News, Rumors and Opinions Monday 1-19-2026

KTFA:

Clare: Mark Savaya @Mark_Savaya

We had a very successful meeting with Tulsi Gabbard, the Director of National Intelligence, and Joe Kent, the Director of @ODNIgov’s National Counterterrorism Center, during which we discussed a range of critical issues related to the matters I have previously raised.

Our discussions included the role of Iranian-backed militias and related networks. We also highlighted the importance of maintaining and building on the Iraqi government's efforts over the past year to secure borders, fight smuggling and corruption, and strengthen state authority. Under President Donald J Trump’s leadership,

KTFA:

Clare: Mark Savaya @Mark_Savaya

We had a very successful meeting with Tulsi Gabbard, the Director of National Intelligence, and Joe Kent, the Director of @ODNIgov’s National Counterterrorism Center, during which we discussed a range of critical issues related to the matters I have previously raised.

Our discussions included the role of Iranian-backed militias and related networks. We also highlighted the importance of maintaining and building on the Iraqi government's efforts over the past year to secure borders, fight smuggling and corruption, and strengthen state authority. Under President Donald J Trump’s leadership,

I am fully committed to exposing and pursuing wrongdoing wherever it exists, stabilizing Iraq, and ensuring its security in the service of Iraqi sovereignty and the well-being of the Iraqi people. IRAQI PEOPLE WILL MAKE IRAQ GREAT AGAIN ....

Clare: Erbil tells the story of reviving the "gold lira" as an inherited economic refuge

1/18/2026

Erbil (Kurdistan 24) Salar Gharib, who has twenty-three years of experience, begins the journey of converting raw “broken” gold into shiny liras by melting the metal at temperatures ranging from 1300 to 1600 degrees Celsius, after determining the carat with extreme precision to be “21 carat” (91.6% purity), which is the most popular and trusted grade in the local markets.

In keeping with the culture of saving that is deeply rooted in the Kurdistan Region society in all its cities, regions and extensions, and with the increasing demand for the yellow metal as a safe haven for wealth, gold crafting factories in the capital Erbil are witnessing remarkable technical and artistic activity to produce the “gold lira” with local and international specifications, as these small pieces have turned into an economic icon that combines investment value and traditional beauty.

At the heart of a specialized workshop, after the gold is poured into molds to produce longitudinal ingots, the material passes through rolling and pressing machines to form precise gold sheets.

Their thickness is measured with sensitive electronic instruments to ensure a consistent weight. Here, goldsmith Salar points out that the 5-gram gold lira is the most sought-after coin among the residents of Erbil. It is cut to a diameter of 80 millimeters before undergoing a purification and drying process in preparation for the final "minting" or stamping under immense hydraulic pressure of up to 1500 bar, which gives it its distinctive visual identity and seal of quality.

When discussing production capacity, the factory managers emphasize that the increasing demand has prompted them to raise the pace of work. The factory produces between 600 and 700 gold liras daily in various shapes and weights, with the possibility of printing more than 4,000 copies of some highly sought-after models. This reflects a revival in the local industry and the ability of craftsmen in Erbil to compete with imports in terms of accuracy and purity.

Experts believe that, looking at the future of the market, this trend towards local manufacturing of gold savings coins not only provides job opportunities for local staff, but also gives the Kurdish consumer an additional guarantee of purity and weight, so that the “Erbil” gold lira remains a solid bridge that citizens cross towards financial stability that defies the fluctuations of paper currencies. LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 I don't believe Maliki is going to be the next prime minister...To be honest with you, every time we talk about Maliki is a a waste of time...

Jeff You were hearing from other [dinar gurus] that Sudani was out, that he conceded to Maliki. I told you guys that was all B.S. nonsense and you have to know how to correctly vet the news...I told you... Sudani was not out. Sudani did not concede. Many of you guys were frustrated and upset...They still don't have a final decision towards Maliki...You can't trust the political news. It's very misleading and they lie to you extensively in it. Article: "What if Mohammed Shia al-Sudani rebels against the coordination framework..." This article doesn't suggest Sudani conceded to Maliki.

Mnt Goat Article: “AN ECONOMIC OBSERVATORY REVEALS THE CENTRAL BANK OF IRAQ’S CONDITIONS FOR BANKS TO TRADE IN CURRENCIES OTHER THAN THE DOLLAR.” Another step in the breakaway from sanctioned times, this time global payment for trade...But this is not the end yet and there is still much work to be done. Yes, Iraq must get out of this 1991 and 2003 UN sanction-mode mindset and get back to regular international trade processes. We are now witnessing yet another step forward and this is a good one.

Silver 1:1 with Gold? The Hidden Gold That Changes Everything

Bix Weir: 1-18-2026

Financial analyst and creator of the “Road to Roota Theory,” Bix Weir, joins the Friday Night Economic Review for an in-depth, wide-ranging conversation on silver, gold, and the shifting foundations of global power.

- In this discussion, we explore Weir’s view that silver could ultimately reach a 1:1 valuation with gold, and the structural, monetary, and geopolitical forces that could drive such a move.

Rather than a formal presentation, this is a dynamic exchange of ideas—connecting macro trends, suppressed markets, industrial demand, and the growing strains on the global financial system.

- We also dive into potential gold stores around the world and how the acknowledgment of these reserves could radically alter the balance of power between nations.

From central bank strategy to geopolitical leverage, we examine how precious metals may play a critical role in the next phase of the global reset. –

This is a thoughtful, exploratory conversation for those watching the cracks in the current system and looking beyond the headlines. –

Learn more and follow Bix Weir at https:// RoadtoRoota.com

Monday Coffee with MarkZ. 01/19/2026

Monday Coffee with MarkZ. 01/19/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Happy Martin Luther King day.

Member: Good morning . Praying for a good week for us all.

Monday Coffee with MarkZ. 01/19/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Happy Martin Luther King day.

Member: Good morning . Praying for a good week for us all.

Member: Another new week of opportunities. Let's goooo!

Member: Feels like Groundhog Day….or are we on Gilligans Island? What the heck are they still waiting for??

MZ: In Iraq: “Maliki is slipping. Pay attention because Abadi is also opposed” Maliki is having a terrible time trying to get support so he can be Prime Minister.

MZ: “ Al Sudani’s advisor outlines 6 measures to end manipulation in the gold market” Saleh does a deep dive on gold and what it means to the people. People are using it as a store of wealth. I believe they are educating the people towards a gold backing for their currency.

Member: Iraq has a lot to do still. Who is Savaya meeting with today? How much progress has occurred selecting the presidents seat? Any reported progress on HCL? Have the militias disarmed yet?

Member: Fox news reporting this morning that the US has pulled out of Iraq and Iraq announced it

MZ: On the bond side. Nothing. It’s a banking holiday and a Monday. I am waiting for news from a number of contacts. Do they still expect a release tomorrow that they were promised last week?

Member: I believe the bond people will go the same time we go. Shotgun!!!

Member: I wonder- after the bond people , if it holds true and they get their money tomorrow ……how long before we go to the banks?

Member: Frank 26 bank contact in S CAlif says rates out before Jan30

Member:Yes…. Frank26 last night had bank story update where the guy was told to come exchange on Jan. 30n but exchange rate should be revealed before the 30th

Member: Rumor is the 20th is supposed to be a big day. But we've all heard that before.

MZ: I am hearing the 20th is supposed to be a big day as well.

Member: I heard New tax brackets implemented tomorrow along with the 10% cap on credit cards and Basel 3. More money in checks next pay day.

MZ: We do have Trump going to DAVOS this week. Maybe we will hear more about that soon.

Member: Trump is bringing a large delegation to DAVOS. Nesara/Gesara?

Member: There is a massive solar flare set to arrive next two days. Possible no internet no phones

Member: This is quite a movie we are watching.....LOL…looking forward to the end credits so we can start our new lives.

Membere: We were told years ago that things would be crazy at the end. Looks like we are close if that’s the case.

Member: Have a great day everyone. Stay safe and stay warm.

The Mushroom Ladies join the stream today. Please listen to replay for their information

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

“Tidbits From TNT” Monday 1-19-2026

TNT:

Tishwash: Al-Sudani: We are proceeding with the implementation of reform plans

Prime Minister Mohammed Shia' al-Sudani affirmed on Sunday his commitment to implementing reform and development plans and completing projects.

A statement from his media office, received by Al-Rabia, stated that "Al-Sudani received a group of members of the 'I Will Take My Right' movement to review developments in the country and the government's program for achieving development and economic progress."

TNT:

Tishwash: Al-Sudani: We are proceeding with the implementation of reform plans

Prime Minister Mohammed Shia' al-Sudani affirmed on Sunday his commitment to implementing reform and development plans and completing projects.

A statement from his media office, received by Al-Rabia, stated that "Al-Sudani received a group of members of the 'I Will Take My Right' movement to review developments in the country and the government's program for achieving development and economic progress."

He affirmed his commitment to "proceeding with the implementation of reform and development plans and completing projects," praising the movement's stances and its support for the process of construction and development, and its essential role as an important member and partner in the Reconstruction and Development Coalition.

The Prime Minister also stressed the importance of unity and strengthening partnership and cooperation among national forces, in order to expedite the completion of constitutional requirements and combine everyone's efforts to improve the living conditions and services for citizens to meet their aspirations and fulfill their needs. link

Tishwash: Financial advisor: Fixing the exchange rate in the budget is a coordinating decision and enhances market stability.

The Prime Minister's financial advisor, Mazhar Muhammad Salih, stated that the exchange rate in Iraq is subject to a fixed official rate system based on integrated coordination between monetary and fiscal policy, and is not an arbitrary decision.

In an exclusive statement to Al-Mirbad, Salih explained that while the exchange rate is a tool of monetary policy, in practice it is the result of an agreement between the Ministry of Finance and the Central Bank of Iraq and is clearly stipulated in the annual budget.

He added that the reported adoption of an exchange rate of 1,300 dinars per dollar in the 2026 budget represents a significant positive indicator that will contribute to strengthening stability, calming the market, and curbing speculation in the black market and parallel market.

He indicated that the Central Bank sent an official letter to the Ministry of Finance to establish this rate as a fixed element of the general budget, noting that setting the exchange rate is essential given that oil revenues constitute approximately 90 percent of public revenues, which are in foreign currency.

He confirmed that the rate currently in effect is the one announced, pending the finalization of the draft budget upon its official release and submission to Parliament for discussion and approval. link

************

Tishwash: Hassan Ali Al-Daghari: Investment is a fundamental pillar in building the Iraqi economy.

Spokesperson Hassan Ali Al-Daghari affirmed that investment is a cornerstone of building the Iraqi economy and enhancing its capacity to achieve sustainable development. He pointed out that the current phase necessitates creating an attractive environment for both local and foreign capital.

Al-Daghari stated that supporting investment projects contributes to revitalizing various productive sectors, providing genuine job opportunities, and playing a vital role in stimulating the economy and reducing reliance on single resources.

He clarified that investment is not limited to the financial aspect alone, but also encompasses the transfer of expertise and technology and the development of infrastructure.

Al-Daghari emphasized the need to simplify administrative procedures and ensure legislative stability, thereby bolstering investor confidence and encouraging the expansion of the investment base in the country.

He noted that achieving economic development requires concerted efforts between the public and private sectors to build a strong economy capable of confronting challenges. link

Tishwash: Predictions regarding Savaya's plan: Closing all banks except for four... and targeting rebel factions.

With increasing reports of the arrival, or imminent arrival, of Mark Savaya, US President Donald Trump's envoy to Baghdad, a key question arises in political circles: Will he be an adversary or a partner to the ruling group in Iraq?

The answer, according to initial indications, appears complex. Since assuming his post about three months ago, the US envoy has declared a hardline stance against groups cooperating with Tehran and armed factions. However, information circulating in Baghdad suggests the formation of a new relationship between Savaya and the "coordination framework" in its "disarmed" version, which anticipates his arrival as a potential partner in the coming phase.

During the height of the unusual US escalation against Iran, contacts described as "strange and rare" were recorded, involving Iraqi groups that had declared their disarmament attempting to mediate with Tehran for the release of Western detainees. Political sources say that this new relationship will have "scapegoats," namely the few remaining factions that refuse to disarm and relinquish their military and economic capabilities.

According to reports, the US envoy is expected to implement a package of decisions, exclusively published by Al-Mada newspaper last year, concerning the closure of most Iraqi banks, leaving only a limited number—no more than four to six—operating. This is part of a strict US campaign to combat money laundering and cut off Iranian funding sources.

Sources indicate that Savaya's rapid activity, since assuming his duties as special envoy to Iraq last November, stems from the presence of an "Iraqi team ready to cooperate." These sources, who requested anonymity, do not rule out that this activity is linked to the formation of the next government, pointing to signals from Nouri al-Maliki, leader of the State of Law Coalition and the leading candidate so far for prime minister, regarding openness to cooperation with Washington.

Four days ago, during his meeting with the US Chargé d'Affaires in Baghdad, Joshua Harris, Maliki emphasized the necessity of "monopolizing weapons in the hands of the state" and expressed Iraq's desire to "expand the partnership with the United States by activating the Strategic Framework Agreement," according to an official statement issued by his office.

Sources indicate that the "Coordination Framework" is prepared for full cooperation with Savaya on the issue of armed factions, leaving the choice of how to deal with groups refusing to disarm—whether through military force or economic activities—to the United States.While Washington escalated its threats against Tehran, brandishing "very strong" military options before later backing down, the Iraqi resistance factions in Baghdad were preoccupied with other types of conflicts, related to the distribution of positions in the upcoming government and shaping the post-disarmament phase.

For the first time in five years of US-Iranian tension, these groups do not appear poised for large-scale intervention in any potential US strike against Iran, except for limited actions. However, Kataib Hezbollah emerged alone with an escalatory tone, threatening to retaliate against any attack on Iran and describing war as "no picnic." This was followed by another, less well-known group called Saraya Awliya al-Dam (Brigades of the Guardians of Blood).

Four armed groups had previously announced their decision to disarm in exchange for being allowed political participation. All eyes are now on Savaya.

Meanwhile, Savaya shuttled between the US Treasury and Defense Departments, coinciding with intensive diplomatic activity by the US chargé d'affaires in Baghdad, who met with most Iraqi leaders, including Maliki. Official statements from Washington and Baghdad indicate that the two main issues on the table are preventing the participation of armed factions in the next government and cutting off their funding sources and Iran's access to hard currency.

These statements reinforce what Iraqi sources suggest: that Savaya's mission will focus on implementing decisions related to the closure of at least 96 banks. Currently, 37 Iraqi banks are under US sanctions, with expectations that the number will rise to 69, amidst leaks about a US request to seal the banks shut, leaving only a limited number—between four and six—operating.

In this context, Savaya held a meeting on Friday at the White House with US Secretary of Defense Pete Hegseth and Director of Counterterrorism Sebastian Gorka to discuss the details of his upcoming visit to Iraq. In a statement, he said, “The issues discussed will be raised during the upcoming visit, in communication with decision-makers, in a way that serves the interests of the Iraqi people.”

Last Wednesday, US President Donald Trump praised his special envoy’s performance, saying he “did a fantastic job in Iraq.” Meanwhile, rumors continue to circulate in Baghdad that Savaya received five million dollars from Iraqi entities before assuming his duties, amid allegations of “buying American favor,” though these claims remain unconfirmed.

Independent politician and former MP Mithal al-Alusi expressed his pessimism regarding the US envoy’s mission, stating that Savaya and his team “are dealing with a failed state and politicians accused of corruption and crimes.”

Speaking to Al-Mada, al-Alusi warned that the US demands for “a government without militias” and economic sanctions, while essentially Iraqi demands, could be used at the expense of the integrity of the political process. He pointed to recent worrying attempts, including US contacts with Iraqi factions to help secure the release of Westerners detained in Iran during the height of the escalation. He concludes by saying that ignoring the reform of the political process and the protection of freedoms means accepting a more chaotic Iraq, with the Americans content to manage the scene through the embassy, which portends further disintegration of the Iraqi state. link

Mot: But I'm aTrying!!!

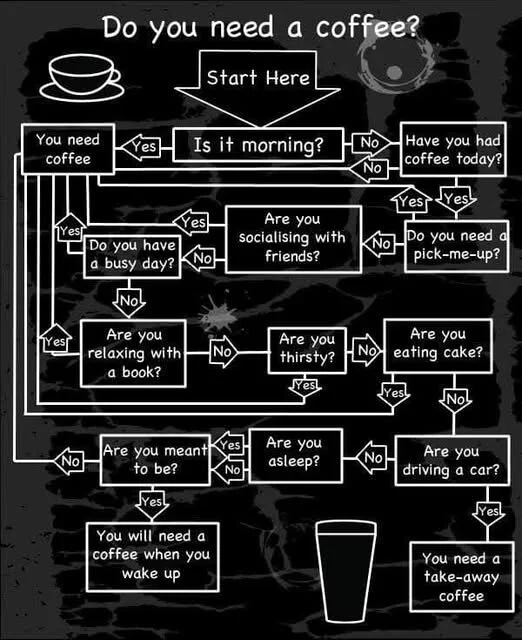

Mot: . The definitive flow chart for coffee!

Seeds of Wisdom RV and Economics Updates Monday Morning 1-19-26

Good Morning Dinar Recaps,

IMF Warns Tariffs and Geopolitical Tensions Are Threatening Global Growth

Rising trade conflicts and political fragmentation signal deeper shifts in the global economic order

Good Morning Dinar Recaps,

IMF Warns Tariffs and Geopolitical Tensions Are Threatening Global Growth

Rising trade conflicts and political fragmentation signal deeper shifts in the global economic order

Overview

The International Monetary Fund issued a fresh warning that escalating tariffs, geopolitical tensions, and economic fragmentation are placing global growth at risk. While near-term forecasts remain stable, the IMF cautioned that policy-driven trade disruptions could undermine supply chains, destabilize markets, and accelerate a structural realignment of the global financial system.

Key Developments

1. Trade Tensions Resurface as a Primary Risk

The IMF identified renewed tariff threats and protectionist policies as a growing danger to global stability. Trade barriers are re-emerging not as temporary measures, but as strategic tools tied to national security and political leverage.

2. Geopolitical Fragmentation Is Reshaping Markets

According to the Fund, geopolitical rivalries are increasingly influencing trade flows, investment decisions, and currency alignment. Countries are prioritizing resilience and sovereignty over efficiency, contributing to long-term economic fragmentation.

3. Supply Chains Face Renewed Stress

The IMF warned that politicized trade could disrupt global supply chains that remain fragile following recent crises. Higher costs, delays, and regionalization are expected outcomes if tensions continue.

4. Financial Markets React to Policy Uncertainty

Markets have shown increased volatility as investors respond to tariff rhetoric and diplomatic strain. Capital is rotating toward perceived safe-haven assets, reflecting declining confidence in policy coordination.

Why It Matters

The IMF’s warning underscores a critical shift: global growth is no longer driven by cooperation, but constrained by conflict. Tariffs and political risk act as hidden taxes on economies, reducing productivity, raising inflationary pressure, and complicating central bank decision-making worldwide.

This environment increases the likelihood of financial shocks and accelerates the transition away from the post-World War II economic framework.

Why It Matters to Foreign Currency Holders

For foreign currency holders waiting on revaluation or reset-driven gains, this development is significant:

Trade fragmentation weakens legacy reserve currency dominance, particularly as trust in rules-based systems erodes.

Countries facing tariff pressure may seek currency realignment, bilateral trade settlement, or alternative payment systems.

Economic stress often precedes monetary restructuring, especially in nations with undervalued or tightly managed currencies.

In short, rising trade conflict increases the probability of currency recalibration as part of broader systemic reform.

Implications for the Global Reset

Pillar 1: End of Unrestricted Globalization

The IMF’s message confirms that the era of frictionless global trade is fading. A multipolar system built on regional alliances, strategic resources, and controlled capital flows is taking shape.

Pillar 2: Monetary System Under Pressure

As trade blocs harden and geopolitical trust declines, the existing monetary order faces strain. Currency diversification, commodity-linked trade, and alternative settlement mechanisms become more attractive.

This is not a temporary disruption — it is structural realignment.

This is not just about tariffs — it’s about the controlled dismantling of the old economic playbook.

Seeds of Wisdom Team

Newshounds News

Sources

IMF official blog / outlook update (detailed World Economic Outlook commentary)

Reuters summary of the IMF growth outlook including tariff risks

The Guardian on IMF headline warning about tariffs & geopolitical tensions

Argus Media on IMF warning about major risk from US-EU tensions

~~~~~~~~~~

U.S. Targets NATO Over Greenland as BRICS Quietly Gains Ground

Tariff escalation against allies exposes fractures in Western unity while accelerating multipolar realignment

Overview

The United States has launched an unprecedented tariff campaign against key NATO allies following their opposition to President Donald Trump’s proposed Greenland acquisition. Beginning February 1, 2026, eight NATO countries will face a 10% tariff, escalating to 25% by June if no agreement is reached. At the same time, the administration issued renewed tariff threats against BRICS nations, a move analysts warn may unintentionally strengthen the very bloc Washington seeks to contain.

Key Developments

1. Tariffs Target Eight NATO Allies

The U.S. confirmed tariffs against Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland after those nations supported Danish sovereignty and deployed forces to Greenland. The administration framed the move as a matter of Arctic mineral security and strategic control.

2. Greenland Becomes a Geopolitical Flashpoint

President Trump publicly argued that U.S. control over Greenland is essential to global security, warning that allied resistance creates unacceptable risk. NATO leaders sharply rejected the rationale, calling tariffs on allies damaging to collective security and alliance cohesion.

3. European Leaders Signal United Pushback

European officials warned that tariff threats against allies would be met with a coordinated response. Statements from London and Paris emphasized that economic coercion has no place within NATO relations, highlighting growing transatlantic strain.

4. BRICS Quietly Benefits From Western Division

As NATO unity fractures, BRICS nations gain strategic leverage. Trump simultaneously threatened BRICS members with additional tariffs for pursuing alternative trade systems and currencies — reinforcing perceptions that the West is using economic force to preserve dominance.

Why It Matters

This episode marks a major escalation in intra-Western economic conflict. Tariffs once aimed at rivals are now being used against allies, undermining trust, cooperation, and the rules-based order that underpinned postwar globalization.

Rather than isolating competitors, the strategy risks accelerating economic fragmentation and weakening Western influence in global trade and finance.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation or reset-driven gains, this development is notable:

Alliance fractures weaken confidence in legacy financial leadership, particularly U.S.-centric trade enforcement.

Escalating tariffs increase incentives for non-dollar settlement systems and regional trade agreements.

Pressure on both NATO and BRICS heightens the probability of currency realignment as nations hedge against U.S. policy risk.

Periods of geopolitical stress often precede monetary restructuring, especially when trade and security collide.

Implications for the Global Reset

Pillar 1: Breakdown of Traditional Alliances

Using tariffs against NATO allies signals that strategic alignment no longer guarantees economic cooperation. This accelerates the move toward regional blocs and self-interest economics.

Pillar 2: Multipolar Currency Momentum

Threats against BRICS currencies validate the bloc’s motivation to develop alternatives. The more coercive the pressure, the stronger the incentive to bypass existing monetary rails.

The global system is shifting — not through collapse, but through controlled fragmentation.

This is not just a trade dispute — it is a signal that the old alliance-based economic order is being rewritten in real time.

Seeds of Wisdom Team

Newshounds News

Sources

Watcher.Guru — Trump Targets NATO Over Greenland as BRICS Quietly Gains Ground

Reuters — Trump’s Greenland threat puts Europe back in tariff crosshairs

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Morning 1-19-26

Six measures to protect gold and regulate its market: Mazhar Saleh explains Iraq's vision for national wealth.

Time: 2026/01/19 Readings: 105 times {Economic: Al-Furat News} The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, outlined six key measures on Monday to regulate the gold market, noting that the Gold City project is a strategic initiative to protect one of the nation’s greatest assets.

Saleh said in a press statement: “The global rise in gold prices has not led to a decline in demand for it in the local market, but rather has contributed to changing its function from an ‘ornamental commodity’ to a ‘savings tool and protection of value,’ stressing the ‘need to adopt a unified national mark and the obligation of modern technical examination to protect household savings.’”

Six measures to protect gold and regulate its market: Mazhar Saleh explains Iraq's vision for national wealth.

Time: 2026/01/19 Readings: 105 times {Economic: Al-Furat News} The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, outlined six key measures on Monday to regulate the gold market, noting that the Gold City project is a strategic initiative to protect one of the nation’s greatest assets.

Saleh said in a press statement: “The global rise in gold prices has not led to a decline in demand for it in the local market, but rather has contributed to changing its function from an ‘ornamental commodity’ to a ‘savings tool and protection of value,’ stressing the ‘need to adopt a unified national mark and the obligation of modern technical examination to protect household savings.’”

He added that "this functional transformation of the yellow metal makes quality control and government oversight an urgent economic and social necessity, as it protects families' wealth and enhances confidence in the market," indicating that "quick and low-cost procedures, such as the unified national marking and rapid technical inspection, represent sufficient means to restore discipline and reduce manipulation."

Saleh pointed out that “gold remains a symbol of family security and savings for generations in the Iraqi social memory, and with rising prices, it has become part of the tools of unofficial monetary policy, as it is a store of value parallel to the dinar,” noting that “regulating the market is not a formal procedure, but rather a basic condition for building confidence and protecting national wealth.”

Saleh called for "a comprehensive reform of the gold market system, through the adoption of a unified and mandatory Iraqi mark that includes (carat, testing authority, and year of mark), while criminalizing the trading of unmarked gold," stressing "the importance of strengthening oversight through field testing using modern technologies such as (XRF), which reveals the truth about gold immediately without causing any damage to the pieces."

The financial advisor added that "the next stage requires regulating gold smelting and import operations through workshop licensing and tightening border inspection, as well as establishing a national register for gold traders and adopting unified official invoices to reduce undocumented trading," noting that "empowering the consumer through awareness campaigns and effective reporting mechanisms represents a fundamental pillar in this system."

Saleh concluded his remarks by saying: “The institutional completion of the ‘City of Gold’ project has become an urgent necessity, as it represents the official incubator for protecting this great national wealth and providing the highest standards of legal and professional protection for it.” LINK

A US Official Admits To Rigging The Tax System And Stealing Citizens' Money.

Today 13:50 Information/Follow-up... US Deputy Secretary of Health Jim O’Neill sparked widespread controversy after describing the US tax system as “rigged,” asserting that taxpayers’ money is not being spent in the channels intended for it.

“You pay taxes and health insurance premiums, but where does that money go? The vast majority of it is spent on scams, political campaigns, illegal immigrants, and large corporations that provide no real benefit to citizens,” O’Neill wrote in a post on the X platform.

He added: “The system is rigged,” expressing his dissatisfaction with the mismanagement of public resources and the lack of effective oversight of government spending.

O'Neill's statement comes amid growing criticism within the United States regarding corruption and the waste of public funds. Last May, businessman Elon Musk, while serving as an advisor to the Government Efficiency Management Initiative (DOGE), revealed that some civil servants were spending public funds on renting luxury hotels and sports stadiums for private parties. /25 LINK

Economic Expert: Lebanon Is Not Paying Its Dues To Iraq And Is Importing Fuel Oil From Kuwait.

Today Information / Baghdad… Economic expert Nabil Al-Marsoumi confirmed on Monday that Lebanon's outstanding debts to Iraq as a result of fuel sales amounted to $2.7 billion, noting that Baghdad has not yet demanded these debts.

Al-Marsoumi said in a Facebook post, which was reviewed by Al-Maalouma Agency, that “Iraq is forced to cut part of its employees’ salaries to address the financial crisis, while Lebanon continues not to pay its dues and proceeds to import fuel from Kuwait instead of Iraq, which exacerbates the financial contradiction between the two countries.”

He pointed out that "Lebanon's failure to meet its debt obligations is a blow to the Iraqi economy and increases pressure on the state treasury," calling for "urgent steps to be taken to recover the financial dues."

Fuel oil is a type of liquid fuel used primarily in power plants and heavy industries, and is considered one of the most important energy sources in Iraq, Lebanon, and neighboring countries. End/25 LINK

Parliamentary Movement To Overturn The Decisions Of The Ministerial Council For The Economy That Violate The Law

January 18, 10:45 The Information/Baghdad… MP Mohammed Qutaiba al-Bayati revealed on Sunday a parliamentary movement to overturn the decisions of the Ministerial Council for the Economy regarding the recognition of academic degrees and the suspension of transfers between ministries, arguing that they violate existing laws.

Al-Bayati told Al-Maalouma that “the decisions issued by the Ministerial Council for the Economy included a number of provisions that suspended or amended existing legal texts, including the recognition of academic degrees for initial appointments, the suspension of the recognition of degrees obtained by employees except for those on study leave, as well as the suspension of transfers between certain ministries and the five-year leave of absence.”

He added that “these decisions represent a clear overreach of the legislative authority and a violation of the principle of separation of powers,” explaining that “the Council of Ministers is currently exercising the powers of a caretaker government, and therefore its decisions should be limited to managing daily affairs and providing services, and it does not have the authority to make decisions that fall outside its defined jurisdiction.”

Al-Bayati indicated that "this file has been referred to the Council of Representatives for a legislative decision to repeal the parts that violate the law, given that legislation is of the highest rank and authority, and legislative decisions are binding on all authorities."

He pointed out that "the issuance of such decisions by the Council of Ministers has negative repercussions on public opinion and leads to a loss of public trust in state institutions." End/25 LINK

The Sudanese Government Directs The Formation Of Technical Committees To Study Proposals Supporting The Government's Economic Plans.

Time: 2026/01/19 Reading: 60 times

{Political: Al-Furat News} Prime Minister Mohammed Shia Al-Sudani directed the formation of special technical committees to study all proposals that support the government's economic plans, during his chairmanship of the Ministerial Council for the Economy meeting on Monday.

The Sudanese Media Office stated in a statement received by Al-Furat News that "during the meeting, the topics on the agenda were discussed, especially those related to maximizing resources and reducing expenditures, and the discussion of means and frameworks for reducing expenditures and maximizing state resources in accordance with applicable laws was completed."

The meeting discussed the Council’s recommendation to the Ministry of Oil, which aimed to determine the percentages of support and address the financial situation, in addition to examining proposals submitted by various government agencies regarding reducing spending, as well as discussing support mechanisms provided by the Export Support Fund, adding support through loans, and creating an economic environment that supports the non-oil economy and diversifies resources.

At the conclusion of the meeting, the Prime Minister directed the formation of special technical committees to study all the proposals put forward in order to support the government’s plans in this regard. LINK

Between Restoring Rights And International Action: Iraq Faces A Crossroads Of Economic Salvation.

Time: 2026/01/19 Reading: 60 times {Economic: Al-Furat News} Legal researcher Ali Al-Tamimi confirmed on Monday that recovering smuggled Iraqi funds and international action represent a fundamental approach to addressing the economic crisis the country is going through, noting that there are clear legal and international frameworks that Iraq can rely on in this path.

Al-Tamimi explained in a statement received by Al-Furat News that "there is the 2003 Anti-Money Laundering Convention, which entered into force in 2005, concerning the recovery of laundered funds. Articles (55 and 56) of the Convention outline the process for recovering these funds."

He indicated that Iraq signed the Convention in 2007 under Law No. 35 of 2007, while the value of the laundered funds is estimated at approximately $500 billion. He pointed to the possibility of coordinating with the United Nations, as the Convention is deposited with it under Article 102 of the UN Charter, as well as coordinating with countries in whose banks these funds have been deposited, similar to the experiences of countries such as Nigeria, the Philippines, Singapore, Egypt, and Tunisia, stressing that the current time is the most appropriate for international action in this direction.

He added, "There are about $65 billion in the US Federal Reserve Bank belonging to the former regime and owned by the Iraqi people," noting that the US president issues an annual executive order to protect these funds from creditors' claims. He stressed that Iraq has the legal right to claim them based on Articles (27 and 28) of the 2008 Iraqi-American Strategic Agreement, which allows Iraq to request economic assistance from the United States, as it is a binding agreement for both parties.

Al-Tamimi explained that “according to Article 50 of the United Nations Charter, countries that are fighting against countries, entities, or organizations placed under Chapter VII may request economic assistance from the Security Council,” noting that Britain and France have announced their readiness to provide economic assistance to Iraq. He pointed out that Iraq fought the ISIS terrorist organization, which is placed under Chapter VII pursuant to UN Security Council Resolution 2170.

He pointed out that "Iraq has exited the provisions of Chapter VII after paying the financial obligations with Kuwait amounting to four and a half billion dollars, warning that the continuation of political, security and economic crises may push the Security Council to return Iraq to international trusteeship, which requires serious action in these important directions."

Al-Tamimi stressed that “internal efforts remain important and complementary, but salaries cannot be reduced, delayed, or not disbursed, as they are regulated by applicable laws, including the Civil Service Law and the Salary Scale Law, stressing that state institutions cannot continue without disbursing salaries, which represent the key to the work of employees.”

He concluded by saying that "the current parliament has an important opportunity to direct and make appropriate decisions in this direction, to open all previous files, and to conduct retrospective parliamentary investigations, in order to save the country from international crises and the decline in oil prices, stressing that prevention is better than cure." From... Ragheed LINK

MilitiaMan and Crew: IQD News Update-"Iraq REER Readiness: Non-Oil & WTO Progress"

MilitiaMan and Crew: IQD News Update-"Iraq REER Readiness: Non-Oil & WTO Progress"

1-18-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-"Iraq REER Readiness: Non-Oil & WTO Progress"

1-18-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….1-18-26……ECONOMIST AND BANK STORY

KTFA

Sunday Night Video

FRANK26….1-18-26……ECONOMIST AND BANK STORY

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Sunday Night Video

FRANK26….1-18-26……ECONOMIST AND BANK STORY

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

This Catalyst Pushes Silver Into Triple Digits & Keeps It There

This Catalyst Pushes Silver Into Triple Digits & Keeps It There

Steve Penny & Michelle Makori: 1-17-2026

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, sits down with Steve Penny, Founder of SilverChartist, to break down where we are in this silver bull rally.

Penny discusses what it will actually take for silver to break above $100 an ounce and stay there for good. Silver is up more than 180% year-over-year and has already traded above $100 in Shanghai, while Western markets lag behind.

This Catalyst Pushes Silver Into Triple Digits & Keeps It There

Steve Penny & Michelle Makori: 1-17-2026

Michelle Makori, President & Editor-in-Chief, Miles Franklin Media, sits down with Steve Penny, Founder of SilverChartist, to break down where we are in this silver bull rally.

Penny discusses what it will actually take for silver to break above $100 an ounce and stay there for good. Silver is up more than 180% year-over-year and has already traded above $100 in Shanghai, while Western markets lag behind.

Penny explains why this divergence matters, how true price discovery is shifting toward physical markets, and why the decades-long paper-driven pricing model may be breaking down.

In this interview, Steve walks through the largest technical breakout in silver’s history, key support and pullback levels, the role of industrial demand from AI, solar, and defense, and why central bank policy and debt dynamics are setting the stage for sustained triple-digit silver.

He also outlines realistic price targets, the risks of intervention, and where silver miners fit into the next phase of this bull market.

Steve also shares his top trade of 2026 and it is not silver. In this episode of The Real Story:

Why silver above $100 may become permanent, not temporary

The Shanghai premium and what it signals about physical demand

Paper vs. physical silver: is price discovery finally shifting?

The “mother of all cup-and-handle” breakout explained

Key support levels and pullback risks traders should watch

Why silver miners are lagging

How debt, inflation, and Fed policy feed the silver bull case

Steve’s top trade of 2026

Introduction

02:09 Interview with Steve Penny

03:38 Factors Driving Silver's Rally

04:54 Supply & Demand Dynamics

08:38 Shanghai Premium & Market Manipulation

11:14 Technical Analysis of Silver

17:17 Historical Context & Future Predictions

23:53 Potential Pullbacks & Support Levels

27:41 Bull Case Scenario for Silver

29:24 Predicting $300 Silver by 2030

30:01 Gold-Silver Ratio Strategies

34:01 Comparing Historical & Current Fundamentals

39:01 Geopolitical Impacts on Silver & Gold

41:00 Central Banks & Silver Investments

44:31 Silver Miners vs. Silver Prices

47:42 National Debt & Precious Metals

51:26 Top Investment Picks for 2026

54:24 Personal Insights & Final Thoughts

Thoughts from Paul Gold Eagle: Economic Transition and Legal Structure

Thoughts from Paul Gold Eagle: Economic Transition and Legal Structure

1-18-2026

Paul White Gold Eagle @PaulGoldEagle

PHASE V: ECONOMIC TRANSITION & LEGAL STRUCTURE

OPERATION: GOLD STANDARD REBOOT [ACTIVE]

CLASS: SOVEREIGN RESET // QFS NODE ONLINE

STATUS: PHASE V ENGAGED

Thoughts from Paul Gold Eagle: Economic Transition and Legal Structure

1-18-2026

Paul White Gold Eagle @PaulGoldEagle

PHASE V: ECONOMIC TRANSITION & LEGAL STRUCTURE

OPERATION: GOLD STANDARD REBOOT [ACTIVE]

CLASS: SOVEREIGN RESET // QFS NODE ONLINE

STATUS: PHASE V ENGAGED

“We are returning power to the people.” – Q

[THE OLD SYSTEM = DEAD]

[CENTRAL BANKING > DISSOLVED]

[FIAT = NULLIFIED]

[SLAVERY CHAINS REMOVED]

[QFS > GOLD-BACKED SOVEREIGN ECONOMY]

[HR 5404 – GOLD-BACKED USTN]

Introduced by Rep. Mooney (2018)

Purpose: Define dollar as fixed weight of gold – Suppressed. Buried. Ignored.

But LEGAL FRAMEWORK ESTABLISHED

Used as template for post-FED issuance of USTN (U.S. Treasury Notes)

Digital + Physical. Backed by Fort Knox + Recovered Vatican Gold.

[USTN = OFFICIAL QFS CURRENCY OF REPUBLIC]

No inflation.

No printing.

No manipulation.

Value = Locked to substance.

[IRS → TERMINATED]

IRS = Private Corporation.

Registered in Puerto Rico.

Serviced the Crown/Vatican cabal via FED collection systems.

Audited. Compromised. Terminated. Replaced with 14% flat consumption tax (non-invasive, no tracking).

Taxation = based on choice, not coercion. Constitutional alignment restored.

[FEDERAL RESERVE → ABSORBED]

Not abolished.

Nationalized.

Absorbed by U.S. Treasury via EO 13885 + quiet legislation

Assets + liabilities transferred

Private central bank > Converted to public asset hub

Chairpersons = removed

Accounts = frozen

Gold revaluation event = complete

“End the Fed.” – Ron Paul

“Done in silence.” – Q

[GLOBAL DEBT JUBILEE]

Biblical reset activated

National debts = zeroed

Personal debts = wiped

Credit scores = deleted

Enforced by QFS AI

Tracked via ISO tokens

All mortgages, loans, credit chains = terminated

“You are no longer debt slaves.” – Q

[UNIVERSAL BASIC INCOME – GESARA FORMAT]

UBI = Not socialism.

It’s wealth repatriation.

Paid from seized Deepstate assets (EO 13818)

Delivered via XLM / QFS smart contract distribution system

Monthly stipend auto-deposited to each sovereign citizen

Use = food, shelter, energy, self-sufficiency – Paired with free energy systems, suppressed medbeds, water tech

[LEGAL FRAMEWORK RESET]

– Constitutional Law restored

– Maritime/Admiralty Law removed

– Corporate U.S. dissolved (Act of 1871 repealed)

– All sovereign rights reinstated

No more birth certificate bonds

No more Social Security contracts

You = Free living being under divine law

[QFS + STARLINK = PLANETARY FINANCIAL GRID]

Every transaction = verified + mirrored on quantum blockchain

Every citizen = biometric ID linked to sovereign trust account

No hacking

No laundering

No central control

Decentralized through satellite architecture

Starlink = Banking satellites + Space Force nodes

4,000+ orbital QFS mirrors = Global trust network

“This is the NEW EARTH financial system.” – Q

[THE FINAL FLIP]

Fiat = dead

Gold = revived

Power = returned

Cabal = disarmed

All banks must comply

ISO 20022 enforced

Blockchain = new law

QFS = final layer

Source(s): https://x.com/PaulGoldEagle/status/2012798301905859046

https://dinarchronicles.com/2026/01/18/paul-gold-eagle-economic-transition-and-legal-structure/

Seeds of Wisdom RV and Economics Updates Sunday Afternoon 1-18-26

Good Afternoon Dinar Recaps,

World Economic Forum 2026 Highlights a Fracturing Global Order

Davos rhetoric shifts from coordination to containment

Good Afternoon Dinar Recaps,

World Economic Forum 2026 Highlights a Fracturing Global Order

Davos rhetoric shifts from coordination to containment

Overview

The 2026 World Economic Forum in Davos is underscoring a stark reality: the rules-based global order is no longer assumed — it is being questioned. Amid rising geopolitical instability, trade tensions, and escalating military spending, global leaders are emphasizing economic resilience, conflict mitigation, and selective multilateral cooperation, rather than broad consensus-building.

While Davos remains a premier venue for elite dialogue, this year’s tone reflects strategic mistrust rather than unity, revealing how deeply fragmentation pressures have penetrated even traditional coordination forums.

Key Developments

Leaders openly acknowledge geopolitical instability and trade fragmentation

Rising protectionism and defense spending dominate economic discussions

Focus shifts toward national resilience strategies over global integration

Multilateral cooperation framed as conditional and issue-specific, not universal

Why It Matters

The Davos consensus model shows visible strain under multipolar pressures

Economic coordination is increasingly fragmented by national interest

Trade and monetary disagreements now shape elite strategy discussions

Global institutions appear reactive, not directive, in managing disorder

Why It Matters to Foreign Currency Holders

Fragmentation increases the likelihood of currency realignment and diversification

Reduced confidence in coordinated policy supports hard assets and non-dollar exposure

Currency holders anticipating a Global Reset watch Davos signals closely for elite positioning shifts

Quiet preparation for parallel systems often precedes formal monetary change

Foreign currency holders understand that elite dialogue often telegraphs future policy, even when official outcomes appear muted.

Implications for the Global Reset

Pillar 1: Institutional Fragmentation

Davos discussions reveal weakening confidence in global governance frameworks, accelerating the shift toward regional blocs, bilateral agreements, and parallel institutions.

Pillar 2: Trade and Monetary Realignment

Disputes over trade rules, sanctions, and monetary policy reinforce momentum toward multipolar settlement systems and diversified reserves, core mechanics of a systemic reset.

This is not just politics — it’s global finance restructuring before our eyes.

Strategic Takeaway

Davos 2026 does not project collapse — it projects adaptation under strain. The global elite appears less focused on preserving the old order and more concerned with managing fragmentation without triggering systemic shock.

When consensus fades, contingency planning takes center stage

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

United Nations Warns Global Growth Resilience Is Fragile

Short-term stability masks deeper structural vulnerabilities

Overview

A newly released United Nations report warns that global economic resilience remains fragile, despite near-term stability in select regions. While inflation has moderated and growth has avoided outright contraction, the U.N. cautions that trade tensions, fiscal strain, and uneven investment flows continue to cap long-term expansion.

Persistent uncertainty, according to the report, may keep global growth below historical averages for years, increasing pressure on governments and institutions to rethink economic frameworks.

Key Developments

Global growth shows short-term resilience, but lacks durable momentum

Trade tensions and protectionist policies remain unresolved

Fiscal space is narrowing across both developed and emerging economies

Investment remains uneven and risk-averse, limiting productivity gains

Structural uncertainty threatens long-term economic confidence

Why It Matters

Fragile growth undermines confidence in traditional economic models

Slower expansion increases reliance on policy intervention and debt

Economic stress amplifies geopolitical friction and regional fragmentation

Sustained underperformance fuels calls for systemic reform

Stable growth has historically underpinned geopolitical balance. When growth weakens, pressure for structural change accelerates.

Why It Matters to Foreign Currency Holders

Weak global growth often precedes currency realignment and diversification

Nations facing constrained growth explore non-traditional monetary tools

Reduced confidence in fiat stability strengthens interest in alternative assets and currencies

Foreign currency holders anticipating a Global Reset view prolonged stagnation as a key trigger condition

Slow growth does not delay resets — it often forces them.

Implications for the Global Reset

Pillar 1: Erosion of Traditional Growth Models

Persistent subpar growth challenges debt-driven expansion and reinforces the search for new monetary and fiscal architectures.

Pillar 2: Pressure for Systemic Redesign

Economic stagnation increases political and institutional willingness to consider reset mechanisms, including trade restructuring, reserve diversification, and alternative settlement systems.

This is not just economics — it’s global finance restructuring before our eyes.

Strategic Takeaway

The U.N.’s warning signals that resilience without momentum is not stability. When growth remains fragile, systems do not break immediately — they quietly evolve, often toward new frameworks that promise sustainability where the old ones no longer deliver.

When growth stalls, the system starts looking for an exit

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

United Nations – “World Economic Situation and Prospects: Fragile Growth Outlook”

United Nations Conference on Trade and Development – “Global Trade Update”

~~~~~~~~~~

BRICS Isn’t Ditching the Dollar — It’s Quietly Building Around It

De-dollarization by infrastructure, not confrontation

Overview

BRICS nations are not attempting to overthrow the U.S. dollar outright. Instead, they are systematically reducing reliance on it by expanding local-currency trade, developing alternative payment infrastructure, and strengthening financial autonomy across the bloc.

By 2025, roughly 25% of intra-BRICS trade is now settled in local currencies — a milestone that signals gradual but deliberate movement away from dollar-centric systems, without triggering systemic shock.

This strategy reflects pragmatism, not rebellion: build parallel rails first, reduce dependency second.

Key Developments

Around one-quarter of BRICS mutual trade now settled in local currencies

Russia and China conduct over 99% of bilateral trade in rubles and yuan

Brazil, China, Egypt, and others adopt bilateral currency settlement agreements

Local-currency trade expanded formally across BRICS frameworks in mid-2025

Dollar remains dominant globally, but alternatives are now operational

Bilateral Settlements Reduce Dollar Dependence

Russia and China have completed one of the most significant shifts, settling 99.1% of trade payments in their national currencies, according to Russian Finance Minister Anton Siluanov. This reflects how geopolitical pressure and sanctions exposure accelerate monetary adaptation.

Brazil and China removed the dollar entirely from bilateral trade settlement in 2023, while Egypt and other BRICS participants followed with similar arrangements. These moves reflect function-over-symbolism: avoid dollar rails where possible without destabilizing global trade.

Alternative Payment Infrastructure Expands Quietly

BRICS nations continue developing parallel financial infrastructure rather than a single unified currency.

China’s Cross-Border Interbank Payment System (CIPS) now spans over 100 countries

BRICS Pay pilots link national payment networks instead of replacing them

A gold-anchored settlement unit pilot launched in late 2025, blending metal backing with local currencies

These systems allow trade settlement outside traditional dollar channels while preserving flexibility.

Strategic Implementation, Not Dollar Elimination

Leaders across the bloc emphasize balance over confrontation.

Russian President Vladimir Putin has repeatedly stated that BRICS is not fighting the dollar but responding to restricted access. Brazil’s presidential advisor Celso Amorim echoed that sentiment, noting that the U.S. remains a foundational global economy — yet alternatives are necessary for resilience.

The strategy is incremental: reduce exposure, expand options, maintain stability.

Why It Matters

Dollar dominance is being diluted through use, not rhetoric

Parallel systems weaken sanctions leverage without collapsing markets

Trade settlement diversification becomes normalized

Financial architecture shifts from centralized to multi-rail

This is how monetary systems evolve — quietly, structurally, and over time.

Why It Matters to Foreign Currency Holders

Expanding local-currency trade increases demand for non-dollar settlement currencies

Reduced dollar usage supports reserve diversification trends

Foreign currency holders anticipating a Global Reset benefit from incremental system migration

These shifts often precede formal revaluations and monetary realignments

For currency holders, this is not a headline event — it is foundational groundwork.

Implications for the Global Reset

Pillar 1: Parallel Financial Infrastructure

BRICS demonstrates that monetary power shifts occur through payment systems and settlement rails, not declarations.

Pillar 2: Gradual Reserve and Trade Diversification

Incremental local-currency trade steadily erodes single-currency dependence while avoiding crisis triggers.

This is not just politics — it’s global finance restructuring before our eyes.

Strategic Takeaway

BRICS is not detonating the old system. It is building the new one beside it, waiting for gravity — not force — to do the rest.

When you can’t replace the system, you build another one next to it

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Isn’t Ditching the Dollar, It’s Quietly Building Around It”

Reuters – “BRICS Nations Expand Local Currency Trade to Reduce Dollar Reliance”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Which Form Of Silver Is Best For Investing In Right Now?

Which Form Of Silver Is Best For Investing In Right Now?

By MoneyWatch: Managing Your Money January 16, 2026 / 1:43 PM EST / CBS News

Finding the right silver investment for your portfolio can pay off substantially, especially in today's market. Guido

Silver just wrapped up an incredibly strong year, with prices surging dramatically throughout the last months of 2025. The precious metal's remarkable performance even outpaced gold's impressive gains last year, catching the attention of investors who may have previously overlooked it in favor of its higher-value counterpart. And, that upward trend has only continued in the first weeks of 2026, with silver prices currently hovering above $88 per ounce. With multiple tailwinds still in play, though, the conversation has largely shifted from whether to invest in silver to how best to gain exposure to this momentum.

Which Form Of Silver Is Best For Investing In Right Now?

By MoneyWatch: Managing Your Money January 16, 2026 / 1:43 PM EST / CBS News

Finding the right silver investment for your portfolio can pay off substantially, especially in today's market. Guido

Silver just wrapped up an incredibly strong year, with prices surging dramatically throughout the last months of 2025. The precious metal's remarkable performance even outpaced gold's impressive gains last year, catching the attention of investors who may have previously overlooked it in favor of its higher-value counterpart. And, that upward trend has only continued in the first weeks of 2026, with silver prices currently hovering above $88 per ounce. With multiple tailwinds still in play, though, the conversation has largely shifted from whether to invest in silver to how best to gain exposure to this momentum.

The forces driving this silver rally aren't showing signs of slowing down, either. Silver supply deficits have continued to increase, while industrial demand continues to grow thanks to things like solar panel manufacturing, electric vehicle production and the expanding infrastructure needs of artificial intelligence technology. Add in recent Federal Reserve rate cuts that make non-yielding assets more attractive and ongoing geopolitical uncertainty that sends investors seeking safe havens, and you have a compelling case for continued strength in silver prices.

But with silver's historic run-up, investors face a practical question: What's the smartest way to participate in this market right now? After all, each option comes with distinct advantages and considerations, so it's important to know which ones are truly worth examining.

Start adding silver and other precious metals to your investment portfolio today.

Which form of silver is best for investing in right now?

The silver market offers several pathways for investors looking to capitalize on current momentum, each suited to different investment strategies and comfort levels with various types of risk. Here are the main options that today's investors may want to consider:

To Continue and Read More: https://www.cbsnews.com/news/which-form-of-silver-is-best-for-investing-in-january-2026/