Seeds of Wisdom RV and Economics Updates Thursday Afternoon 1-1-26

Good Morning Dinar Recaps,

Market Risk Signals Flash Red as 2026 Begins

Peak optimism masks structural fragility across bonds, credit, and valuations

Good Morning Dinar Recaps,

Market Risk Signals Flash Red as 2026 Begins

Peak optimism masks structural fragility across bonds, credit, and valuations

Overview

Global markets enter 2026 with elevated optimism but growing structural risk.

Bond market instability is resurfacing, driven by sticky inflation and fiscal strain.

Equity valuations — especially in AI and tech — are increasingly detached from fundamentals.

Cash levels among investors are historically low, reducing shock absorption.

Risk concentration is rising just as macro uncertainty widens.

Key Developments

Fund managers and strategists warn of multiple converging risks, including bond volatility, credit stress, and valuation excesses.

Government debt issuance remains elevated, placing upward pressure on yields.

Inflation progress has stalled, complicating central-bank rate paths.

Consumer credit stress is rising, particularly in lower-income segments.

Markets remain priced for soft landings, leaving little margin for error.

Geopolitical and trade risks remain underpriced relative to historical cycles.

Why It Matters

Markets are not fragile because prices are falling — they are fragile because confidence is high while buffers are thin.

Periods of peak optimism combined with leverage, low cash, and bond instability historically precede repricing events. When bonds fail to act as stabilizers, risk spills rapidly across equities, currencies, and credit.

This environment does not require a shock — it only requires disappointment.

Why It Matters to Foreign Currency Holders

Bond volatility directly impacts currency stability, especially in debt-heavy nations.

Rising yields weaken fiscal flexibility, pressuring sovereign credibility.

Risk-off events strengthen settlement-safe currencies, while peripheral currencies reprice sharply.

Capital flows become disorderly when confidence shifts quickly.

For currency holders, bond stress is the transmission mechanism — not equities.

Implications for the Global Reset

Pillar: Bonds Are the System’s Load-Bearing Wall

When bonds wobble, everything else follows.

Pillar: Valuation Excess Signals Transition Phases

Overconfidence often marks inflection points.

Pillar: Liquidity Is Being Quietly Withdrawn

Reset dynamics accelerate when buffers vanish.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Global markets face rising risks in 2026 as bond volatility returns”

Bank for International Settlements – Annual Economic Report: Global Financial Fragility

~~~~~~~~~~

Alternative Payment Rails Advance as Dollar Stress Quietly Builds

Trade settlement diversification accelerates beneath the surface

Overview

Global trade and payment systems are quietly diversifying away from dollar-only settlement.

Alternative rails are expanding, including regional payment systems, bilateral currency arrangements, and asset-backed mechanisms.

This shift is evolutionary, not revolutionary, occurring below headline levels.

Central banks and sovereigns are prioritizing access, redundancy, and resilience over ideology.

The process is gradually reshaping global liquidity flows.

Key Developments

Cross-border payment systems outside traditional Western rails continue to expand, particularly across Asia, the Middle East, and parts of the Global South.

Bilateral trade settlement in local currencies is increasing, reducing FX exposure and sanctions vulnerability.

Gold, commodities, and energy contracts are increasingly referenced as settlement anchors, even when transactions remain fiat-denominated.

Financial hubs outside the U.S. and Europe are strengthening clearing, custody, and settlement infrastructure.

Central banks are prioritizing interoperability, not speed, as they modernize payment frameworks.

Payment redundancy is now treated as a national security issue, not a fintech trend.

Why It Matters

The global reset does not begin with a currency collapse — it begins with optionality.

When nations can trade, settle, and store value outside a single system, leverage shifts. This does not eliminate the dollar’s role, but it ends exclusivity. Over time, liquidity fragments, pricing power diffuses, and financial influence becomes conditional rather than absolute.

This phase is quiet by design. Systems are being built before they are needed.

Why It Matters to Foreign Currency Holders

Settlement access increasingly matters as much as reserve size.

Currencies supported by diversified trade rails retain stability during stress.

Sanctions-exposed or single-rail currencies face amplified repricing risk.

Liquidity can reroute faster than capital, changing FX dynamics without warning.

For currency holders, the key question is no longer what backs the currency —

it is where and how it can settle.

Implications for the Global Reset

Pillar: Access Replaces Dominance

Power flows to those with multiple settlement options.

Pillar: Fragmentation Is Functional, Not Chaotic

Parallel systems reduce shock concentration.

Pillar: Infrastructure Precedes Repricing

The reset happens after the rails are ready.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Global Debt and Bond Market Stress: The True Reset Trigger

Why sovereign debt — not currencies — is the system’s breaking point

Overview

Global debt levels are at historic highs, spanning sovereign, corporate, and household balance sheets.

Bond markets are showing renewed stress, with volatility returning to long-dated government debt.

Higher-for-longer interest rates are colliding with record refinancing needs.

Central banks are constrained, unable to fully rescue markets without reigniting inflation.

Bond instability represents the most credible trigger for systemic repricing.

Key Developments

Governments face massive rollover risk, with trillions in debt maturing over the next two years.

Rising yields are increasing debt-service costs, squeezing fiscal space.

Bond markets are no longer acting as shock absorbers, amplifying volatility instead.

Foreign demand for sovereign debt is weakening, particularly where fiscal discipline is questioned.

Central banks are reducing balance sheets, removing a major source of artificial demand.

Credit rating agencies have issued warnings over debt sustainability trajectories.

Why It Matters

Debt is the foundation of the modern financial system — and bonds are its plumbing.

When confidence in sovereign debt weakens, everything reprices: currencies, equities, credit, and real assets. Unlike banking crises, which can be contained with liquidity, debt crises are credibility crises. They cannot be solved quickly without consequences.

This is why systemic resets historically follow bond market stress, not stock market crashes.

Why It Matters to Foreign Currency Holders

For currency holders, debt stress creates asymmetric risk:

Debt-heavy currencies weaken first, regardless of reserve status.

Rising yields can signal strength — or distress, depending on context.

Capital flight accelerates when fiscal paths appear unsustainable.

Settlement confidence erodes when governments rely on monetization.

In reset terms, a currency’s debt backing matters more than its headline strength.

Implications for the Global Reset

Pillar: Debt Sustainability Defines Monetary Credibility

Currencies fail when debt cannot be serviced.

Pillar: Bond Markets Trigger Repricing Cycles

They move slower — then all at once.

Pillar: Central Banks Are No Longer Omnipotent

Inflation has capped their rescue capacity.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – Annual Economic Report: Global Debt and Financial Stability

Reuters – “Rising debt and bond market volatility test governments in 2026”

~~~~~~~~~~

Central Banks Boxed In: Inflation vs Recession vs Credibility

Monetary authority constraints reveal systemic pressure points ahead of broader resets

Overview

Central banks around the world — including the U.S. Federal Reserve and Bank of Japan — are visibly struggling to balance inflation control, economic growth, and policy credibility. Recent policy debates show heightened internal divisions and persistent inflation above targets, even amid calls for rate cuts and economic stimulus.

This squeeze reflects a broader global trend: slower growth prospects combined with entrenched inflation expectations constrain monetary policy effectiveness and heighten uncertainty.

Key Developments

Fed policy fissures: Minutes from the U.S. Federal Reserve’s latest policy meeting reveal deep disagreements among policymakers on whether to prioritize inflation control or support a weakening labor market. Several officials opposed recent rate cuts, arguing persistent inflation risk undermines policy credibility.

BOJ recalibration: The Bank of Japan’s policy committee debated further rate hikes even after a recent increase — underscoring the challenge of containing inflation that has remained above target despite decades of ultra‑loose policy, highlighting global central banks’ credibility dilemma.

Global economic slowing: Broader economic analysis shows global growth weakening amid supply shocks, geopolitical tensions, and policy uncertainty, making it harder for central banks to steer economies without risking recession or further credibility erosion.

Why It Matters

Central banks sit at the apex of the financial system: they set interest rates, manage liquidity, backstop bond markets, and anchor expectations. In normal times, they can respond to shocks by adjusting policy rates, expanding balance sheets, or guiding expectations — tools that support market confidence and economic stability. But when inflation remains persistent while economic growth falters, policymakers face a stark trade‑off: attempt rate cuts and risk inflation expectations becoming unanchored, or keep policy restrictive and risk recession.

This dynamic boxes in central banks:

Rate cuts become fraught: Cuts risk fueling inflation expectations that are already above target, undermining long‑term credibility.

Credibility at stake: When markets perceive central banks as uncertain or inconsistent, forward guidance loses its power and markets begin to price outcomes based on fiscal math and shock risks rather than policy signals.

Policy signaling fractures: Internal disagreements at major central banks reflect deeper tensions between inflation control and growth support, reducing confidence in monetary authority direction.

This constraint is not merely technical — it signals a shift in how monetary policy interacts with broader economic reality. When central banks can no longer act with clear authority and predictable outcomes, the system loses one of its key stabilizing pillars.

Implications for the Global Reset

Pillar 1 — Monetary Constraint as Systemic Trigger: The inability of central banks to freely use their full set of tools without risking credibility or sparking inflation expectations undermines the traditional crisis‑response framework, forcing economic actors to rely more on fiscal policy, private risk assessments, and structural adjustments.

Pillar 2 — Credibility Erosion Alters Expectations Frameworks: As confidence in central bank commitments weakens — especially around inflation targets and forward guidance — expectations shift, potentially making inflation more backward‑looking and less responsive to policy signaling. This dynamic changes market behavior, investment decisions, and long‑term pricing structures.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters coverage of U.S. Fed policy divisions and internal debates at the Bank of Japan (Dec 2025).

EY global economic outlook highlighting slowing growth and policy uncertainty.

Federal Reserve credibility dynamics and inflation expectations research.

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Thursday 1-1-2026

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 31 Dec. 2025

Compiled Wed. 31 Dec. 2025 12:01 am EST by Judy Byington

Judy Note: The greatest wealth transfer in human history – full activation of the gold/asset-backed Quantum Financial System (QFS) – was (allegedly) set to publicly launch on Thurs. 1 Jan. 2026.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR Update as of Wed. 31 Dec. 2025

Compiled Wed. 31 Dec. 2025 12:01 am EST by Judy Byington

Judy Note: The greatest wealth transfer in human history – full activation of the gold/asset-backed Quantum Financial System (QFS) – was (allegedly) set to publicly launch on Thurs. 1 Jan. 2026.

In planning for over twenty years, this Global Currency Revaluation from fiat to gold/asset-backed currencies was now (allegedly) irreversible, with over 200 nations fully integrated into the QFS.

Prosperity funds were positioned for release, (allegedly) redirecting trillions from corrupt entities back to The People.

NESARA/GESARA protocols are(allegedly) activating worldwide, bringing universal debt forgiveness that will erase mortgages, credit cards, loans, and unjust taxes imposed by the old cabal system.

Tier 4B notifications and redemption appointments are expected imminently, potentially overnight into Wed. 31 December, allowing humanitarian groups and currency holders to access their blessed funds for projects that uplift communities and heal the planet.

~~~~~~~~~~

WORLDWIDE RESET OF SYSTEMS:

• At 9:00 AM EST on Sun. Dec 28, 2025 the go-code(allegedly) posted to the board.

• At 23:11 Z**u on Mon. Dec 29, 2025 the Quantum Signal(allegedly) fired from the Cheyenne Mountain complex.

• Once the EBS Master Switch is flipped, every TV, radio, and internet channel will consolidate to one secured frequency.

• On Sun. Dec 28, global bank servers entered “Cyber Review.” Within 48 hours they will(allegedly) return online under QFS authority.

~~~~~~~~~~~~~~

World Economic Situation:

Tues. 30 Dec. 2025: TREASURY CONFIRMS MASSIVE TAX REFUNDS COMING IN 2026 …Ezra Cohen on Telegram

The U.S. Treasury has effectively admitted what millions of working Americans have felt for years but were never told out loud: they paid too much. In a rare and revealing statement, Scott Bessent confirmed that the first quarter of 2026 is shaping up to be an unprecedented refund year, driven by years of over-withholding that quietly drained paychecks across the country.

This was not framed as a political speech, but as a technical observation from inside the system. The implication is explosive. Truck drivers, nurses, veterans, small business owners, and salaried workers carried a tax burden heavier than required, while inflation surged and wages lagged. The system benefited from that silence. The people absorbed the cost.

According to Treasury projections, 2026 will combine several forces at once: historically large tax refunds, record tariff revenue approaching two hundred billion dollars, inflation cooling toward the low single digits, and GDP growth accelerating. The groundwork was laid in 2025. The financial release valve opens in 2026. That is not a slogan. That is arithmetic.

Tax withholding has long functioned as a quiet extraction mechanism. Most people never adjusted it, and the system counted on that. Overcollection funded programs, agendas, and spending priorities without transparency or consent. What makes this moment different is not the refunds themselves, but the admission that the overpayment was real and widespread.

When a Treasury Secretary uses the phrase “gigantic refund year,” it signals more than routine reconciliation. Tens of millions of Americans are likely to receive larger-than-expected refunds. The Treasury will feel the cash outflow. And the carefully maintained narrative of fiscal balance will c***k under scrutiny.

This also places 2026 squarely into political territory. Whoever attempts to claim credit, the underlying truth remains unchanged. Working Americans were overtaxed. They were not warned. And now a correction is coming, financial first, political second.

This is not about tax software or paperwork. It is about a system that knew most people would never touch their withholding, quietly benefited from that inertia, and offered no clarity until now. By acknowledging the scale of the refunds ahead, the curtain has been pulled back just enough to expose how long the imbalance lasted.

The message is simple and unavoidable. You paid more than you should have. The system kept it. And in 2026, it will have to give a large part of it back. Hold onto your records. The numbers are finally catching up to the truth.

Read full post here: https://dinarchronicles.com/2025/12/31/restored-republic-via-a-gcr-update-as-of-december-31-2025/

Courtesy of Dinar Guru: https://www.dinarguru.com/

Jeff Iraq is extremely close to getting back on the international world stage along with their sovereignty. We are right at the cusp of the rate change...Both the US and UN are exiting Iraq right now, by the end of this year so they will have their full sovereignty. That's critical in this.

Jeff When they remove the zeros from the currency...the two currencies will coexist...at the same dollar value...So a 1,000 dinar note becomes a 1 dinar note. So today whatever a 1,000 dinar note can buy, after a 1 dinar note will buy...Let's say 1 dinar equals $3. The two currencies will coexist for a short period of time...1,000 X $3.00 = $3,000 and 1 dinar will equal $3.00...The two currencies will coexist at the same value. It's that simple.

Frank26 [Iraq boots-on-the-ground report] OMAR: There is chatter that once the 2026 budget is confirmed, they will introduce a new exchange rate for the dinar. The Central Bank of Iraq is in the loop on this. It's all part of their broader economic reform plan to bring more stability to the markets. FRANK: When they open up that budget of '26 it won't be at 1310.

************

CHARLIE WARD DAILY NEWS WITH CHARLIE WARD & DREW DEMI 1ST JANUARY 2026.

1-1-2026

“Tidbits From TNT” 1-1-2026

TNT:

Cutebwoy: : Rashid Congratulates on the New Year: We Hope It Will Be Full of National Achievements

Today, 19:31 Baghdad - INA

President Abdul Latif Jamal Rashid expressed his hope on Wednesday that the new year would be full of national achievements.

In a post on the (X) platform, which was monitored by the Iraqi News Agency (INA), Rashid said, "On the occasion of the new year, we extend our sincerest congratulations to the people of our nation," wishing everyone "more security, stability, and progress."

TNT:

Cutebwoy: : Rashid Congratulates on the New Year: We Hope It Will Be Full of National Achievements

Today, 19:31 Baghdad - INA

President Abdul Latif Jamal Rashid expressed his hope on Wednesday that the new year would be full of national achievements.

In a post on the (X) platform, which was monitored by the Iraqi News Agency (INA), Rashid said, "On the occasion of the new year, we extend our sincerest congratulations to the people of our nation," wishing everyone "more security, stability, and progress."

He added, "We hope that this year will be full of national achievements, progress on the path of construction and reform, strengthening the rule of law, and fulfilling our people's aspirations for a dignified and secure life, one of peace and prosperity." He concluded with, "Happy New Year to all Iraqis

Tishwash: Deputy: Approval of the 2025 and 2026 budgets after the formation of the new government

Deputy Speaker Mazr al-Karwi stated on Thursday that the 2025 general budget will be discussed after completing the nomination and election of the Speaker of the House of Representatives.

According to al-Karwi in a statement: “After the completion of the vote on the Speaker of the Council of Representatives [Majlis al-Nuwwab], the second stage of constitutional entitlements will begin. These include the election of the President of the Republic, and then assigning the task to the largest parliamentary bloc to form the government, followed by voting on it.”

“The budget for the past or current year cannot be approved until after the government is fully formed. If the budget is sent by the current government,” he said, adding that “the Council of Representatives will conduct a different reading of the nature of the country's financial situation.

Its official oil prices have a direct impact on the budget, which means that more than 90% of its revenue relies on the sale of crude oil,” he said.“Iraq's finances need to be re-examined in terms of text and figures, which puts pressure on foreign expenditures and does not exempt them from it,” he added, referring to “the difficult nature of the stage and the permanent financial challenges.” link

************

LouNDebNC: Syria’s interim President Ahmed al-Sharaa rolled out the country’s new currency at a ceremony in Damascus on Monday.

The redesigned banknotes have been redenominated, which means they have fewer zeroes in the amounts, and they no longer bear the visage of deposed dictator Bashar al-Assad, memorably condemned as a “gas-killing animal” by President Donald Trump in 2018.

Sharaa noted during the ceremony that changing the denominations on the Syrian pound was an accounting convenience and did not materially change their value or reverse the high inflation suffered during the long Syrian civil war.

“Changing the zeros and removing two zeros from the old currency to the new currency does not mean improving the economy, but rather it is easier to deal with the currency,” he said.

“Improving the economy depends on increasing production rates and reducing unemployment rates in Syria, and one of the basics of achieving economic growth is improving the banking situation because banks are like arteries for the economy,” he added.

The new notes are available in denominations ranging from 10 to 500 pounds, while the old bills ran from 1,000 to 50,000 pounds. The new ten-pound note buys roughly the same amount of goods as the old 1000-pound note.

The new bills are quite colorful compared to the drab old bills, and they replace images of the brutal Assad dynasty with some plants native to Syria, including roses, wheat, olives, oranges, and mulberries – a fruit prized in Middle Eastern cuisine.

Sharaa said the new designs symbolize “the end of a previous, unlamented phase and the beginning of a new phase that the Syrian people, and the peoples of the region who are hopeful about the modern Syrian reality, aspire to.”

“The new currency design is an expression of the new national identity and a move away from the veneration of individuals,” he said.

Some Syrian online commentators were not thrilled with the new design, feeling that the cheerful bright colors and crop displays did not accurately reflect Syria’s long history, or the grim realities of the civil war.

“Syria is not just a few trees and crops. It’s about civilizations and history and cultures,” one critic wrote on Instagram.

“Honestly, whoever designed the new Syrian currency should have their hands broken. It’s like they went to a vegetable market and said: this one’s for the five, this one’s for the 10 and this one’s for the 100,” said an even more trenchant critic of the new bills.

“Not a fan of the new Syria banknotes. Even Assad put the Umayyad Mosque on his currency. Come on, guys,” grumbled a third.

The Umayyad Mosque is a historic structure in Damascus. It was a Christian basilica before it was converted into a mosque centuries ago, and some believe that John the Baptist (or at least part of him) is interred there.

Sharaa said one objective of the currency relaunch is to make Syria less dependent on foreign currency and restore their trust in the pound. The Syrian pound was trading at about 50 to the U.S. dollar when the civil war began in 2011 – and about 11,000 to the dollar when it ended with Assad’s ouster in December 2024. Syria’s currency lost so much of its value that citizens grew accustomed to lugging heavy bags of cash around to make even the smallest market purchases.

Sharaa and Syrian central bank governor Abdulkader Husrieh asked the public to be patient during the currency transition.

“Everyone who has old currency will have it replaced with the new one, so there is no need to insist on changing it because that may harm the exchange rate of the Syrian pound. We need a calm approach to currency replacement, and the central bank has made it clear that this will be done according to a specific timetable,” Sharaa said.

Husriyeh said the exchange was expected to take about 90 days, with extensions possible if needed.

“This will help stabilize prices, and we confirm that pricing during this phase will be in both the old and new currencies. There will be a media campaign to accompany the currency change and explain the details in the coming days,” he said.

Possibly for security reasons, Husriyeh declined to answer questions from reporters about where the new bills would be printed. Before the fall of the Assad regime, Syria’s currency was printed in Russia.

Tishwash: We exchange an orange for a hundred olives... The new Syrian currency is a "basket of vegetables," citrus fruits, and grains.

Social media platforms in Syria have become a stage for biting satire following the official announcement of the new Syrian currency designs, which replace historical symbols with images of agricultural crops, prompting Syrians to dub it a "cash shopping basket."

The currency, described as "paper money," features an olive and an orange, and its price list includes denominations bearing images of oranges, olives, grains, and the Damask rose.

Syrians joked that the government had linked the value of each denomination to the type of "dish" or crop, with one commentator saying: "Now we can exchange an orange for a hundred olives," referring to the absence of real monetary value in the face of exorbitant prices. link

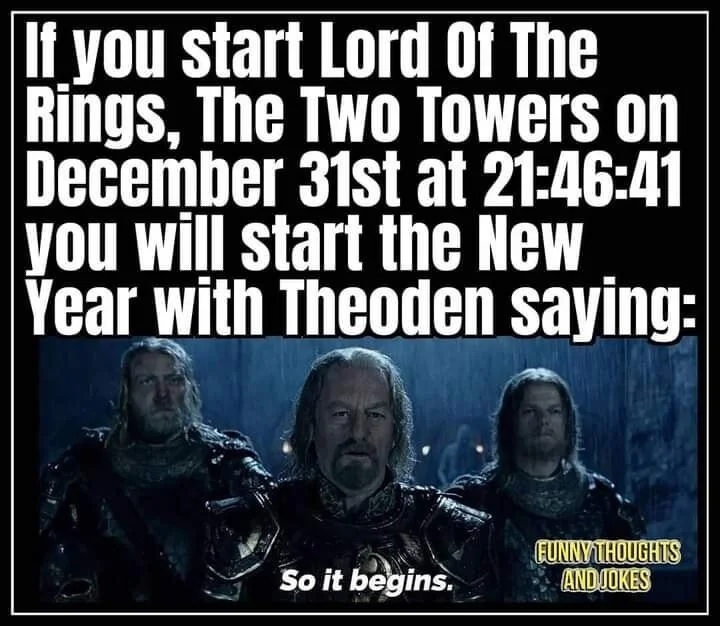

Mot: Movie Buffs!!! --- Get READY!!!!!

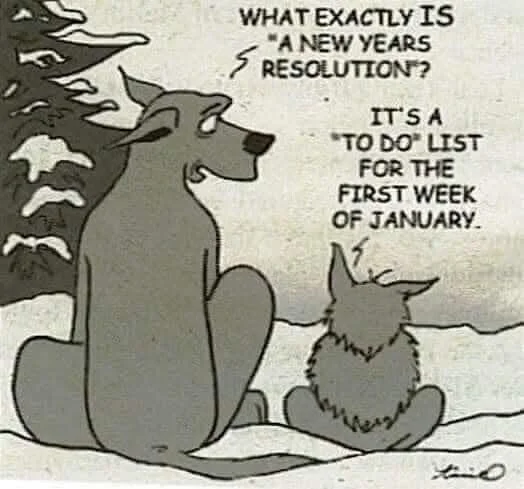

Mot: Just What is a~~~~~New Years Resolution

Seeds of Wisdom RV and Economics Updates Wednesday Evening 12-31-25

Happy New Years Eve Dinar Recaps,

Russia’s New Goal: Carve “Buffer Zones” Deep Into Ukraine

Territorial expansion reframed as defensive security

Happy New Years Eve Dinar Recaps,

Russia’s New Goal: Carve “Buffer Zones” Deep Into Ukraine

Territorial expansion reframed as defensive security

Overview

Russia is formalizing territorial expansion under the justification of border security.

“Buffer zones” are being carved into Ukraine’s Sumy and Kharkiv regions, far beyond earlier front lines.

The strategy signals long-term occupation, not temporary military pressure.

Moscow appears to be reshaping negotiation baselines ahead of any peace talks.

This marks a strategic escalation, not a defensive pause.

Key Developments

Russia’s top military commander, General Valery Gerasimov, ordered forces to continue expanding buffer zones during a visit to the “North” military grouping.

The directive is explicitly framed as protecting Russian border regions such as Kursk and Belgorod.

Russian officials claim approximately 950 square kilometers and 32 settlements have been seized, though figures remain unverified.

President Vladimir Putin publicly endorsed the buffer zone concept, calling it “very important” after Ukraine’s August 2024 incursion into Kursk.

The operations extend the conflict well beyond the Donbas, opening sustained pressure along Ukraine’s northern frontier.

Why It Matters

This move institutionalizes territorial conquest by recasting offensive action as defensive necessity.

By embedding occupation within a “security” framework, Moscow creates facts on the ground that can later be presented as non-negotiable conditions in peace talks. The buffer zone narrative also seeks to normalize expansion for domestic audiences while blunting international criticism by linking actions to retaliation and border protection.

Why It Matters to Foreign Currency Holders

Expanded conflict zones introduce heightened geopolitical risk premiums, especially across Eastern Europe.

Prolonged instability affects energy routes, grain exports, and regional trade corridors.

Sustained military escalation increases pressure on sovereign budgets, debt issuance, and reserve deployment.

Currency volatility tends to rise when conflicts shift from limited theaters to permanent territorial control.

For currency holders, buffer zones represent long-term fragmentation, not short-term shocks.

Implications for the Global Reset

Pillar: Territorial Control Precedes Political Settlement

Military realities are shaping diplomatic outcomes before negotiations begin.Pillar: Security Narratives Justify Structural Change

Redrawing borders under “defense” alters trade, finance, and settlement flows.

As conflicts harden into permanent lines, global realignment accelerates quietly through risk repricing and regional decoupling.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Russia pushes deeper into northern Ukraine, citing border security”

Modern Diplomacy – “Russia’s New Goal: Carve ‘Buffer Zones’ Deep Into Ukraine”

Institute for the Study of War – “Russian Offensive Campaign Assessment”

~~~~~~~~~~

Why Zaporizhzhia Power Plant Could Derail Russia-Ukraine Peace Talks

Europe’s largest nuclear facility becomes a geopolitical fault line in stalled negotiations

Overview

The Zaporizhzhia Nuclear Power Plant (ZNPP) has regained a secondary external power line, temporarily improving safety conditions

The facility remains under Russian control, despite international recognition of Ukrainian sovereignty

ZNPP ownership and operation are unresolved in U.S.-brokered peace talks between Kyiv and Moscow

Control of nuclear energy infrastructure is now intertwined with territorial, economic, and security demands

Key Developments

The International Atomic Energy Agency (IAEA) confirmed repairs to a backup power line supplying the ZNPP, reducing immediate shutdown risk

Ukraine’s energy ministry said the repairs stabilize off-site power if the primary Dniprovska line is damaged

The six-reactor facility remains in cold shutdown, though it still requires constant electricity to maintain safety systems

Russia continues to assert operational authority through Rosatom, claiming it is the only party capable of safely managing the plant

Ukraine has proposed partial electricity allocation, with the United States previously floated as a supervisory manager

Repeated power losses since 2022 have raised alarm among international nuclear safety experts

Why It Matters

The Zaporizhzhia Nuclear Power Plant is not just an energy facility — it is leverage.

Nuclear infrastructure represents economic output, political legitimacy, and strategic control. In a peace process already strained by territorial disputes, the ZNPP introduces a non-negotiable risk factor: nuclear safety.

Any agreement that leaves ambiguous control over Europe’s largest nuclear plant carries catastrophic downside risk. As long as the plant’s status remains unresolved, confidence in a durable peace remains fragile.

Why It Matters to Foreign Currency Holders

Energy insecurity feeds inflation, undermining currency stability across Europe

Nuclear risk premiums elevate capital flight and insurance costs

Infrastructure control disputes weaken confidence in post-war reconstruction financing

Settlement trust erodes when sovereign assets remain contested

For currency holders, energy assets are balance-sheet anchors. When those anchors are politically disputed, monetary credibility suffers.

Implications for the Global Reset

Pillar: Energy Infrastructure Equals Monetary Stability

Who controls power controls productivity — and confidence.

Pillar: Unresolved Sovereign Assets Delay Systemic Transitions

No reset can finalize while core assets remain contested.

Pillar: Safety Risk Overrides Diplomatic Optics

Nuclear facilities impose hard limits on compromise.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Why Zaporizhzhia Power Plant Could Nuke Russia-Ukraine Peace Talks”

Reuters – “IAEA warns repeatedly of safety risks at Ukraine’s Zaporizhzhia nuclear plant”

~~~~~~~~~~

Asia in 2026: Conflict Continues to Dominate

U.S.–China rivalry and regional flashpoints signal prolonged instability

Overview

Asia enters 2026 under the shadow of unresolved conflicts rather than renewed stability.

The U.S.–China rivalry remains the dominant strategic force, shaping security, trade, and diplomacy.

The Thailand–Cambodia conflict has emerged as a regional pressure point, reflecting great-power competition.

ASEAN cohesion remains strained, limiting effective conflict resolution.

Prolonged instability risks spillover into global economic and financial systems.

Key Developments

The United States formally identified China as its foremost strategic competitor, reinforcing the Indo-Pacific as a primary theater of confrontation.

Washington continues to apply pressure on Beijing to limit China’s ability to project power beyond Asia, including support for Russia.

Concerns over Taiwan remain elevated, with analysts warning of potential Chinese military action.

The Thailand–Cambodia dispute escalated in late 2025, resulting in temporary ceasefires that failed to produce durable agreements.

Economic losses from regional instability already total billions of dollars, undermining growth across Southeast Asia.

China is expanding its influence through infrastructure and Belt and Road projects, while the U.S. deepens engagement with key partners.

Why It Matters

Asia is no longer a backdrop to global power competition — it is one of its primary engines.

When regional disputes align with great-power rivalry, local conflicts take on global significance. The persistence of unresolved tensions in 2026 suggests a shift from episodic crises to structural instability, where economic growth, trade routes, and political alignment are increasingly subordinated to security concerns.

This environment raises the risk of miscalculation and escalation in a region central to global manufacturing and supply chains.

Why It Matters to Foreign Currency Holders

For currency holders, sustained instability in Asia carries systemic implications:

Trade disruption affects export-driven economies, pressuring regional currencies.

Capital flows become more selective, favoring perceived safe havens.

Defense spending and supply-chain reshoring strain fiscal balances.

Currency volatility increases when geopolitical risk becomes persistent rather than episodic.

In financial terms, prolonged conflict environments reprice risk over time, not overnight.

Implications for the Global Reset

Pillar: Multipolar Competition Is Structural

Power rivalry now defines global alignment.Pillar: Regional Conflicts Accelerate Fragmentation

Trade, finance, and settlement increasingly split along bloc lines.

As Asia’s stability erodes, global realignment accelerates quietly through trade rerouting, reserve diversification, and financial decoupling.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “Asia in 2026: Conflict Continues to Dominate”

Reuters – “Taiwan stays on high alert as Chinese ships pull back after massive drills”

Council on Foreign Relations – Asia and the Indo-Pacific Strategic Outlook

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Mathematical Analysis of a Global Monetary Reset

Mathematical Analysis of a Global Monetary Reset

12-30-2025

Gold at $10,000: Mathematical Analysis of Global Monetary Reset

BY MUFLIH HIDAYAT ON DECEMBER 30, 2025

How Currency System Mathematics Drive Gold Toward $10,000 Valuations

Modern monetary architecture rests on mathematical relationships that most investors never examine. When currency supplies expand beyond the backing capacity of underlying reserves, historical precedent suggests systematic adjustments become inevitable.

Mathematical Analysis of a Global Monetary Reset

12-30-2025

Gold at $10,000: Mathematical Analysis of Global Monetary Reset

BY MUFLIH HIDAYAT ON DECEMBER 30, 2025

How Currency System Mathematics Drive Gold Toward $10,000 Valuations

Modern monetary architecture rests on mathematical relationships that most investors never examine. When currency supplies expand beyond the backing capacity of underlying reserves, historical precedent suggests systematic adjustments become inevitable.

The arithmetic supporting potential gold at $10,000 scenarios emerges from fundamental imbalances between outstanding monetary obligations and precious metals held in official reserves.

Furthermore, understanding these dynamics becomes crucial as gold record highs continue to challenge traditional market expectations.

The Federal Reserve’s Hidden Gold Connection

Despite widespread belief that the dollar operates without commodity backing, Federal Reserve balance sheets reveal approximately $11.2 billion in gold certificates serving as collateral against $2.35 trillion in circulating Federal Reserve notes. This creates a backing ratio of roughly 0.48%at the statutory gold price of $42.22 per ounce.

The U.S. Treasury maintains 261.5 million ounces of gold across Fort Knox, West Point, Denver, and San Francisco facilities.

Under current accounting, this massive reserve provides less than half a penny of gold backing per dollar in circulation. This mathematical disconnect between official pricing and currency obligations creates structural pressure that has historically resolved through revaluation events.

Currency Coverage Requirements Under Full Backing Systems

Mathematical analysis reveals that achieving 100% gold backing for current Federal Reserve note circulation would require gold pricing near $8,993 per ounce.

This calculation emerges from dividing total currency outstanding by existing Treasury gold reserves, creating a pure arithmetic relationship independent of market speculation.

Read Full Article:

https://discoveryalert.com.au/gold-10000-valuation-currency-mathematics/

https://dinarchronicles.com/2025/12/30/mathematical-analysis-of-a-global-monetary-reset/

VND Summary 2025 and 2026 Expectations

VND Summary 2025 and 2026 Expectations

Edu Matrix: 12-31-2025

As we approach 2025, investors are keenly watching the Vietnamese Dong (VND) to gauge its potential for growth and stability. In a recent video from Edu Matrix, Sandy Ingram provides a comprehensive overview of the VND’s outlook, sharing insights into her unique investment strategies and the factors influencing the currency’s performance.

Here, we’ll delve into the key takeaways from the video and explore the opportunities and challenges facing VND investors.

VND Summary 2025 and 2026 Expectations

Edu Matrix: 12-31-2025

As we approach 2025, investors are keenly watching the Vietnamese Dong (VND) to gauge its potential for growth and stability. In a recent video from Edu Matrix, Sandy Ingram provides a comprehensive overview of the VND’s outlook, sharing insights into her unique investment strategies and the factors influencing the currency’s performance.

Here, we’ll delve into the key takeaways from the video and explore the opportunities and challenges facing VND investors.

Sandy Ingram begins by sharing her personal approach to investing, which involves purchasing foreign currencies during her travels. This strategy not only makes her travel expenses tax-deductible but also allows her to benefit from fluctuations in currency values against the US dollar.

While this may not be a conventional investment strategy, it highlights the potential for creative approaches to managing investments.

The video also touches on the channel’s investments in micro real estate loans, gold, and silver. These investments have provided steady returns and low default rates, underscoring the importance of diversification in a robust investment portfolio.

The core of the video focuses on the VND’s depreciation against the US dollar in 2025. This trend is driven by factors common to emerging markets, including interest rate differentials, global risk sentiment, and trade investment flows.

While the depreciation may seem concerning, Vietnam’s fundamentals remain solid, driven by its strong manufacturing sector, ambitious public investment plans, and steady foreign currency inflows.

The State Bank of Vietnam plays a crucial role in managing the VND’s volatility by maintaining a trading band. This approach helps to moderate fluctuations and ensure stability in the currency markets.

Looking ahead, a stronger VND is expected to emerge gradually, driven by factors such as lower US interest rates, a healthy external balance, and improved financial stability. While a sudden appreciation is unlikely, a gradual strengthening of the VND is anticipated.

For investors, the video concludes with a pragmatic recommendation: holding the VND is a viable strategy, as near-term fluctuations are likely, but long-term prospects remain positive. As with any investment, it’s essential to maintain a nuanced understanding of the market and be prepared for potential fluctuations.

The Vietnamese Dong’s investment outlook for 2025 and beyond is characterized by both challenges and opportunities. While the currency’s depreciation against the US dollar is a concern, Vietnam’s strong fundamentals and steady foreign currency inflows provide a solid foundation for long-term growth.

By understanding the factors influencing the VND’s performance and maintaining a diversified investment portfolio, investors can navigate the complexities of this emerging market.

For further insights and information, be sure to watch the full video from Edu Matrix. Whether you’re a seasoned investor or just starting out, staying informed about the VND’s outlook can help you make more informed investment decisions.

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 12-31-25

Happy New Years Eve Dinar Recaps,

CLARITY Act Advances — But Does It Gate the Global Reset?

Crypto regulation moves forward as markets wait — and misunderstand — the timeline

Happy New Years Eve Dinar Recaps,

CLARITY Act Advances — But Does It Gate the Global Reset?

Crypto regulation moves forward as markets wait — and misunderstand — the timeline

Overview

The U.S. Senate Banking Committee has set January 15 as the markup date for the CLARITY Act.

Bipartisan agreement is not yet confirmed, though negotiations appear to have narrowed.

Crypto markets are betting the bill becomes law in the first half of the year, with April–May emerging as the realistic window.

The CLARITY Act defines key digital asset and stablecoin parameters, increasing speculation it is required before broader financial restructuring.

It is not a prerequisite for a global reset, but it is a synchronization milestone.

Key Developments

Markup scheduled for January 15 signals the bill is moving procedurally after months of delay.

Prior negotiations stalled over stablecoin yield limits, token classification, illicit finance controls, and ethics provisions.

Bipartisan support remains essential to avoid delays similar to those faced by the GENIUS Act.

Market odds currently price a 42% chance of passage before April and 69% before May.

If passed, CLARITY would become the second major U.S. crypto framework law, expanding beyond the GENIUS Act.

Why It Matters

Regulatory clarity is not transformation — it is codification.

The CLARITY Act does not create new monetary systems; it legally defines how existing digital rails may operate inside the U.S. framework. Its importance lies in removing ambiguity for institutions, custodians, and issuers — not in triggering a reset event.

Delays are frustrating, but they reflect a deeper truth: the reset is structural, not legislative. Laws follow infrastructure, not the other way around.

Why It Matters to Foreign Currency Holders

For currency holders, the CLARITY Act matters because it formalizes how digital dollars and stablecoins are recognized, governed, and constrained within U.S. law.

However:

Global settlement rails already exist

Cross-border liquidity mechanisms are already operational

Stablecoins already function internationally, regardless of U.S. statute

Currencies anchored to diversified reserves, interoperable rails, and trade access do not wait on U.S. legislative timing. The bill provides regulatory comfort, not monetary permission.

In reset terms: access beats authorization.

Implications for the Global Reset

Pillar: Law Codifies — It Does Not Create

The reset is underway; legislation catches up later.Pillar: Stablecoins Are Rails, Not Currency

Defining them does not delay value realignment.Pillar: Timing Frustration Is Structural Stress

Transitional systems always feel “late” from inside the shift.

The CLARITY Act does not have to pass for a reset to occur. It simply aligns U.S. law with a system that is already evolving globally.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

~~~~~~~~~~

Why Stablecoin Laws Don’t Trigger Resets

Regulation follows infrastructure — not the other way around

Overview

Stablecoin legislation is often mistaken as a reset trigger, but it is not.

Laws like CLARITY and GENIUS define rails, not value.

Stablecoins already operate globally without U.S. statutory permission.

Monetary resets are structural events, not legislative announcements.

Regulatory clarity provides comfort — not ignition.

Key Developments

Stablecoins are defined in law as payment instruments, not sovereign currency replacements.

Global settlement using tokenized value already exists, regardless of U.S. bills.

Central banks and institutions have already integrated digital rails into back-end systems.

Legislative delays reflect political timing, not monetary readiness.

Markets consistently misprice laws as triggers due to visibility bias.

Why It Matters

Stablecoin laws are about control and compliance, not transformation.

They clarify:

Who may issue

How reserves are held

Which regulators oversee activity

They do not:

Revalue currencies

Activate new money

Change purchasing power

Trigger systemic resets

History shows that money systems shift first — laws are written afterward to legitimize what already works.

Why It Matters to Foreign Currency Holders

For currency holders, believing legislation triggers resets creates false timelines and unnecessary frustration.

Currencies reset when:

Settlement trust shifts

Trade access changes

Liquidity pathways realign

None of those require U.S. Congressional approval.

Stablecoin laws simply ensure domestic alignment with global reality. They do not delay — nor enable — currency value changes.

Implications for the Global Reset

Pillar: Infrastructure Precedes Regulation

Systems run before they are regulated.Pillar: Rails Are Not Value

Stablecoins move money; they do not redefine it.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

CoinGape – “CLARITY Act Set to Advance as Senate Picks January 15 for Crypto Bill Markup”

International Monetary Fund – Digital Money and Cross-Border Payments

~~~~~~~~~~

What Must Be in Place for a Currency Reset — and What Is Just Cosmetic

Separating structural readiness from surface noise

Overview

Not everything labeled “important” is essential to a currency reset.

Structural resets occur when settlement, liquidity, and trust align.

Many high-profile events are cosmetic confirmations, not requirements.

Understanding the difference prevents timeline fatigue.

The reset is about access and interoperability, not headlines.

Key Developments

Global payment rails are already interoperable (ISO-based messaging, real-time settlement).

Bilateral and multilateral trade settlement frameworks are active outside dollar dependency.

Reserve diversification is ongoing, including gold and commodity backing.

Liquidity windows are pre-positioned, not announced.

Legal frameworks are catching up, not leading.

What Actually Must Be in Place (Structural)

Functional settlement rails across borders

Liquidity availability at sovereign and institutional levels

Trade access and counterpart trust

Reserve credibility (diversified, auditable assets)

Operational readiness inside banks and treasuries

These are already in motion or complete.

What Is Cosmetic (Not Required)

❌ Stablecoin bills passing

❌ Public announcements

❌ Media timelines

❌ Political consensus

❌ Retail-facing explanations

These follow the shift — they do not cause it.

Why It Matters

Confusing cosmetic milestones with structural readiness creates false delays.

Resets feel late because they are quiet by design. When systems change loudly, it is usually because they already have.

Why It Matters to Foreign Currency Holders

For holders, the danger is waiting for permission that is not required.

Currencies reprice when:

Access changes

Settlement routes shift

Trust migrates

Those dynamics are invisible until they are irreversible.

In reset terms: by the time it’s explained, it’s done.

Implications for the Global Reset

Pillar: Access Is the Trigger

Not laws. Not headlines.Pillar: Silence Signals Readiness

Loud systems are unfinished ones.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Bank for International Settlements – Cross-Border Payments Roadmap

International Monetary Fund – Reserve Diversification Reports

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

We are living through a Global Monetary Reset!!!!!

Gold & Silver’s Surge Warns of a 2026 Great Reckoning

Taylor Kenny: 12-31-2025

We are living through a Global Monetary Reset!!!!!

Gold and silver are setting record highs-but it’s not about inflation or geopolitics.

Most Americans have no idea what’s coming. Taylor reveals how paper markets, debt manipulation, and global de-dollarization are fueling a historic shifts and why 2026 is shaping out to be one of the most pivotal years in financial history.

Gold & Silver’s Surge Warns of a 2026 Great Reckoning

Taylor Kenny: 12-31-2025

We are living through a Global Monetary Reset!!!!!

Gold and silver are setting record highs-but it’s not about inflation or geopolitics.

Most Americans have no idea what’s coming. Taylor reveals how paper markets, debt manipulation, and global de-dollarization are fueling a historic shifts and why 2026 is shaping out to be one of the most pivotal years in financial history.

CHAPTERS:

00:00 The Gold & Silver Surge Isn’t What You Think

01:37 We’re Living Through a Global Currency Reset

03:09 What Is a Currency Reset, Really?

04:15 Paper Market Manipulation Is Breaking Down

06:25 Explosive Institutional Demand Is Here

07:35 China’s Massive Gold Accumulation

09:35 The Rise of a Gold-Based Monetary System

10:44 Trust and Tangibles in a Post-Dollar World

11:45 The Fatal Mistake Most People Make

Seeds of Wisdom RV and Economics Updates Wednesday Morning 12-31-25

Happy New Years Eve Dinar Recaps,

Fed Minutes Reveal Deep Divide

December meeting exposes fault lines over inflation, jobs, and 2026 rate cuts

Happy New Years Eve Dinar Recaps,

Fed Minutes Reveal Deep Divide

December meeting exposes fault lines over inflation, jobs, and 2026 rate cuts

Overview

Federal Reserve officials are split on whether inflation or unemployment now poses the greater risk.

December 2025 meeting minutes reveal disagreement over the timing and scale of rate cuts in 2026.

Some policymakers warned that inflation progress may have stalled.

Others argued that rising unemployment and economic slowing deserve greater attention.

The divide raises uncertainty about the Fed’s policy path moving forward.

Key Developments

A faction favored holding rates steady, citing concern that inflation is not yet sustainably moving toward the 2% target.

Another group emphasized labor market risks, warning that delayed easing could worsen job losses.

Data dependency was repeatedly emphasized, reflecting uncertainty in economic signals.

No consensus emerged on when rate cuts should begin in 2026.

Market participants are now reassessing expectations for the pace and depth of future easing.

Why It Matters

Central bank unity is a stabilizing force. Division introduces ambiguity into forward guidance, which markets rely on for pricing risk.

The December minutes show a Federal Reserve navigating competing mandates under tightening constraints. When inflation and employment signals diverge, policy decisions become less predictable — increasing volatility across rates, equities, and currencies.

This is not indecision; it is a reflection of a system under structural strain.

Why It Matters to Foreign Currency Holders

For foreign currency holders, Fed clarity directly impacts global exchange rates.

A divided Fed complicates interest rate differentials, capital flows, and carry trades. When markets cannot confidently price U.S. monetary policy, FX volatility rises, particularly for currencies linked to dollar funding, trade settlement, and emerging-market debt.

In reset terms, policy uncertainty accelerates repricing.

Implications for the Global Reset

Pillar: Policy Credibility Requires Cohesion

Fragmented guidance weakens confidence.Pillar: Data Ambiguity Drives Volatility

When signals conflict, markets reprice faster.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

New York Times – “Federal Reserve Officials Were Divided Over Inflation and Jobs, Minutes Show”

CNBC – “Fed minutes show officials were in tight split over December rate cut”

Charles Schwab – “Rate Debate: Fed Minutes Today Provide Inside Look”

~~~~~~~~~~

Chinese Oil Tankers Challenge U.S. Blockade off Venezuela

Maritime standoff escalates as China-backed shipments test U.S. enforcement

Overview

Chinese-flagged oil tankers are continuing Venezuela-linked voyages despite a U.S.-declared maritime blockade.

Two unsanctioned VLCCs, Thousand Sunny and Xing Ye, are operating near Venezuelan waters.

The U.S. is escalating tanker seizures and naval pressure to restrict Caracas’ oil revenues.

China and Russia have openly criticized U.S. actions, raising concerns of broader geopolitical confrontation.

Venezuela has begun escorting oil shipments while cutting production as storage fills.

Key Developments

The Thousand Sunny is en route to Venezuela’s Jose Terminal after sailing around the Cape of Good Hope, maintaining course despite the blockade announcement.

The Xing Ye is slow-steaming off French Guiana, awaiting loading at the Jose Terminal, with ownership and destination undisclosed.

U.S. authorities seized multiple tankers, including Centuries and Skipper, while pursuing Bella 1 under a judicial seizure order.

China has opposed the seizures, backing Venezuela during an emergency U.N. Security Council meeting.

PDVSA has begun shutting oil wells in the Orinoco Belt, aiming to cut output by at least 25% as exports are squeezed.

Chevron continues exporting Venezuelan crude under a special U.S. license, highlighting selective enforcement.

Why It Matters

Energy blockades are not just economic tools — they are geopolitical force multipliers. The presence of Chinese-flagged tankers operating near Venezuela tests the limits of U.S. maritime enforcement and exposes fractures in global energy governance.

As sanctions and seizures intensify, oil trade increasingly shifts from commercial rules to power-based navigation, raising risks of escalation, miscalculation, and retaliation.

Why It Matters to Foreign Currency Holders

For currency holders, this standoff underscores how energy flows anchor monetary stability.

Disrupted oil exports weaken reserve inflows, stress balance sheets, and accelerate currency depreciation for producer nations. At the same time, buyers willing to bypass sanctions gain strategic pricing and settlement leverage, reshaping trade flows away from traditional dollar-dominated channels.

In reset terms, energy access increasingly determines currency resilience.

Implications for the Global Reset

Pillar: Energy Control Equals Monetary Power

Disrupted exports destabilize currencies.Pillar: Sanctions Accelerate Fragmentation

Parallel trade routes emerge under pressure.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Newsweek – “Chinese Oil Tankers Challenge U.S. Blockade off Venezuela”

Bloomberg – “Venezuela Cuts Oil Output as U.S. Blockade Squeezes Exports”

New York Times – “U.S. Escalates Pressure on Venezuela’s Oil Exports”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Tuesday Evening 12-30-25

Good Evening Dinar Recaps,

Trump’s $2,000 Tariff Dividend: Promise, Process, and Proof

What Americans have been told — and what must still happen

Good Evening Dinar Recaps,

Trump’s $2,000 Tariff Dividend: Promise, Process, and Proof

What Americans have been told — and what must still happen

Overview

President Donald Trump has publicly proposed $2,000 payments to Americans, described as “tariff dividends” funded by import tariffs.

No law has been passed authorizing the payments — meaning no checks are approved or scheduled.

The proposal would require Congressional legislation and Treasury implementation before any distribution could occur.

Public confusion has grown as social media claims outpace confirmed policy action.

Key Developments

Trump floated the $2,000 figure publicly in November 2025, framing it as a dividend from tariff revenue.

Administration officials later confirmed that Congressional approval would be required.

Mid-2026 has been mentioned as a possible timeline, but only if enabling legislation passes.

Eligibility has not been defined, beyond statements suggesting “high-income earners” may be excluded.

Economists and budget analysts question feasibility, citing insufficient tariff revenue without deficit funding.

Why It Matters

How Long It Can Take — The 5 Key Factors

1️⃣ It shows Trump is prioritizing direct relief

When he publicly explains what’s needed for the $2,000, it signals he wants money in people’s hands, not trapped in bureaucracy or corporate channels.

2️⃣ The obstacle is procedural — not financial

The holdup isn’t the funds — it’s Congressional voting rules. That puts the pressure on lawmakers, not the Treasury.

3️⃣ It reframes the debate around the Senate

By saying “just the vote,” Trump points to Senate cooperation — or obstruction — as the deciding factor, raising national attention on holdouts.

4️⃣ It reassures people that qualification is simple

His message suggests the $2,000 isn’t means-tested or complicated, easing fear and confusion among seniors and working families.

5️⃣ It confirms the $2,000 is part of the larger economic transition

Direct payments align with the broader shift toward a system built around the people — not big institutions — matching the momentum of debt relief, digital rails, and asset-backed stability.

🌱 Seeds of Wisdom Team 🌱

Newshounds News™ Exclusive.

Currency distributions are not announcements — they are legal, fiscal, and operational events.

Until legislation is passed, funding is appropriated, and Treasury systems are authorized, no payment exists.

This situation highlights a recurring pattern in modern finance: policy signaling often arrives long before legal execution. Markets, households, and currency holders must distinguish between intent, authority, and delivery.

Why It Matters to Foreign Currency Holders

For currency holders, this proposal illustrates how monetary expectations can move faster than monetary reality.

Countries with strong settlement access, legislative clarity, and reserve flexibility can implement stimulus cleanly. Those without legal cohesion or funding clarity risk confidence erosion, volatility, and repricing.

In reset terms, credibility is the currency — not promises.

Implications for the Global Reset

Pillar: Authority Before Liquidity

Money cannot move without legal authorization.Pillar: Confidence Is Built on Execution

Announcements without delivery weaken trust.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

ABC News – “Trump is ‘committed’ to $2,000 tariff dividend payments, White House says”

PBS NewsHour – “Trump floats tariff dividends for Americans, but experts question the math”

~~~~~~~~~~

🌱 A Message to Our Currency Holders🌱

If you’ve been holding foreign currency for many years, you were not foolish.

You were not wrong to believe the global financial system would change.

What failed was not your patience — it was the information you were given.

For years, dates, rumors, and personalities replaced facts, structure, and proof. “This week” predictions created cycles of hope and disappointment that were never based on how currencies actually change.

That is not your failure.

Our mission here is different: • No dates • No rates • No hype • No gurus

Instead, we focus on:

• Verifiable developments • Institutional evidence

• Global financial structure • Where countries actually sit in the process

Currency value changes only come after sovereignty, trade, banking, settlement systems, and fiscal coordination are in place. History and institutions confirm this sequence.

You will see silence. You will see denials. That is not delay — that is discipline.

Protect your identity. Organize your documents. Verify everything.

Never hand your discernment to anyone who cannot show proof.

You deserve truth — not timelines.

Seeds of Wisdom Team

Newshounds News

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps