Iraq Economic News and Points to Ponder Late Friday Evening 2-28-25

Kurdistan Banks Will Take Their Share Of Sanctions .. Economic Shows The Reasons

Economy Yesterday, 12:40 |Baghdad today – Baghdad Economic expert Hevidar Shaban, today, Thursday (27 February 2025), is the reasons for imposing US sanctions on a number of banks in the Kurdistan region.

Shaaban said in an interview with "Baghdad Today" that "in the context of coordination between the US Treasury and the Central Bank of Iraq, sanctions will be imposed on banks in the region, including joint banks in my accounting project for employees salaries in Kurdistan."

Kurdistan Banks Will Take Their Share Of Sanctions .. Economic Shows The Reasons

Economy Yesterday, 12:40 |Baghdad today – Baghdad Economic expert Hevidar Shaban, today, Thursday (27 February 2025), is the reasons for imposing US sanctions on a number of banks in the Kurdistan region.

Shaaban said in an interview with "Baghdad Today" that "in the context of coordination between the US Treasury and the Central Bank of Iraq, sanctions will be imposed on banks in the region, including joint banks in my accounting project for employees salaries in Kurdistan."

He added that "this process is to control the

smuggling of currency in some banks in the region, control

money laundering,

illegal dealings, and the

structural organization of banks."

Earlier this month, two informed sources reported that the

Central Bank of Iraq would prevent local banks from dealing with dollars.

"The Central Bank of Iraq will prevent 5 local banks from dealing with dollars in the US Treasury request." The two sources added,

"3 companies for payment services will be banned from dealing in dollars according to the US Treasury request," the two sources added. They pointed out,

"America has submitted its request due to

severe cash violations and the

smuggling of the dollar outside the country."

https://baghdadtoday.news/268804-مصارف-كردستان-ستأخذ-نصيبها-من-العقوبات.-اقتصادي-يبين-الأسباب.html

The Digital Currency To Be Launched In Iraq ... Between Economic Opportunities And Potential Risks

Economy Yesterday, 16:12 | Baghdad today – Baghdad The specialist in the international economic affairs, Nawar Al -Saadi, revealed today, Thursday (27 February 2025), the importance of the Central Bank of Iraq to launch its own digital currency.

Al -Saadi told "Baghdad Today" that "economically, this step carries great benefits,

but at the same time it involves challenges and risks that must be dealt with with caution." He indicated,

"The importance of this step lies in several aspects, most notably that

it provides a more efficient and transparent electronic payment method, which

reduces dependence on paper criticism and

limits the informal economy."

He continued, "The digital currency of the central bank can contribute to

reducing the costs of printing and

managing the paper currency, and

improving monitoring of cash flows, which contributes to

fighting corruption and money laundering."

He added, "Nevertheless, this step is not without risks, especially in light of the challenges facing the Iraqi financial system," noting that "the most prominent concerns, the possibility of using the digital currency in smuggling operations, especially if there are no strict mechanisms to control digital transactions, and Iraq is already suffering from challenges in controlling transfer of money through informal channels, and any weakness in the management of the digital currency may lead to exploitation before Legal.

Al -Saadi also warned that "there are risks related to cash stability, as

the rapid shift to the digital currency may lead to pressure on the traditional banking system,

especially if the banks are not technically and practically prepared for this change, moreover,

any security or technical defect in the digital infrastructure may make the financial system more vulnerable to electronic or piracy attacks."

The specialist in the international economic affairs pointed out that

"in order to ensure the success of this step, it is necessary for the central bank to

follow a deliberate policy to implement it gradually,

with a clear legal framework to regulate the use of digital currency," stressing "the need to

enhance the digital banking infrastructure and

ensure the readiness of the financial system to accommodate this transformation without affecting economic stability, and

if this policy is applied with caution and transparency, the

digital currency can form The Central Bank has an effective tool to

enhance the Iraqi economy and

push it towards more modernity and financial openness. "

The Governor of the Central Bank, Ali Al -Alaq, revealed earlier on Wednesday,

the approach to the establishment of a bank digital currency, to replace paper currencies.

Al-Alaq said, in a speech during the Ninth Finance and Banking Conference and Exhibition, and followed by "Baghdad Today", that "the financial and banking system will witness fundamental transformations,

including the decline of paper currencies to be replaced by digital payments for central banks." He added that "the central bank is moving to create a digital currency of its own,

to gradually replace the paper process as it is taking place in some central banks in the world," noting that "we are seriously thinking about establishing a data center in Iraq, and the bank starts moving in this matter within the steps of digital transformation."

https://baghdadtoday.news/268817-العملة-الرقمية-المزمع-اطلاقها-في-العراق.-بين-الفرص-الاقتصادية-والمخاطر-المحتملة.html

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Saturday Morning 3-01-25

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Good Morning Dinar Recaps,

CARDANO-XRP BRIDGE GOES LIVE – A GAME CHANGER FOR BOTH ECOSYSTEMS

▪Cardano and XRP Ledger now have a direct connection through the Wanchain bridge.

▪The linkup is a mutually beneficial one for native assets within both ecosystems.

Cardano (ADA) and the XRP Ledger (XRPL), two leading blockchains, have formed a coalition to strive for seamless interoperability. Both ecosystems have launched a new bridge, connecting ADA and XRP, the native coin operating on the XRPL.

Cardano and XRPL Expand Interoperability With New Bridge

TapTools, a digital wallet tracking Cardano trading, brought the attention of the crypto community to the Cardano-XRP bridge. This bridge, which is now live, is facilitated by Wanchain, a decentralized blockchain interoperability solution.

As reported by TapTools, the Cardano-XRP bridge is designed to expand interoperability and liquidity between the two networks. This technical advancement marks a massive milestone for both blockchains, representing the first time they connect via a bridge.

Besides promoting interoperability and liquidity, the bridge will support DeFi adoption and enhance utility for both ADA and XRP.

Historically, both communities have different technological and market positioning. However, they can now leverage the new bridge to interact in unprecedented ways.

Users can utilize the bridge to transfer ADA onto the XRP Ledger and vice versa.

It will also increase the Total Value Locked (TVL) for users exploring Decentralized Finance (DeFi) opportunities on Cardano. This increased interoperability is crucial as the world moves swiftly toward widespread blockchain adoption.

Beyond these benefits, the bridge potentially paves the way for integrating Ripple’s stablecoin, RLUSD, as a bridged asset. It is important to note that the Cardano-XRP bridge operates without centralized control. This means users retain control over their assets without interference from a third party.

Meanwhile, Wanchain will help to preserve the underlying value of wrapped versions of XRP and ADA as they seamlessly interact with applications on the opposite chain.

Wanchain uses a distributed key generation and secure multi-party computation (MPC) mechanism to ensure assets move safely across different blockchains.

Impact on ADA, XRP, and Broader Market

The Wanchain XRP/Cardano bridge will benefit Cardano and the XRP ecosystems in numerous ways. For Cardano, the bridge will help strengthen users’ appeal for the blockchain as more capital flows into ADA-based DeFi platforms. Our latest report covered that the XRPL Decentralized Exchange has surpassed $20 billion in liquidity, highlighting XRP’s expanding role in DeFi.

Also, thanks to this bridge, XRP users are encouraged to explore Cardano’s ecosystem more. This attention toward the network can lead to greater adoption of Cardano’s native smart contracts and Decentralized Applications (dApps).

Regarding XRP, the new bridge can unlock staking, borrowing, lending, and yield farming opportunities previously unavailable to XRP holders. The bridge can also elevate XRP’s role in multi-chain ecosystems, extending its potential beyond traditional payments and remittances.

For the broader market, the new bridge demonstrates that achieving a more interconnected blockchain environment is possible. It also demonstrates the growing importance of interoperability in the blockchain industry and ensures that cryptocurrencies are not isolated.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

BRICS CONFIRMS DEVELOPMENT OF NEW PAYMENT SYSTEMS IN 2025

Brazil, which chairs the upcoming BRICS summit in 2025 confirmed that they plan on the formation of new payment systems. Under the leadership of Brazilian President Luiz Lula da Silva, the alliance will discuss alternative payment options to the US dollar.

The BRICS Sherpas meeting will take the ideas forward and the upcoming 17th summit could see massive changes in the way the bloc operates and settles cross-border transactions.

The move could lead to a paradigm shift in global trade and tilt the financial powers from the West to the East. Developing countries are looking to cut ties with the US dollar and strengthen their local currencies in the forex markets.

The US dollar is in the crosshairs of a major shift that could pave the way for native currencies to take the driver’s seat of the financial markets.

BRICS: New Payment Systems in 2025 Could Be a Reality

Brazil’s President Luiz Lula da Silva made a strong statement saying that BRICS will continue advancing the de-dollarization agenda. The President also added that under their leadership, BRICS will work towards developing new payment systems as an alternative to the US dollar.

“Brazil is going during the period of its presidency to fully develop transparent and safe payment systems,” he said.

The bloc will work towards launching safe payment systems to uplift their GDP and strengthen their native economies. The move will give a boost in the arm to their local currencies making businesses thrive.

The next BRICS summit is scheduled to be held in Brazil’s Rio De Janeiro on July 6th and 7th. All the nine member countries will meet at the summit and discuss policies and sign new trade deals. Details on the new payment systems could be revealed at the 17th summit in July this year.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

“Tidbits From TNT” Saturday Morning 3-1-2025

TNT:

Tishwash: Iraq among the best in the world in controlling the sale of the dollar

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Saturday, that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in an interview with the official agency, followed by Iraq Observer, that “Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country,” explaining that “this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts.”

TNT:

Tishwash: Iraq among the best in the world in controlling the sale of the dollar

The Governor of the Central Bank, Ali Al-Alaq, confirmed today, Saturday, that Iraq has become one of the best countries in the world in controlling the sale of the dollar.

Al-Alaq said in an interview with the official agency, followed by Iraq Observer, that “Iraq has today become one of the best countries in the world in controlling the sale of the dollar, as this process is carried out with transparency and accuracy, and through it the citizen verifies his documents and his departure from the country,” explaining that “this mechanism is the most disciplined, transparent and controlled in the world, as indicated by international experts.”

Al-Alaq added that “false news and media distortion may harm the interests of Iraq and the banking sector,” stressing the importance of being proud of the major developments witnessed by Iraq. He explained that “the government and the Central Bank are working hard to establish sound practices that are compatible with international standards,” calling for “the need to highlight these achievements in the media.”

He pointed out that “highlighting these transformations and developments helps enhance international confidence in the Iraqi banking sector, which is vital to continue developing the financial system in Iraq.” link

Tishwash: Financial Advisor: Central Bank Digital Currency Will Boost Transparency, Improve National Payments

The financial advisor to the Prime Minister, Mazhar Mohammed Saleh, explained today, Saturday, that issuing a digital currency for the Central Bank will be an important step towards enhancing transparency and achieving a qualitative leap in the national payments system.

Saleh said in a statement to the official agency, followed by NRT Arabic, that "the Central Bank plans to issue a digital currency as a gradual alternative to paper currency," noting that this step will contribute to reducing cash leakage and lowering the costs of printing paper currency, in addition to reducing the circulation of money outside the banking system.

He added that the digital currency will allow tracking financial flows, improve control over capital and foreign transfers, support anti-money laundering efforts, and contribute to enhancing financial inclusion, especially for groups less integrated into the banking system.

Saleh explained that Iraq's transition to digital currency requires a strong technical infrastructure, including advanced internet networks and advanced cybersecurity systems to protect data and transactions.

Digital currencies will also support efforts to enhance economic and social integration through government use in collection operations and official transactions. link

************

Tishwash: Federal Oil invites "APICOR" and Kurdistan Wealth to meet in Baghdad

The Federal Ministry of Oil has set next Tuesday as the date for a meeting with the Ministry of Natural Resources in the Kurdistan Region to discuss issues related to the concluded contracts and reach understandings that contribute to the development of oil fields, while an invitation was extended to foreign companies contracting with the Kurdistan Regional Government to develop the region’s fields.

The ministry stated in a statement, received by the Iraqi News Agency (INA) today, Saturday, that it "extended an invitation to international foreign companies under (APICOR) and contracted with the Kurdistan Regional Government to develop the region's fields."

The statement continued, "The ministry extended an invitation to the Ministry of Natural Resources in the region to attend in Baghdad next Tuesday for the purpose of discussing and debating issues related to the concluded contracts to reach understandings that contribute to developing the oil fields with the best international practices and in a manner that serves the national interest." link

*************

Tishwash: Reasons for stopping cash withdrawals outside Iraq by TBI

Today , Friday (February 28, 2025), banking and financial affairs specialist Ahmed Abdul Rabbo revealed the reasons for stopping cash withdrawals outside Iraq by the Trade Bank of Iraq.

“There is a strong possibility that the decision is related to combating currency smuggling, as the Central Bank of Iraq and financial institutions have previously taken similar measures to limit the exit of the dollar through unofficial means,” Abdul Rabbo told Baghdad Today.

He explained that “some parties were using electronic payment cards to withdraw cash from abroad with money purchased at the official exchange rate inside Iraq, then reselling it at higher prices in the parallel market, which constitutes a type of currency smuggling.”

He explained that "there is a strong possibility that the decision came in response to American pressures related to regulating dollar flows and preventing its smuggling to countries subject to American sanctions, such as Iran. Washington has imposed strict restrictions on Iraqi banks in recent periods, and asked the Central Bank of Iraq to take strict measures to control financial transfers, especially after detecting currency smuggling operations through the use of electronic payment cards."

He added that "the decision appears to have come as part of broader measures to control the banking sector and prevent the misuse of the dollar, and is an extension of previous measures imposed by the Central Bank, either in response to American pressure or as part of efforts to combat financial corruption and smuggling."

Yesterday, Wednesday, the Trade Bank of Iraq announced the suspension of cash withdrawals via ATMs outside Iraq.

The bank's media advisor, Aqil Al-Shuwaili, said in a brief statement, "Due to the risks resulting from the misuse of electronic cards (Visa and MasterCard), and to avoid these risks, cash withdrawals via ATM machines for these cards outside Iraq only have been stopped."

He added, "Cards can be used to pay through POS machines and online." link

Mot: . Gotcha!

Mot: . Isn't This da Way it Always Works Out!! --- siiggghhhh

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

2-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew-Iraq Dinar News-Success-Electronic Money Transfers-Accelerated Pace-Future is Now-Forex Warning

2-28-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Lawrence Lepard: The Big Print - Make the Money System Great Again

Lawrence Lepard: The Big Print - Make the Money System Great Again

Palisades Gold Radio: 2-28-2025

Tom welcomes back Lawrence Lepard from Equity Management Associates to discuss his new book, "The Big Print: What Happened to America and How Sound Money Will Fix It."

Lepard emphasized that the U.S. monetary system began deteriorating with Nixon's abandonment of the gold standard in 1971, leading to persistent inflation and debt accumulation.

He argued that sound money — gold, silver, and Bitcoin — is essential to fix these issues.

Lawrence Lepard: The Big Print - Make the Money System Great Again

Palisades Gold Radio: 2-28-2025

Tom welcomes back Lawrence Lepard from Equity Management Associates to discuss his new book, "The Big Print: What Happened to America and How Sound Money Will Fix It."

Lepard emphasized that the U.S. monetary system began deteriorating with Nixon's abandonment of the gold standard in 1971, leading to persistent inflation and debt accumulation.

He argued that sound money — gold, silver, and Bitcoin — is essential to fix these issues.

Gold provides stability, while Bitcoin offers a digital solution to scarcity and divisibility, though it is still volatile.

The interview explored how inflation affects everyday life, with Lepard noting that the government's reported inflation rates often underestimate real costs.

He criticized the Federal Reserve for prioritizing debt servicing over economic fairness, leading to a cycle of printing money that disproportionately harms wage earners. Lepard also discussed the political challenges in transitioning to sound money, suggesting that widespread public awareness and grassroots support are needed to push for systemic change.

He warned against complacency, noting that the U.S. is on a trajectory toward a debt crisis unless decisive action is taken.

The conversation concluded with Lepard encouraging listeners to engage with his book to better understand these issues and advocating for a future where sound money restores economic health and fairness.

Time Stamp Reference

0:00 - Introduction

0:40 - The Big Print

7:20 - Where It Went Wrong

10:00 - CPI Chart 1800-2005

12:00 - Inflation a Key Issue

15:00 - The Wealth Gap

18:30 - Next Monetary Crisis

21:20 - A Moral Imperative

23:00 - Debt System Origin

26:00 - Top Vs. Bottom Wealth

27:00 - Why All Fiats Fail

31:00 - Lies & Inflation Stats

34:50 - Deflation Boogeyman

38:00 - Solutions & Outcomes

45:00 - Peg to Real Assets

48:45 - Bitcoin Advantages

52:20 - Resets & Reserve Currency

56:30 - Book & Wrap Up

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25

Transcribed By WiserNow Emailed To Recaps

Welcome everybody the big call tonight. It is Thursday, February 27th and you're listening to the big call. Thanks for joining us, wherever you're located, around the globe. Thank you sat team for hooking everybody up around the globe to listen in. The rest of you on free conference call glad to have you, and many of you listen to the replay, which is another great way to hear us. So thanks for listening everybody.

Let's, let's get into where we where we want to be on the intel tonight. So what do I want to bring out first. The first thing that I'm thinking of is, yeah, do we do we have any new information about Social Security increases, or about R and R? Not right now, and I told you guys on Tuesday night I wasn't giving it much hope for coming by the end of this month with three days to go, that was on Tuesday night.

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25

Transcribed By WiserNow Emailed To Recaps

Welcome everybody the big call tonight. It is Thursday, February 27th and you're listening to the big call. Thanks for joining us, wherever you're located, around the globe. Thank you sat team for hooking everybody up around the globe to listen in. The rest of you on free conference call glad to have you, and many of you listen to the replay, which is another great way to hear us. So thanks for listening everybody.

Let's, let's get into where we where we want to be on the intel tonight. So what do I want to bring out first. The first thing that I'm thinking of is, yeah, do we do we have any new information about Social Security increases, or about R and R? Not right now, and I told you guys on Tuesday night I wasn't giving it much hope for coming by the end of this month with three days to go, that was on Tuesday night.

Now we're on Thursday night with one day left tomorrow, and I don't think we're going to see this month. That's a pretty safe bet, BUT -- I am encouraged by the fact that we did receive a little bit of information, a couple of small puzzle pieces that we’re using to fill in this puzzle to try to complete the picture that we're looking for, and such is the fact that right now, I know that we had two very strong sources that were telling us that, don't worry, this is going to be the week that we receive our notifications.

And even though we only have two days left, Friday and Saturday this week, I think it's quite possible that we still will get notified and set an appointment this week.

Now, how do I say that? I know, for example, that one of our redemption center staff members is working tomorrow morning at Wells, Fargo Bank, and then goes after lunch into the redemption center tomorrow, Friday.

Why would that be? Why would a person work in the bank in the morning and go to the redemption center in the afternoon, unless they were expecting for the toll free numbers to come out in our emails, our notifications, and then we call, and this person is there on the redemption center end to help set our appointments.

That made perfect sense to me. I thought, you know, tomorrow is the 28th of February, so last day of the month? Could they notify us on Friday still this week. And could they notify us where we get our numbers and we set our appointment tomorrow? Could be tomorrow afternoon, but we set it for Saturday or Sunday or Monday or whatever next week. I think it's very possible

I’m not calling it. I'm not saying that it's definite, but it looks good for us to get notified and set our appointments for exchanges that would start on Saturday, the first of March, in a whole brand new month, 31 days of March. So that is, that is quite possible.

I really think if this is going to happen this week. And I know it's a big if, but if, what we're told was it would be this week, don't worry, then I see that as the way it's going to happen.

Now, as far as redemption centers go, we got some information about one email that was received in the morning yesterday, one was received in the afternoon, still waiting on one more, but did not come this morning, as was expected, but should be there tomorrow.

And we don't know what this email that hasn't been received will say, but what it could say is when the green light will be turned on for our notifications to be released. That's what I believe it should say. It could say. And of course, we won't know it until tomorrow, but I think I'm encouraged by the fact that that is coming.

The other thing that's interesting is or having trouble getting the word from bond holders and bond pay masters that they have money. We believe they have the funds in their accounts, and we believe some have been told how much that is, but we don't know if they have received the email to tell them when they can have access to those funds.

My feeling is, but I don't know this, but my but my feeling is that they should bond owners should get those notifications tomorrow and again, we won't have it for the big call tonight, but if they do get them tomorrow, will it say that they have access to funds on Saturday - or will give them access to funds sometime tomorrow. Either one is possible, either one is possible.

And I believe with that information which I wish I had tonight, I don't but if I knew that they would have access to funds either Friday or Saturday, tomorrow or Saturday, then I would feel really good about saying, Well, we're next. We're going to be notified post haste, and that part of the 48 hour rollout of everybody that's to receive funds, whether it's from bond holders monies, whether it's admirals groups or our Internet Group, all of us to receive funds within a modified shotgun start of 48 hours.

So I'm encouraged by that. I think that that the timing of this is really interesting. The other thing that's that's happening, I'm trying to think of a couple other things that I that I wanted to bring out to you guys tonight, and one of which is today, after the Prime Minister of the United Kingdom had meetings with President Trump, and had a press conference with President Trump, which was very good, by the way. I enjoyed both of those - right after that, President Trump signed off on BOTH NESARA and GESARA -

NESARA, our National Economic Strategic And Recovery Act, and GESARA the global economic strategic and Recovery Act. He signed off on both of those today, this afternoon, and we believe that those will probably be brought out because they weren't mentioned today. They probably will be brought out this coming Tuesday, which should be the fourth of March, or March that is something that's going to be actively in both houses of Congress the Senate as a representative.

Okay, that is a mandatory get together of both House and Senate, joint chambers, if you will, both chambers of Congress, rather a wish of commerce of Congress, and that brought out at that time, and who knows what else?

I think there's a possibility we get something about our new USN, our new our new USA Treasury notes, our new currency, our new money, totally money. And maybe something about our brand new digital currency brought out, then it is going to be, it should be a really good day –

Now could this go before Tuesday. I believe it can, at least that's what I'm hearing from all of our sources. I don't think we're waiting. In other words, I hope we are not waiting on Tuesday.

What else is happening today?

You know, we had Jeffery Epstein papers that were supposed to come out today, and they got a little smattering of some things that wasn't the big impact that our Attorney General Bondi was expecting, but she has taken charge.

She let our brand new Head of the FBI Kash Patel know about the fact that they did not get all the documents out of New York, and so they have to deliver those to Washington and Bondi’s office by 8am tomorrow morning, Eastern Standard Time, but somebody ought to be bringing those down by Jet or train tonight from Heath, from Washington, DC, and get that out and tell by surprise and body by surprise, but don't worry, they're on it. They are on it, and they will make sure FBI is held to account for these documents.

So be prepared for some news on those lines tomorrow, and let's see what else tonight. Unfortunately, there was, let's see what else I want to bring out right now,

I really hoped I would get a little bit more this afternoon and tonight, even during the call, that would indicate that we are right there and we are right there, but a little something that would give us more confirmation about tomorrow.

So I'm going to hold that it's very possible to get notified tomorrow, set appointments starting Saturday, and that would be awesome, because we get it by the end of the month, last day of the month, and then we start exchanges on the first of March. And I'm hoping that's exactly what happens to you guys.

I'm telling you, if that occurs, like I've heard, it would be a win. It'd be a definite win. And I think that we have a lot to be thankful for - things are definitely moving in the right direction.

President Trump is doing an outstanding job, along with Elon Musk and his team and Doge, I love the fact that they're saving billions of dollars a day by going in finding out where is the waste, where is the fraud?

Social Security benefits will not drop, neither will Medicare or Medicaid. If anything, they're going to find the waste in the system. They'll find people that are no longer alive getting checks in Social Security. And you know it, they seem to be really good when they're able to nail down all of those things and tighten up the list and tighten up everything in all organizations in our federal government, and they're doing an outstanding job. And of course, Elon outstanding job, by the way, he's doing it for free. Does he need the money? No, of course not. He doesn't. That is his heart is in the right place, doing doing the right thing for the American people.

Was there anything I want to bring up right now, I can’t think of it right now - if there were, I know that there are a couple of things I was thinking about. They're not coming to me right now, so I think what I'll do is thank Sue for doing an outstanding job

And I'd like to thank Bob for an outstanding job, as well for helping to co host the call and giving beautiful insight and stories that are very relevant for us, And thank you. GCK, everybody else that has contributed to big call.

I'm hoping guys that we get this this weekend and then send out a short celebration call, I think that's all I wanted to bring out tonight. Keep an eye on your emails. All right, all right, everybody, let's pray the call out

Bruce’s Big Call Dinar Intel Thursday Night 2-27-25 REPLAY LINK Intel begins 1:02:22

Bruce’s Big Call Dinar Intel Tuesday Night 2-25-25 REPLAY LINK Intel Begins 1:27:27

Bruce’s Big Call Dinar Intel Thursday Night 2-20-25 REPLAY LINK Intel begins 1:18:12

Bruce’s Big Call Dinar Intel Tuesday Night 2-18-25 REPLAY LINK Intel Begins 1:00:00

Bruce’s Big Call Dinar Intel Thursday Night 2-13-25 REPLAY LINK Intel begins 1:19:20

Bruce’s Big Call Dinar Intel Tuesday Night 2-11-25 REPLAY LINK Intel Begins 1:07:37

Bruce’s Big Call Dinar Intel Thursday Night 2-6-25 REPLAY LINK Intel begins 1:19:4O

Bruce’s Big Call Dinar Intel Tuesday Night 2-4-25 REPLAY LINK Intel Begins 44:24

Seeds of Wisdom RV and Economic Updates Friday Afternoon 2-28-25

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

Good Afternoon Dinar Recaps,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

According to the commissioner’s Feb. 27 statement, memecoins could satisfy the Howey test’s condition of profiting from the managerial efforts of others due to the coordination between developer teams and promoters.

The commissioner added that most, if not all, cryptocurrencies could be defined as memecoins under the SEC’s recent guidance, which was released on the same day. In this guidance, the agency stated that memecoins represent online social trends with speculative value and high volatility — and are not securities. Commissioner Crenshaw, however, has a different viewpoint:

“Today’s statement paints meme coins as cultural projects whose purpose is entertainment and social engagement. The reality is that meme coins, like any financial product, are issued to make money.”

Memecoins have come into sharper focus following several high-profile scams, hacks and even presidential memecoin launches that threaten the long-term viability of the sector and invite scrutiny from state officials.

US regulators and lawmakers attempt to reign in memecoins

Following US President Donald Trump’s memecoin launch, several Democrat lawmakers, including Elizabeth Warren, called for an investigation into potential ethics violations of the presidential token.

On Feb. 27, California Member of Congress Sam Liccardo announced that House Democrats are prepping a bill that would ban presidential memecoins.

The proposed bill, titled “The Modern Emoluments and Malfeasance Enforcement (MEME) Act,” would prohibit US lawmakers from sponsoring, issuing or endorsing any digital asset.

Moreover, spouses and dependents of US representatives, the president, vice president and senior executive branch officials are also prohibited from issuing or sponsoring memecoins under the bill.

Attorney Elizabeth Davis, former chief attorney at the Commodity Futures Trading Commission (CFTC), recently argued that memecoins should be regulated by the CFTC.

Davis told Cointelegraph that if the commodities regulator is granted regulatory oversight over crypto, then there is a strong likelihood that memecoins will be included in their purview.

The attorney also expressed confidence that comprehensive memecoin regulations would be established in the United States over the next year — putting an end to the regulatory ambiguity surrounding social tokens.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

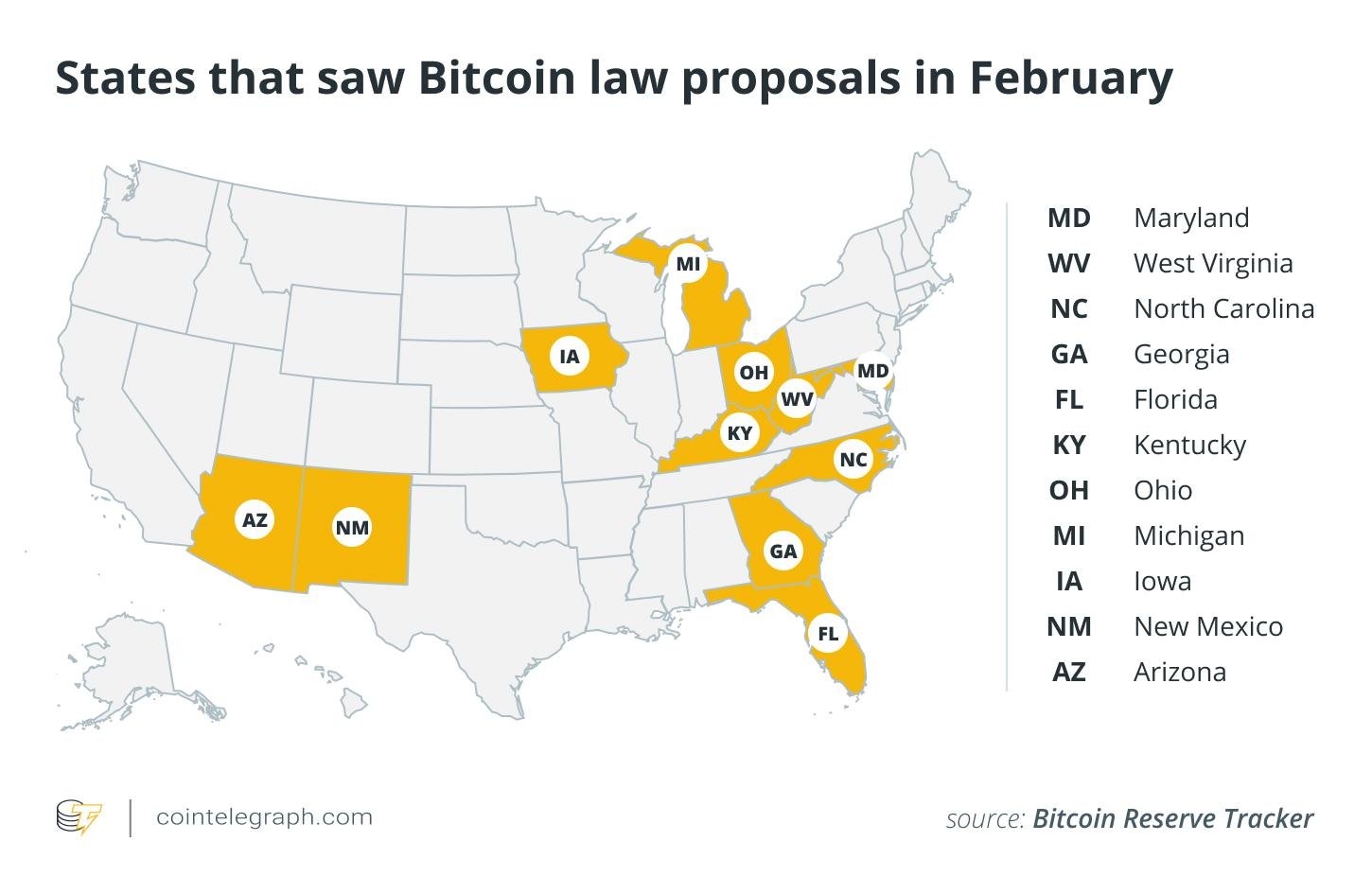

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation - two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin's recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

FEBRUARY IN CHARTS: SEC DROPS 6 CASES, MEMECOIN CRAZE COOLS AND MORE

@ Newshounds News™

Read the story: CoinTelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

More News, Rumors and Opinions Friday PM 2-28-2025

KTFA:

Clare: At an initial rate of 185 thousand barrels.. Oil Minister: Resumption of Kurdistan oil exports will take place within hours - Urgent

- Baghdad

Oil Minister Abdul Ghani Al-Sawad said that Iraq will announce in the coming hours the start of the region's oil export operations.

The Minister of Oil said in a statement received by (Al-Rabia) that "Iraq will announce in the coming hours the commencement of the region's oil export operations through the State Oil Marketing Company (SOMO) via the Turkish port of Ceyhan at an initial rate of 185 thousand barrels, gradually increasing to reach the capacity specified in the general federal budget."

KTFA:

Clare: At an initial rate of 185 thousand barrels.. Oil Minister: Resumption of Kurdistan oil exports will take place within hours - Urgent

- Baghdad

Oil Minister Abdul Ghani Al-Sawad said that Iraq will announce in the coming hours the start of the region's oil export operations.

The Minister of Oil said in a statement received by (Al-Rabia) that "Iraq will announce in the coming hours the commencement of the region's oil export operations through the State Oil Marketing Company (SOMO) via the Turkish port of Ceyhan at an initial rate of 185 thousand barrels, gradually increasing to reach the capacity specified in the general federal budget."LINK

Clare: Analysis detailing the reasons for the fluctuations in the exchange rate of the Iraqi dinar against the dollar over 21 years

2/28/2025

The "Iraq Al-Mustaqbal" Foundation for Economic Studies and Consultations attributed, on Friday, the reasons for the fluctuations in the exchange rate of the dinar against the US dollar in the parallel market over more than two decades in the country to internal and external factors.

This came according to an analysis issued by the institution, in which it explained these fluctuations from 2005 until 2024.

The institution stated in its analysis that "the exchange rate of the Iraqi dinar against the US dollar in the parallel market witnessed noticeable fluctuations over the course of 21 years, as it was affected by a group of factors ranging from political, legislative and economic."

The analysis added that "supply and demand were the most influential, as the patterns of exchange rate changes differed according to the months of the year as a result of internal and external factors, such as the timing of the launch of the general budget and official holidays in major countries exporting goods to Iraq, such as China and Iran."

He pointed out that "by analyzing the exchange rate data in the parallel market from 2005 to 2024, there appears to be a recurring pattern that reflects the dinar's value being affected by specific months more than others."

According to the institution, “December was the month with the most frequent increase in the value of the dinar, as it witnessed a decline in 13 years out of 21 years, followed by: August and June with increases in the value of the dinar against the dollar in 11 years, then April 10 times, while October and November witnessed an increase 9 times, and March 8 times.”

May was the month with the least frequent decline in the value of the dinar, as its value rose only 4 times during the period studied, which gives a semi-impression that the prices of the dinar against the dollar rise in the months of February, March and April, then decline again against the dollar in May as a result of the strong return of demand in May.

The institution warned in its analysis that "despite this clear seasonal impact on the exchange rate, there are other factors that cannot be ignored, such as the levels of dollar sales by the Central Bank of Iraq, which directly affect the size of the money supply in the market, as well as political and financial factors such as the timing of the release of general budget funds, in addition to geopolitical situations that may cause sudden disturbances in the demand for foreign currency."

The analysis concluded that “the seasonal effect remains one of the main elements in determining the exchange rate trends in Iraq, as a recurring pattern appears at the end of the year and the beginning of the fiscal year, in addition to being affected by official holiday periods in countries exporting goods to Iraq. However, other factors, such as monetary policies and political and economic developments, remain a direct influence on the parallel market, which makes it necessary to monitor all these variables to understand exchange rate changes more accurately.” LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 I get chills every time I hear Saleh say they banking structure in Iraq now has security and stability because those were the same words Dr. Shabibi, the author of the Iraqi monetary reform wanted, demanded, before a new exchange rate was released. These are exciting times.

Militia Man For all you folks that have been in the dinar for a long time, if you remember back 15+ years ago, who was there? CitiBank was. Article quote: "In recognition of its outstanding performance gave the excellence award to the National Bank of Iraq...in managing incoming and outgoing financial transfers stressing that this is an achievement that reflects its commitment to the highest standards of quality and transparency in banking services." ...They're ready to go!

Can Trump Expose Fed’s Gold Cover-Up? Feat. Daniel Lacalle - LFTV Ep 212

Kinesis Money: 2-28-2025

In this week’s Live from the Vault, Andrew Maguire sits down with renowned economist Daniel Lacalle to dissect the shifting global financial landscape, from the erosion of trust in political institutions to the rise of gold as a preferred reserve asset.

As resistance grows against mainstream narratives, political and economic turns in Europe, the US, and beyond are driving demand for gold, whilst central banks are reducing reliance on sovereign debt, signalling significant market changes ahead.

00:00 Start

02:22 JD Vance on EU and UK freedom of expression issues

05:10 Could DOGE cuts impact Davos agenda funding?

08:15 UK Labour’s restrictive civil liberty policies

13:45 US wasteful government spending

17:15 Healthy criticism of the EU amid its rapid decline

25:00 Daniel on economic stagnation and persistent inflation

27:50 Aftermath of BIS making gold a first-tier asset

33:00 Why government bonds are no longer a reserve asset

35:20 Trump explores monetising US Treasury gold

37:10 Can Trump audit the Federal Reserve?

42:10 Musk’s DOGE shows how fast frauds can be exposed

46:05 China’s National Regulatory Administration opens gold buying to insurers

52:35 Gold as the ultimate wealth protection

55:40 Daniel on silver’s role in an investment portfolio

Homes aren’t Getting More Expensive and Gold Just Proved it

Homes aren’t Getting More Expensive and Gold Just Proved it

Taylor Kenny: 2-27-2025

We’re all feeling the squeeze. Whether it’s at the grocery store, the gas pump, or even just contemplating the dream of homeownership, the rising cost of everything is a palpable reality.

While inflation is the word on everyone’s lips, understanding the why behind this economic phenomenon is crucial to protecting your financial future. And a key piece of the puzzle lies in the history of the US dollar and its relationship with gold.

For decades, wages and housing prices largely moved in tandem, reflecting a relatively stable economic environment.

However, a significant shift occurred in 1971 when the U.S. government completely severed the dollar’s link to gold. This pivotal decision unleashed forces that continue to impact our financial lives today.

Homes aren’t Getting More Expensive and Gold Just Proved it

Taylor Kenny: 2-27-2025

We’re all feeling the squeeze. Whether it’s at the grocery store, the gas pump, or even just contemplating the dream of homeownership, the rising cost of everything is a palpable reality.

While inflation is the word on everyone’s lips, understanding the why behind this economic phenomenon is crucial to protecting your financial future. And a key piece of the puzzle lies in the history of the US dollar and its relationship with gold.

For decades, wages and housing prices largely moved in tandem, reflecting a relatively stable economic environment.

However, a significant shift occurred in 1971 when the U.S. government completely severed the dollar’s link to gold. This pivotal decision unleashed forces that continue to impact our financial lives today.

Prior to 1971, the dollar’s value was directly tied to gold, meaning a certain amount of dollars could be exchanged for a fixed quantity of gold. This provided a natural constraint on the money supply. With the gold standard abandoned, the Federal Reserve gained the ability to print money virtually without limit.

Without the gold standard to tether it, the dollar’s value became increasingly susceptible to inflation. Printing more money effectively dilutes the existing currency, driving up prices for goods and services.

The detachment of the dollar from gold was a watershed moment in modern economic history. While the full ramifications are still unfolding, understanding the link between monetary policy, inflation, and your purchasing power is paramount.

By taking proactive steps to protect your wealth through diversification, strategic investments, and a proactive approach to financial planning, you can navigate the challenges of dollar devaluation and build a more secure financial future. Remember, knowledge is power, and informed decisions are your best defense against the silent thief of inflation.

Watch the video below from ITM Trading with Taylor Kenney for further insights and information.

Coffee with MarkZ and Mr. Cottrell. 02/28/2025

Coffee with MarkZ and Mr. Cottrell. 02/28/2025

MarkZ Update- Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark Mods & Family

Member: Here we are at the end of another week, and another month too!

Member: Hoping Mark has RV news today

Coffee with MarkZ and Mr. Cottrell. 02/28/2025

MarkZ Update- Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning Mark Mods & Family

Member: Here we are at the end of another week, and another month too!

Member: Hoping Mark has RV news today

Member: Mark, is this weekend the one we have all been praying for so long.?

MZ: I had one historic bond contact check in who said they still expect their payout this month. Wait a minute…..today is the last day of February. Hope that turns out to be accurate. But tons of folks are expecting dollars over this weekend.

MZ: I am still looking for a update on the group side which I do not have

MZ: But one Wealth management/redemption center contact told me they will be working both days this weekend. I don’t know what this means or what they will be doing…..but they are working a full day on Saturday and a half a day on Sunday.

Member: Mike Bara claimed yesterday Bond holders cashing out in Zurich & Reno.

MZ: I think we could see “In the coming days” bond money moving….maybe over the weekend….and then possibly see currency movement . I hope to have a group update over the weekend.

Member: How great would that be!!!!

MZ: If group chatter picks up I would feel really good about the next 4 or 5 days.

Member Maybe the release of the Epstein list will be cover to release the RV?

MZ: That is possible

MZ: A good one on history dropped yesterday from Arcadia Economics. “The shocking truth of the Ft. Knox Gold Audits” for those of you want a little homework today https://www.youtube.com/watch?v=J2mLTtjhJjk

MZ: “The gold at Ft. Knox was stolen from Americans” This is a historical look at where the gold came from. Most came from Americans by not honoring World War 1 Gold bonds. People had bought gold bonds and were supposed to be paid out in gold. Then the government said they don’t have enough and they weren’t going to do that. I bet these Gold based Liberty bonds will have to be paid out with Nesara/Gesara.

MZ: They are also talking about all the gold theft that happened when Roosevelt was president….and his efforts to end the gold reserve system.

MZ: We are still waiting on a real audit of Ft. Knox to find out what is real and what is not.

MZ: “In the coming hours –Iraq begins to resume oil exports in the Kurdistan region” The testing and checking of the pipeline went better than they expected. They are hoping to be started this weekend. Starting at 185 thousand barrels a day and then ramp up…..this is a huge income increase for Iraq.

Member: If Kurdistan is moving oil, don't they need a new rate?

MZ: “ Trump says an additional 10% tariff on china to start March 4th.” Also tarrifs on Mexico and Canada will start Mar 4th because illegal drugs are still pouring in (high and unacceptable levels) from all these countries.

Member: Wow- March 4th Trump is also to give a big speech. Lots of RV rumors about March 4th.

Member: March 4 is the constitutional inauguration day, Lincoln was inaugurated on that day

Member: What is the total amount of currency holders in 4B worldwide?

MZ: I don’t really know. If I had to guess –maybe a quarter of a million currency holders in tier 4b.

MZ: the end of the month would be a great time to do revaluations in many countries.

Member: Just got the official notification, Ramadan starts tomorrow March 1 in the UAE

Member: Ready to exchange the foreign currency for gold backed money. Let’s go

Member: I wish they would just pull the pin already. It’s so frustrating to be awake waiting for the sleepers. Let’s go already!!

Member: Please Lord release the RV!! So many are at the end of their rope

Member: On your journey to your dream, be ready to face oasis and deserts. In both cases, don’t stop

Member: Hope you all have a fantastic and prosperous weekend!

MZ: there will be no podcast tonight

Mr. Cottrell joins the stream today. Please listen to the replay for his information and opinions.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

Kick: https://kick.com/theoriginalmarkz

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ “Back To Basics” Pre-Recorded Call” for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

THANK YOU ALL FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL IN THE MORNING FOR COFFEE @ 10:00 AM EST ~ UNLESS BREAKING NEWS HAPPENS!

Seeds of Wisdom RV and Economic Updates Friday Morning 2-28-25

Good Morning Dinar Recaps,

WHEN IS THE BRICS SUMMIT IN 2025?

Brazil will chair the BRICS summit in 2025 under the helm of President Luiz Lula da Silva. The alliance will reinforce its commitment to reshape the global order and usher their economy into a new financial territory. Apart from discussing financial issues, the bloc will also make decisions on climate change and global governance.

The BRICS alliance will collectively collaborate on policymaking at the 2025 summit and represent the population of developing nations. This year’s summit is important as the nine-member bloc will decide on concrete steps to strengthen their economies. The move could reshape the geopolitical landscape and challenge the Western-dominated global financial order.

Good Morning Dinar Recaps,

WHEN IS THE BRICS SUMMIT IN 2025?

Brazil will chair the BRICS summit in 2025 under the helm of President Luiz Lula da Silva. The alliance will reinforce its commitment to reshape the global order and usher their economy into a new financial territory. Apart from discussing financial issues, the bloc will also make decisions on climate change and global governance.

The BRICS alliance will collectively collaborate on policymaking at the 2025 summit and represent the population of developing nations. This year’s summit is important as the nine-member bloc will decide on concrete steps to strengthen their economies. The move could reshape the geopolitical landscape and challenge the Western-dominated global financial order.

When & Where Is The Next BRICS Summit in 2025?

The next BRICS summit in 2025 is scheduled to take place in Brazil’s Rio De Janeiro from July 6th to 7th. The 17th summit will discuss de-dollarization, strengthening of local currencies, new trade deals, and also rewrite policies favoring developing nations. In addition, the alliance might also consensually decide about inducting new countries into the bloc.

Several leaders have hinted that the 17th BRICS summit in 2025 could begin discussions about alternative payment options to the US dollar. Brazil and India have confirmed that they do not support the formation of a BRICS currency. They are looking at various methods to settle cross-border transactions in local currencies.

“This is being discussed in BRICS (2025 summit), at the initiative of (Brazilian President Luiz Lula da Silva). The previous summit stated a decision on the necessity of developing a proposal on alternative payment platforms through finance ministries and central banks.

Such proposals have been made, they suggest, in particular, the creation of a so-called trans-border payment initiative, the creation of a reinsurance company, and the BRICS Clear settlement and depositary infrastructure,” said Russian Foreign Minister Sergey Lavrov.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

XRP NEWS TODAY: CLOSED-DOOR MEETING FUELS SPECULATION OVER RIPPLE LAWSUIT DISMISSAL

▪Ripple vs SEC’s closed-door meeting sparks speculation about lawsuit being dismissed soon.

▪Political pressure increases as Senator Lummis challenges SEC’s crypto regulatory approach.

▪Ripple's XRP dropped by 8% but lawsuit dismissal could push price toward $3.20

The U.S. Securities and Exchange Commission (SEC) held a closed-door meeting on February 27, 2025, sparking speculation about the future of the Ripple lawsuit. With the SEC recently dropping cases against major crypto firms like Coinbase, Uniswap, and Robinhood, many wonder if Ripple could be next.

Could the SEC End the Ripple Case?

The SEC sued Ripple in December 2020, saying the company sold XRP as an unregistered security. However, Judge Analisa Torres ruled in 2023 that XRP itself is not a security, weakening the SEC’s case.

Now, with increasing pressure on the SEC, people believe the agency might be ready to move on.

At the recent SEC meeting, officials discussed legal matters and settlements. While the details are secret, many think the Ripple case may have been included. Former SEC lawyer Marc Fagel does not believe this is a sign of progress, but pro-XRP lawyer Bill Morgan is confident that Ripple has the upper hand.

Political Pressure May Shake the Market

Senator Cynthia Lummis recently criticized the SEC’s approach to crypto regulation, stating that most digital assets are not securities under the Howey Test. Meanwhile, this aligns with Judge Torres’ ruling in the Ripple case, further strengthening Ripple’s position.

No official decision has been announced yet, but the next key date is April 16, when Ripple must submit its reply to the SEC’s appeal. If the SEC withdraws before then, it could mark the end of the long-running case, paving the way for a brighter future for XRP.

What Next For XRP?

As of now, XRP’s price is trading around $2.03 reflecting a drop of 8.19% with a market cap hitting $142 billion. However, many crypto experts believe that if the SEC drops the case, XRP could rise sharply. Some even predict a jump toward $3.20.

Meanwhile, there is also talk if Ripple lawsuits get dismissed, it will open the door for the approval of an XRP exchange-traded fund (ETF), which could push XRP’s price even higher.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps