FRANK26…1-17-26…..HE’S BACK !!!

KTFA

Saturday Night Video

FRANK26…1-17-26…..HE’S BACK !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Saturday Night Video

FRANK26…1-17-26…..HE’S BACK !!!

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

1-17-2026

Paul White Gold Eagle @PaulGoldEagle

QFS INFORMATION CENTER

UNDERSTANDING TIER 4B, CURRENCY REVALUATION, AND NESARA GESARA PAYMENTS

Paul Gold Eagle: Understanding Tier 4B, Currency RV, and NESARA-GESARA Payments

1-17-2026

Paul White Gold Eagle @PaulGoldEagle

QFS INFORMATION CENTER

UNDERSTANDING TIER 4B, CURRENCY REVALUATION, AND NESARA GESARA PAYMENTS

The global financial system is undergoing a structural transition that most people don’t yet recognize. At the center of this shift are three concepts that keep resurfacing across alternative finance discussions: the Quantum Financial System (QFS), Tier 4B, and NESARA GESARA–related payments. To understand what may be unfolding, it’s critical to separate speculation from structure.

The move underway is a transition from fiat currency systems to asset-backed valuation models.

Fiat currencies, created through debt and leverage, are increasingly unstable. QFS is described as a settlement and verification framework designed to support transparent, asset-guaranteed currencies, removing manipulation, duplication, and unlawful routing.

Much of the confusion surrounds “Tier 4B,” often called the Internet Group.

This does not mean everyone who uses the internet. Tier 4B refers to individuals who actively tracked currency revaluation narratives, prepared by acquiring foreign currencies, followed alternative financial disclosures, and positioned themselves ahead of a potential reset.

In simplified terms, the tier structure is described as follows:

Tier 1–3 involve sovereign, institutional, and historical asset holders.

Tier 4A includes private exchange and secured access participants.

Tier 4B consists of the prepared public community actively following revaluation and QFS developments.

Tier 5 is the general public, who only become aware once changes are announced or visible.

If currency revaluation occurs, Tier 4B participants are expected to receive structured access before the wider public.

This access is commonly associated with Redemption Centers, where foreign currencies would be exchanged under controlled conditions. These centers are not mystical locations.

Rob Cunningham: Wealth and Peace on an Epic Scale

Rob Cunningham: Wealth and Peace on an Epic Scale

1-17-2026

Rob Cunningham | KUWL.show @KuwlShow

Wealth & Peace On An Epic Scale

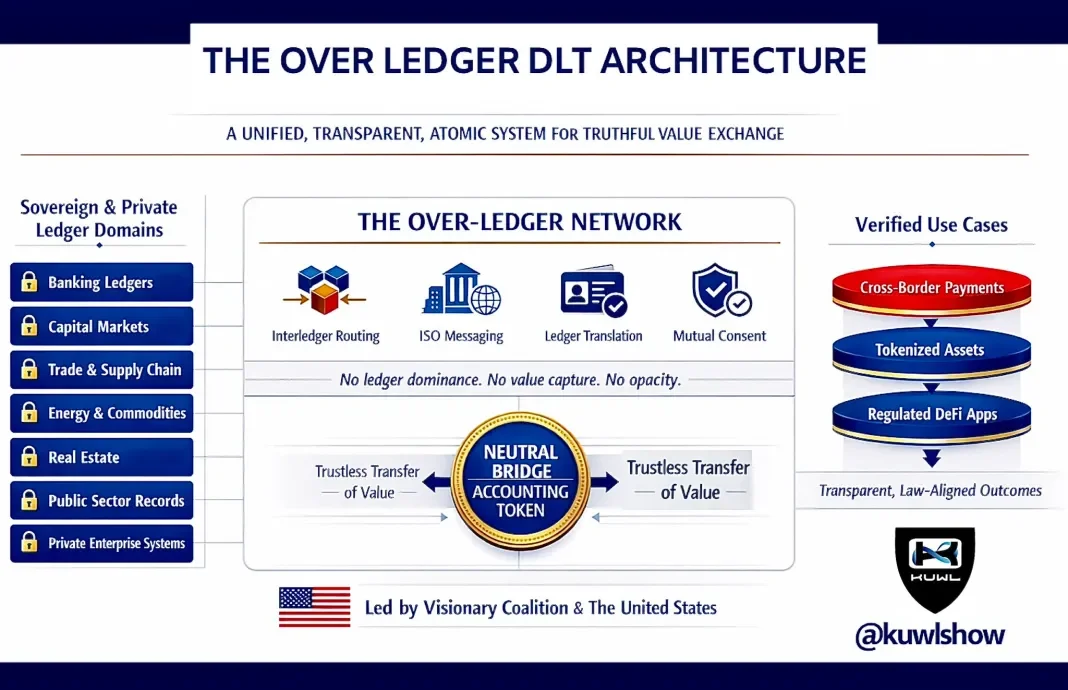

A new global system architecture is now being implemented – one that rises above individual ledgers to unify them through interoperable Distributed Ledger Technology (DLT).

Rob Cunningham: Wealth and Peace on an Epic Scale

1-17-2026

Rob Cunningham | KUWL.show @KuwlShow

Wealth & Peace On An Epic Scale

A new global system architecture is now being implemented – one that rises above individual ledgers to unify them through interoperable Distributed Ledger Technology (DLT).

This architecture is purpose-built for specific, adequately funded use cases; engineered for perfect transparency; capable of atomic settlement; and anchored in real-world asset authentication, immutable identity absolutes, and verifiable ownership.

At its core operates a non-sovereign, neutral bridge accounting token – not as money to be hoarded or weaponized, but as a flawless transporter and transcriber of value: unbiased, instantaneous, and exact.

It neither governs, owns nor extracts, but simply moves truthfully between and in alignment with, compliant systems.

This is not a speculative experiment. It is the natural evolution of law-aligned accounting, trustless verification, and honest weights and measures – emerging through a coalition of public and private leadership, with the United States providing the primary visionary, infrastructural, and moral impetus for its realization.

Fear, or fear not. Transparency renders no place for deception to hide.

And the powers behind the Fed are none too happy.

Transparency yields peace.

Opacity concentrates power.

Centralization yields slavery.

Have Faith.

Source(s): https://x.com/KuwlShow/status/2012172417037201785

https://dinarchronicles.com/2026/01/16/rob-cunningham-wealth-and-peace-on-an-epic-scale/

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 1-17-26

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Good Afternoon Dinar Recaps,

Central Banks Flee Paper for Gold as Dollar Confidence Erodes

Record gold accumulation signals a silent but structural shift in global reserves

Overview

Central banks around the world are accelerating gold purchases at a pace not seen in decades, reflecting growing concern over the long-term credibility of the U.S. dollar. Geopolitical fragmentation, sanctions risk, and increasing political pressure on monetary policy have driven reserve managers toward tangible, politically neutral assets. Gold’s share of global central bank reserves has now climbed above 25%, marking a historic inflection point in reserve strategy.

Key Developments

Central banks have increased gold purchases at multi-decade record levels

Gold now accounts for more than one-quarter of global central bank reserves

Prices have surged to historic highs, confirming sustained institutional demand

China alone reportedly holds over 2,000 tonnes of gold

Emerging market central banks are leading the diversification trend

What’s Really Driving the Shift

This move is not about speculation or short-term hedging. It is about systemic risk management.

Gold offers:

No counterparty risk

Immunity from sanctions and payment freezes

Protection against political interference in monetary policy

Universal acceptability outside any single financial system

As trust in fiat governance weakens, central banks are opting for assets that cannot be debased, frozen, or reprogrammed.

Why It Matters

Accelerated gold accumulation is a classic signal of declining confidence in dominant reserve currencies

Reserve diversification weakens the structural demand for dollar-denominated assets

Gold reasserts itself as a neutral anchor in a fragmenting monetary order

This behavior historically precedes monetary regime adjustments, not follows them

When central banks move first, markets follow later.

Why It Matters to Foreign Currency Holders

For foreign currency holders anticipating revaluation during a Global Reset:

Gold accumulation signals preparation for currency realignment

Tangible reserve backing strengthens the case for future repricing

Fiat-heavy systems face pressure as reserve composition shifts

Holders positioned ahead of formal policy changes benefit most

Gold is not replacing currencies — it is redefining what backs them.

Implications for the Global Reset

Pillar 1 – Assets: Gold regains prominence as a reserve foundation

Pillar 2 – Monetary Trust: Confidence migrates from fiat promises to physical backing

Reserve Architecture: Diversification reduces single-currency dominance

Resets are built quietly in vaults before they appear in headlines.

When central banks choose metal over paper, the message is already clear.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Mumbai Emerges as a Hub for Multipolar Economic Coordination

New Global Economic Cooperation Forum signals accelerating shift away from Western-led frameworks

Overview

A new Global Economic Cooperation 2026 Forum has been announced for February 17–19 in Mumbai, bringing together policymakers, economic planners, and institutional leaders to explore alternative models of global collaboration. The forum reflects growing momentum among emerging and middle powers to coordinate trade, investment, and financial policy outside traditional Western-dominated institutions.

Key Developments

The inaugural forum will convene in Mumbai in mid-February

Focus areas include trade integration, investment flows, and economic coordination

Participants are expected from emerging markets and middle powers

The initiative emphasizes multipolar cooperation rather than bloc dependency

Timing aligns with rising global fragmentation in trade and finance systems

Why This Forum Is Different

Unlike legacy institutions shaped after World War II, this forum is structured around pragmatic economic alignment rather than ideology. Its emphasis is on:

Flexible cooperation across regions

Reduced reliance on dollar-centric systems

Strategic alignment among economies navigating sanctions, debt stress, and trade disruption

This is coalition-building by design — not protest, but preparation.

Why It Matters

Signals intentional coordination for alternative economic architecture

Reinforces the decline of single-center economic governance

Creates space for new trade and settlement frameworks

Aligns with broader moves toward regionalization and multipolar finance

Economic resets rarely begin with formal announcements — they begin with forums like this.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching the Global Reset narrative:

Multipolar coordination supports future currency repricing

Trade integration outside Western systems reduces legacy currency dominance

New settlement mechanisms create opportunities for value recalibration

Forums like this often precede policy harmonization and monetary shifts

Currency value changes are negotiated long before they are declared.

Implications for the Global Reset

Pillar 1 – Trade: Expands non-Western trade coordination pathways

Pillar 2 – Finance: Supports diversification away from dollar-centric systems

Institutional Realignment: Signals early-stage restructuring of global governance

This is not a summit for headlines — it is a workshop for the next system.

Global resets don’t start at the G7 — they start where the future is being built.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Economic Times — Inaugural Global Economic Cooperation Forum to be held in Mumbai Feb 17–19

Observer Research Foundation — Multipolarity and the Future of Global Economic Governance

~~~~~~~~~~

Inside BRICS’ Real De-Dollarization Strategy: Payments Over Politics

Why infrastructure — not a new currency — is quietly reshaping global finance

Overview

For much of 2024 and early 2025, public discussion around BRICS de-dollarization focused on the idea of a new shared currency to rival the U.S. dollar. That narrative missed what was actually happening. Rather than building a euro-style monetary union, BRICS countries pursued a more practical strategy: payment infrastructure, bilateral settlement, and local-currency trade.

The result is a quiet but measurable reduction in dollar usage — achieved not through ideology, but through systems.

Key Developments

BRICS countries prioritized interoperable payment systems instead of a single currency

Russia’s SPFS, China’s CIPS, and India’s UPI were connected through pilot frameworks under BRICS Pay

Russia and China now settle the vast majority of bilateral trade in rubles and yuan

Local-currency trade expanded across energy, commodities, and infrastructure finance

BRICS-backed institutions increased non-dollar lending to Global South projects

This approach sidestepped political resistance while producing tangible outcomes.

Why Payments Became the Strategy

Creating a shared currency would require unified monetary policy, fiscal discipline, and economic convergence — conditions that do not exist inside BRICS. Member economies range from China’s multi-trillion-dollar system to frontier markets still stabilizing basic financial infrastructure.

Instead, BRICS focused on what could be built now:

Clearing systems that bypass dollar settlement

Bilateral trade invoicing in local currencies

Commodity-backed financing structures

Multilateral lending outside Western-dominated institutions

As Russia’s leadership has emphasized publicly, alternatives emerged not as confrontation — but as necessity.

Local Currency Trade and Commodity Finance

Energy trade provided the fastest proof of concept. Oil, gas, and commodities were increasingly settled in yuan, rubles, rupees, and reais, reducing dollar exposure without disrupting supply chains.

Meanwhile, the New Development Bank expanded lending in domestic currencies, supporting infrastructure and development projects without dollar-denominated debt risk. Commodity-backed settlement pilots added further insulation from currency volatility.

Each transaction was incremental — but cumulative impact matters.

Political Limits Still Apply

Despite technical progress, political realities capped ambition. Proposals for a unified BRICS currency were quietly deprioritized in 2025. Leaders acknowledged that monetary integration was premature, particularly amid external trade pressures and tariff threats.

This restraint did not stall de-dollarization — it refined it.

Why It Matters

De-dollarization is happening through systems, not symbols

Payment infrastructure reduces dollar dependency without formal confrontation

Bilateral clearing erodes reserve currency dominance transaction by transaction

This model is scalable beyond BRICS to the wider Global South

The shift is structural, not rhetorical.

Why It Matters to Foreign Currency Holders

For foreign currency holders watching global reset mechanics:

Payment systems matter more than headline currency launches

Local settlement reduces artificial demand for reserve currencies

Commodity-backed finance supports future currency repricing

Infrastructure-first de-dollarization favors measured realignment, not shock events

Currency value changes long before exchange rates move.

Implications for the Global Reset

Pillar 1 – Trade: Local-currency invoicing reshapes global trade flows

Pillar 2 – Finance: Payment rails weaken legacy settlement dominance

Pillar 4 – Assets: Commodities reassert monetary relevance

This is de-dollarization by design — not declaration.

The dollar isn’t being overthrown — it’s being routed around.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru — Inside BRICS’ Next De-Dollarization Playbook: Pay Systems Over Politics

Reuters — Russia and China deepen use of local currencies in trade settlements

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Will The Government Confiscate Your Silver?

Will The Government Confiscate Your Silver? Here’s Why It’s Likely

Noel Lorenzana, CPA Jan 17, 2026

Did you know the US government once seized private gold overnight? In 1933, gold was taken by law with a single signature. No warning. No debate. Today, silver has been declared a US strategic mineral, raising urgent questions about silver confiscation, government control, national security, and private ownership.

Will The Government Confiscate Your Silver? Here’s Why It’s Likely

Noel Lorenzana, CPA Jan 17, 2026

Did you know the US government once seized private gold overnight? In 1933, gold was taken by law with a single signature. No warning. No debate. Today, silver has been declared a US strategic mineral, raising urgent questions about silver confiscation, government control, national security, and private ownership.

Silver is no longer just an industrial or precious metal. It is now tied to the power grid, the military, clean energy, and US national defense. In a national emergency, “strategic” does not mean protected. It means prioritized and controlled. Rules can change without a knock on the door or a new law, turning private silver into a public resource.

This video breaks down the historical gold confiscation of 1933, why silver’s new classification matters, how government control really works, and what this could mean for silver owners today. If you think this cannot happen again, or that silver is immune, you need to pay attention.

“Tidbits From TNT” Saturday 1-17-2026

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

TNT:

Tishwash: Mark Savaya arrives in Erbil

Shafaq News Agency's correspondent reported that Mark Savaya, US President Donald Trump's envoy for Iraq affairs, arrived in Erbil, the capital of the Kurdistan Region, early Saturday morning, as part of a visit that coincides with broader US diplomatic activity related to the Iraq and Syria files.

Tom Barrack, Trump’s envoy for Syria, is scheduled to arrive in Erbil later on Saturday to meet with Mazloum Abdi, the commander of the Syrian Democratic Forces, at a time when the Syrian arena is witnessing a military escalation and international mediation efforts to de-escalate the situation.

Trump had appointed Savaya as special envoy for Iraq affairs on October 19, 2025. He is an American businessman of Iraqi origin.

In his latest remarks, attributed to him ahead of the visit, he said he would deal with the "appropriate decision-makers" in Iraq, and had previously hinted that "big changes are coming" with a focus on "actions, not words." link

Tishwash: Sudanese advisor: The government has achieved economic success, and the International Monetary Fund is witnessing it.

Despite talk of a severe financial crisis in Iraq and the decline of the dinar against the dollar, the Prime Minister's financial advisor, Mazhar Muhammad Salih, says that the country recorded a low inflation rate of about 1.5% by the end of 2025. He pointed out that inflation in Iraq is the lowest in the Arab world, noting that the government's monetary policy succeeded in maintaining price and exchange rate stability and protecting the purchasing power of the dinar.

Regarding the recent cabinet measures, Salih explained that their aim is to address what is known as "job inflation" as a step to support social stability and improve income levels, as he put it.

Saleh told the official agency, as reported by 964 Network , that “the Iraqi economy is witnessing a remarkable phase of monetary stability, as it recorded a low inflation rate of about 1.5% by the end of 2025, according to estimates by the International Monetary Fund, which is among the lowest rates in the Arab region.” He explained that “this achievement is attributed to the monetary policy that succeeded in maintaining price and exchange rate stability, and protecting the purchasing power of the dinar, which strengthened confidence in the national currency and provided a more favorable environment for investment.”

He added that “the recent Cabinet decisions aim to address what is known as ‘job inflation’ as a step to support social stability and improve income levels,” noting that “these measures achieve positive short-term returns by stimulating domestic demand and enhancing economic confidence, especially if they are financed within the limits of financial sustainability and do not exceed the absorptive capacity of the economy.”

He explained that “the biggest challenge remains in transforming this monetary stability into sustainable productive economic growth, since government employment, if not linked to productivity, may create a gap between public spending and real output, and increase the economy’s vulnerability to fluctuations in oil prices.”

He added that “the solution lies in linking employment to training and qualification programs, empowering the private sector through legislative and financial reforms, as well as diversifying the economic base by focusing on agricultural development, manufacturing, renewable energy, and increasing opportunities in the digital economy.”

He stressed that “Iraq today has a rare dual opportunity represented by low inflation and monetary stability,” adding that “this opportunity can turn into a long-term gain if it is invested in building a solid productive base, which will ensure the continuity of financial and monetary stability in the medium and long term, and move the economy from the cycle of rentier dependency to the path of sustainable growth.” link

************

Tishwash: Government advisor: Tourism investment is a gateway to stimulating the private sector and diversifying national income.

The Prime Minister’s financial advisor, Mazhar Muhammad Saleh, confirmed on Friday that Iraq has more than 12,000 archaeological sites that form the basis for a comprehensive tourism launch, explaining that tourism investment is a gateway to stimulating the private sector and diversifying national income.

Saleh told the Iraqi News Agency (INA): “Tourism in Iraq is more than just a recreational activity; it is a strategic tool for wealth creation, achieving balanced development, and diversifying national income sources, provided that investment in it is done seriously and with a clear institutional approach.”

He explained that “this sector has the potential to become a major economic pillar, capable of restoring Iraq to its natural civilizational position and contributing to building a more stable and sustainable economic future.”

He added that “tourism in Iraq represents a strategic economic lever capable of reducing the single dependence on oil, opening up broad prospects for diversifying national income, creating direct and indirect job opportunities, revitalizing the service and commercial sectors, as well as providing the economy with important revenues from foreign currency.”

He pointed out that "tourism leads to an increase in demand for local products and services, especially handicrafts, food products, and national cuisine, which strengthens local value chains. At the employment level, it is estimated that a single tourism event in the hotel accommodation sector alone is capable of generating more than 25 job opportunities at once, which highlights the multiplier effect of this sector on the labor market."

He pointed out that "tourism investment contributes to stimulating private sector trends by supporting the growth of small and medium enterprises, such as transport companies, restaurants and shops, and it also has a positive impact on the macroeconomy through the development of infrastructure by investing in roads, airports, hotels and public facilities, which enhances the investment attractiveness of the country as a whole."

Saleh emphasized that “Iraq has more than 12,000 archaeological sites stretching from Babylon, Ur and Nineveh to Baghdad and Samarra, as well as holy religious shrines. These are unique cultural treasures, some of which have been included in UNESCO’s World Heritage List, and they form a solid foundation for a comprehensive tourism initiative with economic, cultural and civilizational dimensions. link

Mot: Simply Can't Win !!! -- Can He!!!???

Mot: Love the Wisdom of the ""Wee Folks""!!!

Seeds of Wisdom RV and Economics Updates Saturday Morning 1-17-26

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Good Morning Dinar Recaps,

China-Led Digital Currency Network Quietly Surges — Dollar Rails Face a Parallel System

Cross-border CBDC testing accelerates as trade settlement bypasses traditional banking channels

Overview

China-led cross-border digital currency infrastructure has reached a new milestone, as transaction volumes on a multilateral central bank digital currency platform surged dramatically. What began as a limited experiment has evolved into a functioning settlement network used by sovereign institutions, signaling a structural shift in how international trade can be cleared outside legacy dollar-based systems.

Key Developments

A China-backed cross-border digital currency platform recorded tens of billions of dollars in cumulative transactions

Participating central banks include China, Hong Kong, Thailand, the UAE, and Saudi Arabia

The digital yuan accounts for the vast majority of settlement volume

Government-level wholesale transactions have now occurred on the platform

The system operates outside SWIFT and traditional correspondent banking rails

What’s Actually Changing

This is not a retail crypto story. It is institution-to-institution settlement infrastructure being tested live.

Unlike experimental pilots of the past, this platform:

Settles trade directly between central banks

Reduces reliance on intermediary banks

Shortens settlement times from days to seconds

Limits exposure to sanctions and correspondent risk

The most important shift is architectural: payments are being designed without the dollar as a mandatory bridge asset.

Why It Matters

Parallel payment systems weaken the monopoly power of existing reserve currency rails

Trade can increasingly settle without touching U.S. banking infrastructure

Financial influence moves from enforcement to infrastructure control

Once operational, these systems are difficult to unwind

This is how monetary transitions occur quietly — before headlines, not after them.

Why It Matters to Foreign Currency Holders

Foreign currency holders anticipating revaluation during a Global Reset should note:

Alternative settlement systems reduce forced demand for a single reserve currency

Cross-border CBDCs create conditions for regional currency repricing

Infrastructure precedes valuation changes, not the other way around

When trade no longer needs legacy rails, currency hierarchies begin to adjust

This development does not flip the switch — it installs the wiring.

Implications for the Global Reset

Payments Pillar: Live CBDC settlement outside dollar rails

Trade Pillar: Sovereign trade increasingly bypasses correspondent banking

Monetary Power: Influence shifts from currency dominance to network control

The reset does not arrive as an announcement. It arrives as redundancy.

When the rails change, the destination eventually follows.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — China-led cross-border digital currency platform sees surge

Bank for International Settlements — mBridge Project Overview

~~~~~~~~~~

Bank of England Warns Populism Is Undermining Monetary Trust — Confidence Becomes the Risk

Central banks defend credibility as political pressure intensifies

Overview

The Governor of the Bank of England issued a blunt warning that rising populism and political interference are eroding trust in financial institutions. The statement reflects growing concern among central bankers that confidence — not inflation — may become the next systemic vulnerability.

Key Developments

The Bank of England warned of political pressure undermining institutional independence

Central bank credibility was framed as a core pillar of financial stability

Trust erosion was linked to market volatility and capital flight risk

Similar concerns are emerging across multiple Western monetary authorities

What the Warning Really Signals

Central banks rarely speak publicly about trust unless it is already being tested.

This warning suggests:

Monetary authority is being challenged politically

Policy credibility increasingly requires communication management

Financial stability now depends as much on perception as policy tools

Institutional legitimacy is no longer assumed

When trust must be defended verbally, it is already under strain.

Why It Matters

Fiat systems function on confidence, not convertibility

Political interference weakens long-term policy credibility

Markets price trust faster than inflation data

History shows currency transitions often follow legitimacy crises, not recessions

This is a confidence signal — not a policy one.

Why It Matters to Foreign Currency Holders

For those holding foreign currencies expecting a Global Reset:

Declining institutional trust accelerates diversification away from legacy systems

Confidence fractures create sudden repricing windows

Reset events often follow legitimacy loss, not official failure

Holders positioned early benefit from disorderly adjustments

Trust is the invisible reserve asset. When it erodes, values shift.

Implications for the Global Reset

Confidence Pillar: Institutional trust becomes a limiting factor

Monetary Pillar: Independence questioned, credibility strained

Capital Flows: Investors hedge against political monetary risk

Resets begin when belief systems crack — not when systems collapse.

When central banks defend trust, the real currency is already moving.

Seeds of Wisdom Team

Newshounds News

Sources

Reuters — Bank of England governor warns against populism and erosion of trust

Financial Stability Board — Central Bank Independence and Financial Stability

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The U.S. Mint Has SUSPENDED ALL SALES of Silver Numismatic Products.

The U.S. Mint Has SUSPENDED ALL SALES Of Silver Numismatic Products.

The United States Government just blinked. On Wednesday, January 14, 2026, the US Mint officially suspended sales of all silver numismatic products, citing an inability to price the metal during "rapidly rising" market conditions. This is the first signal of a Sovereign Physical Default in modern history.

The U.S. Mint Has SUSPENDED ALL SALES Of Silver Numismatic Products.

The United States Government just blinked. On Wednesday, January 14, 2026, the US Mint officially suspended sales of all silver numismatic products, citing an inability to price the metal during "rapidly rising" market conditions. This is the first signal of a Sovereign Physical Default in modern history.

The entity that prints the currency can no longer source the metal to back it. In this emergency deep dive, we expose the catastrophic disconnect between the Paper Price and the Physical Reality. While Comex silver just hit a new All-Time High of 91.54, the Shanghai Gold Exchange has already shattered the triple−digit barrier, fixing at 100.15.

There are now two prices for silver on Earth: the fake paper price in New York, and the real physical price in China. We analyze the "Whale Raid" on the commercial vaults that triggered this shutdown. Data confirms that 1.3 Million ounces of silver were drained from the JPMorgan vault in a single day, causing a systemic bleed of "Eligible" inventory.

Strategic entities are bypassing the exchange, taking delivery, and shipping metal East to capture the massive arbitrage spread. We map out the "Endgame" scenario. With the Mint closed, dealers rationing inventory, and the Gold-to-Silver ratio collapsing, the path to $300 silver is mathematically locked in.

We discuss the "Ounces to Acres" exit strategy and why selling for dollars during a currency reset is a fatal mistake. The Mint is closed. The Vault is open. And the price is vertical.

Buy the Everything Bubble or Lose to Inflation?

Buy the Everything Bubble or Lose to Inflation?

Heresy Financial: 1-15-2026

As an investor, you’re likely no stranger to uncertainty. But today’s market conditions have left many of us scratching our heads. With asset classes across the board – from stocks and real estate to gold, silver, and commodities – hovering at or near all-time highs, it’s natural to wonder: are we in an “everything bubble”?

And if so, should you stay invested and risk a potentially devastating market crash, or hold onto cash and watch your purchasing power dwindle as inflation continues to rise?

Buy the Everything Bubble or Lose to Inflation?

Heresy Financial: 1-15-2026

As an investor, you’re likely no stranger to uncertainty. But today’s market conditions have left many of us scratching our heads. With asset classes across the board – from stocks and real estate to gold, silver, and commodities – hovering at or near all-time highs, it’s natural to wonder: are we in an “everything bubble”?

And if so, should you stay invested and risk a potentially devastating market crash, or hold onto cash and watch your purchasing power dwindle as inflation continues to rise?

In a recent video from Heresy Financial, market educator Joe Brown tackles this critical dilemma head-on. Brown, a former stockbroker with a unique perspective on the markets, argues that labeling the current situation a bubble oversimplifies the issue.

Instead, he suggests that the root cause of rising asset prices lies in the significant loss of purchasing power of the U.S. dollar.

Brown’s insight is that when you measure asset prices against other stores of value, like gold, the picture changes dramatically. Many assets that appear expensive in dollar terms are, in fact, becoming cheaper when measured against gold.

This indicates that the rising prices we’re seeing aren’t solely the result of overvaluation, but rather a reflection of the dollar’s declining purchasing power.

The culprit behind this debasement is inflation, fueled by a combination of factors including Federal Reserve policies, quantitative easing (QE), and a surge in the money supply. In this environment, holding cash is a losing proposition, as the value of your money erodes over time.

So, how can investors navigate this challenging landscape? Brown recommends a two-pronged approach. First, he advocates for a diversified portfolio with multiple uncorrelated asset classes.

This allows you to rebalance your portfolio and capitalize on relative mispricings without trying to time the market. By spreading your investments across different asset classes, you can reduce your exposure to any one particular market.

Second, Brown suggests allocating a small portion of your portfolio to an aggressive trading strategy, designed to capitalize on market volatility and chaos. His own method has delivered an impressive 36.4% annualized return over the past five years, outpacing major indices by a significant margin.

Looking to the future, Brown warns that Federal Reserve policies are shifting back toward liquidity and monetary easing, signaling continued inflation and asset price inflation. As a result, investors can expect increased market volatility, with frequent bear markets likely to persist. To thrive in this environment, you’ll need strategies that can handle both growth and risk.

In conclusion, the “everything bubble” dilemma is a complex issue that requires a nuanced approach. By understanding the root causes of rising asset prices and adopting a diversified, proactive investment strategy, you can position yourself for success in a rapidly changing market. Watch the full video from Heresy Financial to learn more and take the first step toward securing your financial future.

TIMECODES

0:00 Assets Are in an Everything Bubble

0:21 Staying in Cash Means Losing Purchasing Power

0:50 Gold Silver and Stocks at All Time Highs

1:23 Commodities Are Breaking Records Too

1:43 The Cost of Living Keeps Rising

2:28 The Most Important Question: Compared to What?

4:21 Why Bubbles Are Usually Isolated to One Asset Class

5:11 The Everything Bubble Is Driven by Currency Debasement

6:08 Gold vs Stocks Shows No Clear Bubble

6:51 Bitcoin Appears Expensive Relative to Gold

7:31 How to Navigate the Everything Bubble

8:11 Diversify Across Uncorrelated Asset Classes

8:52 Rebalancing Between Assets Buys Low Sells High

10:04 The Barbell Approach to Portfolio Allocation

10:44 My 36% Average Annual Return Strategy

11:12 The Federal Reserve Restarted Quantitative Easing

12:00 Banks Will Do QE for the Fed Through Deregulation

12:42 Expect More Volatility and Bear Markets Ahead

13:17 Profit From Chaos Instead of Sitting on Sidelines

The Quiet Money Reset, How the IQD Fits in and What to do

The Quiet Money Reset, How the IQD Fits in and What to do

Edu Matrix: 1-15-2026

The world is witnessing a significant, yet subtle transformation in its monetary systems.

Countries such as Iraq, Venezuela, and even the United States are at the forefront of this change, which is characterized by a gradual move away from debt-based financial systems towards ones that are backed by real assets, transparency, and accountability.

This shift, though not dramatic or abrupt, is profound in its implications for the global economy and individual financial security.

The Quiet Money Reset, How the IQD Fits in and What to do

Edu Matrix: 1-15-2026

The world is witnessing a significant, yet subtle transformation in its monetary systems.

Countries such as Iraq, Venezuela, and even the United States are at the forefront of this change, which is characterized by a gradual move away from debt-based financial systems towards ones that are backed by real assets, transparency, and accountability.

This shift, though not dramatic or abrupt, is profound in its implications for the global economy and individual financial security.

At the heart of this transformation is the recognition that traditional monetary systems, heavily reliant on unlimited debt and trust, are being reevaluated.

The presenter in a recent video discussion highlights that this reliance is being replaced by a new paradigm that emphasizes stronger balance sheets and currencies backed by tangible assets. This change is not occurring in a vacuum but is instead being guided by global regulatory frameworks, such as those set forth by the Bank of International Settlements (BIS).

For individuals, navigating this changing landscape requires a proactive and diversified approach. The advice is clear: to remain protected and flexible, one should consider diversifying their holdings across different currencies, accounts, and types of assets.

Keeping debt levels low is also paramount, as is focusing on real-world value rather than getting caught up in hype. The days of placing all your financial eggs in one basket, or worse, keeping them in a safe deposit box, are behind us. A diversified strategy is key to effective risk management in this new era.

The examples of the Iraqi dinar and the Vietnamese dong are particularly instructive. These currencies are being repositioned in a way that ties their value to real economic production, potentially making them valuable in the long term.

This move underscores the broader trend towards asset-backed currencies and away from fiat currency that is not backed by tangible assets.

As this monetary reset continues to unfold, it is crucial for individuals to stay informed and remain calm.

The complexities behind this global shift are multifaceted, and staying abreast of developments is essential for making informed financial decisions.

In conclusion, the ongoing transformation in global monetary systems represents a significant shift towards a more transparent, accountable, and asset-backed financial framework.

While the journey is complex and gradual, being prepared and adopting a diversified financial strategy can help navigate the changes ahead. For further insights and information, watching the full video from Edu Matrix can provide viewers with a more comprehensive understanding of this quiet revolution and its implications for the future.

Seeds of Wisdom RV and Economics Updates Friday Afternoon 1-16-26

Good Afternoon Dinar Recaps,

Silver Structural Shortage Tests Markets and Physical Supply Limits

Paper pricing cracks as physical silver becomes increasingly scarce

Good Afternoon Dinar Recaps,

Silver Structural Shortage Tests Markets and Physical Supply Limits

Paper pricing cracks as physical silver becomes increasingly scarce

Overview

Physical silver is in persistent structural deficit, with global mine production unable to meet industrial and investment demand for multiple years.

Physical inventories in major markets have plunged, leaving little metal available for immediate delivery.

Lease rates and premiums point to acute physical tightness, even as futures and derivatives pricing continues to lag.

These conditions highlight a disconnect between paper markets and real metal, underscoring long-term upward pressure on physical prices.

Key Developments at a Glance

Physical silver usage for industrial demand now accounts for almost 60% of total global supply, driven by solar, electronics, and tech sectors.

Global supply has been in structural deficit for several years, with cumulative shortfalls deepening.

Available deliverable inventory in Western vaults has fallen sharply, reducing immediate physical liquidity.

Lease rates soared, reflecting high costs to borrow metal and tight availability.

Local physical premiums in some markets trade above futures, signaling real-world supply stress.

Silver’s Structural Deficit: What the Data Shows

According to multiple market analyses:

Persistent deficits: Silver supply has failed to meet demand for several consecutive years, with recent deficits estimated in the tens of millions of ounces annually.

Deliverable scarcity: Registered inventories at major exchanges have declined drastically — COMEX stocks are significantly lower than their peaks.

Small free float: Much of the reported vault totals are allocated to ETFs and long-term holders, leaving only a small percentage truly available for immediate physical settlement.

This combination of supply and inventory realities reflects a market where the cost of obtaining physical metal increasingly diverges from paper quotes.

Backwardation and Lease Rates Point to Tightness

Market pricing behavior reveals real physical stress:

Backwardation — where current spot prices trade above future prices — is observed, indicating urgency for immediate delivery.

Lease rates spiked to extraordinary highs in recent periods, far exceeding normal borrowing costs and exposing difficulty sourcing actual metal.

Such unusual dynamics commonly occur when metal is scarce and participants must pay premiums to access physical supply.

Industrial and Strategic Demand Continues

Industry and strategic holders continue to compete for scarce metal:

Industrial demand, particularly from renewable energy and high-tech manufacturing, remains strong and relatively price-inelastic.

ETF and investment demand adds pressure on inventories, as funds take delivery of physical bars to back shares.

Strategic export controls — such as recent restrictions on silver exports from major producing countries — further tighten available supply.

This mix of demand drivers makes it unlikely that inventories will replenish quickly, absent major production increases.

Why It Matters

Paper and physical markets diverging: Futures prices and physical spot premiums no longer align, indicating emerging real scarcity rather than synthetic pricing.

Inventory exhaustion risk: With deliverable inventories shrinking, paper contracts may increasingly fail to represent actual metal availability.

Short positions become riskier: When physical inventories are low and demand remains high, holders of short positions face rising costs and potential forcing events.

Industrial users face supply constraints: Key sectors like solar energy, electronics, and EVs may confront rising input costs and longer fulfillment times.

This structural imbalance is less about short-term speculation and more about long-term supply dynamics.

Why It Matters to Foreign Currency Holders

For readers holding foreign currency with an eye toward the Global Reset:

Scarcity of essential real assets like silver supports hard asset revaluation narratives.

If physical supply fails to meet demand, prices adjust upward regardless of paper markets.

Currency confidence often weakens when real supply of strategic commodities tightens.

Resets historically favor tangible, scarce assets over fiat claims in periods of monetary stress.

In the context of a reset, assets tied to real industrial and monetary demand can outperform traditional paper benchmarks.

Implications for the Global Reset

Pillar 1 – Real Asset Scarcity: Structural shortfalls in strategic commodities like silver reflect deeper supply constraints in the global economy.

Pillar 2 – Trust Shift in Markets: Divergence between paper pricing and physical reality could accelerate reassessment of traditional financial instruments.

This isn’t just a market anomaly — it’s evidence of increasing structural stress in both real supply chains and financial price discovery.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

FinancialContent – Silver’s Historic Surge Highlights Structural Supply Deficit

Investing.com – Silver Flashes Rare Warning Signal as Physical Market Seizes Up

DiscoveryAlert – Silver Supply Imbalance and Delivery Scarcity Signals

~~~~~~~~~~

IMF Signals Resilience — But the Next Shock Is Already Forming

Global growth holds for now, while structural fault lines quietly widen

Overview

The IMF signaled near-term global economic resilience, despite escalating trade, geopolitical, and financial stress.

Officials warned that future shocks are increasingly likely, not less.

The message underscores a system that is stable on the surface, fragile underneath — a classic late-cycle signal.

Key Developments at a Glance

IMF Managing Director Kristalina Georgieva confirmed the upcoming World Economic Outlook shows continued global growth resilience.

Trade fragmentation, geopolitical tensions, and technology disruption were identified as primary risk vectors.

Policymakers are increasingly relying on financial buffers, liquidity tools, and coordination to prevent cascading shocks.

The IMF emphasized that resilience is uneven and conditional, not structural.

What the IMF Is Really Saying

While markets focus on the word resilient, the IMF’s warning centers on shock transmission risk.

Growth is being supported by policy intervention, not organic balance

Trade disruptions are no longer temporary — they are systemic

Technology and capital flows are concentrating power, liquidity, and risk

The global economy is absorbing shocks, not resolving root causes

This reflects a world where stress is deferred, not eliminated.

Why This Matters

A “resilient” system that requires constant intervention is not stable — it is managed.

The IMF’s framing suggests authorities expect disruptions ahead, even if timing is uncertain.

Historically, periods of declared resilience often precede monetary or currency realignments, not prevent them.

Why It Matters to Foreign Currency Holders

Foreign currency holders are watching for revaluation, reset, or repricing events tied to systemic change.

IMF language implies currency stability is being actively defended, not naturally sustained

Trade fragmentation increases pressure for regional settlement systems and non-dollar flows

When shocks finally surface, currency hierarchies tend to adjust rapidly

Resilience messaging often serves as confidence management ahead of transition

For those holding foreign currencies in anticipation of a Global Reset, this reinforces a key reality:

The system is being held together — not healed.

Implications for the Global Reset

Pillar: Trade — Fragmentation is now normalized, accelerating multipolar settlement paths

Pillar: Assets — Capital concentration masks underlying valuation risk

Pillar: Technology — Digital infrastructure is becoming a shock amplifier, not just an efficiency tool

Pillar: Confidence — Official reassurance suggests concern about sentiment durability

This is not a warning of collapse — it is confirmation of controlled instability.

Bottom Line

The IMF is telling the world that the system still works — but only with constant support.

Resilience today may simply be borrowed stability from tomorrow.

This is not just economic forecasting — it’s stress management in a transitioning global order.

Sources

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps