Iraq Economic News and Points to Ponder Tuesday AM 12-3-24

Government Communication To {Al-Sabah}: Electronic Payment Contributes To Strengthening The Economy

Economical 12/03/2024 Baghdad: Hussein Thaghab According to confirmation by the government outreach team, and amid continued support from Prime Minister Muhammad Shiaa Al-Sudani.

Economic benefits

According to the head of the government communication team, Ammar Moneim, to “Al-Sabah,”

“Government support for electronic payment comes from Prime Minister Muhammad Shiaa Al-Sudani’s belief in the economic benefits it brings to the national economy, reviving it and pushing it forward.” Menem stated that "the local market must adopt advanced financial transactions that make the money paths clear, transparent and secure.

Government Communication To {Al-Sabah}: Electronic Payment Contributes To Strengthening The Economy

Economical 12/03/2024 Baghdad: Hussein Thaghab According to confirmation by the government outreach team, and amid continued support from Prime Minister Muhammad Shiaa Al-Sudani.

Economic benefits

According to the head of the government communication team, Ammar Moneim, to “Al-Sabah,”

“Government support for electronic payment comes from Prime Minister Muhammad Shiaa Al-Sudani’s belief in the economic benefits it brings to the national economy, reviving it and pushing it forward.” Menem stated that "the local market must adopt advanced financial transactions that make the money paths clear, transparent and secure.

This approach has great benefits for the national economy and generates revenues."

Government decisions

As for the Executive Director of the Association of Private Banks, Ali Tariq, he told “Al-Sabah”:

“The development that Iraq witnessed in the field of electronic payment comes thanks to the government’s understanding of the reality of electronic payment in financial performance, as

government decisions had a great and influential impact in expanding the circle of its adoption.”

He pointed out that "today there are about 800 government institutions that adopt electronic payment, as government instructions obligated it to be adopted with zero fees." He pointed out that

Financial movements

"electronic payment works to achieve results that serve the national economy, as it

reduces the rates of financial corruption and

avoids transactions in counterfeit currencies, in addition to

documenting financial transactions and

making them safer."

Confident steps

In turn, Ahmed Adel, director of the national awareness campaign to spread the culture of electronic payment, “Asfarlak,” said:

“The campaign is continuing with confident steps and on the ground to reach the largest segment within Iraqi society and inform them of the importance of electronic payment, as we work to organize direct events within human gatherings.” He pointed out that

"there are challenges facing the campaign and its movement, but cooperation with the concerned authorities enabled the campaign management to overcome them and it became possible to be present in public places and reach all segments of society."

Financial transformation

As for the expert and economic consultant, Alaa Fahd, he said: “The culture of electronic payment in Iraq is newly widespread as a result of the progress in global financial systems and the need for financial development of the engines of digital financial transformation.

This transformation requires changing the culture and belief of society, especially the simple popular classes who fear any measure.” “My money is far from cash.” He pointed out that "this requires awareness-raising media campaigns that promote this culture and market it to everyone, including the (Israfilak) campaign,

which was launched at the beginning of the digital transformation in Egypt, and recently was launched in Iraq within the first national campaign forum to spread culture," indicating that the campaign explains "the importance of financial transformation." "electronic". Fahd continued:

Financial security

“There is a gradual change in the culture of electronic payment with the government’s approach to this transformation, providing all facilities and confronting all challenges in order to spread the culture and believe in it from the point of view of benefit, as

it is (Isreflak) in terms of

financial security,

eliminating corruption,

shortening time and efforts,

ease of downloading, and

getting rid of counterfeiting.” "And

this requires redoubling efforts to achieve full success." https://alsabaah.iq/106629-.html

The Central Bank Completes The Exam To Grant The Certified Branch Manager Certificate

December 02, 2024 The Center for Banking Studies, one of the formations of the Central Bank of Iraq, has completed an international examination, the first of its kind, to obtain the Certified Branch Manager (CBM) certificate from the Professional Development Institute (PDI), which is affiliated with the Institute of Accountants and Accounting Assistants (IAB).

64 branch managers from government and private banks participated as an initial stage to grant them this certificate after they completed a qualification course that would help them pass the exam.

This certificate is considered one of the professional certificates that supports the banking sector and enhances the efficiency of branch managers and develops their skills.

The Director General of the Studies Center said:

This qualifying course, followed by the exam, will

help participants develop the basic concepts and principles of banking branch management and

prepare them to be equipped with the basic skills that branch managers must have through developing administrative, behavioral and professional skills,

skills for dealing with customers, and

understanding and developing sales skills.

Banking and resolving problems with customers according to best practices, as well as

building an effective complaints system.

It is worth noting that such international examinations give importance to the Iraqi banking sector and prepare it to keep pace with modernity and rely on the professional certificates of its staff.

The Center for Banking Studies also seeks to provide professional certificates in addition to this certificate to develop the banking and financial sector in Iraq within its training plans.

Central Bank of Iraq Media office December 1, 2024 https://cbi.iq/news/view/2725

It Does Not Remain “Just Attractive”... Iraq Wants To Invest Its Money “In Projects Abroad”

2024-12-02 | 1,199 views Alsumaria News-Economy Today, Monday, a member of the Iraqi Parliament, Representative Ibtisam Al-Hilali, revealed Iraqi plans to activate foreign investments, meaning that Iraq will invest its surplus funds in projects abroad.

Al-Hilali said in an interview with Al-Sumaria News, “Thanks to the good diplomatic relations established by the Sudanese government of Muhammad Shiaa with neighboring countries and the world,

economic relations have also improved,” noting that “there re large internal and external investments.”

She explained that "internal investments serve the country by improving the environmental situation and infrastructure," indicating that "foreign investments have a financial and economic return for Iraq."

She confirmed that "we had a meeting with the French embassy to activate foreign investments," indicating that "Iraq is a financially capable country that can invest its money in foreign investments to benefit the public benefit of Iraq and neighboring countries."

Questions have often been raised about the reason for Iraq investing its money in various sectors, including foreign sports sectors as well as technology, like other countries, which could lead to diverse financial returns with the lack of non-oil revenues in Iraq compared to oil revenues.

https://www.alsumaria.tv/news/economy/508197/لا-يبقى-جاذبًا-فقط-العراق-يريد-استثمار-أمواله-بمشاريع-في-الخارج

Central Bank Of Iraq Sells Over $285 Million In Currency Auction

02/12/2024 Mawazine News – Economy The Central Bank of Iraq's dollar sales, on Monday, recorded more than $285 million during the currency auction.

The bank explained that the total sales amounted to $285 million, 603 thousand and 220, and were covered at a basic exchange rate of 1310 dinars per dollar for documentary credits and international settlements for electronic cards, and at the same rate for foreign transfers, while the cash exchange rate amounted to 1305 dinars per dollar.

Sales focused on strengthening balances abroad in the form of transfers and credits, which amounted to $280 million, 503 thousand and 220, which constitutes 98% of total sales, while cash sales amounted to only five million and 100 thousand dollars.

The bank indicated that one bank bought the dollar in cash, while 13 banks met requests to strengthen balances abroad, with the participation of 8 exchange companies in the auction. https://www.mawazin.net/Details.aspx?jimare=257098

Iraq Stock Exchange Index To Lead Arab Stock Markets In October 2024

Economy | 02/12/2024 Mawazine News – Baghdad The Arab Monetary Fund announced in its monthly report for October 2024 the distinguished performance of Arab financial markets, as the Iraq Stock Exchange topped the list of best performing markets during the month, recording a growth of 12.39%, ahead of the rest of the markets in the region.

According to the report, a copy of which was received by Mawazine News, "The Damascus Stock Exchange came in second place with a growth of 6.99%, while the Dubai and Amman stock exchanges witnessed an improvement of 1.94% and 1.35%, respectively. The Muscat, Bahrain and Kuwait stock exchanges also recorded slight increases of less than 1%."

In this context, the Chairman of the Securities Commission, Faisal Al-Haimus, stated: "This distinguished performance of the Iraq Stock Exchange reflects the positive developments in the local economic environment and the regulatory reforms implemented by the Commission to enhance the attractiveness of investment in the Iraqi financial market.

We will continue to work to provide a stable and transparent investment environment that enhances investor confidence and contributes to supporting the national economy."

Al-Haimas stressed that this achievement is an additional incentive to continue efforts aimed at developing the Iraqi financial market and enhancing its role as an engine of economic growth in Iraq.

https://www.mawazin.net/Details.aspx?jimare=257114

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Morning 12-03-24

Good Morning Dinar Recaps,

HOUSE LAWMAKERS PROPOSE STUDIES ON AI IN FINANCIAL SERVICES, HOUSING

Top lawmakers in the United States introduced a bill that would require federal regulators to conduct studies on how artificial intelligence (AI) impacts the financial services and housing industries.

Congresswoman Maxine Waters introduced a bill directing several federal financial regulators to study the present and potential benefits and risks of AI in the two industries. It was co-sponsored by House Financial Services Committee Chair Patrick McHenry.

Good Morning Dinar Recaps,

HOUSE LAWMAKERS PROPOSE STUDIES ON AI IN FINANCIAL SERVICES, HOUSING

Top lawmakers in the United States introduced a bill that would require federal regulators to conduct studies on how artificial intelligence (AI) impacts the financial services and housing industries.

Congresswoman Maxine Waters introduced a bill directing several federal financial regulators to study the present and potential benefits and risks of AI in the two industries. It was co-sponsored by House Financial Services Committee Chair Patrick McHenry.

The pair have also supported each other in a resolution acknowledging the increasing use of AI in the finance and housing markets, according to a Dec. 2. statement from the House Financial Services Committee.

Under the Waters-sponsored AI Act of 2024, key regulators like the Federal Reserve and the Federal Deposit Insurance Corporation would have to report how banks implement AI to detect and deter money laundering, cybercrime and fraud.

AI is already impacting mortgage lending and credit scoring, among other things, Waters said, explaining the need for a more comprehensive AI reporting regulatory framework.

AI-powered research is also being used for market surveillance purposes and tenant screening, McHenry’s resolution said.

McHenry added: “These bills are a small, but critical, step forward to empower the financial system to realize the numerous benefits artificial intelligence can offer for consumers, firms, and regulators.”

His resolution suggested the House Financial Services Committee should consider whether to reform privacy laws as data use becomes more AI-driven.

McHenry said he wants the US to remain a leader in AI development and utilization.

Waters and McHenry’s measures build on the House Committee’s Bipartisan AI Working Group, which was established on Jan. 11.

Republican members include French Hill, Young Kim, Mike Flood, Zach Nunn and Erin Houchin, while the Democrat members include Stephen Lynch, Sylvia Garcia, Sean Casten, Ayanna Pressley and Brittany Pettersen.

The group’s formation followed US President Joe Biden’s executive order on Oct. 30 to establish a “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

TRUMP’S SEC CHAIR SELECTION: PREDICTION MARKETS SIGNAL MAJOR REGULATORY CHANGES

These prediction markets show trader speculation, not confirmed plans. Paul Atkins leads in trading as a possible Trump’s SEC chair pick, with markets showing a 70% probability. Any appointment would follow the 2024 election results, but traders expect significant changes in financial market oversight.

How Trump’s SEC Chair Appointment Could Impact Crypto Regulation and Market Oversight

The race for the next possible SEC chair shows clear patterns in prediction markets. Here’s what current trading reveals:

Paul Atkins Emerges as Leading SEC Chair Candidate

Traders strongly back Atkins for Trump’s SEC chair position. His SEC commissioner experience and pro-innovation views match his 70% rating in prediction markets. His selection could bring major changes to crypto regulation approaches.

New SEC Chair Appointment Could Reshape Markets

Paul Atkins Emerges as Leading SEC Chair Candidate

Traders strongly back Atkins for Trump’s SEC chair position. His SEC commissioner experience and pro-innovation views match his 70% rating in prediction markets. His selection could bring major changes to crypto regulation approaches.

New SEC Chair Appointment Could Reshape Markets

Prediction markets suggest big changes if Trump picks a new SEC chair. Current market odds favor:

▪️Paul Atkins: Former SEC commissioner (70% chance)

▪️Brian Brooks: Crypto industry expert (20% chance)

▪️Hester Peirce: Current SEC commissioner (2% chance)

Crypto Regulation 2024 Faces Potential Overhaul

Traders believe crypto regulation in 2024 could change significantly. Markets suggest Atkins as SEC chair might ease current restrictions. His past work shows he supports innovation with reasonable oversight.

Market Trading Shows Strong Confidence

Over $503,418 in trading volume reveals high interest in the SEC chair position. Atkins’ probability has jumped from 25% to 70% since November, though these remain speculative bets.

Regulatory Framework Faces Possible Changes

Markets suggest a new SEC chair might change:

▪️How crypto is overseen

▪️Market rules

▪️Support for new ideas

▪️How rules are enforced

Prediction markets offer insights but can’t guarantee outcomes. Any SEC chair needs proper nomination and approval. Current trading shows what markets expect while acknowledging many factors could affect the final choice.

Trading patterns point to possible regulatory shifts, but all predictions remain speculative. The high trading volume shows strong market interest in potential SEC leadership changes, even as the actual appointment process awaits future developments.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

What's Driving XLM Price to OVERTAKE XRP - The Economic Ninja | Youtube

The Ninja compares XLM and XRP.

@ Newshounds News™

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Tuesday Morning “Tidbits From TNT” 12-3-2024

TNT:

Tishwash: CBL to print 30 billion dinars in order to withdraw old banknotes

The Central Bank of Libya (CBL) has announced signing contracts to print 30 billion dinars to replace the old currency, saying the old banknotes will be withdrawn "smoothly" at a later-set date.

This came during a meeting held by the Governor of the Central Bank, Naji Issa, to review the plan of the Central Bank of Libya to solve the problem of cash shortages.

During the meeting, it was agreed to raise the ceilings for immediate payment at the level of individuals and merchants to 20,000 dinars for a single transfer for individuals, and 100,000 for a single purchase transaction.

TNT:

Tishwash: CBL to print 30 billion dinars in order to withdraw old banknotes

The Central Bank of Libya (CBL) has announced signing contracts to print 30 billion dinars to replace the old currency, saying the old banknotes will be withdrawn "smoothly" at a later-set date.

This came during a meeting held by the Governor of the Central Bank, Naji Issa, to review the plan of the Central Bank of Libya to solve the problem of cash shortages.

During the meeting, it was agreed to raise the ceilings for immediate payment at the level of individuals and merchants to 20,000 dinars for a single transfer for individuals, and 100,000 for a single purchase transaction.

The Central Bank also revealed in the statement the launching of a new service for transfers between companies with a ceiling of one million dinars for a single transfer.

According to the statement, Issa ordered the directors of the departments concerned with the Central Bank of Libya, the liquidity team, and banks suffering from a liquidity shortage, to manage according to the plan approved by the Board of Directors to solve this problem gradually and radically starting from January 2025.

The Governor also stressed the need to improve and develop the infrastructure of banks in order to achieve the expansion of electronic payment services according to the prepared plan. link

Tishwash: Securities Commission: Iraq Stock Exchange Leads Arab Stock Markets

The Securities Commission announced, today, Monday, the rise in the Iraq Stock Exchange index, while indicating that it topped the Arab financial markets in October 2024.

The Authority said in a statement received by the Iraqi News Agency (INA): "The Arab Monetary Fund mentioned in its monthly report for October 2024 the distinguished performance of Arab financial markets, as the Iraq Stock Exchange topped the list of best performing markets during the month, recording a growth of 12.39%, ahead of the rest of the markets in the region."

According to the report, the Damascus Stock Exchange came in second place with a growth of 6.99%, while the Dubai and Amman stock exchanges witnessed an improvement of 1.94% and 1.35%, respectively, while the Muscat, Bahrain and Kuwait stock exchanges recorded slight increases of less than 1%.

According to the statement, the Chairman of the Authority, Faisal Al-Haimus, confirmed that "this distinguished performance of the Iraq Stock Exchange reflects the positive developments in the local economic environment and the regulatory reforms implemented by the Authority to enhance the attractiveness of investment in the Iraqi financial market," noting that "we will continue to work to provide a stable and transparent investment environment that enhances confidence among investors and contributes to supporting the national economy."

Al-Haimas stressed that "this achievement is an additional incentive to continue efforts aimed at developing the Iraqi financial market and enhancing its role as an engine of economic growth in Iraq." link

************

Tishwsh: Ways you never thought of.. Judges reveal methods of smuggling hard currency

Several judges and legal experts spoke about the latest methods of smuggling dollars out of the country, pointing out that currency smugglers have developed their means and methods of smuggling money.

They explained in statements covered by (Al-Masry - Monday) that one of the latest methods that have been presented, in practical reality, is smuggling currency through prepaid electronic payment cards, where the accused agrees with ordinary citizens to issue payment cards in their names in exchange for small amounts that he gives them, then he fills the cards, carries them and takes them out of the country through airports and then withdraws the amounts in cash through ATMs in the countries to which he travels.

They continued, currency smugglers collect a large number of Key Cards and Visa Cards after filling them with national currencies and traveling with them outside Iraq. link

***********

Tishwash: Visa Launches Tap to Phone Technology in Iraq

In cooperation with the Moroccan Electronic Monetary Association

Visa, a global leader in digital payments, has launched “Tap to Phone” technology in partnership with the Maghreb Electronic Money Association (S2M) to empower small and medium-sized businesses in Iraq with solutions to accept digital payments at a low cost.

The Maghreb Electronic Money Association’s Mobile Tap solution, which uses Visa’s Tap to Phone technology, enables merchants using Near Field Communication (NFC)-enabled Android devices to accept contactless payments simply by downloading a dedicated app. The collaboration aims to revolutionize the payments landscape by enabling merchants to seamlessly accept payments using their smartphones without the need for additional hardware investment.

“We are delighted to partner with the Maghreb Electronic Money Association to launch Tap to Phone in Iraq. This strategic collaboration is in line with our commitment to enhance financial inclusion for small businesses by providing digital payments capabilities at a lower cost,” said Leila Serhan , Vice Chairman and Regional Head of Corporate Business Leadership for North Africa, Levant and Pakistan at Visa.

This innovative solution enables retail outlets to develop and improve the payment experience for consumers. Service staff at store fronts can support consumers to make payments easily without having to stand in queues at the cashier, which means a better customer experience.”

Mobile Tap provides SMEs with the option to accept digital payments at a lower cost, paving the way for greater participation in the digital economy. This innovative approach eliminates the need for traditional POS terminals and can help facilitate a better consumer experience in payments. The solution provides merchants and customers with greater convenience and flexibility during transactions.

The Mobile Tap service empowerment reflects S2M ’s unwavering commitment to empowering merchants through innovative software and technology, significantly enhancing the commerce experience for all. “This strategic alliance presents a great opportunity to elevate the level of digital payment solutions available and promote financial inclusion across Iraq, ensuring that all consumers and merchants can participate and thrive. Over the past decade, we have witnessed the incredible potential for innovation and growth within the Iraqi market, and we are committed to supporting its dynamic payments ecosystem,” said Mohamed Amarti Rifi, S2M Executive Vice President.

As a network that works for everyone, everywhere, Visa’s mission is to advance digital commerce for the benefit of consumers, businesses and economies across Iraq. This strategic collaboration aligns with Visa’s goal of enabling more payment acceptance points using cutting-edge technologies such as Tap to Phone to support small businesses with digital payments capabilities at a lower cost. link

Mot: .. Not Something You See Every Day!!!!

"Dad gassing up in Eureka Roadhouse, Alaska. Only in Alaska." -- Briana Brumley

Mot: Losing car in parking lot

MilitiaMan & Crew-Iraq Dinar News-CBI Gov Monetary Position Excellent-Stop Gov Loans-Private Sector Stage is Set

MilitiaMan & Crew-Iraq Dinar News-CBI Gov Monetary Position Excellent-Stop Gov Loans-Private Sector Stage is Set

12-2-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew-Iraq Dinar News-CBI Gov Monetary Position Excellent-Stop Gov Loans-Private Sector Stage is Set

12-2-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

How Much Money Can I Give Without Worrying About Taxes?

How Much Money Can I Give Without Worrying About Taxes?

Eric Reed SmartAsset Sun, December 1, 2024

How Much Money Can I Give My Daughter and Her Husband Without Worrying About Taxes?

Perhaps your daughter recently got married and you want to help her and her husband start their new life. Or maybe they suddenly find themselves in need of financial assistance and turn to you for help.

Fortunately, the IRS allows you to give away a certain amount of assets – from real estate and stocks to cold hard cash – free of taxes every year. In 2024, you can give away up to $18,000 per individual and not have to pay taxes on the transfer. In fact, you’ll only trigger taxes in 2024 if you’ve given away more than $13.61 million throughout your life beyond that annual exclusion. In 2025, those limits are set to change.

How Much Money Can I Give Without Worrying About Taxes?

Eric Reed SmartAsset Sun, December 1, 2024

How Much Money Can I Give My Daughter and Her Husband Without Worrying About Taxes?

Perhaps your daughter recently got married and you want to help her and her husband start their new life. Or maybe they suddenly find themselves in need of financial assistance and turn to you for help.

Fortunately, the IRS allows you to give away a certain amount of assets – from real estate and stocks to cold hard cash – free of taxes every year. In 2024, you can give away up to $18,000 per individual and not have to pay taxes on the transfer. In fact, you’ll only trigger taxes in 2024 if you’ve given away more than $13.61 million throughout your life beyond that annual exclusion. In 2025, those limits are set to change.

Understanding the ins and outs of strategic gifting can be important, especially for the wealthy. Speak with a financial advisor today.

What Is The Gift Tax?

A gift is any unilateral transfer of money or property. This means that you give someone assets without receiving either fair value or any value in return. The term “fair value” applies to when you give someone an asset in exchange for payment significantly below its market price. It applies to any kind of transaction so, for example, giving someone real estate, a low-interest loan or access to an income stream would all apply. The classic gift is to simply give someone cash while receiving nothing in return.

There are several exceptions to what the IRS considers a taxable gift. For example, money given to a claimed dependent does not constitute a gift, nor does paying someone’s tuition. However, outside defined exceptions, any unilateral or below-market transfer is considered a gift.

When you make someone a large enough gift, it becomes taxable. The IRS taxes applicable gifts at between 18% and 40% depending on the size of the transfer. You, as the gift giver, pay this tax. Due to the gift tax’s exemptions, it also generally applies only to the very wealthy. But if you need additional help navigating and planning for the gift tax, consider working with a financial advisor.

Gift Tax Exemption

Broadly speaking, the purpose of the gift tax is to prevent people from avoiding estate taxes by simply giving away all their money before they die. As a result, the gift tax only applies to transfers that exceed two fairly high caps.

The first cap is called the annual exclusion. This is the amount of money that you can give away every year without triggering the tax. The annual exclusion is set on a per-recipient basis, meaning that it applies separately to each person to whom you give a gift, and there is no limit to the number of people you can give gifts to under this exemption. In 2024, the annual exclusion limit was $18,000 for individuals and $36,000 for married couples. In 2025, it increases to $19,000 and $38,000, respectively.

The second cap is called the lifetime exemption. This is the amount of money that you can give away throughout your lifetime – and after your death – without triggering either gift or estate taxes. The lifetime exemption is set on a per-donor basis, meaning that all of your gifts/estate collectively apply.

TO READ MORE: https://finance.yahoo.com/news/want-money-daughter-son-law-122000156.html

Seeds of Wisdom RV and Economic Updates Monday Evening 12-02-24

Good Evening Dinar Recaps,

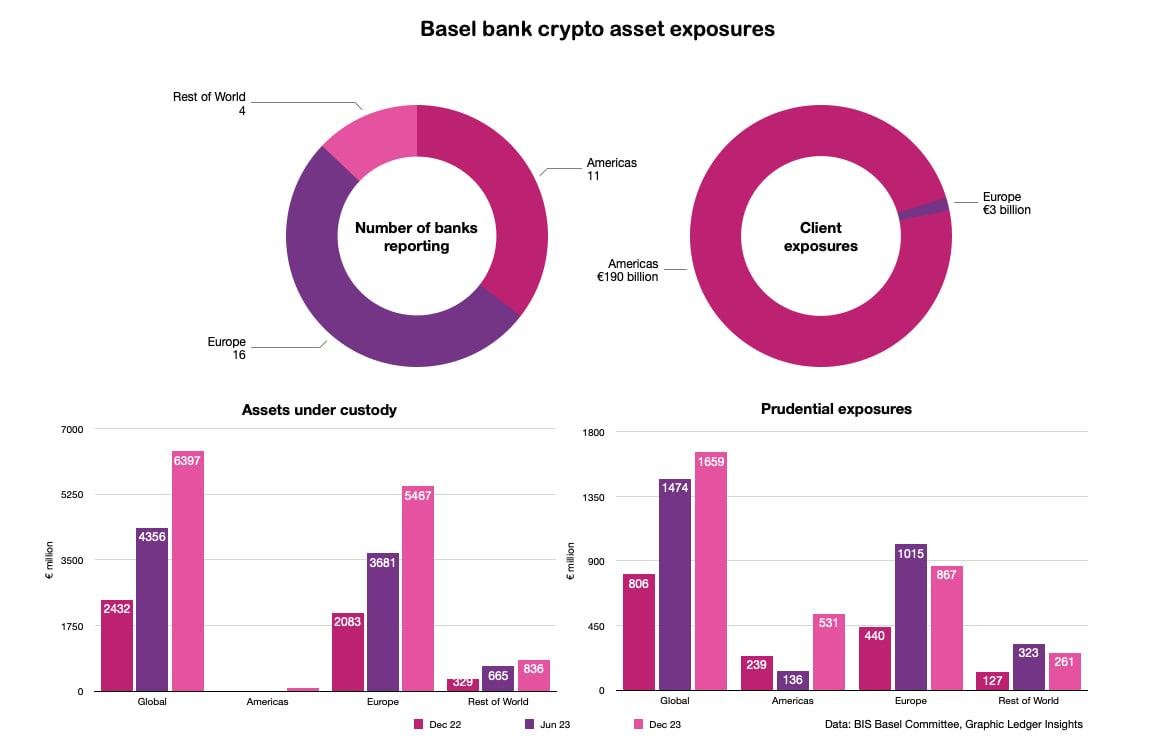

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

Good Evening Dinar Recaps,

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

In particular, the Americas are almost entirely absent from the crypto custody space, largely because of the SEC’s SAB 121 accounting rule, which makes it prohibitive for banks to provide custody. That’s already relaxing and will likely be dropped altogether by the incoming Trump administration.

n the second half of 2023, assets under custody in Europe grew by 49% to €5.5 billion ($5.8bn) compared to the first half. At a global level, 94% of custody was for spot crypto rather than tokenized assets or ETPs.

When it comes to enabling client exposures, the roles are completely reversed. The Americas dominate providing 98% of services. The figures are on a different scale, with American banks enabling €190 billion ($201 billion) of client exposures.

American banks also substantially increased their own exposures – by almost four times, albeit from a small base. 2023 year end prudential exposures amounted to €531 million.

While APAC is viewed as a promising growth sector, by the end of 2023 it still lagged far behind. However, the figures depend on which banks are included in the dataset.

Of the four banks reporting in the ‘rest of world’ category, none reported any client crypto exposures. The banks’ own exposures were down 20% to a negligible €261 million with custody at €836 million. A lot of legislative changes have happened this year, so next year’s figures could be more interesting.

The statistics cover a total of 31 banks globally.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

RIPPLE NEWS : WISDOMTREE SUBMITS XRP ETF S-1 APPLICATION WITH THE US SEC

▪️WisdomTree Files for XRP ETF: WisdomTree Digital submits S-1 filing for an XRP ETF, marking growing institutional interest in Ripple's cryptocurrency.

▪️XRP Demand Surge: XRP's market value rises as institutional investors, including 21Shares and Bitwise, file for XRP ETFs amid U.S. regulatory clarity.

Last week, WisdomTree Digital Commodity Services, LLC, a subsidiary of a prominent New York-based asset management firm with over $113 billion in AUM, filed for an XRP exchange-traded fund (ETF) with Delaware authorities. Earlier today, the investment firm submitted to the Securities and Exchange Commission (SEC) the S-1 filing for the WisdomTree XRP Fund.

According to the SEC filings, the WisdomTree XRP Fund will tap into the Bank of New York Mellon (BNYM) as the trustee, fund accountant, and transfer agent.

However, the prospectus for the WisdomTree XRP Fund did not reveal the ticker that will be listed on the Cboe BZX Exchange, thus indicating several updates of the filings will take place in the near term.

Growing Interest in XRP Among Institutional Investors

As Coinpedia previously reported, the demand for XRP among institutional investors has significantly grown following the anticipated crypto policy implementation in the United States.

In addition to WisdomTree, several other fund managers have filed to offer a spot XRP ETF to prospective investors to help diversify their crypto portfolios.

For instance, asset management firm 21Shares recently fueled for a spot XRP ETF. Additionally, Bitwise, Grayscale Investments, and Canary Capital have all filed for a similar product.

As a result, it is evident that the demand for XRP among institutional investors is exponentially growing amid regulatory clarity in the United States.

Market Impact

The direct impact of the high demand for XRP among institutional investors is visible on the rising market value. The large-cap altcoin, with a fully diluted valuation of about $240 billion, overtook Solana (SOL) and Binance (BNB) to become the third largest crypto asset, excluding stablecoins.

After more than six years of consolidation, XRP price is well positioned to enter its discovery phase of the macro bull cycle in the coming months.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

THE EASY WAY TO GROW YOUR WEALTH WITH XRP IN JUST 30 DAYS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Today is Giving Tuesday, Celebrated in 90 Countries!

Today is Giving Tuesday, Celebrated in 90 Countries!

The Dinar Recaps Team believes in giving back to the helpers who make our world a better place, one community at a time. Nonprofit (NPO) and Nongovernmental (NGO) organizations work on the front lines every day, to make a difference for those in need, to celebrate arts, culture, healthy living, and education for all, among many other causes.

This year, Dinar Recaps has chosen Rise and Share (an IRS-recognized 501(c)(3) charity) as our 2024 Giving Tuesday charity of choice!

As a charitable organization that serves other nonprofits, all donations to Rise and Share will support their expansion campaign to serve 100 additional nonprofits by the end of 2025. A gift to Rise and Share is a great choice for our readers who care about multiple causes, from animal welfare to youth service, from chronic illness to the arts, from the military to programs for the aging and in underserved communities.

Today is Giving Tuesday, Celebrated in 90 Countries!

The Dinar Recaps Team believes in giving back to the helpers who make our world a better place, one community at a time. Nonprofit (NPO) and Nongovernmental (NGO) organizations work on the front lines every day, to make a difference for those in need, to celebrate arts, culture, healthy living, and education for all, among many other causes.

This year, Dinar Recaps has chosen Rise and Share (an IRS-recognized 501(c)(3) charity) as our 2024 Giving Tuesday charity of choice!

As a charitable organization that serves other nonprofits, all donations to Rise and Share will support their expansion campaign to serve 100 additional nonprofits by the end of 2025. A gift to Rise and Share is a great choice for our readers who care about multiple causes, from animal welfare to youth service, from chronic illness to the arts, from the military to programs for the aging and in underserved communities.

To maximize a matching gift offer from an anonymous donor, we humbly invite our Dinar Recaps family to join us in supporting Rise and Share this Giving Tuesday. Any donation, no matter how small or large, is invaluable and very much appreciated. And to keep you updated on cause-related news, look for #GivingEveryTuesday posts throughout the new year. Donations may be made at this link: CLICK HERE (or use this QR code on your phone.)

While we wait... let’s think about other ways each of us can help in our local communities, volunteering or donating goods and funds, sharing our talents and championing the causes we care about.

What is Giving Tuesday?

GivingTuesday is a global generosity movement that unleashes the power of radical generosity around the world.

GivingTuesday was created in 2012 as a simple idea: a day that encourages people to do good. Over the past nine years, this idea has grown into a global movement that inspires hundreds of millions of people to give, collaborate, and celebrate generosity.

GivingTuesday strives to build a world in which the catalytic power of generosity is at the heart of the society we build together, unlocking dignity, opportunity, and equity around the globe.

GivingTuesday’s global network collaborates year-round to inspire generosity around the world, with a common mission to build a world where generosity is part of everyday life.

What is radical generosity?

While many call on philanthropists, policymakers and grantmakers to repair broken systems, GivingTuesday recognizes that we each can drive an enormous amount of positive change by rooting our everyday actions, decisions and behavior in radical generosity—the concept that the suffering of others should be as intolerable to us as our own suffering. Radical generosity invites people in to give what they can to create systemic change.

When is Giving Tuesday?

Every day, although the annual celebration event will take place this year on December 3, 2024!

Who organizes GivingTuesday?

GivingTuesday is an independent nonprofit organization that is dedicated to unleashing the power of people and organizations to transform their communities and the world. The movement is organized in partnership with GivingTuesday’s global network of leaders, partners, communities and generous individuals.

Giving Tuesday’s ultimate goal is to create a more just and generous world, one where generosity is at the heart of the society we build together, unlocking dignity, opportunity, and equity around the globe.

What is a GivingTuesday COUNTRY movement?

GivingTuesday is hosted in 90 countries by leaders who are passionate about growing radical generosity. They rally nonprofits, businesses, and individuals throughout their countries. To get involved in GivingTuesday in your country, CLICK HERE https://www.givingtuesday.org/global/.

What is a GivingTuesday COMMUNITY movement?

GivingTuesday Communities come together around a common geography (e.g., city, state, region) or issue area (e.g., Military, Women/Girls) to collaborate, innovate, transform, and inspire their communities to make a difference. These Community campaigns find creative ways to mobilize their networks, host volunteer events, raise funds for their local nonprofits, spark waves of kindness, and much more. CLICK HERE to find and connect with a local GivingTuesday community group where you live.

Who can participate?

Everyone! GivingTuesday has been built by a broad coalition of partners, including individuals, families, nonprofits, schools, religious organizations, small businesses and corporations. There are people and organizations participating in GivingTuesday in every country in the world.

Participating in GivingTuesday is about joining a movement for generosity, and there are so many ways to do that. Whether you give your voice, goods, your time, or your money, being generous is a way to fight for the causes you care about and help people in need.

What do you do on GivingTuesday?

On GivingTuesday, millions of people all around the world, use their power of radical generosity to change the world. They volunteer at homeless shelters, organize food drives, fill their community fridges, donate to mutual aid funds, spread messages of solidarity and hope.

Here are some ideas you might consider:

· Give your voice to a cause that matters to you - sign and share a petition, send an email to your elected officials

· Volunteer virtually or share your talents

· Give your voice to a cause that matters to you

· Discover a local fundraiser, community drive or coordinated event to join others in your area or with your same interests in giving back — they need your help.

· Give to your favorite cause or a fundraiser to help those in need.

· Talk about giving and generosity using the hashtag #GivingTuesday - share local organizations doing good on your social media pages

So, how will YOU spread radical generosity in your community? Tell us in the comments below!

Share this post with your contacts to spread the word about GivingTuesday!!

A Few More Tidbits From TNT Monday Night 12-2-2024

TNT:

Tishwash: TikTok under scrutiny.. Central Bank suspends financial transactions with its agents in Iraq

The Central Bank announced, today, Sunday (December 1, 2024), the suspension of financial transactions with TikTok agents in Iraq.

The Central Bank stated in a document received by "Baghdad Today" that "it was decided to stop incoming and outgoing financial transactions for TikTok agents inside Iraq. link

TNT:

Tishwash: TikTok under scrutiny.. Central Bank suspends financial transactions with its agents in Iraq

The Central Bank announced, today, Sunday (December 1, 2024), the suspension of financial transactions with TikTok agents in Iraq.

The Central Bank stated in a document received by "Baghdad Today" that "it was decided to stop incoming and outgoing financial transactions for TikTok agents inside Iraq. link

Tishwash: Parliamentary Finance Committee sets a “national path” to end oil disputes between Baghdad and Erbil

The head of the Parliamentary Finance Committee, Atwan Al-Atwani, announced on Sunday the determination of a "national path" to resolve the oil disputes between Baghdad and Erbil, noting that the committee is preparing a report on amending one of the articles in the General Budget Law.

A statement by the committee received by Shafaq News Agency stated that Al-Atwani chaired an expanded meeting with the senior staff of the Ministry of Oil, in the presence of the committee members and a number of members of the Oil, Gas and Natural Resources Committee. The meeting discussed the files of managing the country's oil wealth and the future of oil prices, as the country's budget is formed by 90% of these revenues.

According to the statement, the meeting discussed developments in resolving outstanding issues with the Kurdistan Region regarding resolving disputes over calculating production costs and adapting foreign companies’ contracts to the Iraqi constitution, with the aim of resuming exports via the Turkish Ceyhan pipeline.

Al-Atwani pointed out that his committee is in the process of preparing its report on amending Article 12 of the General Budget Law, and submitting it to the House of Representatives for the second reading.

He stressed that the Finance Committee held a series of continuous meetings with officials in the federal government and the regional government, and "defined a national path to find a radical solution to this problem on a constitutional and legal basis and in a way that achieves justice in the distribution of wealth among Iraqis."

Al-Atwani stressed the need to set a timetable for implementing the provisions of the oil agreement between the center and the region, in accordance with what was stipulated in the draft law amending the Federal General Budget Law, which the Council of Ministers voted on and sent to Parliament.

In turn, the Undersecretary of the Ministry of Oil for Extraction Affairs, Basem Muhammad Khadir, reviewed the mechanisms for calculating the cost of oil production and transportation, and the most prominent understandings reached with the region in this regard.

The Undersecretary of the Ministry of Oil stressed the necessity for the Federal Ministry of Oil to be responsible for the reservoir management of the region’s oil fields, noting that his ministry has fixed standards for calculating the cost of producing a barrel of oil, whether at the level of fields managed by national effort or those managed by foreign companies. link

************

Tishwash: Association of Banks: 75% of the money supply is outside the banking system

The Private Banks Association said on Sunday, December 1, 2024, that three-quarters of the monetary mass in Iraq is outside the banking system.

The Executive Director of the Private Banks Association, Ali Tariq, said in a statement followed by "Ultra Iraq", "About 75 percent of the monetary mass is outside the banking system and requires a great effort to encourage citizens, companies and institutions to use the banking system more, which is currently happening, but this type of work needs to be accelerated to control financial operations in Iraq."

Despite what the director said in this regard, the World Bank claimed last February that the infrastructure for electronic payment systems in Iraq is “among the best in the region,” according to a statement issued by the Central Bank of Iraq .

“During the last two years, deposits in the banking sector have increased, but there is still a large amount of cash outside the banking system. This requires increasing confidence in the banking sector, whether governmental or private, and strengthening this confidence through the Central Bank of Iraq and the Iraqi government, in addition to offering investment programs for deposits that reflect on citizens’ deposits, which could generate returns for depositors in these banks, and thus there is an incentive and motivation to increase these deposits,” Tariq added.

The Iraqi authorities have taken steps towards activating the electronic payment system , starting with localizing employees’ salaries, and then installing electronic payment devices in different places, including gas stations. However, many experts and specialists still believe that the culture of electronic payment is not at the required level, for many reasons, including those related to economic and electronic culture, in addition to the fact that the widespread corruption in the country hinders its full implementation.

According to experts , the Iraqi government, through attempts to implement electronic payment, aims to withdraw the cash mass in circulation in Iraq, which amounts to 84 trillion dinars. link

Mot: Here is photographic evidence that Rudolph was not allowed to play in any reindeer games.

Mot: . ole "'Earl"" is mighty Handy He is!!

Central Bank Of Iraq Is Pleased To Present The Iraqi Banknotes In Circulation

Central Bank Of Iraq Is Pleased To Present The Iraqi Banknotes In Circulation

This technical leaflet highlights the security features and aims to be a guide to the public as well as to companies and commercial banks handling cash on a daily basis. In addition to the enhanced security features, the banknotes include raised printings to facilitate tactile recognition of the denominations by visually impaired users.

We encourage you to take your time to familiarize yourself with our banknotes and share the information with those around you. The current series of banknotes will be in circulation alongside the old banknotes, and there is no intention to withdraw the older banknotes from circulation.

Central Bank Of Iraq Is Pleased To Present The Iraqi Banknotes In Circulation

This technical leaflet highlights the security features and aims to be a guide to the public as well as to companies and commercial banks handling cash on a daily basis. In addition to the enhanced security features, the banknotes include raised printings to facilitate tactile recognition of the denominations by visually impaired users.

We encourage you to take your time to familiarize yourself with our banknotes and share the information with those around you. The current series of banknotes will be in circulation alongside the old banknotes, and there is no intention to withdraw the older banknotes from circulation.

CLICK HERE for the CBI PDF

https://cbi.iq/static/uploads/up/file-173304177261220.pdf

https://cbi.iq/news/view/2724

Seeds of Wisdom RV and Economic Updates Monday Afternoon 12-02-24

Good Afternoon Dinar Recaps,

BRAZIL PROPOSES TO BAN STABLECOIN WITHDRAWALS TO SELF-CUSTODIAL WALLETS

A public consultation notice from the Central Bank of Brazil intends to prohibit stablecoin withdrawals to self-custody wallets.

The Central Bank of Brazil (BCB) has unveiled a regulatory proposal prohibiting centralized exchanges from allowing users to withdraw stablecoins to self-custodial wallets.

Good Afternoon Dinar Recaps,

BRAZIL PROPOSES TO BAN STABLECOIN WITHDRAWALS TO SELF-CUSTODIAL WALLETS

A public consultation notice from the Central Bank of Brazil intends to prohibit stablecoin withdrawals to self-custody wallets.

The Central Bank of Brazil (BCB) has unveiled a regulatory proposal prohibiting centralized exchanges from allowing users to withdraw stablecoins to self-custodial wallets.

According to the public consultation notice, the transfer of stablecoins — called “tokens denominated in foreign currencies” — between residents would be restricted in cases where Brazilian law already allows payments in foreign currencies.

The BCB shared in a statement:

“The initiative reflects our commitment to adapting the financial system to the realities of digital assets while safeguarding the integrity of international capital flows.”

The move is part of the crypto regulation bill approved in Brazil in December 2022, which determined that the BCB is responsible for creating the rules for the crypto industry in the country.

The public consultation will be open until Feb. 28, 2025, and market participants can share their opinions with the regulator. However, the BCB can override the inputs and do as described in the document.

Balancing regulations

According to the Brazilian central bank, the proposed rules aim to enhance legal certainty for businesses and individuals while fostering competition and efficiency in the foreign exchange market.

The proposed regulation outlines three core activities for virtual asset services providers operating in the foreign exchange market: facilitating international payments and transfers via crypto, providing exchange or custody services for tokens denominated in Brazilian reais for non-residents, and managing transactions involving tokens pegged to foreign currencies.

In addition, crypto investments, whether inbound or outbound, would be subject to the same regulatory standards as traditional investments. External credit, direct foreign investment, and Brazilian capital abroad involving crypto would require compliance with existing international capital regulations.

Under the public consultation, centralized exchanges must also get a foreign exchange license to offer stablecoin-related services.

A significant market

According to data from Brazil’s Internal Revenue Service (RFB) published on Nov. 13, nearly 4.4 million Brazilians transferred $4.2 billion in crypto in September.

Stablecoins represented 71.4% of all the value transferred during the month, with roughly $3 billion transacted. Tether USD (USDT) dominated with $2.77 billion moved by Brazilian crypto investors.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

COINBASE ANNOUNCES APPLE PAY FOR FIAT-TO-CRYPTO PURCHASES

“Coinbase Onramp takes the hassle out of fiat-to-crypto conversions with lightweight KYC for eligible purchases, free USDC on and offramping, and access to the most popular payment methods,” Coinbase said in a statement.

Apple Pay will allow users to get onchain in seconds granting quick access to some of the world’s leading cryptocurrencies. Users can access Moonshot, an app using Onramp to get Onchain quickly.

For eligible purchases, Coinbase provides lightweight KYC to make the process of getting Onchain even simpler while still protected. The addition of Apple Pay also allows users to access free USDC on and offramping on Coinbase.

According to Coinbase, if you’re an existing app using Coinbase Onramp, there’s nothing you need to do. Users will automatically see Apple Pay appear as an option when making an eligible purchase. Eligible users can sign up for Onramp quickstart to get started and access Apple Pay as an option on Coinbase. Users can also use one-click-buy for an even faster experience.

Coinbase investors gained confidence in the company following the announcement, with COIN stock climbing 3% Monday.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

XRP BECOMES THE TOP TRADED TOKEN ON BINANCE AND COINBASE, HITS ALMOST 7-YEAR HIGH

XRP, which saw its fourth ETF filing Monday, also now has the third-largest market cap among all cryptocurrencies, after it shot past Tether’s USDT and Solana’s SOL.

XRP has been the most popular token by trading volume in the last 24 hours on several centralized exchanges, such as Binance and Coinbase

XRP’s virality on centralized exchanges comes as the token climbed on Monday to a nearly seven-year high of $2.77, a 40% jump in the last 24 hours and a 433% increase over the past 30 days.

The token native to the Ripple ledger currently has a market cap of about $158 billion, surpassing both Tether’s USDT and Solana’s SOL, making XRP the third largest cryptocurrency by market cap.

On Binance, the dominant non-U.S. centralized exchange, XRP’s 24-hour volume of $7 billion makes up 13.3% of total trading activity. For the U.S.’s biggest exchange, Coinbase, XRP has a 24-hour volume of $3 billion, comprising almost 30% of the total volume.

XRP tops trading volume on OKX, Kraken, and KuCoin as well, market data from CoinGecko shows. XRP trading on Upbit, a prominent centralized exchange in South Korea, makes up 38.6% of the entire venue’s 24-hour trading volume of $19.8 billion.

Wall Street titans are also preparing to launch spot XRP exchange-traded funds as ETF provider WisdomTree submitted a Monday filing for a spot XRP ETF with the U.S. Securities and Exchange Commission, joining Bitwise, Canary Capital, and 21shares.

Small Retail FOMO

“The 6-year (nearly 7-year) high comes as wallets with 1M-10M XRP have accumulated 679.1M tokens (currently worth $1.66B) in just 3 weeks,” the team behind market intelligence platform Santiment wrote on X early Monday. At current prices, one million XRP tokens are worth almost $2.8 million.

Maksim Tkachuk, who works on product at Santiment, further told Unchained over Telegram that the team is observing high levels of FOMO, short for “fear of missing out,” from small retail holders, defined as addresses with 100 to 10,000 XRP tokens.

“Overall when those retail darlings take the spotlight, the whole market becomes dangerous as the main drivers of the price at this point are greed and FOMO,” Tkachuk wrote.

“Per [Santiment’s] internal agreement – the top is near… at least a very sizeable correction is what we agree on like 20-25 percent in majors.”

Stablecoin, RWA and DeFi Plans

Meanwhile, Ripple is gearing up to roll out a new USD stablecoin on its blockchain, as the New York Department of Financial Services is expected to approve the product, according to Fox Business last week.

Sally Zhu, who is part of the venture capital arm of crypto market-making firm Amber Group, messaged Unchained on Telegram saying, “I think XRP’s recent price surge is about the buzz around tokenizing [real-world assets]…” They’re teaming up with players like Archax to bring things like equities and global debts onto the XRP Ledger.”

Archax, a digital asset exchange, broker, and custodian, announced on Nov. 25 that it has provided access to a money market fund in a tokenized form on the XRP Ledger. “With such a huge opportunity to reshape how financial instruments are traded and managed, XRP is riding the wave of optimism now.”

Decentralized finance (DeFi), a subsector of the crypto space that enables users to conduct financial activities without intermediaries, has strong roots in Bitcoin, Ethereum, and Solana. Some crypto users are now exploring DeFi on the XRP Ledger.

For example, Robert Leshner, the CEO of asset management firm Superstate, said he was in the “trenches,” testing the infrastructure of automated market markets and inspecting the memecoins on the network, per an X post on Sunday.

Despite the recent upward price movement of XRP, people in the crypto space have long criticized the XRP Ledger for its lack of decentralization. Justin Bon, founder and chief investment officer of Cyber Capital, specifically pointed to the consensus mechanism for the XRP Ledger. “XRP’s consensus is based on UNLs (Unique Node Lists), literal centralized lists of trusted nodes released by single parties, including the foundation,” Bons wrote on X.

@ Newshounds News™

Source: Unchained Crypto

~~~~~~~~~

XRP WORLD RESERVE CURRENCY | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Monday Afternoon 12-2-2024

KTFA:

Clare: The Iraqi Parliament begins voting on the “Personal Status” law. Learn about its content (documents)

12/2/2024

The Iraqi Parliament began voting on Monday on a draft amendment to the Personal Status Law, after months of political, popular and legal debate over the paragraphs to be amended.

Earlier today, the House of Representatives held a regular session with an agenda that included voting on personal status laws, general amnesty, and returning properties to their owners, which are still a subject of political controversy.

Shafaq News Agency publishes below the draft amendments to the law LINK

KTFA:

Clare: The Iraqi Parliament begins voting on the “Personal Status” law. Learn about its content (documents)

12/2/2024

The Iraqi Parliament began voting on Monday on a draft amendment to the Personal Status Law, after months of political, popular and legal debate over the paragraphs to be amended.

Earlier today, the House of Representatives held a regular session with an agenda that included voting on personal status laws, general amnesty, and returning properties to their owners, which are still a subject of political controversy.

Shafaq News Agency publishes below the draft amendments to the law LINK

Clare: Al-Alaq to {Sabah}: Our critical position is very excellent

12/2/2024 Cairo: Israa Khalifa

Thanks to the well-studied and wise financial policies of Prime Minister Mohammed Shia al-Sudani's government, the country's monetary position has become very excellent, as described by the Governor of the Central Bank of Iraq, Ali Mohsen Al-Alaq, in a special interview with "Al-Sabah".

This position came to reassure citizens and confirm that there are no real fears of any economic crises occurring here or there. Al-Alaq said in a special interview with "Al-Sabah": "The monetary position in Iraq is (very excellent) at the present time in terms of controlling inflation and the high adequacy of foreign reserves, which enables the Central Bank to remain stable, defend the exchange rate, and achieve monetary stability, despite the circumstances surrounding the country and the region."

He explained that "the reserve covers our needs, and this is what distinguishes the Central Bank of Iraq compared to other central banks in the region," noting that "the Central Bank adopts an unconventional monetary policy that is not based only on achieving monetary stability."

Al-Alaq announced the Central Bank's success in implementing the transition plan for "foreign transfers, in line with international practices and standards, and that it is currently taking place smoothly and transparently - especially covering imports at the official exchange rate - which leads to general stability in prices."

Regarding the (Riyada) Bank, the Governor of the Central Bank said: "The (Riyada) Bank will be contributed by Iraqi banks and supported by the Central Bank itself in order to diversify the production base, reduce unemployment levels, and provide basic pillars for sustainable development with the support of specialized international organizations." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat ...I want to tell you the statistics of the monetary mass in Iraq is in dinars not US dollars. Thus, 100 trillion dinars or about not even a trillion US dollars. I also want to bring out that the CBI just told us the size of the Iraqi foreign exchange reserves exceeds by 140% the local currency issued... in the USA...the equivalent of the 1 dinar is expected to come out as about $4 USD.

Militia Man Everyone is very impressed with Iraq's prime minister and especially where they are today. They're focus is financial inclusion, bringing the Iraqi world, to the world...They got new technologies ... electronic taxes and tariffs...they're breaking out with their stock exchange. Their stock exchange has been on fire the last two year. One thing after another supports that Iraq has moved and done...things we've never seen before. It's powerful information...It's exciting times...

LIVE! WORLD DE-DOLLARIZATION WILL ACCELERATE. IT CANNOT BE STOPPED.

Greg Mannarino: 12-2-2024