Iraq Economic News and Points to Ponder Saturday Afternoon 2-28-25

An Analysis Explains In Detail The Reasons For The Fluctuations Of The Iraqi Dinar Exchange Rate Against The Dollar In 21 Years

Economy Iraq Breaking Dollar Fluctuations Dinar prices 2025-02-28 01:04 Shafaq News/ The "Iraq Future" Foundation for Economic Studies and Consultations attributed, on Friday, the reasons for the fluctuations of the dinar exchange rate against the US dollar in the parallel market over more than two decades in the country to internal and external factors.

This came according to an analysis issued by the Foundation in which these fluctuations explained from 2005 until 2024.

An Analysis Explains In Detail The Reasons For The Fluctuations Of The Iraqi Dinar Exchange Rate Against The Dollar In 21 Years

Economy Iraq Breaking Dollar Fluctuations Dinar prices 2025-02-28 01:04 Shafaq News/ The "Iraq Future" Foundation for Economic Studies and Consultations attributed, on Friday, the reasons for the fluctuations of the dinar exchange rate against the US dollar in the parallel market over more than two decades in the country to internal and external factors.

This came according to an analysis issued by the Foundation in which these fluctuations explained from 2005 until 2024.

In its analysis, the Foundation stated that

"the Iraqi dinar exchange rate against the US dollar in the parallel market witnessed noticeable fluctuations over the past 21 years, as it was affected by a group of factors that ranged between

politics,

legislative and

economic."

However, the analysis added that "the supply and demand were the most influential, as the

patterns of changing the exchange rate differed according to the months of the year as a result of internal and external factors, such as the

timing of the public budget launch and

official holidays in major countries exporting goods to Iraq, such as China and Iran."

He pointed out that "by analyzing the exchange rate data in the parallel market from 2005 to the year 2024, it appears almost a repeated format that reflects the impact of the value of the dinar in more months than others." According to the Foundation,

"The month of December was the most frequent in the high value of the dinar, as it witnessed a decline in 13 years out of 21 years, followed by: August and June, with heights in the value of the dinar against the dollar in 11 years, then April 10 times, while the month of October and November had witnessed an increase in 9 times, and March 8 times."

The month of May was the least repeated in the decline in the value of the dinar, as

its value increased only 4 times throughout the studied period, which gives almost the impression that the dinar prices against the dollar rise in February, Azar and Nissan, then the decrease against the dollar in May as a result of the return of the demand strongly in May.

In its analysis, the Foundation warned that

"despite this clear seasonal effect on the exchange rate,

there are other factors that cannot be ignored, such as the levels of the dollar selling by the Central Bank of Iraq that directly affect the size of the cash supply in the market, as well as

political and financial factors such as the timing of the public budget funds, as well as the

geopolitical conditions that may cause sudden disturbances in the demand for foreign currency." The analysis concluded that "the effect of the

seasons of the year remains one of the main elements in determining the trends of the exchange rate in Iraq, where

a frequent pattern appears at the end of the year and the beginning of the fiscal year, in addition to its influence on the official holidays in the countries exporting goods to Iraq,

but other factors, such as

monetary policies and

political and economic developments,

remain a direct impact on the parallel market, which makes it necessary to monitor all these variables to understand the exchange rate changes with more accurately."

https://www.shafaq.com/ar/اقتصـاد/تحليل-يشرح-سباب-تقلبات-سعر-صرف-الدينار-العراقي-مام-الدولار-خلال-21-عاما

Al-Alaq: Iraq Has Become One Of The Best Countries In The World In Controlling The Sale Of The Dollar

Banks Economy News – Baghdad The Governor of the Central Bank, Ali Al-Alaq, confirmed on Saturday that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in a statement reported by the official news agency, and reviewed by "Al-Eqtisad News", that "Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country," explaining that "this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts."

Al-Alaq noted that "false news and media distortion may harm the interests of Iraq and the banking sector," stressing the importance of being proud of the major developments that Iraq is witnessing.

He pointed out that "the government and the Central Bank are working hard to establish sound practices that are compatible with international standards," calling for "the need to highlight these achievements in the media."

He pointed out that "highlighting these transformations and developments helps enhance international confidence in the Iraqi banking sector, which is vital to the continued development of the financial system in Iraq." https://economy-news.net/content.php?id=53062

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 3-01-25

Good afternoon Dinar Recaps,

RUSSIA WANTS TO REVERSE DE-DOLLARIZATION: WHAT IT MEANS FOR THE US DOLLAR?

The US dollar has always been surrounded by serious foes and enemies, the ones that want to derail its reserve currency status.

To expedite the de-dollarization concept, Russia and China have always been quite vocal about their ideas, adding how they both want to derail the US dollar hegemony by putting forth the idea of the multi-polar currency world.

Good afternoon Dinar Recaps,

RUSSIA WANTS TO REVERSE DE-DOLLARIZATION: WHAT IT MEANS FOR THE US DOLLAR?

The US dollar has always been surrounded by serious foes and enemies, the ones that want to derail its reserve currency status.

To expedite the de-dollarization concept, Russia and China have always been quite vocal about their ideas, adding how they both want to derail the US dollar hegemony by putting forth the idea of the multi-polar currency world.

This roughly sparked the promotion of local currencies on an international scale, jeopardizing the dollar’s supremacy. With the US and EU sanctioning Russia and expelling it out of the SWIFT system, Russia opted for yuan, all while promoting the narrative of de-dollarization at a rapid pace.

But now it seems that things have started to take an interesting turn, with Russia showing a softening stance against the US. What is this all about? Let’s find out.

Tables Turning Around: Trump Supporting Russia

With Donald Trump assuming the role of the US president, his ideas of bolstering the US economy via tariffs have been gaining widespread momentum. Apart from that, another significant development that has caught the world’s attention is Trump’s increased effort to conclude the ongoing Ukraine-Russia war.

The US president has often been noted stating the gruesome repercussions of the ongoing Russia-Ukraine war, adding that Zelensky should have made a deal to end the war earlier, showing a supportive stance towards Russia.

“I hear that they’re upset about not having a seat. Well, they’ve had a seat for three years and a long time before that. This could have been settled very easily… Russia wants to do something. They want to stop the savage barbarism.”

"You should have never started it. You could have made a deal…I could have made a deal for Ukraine… That would have given them almost all of the land, everything. Almost all of the land—and no people would have been killed, and no city would have been demolished.”

Trump earlier shared how he has the power to end the war.

“I think I have the power to end this war,” he added.

De-Dollarization To End: Russia Praises Trump

On the other hand, Russian PM Vladimir Putin has notably praised Trump’s effort to resolve the ongoing Russia-Ukraine war.

“Let me note that the first contacts with the American administration instill hope. They too are willing to work towards resuming our ties, solving a colossal amount of strategic problems in world architecture.”

In addition to this, Putin also acknowledged how certain external forces are trying to disrupt the budding Russian-US sense of friendship and commitment.

“I understand that not everybody is pleased with the resumption of Russian-American contacts. Some of the forces are interested in keeping hostilities, and they will try to disrupt the emerging dialogue. We will need to use all the possibilities of diplomacy and special forces to firmly defend our national interests.”

With such developments taking place, the Russia-US fostering relationship could ultimately result in a lasting resolution thwarting BRICS efforts of derailing the US dollar. This development can ultimately put a stop to the rising de-dollarization concepts and ideations.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

RUSSIA DELAYS DIGITAL RUBLE CBDC ROLLOUT

A year ago, the Bank of Russia set July 2025 as the date for the first launch phase of its digital ruble central bank digital currency (CBDC). Now the central bank is delaying the roll out. It follows resistance from merchants, a major banking association, and its largest bank, Sber.

The big bank was excluded from the first wave of banks involved in the pilot, so it only joined this January, a year later than planned. Perhaps its inclusion was delayed to avoid it dominating trials, but that’s speculation. The reality is that six months from the first pilot to launch is rather short for a bank.

Central Bank Governor Elvira Nabiullina announced the delay at a meeting with the Association of Russian Banks (ASROS). However, she said that the pilots are progressing well.

“Our intention is to move on to the mass implementation of the digital ruble somewhat later than originally planned, namely after we have worked out all the details in the pilot and held consultations with banks on the economic model that is most attractive to their clients – for businesses, for people,” the Governor said, as reported by the Association.

The central bank first shared details about the planned business model late last year.

A new schedule has not yet been set, and the central bank did not mention the delay on its website. However, the launch postponement was also reported by the Interfax news agency.

Digital ruble: addressing bank concerns

When banks raised their concerns in the State Duma in December, they highlighted several issues. The main ones were worries about deposit outflows and the costs of implementation.

On the first point, from the start the central bank has appeared unconcerned about this impact. This may be partly because it plans a three phase rollout. Initially larger banks and merchants will join, followed by other banks and mid-sized merchants. The final phase will require non bank providers and all merchants to participate, but that will be two years later.

Regarding the expense, the banking association estimated the cost to a bank could be up to Rubles 100 million ($1.1m). The central bank says it will provide some technical elements to banks free of charge, to help smaller banks.

“For those components that are mandatory from the point of view of information security, we (will) provide these solutions to banks free of charge. This software module for embedding is created and transferred to organizations, and in three different forms, so that banks can choose the most optimal one for their landscape,” said Deputy Governor of the Bank of Russia, Zulfiya Kakhrumanova.

“We provide free cryptographic information protection tools for subordinate certification centers that are deployed by banks, and this is also a significant cost aspect for banks,” she added, according to Interfax.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

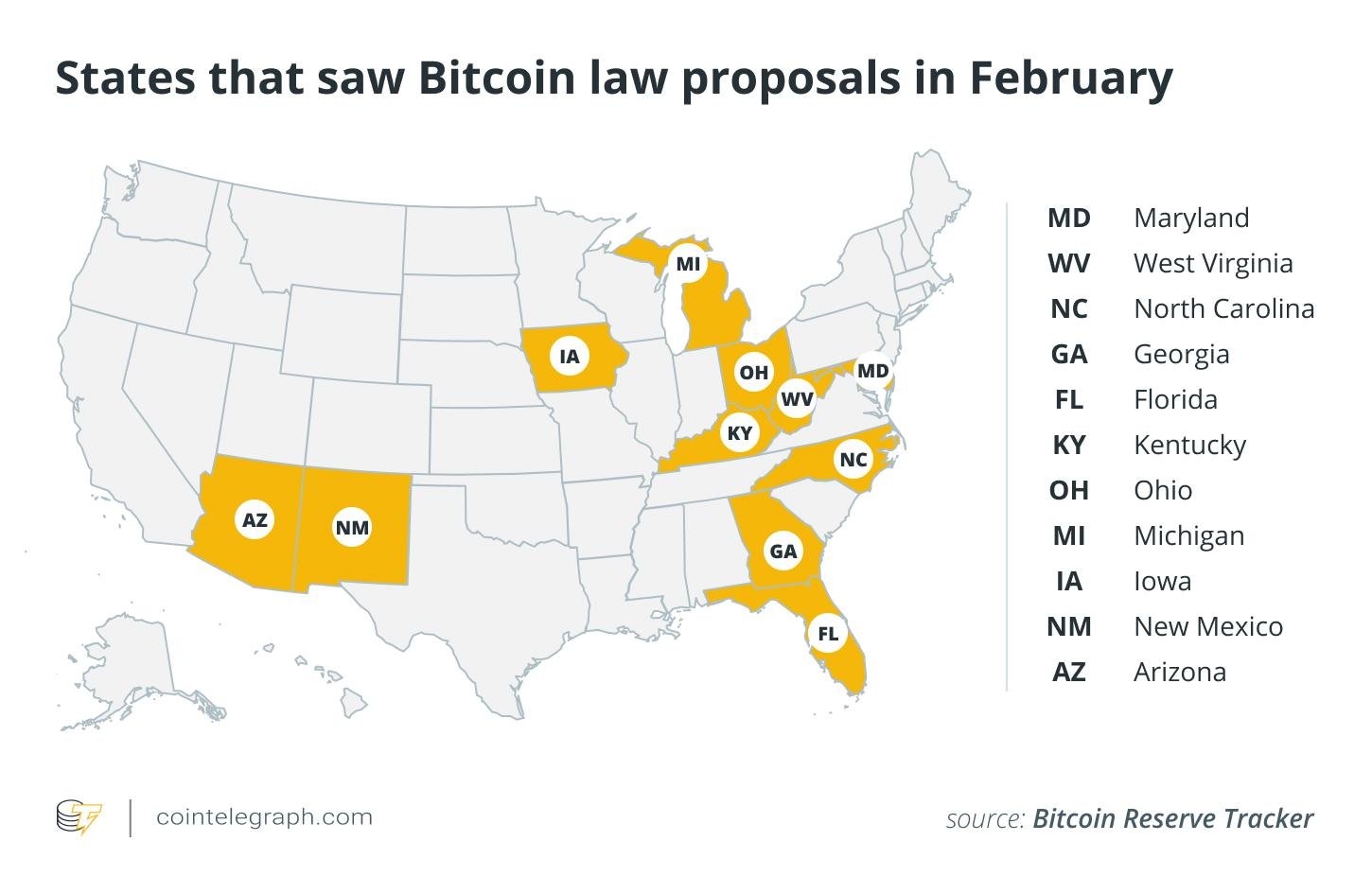

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

BITCOIN NOT FIT FOR SWISS NATIONAL BANK RESERVES, SAYS PRESIDENT

▪The Swiss National Bank president dismissed the idea of holding Bitcoin in reserves due to volatility, liquidity concerns, and security risks.

▪The SNB views cryptocurrencies as a small, volatile "niche phenomenon" unsuitable for central bank reserves.

▪A Swiss initiative is pushing for a public vote to mandate the SNB to include Bitcoin in its reserves.

The Swiss National Bank (SNB) has made its stance on Bitcoin crystal clear—it’s not interested. Despite growing global adoption and a push from Swiss crypto advocates, SNB President Martin Schlegel has firmly rejected the idea of adding Bitcoin to the bank’s reserves.

In a recent interview, he explained why digital assets don’t make the cut, pointing to volatility, liquidity concerns, and security risks.

@ Newshounds News™

Read more: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Weekend Coffee with MarkZ. 03/01/2025

Weekend Coffee with MarkZ. 03/01/2025

MarkZ Update- Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning….It is Saturday and we shall see what the weekend brings…

MZ: We start with Matt and Lucas at CBD Guru’sfor the first 45 minutes before the news.

Weekend Coffee with MarkZ. 03/01/2025

MarkZ Update- Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning….It is Saturday and we shall see what the weekend brings…

MZ: We start with Matt and Lucas at CBD Guru’sfor the first 45 minutes before the news.

Member: March 1, another month bites the dust. Now, the Ramadan is on for the next 30 days...but, I'm remaining hopeful ...April, May is certainly looking awesome...

Member: With bond people staring to get paid- Does that mean we have a new rate?

MZ: Bond people possibly starting getting paid has nothing to do with the rate we will get on currency. They are two separate gigs. But if they are starting to receive dollars-it very much tells us it is soon. Do we know when? No we do not. Not yet.

Member: Mike Bara says a currency holder has an apt early next week

Member: Wer’nt bonds supposed to be paid out in fiat?

MZ: yes they were…at least the first payments were supposed to be in fiat. Before it transitions.

Member: So do bond people actually have funds now?

MZ: Some of the bond facilitators have gotten spendable dollars….The bond side is pretty quiet this morning ..Groups are working but no updates from them.

MZ: My wealth management/redemptions contacts are working today…I hope to get an update today on what they are working on. Is it wealth management related or exchange related?

Member: One of our listeners stated that Wells Fargo called him and stated that they will be open tomorrow..

MZ: In Iraq: “PKK declares cease-fire with Turkey after more than 40 years of conflict” Kurdish militants have declared a cease-fire with Turkey. It is time to lay down arms and have peace.

MZ: “After Ocalan’s announcement to lay down arms: Parliamentary moves to end Turkish presence in Iraq” Peace is breaking out in the middle east.

MZ: “Sudanese advisor: Digital currency will reduce money printing and fight money laundering” they will slowly over time transition out the cash. They have an I-dinar which is an asset backed dinar which is a combination of gold, oil and a basket of currencies. This I-dinar also backs whatever cash they have in the country. This is very different from CBDC’s that are backed by nothing.

Member: Mark did Iraq ever revalue their currency before or will this be the first time?

MZ: Iraq has revalued its currency 4 times in the last 120 years. There is a lot of historic precedence for this. I beleive it was in the 1970’s that we last saw Iraq RV a major move “up”

Member: I wonder- is fed-now going to be our digital gold backed currency ??? or XRP ???

Member: I truly believe we are in very close proximity of this happening

Member: Seems that Tuesday in Iraq with the Oil meetings might bear fruit. So much is pointing to March 4th... 3/4... 34... Double 17... I hope I'm right with my suspicion

Member: Keep your eyes and ears open this weekend everyone... Very well could get notifications since we know that Bara shared that his bond guy was scheduled for Currency appointment "Early Next Week"

Member: I am always hopeful for Saturday nights…best time to reset currencies……maybe this is the one we are waiting for?

Member: Enjoy your weekend everyone…..nothing, nothing, nothing…SUDDENLY

Mod: SEE YALL MONDAY MORNING. 10AM EST

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED NIGHT! SEE YOU ALL IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

News, Rumors and Opinions Saturday 3-1-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 1 March 2025

Compiled Sat. 1 March 2025 12:01 am EST by Judy Byington

THE SYSTEM OF CONTROL IS BEING OBLITERATED

DEBT FORGIVENESS IS UNDERWAY: Illegitimate loans, mortgages, and credit card debts are (allegedly) being wiped clean. The fraudulent banking system is (allegedly) over.

THE FEDERAL RESERVE IS COLLAPSING: The private banking cartel that controlled America since 1913 is being (allegedly) absorbed into the U.S. Treasury.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Sat. 1 March 2025

Compiled Sat. 1 March 2025 12:01 am EST by Judy Byington

THE SYSTEM OF CONTROL IS BEING OBLITERATED

DEBT FORGIVENESS IS UNDERWAY: Illegitimate loans, mortgages, and credit card debts are (allegedly) being wiped clean. The fraudulent banking system is (allegedly) over.

THE FEDERAL RESERVE IS COLLAPSING: The private banking cartel that controlled America since 1913 is being (allegedly) absorbed into the U.S. Treasury.

TRILLIONS IN STOLEN WEALTH SEIZED: Offshore accounts, hidden trusts, and gold reserves are being (allegedly) taken from the Deepstate and returned to the people.

THE IRS IS BEING ABOLISHED: The corrupt tax system that drained Americans for decades is finished. A new, fair tax system is (allegedly) being introduced.

GOLD-BACKED CURRENCY IS COMING: The fiat dollar is (allegedly) dead. The new U.S. Treasury-backed currency will restore economic stability and transparency.

THE QUANTUM FINANCIAL SYSTEM (QFS) IS ONLINE: A new, unhackable, transparent financial system is in place, ensuring no more manipulation by elites.

THE DEEPSTATE IS IN PANIC MODE: Their last moves are exposed:

They are (allegedly) trying to crash the markets—but Trump’s team anticipated it.

They are (allegedly) funding cyberattacks on QFS—but the system is unbreakable.

The Deepstate is(allegedly) out of time. GESARA is about to be (allegedly) fully unleashed.

~~~~~~~~~~~~

Fri. 28 Feb. 2025 QFS Information Center: The Quantum Financial System EXPOSED! Tier 4B, Currency Revaluation & NESARA/GESARA Payments – The Moment Has Arrived! …John F. Kennedy on Telegram

The Quantum Financial System (QFS) is HERE—and the elites are panicking. A total shift from FIAT to asset-backed currency is unfolding before our eyes. The old system of debt slavery, controlled by central banks, is collapsing. If you’re not paying attention, you’ll be left behind.

Tier 4B: The Internet Group Revelation: For those who have studied the signs, the term Tier 4B is no mystery. This is the moment we’ve been waiting for. If you’ve acquired foreign currencies—like Iraqi Dinar, Vietnamese Dong, or Zimbabwe Zim—anticipating revaluation, you may be on the list for redemption. But there’s disinformation everywhere—and that’s by design. The deepstate does NOT want you to know this is happening.

The Financial War—QFS vs. The Old System: The elites have ruled through FIAT currency, creating endless debt and inflation. But the Quantum Financial System is (allegedly) designed to END their control. Once activated, QFS ensures every transaction is fully traceable, hack-proof, and immune to manipulation. This is why central banks are scrambling—they CANNOT reconcile their old money into QFS. Their time is OVER.

NESARA/GESARA: The Hidden Wealth They Didn’t Want You to Have: For years, the cabal hoarded wealth, using birth certificates, mortgages, and taxes to steal from YOU. NESARA/GESARA is about releasing TRILLIONS back to the people. It’s no coincidence that governments worldwide are suddenly talking about “restructuring debt”—they know the game is up. The people who are prepared will THRIVE. Those who remain ignorant will suffer.

Redemption Centers & The Last Chance for Action: If you hold foreign currencies, you may be called to Redemption Centers to exchange them at new rates. This will not be publicly advertised—it’s a controlled process. But once the masses realize what’s happening, chaos will (allegedly) erupt.

ARE YOU READY? The storm is here. The global financial war is peaking. Do not be fooled. Stay vigilant. The window for action is closing FAST. Prepare now—or regret it forever!

Read full post here: https://dinarchronicles.com/2025/03/01/restored-republic-via-a-gcr-update-as-of-march-1-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 These last 20 years...the flow of oil...was paid in American dollars...now the oil that's flowing is being paid in Iraqi dinars...

Frank26 Article: "Confirming Shafaq News.. Trump is heading to impose sanctions on Iraqi groups" Notice that you didn't say Iraqi banks no no no. Is he going to put sanctions on Iraqi government? No. No. No. Is he going to put sanctions on the CBI? No. No. no. Who's he putting sanctions on? Iraqi groups, Framework...Maliki's militia...Iranian politicians in parliament...

Militia Man Article quote: "Trade culture economic exchange with neighboring sisterly and friendly countries is the most important element in building civilization and raising the value of natural resources." ...If they raise the value of their currency to their assets...That's huge. The valuation of that is going to be key...In other words what they're going to do is raise the value of their dinar because that's what they're going to be doing trade in...In my view they're not going to be doing this at 1310 exchange rate. I don't believe that at all...To me it means raising the value of their currency...

Now we talking Iqd exchange rate 21 years long time time to changed back to its original

Nader: 3-1-2025

How to Tell if Your Iraqi Dinars are Real

Edu Matrix: 2-28-2025

This informative video shows you how to audit your IQD Banknotes and identify counterfeit notes. With reports of counterfeit currency circulating, it's essential to ensure your banknotes are genuine.

Iraq Economic News and Points to Ponder Late Friday Evening 2-28-25

Kurdistan Banks Will Take Their Share Of Sanctions .. Economic Shows The Reasons

Economy Yesterday, 12:40 |Baghdad today – Baghdad Economic expert Hevidar Shaban, today, Thursday (27 February 2025), is the reasons for imposing US sanctions on a number of banks in the Kurdistan region.

Shaaban said in an interview with "Baghdad Today" that "in the context of coordination between the US Treasury and the Central Bank of Iraq, sanctions will be imposed on banks in the region, including joint banks in my accounting project for employees salaries in Kurdistan."

Kurdistan Banks Will Take Their Share Of Sanctions .. Economic Shows The Reasons

Economy Yesterday, 12:40 |Baghdad today – Baghdad Economic expert Hevidar Shaban, today, Thursday (27 February 2025), is the reasons for imposing US sanctions on a number of banks in the Kurdistan region.

Shaaban said in an interview with "Baghdad Today" that "in the context of coordination between the US Treasury and the Central Bank of Iraq, sanctions will be imposed on banks in the region, including joint banks in my accounting project for employees salaries in Kurdistan."

He added that "this process is to control the

smuggling of currency in some banks in the region, control

money laundering,

illegal dealings, and the

structural organization of banks."

Earlier this month, two informed sources reported that the

Central Bank of Iraq would prevent local banks from dealing with dollars.

"The Central Bank of Iraq will prevent 5 local banks from dealing with dollars in the US Treasury request." The two sources added,

"3 companies for payment services will be banned from dealing in dollars according to the US Treasury request," the two sources added. They pointed out,

"America has submitted its request due to

severe cash violations and the

smuggling of the dollar outside the country."

https://baghdadtoday.news/268804-مصارف-كردستان-ستأخذ-نصيبها-من-العقوبات.-اقتصادي-يبين-الأسباب.html

The Digital Currency To Be Launched In Iraq ... Between Economic Opportunities And Potential Risks

Economy Yesterday, 16:12 | Baghdad today – Baghdad The specialist in the international economic affairs, Nawar Al -Saadi, revealed today, Thursday (27 February 2025), the importance of the Central Bank of Iraq to launch its own digital currency.

Al -Saadi told "Baghdad Today" that "economically, this step carries great benefits,

but at the same time it involves challenges and risks that must be dealt with with caution." He indicated,

"The importance of this step lies in several aspects, most notably that

it provides a more efficient and transparent electronic payment method, which

reduces dependence on paper criticism and

limits the informal economy."

He continued, "The digital currency of the central bank can contribute to

reducing the costs of printing and

managing the paper currency, and

improving monitoring of cash flows, which contributes to

fighting corruption and money laundering."

He added, "Nevertheless, this step is not without risks, especially in light of the challenges facing the Iraqi financial system," noting that "the most prominent concerns, the possibility of using the digital currency in smuggling operations, especially if there are no strict mechanisms to control digital transactions, and Iraq is already suffering from challenges in controlling transfer of money through informal channels, and any weakness in the management of the digital currency may lead to exploitation before Legal.

Al -Saadi also warned that "there are risks related to cash stability, as

the rapid shift to the digital currency may lead to pressure on the traditional banking system,

especially if the banks are not technically and practically prepared for this change, moreover,

any security or technical defect in the digital infrastructure may make the financial system more vulnerable to electronic or piracy attacks."

The specialist in the international economic affairs pointed out that

"in order to ensure the success of this step, it is necessary for the central bank to

follow a deliberate policy to implement it gradually,

with a clear legal framework to regulate the use of digital currency," stressing "the need to

enhance the digital banking infrastructure and

ensure the readiness of the financial system to accommodate this transformation without affecting economic stability, and

if this policy is applied with caution and transparency, the

digital currency can form The Central Bank has an effective tool to

enhance the Iraqi economy and

push it towards more modernity and financial openness. "

The Governor of the Central Bank, Ali Al -Alaq, revealed earlier on Wednesday,

the approach to the establishment of a bank digital currency, to replace paper currencies.

Al-Alaq said, in a speech during the Ninth Finance and Banking Conference and Exhibition, and followed by "Baghdad Today", that "the financial and banking system will witness fundamental transformations,

including the decline of paper currencies to be replaced by digital payments for central banks." He added that "the central bank is moving to create a digital currency of its own,

to gradually replace the paper process as it is taking place in some central banks in the world," noting that "we are seriously thinking about establishing a data center in Iraq, and the bank starts moving in this matter within the steps of digital transformation."

https://baghdadtoday.news/268817-العملة-الرقمية-المزمع-اطلاقها-في-العراق.-بين-الفرص-الاقتصادية-والمخاطر-المحتملة.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 3-01-25

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Cardano and XRPL Expand Interoperability With New Bridge

TapTools, a digital wallet tracking Cardano trading, brought the attention of the crypto community to the Cardano-XRP bridge. This bridge, which is now live, is facilitated by Wanchain, a decentralized blockchain interoperability solution.

As reported by TapTools, the Cardano-XRP bridge is designed to expand interoperability and liquidity between the two networks. This technical advancement marks a massive milestone for both blockchains, representing the first time they connect via a bridge.

Besides promoting interoperability and liquidity, the bridge will support DeFi adoption and enhance utility for both ADA and XRP.

Historically, both communities have different technological and market positioning. However, they can now leverage the new bridge to interact in unprecedented ways.

Users can utilize the bridge to transfer ADA onto the XRP Ledger and vice versa.

It will also increase the Total Value Locked (TVL) for users exploring Decentralized Finance (DeFi) opportunities on Cardano. This increased interoperability is crucial as the world moves swiftly toward widespread blockchain adoption.

Beyond these benefits, the bridge potentially paves the way for integrating Ripple’s stablecoin, RLUSD, as a bridged asset. It is important to note that the Cardano-XRP bridge operates without centralized control. This means users retain control over their assets without interference from a third party.

Meanwhile, Wanchain will help to preserve the underlying value of wrapped versions of XRP and ADA as they seamlessly interact with applications on the opposite chain.

Wanchain uses a distributed key generation and secure multi-party computation (MPC) mechanism to ensure assets move safely across different blockchains.

Impact on ADA, XRP, and Broader Market

The Wanchain XRP/Cardano bridge will benefit Cardano and the XRP ecosystems in numerous ways. For Cardano, the bridge will help strengthen users’ appeal for the blockchain as more capital flows into ADA-based DeFi platforms. Our latest report covered that the XRPL Decentralized Exchange has surpassed $20 billion in liquidity, highlighting XRP’s expanding role in DeFi.

Also, thanks to this bridge, XRP users are encouraged to explore Cardano’s ecosystem more. This attention toward the network can lead to greater adoption of Cardano’s native smart contracts and Decentralized Applications (dApps).

Regarding XRP, the new bridge can unlock staking, borrowing, lending, and yield farming opportunities previously unavailable to XRP holders. The bridge can also elevate XRP’s role in multi-chain ecosystems, extending its potential beyond traditional payments and remittances.

For the broader market, the new bridge demonstrates that achieving a more interconnected blockchain environment is possible. It also demonstrates the growing importance of interoperability in the blockchain industry and ensures that cryptocurrencies are not isolated.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BRICS CONFIRMS DEVELOPMENT OF NEW PAYMENT SYSTEMS IN 2025

Brazil, which chairs the upcoming BRICS summit in 2025 confirmed that they plan on the formation of new payment systems. Under the leadership of Brazilian President Luiz Lula da Silva, the alliance will discuss alternative payment options to the US dollar.

The BRICS Sherpas meeting will take the ideas forward and the upcoming 17th summit could see massive changes in the way the bloc operates and settles cross-border transactions.

The move could lead to a paradigm shift in global trade and tilt the financial powers from the West to the East. Developing countries are looking to cut ties with the US dollar and strengthen their local currencies in the forex markets.

The US dollar is in the crosshairs of a major shift that could pave the way for native currencies to take the driver’s seat of the financial markets.

BRICS: New Payment Systems in 2025 Could Be a Reality

Brazil’s President Luiz Lula da Silva made a strong statement saying that BRICS will continue advancing the de-dollarization agenda. The President also added that under their leadership, BRICS will work towards developing new payment systems as an alternative to the US dollar.

“Brazil is going during the period of its presidency to fully develop transparent and safe payment systems,” he said.

The bloc will work towards launching safe payment systems to uplift their GDP and strengthen their native economies. The move will give a boost in the arm to their local currencies making businesses thrive.

The next BRICS summit is scheduled to be held in Brazil’s Rio De Janeiro on July 6th and 7th. All the nine member countries will meet at the summit and discuss policies and sign new trade deals. Details on the new payment systems could be revealed at the 17th summit in July this year.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 3-1-2025

TNT:

Tishwash: Iraq among the best in the world in controlling the sale of the dollar

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Saturday, that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in an interview with the official agency, followed by Iraq Observer, that “Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country,” explaining that “this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts.”

TNT:

Tishwash: Iraq among the best in the world in controlling the sale of the dollar

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Saturday, that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in an interview with the official agency, followed by Iraq Observer, that “Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country,” explaining that “this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts.”

Al-Alaq added that “false news and media distortion may harm the interests of Iraq and the banking sector,” stressing the importance of being proud of the major developments witnessed by Iraq. He explained that “the government and the Central Bank are working hard to establish sound practices that are compatible with international standards,” calling for “the need to highlight these achievements in the media.”

He pointed out that “highlighting these transformations and developments helps enhance international confidence in the Iraqi banking sector, which is vital to continue developing the financial system in Iraq.” link

Tishwash: Financial Advisor: Central Bank Digital Currency Will Boost Transparency, Improve National Payments

The financial advisor to the Prime Minister, Mazhar Mohammed Saleh, explained today, Saturday, that issuing a digital currency for the Central Bank will be an important step towards enhancing transparency and achieving a qualitative leap in the national payments system.

Saleh said in a statement to the official agency, followed by NRT Arabic, that "the Central Bank plans to issue a digital currency as a gradual alternative to paper currency," noting that this step will contribute to reducing cash leakage and lowering the costs of printing paper currency, in addition to reducing the circulation of money outside the banking system.

He added that the digital currency will allow tracking financial flows, improve control over capital and foreign transfers, support anti-money laundering efforts, and contribute to enhancing financial inclusion, especially for groups less integrated into the banking system.

Saleh explained that Iraq's transition to digital currency requires a strong technical infrastructure, including advanced internet networks and advanced cybersecurity systems to protect data and transactions.

Digital currencies will also support efforts to enhance economic and social integration through government use in collection operations and official transactions. link

************

Tishwash: Federal Oil invites "APICOR" and Kurdistan Wealth to meet in Baghdad

The Federal Ministry of Oil has set next Tuesday as the date for a meeting with the Ministry of Natural Resources in the Kurdistan Region to discuss issues related to the concluded contracts and reach understandings that contribute to the development of oil fields, while an invitation was extended to foreign companies contracting with the Kurdistan Regional Government to develop the region’s fields.

The ministry stated in a statement, received by the Iraqi News Agency (INA) today, Saturday, that it "extended an invitation to international foreign companies under (APICOR) and contracted with the Kurdistan Regional Government to develop the region's fields."

The statement continued, "The ministry extended an invitation to the Ministry of Natural Resources in the region to attend in Baghdad next Tuesday for the purpose of discussing and debating issues related to the concluded contracts to reach understandings that contribute to developing the oil fields with the best international practices and in a manner that serves the national interest." link

*************

Tishwash: Reasons for stopping cash withdrawals outside Iraq by TBI

Today , Friday (February 28, 2025), banking and financial affairs specialist Ahmed Abdul Rabbo revealed the reasons for stopping cash withdrawals outside Iraq by the Trade Bank of Iraq.

“There is a strong possibility that the decision is related to combating currency smuggling, as the Central Bank of Iraq and financial institutions have previously taken similar measures to limit the exit of the dollar through unofficial means,” Abdul Rabbo told Baghdad Today.

He explained that “some parties were using electronic payment cards to withdraw cash from abroad with money purchased at the official exchange rate inside Iraq, then reselling it at higher prices in the parallel market, which constitutes a type of currency smuggling.”

He explained that "there is a strong possibility that the decision came in response to American pressures related to regulating dollar flows and preventing its smuggling to countries subject to American sanctions, such as Iran. Washington has imposed strict restrictions on Iraqi banks in recent periods, and asked the Central Bank of Iraq to take strict measures to control financial transfers, especially after detecting currency smuggling operations through the use of electronic payment cards."

He added that "the decision appears to have come as part of broader measures to control the banking sector and prevent the misuse of the dollar, and is an extension of previous measures imposed by the Central Bank, either in response to American pressure or as part of efforts to combat financial corruption and smuggling."

Yesterday, Wednesday, the Trade Bank of Iraq announced the suspension of cash withdrawals via ATMs outside Iraq.

The bank's media advisor, Aqil Al-Shuwaili, said in a brief statement, "Due to the risks resulting from the misuse of electronic cards (Visa and MasterCard), and to avoid these risks, cash withdrawals via ATM machines for these cards outside Iraq only have been stopped."

He added, "Cards can be used to pay through POS machines and online." link

Mot: . Gotcha!

Mot: . Isn't This da Way it Always Works Out!! --- siiggghhhh

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

2-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

2-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Lawrence Lepard: The Big Print - Make the Money System Great Again

Lawrence Lepard: The Big Print - Make the Money System Great Again

Palisades Gold Radio: 2-28-2025

Tom welcomes back Lawrence Lepard from Equity Management Associates to discuss his new book, "The Big Print: What Happened to America and How Sound Money Will Fix It."

Lepard emphasized that the U.S. monetary system began deteriorating with Nixon's abandonment of the gold standard in 1971, leading to persistent inflation and debt accumulation.

He argued that sound money — gold, silver, and Bitcoin — is essential to fix these issues.

Lawrence Lepard: The Big Print - Make the Money System Great Again

Palisades Gold Radio: 2-28-2025

Tom welcomes back Lawrence Lepard from Equity Management Associates to discuss his new book, "The Big Print: What Happened to America and How Sound Money Will Fix It."

Lepard emphasized that the U.S. monetary system began deteriorating with Nixon's abandonment of the gold standard in 1971, leading to persistent inflation and debt accumulation.

He argued that sound money — gold, silver, and Bitcoin — is essential to fix these issues.

Gold provides stability, while Bitcoin offers a digital solution to scarcity and divisibility, though it is still volatile.

The interview explored how inflation affects everyday life, with Lepard noting that the government's reported inflation rates often underestimate real costs.

He criticized the Federal Reserve for prioritizing debt servicing over economic fairness, leading to a cycle of printing money that disproportionately harms wage earners. Lepard also discussed the political challenges in transitioning to sound money, suggesting that widespread public awareness and grassroots support are needed to push for systemic change.

He warned against complacency, noting that the U.S. is on a trajectory toward a debt crisis unless decisive action is taken.

The conversation concluded with Lepard encouraging listeners to engage with his book to better understand these issues and advocating for a future where sound money restores economic health and fairness.

Time Stamp Reference

0:00 - Introduction

0:40 - The Big Print

7:20 - Where It Went Wrong

10:00 - CPI Chart 1800-2005

12:00 - Inflation a Key Issue

15:00 - The Wealth Gap

18:30 - Next Monetary Crisis

21:20 - A Moral Imperative

23:00 - Debt System Origin

26:00 - Top Vs. Bottom Wealth

27:00 - Why All Fiats Fail

31:00 - Lies & Inflation Stats

34:50 - Deflation Boogeyman

38:00 - Solutions & Outcomes

45:00 - Peg to Real Assets

48:45 - Bitcoin Advantages

52:20 - Resets & Reserve Currency

56:30 - Book & Wrap Up

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25

Transcribed By WiserNow Emailed To Recaps

Welcome everybody the big call tonight. It is Thursday, February 27th and you're listening to the big call. Thanks for joining us, wherever you're located, around the globe. Thank you sat team for hooking everybody up around the globe to listen in. The rest of you on free conference call glad to have you, and many of you listen to the replay, which is another great way to hear us. So thanks for listening everybody.

Let's, let's get into where we where we want to be on the intel tonight. So what do I want to bring out first. The first thing that I'm thinking of is, yeah, do we do we have any new information about Social Security increases, or about R and R? Not right now, and I told you guys on Tuesday night I wasn't giving it much hope for coming by the end of this month with three days to go, that was on Tuesday night.

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25

Transcribed By WiserNow Emailed To Recaps

Welcome everybody the big call tonight. It is Thursday, February 27th and you're listening to the big call. Thanks for joining us, wherever you're located, around the globe. Thank you sat team for hooking everybody up around the globe to listen in. The rest of you on free conference call glad to have you, and many of you listen to the replay, which is another great way to hear us. So thanks for listening everybody.

Let's, let's get into where we where we want to be on the intel tonight. So what do I want to bring out first. The first thing that I'm thinking of is, yeah, do we do we have any new information about Social Security increases, or about R and R? Not right now, and I told you guys on Tuesday night I wasn't giving it much hope for coming by the end of this month with three days to go, that was on Tuesday night.

Now we're on Thursday night with one day left tomorrow, and I don't think we're going to see this month. That's a pretty safe bet, BUT -- I am encouraged by the fact that we did receive a little bit of information, a couple of small puzzle pieces that we’re using to fill in this puzzle to try to complete the picture that we're looking for, and such is the fact that right now, I know that we had two very strong sources that were telling us that, don't worry, this is going to be the week that we receive our notifications.

And even though we only have two days left, Friday and Saturday this week, I think it's quite possible that we still will get notified and set an appointment this week.

Now, how do I say that? I know, for example, that one of our redemption center staff members is working tomorrow morning at Wells, Fargo Bank, and then goes after lunch into the redemption center tomorrow, Friday.

Why would that be? Why would a person work in the bank in the morning and go to the redemption center in the afternoon, unless they were expecting for the toll free numbers to come out in our emails, our notifications, and then we call, and this person is there on the redemption center end to help set our appointments.

That made perfect sense to me. I thought, you know, tomorrow is the 28th of February, so last day of the month? Could they notify us on Friday still this week. And could they notify us where we get our numbers and we set our appointment tomorrow? Could be tomorrow afternoon, but we set it for Saturday or Sunday or Monday or whatever next week. I think it's very possible

I’m not calling it. I'm not saying that it's definite, but it looks good for us to get notified and set our appointments for exchanges that would start on Saturday, the first of March, in a whole brand new month, 31 days of March. So that is, that is quite possible.

I really think if this is going to happen this week. And I know it's a big if, but if, what we're told was it would be this week, don't worry, then I see that as the way it's going to happen.

Now, as far as redemption centers go, we got some information about one email that was received in the morning yesterday, one was received in the afternoon, still waiting on one more, but did not come this morning, as was expected, but should be there tomorrow.

And we don't know what this email that hasn't been received will say, but what it could say is when the green light will be turned on for our notifications to be released. That's what I believe it should say. It could say. And of course, we won't know it until tomorrow, but I think I'm encouraged by the fact that that is coming.

The other thing that's interesting is or having trouble getting the word from bond holders and bond pay masters that they have money. We believe they have the funds in their accounts, and we believe some have been told how much that is, but we don't know if they have received the email to tell them when they can have access to those funds.

My feeling is, but I don't know this, but my but my feeling is that they should bond owners should get those notifications tomorrow and again, we won't have it for the big call tonight, but if they do get them tomorrow, will it say that they have access to funds on Saturday - or will give them access to funds sometime tomorrow. Either one is possible, either one is possible.

And I believe with that information which I wish I had tonight, I don't but if I knew that they would have access to funds either Friday or Saturday, tomorrow or Saturday, then I would feel really good about saying, Well, we're next. We're going to be notified post haste, and that part of the 48 hour rollout of everybody that's to receive funds, whether it's from bond holders monies, whether it's admirals groups or our Internet Group, all of us to receive funds within a modified shotgun start of 48 hours.

So I'm encouraged by that. I think that that the timing of this is really interesting. The other thing that's that's happening, I'm trying to think of a couple other things that I that I wanted to bring out to you guys tonight, and one of which is today, after the Prime Minister of the United Kingdom had meetings with President Trump, and had a press conference with President Trump, which was very good, by the way. I enjoyed both of those - right after that, President Trump signed off on BOTH NESARA and GESARA -

NESARA, our National Economic Strategic And Recovery Act, and GESARA the global economic strategic and Recovery Act. He signed off on both of those today, this afternoon, and we believe that those will probably be brought out because they weren't mentioned today. They probably will be brought out this coming Tuesday, which should be the fourth of March, or March that is something that's going to be actively in both houses of Congress the Senate as a representative.

Okay, that is a mandatory get together of both House and Senate, joint chambers, if you will, both chambers of Congress, rather a wish of commerce of Congress, and that brought out at that time, and who knows what else?

I think there's a possibility we get something about our new USN, our new our new USA Treasury notes, our new currency, our new money, totally money. And maybe something about our brand new digital currency brought out, then it is going to be, it should be a really good day –

Now could this go before Tuesday. I believe it can, at least that's what I'm hearing from all of our sources. I don't think we're waiting. In other words, I hope we are not waiting on Tuesday.

What else is happening today?

You know, we had Jeffery Epstein papers that were supposed to come out today, and they got a little smattering of some things that wasn't the big impact that our Attorney General Bondi was expecting, but she has taken charge.

She let our brand new Head of the FBI Kash Patel know about the fact that they did not get all the documents out of New York, and so they have to deliver those to Washington and Bondi’s office by 8am tomorrow morning, Eastern Standard Time, but somebody ought to be bringing those down by Jet or train tonight from Heath, from Washington, DC, and get that out and tell by surprise and body by surprise, but don't worry, they're on it. They are on it, and they will make sure FBI is held to account for these documents.

So be prepared for some news on those lines tomorrow, and let's see what else tonight. Unfortunately, there was, let's see what else I want to bring out right now,

I really hoped I would get a little bit more this afternoon and tonight, even during the call, that would indicate that we are right there and we are right there, but a little something that would give us more confirmation about tomorrow.

So I'm going to hold that it's very possible to get notified tomorrow, set appointments starting Saturday, and that would be awesome, because we get it by the end of the month, last day of the month, and then we start exchanges on the first of March. And I'm hoping that's exactly what happens to you guys.

I'm telling you, if that occurs, like I've heard, it would be a win. It'd be a definite win. And I think that we have a lot to be thankful for - things are definitely moving in the right direction.

President Trump is doing an outstanding job, along with Elon Musk and his team and Doge, I love the fact that they're saving billions of dollars a day by going in finding out where is the waste, where is the fraud?

Social Security benefits will not drop, neither will Medicare or Medicaid. If anything, they're going to find the waste in the system. They'll find people that are no longer alive getting checks in Social Security. And you know it, they seem to be really good when they're able to nail down all of those things and tighten up the list and tighten up everything in all organizations in our federal government, and they're doing an outstanding job. And of course, Elon outstanding job, by the way, he's doing it for free. Does he need the money? No, of course not. He doesn't. That is his heart is in the right place, doing doing the right thing for the American people.

Was there anything I want to bring up right now, I can’t think of it right now - if there were, I know that there are a couple of things I was thinking about. They're not coming to me right now, so I think what I'll do is thank Sue for doing an outstanding job

And I'd like to thank Bob for an outstanding job, as well for helping to co host the call and giving beautiful insight and stories that are very relevant for us, And thank you. GCK, everybody else that has contributed to big call.

I'm hoping guys that we get this this weekend and then send out a short celebration call, I think that's all I wanted to bring out tonight. Keep an eye on your emails. All right, all right, everybody, let's pray the call out

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25 REPLAY LINK Intel begins 1:02:22

Bruce’s Big Call Dinar Intel Tuesday Night 2-25-25 REPLAY LINK Intel Begins 1:27:27

Bruce’s Big Call Dinar Intel Thursday Night 2-20-25 REPLAY LINK Intel begins 1:18:12

Bruce’s Big Call Dinar Intel Tuesday Night 2-18-25 REPLAY LINK Intel Begins 1:00:00

Bruce’s Big Call Dinar Intel Thursday Night 2-13-25 REPLAY LINK Intel begins 1:19:20

Bruce’s Big Call Dinar Intel Tuesday Night 2-11-25 REPLAY LINK Intel Begins 1:07:37

Bruce’s Big Call Dinar Intel Thursday Night 2-6-25 REPLAY LINK Intel begins 1:19:4O

Bruce’s Big Call Dinar Intel Tuesday Night 2-4-25 REPLAY LINK Intel Begins 44:24

Seeds of Wisdom RV and Economic Updates Friday Afternoon 2-28-25

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

According to the commissioner’s Feb. 27 statement, memecoins could satisfy the Howey test’s condition of profiting from the managerial efforts of others due to the coordination between developer teams and promoters.

The commissioner added that most, if not all, cryptocurrencies could be defined as memecoins under the SEC’s recent guidance, which was released on the same day. In this guidance, the agency stated that memecoins represent online social trends with speculative value and high volatility — and are not securities. Commissioner Crenshaw, however, has a different viewpoint:

“Today’s statement paints meme coins as cultural projects whose purpose is entertainment and social engagement. The reality is that meme coins, like any financial product, are issued to make money.”

Memecoins have come into sharper focus following several high-profile scams, hacks and even presidential memecoin launches that threaten the long-term viability of the sector and invite scrutiny from state officials.

US regulators and lawmakers attempt to reign in memecoins

Following US President Donald Trump’s memecoin launch, several Democrat lawmakers, including Elizabeth Warren, called for an investigation into potential ethics violations of the presidential token.

On Feb. 27, California Member of Congress Sam Liccardo announced that House Democrats are prepping a bill that would ban presidential memecoins.

The proposed bill, titled “The Modern Emoluments and Malfeasance Enforcement (MEME) Act,” would prohibit US lawmakers from sponsoring, issuing or endorsing any digital asset.

Moreover, spouses and dependents of US representatives, the president, vice president and senior executive branch officials are also prohibited from issuing or sponsoring memecoins under the bill.

Attorney Elizabeth Davis, former chief attorney at the Commodity Futures Trading Commission (CFTC), recently argued that memecoins should be regulated by the CFTC.

Davis told Cointelegraph that if the commodities regulator is granted regulatory oversight over crypto, then there is a strong likelihood that memecoins will be included in their purview.

The attorney also expressed confidence that comprehensive memecoin regulations would be established in the United States over the next year — putting an end to the regulatory ambiguity surrounding social tokens.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

FEBRUARY IN CHARTS: SEC DROPS 6 CASES, MEMECOIN CRAZE COOLS AND MORE

@ Newshounds News™

Read the story: CoinTelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps