Iraq Economic News and Points To Ponder Sunday Morning 1-18-26

Government Advisor: Inflation In Iraq Is The Lowest In The Arab World

The Prime Minister's financial advisor, Mazhar Muhammad Salih, confirmed on Friday that Iraq is experiencing a low inflation rate of approximately 1.5% by the end of 2025, noting that this is the lowest inflation rate in the Arab world.

Salih told the Iraqi News Agency (INA) that "the Iraqi economy is witnessing a remarkable period of monetary stability, with an inflation rate of approximately 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region, “He explained that "this achievement is attributed to the monetary policy that has succeeded in maintaining price and exchange rate stability, protecting the purchasing power of the dinar, thus strengthening confidence in the national currency and providing a more favorable environment for investment."

Government Advisor: Inflation In Iraq Is The Lowest In The Arab World

The Prime Minister's financial advisor, Mazhar Muhammad Salih, confirmed on Friday that Iraq is experiencing a low inflation rate of approximately 1.5% by the end of 2025, noting that this is the lowest inflation rate in the Arab world.

Salih told the Iraqi News Agency (INA) that "the Iraqi economy is witnessing a remarkable period of monetary stability, with an inflation rate of approximately 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region, “He explained that "this achievement is attributed to the monetary policy that has succeeded in maintaining price and exchange rate stability, protecting the purchasing power of the dinar, thus strengthening confidence in the national currency and providing a more favorable environment for investment."

He added that "the recent Cabinet decisions aim to address what is known as 'job inflation' as a step to support social stability and improve income levels," noting that "these measures achieve positive short-term returns by stimulating domestic demand and boosting economic confidence, especially if they are financed within the bounds of fiscal sustainability and do not exceed the economy's absorptive capacity."

He explained that "the biggest challenge remains in translating this monetary stability into sustainable, productive economic growth, as government employment, if not linked to productivity, could create a gap between public spending and real output, and increase the economy's vulnerability to oil price fluctuations."

He added, "The solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, and diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy."

He emphasized that "Iraq currently possesses a rare dual opportunity: low inflation and monetary stability,”He added, "This opportunity can be transformed into a long-term gain if invested in building a robust productive base, ensuring the sustainability of financial and monetary stability in the medium and long term, and moving the economy from a cycle of rentier dependency to a path of sustainable growth." https://ina.iq/en/economy/44846-government-advisor-inflation-in-iraq-is-the-lowest-in-the-arab-world.html

CBI: Iraq Spending Outpaced Revenues In 2025

2026-01-17 07:19 Shafaq News– Baghdad Iraq’s public spending exceeded revenues in the first 10 months of 2025, according to Central Bank of Iraq (CBI) data released on Saturday.

In a report, the CBI revealed that total public revenues reached 104.434 trillion Iraqi dinars ($72.0B), while public expenditures amounted to 115.535 trillion dinars ($79.7B) over the same period.

Non-tax income dominated state revenues at 99.625 trillion dinars ($68.7B), compared with 4.809 trillion dinars ($3.3B) in tax receipts. On the spending side, current expenditures accounted for the bulk of outlays at 96.378 trillion dinars ($66.5B) and investment spending stood at 19.157 trillion dinars ($13.2B).

The gap between revenues and expenditures widened last year, the Eco Iraq Observatory reported, with the fiscal deficit reaching 17.7 trillion dinars ($13.5B), while Iraq has yet to approve the detailed budget tables for 2025, constraining the implementation of spending plans and the release of funds for development projects.https://www.shafaq.com/en/Economy/CBI-Iraq-spending-outpaced-revenues-in-2025

USD/IQD Exchange Rates Dip In Baghdad, Erbil

2026-01-17 Shafaq News– Baghdad/ Erbil The US dollar exchange rates fell on Saturday in the markets of Baghdad and Erbil as trading opened for the week, according to a Shafaq News survey.

Baghdad’s Al-Kifah and Al-Harithiya central exchanges registered a rate of 147,500 Iraqi dinars per $100, down from 148,000 dinars on Thursday. Local exchange shops recorded a selling rate of 148,000 dinars and a buying rate of 147,000 dinars per $100. In Erbil, the dollar eased as well, selling at 147,350 dinars per $100 and buying at 147,250 dinars.https://www.shafaq.com/en/Economy/USD-IQD-exchange-rates-dip-in-Baghdad-Erbil-8-4

Gold Prices Fall In Baghdad, Erbil

2026-01-17 Shafaq News– Baghdad/ Erbil Gold prices, both imported and locally produced, fell on Saturday in the markets of Baghdad and Erbil, according to a Shafaq News survey.

In Baghdad’s wholesale gold market on Al-Nahr Street, the selling price of one mithqal of 21-carat Gulf, Turkish, and European gold dropped to 948,000 Iraqi dinars, with the buying price at 944,000 dinars, down from 958,000 dinars recorded last Thursday.

The price of one mithqal of 21-carat Iraqi gold also declined, selling at 918,000 dinars and buying at 914,000 dinars.

At retail jewelry shops in Baghdad, the selling price of 21-carat Gulf gold ranged between 950,000 and 960,000 dinars, while Iraqi gold of the same purity sold for 940,000 to 950,000 dinars.

In Erbil, the selling price reached 1.005 million dinars for 22-carat gold, 960,000 dinars for 21-carat, and 823,000 dinars for 18-carat gold. https://www.shafaq.com/en/Economy/Gold-prices-fall-in-Baghdad-Erbil-8

Iraqi Crude Exports To US Jump Past 200,000 Bpd

2026-01-18 Shafaq News– Baghdad/ Washington Iraqi crude oil exports to the United States rose sharply last week, exceeding 200,000 barrels per day (bpd), according to data from the US Energy Information Administration (EIA).

In its weekly report, the EIA reported that US imports of crude from Iraq, OPEC's second-largest producer, averaged about 209,000 bpd during the week, up from 129,000 bpd the previous week, marking an increase of roughly 80 bpd.

Overall, US crude oil imports from 10 major suppliers averaged 6.234 million bpd last week, compared with 5.667 million bpd a week earlier, the data showed.

Canada remained the largest source of US crude imports at an average of 4.226 million bpd, followed by Mexico at 386,000, Brazil at 343,000, and Saudi Arabia at 288,000.

The United States consumes around 20 million barrels of oil per day, making it the world’s largest oil consumer, with imports sourced primarily from these major suppliers. https://www.shafaq.com/en/Economy/Iraqi-crude-exports-to-US-jump-past-200-000-bpd

The Matter Is Settled... A Political Agreement Has Been Reached Between Maliki And Sudani Regarding The Premiership.

Information/Baghdad... Nouri al-Maliki, head of the State of Law Coalition and prime ministerial candidate, is awaiting the outcome of the presidential election in the coming days before being tasked with forming the new government and selecting his cabinet. The race for prime minister has narrowed down to al-Maliki and al-Sudani, the two figures considered the frontrunners for the position. Sources within al-Sudani's bloc have confirmed that an agreement has been reached for al-Maliki to assume power for a third term.

Bahaa al-Araji, head of the Reconstruction and Development parliamentary bloc, stated in remarks reported by Information that "the decision to withdraw from the competition with the head of the State of Law Coalition was made with complete conviction. The decision is serious and not tactical, as some believe. The coordinating body rejects any role for the international community in selecting the next prime minister."

He added that “the Reconstruction and Development Party has a project, and Maliki is the closest to his project. Also, the relationship between him and the State of Law Coalition is not related to giving up the position, but rather to joint cooperation in the issue of distributing ministries and parliamentary committees, because the next stage is an important and difficult stage that requires concerted efforts to face internal and external challenges.”

On another front, MP Hussein al-Ankoushi, from the Reconstruction and Development Coalition, confirmed to Al-Maalomah that "Sudani directed the Reconstruction and Development Coalition to support Maliki's nomination for prime minister in the upcoming phase, as Maliki has become the candidate of 81 MPs representing the Reconstruction and Development Coalition and the State of Law Coalition."

He pointed out that "the Coordination Framework did not force Sudani to withdraw his candidacy; rather, the decision came voluntarily and personally from him." He indicated that "the political forces within the framework will not allow its disintegration or abandonment under any circumstances, as the upcoming phase requires maintaining the unity and cohesion of the Coordination Framework to ensure political stability and proceed with forming the government according to clear understandings among all parties."

Meanwhile, former MP Yasser al-Husseini explained to Al-Maalomah that "Maliki and Sudani publicly display harmony and agreement, but this agreement is underpinned by internal and external pressures that have imposed themselves on the political scene. However, the current stage requires the selection of a strong prime minister capable of leading the country through its complex crises."

He continued, "Iraq is facing imminent danger, and citizens may be forced to tighten their belts due to the difficult economic conditions," noting that "the current government has obstructed the work of Parliament and contributed to preventing interrogations and the normal exercise of its oversight role."

He added that "the next government will move to cancel some of the decisions of Sudani's government as part of a comprehensive review of the policies pursued during the past period, especially since the country needs bold decisions to correct its course and confront the upcoming challenges." End 25N LINK

Americans Are Worried More About This Money Issue Than Inflation

Americans Are Worried More About This Money Issue Than Inflation — Here’s Why

Dawn Allcot GOBankingRates Sat, January 10, 2026

Americans are more worried about the job market and their job security than they are about inflation, according to the latest Survey of Consumer Expectations from the Federal Reserve Bank of New York.

Survey respondents said they expect inflation to drop to 3% within the next three to five years, the NY Fed reported. Respondents also believe credit is easier to get now than it was in the recent past, and that trend should continue. Although reduced inflation and loosened credit should bode well for the economy, people are still concerned.

Americans Are Worried More About This Money Issue Than Inflation — Here’s Why

Dawn Allcot GOBankingRates Sat, January 10, 2026

Americans are more worried about the job market and their job security than they are about inflation, according to the latest Survey of Consumer Expectations from the Federal Reserve Bank of New York.

Survey respondents said they expect inflation to drop to 3% within the next three to five years, the NY Fed reported. Respondents also believe credit is easier to get now than it was in the recent past, and that trend should continue. Although reduced inflation and loosened credit should bode well for the economy, people are still concerned.

Consumers also predicted unemployment rising in 2026 and believe they may have a harder time finding a job if they are laid off next year. Those under the age of 60 and those who attended “some college” were the most concerned, according to the report.

“People know that if inflation hits, they will feel it, but they can adjust their spending to offset it,” said Melanie Musson, finance expert at Quote.com. “Inflation hurts, but it’s survivable. Meanwhile, losing your job can feel like there is no solution.”

Gen Z Feels Heavy Uncertainty

Sofiya Deva of the AI-powered personal finance app Vera, said these emotions may be especially prevalent in Gen Z.

“They’ve been nicknamed ‘the most anxious generation.’ And I think a lot of that really does carry over into finances,” she said.

Seeking personalized financial advice, and even relying on AI tools, could be part of the solution for any generation, Deva added.

“[Finance is] a very personal topic. In some ways it’s even more taboo than religion and politics,” Deva said. “Having a safe, judgement-free space where you can share where you are financially, plus your anxieties, hopes and fears, can help.”

How To Prepare for Job Loss

To Continue and Read More: https://www.yahoo.com/finance/news/americans-worried-more-money-issue-115512920.html

MilitiaMan and Crew: IQD News Update-Iraq Dinar: Digital Shift + REER Readiness Now

MilitiaMan and Crew: IQD News Update-Iraq Dinar: Digital Shift + REER Readiness Now

1-17-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-Iraq Dinar: Digital Shift + REER Readiness Now

1-17-2026

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26…1-17-26…..HE’S BACK !!!

KTFA

Saturday Night Video

FRANK26…1-17-26…..HE’S BACK !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Saturday Night Video

FRANK26…1-17-26…..HE’S BACK !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

1-17-2026

Paul White Gold Eagle @PaulGoldEagle

QFS INFORMATION CENTER

UNDERSTANDING TIER 4B, CURRENCY REVALUATION, AND NESARA GESARA PAYMENTS

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

1-17-2026

Paul White Gold Eagle @PaulGoldEagle

QFS INFORMATION CENTER

UNDERSTANDING TIER 4B, CURRENCY REVALUATION, AND NESARA GESARA PAYMENTS

The global financial system is undergoing a structural transition that most people don’t yet recognize. At the center of this shift are three concepts that keep resurfacing across alternative finance discussions: the Quantum Financial System (QFS), Tier 4B, and NESARA GESARA–related payments. To understand what may be unfolding, it’s critical to separate speculation from structure.

The move underway is a transition from fiat currency systems to asset-backed valuation models.

Fiat currencies, created through debt and leverage, are increasingly unstable. QFS is described as a settlement and verification framework designed to support transparent, asset-guaranteed currencies, removing manipulation, duplication, and unlawful routing.

Much of the confusion surrounds “Tier 4B,” often called the Internet Group.

This does not mean everyone who uses the internet. Tier 4B refers to individuals who actively tracked currency revaluation narratives, prepared by acquiring foreign currencies, followed alternative financial disclosures, and positioned themselves ahead of a potential reset.

In simplified terms, the tier structure is described as follows:

Tier 1–3 involve sovereign, institutional, and historical asset holders.

Tier 4A includes private exchange and secured access participants.

Tier 4B consists of the prepared public community actively following revaluation and QFS developments.

Tier 5 is the general public, who only become aware once changes are announced or visible.

If currency revaluation occurs, Tier 4B participants are expected to receive structured access before the wider public.

This access is commonly associated with Redemption Centers, where foreign currencies would be exchanged under controlled conditions. These centers are not mystical locations.

Rob Cunningham: Wealth and Peace on an Epic Scale

Rob Cunningham: Wealth and Peace on an Epic Scale

1-17-2026

Rob Cunningham | KUWL.show @KuwlShow

Wealth & Peace On An Epic Scale

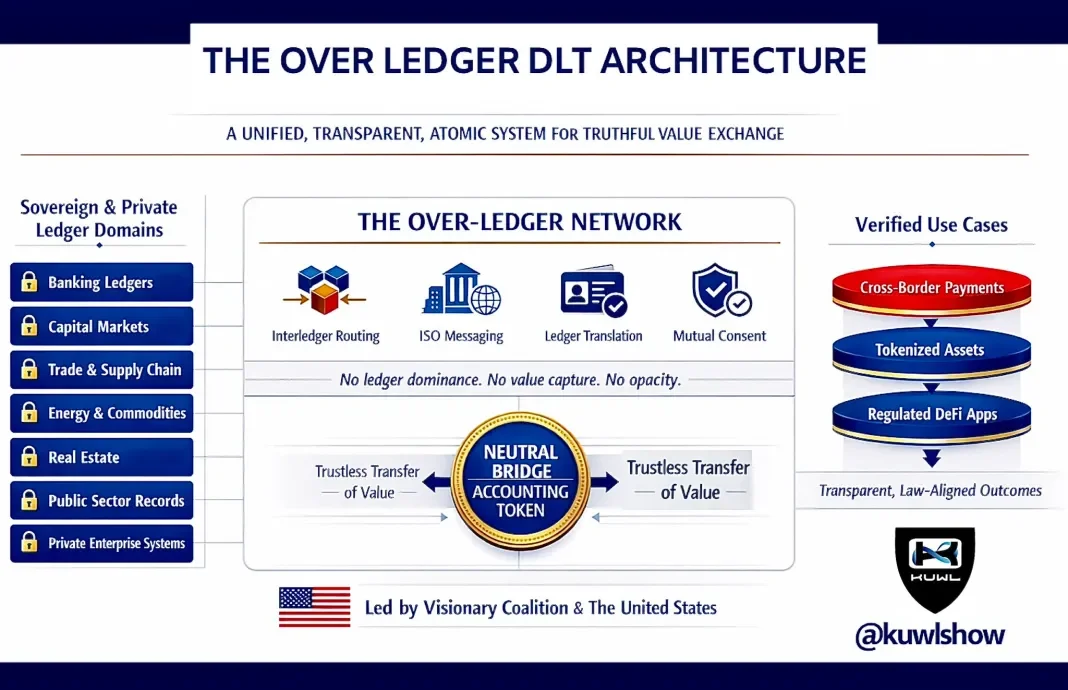

A new global system architecture is now being implemented – one that rises above individual ledgers to unify them through interoperable Distributed Ledger Technology (DLT).

Rob Cunningham: Wealth and Peace on an Epic Scale

1-17-2026

Rob Cunningham | KUWL.show @KuwlShow

Wealth & Peace On An Epic Scale

A new global system architecture is now being implemented – one that rises above individual ledgers to unify them through interoperable Distributed Ledger Technology (DLT).

This architecture is purpose-built for specific, adequately funded use cases; engineered for perfect transparency; capable of atomic settlement; and anchored in real-world asset authentication, immutable identity absolutes, and verifiable ownership.

At its core operates a non-sovereign, neutral bridge accounting token – not as money to be hoarded or weaponized, but as a flawless transporter and transcriber of value: unbiased, instantaneous, and exact.

It neither governs, owns nor extracts, but simply moves truthfully between and in alignment with, compliant systems.

This is not a speculative experiment. It is the natural evolution of law-aligned accounting, trustless verification, and honest weights and measures – emerging through a coalition of public and private leadership, with the United States providing the primary visionary, infrastructural, and moral impetus for its realization.

Fear, or fear not. Transparency renders no place for deception to hide.

And the powers behind the Fed are none too happy.

Transparency yields peace.

Opacity concentrates power.

Centralization yields slavery.

Have Faith.

Source(s): https://x.com/KuwlShow/status/2012172417037201785

https://dinarchronicles.com/2026/01/16/rob-cunningham-wealth-and-peace-on-an-epic-scale/

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-17-26

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Overview

Central banks around the world are accelerating gold purchases at a pace not seen in decades, reflecting growing concern over the long-term credibility of the U.S. dollar. Geopolitical fragmentation, sanctions risk, and increasing political pressure on monetary policy have driven reserve managers toward tangible, politically neutral assets. Gold’s share of global central bank reserves has now climbed above 25%, marking a historic inflection point in reserve strategy.

Key Developments

Central banks have increased gold purchases at multi-decade record levels

Gold now accounts for more than one-quarter of global central bank reserves

Prices have surged to historic highs, confirming sustained institutional demand

China alone reportedly holds over 2,000 tonnes of gold

Emerging market central banks are leading the diversification trend

What’s Really Driving the Shift

This move is not about speculation or short-term hedging. It is about systemic risk management.

Gold offers:

No counterparty risk

Immunity from sanctions and payment freezes

Protection against political interference in monetary policy

Universal acceptability outside any single financial system

As trust in fiat governance weakens, central banks are opting for assets that cannot be debased, frozen, or reprogrammed.

Why It Matters

Accelerated gold accumulation is a classic signal of declining confidence in dominant reserve currencies

Reserve diversification weakens the structural demand for dollar-denominated assets

Gold reasserts itself as a neutral anchor in a fragmenting monetary order

This behavior historically precedes monetary regime adjustments, not follows them

When central banks move first, markets follow later.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation during a Global Reset:

Gold accumulation signals preparation for currency realignment

Tangible reserve backing strengthens the case for future repricing

Fiat-heavy systems face pressure as reserve composition shifts

Holders positioned ahead of formal policy changes benefit most

Gold is not replacing currencies — it is redefining what backs them.

Implications for the Global Reset

Pillar 1 – Assets: Gold regains prominence as a reserve foundation

Pillar 2 – Monetary Trust: Confidence migrates from fiat promises to physical backing

Reserve Architecture: Diversification reduces single-currency dominance

Resets are built quietly in vaults before they appear in headlines.

When central banks choose metal over paper, the message is already clear.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Mumbai Emerges as a Hub for Multipolar Economic Coordination

New Global Economic Cooperation Forum signals accelerating shift away from Western-led frameworks

Overview

A new Global Economic Cooperation 2026 Forum has been announced for February 17–19 in Mumbai, bringing together policymakers, economic planners, and institutional leaders to explore alternative models of global collaboration. The forum reflects growing momentum among emerging and middle powers to coordinate trade, investment, and financial policy outside traditional Western-dominated institutions.

Key Developments

The inaugural forum will convene in Mumbai in mid-February

Focus areas include trade integration, investment flows, and economic coordination

Participants are expected from emerging markets and middle powers

The initiative emphasizes multipolar cooperation rather than bloc dependency

Timing aligns with rising global fragmentation in trade and finance systems

Why This Forum Is Different

Unlike legacy institutions shaped after World War II, this forum is structured around pragmatic economic alignment rather than ideology. Its emphasis is on:

Flexible cooperation across regions

Reduced reliance on dollar-centric systems

Strategic alignment among economies navigating sanctions, debt stress, and trade disruption

This is coalition-building by design — not protest, but preparation.

Why It Matters

Signals intentional coordination for alternative economic architecture

Reinforces the decline of single-center economic governance

Creates space for new trade and settlement frameworks

Aligns with broader moves toward regionalization and multipolar finance

Economic resets rarely begin with formal announcements — they begin with forums like this.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching the Global Reset narrative:

Multipolar coordination supports future currency repricing

Trade integration outside Western systems reduces legacy currency dominance

New settlement mechanisms create opportunities for value recalibration

Forums like this often precede policy harmonization and monetary shifts

Currency value changes are negotiated long before they are declared.

Implications for the Global Reset

Pillar 1 – Trade: Expands non-Western trade coordination pathways

Pillar 2 – Finance: Supports diversification away from dollar-centric systems

Institutional Realignment: Signals early-stage restructuring of global governance

This is not a summit for headlines — it is a workshop for the next system.

Global resets don’t start at the G7 — they start where the future is being built.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Economic Times — Inaugural Global Economic Cooperation Forum to be held in Mumbai Feb 17–19

Observer Research Foundation — Multipolarity and the Future of Global Economic Governance

~~~~~~~~~~

Inside BRICS’ Real De-Dollarization Strategy: Payments Over Politics

Why infrastructure — not a new currency — is quietly reshaping global finance

Overview

For much of 2024 and early 2025, public discussion around BRICS de-dollarization focused on the idea of a new shared currency to rival the U.S. dollar. That narrative missed what was actually happening. Rather than building a euro-style monetary union, BRICS countries pursued a more practical strategy: payment infrastructure, bilateral settlement, and local-currency trade.

The result is a quiet but measurable reduction in dollar usage — achieved not through ideology, but through systems.

Key Developments

BRICS countries prioritized interoperable payment systems instead of a single currency

Russia’s SPFS, China’s CIPS, and India’s UPI were connected through pilot frameworks under BRICS Pay

Russia and China now settle the vast majority of bilateral trade in rubles and yuan

Local-currency trade expanded across energy, commodities, and infrastructure finance

BRICS-backed institutions increased non-dollar lending to Global South projects

This approach sidestepped political resistance while producing tangible outcomes.

Why Payments Became the Strategy

Creating a shared currency would require unified monetary policy, fiscal discipline, and economic convergence — conditions that do not exist inside BRICS. Member economies range from China’s multi-trillion-dollar system to frontier markets still stabilizing basic financial infrastructure.

Instead, BRICS focused on what could be built now:

Clearing systems that bypass dollar settlement

Bilateral trade invoicing in local currencies

Commodity-backed financing structures

Multilateral lending outside Western-dominated institutions

As Russia’s leadership has emphasized publicly, alternatives emerged not as confrontation — but as necessity.

Local Currency Trade and Commodity Finance

Energy trade provided the fastest proof of concept. Oil, gas, and commodities were increasingly settled in yuan, rubles, rupees, and reais, reducing dollar exposure without disrupting supply chains.

Meanwhile, the New Development Bank expanded lending in domestic currencies, supporting infrastructure and development projects without dollar-denominated debt risk. Commodity-backed settlement pilots added further insulation from currency volatility.

Each transaction was incremental — but cumulative impact matters.

Political Limits Still Apply

Despite technical progress, political realities capped ambition. Proposals for a unified BRICS currency were quietly deprioritized in 2025. Leaders acknowledged that monetary integration was premature, particularly amid external trade pressures and tariff threats.

This restraint did not stall de-dollarization — it refined it.

Why It Matters

De-dollarization is happening through systems, not symbols

Payment infrastructure reduces dollar dependency without formal confrontation

Bilateral clearing erodes reserve currency dominance transaction by transaction

This model is scalable beyond BRICS to the wider Global South

The shift is structural, not rhetorical.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching global reset mechanics:

Payment systems matter more than headline currency launches

Local settlement reduces artificial demand for reserve currencies

Commodity-backed finance supports future currency repricing

Infrastructure-first de-dollarization favors measured realignment, not shock events

Currency value changes long before exchange rates move.

Implications for the Global Reset

Pillar 1 – Trade: Local-currency invoicing reshapes global trade flows

Pillar 2 – Finance: Payment rails weaken legacy settlement dominance

Pillar 4 – Assets: Commodities reassert monetary relevance

This is de-dollarization by design — not declaration.

The dollar isn’t being overthrown — it’s being routed around.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — Inside BRICS’ Next De-Dollarization Playbook: Pay Systems Over Politics

Reuters — Russia and China deepen use of local currencies in trade settlements

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Will The Government Confiscate Your Silver?

Will The Government Confiscate Your Silver? Here’s Why It’s Likely

Noel Lorenzana, CPA Jan 17, 2026

Did you know the US government once seized private gold overnight? In 1933, gold was taken by law with a single signature. No warning. No debate. Today, silver has been declared a US strategic mineral, raising urgent questions about silver confiscation, government control, national security, and private ownership.

Will The Government Confiscate Your Silver? Here’s Why It’s Likely

Noel Lorenzana, CPA Jan 17, 2026

Did you know the US government once seized private gold overnight? In 1933, gold was taken by law with a single signature. No warning. No debate. Today, silver has been declared a US strategic mineral, raising urgent questions about silver confiscation, government control, national security, and private ownership.

Silver is no longer just an industrial or precious metal. It is now tied to the power grid, the military, clean energy, and US national defense. In a national emergency, “strategic” does not mean protected. It means prioritized and controlled. Rules can change without a knock on the door or a new law, turning private silver into a public resource.

This video breaks down the historical gold confiscation of 1933, why silver’s new classification matters, how government control really works, and what this could mean for silver owners today. If you think this cannot happen again, or that silver is immune, you need to pay attention.

News, Rumors and Opinions Saturday 1-17-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 17 Jan. 2026

Compiled Sat. 17 2026 12:01 am EST by Judy Byington

Judy Note: BRICS countries and the Global Military Alliance (allegedly) started with taking back The People’s money from the Deepstate Cabal. Their Global Currency Reset (GCR) and Revaluation (RV) to gold/asset-backed currency seriously(allegedly) began Jan. 1 2026.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 17 Jan. 2026

Compiled Sat. 17 2026 12:01 am EST by Judy Byington

Judy Note: BRICS countries and the Global Military Alliance (allegedly) started with taking back The People’s money from the Deepstate Cabal. Their Global Currency Reset (GCR) and Revaluation (RV) to gold/asset-backed currency seriously(allegedly) began Jan. 1 2026.

This week as the new Quantum Financial System (QFS) integration (allegedly) completed worldwide, Tier4b (us, the Internet Group who held foreign currency and Zim Bonds to exchange) notification to exchange was (allegedly) going on right now and imminently for the main group the early part of next week.

Zim redemptions and currency exchanges at secure Centers promise unprecedented wealth transfer, erasing decades of fiat slavery and ushering in NESARA/GESARA prosperity for all nations.

Debt forgiveness under these laws will(allegedly) liberate families from burdensome loans, mortgages, and credit obligations—imagine homes reclaimed, burdens lifted, as abundance flows.

This great wealth shift (allegedly) dismantles the Cabal’s control, redirecting resources to humanitarian efforts, infrastructure rebirth, and global unity under principles of freedom and justice.

Hold fast in faith, Patriots; the payout phase begins soon, bringing financial liberation and the fulfillment of promises long awaited. Prepare appointment details, guard against scams, and give thanks to the Almighty for this restoration of righteousness on Earth.

Have faith, stock provisions and trust in The Lord’s Plan.

~~~~~~~~~~~

Possible Timing

They have announced a Five Day rollout for the Global Currency Reset Redemption Center appointments to exchange foreign currency and redeem bonds (allegedly) starting Monday 19 Jan. and going through Friday 23 Jan.

Tier4b (us, the Internet Group) was expected to be notified for Redemption Center appointments to exchange currencies and redeem Zim Bonds on Tues. 20 Jan.

On Tues. 20 Jan. 2026 the Ten Days of Darkness may start, triggered by a Cabal nationwide Cyber Blackout. Media, radio networks and phone communications (allegedly) shut down simultaneously.

On Wed. 21 Jan. 2026 Martial Law could (allegedly) be declared. Black Hawk helicopters have been conducting drills in Washington DC, signaling readiness for Martial Law enforcement.

At the same time on Wed. 21 Jan. 2026 Global activation sequence could begin of the new financial system, with BRICS Alliance(allegedly) going live alongside NESARA/GESARA implementation and full rollout of the Quantum Financial System (QFS).

Sun. 1 Feb. 2026 Redemption Centers (allegedly) open worldwide under Military Security to set up the new Global Financial System (GFS) Wallets (formerly known as bank accounts) for the general public on the new and secure Star Link Satellite System.

Read full post here: https://dinarchronicles.com/2026/01/17/restored-republic-via-a-gcr-update-as-of-january-17-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 I've always told you the moment you see the HCL you'll see the new exchange rate. Will we see the prime minister? I don't know. You think I'm waiting for the prime minister? I'm waiting for the new exchange rate.

Militia Man Al-Sudani is the most likely Prime Minister based on current momentum and coalition strength. His continued leadership would ensure steady progress in Iraq's economic reforms and global financial integration. The political landscape supports continuity rather than significant change.

Bruce [via WiserNow] I'm going to tell you this timeline that...came through...this morning. The RV/GCR was initiated to the point where it started and cannot be reversed, and that was early this morning, and they were testing by paying redemption centers and banks. And with this test, everything has been put into motion. So redemption centers, 800 number testing, all of that has been completed. Now we're moving through this process...we're looking at a five day rollout, starting Friday, Friday, Saturday, Sunday, Monday, Tuesday. Martin Luther King Day...is the 19th, so it could be 20th, 21st, in that timeframe.

************

The US Government Just Made Silver "National Security"

GoldSilver: 1-16-2026

On January 14, 2026, President Trump issued a White House Proclamation declaring 41 critical minerals — including silver — essential to national security.

The proclamation explicitly acknowledges America's dangerous dependence on foreign sources for mining, processing, and shipping these materials.

Here's where it gets interesting: The administration has instructed trade officials to "consider price floors for trade in critical minerals and other trade-restricting measures." Translation? The government may artificially prop up silver prices — and if that happens, we could see runaway price action.

In this video, Alan breaks down what this proclamation actually means for silver investors, why it matters NOW, and what you should be watching for in the coming months.

Weekend Coffee with MarkZ. 01/17/2026 (Bank Story)

Weekend Coffee with MarkZ. 01/17/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Mod: GOOD MORNING AND HAPPY SATURDAY EVERYONE! CBD GURUS MATT AND LUCAS KICK OFF THE FIRST 45 MINS AND THEN MARK GIVES THE NEWS UPDATE

Member: good Morning everyone….Welcome to a 3 day weekend

Weekend Coffee with MarkZ. 01/17/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Mod: GOOD MORNING AND HAPPY SATURDAY EVERYONE! CBD GURUS MATT AND LUCAS KICK OFF THE FIRST 45 MINS AND THEN MARK GIVES THE NEWS UPDATE

Member: good Morning everyone….Welcome to a 3 day weekend

Member: Any big news today Mark?

MZ: On the bond side I have 2 more historic bond confirmations that they expect the “REST” of their funds on Tuesday of this week. So 2 bond contacts told me they expect the rest. I think this is a very big one. The word “Rest” indicates they may have gotten some of their money.

MZ: One contact is in Europe and the other one is in Asia…..Over the last week they have been in meetings but had not received anything. Then they got a little squirrely and quiet….and then a message from two separate contacts in two separate locations that they expect the rest on Tuesday

MZ: A buddy of mine shared a bank story. He said “Over the last 2 days I had some banking interactions with a large bank. I asked my bank manager if she had seen the new currency. Her answer was _____(silence) I asked her is she was under an NDA and her response was “Yes- you have done your research.”

MZ: “I asked her if the bank had cash on hand for withdrawal for say $9,999.00 bucks so I did not have to do IRS paperwork. She said “I cannot advise you on that due to the FDIC and IRS but yes….you have done your research”

MZ: The next questions was “Are you ISO 20220 and Basel 3 compliant?” and she said “Yes- you have done your research.” I then asked her about the RV or Nesara and she gave the same answer. “Yes- you have done your research”

MZ: The following day (yesterday) I went back to the same bank and spoke to the same manager. Before I left her office she grabbed my arm and whispered “It’s coming , It’s coming soon” I thought that was a exciting one

Member: Best bank story in a long time- Thanks Mark.

MZ: “Silver to $500:Michael Oliver’s Breakout Warning” He says they have been stuck in a heavily manipulated box for 50 years….and silver is breaking out of it. This also means fiat is crashing as metals are soaring. Wow for $500 silver.

Member: I wonder- Did the bankers end up working this weekend as they were told?

Member: I stopped by Chase yesterday to make an in person deposit at the drive through, the teller’s greeting was interesting “welcome to JP Morgan Financial Advisors” or something like that.

Member: Anyone see US Treasury postpone buying back $4 trillion in US bonds due to technical issue…

Member: Mark Savaya is on his way to Iraq, he maybe already there. Folks, maybe we're about to see some action fast.

MZ: Yes he has some big meetings today and tomorrow. (He is Trump’s special envoy to Iraq) He is an Iraqi born American businessman. He was raised in the US. He is coming with a bag full of carrots and sticks.

MZ: From the World Trade Organization Ascensions newsletter for January 2026: “ Lists some of the folks ascending to the WTO this year. And there is Iraq….listed there.

MZ: We also hear rumblings they are working on HCL and working on passing the new budget as quickly as possible. Positive happenings in Iraq.

Member: It’s a 3 day weekend…..MLK Day……

Member: President Trump speaks at Davos on the 19th- just 2 days away.

Member: Mark!!! What advice do u have for those who have been in this for years and their desire to do the humanitarian projects they've been planning for years is dwindling down to not wanting to

MZ: You are not alone. I continue to be told that we will be given some “ready to go” choices where we just have to give a certain amount of money for those projects but do not physically have to go there. They have to know that we are just tired.

Member: Thanks Mark and Mods. Enjoy the rest of the weekend everyone. Much Love

Member: Stay safe…Stay warm…and have a great weekend.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

“Tidbits From TNT” Saturday 1-17-2026

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

Trump had appointed Savaya as special envoy for Iraq affairs on October 19, 2025. He is an American businessman of Iraqi origin.

In his latest remarks, attributed to him ahead of the visit, he said he would deal with the "appropriate decision-makers" in Iraq, and had previously hinted that "big changes are coming" with a focus on "actions, not words." link

Tishwash: Sudanese advisor: The government has achieved economic success, and the International Monetary Fund is witnessing it.

Despite talk of a severe financial crisis in Iraq and the decline of the dinar against the dollar, the Prime Minister's financial advisor, Mazhar Muhammad Salih, says that the country recorded a low inflation rate of about 1.5% by the end of 2025. He pointed out that inflation in Iraq is the lowest in the Arab world, noting that the government's monetary policy succeeded in maintaining price and exchange rate stability and protecting the purchasing power of the dinar.

Regarding the recent cabinet measures, Salih explained that their aim is to address what is known as "job inflation" as a step to support social stability and improve income levels, as he put it.

Saleh told the official agency, as reported by 964 Network , that “the Iraqi economy is witnessing a remarkable phase of monetary stability, as it recorded a low inflation rate of about 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region.” He explained that “this achievement is attributed to the monetary policy that succeeded in maintaining price and exchange rate stability, and protecting the purchasing power of the dinar, which strengthened confidence in the national currency and provided a more favorable environment for investment.”

He added that “the recent Cabinet decisions aim to address what is known as ‘job inflation’ as a step to support social stability and improve income levels,” noting that “these measures achieve positive short-term returns by stimulating domestic demand and enhancing economic confidence, especially if they are financed within the limits of financial sustainability and do not exceed the absorptive capacity of the economy.”

He explained that “the biggest challenge remains in transforming this monetary stability into sustainable productive economic growth, since government employment, if not linked to productivity, may create a gap between public spending and real output, and increase the economy’s vulnerability to fluctuations in oil prices.”

He added that “the solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, as well as diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy.”

He stressed that “Iraq today has a rare dual opportunity represented by low inflation and monetary stability,” adding that “this opportunity can turn into a long-term gain if it is invested in building a solid productive base, which will ensure the continuity of financial and monetary stability in the medium and long term, and move the economy from the cycle of rentier dependency to the path of sustainable growth.” link

************

Tishwash: Government advisor: Tourism investment is a gateway to stimulating the private sector and diversifying national income.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that Iraq has more than 12,000 archaeological sites that form the basis for a comprehensive tourism launch, explaining that tourism investment is a gateway to stimulating the private sector and diversifying national income.

Saleh told the Iraqi News Agency (INA): “Tourism in Iraq is more than just a recreational activity; it is a strategic tool for wealth creation, achieving balanced development, and diversifying national income sources, provided that investment in it is done seriously and with a clear institutional approach.”

He explained that “this sector has the potential to become a major economic pillar, capable of restoring Iraq to its natural civilizational position and contributing to building a more stable and sustainable economic future.”

He added that “tourism in Iraq represents a strategic economic lever capable of reducing the single dependence on oil, opening up broad prospects for diversifying national income, creating direct and indirect job opportunities, revitalizing the service and commercial sectors, as well as providing the economy with important revenues from foreign currency.”

He pointed out that "tourism leads to an increase in demand for local products and services, especially handicrafts, food products, and national cuisine, which strengthens local value chains. At the employment level, it is estimated that a single tourism event in the hotel accommodation sector alone is capable of generating more than 25 job opportunities at once, which highlights the multiplier effect of this sector on the labor market."

He pointed out that "tourism investment contributes to stimulating private sector trends by supporting the growth of small and medium enterprises, such as transport companies, restaurants and shops, and it also has a positive impact on the macroeconomy through the development of infrastructure by investing in roads, airports, hotels and public facilities, which enhances the investment attractiveness of the country as a whole."

Saleh emphasized that “Iraq has more than 12,000 archaeological sites stretching from Babylon, Ur and Nineveh to Baghdad and Samarra, as well as holy religious shrines. These are unique cultural treasures, some of which have been included in UNESCO’s World Heritage List, and they form a solid foundation for a comprehensive tourism initiative with economic, cultural and civilizational dimensions. link

Mot: Simply Can't Win !!! -- Can He!!!???

Mot: Love the Wisdom of the ""Wee Folks""!!!