The US Fertility Rate Hit Another Record Low

.The US Fertility Rate Hit Another Record Low

Notes From The Field By Simon Black

February 17, 2020 Bahia Beach, Puerto Rico

Last month the US government’s National Vital Statistics System released data showing that the birth rate in the Land of the Free has dropped to -yet another- ALL TIME LOW.

It’s the FOURTH year in a row that the fertility rate has reached a record low in the US, meaning that the issue just keeps getting worse.

And it’s one that has enormous, long-term economic consequences.

The US Fertility Rate Hit Another Record Low

Notes From The Field By Simon Black

February 17, 2020 Bahia Beach, Puerto Rico

Last month the US government’s National Vital Statistics System released data showing that the birth rate in the Land of the Free has dropped to -yet another- ALL TIME LOW.

It’s the FOURTH year in a row that the fertility rate has reached a record low in the US, meaning that the issue just keeps getting worse.

And it’s one that has enormous, long-term economic consequences.

If people are having fewer babies today, it means that, in the future, there will be fewer workers in the system paying taxes.

And the biggest loser in that scenario, by far, is Social Security.

The entire long-term viability of Social Security depends on having enough workers paying taxes to support the retirees who are currently receiving benefits.

They call this the worker-to-retiree ratio, and Social Security monitors this very closely.

Social Security’s administrators project that they need a worker-to-retiree ratio of at least 2.8 in order to keep the system functioning. If the ratio drops below 2.8, there simply won’t be enough workers paying taxes to support the monthly benefits for current retirees.

Clearly this system requires steadily rising population.

If you have 1 retiree today, that means there should be at least 2.8 people paying in to the system.

A generation from now, those 2.8 people will be retired, requiring at least 7.84 (2.8 * 2.8) workers paying in to the system. A generation later, those 7.84 people will be retired, requiring 21.95 (7.84 * 2.8) workers paying into the system.

It’s easy to see how this can get totally out of control within just a few generations.

This brings us back to the central problem: birth rate.

Back in the 1960s, the average woman would have nearly 4.0 children in her lifetime.

But this rate has been steadily declining for decades. By 2007 it had fallen to 2.12. And it has fallen every year since then, now down to 1.73.

A fertility rate of 1.73 is below what demographers consider the ‘population replacement level,’ meaning that there are more deaths than births.

More importantly, this long-term decline in the fertility rate has had a slow, damaging effect on the worker-to-retiree ratio.

Back in 1960 there were 5.1 workers for every retiree according to Social Security’s own data. Baby boomers were just starting to join the work force and there weren’t too many people collecting Social Security benefits yet.

By 1990 the ratio had fallen to 3.4 workers for every retiree. That was a lot lower than in 1960, but still sufficient to keep Social Security running.

By 2012, the ratio had already fallen to the minimum 2.8. And given that the US fertility rate continues to decline, the worker-to-retiree ratio is also going to keep falling.

Baby boomers are retiring by the tens of thousands. People are living longer than ever. And there are fewer people being born to pay taxes into the system in the future.

Social Security knows that the fertility rate is critical to its program, and the statistic factors heavily into their long-term projections.

According to its most recent annual report, Social Security’s ‘intermediate’ scenario (i.e. its conservative, base-case projection) assumes a fertility rate of 2.0.

Again, the actual fertility rate in the US is now just 1.73… FAR below Social Security’s assumption. Moreover, the 30 year average fertility rate in the US is around 1.9, which is still below Social Security’s assumption.

Now, you might be thinking that immigration should pick up the slack. As foreigners move to the US, they’ll join the work force and pay taxes into the system, improving the worker-to-retiree ratio.

That’s true in theory. But you may be surprised to learn that the US “net migration rate” has also been falling for decades.

After peaking around 2000, net migration rate in the US has fallen by more than half.

And the Census Bureau announced in late December that just 595,000 net migrants moved to the US in 2019; that’s the fewest net migrants of the entire decade, and a continuation of this trend of declining migrants.

This is another huge problem for Social Security; the program’s base-case scenario assumes that net migration in the US will be nearly 1.3 million people each year.

Yet the average net migration over the past decade was just 840,000… and the rate continues to decline.

You can see the problem here: many of Social Security’s most critical assumptions are totally off-base.

Their assumption about the nation’s fertility rate is far rosier than reality. Their assumption about the net migration rate is far more optimistic than reality.

And with some of the most critical assumptions so off-base, it’s difficult to see how they’re going to meet their projections.

Oh, remember that Social Security’s base-case projection is that its primary trust funds will run out of money in 2035… and that the program will be underfunded by trillions of dollars.

Yet even this dismal forecast is based on highly flawed assumptions… so the reality may be even worse.

This is a global problem, by the way.

Japan and Europe are in the same boat with their fertility rates, and populations in many developed nations are declining. The median age in Japan is nearly 50, and the country sells more adult diapers than baby diapers.

In Italy, deaths exceeded births in 2019 by a whopping 212,000… the biggest figure since World War I ravaged the continent. Even the global average fertility rate has fallen by half since 1960.

These are all critical challenges for pension and social security funds.

I’ve said it before: there is no magic wand to fix this. No politician can sprinkle pixie dust on their pension programs and miraculously make them solvent again. It’s simple arithmetic.

But if you rely on yourself, you can solve this problem with a bit of discipline and planning. LINK

To your freedom & prosperity, Simon Black, Founder, SovereignMan.com

To continue reading, please go to the original article here:

https://www.sovereignman.com/trends/the-us-fertility-rate-hit-another-record-low-27247/

9 Millionaire Success Habits That Will Inspire Your Life

9 Millionaire Success Habits That Will Inspire Your Life

Leon Ho Founder & CEO of Lifehack

As technology evolves and information becomes more accessible, it has also become more challenging to define success. A lot of people are trapped in the rat race while trying to discover the actual formula for success.

You could become overwhelmed with what tools, techniques or philosophies to imbibe while trying to get tips over the internet. At every click and turn, there are ‘how-tos and quick-fix’ on how to become successful overnight. You will find several courses, articles, videos and books on how to achieve financial success.

But what if I tell you it doesn’t have to be complicated as people made it out to be? What if you could achieve success by merely following these 9 millionaire success habits?

9 Millionaire Success Habits That Will Inspire Your Life

Leon Ho Founder & CEO of Lifehack

As technology evolves and information becomes more accessible, it has also become more challenging to define success. A lot of people are trapped in the rat race while trying to discover the actual formula for success.

You could become overwhelmed with what tools, techniques or philosophies to imbibe while trying to get tips over the internet. At every click and turn, there are ‘how-tos and quick-fix’ on how to become successful overnight. You will find several courses, articles, videos and books on how to achieve financial success.

But what if I tell you it doesn’t have to be complicated as people made it out to be? What if you could achieve success by merely following these 9 millionaire success habits?

1. Read for Personal Development

A daily habit I have discovered millionaire share in common is reading. For instance, if you are an entrepreneur, you need to read to become an efficient leader and a productive business owner. Reading helps you to grow and learn without going to a business school.

A research conducted by Thomas Crowley indicates about 85% of self-made millionaires read at least two or more books each month. [1] Warren Buffett is one of these examples. He spends 80% of his day reading. In the early days of his investment career, he would read 600 to 1000 pages in a single day.

While millionaires sometimes read for pleasure, they also learn to improve themselves. They read topics on leadership, how-tos, self-help, biographies, lifehacks and also follow current events.

2. Establish Multiple Sources of Income

To continue reading, please go to the original article here:

The Global War on Cash

.The Global War on Cash

By Jeff Desjardins

Presented by: Texas Precious Metals

The Global War on Cash

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

There is a global push by lawmakers to eliminate the use of physical cash around the world. This movement is often referred to as “The War on Cash”, and there are three major players involved:

1. The Initiators

Who? Governments, central banks.

Why? The elimination of cash will make it easier to track all types of transactions – including those made by criminals.

The Global War on Cash

By Jeff Desjardins

Presented by: Texas Precious Metals

The Global War on Cash

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

There is a global push by lawmakers to eliminate the use of physical cash around the world. This movement is often referred to as “The War on Cash”, and there are three major players involved:

1. The Initiators

Who? Governments, central banks.

Why? The elimination of cash will make it easier to track all types of transactions – including those made by criminals.

2. The Enemy

Who? Criminals, terrorists

Why? Large denominations of bank notes make illegal transactions easier to perform, and increase anonymity.

3. The Crossfire

Who? Citizens

Why? The coercive elimination of physical cash will have potential repercussions on the economy and social liberties.

Is Cash Still King?

Cash has always been king – but starting in the late 1990s, the convenience of new technologies have helped make non-cash transactions to become more viable:

Online banking

Smartphones

Payment technologies

Encryption

By 2015, there were 426 billion cashless transactions worldwide – a 50% increase from five years before.

Year # of cashless transactions

2010 285.2 billion

2015 426.3 billion

And today, there are multiple ways to pay digitally, including:

Online banking (Visa, Mastercard, Interac)

Smartphones (Apple Pay)

Intermediaries ( Paypal , Square)

Cryptocurrencies (Bitcoin)

The First Shots Fired

The success of these new technologies have prompted lawmakers to posit that all transactions should now be digital.

Here is their case for a cashless society:

Removing high denominations of bills from circulation makes it harder for terrorists, drug dealers, money launderers, and tax evaders.

$1 million in $100 bills weighs only one kilogram (2.2 lbs).

Criminals move $2 trillion per year around the world each year.

The U.S. $100 bill is the most popular note in the world, with 10 billion of them in circulation.

This also gives regulators more control over the economy.

More traceable money means higher tax revenues.

It means there is a third-party for all transactions.

Central banks can dictate interest rates that encourage (or discourage) spending to try to manage inflation. This includes ZIRP or NIRP policies.

Cashless transactions are faster and more efficient.

Banks would incur less costs by not having to handle cash.

It also makes compliance and reporting easier.

The “burden” of cash can be up to 1.5% of GDP, according to some experts.

But for this to be possible, they say that cash – especially large denomination bills – must be eliminated. After all, cash is still used for about 85% of all transactions worldwide.

A Declaration of War

Governments and central banks have moved swiftly in dozens of countries to start eliminating cash.

Some key examples of this? Australia, Singapore, Venezuela, the U.S., and the European Central Bank have all eliminated (or have proposed to eliminate) high denomination notes.

Other countries like France, Sweden and Greece have targeted adding restrictions on the size of cash transactions, reducing the amount of ATMs in the countryside, or limiting the amount of cash that can be held outside of the banking system. Finally, some countries have taken things a full step further – South Korea aims to eliminate paper currency in its entirety by 2020.

But right now, the “War on Cash” can’t be mentioned without invoking images of day-long lineups in India. In November 2016, Indian Prime Minister Narendra Modi demonetized 500 and 1000 rupee notes, eliminating 86% of the country’s notes overnight.

While Indians could theoretically exchange 500 and 1,000 rupee notes for higher denominations, it was only up to a limit of 4,000 rupees per person. Sums above that had to be routed through a bank account in a country where only 50% of Indians have such access.

The Hindu has reported that there have now been 112 reported deaths associated with the Indian demonetization. Some people have committed suicide, but most deaths come from elderly people waiting in bank queues for hours or days to exchange money.

Caught in the Crossfire

The shots fired by governments to fight its war on cash may have several unintended casualties:

1. Privacy

Cashless transactions would always include some intermediary or third-party.

Increased government access to personal transactions and records.

Certain types of transactions (gambling, etc.) could be barred or frozen by governments.

Decentralized cryptocurrency could be an alternative for such transactions

2. Savings

Savers could no longer have the individual freedom to store wealth “outside” of the system.

Eliminating cash makes negative interest rates (NIRP) a feasible option for policymakers.

A cashless society also means all savers would be “on the hook” for bank bail-in scenarios.

Savers would have limited abilities to react to extreme monetary events like deflation or inflation.

3. Human Rights

Rapid demonetization has violated people’s rights to life and food.

In India, removing the 500 and 1,000 rupee notes has caused multiple human tragedies, including patients being denied treatment and people not being able to afford food.

Demonetization also hurts people and small businesses that make their livelihoods in the informal sectors of the economy.

4. Cybersecurity

With all wealth stored digitally, the potential risk and impact of cybercrime increases.

Hacking or identity theft could destroy people’s entire life savings.

The cost of online data breaches is already expected to reach $2.1 trillion by 2019, according to Juniper Research.

As the War on Cash accelerates, many shots will be fired. The question is: who will take the majority of the damage?

For Full Detailed Infographic Please Visit :

Got Gold?

Got Gold?

Sanjib Saha February 7, 2020

YEARS AGO, I spent a few days in Bangkok touring the city. A highlight of my short stopover was the temple of Wat Traimit, which houses a five-and-a-half metric ton Golden Buddha, made of approximately $250 million of gold.

Cast more than 700 years ago, the statue symbolized the prosperity and cultural heritage of Sukhothai, the first Thai kingdom. Sometime in the 18th century, the statue was completely plastered over to conceal its value from Burmese invaders.

The significance of the statue was forgotten for some 200 years, until the plaster accidentally chipped off to reveal the gold underneath. The miraculous 1955 discovery made headlines and the statue was restored to its former glory. I was mesmerized by its brilliance and beauty.

Got Gold?

Sanjib Saha February 7, 2020

YEARS AGO, I spent a few days in Bangkok touring the city. A highlight of my short stopover was the temple of Wat Traimit, which houses a five-and-a-half metric ton Golden Buddha, made of approximately $250 million of gold.

Cast more than 700 years ago, the statue symbolized the prosperity and cultural heritage of Sukhothai, the first Thai kingdom. Sometime in the 18th century, the statue was completely plastered over to conceal its value from Burmese invaders.

The significance of the statue was forgotten for some 200 years, until the plaster accidentally chipped off to reveal the gold underneath. The miraculous 1955 discovery made headlines and the statue was restored to its former glory. I was mesmerized by its brilliance and beauty.

Our longing for gold is as old as recorded history. It was significant thousands of years ago, as evidenced by Egyptian archeology. Ancient Greeks, Incans, Aztecs and many other civilizations used gold. It was viewed as a status symbol to separate the elite from the ordinary. Holding gold was synonymous with holding power.

Why such a deep-rooted fascination? There’s no simple answer. The color and luster of the metal create a unique aesthetic appeal. Gold is scarce, yet durable and resilient, hence it’s historical role as a way to store wealth and transfer it to future generations. Even today, in many countries, gold is widely used in social ceremonies and religious offerings. Strong consumer demand persists.

For centuries, gold also played a vital role in monetary systems. The gold standard, a system that promised a fixed gold-based exchange rate for circulating paper currency, was widely used by many countries until World War I. In 1944, gold’s importance was reestablished by the Bretton Woods agreement.

This new system pegged all other currencies to the U.S. dollar and allowed them to be converted to physical gold at $35 per ounce. But the new system soon faltered. The international currency-to-gold convertibility was finally abolished almost half-a-century ago by President Nixon.

Nixon’s decision triggered two shifts in the global monetary system. First, the smooth functioning of fiat—or paper—money around the financial world became solely dependent on the responsible, collaborative action of central banks. Second, the price of gold went haywire.

It spiked almost 20-fold in less than 10 years, only to lose 60% over the following two decades. The rollercoaster ride continued in the current century. Gold climbed from less than $275 per ounce in 2000 to more than $1,900 in 2011. From there, it dropped below $1,075 in 2016 and then crept up again, closing yesterday at $1,570. Widely differing views on its value have made gold a highly speculative asset.

To continue reading, please go to the original article here:

ABCs of Wealth

.ABCs of Wealth: Guest Post

By Vicki Robin

The multiple forms of capital have become a foundational concept in my thinking about the pursuit of financial independence and living a truly rich and resilient life. That’s why I was overjoyed when Vicki Robin, prolific social innovator, writer, speaker, and coauthor with Joe Dominguez of the life-changing book Your Money or Your Life, offered to pen a guest post demonstrating the overlap of what she has come to think of as Natural Wealth with these multiple forms of capital.

It seems like the perfect way to release the free worksheets (which you’ll find at the end of this post) I created so you can take inventory of all of the Natural Wealth and other forms of capital in your own life.

In the 2018 update of Your Money or Your Life, after years of observing how real people creatively use the tools to have a “high joy to stuff ratio” life, I challenged the whole idea of “financial independence (FI).” Money is a small part of our wealth portfolio.

ABCs of Wealth: Guest Post

By Vicki Robin

The multiple forms of capital have become a foundational concept in my thinking about the pursuit of financial independence and living a truly rich and resilient life. That’s why I was overjoyed when Vicki Robin, prolific social innovator, writer, speaker, and coauthor with Joe Dominguez of the life-changing book Your Money or Your Life, offered to pen a guest post demonstrating the overlap of what she has come to think of as Natural Wealth with these multiple forms of capital.

It seems like the perfect way to release the free worksheets (which you’ll find at the end of this post) I created so you can take inventory of all of the Natural Wealth and other forms of capital in your own life.

In the 2018 update of Your Money or Your Life, after years of observing how real people creatively use the tools to have a “high joy to stuff ratio” life, I challenged the whole idea of “financial independence (FI).” Money is a small part of our wealth portfolio.

In the new version, I distinguished between National Currency and Natural Currency. National Currency is the trading chits in the money system: dollars, financial markets, debt, etc. Natural Currency is the flow of gifts, services and mutual aid between people in communities of place or of tribe.

It’s all the helping hands, all the skills, all the hot dishes, all the listening ears, all the celebrations and ceremonies, all the rituals and theater and on and on and on… in short, all the good stuff in life. In the FI program, we build both national currency capital and natural currency wealth to have a happy and free life.

In Permaculture circles, this is known as multiple forms of capital.

To explain this in simple, non technical language, I spoke about it as the ABCs of wealth, where the A, B, and C referred to this abundance of natural wealth – and little “s” referred to “stuff” as in possessions and bank accounts.

Whatever nomenclature you want to assign to it, if you prioritize these natural forms of wealth and capital during your financial accumulation phase your arrival at financial independence (FI) may come sooner, last longer and be happier by far.

Abilities, Belonging and Community are the three forms of natural wealth you build intuitively in the process of aligning how you earn, spend and save money with your purpose and fulfillment.

To continue reading, please go to the original article here:

http://www.triplebottomlinefi.com/abcs-of-wealth-guest-post-by-vicki-robin/

The Wealth Gap: How Changing Fortunes Tear Close Friends Apart

.The Wealth Gap: How Changing Fortunes Tear Close Friends Apart

Sirin Kale

It’s not uncommon for friendships to end because of finances – whether a sudden salary rise or fall. But with care and forethought it is often possible to prevent the rupture

When David Matcham and his wife adopted a baby boy in 2013, their financial situation promptly hit rock bottom. Matcham, 44, from Norfolk, had just completed a PhD, and was looking for work. They were broke; poorer than either of them had been at any point in their lives, even when they were students.

For more than a year, Matcham became a social recluse. In part, this was out of necessity – he had no money for socialising – but it was more than that. His sense of self-worth was in the red. “I felt as if I didn’t matter any more, I had made such a mess of things,” he remembers.

The Wealth Gap: How Changing Fortunes Tear Close Friends Apart

Sirin Kale

It’s not uncommon for friendships to end because of finances – whether a sudden salary rise or fall. But with care and forethought it is often possible to prevent the rupture

When David Matcham and his wife adopted a baby boy in 2013, their financial situation promptly hit rock bottom. Matcham, 44, from Norfolk, had just completed a PhD, and was looking for work. They were broke; poorer than either of them had been at any point in their lives, even when they were students.

For more than a year, Matcham became a social recluse. In part, this was out of necessity – he had no money for socialising – but it was more than that. His sense of self-worth was in the red. “I felt as if I didn’t matter any more, I had made such a mess of things,” he remembers.

The anxiety around his finances was all-consuming. Matcham didn’t feel he could confide in his friends because he was ashamed. “My main fear was that they would think I was asking them for money,” he says. “I was just too embarrassed.”

Matcham stopped returning his friends’ calls, and stopped being invited to things. When Matcham had to socialise with his wife’s family, he would dread it. “They’re lovely people, but they’re all very successful,” he says. “I would use every possible excuse to avoid going. I wanted to withdraw from the aura of their success, which I wasn’t exuding.” He found a job stacking shelves, and then work as a delivery driver. The family clawed their way out of their financial pit.

Years later, when his family’s financial situation had improved, Matcham started having panic attacks. “At the time, I had to keep going for the sake of my son,” he says. “But when things got better, everything I hadn’t dealt with at the time started to emerge.” As well as the panic attacks, the social implications of Matcham’s period of isolation continue to be felt. Many of his friendships from university or school simply fell away, never to be recovered.

Matcham is not the only person to lose friendships because of his finances. The so-called friendship wealth gap was most memorably depicted in the episode of Friends in which Phoebe, Rachel and Joey order side salads and tap water in an upmarket restaurant, before being asked by the rest of the group to split the bill equally.

The award-winning 2006 film Friends With Money chronicled the efforts of a maid, Olivia (played by Jennifer Aniston), to keep up with her high-rolling friends. More recently, the friendship wealth gap is a plotline in the schlocky Netflix drama You, as an aspiring writer Guinevere Beck amasses credit card debt buying expensive presents and rounds of cocktails in Manhattan bars for her wealthy, dissolute girlfriends.

To continue reading, please go to the original article here:

What Is A Power Of Attorney?

.What Is A Power Of Attorney?

By Cameron Huddleston

If there’s one thing I think no adult should be without, it’s a power of attorney.

You were probably thinking I was going to say something more essential to a happy life – such as love and affection or a sense of purpose. Of course those things are important, but I’m a financial journalist and this is a blog about money (mostly). So that’s why I want to highlight how essential having a power of attorney is for everyone.

Unfortunately, most Americans don’t have this legal document. Only one-third of adults 55 and older have a durable power of attorney, according to a survey by Merrill Lynch and Age Wave. The percentage among younger generations is likely even lower.

If so many Americans don’t have a power of attorney, it can’t be that necessary, right? Wrong. If you want to have a say in who gets to make financial decisions for you if you can’t on your own, you need a power of attorney.

What Is A Power Of Attorney?

By Cameron Huddleston

If there’s one thing I think no adult should be without, it’s a power of attorney.

You were probably thinking I was going to say something more essential to a happy life – such as love and affection or a sense of purpose. Of course those things are important, but I’m a financial journalist and this is a blog about money (mostly). So that’s why I want to highlight how essential having a power of attorney is for everyone.

Unfortunately, most Americans don’t have this legal document. Only one-third of adults 55 and older have a durable power of attorney, according to a survey by Merrill Lynch and Age Wave. The percentage among younger generations is likely even lower.

If so many Americans don’t have a power of attorney, it can’t be that necessary, right? Wrong. If you want to have a say in who gets to make financial decisions for you if you can’t on your own, you need a power of attorney.

The ABCs of POA

A power of attorney is a legal document that allows you to name someone to make financial and legal decisions for you if you can’t. You might need someone to make financial decisions for you if an injury or other health emergency leaves you temporarily unable to make decisions on your own.

You might need someone to manage your finances for you if you develop dementia. Or you might simply need someone to make a one-time financial transaction for you if you’re overseas and can’t access your accounts.

In short, there are a variety of situations when you might have to rely on someone else to handle your finances for you. You want that to be someone you trust and have chosen to take on the responsibility.

Otherwise, if something happens to you, the person who steps into this role – or is appointed by a court — might not be the person you would want handling your finances (more on this below).

To continue reading, please go to the original article here:

What Is A Living Trust?

.What Is A Living Trust?

By Cameron Huddleston

Chances are, you know what a will is. This legal document spells out who gets your assets when you die. It also allows you to name an executor to oversee the distribution of your assets and guardians for your children.

If you don’t have a will, your state’s laws will dictate who gets what. That means your home, car, investments or any money in your bank account could go to someone you don’t want to get it. Even your children could end up with someone you wouldn’t have chosen.

Some people go a step beyond a will by creating a living trust. You’re probably thinking those people are the rich and famous. However, trusts aren’t just for the super wealthy. There are benefits of a living trust that make this estate planning tool ideal even for the not-so rich and famous.

What Is A Living Trust?

By Cameron Huddleston

Chances are, you know what a will is. This legal document spells out who gets your assets when you die. It also allows you to name an executor to oversee the distribution of your assets and guardians for your children.

If you don’t have a will, your state’s laws will dictate who gets what. That means your home, car, investments or any money in your bank account could go to someone you don’t want to get it. Even your children could end up with someone you wouldn’t have chosen.

Some people go a step beyond a will by creating a living trust. You’re probably thinking those people are the rich and famous. However, trusts aren’t just for the super wealthy. There are benefits of a living trust that make this estate planning tool ideal even for the not-so rich and famous.

Living Trust Basics

Like a will, a living trust allows you to specify who gets your assets when you die. However, a trust can give you a lot more say over when heirs get the assets you’re leaving behind and how they get those assets, said Geoff Madsen, CEO of Independent Trust Company, which provides trust management services.

The primary difference, though, between a trust and a will is that you must transfer your assets to a trust before you die. That can involve changing the title on property deeds from your name to the trust and filling out forms with your financial institutions.

You also have to name a trustee to manage the assets in the trust. “It’s like forming a business entity,” Madsen said. You can name yourself to be trustee while you’re alive then name a successor trustee to manage the trust once you die.

The trustee has a lot of responsibilities – including distributing assets to beneficiaries, filing an annual tax return for the trust, ensuring the trust complies with state laws and much more.

To continue reading, please go to the original article here:

5 Signs Your Parents Need Help With Their Finances

.5 Signs Your Parents Need Help With Their Finances

By Cameron Huddleston

November is Alzheimer’s Awareness Month. When my mother started exhibiting the early signs of Alzheimer’s, I wasn’t aware that her lapses in memory were the beginning stages of a disease that has gripped her for more than 10 years now.

In fact, I initially thought that she was asking the same questions over and over because of hearing loss from a tumor that she had behind her left ear. I didn’t want to believe that my mom was starting to lose her memory in her early 60s. That was something that happened to people who were much older, I told myself.

But one night while I was at her house, it became painfully obvious that her hearing loss wasn’t the problem.

5 Signs Your Parents Need Help With Their Finances

By Cameron Huddleston

November is Alzheimer’s Awareness Month. When my mother started exhibiting the early signs of Alzheimer’s, I wasn’t aware that her lapses in memory were the beginning stages of a disease that has gripped her for more than 10 years now.

In fact, I initially thought that she was asking the same questions over and over because of hearing loss from a tumor that she had behind her left ear. I didn’t want to believe that my mom was starting to lose her memory in her early 60s. That was something that happened to people who were much older, I told myself.

But one night while I was at her house, it became painfully obvious that her hearing loss wasn’t the problem.

My mom asked me if I wanted to see a new bench she had bought for her patio. We went outside, looked at the bench, then went back in and started talking. Within a few minutes, she asked, “Do you want to see the new bench I got for my patio?” My heart sank.

According to the Alzheimer’s Association, every 65 seconds someone in the U.S. develops Alzheimer’s disease. As I learned, the early signs of the disease can be easy to miss.

However, it’s so important not to write off the lapses in a parent or loved one’s memory as just part of the aging process. That’s because Alzheimer’s and dementia can lead to problems managing money and making financial decisions.

Certainly, you don’t want to see your parents put themselves into financial dire straits or become victims of financial fraud. But these scenarios could easily become reality if you don’t recognize the signs that your parents need help with their finances. Here are five red flags that dementia could be affecting your parents’ ability to manage their money.

They’re Getting Lots of Donation Requests

When visiting with your parents, pay attention to their mail. Is it full of donation requests, sweepstakes entry forms and other solicitations? Do you see numerous “thank you” gifts from organizations around their house – calendars, notepads, pens, stickers, mailing address labels?

To continue reading, please go to the original article here:

https://cameronhuddleston.com/5-signs-your-parents-need-help-with-their-finances/

Everything You Need to Know About Recessions

.Everything You Need to Know About Recessions

January 9, 2020 By Nicholas LePan

Just like in life, markets go through peaks and valleys. The good news for investors is that often the peaks ascend to far greater heights than the depths of the valleys.

Today’s post helps to put recessions into perspective. It draws information from Capital Group to break down the frequency of economic expansions and recessions in modern U.S. history, while also showing their typical impact.

What is a Recession?

Not all recessions are the same. Some can last long while others are short. Some create lasting effects, while others are quickly forgotten. Some cripple entire economies, while others are much more targeted, impacting specific sectors within the economy.

Everything You Need to Know About Recessions

January 9, 2020 By Nicholas LePan

Just like in life, markets go through peaks and valleys. The good news for investors is that often the peaks ascend to far greater heights than the depths of the valleys.

Today’s post helps to put recessions into perspective. It draws information from Capital Group to break down the frequency of economic expansions and recessions in modern U.S. history, while also showing their typical impact.

What is a Recession?

Not all recessions are the same. Some can last long while others are short. Some create lasting effects, while others are quickly forgotten. Some cripple entire economies, while others are much more targeted, impacting specific sectors within the economy.

Recession is when your neighbor loses their job. Depression is when you lose yours. – Harry Truman

According to the National Bureau of Economic Research, a recession can be described as a significant decline in economic activity over an extended period of time, typically several months.

In the average recession, gross domestic product (GDP) is not the only thing shrinking—incomes, employment, industrial production, and retail sales tend to shrink as well. Economists generally consider two consecutive quarters of declining GDP as a recession.

The general economic model of a recession is that when unemployment rises, consumers are more likely to save than spend. This places pressure on businesses that rely on consumers’ income. As a result, company earnings and stock prices decline, which can fuel a negative cycle of economic decline and negative expectations of returns.

During economic recoveries and expansions, the opposite occurs. Rising employment encourages consumer spending, which bolsters corporate profits and stock market returns.

How Long Do Recessions Last?

Recessions generally do not last very long. According to Capital Group’s analysis of 10 cycles since 1950, the average length of a recession is 11 months, although they have ranged from eight to 18 months over the period of analysis.

Jobs losses and business closures are dramatic in the short term, though equity investments in the stock market have generally fared better. Throughout the history of economics, recessions have been relatively small blips.

Average Expansion Average Recession

Months 67 11

GDP Growth 24.3% -1.8%

S&P 500 Returns 117% 3%

Net Jobs Added 12M -1.9M

Over the last 65 years, the U.S. has been in an official recession for less than 15% of all months. In addition, the overall economic impact of most recessions is relatively small. The average expansion increased GDP by 24%, whereas the average recession decreased GDP by less than 2%.

In fact, equity returns can be positive throughout a contraction, since some of the strongest stock rallies have occurred in the later stages of a recession.

Buying the Dip: Recession Indicators

Whether you are an investor or not, it would be wise to pay attention to potential recessions and prepare accordingly.

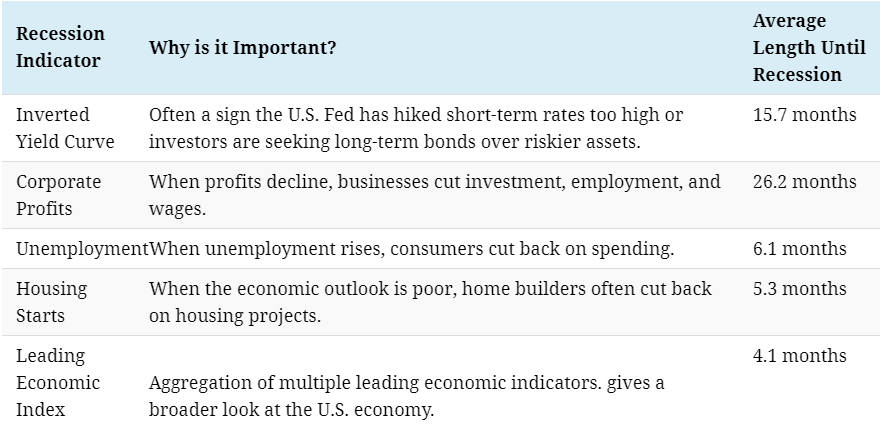

There are several indicators that people can watch to anticipate a potential recession, which might give them an edge in preparing their portfolios:

Screen shot

This is not a magic rubric for anticipating every economic downturn, but it helps individuals see the weather patterns on the horizon. Whether and where the storm hits is another question.

https://www.visualcapitalist.com/recessions-everything-you-need-to-know/

Fed Official: “If there’s a recession, don’t worry”

.Fed Official: “If there’s a recession, don’t worry”

Notes From The Field By Simon Black

January 29, 2020 San Juan, Puerto Rico

Earlier this week I sent one of my team members to a banking conference here in Puerto Rico hosted by the Federal Reserve.

It might strike you as strange that the Fed would be holding an event in Puerto Rico, but it’s not that unusual.

Puerto Rico is a US territory and hence part of the US banking system. So just like the rest of the United States, banks in Puerto Rico (including my own) fall under the umbrella of the Federal Reserve.

The whole point of the event was to help showcase large-scale investments in Puerto Rico that local banks can help finance.

Fed Official: “If there’s a recession, don’t worry”

Notes From The Field By Simon Black

January 29, 2020 San Juan, Puerto Rico

Earlier this week I sent one of my team members to a banking conference here in Puerto Rico hosted by the Federal Reserve.

It might strike you as strange that the Fed would be holding an event in Puerto Rico, but it’s not that unusual.

Puerto Rico is a US territory and hence part of the US banking system. So just like the rest of the United States, banks in Puerto Rico (including my own) fall under the umbrella of the Federal Reserve.

The whole point of the event was to help showcase large-scale investments in Puerto Rico that local banks can help finance.

This is actually part of the Fed’s responsibility, something that comes from an old law from the 1970s called the Community Reinvestment Act.

There were definitely some compelling projects on display yesterday, and I’m particularly interested in a few solar power deals.

(You might recall some of my earlier comments on the pitiful electrical infrastructure in Puerto Rico… the island sorely needs investment in that sector, and the pro-forma numbers look quite lucrative.)

But aside from the investment projects, the really interesting part about the event was what the keynote speakers from the Federal Reserve had to say about the economy, and the Fed itself.

One very senior Fed official, for example, told the audience, “if there’s a recession, don’t worry,” because “the Fed is very powerful” and has all the tools it needs to support the economy.

My colleague was astonished at what had just been uttered, and texted me immediately.

I was dumbstruck. “Don’t worry…???” That’s a bold statement.

Former US Treasury Secretary Larry Summers summed it up recently when he wrote that “the United States is one recession away” from joining Europe and Japan in “monetary black hole economics. . . interest rates stuck at zero and no prospect of escape.”

And he’s right. In every single recession since the 1970s, the US Federal Reserve slashed interest rates by an average of 5%.

At this precise moment the Fed’s key benchmark interest rate is just 1.55%.

Do the math-- if the Fed reduces interest rates in the next recession by this average 5% cut, that would make interest rates NEGATIVE.

Summers calls this the “Black Hole,” because once the economy hits zero or negative rates, there is no escape.

More than 75 years ago, a prominent mid-20th century economist named Alvin Hansen wrote about this concept extensively.

He called it “secular stagnation”-- a prolonged period in which reasonable economic growth can only be achieved with unsustainable financial conditions (like ultra-low / negative interest rates).

One of the core theories in economics is that low interest rates tend to compel people and businesses tend to spend more money.

Low interest rates mean (in theory) that they can afford to borrow more money to buy cars, invest in factories, etc.

So in times of recession or slow growth, the Federal Reserve cuts interest rates to encourage more borrowing and more spending… which in turn generates more economic growth.

But as Alvin Hansen wrote, this theory has limits.

Eventually the lower rates stop achieving any meaningful economic growth, and the Fed has to cut rates even more to move the needle.

The US, Europe, and Japan are all in this position already.

In Europe, for example, interest rates are NEGATIVE. But the combined economies in the ‘eurozone’ grew by just 1.2%. That’s pitiful.

Rates in the US are positive, but still near all record lows. And yet US economic growth is barely 2%.

Back in the 1980s, the US economy routinely grew by 4% to 6% per year, even after adjusting for inflation. And that’s when interest rates were more than 9%.

Today interest rates are almost nothing. The economy should be growing like crazy. But it’s not.

Even the Fed chairman Jerome Powell admitted this to Congress in November: “The new normal now is lower interest rates, lower inflation, probably lower growth... all over the world.”

And when the Fed tried to raise interest rates to a paltry 2.5% last year, the US economy started to suffer, and the Fed was forced to cut rates back to 1.5%.

This is classic ‘secular stagnation,’ just like Alvin Hansen wrote about. These economies can’t manage any meaningful growth, even with rates at / near record lows.

And just a tiny increase in rates creates severe risk of recession.

Well, recession is coming no matter what.

Bloomberg (the news organization, not the guy) recently published some interesting data showing a clear connection between recession risk and low interest rates.

Low interest rates tend to cause extreme financial speculation. People borrow tons of money to buy homes they cannot afford (i.e. the 2008 housing bust), or throw ridiculous sums of money at cash-burning, loser investments (ahem, WeWork!).

Bloomberg points out that since 1985, every recession has been caused by these factors: low interest rates and excess financial speculation.

And these are exactly the conditions that we’re seeing right now in the Land of the Free.

Yet whenever that recession comes, the Fed’s only option is to make interest rates in the US negative, taking the economy deeper into this ‘secular stagnation’ black hole.

I appreciate the Fed official trying to put on a brave face yesterday when he told the audience not to worry.

But the reality is they’re simply not equipped to deal with what’s coming next.

To continue reading, please go to the original article here:

https://www.sovereignman.com/trends/fed-official-if-theres-a-recession-dont-worry-27120/

To your freedom & prosperity, Simon Black, Founder, SovereignMan.com

![expansions-vs-recessions[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1581637978369-5KFPUWH9MB2X1V80SKO9/expansions-vs-recessions%5B1%5D.jpg)

![economic-cycle[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1581638040469-BZRKZHU91QO6919Y9L4J/economic-cycle%5B1%5D.jpg)