Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 7-8-25

Good Afternoon Dinar Recaps,

Lula Defies Trump as U.S. Targets 50+ Nations in BRICS Tariff Threat

A Diplomatic Showdown Over Tariffs and Global Trade

Tensions between Brazilian President Luiz Inácio Lula da Silva and Donald Trump have escalated into a full-blown diplomatic standoff. At the heart of the crisis: Trump’s threat to impose a 10% tariff on countries aligning with BRICS, a coalition increasingly seeking alternatives to U.S. economic dominance.

In a sharp rebuke, Lula directly challenged Trump’s tariff threats, rejecting what he sees as outdated and coercive economic policies.

Good Afternoon Dinar Recaps,

Lula Defies Trump as U.S. Targets 50+ Nations in BRICS Tariff Threat

A Diplomatic Showdown Over Tariffs and Global Trade

Tensions between Brazilian President Luiz Inácio Lula da Silva and Donald Trump have escalated into a full-blown diplomatic standoff. At the heart of the crisis: Trump’s threat to impose a 10% tariff on countries aligning with BRICS, a coalition increasingly seeking alternatives to U.S. economic dominance.

In a sharp rebuke, Lula directly challenged Trump’s tariff threats, rejecting what he sees as outdated and coercive economic policies.

Trump’s Tariff Ultimatum Against BRICS

The controversy erupted following Trump’s warning that any nation aligning with BRICS policies would face an “additional 10% tariff.” His administration is reportedly preparing dozens of trade deals and intends to apply tariffs only if countries are deemed “anti-American.”

Trump stated:

“Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.”

This statement followed public condemnation by BRICS leaders of recent U.S. military actions and growing dissatisfaction with the global trade order.

Lula: “We Don’t Want an Emperor”

Speaking at the BRICS Summit in Rio de Janeiro, Lula was blunt:

“The world has changed. We don’t want an emperor.”

He elaborated on BRICS' purpose as a counterbalance to Western dominance:

“This is a set of countries that wants to find another way of organizing the world from the economic perspective. I think that’s why the BRICS are making people uncomfortable.”

Lula also called for a gradual shift away from the dollar:

“The world needs to find a way that our trade relations don’t have to pass through the dollar. Our central banks have to discuss it with central banks from other countries. That’s something that happens gradually until it’s consolidated.”

BRICS Pushes Back: Toward De-Dollarization

With 50+ nations now cooperating with BRICS, including 13 partner countries—Algeria, Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Turkey, Uganda, Vietnam, and Uzbekistan—calls for alternative trade systems are growing louder.

Iran’s Supreme Leader Ayatollah Ali Khamenei declared:

“One of our problems today is being dependent on the dollar. BRICS countries must strive to eliminate the dollar in trade as much as possible.”

Other responses:

South African President Cyril Ramaphosa affirmed BRICS does not seek confrontation but wants fair trade.

🇨🇳 Chinese Foreign Ministry spokesperson Mao Ning condemned the tariffs as “tools of coercion” and reaffirmed BRICS’ commitment to “win-win cooperation.”

A Larger Battle Over U.S. Economic Hegemony

What began as a spat between Lula and Trump is fast becoming a global referendum on U.S. trade policy and the dollar’s role in international finance.

More than 40 countries have applied to join BRICS or become partners—driven by:

Discontent with U.S. dollar hegemony

Concerns over weaponized trade policies

Interest in multipolar trade frameworks

The broader implications are clear: this is not just a tariff fight—it’s a challenge to the structure of the global financial order.

Summary:

Trump threatens 10% tariffs on “anti-American” BRICS-aligned nations.

Lula responds: “We don’t want an emperor.”

BRICS members call for de-dollarization and a new economic system.

Over 50 countries now aligned with BRICS’ growing influence.

The conflict signals a shift away from U.S.-centric trade norms toward a multipolar financial world.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

India’s Triumph at BRICS: PM Unites Summit Against Terrorism, Pushes Global Reforms

Modi’s Diplomatic Victory at the 17th BRICS Summit

India emerged as a decisive voice at the 17th BRICS Summit in Brazil, uniting the bloc on a firm stance against terrorism and driving calls for reform of global governance institutions.

🔹 Key Outcomes:

• India led unanimous condemnation of terrorism

• PM Modi condemned the Pahalgam terror attack as an “assault on humanity”

• BRICS declaration demanded action against UN-designated terrorists

Terrorism Takes Center Stage

At the session on Peace and Security, Prime Minister Narendra Modi delivered a powerful message against terrorism, directly addressing the April 22 Pahalgam attack in Jammu and Kashmir, which killed 26 civilians.

“This is not just a regional problem—it is an assault on humanity,” the Prime Minister declared.

The Rio de Janeiro Declaration, adopted at the summit’s close, condemned the attack in “the strongest terms”, and emphasized that there can be no “double standards” in the global fight against terrorism.

Para 34 of the declaration, shaped by India’s diplomacy, called for action against those who “abet, finance, covertly or overtly” support terrorism—an implicit rebuke of Pakistan’s alleged role in cross-border attacks.

PM Modi: “Victims and Supporters Cannot Be Treated the Same”

Modi reaffirmed India’s long-standing demand for sanctions on those aiding terrorism, stating:

“Victims and supporters of terrorism cannot be weighed on the same scale.”

All 11 BRICS members and partners endorsed the statement, marking a rare moment of consensus on this issue.

However, China’s double game drew attention. While Premier Li Qiang joined the condemnation, Beijing’s ongoing resistance to UN sanctions against Pakistan-based terrorists remained a sticking point.

Modi’s pointed remark about nations offering “silent consent” for terrorism was seen as a direct critique of China’s contradictory position.

Reforming Global Institutions: A Call for Inclusivity

Beyond security, India led the charge for reforming global governance bodies such as the UN Security Council, IMF, World Bank, and WTO.

“We must build a multipolar and inclusive world order,” Modi told the summit.

According to officials, Para 6 of the declaration “strongly endorsed” this message, and highlighted the roles of India and Brazil in amplifying the voice of the Global South.

Innovation and Development: BRICS Research Push

India also proposed a BRICS Science and Research Repository to:

Strengthen critical mineral supply chains

Advance responsible AI initiatives

Support sustainable growth across developing economies

PM Modi held bilateral meetings with Malaysia, Cuba, South Africa, and Vietnam, promoting collaboration in digital infrastructure (like UPI) and the integration of Ayurveda into healthcare innovation.

India’s BRICS Leadership in 2026

With India set to assume the BRICS presidency in 2026, this summit further solidified its position as:

A global advocate against terrorism

A champion of institutional reform

A driver of inclusive and sustainable development

While China’s strategic contradictions remain a challenge, the Rio summit marked a clear diplomatic win for India—one that could shape the direction of the bloc for years to come.

Summary:

India secured unanimous condemnation of terrorism at BRICS 17.

The Rio Declaration echoed India’s language on sanctions and double standards.

PM Modi pushed for UNSC and IMF reform, backed by Global South partners.

India proposed a BRICS research initiative focused on AI and supply chains.

As future chair, India’s leadership is seen as a defining force in the bloc’s evolution.

@ Newshounds News™

Source: India Today

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Economist’s “News and Views” 7-8-2025

Trump’s 10% Tariff Just Shook BRICS as U.S. Debt Hits a Breaking Point

Daniela Cambone: 7-8-2025

“Tariffs, gold, and the great unraveling.”

Adrian Day, CEO of Adrian Day Asset Management, joins Daniela Cambone at the Rule Symposium in Boca Raton to unpack the global crosswinds shaking the foundation of U.S. dominance.

From Trump’s new 10% tariff threats against BRICS-aligned nations to Powell’s reluctance to cut rates, Day sees deep contradictions in U.S. policy — and a brewing inflection point for the dollar.

Trump’s 10% Tariff Just Shook BRICS as U.S. Debt Hits a Breaking Point

Daniela Cambone: 7-8-2025

“Tariffs, gold, and the great unraveling.”

Adrian Day, CEO of Adrian Day Asset Management, joins Daniela Cambone at the Rule Symposium in Boca Raton to unpack the global crosswinds shaking the foundation of U.S. dominance.

From Trump’s new 10% tariff threats against BRICS-aligned nations to Powell’s reluctance to cut rates, Day sees deep contradictions in U.S. policy — and a brewing inflection point for the dollar.

He warns of a silent shift away from the dollar as a reserve currency, citing its sharp decline in central bank holdings, and points to record debt servicing costs as the real driver behind coming rate cuts.

Amid shaky CPI data, political brinkmanship, and a confused Fed, Day argues gold remains the ultimate hedge. “The messaging is broken. The math is unsustainable. But the case for gold? Stronger than ever.”

The World Is DITCHING the Dollar - Here's WHY

Lena Petrova: 7-8-2025

Market Sell-Off Ahead? | Todd "Bubba" Horwitz

Liberty and Finance: 7-7-2025

Join Todd "Bubba" Horwitz for a live discussion on the recent downside moves in the stock market and what they could mean for investors.

He’ll break down the factors driving the decline and why the risk of further downside remains on the table.

Tuesday Coffee with MarkZ. 07/08/2025

Tuesday Coffee with MarkZ. 07/08/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and members

Member: Are we there yet????

Tuesday Coffee with MarkZ. 07/08/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and members

Member: Are we there yet????

MZ: In Iraq: “The coming hours may witness the signing” This is about the Erbil/Baghdad oil agreements . There is a lot of back and forth right now. But articles are saying they have worked through the issues and signing is imminent.

MZ: We saw this same kind of back and forth in Kuwait.

Member: Never thought we all still be waiting and waiting and waiting all this time for the RV to go but then again, they don't care

MZ: Our regular article from Saleh: “ Advisor to the Prime Minister: Monetary Policy has succeeded in stabilizing prices and curbing inflation” He says “We are in great shape.”

Member: I bet Saleh had black hair when I bought my dinar

MZ: “Banning 18 Islamic banks from dealing in dollars-liquidation is looming” These are the same banks associated with financing terrorist groups. So is it Islamic banks being singled out – or support of terrorism being singled out? I think its part of a world wide cleanup effort.

MZ: I think this one is important. “A security source revealed Tuesday the determination of the International coalition withdrawal from Ain-A-Assad base from Anbar province” Trump has said all along that we will leave when we are paid. Now they are leaving????

MZ: I believe things are much further advanced than the press is reporting

MZ: This one makes me feel good about where we are at: “ TIR system: Iraq is a highway from Turkey to the Gulf” this is part of the development road project connecting the east to the west.

Member: I wonder- when do the Vietnamese new tariff trade agreements and thus new rate go into affect?

Member: With the new trade deal with Vietnam they should just go alone and take the lead

Member: any news from Bonds or groups today?

MZ: I do know a couple folks that have some bond update appointments today and I am hopeful it will give us a better idea where we are? Seems like much of it is misdirection.

Member: Frank's JPM Story...A guy went in for a meeting with Fin Adv. wasn't getting anywhere. Plopped down a brick of Dinar...The VP of Wealth mgmt was called. They have an appt today.

Member: We’re in a proverbial “escape room” looking for the clues together!

Member: Will we have Christmas in July or December?

Member: When this is all said and done and we are on the other side of this shift I vote to remove the word “soon” from the English language going forward!!

Member: They have always said there would be confusion right before this happens—hope that is where we are

Member: Just before the end of a movie the twists and turns increase and then boom

Member: happy Birthday to everyone celebrating and have a great day everyone.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Tuesday 7-8-2025

The Old Pretender: Hyperinflation will be Terminated by a New Gold Standard

7-8-2025

This is why the BRICS are Insulating themselves from the US dollar system by building their own (#gold-based) monetary infrastructure.

Bloomberg: BREAKING: President Donald Trump said he would put an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS,” injecting further uncertainty as the US continues to negotiate levies with trading partners

A good, brief explainer of the new BRICS #gold-based monetary system that is being quietly constructed without publicity.

The Old Pretender: Hyperinflation will be Terminated by a New Gold Standard

7-8-2025

This is why the BRICS are Insulating themselves from the US dollar system by building their own (#gold-based) monetary infrastructure.

Bloomberg: BREAKING: President Donald Trump said he would put an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS,” injecting further uncertainty as the US continues to negotiate levies with trading partners

A good, brief explainer of the new BRICS #gold-based monetary system that is being quietly constructed without publicity.

Note that uses the blockchain to transfer ownership without physically moving the #gold, just like @KinesisMonetary

Trump must know these threats are motivating more countries to join the new BRICS #gold-based monetary system.

Question is, will the US apply punishment tariffs on US states that have anti-fiat dollar sound money policies?

BMGGroup: States are quietly advancing #SoundMoney—tax-free gold, silver, and transparency laws are gaining ground. https://bit.ly/3XYZ624 #Gold #Silver #HardAssets #PreciousMetals

This helps solve the puzzle. Tariffs push more countries to de-dollarize, which adds to the inflation created by the BBB. The debt then gets hyperinflated away, before the hyperinflation is terminated on 4th July 2026 by the launch of a new #gold standard.

Going Underground: ‘If BRICS de-dollarisation succeeds, it would be DEVASTATING for the US economy’ -Former Member of the British Parliament Andrew Bridgen on the latest episode of Going Underground FULL INTERVIEW BELOW IN THE REPLIES

https://twitter.com/i/status/1942263397266944008

Trump is already setting up Jerome Powell as the fall guy to take the blame for the hyperinflation about to hit. But Powell will get paid handsomely to play that role.

This headline should more accurately read: “De-dollarization: BRICS leaders propose switching on alternative payment system to SWIFT”

Source(s): https://x.com/Dioclet54046121/status/1942134999421014411

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Ali Al-Alaq in the CBI is working towards the monetary reform, we have the prime minister Al-Sudani working his magic in the direction of economic reform and his “pet” project of industrial cities. Article: “IRAQ PLANS TO RECEIVE 4 MILLION CONTAINERS ANNUALLY AT UMM QASR PORT.” WOW!...Umm Qasr Port in Basra is undergoing rapid development...Iraq is going to be a “clearing house” for the middle east. This means shipment from all over the world will land in Iraq and they be distributed to other countries. This means massive tariff and customs fees for Iraq...

Frank26 Isn't the goal for the Iraqi dinar to be digital? Yes, check it off the list. Isn't the goal for the Iraqi dinar to have purchasing power? Yes. Check it off the list. 'No. No. No. Wait. Stop. No Frank no. You can't check that off the list!' What if I prove to you it's not 1310 anymore? What would you say? I think you should say something's happening to the exchange rate. The American dollar is being removed out of Iraq. In doing so the value of the Iraqi dinar is going up.

FRANK26….7-7-25….ALOHA…..

Western Media Won’t Show You This: BRICS 2025 Summit Declaration

Lena Petrova: 7-7-2025

Iraq Economic News and Points To Ponder Tuesday Morning 7-8-25

Al-Mustaqilla Reveals: 30 Iraqi Banks No Longer Deal In Dollars!

Al-Mustaqilla publishes the full list: Banks banned from receiving dollars by order of the Central Bank.

July 7, 2025 Last updated: July 7, 2025 Al-Mustaqilla/- Al-Mustaqilla today obtained an updated list of licensed private banks in Iraq that have been banned from dealing in dollars by the Central Bank of Iraq.

This decision comes amidst uncertainty and the lack of official confirmation of the precise reasons that prompted the bank to ban these banks from dollar trading.

Al-Mustaqilla Reveals: 30 Iraqi Banks No Longer Deal In Dollars!

Al-Mustaqilla publishes the full list: Banks banned from receiving dollars by order of the Central Bank.

July 7, 2025 Last updated: July 7, 2025 Al-Mustaqilla/- Al-Mustaqilla today obtained an updated list of licensed private banks in Iraq that have been banned from dealing in dollars by the Central Bank of Iraq.

This decision comes amidst uncertainty and the lack of official confirmation of the precise reasons that prompted the bank to ban these banks from dollar trading.

It is speculated that these banks are linked to US sanctions and other financial oversight concerns.

Banks prohibited from dealing in dollars

According to the official website of the Central Bank of Iraq,

the list included the following banks:

Middle East Iraqi Investment Bank

Iraqi investment

Dar Al Salam Investment

Babylon consumption

Sumer Commercial

Mosul Development and Investment

Iraqi Federation

Ashur International Investment

Across Iraq for Investment

Guidance

Erbil Investment and Finance

Hammurabi's Commercial Code

Elaph Islamic

Kurdistan International Islamic Investment and Development

Islamic Cooperation for Investment (under liquidation, prohibited from dealing in dollars)

Islamic Giving for Investment and Finance

Islamic Investment and Finance Advisor

Islamic World Investment and Finance

South Islamic Investment and Finance

Islamic Arabic

Noor Al Iraq Islamic Investment and Finance

Zain Iraq Islamic Investment and Finance

International Islamic

Islamic Finance Holding Company

Al Ansari Islamic Investment and Finance

International Islamic Trust

Al Rajhi Islamic

Islamic Paper for Investment and Finance

Asia Iraq Islamic Investment and Finance

Islamic Spectrum for Investment and Finance

Islamic money for investment

Possible reasons for ban

To date, the Central Bank of Iraq has not issued an official statement detailing the reasons for banning these banks from dealing in dollars.

However, financial sources and banking sector observers point to the possibility of a link between this decision and US or international sanctions on some of these institutions,

in addition to potential violations related to: money launderingsmuggling hard currency illegal transfers

Failure to comply with financial compliance and banking oversight standards

The repercussions of the decision on the Iraqi economy

This ban comes at a time when the Iraqi economy is suffering from several pressures, including the decline in the value of the Iraqi dinar and fluctuating dollar prices in the local market, which could lead to: The complexity of transactions for companies and individuals dealing with these banks.

Increased demand on the black market for dollar exchange, with the accompanying financial risks. Undermining confidence in the local banking system, especially among private banks facing the threat of sanctions.

Calls for more transparency

Economists believe the Central Bank of Iraq should issue a transparent statement explaining the true reasons behind these decisions, along with a clear plan to address the financial issues related to the banks in question.

Some MPs have also called for the formation of a parliamentary investigation committee to monitor the violating banks and ensure the protection of citizens' funds.

in conclusion

All eyes are on the Central Bank of Iraq's next steps regarding banks banned from dealing in dollars.

Will additional sanctions be imposed, or are these merely temporary measures to regulate the market and improve financial oversight? What impact will this have on the stability of the banking system and the Iraqi economy in general?

https://mustaqila.com/المستقلة-تكشف-30-مصرفًا-عراقيًا-خارج-ال/

Inflation In Iraq Has Declined And Its Gold Reserves Have Increased. Expert Explains

Time: 2025/07/07 21:23:08 Read: 825 times {economic: Al-Furat News} Iraq recorded a noticeable decline in the inflation rate in conjunction with the rise in its gold reserves during the first quarter of 2025, in financial and monetary indicators described as positive despite the challenges posed by oil price fluctuations.

Financial expert Salah Nouri explained in a statement to {Al-Furat News} that:

"The decline in the inflation rate is due to a group of factors, most notably the policy of the Central Bank of Iraq in controlling the supply of cash for circulation, in addition to regulating borrowing to finance the private sector at limited rates that contribute to revitalizing the economy without causing a cash surplus".

He added, "The decline in global commodity prices had a direct impact, given Iraq's heavy reliance on imports to meet its needs for goods and merchandise, which was reflected in a reduction in local price levels."

As for the increase in gold reserves, the expert attributed it to the Central Bank's policy of diversifying investment instruments by balancing debt securities in dollars with the purchase of gold, which is a safe store of value.

According to him He stressed that "these policies aim to support and enhance the Central Bank's reserves within its monetary policy orientations."

In the same context, Nouri warned of

"the negative effects of the decline in the prices of exported oil,

which came as a result of OPEC Plus' decisions to increase production,

which may reflect negatively on the state's general revenues and

thus on the implementation of the operational and investment budget items".

He pointed out that "the Federal Ministry of Finance has two options in light of this decline: either reduce spending to maintain the deficit rate specified in the budget, or continue spending and increase the deficit, which will force the government to resort to internal borrowing".

The expert said, "This challenge is directly related to fiscal policy, which requires a careful balance between spending and revenues."

According to an official report issued by the Central Bank of Iraq, the

Iraqi economy witnessed significant shifts in monetary indicators during the first quarter of 2025.

Inflation fell by 21%, while money transfers abroad fell by 0.6%, indicating a relative improvement in the monetary balance and liquidity control.

The report, which covered the months of January, February and March, also showed a significant increase in the value of Iraq's gold reserves, rising from 17.8 trillion dinars to 21.2 trillion dinars, reflecting the Central Bank's reliance on a policy of diversifying assets and enhancing safe havens to protect cash reserves in light of global market fluctuations.

https://alforatnews.iq/news/تراجع-نسبة-التضخم-في-العراق-وارتفاع-احتياطه-من-الذهب-خبير-يوضح

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Tuesday Morning 7-8-25

Good Morning Dinar Recaps,

Ripple CEO Brad Garlinghouse to Testify at Senate Hearing, Urges Clear Crypto Rules

Brad Garlinghouse to Testify Before U.S. Senate on July 9

Ripple CEO Brad Garlinghouse is set to appear before the U.S. Senate Banking Committee on July 9, where he will urge lawmakers to adopt clear, fair, and strong crypto regulations. This will be Garlinghouse’s first testimony before the committee, signaling a pivotal moment in the industry’s ongoing call for legal clarity.

Good Morning Dinar Recaps,

Ripple CEO Brad Garlinghouse to Testify at Senate Hearing, Urges Clear Crypto Rules

Brad Garlinghouse to Testify Before U.S. Senate on July 9

Ripple CEO Brad Garlinghouse is set to appear before the U.S. Senate Banking Committee on July 9, where he will urge lawmakers to adopt clear, fair, and strong crypto regulations. This will be Garlinghouse’s first testimony before the committee, signaling a pivotal moment in the industry’s ongoing call for legal clarity.

Garlinghouse: “Strong but Fair Rules” Are Key

In a recent announcement, Garlinghouse said he is “honored to speak directly to lawmakers” about the urgent need for clear digital asset laws in the U.S. He thanked Senators Tim Scott, Cynthia Lummis, and Ruben Gallego for advancing legislation that supports innovation while protecting consumers.

“We need smart rules that protect people without killing innovation,” he noted.

For years, Ripple and other crypto firms have asked Congress to clarify how digital assets are classified—specifically, which are treated as securities regulated by the SEC, and which are commodities overseen by the CFTC. The current lack of clarity has led to legal disputes, enforcement confusion, and regulatory overlap.

Key Legislation on the Table

The hearing comes at a critical time. Congress is now reviewing three major crypto-related bills:

The CLARITY Act – Aims to define whether digital assets fall under SEC or CFTC jurisdiction.

The GENIUS Act – Addresses stablecoin standards and regulatory oversight.

The Anti-CBDC Surveillance State Act – Seeks to restrict surveillance mechanisms tied to central bank digital currencies (CBDCs).

Among them, the CLARITY Act stands out. Senator Tim Scott has suggested it could be passed as early as October, depending on bipartisan support. If passed, it could significantly reduce regulatory uncertainty for crypto developers, brokers, and exchanges.

Who Else Is Testifying?

Garlinghouse will join a panel of prominent figures in the crypto and policy sectors, including:

Jonathan Levin, CEO of Chainalysis

Summer Mersinger, CEO of the Blockchain Association

A top Harvard legal expert on digital finance

Together, they aim to present a united case for establishing sensible regulatory frameworks that ensure the U.S. remains a leader in blockchain innovation.

“With clear rules, crypto companies can keep building—and investors can feel confident,” one panelist is expected to say.

The Stakes for the Crypto Industry

This hearing marks a turning point. For industry leaders, congressional inaction is no longer an option. As regulatory ambiguity continues to push innovation offshore, executives like Garlinghouse argue that federal clarity is essential for protecting American leadership in the rapidly evolving crypto economy.

With billions of dollars in market value and countless innovation opportunities at stake, July 9 could become a defining moment for U.S. crypto policy.

Summary:

Ripple CEO Brad Garlinghouse to testify before Senate Banking Committee on July 9.

Will push for strong but fair crypto rules to clarify SEC/CFTC roles.

Hearing coincides with review of major legislation: CLARITY, GENIUS, and Anti-CBDC Acts.

Other speakers include top crypto CEOs and academic experts.

Senate could pass landmark regulation by October, reshaping the U.S. crypto landscape.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Applies for National Banking License as Stablecoin Regulation Accelerates

Ripple Targets OCC Charter to Cement RLUSD Oversight

Ripple has filed an application for a national banking license with the Office of the Comptroller of the Currency (OCC), aiming to elevate the regulatory credibility and oversight of its U.S. dollar-backed stablecoin, RLUSD. The filing was submitted on Wednesday, July 2, according to reporting by The Wall Street Journal.

If approved, Ripple would join a growing class of crypto-native firms seeking national trust bank charters, bringing stablecoin issuance more directly under the dual oversight of federal and state regulators.

“The dual nature of that regulation would basically have set a new bar for transparency and compliance in the stablecoin market,” said Jack McDonald, SVP of Stablecoins at Ripple.

Currently, RLUSD already operates under the jurisdiction of the New York Department of Financial Services (NYDFS). A federal trust bank charter would place RLUSD more squarely within the OCC’s regulatory framework, giving Ripple greater operational latitude and legitimacy in the U.S. financial system.

Ripple Subsidiary Also Seeks Fed Master Account

In a parallel development, Standard Custody & Trust Company, a Ripple subsidiary, filed an application for a Federal Reserve master account on Monday, June 30. If granted, this would allow Ripple to:

Custody stablecoin reserves directly with the Fed

Issue and redeem RLUSD outside of standard banking hours

Streamline operational independence from third-party banks

Such a move would enable Ripple to align more closely with emerging federal standards for stablecoin infrastructure, and to offer enhanced stability and liquidity for users and institutions.

Ripple and Circle Signal New Era of Crypto-Fintech Convergence

Ripple’s application follows a similar move by Circle Internet Group, which also filed on June 30 for a national trust charter. If approved, Circle plans to establish the First National Digital Currency Bank, N.A., a federally chartered entity that would manage the USDC reserve and offer digital asset custody services to institutional clients.

“By applying for a national trust charter, Circle is taking proactive steps to further strengthen our USDC infrastructure,” said Jeremy Allaire, Circle Co-founder and CEO.

“We will align with emerging U.S. regulation for the issuance and operation of dollar-denominated payment stablecoins.”

Circle’s strategic move mirrors Ripple’s efforts and reflects growing readiness among leading crypto firms to embrace full-scale federal oversight—once considered a barrier to innovation.

Institutional Custody and Compliance: The Next Crypto Frontier

As digital asset custody continues to draw attention from both traditional institutions and FinTech platforms, companies like Ripple and Circle are positioning themselves to operate as regulated financial infrastructure providers, not just crypto startups.

A recent PYMNTS report highlighted that these applications show crypto firms are preparing to meet the same supervisory and compliance standards as federally chartered banks—a development that may significantly reshape the crypto regulatory landscape in the U.S.

Summary:

Ripple files application for national trust bank license with OCC

Would place RLUSD under dual oversight of OCC and NYDFS

Subsidiary Standard Custody applies for Federal Reserve master account

Circle also seeks national charter to launch a trust bank for USDC

Signals a broader push by crypto firms toward federal integration and institutional-grade compliance

@ Newshounds News™

Source: PYMNTS

~~~~~~~~~

Worldpay Expands Platform Offering Amid Soaring Embedded Finance Demand

Expansion Reaches Canada, UK, and Deepens Presence in Australia

Worldpay has announced the expansion of its Worldpay for Platforms product into Canada and the United Kingdom, while also extending its reach in Australia, in a move designed to meet the growing demand for embedded finance solutions.

The announcement, made on Tuesday, July 8, marks a strategic pivot as software providers increasingly seek to embed secure and scalable payment services directly into their platforms.

“As business software tools converge into unified experiences, we’re investing in embedded payments to help SaaS providers become the everything platforms for their users,” said Matt Downs, head of Worldpay for Platforms.

“We are committed to serving our current software platforms and new clients in the key geographies where they do business by making embedded solutions easier to integrate and elevating the experiences they provide their users.”

Embedded Finance: Driving a Shift in Digital Commerce

According to PYMNTS, embedded finance is accelerating a larger trend that “moves banking, payments and lending into the non-financial realm.” These solutions allow consumers to access Buy Now, Pay Later (BNPL), credit, and other financial services within apps or digital commerce platforms, transforming smartphones and tablets into full-service commercial gateways.

“These ecosystems keep users engaged while improving the cash flow of businesses and their financial partners,” the report notes.

Embedded Lending Sees Massive Adoption

Recent research by Visa and PYMNTS Intelligence illustrates just how rapidly embedded finance is being adopted:

47% of lenders now offer only embedded lending products

31% offer a hybrid model combining embedded and traditional lending

Just 12% of firms offer no embedded options

These figures reflect growing confidence in embedded lending’s ability to expand financial inclusion, increase conversion rates, and tailor financial offerings using real-time data.

Worldpay Eyes Future with Agentic AI Integration

Looking forward, Worldpay is betting big on the next evolution of payments: agentic artificial intelligence (AI). In a recent interview with PYMNTS, Nabil Manji, SVP and Head of FinTech Growth at Worldpay, outlined the company's vision:

“We’re quite bullish on agentic checkout and agentic commerce,” said Manji.

“Payments companies have been using machine learning and AI for years, if not decades. One of the prerequisites for leveraging these tools is a large, rich dataset — and there’s a lot of data in payments and financial services.”

Agentic AI refers to autonomous digital agents capable of planning, reasoning, and executing transactions on behalf of users—ushering in what experts describe as a seismic shift in commerce infrastructure.

Summary:

Worldpay for Platforms expands into Canada, UK, and Australia

Responds to surge in demand for embedded finance and payments integration

Embedded finance enables in-app lending, BNPL, and payments for non-financial businesses

47% of lenders now operate using embedded finance models exclusively

Agentic AI seen as the next frontier in commerce and checkout experiences

@ Newshounds News™

Source: PYMNTS

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 7-8-2025

TNT:

Tishwash: Oil brings distances closer... Baghdad and Kurdistan on the verge of a formal agreement

2025-07-08 13:09

The Parliamentary Oil and Gas Committee announced on Tuesday that Baghdad and Erbil have reached a preliminary agreement to end the Kurdistan Region's employee salary crisis. The committee indicated that the agreement may be announced within the next few hours, followed by an official signing and presentation to the Council of Ministers at its scheduled session on Tuesday.

Committee member Sabah Sobhi said in a statement to the official newspaper, followed by Al-Mutala'a, that: "The preliminary agreement stipulates that the regional government will deliver 300,000 barrels of oil per day to the federal government through the National Oil Marketing Company (SOMO), in exchange for the region receiving 46,000 barrels per day for local consumption and refining."

TNT:

Tishwash: Oil brings distances closer... Baghdad and Kurdistan on the verge of a formal agreement

2025-07-08 13:09

The Parliamentary Oil and Gas Committee announced on Tuesday that Baghdad and Erbil have reached a preliminary agreement to end the Kurdistan Region's employee salary crisis. The committee indicated that the agreement may be announced within the next few hours, followed by an official signing and presentation to the Council of Ministers at its scheduled session on Tuesday.

Committee member Sabah Sobhi said in a statement to the official newspaper, followed by Al-Mutala'a, that: "The preliminary agreement stipulates that the regional government will deliver 300,000 barrels of oil per day to the federal government through the National Oil Marketing Company (SOMO), in exchange for the region receiving 46,000 barrels per day for local consumption and refining."

He added, "It is hoped that the agreement will be announced within the next few hours, to be officially signed and presented to the Council of Ministers at its session scheduled for today."

This comes 48 hours after Parliament Speaker Mahmoud al-Mashhadani visited Erbil, where he met with regional officials to discuss resolving the disputes between Baghdad and the region. Prime Minister Mohammed Shia al-Sudani and President Abdul Latif Jamal Rashid also discussed the issue of funding the salaries of Kurdistan Region employees on Monday. link

Tishwash: Central Bank: Inflation fell by 21% and gold reserves rose by 19% in the first quarter of 2025.

A report by the Central Bank of Iraq revealed that inflation in Iraq fell by 21% in the first quarter of this year, and that remittances abroad declined by 0.6%, while the value of gold reserves increased from 17.8 trillion dinars to 21.2 trillion dinars.

The Central Bank's report stated that these statistics covered the first quarter of this year, specifically the months of January, February, and March.

The report indicated that the overall inflation rate in Iraq fell by 21% in the first quarter of 2025, reaching 2.2%, compared to the last quarter of 2024, when the inflation rate was 2.8%. The

Central Bank's report stated that this decline indicates a decline in the general price level and an improvement in the purchasing power of individuals and institutions in Iraq.

The report stated that the volume of Iraqi currency transfers abroad by the Central Bank decreased by 0.6% in the first quarter of this year, reaching 99.9 trillion dinars.

This comparison is with the fourth quarter of 2024, when the volume of foreign currency transferred abroad at that time was 100.5 trillion dinars.

Money transfers abroad in Iraq are linked to the conversion of Iraqi oil revenues into dollars, which the bank provides to importers at the official exchange rate.

The Central Bank of Iraq indicated in its report that this decline played a role in reducing inflation and maintaining the stability of the general price level in Iraq.

The report stated that the total money supply granted by banks to the private sector in the first quarter of this year grew by 1.1%. link

************

Tishwah: Iraq gold surges, inflation dips as deficit grows: Central Bank

Iraq's economy showed signs of stabilization in the first quarter of 2025, with inflation dropping by 21 percent and gold reserves seeing a significant increase, according to a report from the Central Bank of Iraq (CBI). This comes as the country grapples with a persistent budget deficit despite rising overall revenues.

The CBI report seen by Rudaw, covering January to March 2025, revealed that the average inflation rate fell to 2.2 percent from 2.8 percent in the last quarter of 2024. “This reduction indicates a decrease in the general price level and an improvement in the purchasing power of individuals and institutions in Iraq,” the report said.

The latter is seen as a good sign for the economy as it means that the cost of goods and services is rising at a slower pace, or even decreasing for some items, thus increasing the purchasing power.

The CBI report also noted a slight decrease in the circulation of Iraqi dinars, down 0.6 percent in the same period, reaching 99.9 trillion dinars (about $76.3 billion) from 100.5 trillion dinars (roughly $76.7 billion) in the final quarter of 2024. This decline, linked to better management of USD oil revenues, is seen as a factor in curbing inflation and stabilizing prices.

Further bolstering economic indicators, lending to the private sector rose by 1.1 percent in the first quarter of 2025, with total credit reaching 44.1 trillion dinars (about $33.7 billion). This increase suggests growing support for private sector projects and a potential diversification of the oil-dependent economy.

Significantly, Iraq’s gold reserves Iraq's gold reserves surged by 19 percent in value, reaching 21.2 trillion dinars (approximately $16.2 billion). This dramatic rise is a positive sign for the country's financial stability and its resilience against economic shocks.

However, the positive economic news is tempered by fiscal challenges.

Iraq’s finance ministry on Wednesday reported revenues of 28 trillion dinars (about $21.3 billion) in the first four months of 2025, a 34 percent increase compared to last year. Yet, expenditures also rose, contributing to a deficit of nearly 900 billion dinars (about $690 million) in the first three months of the year, a 12 percent increase compared to the same period last year.

Oil revenues continued to dominate, accounting for 88.9 percent of total state income. The ongoing deficit, despite higher revenues, highlights Iraq's heavy reliance on oil prices and the substantial spending outlined in its $152 billion federal budget for 2023-2025. The budget, passed in June 2023, had raised concerns about financial stability should oil prices fall below the $70 per barrel threshold set in the legislation.

Iraqi Prime Minister Mohammed Shia’ al-Sudani had previously stated that the record-high budget aimed to address social needs, enhance infrastructure, and foster economic progress. link

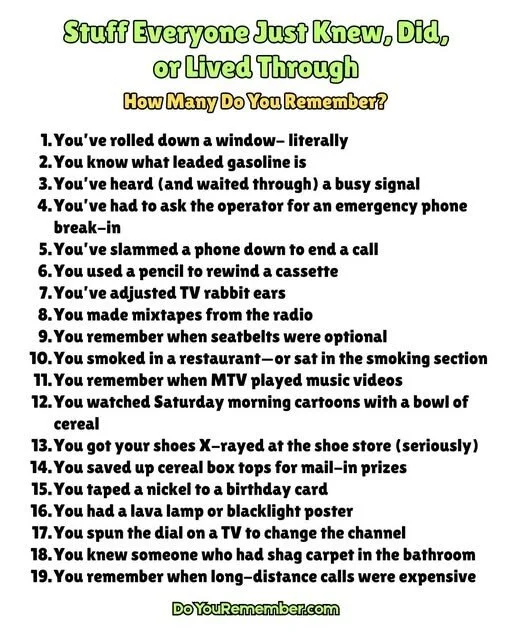

Mot: ..... Anyone Has an Idea WHAT this might beeeee bout????

Mot: . Did Ya!!!??? Remember when?

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

Lena Petrova: 7-7-2025

The recent BRICS summit in Rio de Janeiro marks a significant geopolitical realignment, with Southeast Asia increasingly engaging with the expanded BRICS bloc.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS has grown to include Egypt, Ethiopia, Indonesia, Iran, and the UAE, representing nearly 40% of global GDP by purchasing power—surpassing the G7.

Southeast Asia, led by Indonesia’s full membership and Malaysia, Thailand, and Vietnam’s partner status, is now strategically aligning with BRICS to secure long-term peace and prosperity by leveraging two key initiatives: the New Development Bank (BRICS Bank) and the Contingent Reserve Arrangement (CRA)

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

Lena Petrova: 7-7-2025

The recent BRICS summit in Rio de Janeiro marks a significant geopolitical realignment, with Southeast Asia increasingly engaging with the expanded BRICS bloc.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS has grown to include Egypt, Ethiopia, Indonesia, Iran, and the UAE, representing nearly 40% of global GDP by purchasing power—surpassing the G7.

Southeast Asia, led by Indonesia’s full membership and Malaysia, Thailand, and Vietnam’s partner status, is now strategically aligning with BRICS to secure long-term peace and prosperity by leveraging two key initiatives: the New Development Bank (BRICS Bank) and the Contingent Reserve Arrangement (CRA)

These financial mechanisms offer alternatives to Western-dominated institutions, supporting infrastructure, green energy, and crisis liquidity, helping emerging economies reduce dependence on China or Western powers.

Beyond economics, BRICS offers Southeast Asian nations a strategic hedge amid intensifying US-China tensions, promoting cooperative multipolarity and enabling countries to avoid binary Cold War-style choices.

This aligns with South-South cooperation, empowering developing nations to gain more influence in global affairs. However, this shift is not without challenges: some Southeast Asian countries remain wary of BRICS due to China’s dominant role, ongoing territorial disputes in the South China Sea, and concerns over ASEAN unity. The US views BRICS skeptically, with previous administrations threatening tariffs and economic sanctions against members cooperating too closely with the bloc.

Full ASEAN membership in BRICS is unlikely in the near term, but individual Southeast Asian states will continue to deepen ties with BRICS to diversify economic partnerships and strengthen sovereignty in an unpredictable global environment.

Ultimately, Southeast Asia’s engagement with BRICS reflects a broader desire for autonomy and multipolar cooperation rather than allegiance to a single global power.

The evolving BRICS bloc is reshaping global geopolitics and economics, with Southeast Asia emerging as a key player in this transformation.

The region’s engagement with BRICS reflects a strategic pursuit of economic diversification, financial resilience, and geopolitical autonomy. By leveraging the New Development Bank and the Contingent Reserve Arrangement, Southeast Asian countries gain alternatives to traditional Western institutions and the ability to better navigate global uncertainties.

However, the path forward is fraught with challenges stemming from territorial disputes, regional unity concerns, and US opposition. Ultimately, Southeast Asia’s cautious but steady move toward BRICS embodies a broader global south ambition: to assert sovereignty, avoid binary power struggles, and foster a more multipolar, cooperative international order.

Iraq Economic News and Points To Ponder Monday Evening 7-7-25

A government source told Al-Eqtisad News: The Government Has Taken Major Steps To Promote Electronic Payments And Financial Inclusion, Achieving Qualitative Leaps In 2025.

Money and Business Economy News – Baghdad A government source revealed the steps taken by the Iraqi government to develop and promote electronic payments, noting that since the Iraqi government assumed office more than two and a half years ago, the importance of a strong and efficient banking system has become clear to it.

A government source told Al-Eqtisad News: The Government Has Taken Major Steps To Promote Electronic Payments And Financial Inclusion, Achieving Qualitative Leaps In 2025.

Money and Business Economy News – Baghdad A government source revealed the steps taken by the Iraqi government to develop and promote electronic payments, noting that since the Iraqi government assumed office more than two and a half years ago, the importance of a strong and efficient banking system has become clear to it.

The development of electronic payments and increased financial inclusion in the country are among its most prominent features.

The government and the Prime Minister have considered this goal a top priority, as it is a key objective in the strategies of countries around the world, given its close connection to economic stability and growth.

The source added to Al-Eqtisad News that the Iraqi government has taken a series of decisions and measures through the Council of Ministers and the Ministerial Council for the Economy, in addition to the committees emanating from them, which include representatives from the government, the Central Bank, and the private sector, to monitor this aspect.

These committees include the Electronic Payment Performance Monitoring Committee, the Electronic Payment and Financial Inclusion Stimulation Committee, the Digital Transformation Committee, and the Digital Transformation and Electronic Payment Process Evaluation Committee in Iraqi Ministries and Government Institutions.

He explained that Prime Minister Mohammed Shia Al-Sudani had previously issued a set of decisions and directives based on reports received from these committees, which led to significant progress in several indicators in this field during 2025, as:

- The percentage of digital transformation of Iraqi ministries and institutions rose to about 32%, after it was less than 18% in 2022, with a growth rate of

It reached 78%.

The number of bank accounts reached approximately 20 million, compared to 8 million in 2022, a growth exceeding 150%.

The number of bank cards also increased to 21-22 million cards (of all types, including credit, debit, and prepaid), up from 16 million cards in 2022, representing a growth rate of 38%.

The number of point-of-sale (POS) devices reached approximately 62,000, up from less than 10,000 in 2022, a growth of 520%.

The number of ATMs reached approximately 7,531, up from approximately 2,223 in 2022, a growth rate of 239%.

Total electronic payments reached approximately 1.37 trillion dinars in May 2025, compared to less than 90 billion dinars at the end of 2022, with a growth rate of 1,400%.

Data indicates that financial inclusion in Iraq has reached approximately 40%, up from less than 10% in 2019.

The source revealed that "the Prime Minister recently issued a number of future decisions related to a number of important projects in the field of electronic payments, stressing the need to complete them as soon as possible. These projects include:

- Activation of the local card, which is expected to be completed by the end of 2025.

- Activate the fast payment project.

- Activating the unified electronic collection application.

- Localizing private sector salaries in line with the government sector.

- Establishing a unified center for complaints related to electronic payment transactions, headquartered at the National Data Center.

The source also expected these projects to be completed in less than a year, stressing that their implementation would contribute to Iraq's advancement to a new level among advanced countries in this field. 232 viewshttps://economy-news.net/content.php?id=57098

Al-Sudani: We Are Close To Achieving Complete Self-Sufficiency In Petroleum Derivatives And Will Move To Exports.

Monday, July 7, 2025 11:05 | EconomicNumber of reads: 369 Baghdad / NINA / Prime Minister Mohammed Shia Al-Sudani stressed: "Iraq is close to achieving full self-sufficiency in petroleum derivatives, and will move to exports after the completion of a number of projects."

Al-Sudani said in a speech during the inauguration, via video conference, of the operational works of the Diwaniyah refinery expansion project: "This project falls within the government's vision to reach the conversion of 40% of the produced oil to the refining and transformation industries to meet the needs of the local market and export," indicating that with the entry of a number of projects into service, Iraq is close to achieving full self-sufficiency in petroleum derivatives, and will move to exports after the completion of the refinery expansion projects in Maysan, Diwaniyah, and Najaf.

According to a statement from his media office, he praised the efforts being made on this project, noting: "Diwaniyah Governorate lacks major projects, and this project will contribute to stimulating economic activity and will provide double job opportunities.

" He pointed out: "Refinery expansion projects will be one of the most prominent areas for enhancing the expertise of our youth and developing and investing in the oil wealth."

Al-Sudani explained: "The project, which costs $800 million, will include the addition of liquefied gas processing units with a capacity of 180 tons per day, gasoline improvement with a capacity of 10,000 barrels per day, expansion of kerosene, gas oil and fuel oil production, an 8,000 barrel per day naphtha isomerization unit, an 18,000 barrel per day naphtha hydrogenation unit, a nitrogen production plant, warehouses and storage and pumping stations, and another for electricity production."

The Prime Minister expressed his great confidence in the private sector as a partner in implementing strategic projects, in addition to his greater confidence in national capabilities to implement joint projects and achieve the highest returns from the oil wealth.

Prime Minister Mohammed Shia al-Sudani launched, today, Monday, via a video conference, the executive works of the Diwaniyah refinery expansion project by adding refining units with a capacity of 70,000 barrels/day, so that the total refining capacity of the refinery becomes 90,000 barrels/day. /End https://ninanews.com/Website/News/Details?key=1239422

A Government Delegation From The Region Arrives In Baghdad, And An Oil Agreement Is Imminent Today.

Time: 2025/07/07 11:24:11 Reading: 945 times {Political: Al Furat News} An informed source revealed that a delegation from the Kurdistan Regional Government arrived in Baghdad to hold talks with Iraqi officials regarding the draft agreement between the two sides.

According to the source, the delegation includes Acting Minister of Natural Resources Kamal Mohammed, Cabinet Secretary Amanj Rahim, and Head of the Coordination and Follow-up Office Abdul Hakim Khosro.

The delegation's visit comes as Baghdad has prepared a final draft of the agreement to re-export oil and is awaiting Erbil's response, which is expected today.

A source familiar with the Baghdad-Erbil negotiations, who preferred to remain anonymous due to the sensitivity of the issue, reported yesterday that a draft agreement on the delivery and export of oil was in its final stages. He noted that the most significant amendment to the agreement entails the delivery of all oil produced in exchange for the federal government securing the Kurdistan Region's petroleum product needs.

The source in the Kurdistan Regional Government indicated that the draft agreement stipulates that a delegation from the Ministry of Oil will be sent to the region for two purposes: first, to determine the actual level of oil production, and second, to assess the extent of local needs for petroleum products such as kerosene, gasoline, and diesel, which the federal government will provide according to the agreement.

It is worth noting that the Kurdistan Region's oil exports via the Turkish port of Ceyhan have been halted since March 25, 2023, while the amendment to the budget law entered into force on February 17 with the aim of removing obstacles to the resumption of these exports.

Under the amendment, a consulting firm will assess the costs of extracting and transporting Kurdistan's oil. Until this assessment is completed, Baghdad will temporarily pay $16 per barrel to oil companies as operating costs. LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance (And 2 Reasons They Should)

May 22, 2025 By Sean Bryant

If you’ve generated a significant amount of wealth during your lifetime, you might be starting to think about what will happen to it once you are gone. You could donate it to a worthy cause or you could pass it down to your kids. But what if you want to go ahead and give them some of your wealth now, before you pass?

With the Great Wealth Transfer underway, it’s expected that by 2045, roughly $84 trillion will be passed down from the silent generation and baby boomers to their kids. And a lot of this will be done as a living inheritance.

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance (And 2 Reasons They Should)

May 22, 2025 By Sean Bryant

If you’ve generated a significant amount of wealth during your lifetime, you might be starting to think about what will happen to it once you are gone. You could donate it to a worthy cause or you could pass it down to your kids. But what if you want to go ahead and give them some of your wealth now, before you pass?

With the Great Wealth Transfer underway, it’s expected that by 2045, roughly $84 trillion will be passed down from the silent generation and baby boomers to their kids. And a lot of this will be done as a living inheritance.

This huge transfer of wealth has caused a lot of debate about whether or not leaving your kids a living inheritance is a good idea. Keep reading as we look into some reasons why retired boomers should not leave their kids a living inheritance and a couple of reasons why they should.

Why You Shouldn’t Leave Your Kids a Living Inheritance

Risking Your Own Financial Security

It’s common to want to see your kids succeed. This is true not only with their careers but also financially. Seeing them experience things like purchasing a home or traveling the world can give you self-gratification because you can witness and enjoy their success.

However, you also need to think about your own needs. If you plan to provide your kids with an inheritance while you’re still alive, it’s important to do so carefully. What happens if an unexpected expense pops up? Are you still going to have the funds available to continue living your current lifestyle?

Family Resentment

If you have multiple children that you’re planning to leave an early inheritance for, you need to do so carefully. It’s easy to leave cash assets and know the distribution is even. But what if you’re planning to leave someone with a business or real estate?

These types of assets can have fluctuating values, and if one dependent receives something that becomes more valuable, it could cause tension within the family — not just between siblings but also between you and them.

Potential for Financial Irresponsibility

Let’s be honest with each other. Sometimes people make bad decisions with money. Lifestyle inflation is a real thing and can have some severe outcomes. When people come into additional money, whether it’s a raise at work or an inheritance, they feel more freedom. They want to go out and treat themselves to something they’ve wanted but couldn’t afford. And while this is OK to a certain extent, there must be some restraint.

Operation Gold Hollow: 90% Of London’s Bullion Was Never There—Now The Exit Doors Are Locked | Andy Schectman

Operation Gold Hollow: 90% Of London’s Bullion Was Never There—Now The Exit Doors Are Locked | Andy Schectman

Two Dollars Investing: 7-7-2025

London’s gold vaults just got exposed—and it’s worse than anyone imagined.

Andy Schectman returns with a bombshell: over 279 million ounces of gold claimed in the LBMA system… but only 36 million ounces are actually available for delivery.

The rest? Vanished, double-counted, or never there to begin with.

Operation Gold Hollow: 90% Of London’s Bullion Was Never There—Now The Exit Doors Are Locked | Andy Schectman

Two Dollars Investing: 7-7-2025

London’s gold vaults just got exposed—and it’s worse than anyone imagined.

Andy Schectman returns with a bombshell: over 279 million ounces of gold claimed in the LBMA system… but only 36 million ounces are actually available for delivery.

The rest? Vanished, double-counted, or never there to begin with.

In this urgent episode, we expose the paper gold illusion propping up the entire global bullion system, how the U.S. quietly cornered supply using “logistics” as cover, and why major players are now scrambling before the exit doors slam shut.