Iraq Economic News and Points To Ponder Late Saturday Evening 9-28-24

Washington And Baghdad Announce The End Of The Coalition's Military Mission In Iraq

Ali Mohsen Radhi2722024-09-27 Baghdad and Washington announced today, Friday, the end date of the international coalition's military mission in Iraq.

According to a joint statement by Baghdad and Washington, “Iraq and the United States of America have a strategic relationship, and as a result of consultations and discussions with the leadership of the international coalition to defeat ISIS and friendly member states, and intensive discussions within the US-Iraq Supreme Military Committee, which has worked diligently and professionally in intensive meetings over the past nine months, and after studying and evaluating the military and security situation in Iraq and the region, it announces the following:

First: Ending the coalition’s military mission in Iraq within the next twelve months, and no later than the end of September 2025, and moving to bilateral security partnerships that support Iraqi forces and maintain pressure on ISIS.

Washington And Baghdad Announce The End Of The Coalition's Military Mission In Iraq

Ali Mohsen Radhi2722024-09-27 Baghdad and Washington announced today, Friday, the end date of the international coalition's military mission in Iraq.

According to a joint statement by Baghdad and Washington, “Iraq and the United States of America have a strategic relationship, and as a result of consultations and discussions with the leadership of the international coalition to defeat ISIS and friendly member states, and intensive discussions within the US-Iraq Supreme Military Committee, which has worked diligently and professionally in intensive meetings over the past nine months, and after studying and evaluating the military and security situation in Iraq and the region, it announces the following:

First: Ending the coalition’s military mission in Iraq within the next twelve months, and no later than the end of September 2025, and moving to bilateral security partnerships that support Iraqi forces and maintain pressure on ISIS.

Second: Since Iraq is a key member of the coalition, and in order to prevent the return of the terrorist threat of ISIS from northeastern Syria, and depending on field conditions and consultations between Iraq, the United States, and coalition members, the coalition’s military mission operating in Syria from a platform to be determined by the Supreme Military Council will continue until September 2026.

Third: The Supreme Military Authority is committed to formulating the necessary procedures to achieve what is stated in the above paragraphs, and the timing and mechanisms for their implementation, including procedures to ensure the physical protection of coalition advisors present in Iraq during the transitional period, in accordance with the Iraqi constitution and laws. Practical steps to implement these obligations have begun.

Iraq thanks the coalition for the support and assistance it provided to the Iraqi security forces to confront this common threat and secure the defeat of ISIS on the ground in Iraq, and at the forefront of these countries is the United States of America, which stood with Iraq in difficult circumstances.

The coalition appreciates the role of Iraq and the great sacrifices made by all Iraqi security forces in fighting this terrorist organization that posed a threat to the entire world, and stresses the need to continue all efforts to ensure that the threat from this terrorist organization does not return in any form.

We look forward to strengthening relations between Iraq and the United States, as both countries seek to enhance security assistance and cooperation based on mutual respect, consistent with the U.S.-Iraq Strategic Framework Agreement and the Iraqi Constitution, and to advance an enduring bilateral partnership consistent with the U.S.-Iraq Joint Statement issued during Prime Minister Mohammed Shia al-Sudani’s visit to Washington, D.C., on April 15-16, 2024, and the U.S.-Iraq Joint Statement following the Second U.S.-Iraq Joint Security Cooperation Dialogue held in Washington, D.C., on July 22-23, 2024.

This historic transition marks a decade since the formation of the coalition military mission in Iraq, and Iraq continues to cooperate with the United States and other coalition members to establish bilateral security relationships where appropriate.

In order to facilitate the safe and orderly conclusion of the international coalition's military mission, the Government of Iraq affirms its commitment, in line with its international obligations, to protect international advisers present in Iraq at the invitation of the Iraqi Government. https://burathanews.com/arabic/news/451119

Al-Rafidain: Continuing To Update Data And Information To Ensure Safety From Suspicions Of Money Laundering

Friday 27 September 2024 09:34 | Economical Number of readings: 334 Baghdad / NINA / Al-Rafidain Bank announced, today, Friday, the continued updating of data and information to ensure safety from suspicions of money laundering. A statement from the bank stated, “In implementation of government directives and instructions from the Central Bank of Iraq/Anti-Money Laundering and Terrorist Financing Office, the Money Laundering and Terrorist Financing Reporting Department at Al-Rafidain Bank

conducted field visits to the bank’s branches in Baghdad and the governorates,” pointing to

“introducing the risks of money laundering and terrorist financing.” And

mechanisms for combating them,

reporting suspicious transactions and

monitoring them using available means and methods.” He added,

"The visits resulted in auditing the work of the liaison officers and following up on updating the (KYC) form, which guarantees the safety of customers' funds and accounts from any suspicions of money laundering," noting that

"due diligence measures were taken for companies and customers in accordance with the

Anti-Money Laundering and Terrorism Financing Law." /End2

https://ninanews.com/Website/News/Details?key=1157893

The Sudanese Advisor Indicates A Major Development In Iraq’s Financial Capabilities During 2024

September 28 13:32 Information/Baghdad... Today, Saturday, Mazhar Muhammad Salih, economic affairs advisor to Prime Minister Muhammad Shiaa al-Sudani, highlighted the development of Iraqi financial capabilities during 2024. Saleh said in a statement to the Al-Ma’louma Agency,

“The semi-annual oil revenues for the year 2023 amounted to 53.88 trillion dinars, while they rose during 2024 to more than 58.80 trillion dinars.” He added,

"Non-oil revenues amounted to approximately 0.42 trillion dinars during the six months of the year 2023, and at the end of the first half of the year 2024 they reached 7.18 trillion dinars." Saleh pointed out that

"there is a significant development in public financial capabilities during the year 2024 by maximizing Iraq's resources from non-oil sources."

On Monday, June 12, 2023, the House of Representatives approved the financial budget law for the three years 2023, 2024, and 2025, as the budget approved more expenditures and investments as a direct result of the increase in oil revenues, which constitute 90% of the country’s revenues at a price of $70 per barrel. Ended / 25 Q

https://almaalomah.me/news/77909/politics/مستشار-السوداني-يؤشر-تطورا-كبيرا-بقدرات-العراق-المالية-خلال

Specialist: The Iraqi Private Sector Is Capable Of Managing The National Economy

September 28, 2024 Last updated: September 28, 2024 The Independent/- Economic affairs specialist Hawraa Nouri Al-Qassab confirmed that the private sector is now capable of managing important aspects within the Iraqi economy.

Al-Qassab said that the past years have left behind accumulations of experience in the Iraqi private sector, enabling it to develop the reality of the national economy, which seeks qualitative performance that enhances all its production and service aspects.

She added that the Iraqi constitution gives the private sector a wide space in managing the national economy and moving it to a better stage than it was before. She pointed out that Iraqi human resources are the smartest in the region, which has made them gain experience faster. https://mustaqila.com/مختصالقطاع-الخاص-العراقي-قادر-على-ادا/

Iraq confirms its readiness to ensure the success of its mission to chair the Group of 77 and China for 2025

September 28, 2024

Baghdad / Iraq Observer

Today, Saturday, Foreign Minister Fuad Hussein affirmed Iraq’s readiness to cooperate with everyone to ensure the success of its mission to chair the Group of 77 and China for the year 2025.

A statement by the Ministry of Foreign Affairs stated, “Iraq achieved an important diplomatic achievement today by being officially elected to chair the Group of 77 and China for the year 2025 during the forty-eighth annual meeting held at the United Nations headquarters in New York on September 27, 2024.”

The statement added that “Deputy Prime Minister and Foreign Minister Fouad Hussein participated in the meeting in the presence of the Secretary-General of the United Nations, Antonio Guterres, and the President of the seventy-ninth session of the General Assembly, Philman Yang,” noting that

“the Foreign Minister delivered a speech in which he expressed his thanks and appreciation for the trust.” Which member states granted to Iraq.”

Hussein stressed that “Iraq will assume this role with seriousness and commitment to enhance solidarity among developing countries and achieve sustainable development goals,” stressing

“Iraq’s readiness to cooperate closely with all delegations and partners to ensure the success of its mission in the coming year and coordination to achieve the interests of member states and confront common challenges.”

Hussein expressed his “aspiration to work with all parties to achieve the group’s visions and enhance the active role of developing countries on the international scene, especially in light of the current global circumstances that require strengthening partnership and cooperation to achieve sustainable development and build a better future for all.”

The statement added, “This election reflects the confidence that the international community has given to Iraq and strengthens its leadership role on the international arena,” noting that

“the Foreign Minister’s speech was widely welcomed by the member states, as many countries extended their congratulations to Iraq and expressed their full support for his leadership of the group.” The participants pointed out the importance of strengthening cooperation. https://observeriraq.net/العراق-يؤكد-استعداده-لضمان-نجاح-مهمته/

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/

Exponential Debt Cycle is Past the Point of no Return

Steve St. Angelo: Exponential Debt Cycle is Past the Point of no Return

Palisades Gold Radio: 9-27-2024

Tom welcomes back Steve St. Angelo of the SRSrocco Report for a discussion on the record-high prices of gold and silver.

St. Angelo suggests these levels for silver could be a new floor as they've historically returned to production costs following price spikes. The average cost of primary silver production is around $26 an ounce, taking taxes and developmental costs into account.

Steve St. Angelo: Exponential Debt Cycle is Past the Point of no Return

Palisades Gold Radio: 9-27-2024

Tom welcomes back Steve St. Angelo of the SRSrocco Report for a discussion on the record-high prices of gold and silver.

St. Angelo suggests these levels for silver could be a new floor as they've historically returned to production costs following price spikes. The average cost of primary silver production is around $26 an ounce, taking taxes and developmental costs into account.

St. Angelo stresses the importance of distinguishing investment demand from industrial demand when analyzing the silver market dynamics.

A decade ago, there was a significant silver surplus due to decreased industrial demand which has since reversed with increased investment demand. Industrial demand is expected to consume all available supply, making additional investment demand potentially price-volatile.

Steve explores the impact of energy scarcity and continued money printing on production costs, driving up gold and silver prices due to inflationary pressures.

They discuss the possibility of a market correction offering the last chance to buy silver at present rates.

Steve and Tom delve into the relationship between expanding money supply, debt, federal funds rate, and silver price. Looking towards the period leading up to 2025, a market correction is anticipated due to increasing unemployment and possible employment data revisions.

Economic weakness could lead to reduced interest rates and more money printing, instigating inflation and purchasing power reduction. However, Commitment of Traders reports may not accurately reflect demand.

The global silver mine supply and output have been declining since 2015, necessitating existing inventories to bridge the deficit. This imbalance could lead to a substantial correction when prices significantly surpass production costs.

Concerns about marginal silver supply include transparent and non-transparent inventories, solar industry demand, and copper prices as indicators of industrial demand and potential recession. Steve discusses the shift from LBMA to ETF silver inventories.

Pre-pandemic, there was significant physical buying leading to expanded ETF inventories. However, in 2022, overall LBMA inventories decreased due to Indian purchasing and ETF withdrawals. Finally, Steve discusses the merits of assets such as Bitcoin, gold, and silver.

While some view Bitcoin as a digital counterpart to gold, Steve contends that saving in Bitcoin is not the same as saving in precious metals. This is due to Bitcoin mining causing considerable share dilution and due to the energy costs.

Steve advocates understanding asset worth based on economic progress versus past activity, emphasizing energy's role in asset value, and preparing for future energy realities.

Talking Points From This Episode

- Silver's new floor could be around average production cost ($26/oz).

- Industrial demand vs investment demand crucial in analyzing silver market dynamics.

- Economic instability, the energy cliff, inflation, and supply concerns may lead to significant price volatility.

Time Stamp References:

0:00 – Introduction

1:22 - New Silver Price Floor

3:30 - Miners & All-In Costs

5:55 - Energy & Money Supply

8:44 - Types of Metal Demand

11:35 - Money Printing & Silver

15:13 - Purchasing Power & Rates

17:06 - Fed Cuts & Corrections

21:37 - Utility of COT Reports

23:52 - Mine Supply & Output

28:44 - Silver & Manufacturing

31:54 - Grid Stability & Solar

34:40 - LBMA Silver Trends

37:06 - Miner Production & Shares

40:35 - Dedollarization & Gold

47:50 - Dr. Copper & Economy

51:34 - Energy & Volatile Mkts.

54:13 - Energy, GDP, & Debt

55:20 - Federal Deficits Chart

57:10 - Trends & Collapse

1:00:48 - U.S. Spending & Budget

1:02:50 - Bitcoin & Precious Metals

1:06:10 - Energy Store of Value

1:09:25 - Wrap Up

Seeds of Wisdom RV and Economic Updates Saturday Afternoon 9-28-24

Good Afternoon Dinar Recaps,

RIPPLE ADVANCES STABLECOIN INITIATIVE, ISSUES ANOTHER 350K RLUSD

Ripple mints 350,000 RLUSD to enhance testing on XRP Ledger and Ethereum, aiming for regulatory approval and improved ecosystem integration.

▪️Ripple mints 350,000 RLUSD stablecoins in 24 hours on XRPL and Ethereum.

▪️RLUSD stablecoin undergoes private beta testing for security and efficiency.

▪️XRP Ledger enhancements improve RLUSD's security and efficiency in beta testing.

Good Afternoon Dinar Recaps,

RIPPLE ADVANCES STABLECOIN INITIATIVE, ISSUES ANOTHER 350K RLUSD

Ripple mints 350,000 RLUSD to enhance testing on XRP Ledger and Ethereum, aiming for regulatory approval and improved ecosystem integration.

▪️Ripple mints 350,000 RLUSD stablecoins in 24 hours on XRPL and Ethereum.

▪️RLUSD stablecoin undergoes private beta testing for security and efficiency.

▪️XRP Ledger enhancements improve RLUSD's security and efficiency in beta testing.

Ripple has expanded its stablecoin operations by minting an additional 350,000 units of its RLUSD stablecoin within a span of 24 hours. This activity was carried out in two separate transactions, one consisting of 300,000 RLUSD and the other 50,000 RLUSD. The process was monitored by the Ripple stablecoin tracker, a community-driven XRP Ledger account that tracks the issuance and redemption of these stablecoins.

Ripple Sets Pace with Massive 350K RLUSD Stablecoin Mint

According to the Ripple stablecoin tracker, the recent minting marks a significant step in the testing phase for RLUSD. The issuance occurred through two separate transactions, one for 300,000 RLUSD and another for 50,000 RLUSD. This testing phase is crucial for ensuring the RLUSD meets the highest standards of security, efficiency, and reliability before its full-scale launch.

The minting demonstrates Ripple’s commitment to advancing its stablecoin offerings and enhances the liquidity and functionality of the RLUSD. Most recently, the XRP company reported issuing a record 485 RLUSD stablecoins, its largest single batch yet.

The private beta testing of the RLUSD aims to streamline the integration process across different blockchain platforms. This phase is vital for gaining regulatory approvals and for ensuring that the RLUSD can operate across various blockchain environments.

XRPL Upgrades Enhance Stablecoin Efficacy

The recent enhancements in the XRP Ledger are also pivotal to the optimal functioning of the RLUSD. Two major amendments, fixEmptyDID and fixPreviousTxnID, were activated on the XRPL mainnet, improving the ledger’s efficiency.

These updates will boost the stability and reliability of Ripple’s stablecoin operations. Concurrently, these will impact RLUSD’s performance and its integration within the broader ecosystem.

These technical upgrades facilitate a more robust framework for Ripple’s stablecoin initiatives. This will make the infrastructure supporting RLUSD align with the latest blockchain innovations.

In addition, the legal environment surrounding digital currencies remains a significant aspect of Ripple’s operational strategy. Recent developments in the Ripple vs. SEC case have brought to light the challenges faced by blockchain enterprises.

Insights from legal experts suggest that the SEC’s potential appeal against a favorable ruling for Ripple in the XRP lawsuit may have limited success.

XRP price reacted positively to the recent mint of RLUSD, surging to $0.622. The increase reflects a 5.44% gain over the last 24 hours, accompanied by a 60% rise in trading volume. However, recent CoinGape analysis have hinted at a potential 25% crash on on XRP price if SEC appeals before the October 7 deadline.

@ Newshounds News™

Source: CoinGape

~~~~~~~~~

NEW HOME SALES DECLINE IN AUGUST, YET YEAR-OVER-YEAR GROWTH REMAINS STRONG

▪️U.S. new home sales hit 716,000 in August 2024, exceeding the forecast of 699,000 but marking a 4.7% drop from July's figures.

▪️Year-over-year, new home sales jumped 9.8% compared to August 2023, signaling sustained housing market strength.

▪️August inventory climbed to 467,000 units, representing a 7.8-month supply, hinting at potential downward pressure on prices.

▪️Despite year-over-year gains, rising inventory and slower sales indicate a slightly bearish short-term housing outlook.

New Home Sales Fall in August, But Year-Over-Year Growth Persists

New residential home sales in the U.S. declined in August 2024, coming in below both the previous month’s figures and market expectations. However, despite this monthly dip, year-over-year data reveals a significant rise in activity.

Sales of New Homes Exceed Expectations in August

New single-family home sales in August 2024 came in at a seasonally adjusted annual rate of 716,000 units. This is a 4.7% decrease from the revised July figure of 751,000.

However, it exceeded economists’ forecast of 699,000 units, suggesting demand remains robust despite the monthly drop. Additionally, August 2024 sales showed a significant 9.8% increase compared to August 2023’s 652,000 units, highlighting continued year-over-year growth.

Home Prices Show Mixed Trends

The data also revealed mixed signals in home prices. The median sales price for new homes in August was $420,600. While this figure suggests the majority of home sales were occurring at relatively high price points, the average sales price jumped significantly higher, reaching $492,700. The gap between median and average prices highlights that a portion of the market consists of high-end sales, skewing the average price upward.

Inventory and Supply

At the end of August 2024, there were approximately 467,000 new homes on the market, representing a 7.8-month supply at the current sales pace. This indicates a relatively balanced market in terms of supply and demand, as a six-month supply is generally considered healthy. However, with sales slowing from the prior month, it suggests a potential buildup of inventory that could pressure future pricing if demand doesn’t rebound.

Market Forecast: Slightly Bearish Outlook

Given the month-over-month decline and higher-than-expected inventory levels, the outlook for the new home sales market leans bearish in the short term. The 4.7% drop from July, coupled with the rising inventory, suggests some cooling off in demand, which could impact pricing and sales volume in the coming months. However, the solid year-over-year growth hints that the market’s longer-term trend remains positive.

@ Newshounds News™

Source: FX Empire

~~~~~~~~~

$1,100,000,000,000 POURS INTO US BANKS AMID HIGH INTEREST RATES AS JPMORGAN CHASE, BANK OF AMERICA PAY PITTANCE TO DEPOSITORS: REPORT

US banks have reportedly raked in more than $1 trillion after two and a half years of the Fed’s “higher for longer” interest rate policy.

Data from the Federal Deposit Insurance Corporation (FDIC) shows the high interest rate regime allowed thousands of US banks to reap higher yields on their deposits at the Fed, reports the Financial Times.

And although a number of analysts and market observers thought the banks would pass on a significant portion of the higher interest rates to their customers, that didn’t happen.

In the second quarter of 2024 when the Fed was paying banks 5.5% in interest on deposits, savers were getting an average annual rate of 2.2%, according to regulatory data that includes accounts that do not pay any interest.

At JPMorgan Chase, savers received an annual interest rate of just 1.5% while Bank of America depositors collected 1.7% in interest per year.

With low interest for depositors, banks gained $1.1 trillion in additional revenue, about 66.67% of what the Fed paid in interest during the last two and a half years. Meanwhile, savers received only $600 billion.

When the Fed lowered interest rates this month, some banking giants were quick to further reduce the interest paid to wealthy depositors, with JPMorgan and Citi announcing 50 bps cuts in line with the Fed’s own actions.

@ Newshounds News™

Source: DailyHodl

~~~~~~~~~

ETHENA ANNOUNCES USTB STABLECOIN BACKED BY BLACKROCK'S BUIDL

Reserves for UStb will be invested in BUIDL, which in turn holds U.S. dollars, U.S. Treasury bills, and repurchase agreements.

▪️Ethena has announced a new stablecoin that invests its reserves in Blackrock's real-world asset fund called BUIDL.

▪️The team said UStb can support its synthetic stablecoin USDe during tough market conditions by allowing Ethena’s governance to close USDe hedging positions and reallocate assets to UStb.

Ethena announced today that it's developing a new stablecoin called UStb, which invests its reserves in BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

Its the second stablecoin from Ethena, as earlier this year it launched USDe, a synthetic stablecoin that derives its value from the cash-and-carry trade, an arbitrage strategy between an asset and its derivative to maintain its $1 peg.

In a blog post, the team explained that UStb will be a "wholly independent product" with a different risk profile compared to USDe.

The team also wrote that UStb helps USDe manage risk during tough markets by allowing Ethena's governance to reallocate backing assets to UStb when needed.

USDe has brought about some concern from industry stakeholders who say that while the trade is safe, volatility in the markets – which crypto is known for – can quickly cause it to unwind.

In a thread on X, the team addressed some of these concerns, pointing out that while USDe has remained stable despite recent bearish conditions, it can dynamically adjust its backing between basis positions and liquid stable products and may incorporate UStb during periods of weak funding rates if needed.

Ethena said in the post that UStb will be listed on centralized exchanges like Bybit, Bitget, and any future exchanges that Ethena partners with, where USDe is already used as margin collateral.

More details on UStb will be available in the coming weeks, Ethena said.

@ Newshounds News™

Source: CoinDesk

~~~~~~~~~

🌍 JIM SAID WHAT? ROCKS IN HEAD OR FACTS? | Youtube

Jim discusses historical information on our Constitution and rights and how we got to where we are today. Must hear this information.

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Economist’s “News and Views” Saturday 9-28-2024

Commodity Culture: BRICS Gold-Backed Currency to be Serious Rival to the Dollar within 2 Years

Friday, 27 September 2024, 22:04 PM

In an enlightening discussion with Commodity Culture, Simon Hunt painted a vivid picture of a world on the brink of significant geopolitical upheaval. As he delves into the complexities of modern power dynamics, he posits that the BRICS nations — Brazil, Russia, India, China, and South Africa — are poised to turn the tables on what has long been considered Western hegemony.

This change, he suggests, won’t just be economic; it will be accompanied by kinetic conflicts in the Middle East and Europe, presenting a multifaceted challenge to the existing world order.

Commodity Culture: BRICS Gold-Backed Currency to be Serious Rival to the Dollar within 2 Years

Friday, 27 September 2024, 22:04 PM

In an enlightening discussion with Commodity Culture, Simon Hunt painted a vivid picture of a world on the brink of significant geopolitical upheaval. As he delves into the complexities of modern power dynamics, he posits that the BRICS nations — Brazil, Russia, India, China, and South Africa — are poised to turn the tables on what has long been considered Western hegemony.

This change, he suggests, won’t just be economic; it will be accompanied by kinetic conflicts in the Middle East and Europe, presenting a multifaceted challenge to the existing world order.

As the dollar faces threats from rival currencies and growing inflationary pressures mount, investors may increasingly turn to gold not merely as an investment but as a protection against potential currency collapse. The perception of gold as a timeless store of value may experience a renaissance, prompting individuals and nations alike to stockpile the precious metal to buffer against future uncertainties.

Simon Hunt’s discussion with Commodity Culture serves as a clarion call to recognize the dynamic changes underway in global politics and economics. With the rise of BRICS, potential currency wars, and the specter of World War 3, we must prepare for a radically different world.

Investors, policymakers, and everyday individuals need to stay informed about these developments, understand the implications of shifting power dynamics, and take proactive steps to protect their economic interests.

As we look to the future, commodities, particularly gold, will likely form the bedrock of a resilient strategy to navigate the choppy waters ahead. It’s an urgent reminder: in a world marked by conflict and uncertainty, preparedness is the key to survival.

A 1930s Economic Crisis is Here: “I’m Going to Be Screaming to Buy Gold”

Daniela Cambone: 9-27-2024

Join Daniela Cambone for an electrifying episode of The Daniela Cambone Show! Today’s guest, Joel Litman of Altimetry, warns us of a potential return to economic conditions similar to the 1930s and 1970s.

With five key policies being discussed in Washington—including raised taxes, capital gains hikes, and price controls—we could be on the brink of significant market shifts.

Joel shares why, for the first time in his career, he believes gold could outperform the S&P 500, and he explains the critical factors investors should be watching now.

Could these economic headwinds signal a gold rush? Or will the stock market prevail?

Tune in as Joel dives into how government policies, potential tax changes, and economic history could impact your investments.

CHAPTERS:

00:00 5 things in economy to watch out

3:50 Harris and Biden’s economic plans

5:52 Gold performance

6:46 Stock market

8:30 Fed rate cuts

10:01 Debt crisis

11:42 Trump’s tariff protection policy

18:42 Joel’s conference

US Economy on Brink of Collapse: Japan ditch US Dollar!

Fastepo: 9-27-2024

Foreign governments heavily invest in U.S. Treasury securities, facing significant risks. Rising U.S. interest rates can decrease the market value of Treasuries, leading to potential losses during sudden rate hikes often triggered by inflation.

Additionally, a weakening U.S. dollar diminishes the value of these investments when converted to other currencies, presenting a risk particularly for nations with volatile or strengthening currencies.

Threats of inflation can also reduce the real returns on U.S. Treasuries if the inflation rate exceeds the yields, which erodes the purchasing power of foreign reserves.

Political and geopolitical tensions, such as U.S. debt ceiling debates, may disrupt market confidence and financial market access, increasing investment risk.

Furthermore, liquidity risks during financial crises can force large holders to sell at lower prices, negatively impacting market values. Countries with substantial holdings, like China and Japan, face concentration risks that could result in significant losses if the U.S. financial system struggles or if the dollar sharply declines, complicating their market exit strategies.

As of September 2024, Japan is the top international investor in U.S. government bonds, despite experiencing noticeable fluctuations in its investment levels over the year. In March 2024, Japan held U.S. Treasuries worth approximately $1.87 trillion.

However, by May, this figure had reduced to about $1.128 trillion following cumulative sales of $59.5 billion, including a significant reduction of $22 billion in May after a $37.5 billion decrease in April.

“Tidbits From TNT” Saturday 9-28-2024

TNT:

Tishwash: Setting a date to launch 102 investment opportunities in Iraq

Today, Friday, the Chairman of the National Investment Commission, Haider Makiya, set the date for launching 102 investment opportunities in various sectors.

Makiya said, "The Investment Commission is preparing, during the Iraqi Investment Forum conference that will be held on the second of next October, to launch 102 investment opportunities that have completed sectoral approvals," noting that "these projects that will be announced will include various sectors, and will benefit the citizen and the state."

TNT:

Tishwash: Setting a date to launch 102 investment opportunities in Iraq

Today, Friday, the Chairman of the National Investment Commission, Haider Makiya, set the date for launching 102 investment opportunities in various sectors.

Makiya said, "The Investment Commission is preparing, during the Iraqi Investment Forum conference that will be held on the second of next October, to launch 102 investment opportunities that have completed sectoral approvals," noting that "these projects that will be announced will include various sectors, and will benefit the citizen and the state."

He pointed out that "these projects were the result of numerous discussions within the operations room within the authority, with the membership of the Iraqi Economic Council, as well as the Prime Minister's Office, and a map was drawn up for the projects that are expected to be implemented by the beginning of November."

Regarding environmental sustainability projects, Makiya confirmed that “the Authority is working with Iraqi banks to set goals, plans and applications for banks to finance climate and environmental change projects,” indicating that “the Authority has projects and a round of discussions with the International Finance Organization that will be announced soon.” link

Tishwash: Foreign Minister invites his Venezuelan counterpart to visit Baghdad

Deputy Prime Minister and Minister of Foreign Affairs Fuad Hussein extended an official invitation to Venezuelan Foreign Minister Ivan Gil Pinto to visit Baghdad.

The Ministry of Foreign Affairs stated in a statement received by Al-Maalouma Agency, that “the Minister of Foreign Affairs met with his Venezuelan counterpart, on the sidelines of the 79th session of the United Nations General Assembly in New York, and discussed with him relations between Iraq and Venezuela and the importance of strengthening them after 75 years of its establishment.

The common denominators in the fields of oil production and gas reserves were also discussed, stressing the need for continuous coordination in these important areas.”

International issues of common interest were also discussed, most notably the Palestinian issue. Fuad Hussein thanked Venezuela for its honorable and supportive stances towards the Palestinian cause.

Within the framework of strengthening bilateral relations, the available opportunities for developing cooperation in the fields of agriculture and oil expertise were discussed.

The two ministers focused on the importance of exchanging expertise in exploiting associated gas and enhancing cooperation in this field.

It was emphasized to follow up on the work of the joint committee between the two countries, activate the signed memoranda of understanding, and move forward in completing the procedures for signing the memoranda that are still under completion.

At the end of the meeting, Fuad Hussein extended an invitation to his Venezuelan counterpart to visit Baghdad, to strengthen bilateral relations between the two countries. link

************

Tishwash: Kurdistan Finance announces the results of its delegation's recent visit to Baghdad

The Ministry of Finance in the Kurdistan Regional Government announced the results of its delegation's visit to the capital, Baghdad, regarding the issue of financing the salaries of employees in the region.

A statement by the ministry said, "During the past few days, a delegation from the Ministry of Finance in the Kurdistan Regional Government visited the capital, Baghdad, and met with the federal Ministry of Finance on the issue of financing employees' salaries," noting that "the two sides reached a number of understandings."

The statement pointed out that "the Kurdistan Ministry of Finance has submitted the list of employees' salaries for the months of August and September, as requested by the Federal Ministry of Finance last time."

He added, "In order to cover the deficit in August salaries, which is estimated at 243 billion dinars, the Federal Ministry of Finance decided to disburse the suspended payments from February to August, and it is scheduled to begin distributing salaries at the beginning of next week with the arrival of supplementary funding from Baghdad." link

************

Tishwsh: Al-Asadi: We call on citizens to invest in the retirement and social security law

During his visit to Najaf Governorate today, Saturday, September 24, 2024, the Minister of Labor and Social Affairs, Mr. Ahmed Al-Asadi, called on citizens to invest in the Retirement and Social Security Law and expedite registration for optional insurance.

Al-Asadi announced the completion of the procedures for issuing smart cards to more than 17,074 new families during the opening of schools designated for people with special needs.

During the visit, he explained a number of measures regarding what the ministry has accomplished:

* Issuing smart cards to 13,498 people with disabilities and special needs.

* Completion of the smart card for children with diabetes, amounting to 3496.

* Completion of the smart card for 80 orphans, and they will receive the cash assistance next Tuesday, corresponding to 10-1-2024.

* The number of those included in Najaf Governorate reached more than 110,594 families.

* 2,433 new families from Najaf Governorate were included, and smart cards were issued to more than 1,226 families in Najaf, and they will receive the aid next Tuesday.

* We have completed the transfer of more than 12,000 social protection beneficiaries to the Ministry of Interior, including 998 beneficiaries from Najaf Governorate.

* Today we opened Elia Elementary School for Special Education in Najaf Governorate.

* Today we opened the main reception hall for beneficiaries in the Women's Social Protection Department.

* Today we opened the safe environment hall for raising children in the Women's Social Protection Department.

* We opened electronic inquiries and a central computer room for the Social Protection Department for Men.

* We announce that all individuals at Elia School are included in the social protection allowance and the full-time assistant.

* We have directed to take rapid measures to facilitate the granting of loans.

* We directed the Disability Rights Commission to open more than one new medical committee in the governorate.

* We directed to focus on opening new sub-committees for social protection in the governorate. link

Mot: ... Issues I Can Get Behind

Mot: Have a wonderful day everyone.

Seeds of Wisdom RV and Economic Updates Saturday Morning 9-28-24

Good Morning Dinar Recaps,

HAS ECB CRACKED THE CODE FOR DIGITAL EURO CBDC ADOPTION?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the digital euro in particular.

They distinguish between adoption and usage. While consumers may decide to include a new payment method, they won’t necessarily use it that often.

Good Morning Dinar Recaps,

HAS ECB CRACKED THE CODE FOR DIGITAL EURO CBDC ADOPTION?

Two economists at the European Central Bank have modelled how to get consumers to adopt a central bank digital currency (CBDC) and the digital euro in particular.

They distinguish between adoption and usage. While consumers may decide to include a new payment method, they won’t necessarily use it that often.

To create their model, the economists used the 2022 ECB Study on Payment Attitudes of Consumers in the EU (SPACE). Given it was post COVID, it showed changes in payment behaviors such as an increase in usage of mobile payments for person-to-person payments which rose from 3% in 2019 to 10% in 2022.

Unsurprisingly, they found consumers prefer to stick to familiar methods, such as cards and cash. Switching incurs a significant adoption cost, in terms of money, time and effort.

Three steps to make adoption worthwhile

One avenue to make the switching costs worthwhile is to design the CBDC to combine the relative advantages of both cards (usability) and cash (controlling usage and privacy). The model showed this could increase adoption by 80% and usage by 140%.

A second strategy is to communicate these benefits effectively. While this had some benefit, the impact was smaller compared to the design choices.

Thirdly, the economists highlight the importance of surfing network effects. We believe this implies there could be different strategies for different jurisdictions. In some regions P2P payments might be more popular, so this could be the area to push. In other jurisdictions there may be more potential for Point of Sale payments (PoS). For example, the SPACE survey showed usage of mobile payments at PoS at 10% in the Netherlands versus 1% in Slovenia.

They argue that regions more eager to adopt new payment technologies will be more open to CBDC. That makes sense. However, we see a counterargument that if users adopt new payment technologies they could perceive less need for a CBDC.

The economists also highlight the role of legislation in ensuring distribution, such as obliging banks, and requiring merchants to accept the digital euro at PoS.

Other digital euro reports

Meanwhile, in other digital euro news, during August an NEBR paper explored the impact of a potential digital euro on banks, European payment providers and US payment providers.

It found upbeat press mentions of a digital euro coincided with positive stock price movements for European payment firms and negative ones for American firms. There was no impact on banks.

Another report was published by the Veblen Institute and Positive Money, two organizations that are critical of banks. They highlight that there’s an option for the ECB and national central banks to sidestep private payment providers and go direct to consumers.

We confirm that legally the central banks and governments are also ‘payment service providers’ (PSPs), and it is PSPs that will provide wallet services for the digital euro, per draft legislation.

The IMF recently published a report on CBDCs exploring how to encourage adoption by consumers and merchants.

@ Newshounds News™

Source: Ledger Insights

~~~~~~~~~

COULD ROBINHOOD AND REVOLUT FIND STABLECOIN SUCCESS WHERE PAYPAL STUMBLED?

If Robinhood and Revolut do make a run at launching a stablecoin, as reported, can they each avoid the same fate as PayPal's PYUSD?

Fintech heavyweights Robinhood, a U.S. investing app, and Revolut, a crypto-friendly neobank based in London, are considering launching their own stablecoins, unnamed sources told Bloomberg this week.

The giants are eyeing the stablecoin market at a time when Tether (USDT), with its $119 billion market capitalization, accounts for roughly 68% of the $173.5 billion category.

With Europe offering clearer regulatory frameworks, the fintech giants could bring a new wave of competition. However, the question remains: Can they break through Tether's dominance, or will they struggle like other giants before them?

Although neither company has officially confirmed their plans, both companies are considering stablecoin issuance, according to a report on September 26.

Fred Schebesta, founder of Finder.com, sees the potential for Robinhood and Revolut but acknowledged the challenge.

“Revolut and Robinhood definitely have a shot at making a dent in USDT’s dominance, but it's going to take a lot of integration to get there,” he said. “USDT has a deep-rooted presence in the market, and people, for some reason, still place an unusual amount of trust in it.”

He said PayPal's stablecoin demonstrates that “even big players aren’t gaining much traction yet,” but added that Robinhood and Revolut have a chance to try a different approach.

“Their platforms are more integrated with retail investors,” Schebesta said, “and if they can leverage those ecosystems properly, they might find an edge that PayPal hasn't tapped into yet.”

Pav Hundal, a market analyst at Australian crypto exchange Swyftx, agrees that scale will be crucial.

“Stablecoins are a game of scale, or relative scale if you have a niche offering,” he told Decrypt. “Robinhood and Revolut possess scale in abundance and clearly have some level of conviction that they can leverage their huge global networks to take a slice of Tether’s market.”

The two companies also have one major advantage, he added: Both companies are already regulated in many jurisdictions around the world. “But for now, Tether exists on an entirely different plane of existence to its competitor,” Hundal said.

PayPal isn’t alone in its struggles with PYUSD. Even giants like JPMorgan Chase, Meta (Facebook), and Binance have attempted to conquer the stablecoin world—each meeting their own unique challenges and limitations.

JPM Coin found its place within internal banking but failed to penetrate wider retail or DeFi markets. Meta’s Diem, once heralded as the “future of money,” crumbled under regulatory pressures, never seeing the light of day.

Binance's BUSD has grown, but even it remains a distant competitor to Tether, unable to topple the giant.

Tether’s entrenched position as the crypto exchanges’ primary trading pair sets a high bar for liquidity that new entrants must match. The stablecoin market's deep liquidity pools, network effects, and established trust create high barriers for new entrants.

@ Newshounds News™

Source: Decrypt

~~~~~~~~~

XRP LEDGER IMPLEMENTS TWO MAJOR UPDATES TO BOOST ECOSYSTEM FUNCTIONALITY

▪️XRP Ledger announces two updates that enhance its functionality.

▪️Ripple’s stablecoin RLUSD may benefit from these new updates.

▪️Continued blockchain advancements support Ripple's ecosystem growth.

The XRP Ledger (XRPL) has announced two significant updates following a recent modification.

These developments have attracted attention, particularly due to rising expectations surrounding the potential launch of Ripple’s stablecoin, RLUSD. Consequently, there is curiosity about how these updates will impact the stablecoin’s functionality and the overall ecosystem.

XRP Ledger Executes Two Major Updates

According to an XRPScan report, the XRP Ledger implemented two important updates named “fixEmptyDID” and “fixPreviousTxnID” last Friday. Both updates received support from 31 validators, surpassing the 28/35 threshold.

The first update aims to prevent the creation of empty DID ledger entries that previously occupied unnecessary space. With this change, any transaction attempting to create such entries will result in an error. This endeavor is expected to enhance ledger efficiency without interfering with existing processes.

Will Ripple’s Stablecoin RLUSD Be Affected?

Ripple $0.620272 has begun beta testing its stablecoin on both the XRPL and Ethereum $2,675 networks. Recently, Ripple released two batches of the RLUSD stablecoin, each containing 485 RLUSD. These developments have intensified speculation regarding how the recent updates on XRPL will influence the operation of the stablecoin.

Ripple President Monica Long confirmed that RLUSD would be launched this year if it receives U.S. approval.

Long expressed expectations that the stablecoin would serve broader areas compared to Ripple’s native cryptocurrency, XRP. She also noted that decentralized exchanges (DEX) on the XRPL could benefit from the stablecoin’s efficiency, while XRP would be utilized for smaller cryptocurrency transactions.

These statements suggest that the recent XRPL updates could empower both RLUSD and the XRP ecosystem, offering more functionality and flexibility across multiple applications.

In a period marked by continuous advancements in blockchain technology, such technical updates within the XRP Ledger may contribute to strengthening the Ripple ecosystem and enhancing investor confidence.

@ Newshounds News™

Source: CoinTurk

~~~~~~~~~

IS THE US DEBT CLOCK ACCURATE? LET'S PEEK | Youtube

@ Newshounds News™

Source: Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Sovereign Debt Collapse to Flip Global Monetary System

Sovereign Debt Collapse to Flip Global Monetary System

Sean Foo and Andy Schectman: 8-27-2024

As the US debt plateaus at over $31 trillion, a significant concern looms for economists, policy makers, and citizens alike: the possibility of sovereign default.

The consequences of such an event extend beyond mere finances; it signals a seismic shift in the global economic order, potentially leading to a reset of monetary systems and a renewed recognition of gold’s value as a cornerstone of wealth preservation.

Sovereign Debt Collapse to Flip Global Monetary System

Sean Foo and Andy Schectman: 8-27-2024

As the US debt plateaus at over $31 trillion, a significant concern looms for economists, policy makers, and citizens alike: the possibility of sovereign default.

The consequences of such an event extend beyond mere finances; it signals a seismic shift in the global economic order, potentially leading to a reset of monetary systems and a renewed recognition of gold’s value as a cornerstone of wealth preservation.

This exploration examines the factors contributing to the current financial landscape, the looming threat of default, and how international tensions shape our economic reality.

Every day, the US government grows tighter with its fiscal policies, choosing to borrow extensively to finance its obligations. The debt has soared due to persistent budget deficits, which often result from a mix of extravagant spending and declining revenues.

As interest rates rise, so do the costs associated with servicing this gargantuan debt. The Debt-to-GDP ratio continues to climb, causing concern among analysts that a tipping point will soon be reached—one where the US will spend more on debt servicing than it does on crucial domestic programs.

In the face of potential economic turmoil, many investors are revisiting gold as a fundamental asset. Historically, gold has maintained its value even in times of crisis, often serving as a hedge against inflation and currency devaluation. Should a sovereign default occur, it’s likely we would see a rush to gold, as investors seek to protect their wealth when traditional currencies falter.

Moreover, gold’s growing appeal can be linked to the increasing uncertainty surrounding fiat currencies, especially the US dollar. The more volatile and unpredictable the monetary policy, the more individuals and countries may turn to gold as a reliable store of value.

While the internal economic factors pose significant challenges, the landscape of international relations exacerbates the situation. The economic war between the US, China, and Russia is intensifying, with sanctions, trade conflicts, and technological rivalry shaping a new multipolar world order.

Superpowers are increasingly weaponizing economic dependencies, with China promoting the Yuan in international trade and Russia expediting efforts to bypass the US dollar. This tension heightens the potential for conflict and instability, which could ultimately bring about an economic environment ripe for crisis.

As the dynamics of international economics shift, the US’s precarious financial situation becomes even more alarming. The interplay of escalating debt, potential default, and the increasing value of gold amidst geopolitical strife creates a perfect storm that could steer us toward a financial cliff.

The confluence of skyrocketing US debt, the specter of sovereign default, and escalating geopolitical tensions creates a maelstrom of uncertainty in our economic landscape. While we can only speculate on the exact timeline and nature of these impending crises, one truth remains clear: the decisions we make today will shape the financial reality of tomorrow.

Understanding these risks and strategically positioning oneself for the potential economic reset could be the key to navigating what lies ahead. Prepare, adapt, and maintain vigilance—because the storm is approaching, and its arrival could redefine the world as we know it.

Watch the video below from Sean Foo with Andy Schectman for further insights.

IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts - Non-Oil GDP Growth

IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts - Non-Oil GDP Growth

MilitiaMan and Crew: 9-27-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts - Non-Oil GDP Growth

MilitiaMan and Crew: 9-27-2024

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economic Updates Friday Evening 9-27-24

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

Good Evening Dinar Recaps,

GENSLER SUGGESTS BNY MELLON’S CRYPTO CUSTODY MODEL COULD EXPAND BEYOND BITCOIN AND ETHER ETFS

BNY Mellon explores extending regulated crypto custody beyond ETFs.

▪️Gensler suggests BNY Mellon's crypto custody model could apply to various digital assets.

▪️The crypto custody market is growing rapidly, with banks poised to benefit from secure, regulated services.

In comments to Bloomberg today, SEC Chair Gary Gensler discussed BNY Mellon’s crypto custody structure. He suggested that the model used for Bitcoin and Ether ETFs could be applied to other digital assets.

While the current approval applies only to Bitcoin and Ether ETFs, Gensler noted that the custody structure is not limited to specific crypto assets.

“Though the actual consultation related to two crypto assets, the structure itself was not dependent on what the crypto was, it didn’t matter what the crypto was.” said Gensler.

BNY Mellon now has the flexibility to extend its custody services to other digital assets if it chooses. Gensler emphasized that the “non-objection” is based on the structure itself, not the type of crypto asset, allowing other banks to adopt the same model for crypto custody.

The approval hinges on BNY’s use of individual crypto wallets, ensuring that customer assets are protected and segregated from the bank’s own assets in the event of insolvency. This wallet structure was developed in consultation with the SEC’s Office of Chief Accountant, leading to the agency’s “non-objection” decision.

This approval guarantees that the bank’s approach complies with regulatory requirements, preventing customer assets from being at risk during bankruptcy, a key issue that has plagued crypto platforms like Celsius, FTX, and Voyager.

The crypto custody market, estimated to be worth $300 million and growing by 30% annually, represents a lucrative opportunity for financial institutions.

With non-bank providers typically charging much higher fees for digital asset custody compared to traditional assets, banks like BNY Mellon are well-positioned to capitalize on this growing demand by offering more secure and regulated solutions.

@ Newshounds News™

Source: CryptoBriefing

~~~~~~~~~

@ Newshounds News™

Live Call: https://t.me/+CpYhls2JLGc5YWRh

~~~~~~~~~

BIG Silver Price and coin news

The Economic Ninja

(9/26/2024)

🚀 Silver surged to a 12-year high in 2022, gaining 37% since January 2023, driven by expectations of Fed rate cuts and increased demand in renewable energy, electronics, and electric vehicles.

💡 The global renewable energy market is projected to grow from $1.14 trillion in 2023 to $5.62 trillion by 2025, with a 17.3% annual growth rate, boosting silver's industrial applications.

🔬 Silver has more patents tied to it than any other metal, used in everyday items like water filters, cell phones, and solar panels, with companies indifferent to price fluctuations due to the small amounts needed in production.

📈 The Federal Reserve's pivot towards easier monetary policy, potential future rate cuts, and China's economic boost efforts have supported silver's price gains.

💼 Silver is considered a tangible, real investment that can be vaulted, contrasting with the stock market's perceived "vaporware" nature, with recommendations to invest in the cheapest possible silver coins.

@ Newshounds News™

Source: The Economic Ninja

~~~~~~~~~

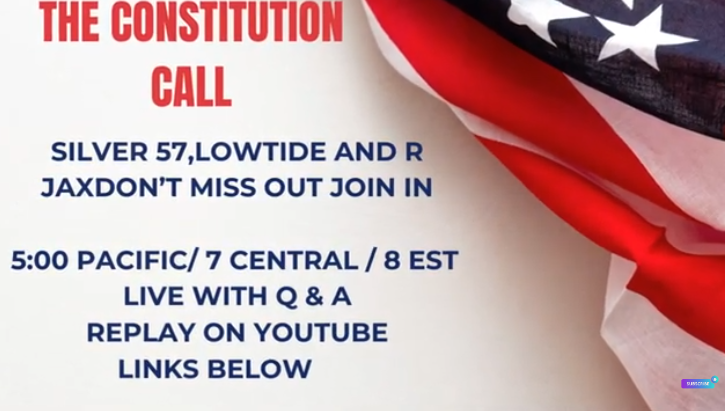

Join Us for the Constitution Call Tonight - You Won't Want to Miss It! Seeds of Wisdom Team | Youtube

@ Newshounds News™

Visit, Like and Subscribe to Seeds of Wisdom Team Currency Facts

~~~~~~~~~

Seeds of Wisdom Team Currency Facts Youtube and Rumble

Newshound's Podcast Link

Newshound's News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter

Thank you Dinar Recaps

Some “Iraq News” Posted by Clare at KTFA 9-27-2024

KTFA:

Clare: The government announces the suspension of gasoline imports and the closure of the currency auction at the end of the year

9/26/2024

Prime Minister Mohammed Shia Al-Sudani participated in New York, after midnight on Wednesday, in a dialogue session held by the American Chamber of Commerce and Al-Monitor, in the presence of an elite group of investors, businessmen, representatives of American companies, and the Iraqi-American Business Council.

During the session, Al-Sudani pointed to the new reality of Iraq, which is witnessing an economic and developmental renaissance in all its sectors. It has also taken great steps in the field of energy investment and associated gas, which had been wasted for years and cost the country losses estimated at billions of dollars, due to the import of gas and petroleum derivatives.

KTFA:

Clare: The government announces the suspension of gasoline imports and the closure of the currency auction at the end of the year

9/26/2024

Prime Minister Mohammed Shia Al-Sudani participated in New York, after midnight on Wednesday, in a dialogue session held by the American Chamber of Commerce and Al-Monitor, in the presence of an elite group of investors, businessmen, representatives of American companies, and the Iraqi-American Business Council.

During the session, Al-Sudani pointed to the new reality of Iraq, which is witnessing an economic and developmental renaissance in all its sectors. It has also taken great steps in the field of energy investment and associated gas, which had been wasted for years and cost the country losses estimated at billions of dollars, due to the import of gas and petroleum derivatives.

Al-Sudani stressed that the government has embarked on a series of rapid projects, including the important agreement with Total, which will contribute to increasing oil production and investment in associated gas by about (600) million standard cubic feet, in addition to offering the fifth and sixth rounds’ annexes, and entering into contracts to produce oil and invest in gas

Indicating that after 2028, Iraq will achieve self-sufficiency in gas, in addition to activating oil derivatives projects, including the strategic Karbala refinery, whose production capacity reaches 140 thousand barrels per day, as well as rehabilitating the Baiji refinery, which was completely destroyed during the battles to liberate Baiji, and its production capacity is 150 thousand barrels per day.

The following are the highlights of the Prime Minister's speech during the dialogue session:

When I assumed my duties as Prime Minister, the investment in associated gas was less than 40 percent, and now the percentage has risen to about 70 percent.

We have ended the import of petroleum derivatives, and we will stop importing gasoline at the beginning of next year, after completing the FCC project in Basra.

We are ready to enter into a partnership with American companies in the oil industry sector.

Our vision is to convert 40% of exported oil into transformation industries, which will give us more benefits than selling crude oil.

Our policy is based on diversifying the contracting parties that invest in our oil and gas fields without specific conditions.

The licensing round procedures are clear and transparent, and there is no favoritism or preference for one company over another.

Development cannot be achieved without a solid banking sector that operates according to approved international standards, and 95% of financial transfers in Iraqi trade are conducted through reliable banks.

The currency selling window will be closed at the end of this year, and the money laundering office at the Central Bank is operating effectively. The government contracted with Ernst & Young to reform the government banking sector, and we strengthened citizens’ confidence in banks and expanded financial inclusion.

Iraq is going through an unprecedented period of stability and recovery since 2003, which is an opportunity to support the transition from a period of wars and conflicts to a period of development and stability.

A stable Iraq in a sensitive region is beneficial to the world, which is what we have witnessed since October 7, as Iraq has largely maintained balance and calm, and we have kept Iraq away from the arena of conflict.

Our security forces have reached an advanced stage of capability and efficiency, and we have begun an armament program to enhance their capabilities, and ISIS today does not pose a threat to our security.

We need American small and medium-sized companies to partner with Iraqi companies.

We work to create job opportunities for young people by activating the private sector or supporting their private projects, through several programs, including the (Riyada) initiative.

The size of the projects granted for investment will provide a large number of jobs, and it is necessary for companies operating in Iraq to open training centers to develop the capabilities of young people.

We have confirmed to the companies operating in the electricity sector the establishment of stations maintenance centers in order to speed up completion and reduce costs.

The government has a clear direction to support the agricultural sector, and farmers and growers are in a transitional phase to use modern irrigation technologies, which we supported by 30%.

We provided loans to workers in the food industries sector of various types, part of which is covered by sovereign guarantees.

The Central Bank has independence and exercises its powers with complete professionalism, and we intend to establish a new bank that adopts the latest technologies.

We invite all companies working in the field of electronic payment to work in Iraq and we will provide them with all facilities.

We have developed a plan to develop the infrastructure, with allocations amounting to $83 billion. LINK

**

Clare: Al-Sudani issues banking directives, including suspending capital increases for banks subject to US sanctions

9/26/2024

A Government source revealed, on Thursday, that Prime Minister Mohammed Shia al-Sudani issued directives related to financial and banking reforms, including not increasing the capital of banks subject to US sanctions.

The source told Shafaq News Agency, "Prime Minister Mohammed Shia al-Sudani, before leaving for New York, held a number of meetings with banks and the Central Bank of Iraq, where those meetings discussed in detail the Central Bank of Iraq's plan to rehabilitate private banks by contracting with an international consulting company."

He explained that "the Prime Minister directed a number of points, on the importance of the plan for developing private banks by Oliver Wyman Company being clear in terms of timing, distribution of responsibilities, and issuing progress reports in this regard."

The directives included "accelerating the implementation of the recommendations issued by the Ministerial Council for the Economy to support Iraqi banks, including delaying the increase in capital for banks banned from dealing in dollars by the US Treasury."

The source indicated that Al-Sudani also directed "the preparation of a study to activate the local cards project internally, as well as urging Iraqi ministries and institutions to increase dealings with licensed Iraqi banks in various banking services and open accounts with them."

Last Monday evening, Iraqi Prime Minister Mohammed Shia al-Sudani received US Deputy Treasury Secretary Wally Adeyemo and a number of officials from the Treasury Department, according to a statement received by Shafaq News Agency.

The meeting witnessed discussion of bilateral economic relations between the two countries in various vital sectors, review of the government's efforts and plans for economic and financial reform, the move towards diversifying sources of Iraqi output, enhancing development targets, and practical measures implemented in the field of combating money laundering.

Al-Sudani stressed that the government has made great strides in the financial and banking reform file, and 95% of bank transfers have been completed through the electronic platform, and less than 5% remains to be completed by the end of this year, after which the transition to the correspondent banking system will take place, in accordance with the government’s approach and its commitment to raising the capabilities of Iraqi banks, in line with international standards and meeting the needs of the thriving investment environment in Iraq.

For his part, Adeyemo praised the progress witnessed by Iraq in the field of economic and banking reforms that were achieved in record time, and the state of economic growth that reached a total of about 6 % , which enhances the government's efforts in development, expressing readiness to cooperate and work within a bilateral partnership that serves the interests of economic development. LINK

Clare: Masoud Barzani to a parliamentary delegation: There is an opportunity to legislate the oil and gas law

9/25/2024

The President of the Kurdistan Democratic Party, Masoud Barzani, stressed that "the opportunity exists to legislate the oil and gas law to regulate the distribution of wealth."

Barzani expressed during his reception of a delegation from the Parliamentary Finance Committee today, Wednesday, according to a press statement, his desire to resolve the differences between the central government and the region, expressing his support for the Finance Committee's movement in this regard.

The meeting discussed, according to the statement, "the overall common conditions and ways to resolve the outstanding issues between the central government and the Kurdistan Regional Government in a way that establishes a new phase of cooperation, coordination and understanding based on respect for the Iraqi constitution."

The head of the committee, Atwan Al-Atwani, reviewed the files that the Finance Committee delegation came to discuss with the Kurdistan Regional Government, most notably the implementation of the provisions of the Federal General Budget Law, the oil and national wealth file, the localization of employees' salaries, border crossings, taxes and customs, and other issues related to the financial aspect.

He stressed "the Finance Committee's constant endeavor to find understandings that lead to radical solutions to the outstanding issues between the federal government and the region," stressing that "deferring the differences does not solve them, but rather increases their complexity."

Barzani praised the efforts of the Finance Committee, in terms of legislating laws, monitoring performance, and taking the initiative to end the differences. LINK

************

Clare: Al-Atwani: Agreement with the Kurdistan Regional Government to review its oil contracts and adapt them constitutionally

9/26/2024

The head of the Parliamentary Finance Committee, Atwan Al Atwani, announced today, Thursday, an agreement with the Kurdistan Regional Government to review its oil contracts and adapt them constitutionally.

A statement from his office, a copy of which was received by {Atlfrat News}, stated that "the parliamentary finance committee delegation, currently visiting Erbil, headed by Al-Atwani, held an expanded technical meeting with representatives of the Kurdistan Regional Government, in the regional council of ministers building, to discuss resolving the outstanding issues between Baghdad and Erbil."

Al-Atwani said, "The meeting reviewed the oil files, financial revenues, automation of border crossings, unification of customs tariffs, and localization of employees' salaries," announcing "the development of a roadmap to resolve the points of contention between the central government and the regional government regarding the oil export file."

He stressed that "the attendees reached an initial agreement with the regional government to conduct a comprehensive review of the oil contracts to adapt them to the Iraqi constitution, in preparation for solving the problem of the halt in the region's oil exports," explaining that "the agreement stipulates that the central government and the regional government enter as a unified party in negotiations with international oil companies operating in the region with the aim of amending their contracts from production partnership to profit-sharing, in addition to reviewing the economic and commercial terms."

Al-Atwani pointed out that "the parliamentary finance committee is working to establish a sound basis for negotiations on resolving the pending issues, in order to resolve the oil export file during this year and eliminate the differences with the region," stressing that "the committee will meet, upon its return to Baghdad, with the federal oil ministry, in order to discuss the controversial issues and push towards resolving them under the umbrella of the constitution."

He said, "The meeting reviewed, in numbers, the steps for implementing the file of localizing the salaries of the region's employees, where the necessity of adhering to the decisions of the Federal Court was emphasized."

The meeting also discussed, according to Al-Atwani, the file of border crossings, customs, and taxes, and ways to include their revenues in the country's general budget, and the extent of the regional government's commitment to sending these funds to the federal government. LINK

Economist’s “News and Views” Friday 9-27-2024

Currencies BLOWING UP - Expect $3000/oz Gold Soon | Tony Greer

Liberty and Finance: 9-26-2024

Tony Greer discussed the current state of the gold and silver markets, emphasizing gold's strong performance amid ongoing fiat currency instability.

He pointed out that Western central banks' relentless currency creation is driving investors toward gold as a safe haven, predicting it could reach $3,000 per ounce by mid-2025.

Currencies BLOWING UP - Expect $3000/oz Gold Soon | Tony Greer

Liberty and Finance: 9-26-2024

Tony Greer discussed the current state of the gold and silver markets, emphasizing gold's strong performance amid ongoing fiat currency instability.

He pointed out that Western central banks' relentless currency creation is driving investors toward gold as a safe haven, predicting it could reach $3,000 per ounce by mid-2025.

Greer also expressed a cautious optimism about the stock market, noting that recent economic volatility has led to a potential resurgence in tech stocks and cyclicals, suggesting the S&P 500 could rally significantly.

He contrasted the investment behaviors in gold and silver, advocating for a focus on gold due to its stability and historical value as a hedge against inflation.

INTERVIEW TIMELINE:

0:00 Intro

1:15 Gold market

4:28 S&P 500 update

11:06 Recession

13:20 Stock market valuation

15:45 Silver vs gold

21:14 Commodities outlook

CHINA Sell Off 39% of US Treasury: What's Next?

Fastepo: 9-26-2024

The U.S. government continues to regard Treasury securities as stable and secure investment options, especially during economic uncertainties.

Despite this, there are growing concerns about the national debt, which has escalated to over $35 trillion as of mid-2024. This figure has doubled in the last 15 years, highlighting a trend of increasing government expenditure and debt accumulation.

The U.S. government's rising debt poses several long-term economic risks, notably due to the increasing cost of servicing this debt amidst rising interest rates. These higher rates make debt servicing more expensive, potentially leading to inflation and increased borrowing costs, which could crowd out private investment and necessitate higher taxes or reduced government spending.

Compounding these concerns is the U.S.'s reliance on foreign investment to fund its national debt.

Notably, China, which was once the largest foreign holder of U.S. debt, has reduced its holdings significantly, from a peak of $1.316 trillion in 2013 to about $749 billion by mid-2024.

This reduction is part of a broader trend of decreasing foreign ownership of U.S. debt, driven by geopolitical shifts and policy changes both in the U.S. and abroad.

Such a reduction in foreign investment could force the U.S. to offer higher interest rates to attract new investors, thereby increasing borrowing costs further.

This is How The Fed Just Ruined Your Life - George Gammon Goes Off

Daniela Carbone: 9-25-2024

In this insightful interview, George Gammon discusses the Federal Reserve's recent moves and the narrative they want us to believe. Are we heading for a hard landing, or can the Fed really control the economy?

George argues that despite the Fed's attempts to orchestrate a "soft landing," history shows that they often lag behind the curve.

Daniela Cambone dives deeper with George on the Fed’s decision-making, the realities of the labor market, and the significance of the inverted yield curve.

Tune in as they break down complex economic indicators and what they mean for the future of the economy.

CHAPTERS:

0:00 Fed’s Huge Mistake

4:30 More Rate Cuts Needed

8:30 Economic Downturn

13:00 Powell & Elections

18:00 Recession

24:00 Gold Safe Haven

33:00 Future Outlook