Seeds of Wisdom RV and Economics Updates Friday Afternoon 7-12-24

Good Afternoon Dinar Recaps,

CFTC CHAIRMAN TOLD AN ILLINOIS COURT THAT BITCOIN AND ETHEREUM ARE DIGITAL COMMODITIES

"CFTC Chair Rustin Behnam says 70-80% of cryptos are not securities."

"(Kitco News) – The battle over digital asset regulation appears to be heating up as Commodity Futures Trading Commission (CFTC) Chair Rustin Behnam told an Illinois court that Bitcoin (BTC) and Ethereum (ETH) are digital commodities under the Commodity Exchange Act and that 70-80% of tokens in the cryptocurrency market are not securities. "

"Behnam made the comments while testifying before the U.S. Senate Committee on Agriculture, Nutrition and Forestry’s hearing on the oversight of digital commodities."

"Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee. Congress must act quickly in order for regulators, like the CFTC, to provide basic customer protections that are core to U.S. financial markets.”

"Federal legislation is urgently needed to create a pathway for a regulatory framework that will protect American investors and possibly the financial system from future risk.”

"Dr. Roger Marshall, the Republican Senator from Kansas, brought up the turf war between the SEC and the CFTC over who gets to regulate digital assets, and asked Behnam, “Wouldn’t it be simpler if we put this whole thing under the CFTC's jurisdiction?”

@ Newshounds News™

Read more: Kitco

~~~~~~~~~

PUTIN SAYS THAT BRICS WILL LIKELY CREATE THEIR OWN PARLIAMENT while speaking at the 10th BRICS Parliamentary Forum

"Russia’s President Vladimir Putin, speaking Thursday at the tenth BRICS Parliamentary Forum in St. Petersburg, indicated his openness to the creation of a BRICS Parliament. "

"Present were guests from 18 countries, including non-BRICS CIS States. This is the first such forum since the UAE, Iran, Egypt, and Ethiopia joined the group in January."

“BRICS does not yet have its own parliamentary institution, however, I believe that the idea will definitely be implemented in the future,” Putin said.

@ Newshounds News™

Read more: The American Conservative

~~~~~~~~~

OIL PRICES RISE AGAINST THE BACKDROPOF DECLINING INVENTORIES

Oil prices rose today, Thursday, against the backdrop of a decline in gasoline stocks and a decline in crude stocks after American refineries intensified processing operations, reflecting strong demand.

Brent crude futures rose 35 cents, or 0.4 %, to $85.43 per barrel.

US West Texas Intermediate crude rose 36 cents, or 0.5 %, to reach $82.47 a barrel.

Source: National Iraqi News Agency

@ Newshounds News™

Read: Iraq News Gazette

~~~~~~~~~

JP MORGAN EXPECTS BITCOIN AND THE CRYPTO MARKET TO REBOUND IN AUGUST

"Investment banking giant JPMorgan recently said that Bitcoin and the greater cryptocurrency market will see a massive rebound take place in August. Indeed, the bank also noted that ongoing liquidations taking place in the market are expected to last through the end of July."

“The reduction in the estimated net flow largely driven by the decline in Bitcoin reserves across exchanges over the past month,” JPMorgan’s Nikolaos Panigirtzoglous said. The bank said that the $12 billion mark was highly doubtful. This is likely due to BTC price relative to the production cost and price of assets like gold."

@ Newshounds News™

Read more: Watcher Guru

~~~~~~~~~

SILVER PRICE OUTLOOK: Will Strong Demand and Tight Supply Keep Prices Shining?

—Silver prices have risen due to a supply and demand gap, with demand outstripping supply for the fifth consecutive year.

—Industrial demand, driven by green energy, AI, and EVs, now accounts for 64% of global silver demand.

—A potential slowdown in China’s economy and prolonged high interest rates could dampen silver prices.

—Bullish Pennant pattern breakout hints at further upside. Will inflation data halt the move?

Silver prices have seen a remarkable rise this year, and with six months still to go, many are wondering just how high they could climb. One key factor to watch is the supply and demand dynamics, as demand for silver continues to outstrip supply.

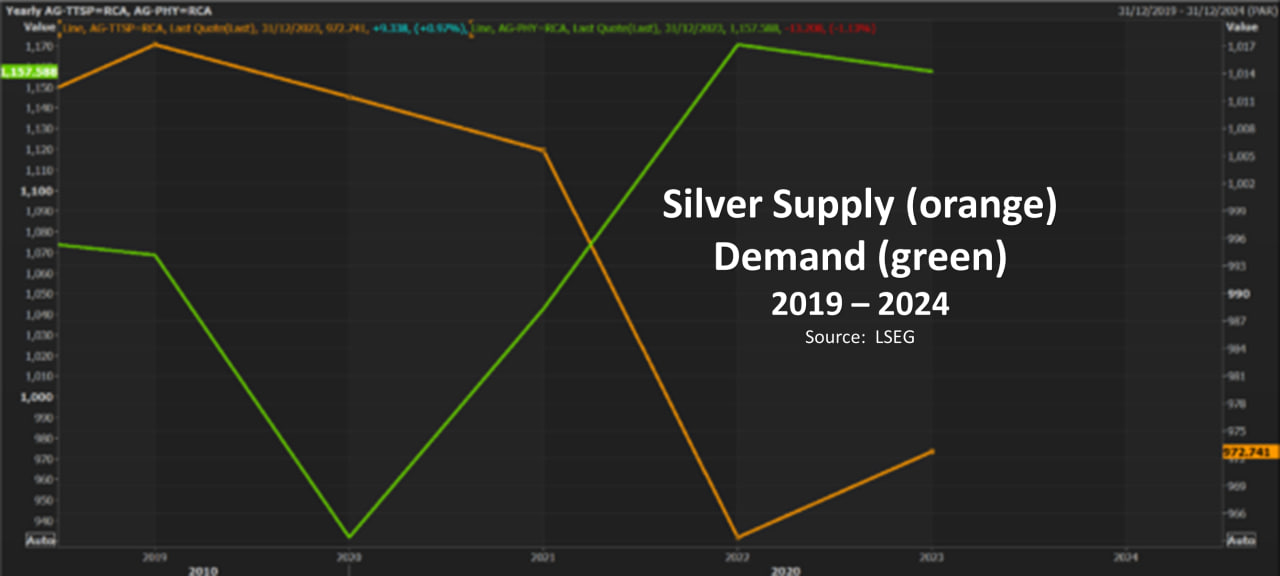

According to the World Silver Survey, 2024 is the fifth year in a row with a silver shortage. In 2023, silver demand was higher than supply, leading to a market deficit of over 142 million ounces. By the end of 2024, this shortfall is expected to nearly double to 265 million ounces because of increasing industrial demand.

PIC

Silver Supply (Orange Line) and Demand (Green Line), 2019-2024

Historically, half of the demand for silver was for industrial use and the other half for investment. Recently, industrial demand has grown significantly, now making up 64% of global silver demand, up 19% from last year.

This trend shows no signs of slowing. The primary drivers of the silver supply squeeze are the Green Energy Transition, particularly solar energy, and the high demand from the Artificial Intelligence and electric vehicle (EV) sectors. These industries are among the fastest-growing in the world today.

The only worry has been a recent dip in demand from China and the possibility of a slowdown in the Chinese economy. This could help balance the demand and supply gap. Prolonged higher interest rates from Central Banks could also dampen silver prices and possibly stop the rally. The sooner the US Federal Reserve cuts rates, the better it would be for silver prices.

@ Newshounds News™

Read more: Action Forex

~~~~~~~~~

SATOSHI'S VISION STILL ALIVE. BITCOIN IS SHIFTING TOWARDS MORE P2P PAYMENTS

On-chain data suggests Satoshi’s original vision is alive and kicking as the Bitcoin network has shifted towards smaller transactions.

Bitcoin P2P Payment Transfers Have Been Gaining Steam Recently

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about a pattern shift on the BTC network regarding transactions that may be classified as peer-to-peer (P2P) payments.

First, Ju has discussed the trend in the transaction fees on the Bitcoin network. The “transaction fees” here naturally refer to the fees that senders on the blockchain have to attach with their moves as compensation for the validators.

@ Newshounds News™

Read more: Bitcoinist

~~~~~~~~~

THIS ARTICLE IS A PERFECT EXAMPLE OF HOW 3 LETTER AGENCIES CAN LEGISLATE BY MAKING "RULES" THEN PROCEED TO "ENFORCE" THOSE RULES WITHOUT THEM EVER BECOMING LAW OR SOMETIMES SLIPPING THROUGH A REVIEW PROCESS BY LAWMAKERS

GAO Concludes SEC's SAB 121 Is Subject to Congressional Review Act

"The SEC’s staff accounting bulletin 121 says that when an entity has an obligation to safeguard crypto for its users, that entity ought to reflect a liability on its balance sheet to reflect its obligation to safeguard that crypto at the fair value of the crypto. SAB 121 also says that the entity should, in turn, recognize a corresponding asset on its balance sheet measured at the fair value of the crypto."

"SEC Chair Gensler has said he is “actually quite proud” of SAB 121."

So, bottom line, if a something is a “rule” for purposes of the CRA, Congress has to be given a chance to review and reject that rule under fast-track procedures.

The GAO Says SAB 121 Is a Rule

"In August 2022, Senator Cynthia Lummis asked the Government Accountability Office to determine whether SAB 121 is a “rule” for purposes of the Congressional Review Act.1"

"Today the GAO released an opinion concluding (over the objections of the SEC) that, yes, SAB 121 is a “rule” for Congressional Review Act purposes."

"SEC did not submit a CRA report to Congress or to the Comptroller General in regard to the Bulletin. In its response to us, SEC maintained that the Bulletin is not subject to CRA because it does not meet the APA definition of a rule as it is not an “agency statement” of “future effect.” Response Letter, at 2–4. For the reasons explained below, we disagree. We find that the Bulletin does meet the definition of a rule under APA and that no exception applies. Thus, the Bulletin is subject to CRA’s submission requirement."

"It is true that the fact that SAB 121 is a “rule” for Congressional Review Act purposes will, for a window of time,2 make this easier. As noted above, a resolution of disapproval brought under the Congressional Review Act cannot be filibustered, so Senator Lummis or another pro-crypto Senator could force a vote on it if they so choose. But legislatively overturning SAB 121 would still require a majority vote in the Senate and in the House, and then the President signing the resolution into law. That seems unlikely here, for obvious reasons."

THIS PARAGRAPH ABOVE IS WHAT TOOK PLACE YESTERDAY (7/11/24) WITH THE HOUSE TAKING A VOTE TO OVERTURN BIDEN'S VETO UNSUCCESSFULLY

"The bigger question though is, regardless of when SAB 121 becomes “effective,” what exactly does that mean? And, equally, what does it mean for SAB 121 to have been ineffective from the time it was issued until the time (presumably in the near future) that the SEC submits SAB 121 to Congress?"

"Here again, I am not sure. The SEC’s position, according to today’s GAO opinion, is that SAB 121 “at most” indicates “how the Office of the Chief Accountant and the Division of Corporation Finance would recommend that the agency act.” So, taking the SEC at face value, SAB 121 should not, on its own, and whether “effective” or otherwise, have been the basis for any action by the Commission."

THE ARTICLE REFERENCED WAS WRITTEN IN OCTOBER OF 2023. THIS SHOWS HOW LONG THE DEBATE OVER SAB 121 HAS BEEN GOING ON. FOR FURTHER CLARITY PLEASE READ THE FULL ATTACHED BLOG ARTICLE.

@ Newshounds News™

Read more: BankRegBlog

~~~~~~~~~

BRICS DEVELOPING A PAYMENT SYSTEM USING BLOCKCHAIN

"In March, we learned that BRICS is actively developing a payment system utilizing the blockchain. Many countries are starting to link payment systems.

Russia and China have almost stopped using the dollar in their mutual trade."

'Trade between Russia and China surged by 26% to $240 billion in 2023, with over 90% of settlements conducted in their national currencies.

This is very significant as the blueprint has arrived.

China's trade with other BRICS members rose 11.3% year-on-year in the first quarter, underscoring the growing ties within the group."

"The result?

More and more countries are shifting to localize trade to become less dependent on the dollar.

They are starting to put their foot down.

This week, a Russian IMF rep said BRICS could offer an alternative currency in the event of the dollar's and the international monetary system's collapse."

"Gold reigns supreme on this reset's chessboard, serving as the most strategic piece in this intricate puzzle."

@ Newshounds News™

Read more: Twitter - Gold Telegraph

~~~~~~~~~

Newshound's Daily Breakdown Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps