Iraq News Highlights and Points to Ponder Tuesday Evening 12-3-24

Iraq Considers Its Future Away From The Dollar

December 3, 2024 Baghdad/Al-Masala: In light of the escalating tensions in the global financial system, former US President Donald Trump is exerting renewed pressure on countries to adhere to using the US dollar as the global reserve currency, which may create unexpected repercussions that may affect the dollar’s position in global markets.

This pressure, which comes from Trump's well-known positions in using tariffs as a political tool, may reinforce trends seeking to move away from dependence on the dollar, and accelerate the steps of countries wishing to reduce their use of the American currency.

Iraq Considers Its Future Away From The Dollar

December 3, 2024 Baghdad/Al-Masala: In light of the escalating tensions in the global financial system, former US President Donald Trump is exerting renewed pressure on countries to adhere to using the US dollar as the global reserve currency, which may create unexpected repercussions that may affect the dollar’s position in global markets.

This pressure, which comes from Trump's well-known positions in using tariffs as a political tool, may reinforce trends seeking to move away from dependence on the dollar, and accelerate the steps of countries wishing to reduce their use of the American currency.

Although the dollar dominates more than 88% of foreign exchange trading, reflecting its exceptional power as a global lending and reserve instrument, experts say Trump’s attempts to boost the use of the dollar could backfire.

The mounting pressure could prompt some countries to look for alternatives to the dollar to avoid the risk of U.S. dominance, says Rodrigo Cattral of National Australia Bank. Cindy Lau of Avanda Investment Management says Trump’s moves are aimed at preserving the dollar’s dominance as a safe store of value, which could make countries more determined to settle trade in their own currencies.

What highlights the impact of this policy on Iraq is that as a country dependent on an oil-based economy, it may come under increasing pressure as moves are made towards concluding trade agreements away from the dollar.

Iraq, which is closely linked to the global financial system through its oil exports, may find itself in a position that requires changing its financial and trade strategies to avoid excessive dependence on the dollar, which may reflect on its economic stability.

Countries such as China, Brazil and India have already begun to trade in their local currencies, a move that could mark the beginning of a new era in the international trading system. Meanwhile, Ulrich Leuchtmann of Commerzbank said the dollar’s continued dominance will be challenged by increasingly self-serving US policy practices.

These developments may prompt Iraq to consider proactive steps to keep pace with future transformations, to secure its economic position in a world witnessing transformations that may threaten the stability of the current financial system.

Although Trump’s threats may not lead to an immediate collapse of the dollar’s dominance, their long-term impact will be an incentive for other countries to seek ways to achieve greater economic independence, which may require Iraq to take measures to ensure the sustainability of its economy in this changing landscape. https://almasalah.com/archives/107102

Finance Confirms The Government's Keenness To Implement Reforms To Ensure The Stability Of The National Economy

Money and business Economy News – Baghdad Finance Minister Taif Sami confirmed today, Tuesday, the government's keenness to implement reforms to ensure the stability of the national economy.

A statement by the Ministry of Finance, received by "Al-Eqtisad News", stated that "Minister of Finance Taif Sami Mohammed received in her official office in Baghdad, the representative of the World Bank in Iraq, Jean-Christophe Carré, where they discussed ways to enhance cooperation between Iraq and the World Bank to support development projects and economic reforms."

The Minister of Finance stressed to the Bank’s representative “the importance of partnership with the World Bank in financing programs that aim to achieve sustainable development,” expressing at the same time her welcome to the World Bank’s representative in Iraq, who was appointed as the Bank’s new representative in Iraq, replacing Richard Abdel Nour, whose duties in Iraq ended last November.

Minister Sami stressed the "Iraqi government's keenness to implement financial and economic reforms to ensure the stability of the national economy. It is working to implement these reforms with the aim of enhancing sustainable growth, improving the management of financial resources, combating corruption, and strengthening transparency in government institutions.

For his part, the World Bank representative praised "the Iraqi government's efforts to improve the economic environment and implement programs that enhance transparency and efficiency, expressing the bank's readiness to provide more technical and financial support in line with Iraq's development priorities."

The statement added, "The two sides agreed to continue coordination and joint work to achieve strategic goals and enhance economic stability in the country."

21 views Added 12/03/2024 - 1:42 PM https://economy-news.net/content.php?id=50495

Government Communication To {Sabah}: Electronic Payment Contributes To Strengthening The Economy

Economic 12/03/2024 According to the confirmation of the government outreach team, and amidst the continuous support of Prime Minister Mohammed Shia al-Sudani.

Economic Benefits

According to the head of the government outreach team, Ammar Munim, to "Al-Sabah", "the government support for electronic payment comes from Prime Minister Mohammed Shia al-Sudani's belief in the economic benefits it brings to the national economy, revitalizing it and pushing it forward."

Munim explained that "the local market must adopt advanced financial transactions that make money paths clear, transparent and secure, and in this direction there are great benefits for the national economy and achieving revenues."

Government Decisions

As for the Executive Director of the Association of Private Banks, Ali Tariq, he told "Al-Sabah": "The development witnessed by Iraq in the electronic payment joint comes thanks to the government's understanding of the reality of electronic payment in financial performance, as government decisions had a great and influential echo in expanding the circle of its adoption."

He pointed out that "today there are about 800 government institutions that adopt electronic payment, as government instructions obligated its adoption with zero fees."

Financial Movements

He pointed out that "electronic payment works to achieve results that serve the national economy, as it reduces the rates of financial corruption and avoids dealing with counterfeit currencies, in addition to documenting financial movements and making them safer."

Confident Steps

In turn, the director of the national awareness campaign to spread the culture of electronic payment "Esreflak" Ahmed Adel said: "The campaign is continuing with confident steps and in the field to reach the largest segment within Iraqi society and inform them of the importance of electronic payment, as we work to organize direct events within human gatherings."

He pointed out that "there are challenges facing the campaign and its movement, but cooperation with the relevant authorities enabled the campaign management to overcome them and it became possible to be present in public places and reach all segments of society.

Financial Transformation

As for the economic expert and consultant Alaa Fahd, he said: "The culture of electronic payment in Iraq is a recent spread as a result of the progress in global financial systems and the need for financial development of the engines of digital financial transformation, and this transformation requires changing the culture and belief of society, especially the simple popular classes who fear any financial procedure away from cash."

He pointed out that "this requires awareness media campaigns that promote this culture and market it to everyone, including the (Spend for You) campaign that was launched at the beginning of the digital transformation in Egypt, and was recently launched in Iraq as part of the first national campaign forum to spread culture," indicating that the campaign clarifies "the importance of electronic financial transformation."

Financial Security

Fahd continued: "There is a gradual change in the culture of electronic payment with the government's orientation towards this transformation and providing all facilities and facing all challenges in order to spread the culture and believe in it from the standpoint of benefit, as it is (Spend for You) in terms of financial security, eliminating corruption, saving time and effort, ease of carrying, and getting rid of counterfeiters Damaged and stolen items and other benefits provided by financial transformation, this requires doubling efforts to achieve full success.” https://alsabaah.iq/106629-.html

Seeds of Wisdom RV and Economic Updates Tuesday Evening 12-03-24

Good Evening Dinar Recaps,

TRUMP TAPS PAUL ATKINS FOR NEXT SEC CHAIR, MAKING GOOD ON HIS CRYPTO PROMISES

Atkins has been vocal in his support of the industry and was the first libertarian to serve as an SEC commissioner under President George W. Bush.

President-elect Donald Trump has selected the pro-crypto Paul Atkins to chair the Securities and Exchange Commission (SEC), according to three sources familiar with the discussions.

Good Evening Dinar Recaps,

TRUMP TAPS PAUL ATKINS FOR NEXT SEC CHAIR, MAKING GOOD ON HIS CRYPTO PROMISES

Atkins has been vocal in his support of the industry and was the first libertarian to serve as an SEC commissioner under President George W. Bush.

President-elect Donald Trump has selected the pro-crypto Paul Atkins to chair the Securities and Exchange Commission (SEC), according to three sources familiar with the discussions.

One source specified that Trump has reached out to Atkins but is waiting on him to accept. By selecting Atkins, Trump is delivering on a promise he made to the crypto community during his campaign.

Spokespeople for Atkins did not respond to immediate requests for comment.

“President-Elect Trump has made brilliant decisions on who will serve in his second Administration at lightning pace,” Trump-Vance Transition Spokeswoman Karoline Leavitt told Unchained. “Remaining decisions will continue to be announced by him when they are made.”

Current Chair Gary Gensler, who announced two weeks ago that he will resign on Jan. 20 when Trump is inaugurated, has made himself a pariah in the crypto industry for pursuing what’s been seen as a policy of regulation by enforcement.

Atkins will now need to be confirmed by the Senate, unless Trump chooses to pursue a recess appointment while the Senate is out of session.

Atkins served as an SEC commissioner under President George W. Bush and is widely respected in conservative legal circles and amongst the establishment Republican party.

Since leaving the commission he’s become outspokenly supportive of the crypto industry, having co-chaired the Token Alliance at the industry group Digital Chamber of Commerce since 2017.

As founder and chief executive of the consultancy Potomak Global Partners, Atkins has advised digital finance companies on regulatory compliance topics since 2009.

“Senate Republicans really respect the tradition of Commissioner Paul Atkins,” explained George Mason University professor J.W. Verret, who previously served on the SEC Advisory Committee, in a call earlier this month. “He was the first time anyone had been a true libertarian and SEC commissioner, and that was a unique thing.”

The team vetting candidates for the chairperson position reached out to crypto industry leaders two weeks ago asking for their preferences, demonstrating how much Gensler’s unpopularity has figured in Trump’s latest nomination.

Gensler was criticized for not establishing clear rules and guidelines for the crypto industry.

Under his leadership, the SEC instead pursued a plethora of enforcement actions against crypto companies and protocols, including exchanges, token issuers, and NFT creators, for failing to register with the agency or disclose their work with what the SEC claimed were unregistered securities offerings.

For his part, Gensler only clarified that he saw Bitcoin as a commodity, insisting that existing securities laws could be applied to other crypto projects, even including ether until the SEC approved spot ether ETFs.

Gensler had also developed a reputation for being difficult to work with. Atkins, by contrast, is known to find a way to retain strong working relationships with people despite ideological disagreements.

“There was never a commissioner at the history of the commission that was more respectful and thankful of the staff at the commission,” said John Reed Stark, who worked with Atkins at the SEC in 2008.

Seizing upon the industry’s hatred for Gensler, Trump began promising clearer rules for the industry this summer. Framing crypto innovation as a key point of competition between the United States and other countries, Trump promised to make the United States a “world capital” for crypto in part by replacing Gensler.

He also said that he would appoint an “advisory council” focused on crypto to help him fine-tune policy, and potentially establish a national bitcoin strategic reserve, in part by not selling bitcoin that the government has seized in various financial crimes.

Because of his support for the industry, numerous crypto entrepreneurs donated both cash and crypto to Trump’s campaign. People interested in crypto who prioritized crypto policy in their voting decisions, from industry leaders to retail traders, had also tilted towards favoring Trump in the months leading up to the national election.

@ Newshounds News™

Source: Unchained Crypto

~~~~~~~~~

FED RATE CUT IN DECEMBER? HERE’S HOW BITCOIN PRICE WILL REACT

▪️The market is anticipating a 0.25% interest rate cut by the US Federal Reserve in December.

▪️A rate cut could boost investor confidence, leading to increased investment in riskier assets like Bitcoin.

▪️The overall economic outlook, especially under a potential Trump presidency, could influence the Fed's decision.

The crypto market is buzzing with anticipation as investors bet that the US Federal Reserve will cut interest rates by 0.25% in December. According to the CME FedWatch tool, the chances of this happening have jumped to 74.5%, up from 66% just a few days ago. What’s driving this growing confidence? If the Fed cuts rates, it would mark the third reduction this year, and it could have major implications for the economy—and for Bitcoin.

What Could a Fed Rate Cut Mean for Crypto?

A rate cut lowers the cost of borrowing for individuals and businesses. When interest rates are lower, loans become cheaper, which can encourage spending and investment. For the stock market and riskier assets like Bitcoin, rate cuts are generally seen as a positive development.

Investors tend to feel more comfortable taking on risks when borrowing costs decrease, making them more likely to invest in assets with higher potential returns, like cryptocurrencies.

Currently, the Federal Reserve’s interest rate is between 4.5% and 4.75%, following two previous cuts this year. Another reduction would signal a more supportive economic environment, which could encourage investors to put their money into riskier assets like Bitcoin.

Experts Weigh In

Marko Papic, Chief Strategist at BCA Research, predicts the US Federal Reserve will cut interest rates in December. He also believes the US dollar may peak by mid-2025, driven by possible economic disappointments under Donald Trump.

At the same time, Federal Reserve officials are hinting at a rate cut. Governor Christopher Waller stated on December 2 that he leans toward supporting a cut, but the decision will depend on upcoming economic data, like inflation and job reports. New York Fed President John Williams has also mentioned that interest rates might be reduced gradually, though he hasn’t specified when this might happen.

Ultimately, the Fed’s decision will depend on the economic performance over the next few weeks.

Could the Rate Cut Fuel Bitcoin?

Bitcoin has already seen impressive growth this year, more than doubling in value. Many analysts are optimistic that Bitcoin could break the $100,000 mark by the end of 2024. With a possible rate cut from the Fed, Bitcoin’s price could continue to rise, benefiting from the increased investor interest in riskier assets.

With Bitcoin on the rise, the stage is set for a thrilling end to 2024, with the Fed’s actions playing a central role.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

CRYPTO EXPERT SHARES TOP BOND INVESTING STRATEGIES | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

$36 Trillion Debt Crisis and New Trade Wars

$36 Trillion Debt Crisis and New Trade Wars

David Lin: 12-3-2024

In a world where economic indicators are often painted with a broad brush, the recent discussion between Matthew Piepenburg of Von Greyerz AG and David Lin has brought to light the perils that arise from massive national debts and the looming threat of trade wars.

With the U.S. debt surpassing a staggering $36 trillion, experts like Piepenburg are sounding alarms about potential economic collapse and the cascading effects of tariffs on inflation and growth.

$36 Trillion Debt Crisis and New Trade Wars

David Lin: 12-3-2024

In a world where economic indicators are often painted with a broad brush, the recent discussion between Matthew Piepenburg of Von Greyerz AG and David Lin has brought to light the perils that arise from massive national debts and the looming threat of trade wars.

With the U.S. debt surpassing a staggering $36 trillion, experts like Piepenburg are sounding alarms about potential economic collapse and the cascading effects of tariffs on inflation and growth.

The enormity of the U.S. national debt is hard to fathom. With fiscal policies driven by ongoing governmental spending, social programs, and responses to crises such as the Covid-19 pandemic, this figure continues to climb.

Piepenburg highlights that the sheer size of this debt is unsustainable, potentially leading to adverse consequences for the economy. As the government borrows more to cover its obligations, the risk of default—or inflation as a means to reduce the real value of that debt—grows.

An economy burdened by such debt also accumulates risks associated with higher interest rates, which could become necessary to attract investors to buy more government bonds. Higher interest rates would, in turn, increase borrowing costs for businesses and consumers, adversely affecting spending, investment, and overall economic growth.

In conjunction with soaring debt levels, escalating trade tensions further compound these economic challenges. The U.S. administration’s recent imposition of tariffs on various imports is a focal point of Piepenburg’s discussion, evoking fears of a new trade war reminiscent of the one initiated in 2018. Trade wars often result in increased costs for goods, driving up inflation as prices are passed down to consumers.

Economists argue that tariffs can lead to disruptions in supply chains, decrease the efficiency of markets, and stifle global trade, which has historically fueled economic growth. Piepenburg emphasizes that the interplay between rising tariffs and inflation could create a challenging environment, not just for U.S. consumers but for the global economy as well.

Amidst these conflicting headwinds, the outlook for the dollar itself appears uncertain. As the largest economy grapples with historic levels of debt and potential trade conflicts, the strength of the dollar, long seen as a global safe haven, could be tested. Piepenburg articulates concerns about a potential loss of confidence in the currency as inflation rises and purchasing power diminishes.

Should the dollar weaken significantly, it could trigger a series of negative effects—from increased costs of imports to struggles in maintaining financial stability—potentially leading to a scenario where the U.S. economy suffers further contraction.

Piepenburg’s warning of “crazier times” reflects a sentiment that is increasingly echoed among analysts and economists. As monetary policy grapples with inflation management and attempts to stabilize the economy amidst geopolitical uncertainties, markets may see volatility like never before.

Investors are urged to consider hedging their wealth not just against inflation, but also against the destabilizing effects of potential trade wars. Gold and other commodities are often seen as safe-haven assets in uncertain economic climates, with many market participants exploring diversification strategies in anticipation of turbulent times ahead.

As the United States navigates a debt crisis and examines the implications of new trade wars, the questions of inflation, economic growth, and the future of the dollar loom larger than ever. Matthew Piepenburg’s insights into these matters serve as a clarion call for vigilance amid a complex and evolving economic landscape.

As consumers, investors, and policymakers grapple with these issues, the conversation about sustainability, resilience, and structural reform becomes more critical than ever. A cautious approach may be warranted as the global economy stands at a precipice, ready to either soar or stumble in response to the extraordinary challenges ahead.

Seeds of Wisdom RV and Economic Updates Tuesday Afternoon 12-03-24

Good Afternoon Dinar Recaps,

COINBASE WILL DROP LAW FIRMS WHO HIRE ANTI-CRYPTO FORMER SEC STAFF — CEO

Coinbase CEO Brian Armstrong said the exchange stopped working with law firm Milbank after it hired former SEC official Gurbir Grewal.

Coinbase CEO Brian Armstrong said the cryptocurrency exchange will not work with law firms that hire individuals involved in what he described as anti-crypto actions during their tenure in government.

Good Afternoon Dinar Recaps,

COINBASE WILL DROP LAW FIRMS WHO HIRE ANTI-CRYPTO FORMER SEC STAFF — CEO

Coinbase CEO Brian Armstrong said the exchange stopped working with law firm Milbank after it hired former SEC official Gurbir Grewal.

Coinbase CEO Brian Armstrong said the cryptocurrency exchange will not work with law firms that hire individuals involved in what he described as anti-crypto actions during their tenure in government.

On Dec. 3, Armstrong said in an X post that Coinbase will avoid law firms that hire people who tried to “unlawfully kill” an industry without clarifying the rules. He urged the crypto community not to support individuals who had worked against the sector.

Armstrong claimed senior partners at law firms are often unaware of the crypto industry’s position on this issue. He encouraged community members to make their law firms aware that hiring anti-crypto officials could result in losing business.

Coinbase drops Milbank after law firm hires Gurbir Grewal

Armstrong said that Coinbase ended its relationship with Milbank after the law firm hired Gurbir Grewal, the former enforcement director at the United States Securities and Exchange Commission.

On Oct. 2, the SEC announced that Grewal would resign from his position at the agency. The securities regulator said that Grewal had recommended over 100 enforcement actions to address “widespread noncompliance” in the digital asset industry.

On Oct. 15, Milbank said it had onboarded the former SEC official to its litigation and arbitration group. Milbank chairman Scott Edelman praised Grewal’s “record of success” as a federal prosecutor and the SEC’s enforcement head.

Because of this, Armstrong said Coinbase decided to stop working with Milbank. He said:

“If you were senior there, you cannot say you were just following orders. They had the option to leave the SEC and many good people did. It was not a normal SEC tenure.”

Following Donald Trump’s victory in the 2024 US presidential election, members of the crypto community have expressed optimism about a more favorable regulatory environment in the US. This has contributed to bullish momentum in the market, with Bitcoin reaching an all-time high of $99,645 on Nov. 22.

@ Newshounds News™ Source: CoinTelegraph

~~~~~~~~~

BRICS NEWS: BRICS COUNTRIES REACT TO TRUMP’S 100% TARIFF THREATS

President-elect Donald Trump threatened BRICS countries with 100% tariff rates if they decide to ditch the US dollar for trade.

Trump made it clear that de-dollarization or launching a new currency and payment system to bypass the US dollar will be met with a 100% tariff on goods entering the US markets. If the tariff is imposed, BRICS countries will find it hard as their imports and export sectors will be hit.

On the heels of the recent 100% tariff threats by Trump, BRICS countries have reacted to the development. While some members doubt the tariff can be put in place, others remain cautious to not irk the President-elect. The balancing act of diplomacy now comes into the picture and how they navigate the next four years will decide the success of the de-dollarization agenda.

100% Tariffs on Goods Entering the US: BRICS

BRICS member Russia said that Trump’s threats will backfire as the alliance is committed to uprooting the US dollar’s dominance. “More and more countries are switching to the use of national currencies in their trade and foreign economic activities,” said Kremlin spokesman Dmitry Peskov to Reuters.

The spokesperson said that BRICS countries will band together stronger if Trump adds further economic pressure on the alliance. “If the US uses force, as they say, economic force, to compel countries to use the dollar it will further strengthen the trend of switching to national currencies,” said Peskov.

On the other hand, BRICS member India also remains skeptical of Trump’s 100% tariff threats. The think tank GTRI said that imposing tariffs will inadvertently make consumer goods more expensive for US customers. While the export and import sectors will take heat, eventually the sellers will place the tax on the consumer’s shoulders.

@ Newshounds News™ Source: Watcher Guru

~~~~~~~~~

WANT TO STAY AHEAD IN CRYPTO? WATCH THIS NOW | Youtube

The UK Introduces Regulations!

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Iraq Economic News and Points to Ponder Tuesday AM 12-3-24

Government Communication To {Al-Sabah}: Electronic Payment Contributes To Strengthening The Economy

Economical 12/03/2024 Baghdad: Hussein Thaghab According to confirmation by the government outreach team, and amid continued support from Prime Minister Muhammad Shiaa Al-Sudani.

Economic benefits

According to the head of the government communication team, Ammar Moneim, to “Al-Sabah,”

“Government support for electronic payment comes from Prime Minister Muhammad Shiaa Al-Sudani’s belief in the economic benefits it brings to the national economy, reviving it and pushing it forward.” Menem stated that "the local market must adopt advanced financial transactions that make the money paths clear, transparent and secure.

Government Communication To {Al-Sabah}: Electronic Payment Contributes To Strengthening The Economy

Economical 12/03/2024 Baghdad: Hussein Thaghab According to confirmation by the government outreach team, and amid continued support from Prime Minister Muhammad Shiaa Al-Sudani.

Economic benefits

According to the head of the government communication team, Ammar Moneim, to “Al-Sabah,”

“Government support for electronic payment comes from Prime Minister Muhammad Shiaa Al-Sudani’s belief in the economic benefits it brings to the national economy, reviving it and pushing it forward.” Menem stated that "the local market must adopt advanced financial transactions that make the money paths clear, transparent and secure.

This approach has great benefits for the national economy and generates revenues."

Government decisions

As for the Executive Director of the Association of Private Banks, Ali Tariq, he told “Al-Sabah”:

“The development that Iraq witnessed in the field of electronic payment comes thanks to the government’s understanding of the reality of electronic payment in financial performance, as

government decisions had a great and influential impact in expanding the circle of its adoption.”

He pointed out that "today there are about 800 government institutions that adopt electronic payment, as government instructions obligated it to be adopted with zero fees." He pointed out that

Financial movements

"electronic payment works to achieve results that serve the national economy, as it

reduces the rates of financial corruption and

avoids transactions in counterfeit currencies, in addition to

documenting financial transactions and

making them safer."

Confident steps

In turn, Ahmed Adel, director of the national awareness campaign to spread the culture of electronic payment, “Asfarlak,” said:

“The campaign is continuing with confident steps and on the ground to reach the largest segment within Iraqi society and inform them of the importance of electronic payment, as we work to organize direct events within human gatherings.” He pointed out that

"there are challenges facing the campaign and its movement, but cooperation with the concerned authorities enabled the campaign management to overcome them and it became possible to be present in public places and reach all segments of society."

Financial transformation

As for the expert and economic consultant, Alaa Fahd, he said: “The culture of electronic payment in Iraq is newly widespread as a result of the progress in global financial systems and the need for financial development of the engines of digital financial transformation.

This transformation requires changing the culture and belief of society, especially the simple popular classes who fear any measure.” “My money is far from cash.” He pointed out that "this requires awareness-raising media campaigns that promote this culture and market it to everyone, including the (Israfilak) campaign,

which was launched at the beginning of the digital transformation in Egypt, and recently was launched in Iraq within the first national campaign forum to spread culture," indicating that the campaign explains "the importance of financial transformation." "electronic". Fahd continued:

Financial security

“There is a gradual change in the culture of electronic payment with the government’s approach to this transformation, providing all facilities and confronting all challenges in order to spread the culture and believe in it from the point of view of benefit, as

it is (Isreflak) in terms of

financial security,

eliminating corruption,

shortening time and efforts,

ease of downloading, and

getting rid of counterfeiting.” "And

this requires redoubling efforts to achieve full success." https://alsabaah.iq/106629-.html

The Central Bank Completes The Exam To Grant The Certified Branch Manager Certificate

December 02, 2024 The Center for Banking Studies, one of the formations of the Central Bank of Iraq, has completed an international examination, the first of its kind, to obtain the Certified Branch Manager (CBM) certificate from the Professional Development Institute (PDI), which is affiliated with the Institute of Accountants and Accounting Assistants (IAB).

64 branch managers from government and private banks participated as an initial stage to grant them this certificate after they completed a qualification course that would help them pass the exam.

This certificate is considered one of the professional certificates that supports the banking sector and enhances the efficiency of branch managers and develops their skills.

The Director General of the Studies Center said:

This qualifying course, followed by the exam, will

help participants develop the basic concepts and principles of banking branch management and

prepare them to be equipped with the basic skills that branch managers must have through developing administrative, behavioral and professional skills,

skills for dealing with customers, and

understanding and developing sales skills.

Banking and resolving problems with customers according to best practices, as well as

building an effective complaints system.

It is worth noting that such international examinations give importance to the Iraqi banking sector and prepare it to keep pace with modernity and rely on the professional certificates of its staff.

The Center for Banking Studies also seeks to provide professional certificates in addition to this certificate to develop the banking and financial sector in Iraq within its training plans.

Central Bank of Iraq Media office December 1, 2024 https://cbi.iq/news/view/2725

It Does Not Remain “Just Attractive”... Iraq Wants To Invest Its Money “In Projects Abroad”

2024-12-02 | 1,199 views Alsumaria News-Economy Today, Monday, a member of the Iraqi Parliament, Representative Ibtisam Al-Hilali, revealed Iraqi plans to activate foreign investments, meaning that Iraq will invest its surplus funds in projects abroad.

Al-Hilali said in an interview with Al-Sumaria News, “Thanks to the good diplomatic relations established by the Sudanese government of Muhammad Shiaa with neighboring countries and the world,

economic relations have also improved,” noting that “there re large internal and external investments.”

She explained that "internal investments serve the country by improving the environmental situation and infrastructure," indicating that "foreign investments have a financial and economic return for Iraq."

She confirmed that "we had a meeting with the French embassy to activate foreign investments," indicating that "Iraq is a financially capable country that can invest its money in foreign investments to benefit the public benefit of Iraq and neighboring countries."

Questions have often been raised about the reason for Iraq investing its money in various sectors, including foreign sports sectors as well as technology, like other countries, which could lead to diverse financial returns with the lack of non-oil revenues in Iraq compared to oil revenues.

https://www.alsumaria.tv/news/economy/508197/لا-يبقى-جاذبًا-فقط-العراق-يريد-استثمار-أمواله-بمشاريع-في-الخارج

Central Bank Of Iraq Sells Over $285 Million In Currency Auction

02/12/2024 Mawazine News – Economy The Central Bank of Iraq's dollar sales, on Monday, recorded more than $285 million during the currency auction.

The bank explained that the total sales amounted to $285 million, 603 thousand and 220, and were covered at a basic exchange rate of 1310 dinars per dollar for documentary credits and international settlements for electronic cards, and at the same rate for foreign transfers, while the cash exchange rate amounted to 1305 dinars per dollar.

Sales focused on strengthening balances abroad in the form of transfers and credits, which amounted to $280 million, 503 thousand and 220, which constitutes 98% of total sales, while cash sales amounted to only five million and 100 thousand dollars.

The bank indicated that one bank bought the dollar in cash, while 13 banks met requests to strengthen balances abroad, with the participation of 8 exchange companies in the auction. https://www.mawazin.net/Details.aspx?jimare=257098

Iraq Stock Exchange Index To Lead Arab Stock Markets In October 2024

Economy | 02/12/2024 Mawazine News – Baghdad The Arab Monetary Fund announced in its monthly report for October 2024 the distinguished performance of Arab financial markets, as the Iraq Stock Exchange topped the list of best performing markets during the month, recording a growth of 12.39%, ahead of the rest of the markets in the region.

According to the report, a copy of which was received by Mawazine News, "The Damascus Stock Exchange came in second place with a growth of 6.99%, while the Dubai and Amman stock exchanges witnessed an improvement of 1.94% and 1.35%, respectively. The Muscat, Bahrain and Kuwait stock exchanges also recorded slight increases of less than 1%."

In this context, the Chairman of the Securities Commission, Faisal Al-Haimus, stated: "This distinguished performance of the Iraq Stock Exchange reflects the positive developments in the local economic environment and the regulatory reforms implemented by the Commission to enhance the attractiveness of investment in the Iraqi financial market.

We will continue to work to provide a stable and transparent investment environment that enhances investor confidence and contributes to supporting the national economy."

Al-Haimas stressed that this achievement is an additional incentive to continue efforts aimed at developing the Iraqi financial market and enhancing its role as an engine of economic growth in Iraq.

https://www.mawazin.net/Details.aspx?jimare=257114

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Seeds of Wisdom RV and Economic Updates Tuesday Morning 12-03-24

Good Morning Dinar Recaps,

HOUSE LAWMAKERS PROPOSE STUDIES ON AI IN FINANCIAL SERVICES, HOUSING

Top lawmakers in the United States introduced a bill that would require federal regulators to conduct studies on how artificial intelligence (AI) impacts the financial services and housing industries.

Congresswoman Maxine Waters introduced a bill directing several federal financial regulators to study the present and potential benefits and risks of AI in the two industries. It was co-sponsored by House Financial Services Committee Chair Patrick McHenry.

Good Morning Dinar Recaps,

HOUSE LAWMAKERS PROPOSE STUDIES ON AI IN FINANCIAL SERVICES, HOUSING

Top lawmakers in the United States introduced a bill that would require federal regulators to conduct studies on how artificial intelligence (AI) impacts the financial services and housing industries.

Congresswoman Maxine Waters introduced a bill directing several federal financial regulators to study the present and potential benefits and risks of AI in the two industries. It was co-sponsored by House Financial Services Committee Chair Patrick McHenry.

The pair have also supported each other in a resolution acknowledging the increasing use of AI in the finance and housing markets, according to a Dec. 2. statement from the House Financial Services Committee.

Under the Waters-sponsored AI Act of 2024, key regulators like the Federal Reserve and the Federal Deposit Insurance Corporation would have to report how banks implement AI to detect and deter money laundering, cybercrime and fraud.

AI is already impacting mortgage lending and credit scoring, among other things, Waters said, explaining the need for a more comprehensive AI reporting regulatory framework.

AI-powered research is also being used for market surveillance purposes and tenant screening, McHenry’s resolution said.

McHenry added: “These bills are a small, but critical, step forward to empower the financial system to realize the numerous benefits artificial intelligence can offer for consumers, firms, and regulators.”

His resolution suggested the House Financial Services Committee should consider whether to reform privacy laws as data use becomes more AI-driven.

McHenry said he wants the US to remain a leader in AI development and utilization.

Waters and McHenry’s measures build on the House Committee’s Bipartisan AI Working Group, which was established on Jan. 11.

Republican members include French Hill, Young Kim, Mike Flood, Zach Nunn and Erin Houchin, while the Democrat members include Stephen Lynch, Sylvia Garcia, Sean Casten, Ayanna Pressley and Brittany Pettersen.

The group’s formation followed US President Joe Biden’s executive order on Oct. 30 to establish a “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence.”

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

TRUMP’S SEC CHAIR SELECTION: PREDICTION MARKETS SIGNAL MAJOR REGULATORY CHANGES

These prediction markets show trader speculation, not confirmed plans. Paul Atkins leads in trading as a possible Trump’s SEC chair pick, with markets showing a 70% probability. Any appointment would follow the 2024 election results, but traders expect significant changes in financial market oversight.

How Trump’s SEC Chair Appointment Could Impact Crypto Regulation and Market Oversight

The race for the next possible SEC chair shows clear patterns in prediction markets. Here’s what current trading reveals:

Paul Atkins Emerges as Leading SEC Chair Candidate

Traders strongly back Atkins for Trump’s SEC chair position. His SEC commissioner experience and pro-innovation views match his 70% rating in prediction markets. His selection could bring major changes to crypto regulation approaches.

New SEC Chair Appointment Could Reshape Markets

Paul Atkins Emerges as Leading SEC Chair Candidate

Traders strongly back Atkins for Trump’s SEC chair position. His SEC commissioner experience and pro-innovation views match his 70% rating in prediction markets. His selection could bring major changes to crypto regulation approaches.

New SEC Chair Appointment Could Reshape Markets

Prediction markets suggest big changes if Trump picks a new SEC chair. Current market odds favor:

▪️Paul Atkins: Former SEC commissioner (70% chance)

▪️Brian Brooks: Crypto industry expert (20% chance)

▪️Hester Peirce: Current SEC commissioner (2% chance)

Crypto Regulation 2024 Faces Potential Overhaul

Traders believe crypto regulation in 2024 could change significantly. Markets suggest Atkins as SEC chair might ease current restrictions. His past work shows he supports innovation with reasonable oversight.

Market Trading Shows Strong Confidence

Over $503,418 in trading volume reveals high interest in the SEC chair position. Atkins’ probability has jumped from 25% to 70% since November, though these remain speculative bets.

Regulatory Framework Faces Possible Changes

Markets suggest a new SEC chair might change:

▪️How crypto is overseen

▪️Market rules

▪️Support for new ideas

▪️How rules are enforced

Prediction markets offer insights but can’t guarantee outcomes. Any SEC chair needs proper nomination and approval. Current trading shows what markets expect while acknowledging many factors could affect the final choice.

Trading patterns point to possible regulatory shifts, but all predictions remain speculative. The high trading volume shows strong market interest in potential SEC leadership changes, even as the actual appointment process awaits future developments.

@ Newshounds News™

Source: Watcher Guru

~~~~~~~~~

What's Driving XLM Price to OVERTAKE XRP - The Economic Ninja | Youtube

The Ninja compares XLM and XRP.

@ Newshounds News™

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

Tuesday Morning “Tidbits From TNT” 12-3-2024

TNT:

Tishwash: CBL to print 30 billion dinars in order to withdraw old banknotes

The Central Bank of Libya (CBL) has announced signing contracts to print 30 billion dinars to replace the old currency, saying the old banknotes will be withdrawn "smoothly" at a later-set date.

This came during a meeting held by the Governor of the Central Bank, Naji Issa, to review the plan of the Central Bank of Libya to solve the problem of cash shortages.

During the meeting, it was agreed to raise the ceilings for immediate payment at the level of individuals and merchants to 20,000 dinars for a single transfer for individuals, and 100,000 for a single purchase transaction.

TNT:

Tishwash: CBL to print 30 billion dinars in order to withdraw old banknotes

The Central Bank of Libya (CBL) has announced signing contracts to print 30 billion dinars to replace the old currency, saying the old banknotes will be withdrawn "smoothly" at a later-set date.

This came during a meeting held by the Governor of the Central Bank, Naji Issa, to review the plan of the Central Bank of Libya to solve the problem of cash shortages.

During the meeting, it was agreed to raise the ceilings for immediate payment at the level of individuals and merchants to 20,000 dinars for a single transfer for individuals, and 100,000 for a single purchase transaction.

The Central Bank also revealed in the statement the launching of a new service for transfers between companies with a ceiling of one million dinars for a single transfer.

According to the statement, Issa ordered the directors of the departments concerned with the Central Bank of Libya, the liquidity team, and banks suffering from a liquidity shortage, to manage according to the plan approved by the Board of Directors to solve this problem gradually and radically starting from January 2025.

The Governor also stressed the need to improve and develop the infrastructure of banks in order to achieve the expansion of electronic payment services according to the prepared plan. link

Tishwash: Securities Commission: Iraq Stock Exchange Leads Arab Stock Markets

The Securities Commission announced, today, Monday, the rise in the Iraq Stock Exchange index, while indicating that it topped the Arab financial markets in October 2024.

The Authority said in a statement received by the Iraqi News Agency (INA): "The Arab Monetary Fund mentioned in its monthly report for October 2024 the distinguished performance of Arab financial markets, as the Iraq Stock Exchange topped the list of best performing markets during the month, recording a growth of 12.39%, ahead of the rest of the markets in the region."

According to the report, the Damascus Stock Exchange came in second place with a growth of 6.99%, while the Dubai and Amman stock exchanges witnessed an improvement of 1.94% and 1.35%, respectively, while the Muscat, Bahrain and Kuwait stock exchanges recorded slight increases of less than 1%.

According to the statement, the Chairman of the Authority, Faisal Al-Haimus, confirmed that "this distinguished performance of the Iraq Stock Exchange reflects the positive developments in the local economic environment and the regulatory reforms implemented by the Authority to enhance the attractiveness of investment in the Iraqi financial market," noting that "we will continue to work to provide a stable and transparent investment environment that enhances confidence among investors and contributes to supporting the national economy."

Al-Haimas stressed that "this achievement is an additional incentive to continue efforts aimed at developing the Iraqi financial market and enhancing its role as an engine of economic growth in Iraq." link

************

Tishwsh: Ways you never thought of.. Judges reveal methods of smuggling hard currency

Several judges and legal experts spoke about the latest methods of smuggling dollars out of the country, pointing out that currency smugglers have developed their means and methods of smuggling money.

They explained in statements covered by (Al-Masry - Monday) that one of the latest methods that have been presented, in practical reality, is smuggling currency through prepaid electronic payment cards, where the accused agrees with ordinary citizens to issue payment cards in their names in exchange for small amounts that he gives them, then he fills the cards, carries them and takes them out of the country through airports and then withdraws the amounts in cash through ATMs in the countries to which he travels.

They continued, currency smugglers collect a large number of Key Cards and Visa Cards after filling them with national currencies and traveling with them outside Iraq. link

***********

Tishwash: Visa Launches Tap to Phone Technology in Iraq

In cooperation with the Moroccan Electronic Monetary Association

Visa, a global leader in digital payments, has launched “Tap to Phone” technology in partnership with the Maghreb Electronic Money Association (S2M) to empower small and medium-sized businesses in Iraq with solutions to accept digital payments at a low cost.

The Maghreb Electronic Money Association’s Mobile Tap solution, which uses Visa’s Tap to Phone technology, enables merchants using Near Field Communication (NFC)-enabled Android devices to accept contactless payments simply by downloading a dedicated app. The collaboration aims to revolutionize the payments landscape by enabling merchants to seamlessly accept payments using their smartphones without the need for additional hardware investment.

“We are delighted to partner with the Maghreb Electronic Money Association to launch Tap to Phone in Iraq. This strategic collaboration is in line with our commitment to enhance financial inclusion for small businesses by providing digital payments capabilities at a lower cost,” said Leila Serhan , Vice Chairman and Regional Head of Corporate Business Leadership for North Africa, Levant and Pakistan at Visa.

This innovative solution enables retail outlets to develop and improve the payment experience for consumers. Service staff at store fronts can support consumers to make payments easily without having to stand in queues at the cashier, which means a better customer experience.”

Mobile Tap provides SMEs with the option to accept digital payments at a lower cost, paving the way for greater participation in the digital economy. This innovative approach eliminates the need for traditional POS terminals and can help facilitate a better consumer experience in payments. The solution provides merchants and customers with greater convenience and flexibility during transactions.

The Mobile Tap service empowerment reflects S2M ’s unwavering commitment to empowering merchants through innovative software and technology, significantly enhancing the commerce experience for all. “This strategic alliance presents a great opportunity to elevate the level of digital payment solutions available and promote financial inclusion across Iraq, ensuring that all consumers and merchants can participate and thrive. Over the past decade, we have witnessed the incredible potential for innovation and growth within the Iraqi market, and we are committed to supporting its dynamic payments ecosystem,” said Mohamed Amarti Rifi, S2M Executive Vice President.

As a network that works for everyone, everywhere, Visa’s mission is to advance digital commerce for the benefit of consumers, businesses and economies across Iraq. This strategic collaboration aligns with Visa’s goal of enabling more payment acceptance points using cutting-edge technologies such as Tap to Phone to support small businesses with digital payments capabilities at a lower cost. link

Mot: .. Not Something You See Every Day!!!!

"Dad gassing up in Eureka Roadhouse, Alaska. Only in Alaska." -- Briana Brumley

Mot: Losing car in parking lot

MilitiaMan & Crew-Iraq Dinar News-CBI Gov Monetary Position Excellent-Stop Gov Loans-Private Sector Stage is Set

MilitiaMan & Crew-Iraq Dinar News-CBI Gov Monetary Position Excellent-Stop Gov Loans-Private Sector Stage is Set

12-2-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

MilitiaMan & Crew-Iraq Dinar News-CBI Gov Monetary Position Excellent-Stop Gov Loans-Private Sector Stage is Set

12-2-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economic Updates Monday Evening 12-02-24

Good Evening Dinar Recaps,

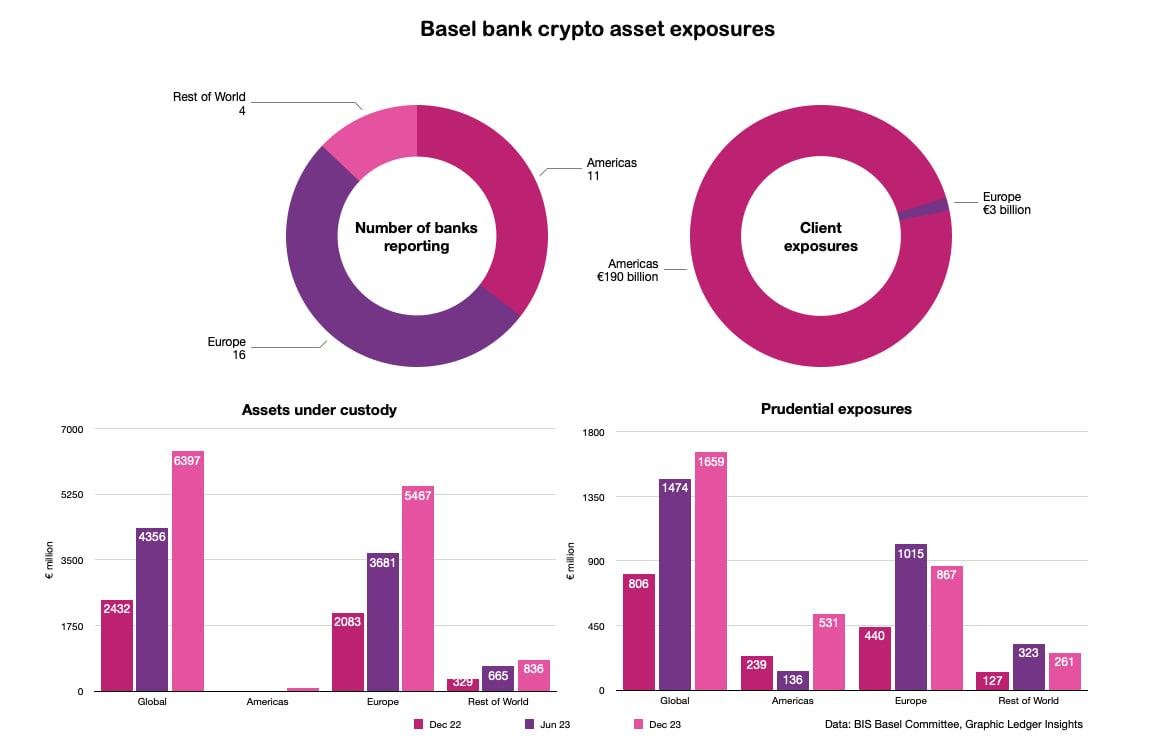

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

Good Evening Dinar Recaps,

BASEL FIGURES: AMERICAN BANKS ENABLED $201 BILLION IN CLIENT CRYPTO EXPOSURES IN 2023

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale.

However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

In particular, the Americas are almost entirely absent from the crypto custody space, largely because of the SEC’s SAB 121 accounting rule, which makes it prohibitive for banks to provide custody. That’s already relaxing and will likely be dropped altogether by the incoming Trump administration.

n the second half of 2023, assets under custody in Europe grew by 49% to €5.5 billion ($5.8bn) compared to the first half. At a global level, 94% of custody was for spot crypto rather than tokenized assets or ETPs.

When it comes to enabling client exposures, the roles are completely reversed. The Americas dominate providing 98% of services. The figures are on a different scale, with American banks enabling €190 billion ($201 billion) of client exposures.

American banks also substantially increased their own exposures – by almost four times, albeit from a small base. 2023 year end prudential exposures amounted to €531 million.

While APAC is viewed as a promising growth sector, by the end of 2023 it still lagged far behind. However, the figures depend on which banks are included in the dataset.

Of the four banks reporting in the ‘rest of world’ category, none reported any client crypto exposures. The banks’ own exposures were down 20% to a negligible €261 million with custody at €836 million. A lot of legislative changes have happened this year, so next year’s figures could be more interesting.

The statistics cover a total of 31 banks globally.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

RIPPLE NEWS : WISDOMTREE SUBMITS XRP ETF S-1 APPLICATION WITH THE US SEC

▪️WisdomTree Files for XRP ETF: WisdomTree Digital submits S-1 filing for an XRP ETF, marking growing institutional interest in Ripple's cryptocurrency.

▪️XRP Demand Surge: XRP's market value rises as institutional investors, including 21Shares and Bitwise, file for XRP ETFs amid U.S. regulatory clarity.

Last week, WisdomTree Digital Commodity Services, LLC, a subsidiary of a prominent New York-based asset management firm with over $113 billion in AUM, filed for an XRP exchange-traded fund (ETF) with Delaware authorities. Earlier today, the investment firm submitted to the Securities and Exchange Commission (SEC) the S-1 filing for the WisdomTree XRP Fund.

According to the SEC filings, the WisdomTree XRP Fund will tap into the Bank of New York Mellon (BNYM) as the trustee, fund accountant, and transfer agent.

However, the prospectus for the WisdomTree XRP Fund did not reveal the ticker that will be listed on the Cboe BZX Exchange, thus indicating several updates of the filings will take place in the near term.

Growing Interest in XRP Among Institutional Investors

As Coinpedia previously reported, the demand for XRP among institutional investors has significantly grown following the anticipated crypto policy implementation in the United States.

In addition to WisdomTree, several other fund managers have filed to offer a spot XRP ETF to prospective investors to help diversify their crypto portfolios.

For instance, asset management firm 21Shares recently fueled for a spot XRP ETF. Additionally, Bitwise, Grayscale Investments, and Canary Capital have all filed for a similar product.

As a result, it is evident that the demand for XRP among institutional investors is exponentially growing amid regulatory clarity in the United States.

Market Impact

The direct impact of the high demand for XRP among institutional investors is visible on the rising market value. The large-cap altcoin, with a fully diluted valuation of about $240 billion, overtook Solana (SOL) and Binance (BNB) to become the third largest crypto asset, excluding stablecoins.

After more than six years of consolidation, XRP price is well positioned to enter its discovery phase of the macro bull cycle in the coming months.

@ Newshounds News™

Source: CoinPedia

~~~~~~~~~

THE EASY WAY TO GROW YOUR WEALTH WITH XRP IN JUST 30 DAYS | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter

Thank you Dinar Recaps

A Few More Tidbits From TNT Monday Night 12-2-2024

TNT:

Tishwash: TikTok under scrutiny.. Central Bank suspends financial transactions with its agents in Iraq

The Central Bank announced, today, Sunday (December 1, 2024), the suspension of financial transactions with TikTok agents in Iraq.

The Central Bank stated in a document received by "Baghdad Today" that "it was decided to stop incoming and outgoing financial transactions for TikTok agents inside Iraq. link

TNT:

Tishwash: TikTok under scrutiny.. Central Bank suspends financial transactions with its agents in Iraq

The Central Bank announced, today, Sunday (December 1, 2024), the suspension of financial transactions with TikTok agents in Iraq.

The Central Bank stated in a document received by "Baghdad Today" that "it was decided to stop incoming and outgoing financial transactions for TikTok agents inside Iraq. link

Tishwash: Parliamentary Finance Committee sets a “national path” to end oil disputes between Baghdad and Erbil

The head of the Parliamentary Finance Committee, Atwan Al-Atwani, announced on Sunday the determination of a "national path" to resolve the oil disputes between Baghdad and Erbil, noting that the committee is preparing a report on amending one of the articles in the General Budget Law.

A statement by the committee received by Shafaq News Agency stated that Al-Atwani chaired an expanded meeting with the senior staff of the Ministry of Oil, in the presence of the committee members and a number of members of the Oil, Gas and Natural Resources Committee. The meeting discussed the files of managing the country's oil wealth and the future of oil prices, as the country's budget is formed by 90% of these revenues.

According to the statement, the meeting discussed developments in resolving outstanding issues with the Kurdistan Region regarding resolving disputes over calculating production costs and adapting foreign companies’ contracts to the Iraqi constitution, with the aim of resuming exports via the Turkish Ceyhan pipeline.

Al-Atwani pointed out that his committee is in the process of preparing its report on amending Article 12 of the General Budget Law, and submitting it to the House of Representatives for the second reading.

He stressed that the Finance Committee held a series of continuous meetings with officials in the federal government and the regional government, and "defined a national path to find a radical solution to this problem on a constitutional and legal basis and in a way that achieves justice in the distribution of wealth among Iraqis."

Al-Atwani stressed the need to set a timetable for implementing the provisions of the oil agreement between the center and the region, in accordance with what was stipulated in the draft law amending the Federal General Budget Law, which the Council of Ministers voted on and sent to Parliament.

In turn, the Undersecretary of the Ministry of Oil for Extraction Affairs, Basem Muhammad Khadir, reviewed the mechanisms for calculating the cost of oil production and transportation, and the most prominent understandings reached with the region in this regard.

The Undersecretary of the Ministry of Oil stressed the necessity for the Federal Ministry of Oil to be responsible for the reservoir management of the region’s oil fields, noting that his ministry has fixed standards for calculating the cost of producing a barrel of oil, whether at the level of fields managed by national effort or those managed by foreign companies. link

************

Tishwash: Association of Banks: 75% of the money supply is outside the banking system

The Private Banks Association said on Sunday, December 1, 2024, that three-quarters of the monetary mass in Iraq is outside the banking system.

The Executive Director of the Private Banks Association, Ali Tariq, said in a statement followed by "Ultra Iraq", "About 75 percent of the monetary mass is outside the banking system and requires a great effort to encourage citizens, companies and institutions to use the banking system more, which is currently happening, but this type of work needs to be accelerated to control financial operations in Iraq."

Despite what the director said in this regard, the World Bank claimed last February that the infrastructure for electronic payment systems in Iraq is “among the best in the region,” according to a statement issued by the Central Bank of Iraq .

“During the last two years, deposits in the banking sector have increased, but there is still a large amount of cash outside the banking system. This requires increasing confidence in the banking sector, whether governmental or private, and strengthening this confidence through the Central Bank of Iraq and the Iraqi government, in addition to offering investment programs for deposits that reflect on citizens’ deposits, which could generate returns for depositors in these banks, and thus there is an incentive and motivation to increase these deposits,” Tariq added.

The Iraqi authorities have taken steps towards activating the electronic payment system , starting with localizing employees’ salaries, and then installing electronic payment devices in different places, including gas stations. However, many experts and specialists still believe that the culture of electronic payment is not at the required level, for many reasons, including those related to economic and electronic culture, in addition to the fact that the widespread corruption in the country hinders its full implementation.

According to experts , the Iraqi government, through attempts to implement electronic payment, aims to withdraw the cash mass in circulation in Iraq, which amounts to 84 trillion dinars. link

Mot: Here is photographic evidence that Rudolph was not allowed to play in any reindeer games.

Mot: . ole "'Earl"" is mighty Handy He is!!

Central Bank Of Iraq Is Pleased To Present The Iraqi Banknotes In Circulation

Central Bank Of Iraq Is Pleased To Present The Iraqi Banknotes In Circulation

This technical leaflet highlights the security features and aims to be a guide to the public as well as to companies and commercial banks handling cash on a daily basis. In addition to the enhanced security features, the banknotes include raised printings to facilitate tactile recognition of the denominations by visually impaired users.

We encourage you to take your time to familiarize yourself with our banknotes and share the information with those around you. The current series of banknotes will be in circulation alongside the old banknotes, and there is no intention to withdraw the older banknotes from circulation.

Central Bank Of Iraq Is Pleased To Present The Iraqi Banknotes In Circulation

This technical leaflet highlights the security features and aims to be a guide to the public as well as to companies and commercial banks handling cash on a daily basis. In addition to the enhanced security features, the banknotes include raised printings to facilitate tactile recognition of the denominations by visually impaired users.

We encourage you to take your time to familiarize yourself with our banknotes and share the information with those around you. The current series of banknotes will be in circulation alongside the old banknotes, and there is no intention to withdraw the older banknotes from circulation.

CLICK HERE for the CBI PDF

https://cbi.iq/static/uploads/up/file-173304177261220.pdf

https://cbi.iq/news/view/2724