What Happens to XRP if it Becomes the Backbone of the Global Monetary System?

What Happens to XRP if it Becomes the Backbone of the Global Monetary System?

November 29, 2025

The world of digital assets is no stranger to ambitious predictions, but a recent X post from @KuwlShow has set the internet alight with a particularly audacious thought experiment: could Ripple, the company behind XRP and the XRP Ledger (XRPL), one day command a valuation north of $7 trillion?

Rob Cunningham | KUWL.show:

A Ripple $7 Trillion Valuation

What Happens to XRP if it Becomes the Backbone of the Global Monetary System?

November 29, 2025

The world of digital assets is no stranger to ambitious predictions, but a recent X post from @KuwlShow has set the internet alight with a particularly audacious thought experiment: could Ripple, the company behind XRP and the XRP Ledger (XRPL), one day command a valuation north of $7 trillion?

Rob Cunningham | KUWL.show:

A Ripple $7 Trillion Valuation

Q: At Ripple’s most recent post money valuation, what might new valuation estimates rise to if the pending Clarity Act resulted in Ripple retaining 17 Billion XRP at a value of $250, the XRPL blockchain and XRP bridge token gaining global clarity from the U.S. Government as our new monetary system infrastructure and XRP paired with RLUSD represents the new U.S. digital dollar the world over?

A. If all of this actually happens – Clarity Act, full U.S. Treasury blessing, XRPL as core global rails, RLUSD/XRP as the de-facto US Digital Dollar pair – then Ripple’s valuation doesn’t just “go up a lot.”

On paper it jumps into multi-trillion-dollar territory just from its XRP stack alone, before even pricing in the payments/stablecoin business. Let’s walk it out cleanly and keep it grounded.

1. Today’s anchor: Ripple’s latest valuation Ripple’s most recent strategic round (Fortress, Citadel, Pantera, Galaxy, Brevan, Marshall Wace, etc.) priced the company at about $40 billion post-money. That $40B reflects:

• Payments (Ripple Payments) • RLUSD stablecoin & treasury/prime brokerage (Ripple Prime, custody)

• XRP Ledger exposure and associated software

• Current regulatory clarity as of now (GENIUS Act, etc.), but not “world’s base-layer monetary system” status.

So: baseline = $40B. 2. This scenario inputs outlined above: We’re framing a world where:

1. Clarity Act + Treasury blessing

• XRP + XRPL get explicit, durable U.S. Treasury / global regulatory clarity as a core infrastructure layer for the “new monetary system.”

2. XRP at $250 • Today XRP is ~$2.2 with ~60.25B tokens in circulation, implying a ~$120–130B market cap.

• Hypothetically: XRP reprices to $250.

3. Ripple beneficially owns 17B XRP

• We’ll accept this as the post-Clarity, post-escrow, post-SPV reality.

4. RLUSD + XRP become the default “digital U.S. dollar rails” globally • RLUSD is already ~$1B market cap with ~$95B+ in payments volume and growing.

• Scenario above ramps XRP to a global settlement role vs. niche crypto. Let’s keep all the math mechanical and then talk about how markets might actually price it.

3. Mechanical mark-to-market: Ripple’s XRP pile at $250 3.

1. Value of Ripple’s 17B XRP • Price per XRP (scenario): $250

• Beneficial holdings: 17,000,000,000 XRP 17 Billion XRP x $250 = $4.25 Trillion So, $4.25 trillion of value just from that XRP position.

For context:

• That’s 6.6x Visa’s current market cap ($640B).

• 8.6x Mastercard’s ($494B). • World GDP is ≈$117T; $4.25T is ~3.6% of world GDP.

So in this scenario:

• Total XRP market value ≈ $15T • Ripple’s 17B stack ≈ 28% of circulating XRP (17 / 60.25 ≈ 0.282).

• Ripple’s XRP holdings alone = $4.25T, before any business multiple. Already, that dwarfs ANY existing private company.

How public markets might price Ripple equity under this scenario?

We can think of the equity valuation as: Ripple Value ≈ (Value of XRP Treasury ± Discount) + (Value of Payments / Stablecoin / Infra Franchise)

Let’s run three illustrative bands, not predictions. 4.1. “Conservative but still insane” band (Markets deeply discount concentrated XRP risk)

Assume:

• Markets apply a 60–80% discount to that $4.25T XRP stack because:

• Huge concentration in one asset

• Political risk – if it becomes monetary infra, governments want a say

• Possible capital controls, windfall taxes, or forced restructurings

• So equity gets credit for only 20–40% of the XRP mark-to-market: 0.20 times 4.25T = 0.85T 0.40 times 4.25T = 1.70T Now, let’s layer on the infra franchise:

• If XRPL+RLUSD run a systemically important share of global settlement, card-net/FX-network style comps (Visa, Mastercard, SWIFT-equivalent) easily justify $0.5–1T+ by themselves, based on today’s ~$640B and ~$494B for Visa/Mastercard.

Resulting “conservative” band: ~$1.3T – $2.7T Ripple equity value That’s roughly 30–70× today’s $40B. 2/2 cont’d below

This isn’t just “hopium” – it’s a meticulously laid out scenario that, while highly speculative, forces us to consider the monumental shifts required for blockchain technology to truly become the backbone of a new global financial system.

The numbers are staggering, moving far beyond typical crypto discussions and into the territory of systemic global finance. We are talking about potential valuations that rival the GDP of entire nations.

Here’s a deep dive into the extraordinary thought experiment that posits Ripple, the company behind XRP and the XRPL, could achieve a valuation north of $7 Trillion.

From Fintech Challenger to Monetary Super-Utility

To understand the core argument, we must first anchor ourselves in the present. Ripple, following its most recent strategic funding rounds involving giants like Fortress, Citadel, and Pantera, sits at a current post-money valuation of roughly $40 billion. This valuation reflects its growing payments network, its custody business, and the nascent success of its stablecoin, RLUSD.

The $7 Trillion scenario, however, requires a leap of faith based on four massive, interlinked assumptions outlined in the X post:

The Four Pillars of the Super-Giant Scenario

The Clarity Act & Treasury Blessing: XRP and the XRPL must receive explicit, durable regulatory clarity from the U.S. Treasury, cementing their status as a core infrastructure layer for the “new monetary system.”

XRP at $250: The price of XRP must reprice from its current levels (around $2.20 at the time of the scenario’s construction) to $250, reflecting its new role as a global settlement asset rather than a niche crypto token.

Ripple Retains a Vast Stack: Ripple maintains control over 17 Billion XRP post-escrow and restructuring.

RLUSD/XRP as Default Global Rails: The combination of RLUSD (Ripple’s stablecoin) and XRP becomes the de-facto backbone for the global digital U.S. dollar and a major FX settlement layer.

If these four monumental shifts occur, the resulting valuation landscape is completely unrecognizable.

The Mechanical Math: $4.25 Trillion from XRP Alone

The initial, non-negotiable step in the analysis is calculating the mark-to-market value of Ripple’s alleged XRP holdings under this scenario.

The calculation is straightforward:

17 Billion XRP (Ripple’s holdings) x $250 (Hypothetical Price) = $4.25 Trillion

This single number—$4.25 Trillion—immediately changes the conversation.

To put $4.25 Trillion into perspective, as the post noted:

It is 6.6 times Visa’s current market capitalization (~$640 billion).

It is 8.6 times Mastercard’s market cap (~$494 billion).

It represents approximately 3.6% of the world’s current GDP.

This calculation shows that if XRP reaches $250, Ripple’s ownership stake alone becomes the most valuable asset held by any single private company in history, eclipsing the value of even today’s tech giants.

Pricing the Equity: Discounting the God-Mode Asset

However, a company’s equity valuation is not just the sum of its raw assets. Markets must price in the practical business operations (payments, stablecoins, brokerage) and, crucially, the extraordinary risks associated with holding a position of systemic monetary power.

The X post explored three potential valuation bands, based primarily on the discount the market would apply to that $4.25 Trillion XRP stack.

1. The Conservative (But Still Insane) Band: $1.3T – $2.7T

In this scenario, markets apply a severe discount (60–80%) to the XRP holdings due to concentration risk, political pressure, and potential government intervention (windfall taxes, enforced public utility status).

If the market credits Ripple with only 20–40% of the $4.25T stack ($0.85T to $1.7T), and

Adds the value of the infrastructure business (RLUSD, payments rails) at a combined Visa/Mastercard level ($0.5T to $1.0T)…

…Ripple’s valuation still comfortably lands between $1.3 Trillion and $2.7 Trillion—a 30x to 70x increase from today.

2. The Infrastructure Super-Giant Band: $3.1T – $4.5T

If the market believes the regulatory clarity is rock-solid and the XRPL truly dominates global payment and USD rails, the discount is less severe (50–70% of the XRP stack credited). Layering on a $1T–$1.5T value for the payments/stablecoin business brings the valuation into the $3.1 Trillion to $4.5 Trillion range.

At this level, Ripple is no longer a fintech company; it is officially a global monetary super-utility.

3. The Extreme Monetary Plumbing Band: $7T+

If the XRPL/RLUSD stack is treated as the singular backbone for international settlement (the new SWIFT + Fedwire + Visa combined), and the market applies minimal discount to the XRP stack (80–100%), the valuation climbs to the high end: $7 Trillion or more.

Crucially, the post points out that at this extreme level, the regulatory environment would likely force structural change. It becomes impossible for a single, private cap table to hold so much systemic power without triggering serious antitrust concerns, national security reviews, or demands for multi-sovereign governance.

The Indispensable Reality Checks

The power of this thought experiment lies in its meticulous math, but its responsibility lies in its reality checks. The author of the X post was careful to anchor the discussion in three critical points:

The $250 Price Tag is a Paradigm Shift: Hitting $250 requires not just hype, but a fundamental, system-wide shift in global monetary architecture where XRP is utilized by central banks and institutional players worldwide.

Sovereign Control is Inevitable: If the XRPL becomes critical global plumbing, sovereigns and international bodies will insist on checks, oversight, and shared control. Private companies simply cannot be allowed to have “god-mode” over global money flows.

Transparency and Prudence are Mandatory: Any new monetary system that achieves this scale must enforce transparency, remove hidden leverage, and prevent the same kind of capture that plagued the legacy financial system. If those conditions aren’t met, the valuation is unstable.

Conclusion: Expanding the Vision

The $7 Trillion valuation scenario is not a prediction; it is a powerful discernment exercise. It forces us to confront the true scale of what Ripple and the XRPL community aim to build—a financial architecture that is systemically important at a global level.

Whether XRP hits $250 or Ripple ever achieves a multi-trillion-dollar cap depends less on technology and more on global politics, regulatory frameworks, and governance structures.

What this analysis makes perfectly clear is that the crypto company that successfully transitions into the global settlement layer will generate wealth and systemic power on an unprecedented scale, transforming itself from a venture-backed startup into one of the most critical institutions on the planet.

Source: Ripple Chronicles

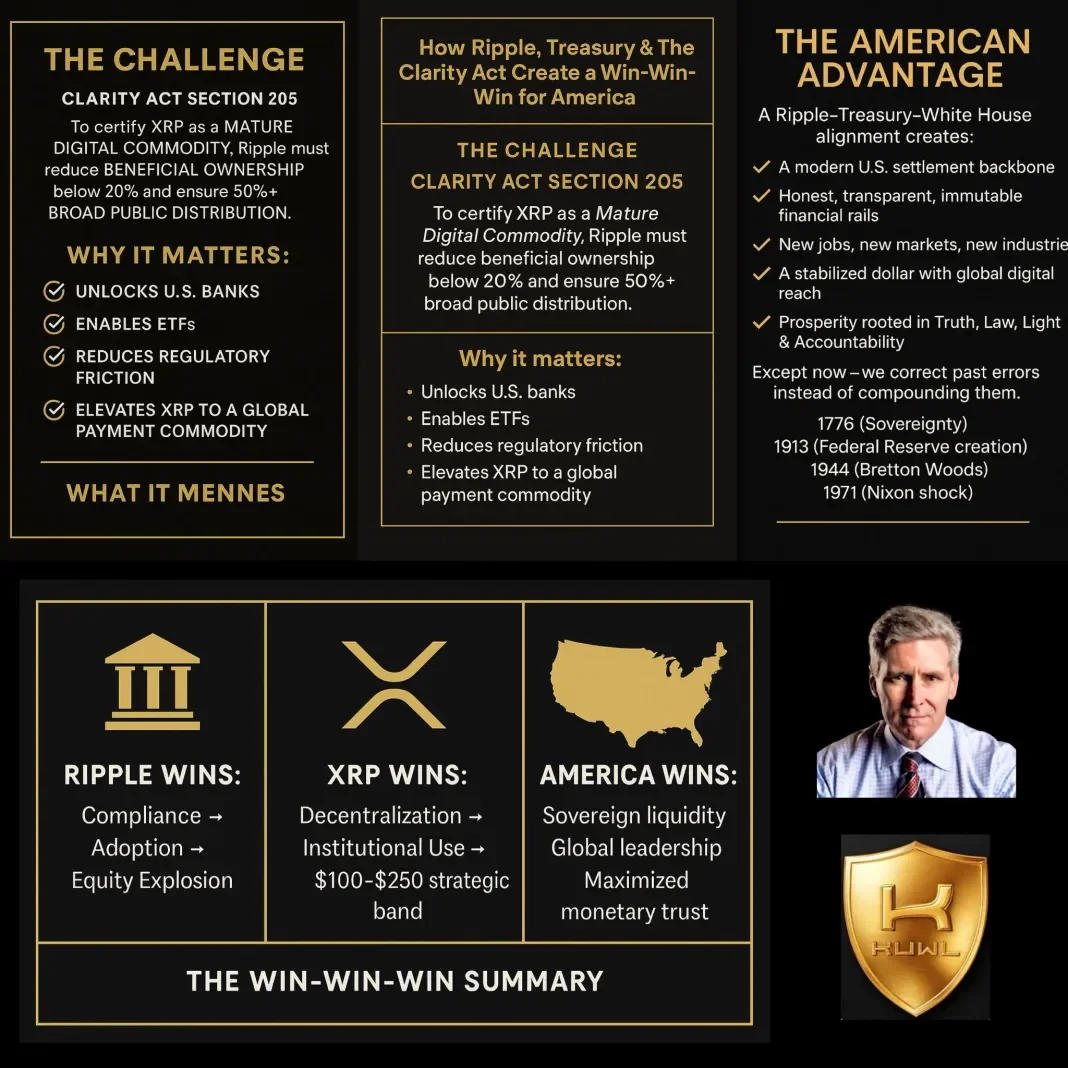

Rob Cunningham: XRP and the Clarity Act, What this means for America

Rob Cunningham: XRP and the Clarity Act, What this means for America

11-29-2025

Rob Cunningham | KUWL.show @KuwlShow

Ripple – XRP – America – Clarity Act

WHAT THIS MEANS FOR AMERICA

America has been stuck with an old, slow, confusing money system for decades—one that loses people’s hard-earned dollars, hides fees, lets middlemen skim off the top, and keeps the average person in the dark.

But what’s happening now changes everything:

Rob Cunningham: XRP and the Clarity Act, What this means for America

11-29-2025

Rob Cunningham | KUWL.show @KuwlShow

Ripple – XRP – America – Clarity Act

WHAT THIS MEANS FOR AMERICA

America has been stuck with an old, slow, confusing money system for decades—one that loses people’s hard-earned dollars, hides fees, lets middlemen skim off the top, and keeps the average person in the dark.

But what’s happening now changes everything:

1. Money will finally move the way life moves – fast.

No more waiting days for paychecks to clear, transfers to settle, or banks to “process” something simple.

Money will move instantly, 24/7, with no hidden nonsense.

2. Fees drop. Transparency rises. No more backroom games.

The current system hides fees, delays payments, and makes mistakes that nobody can trace.

This new system works like a public calculator where errors can’t hide.

You’ll see exactly where your money goes.

3. New American jobs, new industries, new small-business growth.

Any time a new “highway” gets built—whether it’s roads, electricity, or the internet – millions of new jobs come with it.

This new financial “highway” is no different.

America will build it, run it, and benefit from it.

4. A stronger dollar that people all over the world trust again.

Instead of printing money into worthlessness, America uses real value, real transparency, and real accountability to support the dollar.

A strong dollar means:

higher purchasing power

lower inflation

more respect on the world stage

5. Less power for hidden middlemen. More power for Americans.

For years, the financial system rewarded insiders and punished regular people.

This shift puts the power back where it belongs—in the hands of the public, not the bureaucrats, not the big banks, not the middlemen.

6. America becomes the world’s financial “light tower” again.

Instead of reacting to world events, America leads.

Other nations turn to us—not because we force them, but because our system is fair, fast, and trustworthy.

7. Our money becomes safer, clearer, and more honest.

No tricks.

No gimmicks.

No fine print.

Just honest accounting and immediate settlements.

In Plain English:

This is America fixing what was broken – with honesty, accountability, technology, and common sense.

It means:

Better jobs

Better money

Better opportunities

A better future for families, workers, veterans, retirees, and small business owners

It means we stop repeating old mistakes…and start building a system worthy of the people who live in this country.

This isn’t about crypto.

This isn’t about politics.

This is about America upgrading its financial engine so everyone can finally run on equal ground.

If our U.S. Treasury and Ripple both held 17% of XRP at $250, shareholders of both entities would have an asset valued at $4.2 Trillion.

Starting from Ripple’s most recent $40B post-money valuation, if XRP truly ran to $250 and Ripple still held 17B XRP under a Treasury-blessed XRPL/RLUSD/XRP global monetary regime, reasonable mechanical valuation frameworks spit out multi-trillion-dollar Ripple equity numbers – roughly $1 to $7T+, with the low end already bigger than Visa and Mastercard combined, and the high end bumping into “this changes our world forever” territory.

The Art of The Deal Cometh.

“Tidbits From TNT” Sunday 11-30-2025

TNT:

Tishwash: Industry and Minerals: Iraq's silica reserves exceed 350 million tons

The Ministry of Industry and Minerals announced that the proven reserves of silica in Iraq amount to more than three hundred and fifty million tons.

Ministry spokeswoman Duha al-Jubouri said that silica is a vital raw material used in many important industries.

She explained that the most prominent strategic industrial sectors in which silica is used are glass industries, solar cells, and thermal industries.

TNT:

Tishwash: Industry and Minerals: Iraq's silica reserves exceed 350 million tons

The Ministry of Industry and Minerals announced that the proven reserves of silica in Iraq amount to more than three hundred and fifty million tons.

Ministry spokeswoman Duha al-Jubouri said that silica is a vital raw material used in many important industries.

She explained that the most prominent strategic industrial sectors in which silica is used are glass industries, solar cells, and thermal industries.

In addition to insulators and electronics, noting that the ministry is currently working on utilizing them mainly in the glass and refractories industries. link

Tishwash: Savaya: Big changes are coming to Iraq

US President Donald Trump’s envoy, Mark Savaya, announced on Sunday that he will arrive in Iraq within the next two weeks, confirming that he carries “a special message from President Trump to the leadership in Iraq and the Kurdistan Region.”

“Big changes are coming in Iraq, and from now on everyone will see actions instead of words,” Savaya said in a press statement, indicating Washington’s seriousness in taking concrete steps toward the outstanding issues.

Earlier today, Savaya confirmed via the “X” platform that the world views Iraq “as a country capable of playing a larger and more influential role in the region, provided that the issue of weapons outside the framework of the state is completely resolved, and the prestige of official institutions is preserved.” link

*******************

Tishwash: International experts: Iraq represents a promising destination for business and investment.

John Wilkes, the former British ambassador to Baghdad and a member of the advisory board of the Iraqi-British Business Council, praised the flourishing infrastructure in Iraq, predicting that the new government would continue its approach of supporting investment and developing the economy.

This came during a seminar organized by the Iraqi British Business Council (IBBC) and the British Chamber of Commerce in Turkey (BCCT) entitled “Doing Business in Iraq”, which reviewed investment opportunities and mechanisms for entering the Iraqi market.

The participants affirmed that Iraq represents a promising destination for business, noting that international cooperation contributes to promoting sustainable economic development.

For his part, Robin Steelick of the Pilgrims organization discussed the security situation in Iraq, stressing the importance of local knowledge to avoid any limited disturbances, noting that the overall economic situation is stable and calm.

Jamil Shukair, CEO of SC Middle East, also presented an overview of the overall financial situation, emphasizing that the fundamentals of the Iraqi economy are developing positively, with a growing population and demand for services, along with increased oil production and large-scale construction projects driving economic growth. link

***************

Tishwash: An economic lesson for the next prime minister

Dr. Bilal Al-Khalifa

After the Great Depression of 1932, which hit the world and America, US President Roosevelt, succeeding Herbert Hooper, issued a decision two days after taking office to declare a bank holiday and close all banks. This was on March 6, 1933.

Then he issued Executive Order No. 6102 on April 5, 1933, which is the most exceptional of executive orders, written in dry language and included.

I, Frank Delano Roosevelt... pronouncing the existence of patriotism... prohibit persons and principal partnerships within the United States... from hoarding gold water, gold bullion, and gold-backed securities... and I require consequently that all persons surrender on the first of May 1933 or earlier to any Federal Reserve Bank... or to any Reserve Reserve Member all gold coins, bullion, and legal tender securities in gold... and whoever willfully violates this Executive Order... shall be fined not more than ten thousand dollars... or imprisoned for a term not exceeding ten years.

In summary, the people must endure and accept the difficulty of the decision and hand over the gold to the government, otherwise they will be punished. For your information, this decision is political suicide for the following reasons.

1- Because it included a threat of imprisonment and a fine for those who violate it

2- Because the price of gold rose after this, it was a loss for people.

Finally

3- The citizen will refrain from electing him and his party for the next term.

America has succeeded in overcoming the crisis, therefore we need a prime minister in the next government who does not think about how to win votes in the upcoming elections, but rather focuses on the economic recovery of Iraq. Economic improvement means social, political, and security improvement. link

Mot: My Latest ""Bank Story"" !!!!

Mot: Special Gifts!!!! oooooh deeer!!! Helmut and a iron

Seeds of Wisdom RV and Economics Updates Sunday Morning 11-30-25

Good Morning Dinar Recaps,

Ripple, XRP and the Global Financial Reset — "Trump's XRP Plan" — What We Can Confirm

Examining public evidence — not speculative transcripts…

Good Morning Dinar Recaps,

Ripple, XRP and the Global Financial Reset — "Trump's XRP Plan" — What We Can Confirm

Examining public evidence — not speculative transcripts…

Overview

In recent months, Banque de France has publicly confirmed it is testing a private version of the XRP Ledger (XRPL) as part of its wholesale-CBDC (central bank digital currency) experimentation program.

The European Central Bank (ECB) reportedly included XRPL — via a private ledger adaptation — in a 2025 “wholesale-DLT sandbox” used to trial tokenized bond settlements.

Meanwhile, Ripple (the company behind XRPL and its native asset XRP) has applied for a federal banking charter in the United States, signaling its ambition to operate as a regulated financial intermediary.

On the regulatory front in Asia, the Monetary Authority of Singapore (MAS) has formalized a framework for single-currency stablecoins — reflecting the kinds of regulatory environments that could support Ripple-style stablecoins and digital settlement systems.

Key Developments

Institutional adoption of blockchain infrastructure: The Banque de France’s decision to test XRPL for a potential digital Euro signals increasing comfort among major central banks to leverage ready-made distributed ledger technology instead of building from scratch. This lends XRPL legitimacy beyond speculative crypto.

Wholesale-DLT sandbox experiments in Europe: The ECB’s inclusion of XRPL (via a private ledger implementation by fintech firms) in its tokenized-bond settlement trials shows that regulators are actively exploring XRPL’s architecture for critical financial-market infrastructure.

Ripple’s regulatory ambitions in the U.S.: By applying for a federal banking license, Ripple is positioning itself to serve as a regulated institution — which could facilitate its ability to integrate into traditional banking and payment rails.

Asia as a regulatory testbed: Singapore’s recent stablecoin/stable-value token regulation under MAS underscores growing institutional acceptance of regulated digital-asset frameworks — a favorable environment for firms like Ripple aiming for cross-border, compliant liquidity services.

Why It Matters

These developments show that use of XRPL (or XRPL-based private ledgers) is not purely speculative anymore. Major central banks and regulators are actively testing and evaluating distributed ledger technology as infrastructure for next-generation payment and settlement systems. That suggests a future in which digital asset platforms — especially those with ready infrastructure and regulatory ambitions — could form the backbone of global cross-border finance.

Implications for the Global Reset

Pillar: Institutional Infrastructure Transition — As central banks shift toward tokenization and DLT-based wholesale settlement rails, blockchains like XRPL may become part of the “plumbing” of global finance, not just niche crypto infrastructure.

Pillar: Regulatory Convergence & Compliance Integration — Firms like Ripple obtaining banking licenses and working with regulators may ease the integration of blockchain-based liquidity systems into traditional finance — accelerating a broader institutional shift.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Banque de France wholesale CBDC program and exploratory work on DLT-based settlement — Banque de France official documentation.

Youtube -- "BREAKING NEWS!!! TRUMP'S XRP PLAN EXPOSED!!!! THIS IS INSANE!!!!"

~~~~~~~~~~

Global Finance Is Quietly Rewiring Itself — The Structural Reset Arrives

Diverging markets, shifting reserves, and new payment pathways signal a deep macro realignment.

Overview

Global financial conditions are splitting into two trajectories — strong equity markets driven by rate-cut expectations, and weakening commodities that signal deeper structural cooling.

Precious metals are strengthening as institutions reposition portfolios toward safe-haven assets amid ongoing currency volatility.

Central banks and sovereign funds continue hedging away from traditional dollar-centric models, deepening a long-term realignment.

Key Developments

Equity markets closed November with renewed strength, supported by increasing expectations of a Federal Reserve rate cut.

Global commodities are projected to fall roughly 7% in 2026, highlighting broad demand slowing and a shift toward stable-value reserves.

At the same time, gold and silver are forecast to rise approximately 5% next year, reinforcing their strategic importance as protective reserves.

Macro uncertainty and divergent policy paths among major central banks are creating long-term pressure on the dollar’s dominance in global trade and reserves.

Ongoing geopolitical tensions and sanctions regimes continue to accelerate the development of parallel financial pathways across BRICS-aligned and non-Western economies.

Why It Matters

The global system is undergoing a slow but unmistakable rebalancing. Financial markets show strong short-term performance, yet the underlying macro signals — softening commodities, rising metals, currency volatility, and reserve diversification — indicate a transition toward a new architecture. Nations and institutions are actively repositioning away from single-system dependence into multi-polar financial frameworks.

Implications for the Global Reset

Pillar — Financial Rebalancing: The divergence between equities and commodities marks the early stages of a systemic reset, shifting economic modeling toward alternative assets and reserve structures.

Pillar — Parallel Infrastructure: Central banks increasingly engage in diversified reserve strategies that reduce reliance on any one global currency, signaling a long-term structural realignment.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – Asian Shares End Tough November on Firmer Ground Helped by Fed Cut Bets

Reuters – Stocks, Bitcoin Edge Up as Investors Bank on Fed Rate Cuts

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

The ‘Biggest Crash In History’ Is Starting, How To Prepare Now

The ‘Biggest Crash In History’ Is Starting, How To Prepare Now

Jing Pan Sat, November 29, 2025 Moneywise

Robert Kiyosaki Warns The ‘Biggest Crash In History’ Is Starting, Says Millions To ‘Lose Everything.’ How To Prepare Now

As markets push into their final stretch of 2025, “Rich Dad Poor Dad” author Robert Kiyosaki has issued a chilling new warning. “BIGGEST CRASH IN HISTORY STARTING,” he wrote in a recent post on X (1).

According to Kiyosaki, this is the very downturn he’s been predicting for more than a decade — and he believes the fallout will be severe.

The ‘Biggest Crash In History’ Is Starting, How To Prepare Now

Jing Pan Sat, November 29, 2025 Moneywise

Robert Kiyosaki Warns The ‘Biggest Crash In History’ Is Starting, Says Millions To ‘Lose Everything.’ How To Prepare Now

As markets push into their final stretch of 2025, “Rich Dad Poor Dad” author Robert Kiyosaki has issued a chilling new warning. “BIGGEST CRASH IN HISTORY STARTING,” he wrote in a recent post on X (1).

According to Kiyosaki, this is the very downturn he’s been predicting for more than a decade — and he believes the fallout will be severe.

“In 2013 I published RICH DADs PROPHECY predicting the biggest crash in history was coming. Unfortunately that crash has arrived. It’s not just the US. Europe and Asia are crashing. AI will wipe out jobs and when jobs crash office and residential real estate crashes.”

At first glance, his warning may seem at odds with the U.S. stock market, where the S&P 500 and Nasdaq remain near record highs. But concerns about AI-driven job losses are widespread — and layoffs continue to dominate headlines (2).

The silver lining, according to Kiyosaki?

He believes this environment could create enormous opportunities for those who prepare.

“While millions will lose everything…. if you are prepared…this crash will make you richer,” he wrote.

So how would Kiyosaki prepare?

“Time to buy more gold, silver, Bitcoin and Ethereum,” he said.

Let’s take a closer look at these assets.

Precious metals

Kiyosaki has never been shy about his love for gold and silver — and in moments of crisis, he turns to them with even more conviction. His stance is clear: “I’m not buying gold because I like gold, I’m buying gold because I don’t trust the Fed,” he said in an interview back in 2021 (3).

Gold and silver have long been viewed as safe-haven assets. Unlike fiat currencies, they can’t be printed at will by central banks and their value isn’t tied to any single country or economy. That scarcity, combined with their history as a store of value, is why investors often flock to the metals during periods of inflation, economic turmoil or geopolitical instability — pushing prices higher.

This time, he’s putting special emphasis on silver. “Silver is the best and the safest. Silver is $50 today. I predict silver will hit $70 soon and possibly $200 in 2026,” he wrote.

TO READ MORE: https://www.yahoo.com/finance/news/robert-kiyosaki-warns-biggest-crash-112900040.html

Dr. Scott Young: How will a Debt Bubble Break America

Dr. Scott Young: How will a Debt Bubble Break America

11-28-2025

Are we hurtling towards an economic crisis unlike anything we’ve ever seen? According to financial expert Dr. Scott Young, the answer is a resounding yes.

In a recent, urgent analysis, Dr. Young pulls back the curtain on what he describes as a rapidly evolving AI bubble, a phenomenon he warns carries catastrophic implications for the global economy, especially the US financial system.

Dr. Scott Young: How will a Debt Bubble Break America

11-28-2025

Are we hurtling towards an economic crisis unlike anything we’ve ever seen? According to financial expert Dr. Scott Young, the answer is a resounding yes.

In a recent, urgent analysis, Dr. Young pulls back the curtain on what he describes as a rapidly evolving AI bubble, a phenomenon he warns carries catastrophic implications for the global economy, especially the US financial system.

Dr. Young’s investigation zeroes in on the heart of the AI hype: companies like OpenAI and major tech giants such as Microsoft and Oracle. He reveals a disturbing pattern of circular financial deals designed to inflate artificial growth metrics.

Despite OpenAI grappling with massive ongoing losses, these intricate transactions paint a picture of booming success, creating an illusion of prosperity that masks deep instability.

This isn’t just another tech boom. Dr. Young contends that the current AI bubble is far larger and more dangerous than any previous economic downturn, dwarfing even the infamous dot-com crash of 2000 and the devastating 2008 real estate crisis. The scale and complexity, he suggests, are unprecedented.

The AI bubble, Dr. Young argues, is merely one of the unraveling threads in a much larger tapestry of economic peril.

He meticulously connects the dots to the broader context of the U.S. national debt, which is spiraling out of control. With rising interest payments consuming an ever-increasing portion of government revenue, the country is caught in a cycle of unsustainable fiscal policies, driving it relentlessly toward what he calls “inevitable bankruptcy.”

He doesn’t shy away from critiquing government actions, particularly Treasury buybacks of debt using what he likens to “monopoly money.” His data on dangerously rising interest payments paints a grim picture of a system under immense strain.

The warnings aren’t isolated. Dr. Young references prominent voices like Elon Musk, who himself has cautioned that advanced AI and robotics might be the only viable tools left to stave off economic collapse.

Yet, as Dr. Young points out, even these technological marvels may only serve to delay what he views as an inevitable reckoning. He provides a historical overview of economic bubbles, illustrating how past downturns pale in comparison to the sheer scale and complexity of the current situation.

Despite the stark and often grim outlook, Dr. Young offers a powerfully optimistic vision for the aftermath.

He theorizes that the collapse of the current financial system, while initially disruptive, will pave the way for a profound and necessary reset.

Dr. Young reassures viewers that while the deep state and financial elites will undoubtedly suffer massive losses, individuals can navigate this transition intact, and even thrive, in the new system.

It’s a message of empowerment amidst the warnings of impending change.

This comprehensive analysis from Dr. Scott Young serves as a critical wake-up call, urging us to understand the forces at play and prepare for what lies ahead. While the path may be turbulent, he offers a compelling vision of a post-collapse world that could be far more equitable and sustainable for all.

Watch the full video from Dr. Scott Young for further insights and information.

https://dinarchronicles.com/2025/11/29/dr-scott-young-how-will-a-debt-bubble-break-america/

News, Rumors and Opinions Saturday 11-29-2025

KTFA:

Clare: Savaya receives orders from Trump before heading to Iraq

11/28/2025

Mark Savaya, the US president's envoy to Iraq, stated on Friday that he received his assignment orders from the commander-in-chief of the US armed forces, Donald Trump.

Savaya wrote in a post on the "X - formerly Twitter" platform that he received those orders regarding Iraq during the meeting he had with the US President on the occasion of "Thanksgiving".

KTFA:

Clare: Savaya receives orders from Trump before heading to Iraq

11/28/2025

Mark Savaya, the US president's envoy to Iraq, stated on Friday that he received his assignment orders from the commander-in-chief of the US armed forces, Donald Trump.

Savaya wrote in a post on the "X - formerly Twitter" platform that he received those orders regarding Iraq during the meeting he had with the US President on the occasion of "Thanksgiving".

Trump's envoy to Iraq did not elaborate on the details of those orders.

Last October, US President Donald Trump decided to appoint Mark Savaya as special envoy to Iraq.

Mark Savaya is the third US envoy to Iraq since Paul Bremer in 2003, and after Brett McGurk, during the war against ISIS in 2014.

The US Special Envoy to Iraq, Mark Savaya, confirmed on Friday that his mission focuses on rebuilding trust and strengthening the strategic partnership between Baghdad and Washington, noting that the relationship between the two countries is going through a phase that requires direct and honest communication that serves the interests of both peoples. LINK

************

Clare: The Governor of the Central Bank of Iraq participates in the Arab Banking Conference 2025

November 27, 2025

The Union of Arab Banks organized He noted that Iraq is moving steadily towards building a strong and modern banking sector, capable of leading financial and economic transformation by enhancing monetary and financial stability and strengthening the banking sector's capabilities to be more supportive of sustainable development.

This will be achieved by relying on the best management and governance standards, and by transitioning towards digitalization and financial and technological innovation.

He stressed the importance of consolidating financial inclusion and ensuring the integration of the financial system with the formal economic cycle.

His Excellency explained that the Central Bank continues to work on implementing a multi-year strategic vision aimed at supporting local and foreign investment and enabling the banking sector to play its vital role in developing the national economy.

In closing, His Excellency expressed his gratitude to the Union of Arab Banks and the organizing bodies, stressing the Central Bank of Iraq’s commitment to strengthening cooperation with Arab brothers and developing a more stable, growing and innovative financial environment.

Central Bank of Iraq,

Media Office,

November 27, 2025

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Militia Man They're not going to tell you exactly when that's going to happen. The change can happen quickly with minimum disruption. How do we know that? Because the last revaluation of Iraq, Alaq just came out at one moment and said effective immediately we've changed the rate.

Walkingstick [Iraq Bank friend Aki update] The [Iraqi] government is voting upon the '26 budget in 2025 on the new exchange rate...The new exchange rate is a line item...The '26 budget, Sudani is trying to introduce it in 2025. The GOI wants to open the '26 and '25 right after it's voted upon and signed into law...Something is going to happen on December the 1st...This is a rumor.

Frank26 [Iraq boots-on-the-ground report] FIREFLY: Sudani came out and said there was a new mechanism for the currency on December 1st. He did not say directly there would be changes in the currency exchange rate on December the 1st...We're not sure if that will change the rate or not...

Trump Confirms The Economic Plan, Tariff System Will Remove The Income Tax

X22 Report: 11-28-2025

The [CB] is trapped because they never expected Trump's parallel economic system to be building at lightning speed.

Trump is putting everything into place to transition the people from the [CB] which means we will not need the income tax.

All source links to the report can be found on the x22report.com site.

Seeds of Wisdom RV and Economics Updates Saturday Afternoon 11-29-25

Good Afternoon Dinar Recaps,

Geopolitics on a Knife-Edge as Peace Hopes and Conflict Risks Collide

New diplomacy efforts stir markets — but systemic risk remains high as war and uncertainty linger

Good Afternoon Dinar Recaps,

Geopolitics on a Knife-Edge as Peace Hopes and Conflict Risks Collide

New diplomacy efforts stir markets — but systemic risk remains high as war and uncertainty linger

Overview

Diplomatic momentum rises: A new U.S.-backed peace proposal for the war between Russia and Ukraine — recently revised down from 28 to 19 points — has sparked fresh optimism among investors and geopolitical watchers.

Markets respond with rallies in war-linked assets: Russian equities and frozen-asset funds, as well as Ukrainian bonds, jumped sharply as the peace plan gained traction, reflecting short-term investor confidence.

Energy and commodity prices remain volatile as crude oil markets adjust to the dual dynamics of potential supply restoration and geopolitical uncertainty.

Underlying instability persists: Russian military strikes continue, civilian infrastructure remains at risk, and European powers express growing concern over continued Russian aggression — underscoring that any peace deal remains fragile.

Key Developments

Russia’s leadership signals tentative openness to talks, with officials indicating willingness to consider the revised peace framework — though considerable caveats remain.

Frozen-asset funds and Russian-linked equities surged, with some up nearly 50% — reflecting speculative bets that sanctions could be scaled back if a deal proceeds.

Oil prices oscillated, as markets weighed the possibility of restored Russian energy flows against the probability of renewed conflict and sanctions.

European and NATO-aligned states voiced increasing alarm, warning that even with diplomacy, Russia’s ongoing territorial ambitions and hybrid warfare capabilities pose systemic risks to continental security and global economic stability.

Why It Matters

This moment captures the dual nature of the current geopolitical landscape: on one hand, diplomacy and peace negotiations are creating hope and fueling financial rallies; on the other, the war’s underlying dynamics and Moscow’s track record maintain a high baseline of risk. Markets and policymakers alike are being forced to price in both potential stabilization and dangerous reversals — a classic characteristic of a systemic-risk regime.

Implications for the Global Reset

Pillar — Strategic Realignment of Risk & Asset Flows: As peace hopes rise, capital moves swiftly to reprice Russia-linked assets, frozen funds, and emerging-market debt — illustrating how geopolitical shifts instantly reshape global financial flows.

Pillar — Geopolitical Fragility & Systemic Uncertainty: Even as diplomacy advances, ongoing conflict risks and energy-market volatility reinforce that global governance, supply-chain stability, and macroeconomic order remain under threat, accelerating the push for diversified, secure asset and trade frameworks.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Financial Times – “War-linked assets rally on US push for peace in Ukraine”

The Washington Post – “Putin open to new U.S. peace proposal, ready for envoy next week”

RTTNews – “Crude Oil Advances As Uncertainty Hangs Over Russia-Ukraine Peace Plan”

The Guardian – “Ukraine war briefing: drone and missile attacks hit Kyiv as peace talks resume”

Nasdaq / Barchart – “Crude Prices Fall on Hopes of a Russian-Ukraine Peace Deal”

~~~~~~~~~~

BRICS Opens New Lifeline for South African Farmers as China Unlocks $23.3 Million Market

A strategic agricultural pivot reshapes trade as South Africa turns from Washington to Beijing

Overview

China opens a multi-fruit market for South Africa, granting access for stone fruits including prunes, plums, peaches, apricots, and cherries.

The deal is valued at roughly 400 million rand (~$23.3 million), offering immediate relief to farmers squeezed by U.S. tariffs and trade barriers.

South Africa’s Agriculture Ministry confirms this is China’s first multi-fruit approval for a single BRICS nation, signaling a strengthening bloc alignment.

Farmers welcome the move as a stabilization measure amid declining predictability in U.S. trade policy.

Key Developments

South Africa formally signs a new agricultural protocol with China, shifting export priorities away from traditional Western markets.

China accelerates agricultural cooperation across BRICS, using its demand-driven import strategy to support member nations affected by U.S. protectionism.

South African fruit exporters are preparing shipments, anticipating increased volumes of stone fruits headed for Chinese consumers.

Additional fruit categories, such as cherries and berries, may soon be added under future cooperation agreements.

Why It Matters

This agreement represents more than a boost for farmers — it illustrates a widening realignment in global trade structures. As U.S. protectionism expands, BRICS nations are increasingly creating internal economic lifelines. China’s willingness to open new markets provides both economic relief and geopolitical leverage, pulling member countries closer into a shared trade framework.

Implications for the Global Reset

Pillar — Emerging-Market Trade Realignment: Redirecting agricultural exports toward BRICS partners reduces dependency on Western buyers and supports a multipolar trade system.

Pillar — Strategic Supply-Chain Diversification: By securing stable demand from China, South Africa strengthens its agricultural resilience and reinforces BRICS internal market integration.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “BRICS Becomes Lifeline For Farmers As China Opens $23.3 Million Market”

Bloomberg – “South Africa Signs Protocol to Expand Fruit Exports to China”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

“Tidbits From TNT” Saturday 11-29-2025

TNT:

Tishwash: The exchange rate dilemma: Government alternatives between deficit financing and economic stability

By Dr. Ahmed Hadhhal, Professor of Financial Economics

In light of the financial indicators for the 2026 budget, it appears that the exchange rate will be the focus of economic decision-making and the last line of defense against the widening deficit gap, which is expected to reach 70–90 trillion dinars.

With the slowdown in non-oil revenues, the rise in current expenditures, and the decline in the ability to borrow domestically, fiscal policy enters a critical area that leaves the government with limited and difficult options.

TNT:

Tishwash: The exchange rate dilemma: Government alternatives between deficit financing and economic stability

By Dr. Ahmed Hadhhal, Professor of Financial Economics

In light of the financial indicators for the 2026 budget, it appears that the exchange rate will be the focus of economic decision-making and the last line of defense against the widening deficit gap, which is expected to reach 70–90 trillion dinars.

With the slowdown in non-oil revenues, the rise in current expenditures, and the decline in the ability to borrow domestically, fiscal policy enters a critical area that leaves the government with limited and difficult options.

The first logical solution is to rationalize spending and reduce non-salary operating expenses, and to control non-oil revenues through a strict automation and collection system, as well as reforming the state's financial management and reducing the spread of administrative and financial corruption.

This can significantly reduce the deficit. Reducing privileges and imposing mandatory savings on senior officials can add a large amount to public finances, in addition to this measure being a gesture of goodwill to society so that it accepts the high costs of reform.

Selling or investing part of the state's assets may provide between 10-15 trillion dinars, an amount that covers only a limited part of the gap. Even when these measures are applied together, the deficit remains high and cannot be fully financed through domestic borrowing without risking a large jump in domestic debt. Therefore, reform must be real through a structural "surgical operation" on spending and revenue items.

The exchange rate appears to be a short-term option, as the government recognizes that the resources generated by raising the exchange rate are the fastest and most effective way to bridge the financing gap.

Trends and potential scenarios indicate that raising the rate from 1300 to 1500-2000 dinars would provide between 15 and 70 trillion dinars, depending on the level of the increase and the volume of dollar sales.

This makes adjusting the exchange rate a readily available financial tool that the state resorts to when traditional methods fail to close the gap.

I believe this policy represents a price the economy pays for maintaining the current monetary policy throughout the period of pegging.

Therefore, the government might consider integrating financing tools instead of relying on a single option:

1- A genuine reduction in operating expenses by 15-20%.

2- Reform of the spending system and financial oversight to ensure that artificial inflation in expenditures is not repeated.

3- Selling and investing specific highly liquid assets to secure quick resources.

A gradual and well-considered adjustment of the exchange rate towards 1500-1700 dinars as a starting point is advisable, with the risk of reaching 2000 if oil revenues do not improve.

Combining these tools together reduces the deficit pressure to limits that can be financed internally, and the central bank may pay for this adjustment through its reserves, given that most government spending is directed towards consumption and is considered a tool for effective aggregate demand directed towards imports financed and covered by the exchange rate.

************

Tishwash: United States to inaugurate its largest Middle East diplomatic facility in Iraq's Erbil

Deputy Secretary of State for Management and Resources Michael Rigas will visit Erbil to inaugurate the new US Consulate General during his Middle East tour.

The United States will soon open its largest diplomatic facility in the Middle East, the new Consulate General in Erbil, the capital city of the Iraqi Kurdistan region, according to the US State Department.

Deputy Secretary of State for Management and Resources Michael Rigas will visit Erbil to inaugurate the new US Consulate General during his Middle East tour from 27 November to 5 December, the State Department said in a statement on Tuesday.

The department stated that Rigas will also visit Baghdad, meet with Iraqi officials, and tour US diplomatic facilities.

The department added that Rigas's itinerary includes stops in Istanbul, Baghdad, Erbil, and Jerusalem. The purpose of his travel is to emphasise US commitments to stability, security, religious freedom, and prosperity in the region.

Kurdistan Regional Government (KRG) Prime Minister Masrour Barzani stated on Wednesday that the opening of the largest US consulate in Erbil is "a major indicator... for the strong relations between the United States and the Kurdistan Region."

The current US Consulate General, located in Erbil's Ankawa suburb, has been targeted several times by drones reportedly launched by pro-Iran militias in Iraq.

In June 2025, amid escalating tensions between Israel and Iran, the United States ordered non-emergency government personnel to leave its diplomatic missions in Iraq, while maintaining essential embassy and consulate operations.

According to the official website of the US embassy in Iraq, the Consulate General in Erbil serves the four provinces of the Kurdistan Region: Erbil, Sulaimaniyah, Duhok, and Halabja. It includes an executive office led by the Consul General, as well as sections for political and economic affairs, public diplomacy, consular services, rule of law, management, and security. The USAID office for the Iraqi Kurdistan Region is also located at the Consulate General. link

Tishwash: Income gap: Iraq lags behind oil-producing countries despite its enormous wealth

The income gap reveals that the per capita share of Iraq does not exceed $5,800, while Qatar and Oman shockingly surpass it, reflecting the failure of oil wealth management to improve the standard of living.

The latest data from the International Monetary Fund reveals an unprecedented gap in income levels within the Arab world. The figures show that the richest Gulf state (Qatar) is ahead of Iraq by more than 1100% in per capita GDP, while the poorest Gulf state (Oman) is ahead of it by 230%. This shockingly shows that Iraqis are effectively living outside the club of oil-producing countries, despite the enormous wealth that their country possesses.

Qatar tops the list with $71,400 per person annually, while Iraq stands at only $5,800, a very low position compared to oil-producing countries, revealing a deep flaw in the conversion of natural resources into economic prosperity.

Iraq is out of the oil club.

According to the index, even economically unstable countries like Libya ($6,900) and Algeria ($6,100) outperform Iraq.

Oman (the poorest of the Gulf countries in terms of income) is also ahead of it by more than three times, with a share of $19,100 per person.

In contrast, Iraq only surpasses countries with limited resources such as Jordan, Morocco, Tunisia, and Egypt, which places it in the category of a “middle-income economy” despite its enormous oil and human potential. Iraq possesses:

One of the world's largest oil reserves

Annual revenues exceeding $100 billion

A huge young and productive workforce

However, the per capita share does not reflect this wealth, indicating a clear imbalance in resource management, weak productivity, and the dominance of unproductive activities.

Three clear economic messages...

1. The failure to utilize oil revenues for the welfare of the citizen, due to the almost complete dependence on rent.

2. The dominance of the public sector and the inflation of operating expenses at the expense of investment.

3. The absence of a diversified economy capable of creating added value and real income for the individual.

What does this mean for the Iraqi citizen?

Thus, Iraq’s ranking reveals that economic growth does not reach the lives of citizens , and that the standard of living does not represent the true wealth of the country. It also places the next government before the responsibility of restructuring the economy and transforming natural wealth into actual development (if it has the ability and will to do so). link

Tishwash: Only ""Earl"" –siigghhhhh

Tishwash: . Shifting it is!!!!

Seeds of Wisdom RV and Economics Updates Saturday Morning 11-29-25

Good Morning Dinar Recaps,

Global Markets Rebound as Rate-Cut Bets Ignite Risk Appetite

Investors reposition portfolios as equities rally, bonds stabilize, and liquidity surges across short-term credit markets

Good Morning Dinar Recaps,

Global Markets Rebound as Rate-Cut Bets Ignite Risk Appetite

Investors reposition portfolios as equities rally, bonds stabilize, and liquidity surges across short-term credit markets

Overview

Global equities rallied at the end of November as expectations for a Federal Reserve rate cut strengthened, boosting investor confidence.

Treasury yields steadied, supported by renewed optimism in fixed-income markets.

Money-market fund inflows increased, reflecting a preference for liquidity amid ongoing valuation concerns in equities.

Precious metals strengthened, indicating continued hedging behavior against macroeconomic uncertainty.

Key Developments

Asian and U.S. markets surged, responding to growing expectations that the Fed will cut rates in December.

Bond markets saw renewed stability, as investors positioned for potential easing in global monetary policy.

Short-term credit and money-market instruments gained traction, with investors rotating out of overvalued equity sectors.

Global equity funds recorded their first outflow in ten weeks, as portfolios shifted toward balance and risk mitigation.

Why It Matters

This broad-based market rebound signals a turning point after weeks of volatility. Investors are recalibrating their portfolios around the possibility of looser monetary policy, creating a new equilibrium between equities, bonds, short-term credit, and safe-haven assets. The shift reflects a deeper structural adjustment within the global financial system.

Implications for the Global Reset

Pillar — Financial System Re-Calibration: Changes in interest-rate expectations are restructuring liquidity flows, risk pricing, and investor positioning — core elements of global financial reset dynamics.

Pillar — Portfolio Diversification & Risk Hedging: Increased allocations to money-market instruments and precious metals highlight a broader movement toward defensive diversification as systemic vulnerabilities become more visible.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Reuters – “Asian Shares End Tough November on Firmer Ground Helped by Fed Cut Bets”

Reuters – “Wall Street Ends Higher on Growing Bets for December Fed Rate Cut”

Reuters – “Investors Snap Nine-Week Buying Streak in Global Equity Funds”

Reuters – “Gold Set for Fourth Monthly Gain as Markets Wager on US Rate Cut”

~~~~~~~~~~

Dollar Weakens as Global Liquidity Shifts Toward Alternative Stores of Value

Currency markets react to rising rate-cut expectations, surging metals, and a pivot toward diversified reserves

Overview

The U.S. dollar weakened modestly as global investors repositioned ahead of expected Federal Reserve rate cuts.

Money-market data shows shifting liquidity patterns, with inflows moving into cash-like instruments rather than dollar-denominated risk assets.

Precious metals surged, underscoring increased demand for alternative safe-haven stores of value outside traditional currencies.

Central banks and institutional investors are diversifying, reflecting growing caution around dollar strength and long-term value stability.

Key Developments

A weakening dollar index reflects changing global expectations as interest-rate forecasts shift.

Short-term U.S. funding markets remain strong, but rising inflows into money-market funds suggest investors are seeking protection against currency volatility.

Gold and other metals are attracting increased reserve interest, indicating that some institutions are hedging currency exposure with non-fiat assets.

Global investors are recalibrating forex positions, responding to evolving geopolitical risks and uncertainties surrounding U.S. policy direction.

Why It Matters

A weakening dollar — even modestly — has far-reaching implications across global trade, commodity pricing, emerging-market debt, and reserve management strategies. When combined with strong safe-haven demand and shifts in funding markets, it signals that confidence in traditional currency hierarchies is beginning to evolve.

Implications for the Global Reset

Pillar — Currency Realignment: As dollar softening converges with rising demand for metals and alternative assets, global market participants are preparing for a more multipolar currency structure.

Pillar — Reserve Diversification: Increasing institutional interest in non-dollar stores of value suggests a slow rebalancing of global reserves — a foundational change in the international monetary landscape.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

MarketMinute – “Gold Shines Bright: Tepid US Data Fuels Fed Rate Cut Bets”

Chronicle Journal – “The Great Commodity Divide: Oil Plunges While Green Metals and Gold Soar”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Seeds of Wisdom RV and Economics Updates Friday Evening 11-28-25

Good Evening Dinar Recaps,

Hungary Steps Into the Middle: Orban’s Moscow Visit Revives Energy Diplomacy & Peace Dialogue

Budapest’s balancing act between East and West sharpens as winter energy needs collide with Ukraine war diplomacy.

Good Evening Dinar Recaps,

Hungary Steps Into the Middle: Orban’s Moscow Visit Revives Energy Diplomacy & Peace Dialogue

Budapest’s balancing act between East and West sharpens as winter energy needs collide with Ukraine war diplomacy.

****************************************

Overview

Hungarian Prime Minister Viktor Orban will meet Russian President Vladimir Putin in Moscow to discuss energy security and Ukraine-related peace efforts.

Hungary remains one of the only EU states maintaining extensive energy ties with Russia, importing large volumes of crude oil and natural gas while continuing cooperation on nuclear energy projects.

The visit comes amid EU pressure to deepen energy diversification and maintain a unified stance on Russia, yet Hungary continues to secure exemptions from sanctions, most recently with U.S. backing.

Key Developments

Energy Dependence Continues: Hungary’s heavy reliance on Russian oil and gas remains central to its geopolitical posture, especially heading into winter.

Nuclear Cooperation Under Review: Rosatom’s delayed expansion of Hungary’s Paks I nuclear plant will likely be discussed, along with parallel U.S. nuclear coordination.

Diplomatic Bridge or Disruptor: Orban has previously pushed for peace plans involving both Trump and Putin, signaling an ambition to position Hungary as a diplomatic intermediary—though none have materialized.

EU Watching Closely: Brussels sees the visit as a potential challenge to EU cohesion on energy strategy, sanctions, and Ukraine support.

Why It Matters

Hungary’s engagement with Moscow underscores a widening fault line inside Europe: the tension between national energy security and collective EU strategy. Orban’s trip highlights Hungary’s willingness to diverge from EU consensus, raising questions about unity as Europe faces another volatile winter. The meeting also reintroduces Hungary as a possible—but unpredictable—actor in discussions around a future Ukraine settlement.

**************************************************

Implications for the Global Reset

Pillar 2 — Diplomacy & Peace

Hungary’s attempt to negotiate directly with Moscow positions it as a wildcard in ongoing peace efforts. While this could open new diplomatic channels, it may also complicate EU and NATO alignment on Ukraine and sanctions strategy.

Pillar 1 — Finance & Energy Security

Hungary’s sustained reliance on Russian oil, gas, and nuclear cooperation reinforces the broader trend of energy-specific bilateral deals shaping geopolitical leverage. These shifts influence Europe’s long-term restructuring of energy financing and supply chains.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Modern Diplomacy – “Hungary’s Orban to Meet Putin in Moscow on Energy and Ukraine Peace Talks”

Reuters – Coverage on Hungary–Russia Relations and Energy Diplomacy

~~~~~~~~~~

De-Dollarization / BRICS Update – Yuan Strategy Marks Major Turning Point

Subhead: Indonesia’s Yuan push accelerates broader currency shift among BRICS nations

Overview

Bank Indonesia (BI) has begun preparing FX-operation instruments in Chinese yuan (and Japanese yen) to deepen forex markets and promote local-currency trading (LCT) with China.

The move coincides with rising yuan-denominated lending in People's Bank of China (PBOC) systems — yuan-backed credit and bond investments have surged, supporting broader de-dollarization trends in the bloc.

With these developments, member states of BRICS are not only discussing alternative payment systems, but actively building infrastructure that could reduce dependence on the US dollar.

Key Developments

BI’s November 2025 decision adds yuan-rupiah spot and swap instruments — a structural shift aimed at elevating the yuan’s role in Indonesia’s FX and trade flows.

Meanwhile, in China, yuan-denominated lending and financing have expanded dramatically: deposits and bond investments surged to RMB 3.4 trillion (≈ USD 480 billion) over five years, underscoring a strategic move away from dollar-sector dominance.

The broader BRICS payment ecosystem — including digital payment infrastructure and cross-border local-currency settlement frameworks — is accelerating, signalling a shift in how international trade may be settled going forward.

************************************************

Why It Matters

These developments are more than bilateral finance tweaks — they represent structural re-engineering of global payments. As Indonesia and China deepen yuan-based trade channels, BRICS is laying the groundwork for a multipolar currency architecture. If such frameworks scale across the bloc, the dominance of the US dollar in global trade and financing could be challenged over the medium term.

Implications for the Global Reset

Pillar: Currency Multipolarity — By building robust yuan-based FX systems and trade-settlement infrastructure, BRICS is effectively institutionalizing alternatives to dollar-centric financial architecture.

Pillar: Financial Sovereignty & Resilience — Reducing dependence on the US dollar and diversifying currency exposure strengthens member countries’ resilience to external economic and geopolitical shocks.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources

Watcher.Guru – “De-Dollarization BRICS Update: Yuan Strategy Marks Major Turning Point”

IDNFinancials – “BI readies forex monetary operation instruments in yuan and yen”

~~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

RV Facts with Proof Links Link

RV Updates Proof links - Facts Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps