Swisher1776: This is a Modern Sovereign Transition, Not Kuwait 2.0

Swisher1776: This is a Modern Sovereign Transition, Not Kuwait 2.0

1-14-2025

Respectfully, this comparison is not accurate, and here’s why:

Kuwait’s 1991 revaluation occurred after a foreign occupation and currency replacement, under a monarchal system, with an external peg restored almost immediately. That situation involved physical currency withdrawal and reinstatement, not institutional reform.

Iraq today is in a completely different framework.

Swisher1776: This is a Modern Sovereign Transition, Not Kuwait 2.0

1-14-2025

Respectfully, this comparison is not accurate, and here’s why:

Kuwait’s 1991 revaluation occurred after a foreign occupation and currency replacement, under a monarchal system, with an external peg restored almost immediately. That situation involved physical currency withdrawal and reinstatement, not institutional reform.

Iraq today is in a completely different framework.

What we’re seeing now is constitutional, judicial, and institutional sequencing:

Central Bank executing monetary policy

Ministry of Finance aligning fiscal controls

Courts and political blocs resolving legitimacy and authority

Caretaker limitations being clarified by law

That is not misdirection — that is rule-of-law execution.

No exchange rate mechanism activates without:

legal authority

institutional continuity

international compliance

banking system readiness

Political noise often increases during ececution phases, because decisions are being locked in, not undone.

Kuwait didn’t have Basel III, FATCA, global payment rails, or modern compliance requirements. Iraq does.

This isn’t Kuwait 2.0.

This is a modern sovereign transition under global standards.

Appreciate the discussion.

Swisher1776: IQD RV: CARETAKER GOVERNMENT ACTIVATED AS DISCLOSURE SIGNALS SUDANI ACCOUNTABILITY

The leader of the State of Law Coalition (SLC), Nouri Al-Maliki, who will head the next government, will revoke all recent decisions issued by the caretaker government led by Prime Minister Mohammed Shia Al-Sudani

Iraqi lawmaker Ibtisam Al-Hilali said on Tuesday. Speaking to Shafaq News, Al-Hilali described the decisions taken by the government and the prime minister as illegal and lacking constitutional legitimacy, citing Federal Supreme Court ruling No. 213/Federal/2025, which she said ended the fifth parliamentary term and “converted Mohammed Shia Al-Sudani’s cabinet into a caretaker government with limited authority restricted to managing daily affairs.”

The reversals, Al-Hilali stated, would include decisions related to “incorrect tax and customs fees, as well as measures suspending leave, scholarships, and employee transfers.” Iraq’s caretaking government approved a series of decisions affecting multiple sectors during its most recent session, according to documents issued by the General Secretariat of the Council of Ministers.

Among the measures, the cabinet endorsed a recommendation from the Ministerial Council for the Economy allowing ministries and entities not affiliated with a ministry to sell non-productive vehicles that are at least 15 years old.

The approval also covers the sale of all idle or surplus productive and non-productive vehicles, equipment, generators, construction machinery, and other types of machinery, regardless of their year of manufacture, across government departments. Fuel allocations for ministries, non-ministerial entities, and provincial administrations will be reduced by 50 percent from current levels.

Another decision establishes the academic certificate under which an employee was first appointed to a state institution as the final qualification for all official purposes. Degrees obtained during employment will not be recognized across government institutions and specializations, with a limited exception applied to the Ministry of Higher Education.

Additional measures include suspending transfers to the Ministries of Oil, Finance, Education, and Higher Education, as well as to any other entity where a transfer or secondment would result in increased financial allocations. State-funded overseas scholarships for all fields of study have also been halted.

Thomas Price: The Maliki information is misdirection… Just like Kuwait when they RVd and said the King is dead etc. - Kuwait 2.0

https://x.com/price_thom18702/status/2011263487956435448

Source(s): https://x.com/swisher1776/status/2011291858488512749

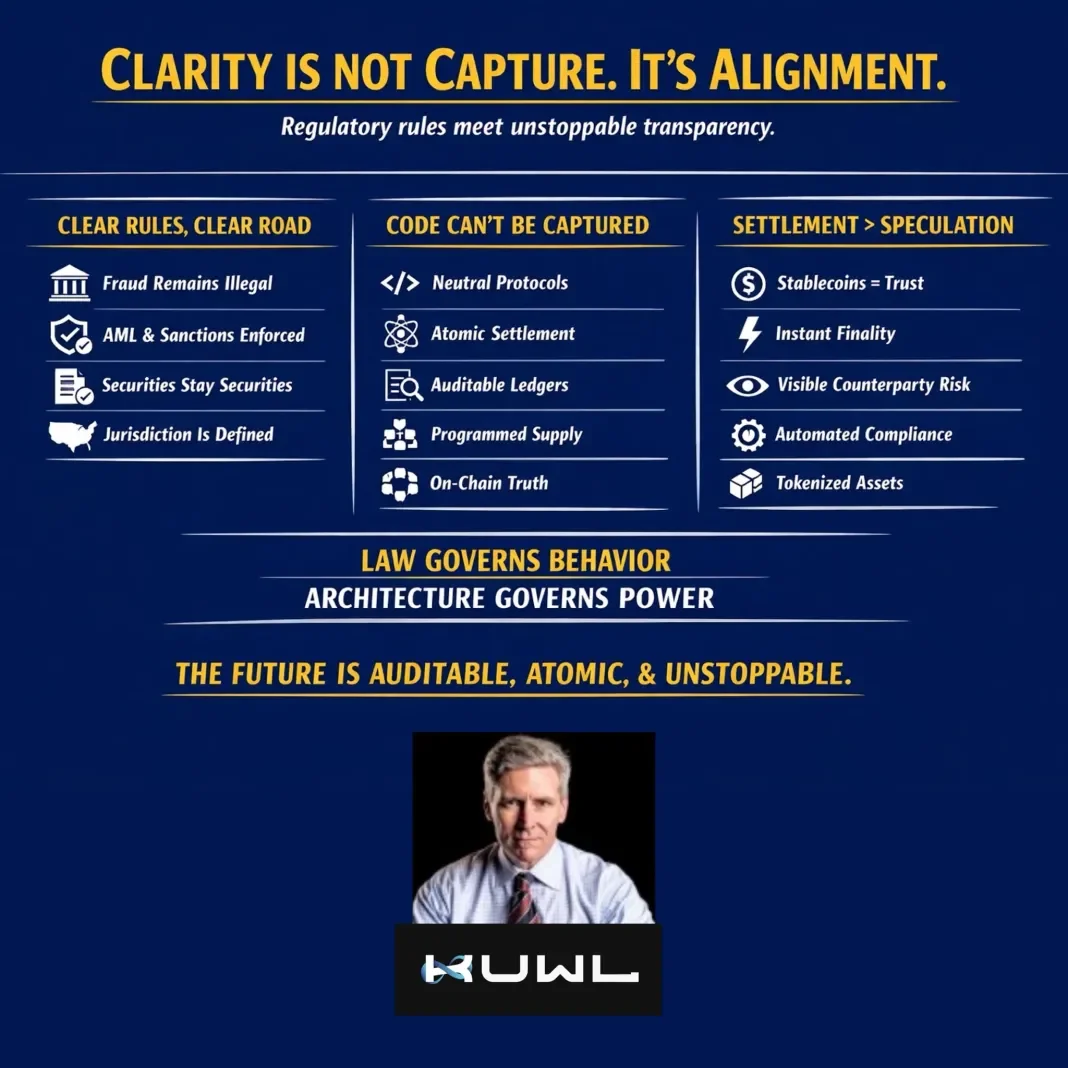

The Clarity Act is Not Capture, it’s Alignment

The Clarity Act is Not Capture, it’s Alignment

1-14-2026

Rob Cunningham | KUWL.show @KuwlShow

The Clarity Act Is Not “Capture.” It Is Alignment.

The Clarity Act governs behavior – but the architecture governs power.

Law can constrain actors, but only transparent, atomic systems eliminate the incentives and mechanisms for abuse.

The Clarity Act is Not Capture, it’s Alignment

1-14-2026

Rob Cunningham | KUWL.show @KuwlShow

The Clarity Act Is Not “Capture.” It Is Alignment.

The Clarity Act governs behavior – but the architecture governs power.

Law can constrain actors, but only transparent, atomic systems eliminate the incentives and mechanisms for abuse.

Digital asset markets don’t fail because of innovation.

They fail because of opacity, jurisdictional confusion, and discretionary power.

The CLARITY Act does one simple thing:

It replaces uncertainty with enforceable rules.

And here’s the part many are missing:

Clear rules do not enable institutional capture – they remove it.

Why?

Because institutions cannot capture:

Neutral code

Atomic settlement

Public, auditable ledgers

Programmatic supply

On-chain truth

They can only participate.

And participation under transparent, rules-based systems is the opposite of capture.

This is not crypto being absorbed by legacy finance.

This is legacy finance being forced to behave honestly.

Investor Protection Is Structural, Not Cosmetic

Fraud remains illigal.

Securities remain securities.

AML, sanctions, and enforcement remain intact.

But once settlement is atomic and ledgers are auditable:

Market manipulation becomes visible

Rehypothecation becomes impossible

Counterparty risk becomes measurable

Insider abuse loses cover

Stablecoins Aren’t Speculation – They’re Settlement

Record stablecoin supply is not a bull signal.

It’s a plumbing signal.

They represent:

Unit-of-account trust

Velocity without volatility

Cross-border neutrality

Finality without intermediaries

No opaque monetary system survives once:

Settlement is instant

Liquidity is transparent

Compliance is automated

Assets are tokenized at the source

This Isn’t Optimism — It’s Engineering

When regulators talk about markets moving on-chain, they’re not predicting adoption.

They’re describing deployment.

Capital isn’t ideological.

It flows where:

Friction is lowest

Risk is smallest

Cost is minimal

Truth is highest

Finality is guaranteed

That equation is already solved.

Bottom Line

CLARITY doesn’t weaken markets – it hardens them.

It doesn’t protect bad actors – it exposes them.

It doesn’t enable capture – it ends opacity.

This isn’t a bull market thesis.

It’s a NEW monetary operating system.

Goodbye @federalreserve.

And once it’s live, no serious actor goes back.

1) Uncertainty enables abuse. Clear rules + transparent systems do not.

2) Bad actors lose leverage.

3) Intent and control matter – not mere publication of software.

4) Liquidity follows structural advantage, not ideology.

“How do we constrain institutions?”

By removing the tools they used to abuse power in the first place.

Source(s): https://x.com/KuwlShow/status/2011259630597603748

https://dinarchronicles.com/2026/01/14/rob-cunningham-the-clarity-act-is-not-capture-its-alignment/

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 1-14-26

Good Afternoon Dinar Recaps,

U.S. Trade Deficit Nearly Halved — Markets Take Notice

CNBC highlights a rare contraction in America’s trade gap

Good Afternoon Dinar Recaps,

U.S. Trade Deficit Nearly Halved — Markets Take Notice

CNBC highlights a rare contraction in America’s trade gap

Overview

Newly released U.S. trade data shows a dramatic narrowing of the trade deficit.

The gap fell from roughly $136 billion earlier in the year to about $29.4 billion in the most recent report.

CNBC analysts discussed the figures live, noting the change reflects shifts in trade flows and policy enforcement.

Based on available records, this marks the smallest reported U.S. trade deficit in nearly two decades.

Key Developments

Imports declined sharply, while exports held firmer, tightening the overall balance.

Trade enforcement measures and tariffs were cited as altering import behavior.

Market observers flagged the report as an unusual data point amid long-running deficit trends.

Why It Matters

Trade balances directly influence currency flows and capital movement.

A smaller deficit means fewer dollars exiting the U.S. system to pay for imports.

Sustained improvement could signal structural adjustment, not just statistical noise.

Why It Matters to Currency Holders

Dollar leakage slowed: Reduced outflows ease downward pressure on the dollar supply.

Trade mechanics at work: When imports fall faster than exports, currency dynamics shift — a signal closely watched by currency holders.

What this does not mean: This is not a payout, RV trigger, or instant economic win. It is a verified accounting change, not a promise or timeline.

Key Takeaway

Currencies reflect flows, not hype.

This trade data shows a real, measurable shift worth monitoring — but conclusions must remain grounded in confirmed reports, not speculation.

Implications for the Global Reset

Pillar 1: Dollar Flow Containment

A sharply reduced U.S. trade deficit signals less dollar outflow into the global system, tightening offshore dollar liquidity.

When fewer dollars leak abroad through imports, global dollar availability contracts, forcing trading partners and financial institutions to adjust funding, settlement, and reserve strategies.

This supports a re-centralization of dollar power, reinforcing U.S. leverage even as de-dollarization narratives persist elsewhere.

Pillar 2: Trade Enforcement as a Monetary Tool

The data underscores how trade policy and enforcement now function as indirect monetary instruments.

By reshaping import behavior, tariffs and compliance measures influence currency flows without central bank action, shifting power from purely monetary authorities toward executive and trade-policy frameworks.

This marks a structural shift in global finance, where trade mechanics increasingly drive currency outcomes, a key feature of an emerging reset phase.

Trade balances don’t make headlines often — until they suddenly do.

Seeds of Wisdom Team

Newshounds News

Sources

~~~~~~~~~~

BRICS Unit Stalls as India and China Reject a Shared Currency

Internal resistance exposes limits of de-dollarization ambitions

Overview

Momentum toward a unified BRICS settlement currency (“BRICS Unit”) is facing growing resistance.

India and China, two of the bloc’s largest economies, have both declined to support a single common currency.

The pushback highlights deep internal divisions and raises questions about whether BRICS can move beyond bilateral, local-currency trade arrangements.

Key Developments

India firmly rejected the idea of sharing a currency with China, citing economic stability and policy independence.

China continues to prioritize internationalizing the yuan, rather than backing a collective BRICS currency.

The lack of consensus is slowing BRICS de-dollarization efforts and limiting progress on multilateral settlement systems.

India Draws a Clear Line

At the IT-BT Round Table 2025, India’s Commerce Minister stated that a shared BRICS currency is “impossible to think of.”

India’s External Affairs Minister has repeatedly emphasized that abandoning the dollar is not part of India’s policy.

Officials argue the dollar remains critical for financial stability and global trade continuity, especially during periods of turbulence.

China Chooses an Independent Currency Path

China has focused on expanding yuan usage globally through swap lines and payment infrastructure.

Its Cross-Border Interbank Payment System (CIPS) now includes hundreds of participants across more than 160 countries.

Beijing appears to see greater strategic value in yuan internationalization than in supporting a shared BRICS instrument.

Structural Barriers Inside BRICS

Analysts point out that BRICS lacks the foundations required for a common currency:

No common market

No unified trade policy

Divergent geopolitical priorities

Even Russia has acknowledged that talk of a single BRICS currency is premature, despite advocating reduced reliance on the dollar.

Rio Summit Signals a Pause

The July 2025 BRICS Summit in Rio produced a 126-point declaration that made no mention of a BRICS currency or de-dollarization plan.

Trade cooperation remains largely bilateral, relying on local currencies rather than a unified system.

Member states continue to prioritize economic stability over symbolic monetary shifts.

Why It Matters

The resistance underscores how difficult it is for major economies with competing interests to align on monetary policy.

Without consensus from India and China, a BRICS-wide currency alternative to the dollar remains theoretical, not operational.

Why It Matters to Foreign Currency Holders

Expectations of a rapid BRICS-led dollar replacement appear overstated.

Currency realignments, if they occur, are more likely to emerge through gradual bilateral trade changes, not a sudden bloc-wide reset.

Stability — not confrontation — continues to guide decision-making among key BRICS members.

Key Takeaway

BRICS de-dollarization is fragmented, cautious, and internally constrained.

The bloc is adjusting around the dollar, not uniting against it.

A currency union fails fast when national interests refuse to bend.

Seeds of Wisdom Team

Newshounds News

Sources

Watcher.Guru — BRICS Unit Hits Resistance as Major Economies Say No

Reuters — BRICS nations play down prospects of a shared currency

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. it is Tuesday, January 13th and you're listening to the big call. Thanks everybody for tuning in. Yet, once again, we're happy to have another call tonight and to bring everybody up to speed. I'm looking forward to Sue and her teaching and I'm looking forward to Bob and what he's going to bring tonight. Hopefully, I'll have good for you guys tonight in my segment

Thank you, Bob. I appreciate that very much. Let's go to some intel for right now.

Now, let's cut to the chase. Where do we sit right now?

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. it is Tuesday, January 13th and you're listening to the big call. Thanks everybody for tuning in. Yet, once again, we're happy to have another call tonight and to bring everybody up to speed. I'm looking forward to Sue and her teaching and I'm looking forward to Bob and what he's going to bring tonight. Hopefully, I'll have good for you guys tonight in my segment

Thank you, Bob. I appreciate that very much. Let's go to some intel for right now.

Now, let's cut to the chase. Where do we sit right now?

We have heard in the last couple of days, and really probably Saturday. We've heard information that was pointing toward early in the week, which would be today, tomorrow, or later in the week, which would be anywhere from Thursday all the way to Sunday.

Well, that's good. We didn't make the earlier.

Or in the later, and the later, I think now we can say, since the latest information that came in right before the big call tonight, that Sue hasn't even heard yet is coming from a very, very top Wells Fargo source, and it is that we are expecting everything to fly for us, either Sunday evening or this coming Wednesday, which I'm going to say next Wednesday, a week from tomorrow, that would be The 21st of January, after MLK Day, which is a national holiday on the 19th of January.

So what happens with our redemption centers?

With a three day weekend where Monday is a national holiday? probably it means nothing's going to happen on that day for us, but Sunday evening, all the way from there to the 21st which is Wednesday.

So it looks like we're less than a week to a week away, is about what it looks like , and yes, we are taking out various entities in our hemisphere and not in our hemisphere. Things are happening. As you guys can tell the demonstrations in Iran.

It's interesting that there's no value for the Iranian Rial, according to the news zero, redemption centers have it differently, they have a rate for the rial on the screen today.

So something is happening to reverse that, and I think we'll end up with a new Iranian government very, very soon.

So everything is moving. They are taking the extra time they need for cleanup. As you guys know, if you're following anything you can tell there's quite a bit going on for arrests to be made, for illegals to be people that's not going to stop, that will continue, but I don't believe that is holding us up at this point.

But I'll give you the timeline that's really about the best I can do is give you what I'm hearing from excellent sources. Some of the people that are at the redemptive leadership positions are saying it could be, could be a little sooner than that. It could be Friday, Saturday, so maybe the weekends in play.

But I think the weekend would be in play if he counts on the evening for sure. So all I can say is, the best thing we can do is stay patient and do what we need to do to stay healthy, stay hydrated and be ready when this thing does hit, because it is close. It's right around the corner.

And as I mentioned earlier, med beds are at least 28,000. Plus are activated. Then that's med bed centers with two med beds in each center in the United States, the numbers are probably closer to 30 to 32,000 med bed centers now in us.

So we're we're looking forward to taking advantage of those, but we have to set our appointments at the redemption center, so in the redemption center first, and let them know, yes, I am a zim holder – yes I have a dire need - they'll enter the keystrokes on their computers, to put you in the system - and then you'll be notified and called as to when your Med bed appointment would be, but it follows your actual appointment i in the redemption center.

Let's see, is there anything else?

There is information that's out there that I've looked into today, everything. There are some things that could be true, but not necessarily true at all, and I don't even want to get into it. You guys read all kinds of things out there that are brought in, and I can tell you that a lot of it is cut and paste stuff from before and has dates that don't really make sense. It's not what I'm hearing. I'm just going to tell you to leave alone, set it aside.

So that is really what I wanted to say tonight – that’s it - That's it.

We have what we have, and we'll keep an eye on this. We'll see what happens to some banks. They end up falling short of covering their silver shorts. We'll see what happens. I know that we're looking for things to start popping for us, and I know that this is going to happen very soon, but instead of doing it right, I think in a way, they're waiting for Iran. But there may be, there may be other things involved in that, but I want to thank everybody for listening.

Thank you Sue, thank you Bob for your input. So much. And thank you everybody who's listening. GCK Doug, everybody that's been contributor to the big call, like Pastor Scott Jeannie, thank you satellite team. Thank you everybody in big call universe that's been listening to the call. We're in our 15th year, who knew??

but I appreciate you and care about you, and thank you so much for everything that you've done to stay with us this long, and we will see you on Thursday night a couple nights from now. We'll see what else you have to report.

Okay, in the meantime, let's pray the call out -- Everybody have a great night and we'll talk to you Thursday night

God bless you

Bruce’s Big Call Dinar Intel Tuesday Night 1-13-26 REPLAY LINK Intel Begins 1:14:54

Bruce’s Big Call Dinar Intel Thursday Night 1-8-26 REPLAY LINK Intel Begins 1:22:42

Bruce’s Big Call Dinar Intel Tuesday Night 1-6-26 REPLAY LINK Intel Begins 1:13:10

Bruce’s Big Call Dinar Intel Thursday Night 1-1-26 New Year’s Day NO CALL

Bruce’s Big Call Dinar Intel Tuesday Night 12-30-25 REPLAY LINK Intel Begins 56:00

Bruce’s Big Call Dinar Intel Thursday Night 12-25-25 REPLAY LINK Intel Begins 20:40

Bruce’s Big Call Dinar Intel Tuesday Night 12-23-25 REPLAY LINK Intel Begins 1:05:35

Bruce’s Big Call Dinar Intel Thursday Night 12-18-25 REPLAY LINK Intel Begins 1:02:02

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:08:08

Bruce’s Big Call Dinar Intel Thursday Night 12-11-25 REPLAY LINK Intel Begins 1:21:00

Bruce’s Big Call Dinar Intel Tuesday Night 12-9-25 REPLAY LINK Intel Begins 1:02:50

Bruce’s Big Call Dinar Intel Thursday Night 12-4-25 No Transcription Intel Begins 1:17:33

Bruce’s Big Call Dinar Intel Tuesday Night 12-2-25 REPLAY LINK Intel Begins 1:07:20

Wednesday Coffee with MarkZ, joined by Bob Lock. 01/14/2026

Wednesday Coffee with MarkZ, joined by Bob Lock. 01/14/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning….Great to see you all today.

Member: We have a 3-day federal holiday weekend this weekend with Martin Luther King, Jr Day. With all the other news. I wonder what are the chances of things happening this weekend??

Wednesday Coffee with MarkZ, joined by Bob Lock. 01/14/2026

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning….Great to see you all today.

Member: We have a 3-day federal holiday weekend this weekend with Martin Luther King, Jr Day. With all the other news. I wonder what are the chances of things happening this weekend??

Member: Any bond updates?

MZ: My bond update is there will be a meeting occurring in about 2 hours for a contact. This one is in Europe…in Zurich. Very quiet in Asia right now….but hope to get a update soon.

MZ: In Iraq: “ A new rise on the exchange rate on the dollar in Iraq” The dinar rate is sliding as people are using the dollar.

MZ: “The governor of the Central Bank of Iraq meets discusses with Oliver Wyman Company and ways to improve Iraq’s sovereignty and credit rating” They want to lift the value of their currency and get a better credit rating. This article is telling us they are getting ready for that change.

Member: Does anybody else think this Maliki, Sudani election is a smoke screen?

Member: I think a lot of things they are doing is a smoke screen!!

Member: Some days it seems like Iraq doesn’t want to RV

Member: Mnt. Goat still thinks they will delete the 3 zeros this month

MZ: The Iranian currency crashed this week……yesterday in the wee hours. I am a bit concerned and think Iraq may have already gone if not for what is happening right now in Iran.

MZ: Everything happening in Venezuela and Iran look good for the global reset …but may have slowed things down a bit.

MZ: But I am still hearing things are well underway and we are on the precipice for our blessing.

Member: Have you heard that Trump is pausing all IRS transactions for 90 days while they look for fraud?

MZ: Yes. A number of people who work for the IRS told me and they are looking forward to changes. There are rumors that in 6 days or so they will announce the end of the IRS or a change to the “External Revenue Service” . Lots of rumors and very difficult to know what is reality and what is not.

MZ: Our best move may be to sit back and watch it.

Member: Any dong news?

MZ: I did reach out to a banker and they are very much organizing and training on the Vietnamese dong and expect the dong the Iraqi dinar to go at the same time.

Member: Silver is at $88 but the asking price is $91

Member: They are saying possible $300 dollar silver soon.

Member: I'm hearing HSBC must exit all silver positions by jan 31st which should push silver to $347

Member: Ariel believes scotus may go against Trump on tariffs and Trump will start throwing RV switches we r looking for….good rumor to watch.

Member: If they vote against tariffs….possible it forces the RV?

Member: Supreme Court Tariff ruling today- supposedly

Member: Just saw that Supreme Court won't rule on tariffs today

Member: Why am I not surprised.

Member: Skye thinks we are in a 72 hour window.

Member: President Trump will be heading to DAVOS soon. Big world economic meetings this weekend…may be important for us.

MZ: I believe he addresses the forum on the 19th which is in 5 days. “Trump to speak at globalist WEF forum “ What’s it going to look like? Can’t wait to see it.

Member: Hi Mark- have any of your redemption contacts given you any RV exchange protocols? If not, do you know if they will?

Member: Just take all your currency, and receipts…..and everything you would take to the bank to open new accounts with…..but hopefully we get a detailed list before then.

Member: Have a great day to all……the best is yet to come.

Bob Lock joins the stream today. Please listen to the replay for his information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

https://rumble.com/user/theoriginalmarkz

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL TONIGHT AT 7:00 PM EST OR IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Wednesday 1-14-2026

Ariel: Tomorrow will be a Crossover Event

1-14-2026

Tomorrow Will Be A Crossover Event:

– SCOTUS might force massive tariff refunds, hitting Treasury hard. Which will not bold well for reserves of course.

– Trump’s Plan B ready to offset that cash drain fast. And he may just have to act on that ASAP.

– Iraqi Dinar reval at 1:1 or better could flood trillions in value.

Ariel: Tomorrow will be a Crossover Event

1-14-2026

Tomorrow Will Be A Crossover Event:

– SCOTUS might force massive tariff refunds, hitting Treasury hard. Which will not bold well for reserves of course.

– Trump’s Plan B ready to offset that cash drain fast. And he may just have to act on that ASAP.

– Iraqi Dinar reval at 1:1 or better could flood trillions in value.

Another point to contend with here.

– Venezuela’s oil surge under U.S. control drops global prices quick. Remember China & Russia will have to buy from US.

– China and Russia forced back to USD oil payments soon.

– Midterms looming, so Trump needs fast wins to shut critics up. He doesn’t want to give any ammo away.

– Iran’s proxies weakened big time, clearing path for Iraq’s move. This will embolden Iraq to strike with monetary moves.

– Trump is no longer interested in talking to any Iranian officials which to me implies he’s ready to strike.

– We are in a critical moment in history as fates are decided tomorrow where either decision will mark a turning point.

– Not to mention the Clarity Act is about to be voted on in a few days. Which will further speed up things.

Do you all see how everything is perfectly lined up to make people wealthy across multiple domains?

Watcher.Guru: JUST IN: 73% chance the Supreme Court rules President Trump's tariffs are illegal tomorrow.

Source(s): https://x.com/Prolotario1/status/2011164782984872330

https://dinarchronicles.com/2026/01/14/ariel-prolotario1-tomorrow-will-be-a-crossover-event/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Nobody knows the date. Nobody knows the rate. But we do know they're going through a monetary reform process. It doesn't take a Five Beta Kappa, it doesn't take Sumakum Laude, it doesn't take my brain to figure this out. I'm going to miss you because our days are coming to an end.

Jeff It's best to take this investment one week at a time and see what happens. They're not going to give us the date as to when the rate's going to change. We have to sit back, observe and study it.

Jeff There's 4 steps in their government formation. Parliament is one. Presidents are two. Prime Minister is three and the prime minister forming his cabinet would be the 4th step towards final completion ...Sudani's got this...The next major thing I'm looking for...is to know when they're going to...complete the president. That's going to give me a better idea as to how soon they might finish forming the government allowing them to revalue. In other words, is there a possibility we have a change for January or will it go into February...They have until January 29th to complete the president. I don't think it'll take that long. They could have the president done this week...They're not far out on that.

“We're in Serious Trouble” - Signal Shows Gold Headed to $9,000, Silver $375

Daniela Cambone: 1-12-2026

“We’re in Serious Trouble” – Signal Shows Gold Headed to $9,000, Silver $375. In today’s interview with Daniela Cambone, macro strategist Tom Bradshaw issued a stark warning, declaring that surging precious metals are flashing a classic signal of deep economic stress.

“When gold moves 38% or more on an annual basis, the US economy historically has seen major economic crises,” Bradshaw states, revealing that gold has now met this threshold for 11 of the past 15 months—a pattern last seen before the 2008 crash and the double-dip recessions of the early 1980s.

“The longest lead time we’ve had on this indicator is nine months. So a recession could well be imminent if not already underway.”

Iraq Economic News and Points To Ponder Wednesday Morning 1-14-26

Gold Rises 1% And Silver Surpasses $90 An Ounce

Money and Business Economy News - Gold prices rose to new record highs on Wednesday, while silver jumped to an all-time high above $90 an ounce, supported by weaker-than-expected US inflation readings that boosted bets on interest rate cuts. Gold rose 1.02% in spot trading to reach $4,634.40 an ounce.

US gold futures for February delivery also rose 0.9% to $4,643.80. The data showed that the US consumer price index rose 0.2% month-on-month and 2.6% year-on-year in December, driven by higher rent and food costs.

Gold Rises 1% And Silver Surpasses $90 An Ounce

Money and Business Economy News - Gold prices rose to new record highs on Wednesday, while silver jumped to an all-time high above $90 an ounce, supported by weaker-than-expected US inflation readings that boosted bets on interest rate cuts. Gold rose 1.02% in spot trading to reach $4,634.40 an ounce.

US gold futures for February delivery also rose 0.9% to $4,643.80. The data showed that the US consumer price index rose 0.2% month-on-month and 2.6% year-on-year in December, driven by higher rent and food costs.

This increase came as the impact of some distortions related to the government shutdown, which had put pressure on inflation in November, eased, but it remained below analysts' expectations of a rise of 0.3% monthly and 2.7% annually.

US President Donald Trump welcomed the inflation figures, renewing his pressure on Federal Reserve Chairman Jerome Powell to cut interest rates.

Investors and major brokerage firms, including Goldman Sachs and Morgan Stanley, expect two interest rate cuts of 25 basis points each this year, with the first possible cut in June.

On the geopolitical front, Trump on Tuesday called on Iranians to continue the protests, saying that “help is on the way,” amid the largest wave of protests in Iran in years.

As for other precious metals, silver surged in spot trading, surpassing $90 an ounce for the first time ever. Platinum climbed 3.5% to $2,405.30, its highest level in a week, after hitting a record high of $2,478.50 on December 29. Palladium rose 1.8% to $1,873. https://economy-news.net/content.php?id=64561

Iraq Is The Largest Importer Of Iranian Goods, With A Value Of $10 Billion.

Money and Business Economy News – Baghdad Middle East News reported on Wednesday that Iraq tops the list of countries importing Iranian goods, with purchases amounting to about $10 billion between April 2024 and January 2025, followed by the UAE with about $6 billion, and then Turkey with $5.5 billion.

According to official data from the Iranian Customs Administration, the volume of non-oil trade between Iran and its fifteen neighboring countries reached $13.42 billion during the period from March 20 to June 21 of last year, with the exchange of about 23 million tons of goods.

In terms of exports, Iraq remained the primary destination for Iranian goods, with a value of $1.9 billion, followed by the UAE at $1.6 billion, then Turkey at $940 million, Afghanistan at $510 million, and Oman at $437 million. Imports from neighboring countries reached $6.8 billion, with the UAE topping the list of countries supplying Iran with over $3.9 billion, followed by Turkey at $1.98 billion, then Russia at $353 million, and Oman at $223 million.

According to the same data, the volume of non-oil trade between Iran and neighboring countries continued to rise, recording an increase of 21% year-on-year until March 19, 2025, reaching $74.32 billion, with exports rising to $36.01 billion compared to imports of $38.31 billion.

Despite concerns expressed by Iraq, the UAE, and Oman regarding the impact of the US tariffs, the decision has not yet included clear details on the implementation mechanism or any potential exemptions. In this context, the UAE Minister of Foreign Trade, Thani Al Zeyoudi, stated that his country is monitoring the situation to determine the extent of the decision's impact on food imports.

Turkey is also facing a state of confusion as its trade with the United States expands from $30 billion to $100 billion, but it knows how to deal with such situations without a direct clash with Washington, according to analyst Taha Aydinoglu.

In contrast, China, the largest buyer of Iranian oil, continues to protect its interests and oppose any unilateral sanctions, while European economies such as Germany and Switzerland, along with India and Uzbekistan, also appear to be exposed to the impact of this tariff, reflecting the widening commercial reach of Iran across different continents.

In recent days, the United States announced that any country that conducts trade with Iran will face a 25% tariff on its trade with the United States, a move that could include Iraq, which is among the Arab countries most closely linked to trade with Tehran.

The US decision comes at a time when Iran is witnessing its largest anti-government protests in years, within the context of a series of sanctions imposed by Washington on Tehran for years. https://economy-news.net/content.php?id=64562

Oil Prices Jump, With Brent Rising Above $65 Per Barrel

INA-Baghdad Oil prices rose in global markets on Tuesday, with Brent crude trading above $65 a barrel, while US crude also posted gains. Data from the global oil market, reviewed by the Iraqi News Agency (INA), showed that Brent crude futures rose by 1.70% to reach $65.08 a barrel. The data also indicated that West Texas Intermediate (WTI) crude futures climbed by 2.65% to reach $60.60 a barrel. https://ina.iq/en/economy/44793-oil-jumps-above-65-per-barrel.html

CBI Foreign Currency Reserves Decline

2026-01-14 06:03 Shafaq News– Baghdad Iraq’s foreign currency reserves declined by the end of October 2025, according to figures released by the Central Bank of Iraq (CBI) on Wednesday.

Official data showed the reserves stood at 126.857 trillion Iraqi dinars ($97.582B) as of October 31, easing from 127.601 trillion dinars ($98.155B) at the end of September.

Despite the monthly decline, the data showed an increase compared with August, when reserves totaled 123.033 trillion dinars ($94.641B).

The figures also pointed to a broader downward trajectory from the same period in 2024, when reserves stood at 130.347 trillion dinars ($100.267B), as well as from 2023, when they reached 145.257 trillion dinars ($111.736B).

https://www.shafaq.com/en/Economy/CBI-foreign-currency-reserves-decline-8

Dollar Rises In Baghdad, Erbil Markets

2026-01-14 03:47 Shafaq News– Baghdad/ Erbil The US dollar rose at the opening of Wednesday trading against the Iraqi dinar in Baghdad and Erbil markets.

According to a Shafaq News correspondent, the dollar climbed at Baghdad’s Al-Kifah and Al-Harithiya central exchanges to 147,500 dinars per $100, up from 146,400 dinars recorded on Tuesday.

Exchange shops in the capital also reported higher rates, with the selling price reaching 148,000 dinars per $100 and the buying price standing at 147,000 dinars. In Erbil, the dollar followed the same upward trend, selling at 147,550 dinars per $100 and buying at 147,450 dinars. https://www.shafaq.com/en/Economy/Dollar-rises-in-Baghdad-Erbil-markets

Precious Metals Surge To Historic Milestone

2026-01-14 Shafaq News Gold climbed on Wednesday to again hit a record, while silver surpassed the never-before-seen $90 mark, as softer-than-expected U.S. inflation readings cemented bets on interest rate cuts amid ongoing geopolitical uncertainty.

Spot gold rose 1% to $4,633.40 per ounce as of 0525 GMT, after hitting a record high of $4,639.42 earlier in the session. U.S. gold futures for February delivery rose 0.8% to $4,640.90.

Spot silver jumped 4.2% to $90.59 per ounce after breaching $90 for the first time, having shot up nearly 27% already this year.

"U.S. CPI figures showed that inflation remained relatively contained at 2.6% (year-on-year), and risk assets may be hoping for a similarly benign PPI reading to keep expectations alive for further monetary policy easing," said Tim Waterer, KCM Trade's chief market analyst.

The U.S. core Consumer Price Index rose 0.2% month-on-month and 2.6% year-on-year in December, falling short of analysts' expectations of a 0.3% and 2.7% increase, respectively. U.S. core Producer Price Index data for December is due later in the day.

U.S. President Donald Trump welcomed the inflation figures, reiterating his push for the U.S. Federal Reserve Chair Jerome Powell to cut interest rates "meaningfully."

Global central bank chiefs and top Wall Street bank CEOs lined up in support of Powell on Tuesday after news of the Trump administration's decision to investigate him drew condemnation from former Fed chiefs as well.

Analysts say worries around Fed independence and trust in U.S. assets added to safe-haven demand for the yellow metal. Investors expect two 25-basis-point rate cuts this year, with the earliest in June.

Non-yielding assets tend to do well in a low-interest-rate environment and during geopolitical or economic uncertainty.

ANZ expects gold to trade above $5,000/oz in the first half of 2026, the bank said in a note on Wednesday.

For silver, the next big figure was the $100 mark and high two-digit percentage gains for the metal seem likely this year, said GoldSilver Central managing director Brian Lan.

Elsewhere, spot platinum climbed 4% to $2,415.95 per ounce, a one-week high. It hit a record $2,478.50/oz on December 29. Palladium was up 3.3% at $1,899.44 per ounce. https://www.shafaq.com/en/Economy/Precious-metals-surge-to-historic-milestone

“Tidbits From TNT” Wednesday Morning 1-14-2026

TNT:

Tishwash: The Ministry of Interior announces the arrest of 91 individuals manipulating the dollar exchange rate.

The Ministry of Interior announced on Tuesday the arrest of 91 people manipulating dollar prices.

Ministry spokesman Miqdad Miri told Al-Eqtisad News that "security forces were able to arrest 91 people on charges of manipulating dollar prices."

He pointed out that "the ministry was also able to arrest 147 people manipulating the prices of food and medicine," indicating that "the Ministry of Interior has contracted for 100 fixed and mobile radars to monitor external roads

TNT:

Tishwash: The Ministry of Interior announces the arrest of 91 individuals manipulating the dollar exchange rate.

The Ministry of Interior announced on Tuesday the arrest of 91 people manipulating dollar prices.

Ministry spokesman Miqdad Miri told Al-Eqtisad News that "security forces were able to arrest 91 people on charges of manipulating dollar prices."

He pointed out that "the ministry was also able to arrest 147 people manipulating the prices of food and medicine," indicating that "the Ministry of Interior has contracted for 100 fixed and mobile radars to monitor external roads link

Tishwash: An economist explains the budget and spending mechanism (1/12) under the caretaker government.

Economic expert Salah Nouri explained on Tuesday the legal foundations for submitting and approving the federal general budget, and the financial disbursement mechanisms adopted in the event of its non-approval, especially in light of the caretaker government situation.

Nouri pointed out in his statement to Al-Furat News Agency that “Article (11) of the Federal Financial Management Law No. (6) of 2019 stipulated that the draft federal general budget law be submitted by the Council of Ministers to the House of Representatives before the middle of October of each year.”

He explained that “Article (13), Paragraph Three, dealt with the situation of the House of Representatives not approving the draft budget law until 12/31 of the fiscal year, as the final financial statements for the previous year are considered the basis for the financial statements for the current year, and are submitted to the House of Representatives for the purpose of approving them.”

He added that "the current situation is that the government is a caretaker government, and therefore paragraph one of Article (13) is applied, which allows spending at a rate of 1/12 of the total actual expenditures of the previous year, after excluding non-recurring expenditures for the current and investment budgets." link

************

Tishwash: Warnings of escalating public anger following tax and customs duty hikes

Economic expert Ahmed Al-Tamimi warned on Monday (January 12, 2026) of the possibility of escalating public anger in Iraq due to the government's decisions to raise taxes and customs duties, coinciding with rising prices of basic commodities in the markets, which increases the pressure on the living standards of citizens, especially those with limited income.

Al-Tamimi told Baghdad Today: “Any increase in taxes or customs duties, if not accompanied by clear social protection measures, will directly affect the prices of goods and services, because the merchant and the importer will pass on the cost of the increase to the end consumer, while the Iraqi citizen is already suffering from the erosion of income as a result of inflation and the high cost of living.”

He added that “the Iraqi public is sensitive to economic decisions that affect livelihoods, and such measures could turn from an economic issue into a social and perhaps political crisis if they are not managed wisely and transparently.”

He pointed out that “raising customs duties may be financially justified to support non-oil revenues, but the current timing is not appropriate due to weak market control and the absence of local alternatives capable of meeting market needs, which leads to higher prices without a tangible improvement in services or income levels.”

Al-Tamimi stressed that “continuing this approach without societal dialogue or governmental clarification will increase public discontent, especially with citizens feeling that the economic burdens fall on them alone, in light of the absence of real reforms to combat waste and corruption and improve financial management.”

For his part, economist Ziad Al-Hashemi believes that implementing the new customs system and imposing customs duties, along with regulating remittances through a unified governance system, represents a correct and initial step in the right direction, but he stressed that the problem lies in the implementation mechanism and the state’s management of the transition process from the previous situation to the new system.

Al-Hashemi explained in a statement to “Baghdad Today” on Sunday (January 11, 2026) that “the rapid and comprehensive application of the system has led to confusion in Iraqi markets and has directly affected citizens,” noting the need for “the government to reassess the implementation mechanism, and perhaps introduce amendments to mitigate the damage caused by the speed of implementation.”

He added that "the solution lies in adopting a phased implementation mechanism, starting with focusing on specific priority goods, reviewing the customs duties imposed on them, and monitoring the repercussions of this phase before moving on to other goods, so that the process is carried out in several stages that allow for absorbing the change and reducing the damage to society, markets and traders, in addition to its impact on supply and demand."

Al-Hashemi stressed that “the gradual approach helps the government achieve its goals in controlling remittances and commercial operations and achieving non-oil revenues that support public finances, while at the same time giving traders an opportunity to rearrange their situations and the volume of goods, and sparing the consumer the shock of a sudden rise in prices in the markets.”

He concluded by saying that "this well-thought-out approach will ensure a smooth transition to the new system," expressing his hope that the government will adopt this path during the next phase to ensure market stability and protect the citizen. link

Mot: But Mommie!!!!!

Mot: Now Tell Me... Who Is the Most Encouraging!!!

FRANK26….1-13-26…….GOODBYE

KTFA

Tuesday Night Video

FRANK26….1-13-26…….GOODBYE

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Tuesday Night Video

FRANK26….1-13-26…….GOODBYE

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Frank’s is wearing a new color:

What Frank’s suit color’s mean…. FRANKS SUIT COLORS FOR CC'S..... WHITE = NEW INFO…. SILVER = INTEL FROZEN…. RED= HIGH ALERT… PURPLE=GUEST WITH US…. BLUE = AIR FORCE…. BLACK = GROUND/FF’S…. GREEN= MR OR FAB 4 ... GOLD = CHANGE… ORANGE=IMPLEMENTATION

Seeds of Wisdom RV and Economics Updates Tuesday Evening 1-13-26

Good Evening Dinar Recaps,

Trump’s $2,000 Tariff Checks in 2026: Status and Outlook

Tariff revenue promises collide with legal and practical reality

Good Evening Dinar Recaps,

Trump’s $2,000 Tariff Checks in 2026: Status and Outlook

Tariff revenue promises collide with legal and practical reality

Overview

Former President Donald Trump has renewed talk of sending $2,000 “tariff dividend” checks to Americans funded by tariff revenue.

The timing is uncertain: administration statements now target “toward the end of 2026.”

Implementation hinges on legislation from Congress and the outcome of a critical Supreme Court decision on the legality of the tariffs themselves.

Latest Signals

Trump appeared to momentarily forget his own promise in a recent interview, later reaffirming plans for checks by end of 2026.

The White House has not released a detailed, concrete roadmap for the program.

Treasury Secretary Scott Bessent stated that tariff rebates would require new legislation, adding uncertainty to execution.

Constraints and Challenges

The tariff revenue Trump cites has been widely questioned; available funds are far short of early estimates required to support $2,000 payments at scale.

Congressional approval is essential — executive action alone won’t deliver the checks.

Why It Matters

If implemented, these checks could stimulate consumer spending and redistribute tariff-generated revenue — a politically powerful but economically debated policy.

Failure to secure legal footing for the underlying tariffs directly jeopardizes the revenue base imagined for these checks.

Tariff dreams meet the hard wall of legal and legislative reality.

Seeds of Wisdom Team

Newshounds News

Sources

People — Trump appears unsure about $2,000 tariff checks but suggests late-2026 payout

Forbes — Treasury says $2,000 tariff checks need congressional approval

~~~~~~~~~~

Supreme Court and Tariffs: Ruling Pending, Stakes Very High

Justices weigh executive power, congressional authority, and economic fallout

Overview

The U.S. Supreme Court is expected soon to rule on whether broad tariffs imposed by Trump under the International Emergency Economic Powers Act (IEEPA) were lawful.

Lower courts previously held that the tariffs exceeded presidential authority and were illegal.

Trump’s Response

Trump warned that a ruling against tariff legality would leave the U.S. “screwed,” potentially requiring hundreds of billions (or even trillions) in refunds to companies and trading partners.

The president described the fallout as a “complete mess.”

Treasury’s Comment

Treasury Secretary Scott Bessent says that if the Supreme Court strikes down the tariffs, the Treasury has sufficient funds to issue refunds, though the process could take weeks to a year.

Judicial Timing

The Supreme Court has not yet released a decision on the tariffs, leaving markets and policymakers in suspense.

Why It Matters

A ruling against the tariffs would be a significant judicial check on executive economic power, reaffirming Congressional authority over trade policy.

Substantial refunds could reshape Treasury finances and alter fiscal forecasts.

The outcome directly affects the viability of the $2,000 tariff check idea since those payments are premised on tariff revenue.

When the judiciary weighs in, both trade policy and fiscal strategy are on the line.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — U.S. tariffs at risk of refunds exceeding $133.5 B if Supreme Court rules against legality

AFP via Yahoo Finance — Trump says U.S. could be ‘screwed’ if Supreme Court strikes tariffs down

~~~~~~~~~~

Economic and Policy Implications

Three potential pathways shaping the U.S. fiscal landscape

Scenario A: Tariffs Upheld

Tariffs remain a significant revenue source.

The Trump administration could attempt to formalize $2,000 tariff checks via legislation.

Confidence in executive economic policy might strengthen, though legal debate persists.

Scenario B: Tariffs Overturned

The Supreme Court invalidates the tariff authority under IEEPA.

The Treasury may refund hundreds of billions, dampening revenue projections.

The $2,000 check plan loses much of its funding foundation, likely killing or reshaping it entirely.

Scenario C: Mixed Ruling

The Court limits certain tariffs but allows others.

Revenue streams may shrink but not vanish, prompting partial redistribution strategies or alternative tax incentives.

The legal fight over tariffs is not just about trade — it’s about who controls fiscal policy and how the government finances major programs.

Seeds of Wisdom Team

Newshounds News

Source

The Independent — Tariff rebate checks hinge on Supreme Court ruling and revenue outlook

https://www.the-independent.com/news/world/americas/us-politics/trump-tariff-rebate-checks-2026-b2886295.html

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Evening 1-13-26

The Ministry Of Interior Is Pursuing Dollar Speculators

First 2026/01/14 Baghdad: Sorour Al-Ali The Ministry of Interior intensified its efforts to protect economic security and pursue those manipulating the dollar exchange rate, taking action against (91) accused persons, in parallel with strengthening traffic control and developing roads, which contributed to reducing accidents by (33%) and organizing data for more than (12) million cars through a modern national electronic database.

The Ministry Of Interior Is Pursuing Dollar Speculators

First 2026/01/14 Baghdad: Sorour Al-Ali The Ministry of Interior intensified its efforts to protect economic security and pursue those manipulating the dollar exchange rate, taking action against (91) accused persons, in parallel with strengthening traffic control and developing roads, which contributed to reducing accidents by (33%) and organizing data for more than (12) million cars through a modern national electronic database.

The Ministry's spokesman, Brigadier General Miqdad Miri, said in a joint press conference held yesterday, Tuesday, with the Director General of the Traffic Directorate, Lieutenant General Dr. Uday Samir: that the legal procedures to prosecute those manipulating the price of the dollar included (91) defendants in various governorates, in addition to monitoring (104) activities related to imported food items to ensure consumer protection and market control.

On the traffic front, the Ministry confirmed that the efforts of the General Directorate of Traffic contributed to a 33% decrease in accidents during 2025 compared to 2024, along with a reduction in traffic fatalities through monitoring common violations, most notably using a mobile phone while driving and inattentiveness. The measures included regulating traffic on internal and external roads through 473 traffic centers and 1,354 field vehicles, addressing accident black spots, and designating safer lanes.

As part of the digital transformation, information on more than (12) million vehicles was registered and standardized in the national database and linked to the national system, in addition to activating electronic booking and issuing license plates through (27) traffic sites, which contributed to improving discipline and facilitating procedures.

For The Citizens.

The Director General of Traffic, Lieutenant General Uday Samir, confirmed that all these steps aim to enhance economic and traffic security, raise awareness of the laws, and ensure the safety of citizens on the roads, while continuing to follow up on violators firmly. https://alsabaah.iq/126442-.html

Experts: The Rise In The Parallel Market Exchange Rate For The Dollar Is Temporary.

Economic 2026/01/07 Baghdad: Hussein Thagab and Anwar Ayed The parallel exchange market in Iraq witnessed a significant increase in the dollar exchange rate against the dinar in recent days, reaching around 149,000 dinars per 100 dollars, which had a "slight" impact on the prices of various goods and materials.

Despite the rise in “parallel exchange rates”, specialists confirm that these surges are “temporary” and do not pose any economic concerns at all, especially with the precautionary measures taken by the “monetary authority” to absorb the severity of the rise.

The Prime Minister’s financial advisor, Dr. Mazhar Muhammad Saleh, had previously described the fluctuation in the exchange rate as “temporary” and not reflecting a structural imbalance, especially since it had practically become detached from the level of income and consumption.

Structural Factors

Economic and financial expert, Dr. Nabil Al-Abadi, believes that this phenomenon is not a coincidence or the result of a single factor, but rather the result of a complex interaction between a number of structural and circumstantial factors, internal and external, which can be analyzed into three reasons: internal structural and institutional factors, market behaviors and speculation, and external restrictions and influences.

Al-Abadi explained in an interview with Al-Sabah that, with regard to internal structural and institutional factors, the Iraqi economy is a mono-type economy, as oil revenues constitute the main source of hard currency, noting that this framework makes the balance of payments and the exchange rate highly vulnerable to the fluctuations of global oil markets.

Single Economy

Al-Abadi added that, on the monetary front, policies aimed at de-dollarization, which are essential for long-term monetary sovereignty, are being implemented rapidly. However, this implementation has been accompanied by stricter controls on dollar sales and remittance channels, leading to a reduction in supply through semi-official channels and pushing a significant portion of demand towards the parallel market.

Furthermore, the weakness of the private productive sector, whether industrial or agricultural, means the absence of an alternative domestic source of foreign currency beyond oil revenues, depriving the economy of a crucial lever for exchange rate stability.

In addition, recent developments in the customs system, particularly the requirement for prior documentation under the ASYCUDA system to obtain dollars at the official rate, have disrupted normal trade flows. He explained that this complexity and delay have driven a number of traders, especially medium-sized ones, to resort to the parallel market to finance their urgent transactions, thus increasing actual demand there.

Market And Speculation

Al-Abadi added that, regarding market behavior and speculation, in the absence of attractive and effective regulatory investment channels, a portion of local liquidity tends to be used for exchange rate speculation as a means of achieving quick profits. He explained that this speculation is often fueled by information noise and rumors, which amplifies short-term volatility. Informal practices have also been observed within the parallel market itself, such as price discrimination between different denominations of the same US dollar, indicating distortions in the market's operational mechanisms.

Regarding the third factor, “external restrictions and influences,” the financial and economic expert said that currency transfers through official Iraqi banking channels are facing increasing difficulties, especially when it comes to neighboring countries subject to international sanctions regimes.

He noted that this reality pushes the commercial sector’s need to transfer through these channels to the parallel market, creating additional structural demand. Moreover, the impact of the general regional and international geopolitical climate cannot be ignored, as any tensions lead to an increase in demand for hard currencies as a safe haven, which is reflected in the markets of fragile countries.

The impact of rumors

Al-Abadi added that in response to this analysis, official bodies are presenting a different narrative, focusing on the transient nature of this rise, as government officials describe it as “emergency and temporary,” and a result of rumors that can be contained, while emphasizing the stability of the official price at 1320 dinars to the dollar as a basic anchor. It is also believed that the reform measures in customs and the banking sector will soon begin to show their positive results.

He stressed that from a professional point of view, the official view, despite the necessary reassurance it provides, deals with the apparent symptoms more than it addresses the root causes, emphasizing that circumstantial factors such as new procedures and rumors play a stimulating role, but the roots of the crisis lie in that dangerous mix of a rentier, mono-economic economic structure, chronic weakness in domestic production, and the complexities of the geopolitical environment.

Repeated Cycles

He stated that without addressing this triad, the Iraqi economy and its currency exchange rate will remain vulnerable to repeated cycles of instability, with crises appearing intermittently and then temporarily disappearing before returning in other forms. He explained that the solution to the exchange rate dilemma does not lie in limited technical intervention to balance the parallel market or simply blaming speculators, despite the importance of these short-term measures.

The spokesperson stressed that a real and sustainable solution requires a comprehensive economic policy that aims to diversify sources of national income, stimulate the productive private sector through a supportive investment and legislative environment, and restructure the financial sector to be more efficient and inclusive.

He pointed out that these structural reforms are the only way to create an economy that is less dependent on the outside and more resistant to shocks, which in turn will reflect on the strength and stability of the national currency in the medium and long term.

Official Price Remains Stable

For his part, Haider Ghazi, the media officer of the Central Bank of Iraq, confirmed that there has been no change in the exchange rate of the dollar against the dinar, and it remains fixed at 1,320 dinars per dollar, explaining that what is being circulated as an exchange rate is only the demand of the unofficial market for dollars outside the system of banks licensed to work in foreign transfers through correspondent banks.

In an interview with Al-Sabah, Ghazi attributed the main reason for the rise in the parallel market to the customs duty due to demand outside the banking system, noting that the application of the prior customs duty for transfer purposes may have put significant pressure on those seeking cash dollars, and was behind the rise in demand for the dollar against the dinar in local markets.

He explained that traders are required to bring the customs declaration (customs statement) from the ASYCUDA system before the bank transfer is made to them, adding that on many occasions the Central Bank of Iraq stated that the ways to obtain dollars are through: First, external transfers through banks in a systematic and documented manner with all parties, and second, through the traveler's dollar after depositing an amount in Iraqi dinars with companies of categories A and B, and it is received through outlets inside Iraqi airports, as the bank set the traveler's share per month at $3,000.

Supply And Demand

In addition, a number of traders reported that the rise in the dollar price led to fluctuations in the price of goods, especially imported ones. While they indicated that some commercial activities witnessed a temporary slowdown while awaiting the stabilization of the exchange rate, money exchange shop owners explained that the demand for the dollar had increased during the past few days, compared to a relative decline in supply, which contributed to the rise in the price in the parallel market.

Iraq’s economy is mainly dependent on oil revenues, which represent the largest share of the general budget resources. The local market also depends largely on imports to secure basic goods, making exchange rates an influential factor in the cost of imports and the prices of materials in the market.

Government Procedures

On a related note, economist Mustafa Faraj believes that fluctuations in the dollar exchange rate directly impact the local market, given the nature of the Iraqi economy. He stressed the importance of taking regulatory measures when the exchange rate rises, including controlling the market and regulating trade, as well as ensuring the regular distribution of the food basket to reduce the impact of price changes in basic commodities.

Faraj added that oil prices and geopolitical factors in the region play a role in influencing economic performance, noting that the general budget was built on specific oil price estimates, and with any change in these prices, challenges arise in managing spending.

He suggested that the recent rise in the dollar's price was temporary, linked to the implementation of new mechanisms for regulating trade at the beginning of the year.

Trade Finance Mechanisms

For his part, Professor of International Economics, Nawar Al-Saadi, said that the recent rise in the price of the dollar in the parallel market reflects imbalances in the mechanisms for financing foreign trade and managing the demand for foreign currency, more than it is an indication of weakness in the country’s dollar resources.

Al-Saadi explained that part of the demand for the dollar is related to trade outside official banking channels, in addition to the impact of speculation and psychological factors in the market, stressing that the continued gap between the official price and the parallel market price limits the ability of monetary policies to achieve stability.

Meanwhile, economist Ahmed Eid believes that the rise in the dollar's price came as a result of the convergence of several factors at the same time, including increased commercial demand at the beginning of the year, in addition to psychological and hedging factors among some market participants.

Eid added that these developments do not currently indicate a structural monetary crisis, unless the pressures continue for a longer period or are accompanied by broader economic changes.

Given these circumstances, local market participants are awaiting government measures to control exchange rate activity, amid expectations that the dollar's price trajectory in the coming period will be determined by the balance of supply and demand and trade financing mechanisms.