The Clarity Act is Not Capture, it’s Alignment

The Clarity Act is Not Capture, it’s Alignment

1-14-2026

Rob Cunningham | KUWL.show @KuwlShow

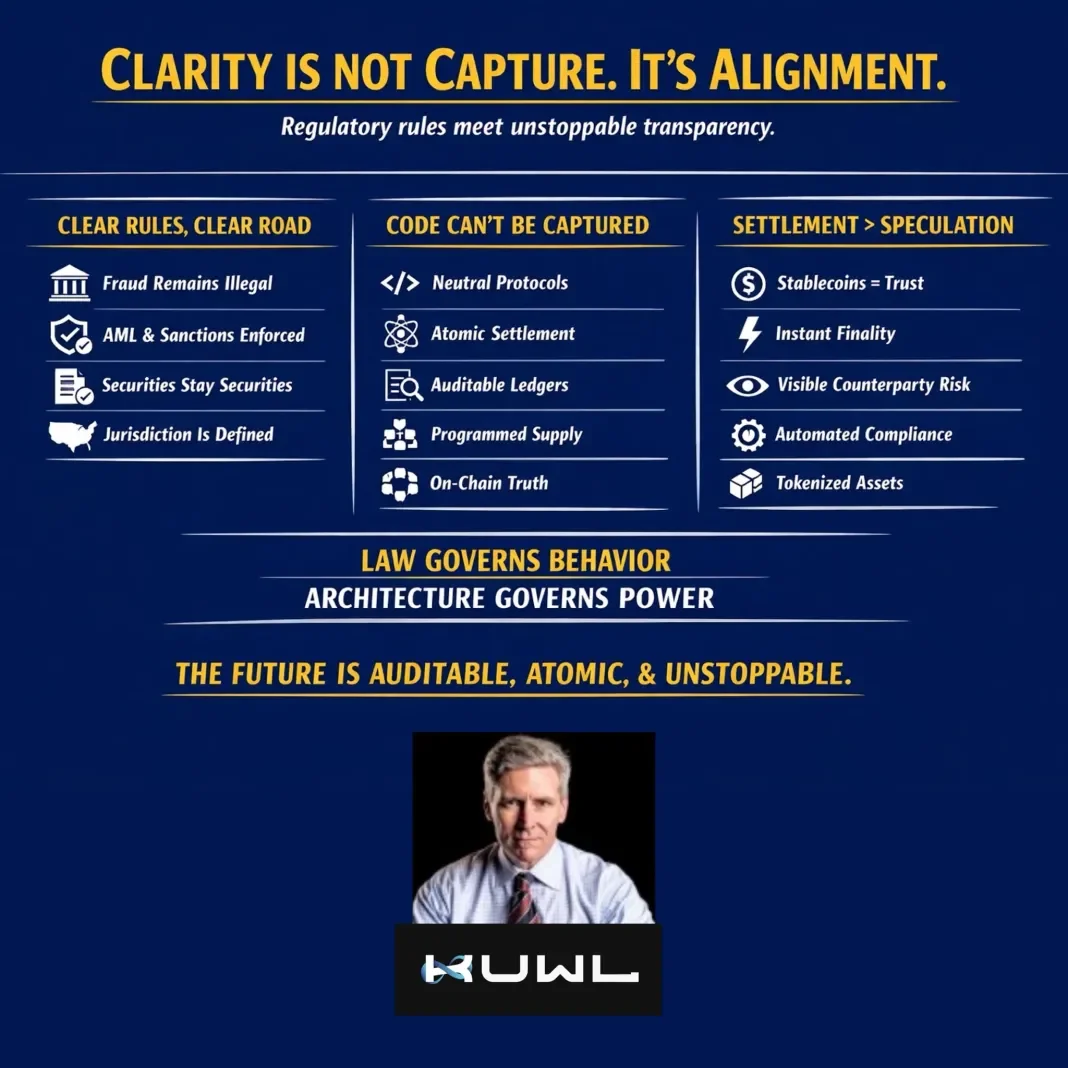

The Clarity Act Is Not “Capture.” It Is Alignment.

The Clarity Act governs behavior – but the architecture governs power.

Law can constrain actors, but only transparent, atomic systems eliminate the incentives and mechanisms for abuse.

Digital asset markets don’t fail because of innovation.

They fail because of opacity, jurisdictional confusion, and discretionary power.

The CLARITY Act does one simple thing:

It replaces uncertainty with enforceable rules.

And here’s the part many are missing:

Clear rules do not enable institutional capture – they remove it.

Why?

Because institutions cannot capture:

Neutral code

Atomic settlement

Public, auditable ledgers

Programmatic supply

On-chain truth

They can only participate.

And participation under transparent, rules-based systems is the opposite of capture.

This is not crypto being absorbed by legacy finance.

This is legacy finance being forced to behave honestly.

Investor Protection Is Structural, Not Cosmetic

Fraud remains illigal.

Securities remain securities.

AML, sanctions, and enforcement remain intact.

But once settlement is atomic and ledgers are auditable:

Market manipulation becomes visible

Rehypothecation becomes impossible

Counterparty risk becomes measurable

Insider abuse loses cover

Stablecoins Aren’t Speculation – They’re Settlement

Record stablecoin supply is not a bull signal.

It’s a plumbing signal.

They represent:

Unit-of-account trust

Velocity without volatility

Cross-border neutrality

Finality without intermediaries

No opaque monetary system survives once:

Settlement is instant

Liquidity is transparent

Compliance is automated

Assets are tokenized at the source

This Isn’t Optimism — It’s Engineering

When regulators talk about markets moving on-chain, they’re not predicting adoption.

They’re describing deployment.

Capital isn’t ideological.

It flows where:

Friction is lowest

Risk is smallest

Cost is minimal

Truth is highest

Finality is guaranteed

That equation is already solved.

Bottom Line

CLARITY doesn’t weaken markets – it hardens them.

It doesn’t protect bad actors – it exposes them.

It doesn’t enable capture – it ends opacity.

This isn’t a bull market thesis.

It’s a NEW monetary operating system.

Goodbye @federalreserve.

And once it’s live, no serious actor goes back.

1) Uncertainty enables abuse. Clear rules + transparent systems do not.

2) Bad actors lose leverage.

3) Intent and control matter – not mere publication of software.

4) Liquidity follows structural advantage, not ideology.

“How do we constrain institutions?”

By removing the tools they used to abuse power in the first place.

Source(s): https://x.com/KuwlShow/status/2011259630597603748

https://dinarchronicles.com/2026/01/14/rob-cunningham-the-clarity-act-is-not-capture-its-alignment/