News, Rumors and Opinions Saturday 1-17-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 17 Jan. 2026

Compiled Sat. 17 2026 12:01 am EST by Judy Byington

Judy Note: BRICS countries and the Global Military Alliance (allegedly) started with taking back The People’s money from the Deepstate Cabal. Their Global Currency Reset (GCR) and Revaluation (RV) to gold/asset-backed currency seriously(allegedly) began Jan. 1 2026.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Sat. 17 Jan. 2026

Compiled Sat. 17 2026 12:01 am EST by Judy Byington

Judy Note: BRICS countries and the Global Military Alliance (allegedly) started with taking back The People’s money from the Deepstate Cabal. Their Global Currency Reset (GCR) and Revaluation (RV) to gold/asset-backed currency seriously(allegedly) began Jan. 1 2026.

This week as the new Quantum Financial System (QFS) integration (allegedly) completed worldwide, Tier4b (us, the Internet Group who held foreign currency and Zim Bonds to exchange) notification to exchange was (allegedly) going on right now and imminently for the main group the early part of next week.

Zim redemptions and currency exchanges at secure Centers promise unprecedented wealth transfer, erasing decades of fiat slavery and ushering in NESARA/GESARA prosperity for all nations.

Debt forgiveness under these laws will(allegedly) liberate families from burdensome loans, mortgages, and credit obligations—imagine homes reclaimed, burdens lifted, as abundance flows.

This great wealth shift (allegedly) dismantles the Cabal’s control, redirecting resources to humanitarian efforts, infrastructure rebirth, and global unity under principles of freedom and justice.

Hold fast in faith, Patriots; the payout phase begins soon, bringing financial liberation and the fulfillment of promises long awaited. Prepare appointment details, guard against scams, and give thanks to the Almighty for this restoration of righteousness on Earth.

Have faith, stock provisions and trust in The Lord’s Plan.

~~~~~~~~~~~

Possible Timing

They have announced a Five Day rollout for the Global Currency Reset Redemption Center appointments to exchange foreign currency and redeem bonds (allegedly) starting Monday 19 Jan. and going through Friday 23 Jan.

Tier4b (us, the Internet Group) was expected to be notified for Redemption Center appointments to exchange currencies and redeem Zim Bonds on Tues. 20 Jan.

On Tues. 20 Jan. 2026 the Ten Days of Darkness may start, triggered by a Cabal nationwide Cyber Blackout. Media, radio networks and phone communications (allegedly) shut down simultaneously.

On Wed. 21 Jan. 2026 Martial Law could (allegedly) be declared. Black Hawk helicopters have been conducting drills in Washington DC, signaling readiness for Martial Law enforcement.

At the same time on Wed. 21 Jan. 2026 Global activation sequence could begin of the new financial system, with BRICS Alliance(allegedly) going live alongside NESARA/GESARA implementation and full rollout of the Quantum Financial System (QFS).

Sun. 1 Feb. 2026 Redemption Centers (allegedly) open worldwide under Military Security to set up the new Global Financial System (GFS) Wallets (formerly known as bank accounts) for the general public on the new and secure Star Link Satellite System.

Read full post here: https://dinarchronicles.com/2026/01/17/restored-republic-via-a-gcr-update-as-of-january-17-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 I've always told you the moment you see the HCL you'll see the new exchange rate. Will we see the prime minister? I don't know. You think I'm waiting for the prime minister? I'm waiting for the new exchange rate.

Militia Man Al-Sudani is the most likely Prime Minister based on current momentum and coalition strength. His continued leadership would ensure steady progress in Iraq's economic reforms and global financial integration. The political landscape supports continuity rather than significant change.

Bruce [via WiserNow] I'm going to tell you this timeline that...came through...this morning. The RV/GCR was initiated to the point where it started and cannot be reversed, and that was early this morning, and they were testing by paying redemption centers and banks. And with this test, everything has been put into motion. So redemption centers, 800 number testing, all of that has been completed. Now we're moving through this process...we're looking at a five day rollout, starting Friday, Friday, Saturday, Sunday, Monday, Tuesday. Martin Luther King Day...is the 19th, so it could be 20th, 21st, in that timeframe.

************

The US Government Just Made Silver "National Security"

GoldSilver: 1-16-2026

On January 14, 2026, President Trump issued a White House Proclamation declaring 41 critical minerals — including silver — essential to national security.

The proclamation explicitly acknowledges America's dangerous dependence on foreign sources for mining, processing, and shipping these materials.

Here's where it gets interesting: The administration has instructed trade officials to "consider price floors for trade in critical minerals and other trade-restricting measures." Translation? The government may artificially prop up silver prices — and if that happens, we could see runaway price action.

In this video, Alan breaks down what this proclamation actually means for silver investors, why it matters NOW, and what you should be watching for in the coming months.

Weekend Coffee with MarkZ. 01/17/2026 (Bank Story)

Weekend Coffee with MarkZ. 01/17/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Mod: GOOD MORNING AND HAPPY SATURDAY EVERYONE! CBD GURUS MATT AND LUCAS KICK OFF THE FIRST 45 MINS AND THEN MARK GIVES THE NEWS UPDATE

Member: good Morning everyone….Welcome to a 3 day weekend

Weekend Coffee with MarkZ. 01/17/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Mod: GOOD MORNING AND HAPPY SATURDAY EVERYONE! CBD GURUS MATT AND LUCAS KICK OFF THE FIRST 45 MINS AND THEN MARK GIVES THE NEWS UPDATE

Member: good Morning everyone….Welcome to a 3 day weekend

Member: Any big news today Mark?

MZ: On the bond side I have 2 more historic bond confirmations that they expect the “REST” of their funds on Tuesday of this week. So 2 bond contacts told me they expect the rest. I think this is a very big one. The word “Rest” indicates they may have gotten some of their money.

MZ: One contact is in Europe and the other one is in Asia…..Over the last week they have been in meetings but had not received anything. Then they got a little squirrely and quiet….and then a message from two separate contacts in two separate locations that they expect the rest on Tuesday

MZ: A buddy of mine shared a bank story. He said “Over the last 2 days I had some banking interactions with a large bank. I asked my bank manager if she had seen the new currency. Her answer was _____(silence) I asked her is she was under an NDA and her response was “Yes- you have done your research.”

MZ: “I asked her if the bank had cash on hand for withdrawal for say $9,999.00 bucks so I did not have to do IRS paperwork. She said “I cannot advise you on that due to the FDIC and IRS but yes….you have done your research”

MZ: The next questions was “Are you ISO 20220 and Basel 3 compliant?” and she said “Yes- you have done your research.” I then asked her about the RV or Nesara and she gave the same answer. “Yes- you have done your research”

MZ: The following day (yesterday) I went back to the same bank and spoke to the same manager. Before I left her office she grabbed my arm and whispered “It’s coming , It’s coming soon” I thought that was a exciting one

Member: Best bank story in a long time- Thanks Mark.

MZ: “Silver to $500:Michael Oliver’s Breakout Warning” He says they have been stuck in a heavily manipulated box for 50 years….and silver is breaking out of it. This also means fiat is crashing as metals are soaring. Wow for $500 silver.

Member: I wonder- Did the bankers end up working this weekend as they were told?

Member: I stopped by Chase yesterday to make an in person deposit at the drive through, the teller’s greeting was interesting “welcome to JP Morgan Financial Advisors” or something like that.

Member: Anyone see US Treasury postpone buying back $4 trillion in US bonds due to technical issue…

Member: Mark Savaya is on his way to Iraq, he maybe already there. Folks, maybe we're about to see some action fast.

MZ: Yes he has some big meetings today and tomorrow. (He is Trump’s special envoy to Iraq) He is an Iraqi born American businessman. He was raised in the US. He is coming with a bag full of carrots and sticks.

MZ: From the World Trade Organization Ascensions newsletter for January 2026: “ Lists some of the folks ascending to the WTO this year. And there is Iraq….listed there.

MZ: We also hear rumblings they are working on HCL and working on passing the new budget as quickly as possible. Positive happenings in Iraq.

Member: It’s a 3 day weekend…..MLK Day……

Member: President Trump speaks at Davos on the 19th- just 2 days away.

Member: Mark!!! What advice do u have for those who have been in this for years and their desire to do the humanitarian projects they've been planning for years is dwindling down to not wanting to

MZ: You are not alone. I continue to be told that we will be given some “ready to go” choices where we just have to give a certain amount of money for those projects but do not physically have to go there. They have to know that we are just tired.

Member: Thanks Mark and Mods. Enjoy the rest of the weekend everyone. Much Love

Member: Stay safe…Stay warm…and have a great weekend.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

“Tidbits From TNT” Saturday 1-17-2026

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

Trump had appointed Savaya as special envoy for Iraq affairs on October 19, 2025. He is an American businessman of Iraqi origin.

In his latest remarks, attributed to him ahead of the visit, he said he would deal with the "appropriate decision-makers" in Iraq, and had previously hinted that "big changes are coming" with a focus on "actions, not words." link

Tishwash: Sudanese advisor: The government has achieved economic success, and the International Monetary Fund is witnessing it.

Despite talk of a severe financial crisis in Iraq and the decline of the dinar against the dollar, the Prime Minister's financial advisor, Mazhar Muhammad Salih, says that the country recorded a low inflation rate of about 1.5% by the end of 2025. He pointed out that inflation in Iraq is the lowest in the Arab world, noting that the government's monetary policy succeeded in maintaining price and exchange rate stability and protecting the purchasing power of the dinar.

Regarding the recent cabinet measures, Salih explained that their aim is to address what is known as "job inflation" as a step to support social stability and improve income levels, as he put it.

Saleh told the official agency, as reported by 964 Network , that “the Iraqi economy is witnessing a remarkable phase of monetary stability, as it recorded a low inflation rate of about 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region.” He explained that “this achievement is attributed to the monetary policy that succeeded in maintaining price and exchange rate stability, and protecting the purchasing power of the dinar, which strengthened confidence in the national currency and provided a more favorable environment for investment.”

He added that “the recent Cabinet decisions aim to address what is known as ‘job inflation’ as a step to support social stability and improve income levels,” noting that “these measures achieve positive short-term returns by stimulating domestic demand and enhancing economic confidence, especially if they are financed within the limits of financial sustainability and do not exceed the absorptive capacity of the economy.”

He explained that “the biggest challenge remains in transforming this monetary stability into sustainable productive economic growth, since government employment, if not linked to productivity, may create a gap between public spending and real output, and increase the economy’s vulnerability to fluctuations in oil prices.”

He added that “the solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, as well as diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy.”

He stressed that “Iraq today has a rare dual opportunity represented by low inflation and monetary stability,” adding that “this opportunity can turn into a long-term gain if it is invested in building a solid productive base, which will ensure the continuity of financial and monetary stability in the medium and long term, and move the economy from the cycle of rentier dependency to the path of sustainable growth.” link

************

Tishwash: Government advisor: Tourism investment is a gateway to stimulating the private sector and diversifying national income.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that Iraq has more than 12,000 archaeological sites that form the basis for a comprehensive tourism launch, explaining that tourism investment is a gateway to stimulating the private sector and diversifying national income.

Saleh told the Iraqi News Agency (INA): “Tourism in Iraq is more than just a recreational activity; it is a strategic tool for wealth creation, achieving balanced development, and diversifying national income sources, provided that investment in it is done seriously and with a clear institutional approach.”

He explained that “this sector has the potential to become a major economic pillar, capable of restoring Iraq to its natural civilizational position and contributing to building a more stable and sustainable economic future.”

He added that “tourism in Iraq represents a strategic economic lever capable of reducing the single dependence on oil, opening up broad prospects for diversifying national income, creating direct and indirect job opportunities, revitalizing the service and commercial sectors, as well as providing the economy with important revenues from foreign currency.”

He pointed out that "tourism leads to an increase in demand for local products and services, especially handicrafts, food products, and national cuisine, which strengthens local value chains. At the employment level, it is estimated that a single tourism event in the hotel accommodation sector alone is capable of generating more than 25 job opportunities at once, which highlights the multiplier effect of this sector on the labor market."

He pointed out that "tourism investment contributes to stimulating private sector trends by supporting the growth of small and medium enterprises, such as transport companies, restaurants and shops, and it also has a positive impact on the macroeconomy through the development of infrastructure by investing in roads, airports, hotels and public facilities, which enhances the investment attractiveness of the country as a whole."

Saleh emphasized that “Iraq has more than 12,000 archaeological sites stretching from Babylon, Ur and Nineveh to Baghdad and Samarra, as well as holy religious shrines. These are unique cultural treasures, some of which have been included in UNESCO’s World Heritage List, and they form a solid foundation for a comprehensive tourism initiative with economic, cultural and civilizational dimensions. link

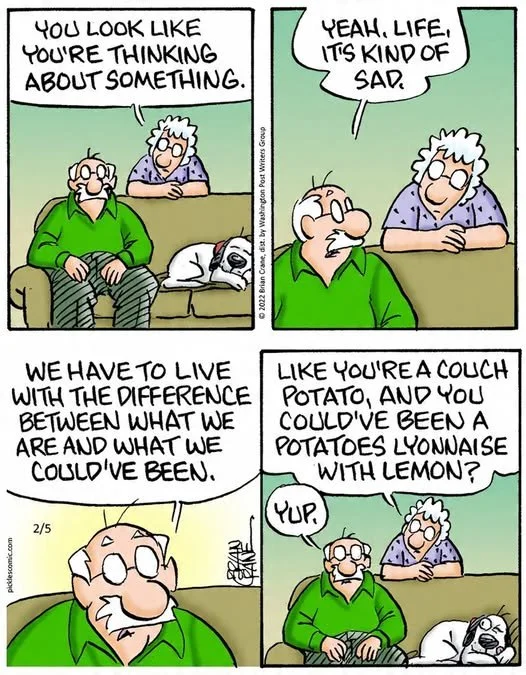

Mot: Simply Can't Win !!! -- Can He!!!???

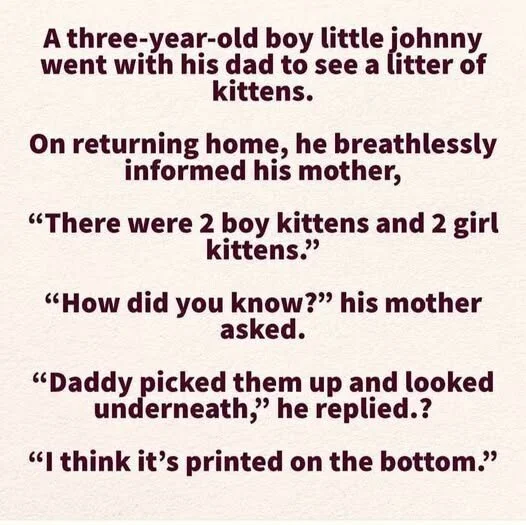

Mot: Love the Wisdom of the ""Wee Folks""!!!

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-17-26

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Overview

China-led cross-border digital currency infrastructure has reached a new milestone, as transaction volumes on a multilateral central bank digital currency platform surged dramatically. What began as a limited experiment has evolved into a functioning settlement network used by sovereign institutions, signaling a structural shift in how international trade can be cleared outside legacy dollar-based systems.

Key Developments

A China-backed cross-border digital currency platform recorded tens of billions of dollars in cumulative transactions

Participating central banks include China, Hong Kong, Thailand, the UAE, and Saudi Arabia

The digital yuan accounts for the vast majority of settlement volume

Government-level wholesale transactions have now occurred on the platform

The system operates outside SWIFT and traditional correspondent banking rails

What’s Actually Changing

This is not a retail crypto story. It is institution-to-institution settlement infrastructure being tested live.

Unlike experimental pilots of the past, this platform:

Settles trade directly between central banks

Reduces reliance on intermediary banks

Shortens settlement times from days to seconds

Limits exposure to sanctions and correspondent risk

The most important shift is architectural: payments are being designed without the dollar as a mandatory bridge asset.

Why It Matters

Parallel payment systems weaken the monopoly power of existing reserve currency rails

Trade can increasingly settle without touching U.S. banking infrastructure

Financial influence moves from enforcement to infrastructure control

Once operational, these systems are difficult to unwind

This is how monetary transitions occur quietly — before headlines, not after them.

Why It Matters to Foreign Currency Holders

Foreign currency holders anticipating revaluation during a Global Reset should note:

Alternative settlement systems reduce forced demand for a single reserve currency

Cross-border CBDCs create conditions for regional currency repricing

Infrastructure precedes valuation changes, not the other way around

When trade no longer needs legacy rails, currency hierarchies begin to adjust

This development does not flip the switch — it installs the wiring.

Implications for the Global Reset

Payments Pillar: Live CBDC settlement outside dollar rails

Trade Pillar: Sovereign trade increasingly bypasses correspondent banking

Monetary Power: Influence shifts from currency dominance to network control

The reset does not arrive as an announcement. It arrives as redundancy.

When the rails change, the destination eventually follows.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — China-led cross-border digital currency platform sees surge

Bank for International Settlements — mBridge Project Overview

~~~~~~~~~~

Bank of England Warns Populism Is Undermining Monetary Trust — Confidence Becomes the Risk

Central banks defend credibility as political pressure intensifies

Overview

The Governor of the Bank of England issued a blunt warning that rising populism and political interference are eroding trust in financial institutions. The statement reflects growing concern among central bankers that confidence — not inflation — may become the next systemic vulnerability.

Key Developments

The Bank of England warned of political pressure undermining institutional independence

Central bank credibility was framed as a core pillar of financial stability

Trust erosion was linked to market volatility and capital flight risk

Similar concerns are emerging across multiple Western monetary authorities

What the Warning Really Signals

Central banks rarely speak publicly about trust unless it is already being tested.

This warning suggests:

Monetary authority is being challenged politically

Policy credibility increasingly requires communication management

Financial stability now depends as much on perception as policy tools

Institutional legitimacy is no longer assumed

When trust must be defended verbally, it is already under strain.

Why It Matters

Fiat systems function on confidence, not convertibility

Political interference weakens long-term policy credibility

Markets price trust faster than inflation data

History shows currency transitions often follow legitimacy crises, not recessions

This is a confidence signal — not a policy one.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies expecting a Global Reset:

Declining institutional trust accelerates diversification away from legacy systems

Confidence fractures create sudden repricing windows

Reset events often follow legitimacy loss, not official failure

Holders positioned early benefit from disorderly adjustments

Trust is the invisible reserve asset. When it erodes, values shift.

Implications for the Global Reset

Confidence Pillar: Institutional trust becomes a limiting factor

Monetary Pillar: Independence questioned, credibility strained

Capital Flows: Investors hedge against political monetary risk

Resets begin when belief systems crack — not when systems collapse.

When central banks defend trust, the real currency is already moving.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — Bank of England governor warns against populism and erosion of trust

Financial Stability Board — Central Bank Independence and Financial Stability

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The U.S. Mint Has SUSPENDED ALL SALES of Silver Numismatic Products.

The U.S. Mint Has SUSPENDED ALL SALES Of Silver Numismatic Products.

The United States Government just blinked. On Wednesday, January 14, 2026, the US Mint officially suspended sales of all silver numismatic products, citing an inability to price the metal during "rapidly rising" market conditions. This is the first signal of a Sovereign Physical Default in modern history.

The U.S. Mint Has SUSPENDED ALL SALES Of Silver Numismatic Products.

The United States Government just blinked. On Wednesday, January 14, 2026, the US Mint officially suspended sales of all silver numismatic products, citing an inability to price the metal during "rapidly rising" market conditions. This is the first signal of a Sovereign Physical Default in modern history.

The entity that prints the currency can no longer source the metal to back it. In this emergency deep dive, we expose the catastrophic disconnect between the Paper Price and the Physical Reality. While Comex silver just hit a new All-Time High of 91.54, the Shanghai Gold Exchange has already shattered the triple−digit barrier, fixing at 100.15.

There are now two prices for silver on Earth: the fake paper price in New York, and the real physical price in China. We analyze the "Whale Raid" on the commercial vaults that triggered this shutdown. Data confirms that 1.3 Million ounces of silver were drained from the JPMorgan vault in a single day, causing a systemic bleed of "Eligible" inventory.

Strategic entities are bypassing the exchange, taking delivery, and shipping metal East to capture the massive arbitrage spread. We map out the "Endgame" scenario. With the Mint closed, dealers rationing inventory, and the Gold-to-Silver ratio collapsing, the path to $300 silver is mathematically locked in.

We discuss the "Ounces to Acres" exit strategy and why selling for dollars during a currency reset is a fatal mistake. The Mint is closed. The Vault is open. And the price is vertical.

Jon Dowling & Mark Z & Zester Discuss The Great Wealth Transfer Latest Updates

Jon Dowling & Mark Z & Zester Discuss The Great Wealth Transfer Latest Updates

1-16-2026

Today we have the dynamic duo The Original MarkZ and his son Zester.

We will be talking about everything with the global reset specifically currencies, bonds, cryptos and precious metals.

Jon Dowling & Mark Z & Zester Discuss The Great Wealth Transfer Latest Updates

1-16-2026

Today we have the dynamic duo The Original MarkZ and his son Zester.

We will be talking about everything with the global reset specifically currencies, bonds, cryptos and precious metals.

FRANK26…..1-16-26…….WITNESS

KTFA

Friday Night Video

FRANK26…..1-16-26…….WITNESS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Friday Night Video

FRANK26…..1-16-26…….WITNESS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Buy the Everything Bubble or Lose to Inflation?

Buy the Everything Bubble or Lose to Inflation?

Heresy Financial: 1-15-2026

As an investor, you’re likely no stranger to uncertainty. But today’s market conditions have left many of us scratching our heads. With asset classes across the board – from stocks and real estate to gold, silver, and commodities – hovering at or near all-time highs, it’s natural to wonder: are we in an “everything bubble”?

And if so, should you stay invested and risk a potentially devastating market crash, or hold onto cash and watch your purchasing power dwindle as inflation continues to rise?

Buy the Everything Bubble or Lose to Inflation?

Heresy Financial: 1-15-2026

As an investor, you’re likely no stranger to uncertainty. But today’s market conditions have left many of us scratching our heads. With asset classes across the board – from stocks and real estate to gold, silver, and commodities – hovering at or near all-time highs, it’s natural to wonder: are we in an “everything bubble”?

And if so, should you stay invested and risk a potentially devastating market crash, or hold onto cash and watch your purchasing power dwindle as inflation continues to rise?

In a recent video from Heresy Financial, market educator Joe Brown tackles this critical dilemma head-on. Brown, a former stockbroker with a unique perspective on the markets, argues that labeling the current situation a bubble oversimplifies the issue.

Instead, he suggests that the root cause of rising asset prices lies in the significant loss of purchasing power of the U.S. dollar.

Brown’s insight is that when you measure asset prices against other stores of value, like gold, the picture changes dramatically. Many assets that appear expensive in dollar terms are, in fact, becoming cheaper when measured against gold.

This indicates that the rising prices we’re seeing aren’t solely the result of overvaluation, but rather a reflection of the dollar’s declining purchasing power.

The culprit behind this debasement is inflation, fueled by a combination of factors including Federal Reserve policies, quantitative easing (QE), and a surge in the money supply. In this environment, holding cash is a losing proposition, as the value of your money erodes over time.

So, how can investors navigate this challenging landscape? Brown recommends a two-pronged approach. First, he advocates for a diversified portfolio with multiple uncorrelated asset classes.

This allows you to rebalance your portfolio and capitalize on relative mispricings without trying to time the market. By spreading your investments across different asset classes, you can reduce your exposure to any one particular market.

Second, Brown suggests allocating a small portion of your portfolio to an aggressive trading strategy, designed to capitalize on market volatility and chaos. His own method has delivered an impressive 36.4% annualized return over the past five years, outpacing major indices by a significant margin.

Looking to the future, Brown warns that Federal Reserve policies are shifting back toward liquidity and monetary easing, signaling continued inflation and asset price inflation. As a result, investors can expect increased market volatility, with frequent bear markets likely to persist. To thrive in this environment, you’ll need strategies that can handle both growth and risk.

In conclusion, the “everything bubble” dilemma is a complex issue that requires a nuanced approach. By understanding the root causes of rising asset prices and adopting a diversified, proactive investment strategy, you can position yourself for success in a rapidly changing market. Watch the full video from Heresy Financial to learn more and take the first step toward securing your financial future.

TIMECODES

0:00 Assets Are in an Everything Bubble

0:21 Staying in Cash Means Losing Purchasing Power

0:50 Gold Silver and Stocks at All Time Highs

1:23 Commodities Are Breaking Records Too

1:43 The Cost of Living Keeps Rising

2:28 The Most Important Question: Compared to What?

4:21 Why Bubbles Are Usually Isolated to One Asset Class

5:11 The Everything Bubble Is Driven by Currency Debasement

6:08 Gold vs Stocks Shows No Clear Bubble

6:51 Bitcoin Appears Expensive Relative to Gold

7:31 How to Navigate the Everything Bubble

8:11 Diversify Across Uncorrelated Asset Classes

8:52 Rebalancing Between Assets Buys Low Sells High

10:04 The Barbell Approach to Portfolio Allocation

10:44 My 36% Average Annual Return Strategy

11:12 The Federal Reserve Restarted Quantitative Easing

12:00 Banks Will Do QE for the Fed Through Deregulation

12:42 Expect More Volatility and Bear Markets Ahead

13:17 Profit From Chaos Instead of Sitting on Sidelines

The Quiet Money Reset, How the IQD Fits in and What to do

The Quiet Money Reset, How the IQD Fits in and What to do

Edu Matrix: 1-15-2026

The world is witnessing a significant, yet subtle transformation in its monetary systems.

Countries such as Iraq, Venezuela, and even the United States are at the forefront of this change, which is characterized by a gradual move away from debt-based financial systems towards ones that are backed by real assets, transparency, and accountability.

This shift, though not dramatic or abrupt, is profound in its implications for the global economy and individual financial security.

The Quiet Money Reset, How the IQD Fits in and What to do

Edu Matrix: 1-15-2026

The world is witnessing a significant, yet subtle transformation in its monetary systems.

Countries such as Iraq, Venezuela, and even the United States are at the forefront of this change, which is characterized by a gradual move away from debt-based financial systems towards ones that are backed by real assets, transparency, and accountability.

This shift, though not dramatic or abrupt, is profound in its implications for the global economy and individual financial security.

At the heart of this transformation is the recognition that traditional monetary systems, heavily reliant on unlimited debt and trust, are being reevaluated.

The presenter in a recent video discussion highlights that this reliance is being replaced by a new paradigm that emphasizes stronger balance sheets and currencies backed by tangible assets. This change is not occurring in a vacuum but is instead being guided by global regulatory frameworks, such as those set forth by the Bank of International Settlements (BIS).

For individuals, navigating this changing landscape requires a proactive and diversified approach. The advice is clear: to remain protected and flexible, one should consider diversifying their holdings across different currencies, accounts, and types of assets.

Keeping debt levels low is also paramount, as is focusing on real-world value rather than getting caught up in hype. The days of placing all your financial eggs in one basket, or worse, keeping them in a safe deposit box, are behind us. A diversified strategy is key to effective risk management in this new era.

The examples of the Iraqi dinar and the Vietnamese dong are particularly instructive. These currencies are being repositioned in a way that ties their value to real economic production, potentially making them valuable in the long term.

This move underscores the broader trend towards asset-backed currencies and away from fiat currency that is not backed by tangible assets.

As this monetary reset continues to unfold, it is crucial for individuals to stay informed and remain calm.

The complexities behind this global shift are multifaceted, and staying abreast of developments is essential for making informed financial decisions.

In conclusion, the ongoing transformation in global monetary systems represents a significant shift towards a more transparent, accountable, and asset-backed financial framework.

While the journey is complex and gradual, being prepared and adopting a diversified financial strategy can help navigate the changes ahead. For further insights and information, watching the full video from Edu Matrix can provide viewers with a more comprehensive understanding of this quiet revolution and its implications for the future.

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. it is Thursday, January 15th and you're listening to the big call. Welcome everybody from near and far, all around the globe. Thank you for tuning in on this wonderful Thursday night.

Let's get into the Intel for tonight, which it's interesting, because a lot of this came to me this afternoon and later this afternoon, which is great. You know, we always get something every day. Sometimes it's not a whole lot. It might be one or two pieces or maybe three pieces. But I'm going to just tell you right now that what we're hearing we're going to start with, we're going to start with what's happening for the bondholders.

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. it is Thursday, January 15th and you're listening to the big call. Welcome everybody from near and far, all around the globe. Thank you for tuning in on this wonderful Thursday night.

Let's get into the Intel for tonight, which it's interesting, because a lot of this came to me this afternoon and later this afternoon, which is great. You know, we always get something every day. Sometimes it's not a whole lot. It might be one or two pieces or maybe three pieces. But I'm going to just tell you right now that what we're hearing we're going to start with, we're going to start with what's happening for the bondholders.

And the reason I bring that up is because tier three bond holders are supposed to go right before we start in tier 4b - So may not have a true, exact shotgun start, but I know the plan for the rollout, and I'll tell you about that in a minute.

So the bondholders have had meetings yesterday and again today in Reno somewhere in California, in New York and in Miami, also in Switzerland, in Zurich Geneva.

Well, we know that they had some issues yesterday with some of the bondholders and representatives in those four US areas, and we had, oh, let's say we had the people that got arrested because they were trying to impersonate other people and mess with the biometrics, and they were caught and arrested, but that slowed the process down a little bit, so they had to restart this morning.

They were going to shoot for 6am they ended up shooting for 9am between nine and 930 this morning, everything started back up.

And what I'm saying is that the bond pay masters or bond representatives were paying out the bond holders into their accounts.

They got started yesterday. They resumed today. They probably, I don't know if they'll be done tomorrow or not, and I think they might make it by tomorrow.

So what does that mean? That means the bondholders are looking to get access to those funds, and I believe the timing is over the weekend, and I'm going to include Saturday and Sunday as availability of funds, getting access to funds, that's what we've heard consolidated today.

Okay, so that's moving on. What about us? I'm going to tell you this timeline that kind of came through today at 4:47am, this morning.

The RV / GCR was initiated to the point where it started and cannot be reversed, and that was early this morning, and they were testing by paying redemption centers and banks.

And with this test, everything has been put into motion.

So redemption centers, 800 number testing, all of that has been completed. Now we're moving through this process.

We have the adjudicated settlements are lined up and essentially are ready to go to all of the what I used to call intermediaries. They have lumped the intermediaries into tier 4A - tier 4A including not only the admirals groups and a number of different groups, not the Internet Group everything, but the Internet Group seems to be in tier 4A - the adjudicated settlements, the CMKS, the Indian claims, farm claims, the quite a bit is all - Let's say it's off ledger.

So they've got it ready to go. I can use the term it's mirrored. It's ready. They have it, like I said, off ledger, ready to pay. And they're using the St Germain trust tomorrow, Friday, to come in with huge amounts of money to sustain all of those intermediaries, or tier 4A so that's where that stands.

So as we move through this weekend, we're looking at a five day rollout, starting Friday, Friday, Saturday, Sunday, Monday, Tuesday.

Well, we know Monday is Martin Luther King Day here in states, and we don't expect anything for us on that day, but we do expect the bondholders to at least see their accounts and maybe get access to their funds over the weekend, and then we in tier 4B the Internet Group, should be receiving our email notifications with the 800 number to call the set appointments. I would think it's going to be a Tuesday, Wednesday.

So that's our five day roll out, and it does take us beyond. - Beyond. Martin Luther King Day, which is the 19th, so it could be 20th, 21st in that timeframe.

Now what else is happening?

Okay, see if I can find out what I was going to tell you guys a minute ago. Do Um,

Okay, let's talk about redemption centers. Redemption centers are going to be the way to go. Why? Because the rates are going to be higher. The only way you're going to get a contract rate on the dinar is at the redemption center, and it's extremely high.

We believe, by what we've seen so far, that the Dong rate is higher at the redemption center, at least initially.

And of course, the Zim is only redeemable at the redemption center.

All of that is set up for us to use the 800 number to call in, set our appointment and then go to our appointment. You guys know that that's the drill.

Now today, rates were coming up on the redemption centers this afternoon, and they were already at the banks with 25 currencies on the screens today.

Now Sunday night, we expect six more currencies to show up on the redemption center screens. So that'd be 25 and 6 is 31, currencies should be visible Monday morning, and I think we're going to find that our redemption center leaders will go in Monday morning just to see and verify the rates that are on those screens on Monday, because the change is supposed to take place Sunday night.

So theoretically, if they were in there Sunday night, they might see those additional 6 currencies I found interesting today was the Iranian rial. Rial is on the screen. The Venezuelan Bolivar is on the screen.

And you realize that there's a designation for the Korean won, which is spelled W, O, N, and it's n, k, s, k, North Korea, South Korea, they're both using the one spelled W, O, N, and I don't know if I've mentioned this before on the big call, but I believe you will see a unification of North and South Korea in our near future.

Believe it's going to be similar to North and South Vietnam that came back in as Vietnam.

So that's something to pray about and look forward to.

And I know President Trump has met with a leader of Korea twice, and I believe they have sure they've talked about that and talked about future plans for North Korea. So I found that interesting.

So we have new currencies coming up on the screens Sunday night, which should be visible Monday morning. Realize now that we, our country, is the only care of that celebrates Martin Luther King day on Monday.

So the other countries are going to be just doing their thing. Or we have a bank holiday, a federal holiday Monday. So are our redemption centers going to be used for our exchanges and redemption on Monday? I don't think so. I doubt it.

I don't think so, because the banks are closed too, and we sort of like to have the banks and the redemption centers both open. But does the three day weekend mean anything? I don't think so, but never.

It's sort of something that somebody started a long time ago. There's no real evidence that we had to have a three day weekend, but it looks like we're pushing beyond this to a couple of days after the holiday.

Are we pushed all the way in the first of February? No, I don't think so, not for us. There's talk about, with the sources we have that they're talking about certain placement groups, certain privates, certain platform groups, starting after the first, because the first is a Sunday, so I think they'll start after the first, and the so called general public might start then.

But you know, we're going to be exchanging for two to three weeks at the redemption centers, and redeeming Zim depending on the demographic, depending on where you are and how many appointments they can line up in a given day, and how long it'll take to run through everybody that has ZIM, and also other currencies to exchange.

Some areas don't have that many currency holders in it might only take four or five days to finish up an area. Other places like Florida, Texas, California, might take three weeks to for the redemption centers and so on to work.

So don't pay any real attention right now. I don't have anything that says we're going to wait as long as February 2.

I think our Start is going to be as part of this five day rollout that starts tomorrow, tomorrow, Friday, but Friday / Saturday primarily is for the funding of certain aspects of the intermediaries in tier 4A and I think that's going to kick us off and kick them off. I think we're moving right through it.

This is should be good. I don't know that we're going to get notified over the weekend like we had hoped, it might end up becoming a Tuesday, Wednesday, start for us.

Okay, so that's what we have so far. That's the Intel for tonight, and I'm encouraged by it. I can see the movement in that direction. I can see from some of the information that we've received. There's quite a bit that has initiated this morning. I believe the time that I didn't say it right? I think it was 347 - this morning. 3:47am was the start of it with no turning back.

So that's encouraging. We haven't quite been here before, and I think we're, moving in the right direction.

So let's do this. I want to thank Sue for her wonderful teaching and her segment tonight and everything that she always does for us, and Bob for information and everything that he does.

And I want to thank GCK and Doug and thank you Pastor Scott and Jeannie and team for getting the signal out all over the globe. And thank you just 15th year now. And thank you for listening and being part of big call for this period, we're looking forward to doing a lot of things together, you guys, and I'm not going to hammer that, but you guys know what we're looking forward to doing with our projects.

So let's pray the call out, and we'll have it over the weekend and Monday, Tuesday, we will plan to have a call on Tuesday. We'll see where we are. Okay, everybody. Have a great night tonight, a great weekend. All right, let's see what happens .

Bruce’s Big Call Dinar Intel Thursday Night 1-15-26 REPLAY LINK Intel Begins 1:05:30

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Bruce’s Big Call Dinar Intel Tuesday Night 1-6-26 REPLAY LINK Intel Begins 1:13:10

Bruce’s Big Call Dinar Intel Thursday Night 1-1-26 New Year’s Day NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25 REPLAY LINK Intel Begins 56:00

Bruce’s Big Call Dinar Intel Thursday Night 12-25-25 REPLAY LINK Intel Begins 20:40

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25 REPLAY LINK Intel Begins 1:05:35

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:08:08

Bruce’s Big Call Dinar Intel Thursday Night 12-11-25 REPLAY LINK Intel Begins 1:21:00

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:02:50

Bruce’s Big Call Dinar Intel Thursday Night 12-4-25 No Transcription Intel Begins 1:17:33

Bruce’s Big Call Dinar Intel Tuesday Night 12-2-25 REPLAY LINK Intel Begins 1:07:20

Seeds of Wisdom RV and Economics Updates Friday Afternoon 1-16-26

Good Afternoon Dinar Recaps,

Silver Structural Shortage Tests Markets and Physical Supply Limits

Paper pricing cracks as physical silver becomes increasingly scarce

Good Afternoon Dinar Recaps,

Silver Structural Shortage Tests Markets and Physical Supply Limits

Paper pricing cracks as physical silver becomes increasingly scarce

Overview

Physical silver is in persistent structural deficit, with global mine production unable to meet industrial and investment demand for multiple years.

Physical inventories in major markets have plunged, leaving little metal available for immediate delivery.

Lease rates and premiums point to acute physical tightness, even as futures and derivatives pricing continues to lag.

These conditions highlight a disconnect between paper markets and real metal, underscoring long-term upward pressure on physical prices.

Key Developments at a Glance

Physical silver usage for industrial demand now accounts for almost 60% of total global supply, driven by solar, electronics, and tech sectors.

Global supply has been in structural deficit for several years, with cumulative shortfalls deepening.

Available deliverable inventory in Western vaults has fallen sharply, reducing immediate physical liquidity.

Lease rates soared, reflecting high costs to borrow metal and tight availability.

Local physical premiums in some markets trade above futures, signaling real-world supply stress.

Silver’s Structural Deficit: What the Data Shows

According to multiple market analyses:

Persistent deficits: Silver supply has failed to meet demand for several consecutive years, with recent deficits estimated in the tens of millions of ounces annually.

Deliverable scarcity: Registered inventories at major exchanges have declined drastically — COMEX stocks are significantly lower than their peaks.

Small free float: Much of the reported vault totals are allocated to ETFs and long-term holders, leaving only a small percentage truly available for immediate physical settlement.

This combination of supply and inventory realities reflects a market where the cost of obtaining physical metal increasingly diverges from paper quotes.

Backwardation and Lease Rates Point to Tightness

Market pricing behavior reveals real physical stress:

Backwardation — where current spot prices trade above future prices — is observed, indicating urgency for immediate delivery.

Lease rates spiked to extraordinary highs in recent periods, far exceeding normal borrowing costs and exposing difficulty sourcing actual metal.

Such unusual dynamics commonly occur when metal is scarce and participants must pay premiums to access physical supply.

Industrial and Strategic Demand Continues

Industry and strategic holders continue to compete for scarce metal:

Industrial demand, particularly from renewable energy and high-tech manufacturing, remains strong and relatively price-inelastic.

ETF and investment demand adds pressure on inventories, as funds take delivery of physical bars to back shares.

Strategic export controls — such as recent restrictions on silver exports from major producing countries — further tighten available supply.

This mix of demand drivers makes it unlikely that inventories will replenish quickly, absent major production increases.

Why It Matters

Paper and physical markets diverging: Futures prices and physical spot premiums no longer align, indicating emerging real scarcity rather than synthetic pricing.

Inventory exhaustion risk: With deliverable inventories shrinking, paper contracts may increasingly fail to represent actual metal availability.

Short positions become riskier: When physical inventories are low and demand remains high, holders of short positions face rising costs and potential forcing events.

Industrial users face supply constraints: Key sectors like solar energy, electronics, and EVs may confront rising input costs and longer fulfillment times.

This structural imbalance is less about short-term speculation and more about long-term supply dynamics.

Why It Matters to Foreign Currency Holders

For readers holding foreign currency with an eye toward the Global Reset:

Scarcity of essential real assets like silver supports hard asset revaluation narratives.

If physical supply fails to meet demand, prices adjust upward regardless of paper markets.

Currency confidence often weakens when real supply of strategic commodities tightens.

Resets historically favor tangible, scarce assets over fiat claims in periods of monetary stress.

In the context of a reset, assets tied to real industrial and monetary demand can outperform traditional paper benchmarks.

Implications for the Global Reset

Pillar 1 – Real Asset Scarcity: Structural shortfalls in strategic commodities like silver reflect deeper supply constraints in the global economy.

Pillar 2 – Trust Shift in Markets: Divergence between paper pricing and physical reality could accelerate reassessment of traditional financial instruments.

This isn’t just a market anomaly — it’s evidence of increasing structural stress in both real supply chains and financial price discovery.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

FinancialContent – Silver’s Historic Surge Highlights Structural Supply Deficit

Investing.com – Silver Flashes Rare Warning Signal as Physical Market Seizes Up

DiscoveryAlert – Silver Supply Imbalance and Delivery Scarcity Signals

~~~~~~~~~~

IMF Signals Resilience — But the Next Shock Is Already Forming

Global growth holds for now, while structural fault lines quietly widen

Overview

The IMF signaled near-term global economic resilience, despite escalating trade, geopolitical, and financial stress.

Officials warned that future shocks are increasingly likely, not less.

The message underscores a system that is stable on the surface, fragile underneath — a classic late-cycle signal.

Key Developments at a Glance

IMF Managing Director Kristalina Georgieva confirmed the upcoming World Economic Outlook shows continued global growth resilience.

Trade fragmentation, geopolitical tensions, and technology disruption were identified as primary risk vectors.

Policymakers are increasingly relying on financial buffers, liquidity tools, and coordination to prevent cascading shocks.

The IMF emphasized that resilience is uneven and conditional, not structural.

What the IMF Is Really Saying

While markets focus on the word resilient, the IMF’s warning centers on shock transmission risk.

Growth is being supported by policy intervention, not organic balance

Trade disruptions are no longer temporary — they are systemic

Technology and capital flows are concentrating power, liquidity, and risk

The global economy is absorbing shocks, not resolving root causes

This reflects a world where stress is deferred, not eliminated.

Why This Matters

A “resilient” system that requires constant intervention is not stable — it is managed.

The IMF’s framing suggests authorities expect disruptions ahead, even if timing is uncertain.

Historically, periods of declared resilience often precede monetary or currency realignments, not prevent them.

Why It Matters to Foreign Currency Holders

Foreign currency holders are watching for revaluation, reset, or repricing events tied to systemic change.

IMF language implies currency stability is being actively defended, not naturally sustained

Trade fragmentation increases pressure for regional settlement systems and non-dollar flows

When shocks finally surface, currency hierarchies tend to adjust rapidly

Resilience messaging often serves as confidence management ahead of transition

For those holding foreign currencies in anticipation of a Global Reset, this reinforces a key reality:

The system is being held together — not healed.

Implications for the Global Reset

Pillar: Trade — Fragmentation is now normalized, accelerating multipolar settlement paths

Pillar: Assets — Capital concentration masks underlying valuation risk

Pillar: Technology — Digital infrastructure is becoming a shock amplifier, not just an efficiency tool

Pillar: Confidence — Official reassurance suggests concern about sentiment durability

This is not a warning of collapse — it is confirmation of controlled instability.

Bottom Line

The IMF is telling the world that the system still works — but only with constant support.

Resilience today may simply be borrowed stability from tomorrow.

This is not just economic forecasting — it’s stress management in a transitioning global order.

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps