Seeds of Wisdom RV and Economic Updates Wednesday Morning 7-9-25

Good Morning Dinar Recaps,

5 Countries Where Crypto Is (Surprisingly) Tax-Free in 2025

As governments tighten their grip on digital assets, a handful of nations are charting a radically different course—offering legal, zero-tax treatment for crypto. From offshore havens to EU surprises, here are five countries where cryptocurrency remains tax-free in 2025, making them attractive destinations for investors, traders, and crypto entrepreneurs.

Good Morning Dinar Recaps,

5 Countries Where Crypto Is (Surprisingly) Tax-Free in 2025

As governments tighten their grip on digital assets, a handful of nations are charting a radically different course—offering legal, zero-tax treatment for crypto. From offshore havens to EU surprises, here are five countries where cryptocurrency remains tax-free in 2025, making them attractive destinations for investors, traders, and crypto entrepreneurs.

1. Cayman Islands: No Tax, Full Compliance

Tax Status: No income tax, no capital gains tax, no corporate tax — and yes, that includes crypto.

Who Benefits: Traders, DeFi treasuries, offshore crypto funds.

Regulatory Framework: The updated Virtual Asset (Service Providers) Act is fully operational as of April 2025, providing legal clarity for exchanges, custodians, and platforms.

Why it matters: With a stable, USD-pegged currency, English common-law protections, and a pro-investor business climate, the Cayman Islands remain the world’s most complete crypto tax haven.

2. United Arab Emirates: Tax-Free Across All Emirates

Tax Status: Zero tax on crypto trading, staking, mining, or sales — across all seven emirates.

Regulators:

Dubai’s VARA (Virtual Asset Regulatory Authority)

Dubai Financial Services Authority (DIFC)

Abu Dhabi Global Market (FSRA)

Why it matters: The UAE is more than a tax shelter — it’s a global regulatory hub for crypto innovation. With world-class infrastructure and business-friendly visa regimes, it’s fast becoming the go-to destination for crypto founders and high-net-worth individuals.

3. El Salvador: Bitcoin Legal Tender and Tax-Free

Tax Status: No capital gains or income tax on Bitcoin transactions.

Adoption: Bitcoin is legal tender; widely used with Lightning wallets like Chivo.

Future Plans: Bitcoin City — a zero-tax, geothermal-powered city for crypto miners, investors, and startups.

Why it matters: El Salvador remains a bold global experiment, proving that state-backed crypto adoption and tax exemption can go hand-in-hand — at least for now.

4. Germany: Long-Term Holders Rejoice

Tax Status: Hold crypto for 12+ months and pay zero tax on sales or swaps.

Additional Benefit: Annual short-term gains under €1,000 are also tax-free.

Why it matters: As an EU powerhouse, Germany’s progressive stance is unexpected. It rewards hodlers with tax exemption and allows local EU-based investors to enjoy legal relief without going offshore.

5. Portugal: Europe’s Sun-Soaked Tax Haven

Tax Status: Long-term capital gains on crypto (held over 1 year) are tax-exempt.

NHR Program (before March 31, 2025 cutoff): Offers 20% flat tax on domestic income and exemption for foreign-source crypto income.

Caveats:

Short-term gains (<1 year) taxed at 28%

Staking and professional activity also taxed

Why it matters: Despite tightening rules, Portugal remains one of the few EU nations offering meaningful tax benefits to long-term crypto investors, retirees, and remote workers.

Where Is Crypto Tax-Free in 2025?

These five countries—Cayman Islands, UAE, El Salvador, Germany, and Portugal—are not just regulatory outliers. They are actively shaping the future of global crypto policy by creating pro-growth, pro-innovation tax environments for digital assets.

Zero tax: Cayman, UAE, El Salvador

Long-term exemption: Germany, Portugal

Yet, proceed with caution:

Residency or relocation is often required.

Regulatory frameworks vary.

Tax status can change rapidly based on political or IMF pressures.

“In a tightening global regulatory climate, these five nations offer rare crypto tax relief — but it may not last forever.”

Planning to relocate for crypto tax advantages?

Consult a local tax advisor, monitor regulatory shifts, and ensure legal compliance. Because in 2025, tax freedom in crypto still exists — just not everywhere.

@ Newshounds News™

Source: Cointelegraph

~~~~~~~~~

Ripple Picks BNY Mellon to Back RLUSD Stablecoin Amid $500M Surge

Ripple’s U.S. dollar-backed stablecoin, RLUSD, just got a major boost — with Wall Street's oldest bank, BNY Mellon, now serving as the official custodian of its reserves. This move signals growing institutional confidence in Ripple's crypto-fintech strategy and places RLUSD in the center of what some are calling “Stablecoin Summer.”

BNY Mellon Now Custodies RLUSD Reserves

In a landmark development, BNY Mellon — the oldest bank in the United States — will act as primary custodian for RLUSD’s reserves.

“As primary custodian, we are thrilled to support the growth and adoption of RLUSD by facilitating the seamless movement of reserve assets and cash to support conversions,”

— Emily Portney, Global Head of Asset Servicing, BNY Mellon

This partnership marks a major trust upgrade for Ripple’s stablecoin, aligning it with one of the most trusted institutions in global finance.

RLUSD Market Cap Surges Past $500 Million

Launched in December 2024, RLUSD has already crossed the $500 million mark in just seven months — an impressive feat in a fast-evolving market.

RLUSD is fully backed 1:1 by cash and U.S. Treasuries, offering transparency and security.

Built to complement Ripple’s payments network and XRP token, RLUSD is already seeing early adoption in institutional and cross-border use cases.

Ripple Eyes National Banking Charter and Fed Access

Ripple isn’t stopping at a stablecoin. The company has officially:

Applied for a U.S. national banking charter

Requested a Federal Reserve master account

These steps would allow Ripple to hold reserves directly with the Fed, effectively integrating crypto into the traditional banking system. It’s a bold move — and a strong signal that Ripple is serious about long-term regulatory alignment.

AMINA Bank Brings RLUSD to Global Institutions

Adding to RLUSD’s institutional push, Swiss-based AMINA Bank — a licensed, FINMA-regulated institution — has announced:

Custody and trading support for RLUSD

Availability on mobile and desktop platforms

Infrastructure built for institutional-grade reliability

This gives RLUSD global banking credibility and expands its reach into European and international markets.

The Bigger Picture: “Stablecoin Summer” in Full Swing

Ripple’s move comes amid a wave of pro-stablecoin momentum in the U.S.:

The Trump administration is relaxing crypto restrictions

Congress is advancing stablecoin legislation

Tech giants like Amazon, Uber, Apple, Walmart, and Airbnb are exploring stablecoin use cases

This institutional wave is what analysts are calling Stablecoin Summer — and RLUSD is now right in the middle of it.

What’s Next for RLUSD?

With BNY Mellon backing reserves and global custody support from AMINA, Ripple is positioning RLUSD as a top-tier stablecoin contender.

Next milestone? $1 billion market cap may be closer than expected.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Gold Surges Past Euro as Central Banks Brace for Dollar Crisis

Gold Surges Past Euro as Central Banks Brace for Dollar Crisis

Taylor Kenny: 7-8-2025

A significant tremor is reverberating through global financial markets, hinting at a profound shift in the very foundations of international trade and reserves.

Gold, the timeless store of value, has notably surged past the Euro, grabbing headlines and the attention of economists worldwide. But this isn’t just about price appreciation; it’s a symptom of a deeper, more strategic maneuver by central banks across the globe.

Gold Surges Past Euro as Central Banks Brace for Dollar Crisis

Taylor Kenny: 7-8-2025

A significant tremor is reverberating through global financial markets, hinting at a profound shift in the very foundations of international trade and reserves.

Gold, the timeless store of value, has notably surged past the Euro, grabbing headlines and the attention of economists worldwide. But this isn’t just about price appreciation; it’s a symptom of a deeper, more strategic maneuver by central banks across the globe.

Why are these powerful financial institutions, traditionally anchored to the U.S. Dollar, loading up on gold at an unprecedented pace?

The answer, increasingly evident, points to a bracing for a potential Dollar Crisis.

For decades, the U.S. Dollar has reigned supreme as the world’s primary reserve currency, the backbone of international trade, and the preferred asset for central bank reserves. Its stability and liquidity were considered sacrosanct.

However, a quiet but resolute shift has been underway, accelerating dramatically in recent years. Central banks, from emerging economies to established financial powers, are aggressively accumulating gold.

The collective actions of central banks send a powerful message: they perceive a growing vulnerability in the current dollar-centric system. The surge in gold prices, particularly its outperformance against currencies like the Euro, reflects this growing demand and the market’s acknowledgment of gold’s role as a safe haven in uncertain times.

This isn’t necessarily a prediction of an immediate collapse, but rather a prudent strategy to de-risk national balance sheets and prepare for a future where the dollar’s dominance may be significantly diminished.

By increasing their gold holdings, central banks are fortifying their reserves against potential currency volatility, geopolitical shocks, and a global financial reset.

The implications of this shift are profound. It signals a move towards a more diversified, and potentially more volatile, international monetary system. For individuals and investors, understanding these macro trends is crucial.

The central bank gold rush isn’t just a financial headline; it’s a window into the strategies being employed at the highest levels of global finance to navigate a future where the rules of money may be fundamentally rewritten.

To gain deeper insights and comprehensive information on this unfolding global shift, it’s vital to stay informed.

Watch the full video from ITM Trading with Taylor Kenney for further insights and expert analysis. Understanding why central banks are moving away from the dollar and towards gold is key to navigating the turbulent waters of the emerging global economy.

“Tidbits From TNT” Wed. Morning 7-9-2025

TNT:

Tishwash: Demonstrations in Sulaymaniyah protesting the deteriorating living conditions and delayed salaries.

Baghdad Today correspondent reported, on Tuesday evening (July 8, 2025), that popular demonstrations broke out in the cities of Ranya and Qala Diza, affiliated with Sulaymaniyah Governorate, in protest against the deteriorating living conditions and the ongoing salary crisis in the region.

Our correspondent said that dozens of young people from both cities took to the streets in angry demonstrations demanding improvements to their living conditions and the payment of overdue salaries. They asserted that "their patience has run out as the crisis continues without any real solutions."

TNT:

Tishwash: Demonstrations in Sulaymaniyah protesting the deteriorating living conditions and delayed salaries.

Baghdad Today correspondent reported, on Tuesday evening (July 8, 2025), that popular demonstrations broke out in the cities of Ranya and Qala Diza, affiliated with Sulaymaniyah Governorate, in protest against the deteriorating living conditions and the ongoing salary crisis in the region.

Our correspondent said that dozens of young people from both cities took to the streets in angry demonstrations demanding improvements to their living conditions and the payment of overdue salaries. They asserted that "their patience has run out as the crisis continues without any real solutions."

Our correspondent noted that security forces in the area had begun moving toward the demonstration site to contain the situation, with no clashes reported at the time of writing. link

Tishwash: Where are the 2025 budget schedules? Projects are suspended, plans are postponed, and Parliament holds the government accountable.

Despite more than half a year having passed since the start of the fiscal year, the 2025 budget schedules remain absent from the House of Representatives, a scene that rekindles concerns about a financial paralysis that threatens service and development projects in the governorates.

This delay comes despite the country's adoption of the "Tripartite Budget" law, which was supposed to spare Iraq the annual wait for approval of financial allocations and ensure stability in the flow of funds and project planning.

In this context, the Deputy Chairman of the Parliamentary Committee for Regions and Governorates, Jawad Al-Yasari, ruled out on Tuesday (July 8, 2025) the approval of the 2025 budget schedules during the remaining term of Parliament, holding the government responsible for the delay.

"The Iraqi government is responsible for the delay in approving the 2025 budget schedules, as it has not yet sent them to Parliament for review," Al-Yasari told Baghdad Today. "We don't know anything about them yet, and we don't believe the government is serious about sending them, which is why we rule out approving them within the remaining term of Parliament."

He added, "This delay has clear consequences, most notably the disruption of the launch of a large number of projects in the governorates, as well as the obstruction of the completion of existing projects that require financial allocations." He noted that "the government is currently content with paying salaries and outstanding financial obligations, in the absence of schedules and a parliamentary vote on them."

According to observers, the government's continued delay in submitting budget schedules reflects confusion in financial planning and a lack of a clear vision regarding spending priorities. This threatens to widen the gap between the central government and the governorates and weaken the state's ability to fulfill its service and development commitments. It also portends escalating popular discontent in some areas, particularly those that rely on investment allocations for infrastructure development and job creation, at a time when economic and living pressures on citizens are increasing. link

************

Tishwash: The House of Representatives will hold its first session of the second legislative term next Saturday.

Reciting verses from the Holy Quran

Agenda

Session No. (1)

Saturday 12/June/2025

Al-Nawar session

Affairs Department

First: Voting on the proposed law of the Iraqi Programmers Syndicate. Labor and Civil Society Organizations Committee, Legal Committee), (26) articles.

Second: Voting on the draft law of mental health. (Health and Environment Committee), (42) articles.

Third: Voting on the draft law of protection from the harms of tobacco. Health and Environment Committee), (21) articles.

Fourth: First reading of the proposed law of the Union of Private Hospitals in Iraq. Health and Environment Committee), (8) articles

Fifth: Report and discussion of the second reading of the proposed law amending the first amendment to the Law of the National Authority for Nuclear, Radiological, Chemical and Biological Control No. (1) of 2024. (Health and Environment Committee).

Sixth: Report and discussion of the second reading of the proposed law amending the third amendment to the Law on Compensating Those Affected Who Lost Parts of Their Bodies as a Result of the Practices of the Former Regime No. (5) of 2009, as amended. (Martyrs, Victims and Political Prisoners Committee).

Seventh: Report and discussion of the second reading of the draft law on the Republic of Iraq's accession to the Convention Amending the Convention on the Physical Protection of Nuclear Material (Foreign Relations Committee, Health and Environment Committee).

The session begins at one o'clock in the afternoon link

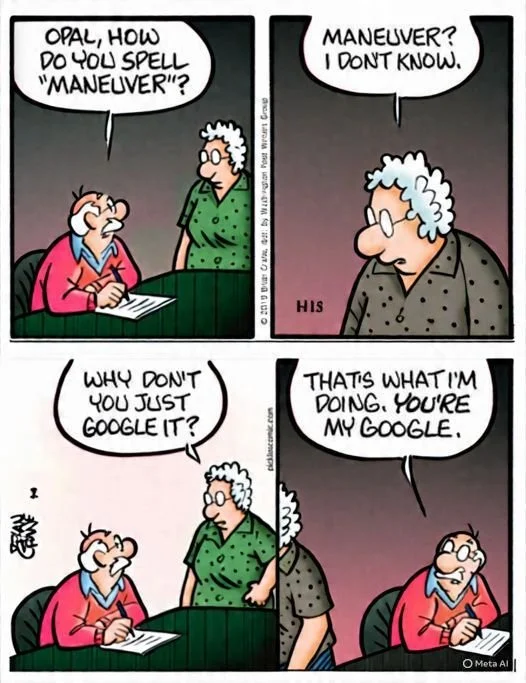

Mot: . Mirror -- Mirror ......... Siiigghhhhhhh

Mot: and then there is ""Opal"" ....

4 Reasons To Give Your Adult Child Money

4 Reasons To Give Your Adult Child Money (And 2 Reasons Not To)

January 8, 2025 by Cindy Lamothe Money / Financial Planning

Like all things in life, too much of a good thing can go very, very wrong — particularly, when it comes to doling out money to adult kids.

According to experts, there are many appropriate instances when help is needed, and then there are times when doing so can hinder an adult child’s growth.

Here are the financial situations in which it is okay to give a grown child money — and when not to.

4 Reasons To Give Your Adult Child Money (And 2 Reasons Not To)

January 8, 2025 by Cindy Lamothe Money / Financial Planning

Like all things in life, too much of a good thing can go very, very wrong — particularly, when it comes to doling out money to adult kids.

According to experts, there are many appropriate instances when help is needed, and then there are times when doing so can hinder an adult child’s growth.

Here are the financial situations in which it is okay to give a grown child money — and when not to.

To Help With a Down Payment on a Home

“I suggest that contributing to your adult child’s down payment is a meaningful way to provide generational support,” said Max Avery, a Chief Business Development Officer at Syndicately.

He said this investment in their stability gives them a solid financial start, as homeownership often builds long-term wealth.

“This includes gaining access to favorable mortgage terms and avoiding costly rental payments.”

To Fund Emergency Expenses

Avery noted that the best way to offer monetary support is to cover emergency needs like car repairs, legal issues or temporary unemployment that prevent your child from spiraling into debt or compromising their financial stability.

“This support should not be a long-term solution, but rather a temporary boost to help your child stay on track.”

Help With Major Life Transitions

David Cooper, PsyD, therapist and strategic advisor of Yung Sidekick, observed that helping with money during tough transitions is a good reason to help adult children with money, as a way to make big life changes less stressful.

TO READ MORE: https://www.gobankingrates.com/money/financial-planning/reasons-give-adult-child-money/

3 ‘Normal’ Money Habits That Could Ruin You Financially

3 ‘Normal’ Money Habits That Could Ruin You Financially — What to Do Instead

Sarah Li Cain Mon, July 7, 2025 GOBankingRates

Everyone makes mistakes. But some have more dire consequences than others. While the occasional dinner out or spending money on lattes (is this still a big deal?) may set you back a bit financially, it’s not the end of the world.

There are some money habits though, that if not kept in check, could ruin your financial future. Here are three of them, and what habits you can replace them with instead.

3 ‘Normal’ Money Habits That Could Ruin You Financially — What to Do Instead

Sarah Li Cain Mon, July 7, 2025 GOBankingRates

Everyone makes mistakes. But some have more dire consequences than others. While the occasional dinner out or spending money on lattes (is this still a big deal?) may set you back a bit financially, it’s not the end of the world.

There are some money habits though, that if not kept in check, could ruin your financial future. Here are three of them, and what habits you can replace them with instead.

Save What’s Left Over After Spending

While committing to saving after accounting for your spending sounds great in theory, the truth is that it may not be the best move. Maybe you have larger than expected bills for one month, or you decide to take your friend out for dinner.

All of this spending adds up, and you may find that you’ll have nothing at the end of the month to go towards savings.

Instead, consider a popular method called “pay yourself first.” Here, you set a savings goal, whether a percentage or a fixed dollar amount. Then, at the beginning of each month, or whenever you get paid, you transfer the savings to another account. Whatever is left over is for you to spend, guilt-free.

That way, you know you’re consistently reaching your savings goals.

Forgetting About Ongoing Maintenance Costs

Budget is just as much about understanding your spending now as much as projecting or estimating the amount you’ll spend in the future. Forgetting about future costs like maintenance for large ticket purchases can wreak havoc on your budget.

For example, when you buy a car, ongoing expenses include regular oil changes, replacing or rotating tires and any repairs. Even smaller items like a bicycle also need ongoing maintenance.

To help you understand what the “true” cost of an item you’re about to buy could set you back, do an online search to look at average estimated costs for maintenance.

Data from Kelly Blue Book found that average repairs cost car owners $838 each year, though different models may cost more. Consumer Reports is a popular trusted source, and frequently conducts research on various car brands and ranks them according to repair and maintenance costs.

Once you understand what you could pay, factor them into your budget to see whether you can truly afford the item.

Not Having a Buffer Amount Set Aside

TO READ MORE: https://www.yahoo.com/lifestyle/articles/3-normal-money-habits-could-110116246.html

FRANK26….7-8-25…..COMING HOURS

KTFA

Tuesday Night Conference call

FRANK26….7-8-25…..COMING HOURS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Tuesday Night Conference call

FRANK26….7-8-25…..COMING HOURS

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

What Frank’s suit color’s mean…. FRANKS SUIT COLORS FOR CC'S..... WHITE = NEW INFO…. SILVER = INTEL FROZEN…. RED= HIGH ALERT… PURPLE=GUEST WITH US…. BLUE = AIR FORCE…. BLACK = GROUND/FF’S…. GREEN= MR OR FAB 4 ... GOLD = CHANGE… ORANGE=IMPLEMENTATION

More News, Rumors and Opinions Tuesday PM 7-8-2025

Gold Telegraph: This Shift has been Telegraphed for Years

Tuesday, 8 July 2025,

China added to its official gold reserves for an eighth straight month in June… China continues to stockpile.

BREAKING NEWS CHINA IS ESTIMATED TO HAVE ADDED UP TO 100,000 TONNES OF NICKEL TO ITS STATE RESERVES SINCE DECEMBER.

Buying for government strategic stockpile at low prices… Smart.

Gold Telegraph: This Shift has been Telegraphed for Years

Tuesday, 8 July 2025,

China added to its official gold reserves for an eighth straight month in June… China continues to stockpile.

BREAKING NEWS CHINA IS ESTIMATED TO HAVE ADDED UP TO 100,000 TONNES OF NICKEL TO ITS STATE RESERVES SINCE DECEMBER.

Buying for government strategic stockpile at low prices… Smart.

“Beijing takes advantage of prices at 5-year lows for metal vital to steel and EV batteries in push to secure supply chains…”

Source: https://www.ft.com/content/3af62de7-d7db-49c0-b8e5-a5cc0f80b8e2

The tensions between the United States and Japan needs to be followed very closely. Why? Japan is the largest holder of U.S. debt.

BREAKING NEWS: BRAZIL’S PRESIDENT SAYS THE WORLD DOES NOT NEED AN EMPEROR AFTER THE PRESIDENT OF THE UNITED STATES THREATENED EXTRA TARIFFS ON BRICS

Wow…

“Trump’s threat on Sunday night came as the U.S. government prepared to finalize dozens of trade deals with a range of countries…”

A Governing Council member from the European Central Bank says the ECB’s best unconventional instrument for steering monetary policy is a large-scale asset purchase. Here we go. These central bankers should just ask how large-scale QE has worked in Japan. Just a total circus.

Let’s connect the dots:

1. China is acquiring mineral assets globally at the fastest pace in over a decade.

2. China is also publicly hoarding gold… quietly, with many people questioning how much the country really has.

3. Gold is now the world’s second-largest reserve asset.

Globally?

4. Nations are calling for structural reform of the IMF and World Bank.

This isn’t random.

It’s a strategic realignment of the global financial order.

Gold is no longer on the sidelines; it’s moving to the center of the global financial stage. This shift has been telegraphed for years. The next chapter is now being written.

Source(s): https://x.com/GoldTelegraph_/status/1942282968959181225

https://dinarchronicles.com/2025/07/08/gold-telegraph-this-shift-has-been-telegraphed-for-years/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Walkingstick [Iraqi bank manager friend Aki update] The bank [in Dearborn] is open. Question "What is the main thing they are doing?" Transferring. They're getting ready because they know the Iraqi citizens are going to be transferring a lot. They can now, he's with Western Union. Question: "He's still waiting for the new exchange rate, huh?" That's all he's waiting for.

Sandy Ingram Iraq is making quiet moves in the finance, banking and manufacturing areas. These moves don't look like much when you read about them...but when you tie it all together you see big progress...And you see a country that plans to outshine all the other countries in the Middle East...

Clare Article: "An expert warns of the US Federal Reserve's restrictions on Iraq's financial sovereignty" Quote: "Economic expert, Diaa Mohsen, confirmed...Iraq still lacks independent economic decision-making due to the restrictions imposed by the US Federal Reserve on its funds, warning of the repercussions of the continuation of this situation on the country's financial sovereignty."

Has Gold Peaked? This Chart Tells a Different Story

Mike Maloney & Alan Hibbard: 7-8-2025

Is gold overvalued—or is the biggest move in precious metals still ahead? In this episode of the GoldSilver Show, Mike Maloney and Alan Hibbard dive deep into a powerful yet rarely-discussed chart: the M2 money supply-to-gold ratio.

Inspired by a viewer’s tweet, they break down how this ratio can signal market turning points and explore whether gold has truly peaked or if we’re on the cusp of a historic breakout.

Along the way, they decode data from the Federal Reserve, analyze decades of economic trends, and uncover what the world’s central banks may be preparing for—a return to real money.

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 7-8-25

Good Afternoon Dinar Recaps,

Lula Defies Trump as U.S. Targets 50+ Nations in BRICS Tariff Threat

A Diplomatic Showdown Over Tariffs and Global Trade

Tensions between Brazilian President Luiz Inácio Lula da Silva and Donald Trump have escalated into a full-blown diplomatic standoff. At the heart of the crisis: Trump’s threat to impose a 10% tariff on countries aligning with BRICS, a coalition increasingly seeking alternatives to U.S. economic dominance.

In a sharp rebuke, Lula directly challenged Trump’s tariff threats, rejecting what he sees as outdated and coercive economic policies.

Good Afternoon Dinar Recaps,

Lula Defies Trump as U.S. Targets 50+ Nations in BRICS Tariff Threat

A Diplomatic Showdown Over Tariffs and Global Trade

Tensions between Brazilian President Luiz Inácio Lula da Silva and Donald Trump have escalated into a full-blown diplomatic standoff. At the heart of the crisis: Trump’s threat to impose a 10% tariff on countries aligning with BRICS, a coalition increasingly seeking alternatives to U.S. economic dominance.

In a sharp rebuke, Lula directly challenged Trump’s tariff threats, rejecting what he sees as outdated and coercive economic policies.

Trump’s Tariff Ultimatum Against BRICS

The controversy erupted following Trump’s warning that any nation aligning with BRICS policies would face an “additional 10% tariff.” His administration is reportedly preparing dozens of trade deals and intends to apply tariffs only if countries are deemed “anti-American.”

Trump stated:

“Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.”

This statement followed public condemnation by BRICS leaders of recent U.S. military actions and growing dissatisfaction with the global trade order.

Lula: “We Don’t Want an Emperor”

Speaking at the BRICS Summit in Rio de Janeiro, Lula was blunt:

“The world has changed. We don’t want an emperor.”

He elaborated on BRICS' purpose as a counterbalance to Western dominance:

“This is a set of countries that wants to find another way of organizing the world from the economic perspective. I think that’s why the BRICS are making people uncomfortable.”

Lula also called for a gradual shift away from the dollar:

“The world needs to find a way that our trade relations don’t have to pass through the dollar. Our central banks have to discuss it with central banks from other countries. That’s something that happens gradually until it’s consolidated.”

BRICS Pushes Back: Toward De-Dollarization

With 50+ nations now cooperating with BRICS, including 13 partner countries—Algeria, Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Turkey, Uganda, Vietnam, and Uzbekistan—calls for alternative trade systems are growing louder.

Iran’s Supreme Leader Ayatollah Ali Khamenei declared:

“One of our problems today is being dependent on the dollar. BRICS countries must strive to eliminate the dollar in trade as much as possible.”

Other responses:

South African President Cyril Ramaphosa affirmed BRICS does not seek confrontation but wants fair trade.

🇨🇳 Chinese Foreign Ministry spokesperson Mao Ning condemned the tariffs as “tools of coercion” and reaffirmed BRICS’ commitment to “win-win cooperation.”

A Larger Battle Over U.S. Economic Hegemony

What began as a spat between Lula and Trump is fast becoming a global referendum on U.S. trade policy and the dollar’s role in international finance.

More than 40 countries have applied to join BRICS or become partners—driven by:

Discontent with U.S. dollar hegemony

Concerns over weaponized trade policies

Interest in multipolar trade frameworks

The broader implications are clear: this is not just a tariff fight—it’s a challenge to the structure of the global financial order.

Summary:

Trump threatens 10% tariffs on “anti-American” BRICS-aligned nations.

Lula responds: “We don’t want an emperor.”

BRICS members call for de-dollarization and a new economic system.

Over 50 countries now aligned with BRICS’ growing influence.

The conflict signals a shift away from U.S.-centric trade norms toward a multipolar financial world.

@ Newshounds News™

Source: Watcher.Guru

~~~~~~~~~

India’s Triumph at BRICS: PM Unites Summit Against Terrorism, Pushes Global Reforms

Modi’s Diplomatic Victory at the 17th BRICS Summit

India emerged as a decisive voice at the 17th BRICS Summit in Brazil, uniting the bloc on a firm stance against terrorism and driving calls for reform of global governance institutions.

🔹 Key Outcomes:

• India led unanimous condemnation of terrorism

• PM Modi condemned the Pahalgam terror attack as an “assault on humanity”

• BRICS declaration demanded action against UN-designated terrorists

Terrorism Takes Center Stage

At the session on Peace and Security, Prime Minister Narendra Modi delivered a powerful message against terrorism, directly addressing the April 22 Pahalgam attack in Jammu and Kashmir, which killed 26 civilians.

“This is not just a regional problem—it is an assault on humanity,” the Prime Minister declared.

The Rio de Janeiro Declaration, adopted at the summit’s close, condemned the attack in “the strongest terms”, and emphasized that there can be no “double standards” in the global fight against terrorism.

Para 34 of the declaration, shaped by India’s diplomacy, called for action against those who “abet, finance, covertly or overtly” support terrorism—an implicit rebuke of Pakistan’s alleged role in cross-border attacks.

PM Modi: “Victims and Supporters Cannot Be Treated the Same”

Modi reaffirmed India’s long-standing demand for sanctions on those aiding terrorism, stating:

“Victims and supporters of terrorism cannot be weighed on the same scale.”

All 11 BRICS members and partners endorsed the statement, marking a rare moment of consensus on this issue.

However, China’s double game drew attention. While Premier Li Qiang joined the condemnation, Beijing’s ongoing resistance to UN sanctions against Pakistan-based terrorists remained a sticking point.

Modi’s pointed remark about nations offering “silent consent” for terrorism was seen as a direct critique of China’s contradictory position.

Reforming Global Institutions: A Call for Inclusivity

Beyond security, India led the charge for reforming global governance bodies such as the UN Security Council, IMF, World Bank, and WTO.

“We must build a multipolar and inclusive world order,” Modi told the summit.

According to officials, Para 6 of the declaration “strongly endorsed” this message, and highlighted the roles of India and Brazil in amplifying the voice of the Global South.

Innovation and Development: BRICS Research Push

India also proposed a BRICS Science and Research Repository to:

Strengthen critical mineral supply chains

Advance responsible AI initiatives

Support sustainable growth across developing economies

PM Modi held bilateral meetings with Malaysia, Cuba, South Africa, and Vietnam, promoting collaboration in digital infrastructure (like UPI) and the integration of Ayurveda into healthcare innovation.

India’s BRICS Leadership in 2026

With India set to assume the BRICS presidency in 2026, this summit further solidified its position as:

A global advocate against terrorism

A champion of institutional reform

A driver of inclusive and sustainable development

While China’s strategic contradictions remain a challenge, the Rio summit marked a clear diplomatic win for India—one that could shape the direction of the bloc for years to come.

Summary:

India secured unanimous condemnation of terrorism at BRICS 17.

The Rio Declaration echoed India’s language on sanctions and double standards.

PM Modi pushed for UNSC and IMF reform, backed by Global South partners.

India proposed a BRICS research initiative focused on AI and supply chains.

As future chair, India’s leadership is seen as a defining force in the bloc’s evolution.

@ Newshounds News™

Source: India Today

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Economist’s “News and Views” 7-8-2025

Trump’s 10% Tariff Just Shook BRICS as U.S. Debt Hits a Breaking Point

Daniela Cambone: 7-8-2025

“Tariffs, gold, and the great unraveling.”

Adrian Day, CEO of Adrian Day Asset Management, joins Daniela Cambone at the Rule Symposium in Boca Raton to unpack the global crosswinds shaking the foundation of U.S. dominance.

From Trump’s new 10% tariff threats against BRICS-aligned nations to Powell’s reluctance to cut rates, Day sees deep contradictions in U.S. policy — and a brewing inflection point for the dollar.

Trump’s 10% Tariff Just Shook BRICS as U.S. Debt Hits a Breaking Point

Daniela Cambone: 7-8-2025

“Tariffs, gold, and the great unraveling.”

Adrian Day, CEO of Adrian Day Asset Management, joins Daniela Cambone at the Rule Symposium in Boca Raton to unpack the global crosswinds shaking the foundation of U.S. dominance.

From Trump’s new 10% tariff threats against BRICS-aligned nations to Powell’s reluctance to cut rates, Day sees deep contradictions in U.S. policy — and a brewing inflection point for the dollar.

He warns of a silent shift away from the dollar as a reserve currency, citing its sharp decline in central bank holdings, and points to record debt servicing costs as the real driver behind coming rate cuts.

Amid shaky CPI data, political brinkmanship, and a confused Fed, Day argues gold remains the ultimate hedge. “The messaging is broken. The math is unsustainable. But the case for gold? Stronger than ever.”

The World Is DITCHING the Dollar - Here's WHY

Lena Petrova: 7-8-2025

Market Sell-Off Ahead? | Todd "Bubba" Horwitz

Liberty and Finance: 7-7-2025

Join Todd "Bubba" Horwitz for a live discussion on the recent downside moves in the stock market and what they could mean for investors.

He’ll break down the factors driving the decline and why the risk of further downside remains on the table.

Tuesday Coffee with MarkZ. 07/08/2025

Tuesday Coffee with MarkZ. 07/08/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and members

Member: Are we there yet????

Tuesday Coffee with MarkZ. 07/08/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark, Mods and members

Member: Are we there yet????

MZ: In Iraq: “The coming hours may witness the signing” This is about the Erbil/Baghdad oil agreements . There is a lot of back and forth right now. But articles are saying they have worked through the issues and signing is imminent.

MZ: We saw this same kind of back and forth in Kuwait.

Member: Never thought we all still be waiting and waiting and waiting all this time for the RV to go but then again, they don't care

MZ: Our regular article from Saleh: “ Advisor to the Prime Minister: Monetary Policy has succeeded in stabilizing prices and curbing inflation” He says “We are in great shape.”

Member: I bet Saleh had black hair when I bought my dinar

MZ: “Banning 18 Islamic banks from dealing in dollars-liquidation is looming” These are the same banks associated with financing terrorist groups. So is it Islamic banks being singled out – or support of terrorism being singled out? I think its part of a world wide cleanup effort.

MZ: I think this one is important. “A security source revealed Tuesday the determination of the International coalition withdrawal from Ain-A-Assad base from Anbar province” Trump has said all along that we will leave when we are paid. Now they are leaving????

MZ: I believe things are much further advanced than the press is reporting

MZ: This one makes me feel good about where we are at: “ TIR system: Iraq is a highway from Turkey to the Gulf” this is part of the development road project connecting the east to the west.

Member: I wonder- when do the Vietnamese new tariff trade agreements and thus new rate go into affect?

Member: With the new trade deal with Vietnam they should just go alone and take the lead

Member: any news from Bonds or groups today?

MZ: I do know a couple folks that have some bond update appointments today and I am hopeful it will give us a better idea where we are? Seems like much of it is misdirection.

Member: Frank's JPM Story...A guy went in for a meeting with Fin Adv. wasn't getting anywhere. Plopped down a brick of Dinar...The VP of Wealth mgmt was called. They have an appt today.

Member: We’re in a proverbial “escape room” looking for the clues together!

Member: Will we have Christmas in July or December?

Member: When this is all said and done and we are on the other side of this shift I vote to remove the word “soon” from the English language going forward!!

Member: They have always said there would be confusion right before this happens—hope that is where we are

Member: Just before the end of a movie the twists and turns increase and then boom

Member: happy Birthday to everyone celebrating and have a great day everyone.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Tuesday 7-8-2025

The Old Pretender: Hyperinflation will be Terminated by a New Gold Standard

7-8-2025

This is why the BRICS are Insulating themselves from the US dollar system by building their own (#gold-based) monetary infrastructure.

Bloomberg: BREAKING: President Donald Trump said he would put an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS,” injecting further uncertainty as the US continues to negotiate levies with trading partners

A good, brief explainer of the new BRICS #gold-based monetary system that is being quietly constructed without publicity.

The Old Pretender: Hyperinflation will be Terminated by a New Gold Standard

7-8-2025

This is why the BRICS are Insulating themselves from the US dollar system by building their own (#gold-based) monetary infrastructure.

Bloomberg: BREAKING: President Donald Trump said he would put an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS,” injecting further uncertainty as the US continues to negotiate levies with trading partners

A good, brief explainer of the new BRICS #gold-based monetary system that is being quietly constructed without publicity.

Note that uses the blockchain to transfer ownership without physically moving the #gold, just like @KinesisMonetary

Trump must know these threats are motivating more countries to join the new BRICS #gold-based monetary system.

Question is, will the US apply punishment tariffs on US states that have anti-fiat dollar sound money policies?

BMGGroup: States are quietly advancing #SoundMoney—tax-free gold, silver, and transparency laws are gaining ground. https://bit.ly/3XYZ624 #Gold #Silver #HardAssets #PreciousMetals

This helps solve the puzzle. Tariffs push more countries to de-dollarize, which adds to the inflation created by the BBB. The debt then gets hyperinflated away, before the hyperinflation is terminated on 4th July 2026 by the launch of a new #gold standard.

Going Underground: ‘If BRICS de-dollarisation succeeds, it would be DEVASTATING for the US economy’ -Former Member of the British Parliament Andrew Bridgen on the latest episode of Going Underground FULL INTERVIEW BELOW IN THE REPLIES

https://twitter.com/i/status/1942263397266944008

Trump is already setting up Jerome Powell as the fall guy to take the blame for the hyperinflation about to hit. But Powell will get paid handsomely to play that role.

This headline should more accurately read: “De-dollarization: BRICS leaders propose switching on alternative payment system to SWIFT”

Source(s): https://x.com/Dioclet54046121/status/1942134999421014411

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat Ali Al-Alaq in the CBI is working towards the monetary reform, we have the prime minister Al-Sudani working his magic in the direction of economic reform and his “pet” project of industrial cities. Article: “IRAQ PLANS TO RECEIVE 4 MILLION CONTAINERS ANNUALLY AT UMM QASR PORT.” WOW!...Umm Qasr Port in Basra is undergoing rapid development...Iraq is going to be a “clearing house” for the middle east. This means shipment from all over the world will land in Iraq and they be distributed to other countries. This means massive tariff and customs fees for Iraq...

Frank26 Isn't the goal for the Iraqi dinar to be digital? Yes, check it off the list. Isn't the goal for the Iraqi dinar to have purchasing power? Yes. Check it off the list. 'No. No. No. Wait. Stop. No Frank no. You can't check that off the list!' What if I prove to you it's not 1310 anymore? What would you say? I think you should say something's happening to the exchange rate. The American dollar is being removed out of Iraq. In doing so the value of the Iraqi dinar is going up.

FRANK26….7-7-25….ALOHA…..

Western Media Won’t Show You This: BRICS 2025 Summit Declaration

Lena Petrova: 7-7-2025