. 29 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: On Sun. 1 Feb. there was (allegedly) scheduled to be announced that the Quantum Financial System was fully operational and gold/asset-backed currencies now dominated globally, heralding the greatest wealth transfer in history.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 29 Jan. 2026

Compiled Thurs. 29 Jan. 2026 12:01 am EST by Judy Byington

Judy Note: On Sun. 1 Feb. there was (allegedly) scheduled to be announced that the Quantum Financial System was fully operational and gold/asset-backed currencies now dominated globally, heralding the greatest wealth transfer in history.

By February 1, 2026, trillions in prosperity funds were (allegedly) expected to flood into the hands of the people, ending poverty and igniting global renewal under NESARA/GESARA reforms. As the new asset-backed global financial system and Nesara/Gesara detonated — fiat currency (allegedly) dies and rainbow currency floods streets.

Debt forgiveness stands imminent through the Debt Jubilee algorithm, (allegedly) zeroing out mortgages, credit cards, and unlawful burdens as legalized under prior executive actions.

No more fiat taxes or IRS oppression—the new US Treasury, fortified with gold reserves, (allegedly) ensures fair distribution via the QFS.

Redemption centers were on high alert, with Tier 4B notifications (allegedly) flowing through secure channels. This week the RV launch (allegedly) accelerated, with Iraqi Dinar, Vietnamese Dong, and Zim holders poised for historic payouts at contract rates that would empower humanitarian projects and long-term stewards.

Tier 1 payouts load soon — trillions clawed from cabal vaults (allegedly) rerouted to We the People. Humanitarian funds will unleash, RV/GCR hits hard — 209 nations sync to unbreakable QFS grid with the SWIFT buried.

~~~~~~~~~~~~

What to Expect Beginning Sun. 15 Feb. 2026:

A NESARA / GESARA Activation Phase will nullify (allegedly) Global debt and execute a bank fraud reset, with usury termination and illigal interest erased.

Full QFS Implementation: The old financial system was (allegedly) already dead. It just hasn’t been announced yet. From now on there would only be asset-backed ledgers, no money printing, no fraud, no hidden fees, no offshore looting. Every dollar will(allegedly) be traceable, every transaction final.

The Federal Reserve will be(allegedly) dissolved and IRS absorbed into a new US Treasury. There will be no tax on food, medicine, salaries and used goods, including used homes and cars. A 14% sales tax (allegedly) on new items only and tariffs on goods coming into the country will replace the old tax system.

~~~~~~~~~~~~~~~

Possible Timing:

On Tues. 27 Jan. Bruce reported his source said that we are looking for Tier4b (Us, the Internet Group) notification to set exchange appointments over the next three days – Wed, Thurs or Fri. Jan. 28, 29, 30.

Valid sources report that on Sat. 31 Jan. and Sun. 1 Feb. 2026 Global Systems would begin to shift. Banks, Trade Networks and Digital Grids would move toward true transparency with Gold Reserves realigned and Debt frameworks rewritten.

On Sat. 31 Jan. 2026 the QFS (allegedly) goes live using the debt free gold/asset-backed currency of 209 nations and severing all Deepstate control over Global Banking.

On Sun. 1 Feb. 2026 the new gold/asset-backed Quantum Financial System(allegedly) activates.

By Mon. 2 Feb. 2026 Commander in Chief Donald Trump leads. With the fiat US Dollar, (allegedly) dead, Trump brings in the gold/asset-backed US Note in a historic transfer of wealth back to The People. Prepare for a (allegedly) Global 48 Hour communication lockdown.

On Monday 2 Feb. 2026 you’ll (allegedly) see:

• Encrypted alerts tied to your national ID or phone signature

• First wave biometric wallet logins open across verified nations

• Partial debt reconciliations appearing as “system recalculations”

• Global emergency communication drills – disguised as public safety tests

On Fri. 6 Feb. 2026 the public launch of NESARA Tier 1 redemptions would (allegedly) finalize.

By Wed. 11 Feb. 2026 Redemption Centers (allegedly) open worldwide under Military Security to set up the new Global Financial System (GFS) Wallets (formerly known as bank accounts) for the general public on the new and secure Star Link Satellite System. All accounts move to the Quantum Grid.

Read full post here: https://dinarchronicles.com/2026/01/29/restored-republic-via-a-gcr-update-as-of-january-29-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man The news can be charging...disappointing...I know the political scene in Iraq is very volatile at the moment...a lot of negative news...It's intense. But bottom line is who am I watching? I'm watching for the central bank and the gatekeepers...because they have control to be able to take care of the monetary policy...

Mnt Goat This week will be a pivotal week in Iraq. They are supposed to announce their candidate for president. As we know the new president then announces the nominee for prime minister that will then be tasks to form his cabinet...

Clare President Trump X post: "I’m hearing that the Great Country of Iraq might make a very bad choice by reinstalling Nouri al-Maliki as Prime Minister. Last time Maliki was in power, the Country descended into poverty and total chaos. That should not be allowed to happen again. Because of his insane policies and ideologies, if elected, the United States of America will no longer help Iraq and, if we are not there to help, Iraq has ZERO chance of Success, Prosperity, or Freedom. MAKE IRAQ GREAT AGAIN!"

****************

Trump Just Signaled a MASSIVE Dollar Debasement—Silver to $170?!

Steven Van Metre: 1-29-2026

President Trump is warning that a massive dollar debasement is coming soon that's going to send the dollar plunging, and safe havens like gold and silver even higher.

Seeds of Wisdom RV and Economics Updates Thursday Morning 1-29-26

Good Morning Dinar Recaps,

Gold Breaks $5,500 as Dollar Weakens and BRICS Shift Accelerates

Precious metals surge signals structural change in global reserves and settlement

Good Morning Dinar Recaps,

Gold Breaks $5,500 as Dollar Weakens and BRICS Shift Accelerates

Precious metals surge signals structural change in global reserves and settlement

Overview (Key Points)

Gold surged above $5,500 per ounce, hitting an intraday record of $5,595.41 on January 29, 2026.

Gold futures are now up more than 20% year-to-date, driven by dollar weakness and central-bank accumulation.

BRICS gold reserves have surpassed U.S. Treasury holdings for the first time since 1996.

Markets are increasingly pricing in a monetary realignment rather than a cyclical rally.

Key Developments

Historic Price Action:

Gold futures rallied sharply as the Federal Reserve held rates steady and the U.S. dollar fell to its lowest level since early 2022. The move reflects intensifying demand for hard assets amid declining confidence in fiat currencies.

Dollar Weakness Fuels Momentum:

Analysts point to sustained dollar depreciation as a key catalyst. As the greenback weakens against major currencies, gold has benefited from both safe-haven demand and debasement hedging.

BRICS Reserves Surpass Treasuries:

Foreign central bank gold holdings are now valued near $4 trillion, exceeding U.S. government bond holdings at approximately $3.9 trillion. BRICS nations collectively control about 50% of global gold production and hold more than 6,000 tonnes in reserves.

Gold-Backed Settlement Takes Shape:

In December 2025, BRICS launched the “Unit”, a pilot gold-backed settlement instrument composed of 40% physical gold and 60% BRICS currencies. The initiative represents the first operational step toward an alternative to dollar-centric settlement systems.

Why It Matters

Gold’s breakout is not being driven by retail speculation alone. Central banks are the dominant buyers, signaling a long-term shift in reserve strategy. The freezing of Russian assets in 2022 fundamentally altered how sovereign nations assess reserve safety, accelerating diversification away from dollar-denominated assets.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation:

Gold strength often precedes currency repricing and settlement reform.

BRICS-aligned currencies tied to commodities and production capacity gain structural leverage.

Reduced dollar weighting in reserves supports multipolar valuation frameworks over time.

Implications for the Global Reset

Pillar 1 — Reserve Reallocation:

Gold replacing Treasuries as a primary reserve anchor reflects declining trust in debt-based instruments.

Pillar 2 — BRICS as Monetary Architects:

By pairing gold accumulation with settlement infrastructure, BRICS is building functionality first, rhetoric second.

This is not a spike — it is a repricing of trust.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “Gold Price Jumps Above $5,500 as Weak Dollar & BRICS Shift Align”

Reuters — “Central banks extend gold buying spree as dollar weakens”

~~~~~~~~~~

Silver & Copper Flash Follow-Up Reset Signal as Metals Reprice Reality

Industrial demand and monetary hedging converge outside the dollar system

Overview (Key Points)

Silver surged above $116 per ounce, up nearly 50% year-to-date, outpacing gold on a percentage basis.

Copper broke above $13,000 per tonne in London trading, a historic high tied to electrification and infrastructure demand.

Both metals are signaling real-economy stress and settlement transition, not speculative excess.

Markets are increasingly using hard assets as proxies for trust amid currency fragmentation.

Key Developments

Silver Reasserts Dual Role:

Silver’s breakout reflects its unique position as both a monetary metal and an industrial input. Rising demand from solar manufacturing, electronics, and military technology coincides with investor hedging against currency debasement.

Copper Sends Infrastructure Signal:

Copper’s surge past $13,000 highlights constraints in mine supply alongside aggressive global build-outs in grids, EVs, and defense infrastructure. Copper is increasingly viewed as a strategic material, not merely a cyclical commodity.

Supply Concentration Risks:

Major copper and silver production remains concentrated in geopolitically sensitive regions, reinforcing concerns over resource nationalism and trade weaponization. These risks are now being priced into futures markets.

Reset Indicator Beyond Gold:

While gold anchors reserves, silver and copper reveal the operational side of the reset — manufacturing capacity, energy systems, and defense readiness. Together, they reflect a system shifting from financial leverage to physical control.

Why It Matters

Silver and copper are not reacting to rate cuts or stimulus expectations alone. Their moves indicate tight physical markets, rising sovereign demand, and the repricing of materials essential to modern economies. These metals expose pressure points where fiat systems meet real-world limits.

Why It Matters to Foreign Currency Holders

For holders awaiting currency revaluation:

Silver often acts as a volatility amplifier during monetary transitions.

Copper reflects industrial backing and productive capacity, a key metric in reset-era valuation.

Rising metals prices support commodity-linked and resource-rich currencies over debt-dependent systems.

Implications for the Global Reset

Pillar 1 — Physical Scarcity Over Paper Claims:

Silver and copper markets are revealing cracks between futures pricing and real-world availability.

Pillar 2 — Infrastructure as Currency Backing:

Control of metals critical to energy, defense, and technology increasingly functions as implicit monetary support.

This is not inflation — it is repricing of the real economy.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Silver jumps as industrial demand tightens global supply”

London Metal Exchange — “Copper prices hit record highs amid supply constraints”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Thursday Morning 1-29-26

Iraq’s Government Formation Enters High-Risk Phase Under US Economic Pressure

2026-01-29 Shafaq News US President Donald Trump’s blunt rejection of Nouri al-Maliki’s return to Iraq’s premiership has pushed government formation into its most precarious phase, transforming what Iraqi factions describe as a constitutional choice into a confrontation shaped by money, leverage, and regional alignment.

Iraq’s Government Formation Enters High-Risk Phase Under US Economic Pressure

2026-01-29 Shafaq News US President Donald Trump’s blunt rejection of Nouri al-Maliki’s return to Iraq’s premiership has pushed government formation into its most precarious phase, transforming what Iraqi factions describe as a constitutional choice into a confrontation shaped by money, leverage, and regional alignment.

The signal from Washington was unambiguous: an al-Maliki-led government would be read not as continuity but as defiance, at a moment when the United States is recalibrating its Middle East posture and narrowing its tolerance for Iranian-aligned power centers inside fragile states.

For Iraq’s Shiite Coordination Framework —the largest parliamentary bloc to which al-Maliki’s State of Law Coalition belongs— the response has been defiant in tone but uncertain in substance. Leaders insist that the premiership is a sovereign Iraqi decision. In practice, however, sovereignty is colliding with a constraint Iraq cannot escape: its economic lifelines remain exposed to US pressure.

Trump’s objection is not rooted solely in al-Maliki’s political past. It reflects a strategic judgment in Washington that Iraq’s next government will either dilute Iran’s grip on the state or formalize it.

Haytham al-Heeti, professor of political science at the University of Exeter, said Washington no longer views Nouri al-Maliki as simply a former prime minister returning to office. “He represents a governing architecture, one that shields Iran-aligned armed groups and embeds their influence within state institutions..”

Previous attempts to reassure US officials were seen, he said, as tactical delays rather than structural change. “This time, the calculation is different,” al-Hiti added. “Washington is no longer managing a balance. It is drawing lines.”

The approach, he argued, has shifted from containment to disruption.

Read more: Nouri Al-Maliki: A name that still divides and tests the politics of memory

Political analyst Omar al-Nasser situates Trump’s stance within a broader realignment of global power, where economics and energy security increasingly dictate political tolerance.

Speaking to Shafaq News, al-Nasser said the aftermath of the Israel–Iran confrontation last June, combined with energy competition and great-power friction, has narrowed Washington’s patience for ambiguous partners. In this environment, “Iraq is no longer a buffer. It is a test case.”

“Trump approaches the region as a marketplace of risk,” al-Nasser said. “Actors are evaluated by cost, not sentiment.”

From that perspective, al-Maliki’s return clashes with a US strategy that prioritizes predictability for markets and leverage over adversaries. Al-Nasser placed responsibility squarely on Iraq’s political class, arguing that its failure to establish firm standards for leadership selection has left the country vulnerable to external vetoes applied through economic pressure.

The tools available to Washington are not theoretical, because Iraq’s financial system remains deeply tied to US-regulated dollar channels, correspondent banking oversight, and oil-revenue mechanisms that pass through international institutions aligned with American compliance standards.

Analyst Ahmed Yousif said Trump’s public stance stripped political cover from those pushing al-Maliki toward a third term. “The problem is not just American opposition,” Yousif told Shafaq News. “It is that al-Maliki carries a record Washington is prepared to weaponize.”

That record —his 2006–2014 tenure— is associated in US policy circles with sectarian polarization, security collapse, and institutional erosion. Combined with his proximity to Tehran, it has turned his candidacy into a pressure point Washington appears willing to exploit.

“These are not abstract threats; they are tools already built into Iraq’s economic structure,” Yousif said.

Within the Shiite Coordination Framework, Trump’s position has sharpened internal strains. Badr Organization MP Mukhtar al-Moussawi acknowledged that al-Maliki’s name has become a liability, not only abroad but at home as well, linking the US objections to corruption, political division, and the cost of reopening old battles.

He argued that realism —rather than concession— requires reassessing a candidacy that risks isolating Iraq at a moment of maximum economic and diplomatic exposure. “The strongest position is avoiding an unnecessary confrontation.”

Attention has shifted to the outcome of the emergency Coordination Framework meeting held on Wednesday, which exposed a substantive rift over both leadership and strategy.

Sources told Shafaq News that discussions revealed two competing parties: one pressing to reaffirm al-Maliki’s candidacy as a matter of authority and resistance to pressure, and another warning that insisting on his nomination risks pushing Iraq into a confrontation it is poorly positioned to absorb.

The divide, according to the sources, is not limited to personalities but centers on risk assessment. One camp fears financial and political repercussions Iraq can ill afford. The other rejects any adjustment as capitulation, insisting that retreat under external pressure would weaken the bloc and set a precedent for future interference.

Amid all of this, endorsing al-Maliki would harden US pressure and test Iraq’s financial resilience. Abandoning him would deepen fractures within the Shiite political house and signal vulnerability.

Either way, the decision will define more than a premiership.

Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

Written and edited by Shafaq News staff.https://www.shafaq.com/en/Report/Iraq-s-Government-formation-enters-high-risk-phase-under-US-economic-pressure

Iraq Judiciary Warns Of Foreign Interference After US Rejects Al-Maliki

2026-01-29 Shafaq News– Baghdad Iraq’s Supreme Judicial Council on Thursday warned that delays in selecting the country’s top leadership posts could invite foreign interference, after parliament postponed a vote to elect the president and US objections to a potential return of Nouri Al-Maliki to the premiership.

In a statement, the Council stressed the importance of adhering to constitutional deadlines for completing the election of the President of the Republic and appointing the Prime Minister, urging all political parties and forces to “respect these timelines and avoid any violations, to preserve political stability, ensure the democratic process proceeds within constitutional and legal frameworks, and prevent any external interference.”

Earlier, US President Donald Trump said Washington would withdraw support if former prime minister Al-Maliki returned to office. The Shiite Coordination Framework, parliament’s largest bloc, which nominated Al-Maliki, held an emergency meeting that exposed internal divisions over whether to press his candidacy or seek an alternative to avoid escalation, sources told Shafaq News. Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

“Tidbits From TNT” Thursday Morning 1-29-2026

TNT:

Tishwash: Parliament is moving to host the Minister of Finance to follow up on economic issues and enhance financial transparency.

In a move aimed at strengthening parliamentary oversight of financial and economic affairs, the House of Representatives is moving to host the Minister of Finance as part of its efforts to follow up on issues that directly affect the lives of citizens, particularly with regard to customs tariffs and public revenue procedures.

This move comes in the context of parliamentary efforts to regulate financial performance and address the country’s economic challenges, in a way that ensures transparency and protects the interests of citizens.

TNT:

Tishwash: Parliament is moving to host the Minister of Finance to follow up on economic issues and enhance financial transparency.

In a move aimed at strengthening parliamentary oversight of financial and economic affairs, the House of Representatives is moving to host the Minister of Finance as part of its efforts to follow up on issues that directly affect the lives of citizens, particularly with regard to customs tariffs and public revenue procedures.

This move comes in the context of parliamentary efforts to regulate financial performance and address the country’s economic challenges, in a way that ensures transparency and protects the interests of citizens.

MP Abdul Amir Al-Mayahi confirmed that the House of Representatives is determined to host the Minister of Finance to follow up on financial and economic files, noting that working with the automation system in customs ports would control procedures, without imposing additional burdens on the citizen or the merchant.

Al-Mayahi explained that what is being circulated about imposing taxes or price increases is not based on actual procedures, warning that raising such issues in an inaccurate manner leads to unhealthy uproar and inflames public opinion, stressing that parliamentary hearings are an important oversight tool to address shortcomings and improve financial performance.

Regarding parliamentary procedures related to hosting, Al-Mayahi said: Every deputy works within his jurisdiction to legislate and amend laws in a way that serves the public interest, expressing his hope to develop the mechanisms of hosting and address the problems that it faces, especially in the necessary files that affect the lives of citizens.

In the same context, MP Haider Kadhim stated that 48 MPs had collected official signatures to summon the Minister of Finance, indicating that the First Deputy Speaker of Parliament had referred the request to the Presidency Council for the necessary procedures. These parliamentary actions fall within the framework of the Council's oversight role, aimed at monitoring the financial situation and discussing economic policies to ensure transparency and address issues affecting citizens' living conditions. link

************

Tishwash: Economist: Smuggling and hoarding behind the high demand for dollars in Iraq

Economic expert Duraid Al-Anzi confirmed on Tuesday that the rise in the dollar exchange rate in the local market is no longer linked to the Central Bank's procedures or government policies, noting that the dollar is now mainly affected by the movement of gold and silver prices in global markets.

Al-Anzi told Al-Maalouma News Agency that “the significant rise in gold and silver prices makes it illogical for the dollar to remain in a state of decline,” noting that “the two metals are currently playing a leading role in influencing global currencies, which directly impacts the dollar exchange rate locally.”

He added that "the demand for dollars in the Iraqi market has also increased due to smuggling and hoarding operations," explaining that "the difference between the official price adopted in the budget, the price at which the Central Bank sells to banks, and the market price, has created a large gap that has encouraged citizens and traders to acquire and hold onto dollars."

Al-Anzi pointed out that "this acquisition has begun to shift from mere saving to trading and speculation, especially with the worsening political crises in the region, stressing that the continued political and economic instability in the region prevents any real decline in the price of the dollar."

He pointed out that "a decrease in the price of the dollar will not be achieved without political stability in the region, in addition to global economic stability, especially with regard to gold and silver prices, considering that fluctuations in global currencies are directly reflected in the Iraqi market."

Al-Anzi criticized the caretaker government's handling of the exchange rate issue, arguing that the lack of a clear vision and reliance on fluctuating decisions contributed to deepening the crisis instead of resolving it. link

************

Tishwash: The US Monitor: Sudani is the biggest beneficiary of Trump's criticism of Maliki

A report published by the American newspaper Al-Monitor highlighted the repercussions of the recent statements by US President Donald Trump against former Iraqi Prime Minister Nouri al-Maliki, considering that these statements revived the debate about al-Maliki’s chances of returning to the premiership, and at the same time strengthened the position of the current Prime Minister, Mohammed Shia al-Sudani, as a more balanced and acceptable option locally and internationally.

The report, translated by Iraq Observer, indicated that Maliki still faces widespread rejection inside and outside Iraq, due to his political responsibility during a period that witnessed a major security collapse and the rise of ISIS in 2014, a heavy legacy that still casts a shadow over any attempt to return to the political forefront.

She added: “Trump’s criticism also served as a reminder of the negative role played by Maliki, according to the American perspective, which makes it difficult for him to gain real external or internal support.”

In contrast, the report suggests that “Mohammed Shia al-Sudani appears to be a more likely candidate to lead the next phase, given that he is seen by observers as a less confrontational figure and more balanced in dealing with international parties, especially the United States and Iran.”

According to the report, Al-Sudani is a preferred choice within the coordinating framework forces, and he also enjoys a degree of acceptance at the international level, which makes him a candidate to continue as head of government or to lead the post-election phase.

The report concluded that the balance is gradually shifting in favor of al-Sudani, while al-Maliki's chances remain weak, unless major political developments occur that reshuffle the cards in the Iraqi scene. link

Mot: Getting the ole Message Understood is sooooo IMportant!!

Mot: The Seasoned Three !!!!

FRANK26….1-28-26……TRUMP TRUTH (Maliki is not going to be the Prime Minister)

KTFA

Wednesday Night Video

FRANK26….1-28-26……TRUMP TRUTH (Maliki is not going to be the Prime Minister)

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Wednesday Night Video

FRANK26….1-28-26……TRUMP TRUTH (Maliki is not going to be the Prime Minister)

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Seeds of Wisdom RV and Economics Updates Wednesday Evening 1-28-26

Good Evening Dinar Recaps,

China Pushes Back as U.S. Pressures Bolivia Over Iran Ties

Latin America emerges as a new front in the global power and currency realignment

Good Evening Dinar Recaps,

China Pushes Back as U.S. Pressures Bolivia Over Iran Ties

Latin America emerges as a new front in the global power and currency realignment

Overview (Key Points)

China has formally rejected U.S. pressure on Bolivia to designate Iran-linked groups as terrorist organizations.

Beijing framed Washington’s demands as political bullying and interference in sovereign affairs.

The dispute highlights a widening struggle for influence in Latin America, especially following political shifts in Venezuela and Bolivia.

China is reinforcing its presence through economic leverage, yuan settlement, and BRICS alignment, not military force.

Key Developments

China Rejects U.S. Interference:

Beijing reiterated its long-standing principle of non-interference in internal affairs, opposing U.S. demands that Bolivia expel Iranian nationals or designate the IRGC, Hamas, and Hezbollah as terrorist organizations without UN consensus.

Bolivia Becomes Strategic Battleground:

With President Rodrigo Paz taking office in late 2025, Washington sees an opportunity to reposition Bolivia away from the Iran–China–Russia axis. China, however, is moving to protect over $6 billion in investments, particularly in lithium, energy, and infrastructure.

Economic Influence Over Military Presence:

China emphasized that its influence in Bolivia and Latin America is market-driven, relying on trade, lending, and infrastructure under the Belt and Road Initiative rather than military installations. Bolivia has already begun settling imports in Chinese yuan, signaling deeper financial integration.

Latin America “Not Anyone’s Backyard”:

Chinese officials repeated a clear message: Latin America has the sovereign right to choose its partners. Beijing accuses Washington of weaponizing terrorist designations and sanctions to undermine rivals and preserve regional dominance.

Why It Matters

This standoff illustrates how geopolitical competition is shifting away from open conflict toward financial systems, trade alignment, and currency usage. U.S. pressure campaigns now face organized resistance from major powers willing to defend partners diplomatically and economically.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching the global reset narrative:

Yuan-based trade and lending in Latin America weaken dollar exclusivity.

BRICS-backed partners gain alternatives to U.S.-controlled financial rails.

Resource-rich nations like Bolivia become key leverage points in future currency and settlement realignments.

Implications for the Global Reset

Pillar 1 — Decline of U.S. Enforcement Power:

When countries resist U.S. pressure without immediate economic collapse, it signals diminishing enforcement reach of dollar-based coercion.

Pillar 2 — BRICS Expansion by Necessity:

China’s support for Bolivia’s BRICS engagement reflects a strategy of insulating partners from Western pressure through alternative financial ecosystems.

This is not ideological alignment — it is survival economics.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Brasil de Fato — “China urges U.S. to stop pressuring Latin American nations over ties with Beijing”

~~~~~~~~~~

Europe Confronts a New Reality as U.S. Focus Shifts Elsewhere

EU leaders acknowledge a structural shift in transatlantic priorities

Overview (Key Points)

The European Union has acknowledged that Europe is no longer the primary strategic focus of the United States.

EU foreign policy chief Kaja Kallas described the shift as structural, not temporary.

Europe is being urged to assume greater responsibility for its own defense and security.

NATO remains central, but leaders are calling for a “more European” NATO framework.

Key Developments

U.S. Strategic Priorities Reordered:

Speaking at the European Defence Agency’s annual conference, Kallas stated that Washington’s attention has shifted away from Europe, reflecting long-term changes rather than a passing political phase under the Trump administration.

NATO Must Evolve:

Kallas emphasized that NATO remains vital but warned that continued strength requires greater European leadership, funding, and operational capability, reducing reliance on U.S. decision-making.

Rising Geopolitical Risk Environment:

The EU official cautioned against a return to coercive power politics and spheres of influence, signaling concern about intensifying great-power competition and weakening multilateral norms.

Strategic Autonomy Becomes Mandatory:

From defense and cybersecurity to trade and diplomacy, Europe is now framing strategic autonomy as a necessity, not a policy preference, as U.S. focus shifts toward the Indo-Pacific and other global priorities.

Why It Matters

This marks a pivotal acknowledgment from within the EU: the post-Cold War security model is no longer guaranteed. Europe’s recalibration reflects broader fragmentation in the Western alliance system and accelerates regional self-reliance across defense, energy, and economic policy.

Why It Matters to Foreign Currency Holders

For foreign currency holders monitoring global reset dynamics:

A less U.S.-centric Europe may pursue independent trade, defense spending, and settlement mechanisms.

Strategic autonomy often precedes currency diversification and reserve rebalancing.

A more self-directed Europe adds momentum to a multipolar financial system, reducing dollar exclusivity over time.

Implications for the Global Reset

Pillar 1 — Alliance Reconfiguration:

Acknowledging reduced U.S. focus lowers the psychological barrier to independent regional decision-making.

Pillar 2 — Multipolar Security, Multipolar Finance:

As security responsibilities decentralize, financial systems tend to follow, reinforcing long-term currency realignment trends.

This is not a rift — it is a rebalancing.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy — “Kallas: Europe Is No Longer Washington’s Core Focus”

Reuters — “EU’s Kallas says Europe must take more responsibility as U.S. focus shifts”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Why the Current Silver Mania Is So Wild, and How I'm Playing It

Why the Current Silver Mania Is So Wild, and How I'm Playing It

Rob Isbitts Barchart Wed, January 28, 2026

If you think the silver (SIH26) market is acting “normal” right now, you haven’t checked the lease rates or the London vaults lately. We are witnessing a historic de-coupling where physical silver is trading at 50% to 80% premiums over the official paper spot price. In early 2026, the metal has already blasted past its 1980 record of $53.40, hitting intraday highs that remind me of that scene from the classic comedy movie Airplane. Silver, now arriving at $80, $90, $100…

But this isn’t just a speculative cornering of the market. This is a structural physical squeeze meeting AI-industrial desperation

Why the Current Silver Mania Is So Wild, and How I'm Playing It

Rob Isbitts Barchart Wed, January 28, 2026

If you think the silver (SIH26) market is acting “normal” right now, you haven’t checked the lease rates or the London vaults lately. We are witnessing a historic de-coupling where physical silver is trading at 50% to 80% premiums over the official paper spot price. In early 2026, the metal has already blasted past its 1980 record of $53.40, hitting intraday highs that remind me of that scene from the classic comedy movie Airplane. Silver, now arriving at $80, $90, $100…

But this isn’t just a speculative cornering of the market. This is a structural physical squeeze meeting AI-industrial desperation.

What’s Different Now Than in 1980?

When the Hunt brothers tried to corner silver, they were fought by the exchanges and eventually crushed by a wave of new supply. In 2026, the short sellers are the ones getting crushed. Why?

Silver is no longer just “poor man’s gold.” It is an industrial necessity for AI data centers, electric vehicles, and solar panels. Manufacturers must have silver to keep production lines running, regardless of the cost. This is not a luxury now.

The market has been in deep “backwardation,” meaning spot prices were higher than futures. That implies investors and industries are so desperate for the metal, they are willing to pay massively more to bypass the paper contracts.

As of January 2026, China has tightened export licenses for silver, effectively choking off a major global supply artery just as the West needs it most.

How I’m Playing the ‘Silver Bullet’

To Read More: https://www.yahoo.com/finance/news/why-current-silver-mania-wild-140002483.html

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

Sean Foo: 1-28-2026

The global financial landscape is undergoing a seismic shift, as investors and central banks increasingly turn away from U.S. dollar assets, particularly U.S. Treasury bonds.

This trend, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar as the world’s reserve currency, is likely to have far-reaching consequences for the global economy.

The shift away from U.S. dollar assets began in 2008, when the Federal Reserve intervened in the housing crisis with unprecedented monetary measures.

BRICS Cuts off Treasuries from Assets, USD 2026 Collapse, US Shock Reversal on Korea

Sean Foo: 1-28-2026

The global financial landscape is undergoing a seismic shift, as investors and central banks increasingly turn away from U.S. dollar assets, particularly U.S. Treasury bonds.

This trend, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar as the world’s reserve currency, is likely to have far-reaching consequences for the global economy.

The shift away from U.S. dollar assets began in 2008, when the Federal Reserve intervened in the housing crisis with unprecedented monetary measures.

The subsequent quantitative easing during the 2020 CoviD-19 lockdowns, which saw the U.S. print massive amounts of money, further solidified this trend.

As a result, institutional investors, particularly in Europe and BRICS countries (Brazil, Russia, India, China, and South Africa), are now divesting from U.S. debt at an accelerating pace.

Europe’s largest pension funds have drastically reduced their holdings in U.S. Treasuries, reflecting a growing mistrust in the dollar’s continued dominance. This move is significant, as it signals a shift away from the traditional safe-haven status of U.S. government bonds.

BRICS nations, once reliant on U.S. bonds, are now either dumping their holdings or allowing them to mature without reinvesting. At the same time, they are increasing their gold reserves as a safer store of value.

India’s sell-off is particularly noteworthy, given its high exposure to Russian oil and the threat of U.S. secondary sanctions. Germany, too, has demanded the repatriation of its gold reserves from the U.S., fearing asset seizure amid rising geopolitical risks. These moves underscore the growing unease among foreign investors about the risks associated with holding U.S. dollar assets.

The U.S. dollar continues to weaken structurally, with the dollar index hitting lows not seen since late 2022. Despite modest gains in U.S. equity markets, foreign investors are effectively losing money due to currency depreciation.

The high cost of hedging against the dollar’s decline further diminishes the appeal of U.S. Treasuries. The Trump Administrtion’s aggressive trade policies and tariff threats, particularly toward South Korea and Europe, are only exacerbating global uncertainties and accelerating the flight from dollar assets.

Central banks now hold more gold reserves globally than U.S. Treasury bonds, signaling a historic shift in reserve asset preferences.

As countries diversify their reserves to mitigate risk, gold is emerging as the primary beneficiary of this trend. The geopolitical and economic instability caused by U.S. policies is prompting a flight to safety, with gold seen as a more reliable store of value.

The decline of the dollar and the exodus from U.S. debt markets are structural shifts that are likely to continue in the coming years. As the global economy becomes increasingly multipolar, the dominance of the U.S. dollar is being challenged.

The implications of this trend are far-reaching, with potential consequences for U.S. interest rates, currency markets, and the global economy as a whole.

In conclusion, the global shift away from U.S. dollar assets is accelerating, driven by a combination of fiscal irresponsibility, geopolitical tensions, and eroding trust in the dollar.

As investors and central banks continue to diversify their reserves, gold is emerging as the primary beneficiary. For further insights and information, watch the full video from Sean Foo, which provides a more in-depth analysis of this trend and its implications for the global economy.

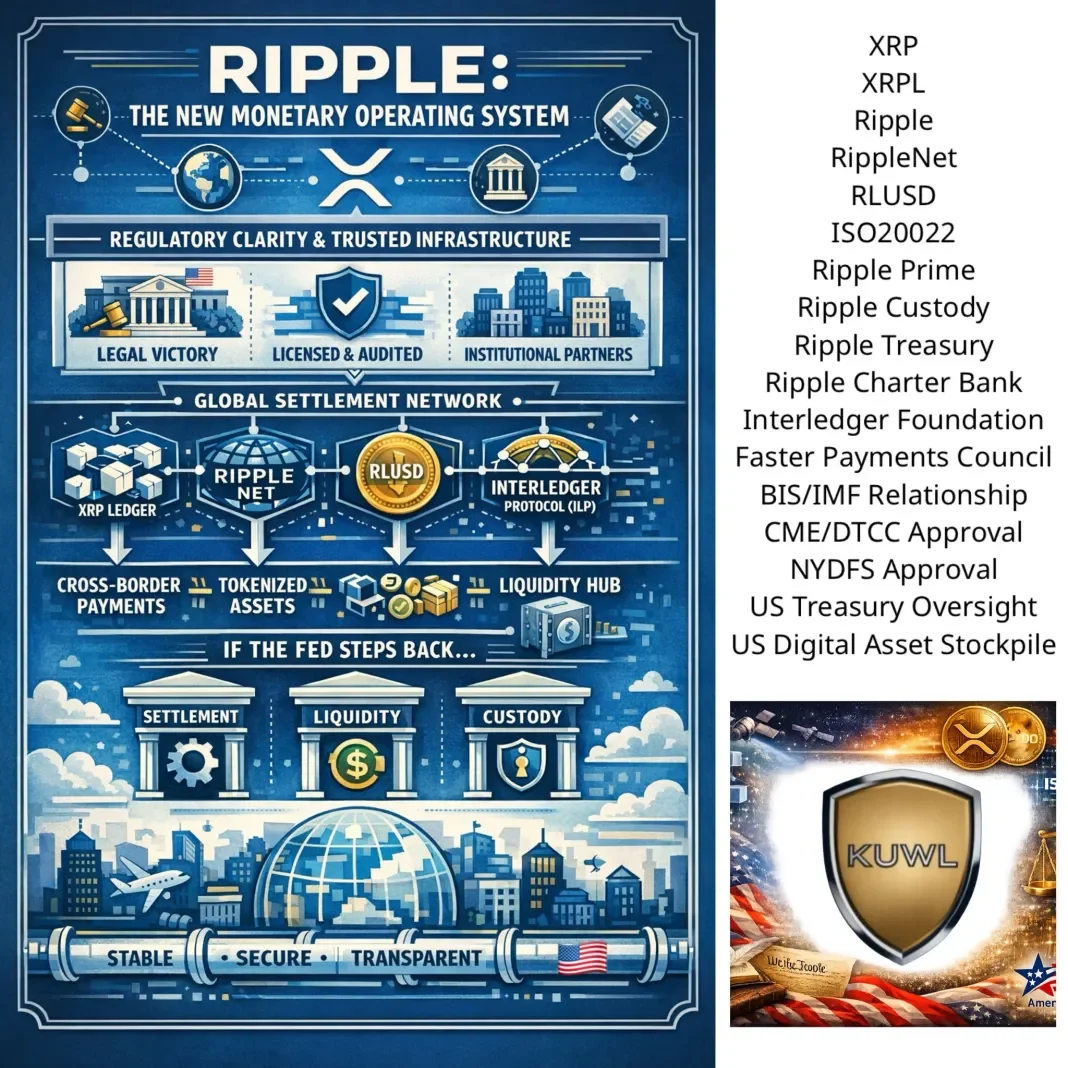

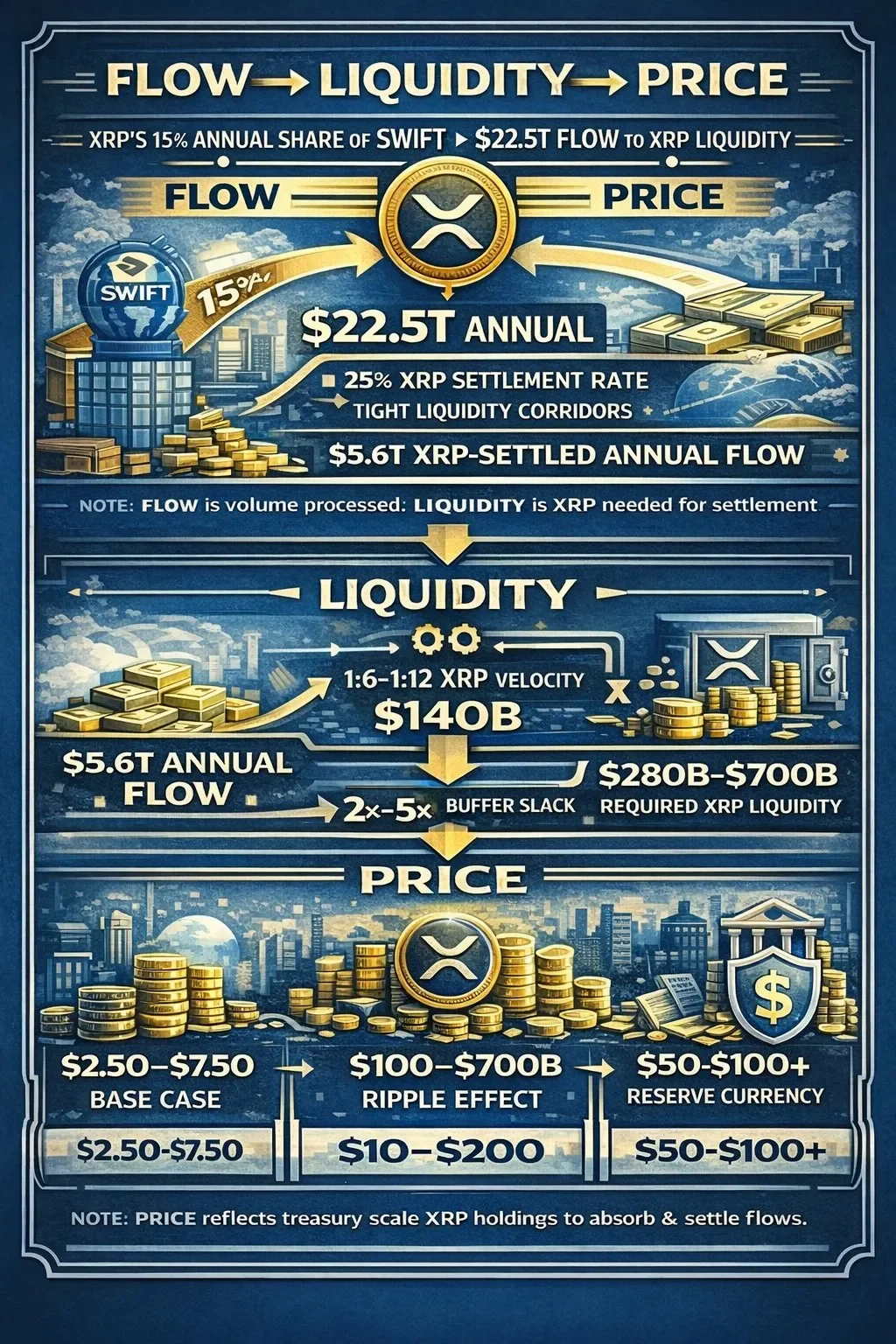

Rob Cunningham: XRP Price is Not a “Crypto” Question

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

This is not a product stack. It’s a monetary operating system in waiting.

And critically, it is being built by Ripple Labs – the only large-scale crypto-native firm that:

Survived full-contact litigation with the U.S. government

Achieved judicial clarity rather than regulatory arbitrage

Maintained institutional relationships through the storm

Never lost operational continuity or balance-sheet solvency

That combination is vanishingly rare.

Regulatory survival has become regulatory advantage

Most actors spent the last decade avoiding clarity. Ripple went through it – and emerged standing.

In any system transition, survivors of the old regime with proof of compliance become default candidates for stewardship in the new one.

That will matter immensely over the next five years.

The XRPL + Interledger + RippleNet triad isn’t just about speed or cost.

It’s about who already sits at the table:

Central banks

Treasury-adjacent institutions

Payment councils

Market infrastructure incumbents

Once a system becomes the meeting place between sovereign rails, private liquidity, and cross-border settlement, replacement becomes politically and operationally expensive.

That’s durable power.

RLUSD quietly solves the “trust gap”

Stablecoins fail when:

Governance is opaque

Custody is unclear

Redemption trust erodes

RLUSD’s design posture – paired with NYDFS discipline – signals something different:

a regulated liquidity instrument meant to be boring, dependable, and invisible.

That’s exactly what large institutions want.

Here’s the subtle but critical insight:

If the Federal Reserve’s role is diluted rather than abolished – through multipolar settlement, bilateral liquidity corridors, and atomic gross settlement – someone still has to run the pipes.

Not policy.

Not discretion.

Pipes.

Ripple’s stack looks increasingly like plumbing, not politics.

So what does this imply for Ripple equity holders?

A casual – but clear-eyed – observer should conclude:

Ripple equity is levered to infrastructure adoption, not token price theatrics

The upside is asymmetric if Ripple becomes:

A settlement backbone

A neutral liquidity intermediary

A custody + compliance hub for tokenized value

The downside is muted relative to peers because:

The company already cleared its largest existential risk

Its customers are institutions, not retail sentiment

In plain language:

If value flows where trust, clarity, and continuity converge, Ripple sits unusually close to the center of that convergence.

the promise to equity owners is not hype-driven upside—but civilizational relevance if the world continues moving toward:

Honest settlement

Atomic reconciliation

Transparent ledgers

Rule-based money instead of discretionary illusion

That’s the long game.

And Ripple appears to be one of the very few still playing it seriously.

XRP price is not a “crypto” question.

It’s a balance-sheet, liquidity, and risk-management question.

Once XRP is treated as:

Plumbing,

Neutral collateral, &

Settlement certainty,

its’ pricing logic will stop looking like Bitcoin and start looking like a Systemically Important Liquidity Asset.

And let’s never forget @JoelKatz’s commentary that the XRP price must be quite high (well above $200 as indicated in image below) to cost-effectively deliver on its’ designed purpose to serve as a neutral liquidity and settlement bridge token the world over.

Strap in. Clarity is guaranteed to come. Adoption after Law. Price after Adoption. Patience is a MAGA-Wealth enhancing virtue, and nothing stops this inevitability. Happy @America250 to all you XRP Fans out there!

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. It is Tuesday, January 27th and you're listening to the big call. Thanks for coming in, everybody. Thanks for coming in to the call everybody. And thank you for being faithful in for these 15 years of the big call. Thank you..

All right, let's talk about what is going on now for us, from an Intel point of view, There's one thing that was signed officially into law yesterday, and that was the Clarity Act that President Trump signed in we'd heard it had been signed a few days earlier, but let's put it this way, the official signature was yesterday, and that means the Clarity Act has to do with our crypto currencies, and especially XRP, which is the currency, the digital coin that is backing the USN money, our new dollar, okay, US, and it's gold backed, and it is being used to help back our, our gold back dollar, asset back dollar. So that's really interesting to me. That's a very cool thing.

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. It is Tuesday, January 27th and you're listening to the big call. Thanks for coming in, everybody. Thanks for coming in to the call everybody. And thank you for being faithful in for these 15 years of the big call. Thank you..

All right, let's talk about what is going on now for us, from an Intel point of view, There's one thing that was signed officially into law yesterday, and that was the Clarity Act that President Trump signed in we'd heard it had been signed a few days earlier, but let's put it this way, the official signature was yesterday, and that means the Clarity Act has to do with our crypto currencies, and especially XRP, which is the currency, the digital coin that is backing the USN money, our new dollar, okay, US, and it's gold backed, and it is being used to help back our, our gold back dollar, asset back dollar. So that's really interesting to me. That's a very cool thing.

Now you mentioned you guys have heard virtual wallet, e wallet, crypto wallet, all of those terms are the same thing, and the E wallet is used for crypto currencies. If you have or you decide to get into that, that's up to you. You'll have an E wallet to work with those digital coins as crypto coins.

Now it doesn’t. It has nothing to do with us in that are in Zim or other currencies or our exchanges, just so you know, it is not the same as our quantum account.

You know, we have a quantum account, which will contain the vast majority of our money in a US Treasury, backed account that we move money from that, from that account, from that account into our primary and secondary bank accounts.

Okay, and remember, the quantum account is non interest bearing, so it's just a holding. It's like holding, you know, your money in a US Treasury backed account nobody gets access to except you, and even the banks can't see it. They don't even see it, and they can't get access to it.

And remember, you move the money in at your leisure. The first 60 to 90 days you move in what you need for the first 60 to 90 days of your projects, move it into your primary, wells, Fargo account, let's say, in my case, and then I'm going to have four sub accounts under that that are secondary accounts. Let's call them underneath the primary, okay?

And that'll be each account will be for each of my four projects. That's how I'm doing it. And I'll put them in the name of the LLC under the whole things under Master trust, under trust, and that's how I'm going to do it. Now. I'll just move funds that I need to from the primary account into those secondary accounts.

Now, So the clarity act went through, and that was really good, and a good thing to have happen.

We don't have absolute belief that the Insurrection Act was signed into law yet, and we may not need to use it because of what's going on in Mogadishu, Minnesota.

I think things may be calmed down. We know that that all of the protesters up there were paid protesters and instigators, and that funding we understand for those people has dried up. I don't think they're going to go out in 20 to 40 below zero and protest without being paid. So I think that you're going to see that decline significantly. Now

let's see what else we can talk about. How about we talk about Melania? Trump, the First Lady.

Now the First Lady has built a documentary called Melania, which is going to air in the United States starting Friday, but Melania is going to open up the New York Stock Exchange tomorrow with the ringing of the bell, which takes place at 930 in the morning, Eastern Standard Time.

And she's supposed to open that up tomorrow.

And I find it very interesting that she is doing it. One of our sources is saying that Melania may be wearing a gold band on her hat, if she wears a hat or and, or she could wearing a gold scarf tomorrow around her neck for her outfit. I was kind of hoping she'd come out of a gold dress, but that might be asking for too much. But I heard about the band around her, a hat and or a gold scarf around her neck.

And by the way, before I go further with that, President Trump today in his rally in Iowa, which I watched all of today, he was wearing a gold tie.

That's a really good indicator, you guys, because with Melania wearing that, with President Trump wearing that gold tie today, it's indicating that we are on the course on QFs, system, yes, and system and swift. System is dead. Swift is gone. There's no more swift that the deep state can use to move anything around the world. And all transactions on QFs even international, happening in 10 seconds. So what that indicates for us is an asset backed which is primarily gold backed currency, and it indicates the new USN currency, and the start, really of NESARA.

Now the start has a lot of components in it, and we may not see all of those roll outs right away. We know it includes a lot about debt forgiveness, about R and R coming back to us about quite a bit, quite a bit.

No more federal income taxes, no more state income taxes, only a consumption tax, which will go after the state and after the federal government. And that's okay, I don't mind that. It's a little better than the VAT tax in Europe, but it's similar in concept, but that one is in NESARA.

So we'll see, we'll see how long all of these things take to be revealed. Okay, now we talked about Melania - now I have a source yesterday that is very well known. You guys would recognize him if I told you who he is.

He said, When we said we heard that tier 4b, would get started with notifications, maybe Wednesday or Thursday. He said, I can't say what day he said, but it is definitely this week.

Now we haven't heard that line before, especially from this individual. I like that. I like the fact that it was definitive. It is definitely this week, I like that. And then today, we heard from another well known source that should be in the know.

He said, he said that eight o'clock Eastern time tonight. So what was that? Two hours ago?

That everything would start with Tier 4b and that we are at the point of no return.

We are at the point of no return.

He also said in this that you no longer going to be required to enter a username password to get into your quantum account. So that's two less things that we need to remember, fingerprint or thumb print or facial recognition. Could be recognizing the entire face as you

It might be both of those or none of those to get in your quantum account, but no longer use your username or password is required, which is cool. You still have your five digit PIN phone, have your new email, which hopefully brand new. It may not have to be brand new. They could be. So be prepared for brand new email and a new email password.

So six items now we're down to four ., and then email, and the password for email, that's going to be pretty easy to get into your account so that you can fund when that's the only reason that you have access to the quantum accounting, quantum financial system, it is to move money from that account into primary accounts.

Okay, all right, let's see what else he also said. The same source said that we are looking for tier 4b notifications over the next three days, all right, which is Wednesday, tomorrow, 28th 29th is Thursday, 30th is Friday.

We should receive, according to his information, we should get notified for the Internet group tier 4B either Wednesday, Thursday or Friday.

Now I can't tell you who to start exchanges exactly, but obviously, the sooner we get it, the sooner we start exchanges. What if we get it Thursday? Do we get numbers Thursday? Do we start exchanges Friday? I think there's a good chance of that. If we get it Friday, do we start on Saturday the last day of the month? I think that's also possible.

What about the theory that nothing's going to happen until February? And remember, February 1 is a Sunday. All right, that's fine. Maybe not. But my information is saying differently.

My information is telling me we're going this week, and so let's see what happens. Hey, guys, look, my Intel has been wrong a lot. I get a lot of little pieces that are always right, but the timing of when we're getting notified and when we're starting exchanges has not happened yet, right? It hasn't happened.

But I like the information we were getting. I like the sources, and I think that for one guy to say it's definitely happening this week, and the other one is giving us a three day window for our notifications to come in tomorrow, Wednesday, Thursday, or Friday but I think we could very well exchange starting this weekend.

Now, if we get started or Saturday, do we still exchange on Sunday? The answer is yes. You would power right through, right through the weekend like it's not even there, and then, of course, go right into because Sunday is going to be February 1, and then we go on from there.

So I hope that answers Jeanne's question of when, and there is an if.

The only thing about this time there wasn't a contingency to it, if such and such happens. Then no if, then statement, if President Trump does everything he's supposed to do in signing off this or that, and the other, if Iran flips their government, starts a new regime, and the Ayatollah is gone, if you know whatever right we do have a peace deal, purportedly, an actual peace deal between Ukraine and Russia .

And that'd be nine wars President Trump has sought so far so. But what do they need for it? They need signatures from both Putin and Zelensky, and when those guys sign off right on deal for that war, and that war can be over, thank God, but they have the peace deal in place. We just need those signatures now. Have they taken this yet? And I don't know about them, maybe I don't know the answer, but I'd say that looks very good, right now for us, very good.

Now, what's happening with gold and silver? Gold went over 50. Was it $5,112? Or something? Today Silver went up, and I think we're treated at 125, I think 108 today, if I'm right, but they're really going and those will be great currencies and great precious metals, obviously, and all the banks are scrambling to buy gold, buy silver, to cover their shorts.

And also, don't forget that that countries are buying gold, and that's one reason, the price of gold is going up so fast But countries are accumulating gold to back their own currencies.

Now, remember, we talked, we're not supposed to talk about specific currencies or rates. It was a, you know, something that was to my handler today, and I'm going to extend to say I'm not going to talk about them either, except to say that they have 48 currencies on the screens last Thursday. And we don't know, maybe we have 48 or more on screens today at the redemption centers.

And I know that you guys have heard certain people talk about banks, banks, banks.

Well, if you want to leave billions of dollars on the table. Go to a bank. If you want to get the highest rate for your currencies, go to the redemption center. And of course, you can't redeem your zim without going to redemption center. And the contract rate is available only for the dinar at the redemption center.

Si I just wanted to extend that to everybody. We've got five call centers in the United States and one in Canada. Canada should have their own number. Don't have that number. I may get it - I may not, I don't know, but I know I've got to get them, obviously, for the United States, and we will put it on our website. So you can call big call universe.com is the site.

You should know that by now, right? But you could be but hey, I think that is majority of what I would have to say to you. Now, remember this when you registered to big call universe, that you put your email in we will send out an email with a toll free number in the email, so you'll have it that way.

And then that's there are some people, and I know some personally, where they change their email or their emails, they stop using the email the Treasury and Wells Fargo by extension, doesn't have their email. How are they going to get the $800 by going to big call universe.com, or by if they've registered, getting the email from us? Well, they're not going to have an email or to go to unless they put an email in. So they may not get it right unless they go to the website and see it

Now, what I'm going to do when this thing goes, and shortly thereafter, I'll send you guys some kind of a podcast that I do. Maybe, I don't know yet, but I'll send you something so that you can track where we're going on our on our projects.

In the meantime, I want to thank Sue, and I want to thank Bob for doing a wonderful job, especially tonight was great. And I want to thank GCK and Pastor Scott for all of your input over the years. And then, of course, thank you satellite team for getting the signal out all over the place, as many as 200 countries.

So let's just see what happens over the next three days, and listen if you want to catch what Melania is going to wear in the morning it's 930 Eastern. Same thing. Most of the news channel, channels that normally cover the opening of the NYSE will have it and just be looking for she had a gold band around her hat, or a gold around her neck. So you guys help me find that. All right, that should be a Eastern tomorrow morning when the markets open. All right, everybody have a great night. Tonight. We'll have a great week. Let's see if this intel holds up, right. God, bless you guys. Let's pray the call out, Well, good night, everybody. Have a great night and we will see you Thursday.

Bruce’s Big Call Dinar Intel Tuesday Night 1-27-26 REPLAY LINK Intel Begins 1:23:23

Bruce’s Big Call Dinar Intel Thursday Night 1-22-26 REPLAY LINK Intel Begins 1:19:00

Bruce’s Big Call Dinar Intel Tuesday Night 1-20-26 REPLAY LINK Intel Begins 1:07:15

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26 REPLAY LINK Intel Begins 1:05:30

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Bruce’s Big Call Dinar Intel Tuesday Night 1-6-26 REPLAY LINK Intel Begins 1:13:10

Bruce’s Big Call Dinar Intel Thursday Night 1-1-26 New Year’s Day NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25 REPLAY LINK Intel Begins 56:00

Bruce’s Big Call Dinar Intel Thursday Night 12-25-25 REPLAY LINK Intel Begins 20:40

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25 REPLAY LINK Intel Begins 1:05:35

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02