Rob Cunningham: XRP Price is Not a “Crypto” Question

Rob Cunningham: XRP Price is Not a “Crypto” Question

1-28-2026

Rob Cunningham | KUWL.show @KuwlShow

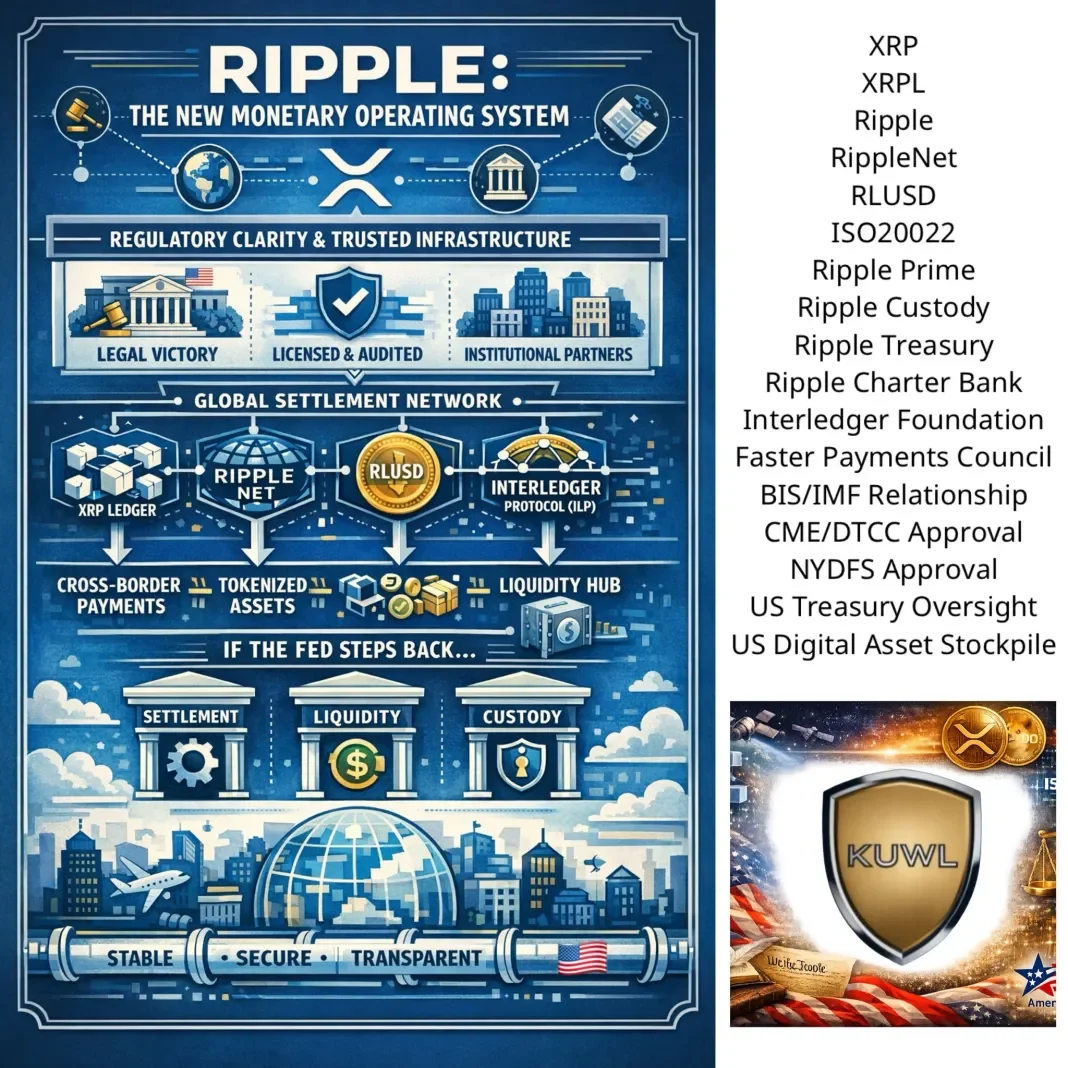

When you line up the assets – XRPL, XRP, RippleNet, RLUSD, custody, prime, treasury services, Interledger, ISO 20022 alignment, NYDFS oversight, CME/DTCC gravity, BIS/IMF adjacency – a pattern emerges that even a non-technical observer can recognize

This is not a product stack. It’s a monetary operating system in waiting.

And critically, it is being built by Ripple Labs – the only large-scale crypto-native firm that:

Survived full-contact litigation with the U.S. government

Achieved judicial clarity rather than regulatory arbitrage

Maintained institutional relationships through the storm

Never lost operational continuity or balance-sheet solvency

That combination is vanishingly rare.

Regulatory survival has become regulatory advantage

Most actors spent the last decade avoiding clarity. Ripple went through it – and emerged standing.

In any system transition, survivors of the old regime with proof of compliance become default candidates for stewardship in the new one.

That will matter immensely over the next five years.

The XRPL + Interledger + RippleNet triad isn’t just about speed or cost.

It’s about who already sits at the table:

Central banks

Treasury-adjacent institutions

Payment councils

Market infrastructure incumbents

Once a system becomes the meeting place between sovereign rails, private liquidity, and cross-border settlement, replacement becomes politically and operationally expensive.

That’s durable power.

RLUSD quietly solves the “trust gap”

Stablecoins fail when:

Governance is opaque

Custody is unclear

Redemption trust erodes

RLUSD’s design posture – paired with NYDFS discipline – signals something different:

a regulated liquidity instrument meant to be boring, dependable, and invisible.

That’s exactly what large institutions want.

Here’s the subtle but critical insight:

If the Federal Reserve’s role is diluted rather than abolished – through multipolar settlement, bilateral liquidity corridors, and atomic gross settlement – someone still has to run the pipes.

Not policy.

Not discretion.

Pipes.

Ripple’s stack looks increasingly like plumbing, not politics.

So what does this imply for Ripple equity holders?

A casual – but clear-eyed – observer should conclude:

Ripple equity is levered to infrastructure adoption, not token price theatrics

The upside is asymmetric if Ripple becomes:

A settlement backbone

A neutral liquidity intermediary

A custody + compliance hub for tokenized value

The downside is muted relative to peers because:

The company already cleared its largest existential risk

Its customers are institutions, not retail sentiment

In plain language:

If value flows where trust, clarity, and continuity converge, Ripple sits unusually close to the center of that convergence.

the promise to equity owners is not hype-driven upside—but civilizational relevance if the world continues moving toward:

Honest settlement

Atomic reconciliation

Transparent ledgers

Rule-based money instead of discretionary illusion

That’s the long game.

And Ripple appears to be one of the very few still playing it seriously.

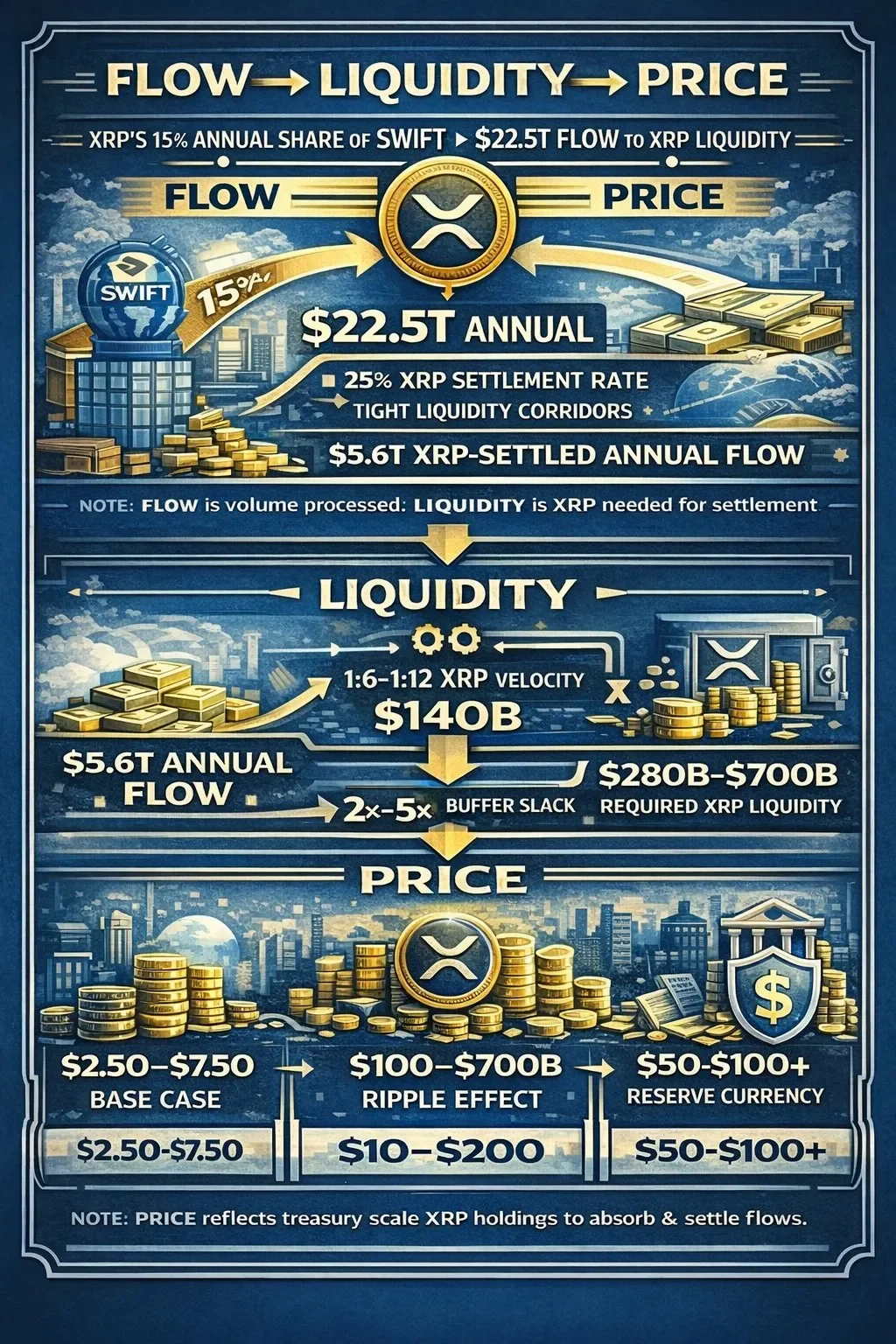

XRP price is not a “crypto” question.

It’s a balance-sheet, liquidity, and risk-management question.

Once XRP is treated as:

Plumbing,

Neutral collateral, &

Settlement certainty,

its’ pricing logic will stop looking like Bitcoin and start looking like a Systemically Important Liquidity Asset.

And let’s never forget @JoelKatz’s commentary that the XRP price must be quite high (well above $200 as indicated in image below) to cost-effectively deliver on its’ designed purpose to serve as a neutral liquidity and settlement bridge token the world over.

Strap in. Clarity is guaranteed to come. Adoption after Law. Price after Adoption. Patience is a MAGA-Wealth enhancing virtue, and nothing stops this inevitability. Happy @America250 to all you XRP Fans out there!