Seeds of Wisdom RV and Economics Updates Wednesday Morning 2-18-26

Good Morning Dinar Recaps,

Lagarde May Quit ECB Early to Let Macron Shape Successor

Potential early departure signals strategic positioning inside Europe’s monetary leadership

Good Morning Dinar Recaps,

Lagarde May Quit ECB Early to Let Macron Shape Successor

Potential early departure signals strategic positioning inside Europe’s monetary leadership

Overview

Reports indicate that Christine Lagarde, President of the European Central Bank, is considering stepping down before her term ends in October 2027.

According to the Financial Times, an early exit could allow French President Emmanuel Macron to influence the selection of her successor ahead of France’s 2027 presidential election.

While no decision has been confirmed, the timing is politically and monetarily significant for the eurozone’s financial architecture.

Key Developments

Strategic Timing During Stability

Lagarde’s potential departure comes during a period of relative equilibrium: inflation near target, interest rates at neutral levels, and growth at potential. Markets reacted calmly, with limited movement in bond yields or the euro — signaling no expectation of immediate policy disruption.

Political Influence Over Succession

The ECB president is approved by eurozone leaders, with France and Germany traditionally holding decisive influence. An early resignation would allow the current French administration to shape the appointment process before potential political shifts in 2027.

Successor Landscape Remains Fluid

While no formal shortlist exists, several senior European monetary figures are viewed as possible candidates. Lagarde’s own unexpected appointment in 2019 demonstrates that ECB leadership transitions can be strategically negotiated and politically dynamic.

Policy Continuity Likely

The ECB operates largely by consensus. A leadership change alone is unlikely to trigger abrupt monetary policy shifts, particularly while economic conditions remain stable.

This is not just leadership speculation — it’s monetary power positioning before 2027.

Why This Matters

Leadership at the ECB directly influences:

• Eurozone interest rate policy

• Sovereign bond market stability

• Euro currency valuation

• Crisis response coordination across member states

Even absent immediate policy changes, the optics of political influence over central bank succession can subtly affect long-term investor confidence.

Why This Matters to Foreign Currency Holders

For foreign currency holders and global monetary observers, ECB leadership stability impacts:

• Confidence in the euro as a reserve currency

• Cross-border capital flows into euro-denominated bonds

• Sovereign yield spreads across member states

• The euro’s comparative strength versus the U.S. dollar and emerging CBDC blocs

If markets begin to price in governance risk, currency volatility could rise — particularly at a time when alternative settlement systems and digital currencies are expanding globally.

Implications for the Global Reset

Central Bank Independence Under Spotlight

The intersection of domestic elections and supranational monetary leadership highlights the delicate balance between political influence and central bank independence.

Euro’s Strategic Role in a Multipolar Financial System

As BRICS nations advance CBDCs and alternative trade mechanisms, continuity at the ECB helps preserve euro stability within an evolving global order.

Leadership Timing as Financial Strategy

Succession decisions at major central banks increasingly carry geopolitical weight — not just economic implications.

This is not just central bank turnover — it’s strategic positioning within Europe’s monetary command structure.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy — “Lagarde May Quit ECB Early to Let Macron Shape Successor”

Reuters — “ECB’s Lagarde Reportedly Weighing Early Departure”

~~~~~~~~~~

India Expands Trade with EU and US, Reshapes BRICS Power Balance

New Delhi’s Western trade surge signals strategic recalibration inside a shifting global order

Overview

India has finalized major trade agreements with both the European Union and the United States, marking a significant shift in its global trade posture.

On February 3, 2026, President Donald Trump announced a revised U.S.–India trade arrangement lowering reciprocal tariffs on Indian goods from 50% to 18%, effective immediately. Just one week earlier, India concluded a long-negotiated free trade agreement with the EU, ending nearly two decades of talks.

Together, the deals reposition India at the center of Western trade networks — even as it holds the 2026 presidency of BRICS.

Key Developments

India–EU Trade Breakthrough

The India–EU FTA eliminates tariffs on 96.6% of EU goods entering India and provides major export advantages for Indian sectors such as gems, jewellery, textiles, and services. The agreement spans all 27 EU member states and is projected to save up to €4 billion annually in duties.

European Commission President Ursula von der Leyen described it as the “mother of all deals,” emphasizing the creation of a vast free trade zone covering roughly two billion people.

U.S.–India Tariff Reduction

Following discussions between Trump and Prime Minister Narendra Modi, the U.S. lowered its reciprocal tariff rate to 18%. However, India agreed to reduce certain tariffs and non-tariff barriers to zero and committed to purchasing over $500 billion in American energy, technology, and agricultural goods.

Critics argue the arrangement may be asymmetric, particularly regarding agricultural market access.

India’s Expanding Trade Network

Since 2014, India has signed 10 FTAs, including agreements with the UK, Oman, and New Zealand. The latest EU and U.S. deals reinforce New Delhi’s long-term strategy of trade diversification beyond traditional alignments.

Impact on BRICS Trade Dynamics

Intra-BRICS trade has grown from $84.2 billion in 2003 to $1.17 trillion in 2024, yet the bloc still accounts for only about 5% of global trade and lacks a comprehensive group-wide FTA. India’s strengthening Western ties introduce new strategic complexity into the bloc’s cohesion.

Why This Matters

India now straddles two major economic spheres:

• Western advanced economies

• Emerging multipolar BRICS markets

By deepening trade with both the EU and the U.S., India enhances export access while reinforcing its position as a swing power in global trade architecture.

This is not just new trade deals — it’s India redefining its position between East and West.

Why This Matters to Foreign Currency Holders

For currency holders and global reset observers, these agreements influence:

• Capital flows into the Indian rupee and euro markets

• Dollar demand tied to expanded U.S.–India trade

• Trade settlement volumes within BRICS versus Western corridors

• Long-term positioning of India as a bridge between blocs

If India’s trade flows increasingly align with Western economies while maintaining BRICS leadership, currency markets may adjust expectations about bloc cohesion and settlement dominance.

This is not just tariff reductions — it’s a recalibration of BRICS influence in real time.

Implications for the Global Reset

India as a Balancing Power

As 2026 BRICS chair, India must balance bloc solidarity with expanded Western integration — a delicate geopolitical calculus.

Multipolar Trade vs. Integrated Markets

The new agreements reinforce that global trade is not cleanly splitting into East and West. Instead, nations are pursuing multi-alignment strategies.

Shift in BRICS Internal Power Dynamics

Stronger Western economic ties could elevate India’s influence within BRICS while complicating efforts to establish unified trade or currency frameworks.

This is not just new trade paperwork — it’s India recalibrating its position at the crossroads of global economic power.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “India Expands Trade with EU and US, Reshapes BRICS Power Balance”

European Commission — “EU and India Conclude Free Trade Agreement”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Wednesday Morning 2-18-26

Sudanese Advisor: The Iraqi Economy Has Maintained Its Stability Despite The Challenges

Money and Business Economy News – Baghdad The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed on Wednesday that the Iraqi economy has maintained its stability despite the challenges.

Saleh said, according to the official newspaper, that "the announced figures for the Consumer Price Index, which is the official indicator of annual inflation compared to 2024, show a high stability in the standard of living and the value of monetary income for the Iraqi individual.

Sudanese Advisor: The Iraqi Economy Has Maintained Its Stability Despite The Challenges

Money and Business Economy News – Baghdad The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed on Wednesday that the Iraqi economy has maintained its stability despite the challenges.

Saleh said, according to the official newspaper, that "the announced figures for the Consumer Price Index, which is the official indicator of annual inflation compared to 2024, show a high stability in the standard of living and the value of monetary income for the Iraqi individual.

Saleh added that the inflation growth rate did not exceed a very low level, noting that the figure came below the normal fraction of acceptable annual price growth, which usually ranges between 2 and 3 percent, which gives a positive indication of the ability of the Iraqi economy to maintain price stability despite the various economic challenges.

He pointed out that “the annual inflation rate for 2025 was very slightly positive, with an average growth rate of approximately 32.0 percent, meaning that prices rose very limitedly compared to 2024, even though most of the 7 months of the year out of 12 witnessed a decrease in inflation rates.

He explained that the indications of the price index from an economic theory perspective, low inflation is a positive indicator in controlling the money supply, and that there is stability in the exchange rate, and the absence of external price shocks.

These indicators promise success for monetary and trade policies, as well as success for the policy of supporting prices in the general budget, which exceeds 13 percent of GDP. However, the fact that inflation remains below the normal level (2/3) indicates a disruption in market dynamics, especially in our country’s rentier economy. The structural reading of the figures reflects that near-zero inflation represents stable private consumption.

He noted that “the stability of investment and the tendency of families to save or hoard indicates the existence of possible quasi-deflationary tendencies, confirmed by the low inflation rates in most months of 2025, which reflects consumer caution, warning of the possibility of a slide towards deflation if the decline in growth in the general price level continues.”

He explained that “based on the above, it is necessary to move in economic policy from a policy of curbing prices to a policy of stimulating economic growth, by targeting a price growth rate of around 2.5 percent for the year 2026, through the accelerated expansion of support for small and medium enterprises, and the expansion of non-consumer credit.

Saleh added that an economy operating within an annual inflation rate that falls within the normal range of 2 percent and 3 percent for price growth will be stable, but at the same time enjoys higher dynamism in employment and real economic growth, and this is what the country’s economy requires for the years 2026/2027, i.e., a high-growth, high-employment economy and taking advantage of the opportunity to manage price stability. https://economy-news.net/content.php?id=65788

Advisor To The Prime Minister: Public Finances For 2026 Have Entered The Practical Implementation Phase.

Money and Business Economy News – Baghdad Attention is focused on revenue indicators and public spending patterns as the clearest measure of economic stability. With the continued flow of oil revenues, the issue of salaries has emerged as a top priority for a large segment of society, and assurances have been given that salaries are secured.

The Prime Minister's financial advisor, Mazhar Muhammad Salih, stated that "public finances for 2026 have entered the practical implementation phase of the provisions of the amended Federal Financial Management Law No. (6) of 2019, which mandates securing monthly resources of the highest priority to cover mandatory expenditures, primarily employee salaries, pensions, and social welfare allocations, estimated at approximately (8) trillion Iraqi dinars per month."

These obligations constitute the core of current social spending, necessitating meticulous liquidity management and strict regulation of spending priorities, especially given the application of the (1/12) rule of actual current expenditures for the previous year (2025) in the absence of a valid annual budget.https://economy-news.net/content.php?id=65760

Sudani: The Government Will Conduct An Evaluation Of The Officials Concerned In The Ministry Of Electricity According To Their Level Of Performance In The Field Of Revenue Collection.

Money and Business Economy News – Baghdad Prime Minister Mohammed Shia Al-Sudani directed on Wednesday that work capacities be increased to ensure the provision of electricity service to citizens during the holy month of Ramadan.

A statement from his office, received by "Al-Eqtisad News," said that "Al-Sudani chaired a meeting to follow up on the collection file in the electricity sector, in the presence of a number of concerned advisors and executive officials at the Ministry of Electricity."

The ministry's staff, distribution companies, and maintenance departments were directed to increase their work capacities and redouble their efforts to ensure service delivery to citizens during the holy month.

According to the statement, the Undersecretary presented a comprehensive overview of all the Ministry's procedures during the past period, based on the outcomes of previous meetings and the decisions issued from them, and emphasized the conversion of high loads (industrial, commercial) to electronic billing in full starting next March.

The directors of the distribution companies (Southern, Central, Baghdad, Northern) also submitted "detailed reports on the amount of their collection, the number of meter readers, the geographical area and the number of subscribers in all regions of the country."

The Prime Minister affirmed that "the government will conduct an evaluation of the officials concerned in the Ministry of Electricity according to their level of performance in the field of collection, stressing that this file receives special attention due to its role in reducing waste and ensuring the sustainability of providing services to citizens."

The statement noted that "the meeting witnessed a discussion of the issue of violations on the network and the measures taken regarding them, as well as a discussion of the issue of faulty meters and proposals to restore them to operation, the installation of smart meters and their types and their compatibility with the (HES) system, in addition to discussing the collection file for government departments in all governorates."

Al-Sudani directed “the continuation of implementing the decisions and plans that were agreed upon as outcomes of previous meetings and the current meeting in addressing the amount of losses and reducing expenses, and achieving the full percentage of meter readings and the amount of collection, especially for high loads, government departments and general collection.” https://economy-news.net/content.php?id=65796

Iraqi Parliament Misses Constitutional Deadline To Elect President, Awaits Federal Court Decision

Ahmed Mohammed 16/02/2026 The Iraqi Parliament is to convene on December 29, 2025, to elect the Speaker and two Deputy Speakers. Photo: Barzan Mala Amin / Channel8

The Iraqi Parliament has not been able to unify on electing the president within the constitutional timeframe.

The reason for this delay is the lack of agreement among Kurdish parties on a joint candidate, as well as disputes within the Shiite bloc over the issue of the prime minister. Now, all political factions are waiting for a binding decision from the Federal Court to determine a roadmap and set a new deadline for electing the president.

Request for Clarification from the Federal Court

Haibat al-Halbousi, Speaker of the Iraqi Parliament, has officially submitted a written request to the Federal Court, asking for clarification and a ruling regarding the expiration of the constitutional deadline. Halbousi wants the Court to specify the legal and constitutional mechanism for Parliament to follow so that the election process can move forward.

Purpose of the Speaker’s Request

Ghaith Raad Mohammed, a member of Parliament, announced that the purpose of the Speaker’s step is for the Federal Court to clearly outline the future steps to overcome this deadlock. He emphasized that the Court must issue a binding ruling that all parties must adhere to, in order to unify the process of electing the president.

Proposal to Present Multiple Kurdish Candidates

One of the proposals raised in Parliament is that if Kurdish parties fail to reach an agreement, two or more Kurdish candidates should be presented to Parliament. In that case, MPs would vote to select one of them for the presidency, thereby resolving the dispute.

Efforts to Bring Parties Closer Together

Suham Mousawi, a member of the Renewal and Development bloc, stated that there is still an opportunity for the Kurdistan Democratic Party (KDP) and the Patriotic Union of Kurdistan (PUK) to reach an agreement. Mousawi pointed out that within the framework of coordination, there are signs of rapprochement, and it is expected that this week the parties will participate in a parliamentary session to unify the process of electing the president. https://channel8.com/english/news/53081

Iraq’s SLC Defies Pressure Over Al-Maliki PM Nomination

2026-02-17 Shafaq News- Baghdad The State of Law Coalition (SLC), led by former Prime Minister Nouri Al-Maliki, is standing firmly behind its leader as Iraq’s next premier, insisting that any adjustments, whether in leadership or direction, must be decided within the Shiite Coordination Framework (CF).

In a statement, Abbas Al-Moussawi, a senior leader within the Coalition, underlined SLC’s steadfast position, describing the commitment as a reflection of shared decision-making and the effort to maintain unity within the Framework.

Earlier, a source informed Shafaq News that Al-Maliki rejects reports of a potential withdrawal from the race for Iraq’s premiership, noting that no meeting of the CF was scheduled to reassess his nomination.

The Coordination Framework, representing more than 185 of Iraq’s 329 parliamentary seats, had nominated Al-Maliki as its candidate for prime minister; he previously led two governments from 2006 to 2014.

US President Donald Trump has publicly opposed Al-Maliki’s potential return to office, asserting that Iraq would have “zero chance of success, prosperity, or freedom” under his administration and warning that Washington “will no longer help Iraq” if he is chosen.

Read more: Nouri Al-Maliki’s return rekindles Iraq’s divisions as Iran and the US pull apart

https://www.shafaq.com/en/Iraq/Iraq-s-SLC-defies-pressure-over-Al-Maliki-PM-nomination

Al-Awadi: Implementing The ASYCUDA System Is A Global Commitment To Prevent Currency Smuggling And Correct The Trade Path

Baghdad (INA) – Government spokesman Basim al-Awadi affirmed on Tuesday that the implementation of the global electronic automation system ASYCUDA represents an international commitment and a reformative step to combat money laundering. He also noted that the recent urgent government decisions regarding goods at ports were issued to facilitate procedures for traders and alleviate financial burdens.

Al-Awadi told the Iraqi News Agency (INA): “The ASYCUDA system is a global electronic automation system issued by the United Nations Conference on Trade and Development (UNCTAD), and it is currently implemented in 102 countries worldwide.” He explained that “the system is not a local innovation but rather an international commitment within Iraq’s obligations to combat currency smuggling and money laundering. Its implementation also aims to ensure fairness in commercial competition.”

Al-Awadi acknowledged "delays and confusion at the ports that coincided with the start of the system's implementation, leading to delays in the arrival of goods." He noted that "the government took immediate decisions to address this confusion, including completely eliminating the government's share of port storage fees and reducing the investment partner's fees by 50%."

He added that "Prime Minister Mohammed Shia' al-Sudani directed the facilitation of goods release and the provision of necessary support to importers to overcome the technical obstacles they faced," pointing out that "the government views the private sector as an essential part of the country's economic and financial cycle."

The government spokesperson refuted rumors linking the implementation of these regulations to a lack of state liquidity, emphasizing that they are "purely regulatory steps aimed at reform." He stressed that "the government's doors are open, in coordination with unions and federations, to address any injustices or shortcomings that may arise during the system's practical application." https://ina.iq/ar/economie/255285-.html

Zebari: No President Can Task Maliki With Forming The Government

Baghdad – One News Hoshyar Zebari, a member of the political bureau of the Kurdistan Democratic Party, dropped a bombshell regarding the nomination of Maliki for the next prime ministership.

Zebari indicated that regional circumstances and the large gatherings in the Gulf will make it difficult for any new president of the Republic of Iraq, whether from the KDP or PUK, to task Nouri al-Maliki with forming the government, given all the rejection announced by Donald Trump. He emphasized that the coordination framework raised the question with the White House twice and received the same negative answer.

He added that information coming from Washington indicates that the Americans are urging Baghdad to form a new government. https://1news-iq.net/زيباري-أي-رئيس-جمهورية-لا-يستطيع-تكليف/

“Tidbits From TNT” Wednesday Morning 2-18-2026

TNT:

Tishwash: The European Bank launches financing programs for small and medium-sized enterprises in Iraq.

The European Bank for Reconstruction and Development (EBRD) announced on Friday the launch of a package of programs aimed at supporting small and medium-sized enterprises (SMEs) in Iraq, providing specialized advisory services and financing facilities for these projects .

The bank also officially launched its first call for applications to join its flagship "Star Venture" program, inviting promising technology-based startups to participate through a competitive selection process, according to a statement received by Shafaq News Agency.

TNT:

Tishwash: The European Bank launches financing programs for small and medium-sized enterprises in Iraq.

The European Bank for Reconstruction and Development (EBRD) announced on Friday the launch of a package of programs aimed at supporting small and medium-sized enterprises (SMEs) in Iraq, providing specialized advisory services and financing facilities for these projects .

The bank also officially launched its first call for applications to join its flagship "Star Venture" program, inviting promising technology-based startups to participate through a competitive selection process, according to a statement received by Shafaq News Agency.

“This day is a milestone in our partnership with Iraq,” said Katarina Björlin Hansen, the bank’s country director for Iraq, during the launch ceremony for the bank’s programs. “We see promising potential in the Iraqi private sector, which is a key pillar for achieving sustainable growth and creating opportunities for future generations .”

She affirmed: “The bank is committed to working with our partners to foster an environment conducive to their growth and success,” noting that the bank “supports ambitious Iraqi entrepreneurs, helping them expand their businesses, employ more talent, and enhance their international competitiveness, through launching our programs to finance and develop small and medium enterprises, and launching the first local call for companies to join the program .”

The selected startups will receive specialized consulting services, international expertise, and opportunities to access networks of investors and mentors, which will support their growth and enable them to expand into regional and global markets, according to the office director .

The launch event was attended by representatives of the Iraqi government, the donor community, financial institutions, business associations, and private sector leaders, and formed a platform to promote common goals for the development of small and medium enterprises, enhance the competitiveness of Iraqi companies, and present solutions, cooperation opportunities, and financing .

The conference also provided valuable opportunities for communication, networking and introductions between small and medium enterprises and banks and development financial institutions, which contributed to strengthening cooperation with Iraqi business associations with which the bank will work to enhance trade networks and help identify and reduce obstacles to growth .

It is noted that the European Bank for Reconstruction and Development (EBRD) began its operations in Iraq in September 2025, focusing on private sector development to improve access to finance, support local entrepreneurs, and promote long-term sustainable economic growth.

The bank supports small and medium-sized enterprises (SMEs) by laying the foundations that enable them to grow, create jobs, and enhance their competitiveness. It also works through an integrated approach that combines financing, advisory support, and participation in policy formulation to build resilient institutions and sustainable local markets link

************

Tishwash: The Central Bank of Iraq clarifies the mechanisms for dealing with the dollar in all its issuances.

The Central Bank of Iraq, in a directive to licensed banks and non-bank financial institutions, stressed the importance of reducing discrimination in the exchange rate of the US dollar between old and new issues, stressing the need for all banks and financial institutions to adhere to the instructions for trading and exchanging banknotes, in accordance with the approved standards for foreign banknotes, especially the US dollar, in order to ensure the safety of monetary transactions and market stability.

The Central Bank clarified that the laws, instructions and regulations in force do not adopt any discrimination between the different editions of the US dollar currency, noting that the bank continues to receive these issues and deal with them through all authorized banks, provided that they are within the internationally and locally approved standards and regulations.

This clarification comes within the framework of the Central Bank of Iraq’s commitment to enhancing transparency and discipline in the banking sector, protecting customers, and supporting monetary and financial stability in Iraq.

Central Bank of Iraq,

Media Office,

February 16, 2026 link

************

Tishwash: The Kurds agree on a single candidate for the presidency... a significant step that could end the political chaos.

The Iraqi political scene is witnessing intense activity regarding the presidential election, amid increasing pressure to fulfill constitutional requirements in a way that strengthens political stability and ensures respect for the constitution.

This activity involves reaching preliminary understandings that would allow for the selection of a consensus candidate representing all Kurdish parties before heading to Baghdad, in a move aimed at ending the political deadlock and rearranging priorities within the federal government.

Mayada al-Najjar, a member of the Kurdistan Democratic Party, affirmed on Tuesday that the position of President of the Republic is one of the most important sovereign positions in the country due to its direct connection to protecting the constitution and ensuring adherence to its implementation, stressing that this position has become a stable political custom for the Kurds.

Al-Najjar told Al-Maalomah that “no candidate for this position can be put forward by the Patriotic Union of Kurdistan or other Kurdish forces without a comprehensive Kurdish political consensus,” noting that “a unified Kurdish position is a fundamental condition for resolving the entitlement and preventing a recurrence of previous disputes that affected the formation of the federal authorities.”

She added that “former President Barham Salih did not achieve any tangible accomplishments during his time in office,” stressing that “the next phase requires a figure with a political vision capable of strengthening the balance of power and consolidating constitutional stability.” She also noted that “the ongoing dialogues between the Kurdish forces are witnessing significant progress, amidst efforts to reach a consensus candidate who enjoys unified support before heading to Baghdad.”

In a related context, Jamal Khalil, a member of the Patriotic Union of Kurdistan, confirmed that “political consultations between his party and the Kurdistan Democratic Party are still ongoing,” noting that “significant progress has been made, resulting in an agreement in broad outlines to go to Baghdad with a single candidate for the presidency.”

Khalil explained that “both sides are seeking to accelerate the pace of meetings and bring viewpoints closer, given their awareness of the importance of unifying the Kurdish position within Baghdad to enhance the chances of national consensus in the upcoming constitutional entitlements,” indicating that “agreeing on a single candidate represents clear progress compared to previous stages that witnessed a divergence in proposals, and it will be officially announced after the completion of understandings related to balances and alliances within Parliament.”

These developments come at a time when the Iraqi public is awaiting a decisive step towards ending the political deadlock, amid expectations that the anticipated Kurdish agreement will contribute to expediting the presidential election and strengthening internal political stability, while keeping the presidential file under the scrutiny of all political forces to ensure a comprehensive national consensus. link

Mot: Do Ya Needs a ""Belly Laugh"" -- Blast frum da Past!!!! 4 old ladies

THE GOLD & SILVER MOVE THAT WILL SHOCK THE WORLD

THE GOLD & SILVER MOVE THAT WILL SHOCK THE WORLD

Gold Switzerland by Egon /vib Greyerz: 2-18-2026

We are now looking at nearly $3 quadrillion in total debt: a clear sign of the end of the monetary era.

In this discussion, Egon von Greyerz mentions why this debt can never realistically be repaid and what that means for bonds, currencies, and the financial system built on constant borrowing.

Egon also makes the case for holding physical gold, silver, and real assets outside the banking system as protection against the consequences of excessive leverage.

THE GOLD & SILVER MOVE THAT WILL SHOCK THE WORLD

Gold Switzerland by Egon /vib Greyerz: 2-18-2026

We are now looking at nearly $3 quadrillion in total debt: a clear sign of the end of the monetary era.

In this discussion, Egon von Greyerz mentions why this debt can never realistically be repaid and what that means for bonds, currencies, and the financial system built on constant borrowing.

Egon also makes the case for holding physical gold, silver, and real assets outside the banking system as protection against the consequences of excessive leverage.

Watch the full video if you want to know what to expect after the biggest debt bubble in history.

Seeds of Wisdom RV and Economics Updates Tuesday Evening 2-17-26

Good Evening Dinar Recaps,

ECB Moves to Expand Euro’s Global Role

Europe positions the euro as a stronger global liquidity alternative in a shifting monetary order

Good Evening Dinar Recaps,

ECB Moves to Expand Euro’s Global Role

Europe positions the euro as a stronger global liquidity alternative in a shifting monetary order

Overview

• The European Central Bank is working to strengthen the euro’s role in global finance, expanding access to euro liquidity facilities for foreign central banks.

• Policymakers see an opportunity to increase the euro’s influence as global uncertainty rises and reserve diversification accelerates.

• Discussions include reinforcing swap lines and liquidity backstops to make the euro more accessible in times of financial stress.

• The move comes amid broader debate about long-term dollar dominance and the emergence of a more multipolar monetary system.

Key Developments

1. Expanded Euro Liquidity Access

The ECB is increasing its engagement with foreign central banks, ensuring access to euro liquidity through standing swap and repo facilities. These tools allow non-euro area institutions to stabilize funding markets during volatility, strengthening the euro’s credibility as a reserve currency.

2. Strategic Timing Amid Global Uncertainty

The initiative comes as global economic uncertainty reaches elevated levels. In such environments, central banks reassess reserve allocations and seek diversification away from single-currency dependence.

3. Positioning the Euro as a Stability Anchor

European officials are signaling that the euro can function as a reliable liquidity provider during crises — a role historically dominated by the U.S. dollar through Federal Reserve swap lines.

4. Multipolar Monetary Architecture Emerging

By strengthening financial infrastructure rather than relying on rhetoric, the ECB is reinforcing the euro’s international standing. This reflects a broader structural trend toward shared reserve influence rather than exclusive dominance.

Why It Matters

Reserve currency status is not declared — it is built through liquidity access, institutional trust, and crisis performance. By expanding global euro liquidity channels, Europe is laying the groundwork for a more competitive reserve environment. This is infrastructure development with long-term consequences.

Reserve power is earned through liquidity — and Europe is building the pipes.

Why It Matters to Foreign Currency Holders

For readers holding foreign currencies in anticipation of Global Reset dynamics:

Expanded euro liquidity access increases the euro’s credibility as a diversified reserve asset.

A stronger euro role could gradually rebalance global reserve allocations, influencing long-term exchange rate trajectories.

As central banks diversify, volatility may increase between major currencies during transitional periods.

Foreign currency holders should understand that shifts in global liquidity backstops directly affect currency demand over time.

When liquidity shifts, currency hierarchies follow.

Implications for the Global Reset

Pillar 1: Liquidity Infrastructure Redefined

Global financial stability depends on access to crisis liquidity. By institutionalizing broader euro swap and repo frameworks, Europe is positioning itself as a co-equal provider of emergency funding — a foundational element in any multipolar reset.

Pillar 2: Reserve Diversification Acceleration

Rising geopolitical fragmentation encourages central banks to diversify reserves across currencies. The ECB’s actions make such diversification operationally feasible rather than theoretical.

The future reserve system may not replace the dollar — it may surround it.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Axios – “Euro uses Trump-shaped world order to encroach on U.S. financial power”

European Central Bank – “ECB expands euro liquidity facilities to strengthen global role”

~~~~~~~~~~

U.S. Pressure Mounts as Ukraine Enters High-Stakes Geneva Talks With Russia

Peace negotiations resume under military fire and geopolitical urgency

Overview

Ukraine and Russia have begun two days of peace talks in Geneva, with U.S. President Donald Trump urging rapid progress toward ending the war.

Russia is demanding that Ukraine surrender the remaining 20% of the Donetsk region, a core sticking point in negotiations.

Ukrainian President Volodymyr Zelenskiy acknowledged intense pressure to make concessions amid continued battlefield strain.

Talks unfold as Russia conducts heavy airstrikes, damaging infrastructure in Odesa and leaving civilians without heat and water.

Key Developments

1. Land Concessions at the Center of Dispute

The primary issue in Geneva is territorial control, particularly Russia’s demand that Ukraine relinquish the remainder of Donetsk. Moscow currently occupies roughly 20% of Ukrainian territory, including Crimea and parts of eastern regions. Kyiv has consistently resisted formalizing territorial losses, making land concessions the most sensitive negotiating fault line.

2. Military Pressure Continues During Diplomacy

Even as talks began, Russia launched heavy airstrikes across Ukraine, severely damaging power infrastructure in Odesa. The strikes underscore a pattern in which diplomacy and military escalation proceed simultaneously, increasing skepticism within Ukraine about Moscow’s intentions.

3. Broader Security Issues in Play

Ukrainian negotiator Rustem Umerov stated that security and humanitarian concerns would be addressed, aiming for a framework supporting lasting peace. However, both sides remain divided on key issues, including control of the Zaporizhzhia nuclear power plant and the potential presence of Western forces in postwar Ukraine.

4. U.S. Involvement Raises Stakes

President Trump urged Ukraine to move quickly, signaling growing U.S. impatience with prolonged conflict. American envoys have been present at parallel diplomatic efforts in Geneva, highlighting Washington’s attempt to manage simultaneous geopolitical crises involving both Ukraine and Iran.

Why It Matters

The Geneva talks represent more than a ceasefire attempt — they test whether territorial compromise, security guarantees, and Western leverage can converge into a sustainable settlement. Continued Russian airstrikes during negotiations reinforce doubts about long-term intentions and make diplomatic progress fragile.

Negotiations begin under fire — and every concession carries geopolitical weight.

Why It Matters to Foreign Currency Holders

For readers holding foreign currencies in anticipation of Global Reset dynamics:

Prolonged conflict supports continued sanctions regimes, influencing energy flows and reserve allocations.

A breakthrough agreement could ease geopolitical risk premiums, affecting safe-haven currencies and European economic stability.

Any territorial settlement reshapes reconstruction financing, sovereign debt issuance, and multilateral lending frameworks, all of which impact currency valuations.

War, sanctions, and reconstruction financing are deeply connected to global liquidity flows.

Where borders shift, capital flows follow.

Implications for the Global Reset

Pillar 1: Territorial Sovereignty and Financial Reconstruction

If territorial concessions are formalized, reconstruction financing will likely involve multilateral institutions, sovereign guarantees, and structured debt issuance. This process influences capital markets and shifts financial dependencies toward coordinated Western funding mechanisms.

Pillar 2: Sanctions as Structural Policy Tools

Sanctions have become long-term instruments shaping global trade and payments systems. Whether tightened or relaxed, they alter cross-border settlement patterns and reinforce evolving blocs within the international financial system.

This is not just politics — it’s global finance restructuring before our eyes.

Peace in Geneva could redraw more than maps — it could redirect global capital.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “US Pressure Mounts on Ukraine as It Enters Geneva Talks With Russia”

Reuters – “Ukraine, Russia begin Geneva talks as U.S. urges swift deal”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Evening 2-17-26

Al-Arabiya TV: US Deadline For Withdrawing Nominations Of Maliki And Sudani Extended

Baghdad – One News A report published by Al-Araby TV confirmed that a secret American message was sent to supporters of Nouri al-Maliki, giving them until February 16 to respond to the demand to withdraw his candidacy and end their support for him.

According to the website, the message contained threats of imposing sanctions on the Shiite forces involved in the coordination framework, and major economic sanctions on Iraq, if this did not happen.

Al-Arabiya TV: US Deadline For Withdrawing Nominations Of Maliki And Sudani Extended

Baghdad – One News A report published by Al-Araby TV confirmed that a secret American message was sent to supporters of Nouri al-Maliki, giving them until February 16 to respond to the demand to withdraw his candidacy and end their support for him.

According to the website, the message contained threats of imposing sanctions on the Shiite forces involved in the coordination framework, and major economic sanctions on Iraq, if this did not happen.

The report indicated that the sanctions target the Central Bank and the Iraqi State Oil Marketing Company (SOMO), as well as Nouri al-Maliki and any figure within the coalition proven to support him. The report added that, with the expiration of the deadline given by the administration of US President Donald Trump to the parties within the coalition, the caretaker government led by Mohammed Shia al-Sudani initiated contacts to mitigate US pressure.

Al-Sudani reportedly contacted the US side to request an extension until the end of the week to resolve the issue of al-Maliki's withdrawal from the race for the premiership of the new Iraqi government, before the United States proceeds with its potential sanctions. https://1news-iq.net/التلفزيون-العربي-مهلة-أميركية-لسحب-تر/

State Of Law: Replacing Maliki With Another Candidate For Prime Minister Is "Exclusively" In The Hands Of The Coordinating Framework.

026-02-17 02:09 Shafaq News – Baghdad On Tuesday, Abbas al-Moussawi, a leader in the State of Law Coalition, affirmed the coalition's commitment to nominating Nouri al-Maliki for the position of Prime Minister in the next Iraqi government, stressing that any change must be made through consensus within the forces of the Coordination Framework "exclusively".

These assurances from the State of Law coalition come at a time when the nomination of its leader, former Prime Minister Nouri al-Maliki, is facing increasing international pressure, as US President Donald Trump has explicitly expressed his objection to the coalition leader’s return to the premiership, threatening to halt aid to Iraq.

Although the coordination framework has shown declared cohesion in its official statements, observers point to a state of caution and hesitation in proceeding with this option to avoid an early clash with the US administration.

Al-Moussawi said in a post on the social networking site Facebook today, “Our position is firm, there is no withdrawal or retreat, because it is a position based on a firm conviction and a moral and political commitment to the framework decision,” referring to Maliki as a candidate for the position of the next federal prime minister.

He added, "We are part of this decision and not outside of it, and we believe that unity of position and respect for the agreed mechanisms are the basis of stability and steadfastness."

Al-Moussawi also pointed out that “Al-Maliki was assigned according to the same mechanism and by the will of the framework, so any change in the course or in the people can only be done through the same framework and according to its decision,” stressing that “our commitment is not formal, but rather a commitment to the institution, to the approach, to the principle of partnership in decision-making, and to preserving the unity of the framework and the decision of its largest constituent bloc.”

It is worth noting that the Coordination Framework announced at the beginning of 2026 the nomination of Maliki for the position of Prime Minister, more than two months after the sixth legislative elections in Iraq. The decision was met with rejection and discontent from some political leaders inside Iraq, most notably the leader of the Sunni “Progress” party, former Speaker of Parliament Mohammed al-Halbousi.

A few days ago, the US president returned to comment on al-Maliki's nomination, saying in press statements that he is considering the issue of appointing a new prime minister in Iraq, while indicating that he has "some options" regarding that.

State Of Law: Withdrawing Maliki's Nomination Is "Impossible," And The Leaders Of The Framework Must Show Courage.

Baghdad Today – Baghdad: Jassim Mohammed Jaafar, a leading figure in the State of Law Coalition, confirmed on Tuesday, February 17, 2026, that it is impossible to withdraw Nouri al-Maliki's nomination for the position of Prime Minister.

In a televised statement monitored by Baghdad Today, Jaafar said, "Replacing al-Maliki can only happen through a decision by the Coordination Framework, by nominating an alternative candidate, provided that 80% of the Framework's leaders agree on this measure."

Jaafar called on the Coordination Framework to "make a decisive decision regarding al-Maliki's nomination and to act with courage and without hesitation," stressing the need to avoid relying on other political blocs or external parties in this matter.

Meanwhile, Hisham al-Rikabi, the media advisor to the head of the State of Law Coalition, denied on Tuesday the reports circulating about the Coordination Framework withdrawing Nouri al-Maliki's nomination for Prime Minister.

In a post on his account on the X platform, al-Rikabi stated, "In light of the malicious media campaign promoting claims that al-Maliki's nomination has been withdrawn by the Coordination Framework and the introduction of alternative names, we affirm that these reports are baseless."

He added that "the coordinating framework is committed to its political positions," stressing that "attempts to confuse public opinion will not succeed." https://baghdadtoday.news/293480-.html

CF Awaits Court Ruling To Resolve Presidency And Premiership Dispute

2026-02-17 Shafaq News- Baghdad The Coordination Framework, the coalition of Iraq’s ruling Shiite forces, is awaiting the Federal Supreme Court’s response on constitutional deadline violations and their consequences to determine an ending scenario to resolve the dispute over the presidency and premiership, a source within the CF told Shafaq News on Tuesday.

“The closest proposal under discussion is to extend the term of the current caretaker government headed by Mohammed Shia al-Sudani for six months with limited powers,” the source added, noting that a delegation from the Reconstruction and Development bloc visited leaders of the Shiite political camp last week to discuss the causes of the political impasse and ways to overcome it.

The discussions concluded on the need to avoid consequences resulting from nominating a controversial candidate at a time of significant national challenges, “taking into account messages from Washington and its warning of potential economic sanctions targeting the State Oil Marketing Organization (SOMO) and the Central Bank of Iraq.”

Meanwhile, Abbas al-Moussawi, a senior member of the State of Law Coalition (SLC) led by Nouri Al-Maliki, reaffirmed the coalition’s commitment to nominating Al-Maliki for the post of prime minister in the next Iraqi government, stressing that any change must occur exclusively through consensus within the Coordination Framework.

Earlier, a source informed Shafaq News that Al-Maliki rejects reports of a potential withdrawal from the race for Iraq’s premiership, noting that no meeting of the CF was scheduled to reassess his nomination.

The Coordination Framework, representing more than 185 of Iraq’s 329 parliamentary seats, had nominated Al-Maliki as its candidate for prime minister; he previously led two governments from 2006 to 2014.

US President Donald Trump has publicly opposed Al-Maliki’s potential return to office, asserting that Iraq would have “zero chance of success, prosperity, or freedom” under his administration and warning that Washington “will no longer help Iraq” if he is chosen. https://www.shafaq.com/en/Iraq/CF-awaits-court-ruling-to-resolve-presidency-and-premiership-dispute

Japan Funds $280M Environmental Project In Kurdistan Region

2026-02-17 Shafaq News- Erbil The Japan International Cooperation Agency (JICA), is set to begin implementing the first phase soon at a cost of $288 million, covering the treatment and rehabilitation of sewage networks extending up to 75 kilometers, Erbil Governor Omed Xoshnaw said on Tuesday.

In a statement, Xoshnaw noted household wastewater will be reused to irrigate parks and public gardens, and the second phase, estimated at $300 million, will be launched at a later stage. He described the initiative as the largest environmental infrastructure project in Erbil, while it will reduce pollution and prevent wastewater from contaminating the Greater Zab River and groundwater.

Omed Xoshnaw otesnrdopSh338m1auhcgl8g14f2lgfa8cg709m2i6gt1ifh7fl70lah4f4c ·

The first stage of Erbil's heavy water recycling project has been implemented by (288 million dollars)

Today Tuesday 2026.2.17, Umed Khoshnaw, the governor of Erbil, in the province, welcomed a senior delegation of the Japanese Agency, with the presidency of "Taketsuru Eko" the deputy director of the famous agency in Iraq and Kurdistan Region.

At the beginning of the meeting, discussions about the "heavy water recycling project" in Erbil and solving the water problems in Erbil, which is the first phase of the ($288 million) by the Japanese Jika Agency will soon be implemented to solve the water problems, the project is one of the important and strategic projects The regional government and the largest environmental underground project in the capital of Kurdistan Region, the first stage of the project will be done (75 kilometers) and the wastewater of the homes will be cleaned again and used for parks and gardens and the water will be built in a modern way, it is the decision.

After the first phase of the project, the second phase of the project will be implemented with 300 million dollars, the benefits of the project are to reduce environmental pollution, preventing mixing water with large water and underground water, and for watering trees and trees around Erbil as a green belt.

In that case, the governor of Erbil, the works of the renowned agency appreciated and thanked the Japanese government and Jaika Agency for their support to the Kurdistan regional government offices and continued their cooperation, and highlighted that the general steps of Japanese and Jika Agency for implementing high service projects. Appreciate, they have done many projects in the field of water, water, and other services in the past.

He also said: "In the policy framework of the Kurdistan Region government, we wish that the cooperation and cooperation between Kurdistan region and Japan should improve and benefit from the ability of professionals in Japan to implement more service projects and more opportunities for Japanese companies in Kurdistan. It will be enlightened and further developed the relationship between the two sides.

The project follows the launch of a separate $479 million water infrastructure project in Erbil, which aims to transfer 480,000 cubic meters of water per day from the Greater Zab River to around 1.5 million residents.

Iraq faces its most severe water crisis in eight decades, with strategic reserves falling to their lowest levels since the 1940s. More than 70% of Iraq’s water originates outside its borders, while the Euphrates has lost over 60% of its flow in the past two decades, and the Tigris continues to shrink, increasing pressure on drinking supplies, agriculture, and electricity generation.

Read more: Drop by drop: Can Iraq avert a thirsty future?

https://www.shafaq.com/en/Kurdistan/Japan-funds-280M-environmental-project-in-Kurdistan-Region

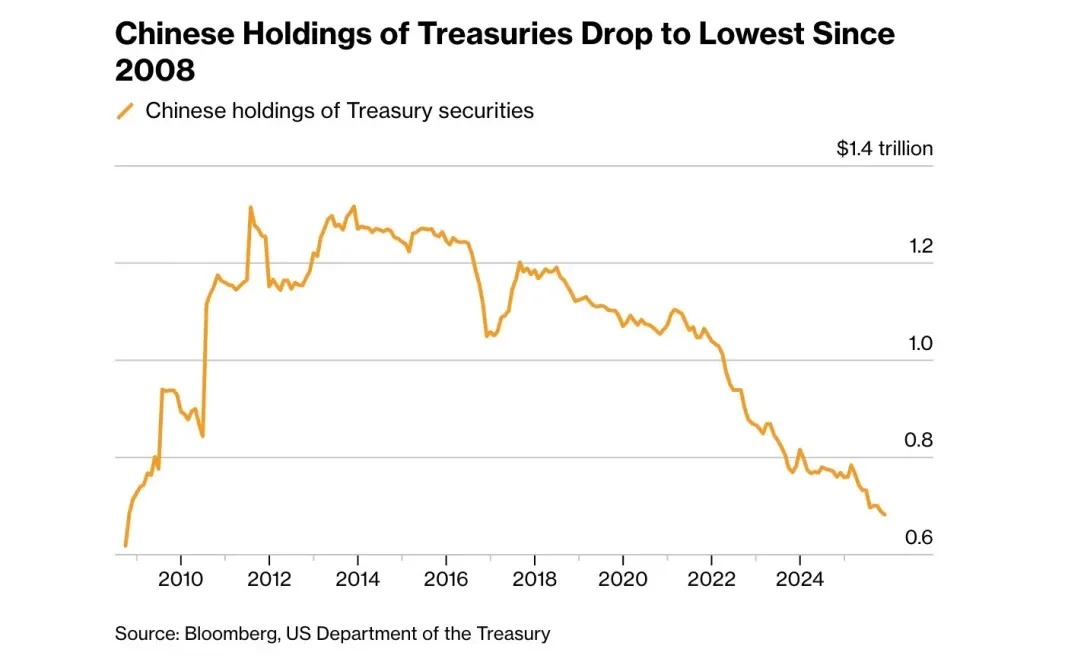

U.S. Debt Crisis Erupts as China Ramps Up Massive Selloff

U.S. Debt Crisis Erupts as China Ramps Up Massive Selloff

Taylor Kenny: 2-17-2026

If you think today’s cost of living crisis is painful, just wait until the China Treasury dump accelerates.

For years, China has been quietly cutting its U.S. Treasury holdings. But now something has changed. This is no longer a slow portfolio rebalance — it’s starting to look like a structural shift away from the dollar itself.

And with more than $9 trillion in U.S. debt set to refinance by 2026, the timing couldn’t be worse.

U.S. Debt Crisis Erupts as China Ramps Up Massive Selloff

Taylor Kenny: 2-17-2026

If you think today’s cost of living crisis is painful, just wait until the China Treasury dump accelerates.

For years, China has been quietly cutting its U.S. Treasury holdings. But now something has changed. This is no longer a slow portfolio rebalance — it’s starting to look like a structural shift away from the dollar itself.

And with more than $9 trillion in U.S. debt set to refinance by 2026, the timing couldn’t be worse.

CHAPTERS:

00:00 – China’s Treasury Dump Warning

01:12 – The Fragile U.S. Debt System

02:10 – Moody’s Downgrade & Inflation Risk

04:27 – Private Investors: The Hidden Danger

06:18 – The $9 Trillion Debt Wall

07:18 – Bank Fragility & Unrealized Losses

08:03 – Fed Money Printing Ahead

08:32 – Why Gold & Silver Are Critical Now

FRANK26….2-17-26…..REMITTANCE !!!

KTFA

Tuesday Night Video

FRANK26….2-17-26…..REMITTANCE !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie and Omar in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Tuesday Night Video

FRANK26….2-17-26…..REMITTANCE !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie and Omar in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

What Frank’s suit color’s mean…. FRANKS SUIT COLORS FOR CC'S..... WHITE = NEW INFO…. SILVER = INTEL FROZEN…. RED= HIGH ALERT… PURPLE=GUEST WITH US…. BLUE = AIR FORCE…. BLACK = GROUND/FF’S…. GREEN= MR OR FAB 4 ... GOLD = CHANGE… ORANGE=IMPLEMENTATION

Seeds of Wisdom RV and Economics Updates Tuesday Afternoon 2-17-26

Good Afternoon Dinar Recaps,

U.S. and Iran Open Nuclear Talks in Geneva as Military Pressure Builds

Diplomacy resumes under the shadow of naval deployments and rising energy market sensitivity

Good Afternoon Dinar Recaps,

U.S. and Iran Open Nuclear Talks in Geneva as Military Pressure Builds

Diplomacy resumes under the shadow of naval deployments and rising energy market sensitivity

Overview

The United States and Iran have begun indirect nuclear negotiations in Geneva, mediated by Oman, in an effort to ease a long-running nuclear dispute.

U.S. envoys Steve Witkoff and Jared Kushner participated alongside Iranian Foreign Minister Abbas Araqchi, with President Donald Trump stating he would be involved “indirectly.”

Talks unfold amid heightened military posturing, including U.S. naval deployments and Iranian drills in the Strait of Hormuz.

Energy markets reacted cautiously, with Brent crude fluctuating as investors assess geopolitical risk.

Key Developments

1. Indirect Diplomacy Returns to Geneva

The negotiations are being conducted indirectly through Omani mediation, reflecting the fragile trust between Washington and Tehran. Iranian officials stressed that progress depends on the U.S. avoiding “unrealistic demands” and demonstrating a genuine commitment to sanctions relief.

2. Military Assets Raise the Stakes

The United States has deployed significant naval forces to the region, while Iran conducted drills in the Strait of Hormuz — a passage responsible for roughly 20% of global oil exports. The dual signaling of diplomacy and deterrence increases the risk of rapid escalation should talks falter.

3. Historical Tensions Shape Current Caution

Previous negotiation attempts were disrupted by military strikes targeting Iranian nuclear facilities. Since then, Iran has paused certain enrichment activities but continues to face internal economic strain and sanctions pressure, complicating its negotiating position.

4. Energy Markets on Alert

Brent crude prices slipped slightly during Asian trading as markets weighed the probability of supply disruptions. With global oil flows heavily reliant on Hormuz transit, even minor miscalculations could trigger sharp volatility across commodities and currencies.

Why It Matters

These talks are unfolding in a highly fragile environment where diplomatic progress and military escalation exist side by side. Markets are sensitive not only to the outcome of negotiations but also to the credibility of deterrence signals. Any breakthrough could ease sanctions and stabilize oil supply expectations; failure could tighten global energy markets almost immediately.

Diplomacy at sea level — where one misstep can move global markets.

Why It Matters to Foreign Currency Holders

Foreign currency holders anticipating Global Reset dynamics should understand:

Escalation in the Gulf could strengthen safe-haven currencies in the short term.

Sanctions relief for Iran could increase oil supply, potentially influencing petrodollar flows and regional currency stability.

Heightened geopolitical tension often accelerates shifts in reserve allocation strategies and commodity-linked currency demand.

Energy chokepoints and sanctions frameworks directly affect currency flows — especially in oil-linked economies.

When oil routes tremble, currency markets listen.

Implications for the Global Reset

Pillar 1: Energy Security and Currency Leverage

Control over strategic energy corridors such as the Strait of Hormuz reinforces the geopolitical link between oil trade and currency dominance. Any restructuring of sanctions or settlement frameworks can reshape how energy is priced and transacted globally.

Pillar 2: Sanctions as Financial Architecture

Sanctions are no longer temporary tools — they are embedded mechanisms shaping sovereign finance. Whether lifted or expanded, they influence cross-border payment systems, reserve composition, and geopolitical alliances.

Negotiations in Geneva may decide more than uranium limits — they may influence the future pricing of power.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “US and Iran Begin Nuclear Talks in Geneva as Tensions Escalate”

• Reuters – “U.S. and Iran start indirect nuclear talks in Geneva amid military buildup”

~~~~~~~~~~

China Surges to Record Russian Oil Purchases — A Strategic BRICS Energy Pivot

With India pulling back, China’s record purchases of Russian oil are reshaping energy flows and challenging long-standing dollar-linked trade dynamics.

Overview

China is buying Russian oil at record levels in February 2026, surpassing 2 million barrels per day, driven by discounted pricing and shifting purchasing patterns.

Russia fills the void left by India’s reduced Russian oil imports, leveraging BRICS ties and deepening energy cooperation with Beijing.

China’s increased imports come as U.S. sanctions influence global crude flows and pricing dynamics.

Lower pricing of Russian crude relative to benchmarks such as Brent makes it especially attractive to independent refiners.

Key Developments

1. Record Russian Oil Purchases by China

China is set to import around 2.07–2.08 million barrels per day (bpd) of Russian crude in February 2026 — a new all-time high — reflecting stronger demand and deeper energy ties. These volumes exceed January’s imports and indicate China’s expanding role as Russia’s primary oil customer amid Western sanctions.

2. India Reduces Russian Oil Intake

India, previously a major buyer of Russian crude, has cut back sharply due to trade deal pressures and sanctions considerations. This has opened up greater export capacity for China, particularly at discounted prices widely below benchmark levels.

3. Sanctions and Discounted Pricing Dynamics

U.S. and Western sanctions on Russian exporters have widened discounts on grades like Urals crude by $9–$11 per barrel below Brent, increasing attractiveness for Chinese refineries — especially independent “teapot” operators.

4. Geopolitical & Energy Market Implications

China’s surge in Russian oil imports reduces Moscow’s vulnerability to Western sanctions while deepening practical economic linkages within the BRICS energy corridor. These flows are key to financing Russia’s fiscal needs and altering traditional energy trade balances.

Why It Matters

China’s record oil purchases from Russia demonstrate a strategic energy and financial alignment within BRICS partners that reinforces alternative trade networks outside direct Western influence. This reshapes global crude flows, sustains Russian export capacity under sanctions, and strengthens China’s negotiating leverage in energy markets — an indicator of broader shifts in global economic alliances.

As China fills the Russian oil gap, traditional energy flows realign under multipolar pressure.

Why It Matters to Foreign Currency Holders

Foreign currency holders positioning for movements in the Global Reset should note:

Heavy Chinese demand for discounted Russian crude could support stronger yuan demand through bilateral trade settlements.

Reduced reliance on dollar-based energy trade frameworks may, over time, pressure structural dollar demand in global markets.

Energy flow realignments often precede shifts in capital allocations and reserve currency diversification strategies.

These dynamics are not just energy stories — they influence currency flows, trade balances, and reserve positioning at a structural level.

Implications for the Global Reset

Pillar 1: Energy Trade Realignment

Record Chinese purchases of Russian oil signal a reconfiguration of global energy trade corridors. These flows strengthen economic interdependence among BRICS members and weaken traditional dollar-centric settlement patterns in energy markets.

Pillar 2: Multipolar Financial Leverage

As China and Russia deepen trade ties under sanctions pressure, they build practical infrastructure and demand patterns that support currency diversification and reduce exclusive dependence on the U.S. dollar as the dominant medium of energy exchange.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher Guru – “China Supports BRICS Member Russia With Record Oil Purchases”

Reuters – “China’s Russian oil imports to hit new record in February as India cuts back”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Afternoon 2-17-26

President Barzani Marks Ramadan With Call For Tolerance And Unity

2026-02-17 / Shafaq News- Erbil

Kurdish President Nechirvan Barzani on Tuesday extended Ramadan greetings to Muslims in the Kurdistan Region, Iraq, and worldwide.

In a post on X, Barzani said the holy month should strengthen tolerance, harmony, and coexistence, describing them as pillars of the Region’s social fabric. He expressed hope that Ramadan would help ease suffering and crises and amplify messages of unity and peace.

President Barzani Marks Ramadan With Call For Tolerance And Unity

2026-02-17 / Shafaq News- Erbil

Kurdish President Nechirvan Barzani on Tuesday extended Ramadan greetings to Muslims in the Kurdistan Region, Iraq, and worldwide.

In a post on X, Barzani said the holy month should strengthen tolerance, harmony, and coexistence, describing them as pillars of the Region’s social fabric. He expressed hope that Ramadan would help ease suffering and crises and amplify messages of unity and peace.

Nechirvan Barzani @IKRPresident

On the occasion of the arrival of the blessed month of Ramadan, I extend my warmest congratulations to the Muslim community of Kurdistan, Iraq, and the world. I hope that the coming of this blessed month becomes a source of goodness, prosperity, and resilience for the people of Kurdistan and the entire region.

May we seize this sacred occasion as an opportunity to deepen the spirit of tolerance, coexistence, and unity, which has always been the noble identity of our homeland Kurdistan.

From the Almighty God, we beseech that this blessed month becomes the beginning of the end of hardships and troubles, and that the message of peace and coexistence spreads throughout the world.

May Ramadan be blessed for all, and may every year bring goodness and joy.

Ramadan, the ninth month of the Islamic calendar, is observed through fasting from dawn to dusk and heightened spiritual reflection. Iraq’s Sunni Endowment and the Kurdistan Region’s religious authorities announced that Wednesday will mark the first day of Ramadan, while several other Muslim-majority countries declared Thursday as the start date due to differing moon-sighting criteria.

KDP Bloc Rejects Parliament Vote On Army Chief, Cites Lack Of Consensus

2026-02-17 Shafaq News- Baghdad The Kurdistan Democratic Party (KDP) parliamentary bloc objected to the mechanism used to vote on the position of Iraqi Army Chief of Staff during the parliamentary session, the bloc’s head, Shakhawan Abdullah, told Shafaq News on Tuesday.

Abdullah clarified that lawmakers had agreed beforehand to keep the agenda unchanged, “but the Speaker of Parliament (pro- Iran) introduced additional items, prompting objections from the Deputy Speaker in accordance with internal regulations.” He called the step a violation of the law and “an unsuccessful beginning,” noting that the KDP would address the matter later.

He also argued that presenting a candidate for a position and voting on it while the government is operating in a caretaker capacity constitutes “a constitutional violation.” Abdullah described the current Chief of Staff’s relationship with the Kurdistan Region as positive, stating that “this position was allocated to the Kurds and cannot be taken and given to another component. If the position of Chief of Staff is taken from the Kurds, dialogue must be pursued, and the issue discussed.”

In its latest session, the Iraqi Parliament confirmed the continuation of Baghdad Mayor Ammar Musa Kazem and Iraqi Army Chief of Staff Lieutenant General Abdul Amir Rashid Yarallah in their posts.

MPs from Al-Azm bloc, led by Muthanna Al-Samarrai, condemned “Iraqi Parliament’s presidency proceeding with measures that affect the political balance at the national level,” adding that these steps “do not take into account the principle of genuine partnership in managing state institutions and distributing senior positions.”

Iraqi Parliament Approves Amended Bylaws, Confirms Army Chief And Baghdad Mayor

2026-02-17 Shafaq News- Baghdad Iraq’s Council of Representatives voted on Tuesday to approve the amended internal bylaws related to parliamentary committees, and confirmed the continuation of Baghdad Mayor Ammar Musa Kazem and Iraqi Army Chief of Staff Lieutenant General Abdul Amir Rashid Yarallah in their posts.

Hamam Al-Tamimi, a lawmaker from the Badr bloc led by Hadi Al-Ameri, said during a press conference after the session that his bloc gathered the signatures required to confirm the Army Chief of Staff, adding that the bloc “takes responsibility for correcting the course of security leaders.” He noted that this step “is the first by the Council of Representatives to confirm a commander of the Iraqi Army, with the institution managed in an official capacity rather than by proxy.”

Earlier, the Council of Representatives issued a parliamentary order to form a temporary committee comprising 19 lawmakers to amend Internal Regulation No. (1) of 2022, specifically regarding permanent parliamentary committees. The order stipulated that the committee would be chaired by the First Deputy Speaker of Parliament and include a number of male and female lawmakers. The committee is tasked with amending provisions related to the permanent parliamentary committees.

Later, the Speakership of the Council announced the permanent parliamentary committees for the current legislative term, which are:

1- Legal Committee.

2- Finance Committee.

3- Security and Defense Committee.

4- Integrity Committee.

5- Oil, Gas and Natural Resources Committee.

6- Foreign Relations Committee.

7- Services and Reconstruction Committee.

8- Electricity and Energy Committee.

9- Economy, Industry and Trade Committee.

10- Investment and Development Committee.

11- Health and Narcotics Control Committee.

12- Regions and Governorates Not Organized in a Region, Planning and Government Program, and Endowments Committee.

13- Transport, Communications and Governance Committee.

14- Culture, Media, Tourism and Antiquities Committee.

15- Education Committee.

16- Higher Education Committee.

17- Agriculture, Water Resources and Environment Committee.

18- Labor, Civil Society Organizations, Federal Public Service, Youth and Sports Committee.

19- Migration, Displacement, Community Reconciliation and Tribes Committee.

20- Martyrs, Victims and Political Prisoners Committee.

21- Human Rights, Women, Family and Childhood Committee.

22- Border Crossings and Protection of National Product Committee.

Gold vs. the Federal Reserve, is America about to Reinvent its Money?

Gold Telegraph: Gold vs. the Federal Reserve, is America about to Reinvent its Money?

2-16-2026

Gold Telegraph @GoldTelegraph

Gold vs. The Federal Reserve: Is America About to Reinvent Its Money?

“Gold and silver are the only true measure of value.” — James Madison

For years, I have focused on restoring the conversation around sound money, not as some blind belief, but as a discipline.

Gold Telegraph: Gold vs. the Federal Reserve, is America about to Reinvent its Money?

2-16-2026

Gold Telegraph @GoldTelegraph

Gold vs. The Federal Reserve: Is America About to Reinvent Its Money?

“Gold and silver are the only true measure of value.” — James Madison

For years, I have focused on restoring the conversation around sound money, not as some blind belief, but as a discipline.

Today, the United States faces record sovereign debt, a weakening dollar, widening wealth inequality, and deep political division. These conditions are not isolated. They are monetary symptoms.

It is no coincidence that, in this environment, gold has quietly reasserted itself. Central banks are accumulating it. Nations are repatriating it. Investors are rediscovering it.

Gold is not simply a “safe haven.” It is a measuring stick, one that has endured for thousands of years when paper systems have failed.

And now, as serious discussions around Federal Reserve reform begin to surface, a deeper question emerges:

Is America preparing to reconsider the foundation of its money?

Nearly two years ago, I raised a question that at the time seemed improbable:

Was the United States considering a gold-backed Treasury instrument?

Today, that question no longer feels speculative.

One of the world’s leading monetary thinkers and former economic advisor to the President of the United States Judy Shelton has continued to advance the idea of a 50-year gold-backed Treasury bond aimed at restoring discipline and credibility to the American financial system.

The signals surrounding a potential transition have not been subtle.

At the outset of the current presidential term, the sitting U.S. Treasury Secretary spoke openly of a coming “global economic reordering,” adding, “I’d like to be a part of it. I’ve studied this.”

Those words matter.

Because monetary systems do not change overnight, they evolve through deliberate signals, intellectual groundwork, and policy preparation.And the groundwork has been underway.

In fact, one can trace the modern political interest in gold directly to the sitting President of the United States.

Nearly a decade ago, President Trump said in an interview with GQ:

“Bringing back the gold standard would be very hard to do, but boy would it be wonderful. We’d have a standard on which to base our money.”

He also stated:

“We used to have a very, very solid country because it was based on a gold standard.”

Gold Telegraph: President-Elect Donald Trump in 2016: “We used to have a very, very solid country because it was based on a gold standard.” He added that America no longer has the gold.

Watch on X: https://twitter.com/i/status/1863321274463961552

At another point, he suggested that America may no longer have the gold and that this, in itself, is the problem.

Gold Telegraph: The last audit of the gold in Fort Knox was in 1953. Eisenhower was president. Elvis Presley hadn’t even released a record. Is this still happening? @elonmusk

Then in 2025, something even more telling happened.

For months, both the President and Elon Musk publicly and repeatedly referenced a visit to Fort Knox.

The President stated: “We’re going to Fort Knox. I’m going to go with Elon. We want to see if the gold is still there.”

Gold Telegraph: The President of the United States: “We're going to Fort Knox. I'm going to go with Elon. We want to see if the gold is still there." The conversation across America on gold is alive. Talk about a plot twist.

Watch on X: https://twitter.com/i/status/1893536526425862435

Adding: “I don’t want to open it and the cupboards are bare. It could happen.”

Watch on X: https://twitter.com/i/status/1893035882501837106

To date, no formal audit or public verification of America’s gold reserves has been conducted under this administration.

But these remarks are not random.

The tension between gold and fiat currency has followed American presidents for decades even if the mainstream has often dismissed serious monetary debate as fringe thinking.

In January 1986, President Ronald Reagan walked into a meeting of his economic advisory board frustrated by inflation.

“I used to pay $50 for a suit,” he said. “Now $50 will hardly get it cleaned.”