Seeds of Wisdom RV and Economics Updates Friday Afternoon 1-2-26

Good Afternoon Dinar Recaps,

Global Government Debt and Bond Stress Re-Emerge as 2026 Begins

Rising yields expose the limits of fiscal and monetary support

Good Afternoon Dinar Recaps,

Global Government Debt and Bond Stress Re-Emerge as 2026 Begins

Rising yields expose the limits of fiscal and monetary support

Overview

Global sovereign debt levels remain at historic highs, pressuring government finances worldwide

Bond market volatility is resurfacing, particularly in long-dated government debt

Higher-for-longer interest rates are colliding with massive refinancing needs

Central banks are constrained, unable to stabilize bond markets without risking inflation credibility

Bond stress is increasingly viewed as a leading reset trigger

Key Developments

Governments face trillions in debt rollovers over the next two years, raising refinancing risk

Rising yields are increasing debt-service costs, squeezing fiscal budgets

Bond markets are no longer acting as shock absorbers, amplifying volatility instead

Foreign demand for sovereign debt is weakening, especially where fiscal discipline is questioned

Central banks continue balance-sheet reduction, removing a major source of artificial bond demand

Why It Matters

Debt markets form the foundation of the modern financial system. When confidence in sovereign bonds weakens, currencies, equities, credit, and trade financing all reprice.

Unlike banking crises, which can be addressed with liquidity, bond crises are credibility crises. Once investors question a government’s ability to service debt without inflation or monetization, stabilization becomes far more difficult.

Historically, systemic resets follow bond market stress — not equity selloffs.

Why It Matters to Foreign Currency Holders

For foreign currency holders, bond instability creates asymmetric risk:

Debt-heavy currencies weaken first, regardless of reserve status

Rising yields can signal distress rather than strength

Capital flows shift rapidly when fiscal sustainability is questioned

Settlement confidence erodes when monetization becomes the backstop

In reset terms, currency value increasingly reflects debt credibility, not political power.

Implications for the Global Reset

Pillar: Debt Sustainability Defines Monetary Credibility

Currencies fail when debt cannot be credibly serviced.Pillar: Bond Markets Trigger Repricing Cycles

They move slowly — then all at once.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Why investors will learn to love government bonds again — after volatility”

Bank for International Settlements – Annual Economic Report: Global Debt and Financial Stability

~~~~~~~~~~

Iran Unrest Escalates as Inflation and Currency Collapse Fuel Instability

Domestic pressure collides with external escalation risk

Overview

Nationwide protests have erupted across Iran, driven by soaring inflation and currency collapse

The unrest represents Iran’s most serious internal challenge in three years

Security forces have reportedly used force against demonstrators, resulting in deaths and arrests

U.S. warnings of possible intervention have heightened geopolitical risk

Economic stress and external pressure are converging at a critical moment

Key Developments

Protests began over rising prices and cost-of-living pressures, then spread across multiple cities

The Iranian rial has plunged to historic lows, intensifying public anger and instability

President Masoud Pezeshkian acknowledged government failures, while warning unrest would not be tolerated

U.S. President Donald Trump warned Washington could act if protesters are fired upon, escalating tensions

Iran continues to face sanctions pressure and regional confrontation, limiting policy flexibility

Why It Matters

Iran’s unrest reflects a classic reset pattern: currency failure precedes political instability. Inflation, sanctions, and isolation have eroded purchasing power and public trust, leaving the government with narrowing options.

What makes this episode particularly dangerous is timing. Domestic unrest is unfolding amid heightened regional tension involving the United States and Israel, increasing the risk that internal instability spills outward into broader conflict.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Iran’s situation highlights systemic warning signals:

Currency collapse accelerates social unrest and political fracture

Sanctions magnify FX volatility and settlement risk

Escalation risk drives capital flight and safe-haven demand

Access to global payment systems matters more than reserves

In reset terms, currencies fail first at home — then in global markets.

Implications for the Global Reset

Pillar: Currency Credibility Equals Political Stability

When money fails, legitimacy erodes.Pillar: Sanctions Expose Structural Weaknesses

Isolation accelerates internal fracture points.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Trump warns Iran as protests rage over inflation and currency collapse”

Financial Times – “Iran unrest tests leadership as economic pressure mounts”

~~~~~~~~~~

Eurozone Expands as Bulgaria Moves Closer to Adoption

Currency bloc growth signals deeper monetary realignment

Overview

Bulgaria has moved closer to joining the euro area, advancing deeper European monetary integration

The expansion comes amid global currency volatility and geopolitical fragmentation

Eurozone growth strengthens bloc cohesion but also raises policy complexity

Monetary alignment increasingly reflects access and stability, not just growth metrics

Currency blocs are becoming more relevant in the reset phase

Key Developments

European institutions approved Bulgaria’s progress toward euro adoption, citing fiscal and inflation benchmarks

The move expands the euro’s geographic and financial footprint

Concerns over disinformation and political influence accompanied the process, underscoring strategic sensitivity

Eurozone policymakers face rising internal divergence, even as membership expands

Bloc expansion reinforces the euro’s role as an alternative settlement anchor

Why It Matters

Eurozone expansion reflects a broader reset trend: currencies are consolidating into trusted networks. As global trade and finance fragment, nations are seeking protection through larger, rules-based monetary blocs.

While expansion strengthens the euro’s reach, it also increases internal complexity. More members mean greater strain on shared fiscal discipline and monetary coordination, especially during periods of stress.

This is less about optimism — and more about positioning for stability in a fractured global system.

Why It Matters to Foreign Currency Holders

For foreign currency holders, eurozone expansion signals:

Bloc-aligned currencies gain settlement credibility

FX stability increasingly depends on network inclusion

Peripheral currencies outside blocs face repricing risk

Monetary policy becomes more political and structural

In reset terms, access to trusted currency systems matters more than independence.

Implications for the Global Reset

Pillar: Currency Blocs Replace Global Uniformity

Monetary order is reorganizing around trusted networks.Pillar: Access Defines Currency Value

Inclusion matters more than scale alone.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Times – “Bulgaria moves closer to joining the eurozone despite disinformation concerns”

Reuters – “Bulgaria clears hurdles toward euro adoption as bloc expands”

~~~~~~~~~~

BRICS De-Dollarization Agenda for 2026 Enters Implementation Phase

From planning to parallel financial systems

Overview

BRICS has shifted from de-dollarization rhetoric to real-world execution

India’s 2026 BRICS presidency is accelerating alternative financial infrastructure

Payment systems, gold-backed settlement, and CBDC interoperability are now operational

Dollar use in intra-BRICS trade is already sharply reduced

This marks a structural change in global settlement architecture

Key Developments

India formally assumed the BRICS presidency, with the 18th BRICS Summit expected in New Delhi later this year

BRICS Pay is expanding as a decentralized payment network, linking national systems such as CIPS, SPFS, and UPI

Intra-BRICS trade has reduced U.S. dollar usage by roughly two-thirds, according to bloc-linked estimates

CBDC interoperability frameworks are under active development, connecting the digital yuan, ruble, and rupee

The BRICS Unit, a gold-backed settlement instrument, is scheduled for launch in 2026, following a 2025 pilot backed by gold and member currencies

The New Development Bank continues expanding local currency lending, reducing reliance on dollar-based debt

Why It Matters

The BRICS agenda has entered what analysts describe as “De-dollarization 2.0” — not the abandonment of the dollar, but the construction of parallel systems that make the dollar optional.

Rather than challenging the dollar directly, BRICS members are routing around it, building payment rails, settlement units, and financing mechanisms that operate independently of Western-controlled systems.

This is not a sudden break — it is a gradual rebalancing of monetary power.

Why It Matters to Foreign Currency Holders

For foreign currency holders, the implications are clear:

Settlement optionality weakens single-currency dominance

Gold-linked and asset-backed instruments regain relevance

Currencies tied to alternative payment rails gain strategic value

Dollar-based leverage tools lose exclusivity

In reset terms, currency power now flows through infrastructure, not headlines.

Implications for the Global Reset

Pillar: Parallel Financial Systems Are Now Live

De-dollarization is operational, not theoretical.Pillar: Gold Re-enters the Settlement Layer

Asset backing restores trust outside fiat-only systems.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS De-Dollarization Agenda for 2026 Advances With Global Launch”

Reuters – “BRICS nations expand local currency trade and payment systems amid sanctions pressure”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

50X Silver Revaluation: They Tried To Smash Silver But Ended Up Buying Physical! Andy Schectman

50X Silver Revaluation: They Tried To Smash Silver But Ended Up Buying Physical! Andy Schectman

Smart Stock Trading and Gold Silver Investing: 1-2-2026

In this interview, Andy Schectman, President of Miles Franklin Precious Metals, delivers a bullish outlook on silver, predicting a massive rally potentially reaching 50X its current value due to an impending revaluation driven by global monetary shifts, de-dollarization, supply shortages, and institutional demand.

He warns that the transition will be turbulent ("buckle up, it's going to be rough"), with economic challenges ahead as the US dollar weakens and fiat systems face stress.

50X Silver Revaluation: They Tried To Smash Silver But Ended Up Buying Physical! Andy Schectman

Smart Stock Trading and Gold Silver Investing: 1-2-2026

In this interview, Andy Schectman, President of Miles Franklin Precious Metals, delivers a bullish outlook on silver, predicting a massive rally potentially reaching 50X its current value due to an impending revaluation driven by global monetary shifts, de-dollarization, supply shortages, and institutional demand.

He warns that the transition will be turbulent ("buckle up, it's going to be rough"), with economic challenges ahead as the US dollar weakens and fiat systems face stress.

Schectman highlights 2026 as a pivotal year where gold and silver could outperform all other assets, but emphasizes that most Americans are unprepared for the coming financial disruptions, including inflation, debt crises, and BRICS-related changes.

Key drivers include physical silver shortages, manipulation suppression ending, central bank accumulation, and silver's dual role as an industrial and monetary metal.

Timestamps:

– The Psychological Thresholds for Silver's Price

– JP Morgan's Historic Flip from Biggest Silver Short to Long

– Physical Silver Removed from COMEX Vaults and Supply Tightening

– Record-Breaking Deliveries of Physical Silver and Gold

– US Banks Exit Silver Shorts; Foreign Banks Remain Exposed

– China's Export Ban and the Geopolitical Race for Silver

– Silver Supply Shortages and Physical Demand

– The Potential 50X Rally in Silver and Revaluation Drivers

– De-Dollarization, BRICS, and Global Monetary Shifts

– US Debt Crisis, Inflation, and Economic Turbulence Ahead ("Buckle Up")

– Manipulation Ending and Institutional/Central Bank Buying

– Silver's Dual Role (Industrial + Monetary) and Shortage Risks

Coffee with MarkZ. Joined by Mr. Cottrell 01/02/2026

Coffee with MarkZ. Joined by Mr. Cottrell 01/02/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Welcome to a new Year……..

Member: Greetings going into 2026. Happy New Years to ALL

Coffee with MarkZ. Joined by Mr. Cottrell 01/02/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Welcome to a new Year……..

Member: Greetings going into 2026. Happy New Years to ALL

Member: so I'm guessing Iraq is still using their 1310 rate and not international?

Member: I had really been hopeful they would actually do it for Jan 1……sigh

MZ: Its all good and lots of things are happening. It’s going to be an epic year.

Member: Hopefully It’s going to be an epic weekend!!!

Member: Mark, we need to see all of the accomplishments that have put us this close to the RV. That will keep everyone connected and more confident that it will happen soon.

MZ: I will try to do that over the next few days.

Member: Mark with Iraq it seems they r moving but no fan fair… do u think they will just switch very quietly and we see it days later?

MZ: That is exactly what I believe it will appear like to the rest of the world. They are going to try to keep this as quiet as they can. It will appear differently to us….we are more plugged in and banks will want us to come in so they have liquidity

MZ: There is so much focus on Iran right now.

Member: Could Iraq use the instability in Iran to no do the RV…..they always seem to have an excuse not to flip the switch

MZ: I have a theory that this is why we are not already in the bank today. Maybe they are delaying for a very short time because it appears Iran may be ready to go with it. (RV?) Maybe Venezuela as well??? Just a theory

MZ: “Trump threatens intervention in Iran to protect the protestors” the government has started shooting into the protests.

Member: The Iranians are chanting for the Prince. And carrying the flag with the sun and lion.

Member: I wonder- Are the Iraqi citizens getting tired of waiting on their RV? After all, they were promised an increase in their purchasing power.

MZ: “ Iraqi dinar Strengthens at year end amid reduced market activity and holiday calm”

MZ: No bond updates which is really odd. I had expected something but all I am hearing is silence.

Member: Silence on Bonds could be a good sign.

MZ: It could be a good sign but I would feel better if we knew.

Member: As per other podcasters- the QFS is in progress.....

Member: The rumor is many countries released new currency on Jan 1.

Member: My PNC bank said they are no longer selling Vietnamese Dong....called Chase bank & they said the same thing

Member: Just found out my bank (CU) started dealing with foreign currency. Just had to buy me a little more IQD. Excited.

Member: When Dinar recaps sends us 800 # will it be in a separate email from their normal email they send us everyday ?

Member: They stated a while ago…..they would have fireworks and the announcement on their front page…….they might send a special email out to their group……guess we wait and see.

Member: Thanks Mark and Mr. C. Hope everyone has a wonderful weekend. Stay warm

Mr. Cottrell joins the stream today. Please listen to the replay for his information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

Seeds of Wisdom RV and Economics Updates Friday Morning 1-2-26

Trade Fragmentation: The Downstream Consequence of Systemic Stress

How fractured commerce and payment systems reveal deeper global economic realignments

Overview

Global trade networks are increasingly splitting into regional and strategic blocs as geopolitical tensions, sanctions regimes, and financial fragmentation intensify.

Trade fragmentation is not the initial trigger of systemic crisis — it is a downstream consequence of deeper monetary and financial stress.

As payment system access becomes weaponized and currency volatility rises, nations are realigning trade corridors based on trust, interoperability, and financial access rather than comparative advantage.

Trade Fragmentation: The Downstream Consequence of Systemic Stress

How fractured commerce and payment systems reveal deeper global economic realignments

Overview

Global trade networks are increasingly splitting into regional and strategic blocs as geopolitical tensions, sanctions regimes, and financial fragmentation intensify.

Trade fragmentation is not the initial trigger of systemic crisis — it is a downstream consequence of deeper monetary and financial stress.

As payment system access becomes weaponized and currency volatility rises, nations are realigning trade corridors based on trust, interoperability, and financial access rather than comparative advantage.

Key Developments

Sanctions and counter-sanctions have constrained access to traditional trade settlement systems, prompting several nations to explore alternative payment rails and bilateral settlement arrangements.

Major economies and trading blocs are increasingly negotiating currency swap lines, local currency trade agreements, and digital payment linkages to bypass dominance by any single system.

Supply chains are being reshaped — not just for efficiency, but for redundancy and security, with firms and governments diversifying sourcing to reduce exposure to any one currency or financial network.

Emerging markets with limited access to major payment systems face higher financing costs, greater FX volatility, and reduced foreign demand for sovereign debt — accelerating trade realignment.

Regional trade groupings — both economic and geopolitical — are prioritizing internal trade facilitation over integration with traditional global chains, reflecting trust over optimal economic logic.

Why It Matters

Trade fragmentation is significant because it reveals a shift in the underlying architecture of global commerce. Traditional trade theory assumes frictionless movement of goods and capital underpinned by trusted settlement systems and credible currencies. But as financial stress rises and central banks’ policy space narrows, trade is no longer just about comparative advantage — it’s about access and survivability.

When settlement systems become perceived as weaponizable, and when financing costs vary sharply across currency regimes, countries begin to reroute trade flows based on financial trustworthiness and system access. This isn’t a temporary distortion — it is a structural change in how cross-border commerce operates.

Why It Matters to Foreign Currency Holders

For foreign currency holders, trade fragmentation introduces complex new dynamics:

Settlement Access Becomes a Currency Driver: Access to major payment networks becomes as important as reserve status in determining currency demand.

Regional Bloc Currencies Strengthen Internally: Currencies within tightly integrated trade blocs may gain relative stability even if they lack traditional reserve status.

FX Volatility Increases Along New Trade Routes: As trade flows reroute, demand and liquidity for certain currencies can surge or collapse based on access rather than economic fundamentals.

Hedging Costs and Financial Risk Rise: Fragmented trade pathways elevate hedging costs and complicate risk management for multinational enterprises and investors.

Reserve Strategy Shifts: Portfolio and reserve allocations begin to tilt toward currencies that facilitate diversified trade network access, not just those with high liquidity.

Implications for the Global Reset

Pillar 1 — Fragmentation Reflects Deeper Financial Stress:

Trade fragmentation is not causal — it is a structural signal that financial and monetary stress has exceeded thresholds where traditional settlement systems can function smoothly.

Pillar 2 — Systemic Realignment Around Trust and Access:

New trade corridors, settlement mechanisms, and financial interoperability standards are emerging based on trust networks and risk exposure, not purely import/export balances.

Pillar 3 — Currency Utility Reprices with Trade Role:

As trade networks reorganize, currency utility increasingly depends on system access and settlement integration, altering long-term valuation models.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Maduro Signals Willingness for Talks With U.S., Offers Cooperation on Oil and Drugs

Venezuela shifts tone as sanctions pressure and energy geopolitics converge

Overview

Venezuelan President Nicolás Maduro signaled openness to renewed dialogue with the United States, proposing cooperation on drug trafficking and offering U.S. companies access to Venezuela’s oil sector

The remarks mark a notable shift from months of hostile rhetoric and confrontation

Maduro framed Venezuela as a “brother country” to the U.S., emphasizing willingness to engage President Donald Trump directly

The outreach comes amid heightened U.S. military activity in the Caribbean and ongoing sanctions pressure

Energy access and geopolitical stability are central to the subtext of the overture

Key Developments

Maduro referenced a prior conversation in which Trump addressed him as “Mr. President,” portraying it as recognition of his authority

The interview aired on state television and was staged in militarized areas of Caracas, projecting strength and control

Maduro offered cooperation on drug trafficking and openness to U.S. oil companies, including expanded access to Venezuela’s reserves

U.S. officials have accused Maduro of leading a “narco-state,” a charge Caracas denies

Chevron and other U.S. firms already maintain limited operations under sanctions exemptions

Why It Matters

Maduro’s conciliatory tone reflects mounting economic pressure and a search for legitimacy amid years of sanctions, inflation, and capital flight. For Washington, any engagement carries implications for energy security, regional stability, and sanctions enforcement.

This is not merely diplomatic theater. Energy access, sanctions relief, and political recognition are deeply intertwined, especially as global oil markets remain sensitive to supply disruptions and geopolitical shocks.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Venezuela’s outreach highlights several critical dynamics:

Sanctions relief directly impacts currency stabilization prospects

Energy access influences hard-currency inflows and balance-of-payments pressure

Political recognition can unlock settlement channels and foreign investment

Currencies under sanctions reprice rapidly when access conditions change

In reset terms, currency value increasingly depends on access, legitimacy, and settlement pathways — not just reserves.

Implications for the Global Reset

Pillar: Energy Access Shapes Monetary Breathing Room

Oil revenue remains a decisive lever for sanctioned states.Pillar: Sanctions Are Negotiation Tools, Not Permanent States

Reset dynamics favor conditional reintegration over isolation.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Trump Threatens Action Over Deadly Protests in Iran

Inflation-driven unrest collides with geopolitical escalation risks

Overview

U.S. President Donald Trump warned that Washington could intervene if Iranian security forces fire on protesters

Nationwide protests over soaring inflation and currency collapse have entered their fourth day

Several deaths have been reported, marking Iran’s most serious unrest in three years

Trump’s comments follow recent U.S. and Israeli strikes on Iranian nuclear facilities

The situation raises the risk of escalation between Washington and Tehran

Key Developments

Trump stated the United States was “locked and loaded” in response to reported violence against protesters

Demonstrations erupted across multiple regions, driven by inflation, unemployment, and economic hardship

Iranian officials condemned Trump’s remarks as foreign interference

Security forces reportedly used force against demonstrators, prompting international concern

President Masoud Pezeshkian acknowledged government failures, while warning unrest would not be tolerated

Why It Matters

Iran’s unrest represents a convergence of economic collapse and geopolitical pressure. Inflation above 36%, a rapidly weakening rial, and years of sanctions have eroded public trust. Trump’s warning injects an external escalation risk into what is already a fragile domestic crisis.

This moment is especially volatile because economic legitimacy, internal stability, and external deterrence are all under strain simultaneously. Any miscalculation could rapidly widen the conflict beyond Iran’s borders.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Iran’s situation highlights critical reset dynamics:

Currency collapse accelerates social unrest and political instability

Sanctions and isolation magnify FX volatility and settlement risk

Escalation risk drives capital flight and safe-haven demand

Access to global payment systems matters more than nominal reserves

In reset terms, currency credibility fails first at home — then abroad.

Implications for the Global Reset

Pillar: Currency Failure Precedes Political Instability

Inflation and FX collapse undermine state legitimacy.Pillar: Sanctions Amplify Internal Fracture Points

Prolonged isolation accelerates systemic stress.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “Trump Threatens Action Over Deadly Protests in Iran”

Reuters – “Trump warns Iran as protests rage over inflation and currency collapse”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Friday 1-2-2025

KTFA:

Frank26: "TARIFFS WORKING ON GLOBAL CURRENCIES"....F26

Major Currency and Financial Resets That Took Effect on January 1

January 1 is ideal for currency resets because it aligns with the start of the fiscal year, offering clarity, a fresh beginning, and minimal disruption to economic activities.

12/31/2025

January 1 has repeatedly served as a symbolic and practical launch date for some of the world’s most consequential currency reforms, redenominations and financial resets, as governments sought clean accounting transitions, psychological breaks from crisis, and alignment with fiscal calendars.

KTFA:

Frank26: "TARIFFS WORKING ON GLOBAL CURRENCIES"....F26

Major Currency and Financial Resets That Took Effect on January 1

January 1 is ideal for currency resets because it aligns with the start of the fiscal year, offering clarity, a fresh beginning, and minimal disruption to economic activities.

12/31/2025

January 1 has repeatedly served as a symbolic and practical launch date for some of the world’s most consequential currency reforms, redenominations and financial resets, as governments sought clean accounting transitions, psychological breaks from crisis, and alignment with fiscal calendars.

Economists say the date is favored because it coincides with new budgets, accounting years and tax cycles, reducing operational disruption while signaling a “new start” to markets and citizens.

The Euro: Europe’s Historic Monetary Reset (1999–2002)

Jan. 1, 1999: The euro was launched as a virtual currency for accounting and financial markets, replacing national currencies in 11 EU states.

Jan. 1, 2002: Euro banknotes and coins entered circulation, permanently ending the franc, mark, lira and others.

Impact: One of the largest financial resets in history, affecting over 300 million people and reshaping global reserve currency dynamics.

Sources: European Central Bank, Reuters, IMF.

Turkey: Lira Redenomination After Hyperinflation (2005)

Jan. 1, 2005: Turkey removed six zeros from its currency.

1,000,000 old lira = 1 new lira (TRY).

Context: Years of inflation had rendered prices unmanageable. The reset followed IMF-backed reforms and restored confidence.

Sources: Turkish Central Bank, IMF, Reuters.

Russia: Post-Soviet Ruble Reform (1998)

Jan. 1, 1998: Russia cut three zeros from the ruble.

1,000 old rubles = 1 new ruble.

Context: Designed to stabilize the economy after post-Soviet collapse and before the 1998 financial crisis.

Sources: Russian Central Bank, World Bank.

Brazil: Real Plan Consolidation (1994)

Jan. 1, 1994: Brazil introduced the real (BRL), ending decades of hyperinflation.

Replaced multiple failed currencies.

Context: One of the most successful inflation-control programs in emerging markets.

Sources: Banco Central do Brasil, IMF.

Poland: Zloty Redenomination (1995)

Jan. 1, 1995: Poland removed four zeros from the zloty.

10,000 old zloty = 1 new zloty.

Context: Part of post-communist economic transition and EU accession path.

Sources: National Bank of Poland, ECB.

Romania: Leu Redenomination (2005)

Jan. 1, 2005: Romania cut four zeros from the leu.

10,000 old lei = 1 new leu (RON).

Context: Aimed at simplifying transactions ahead of EU membership.

Sources: Romanian Central Bank, Reuters.

Argentina: Peso Convertibility Reset (1992)

Jan. 1, 1992: Argentina introduced a new peso, pegged 1:1 to the U.S. dollar.

10,000 australes = 1 peso.

Context: Temporarily curbed inflation but later collapsed in the 2001 crisis.

Sources: IMF, World Bank.

Zimbabwe: Dollarization Reset (2009)

Jan. 1, 2009: Zimbabwe effectively abandoned its currency, allowing foreign currencies for transactions after hyperinflation.

Context: One of history’s most extreme monetary collapses.

Sources: IMF, Reserve Bank of Zimbabwe.

Why January 1?

Economists identify four key reasons:

Fiscal year alignment

Accounting clarity

Public psychology of renewal

Lower transactional disruption

“Currency resets are as much about confidence as arithmetic,” IMF economists note. “January 1 provides a psychological reset alongside a technical one.”

Current Context

Several countries, including Syria, have chosen January 1 for planned redenominations or currency transitions, continuing a long-standing global pattern of using the date to mark economic turning points. LINK

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The float like this <snap>. The float and the REER like, boom!

Frank26 Preparation is being made for a new exchange rate. When is it coming? God only knows. But it's in the works because as of today 1310 does not exist anymore. Now, that's what they said to everyone. They have the articles to prove it.

Militia Man Reforms like deleting the 3 zeros simplify transactions preparing for a real effective exchange rate adjustment based on reserves and growth...Growth is part of the non-oil resources...These developments indicate readiness for a managed revaluation of the dinar to reflect fundamentals. That's what a REER is about. It's about fundamentals such as...$16 trillion worth of natural resources, historic low inflation, political soothness, which we've just witnessed [with the election]...

***************

China Has Changed the SILVER Game From Paper to PHYSICAL - 'Watch Shanghai': Francis Hunt

Commodity Culture: 1-1-2026

Francis Hunt thinks there's a fundamental shift underway in the global silver market and the spread in price between West and East is painting a picture of physical metal replacing paper contracts as the strategic value of silver becomes more apparent.

Francis breaks out the charts to dive into Shanghai's impact on the silver market, why he thinks a $1000 price is possible, and why the gold-silver ratio could be headed to single digits ahead.

00:00 Introduction

01:14 Silver's Incredible Run

08:34 Silver Spread in Shanghai

16:32 Geopolitical Outlook for Silver

23:09 Is the Broad Market in a Bubble?

36:27 Preparing For What's to Come

Most Millionaires Don't Consider Themselves Wealthy. So What Does It Really Mean To Be Rich?

Most Millionaires Don't Consider Themselves Wealthy. So What Does It Really Mean To Be Rich?

Ivana Pino Ivana Pino · Senior Writer Updated December 18, 2025 Yahoo Personal Finance

A new Schwab survey finds that only a third of America’s millionaires feel wealthy. By most traditional measures, having a net worth of $1 million should put someone firmly in the “wealthy” category. Yet a growing number of millionaires don’t see it that way. Just one third (36%) of the nation’s wealthiest citizens — those with at least $1 million in investable assets — consider themselves wealthy, according to Northwestern Mutual’s 2025 Planning and Progress study.

Further, nearly half (49%) of American millionaires say their financial planning needs improvement, citing the possibility of outliving their savings, the impact of taxes in retirement, and potential long-term care needs as their top financial concerns.

Most Millionaires Don't Consider Themselves Wealthy. So What Does It Really Mean To Be Rich?

Ivana Pino · Senior Writer Updated December 18, 2025 Yahoo Personal Finance

A new Schwab survey finds that only a third of America’s millionaires feel wealthy. By most traditional measures, having a net worth of $1 million should put someone firmly in the “wealthy” category. Yet a growing number of millionaires don’t see it that way. Just one third (36%) of the nation’s wealthiest citizens — those with at least $1 million in investable assets — consider themselves wealthy, according to Northwestern Mutual’s 2025 Planning and Progress study.

Further, nearly half (49%) of American millionaires say their financial planning needs improvement, citing the possibility of outliving their savings, the impact of taxes in retirement, and potential long-term care needs as their top financial concerns.

This gap may be surprising, but it highlights how rising costs, longer lifespans, and shifting expectations have redefined what it means to feel rich in modern America.

Why $1 million doesn’t feel like a lot of money anymore

One reason most millionaires don’t consider themselves wealthy is because our definition of wealth has changed over time.

“Being a millionaire used to mean you had done really well and ‘made it,’” said Tom Mathews, CFEd, CPA, and author of "How Money Works." “Today, it really just means you’ve crossed an outdated line.”

Mathews explained the problem isn’t necessarily that people have less money today, but rather, they have less certainty and control around their finances. “Things like inflation, rising taxes, market volatility, and the escalating cost of housing, healthcare, and education have changed what financial security feels like,” he said. “A million dollars on paper doesn’t stretch the way it used to, especially when most of that net worth is tied up in illiquid assets like homes, retirement accounts, or businesses.”

There’s also the issue of longevity. With people living longer, a seven-figure portfolio may not seem substantial when it’s expected to fund decades of living expenses and rising medical costs.

In other words, Mathews said, many people might look wealthy on paper, but that doesn’t mean they feel financially secure.

What does it mean to be rich today?

If millionaires don’t necessarily feel wealthy, what does it take to feel rich in today’s economy?

According to Charles Schwab’s 2025 Modern Wealth Survey, Americans need an average net worth of $839,000 to be financially comfortable, and $2.3 million to feel wealthy.

TO READ MORE: https://finance.yahoo.com/personal-finance/banking/article/how-many-millionaires-in-america-205846046.html

Even Millionaires Don't Feel Wealthy These Days

Even Millionaires Don't Feel Wealthy These Days

Daniel de Visé, USA TODAY December 3, 2025

A million dollars is not what it used to be.

Only 36% of American millionaires consider themselves wealthy in 2025, according to new research from Northwestern Mutual. The finding comes from the 2025 Planning & Progress Study, updated in early November. It draws on a Harris Poll survey of 4,626 Americans, including 969 people with household investable assets greater than $1 million.

Even the wealthiest Americans worry about money, the study found. They fret about having enough of it, deciding how to spend it and whether to pass it on to heirs. If $1 million isn’t enough, then how much money does it take to feel wealthy?

Even Millionaires Don't Feel Wealthy These Days

Daniel de Visé, USA TODAY December 3, 2025

A million dollars is not what it used to be.

Only 36% of American millionaires consider themselves wealthy in 2025, according to new research from Northwestern Mutual. The finding comes from the 2025 Planning & Progress Study, updated in early November. It draws on a Harris Poll survey of 4,626 Americans, including 969 people with household investable assets greater than $1 million.

Even the wealthiest Americans worry about money, the study found. They fret about having enough of it, deciding how to spend it and whether to pass it on to heirs. If $1 million isn’t enough, then how much money does it take to feel wealthy?

“There’s no definitive number,” said Mark Mascarenhas, a private wealth adviser with Northwestern Mutual’s Haven Wealth Advisors.

Many millionaires don't consider themselves wealthy

Feeling wealthy has a lot to do with context and perspective, he said.

A million dollars might go a long way in West Virginia or rural Kansas. In New York or Los Angeles, it might not feel like nearly enough.

A millionaire who hangs out with other millionaires is bound to make unflattering comparisons to wealthier friends.

“All of my clients who are millionaires do not consider themselves wealthy, not by a long shot,” Liz Windisch, a certified financial planner in Denver.

“People with that much money inevitably spend time with other people who are millionaires, and who have even more money than they do and – just like the rest of us – compare themselves to others who have more,” she said.

Nearly half of U.S. millionaires say their financial planning “needs improvement,” Northwestern Mutual found. Only 53% said they expect to leave an inheritance or charitable gift.

“It’s not that they don’t want to leave an inheritance. It’s just that they’re worried about funding their own retirement,” Mascarenhas said.

The top retirement concern for millionaires, the study found, is the prospect of outliving their savings.

The Rise Of Everyday Millionaires

The United States is home to nearly 24 million millionaires, the largest number of any nation in U.S. dollar terms, according to the UBS Global Wealth Report.

TO READ MORE: https://finance.yahoo.com/personal-finance/banking/article/what-is-considered-wealthy-175033814.html

“Tidbits From TNT” Friday Morning 1-2-2026

TNT:

Tishwash: Hassan Ali Al-Daghari: Expanding banking services is the focus of the next phase.

Financial expert Hassan Ali Al-Daghari stressed that expanding banking services is an urgent need for the Iraqi economy at the present stage, in light of growing commercial activity and increasing demands of the local market.

Al-Daghari said that Iraqi banks have begun to take clear steps towards developing their financial tools and expanding the scope of their services in line with the ongoing economic transformations.

Al-Daghari explained that expanding modern banking services, such as electronic payment, facilitating account opening procedures, and expanding the branch network, contributes to enhancing citizens' confidence in the banking sector and encourages official transactions instead of relying on cash.

TNT:

Tishwash: Hassan Ali Al-Daghari: Expanding banking services is the focus of the next phase.

Financial expert Hassan Ali Al-Daghari stressed that expanding banking services is an urgent need for the Iraqi economy at the present stage, in light of growing commercial activity and increasing demands of the local market.

Al-Daghari said that Iraqi banks have begun to take clear steps towards developing their financial tools and expanding the scope of their services in line with the ongoing economic transformations.

Al-Daghari explained that expanding modern banking services, such as electronic payment, facilitating account opening procedures, and expanding the branch network, contributes to enhancing citizens' confidence in the banking sector and encourages official transactions instead of relying on cash.

He pointed out that this expansion not only benefits banks, but also supports market activity and provides a better environment for investment. link

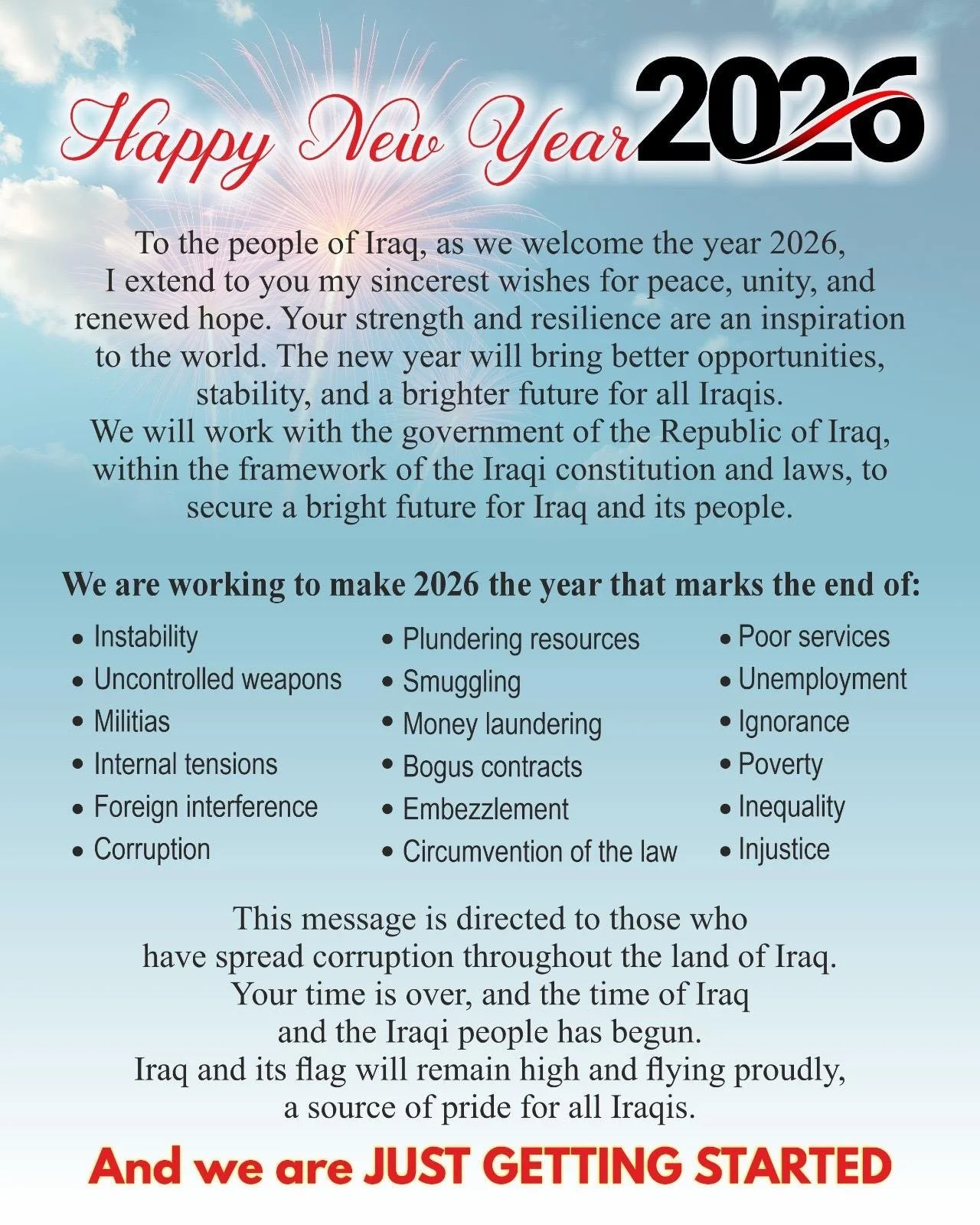

Tishwash: Trump's envoy begins 2026 with a strong message to those who "wrought havoc in Iraq": Your time is up. He outlined a list of 18 objectives.

Mark Savaya, US President Donald Trump’s envoy to Iraq, sent a congratulatory message to the Iraqi people on the occasion of welcoming the year 2026, in which he expressed his wishes for peace, unity and renewed hope.

In his message, which he published in Arabic and English via his account on the X platform, Savaya said: “To the people of Iraq, as we welcome the year 2026, I extend to you my sincerest wishes for peace, unity, and renewed hope. Your strength and resilience are an inspiration to the world,” adding that “the new year will bring better opportunities, stability, and a brighter future for all Iraqis.”

The US envoy affirmed that work will continue with the government of the Republic of Iraq within the framework of the Iraqi constitution and law, in order to secure a bright future for Iraq and its people, expressing his hope that 2026 will be the year of the end of instability, the plundering of the country’s wealth, poor services, uncontrolled weapons, smuggling, unemployment, militias, money laundering, corruption, poverty, foreign interference, and all other manifestations of injustice and circumvention of the law.

He added that this message is directed “to those who have spread corruption in the land of Iraq,” stressing that “your time is over and the time of Iraq and the Iraqis has begun,” and emphasizing that Iraq will remain a flag raised high and a source of pride for all its people.

Savaya concluded his message by saying, “We are still at the beginning link

Tishwash: Sudani congratulates Halbousi and his deputies: Political stability depends on prioritizing Iraq's interests.

Prime Minister Mohammed Shia al-Sudani stressed on Wednesday the need to work towards achieving the country's higher interests.

A statement from his office, received by (Al-Mada), said that “Prime Minister Mohammed Shia Al-Sudani met with the new Speaker of Parliament, Hebat Hamad Al-Halbousi.”

Al-Sudani congratulated Al-Halbousi and his two deputies, Adnan Faihan Al-Dulaimi and Farhad Amin Atroushi, on their election and gaining the confidence of the representatives, praising this step that enhances the political stability of our democratic system.

He also pointed out the need to work towards achieving the country's higher interests.

The Prime Minister stressed "the need to complete the remaining constitutional requirements in order to continue providing public services to citizens in various fields." link

Mot: Goal fir da New Year and am working on it Already!!!

Mot: . Winter - in ""2 stages""

Happy New Year from Dinar Recaps

All of us at Dinar Recaps wish all of our readers a

Happy, Healthy and Safe New Year.

May all your dreams and wishes come true in the new year.

Due to the holiday, we plan to have new posts mostly as usual on Wednesday, New Years Eve and off and on Thursday, New Years Day. Please check our BLOG PAGE for all new posts.

On New Years Eve we plan to have 10am and 6pm (ET) email Newsletters, and NO 10pm (ET) newsletter.

On Thursday New Years Day, we plan to have a 11am (ET) and 6pm email Newsletters, and NO 10pm (ET) newsletter.

Please scroll down for new posts.

All of us at Dinar Recaps wish all of our readers a

Happy, Healthy and Safe New Year.

May all your dreams and wishes come true in the new year.

Due to the holiday, we plan to have new posts mostly as usual on Wednesday, New Years Eve and off and on Thursday, New Years Day. Please check our BLOG PAGE for all new posts.

On New Years Eve we plan to have 10am and 6pm (ET) email Newsletters, and NO 10pm (ET) newsletter.

On Thursday New Years Day, we plan to have a 11am (ET) and 6pm email Newsletters, and NO 10pm (ET) newsletter.

Please scroll down for new posts.

Bill Holter: Failure To Deliver for Silver 'Imminent' & Gold Re-Monetization

Bill Holter: Failure To Deliver for Silver 'Imminent' & Gold Re-Monetization

Palisades Gold Radio: 1-1-2026

Stijn Schmitz welcomes Bill Holter to the show. Bill is a Precious Metals Expert and Broker. In this in-depth discussion about the precious metals market, Holter provides a comprehensive overview of the current dynamics driving silver and gold prices, highlighting a significant structural shift in the global metals market.

Holter emphasizes a substantial supply and demand deficit in silver, estimated at 300-400 million ounces, driven by increasing industrial applications such as AI technology and electric vehicle batteries.

Bill Holter: Failure To Deliver for Silver 'Imminent' & Gold Re-Monetization

Palisades Gold Radio: 1-1-2026

Stijn Schmitz welcomes Bill Holter to the show. Bill is a Precious Metals Expert and Broker. In this in-depth discussion about the precious metals market, Holter provides a comprehensive overview of the current dynamics driving silver and gold prices, highlighting a significant structural shift in the global metals market.

Holter emphasizes a substantial supply and demand deficit in silver, estimated at 300-400 million ounces, driven by increasing industrial applications such as AI technology and electric vehicle batteries.

He notes that physical metal exchanges like Shanghai are experiencing significant premiums over paper markets, indicating a fundamental change in metals trading.

This phenomenon, known as backwardation, suggests investors are increasingly prioritizing physical metal ownership over paper contracts.

Bill predicts a potential transformation in global currency systems, suggesting that the US dollar is declining while BRICS nations are developing a potentially gold-backed settlement currency.

Holter believes this shift could dramatically impact global financial markets, with gold and silver emerging as the only truly trustworthy currencies.

Institutional buying is currently driving the precious metals market, with family offices, hedge funds, and even sovereign nations like Russia purchasing significant quantities. Holter sees this as a critical moment for metals, potentially leading to a delivery failure in silver markets that could trigger massive price increases.

For individual investors, Holter recommends starting with silver, particularly "junk silver" coins minted before 1965, which offer the most practical and recognizable form of silver ownership.

He stresses that it's not too late to enter the market, warning that current financial systems are fundamentally unstable and that precious metals represent a critical hedge against potential economic collapse.

Timestamps:

00:00:00 - Introduction

00:01:00 - 2025 Precious Metals Review

00:01:41 - Structural Supply Deficit

00:02:29 - Industrial Demand & Vaults

00:03:21 - Backwardation and Premiums

00:06:04 - Historical Interventions

00:07:17 - Gold vs Silver Differences

00:09:30 - BRICS Remonetization Outlook

00:11:42 - Failure to Deliver Risks

00:13:58 - Institutional Buying Trends

00:14:56 - Retail Flows and Junk Silver

00:20:10 - Silver Going Mainstream

00:21:48 - Investment Advice for Beginners

00:23:17 - Fiat Collapse and Great Taking

00:26:03 - Concluding Thoughts

Silver Is Breaking the System – This Isn’t a Bubble | Vince Lanci

Silver Is Breaking the System – This Isn’t a Bubble | Vince Lanci

Soar financially: 12-31-2025

Silver has gone parabolic, swinging violently as global supply chains fracture.

Vince Lanci explains why this is not a speculative bubble, how China is being cut off from silver supply, why banks are repositioning, and what this means for silver prices over the next few months.

We also discuss the BRICS “Unit,” critical minerals, and the growing divide in global trade.

Silver Is Breaking the System – This Isn’t a Bubble | Vince Lanci

Soar financially: 12-31-2025

Silver has gone parabolic, swinging violently as global supply chains fracture.

Vince Lanci explains why this is not a speculative bubble, how China is being cut off from silver supply, why banks are repositioning, and what this means for silver prices over the next few months.

We also discuss the BRICS “Unit,” critical minerals, and the growing divide in global trade.

Time Stamps (AI Generated)

00:00 Silver Price Goes Parabolic

01:36 Is This a Bubble?

02:28 Physical Demand Takes Over

03:15 China’s Silver Problem

05:29 Geopolitics & Supply Chains

07:25 Is This a Silver Short Squeeze?

10:30 Are Banks Really in Trouble?

13:58 JPMorgan Turns Net Long

16:08 Silver as a Strategic Asset

18:19 Short-Term Silver Outlook

21:23 What Breaks This Standoff?

24:05 The BRICS “Unit” Explained

30:24 Can the Dollar Be Challenged?

32:01 Final Take on Silver & Trade