Gold vs. the Federal Reserve, is America about to Reinvent its Money?

Gold Telegraph: Gold vs. the Federal Reserve, is America about to Reinvent its Money?

2-16-2026

Gold Telegraph @GoldTelegraph

Gold vs. The Federal Reserve: Is America About to Reinvent Its Money?

“Gold and silver are the only true measure of value.” — James Madison

For years, I have focused on restoring the conversation around sound money, not as some blind belief, but as a discipline.

Today, the United States faces record sovereign debt, a weakening dollar, widening wealth inequality, and deep political division. These conditions are not isolated. They are monetary symptoms.

It is no coincidence that, in this environment, gold has quietly reasserted itself. Central banks are accumulating it. Nations are repatriating it. Investors are rediscovering it.

Gold is not simply a “safe haven.” It is a measuring stick, one that has endured for thousands of years when paper systems have failed.

And now, as serious discussions around Federal Reserve reform begin to surface, a deeper question emerges:

Is America preparing to reconsider the foundation of its money?

Nearly two years ago, I raised a question that at the time seemed improbable:

Was the United States considering a gold-backed Treasury instrument?

Today, that question no longer feels speculative.

One of the world’s leading monetary thinkers and former economic advisor to the President of the United States Judy Shelton has continued to advance the idea of a 50-year gold-backed Treasury bond aimed at restoring discipline and credibility to the American financial system.

The signals surrounding a potential transition have not been subtle.

At the outset of the current presidential term, the sitting U.S. Treasury Secretary spoke openly of a coming “global economic reordering,” adding, “I’d like to be a part of it. I’ve studied this.”

Those words matter.

Because monetary systems do not change overnight, they evolve through deliberate signals, intellectual groundwork, and policy preparation.And the groundwork has been underway.

In fact, one can trace the modern political interest in gold directly to the sitting President of the United States.

Nearly a decade ago, President Trump said in an interview with GQ:

“Bringing back the gold standard would be very hard to do, but boy would it be wonderful. We’d have a standard on which to base our money.”

He also stated:

“We used to have a very, very solid country because it was based on a gold standard.”

Gold Telegraph: President-Elect Donald Trump in 2016: “We used to have a very, very solid country because it was based on a gold standard.” He added that America no longer has the gold.

Watch on X: https://twitter.com/i/status/1863321274463961552

At another point, he suggested that America may no longer have the gold and that this, in itself, is the problem.

Gold Telegraph: The last audit of the gold in Fort Knox was in 1953. Eisenhower was president. Elvis Presley hadn’t even released a record. Is this still happening? @elonmusk

Then in 2025, something even more telling happened.

For months, both the President and Elon Musk publicly and repeatedly referenced a visit to Fort Knox.

The President stated: “We’re going to Fort Knox. I’m going to go with Elon. We want to see if the gold is still there.”

Gold Telegraph: The President of the United States: “We're going to Fort Knox. I'm going to go with Elon. We want to see if the gold is still there." The conversation across America on gold is alive. Talk about a plot twist.

Watch on X: https://twitter.com/i/status/1893536526425862435

Adding: “I don’t want to open it and the cupboards are bare. It could happen.”

Watch on X: https://twitter.com/i/status/1893035882501837106

To date, no formal audit or public verification of America’s gold reserves has been conducted under this administration.

But these remarks are not random.

The tension between gold and fiat currency has followed American presidents for decades even if the mainstream has often dismissed serious monetary debate as fringe thinking.

In January 1986, President Ronald Reagan walked into a meeting of his economic advisory board frustrated by inflation.

“I used to pay $50 for a suit,” he said. “Now $50 will hardly get it cleaned.”

Reagan pointed directly at fiat currency money not backed by gold or any tangible anchor, but created at will.

He questioned whether “mere human beings” should decide how much money enters circulation. In his view, inflation was not mysterious. It was structural. The remedy, as he saw it, was a return to monetary discipline to a time when money was tied to gold and could not be expanded by political discretion.

What is often overlooked is that during Reagan’s presidency, the United States returned to issuing a silver dollar, the American Silver Eagle not for commerce, but for savers, first issued in 1986.

While technically a bullion coin rather than circulating currency, it marked a symbolic return of precious metal coinage backed by the U.S. government.

It was not a restoration of the gold standard.

But it was not nothing.

Reagan left office in 1989. The modern monetary experiment continued.

Yet even in the height of the fiat era, the symbolic reappearance of government-issued silver suggested that the debate over sound money had never fully disappeared.

And if the United States were ever to reconnect its financial system directly to gold, something not seen since 1971, confidence in its physical reserves will be incredibly important.

This is not a new conversation.

It is a recurring one.

Which brings us back to the proposal advanced by Judy Shelton:

A 50-year gold-linked Treasury instrument, issued July 4, 2026, running through 2076 would offer a symbolic and structural bridge between the American founding and its monetary future.

Gold Telegraph: As reported by Bloomberg: Judy Shelton met privately with Treasury Secretary Scott Bessent to discuss Federal Reserve reform. Read that again. @judyshel

Judy Shelton is one of the most original monetary thinkers of our time... unapologetically focused on restoring discipline, credibility, and integrity to the American financial system. When serious minds start talking about reforming the Federal Reserve, watch closely. The United States Treasury Secretary has also hinted at full reform. In our conversation, she laid out a bold proposal: A U.S. Treasury GOLD-convertible bond: Issued July 4th, 2026 Maturing July 4th, 2076 A 50-year signal to the world that America is willing to anchor its debt to something real. Think about what that would mean for demand for U.S. debt.

Watch on X: https://x.com/i/status/2023133931957305650

The proposal may sound ambitious. It is not.

The United States cannot afford to wait while rival nations move to redefine the monetary order.

In October 2025, Judy Shelton published a Wall Street Journal op-ed titled How American Gold Can Shore Up the Dollar.

In it, she outlined a practical proposal: a U.S. Treasury security that would offer gold convertibility at maturity.

The idea is simple but powerful.

If investors knew that, decades from now, their Treasury bond could be redeemed in gold rather than depreciated dollars, it would send a message to markets, to allies, and to adversaries that the United States is serious about protecting the integrity of its currency.

This is not theoretical. It is geopolitical.

Xi Jinping has made it clear that China intends to elevate the renminbi onto the global reserve stage. Just last month, he publicly called for the Chinese currency to strengthen its international role his clearest statement yet on that objective.

Beijing has spent years building the infrastructure to support that ambition: expanding trade settlement agreements, developing alternative payment systems, and steadily accumulating gold.

The world is moving.

The real question is whether the United States moves first or reacts later.

Shelton’s proposal suggests the United States still has the ability to lead.

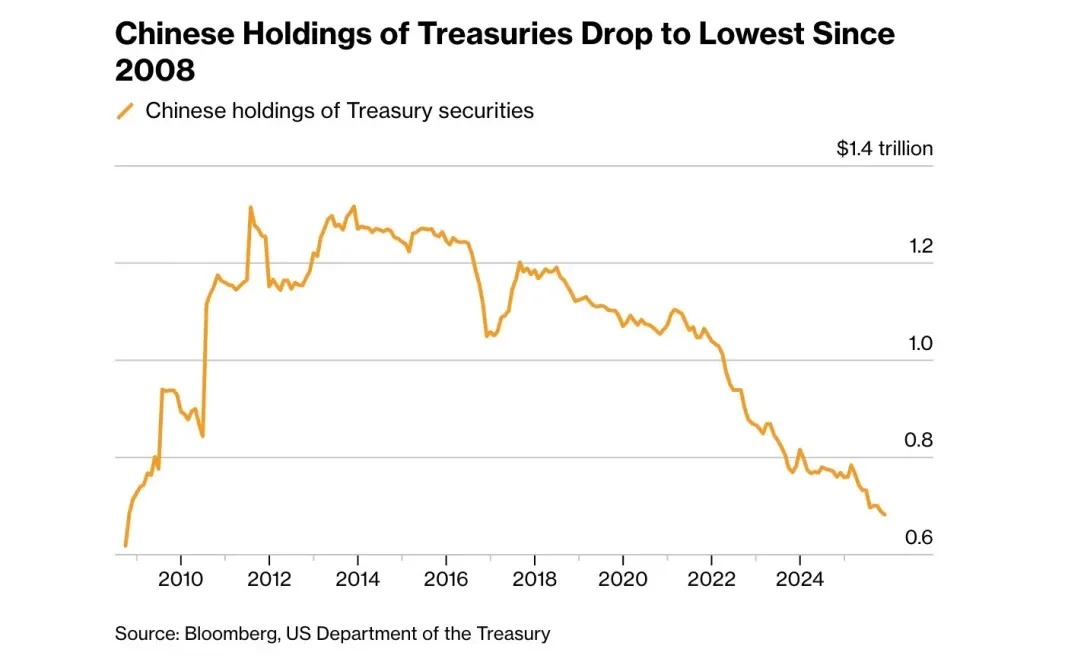

At the same time, the world has watched China steadily reduce its U.S. Treasury holdings now at their lowest level since 2008.

This is not accidental.

Chinese regulators have reportedly advised financial institutions to curb their exposure to U.S. government debt, citing concentration risks. Banks have been encouraged to limit new purchases of Treasuries, and those with elevated positions have been instructed to gradually reduce them.

Less dependence on U.S. paper. Greater emphasis elsewhere and most notably on gold.

There is still a larger question hovering over all of this:

How much gold does China truly own?

China’s central bank extended its official gold-buying streak to 15 consecutive months in January. Bullion held by the People’s Bank of China rose by another 40,000 troy ounces last month alone.

But the official numbers may only tell part of the story.

Even the mainstream financial press has begun to acknowledge what many have long suspected: China’s true gold accumulation may be far greater than publicly disclosed. The country is already the world’s largest producer and consumer of gold. The scale of its domestic supply chain provides structural opacity.

In late 2025, the Financial Times reported that China’s unreported gold purchases could be more than ten times its official figures as it quietly diversifies away from the U.S. dollar.

Unlike oil, which can be tracked via shipping data and satellite imagery, gold is far more difficult to trace once it enters vaults. There is no transparent ledger. No global tracking mechanism. Once refined and stored, it disappears into sovereign balance sheets.

And this direction is not new.

In the aftermath of the 2008 financial crisis, former People’s Bank of China Governor Zhou Xiaochuan published an essay titled Reform the International Monetary System.

His argument was direct: a dollar-centric system was structurally unstable. The world, he wrote, needed a reserve asset divorced from the political discretion of any single country.

That was 2009.

The actions since then speak louder than the essay.

Judy Shelton told me in late 2025 that it is reasonable to assume China is not fully transparent about its gold reserves. Historically, major powers have treated gold as a strategic state secret, the Soviet Union did exactly that and there is little reason to believe China would operate differently.

Through the Shanghai Gold Exchange and related yuan-linked pricing mechanisms, China has steadily built infrastructure that connects its currency more closely to physical gold markets.

Even Western policymakers including a former UK chancellor have publicly suggested that China could one day propose a new international monetary framework with gold playing a central role.

China has been accumulating gold quietly for years.

We do not know the full extent.

But there is a growing body of evidence suggesting it may be positioning itself for a larger role in the next phase of the monetary order.

Gold Telegraph: CHINA’S GOLD STRATEGY: THE QUIET ACCUMULATION Dr. Judy Shelton told me something striking. China, the world’s largest producer and consumer of gold, is almost certainly not being transparent about how much it really holds. Through the Shanghai Gold Exchange, Beijing has quietly built the infrastructure to merge gold and the yuan — setting the stage for settlement through digital instruments or stablecoins. She warned that China may soon propose a new international monetary system anchored to gold — a move that could redefine global finance. Her message was clear: “We still have the world’s largest gold reserves. Let’s use that to our advantage before China does.” The United States has a big opportunity to lead with gold... @judyshel

Watch with X: https://x.com/i/status/1977814268587454783

And China is not acting in isolation.

Over the past decade, countries including Germany, Poland, Hungary, Serbia, the Netherlands, Turkey and India and the list goes on have repatriated gold back to domestic soil or aggressively expanded their reserves.

Central banks globally are buying gold at the fastest pace in modern history.

That is not coincidence.

It is coordination through self-interest.

Gold repatriation is not about optics. It is about sovereignty. When nations bring their bullion home, they are reducing counterparty risk and preparing for a world where trust in paper promises may be tested.

The United States reportedly still holds the largest official gold reserve on the planet more than 8,000 metric tonnes.

That is a strategic advantage.

But advantage only matters if it is reinforced.

As debt climbs past historic thresholds and geopolitical realignment accelerates, the credibility of the dollar cannot rest solely on tradition. It must rest on structure.

The world is quietly rebuilding monetary defences.

Gold accumulation. Reserve diversification. Payment systems outside Western rails.

This is not theory. It is happening.

If the United States chooses to reconnect its financial system, even partially, to gold through a long-dated Treasury instrument, it would not signal weakness.

It would signal strength.

Recent reporting from Bloomberg noted that Judy Shelton has been in open dialogue with the current Treasury Secretary regarding monetary reform. That alone suggests the conversation is no longer confined to academic circles. It is entering policy space.

And that matters.

Because the real risk is not reform.

The real risk is assuming the existing order will endure unchanged while others prepare for what comes next.

Monetary history does not reward hesitation. It rewards those who anchor first. That moment is here.

Gold is not at the edge of this transition. It is at the center of it.

The only question now is whether the United States leads the next monetary chapter or is forced to adapt to one written by others.

Source(s): https://x.com/GoldTelegraph_/status/2023553212306030964