News, Rumors and Opinions Thursday 1-15-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 15 Jan. 2026

Compiled Thurs. 15 2026 12:01 am EST by Judy Byington

Banks Failing

Fiat US Dollar Collapsing

Billions in Stolen Wealth Recovered

Global Currency Reset Activated

And Power Is Shifting Back To The People

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Thurs. 15 Jan. 2026

Compiled Thurs. 15 2026 12:01 am EST by Judy Byington

Banks Failing

Fiat US Dollar Collapsing

Billions in Stolen Wealth Recovered

Global Currency Reset Activated

And Power Is Shifting Back To The People

Tues. 13 Jan. 2026 The Big Call Bruce: The latest information from a hot Wells Fargo source indicated that we were expecting everything to fly either next Sunday 18 Jan. 2026 or the following Wed. 21 Jan. 2026. Some Redemption Center Leadership Staff say it could be earlier, maybe Friday-Saturday.

~~~~~~~~~~~~~~

Wed. 14 Jan. 2026 Fox News TREASURY BOMBSHELL: $100–$150 BILLION SET TO FLOW BACK TO AMERICANS IN Q1 2026 …Ezra Cohen on Telegram

A major development is quietly taking shape beneath the surface, and its impact could be felt across every household and every market. The U.S. Treasury has confirmed that a massive wave of tax refunds is scheduled to hit in early 2026, with an estimated 100 to 150 billion dollars flowing directly back to the American people. For most households, that translates to roughly 1,000 to 2,000 dollars in cash arriving right as the new year begins.

This is not a projection or a theory. These are Treasury-confirmed figures. And just as important, this is not stimulus, not new debt, and not printed money. This is income Americans already earned, simply returning where it belongs.

The scale of this refund cycle matters. When cash moves directly into households, it does not sit idle. Bills get paid, spending increases, confidence improves, small businesses feel the impact first, and the broader economy follows. Treasury expectations point to a measurable lift in economic activity through the first and second quarters of 2026, creating a momentum effect that builds as the year unfolds.

From a market perspective, the signal is just as clear. Liquidity is returning to the system. Historically, when Americans have more cash and less financial pressure, consumer spending accelerates, sentiment improves, and risk appetite returns. Capital finds its way back into stocks, small caps, crypto, and other growth-sensitive assets. Markets do not move on politics or noise. They move on cash flow.

What makes this refund cycle fundamentally different from past stimulus programs is its structure. There is no money printing, no emergency legislation, no expansion of federal debt, and no inflation-driven panic response. This is a refund cycle, meaning existing money is being recycled back into the economy. That supports growth without destabilizing the system. Refunds strengthen the foundation, while stimulus creates new liabilities.

Zooming out, the bigger picture is simple. When Americans keep more of their own money, the economy works better. Households do not need lectures or instructions on how to spend. They need breathing room. Economic confidence does not start on Wall Street. It starts at the kitchen table.

Timing only amplifies the effect. A major refund wave landing in early 2026 boosts morale, strengthens consumer balance sheets, stabilizes expectations, and shifts the narrative from fear to forward momentum. These are the quiet but powerful levers that change sentiment quickly, even without dramatic headlines.

FINAL TAKE Between 100 and 150 billion dollars is set to return to Americans. Most households can expect around 1,000 to 2,000 dollars. The impact begins in Q1 2026, with a broader economic lift expected to follow. This is not hype. This is not speculation. This is money moving. And when money moves, everything else follows. Watch Q1. Watch Q2. The signal is clear.

Read full post here: https://dinarchronicles.com/2026/01/15/restored-republic-via-a-gcr-update-as-of-january-15-2026/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man The goal is to position Iraq as a regional financial center. Think about that. Really? 1310 going to have a regional financial center? I don't think so.

Frank26 It is possible Sudani may not be the Prime Minister…It is possible he has stepped aside. We don’t know the full results yet. It’s possible Donald Trump is going to tell him, ‘Get your ass back in there.’ I don’t know. But we do know Sudani decided to say, ‘I’m going to step aside.’ Apparently Trump got a bad report from Savaya…IMO Sudani blew it…Maliki? Of course not…The reason I suggest to you al-Awadi is because al-Awadi is Sudani’s right hand man…This guy maybe will listen to Trump, play fair with your currency and pay up.

Jeff The central bank is completely autonomous. They can change the rate whenever they want. What we don't know is do they perceive or deem the formation of the government as a level being completed. Is that a level of stability regarding the rate change? We'll never know. We can't confirm. We have no way to verify that...It does make sense for them to change the rate before the government is done formed and completed. Reason why is they still have quite a bit of things they have to do after the rate changes. They have to approved 150+ laws. One of those would be the '26 budget.

***********

Citi's SHOCKING Warning: Why They Say in SIX DAYS Markets Will CRASH!

Steven Van Metre: 1-15-2026

Citibank just dropped a bombshell warning: that in six days we are facing a massive economic slowdown and a stock market crash.

The shocking truth, the real crisis is already brewing.

Seeds of Wisdom RV and Economics Updates Thursday Morning 1-15-26

Good Morning Dinar Recaps,

XRP Faces Jan 15 CLARITY Act Test as ETFs Signal Confidence

Regulatory clarity meets a critical technical support zone

Good Morning Dinar Recaps,

XRP Faces Jan 15 CLARITY Act Test as ETFs Signal Confidence

Regulatory clarity meets a critical technical support zone

Overview

XRP is trading above the key $2.00 level as U.S. lawmakers prepare for a pivotal Jan. 15 vote on the CLARITY Act.

The outcome could shape XRP’s long-term regulatory positioning and institutional adoption.

Despite a broader crypto market pullback, XRP spot ETFs recorded $4.92 million in net inflows, signaling continued investor confidence.

Key Developments

A U.S. Senate Committee markup session for the Digital Asset Market Structure and Clarity Act of 2025 is scheduled for 10:00 AM ET on January 15.

The bill aims to establish a comprehensive regulatory framework for digital commodities.

It outlines oversight responsibilities for the CFTC, addresses wash trading, and mandates proof-of-reserves requirements.

Why the CLARITY Act Matters for Crypto

Passage could reduce regulatory uncertainty that has constrained institutional participation.

Clearer rules may lower compliance barriers for altcoins like XRP, improving scalability and adoption.

Supporters argue the bill balances innovation with transparency and guardrails.

XRP ETFs Show Growing Institutional Interest

On January 9, XRP spot ETFs added approximately 2.32 million XRP, reflecting $4.92M in net inflows.

ETF demand suggests confidence in XRP’s regulatory outlook, even amid near-term market weakness.

Price action continues to track institutional sentiment, not just retail speculation.

Technical Snapshot: Can $2.00 Hold?

XRP is trading near $2.08 after pulling back from recent highs.

Momentum indicators:

MACD below the signal line signals short-term bearish pressure

RSI near 43, indicating a neutral, non-oversold condition

Upside scenario:

Holding $2.00 could allow a move toward $2.20 resistance

A breakout above $2.20 opens targets at $2.35 and $2.50

Downside risk:

A break below $2.00 may expose $1.90, then $1.80 as next supports

Why It Matters

XRP sits at the intersection of regulation and institutional adoption.

The Jan. 15 vote represents a policy catalyst, not just a technical one, that could influence longer-term valuation.

Why It Matters to Foreign Currency Holders

Regulatory clarity for digital assets supports alternative value rails alongside fiat currencies.

For foreign currency holders anticipating a Global Reset, clearer crypto frameworks strengthen the case for multi-system monetary coexistence rather than reliance on a single reserve currency.

XRP’s use case in cross-border settlement narratives keeps it relevant in broader currency realignment discussions.

Key Takeaway

XRP’s near-term price hinges on $2.00 support, but its longer-term trajectory may be shaped by Washington, not charts.

Regulatory clarity could prove more decisive than short-term volatility.

Sometimes the biggest price driver isn’t the market — it’s the vote.

Seeds of Wisdom Team

Newshounds News

Sources

CoinGape — XRP Price Outlook Ahead of Jan 15 CLARITY Act Vote

Cointelegraph — U.S. lawmakers advance crypto market structure legislation

~~~~~~~~~~

Russia Pushes Crypto Into “Everyday Finance” With Retail Access Bill

Caps, controls, and cross-border strategy redefine Moscow’s digital asset stance

Overview

Russia is preparing legislation to open limited cryptocurrency access to everyday investors.

The bill would allow non-qualified retail participants to buy crypto up to 300,000 rubles (about $3,800).

Lawmakers aim to normalize crypto as part of the financial system, rather than treating it as a special or experimental asset class.

Key Developments

The draft bill is expected to be reviewed during the spring session of the State Duma.

It would remove cryptocurrencies from a special regulatory regime that has historically restricted their use.

The proposal reflects a shift toward treating digital assets as routine financial instruments with guardrails.

Retail Access — With Firm Limits

Non-qualified investors would gain access, but only within clearly defined caps.

Authorities stress that crypto exposure must be controlled to prevent speculation and household risk.

The 300,000-ruble limit is designed to allow participation without destabilizing the financial system.

Cross-Border and Strategic Use

Beyond domestic trading, the bill supports:

Crypto-based cross-border settlements

Token issuance in Russia for placement on foreign markets

These measures align with Russia’s ongoing efforts to diversify away from traditional financial rails amid sanctions pressure.

Central Bank Caution Remains

The Bank of Russia continues to warn about systemic risks from unrestricted retail crypto access.

Prior proposals included:

Risk-awareness testing for retail investors

Continued bans on anonymous and privacy-focused digital assets

The new bill reflects a compromise between innovation and strict oversight.

Why It Matters

Russia is signaling that crypto is no longer fringe — but policy-managed infrastructure.

By integrating digital assets into everyday finance, Moscow is building parallel financial capabilities while maintaining tight state control.

Why It Matters to Foreign Currency Holders

Expanded crypto use in Russia strengthens alternative settlement channels outside the dollar system.

For foreign currency holders anticipating a Global Reset, this move reflects gradual system diversification rather than abrupt disruption.

It reinforces the trend toward multiple value rails — fiat, crypto, and local currencies — coexisting during monetary realignment.

Key Takeaway

Russia is not liberalizing crypto — it is institutionalizing it.

Limited retail access, strict caps, and cross-border functionality point to strategic normalization, not speculation.

Crypto doesn’t go mainstream overnight — it gets regulated first.

Seeds of Wisdom Team

Newshounds News

Sources

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

A New Poll Has A Bold Prediction For The Value Of Gold In 2026

A New Poll Has A Bold Prediction For The Value Of Gold In 2026

Kyle Schurman December 18, 2025

If you have been looking for a way to expand your investment returns in recent years, you might have considered gold. While there is a caveat to buying gold in 2025, it did go up in value throughout the year. As of mid-December 2025, it was solidly on its way to its largest year-over-year value increase in more than four decades. With those kinds of gains already locked in, you may now be wondering if gold is again worth buying in 2026.

A New Poll Has A Bold Prediction For The Value Of Gold In 2026

Kyle Schurman December 18, 2025

If you have been looking for a way to expand your investment returns in recent years, you might have considered gold. While there is a caveat to buying gold in 2025, it did go up in value throughout the year. As of mid-December 2025, it was solidly on its way to its largest year-over-year value increase in more than four decades. With those kinds of gains already locked in, you may now be wondering if gold is again worth buying in 2026.

A new poll from Goldman Sachs says that you may want to add gold to your portfolio before the new year. The investment bank took a survey in mid-November 2025 of more than 900 institutional investor clients using the Goldman Sachs Marquee platform. Almost 70% of the people responding to the poll expect gold to exceed $4,500 per ounce by the end of 2026 (via CNBC). As of December 15, 2025, that amount of gold is trading for around $4,300, so that suggests the potential for a pretty sizable increase.

In an interview with Bloomberg Television in late November 2025, Daan Struyven, the co-head of global commodities research at Goldman Sachs, said the company's outlook for gold in 2026 matches its poll respondents' optimism. He predicted at least a 20% increase in the price of gold by the end of 2026, and that it could reach $4,900 per troy ounce in that time.

There's widespread optimism that gold will keep appreciating

According to the Goldman Sachs poll, 36% of those surveyed predict that the price of gold will surpass $5,000 per ounce by the end of 2026. A slightly smaller portion believes gold will settle at between $4,500 and $5,000 per ounce by the time 2026 comes to an end. About 22% of poll participants expect that gold will be roughly stagnant during 2026 and finish out the year at between $4,000 and $4,500 per ounce. Only 5% see gold's per-ounce price dropping during the next year and settling at between $3,500 and $4,000. Even fewer — about 3% — predict it will fall below $3,500.

If the majority is correct, it would mean a continuation of gold hitting unprecedented milestones. This trend has made it difficult for people trying to predict market movements. Many of the predictions that market experts made at the end of 2024 for gold prices in 2025 were surpassed before the midpoint of the year, causing many researchers to adjust their predictions upward. Gold had never surpassed $4,000 per ounce until October 2025.

To Continue and Read More: https://www.moneydigest.com/2054740/new-poll-bold-prediction-gold-value-2026/?zsource=yahoo

Iraq Economic News and Points To Ponder Wednesday Evening 1-14-26

Basrah Crudes Rise Despite Global Decline

2026-01-14 Shafaq News– Basrah On Wednesday, Iraq’s Basrah crude edged up with a drop in global oil prices.

Basrah Heavy crude increased by $1.17 to $59.07 per barrel, and Basrah Medium crude by $1.17 further reaching $61.62 per barrel.

Brent crude futures fell 9 cents, or 0.14%, to $65.38 a barrel. West Texas Intermediate (WTI) crude futures dropped 12 cents, or 0.2%, to $61.03.

Basrah Crudes Rise Despite Global Decline

2026-01-14 Shafaq News– Basrah On Wednesday, Iraq’s Basrah crude edged up with a drop in global oil prices.

Basrah Heavy crude increased by $1.17 to $59.07 per barrel, and Basrah Medium crude by $1.17 further reaching $61.62 per barrel.

Brent crude futures fell 9 cents, or 0.14%, to $65.38 a barrel. West Texas Intermediate (WTI) crude futures dropped 12 cents, or 0.2%, to $61.03. https://www.shafaq.com/en/Economy/Basrah-crudes-rise-despite-global-decline-4-5

US Oil Prices Fall More Than $1 As Trump’s Comments Ease Iran Tension Fears

2026-01-14 Shafaq News US oil prices fell more than $1 in early Asian trade on Thursday after US President Donald Trump said killings in Iran's crackdown on nationwide protests were subsiding, easing fears of supply disruptions and possible military action against Iran.

US West Texas Intermediate crude futures were trading at $60.78 a barrel at 2322 GMT, down $1.24, or 2%, from the previous day's close.

WTI had settled more than 1% higher on Wednesday, then gave back most of those gains after Trump's remarks reduced concerns over a potential US attack on Iran and supply disruptions.

(Reuters) Only the headline is edited by Shafaq News. https://www.shafaq.com/en/Economy/US-oil-prices-fall-more-than-1-as-Trump-s-comments-ease-Iran-tension-fears

Iran Orders Temporary Closure Of National Airspace

2026-01-14 Shafaq News- Tehran Iran issued a Notice to Airmen (NOTAM) on Wednesday ordering the temporary closure of its airspace to all flights, while allowing international flights to and from the country that have obtained prior authorization.

The notice stated that the closure would remain in effect for “slightly more than two hours,” without providing an official explanation for the decision or indicating whether the measure could be extended.

This move followed a heightened regional tensions, as several European countries, including Italy, Poland, Germany, and Spain, urged their citizens to leave Iran.

Earlier, Reuters cited European officials on Wednesday, saying that US military intervention against Iran could occur within the next 24 hours. https://www.shafaq.com/en/Middle-East/Iran-orders-temporary-closure-of-national-airspace

The Central Organization For Standardization Announces The Implementation Of A Plan To Transition From Traditional To Electronic Oversight.

The Central Organization for Standardization and Quality Control (COSQC) revealed on Wednesday a plan to transition from traditional to digital oversight, explaining that this digital transformation will streamline procedures and enhance transparency. The organization also emphasized its commitment to building an integrated system for monitoring the operations of local companies and pre-inspection procedures.

Fayyad al-Dulaimi, head of COSQC, stated that "the organization has a plan to transition from traditional to digital (electronic) oversight, in addition to adopting participatory community oversight, particularly regarding market monitoring and all matters falling outside the organization's traditional scope of work."

Al-Dulaimi explained that "the agency seeks to build an integrated system known as the monitoring and control room, to follow up on the work of local companies and pre-inspection procedures, in order to ensure the accuracy of information and analysis and sound decision-making in monitoring goods and merchandise in terms of quantity, quality, origin, and degree of conformity or non-conformity, which provides a real vision for controlling this file, and will reflect positively on the country’s economy in the future through the accuracy of procedures and ensuring the prevention of the entry of non-conforming goods."

He pointed out that "digital transformation contributes to simplifying procedures and enhancing transparency," noting that "unifying systems reduces errors."

He explained that "any digital transformation project is based on two fundamental aspects: the first is material, represented by providing the infrastructure, and the second is training personnel on digital systems and devices in a manner that suits the nature of the central agency's work."

He affirmed that "the foundations and plans have been laid, and implementation has begun with the first step: establishing the operations room and equipping it with the devices and systems that meet the requirements of the government program."

Al-Dulaimi stated that "the main objective of digital transformation is to ensure citizen security by verifying that goods and products conform to approved specifications, thus achieving public health and safety."

He indicated that "the agency has developed plans to enhance five service areas encompassing more than 28 sub-services. We have started with two services, and the remaining three are scheduled for completion by 2026. These include selling specifications electronically, providing remote goods inspection services, electronic payment, remote patent services, and electronic revenue collection."

He stressed that “traditional oversight will gradually be transformed into electronic oversight, which will be reflected in the speed of completing transactions,” noting that “all these services will be available through the official websites of the Central Agency,” indicating that “the Agency has started with the first steps, and they will be officially announced within the next two months.” https://economy-news.net/content.php?id=64594

The US Deficit Decreased By Approximately $22.8 Billion During The Third Quarter.

The US current account deficit recorded a notable decline during the third quarter of 2025, affected by the application of tariffs on imports, along with an increase in primary revenues.

The U.S. Commerce Department's Bureau of Economic Analysis reported Wednesday that the current account deficit, which reflects the movement of goods, services, and investments to and from the United States, fell by $22.8 billion, or 9.2%, in the third quarter to $226.4 billion, its lowest level since the third quarter of 2023, according to Reuters

.These figures came in below the expectations of economists surveyed by Reuters, who predicted the deficit would fall to around $238.4 billion. The report's release was delayed due to the 43-day government shutdown.

The deficit reached 2.9% of GDP, the lowest level since the first quarter of 2020, compared to 3.3% in the second quarter.

The deficit peaked at 6.3% in the third quarter of 2006. The sweeping tariffs imposed by US President Donald Trump reduced import flows, helping to narrow the trade deficit.

Imports of goods declined.

Imports of goods declined by $5 billion to $815.4 billion in the third quarter, due to a decrease in consumer goods imports, while gold imports increased. Imports of services also rose by approximately $3.1 billion to reach $225 billion.

Conversely, merchandise exports fell by $1.9 billion to $548 billion, impacted by declining gold prices, despite increases in capital and consumer goods exports. Meanwhile, service exports rose by approximately $11.7 billion to reach $314.2 billion.

The merchandise trade deficit narrowed to $267.4 billion, compared to $270.4 billion in the previous quarter.

On the revenue side, core revenue increased by $16.3 billion to $395.2 billion, supported by increased returns on direct investment, while core revenue payments increased by $5.3 billion to $390 billion.

Secondary revenues also declined by $2 billion to $44.4 billion, while secondary revenue payments decreased by about $2.1 billion to $97.9 billion, as a result of a decline in general government transfers. https://economy-news.net/content.php?id=64595

Washington Allocates $700 Billion To Buy Greenland

NBC News reported that the United States might pay $700 billion to purchase Greenland if President Donald Trump succeeds in finalizing the deal.

Citing sources familiar with the planning within the Trump administration, the network indicated that "experts, scientists, and former U.S. officials have been involved in assessing the price of Greenland," noting that "acquiring the island is essential for the United States to create a strategic buffer zone in the Arctic against America's main rivals" (Russia and China).

Trump has repeatedly stated the need for Greenland to join the United States. During his first term as president, he proposed purchasing Greenland, and in March 2025, he expressed confidence in its annexation.

In a related matter, former White House Deputy Chief of Staff Stephen Miller questioned Denmark's right to control the island and stated that it should become part of the United States. Later, Trump stated that Greenland's defense consists of "two teams."

He suggested that Russia or China could "take" the island if the United States does not.

Greenland is currently a self-governing territory of Denmark. In 1951, Washington and Copenhagen signed a treaty to protect Greenland in addition to their alliance obligations under NATO. https://economy-news.net/content.php?id=64591

How Much Is One Ring Worth After Gold Prices Soared In 2025?

How Much Is One Ring Worth After Gold Prices Soared In 2025?

Susan Tompor, Detroit Free Press December 17, 2025

I asked my husband to take off his gold wedding band — again. I wanted to see one more time what I'd get if we wanted to sell it. Sure, we've been married 30 years. But after 30 years of marriage, well, he's learned to roll with oddball requests — and even ribbing when the ring initially didn't want to come off.

"We buy gold" signs grab your eye after gold prices broke one record after another in 2025. The record price for spot gold was trading at an intraday high of $4,380.99 an ounce Oct. 17, according to Kitco.com.

How Much Is One Ring Worth After Gold Prices Soared In 2025?

Susan Tompor, Detroit Free Press December 17, 2025

I asked my husband to take off his gold wedding band — again. I wanted to see one more time what I'd get if we wanted to sell it. Sure, we've been married 30 years. But after 30 years of marriage, well, he's learned to roll with oddball requests — and even ribbing when the ring initially didn't want to come off.

"We buy gold" signs grab your eye after gold prices broke one record after another in 2025. The record price for spot gold was trading at an intraday high of $4,380.99 an ounce Oct. 17, according to Kitco.com.

On Thursday morning, Dec. 11, the day I trekked out in the cold to get a few price quotes, the spot gold price was trading around $4,250 an ounce — up nearly 63% so far in 2025.

On Dec. 11, gold shot up to the highest point in more than a month, following the Federal Reserve's decision Dec. 10 to cut interest rates by a quarter percentage point. Traders expect lower interest rates ahead, which can be bullish for gold prices.

Yet if you're thinking about taking advantage of high gold prices to get rid of some gold, maybe a broken chain for a locket or even a gold ring from a loved one, you shouldn't expect to receive the same amount of money everywhere you go.

What different jewelers and pawn shops offer to pay a seller for old gold jewelry can vary substantially — even as much as 50% in one example I found recently. Sometimes, the price difference is even higher.

Higher prices for gold hits holiday shoppers

Gold is volatile in price but viewed as a hedge against uncertain times — and we've had our share in 2025. Persistent inflation; three rate cuts by the Federal Reserve in 2025 after three rate cuts in 2024, which make some savings vehicles less attractive; a decline in the value of the U.S. dollar; global tensions relating to tariffs and wars.

Gold is commanding a higher price for many shoppers this holiday season, too, according to the annual PNC Christmas Price Index that reviews the cost of the gifts from the classic holiday carol “The Twelve Days of Christmas."

"Five gold rings saw the single-biggest price jump by far" in that grouping of 12 categories, including a partridge in a pear tree. The price of the partridge remained unchanged at $20.18 for one bird, but the pear tree shot up in price by 14.3% to $400 in the past year, according to the index now in its 42nd year.

By contrast, the "five golden rings" in the song soared in price by 32.5% year-over-year. It's sort of a bargain when you consider the 45% jump in gold prices, as of Oct. 31. Jewelers, obviously, didn't raise prices as much to try to hold onto some sales.

The five gold rings would cost $1,649.90 in 2025 based on the PNC analysis.

The cost of the 12 gift basket rose 4.5% compared with last year, outpacing the Bureau of Labor Statistics Consumer Price Index year-over-year reading of 3% for September, which was released Oct. 24.

Data is compiled using sources from across the country, including dance and theater companies, hatcheries, pet stores and others. Overall, the total cost to buy the 12 gifts that comprise the PNC CPI for the holidays hit $51,476.12 in 2025.

Buying all the gifts rattled off in the popular, but incredibly annoying Christmas song would have cost you $46,729.86 just two years ago in 2023. And, oddly enough, in 2023, the price for five gold rings was $1,245 and had stayed flat for the first time in more than five years.

What I discovered trying to cash in gold

To continue and read more: https://finance.yahoo.com/news/one-gold-ring-much-worth-120225006.html

Swisher1776: This is a Modern Sovereign Transition, Not Kuwait 2.0

Swisher1776: This is a Modern Sovereign Transition, Not Kuwait 2.0

1-14-2025

Respectfully, this comparison is not accurate, and here’s why:

Kuwait’s 1991 revaluation occurred after a foreign occupation and currency replacement, under a monarchal system, with an external peg restored almost immediately. That situation involved physical currency withdrawal and reinstatement, not institutional reform.

Iraq today is in a completely different framework.

Swisher1776: This is a Modern Sovereign Transition, Not Kuwait 2.0

1-14-2025

Respectfully, this comparison is not accurate, and here’s why:

Kuwait’s 1991 revaluation occurred after a foreign occupation and currency replacement, under a monarchal system, with an external peg restored almost immediately. That situation involved physical currency withdrawal and reinstatement, not institutional reform.

Iraq today is in a completely different framework.

What we’re seeing now is constitutional, judicial, and institutional sequencing:

Central Bank executing monetary policy

Ministry of Finance aligning fiscal controls

Courts and political blocs resolving legitimacy and authority

Caretaker limitations being clarified by law

That is not misdirection — that is rule-of-law execution.

No exchange rate mechanism activates without:

legal authority

institutional continuity

international compliance

banking system readiness

Political noise often increases during ececution phases, because decisions are being locked in, not undone.

Kuwait didn’t have Basel III, FATCA, global payment rails, or modern compliance requirements. Iraq does.

This isn’t Kuwait 2.0.

This is a modern sovereign transition under global standards.

Appreciate the discussion.

Swisher1776: IQD RV: CARETAKER GOVERNMENT ACTIVATED AS DISCLOSURE SIGNALS SUDANI ACCOUNTABILITY

The leader of the State of Law Coalition (SLC), Nouri Al-Maliki, who will head the next government, will revoke all recent decisions issued by the caretaker government led by Prime Minister Mohammed Shia Al-Sudani

Iraqi lawmaker Ibtisam Al-Hilali said on Tuesday. Speaking to Shafaq News, Al-Hilali described the decisions taken by the government and the prime minister as illegal and lacking constitutional legitimacy, citing Federal Supreme Court ruling No. 213/Federal/2025, which she said ended the fifth parliamentary term and “converted Mohammed Shia Al-Sudani’s cabinet into a caretaker government with limited authority restricted to managing daily affairs.”

The reversals, Al-Hilali stated, would include decisions related to “incorrect tax and customs fees, as well as measures suspending leave, scholarships, and employee transfers.” Iraq’s caretaking government approved a series of decisions affecting multiple sectors during its most recent session, according to documents issued by the General Secretariat of the Council of Ministers.

Among the measures, the cabinet endorsed a recommendation from the Ministerial Council for the Economy allowing ministries and entities not affiliated with a ministry to sell non-productive vehicles that are at least 15 years old.

The approval also covers the sale of all idle or surplus productive and non-productive vehicles, equipment, generators, construction machinery, and other types of machinery, regardless of their year of manufacture, across government departments. Fuel allocations for ministries, non-ministerial entities, and provincial administrations will be reduced by 50 percent from current levels.

Another decision establishes the academic certificate under which an employee was first appointed to a state institution as the final qualification for all official purposes. Degrees obtained during employment will not be recognized across government institutions and specializations, with a limited exception applied to the Ministry of Higher Education.

Additional measures include suspending transfers to the Ministries of Oil, Finance, Education, and Higher Education, as well as to any other entity where a transfer or secondment would result in increased financial allocations. State-funded overseas scholarships for all fields of study have also been halted.

Thomas Price: The Maliki information is misdirection… Just like Kuwait when they RVd and said the King is dead etc. - Kuwait 2.0

https://x.com/price_thom18702/status/2011263487956435448

Source(s): https://x.com/swisher1776/status/2011291858488512749

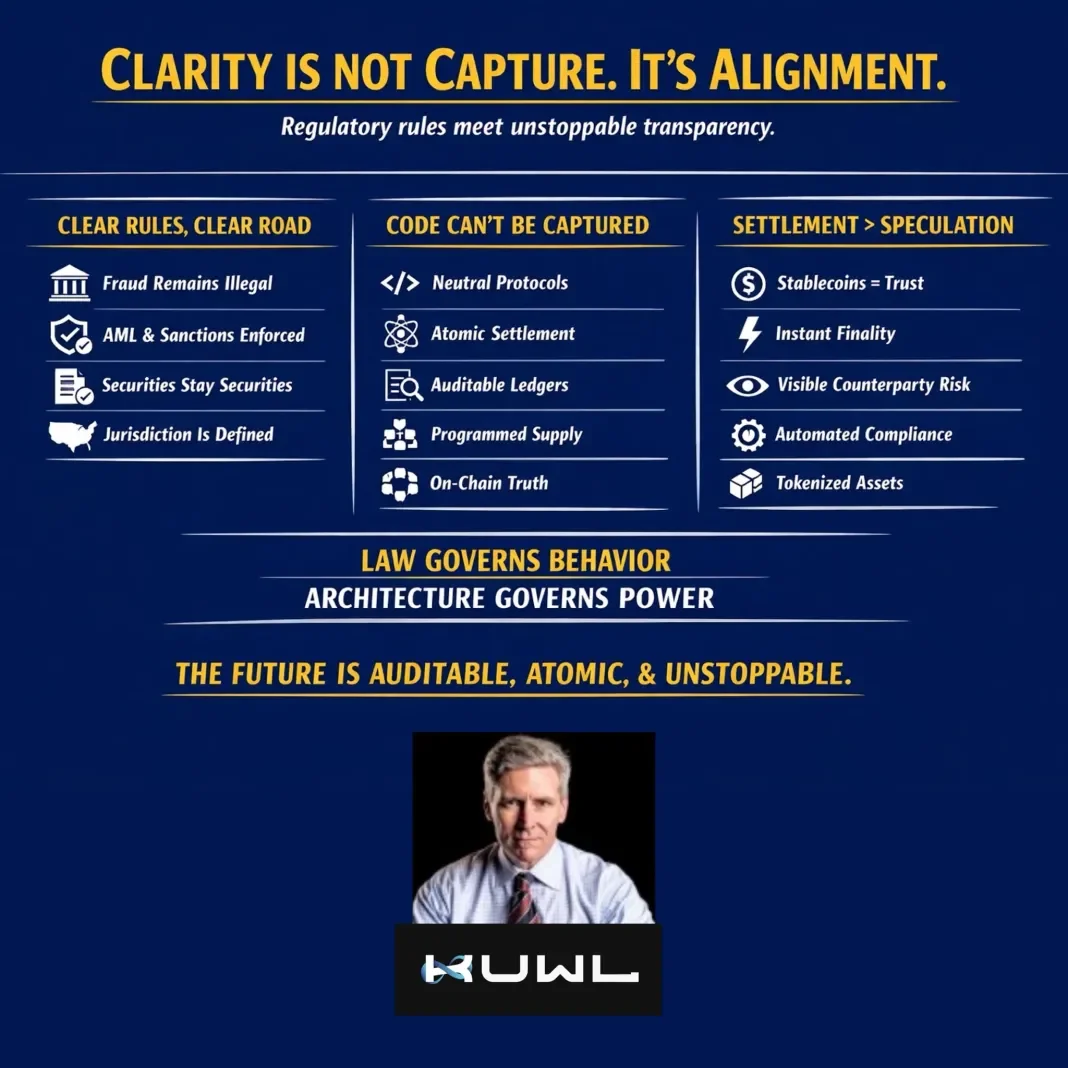

The Clarity Act is Not Capture, it’s Alignment

The Clarity Act is Not Capture, it’s Alignment

1-14-2026

Rob Cunningham | KUWL.show @KuwlShow

The Clarity Act Is Not “Capture.” It Is Alignment.

The Clarity Act governs behavior – but the architecture governs power.

Law can constrain actors, but only transparent, atomic systems eliminate the incentives and mechanisms for abuse.

The Clarity Act is Not Capture, it’s Alignment

1-14-2026

Rob Cunningham | KUWL.show @KuwlShow

The Clarity Act Is Not “Capture.” It Is Alignment.

The Clarity Act governs behavior – but the architecture governs power.

Law can constrain actors, but only transparent, atomic systems eliminate the incentives and mechanisms for abuse.

Digital asset markets don’t fail because of innovation.

They fail because of opacity, jurisdictional confusion, and discretionary power.

The CLARITY Act does one simple thing:

It replaces uncertainty with enforceable rules.

And here’s the part many are missing:

Clear rules do not enable institutional capture – they remove it.

Why?

Because institutions cannot capture:

Neutral code

Atomic settlement

Public, auditable ledgers

Programmatic supply

On-chain truth

They can only participate.

And participation under transparent, rules-based systems is the opposite of capture.

This is not crypto being absorbed by legacy finance.

This is legacy finance being forced to behave honestly.

Investor Protection Is Structural, Not Cosmetic

Fraud remains illigal.

Securities remain securities.

AML, sanctions, and enforcement remain intact.

But once settlement is atomic and ledgers are auditable:

Market manipulation becomes visible

Rehypothecation becomes impossible

Counterparty risk becomes measurable

Insider abuse loses cover

Stablecoins Aren’t Speculation – They’re Settlement

Record stablecoin supply is not a bull signal.

It’s a plumbing signal.

They represent:

Unit-of-account trust

Velocity without volatility

Cross-border neutrality

Finality without intermediaries

No opaque monetary system survives once:

Settlement is instant

Liquidity is transparent

Compliance is automated

Assets are tokenized at the source

This Isn’t Optimism — It’s Engineering

When regulators talk about markets moving on-chain, they’re not predicting adoption.

They’re describing deployment.

Capital isn’t ideological.

It flows where:

Friction is lowest

Risk is smallest

Cost is minimal

Truth is highest

Finality is guaranteed

That equation is already solved.

Bottom Line

CLARITY doesn’t weaken markets – it hardens them.

It doesn’t protect bad actors – it exposes them.

It doesn’t enable capture – it ends opacity.

This isn’t a bull market thesis.

It’s a NEW monetary operating system.

Goodbye @federalreserve.

And once it’s live, no serious actor goes back.

1) Uncertainty enables abuse. Clear rules + transparent systems do not.

2) Bad actors lose leverage.

3) Intent and control matter – not mere publication of software.

4) Liquidity follows structural advantage, not ideology.

“How do we constrain institutions?”

By removing the tools they used to abuse power in the first place.

Source(s): https://x.com/KuwlShow/status/2011259630597603748

https://dinarchronicles.com/2026/01/14/rob-cunningham-the-clarity-act-is-not-capture-its-alignment/

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 1-14-26

Good Afternoon Dinar Recaps,

U.S. Trade Deficit Nearly Halved — Markets Take Notice

CNBC highlights a rare contraction in America’s trade gap

Good Afternoon Dinar Recaps,

U.S. Trade Deficit Nearly Halved — Markets Take Notice

CNBC highlights a rare contraction in America’s trade gap

Overview

Newly released U.S. trade data shows a dramatic narrowing of the trade deficit.

The gap fell from roughly $136 billion earlier in the year to about $29.4 billion in the most recent report.

CNBC analysts discussed the figures live, noting the change reflects shifts in trade flows and policy enforcement.

Based on available records, this marks the smallest reported U.S. trade deficit in nearly two decades.

Key Developments

Imports declined sharply, while exports held firmer, tightening the overall balance.

Trade enforcement measures and tariffs were cited as altering import behavior.

Market observers flagged the report as an unusual data point amid long-running deficit trends.

Why It Matters

Trade balances directly influence currency flows and capital movement.

A smaller deficit means fewer dollars exiting the U.S. system to pay for imports.

Sustained improvement could signal structural adjustment, not just statistical noise.

Why It Matters to Currency Holders

Dollar leakage slowed: Reduced outflows ease downward pressure on the dollar supply.

Trade mechanics at work: When imports fall faster than exports, currency dynamics shift — a signal closely watched by currency holders.

What this does not mean: This is not a payout, RV trigger, or instant economic win. It is a verified accounting change, not a promise or timeline.

Key Takeaway

Currencies reflect flows, not hype.

This trade data shows a real, measurable shift worth monitoring — but conclusions must remain grounded in confirmed reports, not speculation.

Implications for the Global Reset

Pillar 1: Dollar Flow Containment

A sharply reduced U.S. trade deficit signals less dollar outflow into the global system, tightening offshore dollar liquidity.

When fewer dollars leak abroad through imports, global dollar availability contracts, forcing trading partners and financial institutions to adjust funding, settlement, and reserve strategies.

This supports a re-centralization of dollar power, reinforcing U.S. leverage even as de-dollarization narratives persist elsewhere.

Pillar 2: Trade Enforcement as a Monetary Tool

The data underscores how trade policy and enforcement now function as indirect monetary instruments.

By reshaping import behavior, tariffs and compliance measures influence currency flows without central bank action, shifting power from purely monetary authorities toward executive and trade-policy frameworks.

This marks a structural shift in global finance, where trade mechanics increasingly drive currency outcomes, a key feature of an emerging reset phase.

Trade balances don’t make headlines often — until they suddenly do.

Seeds of Wisdom Team

Newshounds News

Sources

~~~~~~~~~~

BRICS Unit Stalls as India and China Reject a Shared Currency

Internal resistance exposes limits of de-dollarization ambitions

Overview

Momentum toward a unified BRICS settlement currency (“BRICS Unit”) is facing growing resistance.

India and China, two of the bloc’s largest economies, have both declined to support a single common currency.

The pushback highlights deep internal divisions and raises questions about whether BRICS can move beyond bilateral, local-currency trade arrangements.

Key Developments

India firmly rejected the idea of sharing a currency with China, citing economic stability and policy independence.

China continues to prioritize internationalizing the yuan, rather than backing a collective BRICS currency.

The lack of consensus is slowing BRICS de-dollarization efforts and limiting progress on multilateral settlement systems.

India Draws a Clear Line

At the IT-BT Round Table 2025, India’s Commerce Minister stated that a shared BRICS currency is “impossible to think of.”

India’s External Affairs Minister has repeatedly emphasized that abandoning the dollar is not part of India’s policy.

Officials argue the dollar remains critical for financial stability and global trade continuity, especially during periods of turbulence.

China Chooses an Independent Currency Path

China has focused on expanding yuan usage globally through swap lines and payment infrastructure.

Its Cross-Border Interbank Payment System (CIPS) now includes hundreds of participants across more than 160 countries.

Beijing appears to see greater strategic value in yuan internationalization than in supporting a shared BRICS instrument.

Structural Barriers Inside BRICS

Analysts point out that BRICS lacks the foundations required for a common currency:

No common market

No unified trade policy

Divergent geopolitical priorities

Even Russia has acknowledged that talk of a single BRICS currency is premature, despite advocating reduced reliance on the dollar.

Rio Summit Signals a Pause

The July 2025 BRICS Summit in Rio produced a 126-point declaration that made no mention of a BRICS currency or de-dollarization plan.

Trade cooperation remains largely bilateral, relying on local currencies rather than a unified system.

Member states continue to prioritize economic stability over symbolic monetary shifts.

Why It Matters

The resistance underscores how difficult it is for major economies with competing interests to align on monetary policy.

Without consensus from India and China, a BRICS-wide currency alternative to the dollar remains theoretical, not operational.

Why It Matters to Foreign Currency Holders

Expectations of a rapid BRICS-led dollar replacement appear overstated.

Currency realignments, if they occur, are more likely to emerge through gradual bilateral trade changes, not a sudden bloc-wide reset.

Stability — not confrontation — continues to guide decision-making among key BRICS members.

Key Takeaway

BRICS de-dollarization is fragmented, cautious, and internally constrained.

The bloc is adjusting around the dollar, not uniting against it.

A currency union fails fast when national interests refuse to bend.

Seeds of Wisdom Team

Newshounds News

Sources

Watcher.Guru — BRICS Unit Hits Resistance as Major Economies Say No

Reuters — BRICS nations play down prospects of a shared currency

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Wednesday 1-14-2026

Ariel: Tomorrow will be a Crossover Event

1-14-2026

Tomorrow Will Be A Crossover Event:

– SCOTUS might force massive tariff refunds, hitting Treasury hard. Which will not bold well for reserves of course.

– Trump’s Plan B ready to offset that cash drain fast. And he may just have to act on that ASAP.

– Iraqi Dinar reval at 1:1 or better could flood trillions in value.

Ariel: Tomorrow will be a Crossover Event

1-14-2026

Tomorrow Will Be A Crossover Event:

– SCOTUS might force massive tariff refunds, hitting Treasury hard. Which will not bold well for reserves of course.

– Trump’s Plan B ready to offset that cash drain fast. And he may just have to act on that ASAP.

– Iraqi Dinar reval at 1:1 or better could flood trillions in value.

Another point to contend with here.

– Venezuela’s oil surge under U.S. control drops global prices quick. Remember China & Russia will have to buy from US.

– China and Russia forced back to USD oil payments soon.

– Midterms looming, so Trump needs fast wins to shut critics up. He doesn’t want to give any ammo away.

– Iran’s proxies weakened big time, clearing path for Iraq’s move. This will embolden Iraq to strike with monetary moves.

– Trump is no longer interested in talking to any Iranian officials which to me implies he’s ready to strike.

– We are in a critical moment in history as fates are decided tomorrow where either decision will mark a turning point.

– Not to mention the Clarity Act is about to be voted on in a few days. Which will further speed up things.

Do you all see how everything is perfectly lined up to make people wealthy across multiple domains?

Watcher.Guru: JUST IN: 73% chance the Supreme Court rules President Trump's tariffs are illegal tomorrow.

Source(s): https://x.com/Prolotario1/status/2011164782984872330

https://dinarchronicles.com/2026/01/14/ariel-prolotario1-tomorrow-will-be-a-crossover-event/

*************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 Nobody knows the date. Nobody knows the rate. But we do know they're going through a monetary reform process. It doesn't take a Five Beta Kappa, it doesn't take Sumakum Laude, it doesn't take my brain to figure this out. I'm going to miss you because our days are coming to an end.

Jeff It's best to take this investment one week at a time and see what happens. They're not going to give us the date as to when the rate's going to change. We have to sit back, observe and study it.

Jeff There's 4 steps in their government formation. Parliament is one. Presidents are two. Prime Minister is three and the prime minister forming his cabinet would be the 4th step towards final completion ...Sudani's got this...The next major thing I'm looking for...is to know when they're going to...complete the president. That's going to give me a better idea as to how soon they might finish forming the government allowing them to revalue. In other words, is there a possibility we have a change for January or will it go into February...They have until January 29th to complete the president. I don't think it'll take that long. They could have the president done this week...They're not far out on that.

“We're in Serious Trouble” - Signal Shows Gold Headed to $9,000, Silver $375

Daniela Cambone: 1-12-2026

“We’re in Serious Trouble” – Signal Shows Gold Headed to $9,000, Silver $375. In today’s interview with Daniela Cambone, macro strategist Tom Bradshaw issued a stark warning, declaring that surging precious metals are flashing a classic signal of deep economic stress.

“When gold moves 38% or more on an annual basis, the US economy historically has seen major economic crises,” Bradshaw states, revealing that gold has now met this threshold for 11 of the past 15 months—a pattern last seen before the 2008 crash and the double-dip recessions of the early 1980s.

“The longest lead time we’ve had on this indicator is nine months. So a recession could well be imminent if not already underway.”

Iraq Economic News and Points To Ponder Wednesday Morning 1-14-26

Gold Rises 1% And Silver Surpasses $90 An Ounce

Money and Business Economy News - Gold prices rose to new record highs on Wednesday, while silver jumped to an all-time high above $90 an ounce, supported by weaker-than-expected US inflation readings that boosted bets on interest rate cuts. Gold rose 1.02% in spot trading to reach $4,634.40 an ounce.

US gold futures for February delivery also rose 0.9% to $4,643.80. The data showed that the US consumer price index rose 0.2% month-on-month and 2.6% year-on-year in December, driven by higher rent and food costs.

Gold Rises 1% And Silver Surpasses $90 An Ounce

Money and Business Economy News - Gold prices rose to new record highs on Wednesday, while silver jumped to an all-time high above $90 an ounce, supported by weaker-than-expected US inflation readings that boosted bets on interest rate cuts. Gold rose 1.02% in spot trading to reach $4,634.40 an ounce.

US gold futures for February delivery also rose 0.9% to $4,643.80. The data showed that the US consumer price index rose 0.2% month-on-month and 2.6% year-on-year in December, driven by higher rent and food costs.

This increase came as the impact of some distortions related to the government shutdown, which had put pressure on inflation in November, eased, but it remained below analysts' expectations of a rise of 0.3% monthly and 2.7% annually.

US President Donald Trump welcomed the inflation figures, renewing his pressure on Federal Reserve Chairman Jerome Powell to cut interest rates.

Investors and major brokerage firms, including Goldman Sachs and Morgan Stanley, expect two interest rate cuts of 25 basis points each this year, with the first possible cut in June.

On the geopolitical front, Trump on Tuesday called on Iranians to continue the protests, saying that “help is on the way,” amid the largest wave of protests in Iran in years.

As for other precious metals, silver surged in spot trading, surpassing $90 an ounce for the first time ever. Platinum climbed 3.5% to $2,405.30, its highest level in a week, after hitting a record high of $2,478.50 on December 29. Palladium rose 1.8% to $1,873. https://economy-news.net/content.php?id=64561

Iraq Is The Largest Importer Of Iranian Goods, With A Value Of $10 Billion.

Money and Business Economy News – Baghdad Middle East News reported on Wednesday that Iraq tops the list of countries importing Iranian goods, with purchases amounting to about $10 billion between April 2024 and January 2025, followed by the UAE with about $6 billion, and then Turkey with $5.5 billion.

According to official data from the Iranian Customs Administration, the volume of non-oil trade between Iran and its fifteen neighboring countries reached $13.42 billion during the period from March 20 to June 21 of last year, with the exchange of about 23 million tons of goods.

In terms of exports, Iraq remained the primary destination for Iranian goods, with a value of $1.9 billion, followed by the UAE at $1.6 billion, then Turkey at $940 million, Afghanistan at $510 million, and Oman at $437 million. Imports from neighboring countries reached $6.8 billion, with the UAE topping the list of countries supplying Iran with over $3.9 billion, followed by Turkey at $1.98 billion, then Russia at $353 million, and Oman at $223 million.

According to the same data, the volume of non-oil trade between Iran and neighboring countries continued to rise, recording an increase of 21% year-on-year until March 19, 2025, reaching $74.32 billion, with exports rising to $36.01 billion compared to imports of $38.31 billion.

Despite concerns expressed by Iraq, the UAE, and Oman regarding the impact of the US tariffs, the decision has not yet included clear details on the implementation mechanism or any potential exemptions. In this context, the UAE Minister of Foreign Trade, Thani Al Zeyoudi, stated that his country is monitoring the situation to determine the extent of the decision's impact on food imports.

Turkey is also facing a state of confusion as its trade with the United States expands from $30 billion to $100 billion, but it knows how to deal with such situations without a direct clash with Washington, according to analyst Taha Aydinoglu.

In contrast, China, the largest buyer of Iranian oil, continues to protect its interests and oppose any unilateral sanctions, while European economies such as Germany and Switzerland, along with India and Uzbekistan, also appear to be exposed to the impact of this tariff, reflecting the widening commercial reach of Iran across different continents.

In recent days, the United States announced that any country that conducts trade with Iran will face a 25% tariff on its trade with the United States, a move that could include Iraq, which is among the Arab countries most closely linked to trade with Tehran.

The US decision comes at a time when Iran is witnessing its largest anti-government protests in years, within the context of a series of sanctions imposed by Washington on Tehran for years. https://economy-news.net/content.php?id=64562

Oil Prices Jump, With Brent Rising Above $65 Per Barrel

INA-Baghdad Oil prices rose in global markets on Tuesday, with Brent crude trading above $65 a barrel, while US crude also posted gains. Data from the global oil market, reviewed by the Iraqi News Agency (INA), showed that Brent crude futures rose by 1.70% to reach $65.08 a barrel. The data also indicated that West Texas Intermediate (WTI) crude futures climbed by 2.65% to reach $60.60 a barrel. https://ina.iq/en/economy/44793-oil-jumps-above-65-per-barrel.html

CBI Foreign Currency Reserves Decline

2026-01-14 06:03 Shafaq News– Baghdad Iraq’s foreign currency reserves declined by the end of October 2025, according to figures released by the Central Bank of Iraq (CBI) on Wednesday.

Official data showed the reserves stood at 126.857 trillion Iraqi dinars ($97.582B) as of October 31, easing from 127.601 trillion dinars ($98.155B) at the end of September.

Despite the monthly decline, the data showed an increase compared with August, when reserves totaled 123.033 trillion dinars ($94.641B).

The figures also pointed to a broader downward trajectory from the same period in 2024, when reserves stood at 130.347 trillion dinars ($100.267B), as well as from 2023, when they reached 145.257 trillion dinars ($111.736B).

https://www.shafaq.com/en/Economy/CBI-foreign-currency-reserves-decline-8

Dollar Rises In Baghdad, Erbil Markets

2026-01-14 03:47 Shafaq News– Baghdad/ Erbil The US dollar rose at the opening of Wednesday trading against the Iraqi dinar in Baghdad and Erbil markets.

According to a Shafaq News correspondent, the dollar climbed at Baghdad’s Al-Kifah and Al-Harithiya central exchanges to 147,500 dinars per $100, up from 146,400 dinars recorded on Tuesday.

Exchange shops in the capital also reported higher rates, with the selling price reaching 148,000 dinars per $100 and the buying price standing at 147,000 dinars. In Erbil, the dollar followed the same upward trend, selling at 147,550 dinars per $100 and buying at 147,450 dinars. https://www.shafaq.com/en/Economy/Dollar-rises-in-Baghdad-Erbil-markets

Precious Metals Surge To Historic Milestone

2026-01-14 Shafaq News Gold climbed on Wednesday to again hit a record, while silver surpassed the never-before-seen $90 mark, as softer-than-expected U.S. inflation readings cemented bets on interest rate cuts amid ongoing geopolitical uncertainty.

Spot gold rose 1% to $4,633.40 per ounce as of 0525 GMT, after hitting a record high of $4,639.42 earlier in the session. U.S. gold futures for February delivery rose 0.8% to $4,640.90.

Spot silver jumped 4.2% to $90.59 per ounce after breaching $90 for the first time, having shot up nearly 27% already this year.

"U.S. CPI figures showed that inflation remained relatively contained at 2.6% (year-on-year), and risk assets may be hoping for a similarly benign PPI reading to keep expectations alive for further monetary policy easing," said Tim Waterer, KCM Trade's chief market analyst.

The U.S. core Consumer Price Index rose 0.2% month-on-month and 2.6% year-on-year in December, falling short of analysts' expectations of a 0.3% and 2.7% increase, respectively. U.S. core Producer Price Index data for December is due later in the day.

U.S. President Donald Trump welcomed the inflation figures, reiterating his push for the U.S. Federal Reserve Chair Jerome Powell to cut interest rates "meaningfully."

Global central bank chiefs and top Wall Street bank CEOs lined up in support of Powell on Tuesday after news of the Trump administration's decision to investigate him drew condemnation from former Fed chiefs as well.

Analysts say worries around Fed independence and trust in U.S. assets added to safe-haven demand for the yellow metal. Investors expect two 25-basis-point rate cuts this year, with the earliest in June.

Non-yielding assets tend to do well in a low-interest-rate environment and during geopolitical or economic uncertainty.

ANZ expects gold to trade above $5,000/oz in the first half of 2026, the bank said in a note on Wednesday.

For silver, the next big figure was the $100 mark and high two-digit percentage gains for the metal seem likely this year, said GoldSilver Central managing director Brian Lan.

Elsewhere, spot platinum climbed 4% to $2,415.95 per ounce, a one-week high. It hit a record $2,478.50/oz on December 29. Palladium was up 3.3% at $1,899.44 per ounce. https://www.shafaq.com/en/Economy/Precious-metals-surge-to-historic-milestone

“Tidbits From TNT” Wednesday Morning 1-14-2026

TNT:

Tishwash: The Ministry of Interior announces the arrest of 91 individuals manipulating the dollar exchange rate.

The Ministry of Interior announced on Tuesday the arrest of 91 people manipulating dollar prices.

Ministry spokesman Miqdad Miri told Al-Eqtisad News that "security forces were able to arrest 91 people on charges of manipulating dollar prices."

He pointed out that "the ministry was also able to arrest 147 people manipulating the prices of food and medicine," indicating that "the Ministry of Interior has contracted for 100 fixed and mobile radars to monitor external roads

TNT:

Tishwash: The Ministry of Interior announces the arrest of 91 individuals manipulating the dollar exchange rate.

The Ministry of Interior announced on Tuesday the arrest of 91 people manipulating dollar prices.

Ministry spokesman Miqdad Miri told Al-Eqtisad News that "security forces were able to arrest 91 people on charges of manipulating dollar prices."

He pointed out that "the ministry was also able to arrest 147 people manipulating the prices of food and medicine," indicating that "the Ministry of Interior has contracted for 100 fixed and mobile radars to monitor external roads link

Tishwash: An economist explains the budget and spending mechanism (1/12) under the caretaker government.

Economic expert Salah Nouri explained on Tuesday the legal foundations for submitting and approving the federal general budget, and the financial disbursement mechanisms adopted in the event of its non-approval, especially in light of the caretaker government situation.

Nouri pointed out in his statement to Al-Furat News Agency that “Article (11) of the Federal Financial Management Law No. (6) of 2019 stipulated that the draft federal general budget law be submitted by the Council of Ministers to the House of Representatives before the middle of October of each year.”

He explained that “Article (13), Paragraph Three, dealt with the situation of the House of Representatives not approving the draft budget law until 12/31 of the fiscal year, as the final financial statements for the previous year are considered the basis for the financial statements for the current year, and are submitted to the House of Representatives for the purpose of approving them.”

He added that "the current situation is that the government is a caretaker government, and therefore paragraph one of Article (13) is applied, which allows spending at a rate of 1/12 of the total actual expenditures of the previous year, after excluding non-recurring expenditures for the current and investment budgets." link

************

Tishwash: Warnings of escalating public anger following tax and customs duty hikes

Economic expert Ahmed Al-Tamimi warned on Monday (January 12, 2026) of the possibility of escalating public anger in Iraq due to the government's decisions to raise taxes and customs duties, coinciding with rising prices of basic commodities in the markets, which increases the pressure on the living standards of citizens, especially those with limited income.

Al-Tamimi told Baghdad Today: “Any increase in taxes or customs duties, if not accompanied by clear social protection measures, will directly affect the prices of goods and services, because the merchant and the importer will pass on the cost of the increase to the end consumer, while the Iraqi citizen is already suffering from the erosion of income as a result of inflation and the high cost of living.”

He added that “the Iraqi public is sensitive to economic decisions that affect livelihoods, and such measures could turn from an economic issue into a social and perhaps political crisis if they are not managed wisely and transparently.”

He pointed out that “raising customs duties may be financially justified to support non-oil revenues, but the current timing is not appropriate due to weak market control and the absence of local alternatives capable of meeting market needs, which leads to higher prices without a tangible improvement in services or income levels.”

Al-Tamimi stressed that “continuing this approach without societal dialogue or governmental clarification will increase public discontent, especially with citizens feeling that the economic burdens fall on them alone, in light of the absence of real reforms to combat waste and corruption and improve financial management.”

For his part, economist Ziad Al-Hashemi believes that implementing the new customs system and imposing customs duties, along with regulating remittances through a unified governance system, represents a correct and initial step in the right direction, but he stressed that the problem lies in the implementation mechanism and the state’s management of the transition process from the previous situation to the new system.

Al-Hashemi explained in a statement to “Baghdad Today” on Sunday (January 11, 2026) that “the rapid and comprehensive application of the system has led to confusion in Iraqi markets and has directly affected citizens,” noting the need for “the government to reassess the implementation mechanism, and perhaps introduce amendments to mitigate the damage caused by the speed of implementation.”

He added that "the solution lies in adopting a phased implementation mechanism, starting with focusing on specific priority goods, reviewing the customs duties imposed on them, and monitoring the repercussions of this phase before moving on to other goods, so that the process is carried out in several stages that allow for absorbing the change and reducing the damage to society, markets and traders, in addition to its impact on supply and demand."

Al-Hashemi stressed that “the gradual approach helps the government achieve its goals in controlling remittances and commercial operations and achieving non-oil revenues that support public finances, while at the same time giving traders an opportunity to rearrange their situations and the volume of goods, and sparing the consumer the shock of a sudden rise in prices in the markets.”

He concluded by saying that "this well-thought-out approach will ensure a smooth transition to the new system," expressing his hope that the government will adopt this path during the next phase to ensure market stability and protect the citizen. link

Mot: But Mommie!!!!!

Mot: Now Tell Me... Who Is the Most Encouraging!!!