Iraq Economic News and Points To Ponder Tuesday Afternoon 1-20-26

The Banking Sector And The New Public

The past year, 2025, witnessed tireless activity at various levels in the pursuit of achieving the desired banking reform in Iraq. On the one hand, the outgoing government made strenuous efforts to reform the state-owned banks, which included merging some banks and making the decision to split Al-Rafidain Bank into two banks. These measures were described as being part of the reform of the state-owned banking sector.

The Banking Sector And The New Public

The past year, 2025, witnessed tireless activity at various levels in the pursuit of achieving the desired banking reform in Iraq. On the one hand, the outgoing government made strenuous efforts to reform the state-owned banks, which included merging some banks and making the decision to split Al-Rafidain Bank into two banks. These measures were described as being part of the reform of the state-owned banking sector.

On the other hand, the Central Bank of Iraq, as the supervisory and regulatory body for the work of private (national) banks, played a pivotal role in advancing the reform of this sector, by taking important steps during 2025, the most prominent of which was bringing in the global company “Oliver Wyman”, which is one of the consulting companies specializing in the development of banking and financial systems.

This contract aims to elevate the private banking sector to meet international standards, especially since Iraq is about to enter a phase of developmental and reconstruction renaissance that requires a robust banking sector capable of meeting the needs of international companies wishing to invest in Iraq, after the wars and crises that the country has gone through that have deeply affected its economic structure.

Oliver Wyman established strict conditions and clear requirements for achieving banking reform, obligating banks to comply and emphasizing that those lagging behind or failing to comply could be forced out of the banking sector. These conditions included: increasing bank capital, encouraging bank mergers, and adhering to international standards for governance, solvency, and risk management.

According to the available data, most banks have responded to these requirements and agreed to bear the costs of consultations and repairs.

This raises a fundamental question commensurate with the scale of this response:

After the banks have fulfilled their obligations, what rights and facilities should they receive to enable them to provide banking services that meet the standards of international banks?

Banking experts believe that successful banking reform is a reciprocal process. After banks commit to the new standards, there is an urgent need for an incentive package to help them conduct their banking activities efficiently, especially since a large portion of banks are still subject to various sanctions.

These stimulus packages include financial and funding support, technical assistance and institutional capacity building, regulatory flexibility and a phased approach to implementing requirements, infrastructure and technological system reforms, and opportunities for growth and regional and international partnerships.

The success of banking reform depends not only on enforcement but also on integrating obligations with rights and building a banking environment capable of supporting comprehensive economic development in Iraq.

Finally, reforming the banking sector in Iraq cannot be measured solely by the number of regulations or the stringency of the conditions, but rather by its ability to become a genuine engine for economic development.

Banks that have responded to the reform requirements and complied with international standards, in turn, need a supportive regulatory environment and practical incentives that enable them to fulfill their natural role in financing, investment, and driving economic growth.

Successful banking reform is a balanced partnership between the regulatory authority and the banks, based on the exchange of obligations and rights, a phased implementation, and addressing structural challenges, foremost among them sanctions, weak infrastructure, and limited financing tools. Without this, reform could transform from an opportunity for advancement into a burden that hinders the sector's effectiveness.

With the start of a new year, the opportunity remains to build a modern, robust Iraqi banking sector that is integrated into the global financial system and capable of meeting the requirements of reconstruction and sustainable development, provided that the reform process is completed with a comprehensive vision that balances discipline and empowerment, and oversight and incentives, in a way that serves the national economy and enhances confidence in the banking system https://alsabaah.iq/126635-.html

The Caretaker Government Issues Several Decisions, Including The Establishment Of Water Treatment Plants.

Today 20:08 The caretaker cabinet issued several decisions on Tuesday, including the establishment of water treatment plants in Basra. A statement from the cabinet's media office ,

received by Al-Maalomah News Agency, indicated that "the cabinet directed the Ministry of Planning to prepare detailed reports on the size and costs of projects included in the plan, whether self-funded or through loans, from 2005 to 2025. The results will be presented to the cabinet for evaluation of public spending." The statement

added that "the cabinet approved setting the price of surplus wheat intended for export at between 415,000 and 420,000 Iraqi dinars per ton, taking into account global market prices. Sales will be conducted from the General Company for Grain's warehouses in Nineveh and Salah al-Din governorates. The cabinet also approved financing the outstanding payments owed to seed producers for 2024 by supplying them with available seeds from the warehouses in lieu of their debts, thus ensuring the continuation of the 2025 agricultural plan."

He noted that "the Council granted the authority to disburse funds for contracts with the Korean company Daewoo related to the infrastructure of the Grand Faw Port, directing the Ministry of Transport to prepare a detailed technical study and cost estimate in coordination with the Air Force before awarding the contract. In Basra, the Council approved the establishment of water treatment plants on the Shatt al-Arab to secure drinking water for the residents of the Al-Baradhiya area, with their costs to be included within the recovered petroleum expenditures for the development of the Zubair field."

He continued, "The Council corrected the gas calculation process to be in dry cubic meters instead of cubic feet, and amended previous decisions related to obligating the Ministry of Oil to purchase refined petroleum products, leaving the determination of investment periods to future technical discussions."

The statement concluded, "The Council approved the continuation of spending by the Ministries of Finance and Planning on completed investment projects according to available liquidity, while allowing the issuance of necessary spare parts orders not exceeding 25% of the contract value, to ensure that vital projects do not stop until the federal budget is approved." LINK

US Official: We Are In An "Active War" With Venezuela For Control Of Its Oil.

January 19, 2:25 PM Information/Follow-up… US Senator Rand of Kentucky asserted that the United States is in an active war with Venezuela to control its oil.

Paul told NBC: "This is an act of war... aimed at continuing to get their oil. It's an ongoing war for the distribution of that oil... I still hope the crisis will be resolved, but we are still in an active war with Venezuela."

Rand added that "the United States has imposed a complete naval blockade on the Venezuelan coast and deployed hundreds of warships off its shores." End/25 LINK

Moscow: The US "Peace Council" Will Not Replace The United Nations

January 19, 21:00 Information/Follow-up...Vladimir Dzhabarov, head of the Russian Federation Council's Committee on the Protection of State Sovereignty, said that the "Peace Council" proposed by US President Donald Trump regarding Gaza would not be able to replace the United Nations.

In a post on Telegram, Japarov stressed that the United Nations is indispensable despite its flaws, asserting that any new council operating according to the principles of a semi-closed club will not be able to address the root causes of conflicts.

He noted that Trump had repeatedly criticized the United Nations and recently signed a memorandum withdrawing the United States from 31 UN agencies, but stressed that the UN had maintained a balance between the two superpowers, the Soviet Union and the United States, throughout the 40 years of the Cold War, and remained the most effective tool the international community possessed thanks to the veto mechanism in the Security Council.

Japarov ruled out the possibility of Trump withdrawing from the UN Security Council, explaining that Washington benefits from the location of the UN headquarters on its territory to achieve its political goals, and that the success of the "Peace Council" depends on the results of the Republicans in the midterm congressional elections scheduled for next November.

He revealed that the US administration expects the role of the "Peace Council" to expand from the reconstruction of the Gaza Strip after the conflict between Hamas and Israel to later include the settlement in Ukraine and Venezuela, and perhaps become an alternative to the United Nations in other hotspots.

He explained that the council included high-level figures to give it weight, including Russian President Putin, Brazilian President Lula da Silva, Kazakh President Kassym-Jomart Tokayev, and Hungarian Prime Minister Viktor Orban, along with leaders from Pakistan, India, Turkey, and other European countries.

Japarov urged caution regarding the idea of a "Peace Council," warning against the inclusion of controversial figures on its executive committee, such as former British Prime Minister Tony Blair, who supported the 2003 US-led invasion of Iraq under the pretext of its possession of weapons of mass destruction. (End of 25) LINK

Al-Sudani To The SDF Commander: The Need To Consolidate Dialogue And Prevent Terrorists From Tampering With The Security Of Syria And Iraq

Time: 2026/01/20 23:25:0 Politics:Al-Furat News} Prime Minister Mohammed Shia Al-Sudani made a phone call this evening, Tuesday, to Mazloum Abdi, the commander of the Syrian Democratic Forces.

The most concise and informative news can be found on the Al-Furat News Telegram channel. To subscribe, click here.

The Prime Minister's Media Office stated in a statement, a copy of which was received by Al-Furat News, that: "During the call, developments in Syria were discussed, in light of the latest security developments and events, and their repercussions on regional security and stability and the situation in Iraq."

Al-Sudani stressed "the need to consolidate dialogue at this critical stage, in a way that guarantees the rights of all Syrian components, preserves the unity and security of the country, and prevents terrorists from escaping from prisons and tampering with the security and stability of Syria and Iraq and the general security in the region." LINK

Gold Prices Climb In Baghdad, Erbil Markets

Economy & Business 2026-01-20 04:25 Shafaq News– Baghdad/ Erbil On Tuesday, gold prices edged higher in Baghdad and Erbil markets, according to a survey by Shafaq News Agency.

Gold prices on Baghdad's Al-Nahr Street recorded a selling price of 982,000 IQD per mithqal (equivalent to five grams) for 21-carat gold, including Gulf, Turkish, and European varieties, with a buying price of 978,000 IQD. The same gold had soldfor 965,000 dinars on Monday.

The selling price for 21-carat Iraqi gold was 952,000 IQD, with a buying price of 948,000 IQD.

In jewelry stores, the selling price per mithqal of 21-carat Gulf gold ranged between 980,000 and 990,000 IQD, while Iraqi gold sold for between 950,000 and 960,000 IQD.

In Erbil, 22-carat gold was sold at 1.034 million IQD per mithqal, 21-carat gold at 987,000 IQD, and 18-carat gold at 846,000 IQD. https://www.shafaq.com/en/Economy/Gold-prices-climb-in-Baghdad-Erbil-markets-8-6

News, Rumors and Opinions Tuesday 1-20-2026

Ariel : US Military Leaves Iraq, What this means for IQD Holders

1-20-2026

US Military Leaves Iraq: 23 Years Of Occupation Now Over (What This Means For IQD Holders)

Can you all feel the electricity in what is being laid out? It’s like watching puzzle pieces snap together after years of waiting in the shadows.

Iraq’s been grinding through reforms for ages, and with the US pullout from federal territory hitting the wires just yesterday (January 18, 2026), the timing feels charged.

Ariel : US Military Leaves Iraq, What this means for IQD Holders

1-20-2026

US Military Leaves Iraq: 23 Years Of Occupation Now Over (What This Means For IQD Holders)

Can you all feel the electricity in what is being laid out? It’s like watching puzzle pieces snap together after years of waiting in the shadows.

Iraq’s been grinding through reforms for ages, and with the US pullout from federal territory hitting the wires just yesterday (January 18, 2026), the timing feels charged.

Trump’s old 2020 line about not leaving until Iraq “pays us back” for those billion-dollar bases is echoing louder now, especially as Baghdad navigates how to settle accounts in a world where the dinar sits at roughly 1,310 to the dollar.

You’re spot on that a massive reval would be the cleanest “repayment” mechanism on paper, but let’s dig deep into the why and how of this moment, especially your sharp question: why route so much through Erbil over Baghdad?

I’ll try to explain with layers of context, pulling from the real dynamics at play, because this isn’t just surface noise it’s structural.

Iraq’s pushing multiple fronts right now, and it does feel anticipatory, like the country is finally clearing the runway for deeper global integration:

Sovereign rating push → Confirmed. That joint meeting with Oliver Wyman, chaired by CBI Governor Ali Mohsen Al-Alaq and attended by PM advisor Mazhar Mohammed Saleh, zeroed in on the five pillars (institutional strength, monetary policy, economic growth prospects, political risks, governance). This isn’t cosmetic they’re building a narrative for S&P, Fitch, and Moody’s to justify upgrades. Better ratings mean cheaper borrowing, more FDI, and smoother access to international markets.

Banking cleanup and OFAC coordination → Real and ongoing. The CBI has been isolating bad actors, tightening dollar auction rules, and aligning with US Treasury to choke illicit flows (think Iran smuggling networks). This creates “clean pipes” for legitimate capital.

WTO track → Accelerating. After resuming talks in 2024 following a 16-year pause, Iraq’s adopting laws (commercial agency tweaks, IP protections) to meet accession criteria. Full membership isn’t tomorrow, but the momentum is there UNCTAD systems at ports like Umm Qasr are modernizing customs to tie into global trade rails.

US withdrawal context → Fresh and nuanced. Reports across CNN, Reuters, AP, and others confirm the full handover of bases like Ain al-Asad in federal Iraq. But notice the precise wording: “federal territory” or “non-Kurdish regions.” That’s deliberate. Remaining advisory/training elements are heavily concentrated in the Kurdistan Region, where US-KRG ties run deep and ISIS remnants still justify a footprint.

All this choreography clean banks, rating upgrades, trade prep does scream preparation for a more open economic regime. But the currency angle? The 2026 budget officially locks in ~1,300 IQD/USD, with no public signals of a dramatic shift. Which of course is very smart to keep the markets in line.

Read Full Article: https://www.patreon.com/posts/us-military-iraq-148634263

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 What is the #1 law for the citizens that is going to be passed right away? The #1 law is the HCL and that requires a new rate. But we learned the HCL can be passed without the rate...[but] if anyone is silly enough to believe they're going to do it at 1300 I got some land to sell you on the moon...The moment you see the HCL, within nanoseconds, you will see the new exchange rate.

Jeff The news is phenomenal. Looks amazing. The next critical thing we're looking for is when they're going to have and hold a session of parliament to tackle and vote on the president. They haven't given us that date yet but they're in close proximity to doing that...When they get to the point of a prime minister, this can go very fast...They could announce the prime minister the same day they announce the president.

Militia Man You see the corruption falling. You see the bite back from the corruption because the new systems are working. They're not having it. They're not liking it. Today's theme in the news has been about misinformation. It's quite evident...You have to be very careful on what you read and how you read it because there's a lot of propaganda out there.

************

BofA Warns: $6 TRILLION BANK RUN IMMINENT!

Steven Van Metre: 1-19-2026

CEO of Bank of America Brian Moynihan is warning there will be a six trillion dollar run on the banks that will spur a massive liquidity crisis even too big for the Fed to fix that could collapse the entire banking system.

“Tidbits From TNT” Tuesday 1-20-2026

TNT:

Tishwash: Shocking photos reveal Saddam Hussein with Trump and Savaya during their meeting! What's going on and what's being planned for Iraq?

Mark Savaya, the special envoy to Iraq, posted a picture of himself with US President Donald Trump on Tuesday (January 20, 2026), which sparked widespread interaction on social media, due to a striking detail that appeared in front of Trump during the meeting.

The image showed an Iraqi coin bearing the image of former Iraqi President Saddam Hussein placed on the table in front of Trump, in a scene described by observers as unusual and carrying symbolic connotations.

TNT:

Tishwash: Shocking photos reveal Saddam Hussein with Trump and Savaya during their meeting! What's going on and what's being planned for Iraq?

Mark Savaya, the special envoy to Iraq, posted a picture of himself with US President Donald Trump on Tuesday (January 20, 2026), which sparked widespread interaction on social media, due to a striking detail that appeared in front of Trump during the meeting.

The image showed an Iraqi coin bearing the image of former Iraqi President Saddam Hussein placed on the table in front of Trump, in a scene described by observers as unusual and carrying symbolic connotations.

Savaya did not comment on the reason for the coin's presence or its background, simply stating, "It was a wonderful day." This opened the door to interpretation and questions about whether the image was intentional or accidental, especially given the sensitivity surrounding symbols associated with Iraq and its political history in the American context. link

Tishwash: Saddam Hussein is "present" on Trump and Savaya's table... Coded messages reshape the contours of the American role in Iraq

another version

A photo posted by the US Special Envoy to Iraq, Mark Savaya, has sparked a storm of political speculation about the nature of the next phase in the relationship between Washington and Baghdad, after he appeared in a meeting with President Donald Trump accompanied by an old Iraqi banknote bearing the image of former President Saddam Hussein .

Although the date the photo was taken could not be definitively verified, the timing of its publication and its content clearly indicate that it reflects the recent trends of the US administration towards the Iraqi issue.

Savaya commented on the photo, describing the meeting as "a great day with a great man," in a statement that observers considered an official declaration of the beginning of an era of "shock diplomacy" which he is leading with a direct presidential mandate that goes beyond traditional diplomatic frameworks.

Political analysts believe that the presence of the “five dinar” denomination, which has been abolished for decades, on the table of discussion between the president and his special envoy cannot be considered a mere coincidence. Rather, it is a coded visual message directed to the Iraqi interior and regional powers, symbolizing Washington’s desire to see a “strong central state” capable of controlling weapons and securing the borders, in an explicit exposure of the current state of security fragmentation and the dominance of armed factions.

This move reinforces the influence of Savaya, who was appointed in October 2025 with a primary mission focused on undermining the influence of pro-Iranian armed groups and drying up their sources of funding, while simultaneously working to open up major investment opportunities for American companies in the energy and infrastructure sectors, which puts Baghdad before a real test of balancing its international relations.

It is expected that Savaya will adopt a similar approach to what Tom Brack did in recent regional files, where this method is based on “stirring up stagnant waters” through major deals conditional on comprehensive political and security stability, especially what happened in Syria.

While Savaya’s mission is described as extremely complex due to the deep-rooted opposition to Washington in Iraqi decision-making centers, his direct line of communication with the White House gives him the ability to exert unprecedented maximum pressure.

This public appearance, with symbols from Iraq’s past, confirms that the US administration is prepared to cross all traditional red lines and political sensitivities in order to redraw the balances in the region and impose a new reality that ends the state of stagnation that has characterized US foreign policy in Iraq for many years.

*****************

Tishwash: Six measures to protect gold and regulate its market: Mazhar Saleh explains Iraq's vision for national wealth.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, outlined six key measures on Monday to regulate the gold market, noting that the Gold City project is a strategic initiative to protect one of the nation’s greatest assets.

Saleh said in a press statement: “The global rise in gold prices has not led to a decline in demand for it in the local market, but rather has contributed to changing its function from an ‘ornamental commodity’ to a ‘savings tool and protection of value,’ stressing the ‘need to adopt a unified national mark and the obligation of modern technical examination to protect household savings.’”

He added that "this functional transformation of the yellow metal makes quality control and government oversight an urgent economic and social necessity, as it protects families' wealth and enhances confidence in the market," indicating that "quick and low-cost procedures, such as the unified national marking and rapid technical inspection, represent sufficient means to restore discipline and reduce manipulation."

Saleh pointed out that “gold remains a symbol of family security and savings for generations in the Iraqi social memory, and with rising prices, it has become part of the tools of unofficial monetary policy, as it is a store of value parallel to the dinar,” noting that “regulating the market is not a formal procedure, but rather a basic condition for building confidence and protecting national wealth.”

Saleh called for "a comprehensive reform of the gold market system, through the adoption of a unified and mandatory Iraqi mark that includes (carat, testing authority, and year of mark), while criminalizing the trading of unmarked gold," stressing "the importance of strengthening oversight through field testing using modern technologies such as (XRF), which reveals the truth about gold immediately without causing any damage to the pieces."

The financial advisor added that "the next stage requires regulating gold smelting and import operations through workshop licensing and tightening border inspection, as well as establishing a national register for gold traders and adopting unified official invoices to reduce undocumented trading," noting that "empowering the consumer through awareness campaigns and effective reporting mechanisms represents a fundamental pillar in this system."

Saleh concluded his remarks by saying: “The institutional completion of the ‘City of Gold’ project has become an urgent necessity, as it represents the official incubator for protecting this great national wealth and providing the highest standards of legal and professional protection for it.” link

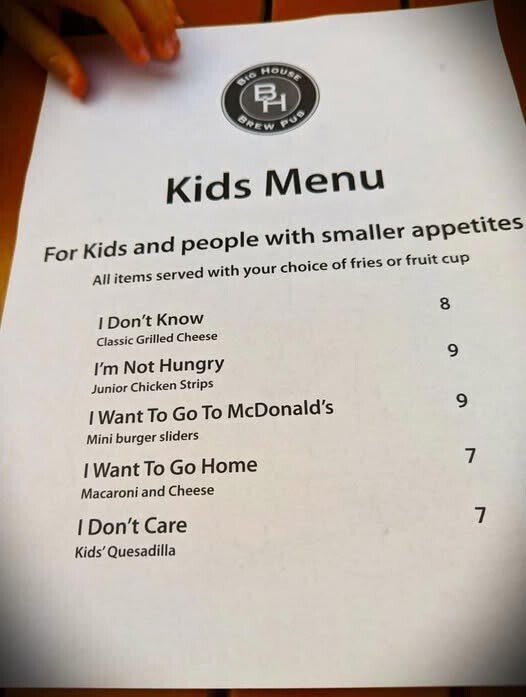

Mot: . Best Kids Menu!!!!

Mot: . Truth be Told -- hmmmmmmmm!!!

Seeds of Wisdom RV and Economics Updates Tuesday Morning 1-20-26

Good Morning Dinar Recaps,

Iran and Venezuela — Similar Look, Different Reality: Do Your Research

Two weak currency visual snapshots, but very different economic stories behind the numbers

Good Morning Dinar Recaps,

Iran and Venezuela — Similar Look, Different Reality: Do Your Research

Two weak currency visual snapshots, but very different economic stories behind the numbers

Overview

Iran’s rial and Venezuela’s bolívar both appear nearly worthless on USD converters — often rounding to zero or showing huge numerical values. At a glance, they look the same. But the underlying causes are fundamentally different. One is a consequence of prolonged inflationary collapse and hyperinflation, the other largely stems from sanctions, restricted foreign exchange access, and structural economic constraints rather than classic hyperinflation cycles.

Key Developments

1. Venezuela’s Bolívar Collapse Was Driven by Hyperinflation

Venezuela endured one of the world’s most severe hyperinflation episodes in recent history, stretching back several years as the bolívar spiraled in value due to runaway price increases, currency devaluations, and a collapse in economic output and confidence. The IMF notes persistent triple-digit inflation figures and deep economic contraction.

2. Iran’s Rial Is Weakened by Sanctions and FX Scarcity

Iran’s currency has plummeted on open markets to prices well above one million rials per USD, reflecting dire foreign currency shortages, strict U.S. and international sanctions, and limited access to global financial systems. This depreciation is not classic hyperinflation driven by runaway domestic money printing alone, but rather external pressure, scarcity, and multiple exchange rate dysfunctions.

3. A Low Converter Value Is a Technical Reflection, Not a Reset Signal

When currencies become so devalued that digital converters display “$0.00” for a unit of local money, that’s a rounding artifact — not evidence of parity, revaluation, or reset. It simply reflects how deeply the local currency has lost purchasing power in global terms.

4. Policy and Structural Differences Matter More Than Zeros

Venezuela’s crisis was rooted in policy-driven hyperinflation — massive money printing to cover fiscal deficits, extreme price controls, and collapse of oil revenue.

Iran’s situation is tied to extended sanctions, capital controls, restricted FX access, and geopolitical isolation, which depress foreign currency inflows and erode market confidence.

Why It Matters to Currency Holders

For those watching currency movements for reset or revaluation implications:

Superficial similarity in exchange rate figures does not imply common outcomes.

Venezuela’s bolívar trajectory was shaped by decades of hyperinflation and economic collapse — not a reset waiting to happen.

Iran’s rial, though extremely weak, reflects external constraints, not the same kind of monetary breakdown seen in hyperinflation crises.

A low converter value alone is not a signal of an imminent revaluation, reset, or parity event.

Understanding the drivers behind currency weakness — not just the headline number — is critical to contextual analysis and realistic expectations.

Implications for the Global Reset

This comparison underscores a broader point in global currency analysis:

Visual indicators are not substitutes for structural fundamentals.

Seeing zeros on a converter does not equate to approaching parity or imminent systemic revaluation — it reveals distortion, dysfunction, or policy pressures. True reset conditions require coordinated systemic shifts, not just numeric quirks.

This isn’t just about zeroes on a screen — it’s about economics vs. appearances.

Sources

Reuters — Venezuelan banks to sell $300M in dollars; bolivar weakened 83% and inflation accelerates

IMF — Venezuela economic profile, inflation and macroeconomic data

Iran’s economics: Explaining the weak rial and rising inflation — The National

Iran’s Rial All but Vanishes on Currency Screens as Economic Crisis Deepens

~~~~~~~~~~

Gold Surges to $4,719.60 on COMEX as Confidence in Fiat Systems Erodes

Safe-haven demand accelerates amid geopolitical stress and monetary uncertainty

Overview

Gold prices surged to $4,719.60 on COMEX, marking another historic high as investors continue rotating out of risk assets and fiat-dependent instruments. The move reflects intensifying concern over geopolitical conflict, trade fragmentation, debt sustainability, and the long-term credibility of existing monetary frameworks.

Key Developments

1. Gold Hits New Record on COMEX

The latest COMEX pricing shows gold trading at $4,719.60, underscoring sustained demand rather than a short-lived spike. Futures market positioning suggests institutional participation alongside central bank accumulation.

2. Safe-Haven Demand Continues to Build

Gold’s rise comes as markets face heightened volatility driven by tariff threats, geopolitical disputes, and policy uncertainty. Investors are increasingly seeking assets outside the traditional debt-based financial system.

3. Currency and Bond Markets Show Stress Signals

Persistently high sovereign debt levels, rising military expenditures, and narrowing central bank policy flexibility are pressuring confidence in long-term fiat stability. Gold is responding as a neutral reserve asset with no counterparty risk.

4. Central Banks Remain Net Buyers

Ongoing central bank gold accumulation reflects a strategic shift toward reserve diversification, particularly among non-Western and emerging economies seeking insulation from sanctions and financial leverage.

Why It Matters

Gold’s move to record territory is not driven by speculation alone. It reflects a structural repricing of risk, where trust in policy coordination, fiscal discipline, and monetary predictability is weakening.

Historically, sustained gold rallies coincide with transitions in the global monetary order, not merely inflation cycles.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching for reset or revaluation conditions:

Rising gold prices signal declining confidence in fiat purchasing power.

Gold strength often precedes currency realignment, repricing, or restructuring.

Nations with gold-backed credibility or reserve leverage may gain positioning advantages during systemic transitions.

Gold does not predict timing — but it reflects directional pressure within the system.

Implications for the Global Reset

Pillar 1: Monetary Trust Is Shifting

Gold’s surge suggests markets are reassessing what constitutes reliable money. Trust is migrating away from promises and toward tangible reserves.

Pillar 2: Reserve Diversification Accelerates

As geopolitical and financial fragmentation deepens, gold increasingly functions as a neutral settlement anchor in a multipolar world.

This is not a panic signal — it is a repricing of monetary reality.

Gold is not just rising — it is being revalued against a changing system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Tuesday Morning 1-20-26

Within a week, trading on the Iraqi Stock Exchange exceeded one billion dinars.

Today 15:10 Economy The Iraq Stock Exchange announced on Tuesday that shares worth more than one billion dinars were traded last week. The exchange stated in a report, which was reviewed by Al-Maalomah News Agency, that "69 companies saw their shares traded last week, while 25 companies did not trade due to a mismatch between buy and sell orders. Trading remains suspended for 10 companies out of the 104 listed on the exchange due to their failure to submit disclosures."

Within a week, trading on the Iraqi Stock Exchange exceeded one billion dinars.

Today 15:10 Economy The Iraq Stock Exchange announced on Tuesday that shares worth more than one billion dinars were traded last week. The exchange stated in a report, which was reviewed by Al-Maalomah News Agency, that "69 companies saw their shares traded last week, while 25 companies did not trade due to a mismatch between buy and sell orders. Trading remains suspended for 10 companies out of the 104 listed on the exchange due to their failure to submit disclosures."

He added that "the number of shares traded reached 1.27 billion, a decrease of 78 percent compared to the previous week, with a financial value of 1.713 billion dinars, a decrease of 69 percent compared to the previous week, through the execution of 2,554 transactions."

He pointed out that "the ISX60 index closed at 984.54 points, registering a decrease of 1.353 percent from its closing in the previous session."

He explained that "the number of shares purchased by non-Iraqi investors last week reached 50 million shares with a financial value of 14 million dinars through the execution of three transactions, while the number of shares sold by non-Iraqi investors reached three million shares with a financial value of 16 million dinars through the execution of 19 transactions."

It is worth noting that the Iraq Stock Exchange holds five trading sessions weekly from Sunday to Thursday, and lists 104 Iraqi joint-stock companies representing the banking, telecommunications, industry, agriculture, insurance, financial investment, tourism, hotels, and services sectors. End 25 LINK

Parliamentary Warnings Of A Political Crisis Due To The Large Number Of Presidential Candidates.

Today 14:20 The Information Agency / Baghdad… MP Sami Oshana warned on Tuesday against the scenario of Kurdish forces presenting multiple candidates for the presidency to parliament, indicating that this could complicate the political landscape.

Oshana told the Information Agency that “discussions between the two Kurdish parties are still ongoing and have not yet reached a final agreement on a presidential candidate,” explaining that “multiple candidates will lead to division within parliament and hinder the decision-making process.”

He added that “the next phase requires a clear consensus to avoid a new political crisis,” stressing that “delaying an agreement opens the door to unforeseen possibilities.” The presidential candidate position remains undecided, given the ongoing Kurdish disagreements over agreeing on a single candidate, which portends further complications in the political scene in the coming period. End / 25 LINK

Dollar Exchange Rates Rise In Baghdad

Time: 2026/01/20 Readings: 390 times

{Economic: Al-Furat News} The exchange rate of the US dollar rose this morning, Tuesday, in the markets of the Iraqi capital, Baghdad. The prices were as follows...

The selling price was 148,250 dinars for 100 dollars, while the buying price was 147,250 dinars for 100 dollars. LINK

International Monetary Fund: Average Oil Price In 2026 At $62.13 Per Barrel

Time: 2026/01/19 17:47:32 Readings: 105 times {Economic: Al-Furat News} The International Monetary Fund expects the average price of oil during 2026 to be around $62.13 per barrel, with a slight increase to $62.17 in 2027.

This came according to a report published by the Fund on Monday regarding the prospects for the global economy during 2026 and 2027.

The fund indicated in its report that it expects a further decline in oil prices due to "weak global demand growth versus strong supply growth".

It is worth noting that the IMF's Director of Communications, Julie Kozak, stated last January that the Fund does not yet see a significant impact of the situation in Venezuela and Iran on oil prices. LINK

Oil Prices Rise, With Brent Crude Reaching $64 A Barrel.

Time: 2026/01/20 08:10:30 Reading: 45 times {Economic: Al-Furat News} Oil prices rose on Tuesday after better-than-expected Chinese economic growth data boosted optimism about demand, while markets also monitored President Donald Trump's threats to increase US tariffs on European countries due to his desire to buy Greenland.

Brent crude futures rose 19 cents, or 0.3%, to $64.13 a barrel The price of the U.S. West Texas Intermediate crude oil contract for February, which expires on Tuesday, rose by 25 cents, or 0.4%, from Friday's close to $59.69. LINK

Gold And Silver At Record Highs

Time: 2026/01/20 08:20:11 Readings: 105 times {Economic: Al-Furat News} Gold and silver traded near record levels on Tuesday, as US President Donald Trump’s threats to annex Greenland deteriorated global sentiment and triggered a rush towards safe-haven assets.

Spot gold rose 0.1% to $4,675.32 an ounce as of 03:36 GMT, after hitting a record high of $4,689.39 in the previous session. U.S. gold futures for February delivery climbed 1.9% to $4,680.30 an ounce.

Spot silver fell 1.4% to $93.33 an ounce, after hitting a record high of $94.72 earlier in the session. Among other precious metals, spot platinum fell 1.8% to $2,331.20 an ounce, while palladium dropped 2% to $1,804.15. LINK

Gold And Silver Hit Record Highs

Time: 2026/01/19 Reading: 90 times {Economic: Al-Furat News} Gold and silver prices recorded new record levels on Monday, driven by increased demand for safe-haven assets, amid escalating trade tensions following US President Donald Trump's threat to impose additional tariffs on European countries over the Greenland dispute.

Spot gold rose 1.5% to $4,663.37 an ounce after hitting an all-time high of $4,689.39, while U.S. gold futures for February climbed 1.6% to $4,669.90 an ounce.

Silver saw a strong jump, with its spot price rising 3.3% to $92.93 an ounce, after hitting a record high of $94.08.

Prices of other precious metals also rose, with platinum climbing 0.9% to $2,348.32 an ounce and palladium rising 0.5% to $1,808.46 an ounce. LINK

Iraq’s Currency In Circulation Exceeded 93T Dinars In October 2025

2026-01-19 Shafaq News– Baghdad Currency in circulation in Iraq rose by 1.604 trillion dinars in October 2025, pushing the total above 93 trillion dinars, according to figures released Monday by the Central Bank of Iraq.

The data showed that net currency in circulation climbed to 93.789 trillion dinars in October, up from 92.185 trillion dinars in September. During the same period, total currency issued reached 101.015 trillion dinars, while cash held inside commercial banks stood at 7.226 trillion dinars.

The Central Bank explained that issued currency includes all banknotes and coins printed and released into the market, encompassing both paper and metal denominations circulating outside its vaults. It noted that the continued expansion of cash held outside the banking system, alongside comparatively low bank reserves, indicates a preference among citizens to keep money in cash rather than deposit it in banks.

The bank warned that this pattern weakens financial intermediation and poses challenges to overall financial stability, as large volumes of liquidity remain outside formal channels.

The figures were released shortly after the Central Bank reported a widening fiscal gap in 2025. Public revenues reached 104.434 trillion dinars ($72.0 billion) in the first ten months of the year, while expenditures totaled 115.535 trillion dinars ($79.7 billion), meaning government spending exceeded income over the same period.https://www.shafaq.com/en/Economy/Iraq-s-Currency-in-circulation-exceeded-93T-dinars-in-October-2025

Oil Gains On Weak Dollar As Investors Track Greenland Row

Economy & Business Oil Prices 2026-01-20 Shafaq News Oil prices edged up on Tuesday, bolstered by a weaker dollar, while markets watched President Donald Trump's threats of higher U.S. tariffs on European nations over his desire to buy Greenland.

Brent futures rose 15 cents, or 0.2%, to $64.09 a barrel at 0430 GMT. The U.S. West Texas Intermediate crude contract for February, which expires on Tuesday, was up 14 cents, or 0.2%, to $59.58.

The more actively-traded WTI March contract gained 6 cents, or 0.1%, to $59.40. WTI contracts did not settle on Monday due to the U.S. Martin Luther King Jr. Day holiday.

"A weaker U.S. dollar provided some support to oil and the broader commodities complex," said ING commodities strategists on Tuesday. A weaker greenback makes dollar-denominated oil contracts cheaper for holders of other currencies.

Prices have held up relatively well amid a broader risk-off move in the markets, said ING, adding this followed the re-emergence of trade tensions between the U.S. and Europe over Trump's Greenland demands.

Over the weekend, fears of a renewed trade war escalated after Trump said he would impose additional 10% levies from February 1 on goods imported from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and Britain, rising to 25% on June 1 if no deal on Greenland was reached.

CHINA DATA SUPPORTS OIL

The oil market is also finding some support from the better-than-expected fourth-quarter Chinese gross domestic product data released on Monday, said IG market analyst Tony Sycamore.

"This resilience in the world's top oil importer provided a lift to demand sentiment," he said.

China's economy grew 5.0% last year, the data showed, meeting the government's target by seizing a record share of global demand for goods to offset weak domestic consumption. That strategy blunted the impact of U.S. tariffs but is increasingly hard to sustain.

The country's refinery throughput in 2025 also climbed, edging up 4.1% year-on-year, while crude oil output grew 1.5%, government data showed on Monday. Both were at all-time highs.

Markets are also keeping a close eye on Venezuela's oil sector after Trump said the U.S. would run the industry following the capture of President Nicolas Maduro.

Vitol offered Venezuelan oil to Chinese buyers at discounts of about $5 per barrel to ICE Brent for April delivery, multiple trade sources said. Reuters https://www.shafaq.com/en/Economy/Oil-gains-on-weak-dollar-as-investors-track-Greenland-row

Seeds of Wisdom RV and Economics Updates Monday Evening 1-19-26

Good Evening Dinar Recaps,

Geo-economic Fragmentation Accelerates as Old Growth Models Break Down

Trade conflict, tech concentration, and militarization expose stress fractures in the global system

Good Evening Dinar Recaps,

Geo-economic Fragmentation Accelerates as Old Growth Models Break Down

Trade conflict, tech concentration, and militarization expose stress fractures in the global system

Overview

A convergence of trade disputes, geopolitical rivalry, and financial concentration is accelerating geoeconomic fragmentation, according to recent warnings from global institutions and market reactions. The combination of tariff escalation, reliance on narrow growth engines, and rising military expenditures signals that the post-globalization economic model is losing coherence — forcing nations toward new frameworks for trade, finance, and currency stability.

Key Developments

1. Tariff Escalation Undermines Cooperative Growth

Renewed tariff threats — including those directed at traditional allies — highlight a sharp departure from decades of trade liberalization. Economic policy is increasingly driven by leverage and security considerations rather than efficiency and cooperation.

2. Growth Concentrated in Narrow Sectors

Global expansion is now heavily dependent on a limited set of drivers, particularly U.S. technology and artificial intelligence investment. This concentration magnifies downside risk if expectations falter or financial conditions tighten.

3. Supply Chains Remain Politically Vulnerable

Export controls, sanctions, and geopolitical alignment are reshaping supply chains into regional and political blocs. Efficiency is being sacrificed for resilience, increasing costs and long-term inflationary pressure.

4. Record Military Spending Crowds Out Development

Rising defense budgets are redirecting capital away from infrastructure, productivity, and social investment. While justified by security concerns, this shift weakens long-term economic growth and fiscal sustainability.

Why It Matters

The erosion of traditional growth engines signals a deeper reality: the global economy is no longer unified by shared incentives. Fragmentation increases volatility, reduces policy coordination, and weakens the mechanisms that once stabilized markets during crises.

This environment raises the probability of disruptive adjustments rather than gradual reform.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching for revaluation or reset-related outcomes:

Fragmentation reduces confidence in single-anchor reserve systems.

Regional trade blocs increase the appeal of currency realignment and bilateral settlement mechanisms.

Rising fiscal and military pressures elevate the risk of monetary restructuring in weaker economies.

Periods of systemic strain historically precede currency resets, repricing, or regime changes.

Implications for the Global Reset

Pillar 1: End of Synchronization

Coordinated global policy is giving way to competitive economic positioning. This accelerates the emergence of multipolar financial centers.

Pillar 2: Structural Stress on Monetary Systems

Debt, demographic pressure, and geopolitical risk are converging. Central banks face shrinking room to maneuver, increasing the likelihood of nontraditional monetary outcomes.

The reset is not an event — it is a process unfolding through pressure and fragmentation.

This is not a temporary slowdown — it is the unwinding of a system built on assumptions that no longer hold.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

International Monetary Fund — Global Economic Outlook and Financial Stability commentary

Reuters — Analysis on trade fragmentation, tariffs, and geopolitical risk

Stockholm International Peace Research Institute (SIPRI) — Global military spending trends

~~~~~~~~~~

Global System Faces Reset Pressure as Supply Chains, Sustainability, and Spending Collide

Economic resilience gives way to structural stress across trade, capital, and governance

Overview

Beyond headline tariff battles and market volatility, deeper forces are reshaping the global system. Strained supply chains, rising calls for sustainability reform, and record military spending are converging to weaken traditional growth models. Together, these pressures point toward a prolonged transition away from efficiency-driven globalization and toward a restructured economic and monetary order.

Key Developments

1. Supply Chains Harden Along Geopolitical Lines

Export controls, sanctions, and strategic competition are forcing companies and governments to regionalize production. While improving security, this shift increases costs, reduces flexibility, and embeds politics directly into trade flows.

2. Sustainability Models Are Being Rewritten

Economists and policymakers are calling for a rethink of growth frameworks that prioritize GDP over resilience. New models increasingly integrate natural capital, social stability, and long-term economic durability — signaling a philosophical shift in how value is measured.

3. Military Spending Reaches Historic Levels

Global defense expenditures continue to rise, diverting capital from infrastructure, development, and productivity investment. This reallocation increases fiscal pressure, especially in debt-heavy economies.

4. Development and Cooperation Lose Ground

As security concerns dominate budgets and policy agendas, international cooperation weakens. This erosion of trust accelerates fragmentation across trade, finance, and diplomatic institutions.

Why It Matters

These trends reflect more than cyclical disruption. They reveal a system under strain from competing priorities: security versus efficiency, sovereignty versus cooperation, and resilience versus growth. As capital is redirected and supply chains restructured, the foundations of the post-war economic order continue to erode.

This raises the risk of abrupt adjustments rather than orderly reform.

Why It Matters to Foreign Currency Holders

For foreign currency holders awaiting revaluation or reset-driven opportunity:

Rising structural costs weaken long-standing currency anchors.

Fragmented trade encourages bilateral settlement and alternative reserve strategies.

Fiscal stress linked to military and supply-chain spending increases the likelihood of currency repricing or regime change in vulnerable nations.

Such conditions historically precede monetary resets, redenominations, or managed revaluations.

Implications for the Global Reset

Pillar 1: Redefinition of Value and Growth

Growth is no longer judged solely by output. Sustainability, resilience, and strategic autonomy are becoming core economic objectives.

Pillar 2: Capital Reallocation and Monetary Stress

As spending priorities shift, central banks face rising pressure to support governments, increasing the probability of nontraditional monetary outcomes.

The reset is emerging not through collapse — but through reprioritization under constraint.

This is not the end of globalization — it is the transition to a more controlled, fragmented, and recalibrated system.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters — Global supply chain and geopolitical risk analysis

Phys.org — Economists and scientists call for rethinking sustainability models

Stockholm International Peace Research Institute (SIPRI) — Global military spending data

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Ex-Treasury Secretary Compared US to Third World Countries

Ex-Treasury Secretary Compared US to Third World Countries

Notes From the Field By James Hickman (Simon Black) January 19, 2026

Former Fed Chair and ex-Treasury Secretary Janet Yellen finally told the truth.

In recent remarks at the American Economic Association, she told the audience that US finances are in worse shape than most third-world countries. She said specifically that America's “needed belt tightening is significant—larger than in most programs supported by the International Monetary Fund."

Let that sink in for a minute. Remember, the International Monetary Fund provides emergency bailout funding for countries who are on the verge of bankruptcy. And naturally this IMF funding comes with strings attached: recipient countries are required to cut spending and tighten their belts.

Ex-Treasury Secretary Compared US to Third World Countries

Notes From the Field By James Hickman (Simon Black) January 19, 2026

Former Fed Chair and ex-Treasury Secretary Janet Yellen finally told the truth.

In recent remarks at the American Economic Association, she told the audience that US finances are in worse shape than most third-world countries. She said specifically that America's “needed belt tightening is significant—larger than in most programs supported by the International Monetary Fund."

Let that sink in for a minute. Remember, the International Monetary Fund provides emergency bailout funding for countries who are on the verge of bankruptcy. And naturally this IMF funding comes with strings attached: recipient countries are required to cut spending and tighten their belts.

Greece is the classic example of what happens when the IMF shows up.

By 2010, Greek debt had spiraled to 130% of GDP and climbing. No one was willing to lend them money anymore... forcing the IMF to swoop in with a "rescue" package that came with brutal strings attached.

Pensions were slashed by 40%. Public sector wages were frozen, then cut. Over 150,000 government workers were laid off. State assets—airports, ports, utilities—were sold off at fire-sale prices to foreign investors.

Greece's economy contracted by 25%. Youth unemployment hit 60%. An entire generation was hollowed out.

Argentina has been through the IMF wringer multiple times; in fact in in 2018, Argentina received the largest bailout in IMF history: $57 billion.

The conditions? Currency controls. Spending freezes. Slashed subsidies. Inflation still ripped past 50%. Poverty rates surged past 40%. The middle class was gutted. (These conditions are what ultimately led to the election of Javier Milei).

Sri Lanka is the most recent cautionary tale.

In 2022, after years of fiscal mismanagement, the country defaulted on its debt. The IMF demanded fuel subsidy cuts, electricity price hikes, and tax increases. Inflation hit 70%. Riots erupted, culminating in protesters storming the Presidential palace.

Pakistan, Egypt, Ukraine, Ecuador, Zambia—the list goes on. Whenever the IMF shows up, a nation loses its sovereignty. Foreign bureaucrats start dictating your tax rates, your spending priorities, your pension formulas.

And here's Janet Yellen—former Fed Chair, former Treasury Secretary—calmly, academically stating that America needs a bigger fiscal adjustment than most of these countries that the IMF bailed out.

She said the quiet part out loud (though coincidentally failed to admit that she was complicit in engineering this crisis).

Now, there are several critical differences between the US versus Greece, Sri Lanka, etc.

The US has a highly robust and productive economy with far more growth potential.

America also possesses (for now) the world's reserve currency.

If Sri Lanka runs out of money, they have no choice but to accept whatever terms the IMF dictates. But the US has the luxury of ‘printing’ its own money to finance the deficit.

And that's exactly what's happening: the Federal Reserve has quietly started buying Treasuries again—expanding reserves and injecting money into a system where inflation is already climbing.

The problem is, ‘printing’ money only works as long as the world keeps accepting dollars. Foreign creditors need to trust they'll be paid back—and that the dollars they receive will still be worth something.

When that confidence erodes, they start to diversify into other assets. And we’re seeing that play out now.

Central banks around the world have been aggressively dumping US dollars and buying gold—hence why the gold price surged over 60% last year. Foreign central bankers are not waiting around to see how America’s debt challenge plays out.

The US government is running out of time to demonstrate to the world that they are serious about cutting spending. And it’s not like there isn’t plenty of fat to trim.

Yet nothing ever happens. Just look at the Minnesota welfare fraud as an example: you’d think the entire country would be united against stopping the fraud.

Instead, apologists have downplayed it. They call critics “racist” and claim that there’s plenty of fraud elsewhere, so why is everyone so focused on Minnesota daycare facilities..?

The President tried to cut funding, and he immediately got sued. Then some activist masquerading as a federal judge ruled against the President, ensuring that the fraud would keep flowing.

If there is to be any change, it’s ultimately going to come down to Congress and its extremely cumbersome appropriations process.

Bear in mind, we’re talking about an institution that can’t even agree to a basic budget without threatening a full-blown government shutdown. So I wouldn’t hold my breath that they’re going to suddenly cut out fraudulent spending.

Yet while it’s doubtful that Congress will suddenly grow a brain, a conscience, and a backbone, it is still possible that you as an individual can sidestep the risks.

Real assets—precious metals, energy, agriculture, productive businesses—hold value regardless of what politicians do to the dollar. And if fiscal instability finally forces the reckoning Yellen warned about, these are the assets that benefit most.

We've been positioning for exactly this environment in our real assets investment research service Strategic Assets.

For example, we've identified gold miners that are now up over 400% since we first highlighted them—plus producers still trading at single-digit earnings multiples despite making money hand over fist with exploding margins at $4,000+ gold.

Last week we released our latest issue, which includes this analysis in full, plus specific undervalued opportunities positioned for the chaos ahead— a core American food producer, a gold mining services company, and a miner that has cornered the market on an industrial metal necessary for all technology. We’re offering a free, full, unredacted issue of Strategic Assets as a sample.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

The Gold-Silver Ratio Is Collapsing — Andy Schectman Warns This Is Serious

The Gold-Silver Ratio Is Collapsing — Andy Schectman Warns This Is Serious

MacroEdge: 1-19-2026

The Gold–Silver Ratio is collapsing — and according to Andy Schectman, this is not a normal market move.

In this video, we break down what’s happening right now in the gold and silver markets, why silver is suddenly outperforming gold, and what a rapidly falling gold-silver ratio has historically signaled during periods of financial stress.

While most investors focus only on price charts, Andy Schectman has consistently warned that the real signal comes from behavior — physical demand, delivery pressure, and how capital moves when confidence in paper markets begins to weaken.

The Gold-Silver Ratio Is Collapsing — Andy Schectman Warns This Is Serious

MacroEdge: 1-19-2026

The Gold–Silver Ratio is collapsing — and according to Andy Schectman, this is not a normal market move.

In this video, we break down what’s happening right now in the gold and silver markets, why silver is suddenly outperforming gold, and what a rapidly falling gold-silver ratio has historically signaled during periods of financial stress.

While most investors focus only on price charts, Andy Schectman has consistently warned that the real signal comes from behavior — physical demand, delivery pressure, and how capital moves when confidence in paper markets begins to weaken.

That’s exactly what we’re seeing today. Gold is holding near historic highs. Silver is surging with outsized daily gains. And the gold-silver ratio is compressing fast.

In this discussion, we cover:

What the gold-silver ratio is and why it matters

Why silver often moves aggressively after gold leads

How physical demand and delivery stress impact the market

Why Andy Schectman believes this moment is serious, not speculative

What a collapsing ratio has historically meant for precious-metals investors

This is not about hype or short-term price predictions.

It’s about understanding macro signals, market structure, and why experienced investors pay attention to gold and silver when confidence in currencies starts to erode.

Silver Supply Chain Disruption Led By Governments? | Mario Innecco

Silver Supply Chain Disruption Led By Governments? | Mario Innecco

Liberty and Finance: 1-17-2025

Mario Innecco explains how growing political pressure on the Federal Reserve is eroding confidence in monetary governance and acting as an accelerant rather than a cause of the current precious metals bull market.

He argues that the deeper driver lies in structural debt saturation, where ever larger amounts of borrowing and money creation are required simply to keep the system functioning, much like adding water to a cracked dam to delay collapse.

Silver Supply Chain Disruption Led By Governments? | Mario Innecco

Liberty and Finance: 1-17-2025

Mario Innecco explains how growing political pressure on the Federal Reserve is eroding confidence in monetary governance and acting as an accelerant rather than a cause of the current precious metals bull market.

He argues that the deeper driver lies in structural debt saturation, where ever larger amounts of borrowing and money creation are required simply to keep the system functioning, much like adding water to a cracked dam to delay collapse.

Moving from fundamentals to market structure, Innecco contrasts past cycles such as 1980 with today’s environment of massive derivatives exposure, distorted inflation metrics, and an inability to raise real interest rates without triggering systemic failure.

He then highlights infrastructure and supply chain realities, noting persistent silver production deficits, tightening retail availability, and a widening gap between physical markets in Asia and paper dominated exchanges in the West.

The cumulative implication is forward looking and sobering, namely that inflation risk, potential currency debasement, and physical scarcity point toward continued outperformance of precious metals with increasing economic consequences for savers, investors, and financial stability.

INTERVIEW TIMELINE:

0:00 Intro

1:15 Powell investigation

9:00 Taking profits in gold/silver?

11:55 Retail availability

13:00 2026 silver outlook

18:00 Asian silver pricing

20:43 CME margins raised

Seeds of Wisdom RV and Economics Updates Monday Afternoon 1-19-26

Good Afternoon Dinar Recaps,

IMF Warns Over Reliance on U.S. AI Boom Could Backfire Globally

Tech-driven growth masks deeper systemic risks forming beneath the surface

Good Afternoon Dinar Recaps,

IMF Warns Over Reliance on U.S. AI Boom Could Backfire Globally

Tech-driven growth masks deeper systemic risks forming beneath the surface

Overview

The International Monetary Fund is warning that global economic resilience has become dangerously dependent on U.S. technology and artificial intelligence investment. In a new assessment, the IMF cautioned that a sharp correction in AI expectations — or tighter financial conditions — could ripple across global markets, lowering growth forecasts and exposing systemic vulnerabilities tied to leverage and concentration risk.

Key Developments

1. Global Growth Tied to U.S. AI Expansion

The IMF noted that a disproportionate share of global growth momentum is now anchored to U.S.-based AI development, capital spending, and equity valuations. This concentration leaves other economies vulnerable to shocks originating in a single sector and country.

2. Rising Leverage in the AI Ecosystem

The report highlighted increasing debt, speculative investment, and valuation pressure among AI-focused firms. The IMF warned that leverage amplifies downside risk if earnings fail to meet expectations.

3. Risk of an AI-Centric Market Correction

A rapid repricing of AI assets could tighten financial conditions worldwide, impacting credit markets, equities, and capital flows — particularly in economies already struggling with high debt levels.

4. Central Bank Policy Becomes More Fragile

The IMF cautioned that monetary policy flexibility is narrowing. If central banks are forced to respond to an AI-driven market shock, the resulting policy shifts could accelerate volatility across currencies and bonds.

Why It Matters

This warning exposes a structural imbalance: global growth is increasingly built on a narrow technological foundation. While AI has boosted productivity and investment optimism, overconcentration increases the risk that a single sector downturn could trigger outsized global consequences.

In past cycles, similar concentration dynamics preceded broader financial instability.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation or reset-driven opportunities, the implications are significant:

Overreliance on U.S. tech strengthens short-term dollar dominance but increases long-term vulnerability.

A sharp AI correction could force monetary realignment, liquidity injections, or currency recalibration in stressed economies.

Nations seeking insulation may accelerate diversification away from tech- and dollar-centric exposure, favoring alternative settlement systems.

Periods of sector-driven imbalance often precede system-wide monetary restructuring.

Implications for the Global Reset

Pillar 1: Fragility Beneath Innovation

AI-led growth is powerful — but brittle. The IMF’s warning signals that innovation alone cannot stabilize a debt-heavy, fragmented global system.

Pillar 2: Pressure on Monetary Orthodoxy

If an AI correction coincides with geopolitical or trade shocks, central banks may be forced into unconventional responses, accelerating the transition toward a new financial architecture.

This is not an argument against AI — it is a warning against systemic dependence without safeguards.

This is not a tech story — it is a monetary risk story disguised as innovation.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

IMF sees steady global growth in 2026 as AI boom offsets trade headwinds — Reuters

IMF lifts 2026 global growth forecast but flags AI, trade risks — New Straits Times (AFP)

~~~~~~~~~~

US Tariff Threat Sparks Global Market Sell-Off

Tariff escalation rattles risk assets while investors flock to safe havens

Overview

Global financial markets experienced renewed volatility after U.S. President Donald Trump announced tariff threats against several European countries tied to his push for Greenland. Equities fell sharply across Europe and Asia, futures dipped, the dollar weakened, and safe-haven assets such as gold and silver surged to record levels. The sell-off reflects increased geopolitical risk, policy uncertainty, and fears of broader trade conflicts — developments that could accelerate structural shifts in the global economic system.

Key Developments

1. Equity Markets Slide Across Regions

European stocks experienced notable declines, with major indices such as the STOXX 600, France’s CAC 40, and Germany’s DAX sliding as tariff threats reignited trade concerns. Asian markets also opened weaker as risk appetite waned.

2. Currency and Dollar Movements Reflect Risk-Off Behavior

The U.S. dollar weakened broadly against rival currencies as investors sought alternatives amid uncertainty. The euro initially dropped before firming, while traditional safe-haven currencies like the yen and Swiss franc strengthened.

3. Safe-Haven Assets Hit New Highs

Gold and silver prices climbed to record highs as traders rotated out of equities and into defensive assets. The move underscores increasing market caution in the face of geopolitical tension and potential escalation in trade disputes.

4. Futures and Risk Sentiment Turn Negative

U.S. stock futures, including S&P 500 and Nasdaq contracts, weakened even with U.S. markets closed for a holiday, highlighting global contagion in risk sentiment as investors priced in rising trade uncertainty.

Why It Matters

This market reaction goes beyond routine profit-taking. Rising tariff threats — especially between longstanding allies — signal a breakdown in traditional economic cooperation and heighten fears of politically driven trade conflict. Financial markets are sensitive to policy risk; when political motives dominate economic logic, volatility spikes and long-term capital allocation shifts, undermining investor confidence in established frameworks.

Why It Matters to Foreign Currency Holders

For foreign currency holders focused on potential reset or revaluation events:

Risk-off shifts can trigger strategic currency diversification, reducing reliance on dollar-centric assets.

Surges in safe-haven currencies may foreshadow broader capital rebalancing away from risk assets tied to traditional financial centers.

Heightened geopolitical risk increases demand for alternative settlement systems and reserve assets, including commodity-linked arrangements.

Periods of systemic stress often precede monetary and structural realignment.

Implications for the Global Reset

Pillar 1: Geoeconomic Fragmentation

Trade policy used as geopolitical leverage accelerates the move toward multipolar economic structures, weakening unified global markets and encouraging regional blocs.

Pillar 2: Financial System Stress Tests

Market stress tied to policy uncertainty places pressure on central banks and fiscal authorities. This could speed the exploration of alternative monetary frameworks and risk management strategies beyond traditional tools.

This isn’t just a market sell-off — it’s a signpost of deeper systemic realignment in how global finance responds to political risk.

This is not just volatility — it’s the markets signaling that the old rules are breaking under political strain.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – World markets jolted, dollar dips as Trump vows tariffs on Europe over Greenland

Reuters – European stocks slide as Trump’s Greenland tariff threat rattles investors

The Economic Times – Gold, silver jump to record highs on Trump tariff threats

Investing.com – Tariff threats over Greenland trigger defensive rotation across global markets

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Monday 1-19-2026

TNT:

Tishwash: Al-Sudani: We are proceeding with the implementation of reform plans

Prime Minister Mohammed Shia' al-Sudani affirmed on Sunday his commitment to implementing reform and development plans and completing projects.

A statement from his media office, received by Al-Rabia, stated that "Al-Sudani received a group of members of the 'I Will Take My Right' movement to review developments in the country and the government's program for achieving development and economic progress."

TNT:

Tishwash: Al-Sudani: We are proceeding with the implementation of reform plans

Prime Minister Mohammed Shia' al-Sudani affirmed on Sunday his commitment to implementing reform and development plans and completing projects.

A statement from his media office, received by Al-Rabia, stated that "Al-Sudani received a group of members of the 'I Will Take My Right' movement to review developments in the country and the government's program for achieving development and economic progress."

He affirmed his commitment to "proceeding with the implementation of reform and development plans and completing projects," praising the movement's stances and its support for the process of construction and development, and its essential role as an important member and partner in the Reconstruction and Development Coalition.

The Prime Minister also stressed the importance of unity and strengthening partnership and cooperation among national forces, in order to expedite the completion of constitutional requirements and combine everyone's efforts to improve the living conditions and services for citizens to meet their aspirations and fulfill their needs. link

Tishwash: Financial advisor: Fixing the exchange rate in the budget is a coordinating decision and enhances market stability.

The Prime Minister's financial advisor, Mazhar Muhammad Salih, stated that the exchange rate in Iraq is subject to a fixed official rate system based on integrated coordination between monetary and fiscal policy, and is not an arbitrary decision.

In an exclusive statement to Al-Mirbad, Salih explained that while the exchange rate is a tool of monetary policy, in practice it is the result of an agreement between the Ministry of Finance and the Central Bank of Iraq and is clearly stipulated in the annual budget.

He added that the reported adoption of an exchange rate of 1,300 dinars per dollar in the 2026 budget represents a significant positive indicator that will contribute to strengthening stability, calming the market, and curbing speculation in the black market and parallel market.

He indicated that the Central Bank sent an official letter to the Ministry of Finance to establish this rate as a fixed element of the general budget, noting that setting the exchange rate is essential given that oil revenues constitute approximately 90 percent of public revenues, which are in foreign currency.

He confirmed that the rate currently in effect is the one announced, pending the finalization of the draft budget upon its official release and submission to Parliament for discussion and approval. link

************

Tishwash: Hassan Ali Al-Daghari: Investment is a fundamental pillar in building the Iraqi economy.

Spokesperson Hassan Ali Al-Daghari affirmed that investment is a cornerstone of building the Iraqi economy and enhancing its capacity to achieve sustainable development. He pointed out that the current phase necessitates creating an attractive environment for both local and foreign capital.

Al-Daghari stated that supporting investment projects contributes to revitalizing various productive sectors, providing genuine job opportunities, and playing a vital role in stimulating the economy and reducing reliance on single resources.

He clarified that investment is not limited to the financial aspect alone, but also encompasses the transfer of expertise and technology and the development of infrastructure.

Al-Daghari emphasized the need to simplify administrative procedures and ensure legislative stability, thereby bolstering investor confidence and encouraging the expansion of the investment base in the country.

He noted that achieving economic development requires concerted efforts between the public and private sectors to build a strong economy capable of confronting challenges. link

Tishwash: Predictions regarding Savaya's plan: Closing all banks except for four... and targeting rebel factions.

With increasing reports of the arrival, or imminent arrival, of Mark Savaya, US President Donald Trump's envoy to Baghdad, a key question arises in political circles: Will he be an adversary or a partner to the ruling group in Iraq?

The answer, according to initial indications, appears complex. Since assuming his post about three months ago, the US envoy has declared a hardline stance against groups cooperating with Tehran and armed factions. However, information circulating in Baghdad suggests the formation of a new relationship between Savaya and the "coordination framework" in its "disarmed" version, which anticipates his arrival as a potential partner in the coming phase.

During the height of the unusual US escalation against Iran, contacts described as "strange and rare" were recorded, involving Iraqi groups that had declared their disarmament attempting to mediate with Tehran for the release of Western detainees. Political sources say that this new relationship will have "scapegoats," namely the few remaining factions that refuse to disarm and relinquish their military and economic capabilities.