Seeds of Wisdom RV and Economics Updates Monday Evening 2-9-26

Good Evening Dinar Recaps,

NatWest’s Transformational Deal Signals Banks Pivot to Fee-Driven Growth

Major UK lender expands wealth arm as traditional interest income faces headwinds

Good Evening Dinar Recaps,

NatWest’s Transformational Deal Signals Banks Pivot to Fee-Driven Growth

Major UK lender expands wealth arm as traditional interest income faces headwinds

Overview

NatWest Group announced a £2.7 billion acquisition of Evelyn Partners, one of Britain’s largest wealth management firms — the bank’s biggest takeover since the 2008 financial crisis. The move significantly strengthens NatWest’s private banking and wealth management footprint, expanding its assets under management from around £56 billion to £127 billion and diversifying income as traditional bank margins face pressure from lower interest rates.

Key Developments

NatWest will merge Evelyn Partners’ £69 billion in client assets with its existing portfolio, creating one of the UK’s largest wealth platforms.

The deal is expected to boost fee income by over 20% and include a £750 million share buyback, signaling confidence in long-term growth.

Funding will come from existing resources, though the transaction may modestly reduce NatWest’s capital ratios.

Analysts note that while the acquisition diversifies revenue streams, the steep valuation could slightly reduce earnings per share through 2028.

Why It Matters

Banks worldwide are grappling with a prolonged low-rate environment that squeezes net interest margins. NatWest’s strategic pivot toward wealth management — a fee-based and less interest-rate-sensitive business — shows how major lenders are reshaping business models to maintain profitability and shareholder value.

Why It Matters to Markets and Financial Stability

Significant bank consolidations and shifts into wealth management can alter capital allocation, risk exposure, and competitive dynamics in the financial sector. As banks diversify away from traditional lending, markets may see changes in credit flows and investor behavior across banking stocks.

Implications for the Global Reset

Pillar 1 – Financial Sector Realignment: NatWest’s move illustrates banking sector adaptation in a low-growth, low-rate world — a structural theme in the evolving global financial system.

Pillar 2 – Asset Allocation Shifts: As banks expand into wealth services, capital flows may shift from credit-based models toward asset management and investment platforms, influencing how savings are mobilized globally.

NatWest’s acquisition is more than a deal — it’s a sign of banking’s new economics.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Escalation in Ukraine: Russian Drone and Missile Attacks Kill Civilians, Target Infrastructure

Violence intensifies amid stalled negotiations, underlining the conflict’s sustained economic and security shockwaves

Overview

On February 8, 2026, Russian forces launched a series of drone and missile strikes across Ukraine, resulting in multiple civilian deaths, including women and children, and extensive damage to energy infrastructure. The intensified attacks come amid ongoing, tentative peace discussions and threaten to undermine broader efforts toward de-escalation. This escalation not only exacerbates human suffering but also carries profound implications for European energy security, military spending, and economic confidence worldwide. (reuters.com)

Key Developments

Russian drone and missile strikes hit multiple regions in Ukraine, killing at least four civilians, including a mother and child, according to regional officials.

Infrastructure hits targeted energy facilities and residential areas, raising concerns about continued disruption to power grids and supply chains.

Ukrainian authorities condemned the attacks as violations of international humanitarian law, calling for strengthened defense measures and international support.

The strikes occurred as peace negotiations remain fragile, complicating diplomatic efforts and raising questions about the conflict’s trajectory.

Why It Matters

Attacks that deliberately target energy and civilian infrastructure extend the economic and humanitarian cost of the war. Beyond immediate human tolls, such strikes strain European energy markets, prompt renewed defense spending commitments, and introduce additional geopolitical risk that influences commodity prices, currency valuations, and investor confidence.

Why It Matters to Foreign Currency Holders

Heightened conflict risk tends to drive demand for safe-haven assets such as the U.S. dollar, U.S. Treasuries, gold, and other hard assets. Persistent volatility can reduce confidence in risk assets and amplify cross-border capital flows toward perceived safety.

Reserve diversification weakens single-currency dominance as global investors hedge against crisis-related currency and asset volatility.

Implications for the Global Reset

Pillar 1 – Security-Driven Economic Shifts:

Sustained military escalation contributes to larger reallocations of national budgets toward defense, emergency energy supplies, and resilient infrastructure, which are reshaping global economic priorities.

Pillar 2 – Energy Market Realignments:

Disruption to Ukrainian energy grids — and fears of expanded conflict — can accelerate the shift toward alternative suppliers, renewables, and diversified energy portfolios, influencing long-term commodity and currency demand patterns.

War remains an active variable in the global economic landscape.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Ukraine Escalates Military Positioning on Energy Infrastructure Amid Ongoing Conflict

Zelenskyy declares Russian energy assets legitimate military targets as strikes and counter-strikes intensify

Overview

Ukraine’s President Volodymyr Zelenskyy has publicly stated that Russian energy infrastructure constitutes a legitimate military target, arguing that revenue from energy exports directly funds Russia’s war effort. This shift in military positioning comes as Russian attacks on Ukraine’s own energy systems continue — inflicting widespread damage to grids, substations, and production facilities — and reflects a broader escalation in the economic dimensions of the conflict.

Key Developments

Zelenskyy said Ukrainian forces will consider Russian energy facilities as legitimate military targets because the funds generated from energy sales are used to procure weapons.

Ukrainian air and drone strikes have damaged Russian energy infrastructure, including reported impacts in border regions such as Belgorod, prompting outages.

Repeated Russian assaults on Ukrainian power grids have led to blackouts and cascading outages amid winter conditions, complicating civilian life and national resilience.

State energy operator UkrEnergo reported that extensive attacks on high-voltage substations and plants have forced nuclear units to reduce output and deepen power deficits, exacerbating strains on electricity supply.

Why It Matters

The explicit designation of energy infrastructure as a legitimate target represents a strategic broadening of military objectives, with long-term implications for economic leverage and civilian welfare. Attacks on energy systems undermine reliable electricity and heating — particularly during winter — and shift the conflict toward infrastructure disruption as a weapon. Such dynamics heighten regional instability and compound humanitarian concerns.

Why It Matters to Foreign Currency Holders

Persisting conflict and deliberate targeting of economic and energy infrastructure can increase demand for safe-haven assets such as gold and major reserve currencies. Volatility in commodity markets, heightened geopolitical risk premiums, and capital flight toward security assets can all influence currency valuations and reserve strategies.

Reserve diversification weakens single-currency dominance by encouraging broader asset mixes to mitigate such geopolitical shocks.

Implications for the Global Reset

Pillar 1 – Economic Warfare Intensification:

Expanding military targeting to include energy systems reflects how modern conflicts interlink economic infrastructures with strategic outcomes.

Pillar 2 – Energy Security and Strategic Autonomy:

As critical infrastructures become focal points of warfare, nations may shift toward greater energy self-sufficiency and resilient grids — affecting long-term energy supply dynamics, investment strategies, and global partnerships.

The battlefield is no longer just geographic — it extends into grids, supply networks, and the economic foundations of war.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

BRICS Unity Tested as India Leverages Western Trade Deals Against China

New U.S. and EU agreements shift internal power dynamics just as India assumes BRICS chairmanship

Overview

India’s rapid succession of high-profile trade agreements with the United States and the European Union is reshaping the internal balance of the BRICS bloc. As New Delhi steps into the BRICS chairmanship in 2026, its westward economic pivot is granting India new leverage over China — introducing strain into a grouping already navigating divergent views on trade, currency strategy, and geopolitical alignment.

Key Developments

India finalized major trade agreements with both the U.S. and EU in early February 2026, sharply reducing tariffs and expanding market access for Indian exports.

The U.S.–India framework cuts American tariffs on Indian goods to roughly 18%, strengthening bilateral economic integration.

The India–EU free trade agreement, described by negotiators as the “mother of all deals,” further anchors India within Western supply chains.

Analysts argue these agreements reduce India’s economic dependence on China, increasing New Delhi’s negotiating leverage on trade, investment, and border-related issues.

As India assumes the BRICS chairmanship, its strategic tilt complicates cohesion within a bloc often portrayed as China-led.

Why It Matters

BRICS has long been framed as a counterweight to Western economic dominance, but India’s recent moves expose structural fault lines within the alliance. Rather than acting as a unified geopolitical bloc, BRICS increasingly resembles a platform of competing national strategies, with India prioritizing economic optionality over ideological alignment.

Why It Matters to Foreign Currency Holders

Diverging BRICS strategies weaken the narrative of a single, coordinated alternative to the dollar system.

As India deepens ties with the U.S. and EU while China accelerates diversification away from U.S. assets, reserve diversification intensifies, fragmenting global capital flows and diluting single-currency dominance.

Implications for the Global Reset

Pillar 1 – Fragmentation of “Bloc Economics”

India’s approach highlights that future global finance may not be dominated by rival blocs, but by flexible, multi-aligned powers optimizing across systems.

Pillar 2 – Multipolar Power Inside Multipolar Systems

Even within BRICS, power is no longer centralized. Competing strategies between India and China signal a multipolar order within the multipolar order itself.

India’s trade diplomacy suggests the global reset is not a clean break from the old system, but a complex rewiring — where leverage comes not from opposition, but from having options in every direction.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — “BRICS Strategy Faces Strain as India Gains Leverage Over China”

Reuters — “India Seals Major Trade Deals With U.S. and EU as Strategic Balancing Act Deepens”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Evening 2-9-26

Iraq–Saudi Trade Jumps 35% In 2024, Deficit Widens

2026-02-09 Shafaq News- Baghdad/ Riyadh Trade between Iraq and Saudi Arabia rose by about 35% in 2024 to nearly $1.8 billion, driven mostly by Iraqi imports, Iraq’s Trade Ministry said on Monday.

In a statement, the ministry said that the Iraqi imports from Saudi Arabia climbed to roughly $1.73 billion in 2024, up from about $1.30 billion a year earlier, marking a growth rate of 33.4%. Construction materials, electrical and electronic goods topped the import list at more than $838 million, fueled by reconstruction and urban expansion, followed by food products at $416 million.

Iraq–Saudi Trade Jumps 35% In 2024, Deficit Widens

2026-02-09 Shafaq News- Baghdad/ Riyadh Trade between Iraq and Saudi Arabia rose by about 35% in 2024 to nearly $1.8 billion, driven mostly by Iraqi imports, Iraq’s Trade Ministry said on Monday.

In a statement, the ministry said that the Iraqi imports from Saudi Arabia climbed to roughly $1.73 billion in 2024, up from about $1.30 billion a year earlier, marking a growth rate of 33.4%. Construction materials, electrical and electronic goods topped the import list at more than $838 million, fueled by reconstruction and urban expansion, followed by food products at $416 million.

Imports of machinery, equipment, and industrial devices recorded the fastest annual growth, exceeding 136%, pointing to expanding investment projects and rising demand for capital goods. Pharmaceutical imports also rose by 32%, reflecting increased pressure on Iraq’s health sector.

Iraqi exports to Saudi Arabia increased by nearly 145% in 2024 to about $49.5 million, accounting for only a small fraction of total bilateral trade, which is conducted mainly through the Arar land border crossing in Al-Anbar. Iraq’s trade deficit with Saudi Arabia widened to approximately $1.69 billion. https://www.shafaq.com/en/Economy/Iraq-Saudi-trade-jumps-35-in-2024-deficit-widens

Dollar Gains In Baghdad And Erbil Markets

2026-02-09 Shafaq News- Baghdad/ Erbil The US dollar closed Monday’s trading higher in Iraq, hovering around 150,000 dinars per 100 dollars.

According to a Shafaq News market survey, the dollar traded in Baghdad's Al-Kifah and Al-Harithiya exchanges at 150,000 dinars per 100 dollars, up from the morning session’s 149,800 dinars.

In the Iraqi capital, exchange shops sold the dollar at 150,500 dinars and bought it at 149,500 dinars, while in Erbil, selling prices stood at 149,850 dinars and buying prices at 149,750 dinars. https://www.shafaq.com/en/Economy/Dollar-gains-in-Baghdad-and-Erbil-markets-7

USD/IQD Exchange Rates Dip In Baghdad, Hold Ground In Erbil

2026-02-09 Shafaq News- Baghdad/ Erbil The US dollar opened Monday’s trading on a mixed note, slipping by 150 Iraqi dinars in Baghdad while remaining steady in Erbil compared with the previous session.

According to a Shafaq News market survey, the dollar traded in Baghdad at 149,800 Iraqi dinars per 100 dollars, after closing at 149,950 dinars in the previous session at the Al-Kifah and Al-Harithiya exchanges.

Local exchange shops in the capital sold the dollar at 150,250 dinars per 100 dollars, while buying prices stood at 149,250 dinars. In Erbil, the selling price reached 149,750 dinars for every 100 dollars, and the buying price was 149,650. https://www.shafaq.com/en/Economy/USD-IQD-exchange-rates-dip-in-Baghdad-hold-ground-in-Erbil-7

Gold Prices Rise In Baghdad And Erbil Markets

2026-02-09 Shafaq News- Baghdad/ Erbil On Monday, gold prices hovered around 1.08 million IQD per mithqal in Baghdad and Erbil markets, continuing their upward trend, according to a survey by Shafaq News Agency.

Gold prices on Baghdad's Al-Nahr Street recorded a selling price of 1,059,000 IQD per mithqal (equivalent to five grams) for 21-carat gold, including Gulf, Turkish, and European varieties, with a buying price of 1,055,000 IQD. The same gold had sold for 1,044,000 IQD on Sunday.

The selling price for 21-carat Iraqi gold stood at 1,029,000 IQD, with a buying price of 1,025,000 IQD.

In jewelry stores, the selling price per mithqal of 21-carat Gulf gold ranged between 1,060,000 and 1,070,000 IQD, while Iraqi gold sold for between 1,030,000 and 1,040,000 IQD.

In Erbil, 22-carat gold was sold at 1,160,000 IQD per mithqal, 21-carat gold at 1,105,000 IQD, and 18-carat gold at 949,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-rise-in-Baghdad-and-Erbil-markets-8-6

Gold Reclaims $5K Milestone Following Dollar Slide

2026-02-09 Shafaq News Gold and silver extended gains on Monday, with the former trading just above the $5,000-per-ounce level as the dollar dipped, while investors awaited key jobs and inflation data due later in the week to gauge U.S. interest rate trajectory.

Spot gold rose 1.1% to $5,012.76 per ounce after a 4% climb on Friday. U.S. gold futures for April delivery gained 1.1% to $5,033.80 per ounce.

"This could be the very short-term intraday correlation between the dollar and silver as well as gold (driving the metals up)," said Kelvin Wong, a senior market analyst at OANDA.

The U.S. dollar was at its lowest level since February 4, making greenback-priced metals cheaper for overseas buyers. The yen strengthened after Japanese Prime Minister Sanae Takaichi swept to victory in Sunday's election.

"Bargain-hunting is (also) pushing gold back above the $5,000 level," said KCM chief analyst Tim Waterer.

Investors await monthly reports on employment and consumer prices this week and expect at least two 25-basis-point rate cuts in 2026, with the first one expected in June. Non-yielding bullion tends to do well in low-interest-rate environments.

"Any softness in the jobs data could help gold's rebound efforts. We are not expecting a rate cut from the Fed until mid-year, unless the jobs data really starts to drop off a cliff," Waterer added.

San Francisco Federal Reserve President Mary Daly said on Friday she thinks one or two more interest rate cuts may be needed to counteract weakness in the labour market.

Spot silver climbed 4.6% to $81.54 per ounce after a near 10% gain in the previous session. It hit an all-time high of $121.64 on January 29.

"Unless silver's able to clear above that key resistance at $92.24, I'm not so convinced in terms of a probability perspective of a medium uptrend," Wong said. Spot platinum edged 0.3% lower to $2,090.13 per ounce, while palladium gained 1% to $1,723.41. (Reuters) https://www.shafaq.com/en/Economy/Gold-reclaims-5K-milestone-following-Dollar-slide

Oil Prices Retreat Despite Lingering Tehran Threats

2026-02-09 Shafaq News Oil prices fell 1% on Monday as immediate fears of a conflict in the Middle East eased after the U.S. and Iran pledged to continue talks about Tehran's nuclear programme over the weekend, calming investors anxious about supply disruptions.

Brent crude futures fell 67 cents, or 1%, to $67.38 a barrel on Monday, while U.S. West Texas Intermediate crude was at $62.94 a barrel, down 61 cents, or 1%.

"With more talks on the horizon the immediate fear of supply disruptions in the Middle East has eased quite a bit," IG market analyst Tony Sycamore said.

Iran and the U.S. pledged to continue the indirect nuclear talks following what both sides described as positive discussions on Friday in Oman despite differences. That allayed fears that failure to reach a deal might nudge the Middle East closer to war, as the U.S. has positioned more military forces in the area.

Investors are also worried about possible disruptions to supply from Iran and other regional producers as exports equal to about a fifth of the world's total oil consumption pass through the Strait of Hormuz between Oman and Iran.

Both benchmarks fell more than 2% last week on the easing tensions, their first decline in seven weeks.

However, Iran's foreign minister said on Saturday Tehran will strike U.S. bases in the Middle East if it is attacked by U.S. forces, showing the threat of conflict is still alive.

"Volatility remains elevated as conflicting rhetoric persists. Any negative headlines could quickly reignite risk premiums in oil prices this week," said Priyanka Sachdeva, senior market analyst at Phillip Nova.

Investors are also continuing to grapple with efforts to curb Russian income from its oil exports for its war in Ukraine. The European Commission on Friday proposed a sweeping ban on any services that support Russia's seaborne crude oil exports.

Refiners in India, once the biggest buyer of Russia's seaborne crude, are avoiding purchases for delivery in April and are expected to stay away from such trades for longer, refining and trade sources said, which could help New Delhi seal a trade pact with Washington.

"Oil markets will remain sensitive to how broadly this pivot away from Russian crude unfolds, whether India’s reduced purchases persist beyond April, and how quickly alternative flows can be brought online," Sachdeva said.

(Reuters) https://www.shafaq.com/en/Economy/Oil-prices-retreat-despite-lingering-Tehran-threats

ISX Posts +$10M Dinars Turnover In January

2026-02-08 Shafaq News- Baghdad The Iraq Stock Exchange (ISX) recorded trading of more than 13.23 billion shares during January, with a total value of 15.99 billion Iraqi dinars (about $10.66M).

According to data released by the exchange, trading took place across 18 sessions, with shares of 78 companies traded out of 104 listed firms, executed through 13,704 buy and sell contracts.

The ISX60 index closed the month at 953.94 points, marking a 2.99% decline compared with the previous period.

In December 2025, the ISX recorded trading of 63.67 billion shares worth 78.7 billion Iraqi dinars (about $52.49M), executed through 18,173 buy and sell contracts, with the ISX60 index closing the month at 983.31 points, up 2.92%.

The Iraq Stock Exchange holds five trading sessions per week, from Sunday to Thursday, and includes 104 Iraqi joint-stock companies operating across banking, telecommunications, industry, agriculture, insurance, financial investment, tourism, and hospitality sectors. https://www.shafaq.com/en/Economy/ISX-posts-10M-dinars-turnover-in-January

The Next Black Swan, Expert Warns of Market ‘Time Bomb’

The Next Black Swan, Expert Warns of Market ‘Time Bomb’

David Lin: 2-8-2026

In a recent in-depth discussion with David Lin, Matthew Piepenburg, a partner at Von Greer’s AG, shared his expert analysis on the current and future state of global financial markets, the role of gold and silver investments, and the geopolitical shifts that are reshaping the world economy.

The conversation provided a sobering look at the challenges facing fiat currencies and the increasing preference for hard assets among central banks and major financial institutions.

The Next Black Swan, Expert Warns of Market ‘Time Bomb’

David Lin: 2-8-2026

In a recent in-depth discussion with David Lin, Matthew Piepenburg, a partner at Von Greer’s AG, shared his expert analysis on the current and future state of global financial markets, the role of gold and silver investments, and the geopolitical shifts that are reshaping the world economy.

The conversation provided a sobering look at the challenges facing fiat currencies and the increasing preference for hard assets among central banks and major financial institutions.

Piepenburg emphasized that the ongoing bull market in gold and silver is not driven by speculative fervor but by a more fundamental reality: the erosion of fiat currency values.

Unprecedented global debt levels and expansive monetary policies have led to a deep-seated mistrust in the sustainability of the global monetary system.

As a result, central banks and major financial institutions are increasingly favoring gold over US treasuries, signaling a significant shift in the global financial landscape.

The discussion also touched on the stock market’s outlook for 2026, highlighting the complex interplay of factors such as Federal Reserve policies, tax-driven inflows, and the shifting of capital from tech growth to global value and hard assets. Piepenburg’s insights underscored the challenges of predicting market movements in a landscape marked by unprecedented monetary policies and geopolitical tensions.

One of the most striking aspects of the conversation was Piepenburg’s warning about the systemic risks embedded in derivatives markets and commodity exchanges.

He highlighted the potential for “black swan” events, such as delivery failures in silver, which could have a cascading effect on other metal markets. This risk, coupled with the unsustainable global debt crisis, underscores the need for honesty and austerity in economic policymaking.

Piepenburg stressed that the current debt crisis cannot be solved by more debt or monetary stimulus but will require painful structural adjustments—a reality that is politically unpalatable but economically inevitable.

The discussion also explored the motivations behind gold and silver investments. Piepenburg characterized gold as a preservation asset against currency debasement, rather than a speculative instrument.

In contrast, silver was described as more volatile, influenced significantly by industrial demand and supply constraints. The recent disruptions in major exchange markets have further complicated the silver market, making it a more challenging investment landscape.

Piepenburg’s critique of the global political and economic order painted a picture of a world where the old order is irreversibly broken.

The current geopolitical tensions and policy responses are symptomatic of deeper systemic failures, indicating a need for a fundamental rethink of the global economic architecture.

The generational wealth transfer caused by inflation and monetary debasement has resulted in younger generations facing diminished purchasing power and fewer opportunities compared to their predecessors.

In light of these challenges, Piepenburg offered pragmatic advice for young investors: to prepare for a tougher economic future by focusing on risk assets like junior mining companies and hard assets. While acknowledging the significant challenges ahead, he emphasized that opportunities exist for those with a long-term perspective and the conviction to navigate the heightened risks.

Seeds of Wisdom RV and Economics Updates Monday Afternoon 2-9-26

Good Afternoon Dinar Recaps,

Global Markets Jolt as UK Political Turmoil Meets Japan’s Election Rally

Bond yields, currencies, and equity patterns shift in response to political and policy expectations

Good Afternoon Dinar Recaps,

Global Markets Jolt as UK Political Turmoil Meets Japan’s Election Rally

Bond yields, currencies, and equity patterns shift in response to political and policy expectations

Overview

On February 9, 2026, financial markets reacted sharply to major political developments in the United Kingdom and Japan, with implications for borrowing costs, equity performance, and global risk sentiment. UK government bond yields initially rose on political uncertainty before stabilizing, while Japan’s stock market surged to record levels following a decisive election victory.

Key Developments

In the UK, government bond yields climbed after key political aides resigned, creating investor concern over Prime Minister Sir Keir Starmer’s leadership and fiscal direction. Yields later moderated after cabinet support was reaffirmed.

The pound weakened against major currencies amid uncertainty before stabilizing as confidence in government support improved.

In Japan, the Nikkei stock index hit record highs, boosted by the ruling party’s landslide election victory and expectations of substantial fiscal stimulus, while the yen showed periods of strength and volatility.

Investors are closely watching Japanese bond markets as yields rise and fiscal policy expectations shift under new leadership.

Why It Matters

Political leadership transitions and fiscal expectations can heavily influence borrowing costs and investor confidence. Rising UK yields reflect concerns over fiscal management and political risk, while Japan’s markets suggest growing optimism about economic stimulus — prompting shifts in capital flows and risk pricing.

Why It Matters to Markets and Sovereign Debt

UK gilt yields are a key benchmark for global borrowing costs; volatility can ripple across sovereign bonds and risk assets.

Japan’s record equity performance highlights how political clarity and fiscal ambitions can drive risk-on sentiment, even amid longstanding debt concerns.

Implications for the Global Reset

Pillar 1 – Policy and Market Coupling: Political decisions now more directly sway market structures, especially sovereign borrowing costs and currency behavior.

Pillar 2 – Risk Redistribution: Divergent market reactions in the UK and Japan illustrate how different policy paths can reorganize investor expectations and capital allocation in a multipolar economic landscape.

Political signals are increasingly market signals — and markets are listening closely.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Russia Sees No Future for U.S. Economic Ties as Global Alignments Shift

Lavrov’s remarks underscore deepening geopolitical divergence and rising reliance on alternative economic blocs

Overview

Russian Foreign Minister Sergei Lavrov said on February 9, 2026, that Moscow does not expect a “bright future” for economic relations with the United States, despite Washington’s stated efforts to end the Ukraine conflict. The comments — made in an interview with TV BRICS — reflect Moscow’s growing focus on alliances like BRICS and skepticism about U.S. economic intentions. Lavrov cited what he described as a U.S. pursuit of “economic dominance” and said Russia is seeking more secure economic cooperation channels with non-Western partners.

Key Developments

Lavrov said Russia remains open to cooperation with the U.S., but does not forecast a robust economic partnership due to geopolitical tensions and sanctions pressures.

He criticized U.S. policy toward the BRICS bloc, alleging Washington creates obstacles to deeper integration among emerging economies.

Remarks come amid ongoing war in Ukraine, where sanctions and economic disengagement from Russia have become entrenched.

Russia is increasingly pivoting to partnerships within BRICS and other non-Western frameworks as part of broader economic strategy shifts.

Why It Matters

Russia’s official skepticism about reviving economic ties with the U.S. signals a more permanent realignment in global economic relations. As Western sanctions remain in place and Russia deepens ties with BRICS partners, this development could accelerate the fragmentation of global trade systems and reinforce alternative economic blocs.

Why It Matters to Foreign Currency Holders

Persistent decoupling from the U.S. economic sphere can weaken confidence in U.S.-centric financial architectures and boost demand for alternative reserve assets and block-based settlements.

Reserve diversification weakens single-currency dominance, encouraging a multipolar monetary environment where non-dollar reserves gain relative importance.

Implications for the Global Reset

Pillar 1 – Strategic Economic Realignment:

Diminished prospects for U.S.–Russia economic cooperation reinforce global bifurcation into competing financial spheres.

Pillar 2 – Multipolar Integration:

Russia’s pivot toward BRICS frameworks exemplifies broader shifts toward bloc-based economic systems and away from hegemony centered on the U.S. dollar and Western financial institutions.

Geopolitical divergence is now reshaping economic alliances.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Russia’s Lavrov sees no ‘bright future’ for economic ties with U.S.”

Economic Times — “No ‘bright future’ for Russia–US economic relations, says Lavrov”

~~~~~~~~~~

Saudi Wealth Fund to Unveil Revised Strategy, Signalling a Strategic Reset

PIF shifts focus from mega projects toward industry, minerals, AI and sustainable growth

Overview

Saudi Arabia’s $925 billion Public Investment Fund (PIF) is set to unveil its 2026–2030 strategy this week, marking the most significant recalibration of Crown Prince Mohammed bin Salman’s economic transformation plan yet. The strategy, previewed to investors and partners in Riyadh, will pivot the fund’s focus toward core growth sectors — including industry, minerals, artificial intelligence, clean energy and tourism — while scaling back or reconfiguring expensive mega projects that have dominated the Vision 2030 agenda.

Key Developments

The PIF has been soft-launching its new strategy at a Riyadh conference, with plans to prioritize sectors with stronger near-term returns and growth potential.

Sectors expected to see increased emphasis include industry, mining, AI development, renewable energy and tourism, with a reduced role for costly real-estate and futuristic gigaprojects such as The Line.

The shift is partly driven by fiscal pressures from lower oil prices and an increasing need to attract foreign capital, particularly from global asset managers.

High-profile megaprojects such as The Line and other Vision 2030 developments have been delayed or re-scoped, aligning with the PIF’s new emphasis on achievable, financially sustainable initiatives.

Why It Matters

This strategic update represents a major shift in direction for Saudi Arabia’s sovereign wealth priorities. Moving away from large-scale, capital-intensive developments toward sectors with clearer economic viability could enhance long-term sustainability, attract diversified investment, and reduce fiscal strain. The pivot reflects broader global trends in sovereign fund management — focusing on durable, diversified returns over symbolic megaprojects.

Why It Matters to Markets, Assets & Investment Flows

Investors and global asset managers will closely watch this strategy, as it redefines Saudi Arabia’s role in key growth sectors and signals stronger integration into global capital markets. Prioritizing industry, technology and minerals over megaprojects may boost confidence in PIF’s future returns and liquidity, influencing asset allocation, sovereign partnerships, and cross-border investment trends.

Implications for the Global Reset

Pillar 1 – Strategic Asset Realignment:

The recalibration away from mega projects towards scalable, revenue-oriented sectors underscores a structural transition in how sovereign wealth funds contribute to economic transformation and global capital flows.

Pillar 2 – Fiscal Discipline and Sustainability:

Reorienting priorities in response to oil price volatility and cost overruns exemplifies strategic risk management essential in an era of multipolar economic pressures and diversified global reserve interests.

Strategic repositioning of one of the world’s largest sovereign funds could reverberate across investment markets and policy frameworks worldwide.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Saudi Arabia’s Public Investment Fund to unveil new 2026–2030 strategy this week”

Brecorder — “Saudi PIF to unveil new 2026–2030 strategy this week, sources say”

~~~~~~~~~~

China Signals Strategic Shift Away From U.S. Treasuries as BRICS Recalibrates Reserves

Beijing urges state banks to reduce U.S. debt exposure, highlighting rising risks in the dollar-based system

Overview

China has instructed its state-run banks to curb exposure to U.S. Treasuries, citing concentration risk and market volatility — a move that underscores a broader reassessment of dollar-denominated assets within the BRICS bloc. The guidance, first reported by Bloomberg, comes as debates intensify globally over the sustainability of U.S. fiscal policy and the long-term role of Treasuries as a “risk-free” reserve asset.

Key Developments

Chinese regulators urged state banks to limit purchases of U.S. Treasuries and gradually pare existing holdings, warning of potential sharp price swings.

The move contrasts with India’s recent pivot toward deeper trade engagement with the United States, highlighting diverging BRICS strategies under shifting global conditions.

China holds roughly $298 billion in U.S. dollar-denominated assets, according to SAFE, though the precise portion held in Treasuries has not been publicly disclosed.

Fund managers globally are also reassessing Treasury exposure, driven less by geopolitics and more by risk diversification and volatility concerns.

Growing anxiety over U.S. debt approaching $40 trillion and a weaker dollar has accelerated scrutiny of U.S. sovereign debt as a core reserve asset.

Why It Matters

China’s guidance represents more than routine portfolio management — it signals a structural shift in reserve strategy by one of the world’s largest holders of foreign assets. If sustained, reduced Chinese demand for Treasuries could affect U.S. borrowing costs and weaken the traditional assumption of automatic global appetite for U.S. debt.

Why It Matters to Foreign Currency Holders

Moves away from U.S. Treasuries by major reserve holders reinforce a global trend toward reserve diversification.

As exposure spreads across gold, alternative sovereign bonds, and non-dollar assets, single-currency dominance erodes, increasing volatility — but also opportunity — across foreign exchange markets.

Implications for the Global Reset

Pillar 1 – Reserve System Rebalancing

China’s actions suggest central banks are no longer treating U.S. Treasuries as untouchable core assets, accelerating a gradual shift toward a multi-asset reserve framework.

Pillar 2 – BRICS Divergence, Not Uniformity

While often viewed as a unified bloc, BRICS members are pursuing different speeds and methods of de-dollarization — revealing a fragmented but directional move toward financial autonomy.

This is not an abrupt exit from the dollar system — it is a controlled, risk-managed retreat, and those tend to reshape global finance far more than dramatic headlines.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bloomberg — “China Urges Banks to Limit Exposure to U.S. Treasuries”

Watcher.Guru — “China Demands Banks To Curb US Treasuries Exposure in New BRICS Shift”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Monday Afternoon 2-9-26

The Presidency Of The Government And The Presidency Of The Republic: To Proceed With A Balanced Policy And Resolve Constitutional Issues

Money and Business Economy News – Baghdad Prime Minister Mohammed Shia Al-Sudani received President Abdul Latif Jamal Rashid on Monday.

The meeting witnessed discussions on developments in the general situation in the country and the region, where the need to strengthen national unity and support the government’s measures and steps in enhancing Iraq’s pivotal role in the region was emphasized.

The Presidency Of The Government And The Presidency Of The Republic: To Proceed With A Balanced Policy And Resolve Constitutional Issues

Money and Business Economy News – Baghdad Prime Minister Mohammed Shia Al-Sudani received President Abdul Latif Jamal Rashid on Monday.

The meeting witnessed discussions on developments in the general situation in the country and the region, where the need to strengthen national unity and support the government’s measures and steps in enhancing Iraq’s pivotal role in the region was emphasized.

The meeting also emphasized the government’s commitment to adopting a balanced foreign policy and its support for dialogue in resolving crises and establishing regional security and stability.

The meeting stressed the importance of resolving constitutional requirements towards forming a government capable of completing the development and economic revival process, and meeting the aspirations of the Iraqi people in the next stage. https://economy-news.net/content.php?id=65514

Customs: Customs Regulations Have Become More Realistic And There Is Significant Trade Exchange.

Money and Business Economy News – Baghdad The General Authority of Customs announced on Monday that there are reassuring rates in customs revenues after the implementation of the latest procedures, noting that these procedures are in place in most countries of the world.

The Director General of the Authority, Thamer Qasim, said that "customs demarcation has become more realistic, and there is a large trade exchange," noting that "there are reassuring rates in customs revenues."

He added that "the fee was previously paid as a lump sum per container, while today the fee is based on the size of the container, and this is the practice in most countries," noting that "the lump sum container fees represent a waste of public money and cannot be returned to this practice."

Regarding the implementation of the ASYCUDA system, Qassem confirmed that "some traders were increasing the amounts for imported goods before the implementation of the ASYCUDA system," noting that "a trader who feels wronged can submit a grievance to reconsider the assessment of the customs tariff for his goods."https://economy-news.net/content.php?id=65513

Sudanese: Directing Reform Measures Towards Strengthening The National Economy

Money and Business Economy News – Baghdad Prime Minister Mohammed Shia al-Sudani stressed on Monday the importance of reform measures being directed towards strengthening the national economy, stressing the need to study the financial and economic impact of every decision taken within this framework.

This came during his chairmanship of the meeting of the Ministerial Council for the Economy, in the presence of the Deputy Prime Minister and Minister of Foreign Affairs, the Minister of Finance, the Ministers of Reconstruction and Housing, Industry, Labor and Social Affairs, and Water Resources (Acting Minister of Agriculture), in addition to the Secretary-General of the Council of Ministers, the Governor of the Central Bank, and a number of relevant advisors.

The meeting addressed the topics on the agenda, followed up on government efforts to maximize revenues and reduce expenditures, and reviewed previous decisions. The Council approved the organizational structure of the Revenue Collection Directorate within the Ministry of Finance, which had been previously approved in the last meeting, emphasizing the need to select qualified personnel to work within it and achieve its intended objectives.

The council also approved exempting security and emergency services from the decision to reduce fuel subsidies that was previously taken, in consideration of the nature of the work of those agencies.

Al-Sudani stressed that the approach of basic economic reforms, which contribute to supporting the national economy in the foreseeable future, enjoys the support of national political forces, emphasizing the need to move forward with implementing reforms in a way that enhances financial stability and serves development. https://economy-news.net/content.php?id=65512

The Mechanism For Selecting Parliamentary Committees: An Official Explanation

Money and Business Economy News – Baghdad MP Mona Hussein explained on Monday the mechanism for distributing MPs among parliamentary committees.

Hussein said, "The distribution of representatives to parliamentary committees is based on the representative's desire to work in the committee he wishes to work in."

She added, "Specialization is important in the process of selecting members of parliamentary committees, and they should have extensive experience in them." https://economy-news.net/content.php?id=65511

China Injects Cash To Cover A $456 Billion Deficit

Banks Economy News — Follow-up The People’s Bank of China – the Chinese central bank – moved aggressively to ensure that banks had sufficient liquidity and could meet the increased demand for cash during the Lunar New Year holiday.

The central bank injected a total of 600 billion yuan ($86.4 billion) through 14-day repurchase agreements late last week, ending a two-month hiatus in such operations, according to Bloomberg. Industrial Securities expects the People's Bank of China to add up to 3.5 trillion yuan in funds through similar instruments before the holiday begins on Sunday.

These injections are intended to address a liquidity gap estimated at around 3.2 trillion yuan ($456 billion), according to Bloomberg calculations. Holiday-related spending, a surge in government bond issuance, and increased corporate demand for yuan are all expected to drain liquidity from the banking system.

For the People’s Bank of China (PBOC), maintaining sufficient liquidity is crucial to avoiding a seasonal liquidity crunch and sustaining economic momentum in the face of mounting challenges. Prior to this latest move, the PBOC doubled its bond purchases in January, injecting a record 1 trillion yuan in medium- and long-term funds into the banking system.

CITIC Securities' chief economist, Ming Ming, said: "The central bank has ample room to replenish liquidity."

He added: "The People's Bank of China is expected to be able to bridge the funding gap by combining the injection of liquidity through traditional liquidity instruments with maintaining a steady level of bond purchases," stressing that "liquidity conditions in the bond market will remain stable."

Part of the liquidity pressure that the People's Bank of China must address stems from household behavior. Analysts at Huaxi Securities predict a liquidity drain of 900 billion yuan due to holiday travel and the tradition of giving cash gifts in red envelopes during the Lunar New Year celebrations.

Additionally, 405.5 billion yuan in reverse repurchase bonds issued by the People's Bank of China are due to mature this week, according to Bloomberg calculations, further straining banks' liquidity. The maturity of another 500 billion yuan in direct reverse repurchase bonds will also drain liquidity.

China is accelerating sales of government bonds ahead of the holiday season, according to Guilian Minsheng Securities, which could exacerbate the liquidity shortage.

Data indicates that local authorities plan to sell approximately 950 billion yuan worth of bonds during the first two weeks of this month, representing an increase of roughly 18% compared to the total bonds issued in January. This is in addition to the central government's issuance of 412 billion yuan worth of bonds.

Exporters converting their dollar earnings into yuan will exacerbate liquidity shortages, according to Sinolink Securities. This demand follows a 2.6% appreciation of the yuan since the end of October, driven by capital inflows, a weaker dollar, and the People's Bank of China's acceptance of the yuan's appreciation.

In addition to the recent liquidity injections, the People’s Bank of China also allowed banks to cut their one-year monetary policy loan interest rate to a record low of 1.5% last month, according to Bloomberg sources.

Economists expect China to cut banks' reserve requirement ratio by 50 basis points this year and lower interest rates. Inflation data this week will help gauge expectations regarding the extent of policy support the People's Bank of China will provide to the economy.

Despite short-term funding costs rising from their lowest level since 2023, analysts expect these rates to remain low. This reflects the People's Bank of China's commitment to supporting the market during peak seasonal periods.

“The last thing markets should be worried about this year is the People’s Bank of China’s tendency to maintain ample liquidity,” Huazhuang Securities analysts wrote in a note. “Despite fluctuations in repurchase rates due to seasonal factors, the money supply still looks very weak.” https://economy-news.net/content.php?id=65492

News, Rumors and Opinions Monday 2-9-2026

KTFA:

Clare: The Iraqi parliament held a brief session and adjourned until further notice.

2/9/2026

The Iraqi parliament held a session on Monday that lasted only a few minutes before deciding to adjourn it until further notice, after three consecutive sessions were disrupted.

The Council’s Media Department stated in a statement that the Speaker of the House of Representatives, Hebat Al-Halbousi, opened the proceedings of session number (7) within the sixth electoral cycle, the first legislative year, the first legislative term.

KTFA:

Clare: The Iraqi parliament held a brief session and adjourned until further notice.

2/9/2026

The Iraqi parliament held a session on Monday that lasted only a few minutes before deciding to adjourn it until further notice, after three consecutive sessions were disrupted.

The Council’s Media Department stated in a statement that the Speaker of the House of Representatives, Hebat Al-Halbousi, opened the proceedings of session number (7) within the sixth electoral cycle, the first legislative year, the first legislative term.

MPs Hassanein Al-Khafaji, Jaafar Shua’il Al-Zamili, and Ali Anhir Al-Sarai took the constitutional oath during the session as members of the House of Representatives.

The council also voted to form a committee to amend the internal regulations of the parliamentary committees, headed by the First Deputy Speaker of the House of Representatives, Adnan Faihan Al-Dulaimi, and decided to adjourn the session, which lasted about 25 minutes, until further notice. LINK

Clare: With the exception of legal matters, Parliament postpones the allocation of committee members until after the formation of the government.

2/9/2026

Zainab Al-Khazraji, a member of the Reconstruction and Development bloc, confirmed that the House of Representatives will vote in the session scheduled for today, Sunday, on the members of the Parliamentary Legal Committee only, even though the agenda includes distributing representatives to committees without naming them.

Al-Khazraji, speaking to Shafaq News Agency, attributed this trend to the delay by the heads of political blocs in submitting the names of their candidates from among the deputies to fill membership in the parliamentary committees.

Al-Khazraji said that the number of parliamentary committees is 25, and the membership of the remaining committees will be decided successively after the political blocs have submitted the names of the candidates.

According to the MP from the bloc, the appointment of the heads of the parliamentary committees will be postponed until after the formation of the next government, noting that the upcoming sessions will witness the appointment of the parliamentary committees in succession.

Al-Khazraji concluded that the process of completing the formation of parliamentary committees may continue for up to a month, until all committees are fully decided. LINK

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff It's a very difficult investment to study right now because there's a lot of unknown information. There's things they're not telling us...They're stalling the formation of the government.

Frank26 IMO American soldiers will deliver the lower notes to the banks that have qualified and are working with the United States Treasury and Donald Trump on your monetary reform...Trump is demanding security and stability for this new exchange rate that we are introducing to [Iraq] because the CBI is too stubborn to introduce it...IMO

Militia Man They're not soft balling it anymore. Highly credible data is out, consistent with the evidence. Alaq's...performance since 2022 has been stellar. Gatekeepers have noticed and endorsed it quietly. The BIS nod via the Bank of International Standards Alignment is real...Iraq is being prepared for deeper global financial engagement....If you tie everything together, you're going to see that, wow, this is big. The Arab League AMF gives regional backing and stability. All part of the quiet long game plan. The "quiet" to me has delivered results...Our study has proven time and time again that the gatekeepers are pleased. The next phase is closer than most realize.

$7 TRILLION WIPED OUT in Gold & Silver - What REALLY Triggered the Crash

Lena Petrova: 2-9-2026

Gold and silver just suffered one of the most violent selloffs in modern history. In a single day, gold plunged nearly 9% and silver collapsed more than 35%, wiping out trillions in market value.

This wasn’t a normal correction — it was a liquidity event driven by crowded trades, leverage, and forced liquidation after a political shock at the Federal Reserve.

In this video, I break down what really caused the crash, why gold and silver failed as “safe havens,” and what this means for the future of the gold bull market. Is this a buying opportunity or a warning sign? Watch before making your next move.

“Tidbits From TNT” Monday 2-9-2026

TNT:

Tishwash: Parliamentary move to summon Al-Sudani and the Minister of Finance

Member of Parliament, Mohammed al-Khafaji, revealed on Sunday a parliamentary move to summon Prime Minister Mohammed Shia al-Sudani and Finance Minister Taif Sami to Parliament to discuss the current financial crisis.

Al-Khafaji told Al-Maalouma, “There is an urgent need to summon those concerned to understand the repercussions of the financial crisis the country is experiencing and to develop effective solutions.”

He added, "The summons also aims to discuss the constitutional violations committed by the Cabinet, represented by making strategic decisions and signing contracts that exceed the powers of a caretaker government."

TNT:

Tishwash: Parliamentary move to summon Al-Sudani and the Minister of Finance

Member of Parliament, Mohammed al-Khafaji, revealed on Sunday a parliamentary move to summon Prime Minister Mohammed Shia al-Sudani and Finance Minister Taif Sami to Parliament to discuss the current financial crisis.

Al-Khafaji told Al-Maalouma, “There is an urgent need to summon those concerned to understand the repercussions of the financial crisis the country is experiencing and to develop effective solutions.”

He added, "The summons also aims to discuss the constitutional violations committed by the Cabinet, represented by making strategic decisions and signing contracts that exceed the powers of a caretaker government."

He pointed out that "the Constitution defines the government's duties at this stage, and any action outside this framework is a legal violation that necessitates accountability and parliamentary oversight." link

Tishwash: The Central Bank Governor visits the Iraqi House and renews his support for humanitarian initiatives.

His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Alaq, visited the Iraqi House, managed by Mr. Hisham Al-Dhahabi, a leading humanitarian institution dedicated to the care of orphans and the elderly, and providing social and developmental support to the most vulnerable groups in society.

During his visit, His Excellency was briefed on the services provided by the Iraqi House to children without guardians. The House takes them in from an early age, nurturing and caring for them, and providing them with academic and vocational training. It also secures employment opportunities for them in both the public and private sectors, contributing to their integration into society and their economic empowerment.

He noted that a number of the children from the House have successfully completed their university studies at prestigious colleges, including medicine, dentistry, pharmacy, and engineering, a true testament to the success of the sustainable care model adopted by the Iraqi House for Innovation.

His Excellency commended the positive results achieved by this initiative and pledged sufficient support to meet the institution's essential needs, as well as those of the elderly care home currently under construction.

The visit included a tour of the facility, during which the governor met with the elderly residents and toured its various amenities, including children's play areas, restaurants, and small businesses run by the sons of Professor Hisham Al-Dhahabi. These businesses serve as practical models of self-reliance and skills development.

During the visit, Mr. Al-Alaq affirmed his full financial and moral support for this humanitarian institution, praising the efforts made in caring for vulnerable groups and emphasizing the importance of partnerships between official institutions and community initiatives in promoting social solidarity and achieving sustainable development.

Central Bank of Iraq,

Media Office,

February 7, 2026 link

************

Tishwash: Baghdad merchants' strike paralyzes trade in protest against increased customs tariffs

On Sunday morning, Iraqis woke up to an unusual sight in the streets of the capital, Baghdad, as markets and shops appeared completely closed, in a general strike carried out by merchants in protest against a government decision to raise customs tariffs.

Major commercial areas such as Al-Shourja, Al-Rashid Street, Al-Karrada, Al-Rabeei, Al-Sina’a, and Jamila witnessed an almost complete closure of shops, while a number of merchants went out in demonstrations in the middle of Al-Shourja, demanding a reversal of the decision, which they described as “suffocating,” due to the sharp rise in commodity prices and the decline in citizens’ purchasing power that it caused.

Traders confirmed that the decision led to a major recession in the markets and increasing financial losses, which prompted them to escalate the strike, indicating their intention to continue the closure until the government responds to their demands to open a serious dialogue and review the customs tariff in a manner that is appropriate to the difficult economic conditions.

This strike comes days after warnings issued by traders about the consequences of implementing the decision, which prompted citizens yesterday, Saturday, to rush to the markets to buy food and consumer goods, fearing price increases or shortages in supply.

While some economic voices blame this decision for the accumulation of goods at ports and the disruption of trade, official sources maintain that the customs increase has generated significant revenue, a move aimed at bolstering the public treasury. However, as the crisis worsens, calls have grown louder to expand the strike to other governorates if immediate action is not taken. link

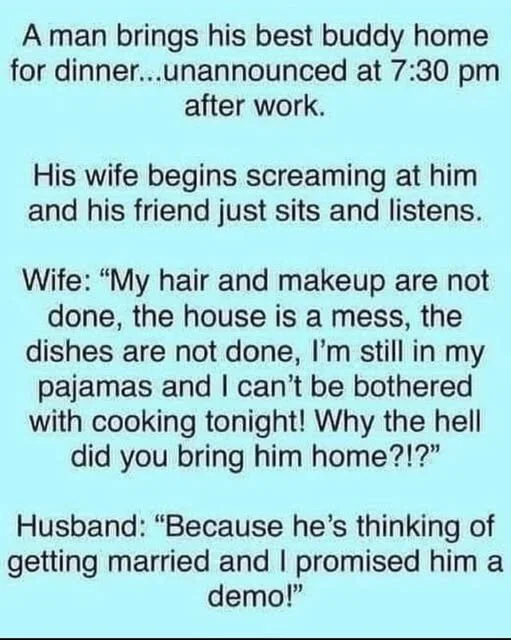

Mot: Wasn't That Funny - Watching those Tourists Run Like That!!!

Mot: it's A - Pre - Marital Thingy !!!!

Seeds of Wisdom RV and Economics Updates Monday Morning 2-9-26

Good Morning Dinar Recaps,

Bank of England Holds Rates as Markets Reprice the Future

A narrow hold signals potential monetary policy pivot as inflation eases and growth slows

Good Morning Dinar Recaps,

Bank of England Holds Rates as Markets Reprice the Future

A narrow hold signals potential monetary policy pivot as inflation eases and growth slows

Overview

The Bank of England (BoE) voted narrowly to keep interest rates unchanged at 3.75%, surprising some markets and underscoring shifting global monetary dynamics. The 5-4 decision reflects ongoing debate among policymakers about the balance between inflation control and economic growth, and has already influenced bond yields, currency valuations, and investor expectations across Europe and beyond.

Key Developments

The BoE’s Monetary Policy Committee held the policy rate steady, with a narrow majority favoring caution amid signs of slowing inflation and mixed growth data.

Financial markets immediately repriced expectations of future rate cuts, driving down gilt yields and weakening sterling against major peers.

Governor Andrew Bailey and other policymakers acknowledged downside risks to the UK economy, with inflation returning toward target and consumption softening.

Investors interpreted the decision as a cue for possible rate reductions later in 2026, influencing global asset allocations.

Why It Matters

Central bank policy in major economies remains a cornerstone of global financial conditions. When the Bank of England — a key institution in the reserve currency and international financial system — signals potential easing, it affects global bond markets, cross-border capital flows, and risk appetite. Markets sometimes react more to expectations than actual rate changes, meaning policy signaling can be as impactful as action.

Why It Matters to Foreign Currency Holders

Interest rate outlooks shape currency values. Expectations of rate cuts can weaken a currency’s relative yield attractiveness, influencing demand and reserve allocations.

Reserve diversification weakens single-currency dominance, as investors and central banks hedge exposures by reallocating assets, including into alternative sovereign bonds, commodities, and non-traditional reserves.

Implications for the Global Reset

Pillar 1 – Monetary Transition:

The BoE’s pause highlights how central banks increasingly navigate between inflation control and growth stimulus in a low-growth, high-debt world — a central theme of the evolving global monetary landscape.

Pillar 2 – Capital Reallocation:

Revised rate expectations accelerate shifts in global capital flows, influencing not only bond markets but also strategic reserve diversification practices that underpin longer-term rebalancing trends.

When major central banks hesitate, markets adjust — and those adjustments often become the policy of tomorrow.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Bank of England leaves rates unchanged after tight vote, sterling falls”

Investing.com — “Bank of England governor speaks after close vote to hold rates”

~~~~~~~~~~

U.S. and EU Stockpile Critical Minerals for Strategic Security

Washington and Brussels move from market reliance to coordinated resource stockpiles in a new geoeconomic era

Overview

At the first U.S. Critical Minerals Ministerial, the United States and European Union outlined new efforts to stockpile essential minerals and coordinate allied supply chains for materials critical to clean energy, advanced manufacturing, and defense systems. The initiative underscores a deeper geoeconomic shift: nations are now treating strategic resources as foundational elements of national security — not mere market commodities. This shift affects global supply chains and alters the strategic landscape for technology, energy transition, and military preparedness.

Key Developments

Officials from the U.S. and EU convened to discuss shared stockpiling, joint procurement, and supply diversification for critical minerals.

The effort targets rare earth elements, lithium, nickel, cobalt, and other essential inputs that currently have concentrated production and processing footprints, particularly in China.

Discussions included potential preferential trade frameworks among allied nations to ensure resource availability and resilience against supply disruptions.

Ministers flagged the importance of strategic stockpiles in ensuring that allied industries — from semiconductors to clean energy infrastructure — can scale without over-dependence on single-source channels.

Why It Matters

Critical minerals are indispensable for the technologies powering the 21st-century economy. Their availability — and the resilience of the supply chains that deliver them — now sits at the intersection of industrial policy, national security, and global economic competition. By stockpiling and coordinating access with allies, the U.S. and EU are signalling a transition from laissez-faire global commodity markets toward managed, strategic resource alliances.

Why It Matters to Foreign Currency Holders

Access to and control of critical mineral resources can influence currency stability, capital flows, and trade balances. As nations move to secure key inputs through alliances and stockpiles, they may also expand reserve diversification and alternative settlement arrangements to reduce exposure to single-currency risk.

Reserve diversification weakens single-currency dominance, encouraging a more multipolar reserve asset landscape.

Implications for the Global Reset

Pillar 1 – Strategic Resource Sovereignty:

Resource stockpiling and allied coordination represent a shift toward managed economic networks where strategic assets are prioritized over market cost-efficiency alone.

Pillar 2 – Geoeconomic Bloc Building:

By linking mineral security to alliance structures, the U.S. and EU are laying the groundwork for bloc-based economic systems that extend beyond traditional trade models — a hallmark of the evolving global reset.

Control of resources is emerging as a defining axis of geopolitical and economic power in the 21st century.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — “Sustainable switch: US and EU stockpile critical minerals”

Reuters — “Italy, France and Germany to lead EU critical materials stockpiling plan — sources”

~~~~~~~~~~

BRICS Progress Surges As Membership And Influence Explode

The bloc expands rapidly, pushes de-dollarization, and strengthens gold-backed financial strategies.

Overview

BRICS continues to accelerate its influence in 2026, representing roughly 35–40% of global GDP and nearly half of the world’s population. Membership expansion, financial innovation, and strategic moves away from the US dollar have positioned the bloc as a growing counterweight to Western economic dominance.

Key Developments

Membership Expansion & Partner Countries – The “partner country” category introduced at the 2024 Kazan Summit now includes nations like Belarus, Malaysia, Nigeria, Thailand, and Vietnam, allowing engagement without full membership. Over 20 additional countries have expressed interest in joining.

Financial Architecture & De-Dollarization – The BRICS Pay system, piloted in 2024, allows trade settlements in local currencies and bypasses SWIFT. Russia reports 90% of intra-bloc trade in national currencies. India maintains a cautious stance on fully replacing the dollar.

The BRICS Unit – Launched in October 2025, this digital currency pilot is backed 40% by gold and 60% by member currencies, aiming to reduce dollar reliance in trade settlements.

Institutional Development – The New Development Bank approved $39 billion for over 120 infrastructure and sustainable development projects. Ongoing initiatives cover AI regulation, global health, and climate finance.

Gold Reserves – Combined BRICS gold holdings exceed 6,000 tonnes, with China at 2,298 tonnes and Russia at 2,336 tonnes, serving as a strategic hedge against currency volatility and sanctions risk.

Why It Matters

BRICS progress highlights a shift toward multipolar financial systems and greater resilience against Western-led monetary influence. Expansion, alternative payment systems, and gold-backed initiatives are tangible steps in reducing dollar dependency.

Why It Matters to Foreign Currency Holders

Reserve diversification and de-dollarization could accelerate, impacting holdings in US-dollar-denominated assets and creating opportunities in gold and local currencies within emerging markets.

Implications for the Global Reset

Pillar 1 – Multipolar Finance: BRICS Pay, the BRICS Unit, and national currency settlements expand alternatives to Western financial networks.

Pillar 2 – Strategic Sovereignty: Membership expansion, gold accumulation, and infrastructure projects strengthen autonomy and resilience, challenging traditional Western economic dominance.

BRICS progress shows no signs of slowing. Despite internal differences and external pressures, the bloc is actively reshaping global financial architecture and trade patterns, signaling a fundamental shift accelerated by geopolitical tensions and sanctions.

From gold to digital currencies, BRICS is rewriting the rules of global finance.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — "BRICS Progress Surges As Membership And Influence Explode"

Business Standard — "BRICS 2026: Membership Expansion and Financial Innovation"

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

5 Signs That Someone You Know Is ‘Fake Rich’

5 Signs That Someone You Know Is ‘Fake Rich’ (and why it’s killing their wealth). Could you be pretending, too?

Vishesh Raisinghani Moneywise Sat, February 7, 2026

Scroll through social media and it’s easy to think everyone is rich and only getting richer. Your favorite influencers are filming videos in luxury SUVs, your friends are on five-star resorts in Bali, and your uncle just made “a fortune” on a new cryptocurrency.

But much of this perceived wealth could be smoke and mirrors. In fact, some of these peers and influencers could be actively undermining real wealth by trying to maintain the façade.

5 Signs That Someone You Know Is ‘Fake Rich’ (and why it’s killing their wealth). Could you be pretending, too?

Vishesh Raisinghani Moneywise Sat, February 7, 2026

Scroll through social media and it’s easy to think everyone is rich and only getting richer. Your favorite influencers are filming videos in luxury SUVs, your friends are on five-star resorts in Bali, and your uncle just made “a fortune” on a new cryptocurrency.

But much of this perceived wealth could be smoke and mirrors. In fact, some of these peers and influencers could be actively undermining real wealth by trying to maintain the façade.

1. Lots of luxury logos

A splashy logo isn’t an asset, but for someone desperate to appear rich it might as well be. From Balenciaga jackets and Chanel belts to Louis Vuitton monogrammed bags, online influencers and social climbers are often covered in conspicuous signals of wealth.

However, many of these mainstream brands are designed to appeal to middle-class buyers. Nearly half of global luxury sales are attributed to this middle-income group, according to Boston Consulting Group data cited by the Wall Street Journal (1).

Genuinely wealthy consumers have increasingly shifted toward lesser-known, exclusive, and niche brands — a movement referred to as “quiet luxury” (2).

Simply put, genuine wealth doesn’t need to announce itself. In fact, very wealthy individuals are often more likely to downplay their affluence. So if you’re tempted to overspend on a specific logo, it may be worth reconsidering.

Read More: The average net worth of Americans is a surprising $620,654. But it almost means nothing. Here’s the number that counts (and how to make it skyrocket)

2. Bragging on social media

There is so much conspicuous consumption and wealth flaunting on social media that it’s leaving many Americans feeling financially left behind.

Gen Z and millennial users are particularly susceptible to this phenomenon, often described as “money dysmorphia,” according to a 2024 Credit Karma report (3).

However, genuinely wealthy families tend to view social media as a potential data privacy and security risk, according to JP Morgan (4). Publicly flaunting wealth online can make individuals more attractive targets for cybercriminals, which is why many high-net-worth individuals choose to keep a low digital profile.

With that in mind, accounts that openly boast about their multiple millions and private jets are more likely promoting questionable products or services than reflecting genuine affluence. The best move is to scroll past.

3. Disproportionately expensive cars

A general rule of thumb is that expenses related to your vehicle shouldn’t exceed 20% of your monthly take-home pay, according to Patrick Roosenberg, senior director of automotive finance intelligence at J.D. Power (5).

To Continue and Read More: https://www.yahoo.com/finance/news/5-signs-someone-know-fake-120000122.html

Gold & Silver Takedown Was No Accident (What Comes Next Is Bigger

Gold & Silver Takedown Was No Accident (What Comes Next Is Bigger

Taylor Kenny: 2-7-2026

After hitting record highs, both gold and silver just got violently crushed. The mainstream media blames "profit-taking," a Fed nomination, or just "normal volatility."

The truth is far more dangerous: what we just witnessed was a cascade of forced liquidations, margin calls, and blatant financial manipulation—all triggered by a deeper liquidity and credit crisis that's still unfolding.

Gold & Silver Takedown Was No Accident (What Comes Next Is Bigger

Taylor Kenny: 2-7-2026

After hitting record highs, both gold and silver just got violently crushed. The mainstream media blames "profit-taking," a Fed nomination, or just "normal volatility."

The truth is far more dangerous: what we just witnessed was a cascade of forced liquidations, margin calls, and blatant financial manipulation—all triggered by a deeper liquidity and credit crisis that's still unfolding.

CHAPTERS:

00:00 – Gold & Silver Collapse: What Just Happened?

00:57 – Forced Liquidations & Margin Calls Explained

03:10 – CME’s Role: Raising Margin Requirements

04:41 – Bank Manipulation: Coordinated Market Rigging?

06:05 – Physical Crisis & Paper Market Distortion

07:02 – The Brewing Private Credit Crisis

09:28 – BlackRock & the Derivatives Domino Effect

11:19 – Liquidity Crisis: A Ticking Time Bomb

12:10 – Why Physical Gold & Silver Still Win

14:05 – Get Your Strategy in Place

Massive Fed’s Gold Revaluation! If You Own Gold or Silver, Watch Now! Mario Innecco & Clive Thompson

Massive Fed’s Gold Revaluation! If You Own Gold or Silver, Watch Now! Mario Innecco & Clive Thompson

Money Sense: 2-7-2026

A massive speculative bet has emerged in the precious metals market, targeting a gold price of $15,000 by November 3rd.

While hitting this strike price seems extreme, the strategy likely focuses on "gamma" exposure—profiting from a sharp, sudden move higher, such as a jump from $5,000 to $6,500 in a matter of weeks.

If such a spike occurs, the value of these deep out-of-the-money options could double rapidly, allowing traders to exit with massive gains well before the maturity date. This suggests an anticipation of a drastic market event rather than a slow grind higher.

Massive Fed’s Gold Revaluation! If You Own Gold or Silver, Watch Now! Mario Innecco & Clive Thompson

Money Sense: 2-7-2026

A massive speculative bet has emerged in the precious metals market, targeting a gold price of $15,000 by November 3rd.

While hitting this strike price seems extreme, the strategy likely focuses on "gamma" exposure—profiting from a sharp, sudden move higher, such as a jump from $5,000 to $6,500 in a matter of weeks.

If such a spike occurs, the value of these deep out-of-the-money options could double rapidly, allowing traders to exit with massive gains well before the maturity date. This suggests an anticipation of a drastic market event rather than a slow grind higher.

However, this is a high-risk "all-or-nothing" play; if gold consolidates or moves slowly, these contracts will expire worthless.

Mario Innecco, financial analyst and host of Maneco64, and Clive Thompson, a seasoned wealth manager, debate whether this trade signals an imminent currency revaluation event or merely a gamble on extreme volatility.

They analyze the potential for a systemic shock that could validate such aggressive positioning before the year ends.