Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Economist’s “News and Views” Saturday 7-13-2024

Financial Blow Up: Little Time Left Before Wheels Come Off System Warns David Morgan

Daniela Cambone: 7-12-2024

"So now all they want is control, saying, 'I own you because you have to pay me interest. And when you can't pay interest, what happens? They take over the property,'" warns David Morgan, founder of The Morgan Report.

He emphasizes that we don’t have much time left to address these issues. However, he expresses his optimism about the silver market. "Silver's not at an all-time high, but it's at an 11-year high or close to it," says Morgan.

He explains to Daniela Cambone that strong monetary demand for silver, combined with steady or increasing industrial demand, could lead to a situation where both forces compete for the same supply, potentially driving prices higher.

Financial Blow Up: Little Time Left Before Wheels Come Off System Warns David Morgan

Daniela Cambone: 7-12-2024

"So now all they want is control, saying, 'I own you because you have to pay me interest. And when you can't pay interest, what happens? They take over the property,'" warns David Morgan, founder of The Morgan Report.

He emphasizes that we don’t have much time left to address these issues. However, he expresses his optimism about the silver market. "Silver's not at an all-time high, but it's at an 11-year high or close to it," says Morgan.

He explains to Daniela Cambone that strong monetary demand for silver, combined with steady or increasing industrial demand, could lead to a situation where both forces compete for the same supply, potentially driving prices higher.

"Around 60% of the silver market is driven by industrial demand, especially in areas like solar energy and electric vehicles.

As currency wars and financial instability continue, the monetary demand for silver could increase significantly."

BRICS Launched Intra-bank Payment System, Crashing USD & SWIFT System!

We Love Africa: 7-12-2024

Has BRICS accidentally ended dollar dominance? BRICS has launched an intra-bank payment system, posing a significant challenge to the supremacy of the US dollar.

This development could lead to a decline from which the dollar may not recover. However, this shift is not unexpected; BRICS has been working for years to achieve this goal.

As the dollar's decline becomes more imminent and its value continues to drop, one must ask: Does the United States have any plans to revive its currency?

More importantly, is it even possible for the US to revive the dollar at this stage, even if it wants to? Let’s find out.

JPMorgan, Bank Of America & Citigroup Are in Big Trouble

Atlantis Report: 7-13-2024

The 2008 financial crisis significantly impacted the global economy, revealing vulnerabilities in the banking sector and leading to government intervention.

The collapse of Lehman Brothers and subsequent bailouts highlighted the need for strong regulatory frameworks to prevent similar crises.

In response, major banks were required to create "living wills."

These living wills ensure that even the largest banks can be dismantled in an orderly manner, reducing risks to the broader economy. However, recent reports from the Fed and the FDIC have raised concerns about the adequacy of these plans for three major American banks. JPMorgan, Bank Of America & Citigroup Are in Big Trouble

“Tidbits From TNT Saturday 7-13-2024

TNT:

CandyKisses: Sources: The Governor of the Central Bank of Iraq made an unannounced visit to Washington on the Chinese yuan

Informed sources revealed on Saturday that the Governor of the Central Bank of Iraq Ali Al-Alaq is making an unannounced visit to United States to discuss with officials in Washington about the US Federal Reserve's decision to stop Baghdad's dealings with the Chinese yuan.

The sources told Shafaq News that the relationship left for Washington last Tuesday to meet with officials of the Federal Bank and the US Treasury.

She added that Al-Alaq is discussing with US officials the decision to stop dealing Iraq in the Chinese yuan, indicating that the Governor of the Central Bank is also discussing during his visit the required obligations regarding Iraqi banks deprived of dealing with the dollar.

TNT:

CandyKisses: Sources: The Governor of the Central Bank of Iraq made an unannounced visit to Washington on the Chinese yuan

Informed sources revealed on Saturday that the Governor of the Central Bank of Iraq Ali Al-Alaq is making an unannounced visit to United States to discuss with officials in Washington about the US Federal Reserve's decision to stop Baghdad's dealings with the Chinese yuan.

The sources told Shafaq News that the relationship left for Washington last Tuesday to meet with officials of the Federal Bank and the US Treasury.

She added that Al-Alaq is discussing with US officials the decision to stop dealing Iraq in the Chinese yuan, indicating that the Governor of the Central Bank is also discussing during his visit the required obligations regarding Iraqi banks deprived of dealing with the dollar.

The visit of the Governor of the Central Bank of Iraq Ali Al-Alaq to Washington coincides with a significant jump in the exchange rate of the dollar against the dinar, and more than two months after the visit of Prime Minister Mohamed Shia Al-Sudani to the United States.

************

Iraqi military delegation visits Washington regarding security agreement

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein revealed today, Friday, that an Iraqi military delegation will soon visit Washington to hold security talks.

Hussein said in a press conference held in the US capital, Washington, that "our visit to Washington was to attend the NATO summit at the invitation of the American side, and on the sidelines of the summit we held intensive meetings with leaders of several countries, and we held a meeting with the US Treasury Department to discuss issues related to monetary policy and banking signs."

He added that "a military delegation will visit Washington to hold talks on the security agreement concluded between Iraq and the United States."

He continued: "We discussed the future of the international mission in NATO meetings in cooperation with the Iraqi Ministry of Defense." link

************

Tishwash: Foreign Minister from Washington: US Treasury positively assessed Central Bank's efforts

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein confirmed that the US Treasury Department evaluated the efforts of the Central Bank positively, while indicating that a military delegation will visit Washington to hold security talks.

"Our visit to Washington was to attend the NATO summit at the invitation of the US side, and on the sidelines of the summit we held intensive meetings with leaders of several countries, and we held a meeting with the US Treasury to discuss issues related to monetary policy and banking signs," Hussein said in a press conference held in the US capital Washington, attended by the Iraqi News Agency (INA).

He added that "the US Treasury positively evaluated the efforts of the Central Bank," indicating that "a military delegation will visit Washington to hold talks on the security agreement concluded between Iraq and the United States."

He continued: "We discussed the future of the international mission in NATO meetings in cooperation with the Iraqi Ministry of Defense." lin

************

Tishwash: Financial expert to Iraq Observer: Western Union has set a ceiling for its money transfers from Iraq and has not stopped them completely

Financial and banking expert Mustafa Hantoush believes that Western Union Banking Company has set a ceiling for sending money transfers from Iraq and has not suspended them permanently.

Hantoush told Iraq Observer, “Western Union has reduced the size of its money transfers. For example, instead of transferring an amount of $1,000, it will become $500.”

He added, "The Central Bank has not issued any official statement regarding the suspension of Western Union Company for money transfers from Iraq," noting that this information must be verified from its primary source, which is the Central Bank."

Local news agencies reported that the world's largest money transfer company, Western Union, has stopped its money transfers from Iraq without providing further details, at a time when the dollar is witnessing a continuous rise. Meanwhile, a prominent financial source who preferred to remain anonymous told Iraq Observer that the matter is related to setting a ceiling for money transfers issued by Western Union from Iraq, ruling out a final halt.

The financial markets in Iraq are witnessing a state of instability in the exchange rate of the dollar against the Iraqi dinar, as it has been approaching 150,000 for days, in anticipation of the visit of the Governor of the Central Bank of Iraq to the United States of America.

Economic researcher Ziad Al-Hashemi said in a tweet on the X platform: The governor of the Central Bank was sent to New York to discuss the issue of the failure of yuan transfers to China, which the Central Bank relied heavily on to sell dollars and provide the dinar needed to feed the government’s finances.

He added: The causes of the problem remaining unresolved and the strong parties hovering around the Central Bank and searching for the dollar, without accountability, neutrality or internal Iraqi restrictions, will make all the pledges that Al-Alaq will present without any real value, as the same person has previously presented the same pledges throughout the past ten years, and the same problem is still ongoing without a solution, according to him. link

************

Mot: Stay Cooooool !!!!!

Mot: .. Yes - Taking sum Time to Reflect m

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 7-13-24

Good Afternoon Dinar Recaps,

NIGERIAN MINISTER URGES SEC TO TACKLE CRYPTO REGULATION CHALLENGES

Nigeria’s cryptocurrency regulations are currently being updated.

The Nigerian Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has called on the newly inaugurated Securities and Exchange Commission (SEC) board to address the complexities of cryptocurrency regulation.

According to local media, Edun emphasized the need to ensure stringent oversight, especially in fast-moving and complex areas such as cryptocurrencies, to maintain market integrity in Nigeria’s capital market during the board’s inauguration in Abuja.

Good Afternoon Dinar Recaps,

NIGERIAN MINISTER URGES SEC TO TACKLE CRYPTO REGULATION CHALLENGES

Nigeria’s cryptocurrency regulations are currently being updated.

The Nigerian Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has called on the newly inaugurated Securities and Exchange Commission (SEC) board to address the complexities of cryptocurrency regulation.

According to local media, Edun emphasized the need to ensure stringent oversight, especially in fast-moving and complex areas such as cryptocurrencies, to maintain market integrity in Nigeria’s capital market during the board’s inauguration in Abuja.

Minimal registration requirements

Edun warned that companies might exploit minimal registration requirements to falsely claim they are licensed, undermining market integrity. Highlighting the potential for regulatory arbitrage, he urged the SEC to implement top-notch corporate governance practices, swiftly identify and disclose conflicts and adhere to global best practices.

The minister also encouraged the newly inaugurated SEC board members to adopt innovative strategies to regulate the country’s capital market effectively. He stressed the importance of staying informed and proactive amid rapid developments in artificial intelligence, digital currency and overall digital transitions.

“Unlike basic industries with settled technologies, the financial sector is rapidly evolving with innovations in fintech, AI and crypto. To provide necessary approvals and guidance, the SEC must stay informed and adaptable.”

SEC pledges innovation and growth

In response, the Chairman of the SEC board, Mairiga Katuka, assured the minister that the board would leverage its collective expertise, innovation and passion to drive growth.

@ Newshounds News™

Read more: CoinTelegraph

~~~~~~~~~

RIPPLE's APPEAL TO CENTRAL BANKS: SPEED, SECURITY, AND DIGITAL INNOVATION

—Ripple’s appeal to central banks lies in its promise of speed, security, and digital innovation, challenging traditional banking methods with blockchain technology for instant global transfers.

—Ripple positions itself as a key player in CBDC solutions, offering infrastructure for governments to deploy their digital currencies.

For many decades, the global central banks have maintained unchallenged control of the global economy by following traditional banking methods. However, with blockchain seeing rising adoption, players like Ripple have come to the forefront offering instant settlement solutions for global transfers.

Last year, Ripple unveiled its own CBDC platform that serves as a one-stop solution allowing governments to deploy their CBDCs providing all the necessary infrastructure for deploying and maintaining the currencies.

Central banks are considering Ripple for its speed, security, and modern appeal. Traditional transfer methods, once slow and cumbersome, can now be transformed into swift, secure blockchain transactions. Moreover, Ripple enables transaction settlements in fractions of a second instead of days, with cryptographic security ensuring maximum protection. This innovation has even the most conservative bankers excited about the possibilities Ripple brings to the table.

By adopting Ripple solutions, central banks have the opportunity to transition into new-age technological platforms instead of being perceived as outdated institutions. This could bring a fundamental change in the way we conduct global transactions more efficiently and securely.

The adoption of CBDCs on Ripple’s platform has the potential to revolutionize the financial industry. Central banks now stand at a crossroads, with the opportunity to lead the digital transformation of finance.

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

HEDRA HASHGRAPH LEADS BLOCKCHAIN INNOVATION WITH NEW SCALABILITY BREAKTHROUGH

—The Hedera Foundation has launched two pilot Request for Proposals (RFPs) aimed at addressing specific ecosystem needs, inviting global developers to apply for grants.

—The initiative aims to enhance transparency and collaboration, providing up to 10 million HBAR in support, to accelerate the growth and development of the Hedera ecosystem.

On Thursday, July 11, the HBAR Foundation announced its pilot Request for Proposal (RFP) to deliver a more transparent and community-supported element to grant giving. Hedera stated that they are piloting two separate RFPs for building solutions thereby meeting specific ecosystem needs. Besides, this development comes as Hedera has been leading in crypto development activity, per the CNF update.

The Hedera Foundation is launching two pilot RFPs aimed at addressing specific needs within the ecosystem. they have also invited developers from across the globe to apply for these grants, with the selection process incorporating open and public community input.

The goal of this pilot is to gather insights from the initial RFPs to enhance and formalize the foundation’s grant program. This would ultimately accelerate the growth and development of the Hedera ecosystem.

We’re excited to announce the launch of our pilot Request For Proposal (RFP) process to to deliver a more transparent, #Hedera community-supported element to grant giving 🤝 pic.twitter.com/VNnatTK5GY

— HBAR Foundation (@HBAR_foundation) July 11, 2024

Hedera Targets Lending Markets With RFP Pilots

The pilot initiative will include two distinct RFPs designed to meet specific requirements:

Credit Market Development: This grant will follow the structure of a standard THF development grant, with funding allocated based on the completion of well-defined development milestones.

Credit Market Liquidity: This grant will be modeled after a network utilization incentive pool. The incentive pool will be evergreen and may be replenished based on ecosystem needs.

The Foundation is initially committing up to 10 million HBAR in support, available to eligible teams. Given the evergreen nature of the pool, project teams can apply multiple times depending on their liquidity needs. Each proposal must align with specific growth objectives, and applicants are required to outline milestones and goal KPIs. The Hedera Foundation also mentioned some of the benefits of conducting the pilot which include:

Increased Transparency and Clarity: By clearly outlining funding intentions, the Hedera Foundation (THF) can provide more timely updates to the community about key priorities. This approach offers further clarity to teams who may not qualify for a grant, not due to inadequacy but because their proposals might not align with the network’s most pressing needs.

Enhanced Ecosystem Collaboration and Diversification of Ideas: By inviting broader participation, THF aims to foster greater collaboration between itself, applicants, and the community, all working together to find better solutions. Additionally, creating more opportunities for builders to share their visions, ideas, and educational insights directly with the community before launching products or platforms will add significant value throughout the development cycle.

Moreover, the Hedera blockchain has been part of some key projects. As reported by Crypto News Flash, Sweden’s central bank tested its retail banking solutions on the Hedera network. Additionally, consulting giant Deloitte also joined hands with Hedera to build next-generation blockchain solutions, per the CNF update.

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

DWS MOVES TOWARD FIRST GERMAN-REGULATED EURO STABLECOIN

German asset management company DWS has launched a new company in a step towards creating the first German-regulated cryptocurrency.

Deutsche Bank-owned DWS announced the launch of the company as part of their wider plan to go live with the new euro stablecoin next year, marking a significant step for the European financial sector considering DWS manages assets worth €941 billion.

The cryptocurrency is set to be regulated by Germany’s Federal Financial Supervisory Authority (BaFin) as DWS looks to be the first company being granted a German e-money licence for a stablecoin.

The newly created company, AllUnity, is a collaboration between DWS, Flow Traders, and Galaxy Digital, working together to introduce the new stablecoin.

Stefan Hoops, CEO of DWS, commented that the stablecoin will gain interest from a broad range of clients, including digital asset investors and industrial applications.

“In the short term, we expect demand from investors in digital assets, but by the medium term we expect wider demand, for instance from industrial companies working with ‘internet of things’ continuous payments,” Hoops stated.

@ Newshounds News™

Read more: Currency Insider

~~~~~~~~~

JAPAN'S CURRENCY HAS STEADILY LOST VALUE AGAINST THE USD OVER THE LAST 12 MONTHS

Japan likely conducted a $22 billion intervention yesterday to support its currency.

Japan spent a record $62 billion in May to prop up the yen.

@ Newshounds News™

Read more: Twitter

~~~~~~~~~

Ripple’s Appeal to Central Banks: Speed, Security, and Digital Innovation

"Ripple positions itself as a key player in CBDC solutions, offering infrastructure for governments to deploy their digital currencies.

For many decades, the global central banks have maintained unchallenged control of the global economy by following traditional banking methods. However, with blockchain seeing rising adoption, players like Ripple have come to the forefront offering instant settlement solutions for global transfers."

"Last year, Ripple unveiled its own CBDC platform that serves as a one-stop solution allowing governments to deploy their CBDCs providing all the necessary infrastructure for deploying and maintaining the currencies."

@ Newshounds News™

Read more: Crypto News Flash

~~~~~~~~~

CENTRAL BANKS ARE BUYING GOLD TO PREPARE FOR A NEW GOLD STANDARD

"Record buying of gold by central banks, which are matching their gold reserves relative to GDP with other countries, revived the debate about the possibility of a reboot of the current monetary system based on a new gold standard."

"Global central banks have been buying record amounts of gold since the beginning of 2022. The pace and regularity with which central banks accumulate gold is unprecedented, as they have been mostly sellers of the precious metal throughout history. This extraordinary demand for gold by central banks, the largest in 55 years, is attributed to a desire to diversify their reserves and reduce dependence on the dollar."

"But beyond the intrinsic capacity of physical gold to maintain its value in the face of economic uncertainty, some indicators suggest that this accumulation of gold by central banks is just the prelude to a restart of the international monetary system and a possible return to the gold standard."

"The bad monetary policies that caused the housing bubble and the way fiat currencies have been managed since the 2008 crisis, depreciating the dollar and exporting US domestic problems to the rest of the world, along with economic sanctions on countries not aligned with Western geopolitical and economic interests, have undermined the credibility of the international monetary system. An alternative based on a new, multipolar, more stable and less inflationary gold standard seems closer than ever, and global central banks want to be included."

@ Newshounds News™

Read more: 11onze

~~~~~~~~~

JPMorgan Chase, Wells Fargo Suffer $3,500,000,000 in Losses As US Banks Report Massive Surge in Bad Debt

Two of the largest banks in the US are declaring a loss on a staggering $3.5 billion in debts that customers can’t pay back.

JPMorgan Chase says its net charge-offs, which are delinquent debts that banks do not expect to receive, hit $2.2 billion in the second quarter of the year.

That’s a $200 million increase from the previous quarter and an $800 million increase from Q2 of 2023.

Meanwhile, Wells Fargo says its net charge-offs surged from $764 billion in Q2 of 2023 to $1.3 billion last quarter – a 70% increase.

Although the pace of inflation has reduced, Wells Fargo’s chief financial officer Michael Santomassimo tells the New York Times that many customers are clearly struggling as their credit card balances rise and savings dwindle.

“[Inflation is] still cumulatively having a bit impact. The folks on the lower end of the wealth or income spectrum are struggling more than folks that are on the higher end.”

In addition to its charge-offs, JPMorgan declared an additional $500 million in losses from failing mortgage investments.

US banks have been sounding the alarm on its customers’ growing credit card balances and issues in the commercial real estate industry since last year.

In its new report, Wells Fargo says it earned a Q2 profit of $4.9 billion, although the bank’s shares tumbled 6% on Friday after net interest income fell short of estimates.

JPMorgan Chase reported a quarterly profit of $13.1 billion as its stock hovers near its all-time high.

@ Newshounds News™

Read more: DailyHodl

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

News, Rumors and Opinions Saturday AM 7-13-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 13 July 2024

Compiled Sat. 13 July 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumor/Opinions)

Thurs. 11 July Bruce: Tier4b would get our notifications either Sat, Sun or Monday 15 July to make appointments before or by Tues. 16 July. Another source said everything would start Sat. night and culminate on Sunday 14 July.

Fri. 12 July 2024 Wolverine: “The Thurs. 11 July 2024 (allegedly) meeting in Reno released the Global Currency Reset.”

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 13 July 2024

Compiled Sat. 13 July 2024 12:01 am EST by Judy Byington

Global Currency Reset: (Rumor/Opinions)

Thurs. 11 July Bruce: Tier4b would get our notifications either Sat, Sun or Monday 15 July to make appointments before or by Tues. 16 July. Another source said everything would start Sat. night and culminate on Sunday 14 July.

Fri. 12 July 2024 Wolverine: “The Thurs. 11 July 2024 (allegedly) meeting in Reno released the Global Currency Reset.”

Yesterday Thurs. 11 July 2024 we had a wonderful talk with Princess Elizabeth Rodriguez Ruiz. She is the real deal, as I have seen the private documentation that is confidential, showing all the proof needed as to her true identity. She has sent me all the proof of her bloodline to the Marcos family which is part of the Chinese Elders/Dynasty.

Yesterday Thurs. 11 July 2024 there was a 3-hour meeting in Reno. It was successful. I have been told they were approved to release the funds.

Suddenly, a few hours later, I got information that payments were being released and Reno was paying, from several sources.

THE SOVEREIGN Committee and the FEDERAL government OF the United States of America just “approved” T4A and B PAYMENTS and this has started in RENO NEVADA, MIAMI, FL AND OTHER EAST COAST STATES.

Today Fri. 12 July 2024 at noon on the EAST coast payments have been made to groups of small holders.

RENO is working on Tier 4 payments from half a day. They are releasing funds from the 1% to even out the bond trade balance.

About two hours ago, I received a call from a huge whale, saying he received his notification. I asked if he was sure, and he let me look at it, and it came from his platform to have ready his CIS papers, his passport to go for his appointment, so he can be blessed.

Notifications are coming out for bondholders.

Most of you are currency holders and I have not received any news. However, if bondholders are getting paid, then Tier 4b is right around the corner.

I received an audio from a high source a good friend, he said, “They are paying Wolvie! Reno has started!”

Medbeds are just about ready. They are waiting for the green light to get healed.

A lot of people are going to Area 51. These are the RV people, just RV people, I do not know if they are driving or flying there, or how.

For Colombia they have to Bogota to the military base. I am sure they will have it all arranged for all of us to go to the proper location.

I have a friend in a private contact getting paid, he is getting billions and billions, and will use this to help millions of people, and help his family for many years to come, but the rest goes to humanity.

I just got word that Pentecostal group is about to go!

Do not get fixed on dates, you will see it on the notifications like thief in the night. For the bonds, it just happened, so it will just happen. All this Intel that just came in, it just happened, and I did not expect things to roll so quickly with Intel, audio and phone calls.

We are on the cusp of this now. I will be going overseas soon, so I will not be on any calls. I may be gone for two or more days. It is all happening. God Bless all of you, take care guys. Wolverine.

NOTE: Wolverine asked Elizabeth if Reno is now open and are people getting paid. I am hearing this from a lot of Intel providers. She agrees.

~~~~~~~~~~~~

Fri. 12 July 2024 NESARA GESARA Reformations:

NESARA / GESARA is the most groundbreaking reformations to sweep the world in the entire history of the world.

All foreigners will be required to return home in order for them to receive their GESARA Payments.

NESARA does the following:

Zero’s out all Credit Card, Mortgage and other bank and loan transaction debts.

Abolishes the Internal Revenue Service and the Income Tax.

IRS employees will be transferred to the US Treasury National Sales Tax area.

The Federal Reserve will be absorbed into the US Treasury.

Creates a 14% – 17% National Sales Tax, applied to NEW ITEMS only for government revenue. Some of it goes to states, rest to new national government.

Used items sold will not be taxed. Food & Medicines will not be taxed.

Sets up Restitution Payments for those victimized by Chattel Property Bonds. Those Aged 61 and over will receive a lump sum payment. Those Aged 41 to 60 will receive scheduled payments set time and sign work contract. Those Aged 29-40 will have to sign a Work Contract to receive their funds. Initiates a Universal Basic Income or UBI for those 16-29 years old.

An increase for retired Senior Citizens up to 3x current SSN amount up to $5,000.00

Creates a new US Treasury Rainbow Currency that is Asset Backed.

Forbids the sale of American Birth Certificates as chattel property bonds.

Initiates a new US Treasury Banking System in alignment with Constitutional Law.

Restores Personal Financial Privacy.

Ceases All Military Activities Worldwide.

Establishes World Peace.

Releases enormous sums of money to be used for Humanitarian Purposes.

Enables the release of over 6,000 patents of suppressed technologies including free energy devices, anti-gravity and medical bed technologies.

Read full post here: https://dinarchronicles.com/2024/07/13/restored-republic-via-a-gcr-update-as-of-july-13-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Bruce [via WiserNow] ... email...came out to the redemption center leaders...describing the fact that...we'd be notified either Saturday, Sunday or Monday......I'm excited about this weekend.

Henig Tweet from From the Director of the Accessions Division of the WTO: #Iraq's Working Party will be formally resumed on 18 July after 16yrs. Had a productive prep meeting w/Baghdad's team in advance of their arrival in GVA. Glad to see their readiness & excitement for this historic meeting. Grateful for the dedication & hard work of the Iraqi team.

************

LIVE! ECONOMIC MELTDOWN WILL CONTINUE TO PUSH THE STOCK MARKET HIGHER.

Greg Mannarino: 7-12-2024

It's Time To Bail On The System | John Rubino

John Rubino discusses the latest rally in gold and silver. Hope of Fed easing along with political chaos appear to be pushing metals higher.

Massive debt issues are so entrenched in the U.S. financial system that regardless of the outcome of the U.S. presidential election, financial catastrophe is inevitable, he says.

And he argues that it's imperative to get out of the financial system and hold hard assets.

INTERVIEW TIMELINE:

0:00 Intro

1:28 Gold & silver update

9:12 Housing market

13:51 Political chaos

More News, Rumors and Opinions Friday PM 7-12-2024

TNT:

Trade confirms the imminent opening of 3 central markets in Baghdad

The Ministry of Trade confirmed, today, Friday, that the General Company for Central Markets has prepared a well-thought-out plan to resume its activity, noting the imminent opening of 3 markets in Baghdad as part of a comprehensive plan to open 19 sites.

Director General of the Central Markets Company, Zahra Al-Kilani, told the Iraqi News Agency (INA): "The plan includes concluding partnership contracts and contracts to open marketing outlets with private sector companies specialized in this field, as the focus was on Baghdad Governorate, and there are marketing outlets that will have priority in opening to reach the final stages." Al-Kilani added that "the central market of Al-Amel neighborhood, Al-Salihiya market, and also Al-Shaab market will be opened very soon, and there will also be some markets with some commercial character, including Al-Rashid Central Market, Al-Khalani Building."

TNT:

Trade confirms the imminent opening of 3 central markets in Baghdad

The Ministry of Trade confirmed, today, Friday, that the General Company for Central Markets has prepared a well-thought-out plan to resume its activity, noting the imminent opening of 3 markets in Baghdad as part of a comprehensive plan to open 19 sites.

Director General of the Central Markets Company, Zahra Al-Kilani, told the Iraqi News Agency (INA): "The plan includes concluding partnership contracts and contracts to open marketing outlets with private sector companies specialized in this field, as the focus was on Baghdad Governorate, and there are marketing outlets that will have priority in opening to reach the final stages."

Al-Kilani added that "the central market of Al-Amel neighborhood, Al-Salihiya market, and also Al-Shaab market will be opened very soon, and there will also be some markets with some commercial character, including Al-Rashid Central Market, Al-Khalani Building."

She stressed that "the company has begun concluding contracts in Nineveh, Kirkuk, Kut and Basra, and the rest of the other markets will witness campaigns to rehabilitate them again," noting that "the General Company for Central Markets owns 19 central markets throughout Iraq, in addition to other sites, warehouses, complexes and shares that it owns with other companies of the ministry." link

************

Tishwash: Saudi Arabia is Iraq's new commercial destination.. Economist predicts the future

Economic experts expected, on Thursday, the growth of trade between Iraq and Saudi Arabia in the coming period, while stressing the importance of developing trade exchange between the two countries, as Saudi Arabia has one of the strongest economies in the Middle East.

Ghazi Faisal, director of the Iraqi Center for Strategic Studies, said in a statement followed by Mawazine News, "Saudi Arabia represents one of the giant regional economies, as its annual GDP is approaching one trillion dollars, and during the past decades it has invested in the field of minerals in addition to gas and oil, as it is the first producer of oil in the world, and it is also an important investor in agriculture and industry, and it previously offered Iraq to invest in agriculture in the south of the country, but pressures from forces opposing openness to Saudi Arabia have disrupted the project."

Faisal added, "Today there is an important openness to Saudi Arabia, as an agreement was signed since the time of former Prime Minister Haider al-Abadi, and the Iraqi-Saudi Economic Council was formed, which holds joint meetings, and Iraq opened up to Saudi investors in various fields."

Faisal pointed out that "Saudi Arabia is a major player in international economic relations and an important member of the G20 group of economic powers in the world, so it is important for Iraq to open up to the Kingdom and benefit from its capabilities."

In comparison with neighboring countries, the director of the Iraqi Center for Strategic Studies explained that "Turkey's products differ in nature, due to the abundance of water and land. It is an important agricultural and industrial country, and trade exchange with Turkey will remain indispensable."

As for Iran, according to Fassal, it is "an important country commercially, but it is shackled by economic sanctions, as it suffers from restrictions on the movement of currency for trade with Iran, which causes the existence of a parallel market in Iraq and black transfers and other issues that burden the Iraqi economy with major problems."

It is known that Iraqi markets depend on Turkey and Iran to meet their needs for goods, as the volume of trade exchange between Iraq and Turkey reached $20 billion according to Turkish President Recep Tayyip Erdogan, while Iran intends to reach this number by 2027. link

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The moment the value goes up where is the Iraqi dinar, where is that exchange rate going internationally? ...Forex. It's going to the community that is starving for this currency...In doing so the value will go up in what's called a float.

Militia Man The Central Bank...is probably telling people [exchange companies], if you don't do this [play by the rules] you're going to have a big problem...Those 1200 entities that were talking about going on strike got a reality check. Because could you imagine holding massive amounts of US dollars when you could be holding dinar and they change the value of the currency to show their purchasing power when they drop the three zeros? It's going to bring value. It's not a lop like a lot of people keep thinking...It doesn't bring any value. A lop is like a reverse split...It's silly.

************

U R G E N T BREAKING NEWS Iraq's Secret Transactions in Chinese Yuan

Edu Matrix: 7-12-2024

THE US DOLLAR DOWNFALL WILL RAPIDLY WORSEN FROM HERE... IMPORTANT UPDATES.

Greg Mannarino: 7-12-2024

Seeds of Wisdom RV and Economics Updates Friday Afternoon 7-12-24

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

"CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

"Federal legislation is urgently needed to create a pathway for a regulatory framework that will protect American investors and possibly the financial system from future risk.”

"Dr. Roger Marshall, the Republican Senator from Kansas, brought up the turf war between the SEC and the CFTC over who gets to regulate digital assets, and asked Behnam, “Wouldn’t it be simpler if we put this whole thing under the CFTC's jurisdiction?”

@ Newshounds News™

Read more: Kitco

~~~~~~~~~

PUTIN SAYS THAT BRICS WILL LIKELY CREATE THEIR OWN PARLIAMENT while speaking at the 10th BRICS Parliamentary Forum

"Russia’s President Vladimir Putin, speaking Thursday at the tenth BRICS Parliamentary Forum in St. Petersburg, indicated his openness to the creation of a BRICS Parliament. "

"Present were guests from 18 countries, including non-BRICS CIS States. This is the first such forum since the UAE, Iran, Egypt, and Ethiopia joined the group in January."

“BRICS does not yet have its own parliamentary institution, however, I believe that the idea will definitely be implemented in the future,” Putin said.

@ Newshounds News™

Read more: The American Conservative

~~~~~~~~~

OIL PRICES RISE AGAINST THE BACKDROPOF DECLINING INVENTORIES

Oil prices rose today, Thursday, against the backdrop of a decline in gasoline stocks and a decline in crude stocks after American refineries intensified processing operations, reflecting strong demand.

Brent crude futures rose 35 cents, or 0.4 %, to $85.43 per barrel.

US West Texas Intermediate crude rose 36 cents, or 0.5 %, to reach $82.47 a barrel.

Source: National Iraqi News Agency

@ Newshounds News™

Read: Iraq News Gazette

~~~~~~~~~

JP MORGAN EXPECTS BITCOIN AND THE CRYPTO MARKET TO REBOUND IN AUGUST

"Investment banking giant JPMorgan recently said that Bitcoin and the greater cryptocurrency market will see a massive rebound take place in August. Indeed, the bank also noted that ongoing liquidations taking place in the market are expected to last through the end of July."

“The reduction in the estimated net flow largely driven by the decline in Bitcoin reserves across exchanges over the past month,” JPMorgan’s Nikolaos Panigirtzoglous said. The bank said that the $12 billion mark was highly doubtful. This is likely due to BTC price relative to the production cost and price of assets like gold."

@ Newshounds News™

Read more: Watcher Guru

~~~~~~~~~

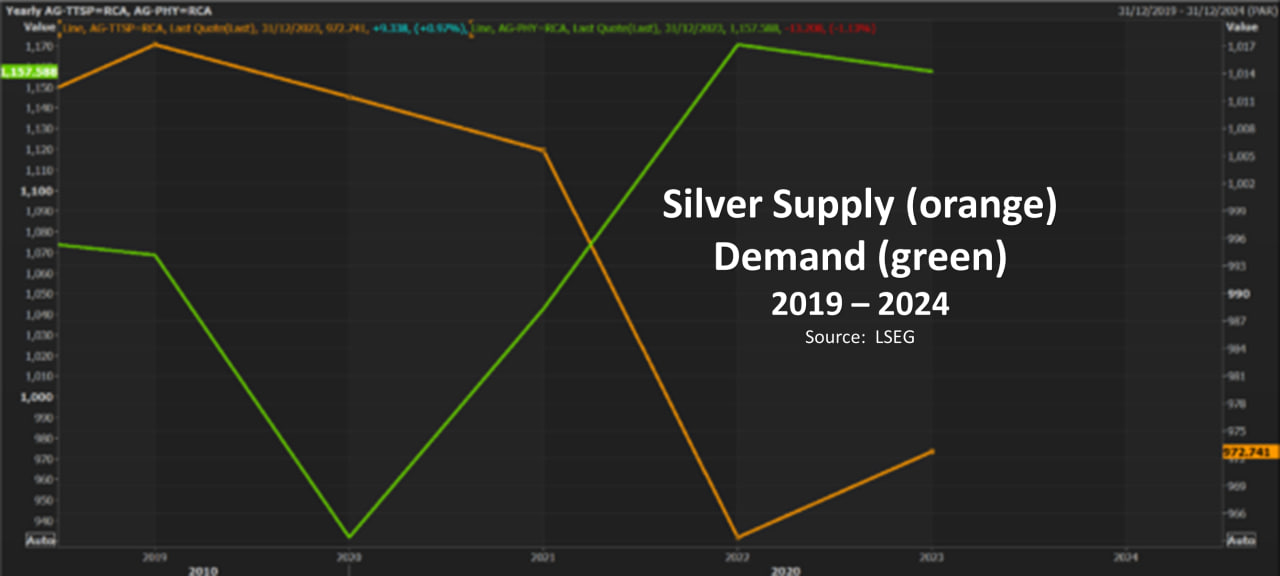

SILVER PRICE OUTLOOK: Will Strong Demand and Tight Supply Keep Prices Shining?

—Silver prices have risen due to a supply and demand gap, with demand outstripping supply for the fifth consecutive year.

—Industrial demand, driven by green energy, AI, and EVs, now accounts for 64% of global silver demand.

—A potential slowdown in China’s economy and prolonged high interest rates could dampen silver prices.

—Bullish Pennant pattern breakout hints at further upside. Will inflation data halt the move?

Silver prices have seen a remarkable rise this year, and with six months still to go, many are wondering just how high they could climb. One key factor to watch is the supply and demand dynamics, as demand for silver continues to outstrip supply.

According to the World Silver Survey, 2024 is the fifth year in a row with a silver shortage. In 2023, silver demand was higher than supply, leading to a market deficit of over 142 million ounces. By the end of 2024, this shortfall is expected to nearly double to 265 million ounces because of increasing industrial demand.

PIC

Silver Supply (Orange Line) and Demand (Green Line), 2019-2024

Historically, half of the demand for silver was for industrial use and the other half for investment. Recently, industrial demand has grown significantly, now making up 64% of global silver demand, up 19% from last year.

This trend shows no signs of slowing. The primary drivers of the silver supply squeeze are the Green Energy Transition, particularly solar energy, and the high demand from the Artificial Intelligence and electric vehicle (EV) sectors. These industries are among the fastest-growing in the world today.

The only worry has been a recent dip in demand from China and the possibility of a slowdown in the Chinese economy. This could help balance the demand and supply gap. Prolonged higher interest rates from Central Banks could also dampen silver prices and possibly stop the rally. The sooner the US Federal Reserve cuts rates, the better it would be for silver prices.

@ Newshounds News™

Read more: Action Forex

~~~~~~~~~

SATOSHI'S VISION STILL ALIVE. BITCOIN IS SHIFTING TOWARDS MORE P2P PAYMENTS

On-chain data suggests Satoshi’s original vision is alive and kicking as the Bitcoin network has shifted towards smaller transactions.

Bitcoin P2P Payment Transfers Have Been Gaining Steam Recently

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about a pattern shift on the BTC network regarding transactions that may be classified as peer-to-peer (P2P) payments.

First, Ju has discussed the trend in the transaction fees on the Bitcoin network. The “transaction fees” here naturally refer to the fees that senders on the blockchain have to attach with their moves as compensation for the validators.

@ Newshounds News™

Read more: Bitcoinist

~~~~~~~~~

THIS ARTICLE IS A PERFECT EXAMPLE OF HOW 3 LETTER AGENCIES CAN LEGISLATE BY MAKING "RULES" THEN PROCEED TO "ENFORCE" THOSE RULES WITHOUT THEM EVER BECOMING LAW OR SOMETIMES SLIPPING THROUGH A REVIEW PROCESS BY LAWMAKERS

GAO Concludes SEC's SAB 121 Is Subject to Congressional Review Act

"The SEC’s staff accounting bulletin 121 says that when an entity has an obligation to safeguard crypto for its users, that entity ought to reflect a liability on its balance sheet to reflect its obligation to safeguard that crypto at the fair value of the crypto. SAB 121 also says that the entity should, in turn, recognize a corresponding asset on its balance sheet measured at the fair value of the crypto."

"SEC Chair Gensler has said he is “actually quite proud” of SAB 121."

So, bottom line, if a something is a “rule” for purposes of the CRA, Congress has to be given a chance to review and reject that rule under fast-track procedures.

The GAO Says SAB 121 Is a Rule

"In August 2022, Senator Cynthia Lummis asked the Government Accountability Office to determine whether SAB 121 is a “rule” for purposes of the Congressional Review Act.1"

"Today the GAO released an opinion concluding (over the objections of the SEC) that, yes, SAB 121 is a “rule” for Congressional Review Act purposes."

"SEC did not submit a CRA report to Congress or to the Comptroller General in regard to the Bulletin. In its response to us, SEC maintained that the Bulletin is not subject to CRA because it does not meet the APA definition of a rule as it is not an “agency statement” of “future effect.” Response Letter, at 2–4. For the reasons explained below, we disagree. We find that the Bulletin does meet the definition of a rule under APA and that no exception applies. Thus, the Bulletin is subject to CRA’s submission requirement."

"It is true that the fact that SAB 121 is a “rule” for Congressional Review Act purposes will, for a window of time,2 make this easier. As noted above, a resolution of disapproval brought under the Congressional Review Act cannot be filibustered, so Senator Lummis or another pro-crypto Senator could force a vote on it if they so choose. But legislatively overturning SAB 121 would still require a majority vote in the Senate and in the House, and then the President signing the resolution into law. That seems unlikely here, for obvious reasons."

THIS PARAGRAPH ABOVE IS WHAT TOOK PLACE YESTERDAY (7/11/24) WITH THE HOUSE TAKING A VOTE TO OVERTURN BIDEN'S VETO UNSUCCESSFULLY

"The bigger question though is, regardless of when SAB 121 becomes “effective,” what exactly does that mean? And, equally, what does it mean for SAB 121 to have been ineffective from the time it was issued until the time (presumably in the near future) that the SEC submits SAB 121 to Congress?"

"Here again, I am not sure. The SEC’s position, according to today’s GAO opinion, is that SAB 121 “at most” indicates “how the Office of the Chief Accountant and the Division of Corporation Finance would recommend that the agency act.” So, taking the SEC at face value, SAB 121 should not, on its own, and whether “effective” or otherwise, have been the basis for any action by the Commission."

THE ARTICLE REFERENCED WAS WRITTEN IN OCTOBER OF 2023. THIS SHOWS HOW LONG THE DEBATE OVER SAB 121 HAS BEEN GOING ON. FOR FURTHER CLARITY PLEASE READ THE FULL ATTACHED BLOG ARTICLE.

@ Newshounds News™

Read more: BankRegBlog

~~~~~~~~~

BRICS DEVELOPING A PAYMENT SYSTEM USING BLOCKCHAIN

"In March, we learned that BRICS is actively developing a payment system utilizing the blockchain. Many countries are starting to link payment systems.

Russia and China have almost stopped using the dollar in their mutual trade."

'Trade between Russia and China surged by 26% to $240 billion in 2023, with over 90% of settlements conducted in their national currencies.

This is very significant as the blueprint has arrived.

China's trade with other BRICS members rose 11.3% year-on-year in the first quarter, underscoring the growing ties within the group."

"The result?

More and more countries are shifting to localize trade to become less dependent on the dollar.

They are starting to put their foot down.

This week, a Russian IMF rep said BRICS could offer an alternative currency in the event of the dollar's and the international monetary system's collapse."

"Gold reigns supreme on this reset's chessboard, serving as the most strategic piece in this intricate puzzle."

@ Newshounds News™

Read more: Twitter - Gold Telegraph

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Friday 7-12-2024

HOW to NOT Lose Everything (The Shocking Truth)

Taylor Kenny: 7-11-2024

Imagine waking up to find your savings and assets are suddenly worthless due to a currency reset.

A terrifying reality for millions worldwide.

Taylor Kenney investigates hyperinflation and national debts that can lead to such resets, devastating your personal finances.

With US record breaking debt and persistent inflation, the threat is closer than you think. Act now to ensure your financial security before it’s too late.

HOW to NOT Lose Everything (The Shocking Truth)

Taylor Kenny: 7-11-2024

Imagine waking up to find your savings and assets are suddenly worthless due to a currency reset.

A terrifying reality for millions worldwide.

Taylor Kenney investigates hyperinflation and national debts that can lead to such resets, devastating your personal finances.

With US record breaking debt and persistent inflation, the threat is closer than you think. Act now to ensure your financial security before it’s too late.

CHAPTERS:

00:00 Looming Reset

01:09 Venezuela's Currency Reset

02:30 Argentina's Currency Reset

04:34 Are My Assets Diversified?

06:02 Money vs. Currency

07:48 True Diversification

Customers Panic As $100 Million In Deposits Just Disappeared From Bank Accounts

Atlantis Report: 7-11-2024

In a time when most people use digital transactions and online banking, a recent financial disaster has caused a lot of trouble for banks. Millions are missing from customers' accounts, leaving depositors very worried about their money.

This unusual event has shown that there are problems with financial technology, fintech, and industry and has made people very concerned about the safety of the banking system.

The disappearance of so much money has made people scared that the whole system is about to fail, and trust in banks is diminishing.

*SILVER ALERT! Silver POPS on CPI News as the Silver Riggers are LOSING CONTROL!!

(Bix Weir) 7-12-2024

There is an all out battle in the silver price suppression scheme! On one side is a Cabal of Western Bankers & Monetary Masters that have suppressed the price of silver for the part 175 years.

On the other side is the Industrial Demand for Physical Silver that is INSATIABLE and shows NO SIGN of weakening in the foreseeable future!

The outcome of this Epic Battle will CHANGE THE WORLD!

“Tidbits From TNT” Friday Morning 7-12-2024

TNT:

Tishwash: The Central Bank explains the reasons for the rise in dollar prices

Today, Wednesday, a member of the Board of Directors of the Central Bank of Iraq, Ahmed Barihi, explained the reasons for the rise in dollar exchange rates in the local market.

Berihi said in a statement to the Maalouma Agency, “The issue of the rise in the exchange rate of the dollar against the Iraqi dinar in the local market is not related to the measures taken by the bank, but rather due to the American restrictions imposed on the Central Bank and related to the electronic platform.”

He added, "Another reason related to the rise in the exchange rate of the dollar is the connection to the electronic platform that controls the floating of the currency in the market where it is less than the demand. Therefore, the price of the dollar will be raised and the platform is controlled by the US Federal Reserve, which will cause a difference from the official price."

TNT:

Tishwash: The Central Bank explains the reasons for the rise in dollar prices

Today, Wednesday, a member of the Board of Directors of the Central Bank of Iraq, Ahmed Barihi, explained the reasons for the rise in dollar exchange rates in the local market.

Berihi said in a statement to the Maalouma Agency, “The issue of the rise in the exchange rate of the dollar against the Iraqi dinar in the local market is not related to the measures taken by the bank, but rather due to the American restrictions imposed on the Central Bank and related to the electronic platform.”

He added, "Another reason related to the rise in the exchange rate of the dollar is the connection to the electronic platform that controls the floating of the currency in the market where it is less than the demand. Therefore, the price of the dollar will be raised and the platform is controlled by the US Federal Reserve, which will cause a difference from the official price."

During the past few days, the exchange rates of the dollar against the dinar recorded a noticeable increase in the stock market and banking shops in the capital, Baghdad, and the provinces.

During the current period, America has worked to destroy the Iraqi currency by imposing sanctions on private banks, and banning the dollar under many pretexts, which in one way or another led to a severe financial crisis in the local markets. link

****************

Tishwash: Foreign Minister discusses with Washington the issue of frozen Iranian funds in Iraq

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein held an important meeting with the US Under Secretary of State for Political and Administrative Affairs, John Bass, in Washington, DC, during which the issue of frozen Iranian funds in Iraq was discussed.

According to a statement by the Ministry of Foreign Affairs, Fuad Hussein stressed "the importance of strengthening US-Iraqi relations in various fields," noting "the common desire to expand political and economic cooperation between the two countries."

The Minister addressed the issue of frozen Iranian funds in Iraq, stressing the need to find a quick and fair solution that serves the interests of both parties and enhances financial stability in the region.

In the context of enhancing economic cooperation and bilateral relations, special emphasis was placed on enhancing economic cooperation between the United States and Iraq. Minister Hussein pointed out the importance of supporting the financial and banking sector in Iraq, with an emphasis on the challenges related to the use of the dollar in financial transactions.

He stressed the "need to find solutions that enhance the stability of the Iraqi economy and contribute to achieving sustainable growth." link

************

Tishwash: Financial Supervision announces the preparation of a draft of the updated unified accounting system

The Financial Supervision Bureau announced, on Thursday, that it has taken measures to develop and improve the accounting and auditing professions in Iraq. While it referred to the issuance of the internal control guide binding on all government agencies, it confirmed the preparation of a draft of the updated unified accounting system in accordance with international standards.

The Deputy Chairman of the Financial Supervision Bureau, Qaisar Al-Saadi, said in a statement reported by the official news agency, and seen by "Al-Eqtisad News", that "the Federal Financial Supervision Bureau seeks to achieve its objectives specified by its founding law, including developing the accounting and auditing professions in Iraq."

He explained that "one of the most prominent steps taken by the Bureau is issuing reports evaluating the internal control systems in ministries, entities not affiliated with a ministry, and governorates," indicating that "the aim of this is to raise the level of performance of these formations, enhance efforts to combat financial and administrative corruption, improve institutional performance, and work on the principle of preventive control to reduce this phenomenon."

He pointed out that "the Bureau issued the Internal Control Guide, which was circulated to all government agencies for mandatory adoption starting from 7/1/2024," noting that "this guide aims to help these agencies accomplish their work in a way that ensures tight control and oversight over financial transactions and the preservation of public money."

He added, "The Court has completed preparing a draft of the updated unified accounting system in accordance with international standards. This draft has been circulated to government agencies, unions and universities for the purpose of expressing their opinions and making appropriate amendments in preparation for its actual implementation in the near future."

He added: "The Bureau also contributed to holding the first session of the Audit and Accounting Standards Board in the Republic of Iraq for the year 2024 after an interruption of more than four years, during which the audit and accounting issues were discussed and appropriate decisions were taken regarding them, which contributes to developing the work of the profession in Iraq."

He pointed out that "these steps come within the framework of the Bureau's commitment to developing and improving the accounting and auditing professions in Iraq in line with international standards and contributing to enhancing integrity and transparency in government institutions."

He added, "The Bureau relies in its work on the international standards issued by the International Organization of Supreme Audit Institutions (INTOSAI). The Bureau is also a prominent member of the organization and has many contributions, including participation as a member of (5) working groups, attendance at seminars between INTOSAI and the United Nations, and cooperation with the INTOSAI Development Initiative in its various programs, in addition to the Bureau assuming the chairmanship of the Strategic Planning Committee in the organization."

Al-Saadi explained that “the Court cooperates with international and local organizations and similar oversight bodies such as the Dutch Court of Audit in the field of performance evaluation and peer review, the Court of Auditors in Morocco in the field of judicial oversight, and the Polish Oversight Body in the field of risk-based auditing, as well as the German Cooperation Agency (GIZ), the Korea International Cooperation Agency (Koica), the Japan International Cooperation Agency (Jika), and the Indian Technical and Economic Cooperation Program (ITEC).”

He pointed out to the "multiple activities with oversight bodies in Arab and Islamic countries such as the General Auditing Bureau in the Kingdom of Saudi Arabia, the Audit Bureau in the State of Qatar, the Turkish Court of Accounts, the Supreme Audit Court in the Islamic Republic of Iran, the Accounting Council in the Algerian Republic, and many others," noting that "these standards and evidence contribute, along with international cooperation, to enhancing the effectiveness and efficiency of the Bureau in carrying out its oversight work in a way that ensures transparency and integrity in government institutions."

He stressed the "commitment of the Federal Audit Bureau to enhance transparency and integrity in all state institutions by working in accordance with international standards and effective cooperation with regulatory bodies and international organizations," stressing "continuing efforts to develop the accounting and auditing professions and providing technical and accounting support to ensure optimal performance and preservation of public funds, in addition to giving great importance to supporting the role of youth in building the future by enhancing their capabilities to be real partners in combating corruption and evaluating government performance in order to achieve the desired goals link

*************

Mot .. Not Saying - I Could Use Da RV – Buuttttttt

Mot: . Gunna beeeee un of Thos Daze!!!!

News, Rumors and Opinions Friday AM 7-12-2024

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Rv Excerpts from the Restored Republic via a GCR: Update as of 12 July 2024

Compiled 12 July 2024 12:01 am EST by Judy Byington

Judy Note: What we think we know as of Fri. 12 July 2024:

Now on Wed. 10 July 2024 Fox News discussed the NESARA Law – indicating that the nation had broken away from the Federal Reserve System by way of a Global Currency Reset to gold/asset-backed currencies of 209 Sovereign nations. That act closed the Federal Reserve and IRS, while the US changed over to a sales tax on new items only – and the Deep State Cabal no longer had control of US Taxpayer monies.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

Rv Excerpts from the Restored Republic via a GCR: Update as of 12 July 2024

Compiled 12 July 2024 12:01 am EST by Judy Byington

Judy Note: What we think we know as of Fri. 12 July 2024:

Now on Wed. 10 July 2024 Fox News discussed the NESARA Law – indicating that the nation had broken away from the Federal Reserve System by way of a Global Currency Reset to gold/asset-backed currencies of 209 Sovereign nations. That act closed the Federal Reserve and IRS, while the US changed over to a sales tax on new items only – and the Deep State Cabal no longer had control of US Taxpayer monies.

~~~~~~~~~~~~~

Global Currency Reset: (Opinions/Rumors)

Thurs. 11 July 2024 Bruce, The Big Call The Big Call Universe (ibize.com) 667-770-1866, pin123456#, 667-770-1865

An Email went out to Redemption Center Leaders and was received at 5 pm today Thurs. 11 July 2024. That email said that Tier4b would get our notifications either Sat, Sun or Monday to make appointments before or by Tues. 16 July.

There was a meeting in Reno today Thurs. 11 July where they decided when to pay out the Bond Holders, private groups and platform traders.

Another source said everything would start Sat. night and culminate on Sunday 14 July.

There was another meeting in Reno on Fri. 12 July and Tier4b could be notified to get their appointments any time after, but likely on either Sat, Sun or Monday 15 July.

There was a solid rate on the Dong.

You would be far better off to use the toll free number to get an appointment at the Redemption Center to do your exchange. They offer far higher rates than the banks. There was no reason to do exchanges at a bank.

The Redemption Centers would offer the Contract rate on the Dinar that is way higher than we expected.

~~~~~~~~~~~

Thurs. 11 July 2024 Wolverine:

We are just about to start any time or any day now to pull the trigger for the green light so get ready. This is what we have been waiting for, for a very long time. The powers above are saying any time now for the Green Light.

This means the opera, Carpathia’s beautiful words, the video and trumpets of freedom will be posted. This will be quite an emotional moment for all you guys, especially when the notifications come through.

Some bond holder platform leaders have received notifications, and this includes the NDA they needed to sign and other things they need to do to get paid. There are bond holders that must go to a redemption center to cash in.

So this is it. There is no more than I can say. We are waiting.

The private contractors are getting paid. Pretorious is about to go. Very soon, maybe today or tomorrow. I am quite excited for that to happen.

I will be traveling soon, but I must go. You will not hear from me for a while.

I have a special guest today. I want you to listen to what she has to say. She is part of the Chinese Elders. Her name is Elizabeth Rodriquez Ruiz.

Ms. Rodriguez: First of all, my time here is morning, so good morning to all the Chosen Ones. It is my honor to be one of your speakers with Mr. Wolverine and thank you for this opportunity. Wolverine saw my YouTube interview and there are lots of things happening right now.

My Name is Elizabeth Rodriquez Ruiz. I was born in the Philippines, and I immigrated to the USA Guam in 1975, so it has been 45 years now of being a resident, but I still hold a Philippine passport. I was here in the Philippines since June 2019 before the lockdown, kind of like house arrest, as I could not get out because I did not have the vaccine and was isolated.

As I told Wolverine, I am the only legitimate Heir of the Rodriguez Trust. This Trust will fund all the projects in all the countries of the world. It all starts in July of 2024, this year. This is the time of year that will explode with redemption.

How does it work, start, when how and who. I told Wolverine when I was back in the USA in Las Vegas, NV that my sources told me it would always start in Reno.

Everyone will get toll free numbers to tell you where to go and what type of facility location you will go to.

The minute you start your paperwork you must sign your non-disclosure.

The money is now 1% mobilized and the rest of the 99% will be received later from the center in the Philippines.

When the time comes, they will have an inauguration in the Philippines. There will be a huge change in the country. It will be a royal monarchy.

After the inauguration the facilitation of account holders, including people from bankers and holders of all documents accounts and assets, will be entitled to get 10% of their share.

Being heir to the Rodriguez Trust, I am the sole executor and all accounts will be done by sole executor as I am the only redeemer to execute this.

This month of July of 2024 is the platinum Jubilee. All is in place still waiting for greenlight. We are looking at any time this week, or next week, but July will have the most incredible global explosion. Anytime soon now it will happen, it all must be willed from God, we cannot control it. If you are not part of the physical and spiritual it will not work.

WOLVERINE: I received an audio from a paymaster, not sure which one. The paymaster said to be patient as the green light is about to go. This came in an audio. That is good news.

MS. RODRIGUEZ: We wait for the green light. I wish I could go now to the bank to trigger the light, to redeem, but when you look at this globally, there is a time that it is meant to happen. But the war came with Russia, then things were delayed – the time has to be properly prepared.

Anytime soon – it can happen, tomorrow or tonight, remember we must never lose our hope and to have faith. All this is for only the Chosen Ones, as you were chosen for this.

~~~~~~~~~~~~

Thurs. 11 July 2024 Goldilocks: The Central Bank of Iraq is now testing their new Iraqi Dinar Rate on the Forex.

Wed. 10 July 2024 Jennifer Fallaw-Doering: “The bonds have been funded. Notifications are expected within a week. Exchange locations are preparing for the rush. I saw a man sitting at a desk watching a computer screen. I felt that they are making sure the program for notifications is safe and working correctly. People walking by around behind him. Someone asked in chat about the 100t Zim. I heard “3” and “ 7 zeros”. So expected rate still stands. Carry on.”

Thurs. 11 July 2024 MarkZ: “I’m hearing the same thing from all of my contacts – that everything is done and they are just waiting for the green light to go. That’s all of my contacts: Banks, Group and Bond leaders, Iraqi contacts, Military contacts – everything is done. They are waiting for the go. …The Prosperity Packages have already started paying out.”

Wed. 10 July 2024 Frank26 Call: Hawaii Airlines and certain hotels were now accepting the IQD. HCL is accomplished and is international.

Wed. 10 July 2024: Executive Order 1110 gave the US the ability to create its own money backed by silver. On June 4, 1963, a little known attempt was made to strip the Federal Reserve Bank of its power to loan money to the government at interest. On that day President John F. Kennedy signed Executive Order No. 11110 that returned to the U.S. government the power to issue currency, without going through the Federal Reserve. Mr. Kennedy’s order gave the Treasury the power “to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury.” DISCLOSED: President John F. Kennedy, The Fed and Executive Order 11110 – American Media Group (amg-news.com)

Thurs. 11 July 2024: The Currency Revolution: Nesara Gesara Law, ISO 20022 Wealth Transfer, QFS, GCR/RV, Gold-backed Currencies and Blockchain Exposed – The Untold Story! – American Media Group (amg-news.com)

Read full post here: https://dinarchronicles.com/2024/07/12/restored-republic-via-a-gcr-update-as-of-july-12-2024/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Nader From The Mid East What's going on in Iraq is really really good. Last month you see me talking about this month, about July. I said from now to July 8th you'll get some good news and that's exactly what happened. You see every proof of possibility to revalue or reinstate. I think it's reinstatement more than revaluation.

RayRen98 SOURCES ARE SAYING "ATTEMPTS" AT THE RATE CHANGE HAVE BEEN MADE EVERY DAY THIS WEEK SO FAR...TECHNICAL ISSUES ARE BEING BLAMED...TIME WILL TELL...

Walkingstick All the sales of oil are now in Iraqi dinars and no longer in American dollars...The National Oil Company of Iraq will now receive the Iraqi dinars, through them, into the banks of Iraq for the GOI to use. No foreign currency. Nobody stealing foreign currency or their currency. Security and stability is because of the control Sudani has.

**************

Foreigners Massively Dumping USD & Rushing To Gold | Alasdair Macleod

Liberty and Finance: 7-11-2024

Although many noticed the rising gold price over the past quarter, most do not realize that is a side-effect of savvy foreign holders of US dollars and bonds dumping the dollar, and not seeing a safe haven in Euros, Yen, or real estate, rushing into to gold as a safe haven asset.

They see the value of the US dollar is going down the drain. Regardless of the outcome of the election, the US national debt crisis is going to get worse, says Alasdair Macleod.

With foreigners massively dumping US dollars and US Treasuries, gold and silver "are the only protection you should consider," he says.

INTERVIEW TIMELINE:

0:00 Intro

1:25 Gold market

29:30 US dollar & BRICS

35:30 Banking system

3 Real Assets Primed For Growth In The Coming Inflation Bonanza

3 Real Assets Primed For Growth In The Coming Inflation Bonanza

Notes From The Field By James Hickman/Simon Black 7-11-24

After today’s inflation report showing ‘only’ 3% inflation, the Federal Reserve is all but guaranteed to start slashing interest rates.

The Fed Chairman essentially promised as much to Congress earlier this week, and has warned that if they don’t start cutting interest rates soon, “we could undermine the [economic] recovery.”

These guys still don’t get it. At this point it’s not even about 3% inflation (which is still too high) or 2% inflation. It’s about prices going back down to pre-pandemic levels… or just lower in general.

But that’s just never going to happen. The Fed doesn’t care about price reductions; they’re happy with a slower rate of price increases… which is totally out of touch with what people want and need.

3 Real Assets Primed For Growth In The Coming Inflation Bonanza

Notes From The Field By James Hickman/Simon Black 7-11-24

After today’s inflation report showing ‘only’ 3% inflation, the Federal Reserve is all but guaranteed to start slashing interest rates.

The Fed Chairman essentially promised as much to Congress earlier this week, and has warned that if they don’t start cutting interest rates soon, “we could undermine the [economic] recovery.”

These guys still don’t get it. At this point it’s not even about 3% inflation (which is still too high) or 2% inflation. It’s about prices going back down to pre-pandemic levels… or just lower in general.

But that’s just never going to happen. The Fed doesn’t care about price reductions; they’re happy with a slower rate of price increases… which is totally out of touch with what people want and need.

They’ve been itching to cut rates for months… almost desperate. And in large part that’s because they’re terrified about the US government’s insolvency.

The national debt is about to pass $35 trillion. And high interest rates mean that the annual interest bill this year will exceed the US military budget-- more than $800 billion-- for the first time in nearly 250 years of American history.

The Fed knows that they have to slash interest rates as quickly as possible. With ultra-low rates (like 1.5%), the interest bill on a $35 trillion national debt is manageable… as long as the federal government can rein in spending and stop the debt from growing further.

Of course there are two key problems with this thinking:

First, there is zero evidence that the government will rein in spending. If anything, they seem primed to spend even more. I’ve mentioned several times before that even the US government’s own budget forecasts project more than $22 trillion in additional debt over the next decade.

Second, slashing interest rates will most likely result in significant inflation-- just like we saw in 2021-2022.

We’ve written before how real assets are a safe haven from inflation, and I wanted to briefly discuss three real assets that look especially promising.

The first is physical gold and silver, which serve as a store of value-- especially during inflationary times.

Higher inflation will likely trigger a surge in demand, making the price of precious metals not only keep up with inflation, but exceed it.

But there is another reason why gold will do especially well the worse inflation gets.

The worse inflation becomes, and the worse the US national debt becomes, the more likely the US dollar will lose its spot as the dominant reserve currency. And central banks all over the world-- India, Poland, Singapore, etc. have been feverishly buying up physical gold over the past few years, most likely to prepare for that potential change.

So if inflation picks up, it’s a good bet that central banks will keep buying up gold-- and driving prices higher.

Gold mining stocks should also do extremely well in that scenario due to their exposure to gold prices.

What’s interesting right now, though, is that despite gold being near an all-time high, share prices of many gold mining companies are incredibly cheap.

That’s because central banks-- which have driven gold prices to record highs-- only buy physical gold bullion. They do not buy gold stocks.

However, while the price of gold has already increased substantially, the stock prices of many great gold miners has not.

This is because most of the current demand for gold is coming from central banks. And central banks only buy physical gold— not gold mining stocks.

This means that gold stocks are currently a bargain-- with a LOT of upside potential.

Last, US natural gas is another compelling real asset primed for huge growth.

Right now, natural gas prices in the US are dramatically lower than they are in Europe… and it’s easy to understand why: the US has some of the biggest natural gas reserves in the world, while Europe has almost nothing by comparison. (This is why Europe is so reliant on Russian gas).

And since Joe Biden has banned new LNG (liquefied natural gas) export terminals from the US, it’s difficult to move that US natural gas to Europe.

This is why prices in the US are less than $3, versus more than $10 in Europe. If US producers were free to export, prices in the US would rise, prices in Europe would fall, and the global natural gas prices would be more or less the same, similar to oil.

In terms of energy equivalence to oil, $3 per million BTU natural gas is the equivalent of paying around $15 - $20 for a barrel of oil. That’s cheap. And it means US natural gas is the most underpriced conventional energy commodity in the world.