Tuesday Coffee with MarkZ. 07/08/2025

Tuesday Coffee with MarkZ. 07/08/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and members

Member: Are we there yet????

Tuesday Coffee with MarkZ. 07/08/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and members

Member: Are we there yet????

MZ: In Iraq: “The coming hours may witness the signing” This is about the Erbil/Baghdad oil agreements . There is a lot of back and forth right now. But articles are saying they have worked through the issues and signing is imminent.

MZ: We saw this same kind of back and forth in Kuwait.

Member: Never thought we all still be waiting and waiting and waiting all this time for the RV to go but then again, they don't care

MZ: Our regular article from Saleh: “ Advisor to the Prime Minister: Monetary Policy has succeeded in stabilizing prices and curbing inflation” He says “We are in great shape.”

Member: I bet Saleh had black hair when I bought my dinar

MZ: “Banning 18 Islamic banks from dealing in dollars-liquidation is looming” These are the same banks associated with financing terrorist groups. So is it Islamic banks being singled out – or support of terrorism being singled out? I think its part of a world wide cleanup effort.

MZ: I think this one is important. “A security source revealed Tuesday the determination of the International coalition withdrawal from Ain-A-Assad base from Anbar province” Trump has said all along that we will leave when we are paid. Now they are leaving????

MZ: I believe things are much further advanced than the press is reporting

MZ: This one makes me feel good about where we are at: “ TIR system: Iraq is a highway from Turkey to the Gulf” this is part of the development road project connecting the east to the west.

Member: I wonder- when do the Vietnamese new tariff trade agreements and thus new rate go into affect?

Member: With the new trade deal with Vietnam they should just go alone and take the lead

Member: any news from Bonds or groups today?

MZ: I do know a couple folks that have some bond update appointments today and I am hopeful it will give us a better idea where we are? Seems like much of it is misdirection.

Member: Frank's JPM Story...A guy went in for a meeting with Fin Adv. wasn't getting anywhere. Plopped down a brick of Dinar...The VP of Wealth mgmt was called. They have an appt today.

Member: We’re in a proverbial “escape room” looking for the clues together!

Member: Will we have Christmas in July or December?

Member: When this is all said and done and we are on the other side of this shift I vote to remove the word “soon” from the English language going forward!!

Member: They have always said there would be confusion right before this happens—hope that is where we are

Member: Just before the end of a movie the twists and turns increase and then boom

Member: happy Birthday to everyone celebrating and have a great day everyone.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Tuesday 7-8-2025

The Old Pretender: Hyperinflation will be Terminated by a New Gold Standard

7-8-2025

This is why the BRICS are Insulating themselves from the US dollar system by building their own (#gold-based) monetary infrastructure.

Bloomberg: BREAKING: President Donald Trump said he would put an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS,” injecting further uncertainty as the US continues to negotiate levies with trading partners

A good, brief explainer of the new BRICS #gold-based monetary system that is being quietly constructed without publicity.

The Old Pretender: Hyperinflation will be Terminated by a New Gold Standard

7-8-2025

This is why the BRICS are Insulating themselves from the US dollar system by building their own (#gold-based) monetary infrastructure.

Bloomberg: BREAKING: President Donald Trump said he would put an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS,” injecting further uncertainty as the US continues to negotiate levies with trading partners

A good, brief explainer of the new BRICS #gold-based monetary system that is being quietly constructed without publicity.

Note that uses the blockchain to transfer ownership without physically moving the #gold, just like @KinesisMonetary

Trump must know these threats are motivating more countries to join the new BRICS #gold-based monetary system.

Question is, will the US apply punishment tariffs on US states that have anti-fiat dollar sound money policies?

BMGGroup: States are quietly advancing #SoundMoney—tax-free gold, silver, and transparency laws are gaining ground. https://bit.ly/3XYZ624 #Gold #Silver #HardAssets #PreciousMetals

This helps solve the puzzle. Tariffs push more countries to de-dollarize, which adds to the inflation created by the BBB. The debt then gets hyperinflated away, before the hyperinflation is terminated on 4th July 2026 by the launch of a new #gold standard.

Going Underground: ‘If BRICS de-dollarisation succeeds, it would be DEVASTATING for the US economy’ -Former Member of the British Parliament Andrew Bridgen on the latest episode of Going Underground FULL INTERVIEW BELOW IN THE REPLIES

https://twitter.com/i/status/1942263397266944008

Trump is already setting up Jerome Powell as the fall guy to take the blame for the hyperinflation about to hit. But Powell will get paid handsomely to play that role.

This headline should more accurately read: “De-dollarization: BRICS leaders propose switching on alternative payment system to SWIFT”

Source(s): https://x.com/Dioclet54046121/status/1942134999421014411

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Ali Al-Alaq in the CBI is working towards the monetary reform, we have the prime minister Al-Sudani working his magic in the direction of economic reform and his “pet” project of industrial cities. Article: “IRAQ PLANS TO RECEIVE 4 MILLION CONTAINERS ANNUALLY AT UMM QASR PORT.” WOW!...Umm Qasr Port in Basra is undergoing rapid development...Iraq is going to be a “clearing house” for the middle east. This means shipment from all over the world will land in Iraq and they be distributed to other countries. This means massive tariff and customs fees for Iraq...

Frank26 Isn't the goal for the Iraqi dinar to be digital? Yes, check it off the list. Isn't the goal for the Iraqi dinar to have purchasing power? Yes. Check it off the list. 'No. No. No. Wait. Stop. No Frank no. You can't check that off the list!' What if I prove to you it's not 1310 anymore? What would you say? I think you should say something's happening to the exchange rate. The American dollar is being removed out of Iraq. In doing so the value of the Iraqi dinar is going up.

FRANK26….7-7-25….ALOHA…..

Western Media Won’t Show You This: BRICS 2025 Summit Declaration

Lena Petrova: 7-7-2025

Iraq Economic News and Points To Ponder Tuesday Morning 7-8-25

Al-Mustaqilla Reveals: 30 Iraqi Banks No Longer Deal In Dollars!

Al-Mustaqilla publishes the full list: Banks banned from receiving dollars by order of the Central Bank.

July 7, 2025 Last updated: July 7, 2025 Al-Mustaqilla/- Al-Mustaqilla today obtained an updated list of licensed private banks in Iraq that have been banned from dealing in dollars by the Central Bank of Iraq.

This decision comes amidst uncertainty and the lack of official confirmation of the precise reasons that prompted the bank to ban these banks from dollar trading.

Al-Mustaqilla Reveals: 30 Iraqi Banks No Longer Deal In Dollars!

Al-Mustaqilla publishes the full list: Banks banned from receiving dollars by order of the Central Bank.

July 7, 2025 Last updated: July 7, 2025 Al-Mustaqilla/- Al-Mustaqilla today obtained an updated list of licensed private banks in Iraq that have been banned from dealing in dollars by the Central Bank of Iraq.

This decision comes amidst uncertainty and the lack of official confirmation of the precise reasons that prompted the bank to ban these banks from dollar trading.

It is speculated that these banks are linked to US sanctions and other financial oversight concerns.

Banks prohibited from dealing in dollars

According to the official website of the Central Bank of Iraq,

the list included the following banks:

Middle East Iraqi Investment Bank

Iraqi investment

Dar Al Salam Investment

Babylon consumption

Sumer Commercial

Mosul Development and Investment

Iraqi Federation

Ashur International Investment

Across Iraq for Investment

Guidance

Erbil Investment and Finance

Hammurabi's Commercial Code

Elaph Islamic

Kurdistan International Islamic Investment and Development

Islamic Cooperation for Investment (under liquidation, prohibited from dealing in dollars)

Islamic Giving for Investment and Finance

Islamic Investment and Finance Advisor

Islamic World Investment and Finance

South Islamic Investment and Finance

Islamic Arabic

Noor Al Iraq Islamic Investment and Finance

Zain Iraq Islamic Investment and Finance

International Islamic

Islamic Finance Holding Company

Al Ansari Islamic Investment and Finance

International Islamic Trust

Al Rajhi Islamic

Islamic Paper for Investment and Finance

Asia Iraq Islamic Investment and Finance

Islamic Spectrum for Investment and Finance

Islamic money for investment

Possible reasons for ban

To date, the Central Bank of Iraq has not issued an official statement detailing the reasons for banning these banks from dealing in dollars.

However, financial sources and banking sector observers point to the possibility of a link between this decision and US or international sanctions on some of these institutions,

in addition to potential violations related to: money launderingsmuggling hard currency illegal transfers

Failure to comply with financial compliance and banking oversight standards

The repercussions of the decision on the Iraqi economy

This ban comes at a time when the Iraqi economy is suffering from several pressures, including the decline in the value of the Iraqi dinar and fluctuating dollar prices in the local market, which could lead to: The complexity of transactions for companies and individuals dealing with these banks.

Increased demand on the black market for dollar exchange, with the accompanying financial risks. Undermining confidence in the local banking system, especially among private banks facing the threat of sanctions.

Calls for more transparency

Economists believe the Central Bank of Iraq should issue a transparent statement explaining the true reasons behind these decisions, along with a clear plan to address the financial issues related to the banks in question.

Some MPs have also called for the formation of a parliamentary investigation committee to monitor the violating banks and ensure the protection of citizens' funds.

in conclusion

All eyes are on the Central Bank of Iraq's next steps regarding banks banned from dealing in dollars.

Will additional sanctions be imposed, or are these merely temporary measures to regulate the market and improve financial oversight? What impact will this have on the stability of the banking system and the Iraqi economy in general?

https://mustaqila.com/المستقلة-تكشف-30-مصرفًا-عراقيًا-خارج-ال/

Inflation In Iraq Has Declined And Its Gold Reserves Have Increased. Expert Explains

Time: 2025/07/07 21:23:08 Read: 825 times {economic: Al-Furat News} Iraq recorded a noticeable decline in the inflation rate in conjunction with the rise in its gold reserves during the first quarter of 2025, in financial and monetary indicators described as positive despite the challenges posed by oil price fluctuations.

Financial expert Salah Nouri explained in a statement to {Al-Furat News} that:

"The decline in the inflation rate is due to a group of factors, most notably the policy of the Central Bank of Iraq in controlling the supply of cash for circulation, in addition to regulating borrowing to finance the private sector at limited rates that contribute to revitalizing the economy without causing a cash surplus".

He added, "The decline in global commodity prices had a direct impact, given Iraq's heavy reliance on imports to meet its needs for goods and merchandise, which was reflected in a reduction in local price levels."

As for the increase in gold reserves, the expert attributed it to the Central Bank's policy of diversifying investment instruments by balancing debt securities in dollars with the purchase of gold, which is a safe store of value.

According to him He stressed that "these policies aim to support and enhance the Central Bank's reserves within its monetary policy orientations."

In the same context, Nouri warned of

"the negative effects of the decline in the prices of exported oil,

which came as a result of OPEC Plus' decisions to increase production,

which may reflect negatively on the state's general revenues and

thus on the implementation of the operational and investment budget items".

He pointed out that "the Federal Ministry of Finance has two options in light of this decline: either reduce spending to maintain the deficit rate specified in the budget, or continue spending and increase the deficit, which will force the government to resort to internal borrowing".

The expert said, "This challenge is directly related to fiscal policy, which requires a careful balance between spending and revenues."

According to an official report issued by the Central Bank of Iraq, the

Iraqi economy witnessed significant shifts in monetary indicators during the first quarter of 2025.

Inflation fell by 21%, while money transfers abroad fell by 0.6%, indicating a relative improvement in the monetary balance and liquidity control.

The report, which covered the months of January, February and March, also showed a significant increase in the value of Iraq's gold reserves, rising from 17.8 trillion dinars to 21.2 trillion dinars, reflecting the Central Bank's reliance on a policy of diversifying assets and enhancing safe havens to protect cash reserves in light of global market fluctuations.

https://alforatnews.iq/news/تراجع-نسبة-التضخم-في-العراق-وارتفاع-احتياطه-من-الذهب-خبير-يوضح

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economic Updates Tuesday Morning 7-8-25

Good Morning Dinar Recaps,

Ripple CEO Brad Garlinghouse to Testify at Senate Hearing, Urges Clear Crypto Rules

Brad Garlinghouse to Testify Before U.S. Senate on July 9

Ripple CEO Brad Garlinghouse is set to appear before the U.S. Senate Banking Committee on July 9, where he will urge lawmakers to adopt clear, fair, and strong crypto regulations. This will be Garlinghouse’s first testimony before the committee, signaling a pivotal moment in the industry’s ongoing call for legal clarity.

Good Morning Dinar Recaps,

Ripple CEO Brad Garlinghouse to Testify at Senate Hearing, Urges Clear Crypto Rules

Brad Garlinghouse to Testify Before U.S. Senate on July 9

Ripple CEO Brad Garlinghouse is set to appear before the U.S. Senate Banking Committee on July 9, where he will urge lawmakers to adopt clear, fair, and strong crypto regulations. This will be Garlinghouse’s first testimony before the committee, signaling a pivotal moment in the industry’s ongoing call for legal clarity.

Garlinghouse: “Strong but Fair Rules” Are Key

In a recent announcement, Garlinghouse said he is “honored to speak directly to lawmakers” about the urgent need for clear digital asset laws in the U.S. He thanked Senators Tim Scott, Cynthia Lummis, and Ruben Gallego for advancing legislation that supports innovation while protecting consumers.

“We need smart rules that protect people without killing innovation,” he noted.

For years, Ripple and other crypto firms have asked Congress to clarify how digital assets are classified—specifically, which are treated as securities regulated by the SEC, and which are commodities overseen by the CFTC. The current lack of clarity has led to legal disputes, enforcement confusion, and regulatory overlap.

Key Legislation on the Table

The hearing comes at a critical time. Congress is now reviewing three major crypto-related bills:

The CLARITY Act – Aims to define whether digital assets fall under SEC or CFTC jurisdiction.

The GENIUS Act – Addresses stablecoin standards and regulatory oversight.

The Anti-CBDC Surveillance State Act – Seeks to restrict surveillance mechanisms tied to central bank digital currencies (CBDCs).

Among them, the CLARITY Act stands out. Senator Tim Scott has suggested it could be passed as early as October, depending on bipartisan support. If passed, it could significantly reduce regulatory uncertainty for crypto developers, brokers, and exchanges.

Who Else Is Testifying?

Garlinghouse will join a panel of prominent figures in the crypto and policy sectors, including:

Jonathan Levin, CEO of Chainalysis

Summer Mersinger, CEO of the Blockchain Association

A top Harvard legal expert on digital finance

Together, they aim to present a united case for establishing sensible regulatory frameworks that ensure the U.S. remains a leader in blockchain innovation.

“With clear rules, crypto companies can keep building—and investors can feel confident,” one panelist is expected to say.

The Stakes for the Crypto Industry

This hearing marks a turning point. For industry leaders, congressional inaction is no longer an option. As regulatory ambiguity continues to push innovation offshore, executives like Garlinghouse argue that federal clarity is essential for protecting American leadership in the rapidly evolving crypto economy.

With billions of dollars in market value and countless innovation opportunities at stake, July 9 could become a defining moment for U.S. crypto policy.

Summary:

Ripple CEO Brad Garlinghouse to testify before Senate Banking Committee on July 9.

Will push for strong but fair crypto rules to clarify SEC/CFTC roles.

Hearing coincides with review of major legislation: CLARITY, GENIUS, and Anti-CBDC Acts.

Other speakers include top crypto CEOs and academic experts.

Senate could pass landmark regulation by October, reshaping the U.S. crypto landscape.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Ripple Applies for National Banking License as Stablecoin Regulation Accelerates

Ripple Targets OCC Charter to Cement RLUSD Oversight

Ripple has filed an application for a national banking license with the Office of the Comptroller of the Currency (OCC), aiming to elevate the regulatory credibility and oversight of its U.S. dollar-backed stablecoin, RLUSD. The filing was submitted on Wednesday, July 2, according to reporting by The Wall Street Journal.

If approved, Ripple would join a growing class of crypto-native firms seeking national trust bank charters, bringing stablecoin issuance more directly under the dual oversight of federal and state regulators.

“The dual nature of that regulation would basically have set a new bar for transparency and compliance in the stablecoin market,” said Jack McDonald, SVP of Stablecoins at Ripple.

Currently, RLUSD already operates under the jurisdiction of the New York Department of Financial Services (NYDFS). A federal trust bank charter would place RLUSD more squarely within the OCC’s regulatory framework, giving Ripple greater operational latitude and legitimacy in the U.S. financial system.

Ripple Subsidiary Also Seeks Fed Master Account

In a parallel development, Standard Custody & Trust Company, a Ripple subsidiary, filed an application for a Federal Reserve master account on Monday, June 30. If granted, this would allow Ripple to:

Custody stablecoin reserves directly with the Fed

Issue and redeem RLUSD outside of standard banking hours

Streamline operational independence from third-party banks

Such a move would enable Ripple to align more closely with emerging federal standards for stablecoin infrastructure, and to offer enhanced stability and liquidity for users and institutions.

Ripple and Circle Signal New Era of Crypto-Fintech Convergence

Ripple’s application follows a similar move by Circle Internet Group, which also filed on June 30 for a national trust charter. If approved, Circle plans to establish the First National Digital Currency Bank, N.A., a federally chartered entity that would manage the USDC reserve and offer digital asset custody services to institutional clients.

“By applying for a national trust charter, Circle is taking proactive steps to further strengthen our USDC infrastructure,” said Jeremy Allaire, Circle Co-founder and CEO.

“We will align with emerging U.S. regulation for the issuance and operation of dollar-denominated payment stablecoins.”

Circle’s strategic move mirrors Ripple’s efforts and reflects growing readiness among leading crypto firms to embrace full-scale federal oversight—once considered a barrier to innovation.

Institutional Custody and Compliance: The Next Crypto Frontier

As digital asset custody continues to draw attention from both traditional institutions and FinTech platforms, companies like Ripple and Circle are positioning themselves to operate as regulated financial infrastructure providers, not just crypto startups.

A recent PYMNTS report highlighted that these applications show crypto firms are preparing to meet the same supervisory and compliance standards as federally chartered banks—a development that may significantly reshape the crypto regulatory landscape in the U.S.

Summary:

Ripple files application for national trust bank license with OCC

Would place RLUSD under dual oversight of OCC and NYDFS

Subsidiary Standard Custody applies for Federal Reserve master account

Circle also seeks national charter to launch a trust bank for USDC

Signals a broader push by crypto firms toward federal integration and institutional-grade compliance

@ Newshounds News™

Source: PYMNTS

~~~~~~~~~

Worldpay Expands Platform Offering Amid Soaring Embedded Finance Demand

Expansion Reaches Canada, UK, and Deepens Presence in Australia

Worldpay has announced the expansion of its Worldpay for Platforms product into Canada and the United Kingdom, while also extending its reach in Australia, in a move designed to meet the growing demand for embedded finance solutions.

The announcement, made on Tuesday, July 8, marks a strategic pivot as software providers increasingly seek to embed secure and scalable payment services directly into their platforms.

“As business software tools converge into unified experiences, we’re investing in embedded payments to help SaaS providers become the everything platforms for their users,” said Matt Downs, head of Worldpay for Platforms.

“We are committed to serving our current software platforms and new clients in the key geographies where they do business by making embedded solutions easier to integrate and elevating the experiences they provide their users.”

Embedded Finance: Driving a Shift in Digital Commerce

According to PYMNTS, embedded finance is accelerating a larger trend that “moves banking, payments and lending into the non-financial realm.” These solutions allow consumers to access Buy Now, Pay Later (BNPL), credit, and other financial services within apps or digital commerce platforms, transforming smartphones and tablets into full-service commercial gateways.

“These ecosystems keep users engaged while improving the cash flow of businesses and their financial partners,” the report notes.

Embedded Lending Sees Massive Adoption

Recent research by Visa and PYMNTS Intelligence illustrates just how rapidly embedded finance is being adopted:

47% of lenders now offer only embedded lending products

31% offer a hybrid model combining embedded and traditional lending

Just 12% of firms offer no embedded options

These figures reflect growing confidence in embedded lending’s ability to expand financial inclusion, increase conversion rates, and tailor financial offerings using real-time data.

Worldpay Eyes Future with Agentic AI Integration

Looking forward, Worldpay is betting big on the next evolution of payments: agentic artificial intelligence (AI). In a recent interview with PYMNTS, Nabil Manji, SVP and Head of FinTech Growth at Worldpay, outlined the company's vision:

“We’re quite bullish on agentic checkout and agentic commerce,” said Manji.

“Payments companies have been using machine learning and AI for years, if not decades. One of the prerequisites for leveraging these tools is a large, rich dataset — and there’s a lot of data in payments and financial services.”

Agentic AI refers to autonomous digital agents capable of planning, reasoning, and executing transactions on behalf of users—ushering in what experts describe as a seismic shift in commerce infrastructure.

Summary:

Worldpay for Platforms expands into Canada, UK, and Australia

Responds to surge in demand for embedded finance and payments integration

Embedded finance enables in-app lending, BNPL, and payments for non-financial businesses

47% of lenders now operate using embedded finance models exclusively

Agentic AI seen as the next frontier in commerce and checkout experiences

@ Newshounds News™

Source: PYMNTS

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Tuesday Morning 7-8-2025

TNT:

Tishwash: Oil brings distances closer... Baghdad and Kurdistan on the verge of a formal agreement

2025-07-08 13:09

The Parliamentary Oil and Gas Committee announced on Tuesday that Baghdad and Erbil have reached a preliminary agreement to end the Kurdistan Region's employee salary crisis. The committee indicated that the agreement may be announced within the next few hours, followed by an official signing and presentation to the Council of Ministers at its scheduled session on Tuesday.

Committee member Sabah Sobhi said in a statement to the official newspaper, followed by Al-Mutala'a, that: "The preliminary agreement stipulates that the regional government will deliver 300,000 barrels of oil per day to the federal government through the National Oil Marketing Company (SOMO), in exchange for the region receiving 46,000 barrels per day for local consumption and refining."

TNT:

Tishwash: Oil brings distances closer... Baghdad and Kurdistan on the verge of a formal agreement

2025-07-08 13:09

The Parliamentary Oil and Gas Committee announced on Tuesday that Baghdad and Erbil have reached a preliminary agreement to end the Kurdistan Region's employee salary crisis. The committee indicated that the agreement may be announced within the next few hours, followed by an official signing and presentation to the Council of Ministers at its scheduled session on Tuesday.

Committee member Sabah Sobhi said in a statement to the official newspaper, followed by Al-Mutala'a, that: "The preliminary agreement stipulates that the regional government will deliver 300,000 barrels of oil per day to the federal government through the National Oil Marketing Company (SOMO), in exchange for the region receiving 46,000 barrels per day for local consumption and refining."

He added, "It is hoped that the agreement will be announced within the next few hours, to be officially signed and presented to the Council of Ministers at its session scheduled for today."

This comes 48 hours after Parliament Speaker Mahmoud al-Mashhadani visited Erbil, where he met with regional officials to discuss resolving the disputes between Baghdad and the region. Prime Minister Mohammed Shia al-Sudani and President Abdul Latif Jamal Rashid also discussed the issue of funding the salaries of Kurdistan Region employees on Monday. link

Tishwash: Central Bank: Inflation fell by 21% and gold reserves rose by 19% in the first quarter of 2025.

A report by the Central Bank of Iraq revealed that inflation in Iraq fell by 21% in the first quarter of this year, and that remittances abroad declined by 0.6%, while the value of gold reserves increased from 17.8 trillion dinars to 21.2 trillion dinars.

The Central Bank's report stated that these statistics covered the first quarter of this year, specifically the months of January, February, and March.

The report indicated that the overall inflation rate in Iraq fell by 21% in the first quarter of 2025, reaching 2.2%, compared to the last quarter of 2024, when the inflation rate was 2.8%. The

Central Bank's report stated that this decline indicates a decline in the general price level and an improvement in the purchasing power of individuals and institutions in Iraq.

The report stated that the volume of Iraqi currency transfers abroad by the Central Bank decreased by 0.6% in the first quarter of this year, reaching 99.9 trillion dinars.

This comparison is with the fourth quarter of 2024, when the volume of foreign currency transferred abroad at that time was 100.5 trillion dinars.

Money transfers abroad in Iraq are linked to the conversion of Iraqi oil revenues into dollars, which the bank provides to importers at the official exchange rate.

The Central Bank of Iraq indicated in its report that this decline played a role in reducing inflation and maintaining the stability of the general price level in Iraq.

The report stated that the total money supply granted by banks to the private sector in the first quarter of this year grew by 1.1%. link

************

Tishwah: Iraq gold surges, inflation dips as deficit grows: Central Bank

Iraq's economy showed signs of stabilization in the first quarter of 2025, with inflation dropping by 21 percent and gold reserves seeing a significant increase, according to a report from the Central Bank of Iraq (CBI). This comes as the country grapples with a persistent budget deficit despite rising overall revenues.

The CBI report seen by Rudaw, covering January to March 2025, revealed that the average inflation rate fell to 2.2 percent from 2.8 percent in the last quarter of 2024. “This reduction indicates a decrease in the general price level and an improvement in the purchasing power of individuals and institutions in Iraq,” the report said.

The latter is seen as a good sign for the economy as it means that the cost of goods and services is rising at a slower pace, or even decreasing for some items, thus increasing the purchasing power.

The CBI report also noted a slight decrease in the circulation of Iraqi dinars, down 0.6 percent in the same period, reaching 99.9 trillion dinars (about $76.3 billion) from 100.5 trillion dinars (roughly $76.7 billion) in the final quarter of 2024. This decline, linked to better management of USD oil revenues, is seen as a factor in curbing inflation and stabilizing prices.

Further bolstering economic indicators, lending to the private sector rose by 1.1 percent in the first quarter of 2025, with total credit reaching 44.1 trillion dinars (about $33.7 billion). This increase suggests growing support for private sector projects and a potential diversification of the oil-dependent economy.

Significantly, Iraq’s gold reserves Iraq's gold reserves surged by 19 percent in value, reaching 21.2 trillion dinars (approximately $16.2 billion). This dramatic rise is a positive sign for the country's financial stability and its resilience against economic shocks.

However, the positive economic news is tempered by fiscal challenges.

Iraq’s finance ministry on Wednesday reported revenues of 28 trillion dinars (about $21.3 billion) in the first four months of 2025, a 34 percent increase compared to last year. Yet, expenditures also rose, contributing to a deficit of nearly 900 billion dinars (about $690 million) in the first three months of the year, a 12 percent increase compared to the same period last year.

Oil revenues continued to dominate, accounting for 88.9 percent of total state income. The ongoing deficit, despite higher revenues, highlights Iraq's heavy reliance on oil prices and the substantial spending outlined in its $152 billion federal budget for 2023-2025. The budget, passed in June 2023, had raised concerns about financial stability should oil prices fall below the $70 per barrel threshold set in the legislation.

Iraqi Prime Minister Mohammed Shia’ al-Sudani had previously stated that the record-high budget aimed to address social needs, enhance infrastructure, and foster economic progress. link

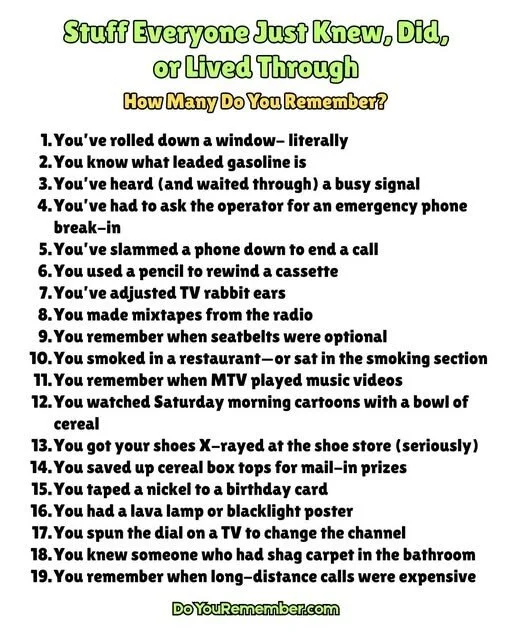

Mot: ..... Anyone Has an Idea WHAT this might beeeee bout????

Mot: . Did Ya!!!??? Remember when?

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

Lena Petrova: 7-7-2025

The recent BRICS summit in Rio de Janeiro marks a significant geopolitical realignment, with Southeast Asia increasingly engaging with the expanded BRICS bloc.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS has grown to include Egypt, Ethiopia, Indonesia, Iran, and the UAE, representing nearly 40% of global GDP by purchasing power—surpassing the G7.

Southeast Asia, led by Indonesia’s full membership and Malaysia, Thailand, and Vietnam’s partner status, is now strategically aligning with BRICS to secure long-term peace and prosperity by leveraging two key initiatives: the New Development Bank (BRICS Bank) and the Contingent Reserve Arrangement (CRA)

BRICS vs. West, America is Losing Southeast Asia, the BRICS Shift No One Saw Coming

Lena Petrova: 7-7-2025

The recent BRICS summit in Rio de Janeiro marks a significant geopolitical realignment, with Southeast Asia increasingly engaging with the expanded BRICS bloc.

Originally comprising Brazil, Russia, India, China, and South Africa, BRICS has grown to include Egypt, Ethiopia, Indonesia, Iran, and the UAE, representing nearly 40% of global GDP by purchasing power—surpassing the G7.

Southeast Asia, led by Indonesia’s full membership and Malaysia, Thailand, and Vietnam’s partner status, is now strategically aligning with BRICS to secure long-term peace and prosperity by leveraging two key initiatives: the New Development Bank (BRICS Bank) and the Contingent Reserve Arrangement (CRA)

These financial mechanisms offer alternatives to Western-dominated institutions, supporting infrastructure, green energy, and crisis liquidity, helping emerging economies reduce dependence on China or Western powers.

Beyond economics, BRICS offers Southeast Asian nations a strategic hedge amid intensifying US-China tensions, promoting cooperative multipolarity and enabling countries to avoid binary Cold War-style choices.

This aligns with South-South cooperation, empowering developing nations to gain more influence in global affairs. However, this shift is not without challenges: some Southeast Asian countries remain wary of BRICS due to China’s dominant role, ongoing territorial disputes in the South China Sea, and concerns over ASEAN unity. The US views BRICS skeptically, with previous administrations threatening tariffs and economic sanctions against members cooperating too closely with the bloc.

Full ASEAN membership in BRICS is unlikely in the near term, but individual Southeast Asian states will continue to deepen ties with BRICS to diversify economic partnerships and strengthen sovereignty in an unpredictable global environment.

Ultimately, Southeast Asia’s engagement with BRICS reflects a broader desire for autonomy and multipolar cooperation rather than allegiance to a single global power.

The evolving BRICS bloc is reshaping global geopolitics and economics, with Southeast Asia emerging as a key player in this transformation.

The region’s engagement with BRICS reflects a strategic pursuit of economic diversification, financial resilience, and geopolitical autonomy. By leveraging the New Development Bank and the Contingent Reserve Arrangement, Southeast Asian countries gain alternatives to traditional Western institutions and the ability to better navigate global uncertainties.

However, the path forward is fraught with challenges stemming from territorial disputes, regional unity concerns, and US opposition. Ultimately, Southeast Asia’s cautious but steady move toward BRICS embodies a broader global south ambition: to assert sovereignty, avoid binary power struggles, and foster a more multipolar, cooperative international order.

Iraq Economic News and Points To Ponder Monday Evening 7-7-25

A government source told Al-Eqtisad News: The Government Has Taken Major Steps To Promote Electronic Payments And Financial Inclusion, Achieving Qualitative Leaps In 2025.

Money and Business Economy News – Baghdad A government source revealed the steps taken by the Iraqi government to develop and promote electronic payments, noting that since the Iraqi government assumed office more than two and a half years ago, the importance of a strong and efficient banking system has become clear to it.

A government source told Al-Eqtisad News: The Government Has Taken Major Steps To Promote Electronic Payments And Financial Inclusion, Achieving Qualitative Leaps In 2025.

Money and Business Economy News – Baghdad A government source revealed the steps taken by the Iraqi government to develop and promote electronic payments, noting that since the Iraqi government assumed office more than two and a half years ago, the importance of a strong and efficient banking system has become clear to it.

The development of electronic payments and increased financial inclusion in the country are among its most prominent features.

The government and the Prime Minister have considered this goal a top priority, as it is a key objective in the strategies of countries around the world, given its close connection to economic stability and growth.

The source added to Al-Eqtisad News that the Iraqi government has taken a series of decisions and measures through the Council of Ministers and the Ministerial Council for the Economy, in addition to the committees emanating from them, which include representatives from the government, the Central Bank, and the private sector, to monitor this aspect.

These committees include the Electronic Payment Performance Monitoring Committee, the Electronic Payment and Financial Inclusion Stimulation Committee, the Digital Transformation Committee, and the Digital Transformation and Electronic Payment Process Evaluation Committee in Iraqi Ministries and Government Institutions.

He explained that Prime Minister Mohammed Shia Al-Sudani had previously issued a set of decisions and directives based on reports received from these committees, which led to significant progress in several indicators in this field during 2025, as:

- The percentage of digital transformation of Iraqi ministries and institutions rose to about 32%, after it was less than 18% in 2022, with a growth rate of

It reached 78%.

The number of bank accounts reached approximately 20 million, compared to 8 million in 2022, a growth exceeding 150%.

The number of bank cards also increased to 21-22 million cards (of all types, including credit, debit, and prepaid), up from 16 million cards in 2022, representing a growth rate of 38%.

The number of point-of-sale (POS) devices reached approximately 62,000, up from less than 10,000 in 2022, a growth of 520%.

The number of ATMs reached approximately 7,531, up from approximately 2,223 in 2022, a growth rate of 239%.

Total electronic payments reached approximately 1.37 trillion dinars in May 2025, compared to less than 90 billion dinars at the end of 2022, with a growth rate of 1,400%.

Data indicates that financial inclusion in Iraq has reached approximately 40%, up from less than 10% in 2019.

The source revealed that "the Prime Minister recently issued a number of future decisions related to a number of important projects in the field of electronic payments, stressing the need to complete them as soon as possible. These projects include:

- Activation of the local card, which is expected to be completed by the end of 2025.

- Activate the fast payment project.

- Activating the unified electronic collection application.

- Localizing private sector salaries in line with the government sector.

- Establishing a unified center for complaints related to electronic payment transactions, headquartered at the National Data Center.

The source also expected these projects to be completed in less than a year, stressing that their implementation would contribute to Iraq's advancement to a new level among advanced countries in this field. 232 viewshttps://economy-news.net/content.php?id=57098

Al-Sudani: We Are Close To Achieving Complete Self-Sufficiency In Petroleum Derivatives And Will Move To Exports.

Monday, July 7, 2025 11:05 | EconomicNumber of reads: 369 Baghdad / NINA / Prime Minister Mohammed Shia Al-Sudani stressed: "Iraq is close to achieving full self-sufficiency in petroleum derivatives, and will move to exports after the completion of a number of projects."

Al-Sudani said in a speech during the inauguration, via video conference, of the operational works of the Diwaniyah refinery expansion project: "This project falls within the government's vision to reach the conversion of 40% of the produced oil to the refining and transformation industries to meet the needs of the local market and export," indicating that with the entry of a number of projects into service, Iraq is close to achieving full self-sufficiency in petroleum derivatives, and will move to exports after the completion of the refinery expansion projects in Maysan, Diwaniyah, and Najaf.

According to a statement from his media office, he praised the efforts being made on this project, noting: "Diwaniyah Governorate lacks major projects, and this project will contribute to stimulating economic activity and will provide double job opportunities.

" He pointed out: "Refinery expansion projects will be one of the most prominent areas for enhancing the expertise of our youth and developing and investing in the oil wealth."

Al-Sudani explained: "The project, which costs $800 million, will include the addition of liquefied gas processing units with a capacity of 180 tons per day, gasoline improvement with a capacity of 10,000 barrels per day, expansion of kerosene, gas oil and fuel oil production, an 8,000 barrel per day naphtha isomerization unit, an 18,000 barrel per day naphtha hydrogenation unit, a nitrogen production plant, warehouses and storage and pumping stations, and another for electricity production."

The Prime Minister expressed his great confidence in the private sector as a partner in implementing strategic projects, in addition to his greater confidence in national capabilities to implement joint projects and achieve the highest returns from the oil wealth.

Prime Minister Mohammed Shia al-Sudani launched, today, Monday, via a video conference, the executive works of the Diwaniyah refinery expansion project by adding refining units with a capacity of 70,000 barrels/day, so that the total refining capacity of the refinery becomes 90,000 barrels/day. /End https://ninanews.com/Website/News/Details?key=1239422

A Government Delegation From The Region Arrives In Baghdad, And An Oil Agreement Is Imminent Today.

Time: 2025/07/07 11:24:11 Reading: 945 times {Political: Al Furat News} An informed source revealed that a delegation from the Kurdistan Regional Government arrived in Baghdad to hold talks with Iraqi officials regarding the draft agreement between the two sides.

According to the source, the delegation includes Acting Minister of Natural Resources Kamal Mohammed, Cabinet Secretary Amanj Rahim, and Head of the Coordination and Follow-up Office Abdul Hakim Khosro.

The delegation's visit comes as Baghdad has prepared a final draft of the agreement to re-export oil and is awaiting Erbil's response, which is expected today.

A source familiar with the Baghdad-Erbil negotiations, who preferred to remain anonymous due to the sensitivity of the issue, reported yesterday that a draft agreement on the delivery and export of oil was in its final stages. He noted that the most significant amendment to the agreement entails the delivery of all oil produced in exchange for the federal government securing the Kurdistan Region's petroleum product needs.

The source in the Kurdistan Regional Government indicated that the draft agreement stipulates that a delegation from the Ministry of Oil will be sent to the region for two purposes: first, to determine the actual level of oil production, and second, to assess the extent of local needs for petroleum products such as kerosene, gasoline, and diesel, which the federal government will provide according to the agreement.

It is worth noting that the Kurdistan Region's oil exports via the Turkish port of Ceyhan have been halted since March 25, 2023, while the amendment to the budget law entered into force on February 17 with the aim of removing obstacles to the resumption of these exports.

Under the amendment, a consulting firm will assess the costs of extracting and transporting Kurdistan's oil. Until this assessment is completed, Baghdad will temporarily pay $16 per barrel to oil companies as operating costs. LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance (And 2 Reasons They Should)

May 22, 2025 By Sean Bryant

If you’ve generated a significant amount of wealth during your lifetime, you might be starting to think about what will happen to it once you are gone. You could donate it to a worthy cause or you could pass it down to your kids. But what if you want to go ahead and give them some of your wealth now, before you pass?

With the Great Wealth Transfer underway, it’s expected that by 2045, roughly $84 trillion will be passed down from the silent generation and baby boomers to their kids. And a lot of this will be done as a living inheritance.

3 Reasons Retired Boomers Shouldn’t Give Their Kids a Living Inheritance (And 2 Reasons They Should)

May 22, 2025 By Sean Bryant

If you’ve generated a significant amount of wealth during your lifetime, you might be starting to think about what will happen to it once you are gone. You could donate it to a worthy cause or you could pass it down to your kids. But what if you want to go ahead and give them some of your wealth now, before you pass?

With the Great Wealth Transfer underway, it’s expected that by 2045, roughly $84 trillion will be passed down from the silent generation and baby boomers to their kids. And a lot of this will be done as a living inheritance.

This huge transfer of wealth has caused a lot of debate about whether or not leaving your kids a living inheritance is a good idea. Keep reading as we look into some reasons why retired boomers should not leave their kids a living inheritance and a couple of reasons why they should.

Why You Shouldn’t Leave Your Kids a Living Inheritance

Risking Your Own Financial Security

It’s common to want to see your kids succeed. This is true not only with their careers but also financially. Seeing them experience things like purchasing a home or traveling the world can give you self-gratification because you can witness and enjoy their success.

However, you also need to think about your own needs. If you plan to provide your kids with an inheritance while you’re still alive, it’s important to do so carefully. What happens if an unexpected expense pops up? Are you still going to have the funds available to continue living your current lifestyle?

Family Resentment

If you have multiple children that you’re planning to leave an early inheritance for, you need to do so carefully. It’s easy to leave cash assets and know the distribution is even. But what if you’re planning to leave someone with a business or real estate?

These types of assets can have fluctuating values, and if one dependent receives something that becomes more valuable, it could cause tension within the family — not just between siblings but also between you and them.

Potential for Financial Irresponsibility

Let’s be honest with each other. Sometimes people make bad decisions with money. Lifestyle inflation is a real thing and can have some severe outcomes. When people come into additional money, whether it’s a raise at work or an inheritance, they feel more freedom. They want to go out and treat themselves to something they’ve wanted but couldn’t afford. And while this is OK to a certain extent, there must be some restraint.

Operation Gold Hollow: 90% Of London’s Bullion Was Never There—Now The Exit Doors Are Locked | Andy Schectman

Operation Gold Hollow: 90% Of London’s Bullion Was Never There—Now The Exit Doors Are Locked | Andy Schectman

Two Dollars Investing: 7-7-2025

London’s gold vaults just got exposed—and it’s worse than anyone imagined.

Andy Schectman returns with a bombshell: over 279 million ounces of gold claimed in the LBMA system… but only 36 million ounces are actually available for delivery.

The rest? Vanished, double-counted, or never there to begin with.

Operation Gold Hollow: 90% Of London’s Bullion Was Never There—Now The Exit Doors Are Locked | Andy Schectman

Two Dollars Investing: 7-7-2025

London’s gold vaults just got exposed—and it’s worse than anyone imagined.

Andy Schectman returns with a bombshell: over 279 million ounces of gold claimed in the LBMA system… but only 36 million ounces are actually available for delivery.

The rest? Vanished, double-counted, or never there to begin with.

In this urgent episode, we expose the paper gold illusion propping up the entire global bullion system, how the U.S. quietly cornered supply using “logistics” as cover, and why major players are now scrambling before the exit doors slam shut.

BRICS Summit 2025 in Brazil, Explained

BRICS Summit 2025 in Brazil, Explained

Lena Petrova: 7-6-2025

The 17th BRICS Summit, held in the vibrant city of Rio de Janeiro, marked a pivotal moment in the evolution of this influential coalition of emerging economies.

Far from its initial five-member structure, BRICS has blossomed into an influential bloc of nine full members – Brazil, Russia, India, China, South Africa, Indonesia, Egypt, Ethiopia, Iran, and the UAE – with a growing roster of partners and keen interest from other nations like Mexico and Colombia.

BRICS Summit 2025 in Brazil, Explained

Lena Petrova: 7-6-2025

The 17th BRICS Summit, held in the vibrant city of Rio de Janeiro, marked a pivotal moment in the evolution of this influential coalition of emerging economies.

Far from its initial five-member structure, BRICS has blossomed into an influential bloc of nine full members – Brazil, Russia, India, China, South Africa, Indonesia, Egypt, Ethiopia, Iran, and the UAE – with a growing roster of partners and keen interest from other nations like Mexico and Colombia.

This expansion underscores BRICS’ burgeoning appeal and its ambition to represent a broader spectrum of emerging economies.

The summit’s ambitious agenda centered on fostering inclusive and sustainable cooperation among the Global South, with a strong focus on economic development, climate action, and the critical reform of global governance institutions.

A key takeaway from the summit challenges a popular misconception: BRICS is not pursuing a common currency. Instead, the focus is squarely on strengthening the use of national currencies for trade and financing.

This strategic move aims to reduce reliance on the US dollar and Euro, thereby building alternative frameworks for global trade and finance that temper Western dominance.

As the host nation, Brazil played a pivotal role in steering the summit’s agenda towards pragmatic and impactful goals. Discussions honed in on vital areas such as infrastructure development, sustainable finance, and fortifying the New Development Bank (NDB), BRICS’ own financial institution headquartered in Shanghai.

Climate cooperation emerged as another critical theme, especially with Brazil poised to host COP30 in the Amazon later in the year. Despite internal divergences, particularly concerning the pace of fossil fuel phase-out, BRICS demonstrated its collective capacity to influence global environmental policies, evidenced by its recent joint proposal at a biodiversity summit.

Beyond economic and environmental cooperation, a central pillar of the summit was the urgent call for reforming global governance institutions.

Leaders emphasized the need to reshape bodies like the United Nations, IMF, and World Bank to ensure fairer representation for the burgeoning economies of the Global South.

This reflects BRICS’ evolving role as a significant counterbalance—rather than a direct replacement—to established Western-led institutions. Amidst growing global uncertainties and questions surrounding the reliability of traditional Western alliances, many developing nations are actively seeking alternative partnerships that offer greater agency and respect for their unique development paths.

With its rapidly expanding economic and demographic footprint, BRICS now commands a substantial 44% of global GDP and represents 56% of the world’s population, unequivocally signaling its rising influence on the global stage.

While the summit’s official outcomes included important declarations on governance, artificial intelligence, climate finance, and health, much of BRICS’ future direction will undoubtedly be shaped by behind-the-scenes negotiations and deals among member states.

Brazil’s pragmatic leadership is seen as crucial in transforming BRICS from primarily a geopolitical counterweight into a truly effective engine of development for the Global South.

The 17th BRICS Summit in Rio stands as a landmark event for emerging economies, clearly articulating their vision for a more inclusive, sustainable, and multipolar world order.

Under Brazil’s pragmatic leadership, the bloc is strategically emphasizing economic empowerment, robust climate cooperation, and the crucial reform of global governance, all while adeptly navigating its internal dynamics.

As BRICS continues its trajectory of growth and diversification, it is undeniably poised to play a transformative role in shaping the future of global politics and economics.

Iraq Economic News and Points To Ponder Monday Afternoon 7-7-25

The Specter Of Sanctions Haunts The "Ki Card." Will Iraqis Face "Salary Cuts?"

Baghdad Today – Baghdad Fears are growing in Iraq over a looming financial crisis, following reports

that Qi Card could be included on the US sanctions list due to ongoing investigations into financial files involving several banks and companies.

With a large segment of Iraqis relying on the company for their salaries, attention is turning to the government and central bank's ability to avoid what could become a paralysis in the routine financial system associated with employees and retirees.

The Specter Of Sanctions Haunts The "Ki Card." Will Iraqis Face "Salary Cuts?"

Baghdad Today – Baghdad Fears are growing in Iraq over a looming financial crisis, following reports

that Qi Card could be included on the US sanctions list due to ongoing investigations into financial files involving several banks and companies.

With a large segment of Iraqis relying on the company for their salaries, attention is turning to the government and central bank's ability to avoid what could become a paralysis in the routine financial system associated with employees and retirees.

Salaries in the circle of concern

Economic and financial expert Nasser Al-Tamimi told Baghdad Today, "Fears over the salaries of employees and retirees due to the possibility of sanctions being imposed on K-Card are natural and justified," noting that "the Central Bank of Iraq has actually begun moving to establish a national payments system to counter such threats."

Al-Tamimi added that "the sanctions, if imposed, will restrict the company's transactions to Iraq alone,

meaning it will be barred from any external activity or transfers." He emphasized that "Iraq's delay in establishing an independent payments system has made it directly vulnerable to any pressure or sanctions affecting the financial sector."

The context of sanctions and banking tensions

These warnings come at a time when the Iraqi banking sector is witnessing successive turmoil,

especially after the US Treasury Department imposed sanctions on several Iraqi banks on charges of money laundering and dollar smuggling.

Global money transfer companies such as Western Union also announced they would suspend their dealings with some of these banks, sparking market chaos and disrupting the flow of salaries and remittances.

Observers warn that any expansion of sanctions could include intermediary companies such as Qi Card,

potentially disrupting the payments infrastructure in the absence of effective alternatives in the short term.

Popular Mobilization Forces without salaries

In one of the most striking manifestations of the current financial chaos, thousands of members of the Popular Mobilization Forces (PMF) have not received their monthly salaries for more than forty days, amid official silence from relevant authorities and a lack of clarification regarding the reasons for the delay. Observers believe this delay may be indirectly related to sanctions imposed on a number of local banks, or the result of increasing restrictions on exchange and remittance channels, particularly in light of reports of tight US oversight of financing mechanisms, some of which are believed to be used outside official frameworks.

What next?

The Iraqi financial landscape is in a state of suspense amid delayed moves to establish national alternatives.

While the Central Bank confirms it is working to establish a new payments system capable of bypassing traditional intermediaries, actual implementation requires time, at a time when citizens cannot tolerate further delays in their salaries.

Experts believe this crisis could be a wake-up call for the state to reevaluate its financial and regulatory structure and provide sovereign tools to ensure financial stability, free from the dominance of companies that may be vulnerable to external targeting. https://baghdadtoday.news/277952-.html

Central Bank: National Electronic Payment Card Does Not Cancel International Cards

Time: 2025/07/04 3:30:17 PM Read: 1,860 Times {Economic: Al Furat News} The Central Bank of Iraq confirmed that the National Electronic Payment Card Project

is an additional local option used exclusively within Iraq and

in Iraqi dinars, stressing that

it does not cancel or restrict existing international cards.

The Central Bank explained in a statement that "the National Electronic Payment Card Project

is an additional local option used exclusively within Iraq and in Iraqi dinars," emphasizing that

this project aims to enhance local banking services.

The bank emphasized that the National Card "does not cancel or restrict existing international cards such as Visa and Mastercard," denying any negative impact on the use of currently available international cards.

The statement added that "there are no plans to cancel these cards or prohibit transactions in dollars outside Iraq," reassuring citizens and banking market users about the continuity of international banking services.

These clarifications come as part of government efforts to develop the local banking system and promote the use of the Iraqi dinar in local transactions, without compromising nternational banking services or restricting foreign currency transactions outside Iraq. https://alforatnews.iq/news/البنك-المركزي-البطاقة-الوطنية-للدفع-الإلكتروني-لا-تلغي-البطاقات-الدولية

The Central Bank Of Iraq Organizes A Workshop On Improving The Skills Of Its Employees.

July 07, 2025 The Human Resources Directorate of the Central Bank of Iraq, in cooperation with the Erbil branch, organized a workshop for branch employees titled "Improving the Skills of Middle Management and Preparing Them for Digital Transformation."

The workshop covered a range of topics related to new management skills, strategic thinking, job behavior, the use of modern digital and technical approaches, and the art of dealing and negotiation.

Central Bank of Iraq Media Office July 7, 202 https://cbi.iq/news/view/2927

Industry: Investment Opportunities For Phosphate Fertilizer Production

Economic 07/07/2025 Baghdad: The pillar of the emirate The Ministry of Industry and Minerals announced the referral of investment opportunities to establish new, integrated

phosphate fertilizer plants to a consortium comprising the Iraqi Asas Engineering Company and East China Company,as part of its efforts to boost national production in the chemical industries sector.

The ministry's media spokesperson, Duha Al-Jubouri, told Al-Sabah:

"The Opinion Board and the relevant departments within the ministry are in the process of approving the referral decision in preparation for signing the final contract next month." She noted that "the new plants will operate with an annual production capacity of 1.5 million tons of phosphate fertilizers.

" Al-Jubouri explained that the investment project includes the development of the phosphate ore mine in Akashat, west of Anbar.

This mine constitutes a fundamental pillar in the production chain, as the raw materials will be transported to the Al-Qaim Industrial Complex for use as raw materials in fertilizer manufacturing.

She confirmed that all production lines in Akashat and Al-Qaim will adopt the latest technologies.

Regarding phosphate reserves, Al-Jubouri revealed that "the confirmed reserves in the Akashat mine alone amount to (3) billion tons, while the other mines in the Sawab and Al-Hari areas contain about (7) billion additional tons, bringing the total confirmed national reserves to about (10) billion tons," considering

this a "strategic wealth suitable for long-term investment.

" She emphasized that the Minister of Industry and Minerals, Khaled Battal Al-Najm, has given special importance to investment in the phosphate sector since assuming office, as three investment conferences were organized specifically for this purpose, and their outcomes were the referral of these major investment opportunities, while there are still two additional opportunities under study by the ministry.

Chemical industry

Regarding the importance of phosphate, economic expert Dr. Ikram Abdel Aziz explained that phosphate represents a vital mineral with multiple uses and is an essential material in many vital and agricultural industries.

Speaking to Al-Sabah, Abdel Aziz said, "Phosphate is used in the manufacture of animal feed supplements, as it provides the phosphorus and calcium necessary for bone growth and reproduction in livestock."

She noted that "this substance is also used in the chemical and agricultural detergent industries, as it is an essential raw material for the production of phosphoric acid, which in turn is used in the manufacture of many industrial chemicals."

She added that phosphate plays an important role in mining operations, by helping to remove impurities and enhance the fluidity of molten metals, which aids in the extraction and purification of metals such as iron, steel, aluminum, and copper.

On the environmental side, Abdelaziz explained that "phosphate is used to stabilize soil and prevent soil erosion by strengthening its structure, which contributes to supporting land management practices, especially in areas prone to erosion."

In the medical field, she emphasized that "calcium phosphate compounds are used to ensure the safety and quality of drinking water and industrial systems, in addition to their role in promoting public health and protecting infrastructure."

Abdelaziz concluded her remarks by highlighting the growing role of phosphate in renewable energy, saying, "Phosphate is a key topic in energy storage research, as it has significant potential in this area.

Scientists are currently seeking to develop technologies to improve its extraction efficiency and expand its use in recycling phosphorus from organic waste and wastewater." https://alsabaah.iq/117039-.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com