“Tidbits From TNT” Sunday 1-18-2026

TNT:

Tishwash: The Iraqi army takes full control of Ain al-Asad base after the American withdrawal.

The Ministry of Defense announced today, Saturday, that the Iraqi army has taken over the management of Ain al-Assad base in full after the withdrawal of American forces.

The Ministry stated in a statement, a copy of which was received by Al-Furat News, that: “The Chief of Staff of the Army, Lieutenant General Abdul Amir Rashid Yarallah, today supervised the distribution of tasks and duties to the military units and formations at Ain al-Assad base, after the withdrawal of the American forces from it and the Iraqi army taking over the management of the base in full.”

TNT:

Tishwash: The Iraqi army takes full control of Ain al-Asad base after the American withdrawal.

The Ministry of Defense announced today, Saturday, that the Iraqi army has taken over the management of Ain al-Assad base in full after the withdrawal of American forces.

The Ministry stated in a statement, a copy of which was received by Al-Furat News, that: “The Chief of Staff of the Army, Lieutenant General Abdul Amir Rashid Yarallah, today supervised the distribution of tasks and duties to the military units and formations at Ain al-Assad base, after the withdrawal of the American forces from it and the Iraqi army taking over the management of the base in full.”

He added, "Yarallah was accompanied during the visit by the Deputy Chief of Staff of the Army for Operations, the commanders of the (land, air, and army aviation) forces, the Deputy Director of Military Intelligence, the Head of the Security Media Cell, the Director of the Sample Branch, and the Director of the Media Branch. They were received by the Commander of Al-Jazira Operations, the Base Commander, and the Commander of the Second Special Forces Division."

Upon his arrival, Yarallah, according to the statement, followed up on the stages of receiving the security file through his field supervision of the distribution of units and formations within the base, represented by the 65th Special Forces Brigade and its regiments, in addition to the distribution of the headquarters of the Air Force and Army Aviation Commands.

Yarallah also inspected all parts of the base with the aim of securing service facilities, infrastructure, and administrative and logistical aspects, in order to ensure raising the level of readiness to carry out the assigned duties in the best possible way.

In the same context, Yarallah directed the relevant authorities at the base to "intensify efforts and enhance joint work, coordination and cooperation between all units holding the base, and to take advantage of its capabilities and vital location," stressing "the need to work as one team and distribute tasks in a way that ensures the security and protection of Ain al-Assad base, as it is one of the most important military bases within the area of responsibility." link

************

Tishwash: A memorandum of understanding was signed between the Development Fund for Iraq and BPI Bank France in Paris.

The Iraqi Embassy in Paris announced the signing of a memorandum of understanding between the Development Fund for Iraq and BPI France in the French capital.

In a statement received by the Iraqi News Agency (INA), the embassy said it participated in the signing ceremony, which was attended by Chargé d'Affaires ad interim, Minister Plenipotentiary Thaer Wahib Hussein.

Hussein emphasized the importance of encouraging companies to enter the Iraqi market and take advantage of available investment opportunities, particularly in the productive and developmental sectors. link

************

Tishwash: On Trump's orders, Savaya is in Baghdad: "Complete compliance or total eradication."

With news of the arrival of US President Donald Trump’s envoy to Iraq, Mark Savaya, today or tomorrow in Baghdad, carrying a “booby-trapped briefcase” of files, sanctions, and what Washington calls “hard gifts,” attention is turning to one of the most complex issues in the Iraqi economy: money smuggling networks, money laundering, and the circulation of hard currency outside legal channels, amid anticipation of the extent of the targeting that may extend to banks, companies, businessmen, and networks linked to armed factions, and what impact this step may have on the stability of the economy, the exchange rate, and the balance of political power internally.

Savaya: An envoy speaking "the language of numbers"

Mark Savaya, an Iraqi-American businessman of Chaldean origin, has served as the US Special Envoy to Iraq since October 2025, with authority directly linking the Iraqi file to the White House. In recent days, he held a series of meetings in Washington, including with US Secretary of Defense Pete Hagseth and the Director of Counterterrorism, before proceeding to the US Treasury Department, where he announced an agreement on a "comprehensive review" of payment records and financial transactions linked to institutions, companies, and individuals in Iraq whose names are associated with smuggling, money laundering, and fraudulent contracts and projects.

Economic and financial expert Ahmed Al-Tamimi believes that this course "reflects an escalating American trend to tighten pressure tools in the near future," explaining to "Baghdad Today" that Washington presents these steps as part of "attempts to protect the international financial system and prevent its exploitation in money laundering operations and financing illegal activities."

From dollar restrictions to selective sanctions

Over the past few years, the United States has tightened restrictions on Iraqi banks' access to dollars through the foreign exchange platform and their dealings with the Federal Reserve Bank of New York. This has resulted in limiting the transactions of several private banks and prohibiting others from using dollars, ostensibly to curb currency smuggling abroad. This context makes the new threat brandished by Savaya an extension of an existing pattern, but one more specifically targeting individuals, companies, and networks.

Al-Tamimi explains one aspect of the nature of the potential sanctions, indicating that "the package may include freezing assets, restrictions on bank transfers, and a ban on dealing with financial institutions and companies suspected of involvement in serious violations," which means that some economic entities may suddenly find themselves outside the network of international transactions, or under strict scrutiny that raises the cost of any external activity for them.

Who is the likely target?

Despite the absence of publicly announced regulations so far, the pattern of US sanctions in similar cases allows for an initial outline of the categories likely to be targeted:

- Banks and money exchange companies whose names frequently appear in compliance and money laundering reports, or which have been linked to dollar transfers that were blocked in the past.

- Front companies in the contracting, equipment, and general trading sectors, operating as cover for government contracts or the supply of essential goods, with suspicions that "margins" are being paid to political entities or armed factions.

- Businessmen and financial intermediaries managing a complex network of cross-border transfers and contracts, particularly with countries subject to sanctions or strict monitoring.

- Entities linked to armed factions that are designated or quasi-designated on sanctions lists, whether through security companies, associations, or commercial and media fronts.

In this context, Al-Tamimi points out that "the message is not directed only at the names that will be placed on the list, but at the wider circle around them," because any businessman, bank or company that gets close to this circle will find himself under the microscope of international compliance systems, even if his name is not directly mentioned in the sanctions decisions.

How will Iraq's economy be affected?

Economically, the effects of sanctions are not limited to freezing an account here or banning a bank there; they extend to the image of the Iraqi market as a whole in the eyes of correspondent banks and investors. Al-Tamimi warns that "any expansion of the scope of sanctions will practically lead to even stricter measures by foreign banks, which may resort to what is called 'excessive compliance,' meaning refraining from dealing with Iraqi entities simply for fear of being sanctioned."

This rigidity is reflected in three main ways:

- Increased cost of remittances and foreign trade: The higher the risk factor in dealing with Iraq, the higher the commissions and processing times for remittances, and some transactions may even be rejected outright.

- Additional pressure on the exchange rate: If the flow of official dollars declines, or the number of restricted banks expands, reliance on the parallel market will increase, threatening to erode citizens' purchasing power and widen the gap between the official and parallel exchange rates.

- Slowdown in investments and major projects: International companies will reconsider their plans, especially in sectors where government contracts involve local entities subject to sanctions or suspicion.

The citizen at the heart of the storm: from the dollar to prices

Although sanctions are legally framed as being "targeted" at specific individuals and entities, experience in Iraq, Iran, and Syria over the past years shows that ordinary citizens often bear the brunt of the impact. Al-Tamimi explains that "any disruption to the flow of dollars or tightening of transfers is quickly reflected in the prices of imported goods, from food to medicine and construction materials, because the Iraqi economy is highly dependent on imports."

As costs rise for banks and companies, the burden is gradually passed on to the end consumer through:

- Increased prices for goods and services.

- Reduced job opportunities in sectors affected by sanctions or banking restrictions.

- Restricted access to loans and financing, especially for small and medium-sized enterprises.

In this sense, how the government manages this issue becomes a crucial factor in mitigating the impact of sanctions on the public: the more organized alternatives for trade and finance are available, and the more the parallel market is controlled and monopolies are prevented, the less able speculators are to turn sanctions into an opportunity to profit at the expense of the citizen.

Will politicians be affected and will the equation be disrupted?

Politically, sanctions of this kind have the potential to rearrange some of the balance of power within the Iraqi political system:

Political blocs whose power is largely derived from money may face restrictions on their traditional funding networks, limiting their ability to manage election campaigns, buy loyalties, or finance media and service-oriented outlets.

Some politicians linked to businessmen or banks subject to sanctions may find themselves facing two equally unpalatable options: either attempting to distance themselves from these networks or engaging in a political and media confrontation with Washington, with all the domestic and international costs that entails.

Other forces may exploit the sanctions to present themselves as "less costly" to the West, through reformist rhetoric and promises of financial compliance, thus adding an external dimension to the internal competition.

Conversely, some factions are attempting to downplay the threats from Savaya, with some of their rhetoric even resorting to mockery of any political or economic entity that seriously addresses the sanctions issue or tries to open channels of understanding with it, going so far as to issue veiled threats against anyone who "cooperates" with the American approach.

These messages may discourage some actors from pursuing financial reform, but they do not negate the fact that the sanctions are imposed from abroad, and their cost will affect everyone to varying degrees.

Two parallel paths: sanctions and "surgical" strikes

Another significant indicator, not lost on observers, is the arrangement of Savaya's meetings in Washington: the Treasury Department on one hand, and the Department of Defense on the other. This arrangement, in the view of many, reflects two parallel approaches within the Trump administration's thinking regarding Iraq and the region.

- A financial and punitive track led by the Treasury Department, through reviewing records, tightening compliance, and imposing sanctions on individuals and entities. -

A "surgical" security and military track remains available as a backup option, based on targeted strikes against objectives classified as a direct threat to US interests or those of its partners.

This is a path Iraq has witnessed in recent years through drone strikes or precision missile attacks targeting leaders and positions of armed factions. The difference this time, according to political assessments, lies in Savaya's position itself; he is presented in political circles as Trump's personal envoy, with whom he has a close relationship and a shared business background. This means that his political mandate may be broader than that of a traditional envoy, and that his recommendations on the issues of sanctions and "surgical" strikes will be closer to the decision-making circle in the White House.

Ahmed Al-Tamimi warns that “combining financial and security tools raises the level of risks; if sanctions alone do not bring about the desired change from Washington’s point of view, the appetite for using other tools may increase, and Iraq has experienced this equation more than once.”

A test of the will for reform before it is a conflict with Washington

Ultimately, the "Safaya sanctions" issue is not simply a bilateral conflict between Baghdad and Washington, but rather reveals an internal test of the will for reform in Iraq:

If the government acts swiftly to cleanse the financial system, tighten oversight of banks and companies, and protect the exchange market from speculation, some of the pressure can be contained and transformed into an opportunity to rebuild confidence.

However, if the threat is treated as "merely a passing political maneuver," met only with denials or verbal escalation, Iraq may find itself facing a broader package of sanctions, where the interests of the White House intersect with regional agendas, while the average citizen bears the brunt of the cost at exchange bureaus and on market shelves.

Between these two paths, Washington and its allies will be watching events unfold, just as the Iraqi public is watching the exchange rate, the cost of living, and job opportunities. The difference is that the former possesses the tools of sanctions and "surgery," while the latter can only wait for the results of the numbers game and the decisions made far from its grasp, only to discover later whether it alone will bear the brunt of it, or whether genuine reform will finally begin from within before being imposed from the outside. link

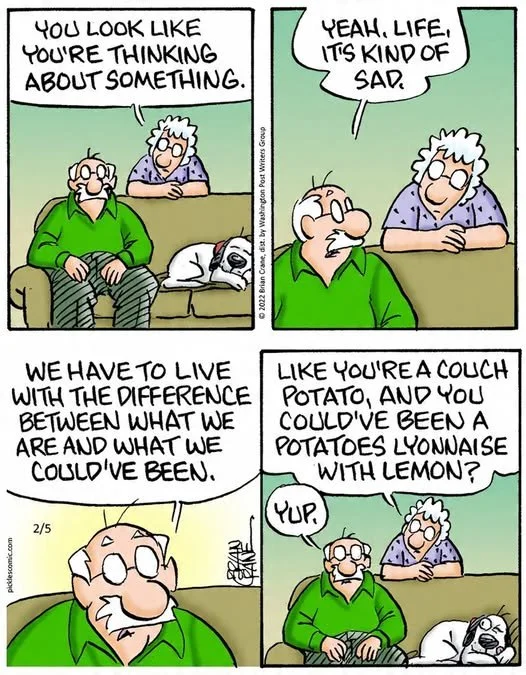

Mot: Finally!!! -- Have Reached Me Seasoned - ""Wonder Years""

Mot: . Its How Ya Says it!! -- LOL !!!

Seeds of Wisdom RV and Economics Updates Sunday Morning 1-18-26

Good Morning Dinar Recaps,

U.S. Tariffs on NATO Allies Signal a New Era of Economic Coercion

Greenland dispute turns trade weapons inward

Good Morning Dinar Recaps,

U.S. Tariffs on NATO Allies Signal a New Era of Economic Coercion

Greenland dispute turns trade weapons inward

Overview

The United States has announced sweeping tariff threats against multiple European NATO allies, marking a sharp escalation in the use of trade policy as a geopolitical weapon. The move, tied to pressure on Denmark over Greenland, represents a historic break from post-WWII alliance norms and signals a structural shift in how power is exercised inside the Western bloc.

Key Developments

Tariffs proposed on eight European allies, including Denmark, Germany, France, and the UK, starting at 10% and rising to 25% if U.S. demands are not met

Greenland leverage used as the pressure point, blending territorial strategy with economic enforcement

European leaders openly condemning the move as coercive and destabilizing

Retaliatory trade discussions already underway inside the EU

Why It Matters

Trade is now being weaponized against allies, not adversaries

NATO unity is strained, as economic punishment replaces diplomatic negotiation

Trust in U.S.-led economic frameworks erodes, accelerating bloc fragmentation

Precedent is set: alliance membership no longer guarantees economic protection

Why It Matters to Foreign Currency Holders

Tariff escalation inside the Western alliance weakens confidence in the dollar-based trade system

Allies may diversify reserves and settlement currencies to reduce exposure to U.S. policy risk

Currency holders positioned outside the dollar benefit if multipolar trade settlement accelerates

Economic coercion historically precedes reserve realignment, a core Global Reset pillar

Implications for the Global Reset

Pillar 1: Trade & Monetary Power Rebalancing

The use of tariffs and economic pressure against long-standing allies signals a breakdown in the post–World War II trade order. When trade becomes coercive rather than cooperative, nations are incentivized to seek alternative settlement systems, bilateral trade arrangements, and non-dollar pathways, accelerating the shift toward a multipolar financial architecture.

Pillar 2: Erosion of Institutional Trust

As allies hedge against unpredictable policy actions, trust in U.S.-led institutions weakens. This erosion encourages reserve diversification, reduced dollar exposure, and parallel economic frameworks, reinforcing long-term reset dynamics already underway.

Bigger Picture

This is not a trade dispute — it is a signal event. When the dominant reserve currency issuer turns trade penalties inward, it forces partners to reconsider dependency. That reconsideration is how monetary systems fracture and reset.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Wall Street Journal – “Trump Threatens Tariffs on European Allies in Greenland Dispute”

Reuters – “EU Warns of Retaliation After U.S. Tariff Threats Against Allies”

~~~~~~~~~~

Trade Realignment Accelerates as U.S. Allies Hedge Away from Washington

Protectionism pushes partners toward multipolar commerce

Overview

In response to escalating U.S. tariff threats and policy unpredictability, long-standing American allies are quietly restructuring trade relationships. The shift is not ideological — it is defensive. Governments are hedging economic exposure by deepening ties with alternative partners, including China and emerging-market trade hubs.

Key Developments

Allies reassessing U.S.-centric trade dependence following tariff threats

Increased engagement with China and regional trade blocs to stabilize exports

Supply chains being re-engineered to reduce vulnerability to U.S. policy swings

Trade diversification framed as risk management, not political alignment

Why It Matters

U.S. trade dominance weakens as partners diversify by necessity

Multipolar trade networks gain legitimacy through practical adoption

Supply chain control shifts, reducing Washington’s leverage

Global trade norms fragment, accelerating systemic reset pressure

Why It Matters to Foreign Currency Holders

Trade diversification often precedes currency diversification

Reduced dollar trade settlement increases demand for alternative currencies

Foreign currency holders benefit as bilateral and regional settlement expands

Long-term reset scenarios rely on exactly this kind of quiet trade migration

Implications for the Global Reset

Pillar 1: Trade Architecture Fragmentation

As U.S. allies hedge simultaneously, the global trade system shifts away from centralized dependency toward regional and bilateral frameworks, weakening the post-war U.S.-led trade model.

Pillar 2: Currency Settlement Realignment

Diversified trade routes naturally reduce dollar settlement volume, accelerating multi-currency trade mechanisms and reinforcing long-term reserve diversification trends.

This is not just politics — it’s global finance restructuring before our eyes.

Strategic Takeaway

This is how resets actually begin — not with announcements, but with incremental exits. When allies hedge at the same time, structural change accelerates faster than official narratives admit.

When protectionism rises, loyalty gets repriced

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

The Times of India – “Trade Realignment: Trump Tariffs Push Allies to Hedge as China Steps In”

Bloomberg – “U.S. Allies Rethink Trade Strategy Amid Tariff Uncertainty”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Iraq Economic News and Points To Ponder Sunday Morning 1-18-26

Government Advisor: Inflation In Iraq Is The Lowest In The Arab World

The Prime Minister's financial advisor, Mazhar Muhammad Salih, confirmed on Friday that Iraq is experiencing a low inflation rate of approximately 1.5% by the end of 2025, noting that this is the lowest inflation rate in the Arab world.

Salih told the Iraqi News Agency (INA) that "the Iraqi economy is witnessing a remarkable period of monetary stability, with an inflation rate of approximately 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region, “He explained that "this achievement is attributed to the monetary policy that has succeeded in maintaining price and exchange rate stability, protecting the purchasing power of the dinar, thus strengthening confidence in the national currency and providing a more favorable environment for investment."

Government Advisor: Inflation In Iraq Is The Lowest In The Arab World

The Prime Minister's financial advisor, Mazhar Muhammad Salih, confirmed on Friday that Iraq is experiencing a low inflation rate of approximately 1.5% by the end of 2025, noting that this is the lowest inflation rate in the Arab world.

Salih told the Iraqi News Agency (INA) that "the Iraqi economy is witnessing a remarkable period of monetary stability, with an inflation rate of approximately 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region, “He explained that "this achievement is attributed to the monetary policy that has succeeded in maintaining price and exchange rate stability, protecting the purchasing power of the dinar, thus strengthening confidence in the national currency and providing a more favorable environment for investment."

He added that "the recent Cabinet decisions aim to address what is known as 'job inflation' as a step to support social stability and improve income levels," noting that "these measures achieve positive short-term returns by stimulating domestic demand and boosting economic confidence, especially if they are financed within the bounds of fiscal sustainability and do not exceed the economy's absorptive capacity."

He explained that "the biggest challenge remains in translating this monetary stability into sustainable, productive economic growth, as government employment, if not linked to productivity, could create a gap between public spending and real output, and increase the economy's vulnerability to oil price fluctuations."

He added, "The solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, and diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy."

He emphasized that "Iraq currently possesses a rare dual opportunity: low inflation and monetary stability,”He added, "This opportunity can be transformed into a long-term gain if invested in building a robust productive base, ensuring the sustainability of financial and monetary stability in the medium and long term, and moving the economy from a cycle of rentier dependency to a path of sustainable growth." https://ina.iq/en/economy/44846-government-advisor-inflation-in-iraq-is-the-lowest-in-the-arab-world.html

CBI: Iraq Spending Outpaced Revenues In 2025

2026-01-17 07:19 Shafaq News– Baghdad Iraq’s public spending exceeded revenues in the first 10 months of 2025, according to Central Bank of Iraq (CBI) data released on Saturday.

In a report, the CBI revealed that total public revenues reached 104.434 trillion Iraqi dinars ($72.0B), while public expenditures amounted to 115.535 trillion dinars ($79.7B) over the same period.

Non-tax income dominated state revenues at 99.625 trillion dinars ($68.7B), compared with 4.809 trillion dinars ($3.3B) in tax receipts. On the spending side, current expenditures accounted for the bulk of outlays at 96.378 trillion dinars ($66.5B) and investment spending stood at 19.157 trillion dinars ($13.2B).

The gap between revenues and expenditures widened last year, the Eco Iraq Observatory reported, with the fiscal deficit reaching 17.7 trillion dinars ($13.5B), while Iraq has yet to approve the detailed budget tables for 2025, constraining the implementation of spending plans and the release of funds for development projects.https://www.shafaq.com/en/Economy/CBI-Iraq-spending-outpaced-revenues-in-2025

USD/IQD Exchange Rates Dip In Baghdad, Erbil

2026-01-17 Shafaq News– Baghdad/ Erbil The US dollar exchange rates fell on Saturday in the markets of Baghdad and Erbil as trading opened for the week, according to a Shafaq News survey.

Baghdad’s Al-Kifah and Al-Harithiya central exchanges registered a rate of 147,500 Iraqi dinars per $100, down from 148,000 dinars on Thursday. Local exchange shops recorded a selling rate of 148,000 dinars and a buying rate of 147,000 dinars per $100. In Erbil, the dollar eased as well, selling at 147,350 dinars per $100 and buying at 147,250 dinars.https://www.shafaq.com/en/Economy/USD-IQD-exchange-rates-dip-in-Baghdad-Erbil-8-4

Gold Prices Fall In Baghdad, Erbil

2026-01-17 Shafaq News– Baghdad/ Erbil Gold prices, both imported and locally produced, fell on Saturday in the markets of Baghdad and Erbil, according to a Shafaq News survey.

In Baghdad’s wholesale gold market on Al-Nahr Street, the selling price of one mithqal of 21-carat Gulf, Turkish, and European gold dropped to 948,000 Iraqi dinars, with the buying price at 944,000 dinars, down from 958,000 dinars recorded last Thursday.

The price of one mithqal of 21-carat Iraqi gold also declined, selling at 918,000 dinars and buying at 914,000 dinars.

At retail jewelry shops in Baghdad, the selling price of 21-carat Gulf gold ranged between 950,000 and 960,000 dinars, while Iraqi gold of the same purity sold for 940,000 to 950,000 dinars.

In Erbil, the selling price reached 1.005 million dinars for 22-carat gold, 960,000 dinars for 21-carat, and 823,000 dinars for 18-carat gold. https://www.shafaq.com/en/Economy/Gold-prices-fall-in-Baghdad-Erbil-8

Iraqi Crude Exports To US Jump Past 200,000 Bpd

2026-01-18 Shafaq News– Baghdad/ Washington Iraqi crude oil exports to the United States rose sharply last week, exceeding 200,000 barrels per day (bpd), according to data from the US Energy Information Administration (EIA).

In its weekly report, the EIA reported that US imports of crude from Iraq, OPEC's second-largest producer, averaged about 209,000 bpd during the week, up from 129,000 bpd the previous week, marking an increase of roughly 80 bpd.

Overall, US crude oil imports from 10 major suppliers averaged 6.234 million bpd last week, compared with 5.667 million bpd a week earlier, the data showed.

Canada remained the largest source of US crude imports at an average of 4.226 million bpd, followed by Mexico at 386,000, Brazil at 343,000, and Saudi Arabia at 288,000.

The United States consumes around 20 million barrels of oil per day, making it the world’s largest oil consumer, with imports sourced primarily from these major suppliers. https://www.shafaq.com/en/Economy/Iraqi-crude-exports-to-US-jump-past-200-000-bpd

The Matter Is Settled... A Political Agreement Has Been Reached Between Maliki And Sudani Regarding The Premiership.

Information/Baghdad... Nouri al-Maliki, head of the State of Law Coalition and prime ministerial candidate, is awaiting the outcome of the presidential election in the coming days before being tasked with forming the new government and selecting his cabinet. The race for prime minister has narrowed down to al-Maliki and al-Sudani, the two figures considered the frontrunners for the position. Sources within al-Sudani's bloc have confirmed that an agreement has been reached for al-Maliki to assume power for a third term.

Bahaa al-Araji, head of the Reconstruction and Development parliamentary bloc, stated in remarks reported by Information that "the decision to withdraw from the competition with the head of the State of Law Coalition was made with complete conviction. The decision is serious and not tactical, as some believe. The coordinating body rejects any role for the international community in selecting the next prime minister."

He added that “the Reconstruction and Development Party has a project, and Maliki is the closest to his project. Also, the relationship between him and the State of Law Coalition is not related to giving up the position, but rather to joint cooperation in the issue of distributing ministries and parliamentary committees, because the next stage is an important and difficult stage that requires concerted efforts to face internal and external challenges.”

On another front, MP Hussein al-Ankoushi, from the Reconstruction and Development Coalition, confirmed to Al-Maalomah that "Sudani directed the Reconstruction and Development Coalition to support Maliki's nomination for prime minister in the upcoming phase, as Maliki has become the candidate of 81 MPs representing the Reconstruction and Development Coalition and the State of Law Coalition."

He pointed out that "the Coordination Framework did not force Sudani to withdraw his candidacy; rather, the decision came voluntarily and personally from him." He indicated that "the political forces within the framework will not allow its disintegration or abandonment under any circumstances, as the upcoming phase requires maintaining the unity and cohesion of the Coordination Framework to ensure political stability and proceed with forming the government according to clear understandings among all parties."

Meanwhile, former MP Yasser al-Husseini explained to Al-Maalomah that "Maliki and Sudani publicly display harmony and agreement, but this agreement is underpinned by internal and external pressures that have imposed themselves on the political scene. However, the current stage requires the selection of a strong prime minister capable of leading the country through its complex crises."

He continued, "Iraq is facing imminent danger, and citizens may be forced to tighten their belts due to the difficult economic conditions," noting that "the current government has obstructed the work of Parliament and contributed to preventing interrogations and the normal exercise of its oversight role."

He added that "the next government will move to cancel some of the decisions of Sudani's government as part of a comprehensive review of the policies pursued during the past period, especially since the country needs bold decisions to correct its course and confront the upcoming challenges." End 25N LINK

Americans Are Worried More About This Money Issue Than Inflation

Americans Are Worried More About This Money Issue Than Inflation — Here’s Why

Dawn Allcot GOBankingRates Sat, January 10, 2026

Americans are more worried about the job market and their job security than they are about inflation, according to the latest Survey of Consumer Expectations from the Federal Reserve Bank of New York.

Survey respondents said they expect inflation to drop to 3% within the next three to five years, the NY Fed reported. Respondents also believe credit is easier to get now than it was in the recent past, and that trend should continue. Although reduced inflation and loosened credit should bode well for the economy, people are still concerned.

Americans Are Worried More About This Money Issue Than Inflation — Here’s Why

Dawn Allcot GOBankingRates Sat, January 10, 2026

Americans are more worried about the job market and their job security than they are about inflation, according to the latest Survey of Consumer Expectations from the Federal Reserve Bank of New York.

Survey respondents said they expect inflation to drop to 3% within the next three to five years, the NY Fed reported. Respondents also believe credit is easier to get now than it was in the recent past, and that trend should continue. Although reduced inflation and loosened credit should bode well for the economy, people are still concerned.

Consumers also predicted unemployment rising in 2026 and believe they may have a harder time finding a job if they are laid off next year. Those under the age of 60 and those who attended “some college” were the most concerned, according to the report.

“People know that if inflation hits, they will feel it, but they can adjust their spending to offset it,” said Melanie Musson, finance expert at Quote.com. “Inflation hurts, but it’s survivable. Meanwhile, losing your job can feel like there is no solution.”

Gen Z Feels Heavy Uncertainty

Sofiya Deva of the AI-powered personal finance app Vera, said these emotions may be especially prevalent in Gen Z.

“They’ve been nicknamed ‘the most anxious generation.’ And I think a lot of that really does carry over into finances,” she said.

Seeking personalized financial advice, and even relying on AI tools, could be part of the solution for any generation, Deva added.

“[Finance is] a very personal topic. In some ways it’s even more taboo than religion and politics,” Deva said. “Having a safe, judgement-free space where you can share where you are financially, plus your anxieties, hopes and fears, can help.”

How To Prepare for Job Loss

To Continue and Read More: https://www.yahoo.com/finance/news/americans-worried-more-money-issue-115512920.html

FRANK26…1-17-26…..HE’S BACK !!!

KTFA

Saturday Night Video

FRANK26…1-17-26…..HE’S BACK !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Saturday Night Video

FRANK26…1-17-26…..HE’S BACK !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

1-17-2026

Paul White Gold Eagle @PaulGoldEagle

QFS INFORMATION CENTER

UNDERSTANDING TIER 4B, CURRENCY REVALUATION, AND NESARA GESARA PAYMENTS

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

1-17-2026

Paul White Gold Eagle @PaulGoldEagle

QFS INFORMATION CENTER

UNDERSTANDING TIER 4B, CURRENCY REVALUATION, AND NESARA GESARA PAYMENTS

The global financial system is undergoing a structural transition that most people don’t yet recognize. At the center of this shift are three concepts that keep resurfacing across alternative finance discussions: the Quantum Financial System (QFS), Tier 4B, and NESARA GESARA–related payments. To understand what may be unfolding, it’s critical to separate speculation from structure.

The move underway is a transition from fiat currency systems to asset-backed valuation models.

Fiat currencies, created through debt and leverage, are increasingly unstable. QFS is described as a settlement and verification framework designed to support transparent, asset-guaranteed currencies, removing manipulation, duplication, and unlawful routing.

Much of the confusion surrounds “Tier 4B,” often called the Internet Group.

This does not mean everyone who uses the internet. Tier 4B refers to individuals who actively tracked currency revaluation narratives, prepared by acquiring foreign currencies, followed alternative financial disclosures, and positioned themselves ahead of a potential reset.

In simplified terms, the tier structure is described as follows:

Tier 1–3 involve sovereign, institutional, and historical asset holders.

Tier 4A includes private exchange and secured access participants.

Tier 4B consists of the prepared public community actively following revaluation and QFS developments.

Tier 5 is the general public, who only become aware once changes are announced or visible.

If currency revaluation occurs, Tier 4B participants are expected to receive structured access before the wider public.

This access is commonly associated with Redemption Centers, where foreign currencies would be exchanged under controlled conditions. These centers are not mystical locations.

Rob Cunningham: Wealth and Peace on an Epic Scale

Rob Cunningham: Wealth and Peace on an Epic Scale

1-17-2026

Rob Cunningham | KUWL.show @KuwlShow

Wealth & Peace On An Epic Scale

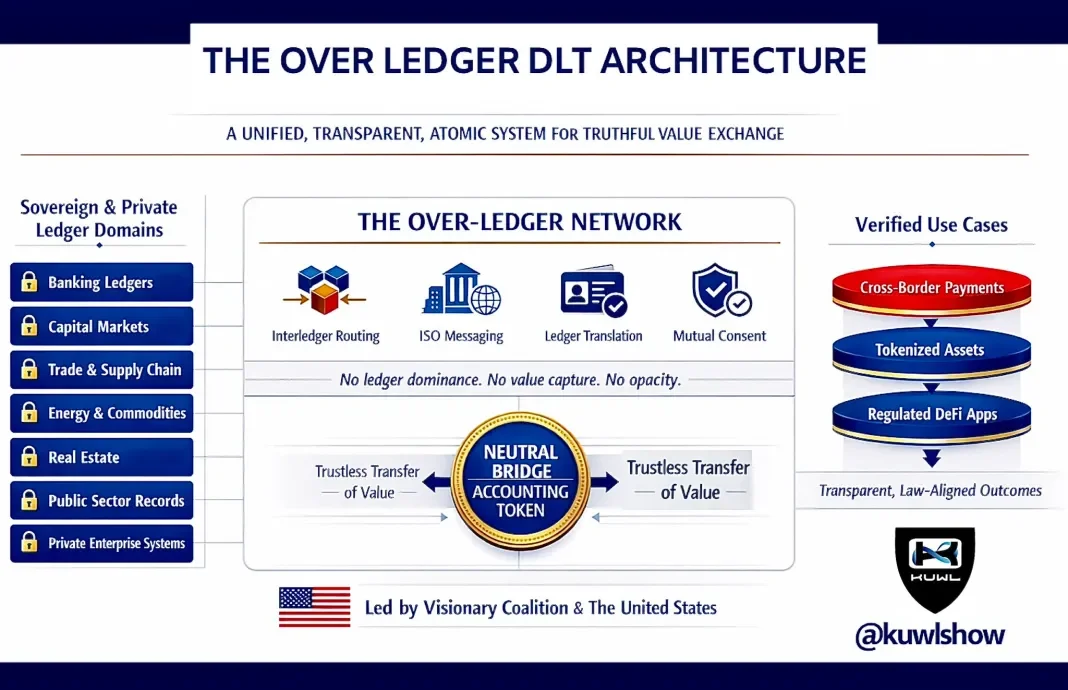

A new global system architecture is now being implemented – one that rises above individual ledgers to unify them through interoperable Distributed Ledger Technology (DLT).

Rob Cunningham: Wealth and Peace on an Epic Scale

1-17-2026

Rob Cunningham | KUWL.show @KuwlShow

Wealth & Peace On An Epic Scale

A new global system architecture is now being implemented – one that rises above individual ledgers to unify them through interoperable Distributed Ledger Technology (DLT).

This architecture is purpose-built for specific, adequately funded use cases; engineered for perfect transparency; capable of atomic settlement; and anchored in real-world asset authentication, immutable identity absolutes, and verifiable ownership.

At its core operates a non-sovereign, neutral bridge accounting token – not as money to be hoarded or weaponized, but as a flawless transporter and transcriber of value: unbiased, instantaneous, and exact.

It neither governs, owns nor extracts, but simply moves truthfully between and in alignment with, compliant systems.

This is not a speculative experiment. It is the natural evolution of law-aligned accounting, trustless verification, and honest weights and measures – emerging through a coalition of public and private leadership, with the United States providing the primary visionary, infrastructural, and moral impetus for its realization.

Fear, or fear not. Transparency renders no place for deception to hide.

And the powers behind the Fed are none too happy.

Transparency yields peace.

Opacity concentrates power.

Centralization yields slavery.

Have Faith.

Source(s): https://x.com/KuwlShow/status/2012172417037201785

https://dinarchronicles.com/2026/01/16/rob-cunningham-wealth-and-peace-on-an-epic-scale/

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-17-26

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Overview

Central banks around the world are accelerating gold purchases at a pace not seen in decades, reflecting growing concern over the long-term credibility of the U.S. dollar. Geopolitical fragmentation, sanctions risk, and increasing political pressure on monetary policy have driven reserve managers toward tangible, politically neutral assets. Gold’s share of global central bank reserves has now climbed above 25%, marking a historic inflection point in reserve strategy.

Key Developments

Central banks have increased gold purchases at multi-decade record levels

Gold now accounts for more than one-quarter of global central bank reserves

Prices have surged to historic highs, confirming sustained institutional demand

China alone reportedly holds over 2,000 tonnes of gold

Emerging market central banks are leading the diversification trend

What’s Really Driving the Shift

This move is not about speculation or short-term hedging. It is about systemic risk management.

Gold offers:

No counterparty risk

Immunity from sanctions and payment freezes

Protection against political interference in monetary policy

Universal acceptability outside any single financial system

As trust in fiat governance weakens, central banks are opting for assets that cannot be debased, frozen, or reprogrammed.

Why It Matters

Accelerated gold accumulation is a classic signal of declining confidence in dominant reserve currencies

Reserve diversification weakens the structural demand for dollar-denominated assets

Gold reasserts itself as a neutral anchor in a fragmenting monetary order

This behavior historically precedes monetary regime adjustments, not follows them

When central banks move first, markets follow later.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation during a Global Reset:

Gold accumulation signals preparation for currency realignment

Tangible reserve backing strengthens the case for future repricing

Fiat-heavy systems face pressure as reserve composition shifts

Holders positioned ahead of formal policy changes benefit most

Gold is not replacing currencies — it is redefining what backs them.

Implications for the Global Reset

Pillar 1 – Assets: Gold regains prominence as a reserve foundation

Pillar 2 – Monetary Trust: Confidence migrates from fiat promises to physical backing

Reserve Architecture: Diversification reduces single-currency dominance

Resets are built quietly in vaults before they appear in headlines.

When central banks choose metal over paper, the message is already clear.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Mumbai Emerges as a Hub for Multipolar Economic Coordination

New Global Economic Cooperation Forum signals accelerating shift away from Western-led frameworks

Overview

A new Global Economic Cooperation 2026 Forum has been announced for February 17–19 in Mumbai, bringing together policymakers, economic planners, and institutional leaders to explore alternative models of global collaboration. The forum reflects growing momentum among emerging and middle powers to coordinate trade, investment, and financial policy outside traditional Western-dominated institutions.

Key Developments

The inaugural forum will convene in Mumbai in mid-February

Focus areas include trade integration, investment flows, and economic coordination

Participants are expected from emerging markets and middle powers

The initiative emphasizes multipolar cooperation rather than bloc dependency

Timing aligns with rising global fragmentation in trade and finance systems

Why This Forum Is Different

Unlike legacy institutions shaped after World War II, this forum is structured around pragmatic economic alignment rather than ideology. Its emphasis is on:

Flexible cooperation across regions

Reduced reliance on dollar-centric systems

Strategic alignment among economies navigating sanctions, debt stress, and trade disruption

This is coalition-building by design — not protest, but preparation.

Why It Matters

Signals intentional coordination for alternative economic architecture

Reinforces the decline of single-center economic governance

Creates space for new trade and settlement frameworks

Aligns with broader moves toward regionalization and multipolar finance

Economic resets rarely begin with formal announcements — they begin with forums like this.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching the Global Reset narrative:

Multipolar coordination supports future currency repricing

Trade integration outside Western systems reduces legacy currency dominance

New settlement mechanisms create opportunities for value recalibration

Forums like this often precede policy harmonization and monetary shifts

Currency value changes are negotiated long before they are declared.

Implications for the Global Reset

Pillar 1 – Trade: Expands non-Western trade coordination pathways

Pillar 2 – Finance: Supports diversification away from dollar-centric systems

Institutional Realignment: Signals early-stage restructuring of global governance

This is not a summit for headlines — it is a workshop for the next system.

Global resets don’t start at the G7 — they start where the future is being built.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Economic Times — Inaugural Global Economic Cooperation Forum to be held in Mumbai Feb 17–19

Observer Research Foundation — Multipolarity and the Future of Global Economic Governance

~~~~~~~~~~

Inside BRICS’ Real De-Dollarization Strategy: Payments Over Politics

Why infrastructure — not a new currency — is quietly reshaping global finance

Overview

For much of 2024 and early 2025, public discussion around BRICS de-dollarization focused on the idea of a new shared currency to rival the U.S. dollar. That narrative missed what was actually happening. Rather than building a euro-style monetary union, BRICS countries pursued a more practical strategy: payment infrastructure, bilateral settlement, and local-currency trade.

The result is a quiet but measurable reduction in dollar usage — achieved not through ideology, but through systems.

Key Developments

BRICS countries prioritized interoperable payment systems instead of a single currency

Russia’s SPFS, China’s CIPS, and India’s UPI were connected through pilot frameworks under BRICS Pay

Russia and China now settle the vast majority of bilateral trade in rubles and yuan

Local-currency trade expanded across energy, commodities, and infrastructure finance

BRICS-backed institutions increased non-dollar lending to Global South projects

This approach sidestepped political resistance while producing tangible outcomes.

Why Payments Became the Strategy

Creating a shared currency would require unified monetary policy, fiscal discipline, and economic convergence — conditions that do not exist inside BRICS. Member economies range from China’s multi-trillion-dollar system to frontier markets still stabilizing basic financial infrastructure.

Instead, BRICS focused on what could be built now:

Clearing systems that bypass dollar settlement

Bilateral trade invoicing in local currencies

Commodity-backed financing structures

Multilateral lending outside Western-dominated institutions

As Russia’s leadership has emphasized publicly, alternatives emerged not as confrontation — but as necessity.

Local Currency Trade and Commodity Finance

Energy trade provided the fastest proof of concept. Oil, gas, and commodities were increasingly settled in yuan, rubles, rupees, and reais, reducing dollar exposure without disrupting supply chains.

Meanwhile, the New Development Bank expanded lending in domestic currencies, supporting infrastructure and development projects without dollar-denominated debt risk. Commodity-backed settlement pilots added further insulation from currency volatility.

Each transaction was incremental — but cumulative impact matters.

Political Limits Still Apply

Despite technical progress, political realities capped ambition. Proposals for a unified BRICS currency were quietly deprioritized in 2025. Leaders acknowledged that monetary integration was premature, particularly amid external trade pressures and tariff threats.

This restraint did not stall de-dollarization — it refined it.

Why It Matters

De-dollarization is happening through systems, not symbols

Payment infrastructure reduces dollar dependency without formal confrontation

Bilateral clearing erodes reserve currency dominance transaction by transaction

This model is scalable beyond BRICS to the wider Global South

The shift is structural, not rhetorical.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching global reset mechanics:

Payment systems matter more than headline currency launches

Local settlement reduces artificial demand for reserve currencies

Commodity-backed finance supports future currency repricing

Infrastructure-first de-dollarization favors measured realignment, not shock events

Currency value changes long before exchange rates move.

Implications for the Global Reset

Pillar 1 – Trade: Local-currency invoicing reshapes global trade flows

Pillar 2 – Finance: Payment rails weaken legacy settlement dominance

Pillar 4 – Assets: Commodities reassert monetary relevance

This is de-dollarization by design — not declaration.

The dollar isn’t being overthrown — it’s being routed around.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — Inside BRICS’ Next De-Dollarization Playbook: Pay Systems Over Politics

Reuters — Russia and China deepen use of local currencies in trade settlements

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Will The Government Confiscate Your Silver?

Will The Government Confiscate Your Silver? Here’s Why It’s Likely

Noel Lorenzana, CPA Jan 17, 2026

Did you know the US government once seized private gold overnight? In 1933, gold was taken by law with a single signature. No warning. No debate. Today, silver has been declared a US strategic mineral, raising urgent questions about silver confiscation, government control, national security, and private ownership.

Will The Government Confiscate Your Silver? Here’s Why It’s Likely

Noel Lorenzana, CPA Jan 17, 2026

Did you know the US government once seized private gold overnight? In 1933, gold was taken by law with a single signature. No warning. No debate. Today, silver has been declared a US strategic mineral, raising urgent questions about silver confiscation, government control, national security, and private ownership.

Silver is no longer just an industrial or precious metal. It is now tied to the power grid, the military, clean energy, and US national defense. In a national emergency, “strategic” does not mean protected. It means prioritized and controlled. Rules can change without a knock on the door or a new law, turning private silver into a public resource.

This video breaks down the historical gold confiscation of 1933, why silver’s new classification matters, how government control really works, and what this could mean for silver owners today. If you think this cannot happen again, or that silver is immune, you need to pay attention.

“Tidbits From TNT” Saturday 1-17-2026

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

Trump had appointed Savaya as special envoy for Iraq affairs on October 19, 2025. He is an American businessman of Iraqi origin.

In his latest remarks, attributed to him ahead of the visit, he said he would deal with the "appropriate decision-makers" in Iraq, and had previously hinted that "big changes are coming" with a focus on "actions, not words." link

Tishwash: Sudanese advisor: The government has achieved economic success, and the International Monetary Fund is witnessing it.

Despite talk of a severe financial crisis in Iraq and the decline of the dinar against the dollar, the Prime Minister's financial advisor, Mazhar Muhammad Salih, says that the country recorded a low inflation rate of about 1.5% by the end of 2025. He pointed out that inflation in Iraq is the lowest in the Arab world, noting that the government's monetary policy succeeded in maintaining price and exchange rate stability and protecting the purchasing power of the dinar.

Regarding the recent cabinet measures, Salih explained that their aim is to address what is known as "job inflation" as a step to support social stability and improve income levels, as he put it.

Saleh told the official agency, as reported by 964 Network , that “the Iraqi economy is witnessing a remarkable phase of monetary stability, as it recorded a low inflation rate of about 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region.” He explained that “this achievement is attributed to the monetary policy that succeeded in maintaining price and exchange rate stability, and protecting the purchasing power of the dinar, which strengthened confidence in the national currency and provided a more favorable environment for investment.”

He added that “the recent Cabinet decisions aim to address what is known as ‘job inflation’ as a step to support social stability and improve income levels,” noting that “these measures achieve positive short-term returns by stimulating domestic demand and enhancing economic confidence, especially if they are financed within the limits of financial sustainability and do not exceed the absorptive capacity of the economy.”

He explained that “the biggest challenge remains in transforming this monetary stability into sustainable productive economic growth, since government employment, if not linked to productivity, may create a gap between public spending and real output, and increase the economy’s vulnerability to fluctuations in oil prices.”

He added that “the solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, as well as diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy.”

He stressed that “Iraq today has a rare dual opportunity represented by low inflation and monetary stability,” adding that “this opportunity can turn into a long-term gain if it is invested in building a solid productive base, which will ensure the continuity of financial and monetary stability in the medium and long term, and move the economy from the cycle of rentier dependency to the path of sustainable growth.” link

************

Tishwash: Government advisor: Tourism investment is a gateway to stimulating the private sector and diversifying national income.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that Iraq has more than 12,000 archaeological sites that form the basis for a comprehensive tourism launch, explaining that tourism investment is a gateway to stimulating the private sector and diversifying national income.

Saleh told the Iraqi News Agency (INA): “Tourism in Iraq is more than just a recreational activity; it is a strategic tool for wealth creation, achieving balanced development, and diversifying national income sources, provided that investment in it is done seriously and with a clear institutional approach.”

He explained that “this sector has the potential to become a major economic pillar, capable of restoring Iraq to its natural civilizational position and contributing to building a more stable and sustainable economic future.”

He added that “tourism in Iraq represents a strategic economic lever capable of reducing the single dependence on oil, opening up broad prospects for diversifying national income, creating direct and indirect job opportunities, revitalizing the service and commercial sectors, as well as providing the economy with important revenues from foreign currency.”

He pointed out that "tourism leads to an increase in demand for local products and services, especially handicrafts, food products, and national cuisine, which strengthens local value chains. At the employment level, it is estimated that a single tourism event in the hotel accommodation sector alone is capable of generating more than 25 job opportunities at once, which highlights the multiplier effect of this sector on the labor market."

He pointed out that "tourism investment contributes to stimulating private sector trends by supporting the growth of small and medium enterprises, such as transport companies, restaurants and shops, and it also has a positive impact on the macroeconomy through the development of infrastructure by investing in roads, airports, hotels and public facilities, which enhances the investment attractiveness of the country as a whole."

Saleh emphasized that “Iraq has more than 12,000 archaeological sites stretching from Babylon, Ur and Nineveh to Baghdad and Samarra, as well as holy religious shrines. These are unique cultural treasures, some of which have been included in UNESCO’s World Heritage List, and they form a solid foundation for a comprehensive tourism initiative with economic, cultural and civilizational dimensions. link

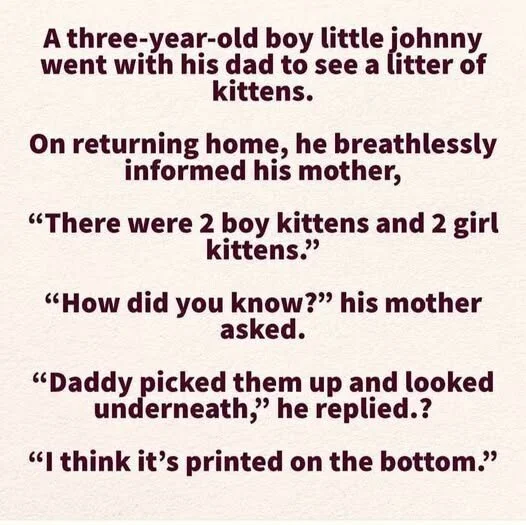

Mot: Simply Can't Win !!! -- Can He!!!???

Mot: Love the Wisdom of the ""Wee Folks""!!!

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-17-26

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Overview

China-led cross-border digital currency infrastructure has reached a new milestone, as transaction volumes on a multilateral central bank digital currency platform surged dramatically. What began as a limited experiment has evolved into a functioning settlement network used by sovereign institutions, signaling a structural shift in how international trade can be cleared outside legacy dollar-based systems.

Key Developments

A China-backed cross-border digital currency platform recorded tens of billions of dollars in cumulative transactions

Participating central banks include China, Hong Kong, Thailand, the UAE, and Saudi Arabia

The digital yuan accounts for the vast majority of settlement volume

Government-level wholesale transactions have now occurred on the platform

The system operates outside SWIFT and traditional correspondent banking rails

What’s Actually Changing

This is not a retail crypto story. It is institution-to-institution settlement infrastructure being tested live.

Unlike experimental pilots of the past, this platform:

Settles trade directly between central banks

Reduces reliance on intermediary banks

Shortens settlement times from days to seconds

Limits exposure to sanctions and correspondent risk

The most important shift is architectural: payments are being designed without the dollar as a mandatory bridge asset.

Why It Matters

Parallel payment systems weaken the monopoly power of existing reserve currency rails

Trade can increasingly settle without touching U.S. banking infrastructure

Financial influence moves from enforcement to infrastructure control

Once operational, these systems are difficult to unwind

This is how monetary transitions occur quietly — before headlines, not after them.

Why It Matters to Foreign Currency Holders

Foreign currency holders anticipating revaluation during a Global Reset should note:

Alternative settlement systems reduce forced demand for a single reserve currency

Cross-border CBDCs create conditions for regional currency repricing

Infrastructure precedes valuation changes, not the other way around

When trade no longer needs legacy rails, currency hierarchies begin to adjust

This development does not flip the switch — it installs the wiring.

Implications for the Global Reset

Payments Pillar: Live CBDC settlement outside dollar rails

Trade Pillar: Sovereign trade increasingly bypasses correspondent banking

Monetary Power: Influence shifts from currency dominance to network control

The reset does not arrive as an announcement. It arrives as redundancy.

When the rails change, the destination eventually follows.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — China-led cross-border digital currency platform sees surge

Bank for International Settlements — mBridge Project Overview

~~~~~~~~~~

Bank of England Warns Populism Is Undermining Monetary Trust — Confidence Becomes the Risk

Central banks defend credibility as political pressure intensifies

Overview

The Governor of the Bank of England issued a blunt warning that rising populism and political interference are eroding trust in financial institutions. The statement reflects growing concern among central bankers that confidence — not inflation — may become the next systemic vulnerability.

Key Developments

The Bank of England warned of political pressure undermining institutional independence

Central bank credibility was framed as a core pillar of financial stability

Trust erosion was linked to market volatility and capital flight risk

Similar concerns are emerging across multiple Western monetary authorities

What the Warning Really Signals

Central banks rarely speak publicly about trust unless it is already being tested.

This warning suggests:

Monetary authority is being challenged politically

Policy credibility increasingly requires communication management

Financial stability now depends as much on perception as policy tools

Institutional legitimacy is no longer assumed

When trust must be defended verbally, it is already under strain.

Why It Matters

Fiat systems function on confidence, not convertibility

Political interference weakens long-term policy credibility

Markets price trust faster than inflation data

History shows currency transitions often follow legitimacy crises, not recessions

This is a confidence signal — not a policy one.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies expecting a Global Reset:

Declining institutional trust accelerates diversification away from legacy systems

Confidence fractures create sudden repricing windows

Reset events often follow legitimacy loss, not official failure

Holders positioned early benefit from disorderly adjustments

Trust is the invisible reserve asset. When it erodes, values shift.

Implications for the Global Reset

Confidence Pillar: Institutional trust becomes a limiting factor

Monetary Pillar: Independence questioned, credibility strained

Capital Flows: Investors hedge against political monetary risk

Resets begin when belief systems crack — not when systems collapse.

When central banks defend trust, the real currency is already moving.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — Bank of England governor warns against populism and erosion of trust

Financial Stability Board — Central Bank Independence and Financial Stability

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps