Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

“Tidbits From TNT” Saturday Morning 9-20-2025

TNT:

Tishwash: Al-Sudani: There is a major economic transformation in Iraq... Investments total $100 billion.

Prime Minister Mohammed Shia al-Sudani announced today, Thursday, September 18, 2025, that the volume of investments in Iraq has reached $100 billion.

A statement from the Prime Minister's Office, received by Baghdad Today, stated that al-Sudani "met a group of tribal sheikhs, dignitaries and academic elites from the people of the Karrada area, at the guest house of Sheikh Mahdi al-Hakak, and expressed his thanks for the invitation and the good opportunity to meet this group of the people of Karrada, the city that made sacrifices during the rule of the dictatorial regime and after the change in 2003, as it turned into a target for terrorism, and is also distinguished by embracing prominent names in the fields of politics, commerce, sports, culture and other fields."

TNT:

Tishwash: Al-Sudani: There is a major economic transformation in Iraq... Investments total $100 billion.

Prime Minister Mohammed Shia al-Sudani announced today, Thursday, September 18, 2025, that the volume of investments in Iraq has reached $100 billion.

A statement from the Prime Minister's Office, received by Baghdad Today, stated that al-Sudani "met a group of tribal sheikhs, dignitaries and academic elites from the people of the Karrada area, at the guest house of Sheikh Mahdi al-Hakak, and expressed his thanks for the invitation and the good opportunity to meet this group of the people of Karrada, the city that made sacrifices during the rule of the dictatorial regime and after the change in 2003, as it turned into a target for terrorism, and is also distinguished by embracing prominent names in the fields of politics, commerce, sports, culture and other fields."

Al-Sudani explained, according to the statement, that "the government has implemented the first package of demands that the people of Karrada had previously submitted to him, and work is underway on the second package, pointing to the state of stability and security throughout Iraq, where the security services are imposing their full control."

Al-Sudani stressed "the necessity of participating in the upcoming elections, with awareness, to ensure accurate selection, which means cutting halfway to the security, stability and development we seek. He also stressed the importance of overcoming the mistakes of the past stages, by prioritizing the national interest."

He promised, "Boycotting the elections is not the solution, and will be a gift to the corrupt and anyone with an agenda that does not serve the country," indicating that "countries of the world look at Iraq today with respect and appreciation for its achievements in many fields."

He pointed out that "the presence of major international companies operating in Iraq is a sign of its recovery, and there is a major economic transformation in Iraq, with the volume of investments reaching $100 billion, meaning that it is a safe and stable country and an attractive environment for investment."

The Prime Minister indicated that "Iraq is a large workshop, and in every governorate there is ongoing work to provide services according to a well-thought-out vision and plan. Integrity is one of the most important criteria for political work, and it is necessary to prioritize the public interest over partisan and factional interests."

He stressed, "The future belongs to the youth, who constitute 60%, and it is our duty to provide job opportunities for them and secure their future." link

************

Tishwash: Government advisor: Economic reforms have put Iraq on a new path to growth and stability.

Written by Dr. Saleh Mahoud Salman / Advisor to the Prime Minister

Prime Minister Salih Mahoud Salman, advisor to the prime minister, affirmed on Friday that the economic reforms adopted by the government have placed Iraq on a new path of growth and stability. While explaining that the country is steadily moving toward a more diversified and resilient economy that places people at the heart of development, he noted that the Development Road Project and the Faw Port are symbols of an economic future that connects Iraq to the world.

Speaking to the Iraqi News Agency (INA), Salman said, "Iraq stands today at a historic crossroads, after its foreign and gold reserves increased, and its investment and infrastructure projects expanded, on a path that establishes a more diversified and resilient economy that places people at the heart of development."

He explained, "The Iraqi economy is not just numbers in the budget or data issued by financial institutions. Rather, it is the story of a country that has suffered for decades from successive crises that have left their mark on people's lives and daily livelihoods."

He added, "Since the 1980s, Iraq has been mired in a cycle of wars and sanctions, which have excluded its banks from the global financial system, weakened its ability to attract investment, and led to an almost total dependence on oil revenues. After 2003, despite the significant opening to international markets, a significant portion of the banks remained little more than 'fronts' for selling currency through the central bank window, unable to practice modern banking. Meanwhile, public companies remained a heavy burden on the budget, without a productive return commensurate with the resources they consumed."

He continued, "This bleak picture is accompanied by other problems, most notably high unemployment and poverty rates, weak productive sectors, heavy bureaucracy, and corruption that has drained the state's resources."

Salman pointed out that, "In the face of these complex challenges, Prime Minister Mohammed Shia al-Sudani's government program came with a set of central priorities, with economic reform at the forefront, along with reforming the banking system, activating electronic payments, completing the unified treasury, improving the business environment, and reforming the tax and customs systems. Thus, Iraq began to prepare for a new phase, after the government realized that continuing with the old approach was no longer a viable option."

He added, "Hence, the need to confront the heavy economic legacy that has shackled the country for decades emerged. The economy remained captive to oil rents, while the agricultural and industrial production sectors declined, and unemployment and poverty rates rose. Perhaps the first step was to reconsider the role of public companies and the government apparatus. Supreme committees were formed to restructure them according to a new philosophy that makes the state a 'manager, not an owner.' This represented the beginning of a comprehensive reform process that paves the way for a more resilient economy."

Salman pointed out, "While these efforts were related to the institutional structure, financial reform represented the other side of the process. The adoption of a three-year budget (2023-2025) was not merely an accounting measure, but rather an unprecedented step that focused on investment spending rather than operational spending. It also launched tax reform packages aimed at raising collection by 30 percent by 2025. With the adoption of a unified treasury and the shift to automation and electronic payment, these decisions quickly reflected in revenues, which recorded a significant jump of more than 100 percent compared to previous years."

Ali emphasized that "although budget control was necessary, financial sector reform alone is not sufficient without addressing the core of the economy, represented by the banking system. This is where the launch of the new trade finance platform in November 2022 changed the nature of banking in Iraq."

He continued, "By linking foreign transfers to private banks under the supervision of the Central Bank, the parallel market was brought under control, and the difference between the official and parallel rates was reduced by more than 60 percent. In parallel, the restructuring of Rafidain and Rashid Banks began with international support, transforming the banks from mere currency brokers into modern financial institutions. The US Treasury even described this step as a 'historic achievement.'"

He pointed out that "from the womb of these banking transformations emerged the electronic payment experiment, which quickly became the most prominent title of reform. As soon as government departments were obligated to use it, the experiment expanded to include the private sector, with points of sale increasing from 10,000 in 2022 to 50,000 in 2025, and the volume of monthly payments jumping from 90 billion dinars to more than 500 billion.

The number of bank cards also increased to 22 million, and the financial inclusion rate jumped from less than 10 percent to 40 percent in just three years, an achievement the World Bank considered unique compared to stable countries that took a full decade to achieve what Iraq accomplished in two years."

“Because money needs an environment that can absorb it, it was only natural for reforms to extend to the field of investment and infrastructure,” Salman said. “Thus, the ‘Development Road’ project and the Grand Faw Port were born as symbols of an economic future linking the Gulf to Europe. Agreements were signed with the World Bank to finance projects in railways, energy, and water.

Internally, Iraq has begun to localize pharmaceutical and construction industries and open industrial projects of various sizes, in addition to launching solar energy initiatives in factories to relieve pressure on the national grid. Thus, reforms have become more comprehensive, not limited to money and banks, but extending to the productive and developmental infrastructure.”

He continued, "While plans and policies are important, numbers remain the truest witness to the magnitude of the transformation. Foreign reserves rose to $106 billion in March 2025, up from $86 billion at the end of 2022, a growth rate of more than 12 percent. Gold reserves rose from 130 tons to 163 tons during the same period, an increase of 25 percent. Inflation declined from 7.5 percent to 2.7 percent, reflecting tangible monetary stability."

He added, "In the banking sector, the number of accounts doubled from eight million to twenty million, and the number of bank cards increased from sixteen to twenty-two million. The electronic payment infrastructure also made a significant leap, with points of sale increasing from ten thousand to fifty thousand, and monthly payments increasing by 460%."

He pointed out that "these indicators did not stop there, as the gap between the official and parallel rates decreased by more than sixty percent, and the financial inclusion rate rose to forty percent after being less than ten percent just two years ago. International financing agreements worth $1.2 billion were signed, and tax revenues increased in 2024 by about thirty percent compared to the previous year.

In the field of digital transformation, the "OR" electronic portal and the electronic passport were launched, and authentication of issuance transactions were canceled through the secure documents system, which processed more than fifteen million transactions. As for customs, revenues rose to 2.131 trillion dinars in 2024 compared to 1.03 trillion in 2023, an increase of 106%, and a growth rate of 128% compared to before 2022."

Salman emphasized that "the transformations were not limited to finance and revenues, but also included development initiatives. The Central Bank and government banks launched programs to support housing, renewable energy, youth entrepreneurship, and industrial cities. The Iraq Development Fund was also established as a new financing arm. In the industrial sector, practical steps were taken to localize the pharmaceutical and construction industries, various production projects were opened, and initiatives were launched to equip factories with solar energy, in addition to signing agreements with global industrial unions."

He pointed out that, "Despite all these results, it is undeniable that the road ahead is still full of challenges. Oil remains the backbone of the budget, and bureaucracy and corruption remain major obstacles to consolidating reform. Nevertheless, the government's goals through 2026 appear both ambitious and realistic: reducing dependence on oil to less than 85% of revenues, reducing the fiscal deficit to less than 3% of GDP, improving Iraq's credit rating, and completing the digital transformation of public finances."

He continued, "Thus, Iraq today stands at a historic crossroads. After decades of crises and turmoil, reforms have begun to become tangible facts, demonstrated by numbers and indicators. While the road is still long, what has been achieved in such a short period proves that change is possible when there is political will and a clear vision."

He pointed out that "Iraq has begun to take steady steps toward a more diversified and resilient economy, one that places people at the heart of development and gives future generations hope for a nation capable of rising again." link

************

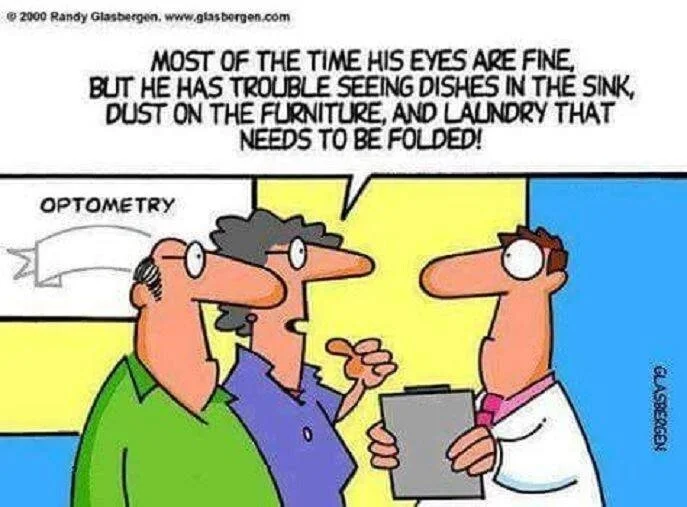

Mot: .... How Can YOu Tell?????

Mot: . Warning Guys!!! - They Will Go to Great Lengths to ~

$10K Gold Revaluation = Massive Inflation | Matthew Piepenburg

$10K Gold Revaluation = Massive Inflation | Matthew Piepenburg

Liberty and Finance: 9-19-2025

Matthew Piepenburg argued that growing discussions around gold revaluation reflect desperation at the highest levels of finance.

He explained that revaluing gold against the dollar would be an admission that current debt levels and monetary distortions are unsustainable, and that only anchoring to real assets can restore trust.

At the same time, he noted that the push for stablecoins shows policymakers are searching for new ways to maintain control over a failing currency system.

$10K Gold Revaluation = Massive Inflation | Matthew Piepenburg

Liberty and Finance: 9-19-2025

Matthew Piepenburg argued that growing discussions around gold revaluation reflect desperation at the highest levels of finance.

He explained that revaluing gold against the dollar would be an admission that current debt levels and monetary distortions are unsustainable, and that only anchoring to real assets can restore trust.

At the same time, he noted that the push for stablecoins shows policymakers are searching for new ways to maintain control over a failing currency system.

To him, both ideas highlight that the existing fiat model is nearing exhaustion.

Piepenburg warned that ordinary citizens who hold no gold will be the ones most hurt when the dollar is deliberately weakened in a reset scenario.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Fed rate cut

12:00 End of cycle

20:50 Gold revaluation & stable coins

28:48 Preparedness

39:30 Von Greyerz

Seeds of Wisdom RV and Economics Updates Friday Afternoon 9-19-25

Good Afternoon Dinar Recaps,

Russia, Vietnam Use Energy Profits to Bypass US Sanctions for Arms Deals

A secretive oil-for-arms mechanism reveals how global powers are rewriting financial pathways outside U.S. control.

A Backdoor Sanctions Evasion Strategy

Internal Vietnamese documents obtained by the Associated Press show that Russia and Vietnam have created a mechanism to conceal arms deal payments by channeling profits from joint oil and gas ventures.

Good Afternoon Dinar Recaps,

Russia, Vietnam Use Energy Profits to Bypass US Sanctions for Arms Deals

A secretive oil-for-arms mechanism reveals how global powers are rewriting financial pathways outside U.S. control.

A Backdoor Sanctions Evasion Strategy

Internal Vietnamese documents obtained by the Associated Press show that Russia and Vietnam have created a mechanism to conceal arms deal payments by channeling profits from joint oil and gas ventures.

Instead of moving cash through the SWIFT system—long controlled by Western oversight—Vietnam is using profits from its Rusvietpetro venture in Siberia to pay off defense contracts with Moscow. Excess profits then move back into Vietnam through joint ventures with Russian oil companies, completing the cycle without crossing Western banking networks.

This arrangement is designed not just to maintain military ties but also to sidestep the very financial infrastructure the U.S. uses to enforce sanctions.

Why This Mechanism Matters

By avoiding international transfers, Russia and Vietnam are insulating themselves from secondary sanctions under U.S. law. It’s a sophisticated workaround:

Step 1: Vietnamese profits from Siberian oil operations repay Russian defense credit.

Step 2: Excess profits flow to Russian state energy firms.

Step 3: Russia’s local ventures in Vietnam return equal sums to PetroVietnam, bypassing global financial systems.

As one analyst noted, “It’s not your typical flexible financing… it’s next-level stuff.”

This isn’t just creative accounting—it’s the deliberate construction of an alternative financial system.

The Broader Context

The U.S. is working to deepen its economic and defense relationship with Vietnam as part of its Indo-Pacific strategy against China. Yet at the same time, Vietnam is strengthening ties with Moscow to secure military supplies.

For Russia, cut off from Western capital markets, these oil-linked payments are a lifeline. For Vietnam, they are a way to preserve both Russian defense cooperation and U.S. trade benefits while navigating sanctions risk.

The mechanism mirrors earlier Russian deals in Southeast Asia, where Moscow traded arms for commodities like palm oil or coffee. This time, however, the stakes are higher: the system directly bypasses Western-controlled finance and exposes cracks in U.S. sanctions enforcement.

Financial Restructuring in Motion

At the heart of this arrangement lies a bigger story: the shift away from Western-dominated financial architecture.

Energy revenues are being re-tasked as covert financial flows.

Sanctions enforcement is pushing nations to create parallel systems of value exchange.

Military deals and resource profits are blending into closed financial loops beyond Washington’s reach.

For Vietnam, this strengthens its strategic autonomy; for Russia, it represents survival in the face of escalating sanctions. For the global system, it accelerates the fragmentation of financial power.

Why This Matters

The oil-for-arms mechanism between Russia and Vietnam illustrates how nations are actively building workarounds to U.S.-centric financial dominance. While sanctions remain a primary American tool, their effectiveness erodes when countries find ways to bypass SWIFT, dollar clearing, and Western oversight altogether.

Key Takeaway: What appears to be an arms deal financing trick is in reality a sign of broader restructuring—energy, finance, and security are merging into closed systems outside U.S. reach.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™

Source: Associated Press

~~~~~~~~~

BRICS Gold-Backed System Sparks Sovereignty Push vs US Dollar

The BRICS gold reserve strategy signals a decisive move away from dollar dominance, laying the groundwork for a new financial order.

Asset-Backed Currencies Re-Entering the System

BRICS nations have pooled over 6,000 tonnes of gold — about 20–21% of global central bank holdings — to back a new currency initiative. While not a classical gold standard, the effort introduces commodity-anchored credibility to trade settlements. Russia leads with 2,335.85 metric tons, closely followed by China at 2,298.53 metric tons, underscoring their dominance in the bloc’s monetary reengineering.

Trade Settlement Beyond SWIFT

The initiative is about more than gold. BRICS countries are actively developing payment infrastructure that bypasses the SWIFT system. This allows trade settlements free from dollar dependency, creating parallel financial plumbing to serve global commerce.

De-Dollarization as Strategic Sovereignty

By insulating themselves from the reach of U.S. sanctions, BRICS nations are turning gold into a geopolitical shield. Russia and China alone control nearly three-quarters of BRICS’ combined gold reserves, giving them the strategic leverage to challenge dollar hegemony.

Ripple Effect Across Global Finance

Even before full launch, the anticipation of a BRICS gold-backed settlement system is influencing global behavior. Nations are reassessing reserve strategies and trade alignments, accelerating the trend of de-dollarization across emerging markets.

Why This Matters

The contrast is stark: while the U.S. is preoccupied with regulatory battles and leadership struggles at institutions like the CFTC, BRICS is executing structural changes that rewire trade and finance in real time. These parallel tracks — digital oversight in the West and hard-asset backing in the East — are converging toward the same destination: a new financial order.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Ariel: Vietnam is on the Verge of a Currency Revaluation

Ariel: Vietnam is on the Verge of a Currency Revaluation

9-19-2025

Vietnam On The Verge? The IMF Concludes In Favor Of Currency Adjustment (The Green Light)

What Article IV Really Means for the Dong

At its core, the Article IV consultation is the IMF’s deep dive into a nation’s economic health, assessing policies and risks with unflinching precision.

Ariel: Vietnam is on the Verge of a Currency Revaluation

9-19-2025

Vietnam On The Verge? The IMF Concludes In Favor Of Currency Adjustment (The Green Light)

What Article IV Really Means for the Dong

At its core, the Article IV consultation is the IMF’s deep dive into a nation’s economic health, assessing policies and risks with unflinching precision.

Directors emphasized that Vietnam’s economy, rebounding to 6.9% growth in early 2025 despite global volatility, is resilient enough to handle shocks through a more flexible exchange rate.

They urged modernization of the monetary policy framework to mitigate risks, explicitly recommending a shift from strict State Bank of Vietnam interventions to a managed float where supply, demand, and investor confidence dictate value.

This isn’t speculation; it’s a formal IMF push for the Dong to breathe freely, setting the stage for appreciation that could multiply holdings overnight.

Echoes from Iraq: The SOMO Agreement as a Global Precursor

This Vietnamese breakthrough doesn’t stand alone it’s amplified by seismic shifts in Iraq, where the State Oil Marketing Organization (SOMO) is finalizing critical oil agreements that pave the way for currency stability.

Just weeks ago, on September 6, 2025, SOMO advanced talks with ExxonMobil for storage and refining in Singapore, alongside wrapping Kurdish oil contracts to resume federal exports under the 2025 budget law.

These pacts, supplying at least 230,000 barrels per day, are the linchpin for Iraq’s economic unification, directly tying into the release of a new exclusive exchange rate for the Dinar mirroring Vietnam’s path but rooted in oil wealth.

Navigating the Road Ahead with Informed Patience

As we stand on this precipice, remember: revaluation isn’t instantaneous, but the IMF’s unequivocal recommendation for managed market determination eradicates the biggest hurdle.

Vietnam’s authorities, buoyed by 2025’s strong start, are poised to implement reforms swiftly, with the State Bank signaling pilot floats by year-end.

Iraq’s SOMO, having ended Kurdish contract overhangs, eyes full resumption by October, triggering the exclusive rate.

For U.S. holders, this duo heralds a life-changing pivot stay vigilant, diversify wisely, and prepare for the influx. The wait has forged resilience; now, it yields revolution.

Read Full Article: https://www.patreon.com/posts/vietnam-on-verge-139227884

News, Rumors and Opinions Friday 9-19-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 19 September 2025

Compiled Fri. 19 September 2025 12:01 am EST by Judy Byington

Summary:

Today, September 19, 2025, marks not just another Friday, but a pivotal moment in the unfolding narrative of a world reborn.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 19 September 2025

Compiled Fri. 19 September 2025 12:01 am EST by Judy Byington

Summary:

Today, September 19, 2025, marks not just another Friday, but a pivotal moment in the unfolding narrative of a world reborn.

Based on the latest intel compiled by Judy Byington, MSW, LCSW, a seismic shift is not just coming; it’s here, and its effects are already rippling across the globe.

Judy Byington suggests that the moment we hear the Emergency Broadcast System (EBS) activate with the iconic sound of Seven Trumpets, our personal notification system will begin.

Expect a flurry of messages on your cell phones,(allegedly) directly from the advanced Starlink Satellite System.

For those holding foreign currencies like the Iraqi Dinar or Vietnamese Dong, or Zim Bonds, these appointments are where you will conduct your exchanges.

For those without, this is your opportunity to set up new Quantum Financial System (QFS) banking accounts and access the benefits of this new era.

For “us” – Tier 4b, the Internet Group – the wait is almost over! Notification to book your currency exchange, Zim Bond redemption, and Med Bed appointments is imminent. Remember, these will (allegedly) be booked through the highly secure Starlink Satellite System via a national/global number linked to a Military secure website, not via traditional texts or emails.

A Word of Caution on Exchange Rates: While some banks (Chase, Wells Fargo, HSBC) (allegedly) opened on Monday, September 15, 2025, for general public Dinar/Dong exchanges, these rates are significantly lower than what will be offered through official Redemption Centers. Patience is key for optimal results!

The Quantum Financial System is the heart of this new era. Described as a secure, instant, and transparent alternative to traditional banking, it leverages quantum computing, resists fraud, and records transfers on a distributed ledger.

Julian Assange on Telegram confirmed as of September 12, 2025, the QFS is running at full speed! Globalists(allegedly) cannot stop it. Tier 3 humanitarian operators, military retirees, and early adopters are already (allegedly) seeing SHI transactions!

President Trump (allegedly) continues to sign daily executive orders to push the QFS rollout forward, with military teams enforcing GESARA compliance worldwide. Quantum nodes are reconciling transactions 24/7.

This is not a drill. The reset is here. The Fed is collapsing, the elites are losing control

The time for speculation is over. The great shift is upon us. Prepare for the EBS, listen for the Seven Trumpets, and get ready for your Starlink notifications. This new era, (allegedly) gold-backed, secured by your DNA, and protected by the military alliance, awaits.

Step into the new era!

~~~~~~~~~~~~

Global Currency Reset:

Mon. 15 Sept. 2025 IMF Releases Dong To RV: https://www.imf.org/en/News/Articles/2025/09/15/pr-25296-vietnam-imf-executive-board-concludes-2025-article-iv-consultation

Thurs. 18 Sept. Wolverine: “I can’t say much, but it’s looking very good to get our appointments. Bond Holders are having their appointments right now.”

Wed. 17 Sept. 2025 FULL-SCALE ASSAULT: TRUMP’S EXECUTIVE ORDERS TAKE AIM AT THE FED AND SHAKE THE GLOBAL BANKING CARTEL! – amg-news.com – American Media Group

Wed. 17 Sept. 2025: GLOBAL CURRENCY RESET: THE OLD SYSTEM DIES HERE — GOLD AS TIER-1, RV, BASEL III & QFS TRIGGER THE FINAL RESET – amg-news.com – American Media Group

Read full post here: https://dinarchronicles.com/2025/09/19/restored-republic-via-a-gcr-update-as-of-september-19-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Nader From The Mid East The currency given to Alaq in England...It is a currency, it's one dinar but it's not currency you can use in the street. That currency represent the digital currency...In Arabic says in the bottom, it's a digital currency which is very exciting for me. Why? Because the zeros are going to be deleted from Forex. And that's it.

Frank26 [Iraq boots-on-the-ground report] FRANK: You know that note that is on that plaque? We established that it's a 1931 [Iraqi dinar note] FIREFLY: Yes it is a symbol...It's also a digital note. That's what they've been talking about. We can prove it to you...it's on the bottom of it. You can see it. FRANK: Holy shit! So that's what they were talking about when they said digital currency. So it's within the lower notes.

************

The $7 Trillion Sideline Asset Soon Heading For Gold & Silver - Mike Maloney

9-18-2025

What do $7.5 trillion, money markets, and your future purchasing power all have in common?

They’re connected — and the implications could be huge.

In this episode of The Gold & Silver Show, Mike and Alan reveal how an unprecedented amount of cash that’s supposed to be “safe” is actually anything but.

With warning signs flashing, this massive pool of money could soon surge into real safe havens: gold and silver.

What you’ll learn:

Why money market funds may look safe — and yet carry hidden risks

How past crises saw similar buildup of cash, followed by collapses and flight to hard assets

The real effects on wealth distribution and what the “bottom 50%” are facing

How central bank policies and massive debt could amplify the next downturn

If you’re thinking about protecting your wealth — whether through precious metals, diversifying assets, or simply staying informed — this video is a must-watch.

Seeds of Wisdom RV and Economics Updates Friday Morning 9-19-25

Good Morning Dinar Recaps,

US, UK to Collaborate on AI, Quantum Computing, Nuclear Energy Development

Washington and London strike a landmark tech pact, signaling a shift in global power competition.

A Strategic Memorandum with Global Implications

US President Donald Trump and UK Prime Minister Keir Starmer signed a memorandum of understanding (MOU) on Thursday during Trump’s state visit to the United Kingdom.

Good Morning Dinar Recaps,

US, UK to Collaborate on AI, Quantum Computing, Nuclear Energy Development

Washington and London strike a landmark tech pact, signaling a shift in global power competition.

A Strategic Memorandum with Global Implications

US President Donald Trump and UK Prime Minister Keir Starmer signed a memorandum of understanding (MOU) on Thursday during Trump’s state visit to the United Kingdom.

The agreement outlines joint development in artificial intelligence, nuclear energy, telecommunications, and quantum computing—all critical sectors shaping the next generation of global infrastructure.

While the MOU is not legally binding, its scope shows intent: joint research initiatives, interoperability standards, and even 6G development. At its core, this deal reinforces something larger—the restructuring of global finance and power through technology.

This is not just politics — it’s global finance restructuring before our eyes.

Quantum Computing and the Crypto Connection

One of the most significant elements is quantum computing. The US-UK task force will develop hardware, software, and algorithms with interoperability standards.

In the crypto world, this development is pivotal. Sufficiently powerful quantum computers could disrupt existing encryption models that safeguard digital assets. The fact that Washington and London are leading this race suggests they see control over quantum systems not just as a military or commercial advantage, but also as a tool to steer the future of money and security.

Here, technology and finance converge—innovation becomes a weapon in the struggle for financial dominance.

AI, 6G, and the Economic Power Play

Trump stressed the investment impact:

“This trip has galvanized $350 billion in deals across many sectors… We are committed to ensuring that the UK is a secure and reliable supply of the best AI hardware and software on Earth.”

With Trump also citing $17 trillion invested in the US over the last year, it’s clear that these technological pushes are part of a broader financial realignment strategy. AI and 6G networks will drive future trade, intelligence, and digital commerce—every piece reinforcing the dollar-led order in competition with BRICS and other rising blocs.

What looks like tech cooperation is, in fact, economic positioning in a financial restructuring already underway.

A Golden Nuclear Age

The announcement also highlighted collaboration on nuclear fusion—hailed as the potential future of limitless clean energy. By investing in advanced reactors, both the US and UK aim to secure energy independence, strengthening their supply chains and removing reliance on adversarial sources.

Energy security has always been tied to financial dominance. Control over nuclear and fusion tech means control over the backbone of industrial power, and ultimately, monetary leverage in a de-dollarizing world.

This is not simply about energy—it is about ensuring financial supremacy in the decades ahead.

Why This Matters

This memorandum may not yet change laws, but it maps out the architecture of tomorrow’s world order:

AI, quantum, and 6G as control points for commerce and finance.

Nuclear fusion as leverage over global energy pricing and reserves.

Anglo-American coordination ensuring Western dominance in the technology-driven economy.

The deal is less about research labs and more about shaping financial and energy flows in the decades ahead.

Key Takeaway: Washington and London are aligning to secure the technologies that underpin global finance and security. What looks like a science partnership is actually an economic and monetary power play.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

White House Eyes Other Candidates for CFTC Chair as Quintenz Confirmation Stalls

Crypto regulation takes center stage as Trump weighs new leadership at the CFTC.

A Search for Leadership in Uncertain Times

The Trump administration is actively considering backup candidates for the Commodity Futures Trading Commission (CFTC) as Brian Quintenz’s confirmation remains stalled. Bloomberg reports that potential contenders include officials with cryptocurrency regulation expertise, reflecting how central digital assets have become in U.S. financial policy.

This is not a simple personnel shuffle. It reveals that the administration views the CFTC chairmanship as a critical post in shaping the regulatory and financial framework of the digital economy.

The CFTC’s Expanding Role in Digital Assets

Congress is currently developing legislation to expand the CFTC’s powers over crypto markets, cementing its place as one of the most influential agencies in digital asset oversight. Unlike the SEC, which has leaned heavily on enforcement, the CFTC is being positioned to act as the market’s stabilizer—regulating derivatives, spot markets, and systemic risks.

This is where the financial restructuring angle emerges: whoever leads the CFTC will effectively steer how crypto integrates into the broader financial system. Decisions on derivatives approvals, stablecoin oversight, and futures markets all tie back into how money flows globally.

Political Drama Meets Financial Power

Quintenz, Trump’s nominee, has faced resistance both in the Senate and within the crypto industry itself. Notably, the Winklevoss twins—staunch Trump supporters and key crypto financiers—have openly opposed him, arguing that his approach is out of alignment with the administration’s policy.

The dispute intensified when Quintenz alleged that the twins lobbied against his nomination after he declined to pursue Gemini’s complaint against the CFTC staff. This clash isn’t just personal; it highlights the tug-of-war between regulators, industry players, and political powerbrokers over who gets to shape the rules of the new financial order.

Why This Matters

The CFTC chair isn’t just another Washington appointment. In 2025, the position will define:

How crypto assets are classified and traded in U.S. markets.

Whether derivatives and futures tied to tokens like XRP, Bitcoin, and stablecoins expand liquidity globally.

How America positions itself in the race against BRICS nations building parallel financial systems.

The chair’s decision-making will ripple far beyond U.S. borders, influencing whether digital assets strengthen or weaken dollar dominance in the global economy.

Key Takeaway: The stalled nomination underscores how crypto regulation has become inseparable from the contest over financial power. Choosing the right CFTC leader is less about politics and more about setting the foundation of tomorrow’s monetary system.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™

Source: The Block

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Friday Morning 9-19-2025

TNT:

Tishwash: Iraq remains America's darling...the Supreme Court dismisses a lawsuit against Baghdad for hundreds of millions.

The Supreme Court in Washington ruled on Wednesday (September 17, 2025) to prevent an American military affairs company from fining the Iraqi government $121 million in a lawsuit related to breach of contract to rehabilitate Iraqi army weapons.

According to a Bloomberg report translated by Baghdad Today, Wy Oak Technology, a military-related company, filed a lawsuit against the Iraqi government, seeking $121 million in damages for the contract's suspension.

TNT:

Tishwash: Iraq remains America's darling...the Supreme Court dismisses a lawsuit against Baghdad for hundreds of millions.

The Supreme Court in Washington ruled on Wednesday (September 17, 2025) to prevent an American military affairs company from fining the Iraqi government $121 million in a lawsuit related to breach of contract to rehabilitate Iraqi army weapons.

According to a Bloomberg report translated by Baghdad Today, Wy Oak Technology, a military-related company, filed a lawsuit against the Iraqi government, seeking $121 million in damages for the contract's suspension.

The Supreme Court affirmed that "Iraq is protected under the U.S. Foreign Immunity Act," noting that this law protects foreign governments from prosecution in such cases, even in the presence of formally signed contracts.

The report added that the court's decision means Iraq retains "immunity," which prevents companies and commercial entities from being sued within the United States, whether for breaches of contract or damages resulting from operating in Iraq.

The roots of this immunity date back to the aftermath of the 2003 invasion of Iraq, when the US Congress passed a special law signed by former President George W. Bush, known as the "Iraq Freedom from Judicial Attachment Act," which granted Iraq exceptional protection from lawsuits and seizures. Experts interpreted this move as maintaining Iraq's status as a "spoiled child" in US politics, amid subsequent presidential successions that ensured this privilege would continue for two full decades. link

**************

Tishwash: The Oil Minister affirms the government's support for the Iraq Investment Forum to attract foreign capital.

Deputy Prime Minister and Minister of Oil, Hayan Abdul-Ghani, reviewed today, Thursday, the preparations for the Iraq Investment Forum, stressing the government's support for the Iraq Investment Forum to attract foreign capital.

A statement by the Ministry of Oil stated: "Abdul Ghani met with a delegation from the Preparatory Committee for the Iraq Investment Forum, headed by Ibrahim Al-Masoudi Al-Baghdadi, Chairman of the Iraqi Economic Council and member of the Preparatory Committee."

The statement added that "the Chairman of the Council provided a detailed explanation of the dialogue session for the Ministry of Oil, which is scheduled to be chaired by the Minister of Oil on September 27. During the meeting, investment opportunities presented by the Ministry of Oil were discussed, which aim to attract investments in the oil and gas sector and petroleum industries.

" It continued, "The meeting discussed logistical preparations and preparations related to sending invitations to the relevant ministers, including the Turkish and Lebanese Ministers of Oil."

The Minister stressed "his keenness to support the forum, which reflects the government's direction towards revitalizing the national economy and attracting foreign capital."

The statement indicated that "the meeting was attended by the Executive Director of the Economic Council, Thabet Kazim Al-Safi, and the Assistant Director General of the Economic Department at the National Investment Commission, Hussein Ali Kanbar, in addition to Hazem Al-Shammari from the Media and Relations Department." link

****************

Tishwash: Abu Raghif inaugurates the e-signature conference in Baghdad to promote digital payments and secure transformation.

The "Activating Electronic Signatures to Support E-Payment" conference kicked off in Baghdad today, Thursday, under the title "Towards a Trusted Digital Environment." The conference, held under the patronage of the Prime Minister and under the supervision of the Central Bank and the Communications and Media Commission, brought together ministries, government institutions, and local and international technology companies.

In his speech during the opening session, which was followed by {Euphrates News}, the Chairman of the Communications and Media Commission, Nofal Abu Ragheef, said: “The conference represents a fundamental step in building a secure digital environment that supports the national economy, under the sponsorship and essential partnership of the Communications and Media Commission as the regulatory body for this vast sector, confirming its tireless pursuit of real partnerships with financial technology (FinTech) companies to develop innovative financial services that respond to the needs of citizens in the digital age.”

Abu Raghif added, "The success of this project requires responsible institutional strengthening of information security, which is the cornerstone of data protection and ensuring digital trust, as well as developing the infrastructure and encouraging informed investment in this field." He emphasized the authority's commitment to implementing applicable legislation, most notably the Electronic Signature and Electronic Transactions Law, in line with international standards and regulations of the International Telecommunication Union.

The Commission Chairman concluded his speech by emphasizing that "digital transformation is no longer just a regulatory option, but rather a national economic necessity," calling for "integrating the efforts of the state, the private sector, and international partners to build a sustainable digital economy that meets the demands of the times and serves the Iraqi citizen." link

***************

Mot: Uh Oh !!!!!

Mot: As You Can See!! -- I Am Now Committed !!!

The Fed Just Became the World’s #1 Gold Salesman..

The Fed Just Became the World’s #1 Gold Salesman...

Notes From the Field By James Hickman (Simon Black) September 18, 2025

To the surprise of absolutely no one, the Federal Reserve announced its decision yesterday to cut interest rates… and kept the door open to further rate cuts in the future.

The funny thing is that we’ll never truly know why.

Sure, it’s possible that Fed officials honestly felt that the economy needs lower rates (despite obviously persistent inflation risks).

The Fed Just Became the World’s #1 Gold Salesman...

Notes From the Field By James Hickman (Simon Black) September 18, 2025

To the surprise of absolutely no one, the Federal Reserve announced its decision yesterday to cut interest rates… and kept the door open to further rate cuts in the future.

The funny thing is that we’ll never truly know why.

Sure, it’s possible that Fed officials honestly felt that the economy needs lower rates (despite obviously persistent inflation risks).

Of course, it’s also possible that Fed Chairman Jerome Powell finally caved to all the insults and pressure from the President.

Or that the rest of the FOMC members looked at what’s happening with Lisa Cook and submitted to inevitability, fearing that they too would be investigated for mortgage fraud (or some other criminal matter) if they didn’t cut rates.

Again, we may never know their real motivations. But it’s clear that the White House has gotten its way.

The President and Treasury Secretary believe that lower rates will stimulate the economy, raise wages, raise asset prices, improve housing affordability, and broadly create conditions for economic prosperity… and they’ve been pushing hard for rate cuts.

Lower rates will also help bail out the US government— whose national debt is so gargantuan that the Treasury is set to spend $1.2 trillion this Fiscal Year (which ends on September 30) just to pay interest.

The Trump administration sees lower rates as the key to slashing that annual interest bill.

Of course, a better solution would be to cut spending, bring the budget closer into balance, and reduce America’s debt-to-GDP ratio.

Putting America’s fiscal house in order would also attract investment in US government bonds the old-fashioned way— by restoring confidence that the US Treasury can pay back its debts through growth, strength, and prestige.

But making such cuts is politically difficult. Even the party that claims to be fiscally conservative isn’t really that interested in meaningful spending cuts.

So, they’re going with Plan B-- push the Fed to lower interest rates.

But as we’ve argued before, they’re setting themselves up for disappointment.

Remember what happened last year— between September and December 2024, the Fed cut rates three times for a total of 1%. Yet over that same period, US government bond yields actually INCREASED by 1%.

This proves that the Fed can’t just snap its fingers and force interest rates lower simply by having a committee meeting.

Interest rates are ultimately determined by supply and demand for money. So if they Fed really wants to see lower rates, they’re going to have to intervene directly in the bond market.

They’ve done this many times before-- this is when the Fed ‘prints’ money, i.e. what they call “quantitative easing”. And the most recent example was during the pandemic when the Fed created about $5 trillion of new money.

They used that money to buy government bonds-- essentially creating artificial demand for Treasurys that pushed yields down to record lows.

And life felt pretty good for a while-- people were able to buy homes and finance mortgages at rates lower than 3%. The government was able to sell 10-year debt for less than 0.5%.

But all those trillions of dollars of new money from the Fed came at a consequence: inflation soared to 9%— the highest in decades.

This is the major tradeoff that the Fed is facing right now: the White House wants lower interest rates. And the Fed seems to be capitulating to the pressure.

But for interest rates to get really low (and remain there), the Fed will almost certainly have to engage in more Quantitative Easing… and that means more inflation.

That alone is going to push a lot more capital into the gold market.

For the past few years, foreign governments and central banks have been selling off their US dollar reserves and funneling that money into gold; this has been the primary reason why gold has soared to all-time highs.

And with the Fed’s capitulation on rates, this trend will continue.

It’s also very likely that pension funds, insurance funds, and other long-term institutional investors will seek refuge in gold as well, driving the price even higher.

To be clear, this isn’t a prediction that gold is going to go up every day, or every month, or even every year.

But if you take a longer-term view—say, 8 to 10 years when the US national debt hits $60 trillion and Social Security runs out of funds— the case for owning gold becomes even more compelling.

I don’t hold this view because I’m a “gold bug”. I’m not fanatical about a hunk of metal. But I do understand these long-term trends, and in my view, we’re still in the early innings.

Another option is to buy gold-related companies, which can offer powerful leverage to the metal itself.

Central banks buy physical gold. They do not buy shares of gold companies. That’s why, even as gold surged, many of the companies we researched traded at dirt-cheap valuations—as low as 2-3x earnings in some cases.

But investors are starting to catch on and pay attention to these deeply undervalued businesses; in fact, we’ve seen several companies in our portfolio gain up to 4x, some even just over the last few months.

Given that Q3 earnings are coming up just around the corner, we believe that some of these gold (and related silver and platinum) companies are about to post record earnings and could see their share prices soar even more.

If you’re interested, we publish all of this investment research, including detailed analysis of deeply undervalued gold companies, in our premium service.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

30-50% Market Crash Incoming, Trillions will be Erased

30-50% Market Crash Incoming, Trillions will be Erased

Commodity Culture: 9-17-2025

Are you feeling the squeeze? The rising cost of living, the persistent worry about the future – you’re not alone. And according to one financial expert, things could be set for a much bigger shift than many realize.

In a recent, highly illuminating discussion on Commodity Culture, financial analyst Michael Pento joined host Jesse Day to deliver a sobering message.

30-50% Market Crash Incoming, Trillions will be Erased

Commodity Culture: 9-17-2025

Are you feeling the squeeze? The rising cost of living, the persistent worry about the future – you’re not alone. And according to one financial expert, things could be set for a much bigger shift than many realize.

In a recent, highly illuminating discussion on Commodity Culture, financial analyst Michael Pento joined host Jesse Day to deliver a sobering message.

Pento isn’t just seeing a few frayed threads in the economic fabric; he’s sounding the alarm on a “multitude of epic bubbles” that he believes are poised for a catastrophic burst.

Perhaps the most chilling aspect of Pento’s warning concerns the backbone of our society: the middle class. Already grappling with persistent inflation eroding purchasing power and wage growth that stubbornly refuses to keep pace, the middle class, Pento argues, is being “completely crushed into poverty.”

This economic pressure cooker has a direct and dangerous link to the credit markets. As everyday families struggle to make ends meet, their ability to service debt diminishes, creating a critical vulnerability in the entire system.

According to Pento, the real danger isn’t merely a slow leak; it’s a catastrophic rupture, beginning with a collapse in the credit markets. This isn’t just about banks; it’s about the lifeblood of commerce and personal finance.

Once credit seizes up, the dominoes fall swiftly, leading to an estimated 30 to 50% crash in the stock market.

And here’s where Pento’s forecast becomes truly grim: he estimates that this kind of market correction could take decades to fully recover. This isn’t a quick dip and rebound; it’s a long, arduous journey back to financial stability, profoundly impacting retirement plans, investments, and overall economic well-being for generations.

Pento’s insights on Commodity Culture paint a picture of significant economic upheaval. While such predictions can be unsettling, understanding the potential landscape is the first step toward navigating it. In times of economic uncertainty, knowledge truly is power.

For a deeper dive into Michael Pento’s detailed analysis, the driving forces behind these bubbles, and what it all means for your financial future, we highly recommend watching the full discussion from Commodity Culture.

Arm yourself with information, understand the risks, and prepare for what could be a very different economic horizon.

Silver Shorts: Blood In The Water | Bill Holter

Silver Shorts: Blood In The Water | Bill Holter

Liberty and Finance: 9-17-2025

Bill Holter explains why recent gold and silver price action points to a looming short squeeze and possible failure to deliver in the metals markets.

He argues that central banks worldwide are shifting from U.S. treasuries to gold and silver as the dollar weakens and global financial war intensifies between East and West.

Silver Shorts: Blood In The Water | Bill Holter

Liberty and Finance: 9-17-2025

Bill Holter explains why recent gold and silver price action points to a looming short squeeze and possible failure to deliver in the metals markets.

He argues that central banks worldwide are shifting from U.S. treasuries to gold and silver as the dollar weakens and global financial war intensifies between East and West.

Domestically, Holter warns that Americans are living "behind enemy lines" in a divided, manipulated system where self-sufficiency is essential. He stresses preparedness—physically, mentally, spiritually, and through community networks—while noting that urban dependence is a major vulnerability.

Ultimately, he believes that gold will re-emerge as the core collateral for settlement worldwide as the U.S. financial system deteriorates.

INTERVIEW TIMELINE:

0:00 Intro

1:30 Silver short squeeze

6:00 Financial war

12:21 US debt and stablecoins

14:00 Stock market euphoria

20:00 Relocation

24:51 Family breakdown

Seeds of Wisdom RV and Economics Updates Thursday Afternoon 9-18-25

Good Afternoon Dinar Recaps,

BRICS Expansion in 2025 Shapes Future of World Order, US on Edge

The rapid growth of BRICS membership signals a seismic realignment in global governance and finance, challenging U.S. dominance.

Membership Numbers Reach Historic Levels

The BRICS expansion map has now engineered inclusion of eleven full members after Saudi Arabia completed its membership in July 2025, integrating Egypt, Ethiopia, Iran, UAE, and Indonesia across several key strategic partnerships.

Good Afternoon Dinar Recaps,

BRICS Expansion in 2025 Shapes Future of World Order, US on Edge

The rapid growth of BRICS membership signals a seismic realignment in global governance and finance, challenging U.S. dominance.

Membership Numbers Reach Historic Levels

The BRICS expansion map has now engineered inclusion of eleven full members after Saudi Arabia completed its membership in July 2025, integrating Egypt, Ethiopia, Iran, UAE, and Indonesia across several key strategic partnerships.

Over 23 nations have formally applied for membership while another 28 have expressed interest, spanning every continent through major diplomatic initiatives.

The alliance has also established nine partner countries including Belarus, Malaysia, Nigeria, and Thailand. Vietnam joined as a strategic partner while Colombia announced accession intentions, demonstrating continued momentum in BRICS expansion.

Trump Threatens Future Relations

President Trump has escalated tensions by threatening 100% tariffs on BRICS members over what he calls “anti-American policies.” The administration also added 10% tariff threats in July 2025, creating diplomatic friction across multiple channels.

Brazilian President Lula da Silva responded firmly during the 2025 BRICS Summit in Rio de Janeiro:

“We are witnessing an unprecedented collapse of multilateralism.”

He also warned that the world “does not want an emperor,” criticizing increased military spending and decreased development assistance.

Global Reach Expands Rapidly

The BRICS expansion map has reshaped geographical diversity. European applicants include Turkey, Serbia, and Belarus, despite Western pressure. Asian and African hopefuls include Azerbaijan, Bangladesh, Cambodia, Morocco, Pakistan, and Zimbabwe.

Looking ahead, BRICS expansion 2026 is expected to include clearer membership criteria and optimized partner-state frameworks, creating a pathway for gradual integration.

India’s Strategic Position Strengthens

India is leveraging its unique position between Western democracies and emerging economies. The country has secured access to major energy suppliers and new trade partnerships with Egypt and Ethiopia, boosting energy security and export markets.

According to the U.S. Institute of Peace, India views BRICS as a platform to promote global leadership, strategic autonomy, and a multipolar world order.

Financial Cooperation Advances

At the July 2025 Rio Summit, BRICS nations issued three finance-related declarations:

Support for IMF quota reforms

Backing of the UN Framework Convention on International Tax Cooperation

Launch of a new multilateral guarantee mechanism via the New Development Bank (NDB)

The NDB continues financing infrastructure projects across BRICS nations, while pilot programs for the new mechanism are expected in 2026.

Global Impact Reshapes Order

BRICS expansion has catalyzed a turning point in international relations. Member countries are demanding greater IMF quotas, representation for emerging economies, and reform of Western-dominated institutions.

The bloc has positioned itself as the voice of developing nations, accelerating a multipolar global system.

Implications for Global Finance

BRICS expansion accelerates the move away from Western-centric financial systems. With new members including major energy exporters and large consumer markets, the bloc is building the foundation for settlement systems that bypass the U.S. dollar.

Tokenization, de-dollarization, and the New Development Bank’s new multilateral guarantee mechanism together set the stage for alternative financing models that challenge the IMF and World Bank.

Impact on the U.S. Dollar System

Trump’s tariff threats underscore Washington’s fear that BRICS could undermine the dollar’s dominance. As more nations apply for membership, the bloc’s combined economic power grows, making dollar alternatives — including gold-backed trade settlements and regional currency swaps — more viable.

If BRICS expands its financial frameworks effectively, U.S. sanctions and tariffs may lose potency in global trade enforcement.

Strategic Outlook

Short Term (2025–2026): Membership grows, partner-state models expand, and BRICS finance declarations begin implementation.

Medium Term (2027–2029): BRICS-led institutions rival IMF/World Bank in development lending, with tokenized settlement systems gaining traction.

Long Term (2030 and beyond): The bloc’s structural reforms could mark the end of unilateral Western dominance in global governance.

Why This Matters

BRICS expansion in 2025 is not only a diplomatic milestone but a financial restructuring event that challenges the U.S.-led order. The implications span global trade, capital markets, and monetary systems.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Thursday 9-18-2025

KTFA:

Clare: The Iraqi judiciary has recovered two billion dinars from two violating companies for financial fraud involving the exchange rate.

9/18/2025

The Iraqi judiciary announced on Thursday that it had recovered two billion dinars for financial fraud involving exchange rates.

The Judicial Media Department said in a statement that the Second Karkh Investigation Court recovered two billion Iraqi dinars on September 17, 2025, for a financial fraud crime.

KTFA:

Clare: The Iraqi judiciary has recovered two billion dinars from two violating companies for financial fraud involving the exchange rate.

9/18/2025

The Iraqi judiciary announced on Thursday that it had recovered two billion dinars for financial fraud involving exchange rates.

The Judicial Media Department said in a statement that the Second Karkh Investigation Court recovered two billion Iraqi dinars on September 17, 2025, for a financial fraud crime.

He pointed out that the amount was recovered from two companies that violated the law by fraudulently obtaining the dollar exchange rate difference through money transfers outside the country.

The statement indicated that the "Second Karkh Investigation Court," through extensive efforts and under the supervision of the court's first judge, recovered this amount. These efforts are ongoing to take legal action against the remaining companies that employ illegal methods to obtain large profits, thereby harming public funds. LINK

************

Clare: Iraq signs an agreement and seven trade memoranda of understanding with Lebanon.

9/18/2025

The Iraqi Ministry of Trade and the Lebanese Ministry of Economy and Trade signed an agreement and seven memoranda of understanding today, Thursday, to enhance trade and investment between the two countries.

This came during the second session of the Iraqi-Lebanese Joint Committee held in the capital, Baghdad, headed by Minister of Trade Athir Dawood Al-Ghariri on the Iraqi side, and Minister of Economy and Trade Amer Al-Bassat on the Lebanese side, in the presence of heads and representatives of the Iraqi private sector and their counterparts from the Lebanese side.

The committee's work witnessed the signing of an agreement and seven memoranda of understanding between the two sides, covering areas such as developing trade exchanges and export promotion, cooperation in organizing international and specialized exhibitions, land transport of passengers and goods, investment, and mutual recognition of maritime qualification certificates for seafarers working at sea. This will contribute to supporting economic integration, facilitating the flow of trade, and exchanging technical and scientific expertise.

In this regard, the Iraqi Minister of Trade, in a speech delivered on the sidelines of the session, affirmed Iraq's keenness to enhance cooperation with Lebanon and expand the horizons of partnership in various economic, trade, and investment sectors, noting that this session represents an important shift in the path of bilateral relations.

He explained that the signing of the minutes and memoranda during the conference reflects the seriousness of both sides in moving directly to the implementation phase, stressing the Iraqi government's full support for all initiatives that would strengthen the partnership with Lebanon and develop relations in a manner that serves common interests.

Al-Ghariri added that "seven memoranda of understanding were signed, in addition to a cooperation agreement between the Iraqi and Lebanese Ministries of Justice, to enhance legal and institutional cooperation between our two countries." He added, "The government will be a true supporter of the private sector, and we are working to launch an investment forum soon that will open broader horizons for trade and investment cooperation."

He pointed out that "these agreements represent a new beginning for the resumption of private sector activity and business owners, in line with the deep economic and trade relations between Iraq and Lebanon."

He continued, "The memoranda of understanding cover various sectors, such as trade, investment, transportation, and exhibitions, and represent an important step to expand trade exchange and enhance joint economic activity." LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat I want to first cover something today that is VERY important to everyone and the timing of the RV we all have been looking for.... this reinstatement and revaluation of the Iraqi dinar was part of a much larger plan. The pieces to the plan are all but in place now. This is not decades from now. It is happening now. It is part of a financial “reset” of the US financial system and it will also eventually move downstream to other countries by the nature of it. But remember its “America First”. The US Treasury is not going to let this opportunity pass by with Iraq...no one knows the entirety of the plan, as they are not sharing it... [Post 1 of 2....stay tuned]

Mnt Goat This much we do know and we know something is moving fast to shift the Iraqi dinar into the global arena for a purpose and to reinstate its currency back to the currency trading. The dinar will be repegged to a basket along with other currencies, each supporting the other. We can already see the new Trump foreign policy with Iraq and to bring huge investment opportunities to Iraq. Remember, however, there must be money enough for both nations or the US will not get involved ...Just know there is a plan and it is in motion... [Post 2 of 2]

Mnt Goat Just remember that the dinar now already trades on the ISX which is the Iraqi Securities Exchange. A link was placed even on FOREX back to the ISX years ago. This made it easier for future investors in the dinar to follow IQD trends. However, it is not on the global exchanges and certainly not at the rate we are waiting to see. The official CBI rate of 1320 is simply not going to help in the Trump reset of the national US debt, get it?

************

This Crisis won’t be like 2008, it will be a US Sovereign Debt Crisis

Kitco News: 9-16-2025

The financial world is abuzz with talk of a looming crisis, and prominent economist and investor Peter Schiff is at the forefront of these warnings.

In a recent, exclusive interview with Kitco News Anchor Jeremy Szafron, Schiff laid out a grim picture of a “great repricing” underway, driven by a U.S. sovereign debt crisis and what he calls the Federal Reserve’s “biggest error yet.”

If Schiff’s predictions hold true, the implications for the U.S. dollar, the price of gold, and your personal savings could be profound and far-reaching. This isn’t a rerun of 2008; Schiff argues we’re heading into uncharted and considerably more perilous territory.

“Tidbits From TNT” Thursday 9-18-2025

TNT:

Tishwash: Trade Bank of Iraq launches direct delivery service for electronic cards.

The Trade Bank of Iraq announced today, Thursday, the launch of a direct delivery service for electronic cards.

A statement from the bank, received by Al-Eqtisad News, stated that "to facilitate customers, it has been decided to activate the direct delivery service for electronic cards."

The bank added, "We announce the activation of the electronic card delivery service in Baghdad and all governorates to ensure their safe and timely arrival."

TNT:

Tishwash: Trade Bank of Iraq launches direct delivery service for electronic cards.

The Trade Bank of Iraq announced today, Thursday, the launch of a direct delivery service for electronic cards.

A statement from the bank, received by Al-Eqtisad News, stated that "to facilitate customers, it has been decided to activate the direct delivery service for electronic cards."

The bank added, "We announce the activation of the electronic card delivery service in Baghdad and all governorates to ensure their safe and timely arrival." link

************

Tishwash: Indonesian Ambassador: Invites Karbala merchants to participate in a trade fair in his country

The Indonesian Ambassador to Iraq, Didik Eko Pujianto, invited merchants from the holy Karbala Governorate to participate in a trade fair to be held in his country next month, stressing his country’s desire to invest in Iraq and Karbala in the fields of medicine, leather industries, electricity, and other projects.

The Indonesian ambassador told Al-Mustaqilla on the sidelines of his visit to the Karbala Chamber of Commerce and his meeting with the chamber’s president, Zaman Sahib Abdul Awad, “We discussed strengthening and deepening bilateral relations between the two countries, opening new horizons for joint cooperation to stimulate trade exchange, and we are working to facilitate procedures for obtaining entry visas.”

For his part, the head of the Karbala Chamber of Commerce said in a statement to Al-Mustaqilla after his meeting with the Indonesian ambassador, “We invited Indonesian traders, companies and businessmen to see and learn about the most important investment opportunities in the province.”

In addition, the Chamber's Vice President, Saeed Shukr, emphasized to the Indonesian Ambassador the importance of reviewing the Iraqi investment law to benefit from it, and to encourage Indonesian companies to establish projects, especially medical projects, to be of a standard befitting the quality of the holy Karbala Governorate, and the necessity of these companies obtaining approvals from the Iraqi Ministry of Health.

Chamber Board Member Mohammed Al-Hussaini concluded by stressing the need for Indonesian companies to visit Karbala Governorate and see for themselves the investment opportunities.

The delegation called for "facilitating the issuance of entry visas to Karbala merchants, as this would have a positive impact on strengthening and deepening economic relations." link

************

Tishwash: Parliament on the brink of closure: MPs' salaries exceed 400 billion dinars

The Council has been inactive for 14 months... and Al-Mashhadani was looking for a "religious fatwa"!

MPs are estimated to have received more than 122 billion dinars in wages, salaries, and services during this current session, "without work" due to the suspension of sessions.

Parliament failed to hold more than 100 sessions during its fifth session, including only 12 sessions during the past 11 months.

Based on this poor performance, it is likely that September will be the last day of the parliament's term, which is supposed to extend its term until early 2026.

Last Tuesday, parliament failed to hold its session for the second time in the same week due to a lack of quorum.

Yasser al-Husseini, an independent MP, told Al-Mada, "Political disagreements over important laws led to the suspension," including a law related to Saudi investments in Iraq.

Al-Husseini asserted that "most MPs are busy preparing for the elections," scheduled for November 11. statement issued after a presidential meeting in parliament last Tuesday described MPs' attendance at sessions as "a national duty that cannot be postponed," following the failure of the last two sessions.

The statement, following a meeting between Parliament Speaker Mahmoud al-Mashhadani and his deputies, Mohsen al-Mandalawi and Shakhwan Abdullah, emphasized "the importance of the presence of parliamentary bloc heads and MPs at the upcoming sessions and their active participation in voting on vital laws."

Parliament published the agenda for the sessions of Monday and Tuesday earlier this week, which included a number of laws described as important.

In a video address, Deputy Speaker Shakhwan Abdullah expressed his regret over the lack of a quorum for the parliamentary session last Tuesday, despite the presence of important laws and legislation on the agenda.

He added that no more than 50 MPs were present, despite the 130 MPs who signed the attendance list. He explained that this was unacceptable, given that many MPs travel from outside Baghdad to attend the sessions.

Full salaries, no cuts!

Last August, Parliament imposed fines on MPs who miss sessions, deducting one million dinars from the salary of each MP absent from a single session. The number of absentees ranged between 100 and 150 MPs per session.

However, it appears that MPs have found a way around this punishment, sitting in the parliament cafeteria without attending sessions, thus avoiding salary cuts.

Mohammed al-Ziyadi, a representative of the Muntasiroun bloc, affiliated with Kata'ib Sayyid al-Shuhada leader Abu Alaa al-Wala'i, told Al-Mada: "We are not school students... MPs can express their opinion by boycotting and not attending sessions, but what matters is that they attend parliament."

In the past, al-Mashhadani, the last parliament speaker, hesitated to cut the salaries of absent MPs, although he said in March 2025 that he was seeking a "fatwa from the Najaf Martyrdom" regarding MPs' attendance at sessions, describing the current session as "the worst."

MPs like Yasser al-Husseini believe that "dismissing the absent MP," rather than simply cutting their salaries, will prevent others from being absent, explaining that "constitutionally, parliament's term is supposed to end on January 8, 2026."

The parliamentary term consists of four legislative years, each of which is divided into two terms, each extending for eight months, with a four-month recess.

This parliament was suspended for three months after the elections, and has two presidents since the removal of former President Mohammed al-Halbousi at the end of 2023.

So far, since its first session on January 9, 2022, the current parliament has only been able to hold 149 sessions out of approximately 265.

This means that parliament has not functioned for 14 months, but during that period, it has received full salaries and expenses amounting to more than "122 billion and 500 million dinars."

According to some reports, each member of parliament receives a monthly salary of 8 million dinars, in addition to 16 million dinars in protection allowances and 3 million dinars in rent allowances for members of parliament not residing in Baghdad, bringing the total monthly salary of each member of parliament to 27 million dinars.

The total annual cost of salaries and allowances for all 329 members of parliament amounts to more than 426 billion dinars.

"Hibernation Time"

Ghaleb Al-Dami, a political affairs researcher, says that "Parliament has now entered the winter hibernation phase.

" Al-Dami added to Al-Mada: "Most of the members of parliament are candidates and are busy campaigning in the governorates," predicting that this September will be "the last day of parliament."

The worst performance of the sessions this term occurred during the tenure of its current speaker, al-Mashhadani, who was only able to hold 12 sessions in 11 months, at a rate of one session per month instead of the usual eight.

For his part, Ziad al-Arar, an academic and researcher, said that "political disagreements between bloc leaders from all parties have brought parliamentary work to a near-standstill."

He added to Al-Mada: "There are clear disagreements between Speaker al-Mashhadani and his deputy, al-Mandalawi, and the Sunni forces, as well as a lack of trust among the leaders of the political scene."

Al-Arar pointed out that, due to these disagreements, the heads of the parliamentary blocs are "upset with each other and are not attending the sessions."

The researcher believes that the origin of the disagreement was on the day al-Mashhadani was elected (late October 2024), due to objections to his assumption of the position.

His election was a "gracious response" to the parliament speaker's previous positions with some political parties. link

************

Dang!!! -- These Young ""Felines"" are Tough!!!

Mot: . Yes - This actually happened and caused 16 accidents !!! moose drivers

This actually happened: they dressed up the truck with a guy tied down on the roof, while the driver and passengers wore moose heads.

They drove down Interstate I-35 and caused 16 accidents.

Yes, they went to jail, yes, they were so drunk, and yes, men cannot be left alone.