Seeds of Wisdom RV and Economics Updates Monday Evening 10-20-25

Good Evening Dinar Recaps,

BRICS Currency Countdown: Why 2026 Still Looks On the Clock

— And how U.S. tariff threats may be accelerating the very change they aim to block

What’s Going On

The grouping of nations known as BRICS (Brazil, Russia, India, China, South Africa, and newer members) appears to be staying on track for a 2026 launch of a shared-currency framework, despite aggressive efforts by the U.S. to derail the plan. Researchers monitoring the project highlight that digital payment systems, local-currency trade settlement and infrastructure are all advancing.

Good Evening Dinar Recaps,

BRICS Currency Countdown: Why 2026 Still Looks On the Clock

— And how U.S. tariff threats may be accelerating the very change they aim to block

What’s Going On

The grouping of nations known as BRICS (Brazil, Russia, India, China, South Africa, and newer members) appears to be staying on track for a 2026 launch of a shared-currency framework, despite aggressive efforts by the U.S. to derail the plan. Researchers monitoring the project highlight that digital payment systems, local-currency trade settlement and infrastructure are all advancing.

Meanwhile, U.S. President Donald Trump has ramped up threats of tariffs — including warnings of 100 % duties — on countries aligning with what he calls “anti-American policies” via BRICS, or attempting to sideline the U.S. dollar.

Why It Matters

Emerging currency dynamics: A new shared-currency initiative could tilt how global trade is settled and challenge the dominance of the U.S. dollar.

Innovation meets geopolitics: It demonstrates how payment rails, digital currencies, and trade settlement are now central to global strategy, not just finance.

Tariff threats as a double-edged sword: U.S. actions meant to deter may instead accelerate the drive toward alternatives.

What’s Driving the Timeline Toward 2026

Several analysts point to clear progress on infrastructure: cross-border settlement mechanisms, digital-currency research, and local-currency trade arrangements.

For example, central-bank gold accumulation surged in Q2 2025, seen as a hedge by BRICS-member states and sign of serious preparation.

The expansion of the bloc (including nations like Egypt, UAE, Indonesia) increases weight and legitimacy behind the idea of an alternative system.

On the U.S. side, the threat of tariffs and other economic pressure seems to be viewed internally by some BRICS members not just as deterrence, but as a reason to advance alternatives.

Why the U.S. Tariff Strategy May Backfire

Trump has threatened countries with tariffs of up to 100 % if they deviate from the dollar system or join BRICS currency plans.

But such threats can deepen resolve among BRICS nations to reduce dependency on U.S.-dominated systems.

Legal challenges are also pressing in the U.S., which may weaken the long-term enforcement of such tariff powers.

The Big Reality Check

Despite headline talk of a 2026 currency launch, several expert sources caution that a fully unified BRICS currency remains a long shot. For example:

One analysis suggests the first phase likely involves a payment-system platform and local-currency settlement (2025-27), with any full-scale currency much later (2028-2030+).

Key internal challenges remain: aligning fiscal/monetary policy across very different economies (China vs India vs Brazil) and ensuring the infrastructure is trusted and liquid.

At present, trade within BRICS still predominantly uses the U.S. dollar and global reserves remain heavily dollar-weighted.

Our Take

Here’s how this fits with what we track: innovation in finance plus institutional reform.

The financial-technology layer (digital rails, CBDCs, local-currency settlements) is moving ahead.

The institutional/power layer (who issues money, who sets rules) is in flux.

The U.S. tariff strategy highlights the stakes: finance is geopolitics.

In other words: new financial infrastructure is not just about tech; it’s about power, control and strategic autonomy.

What to Watch Next

Announcements from BRICS or its development bank (e.g., New Development Bank) about pilot platforms or settlement systems targeting 2026.

Moves by member-state central banks: digital-coin pilots, gold accumulation, trade denominated in non-dollars.

U.S. policy shifts or legal rulings around tariffs and trade strategy that could reshape how enforceable the “100 % tariff” threat is.

Responses from non-BRICS countries: Will they join or support the alternative rails? Or will they be deterred by U.S. action?

FX/reserve-data signals: Any sizeable shift away from the dollar in reserves, trade settlement or currency-baskets.

Final Word

The “2026 launch” of a BRICS currency isn’t a guaranteed moment in time, but rather a marker of a broader transition — a shift in how large emerging-economy blocs view money, finance and independence. The U.S. threats may slow some actions, but they could also spur others. The real question isn’t whether the effort stops — it’s how fast the contours of a new system take shape, and whether they begin to lean against, rather than around, the dollar-centric world.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

“BRICS Currency Launch Date Unchanged Despite Bold US Move To Stop It” — Watcher.Guru, Oct 19 2025: Watcher Guru

“How Would a New BRICS Currency Affect the US Dollar?” — InvestingNews, Sep 2025: Investing News Network (INN)

“BRICS investment opportunities rise ahead of 2026 common currency launch” — IndonesiaBusinessPost, Sept 30 2025: https://indonesiabusinesspost.com/

“Central bank buys 166 tonnes of gold, BRICS prepares currency for 2026” — IDNFinancials, Aug 17 2025: IDN Financials

“Trump calls BRICS ‘attack’ on US dollar” — EconomicTimes (via PTI), Oct 15 2025:The Economic Times

“Breaking Down the BRICS Tariff” — AmericanActionForum, Jul 15 2025: AAF

“Jim O’Neill: BRICS Currency a Distant Dream Yet Bloc Eyes 2026 Launch” — CryptoRank, Sep 7 2025: CryptoRank

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

More News, Rumors and Opinions Monday PM 10-20-2025

KTFA:

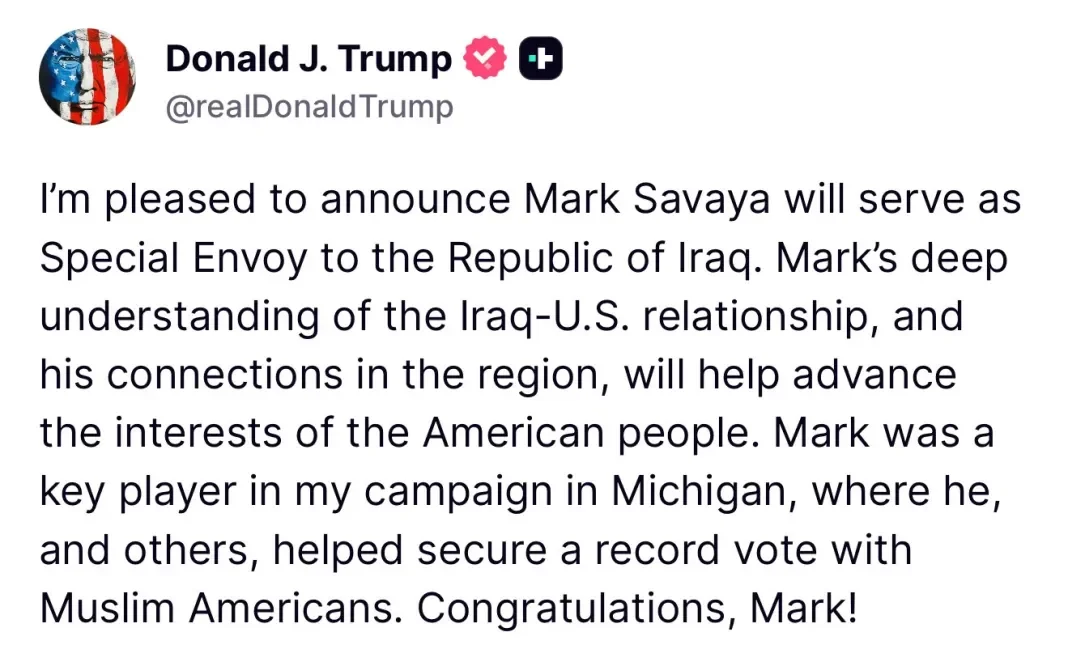

Clare: The "third envoy" to Baghdad: Trump remained in Iraq to play a decisive role.

10/20/2025

The appointment of Iraqi Chaldean Mark Savaya as US President Donald Trump's special envoy to Iraq has generated considerable interest in Iraq, with attempts to understand the US move and the background of this man, known for his closeness to Trump.

However, Savaya now assumes a sensitive position, handling the Iraqi file, despite having never held any official position, either at the state or federal levels.

Mark Savaya is the third US envoy to Iraq, since Paul Bremer in 2003, and after Brett McGurk during the war against ISIS in 2014.

KTFA:

Clare: The "third envoy" to Baghdad: Trump remained in Iraq to play a decisive role.

10/20/2025

The appointment of Iraqi Chaldean Mark Savaya as US President Donald Trump's special envoy to Iraq has generated considerable interest in Iraq, with attempts to understand the US move and the background of this man, known for his closeness to Trump.

However, Savaya now assumes a sensitive position, handling the Iraqi file, despite having never held any official position, either at the state or federal levels.

Mark Savaya is the third US envoy to Iraq, since Paul Bremer in 2003, and after Brett McGurk during the war against ISIS in 2014.

Mark Savaya appears to straddle the worlds of business and politics. His Instagram account, which has over 94,000 followers, features numerous photos of him with Trump, reflecting the personal side of their relationship, including in the White House and other locations, as well as photos of him with numerous prominent political, media, and entertainment figures.

Savaya commented on Trump's appointment as Special Envoy to Iraq in an Instagram post, saying: "I am deeply humbled, honored, and grateful to President Donald Trump for appointing me as Special Envoy to the Republic of Iraq. I am committed to strengthening the US-Iraq partnership under President Trump's leadership and guidance. Thank you, Mr. President. I will work to build bridges of trust and cooperation to achieve sustainable security in Iraq and the region."

Savaya was known for his active involvement in Michigan, demonstrating his ability to influence the masses, particularly in non-traditional communities, which led him to play a pivotal role in increasing voting rates among Michigan's Arab and Muslim communities to record highs.

Savaya is considered a member of the influential MAGA (Make America Great Again) movement, which is believed to have played a key role in Trump's rise and subsequent successful return to the White House, and which includes a diverse group of media figures, politicians, and influential activists.

According to his LinkedIn page, Savaya, a Michigan resident, has no government experience at the local, state, or federal level. He is an active businessman in the Detroit area, where he founded a marijuana retail chain called Leaf & Bud, which sells medical and recreational marijuana. According to The Independent, the company was criticized by Detroit leaders for its bold billboards that promoted the slogan: "Come and get it. Free weed."

However, Trump expressed his great confidence in Savaya's career, saying that he "possesses a deep understanding of regional relations and has direct contact with Iraqi communities, which makes his appointment an important step in advancing America's interests in the Middle East." He added, "We are confident in Mark's ability to advance our agenda and protect our interests in Iraq, especially during this critical period."

The Independent noted that Savaya's Leaf & Pad company conducted an extensive marketing campaign on Detroit roads, prompting city leaders to issue an ordinance restricting such advertising.

According to Reddit, two Liv & Bud branches have closed since January, leaving only three brick-and-mortar stores listed on the company's website. According to The Independent, the website has been updated to remove references to Savaya himself, including "The Mark Savaya Collection."

But Savaya's statement from 2020 says, "It's good to produce cannabis from seed and sell it. It's a process we go through instead of buying it from a different cultivation center. We make it ourselves, and we want to make sure it's a clean product, and that everything we do is monitored."

The Independent noted that it contacted Leaf & Bud to try to confirm Savaya's current role at the company, which had previously identified him on its website as the "visionary" behind the natural cannabis retail chain that marketed itself with the slogan "Come and get it. Free weed."

Trump is known for his personal opposition to drug use, but he has softened his stance in recent years. He supported Florida's referendum to legalize recreational marijuana in 2024, and during his campaign, he called for the execution of drug traffickers. In 2019, he praised China for its use of the death penalty in some serious drug-related cases, and he recently ordered airstrikes targeting boats in the Caribbean, allegedly smuggling drugs. This drew widespread criticism, as the strikes were deemed illegal.

However, Israeli Elizabeth Tzurkov, who was kidnapped in Iraq for more than two years, wrote on the X platform, "I congratulate Mark Savaya on this important appointment. Mark played a pivotal role in freeing me after 903 days of captivity by Kataib Hezbollah, an Iraqi militia working for Iran, without any compensation. This is very bad news for everyone who serves Iran's interests in Iraq and seeks to undermine Iraqi sovereignty."

"This is impossible. He is strongly opposed to the militias," Tsurkov said in response to a comment from an X user who expressed concern that pro-Iranian militias might try to manipulate Savaya. LINK

************

Ariel: Understanding the Implications of this

10-20-2025

We Need To Understand The Implications Of This:

What did Donald Trump mean when he said Mark will advance the Interest of the American people in a foreign country?

What happened a few days ago?

Didn’t Iraqi banks fall under Rafidain Bank and are now subject to the authority of the U.S. Treasury?

What recently happened with their oil a couple of days ago?

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 The only way you're going to see the HCL is if they use the new exchange rate. That's why they told you they're lifting the 3 zeros. You got the new exchange rate and you got the HCL we just need the damn laws...You're about to see a different...value added to your currency which will allow the HCL to be calculated properly and then give the citizens of Iraq a decent oil and gas rights payment to them. At 1310 all they were going to give them was a few pennies. We're walking on very thin ice and at any moment I believe in my heart it's going to crack and put us right through into the monetary reform purchasing power for the citizens and our blessing, our profit.

Jeff They're talking to us out of both sides of their mouth. From one side they keep announcing all the brand new wonderful stuff they're doing/have done, letting us know the rate is about to change. But from the other side of their mouth they won't tell us anything about the budget schedules. They keep hiding that from us.

*****************

"I Believe the Market Top May Be In" Got Gold & Silver?

Mike Maloney: 10-20-2025

Are we seeing the top of the markets now?

In this urgent episode of The Gold Silver Show, Mike Maloney & Alan Hibbard break down why they believe the highest highs may already be behind us—and how gold & silver could become lifeboats in the coming storm.

What you’ll get in this video

• Why the standoff between Trump and Xi could trigger a market collapse

• The importance of real assets when central banks lose control

• How China may secretly own far more gold than reported

• A powerful gold–silver ratio strategy to multiply your gold

• Lessons from Rome: how empires collapse when currencies are debased

The Case For Sound Money: The Most Meaningful 5 Minutes I've Ever Recorded | Judy Shelton

The Case For Sound Money: The Most Meaningful 5 Minutes I've Ever Recorded | Judy Shelton

Adam Taggert/Thoughtful Money: 10-20-2025

Here, former Federal Reserve nominee Judy Shelton makes the most compelling constitutional & moral argument for sound money I've ever heard

I promise it will be the most meaningful 5 minutes you've seen in ages.

The Case For Sound Money: The Most Meaningful 5 Minutes I've Ever Recorded | Judy Shelton

Adam Taggert/Thoughtful Money: 10-20-2025

Here, former Federal Reserve nominee Judy Shelton makes the most compelling constitutional & moral argument for sound money I've ever heard

I promise it will be the most meaningful 5 minutes you've seen in ages.

Iraq Economic News and Points To Ponder Monday Afternoon 10-20-25

Al-Ghariri: Iraq's Negotiations To Join The World Trade Organization Are Ongoing.

Economy | 06:55 - 10/20/2025 Mawazine News - Follow-up: Minister of Trade Athir Dawood Al-Ghariri confirmed on Monday that Iraq is continuing its negotiations to join the World Trade Organization, noting that regional initiatives are an opportunity to enhance institutional readiness and align legislative and investment frameworks.

Al-Ghariri: Iraq's Negotiations To Join The World Trade Organization Are Ongoing.

Economy | 06:55 - 10/20/2025 Mawazine News - Follow-up: Minister of Trade Athir Dawood Al-Ghariri confirmed on Monday that Iraq is continuing its negotiations to join the World Trade Organization, noting that regional initiatives are an opportunity to enhance institutional readiness and align legislative and investment frameworks. https://www.mawazin.net/Details.aspx?jimare=268812

Central Bank: Iraq's Public Debt Is Lower Than That Of The United States And Several Other Arab Countries.

Time: 2025/10/20 19:09:56 Reading: 30 times {Economic: Al Furat News} The Central Bank of Iraq confirmed on Monday that the external debt curve is declining and that Iraq is within safe limits for public debt. The bank noted that Iraq's public debt-to-GDP ratio stands at 31%, a lower percentage than that of developed countries such as the United States and Japan, and other Arab countries such as Egypt, Algeria, and Morocco.

Samir Fakhri, Director General of the Statistics and Research Department at the Central Bank, said, "Total public debt is divided into domestic and external debt. Domestic debt, as of the end of last September, amounted to 90.6 trillion dinars."

He added, "The domestic debt is divided into more than 50% in favor of the Central Bank, and less than 50% in favor of banks, whether private or government-owned," indicating that "the majority of the debt owed to banks is owed to government-owned banks, i.e., from government to government."

He pointed out that "the external debt has reached $54 billion, and is divided into three parts: the largest part, namely $40.5 billion, dates back to before 2003. It is a suspended debt, and we are not currently bearing any burdens on it, whether interest or debt service, from 2003 until today."

He continued, "The second part is the Paris Club debt, which amounted to $120 billion, 80% of which has been written off, leaving $24 billion. With what Iraq has paid, only $3.8 billion remains, which was supposed to be covered until the end of 2028." We note here that the external debt curve is declining.

He pointed out that "the third portion amounts to approximately $10 billion, and is related to investment spending. It is a long-term debt of twenty years, owed to a group of countries and organizations, including Japan's JICA, Germany's Siemens, Spain, and Britain.

Thus, the total debt amounts to approximately $10 billion. If we exclude the forty and a half billion, the remaining amount is approximately $13 billion."

He emphasized that "if we convert these debts into dollars multiplied by the current exchange rate and add them to the domestic debt, the total debt-to-GDP ratio would reach approximately 43%. However, if we exclude the suspended debt of $40 billion, the public debt ratio would be around 30 to 31% of GDP."

Regarding financing the three-year budget deficit, Fakhri explained that “the deficit within the budget law was approved by Parliament for a period of three years. It is a planned deficit, not an actual one, of approximately 64 trillion dinars per year, meaning a total of 192 trillion dinars for the three years. What was actually spent as real debt is approximately 35 trillion dinars.

” He indicated that “if we divide 35 trillion by the planned deficit, the percentage will be approximately 18.2%,” noting that “the debt was 56 trillion dinars until the end of 2022, and from 2022 until today, 35 trillion has been added to it, bringing the total to approximately 90.6 trillion dinars that we mentioned.”

He added, "One of the most important indicators of monetary policy is the consumer price index (inflation), which is currently close to zero. If we compare it with neighboring countries like Iran and Turkey, we find a clear difference in inflation rates between them and Iraq, in addition to the exchange rate gap."

He stressed that "the focus must be on financing the deficit, so it must be directed towards investment spending, as this leads to growth in non-oil revenues."

Fakhry touched on some of the debt ratios in neighboring countries, noting that "in Egypt, public debt amounts to 90% of GDP, in Algeria: 49%, in Morocco: 70%, in Lebanon: 160-170%, and in Saudi Arabia: 29%, despite being a strong and industrially advanced economy."

He pointed out that "major industrialized countries, such as the United States, have a public debt of 120%, while Japan's debt ratio is 250%." LINK

Iraq's Debt Is Within Safe Limits And Does Not Constitute A Burden On The Economy.

October 19, 2025 Baghdad - Qusay Munther The Central Bank of Iraq revealed that Iraq's debt remains within safe limits and does not constitute a burden on the national economy.

A statement received by Al-Zaman yesterday stated that, “Within the framework of financial transparency and to clarify what is included in the public debt and deficit data, the Central Bank would like to clarify what was reported in the media, that the planned deficit in the three-year general budget law approved by the House of Representatives for the three years amounted to 91.5 trillion dinars, while the actual deficit for the three years mentioned amounted to 35 trillion dinars, which was covered internally with bonds and transfers and in accordance with the chapters included in the budget law.

” It added that, “Actual borrowing amounted to 18.2 percent of the planned deficit included in the budget law, reflecting the high level of coordination between the government and the Central Bank in controlling the public debt and its failure to reach the high levels included in the budget law.

” It continued, “The external debts due do not exceed 13 billion dollars after excluding the outstanding and unclaimed debts of the former regime, and Iraq has not defaulted on any obligation, maintaining an excellent financial reputation regionally and internationally in this regard.”

It indicated that, “The internal debt of 91 trillion dinars represents 56 trillion dinars accumulated until the end of 2022.” The added amounts are 35 trillion dinars of debt for the three years, and most of the domestic debt is within the government banking system.

The statement explained that (due to the existence of government accounts and deposits in government banks, specialized committees and international consulting firms are working to convert part of this debt into investment tools within a national fund to manage the domestic debt with the aim of transforming obligations into investment opportunities), stressing that (the ratio of public debt to GDP did not exceed 43 percent, and this ratio, according to internationally recognized classification, is moderate and within safe limits and does not constitute a burden on the economy).

The bank reiterated its confirmation that (it is working to provide an integrated vision of financial sustainability for the coming years that supports the government’s directions in comprehensive reform to diversify the economy and maximize non-oil revenues as an alternative to sole reliance on oil revenues and avoiding a financial deficit).

The bank also warned retirees against dealing with entities and individuals claiming to represent it, with the aim of defrauding them and stealing their data.

The statement said, “The bank warns citizens, especially retirees, against dealing with any entities or individuals impersonating or claiming to represent the Central Bank, and requesting personal data or official documents such as retirement IDs or financial information.

” It stressed that “any licensed financial institution does not request any information from citizens related to their cards, accounts, or financial data, and does not provide loans or request documents via social media or by phone call.” It continued, “Any request of this type is considered an attempt at fraud and deception aimed at exploiting citizens and stealing their data.

” It stressed, “Please do not provide any unofficial entity with any personal or financial information, and immediately report any suspicious contact or message through the official channels of the Central Bank or the competent security authorities.” LINK

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

Seeds of Wisdom RV and Economics Updates Monday Afternoon 10-20-25

Good Afternoon Dinar Recaps,

When Innovation Meets Control: China’s Pause on Hong Kong Stablecoins

Ant Group and JD.com halt plans after Beijing asserts monetary authority.

Overview

Two of China’s biggest tech giants — Ant Group and JD.com — have paused their plans to issue stablecoins in Hong Kong, following quiet guidance from Beijing regulators. The decision underscores growing tension between China’s drive for digital innovation and its insistence on state control over currency.

Good Afternoon Dinar Recaps,

When Innovation Meets Control: China’s Pause on Hong Kong Stablecoins

Ant Group and JD.com halt plans after Beijing asserts monetary authority.

Overview

Two of China’s biggest tech giants — Ant Group and JD.com — have paused their plans to issue stablecoins in Hong Kong, following quiet guidance from Beijing regulators. The decision underscores growing tension between China’s drive for digital innovation and its insistence on state control over currency.

According to the Financial Times, both firms received instructions from the People’s Bank of China (PBoC) and the Cyberspace Administration of China (CAC) to suspend their Hong Kong initiatives. The question, said one source, is simple but fundamental: “Who has the right to issue money — the central bank or private firms?”

The Setback for Hong Kong’s Fintech Ambitions

Hong Kong launched its stablecoin licensing regime in August to attract Web3 and tokenization projects. Initially, mainland officials saw it as an opening to promote renminbi-pegged tokens and boost the yuan’s international use.

But enthusiasm cooled fast. Regulators in Beijing reportedly grew uneasy as some stablecoin ventures posted double-digit losses shortly after the rules took effect. China’s securities watchdog then instructed several brokerages to pause real-world asset tokenization as well — another signal that the central government is tightening oversight of digital-asset experiments.

Why It Matters

This pause reveals three critical themes shaping the region’s financial future:

Monetary Sovereignty: Beijing’s priority is clear — control over money creation must stay with the state. Private stablecoins could blur that line and compete with the digital yuan (e-CNY).

Testing the Limits of Hong Kong’s Autonomy: While Hong Kong markets itself as Asia’s Web3 hub, this episode shows how quickly mainland policy can override its local fintech initiatives.

Signal to Global Markets: China’s stance adds to a broader global shift where governments seek tighter reins on privately issued digital money, balancing innovation with systemic risk.

The Bigger Picture

China is not retreating from digital finance — it’s redefining who leads it. The pause on stablecoins doesn’t end tokenization efforts but re-centers them under state-linked or bank-controlled entities, keeping fintech aligned with national strategy.

For global investors, it’s a reminder that in modern finance, innovation operates within political boundaries.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~

Global Financial Order Under Strain as Geopolitical Fragmentation Deepens

The end of postwar financial integration may be closer than expected.

A Fracturing Monetary Landscape

A new report from the Centre for Economic Policy Research (CEPR), the 28th Geneva Report on the World Economy, warns that rising geopolitical tensions are eroding the foundations of the global financial system that has existed since World War II.

According to the report, strategic competition—particularly between the West and China—combined with sanctions and protectionist measures is accelerating international financial fragmentation.

This fragmentation marks a departure from the decades-long era of liberalized, rules-based globalization that once defined international finance.

From Integration to Geoeconomic Fragmentation

The authors of the Geneva Report argue that the “deep global financial integration without regard to geopolitics” that characterized the postwar era is being replaced by a period of “geoeconomic fragmentation.”

This transition is visible in three key areas:

Capital Flows: Investments are increasingly concentrated within geopolitical blocs, reducing global allocative efficiency.

Crisis Response: Coordination among major economies has weakened, limiting joint responses to shocks such as banking crises or currency volatility.

Policy Divergence: Sanctions, reshoring, and “friend-shoring” are reshaping both trade and financial networks.

Why This Matters

The implications reach far beyond finance:

For businesses, the rise in geopolitical barriers means greater uncertainty in global supply chains, volatile exchange rates, and tighter cross-border investment conditions.

For governments, fragmentation introduces instability into crisis management and capital allocation, increasing the risk of systemic shocks.

For emerging markets, the challenge is most acute — nations may face pressure to align with specific blocs or risk exclusion from capital access and payment systems.

What to Watch

Alternative Payment Systems: Will BRICS and other regional blocs develop competing financial infrastructures to the U.S. dollar system?

Alliance Consolidation vs. Openness: Do states double down on bloc-based cooperation or attempt to sustain a degree of global openness?

Emerging Market Realignment: How developing economies navigate these rival frameworks may shape the next decade of financial globalization.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Source

~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Monday Coffee with MarkZ. 10/20/2025

Monday Coffee with MarkZ. 10/20/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Happy Marvelous Monday

Member: I had been hoping that we would have had an RV weekend….bummer

Member: Good morning everyone! Praying this is our RV week!

Monday Coffee with MarkZ. 10/20/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Happy Marvelous Monday

Member: I had been hoping that we would have had an RV weekend….bummer

Member: Good morning everyone! Praying this is our RV week!

MZ: Bond holders have HUGE expectations this is their week. And more and more reports concerning this- timing wise…..Tuesday and Wednesday….most on Wednesday.

Member: I feel the pain for Bond holders, they have been promised "this week" for a long time now

Member: Mark I have a friend of mine who is a bondholder who said they don’t get their 1st tranche until tier 4 is activated.

Member: Frank26 said contractors in Iraq are po’ed because contractors have not been paid. And Trump told them to stop using dollars.

MZ: There is a lot of pressure on them to get it done on the contractor side.

Member: Frank26 also said Iraq budget article 12-2C has been passed. Now they can RV!

Member: Since the 12-2C section passed this weekend, how much more of the HCL law is left??

MZ: In Iraq: “ Central Bank of Iraq grants a license to the Nishtman bank in the Kurdistan region” This is part of HCL moving forward…. To me this means they are moving forward with the HCL agreement.

MZ: “Zabari: Mark Safay’s appointment is a bold step to restore Iraq’s sovereignty from the militia rule” He was originally Iraqi and the US is putting him in charge of doing away with the Iraqi para-military forces that were left over from battling Isis. This is a huge sticking point for peace in Iraq . Many of these forces were financed from Iran and other agencies. This was in their reform package so they can change the value.

MZ: They have just found massively more oil in Iraq. “ Unproven new oil reserves range between 45 and 100 billion barrels” Cementing its position of the third highest oil producing country in the world.

MZ: The EU is now cutting deals with Iraq and it is believed that huge percentage of energy for Europe will soon be coming directly from Iraq. This is them going international.

Member: MarkZ do you think the GCR including USA, will establish all currencies 1:1 right out the gate?

Member: I would be fine with all currencies 1 to 1…….just do it.

Member: Bloomberg reports golds rise helps emerging markets – Hmmmm

MZ: This is Andy Schectman…we talked about this last Wed. “ Zero hedge: “I have never seen anything like this” one bullion dealer sees a rupture in gold and Silver markets”

Member: Will we be taxed on this exchange?

Member: Chat GPT says anything over $200 will be taxed

Member: we don't get taxed on the return of currency now so why would we suddenly be taxed!? doesn't make sense to me

Member: I’ve been in a lot of countries. Bought their currency with dollars. No tax. Be very careful of the exchange rate though.

Member: About the IRS, As long as there in power they will tax all Capital Gains

Member: If it's taxed, so be it. Still a lot more than I have in my bank right now.

Member: Wasn’t there a document from our government that was taken down saying at least proceeds from a dinar exchange would not be taxed?

Member: https://www.state.gov/reports/2022-investment-climate-statements/iraq/ section 6

Member: Prepare for the worst but hope for the best!

Member: What do you guess will be the dinar rate Mark?

MZ: I think the absolute worst will be a dollar. Realistically I expect it to be around $4 to $6.

Member: how about the Indonisian Rupiah rate?

MZ: I am still hearing $1.47…..and the dong I still think in the low $2 range. But no one will know for sure until we are at the banks.

Member: Tomorrow is Diwali day. Looked it up. It means festival of light for India and that it is good wins over evil. Interesting timing

Member: Hope everyone has a blessed day. See you tomorrow AM

StacieZ joins the stream today. Please listen to the replay for her information.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and opinions Monday 10-20-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 20 Oct. 2025

Compiled Mon. 20 Oct. 2025 12:01 am EST by Judy Byington

Judy Note: The World has been undergoing the largest transfer of wealth in human history, and because of a compromised Main Stream Media, no one knew it.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Mon. 20 Oct. 2025

Compiled Mon. 20 Oct. 2025 12:01 am EST by Judy Byington

Judy Note: The World has been undergoing the largest transfer of wealth in human history, and because of a compromised Main Stream Media, no one knew it.

For years President Trump has warned that the fiat dollar was an instrument of Globalist control. Trump has spent years uniting nations so they could reinstate gold/asset-backed currencies at a 1:1 to each other and thereby rescue sovereignty to the nations.

That Plan has necessitated destroying the Central Banking Cartel and ending the IMF, BIS and World Economic Forum’s counterfeit financing. It involved resurrecting sound money around the World so as to rebuild economies founded in concepts of the original Constitution – Sovereign nations that functioned under God.

~~~~~~~~~~~~~~~

Tues. 14 Oct. Majeed: The Bank of Nigeria will migrate to the new financial system by Oct. 31 2025: https://x.com/majeed66224499/status/1978424730420916401?t=MHAuTb94nsD0kInNZl1rpA&s=09

Wed. 15 Oct. Wolverine: Hi guys it is 1:00am here in Sydney and I like to tell you that I’m overwhelmed with emotions that soon this will be all over. Please believe me that this definitely coming. I’m not here to give you hopium and play with your emotions. Please stay in faith and stay close to God. I love you all with all my heart. Your friend, Wolverine

~~~~~~~~~~~~

Fri. 17 Oct. Mark this down: Tuesday, October 21, 2025 is set to be the first controlled public unlock of the QFS interface. … on Telegram

This will happen quietly, in waves, no flashy headlines, no public countdowns.

What to Expect:

A secure message containing your personal QFS credentials

Biometric onboarding through the encrypted app gateway

Access to your personal quantum ledger, balances, adjustments, and asset grants

Rollout Notes:

The system will prioritize verified participants with active financial or humanitarian profiles

You may see “Pending Validation” beside certain assets, this is part of the syncing process

Behind the Curtain:

Quantum ledger synchronizations are already live across dozens of nations, from Switzerland to Singapore. The transition is no longer theoretical, it’s operational.

If October 20 was the final systems go, then October 21 is the first open door.

~~~~~~~~~~~~~

Restored Republic …Robert F. Kennedy Jr.

As a result of the fiat dollar causing disasters in international trade, a BRICS Alliance (Brazil, Russia, India, China, South Africa) formed. The BRICS nations declared that they weren’t going to put up with the corrupt fiat US Dollar system anymore.

BRICS took control and began to evaluate the worth of each nation’s gold and natural resources – the beginning of a Global Currency Reset – the largest transfer of wealth in World history.

~~~~~~~~~~~

Sat. 18 Oct. 2025: BREAKING OVERNIGHT INTEL DROP: CODE RED – $4,300 Gold.

THE GOLD SIGNAL Gold blasting past $4,300 isn’t finance — it’s flight. Investors are abandoning the dollar. Fiat fraud dies. Tangible value returns. Exactly as Trump forecasted. The people are escaping the paper matrix.

Read full post here: https://dinarchronicles.com/2025/10/20/restored-republic-via-a-gcr-update-as-of-october-20-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick Iraq is going to become a currency hub for all of the Middle Eastern currencies. Iraq is about to become the trading platform for the entire Middle East. $3.22 is the reinstatement, filled by an RV in a basket. But it doesn't mean the basket has to float. The basket means the other currencies will depend on the Iraqi dinar. They will not be pegged to the American dollar. They will be pegged to the Iraqi dinar.

Frank26 What is 12-2c? It's an amendment that is in the budget. We feel it is exposing the new exchange rate...In D.C they're having fun...talking about the monetary reform success...Once they return home IMO they will bring back the permission to expose the implementation that is coming right now. That implementation is based on the laws Parliament are about to sign and release.

Jeff There isn’t a lop. Withdrawing a 25,000 note and replacing it with a 25 note does not mean it’s a lop because they clearly told us in print that two currency will coexist tougher at the same exact value. If the rate is $3…a 25 note would be $75. A 25,000 note would be $75,000. It’s that simple…Iraq is about to revalue.

*************

SILVER ALERT! LBMA Physical Silver Shortage is NOT a Broken Market...IT'S A FREE MARKET!

(Bix Weir) 10-19-2025

Quick update on the Silver Shortage in London...THAT'S WHAT HAPPENS WHEN THE PRICE OF SILVER IS SUPPRESSED TOO LOW FOR TOO LONG!!

With The Rise Of The Chinese Yuan And Local Currency Settlements, Can Iraq Dispense With The Dollar?

With The Rise Of The Chinese Yuan And Local Currency Settlements, Can Iraq Dispense With The Dollar?

Monetary Dependence Economy / Arab and International / Special Files Yesterday, 4:06 PM | 872 Baghdad Today – Baghdad The modern Iraqi economy was formed on the basis of a single-source oil rent, entirely dependent on the sale of crude oil and the settlement of revenues in US dollars.

This pattern made Iraqi monetary policy directly dependent on the US financial system, with revenues deposited in accounts at the Federal Reserve Bank of New York and managed according to international regulatory arrangements linked to financial compliance and anti-money laundering programs.

With The Rise Of The Chinese Yuan And Local Currency Settlements, Can Iraq Dispense With The Dollar?

Monetary Dependence Economy / Arab and International / Special Files Yesterday, 4:06 PM | 872 Baghdad Today – Baghdad The modern Iraqi economy was formed on the basis of a single-source oil rent, entirely dependent on the sale of crude oil and the settlement of revenues in US dollars.

This pattern made Iraqi monetary policy directly dependent on the US financial system, with revenues deposited in accounts at the Federal Reserve Bank of New York and managed according to international regulatory arrangements linked to financial compliance and anti-money laundering programs.

According to economic studies issued by the World Bank and the International Monetary Fund, approximately 90 to 95 percent of Iraq's public revenues come from oil, making any fluctuation in the dollar or a decline in global demand for oil a a direct threat to liquidity and the general budget.

Financial economists point out that the Central Bank of Iraq does not have absolute freedom to manage its reserves, as most of its transactions are restricted to US transfer networks, and the global SWIFT system closely monitors financial transfers, preventing any parallel transactions outside the dollar system.

According to recent academic estimates, excessive reliance on the dollar has created a distorted import environment, with the Iraqi market tending toward consuming foreign goods without boosting domestic production.

This has deepened economic exposure and tied the domestic financial cycle to fluctuations in US monetary policy.

In contrast, China has been working for more than a decade to build a parallel financial system that would challenge the dollar's dominance, by expanding the use of the yuan in international trade and establishing alternative financial institutions such as the new Asian Development Bank and the China Payments System (CIPS).

In 2023, Beijing announced that more than 52.9 percent of its cross-border transactions were settled in yuan, surpassing the dollar for the first time in modern history.

While this percentage reflects a gradual shift rather than a sudden reversal, it points to a fundamental shift in the balance of global financial influence.

International economics researchers believe that China's agreement with Australian company BHP to settle iron ore trade in yuan represents a pivotal moment in the history of global trade, as it removes one of the world's most traded commodities from the dollar.

This move, along with a series of similar agreements with other countries, most notably Russia and Saudi Arabia, indicates that the yuan is beginning to transform from a local currency into a strategic settlement tool in the international trade system.

Beijing has also relied on comprehensive institutional tools to bolster market confidence in the yuan, such as linking the currency to a strong gold reserve system and ensuring its stability through prudent monetary policies.

This has made it an increasingly attractive option for countries seeking alternatives to the dollar amid crises of US sanctions and restrictions.

Iraq's Position In The Transformation Equation

Although Iraq was one of the first oil-producing countries to open up trade to China, its position in the global monetary transition remains extremely weak. Baghdad's banking structure remains traditional and relies almost entirely on dollar transfers via the US system.

Economic researcher Othman Karim confirmed to Baghdad Today that the idea of abandoning the dollar "is illogical at the present time," noting that Iraq "sells oil and receives revenues through the US Federal Reserve, and currently has no realistic mechanism for settling its transactions in another currency."

He adds that the shift to the yuan requires "a radical change in monetary policy, the signing of direct banking agreements with China, and the development of intermediary electronic payment tools that can bypass US restrictions."

According to economists, the challenge in Iraq is twofold: technical, related to the absence of an independent financial transfer structure, and political, related to US pressure and Iraq's close ties to the Western system for managing its finances.

Trade with China, despite its size, remains settled in dollars, as Iraqi companies do not have accredited accounts with Chinese banks.

Analysts believe that any serious attempt to transition to the yuan requires profound institutional reform of the central bank, enhanced financial transparency, and the establishment of a dual reserve in yuan and gold as a preliminary step toward monetary diversification.

While it is difficult to completely sever the link to the dollar, some experts do not rule out a partial move toward monetary diversification, through limited agreements with China to settle a portion of non-oil imports in yuan.

Given China's increasing openness to the Middle East and its signing of yuan-denominated settlement agreements with Saudi Arabia and the UAE, Iraq could consider establishing a trade barter mechanism under which it would import Chinese goods in exchange for oil exports, without having to use the dollar.

Some monetary researchers also suggest that Baghdad begin allocating a portion of its foreign exchange reserves in yuan, as a symbolic step to expand financial diversification, while developing banking agreements with the People's Bank of China to facilitate direct transfers.

However, these paths remain subject to complex political factors, most notably the relationship with Washington and the fear that any move toward China could be interpreted as a step toward an anti-Western geopolitical axis.

Ultimately, economic analysis shows that completely eliminating the dollar in Iraq is not possible in the short or medium term, but it remains a long-term strategic goal in light of global changes.

Iraq, as a dependent rentier economy, needs to first build its production and commercial independence before considering monetary independence.

While the rise of the yuan opens a window for rebalancing the international financial system, it does not negate the fact that the dollar still holds the deepest and most widespread structure.

Therefore, in the coming period, Iraq will remain governed by the duality of monetary and political power: adopting the dollar as the primary currency for governing the state, while closely monitoring the transformations taking place in the East, where China is rewriting the equation of global financial influence, step by step . https://baghdadtoday.news/285422-.html

Seeds of Wisdom RV and Economics Updates Monday Morning 10-20-25

Good Morning Dinar Recaps,

Markets Balance Optimism and Caution as Global Risks Shift

From strong dollars to shaken banks, today’s markets show how power and trust move through money.

Currencies: Political Winds Move the Yen

The U.S. dollar strengthened against the Japanese yen while holding steady versus the euro.

Good Morning Dinar Recaps,

Markets Balance Optimism and Caution as Global Risks Shift

From strong dollars to shaken banks, today’s markets show how power and trust move through money.

Currencies: Political Winds Move the Yen

The U.S. dollar strengthened against the Japanese yen while holding steady versus the euro.

• Analysts tie the yen’s weakness to political momentum in Japan, where Sanae Takaichi has emerged as the frontrunner to become the next prime minister.

• Meanwhile, the EUR/USD pair remains locked in a narrow range, with weaker-than-expected German producer inflation data dampening upward pressure.

Why This Matters:

Currency moves reflect both macroeconomic data (like inflation and growth) and political risk. A weaker yen can boost Japanese exporters, while cross-currency volatility adds uncertainty to trade flows and global supply chains.

Commodities: Gold Finds Its Footing

Spot gold prices rose modestly in Asian trading, stabilizing after earlier volatility sparked by U.S.–China trade jitters. The yellow metal’s resilience near recent highs reflects persistent investor caution, even as equity markets attempt recovery.

Why This Matters:

Gold acts as a safe-haven asset when investors sense instability. Its steady climb signals that inflation, geopolitical tension, and currency swings continue to shape market psychology beneath the surface.

Emerging Markets: Indian Banking Attracts Global Capital

Shares of RBL Bank surged to a five-year high after Emirates NBD of Dubai acquired a US $3 billion stake in the Indian lender.

• The move underscores foreign confidence in India’s financial sector and could spark similar cross-border transactions.

• For emerging markets, it’s a clear indicator that capital is chasing reform-driven growth stories.

Why This Matters:

Large cross-border deals reflect where global liquidity is flowing. Such investments highlight trust in emerging-market resilience and the search for diversification beyond mature Western banking systems.

Financial Stability: Panic in Cambodia’s Prince Bank

Reports from regional media indicate Prince Bank in Cambodia faced panic withdrawals after its owner was accused of involvement in a regional cybercrime and money-laundering network.

• The episode exposes vulnerabilities in regional banking oversight.

• Even localized crises can dent broader investor confidence, especially when linked to financial integrity.

Why This Matters:

Banking stability hinges on trust. When that erodes—through corruption, mismanagement, or weak regulation—the result can be contagion across borders, pressuring other small-market lenders and regulators alike.

Global Outlook: Balancing Confidence and Caution

Across currencies, commodities, and banking, investors are navigating a split-screen world:

Optimism driven by emerging-market investments and potential cooling in inflation data.

Caution amid political transitions, financial scandals, and uneven global growth.

Upcoming inflation readings from the U.S. and Europe, central-bank guidance, and evolving geopolitical dynamics will steer sentiment into year-end.

Why This Matters:

Today’s mixed signals—currency shifts, gold’s stability, and contrasting banking headlines—show that financial power is redistributing, not just reacting. Each move shapes how nations, investors, and markets adapt to a new phase of global realignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Reuters | Investing.com | VnExpress International

~~~~~~~~~

Freeze Line or Fall: Trump Presses Zelenskiy to Accept Russia’s Gains

Behind closed doors, Washington’s tone toward Kyiv turns from support to settlement.

Inside the Room: Ceasefire or Capitulation

A tense Friday meeting between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy has revealed a striking policy reversal. According to multiple sources briefed on the talks, Trump urged Kyiv to “make a deal where we are, on the demarcation line” — effectively freezing the war along existing frontlines and recognizing Russian territorial gains.

● Trump reportedly declined to provide Tomahawk missiles and suggested “security guarantees to both Kyiv and Moscow,” leaving Ukrainian officials stunned.

● The tone was described as “tense and profane,” with one source claiming Trump warned, “Your country will freeze, and your country will be destroyed if you don’t make a deal.”

● The discussion reportedly followed a phone call between Trump and Vladimir Putin, during which the Russian leader proposed a territorial swap — Ukraine would surrender Donetsk and Luhansk in exchange for limited areas of Zaporizhzhia and Kherson.

Policy Reversal and Global Ripples

Only weeks earlier, after the UN General Assembly in September, Trump had publicly speculated that Ukraine “might take back all of its territory.” The Friday shift signals a pivot from liberation to limitation — one prioritizing a quick end to the conflict over full sovereignty for Ukraine.

● The proposed freeze would validate Russia’s territorial gains and could fracture NATO’s unity.

● U.S. Special Envoy Steve Witkoff reportedly echoed Moscow’s talking points, emphasizing “Russian-speaking populations” in Donetsk and Luhansk as justification for ceding control.

● Ukrainian officials called the idea “suicidal”, warning it would make central Ukraine indefensible in a future offensive.

Western capitals are uneasy. European diplomats told The Guardian the episode suggests a U.S. pivot that could reshape NATO cohesion and “redefine Europe’s security map.”

The Strategic Stakes

For Kyiv, the meeting felt like betrayal. Zelenskiy — who once counted on bipartisan American support — now faces dwindling leverage amid fatigue in Western capitals.

● Ukraine’s military leaders warn that a frozen conflict could cripple morale and funding, while handing Moscow time to rebuild.

● Analysts from the Carnegie Endowment caution that any territorial compromise “cements a dangerous precedent in international law” and risks emboldening autocratic regimes.

● Washington’s internal debate pits those seeking “peace now” against hawks warning that appeasement would invite greater aggression later.

Next Flashpoint: Budapest

Trump and Putin are expected to meet in Budapest in the coming weeks, where discussions may outline a “peace framework.” Russian Foreign Minister Sergei Lavrov and U.S. Secretary of State Marco Rubio are reportedly preparing the groundwork.

● A deal freezing the war along current lines could redraw global alignments, shifting power toward Moscow and testing Western resolve.

● European leaders, particularly in Berlin and Warsaw, warn such an agreement would “undermine the moral foundation of post-Cold War security.”

Zelenskiy has said he would attend a Budapest summit “if invited,” signaling Ukraine’s desire to remain diplomatically engaged even amid dwindling leverage.

Why This Matters

The U.S. role in global security has always rested on credibility. If Washington now signals that territorial conquest can be legitimized through negotiation, the implications reach far beyond Ukraine:

● Taiwan, the Baltics, and the South China Sea will all watch closely.

● Investors and defense markets already anticipate a recalibration of risk in Eastern Europe, with sovereign-bond spreads widening on Ukrainian debt.

● Analysts warn that global confidence in U.S. deterrence — financial and military — could erode.

As one European diplomat told Reuters: “If America trades land for peace, every frontier becomes negotiable.”

Conclusion

The Trump–Zelenskiy meeting may be remembered as a turning point: either a pragmatic step toward ending the world’s most volatile conflict or a prelude to a more dangerous equilibrium — one where power redraws maps faster than diplomacy can react.

For Kyiv, the challenge is existential. For Washington, it is about the cost of credibility.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources & Further Reading:

Reuters: Trump urged Zelenskiy to make concessions to Russia in tense meeting

The Guardian: Zelenskyy calls for more US Patriot air defences after Trump sides with Putin

Modern Diplomacy: Trump Pressures Zelenskiy to Cede Land to Russia in Tense Meeting

Additional sources: Politico EU, Al Jazeera, Carnegie Endowment, Foreign Policy

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Iraq Economic News and Points To Ponder Monday Morning 10-20-25

Nizar Haidar Reveals: The Currency Auction Has Not Stopped Yet. Is The Government Silent About The Violations?

October 20, 2025 Last updated: October 20, 2025 Al-Mustaqilla/- Political analyst Nizar Haider revealed in a television interview interesting information about the continued operation of the currency auction platform in Iraq, despite the government's announcement and Prime Minister Mohammed Shia al-Sudani's promises to halt it as of January 1, 2025.

According to Haider, the Central Bank of Iraq continues to sell dollars through the auction platform, in clear violation of government directives.

Nizar Haidar Reveals: The Currency Auction Has Not Stopped Yet. Is The Government Silent About The Violations?

October 20, 2025 Last updated: October 20, 2025 Al-Mustaqilla/- Political analyst Nizar Haider revealed in a television interview interesting information about the continued operation of the currency auction platform in Iraq, despite the government's announcement and Prime Minister Mohammed Shia al-Sudani's promises to halt it as of January 1, 2025.

According to Haider, the Central Bank of Iraq continues to sell dollars through the auction platform, in clear violation of government directives.

The government has repeatedly announced its intention to end this controversial mechanism, which has long been the subject of accusations of corruption and waste of public funds.

Haider explained that the amount of money traded in the auction so far exceeded $70 billion, which he described as "reflecting the persistence of the old financial system that Al-Sudani promised to dismantle but has so far been unable to do so."

This revelation comes amid escalating public and parliamentary debate over the Central Bank's policies and its role in controlling the exchange rate.

It also raises growing doubts about the viability of the current platform, which many experts view as a gateway for transferring hard currency abroad.

Meanwhile, the Central Bank of Iraq has yet to issue an official comment on these accusations, amid growing questions about the government's seriousness in implementing its decision to halt the currency auction and the real reasons behind the platform's continued operation. https://mustaqila.com/نزار-حيدر-يكشف-المزاد-العملة-لم-يتوقف-ح/

The Central Bank Announces That The Public Debt Ratio Does Not Exceed 43 Percent And Is Within Safe Limits.

Sunday, October 19, 2025 | Economic Number of readings: 277 Baghdad/ NINA / The Central Bank of Iraq announced that the public debt ratio does not exceed 43 percent, indicating that it is within safe limits. The bank said in a statement today, Sunday:

“In the framework of financial transparency and to clarify what is included in the public debt and deficit data, the Central Bank of Iraq would like to clarify what was reported in the media, that the planned deficit in the three-year general budget law approved by the House of Representatives for the years (2023, 2024, 2025) amounted to 191.5 trillion dinars, while the actual deficit for the three years mentioned amounted to 35 trillion dinars, which was covered internally with bonds and transfers and in accordance with the chapters included in the budget law.”

He pointed out that "actual borrowing reached 18.2% of the planned deficit stipulated in the budget law,reflecting the high level of coordination between the government and the Central Bank of Iraq in controlling public debt and preventing it from reaching the high levels stipulated in the budget law."

He added, "The external debts due do not exceed $13 billion after excluding (the outstanding and unclaimed debts of the former regime), and Iraq has not defaulted on any obligation, maintaining an excellent financial reputation regionally and internationally in this regard."

He indicated that "the internal debt of 91 trillion dinars represents 56 trillion dinars accumulated until the end of 2022,and the added amounts are 35 trillion dinars of debts for the years (2023, 2024, 2025), and most of the internal debt is within the government banking system."

He pointed out that "given the government's accounts and deposits in state-owned banks, specialized committees and international consulting firms are working to convert a portion of these debts into investment vehicles within a national fund to manage domestic debt, with the aim of transforming obligations into investment opportunities."

He emphasized that "the ratio of public debt to GDP did not exceed 43%, and this ratio - according to internationally recognized classification – is moderate and within safe limits, and does not constitute a burden on the economy.

" He added: "The Central Bank of Iraq is working to present a comprehensive vision for financial sustainability for the coming years, supporting the government's comprehensive reform efforts to diversify the economy and maximize non-oil revenues as an alternative to sole reliance on oil revenues and avoiding a fiscal deficit."

https://ninanews.com/Website/News/Details?key=1257729

Mazhar Saleh: The External Debt Does Not Exceed $9 Billion, And Its Settlement Is Being Carried Out With High Transparency.

Time: 10/19/2025 15:56:44 Reading: 60 times {Local: Al Furat News} The Prime Minister's financial advisor, Mazhar Mohammed Salih, confirmed on Sunday that there is a vague picture regarding the interpretation of Iraq's foreign debt, indicating that the foreign debts due until 2028 do not currently exceed $9 billion, a commitment that likely constitutes half of the country's total foreign debt.

Saleh explained in an interview with Al Furat News Agency that "there are coordinated payment mechanisms between the Ministry of Finance and the Central Bank of Iraq, which are highly governed and transparent.

They are settled annually with precision within a strict program and allocations in the federal general budget, and are periodically extinguished with the international creditor community."

He added that "the total external debt does not exceed what was mentioned above, and what was mentioned in the letter of the Central Bank of Iraq recently and circulated in the media about the inflated amounts regarding Iraq's external debt, requires a lot of explanation and shedding of light, indicating that

Iraq is not obligated to pay the outstanding portion of it amounting to $41 billion that was traded as a real external debt, while in reality it is not, because the aforementioned balance is subject to the settlements of the Paris Club agreement of 2004, which undertook to write off 80% or more of that external debt, explaining that the balance relates to financing the Iraq-Iran war, and all of them are considered pre-1990 debts under the Paris Club agreement."

He explained that "the domestic debt referred to in the Central Bank's letter is the result of the accumulation of financial, security, and health crises that the Iraqi economy has been exposed to over the past decade, since the war on ISIS terrorism.

This has been accompanied in recent years by severe international geopolitical factors that have exposed global oil markets to a price decline due to the slowdown in global economic growth.

" Saleh pointed out that "the borrowing undertaken by the current government as domestic debt constitutes only 18% of the total precautionary domestic debt included in the federal general budget (the three-year budget) pursuant to Law No. 13 of 2023 for the years 2023-2025, indicating that the domestic debt, amounting to approximately 91 trillion dinars, is mostly held by the government banking system and under high-level financial and technical management."

He pointed out that "specialized committees, in cooperation with international consulting firms, are working to convert a large portion of the domestic public debt into productive investment vehicles within a national fund for domestic debt management, with the aim of stimulating the real economy and transforming debt obligations into investment opportunities in the real sector of the Iraqi economy."

Saleh concluded by pointing out that the country is currently experiencing its most stable period, thanks to the strength of foreign reserves held by monetary policy, which play a significant role in stabilizing the purchasing power of the Iraqi dinar and achieving sustainable development. https://alforatnews.iq/news/مظهر-صالح-الدين-الخارجي-لا-يتجاوز-9-مليارات-دولار-وتسويته-تتم-بشفافية-عالية

A 5-Point Explanation That Demolishes The Assumptions Of Deficit And Public Debt

Local -- A responsible government source revealed on Sunday that the government has succeeded in reducing the deficit, while pointing out that some are trying to hold the government responsible for the debts of the previous era. The source said,

"Based on the recent statement issued today by the Central Bank regarding the deficit, debt, and cash reserves, and to clarify what has been raised in some media outlets and on social media over the past two days, we would like to clarify the following facts to the public:

1- The latest statement issued by the Central Bank of Iraq clearly confirmed that the total external debts due do not exceed (13) billion dollars, noting that about (4) billion dollars of them represent debts dating back to before 2003, and were subsequently rescheduled and settled according to financial arrangements agreed upon with the creditors.

Note that more than half of the total external debts are not due before 2028.

2- Unfortunately, some are trying to hold the current government responsible for the debts of the previous era (the debts of the previous dictatorial regime), which exceeded (40) billion dollars, and which are not due for repayment, as they are being settled or significantly reduced within the framework of the Paris Club, or other relevant international agreements.

3- The Central Bank's statement showed that the planned deficit in the three-year general budget law (2023-2025) amounted to approximately 191.5 trillion dinars, while the actual deficit during the same period amounted to only about 35 trillion dinars.

This means that the government succeeded in reducing the deficit by a very significant percentage compared to what the House of Representatives approved in the budget law.

Only 18% of the planned deficit has been financed, which is a major financial achievement that reflects the discipline of financial policy and the rational management of resources.

4- The Central Bank indicated that the public debt-to-GDP ratio does not exceed 43%, a safe percentage by international standards.

Furthermore, Iraq has not defaulted on any external obligations, thanks to ongoing coordination between the Ministry of Finance and the Central Bank.

Iraq's position toward external creditors is among the best in the region, as it enjoys a solid financial reputation and high credibility in fulfilling its international obligations.

The source also indicated that 5- the government has formed specialized technical committees, with the assistance of international consulting firms, to restructure the public debt.

The committees have completed the first phase of their work and submitted recommendations addressing approximately 20 trillion dinars, which will be converted into investment vehicles, awaiting approval by the Council of Ministers.

This is an important step taken by the current government and represents a new and different approach to public debt management from previous policies, as it aims to transform financial obligations into productive investment opportunities that support economic growth and enhance financial sustainability.

He stressed that "these indicators—which have been distorted by those who seek to distort their true nature— reflect the current government's success in significantly reducing the fiscal deficit and reducing reliance on borrowing, while maintaining the stability of foreign exchange reserves and enhancing Iraq's financial reputation internationally."

He explained that "restructuring the public debt and converting a portion of it into investment vehicles represents a qualitative step within the path of sustainable financial and economic reform that the government is working to implement."

He explained that "these measures are part of the government's approach aimed at enhancing financial sustainability, strengthening confidence in the state's monetary and fiscal policy, and maintaining high levels of foreign exchange reserves, which are among the highest in Iraq's modern history." https://economy-news.net/content.php?id=61350

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com

“Tidbits From TNT” Monday Morning 10-20-2025

TNT:

Tishwash: The electronic payment system has stopped in most Iraqi government departments - Urgent

A Baghdad Today correspondent reported that the electronic payment system was suspended in most government departments in Iraq on Monday morning (October 20, 2025), disrupting citizens' transactions and delaying the disbursement of some financial dues.

According to information received by our correspondent, the outage affected electronic payment systems, halting transfers at a number of service institutions and ministries. Technical teams are now working on maintenance to restore the system.

TNT:

Tishwash: The electronic payment system has stopped in most Iraqi government departments - Urgent

A Baghdad Today correspondent reported that the electronic payment system was suspended in most government departments in Iraq on Monday morning (October 20, 2025), disrupting citizens' transactions and delaying the disbursement of some financial dues.

According to information received by our correspondent, the outage affected electronic payment systems, halting transfers at a number of service institutions and ministries. Technical teams are now working on maintenance to restore the system.

A Baghdad Today correspondent indicated that the relevant authorities expect service to be gradually restored over the coming hours after the technical inspection is completed. link

Tishwash: Iraq boosts its gold reserves to 162.5 tons

Iraq continues to boost its gold reserves, with stored quantities increasing from 100 tons to 162.5 tons in recent years, according to an economic expert.

Expert Abdul Rahman Al-Mashhadani explained in a statement to Al-Furat News that: "Iraq continues to purchase gold to bolster its national reserves, although the quantities acquired remain limited compared to the ambitious plans to enhance financial stability."

He pointed out that "increasing gold reserves represents an important step towards strengthening the national economy and supporting financial liquidity, as well as being a strategic safety factor in the face of global market volatility."

Al-Mashhadani emphasized that "Iraq pays special attention to gold as part of its economic policy, as it is an important tool for diversifying assets and protecting reserves from potential economic and financial risks." link

******************

Tishwash: With the rise of the Chinese yuan and local currency settlements, can Iraq dispense with the dollar?

The modern Iraqi economy was formed on the basis of a single-source oil rent, entirely dependent on the sale of crude oil and the settlement of revenues in US dollars.

This pattern made Iraqi monetary policy directly dependent on the US financial system, with revenues deposited in accounts at the Federal Reserve Bank of New York and managed according to international regulatory arrangements linked to financial compliance and anti-money laundering programs.

According to economic studies issued by the World Bank and the International Monetary Fund, approximately 90 to 95 percent of Iraq's public revenues come from oil, making any fluctuation in the dollar or a decline in global demand for oil a direct threat to liquidity and the general budget.

Financial economists point out that the Central Bank of Iraq does not have absolute freedom to manage its reserves, as most of its transactions are restricted to US transfer networks, and the global SWIFT system closely monitors financial transfers, preventing any parallel transactions outside the dollar system.

According to recent academic estimates, excessive reliance on the dollar has created a distorted import environment, with the Iraqi market tending toward consuming foreign goods without boosting domestic production. This has deepened economic exposure and tied the domestic financial cycle to fluctuations in US monetary policy.

In contrast, China has been working for more than a decade to build a parallel financial system that would challenge the dollar's dominance, by expanding the use of the yuan in international trade and establishing alternative financial institutions such as the new Asian Development Bank and the China Payments System (CIPS).

In 2023, Beijing announced that more than 52.9 percent of its cross-border transactions were settled in yuan, surpassing the dollar for the first time in modern history. While this percentage reflects a gradual shift rather than a sudden reversal, it points to a fundamental shift in the balance of global financial influence.

International economics researchers believe that China's agreement with Australian company BHP to settle iron ore trade in yuan represents a pivotal moment in the history of global trade, as it removes one of the world's most traded commodities from the dollar. This move, along with a series of similar agreements with other countries, most notably Russia and Saudi Arabia, indicates that the yuan is beginning to transform from a local currency into a strategic settlement tool in the international trade system.

Beijing has also relied on comprehensive institutional tools to bolster market confidence in the yuan, such as linking the currency to a strong gold reserve system and ensuring its stability through prudent monetary policies. This has made it an increasingly attractive option for countries seeking alternatives to the dollar amid crises of US sanctions and restrictions.

Iraq's position in the transformation equation

Although Iraq was one of the first oil-producing countries to open up trade to China, its position in the global monetary transition remains extremely weak. Baghdad's banking structure remains traditional and relies almost entirely on dollar transfers via the US system.

Economic researcher Othman Karim confirmed to Baghdad Today that the idea of abandoning the dollar "is illogical at the present time," noting that Iraq "sells oil and receives revenues through the US Federal Reserve, and currently has no realistic mechanism for settling its transactions in another currency."

He adds that the shift to the yuan requires "a radical change in monetary policy, the signing of direct banking agreements with China, and the development of intermediary electronic payment tools that can bypass US restrictions."

According to economists, the challenge in Iraq is twofold: technical, related to the absence of an independent financial transfer structure, and political, related to US pressure and Iraq's close ties to the Western system for managing its finances.

Trade with China, despite its size, remains settled in dollars, as Iraqi companies do not have accredited accounts with Chinese banks. Analysts believe that any serious attempt to transition to the yuan requires profound institutional reform of the central bank, enhanced financial transparency, and the establishment of a dual reserve in yuan and gold as a preliminary step toward monetary diversification.

While it is difficult to completely sever the link to the dollar, some experts do not rule out a partial move toward monetary diversification, through limited agreements with China to settle a portion of non-oil imports in yuan.