Rich vs Wealthy: How Are They Different?

.Rich vs Wealthy: How Are They Different?

August 26, 2021 by Steve Cummings

Rich and Wealthy are two words people talk about interchangeably, but why?

Is being rich the same thing as being wealthy? “NO!!!”

Being rich and being wealthy are two different things. Yes, a wealthy person can be rich, and a rich person can be wealthy, but we have seen that high-priced athletes make vast sums of money but end up broke while a janitor makes a little bit of money and ends up super-wealthy.

How does all of this make sense? There are significant differences between being rich vs wealthy.

Rich vs Wealthy: How Are They Different?

August 26, 2021 by Steve Cummings

Rich and Wealthy are two words people talk about interchangeably, but why?

Is being rich the same thing as being wealthy? “NO!!!”

Being rich and being wealthy are two different things. Yes, a wealthy person can be rich, and a rich person can be wealthy, but we have seen that high-priced athletes make vast sums of money but end up broke while a janitor makes a little bit of money and ends up super-wealthy.

How does all of this make sense? There are significant differences between being rich vs wealthy.

What Does It Mean to be Rich?

Rich is an adjective we use to describe how much money you are bringing in via your income. In the dictionary, it says having a great deal of money or assets. An athlete making over a million dollars a year is considered rich. They would be regarded as some of the richest people in America. A teacher bringing in $50,000 a year is considered not rich at all. They would be regarded as middle income or middle class.

Being rich may also mean that you have high expenses. Your house is the biggest on the street. You drive fancy cars. Going out to eat at excellent restaurants is a norm for you. These things come with massive debt as well. If you are rich and spend the money as a rich person would, you will be poor once that job and income cease to exist. You will have high debts but no way to pay them off.

How is being rich different than being wealthy?

What Does Being Wealthy Mean?

Being wealthy is about having the money to cover your expenses and being able to have the freedom to do as you like. Wealthy people have accumulated assets that help produce a good flow of income.

In the book, Rich Dad Poor Dad Rober Kiyosaki talks about accumulating assets. It is not about how much you make it is about how much you keep. The wealthy people work on using their money to accumulate assets that can produce wealth for them. It is not about spending the money; it is about accumulating assets that will make income to hit financial freedom.

Most Wealthy people have a few traits that have:

Buy Income producing assets

Own their own time

Can do what they like

Spend less than they earn

To continue reading, please go to the original article here:

Advice for Everyone Who’s Confused About Money Right Now

.Advice for Everyone Who’s Confused About Money Right Now

MY TWO CENTS FEB. 10, 2022 By Charlotte Cowles

Ramit Sethi’s no-nonsense book, I Will Teach You to Be Rich, became a New York Times best seller in 2009 and spawned an eponymous podcast, newsletter, and range of personal finance courses that have made Sethi very, well, rich. It’s easy to be skeptical of what Sethi is selling, but dig under his bold promises and you’ll find approachable, empathetic advice on saving, spending, and organizing your money.

He’s also something of an anti-finance guru in that he eschews jargon and doesn’t lecture people about credit-card points and other minutiae. Instead, he has a talent for breaking down big-picture financial concepts into real-life steps. Which is why I wanted to talk to him right now, at a time when money seems especially complicated (Inflation! Interest rates! Crypto!). Here, we discussed why moments like this can be ideal for taking charge of your finances, and what that process can look like.

Advice for Everyone Who’s Confused About Money Right Now

MY TWO CENTS FEB. 10, 2022 By Charlotte Cowles

Ramit Sethi’s no-nonsense book, I Will Teach You to Be Rich, became a New York Times best seller in 2009 and spawned an eponymous podcast, newsletter, and range of personal finance courses that have made Sethi very, well, rich. It’s easy to be skeptical of what Sethi is selling, but dig under his bold promises and you’ll find approachable, empathetic advice on saving, spending, and organizing your money.

He’s also something of an anti-finance guru in that he eschews jargon and doesn’t lecture people about credit-card points and other minutiae. Instead, he has a talent for breaking down big-picture financial concepts into real-life steps. Which is why I wanted to talk to him right now, at a time when money seems especially complicated (Inflation! Interest rates! Crypto!). Here, we discussed why moments like this can be ideal for taking charge of your finances, and what that process can look like.

It’s a confusing time to be making decisions about money. The economy is all over the place, the pandemic is still happening — it just seems impossible to plan for the future. What’s your advice on how to make sense of this moment, financially?

I get over 2,000 messages a day, from people of different ages and different socioeconomic backgrounds. Over the past two years, I’ve heard from people who have lost jobs, had loved ones die, had to cancel their weddings — people have had a total disruption in their expectations for what they thought life was going to be like.

But there has also been this rare opportunity for people to take control of their money. I’ve seen a huge growth in interest in personal finance. Savings rates were at a historic high. People actually saw the value of things like an emergency fund. Especially back in March and April of 2020, they started to realize, “Oh my God, I know I should have saved, but I never actually did it. Now, I understand. What do I do?”

Right. It was a moment of reckoning.

There are several pivotal moments in somebody’s life when they decide to take control of their money — when they’re graduating from college, getting married, having children, getting divorced, getting a new job. There’s a few others. But usually it’s a time with high stakes, where there’s an external force that gets them to take stock.

It’s the rare person who just wakes up and goes, “I’m going to sit down and make a long-term plan with a low-cost investing strategy.” That almost never happens. Instead, something external causes us to say, “I’ve got to do this now.”

When that moment happens, what’s the best way to harness it? I think a lot of people try to dive in and then get overwhelmed and give up.

Well, you can read a book. I mean, the majority of people who complain about personal finance, who worry about personal finance, who feel guilty about personal finance, have never read a single book on personal finance. It’s pretty straightforward. A lot of people ask, how do I get confident with my money?

The way you get confident is through competence. In order to be competent, you have to learn the basic language of money. This is not complicated stuff. The words are a little unapproachable. If it were me, I would not have called it a 401(k). The reason most people do not engage with their money is simply that money is talked about in a restrictive and unappealing way.

I personally hold a lot of the financial media to account for this. They tell people all the things you can’t do with your money — “No, you can’t buy jeans. No, you can’t go on vacation.” No wonder people are turned off.

I want to use money to say yes. I want to tell people that they can spend extravagantly on the things they love if they cut costs mercilessly on the things they don’t. That gets into prioritizing, and designing and crafting what a rich life looks like to you, which is different for every person. As you start to dial in on this concept, it gets exciting and appealing, and it makes you want to read about IRAs and investments.

How do people actually go about determining what they actually want, though? It can be hard to figure that out — financially and otherwise. And it can change.

To continue reading, please go to the original article here:

https://www.thecut.com/2022/02/money-advice-confusing-times.html

A Halsted vs. Dwight Eisenhower Investor - Over Confident vs Healthy Confident - Risk vs Opportunity

.A Halsted vs. Dwight Eisenhower Investor - Over Confident vs Healthy Confident - Risk vs Opportunity

Write Two Letters Feb 22, 2022 by Ted Lamade Collaborative Fund

Guest post by Ted Lamade, Managing Director at The Carnegie Institution for Science

So, what differentiates someone with a healthy amount of confidence from someone with too much of it? In my experience, people with the right amount of confidence share the credit when they succeed, but more importantly, accept the responsibility when they fail. This combination translates into an ability to admit when they’re wrong and change direction if needed.

Overconfidence is everywhere in life. In finance, it is what caused John Merriweather, Dick Fuld, and Jeff Immelt to destroy billions in shareholder value. In sports, Barry Bonds, Roger Clemens, and Pete Rose are three of the greatest baseball players of all-time, yet none are in the Hall of Fame because of it. In entertainment, Martha Stewart, Michael Eisner in his last few years at Disney, and John Antico at Blockbuster all fell victim to it. In politics, the list is simply too long to get started.

A Halsted vs. Dwight Eisenhower Investor - Over Confident vs Healthy Confident - Risk vs Opportunity

Write Two Letters Feb 22, 2022 by Ted Lamade Collaborative Fund

Guest post by Ted Lamade, Managing Director at The Carnegie Institution for Science

So, what differentiates someone with a healthy amount of confidence from someone with too much of it? In my experience, people with the right amount of confidence share the credit when they succeed, but more importantly, accept the responsibility when they fail. This combination translates into an ability to admit when they’re wrong and change direction if needed.

Overconfidence is everywhere in life. In finance, it is what caused John Merriweather, Dick Fuld, and Jeff Immelt to destroy billions in shareholder value. In sports, Barry Bonds, Roger Clemens, and Pete Rose are three of the greatest baseball players of all-time, yet none are in the Hall of Fame because of it. In entertainment, Martha Stewart, Michael Eisner in his last few years at Disney, and John Antico at Blockbuster all fell victim to it. In politics, the list is simply too long to get started.

William Halsted is widely regarded as one of the “Fathers of Modern Surgery.” He is also known for being an extremely confident surgeon, co-founding Johns Hopkins Hospital, creating multiple surgical techniques, introducing sterilization procedures in the operating room, helping develop anesthesia, and creating the first formal surgical residency training program in the United States.

One of the notable surgical techniques Halsted pioneered was the “radical mastectomy”, which was a novel approach to treating breast cancer. Designed to go well beyond the breast tissue, the procedure would remove pectoral muscles, the mammary gland, lymph nodes under the armpit, and even extend down to the ribcage if necessary in an attempt to more effectively rid the patient of malignant cells.

The radical mastectomy quickly became the preferred method for treating breast cancer and would remain so for decades. There was just one problem. It didn’t work. Halsted was wrong.

Instead of curing breast cancer, the radical mastectomy was overly invasive, debilitating, and ineffective for most patients. Yet, Halsted failed to acknowledge this reality. In fact, he and countless other surgeons continued to perform it even as studies increasingly showed that the ultimate survival from breast cancer had more to do with how extensively the cancer had spread before surgery than how extensively a surgeon operated.

The logical question then is, why did Halsted continue performing and promoting the radical mastectomy in the face of disconfirming evidence?

As Siddhartha Mukherjee describes in his seminal book on Cancer, “The Emperor of all Maladies,”

The Gospel of the surgical profession was ideally arranged to resist change and to perpetuate an orthodoxy. Rather than address the real question raised by the data – did radical mastectomy truly extend lives? – they clutched to their theories even more adamantly. Where others might have seen reason for caution, Halsted only saw opportunity.

Halsted was blinded by what he wanted to believe. Instead of seeking the truth, he sought confirming evidence. When the results weren’t what he had hoped for, he would often make the case that he simply needed to go further.

To continue reading, please go to the original article here:

Saving Happiness

.Saving Happiness

Jiab Wasserman

RESEARCHERS HAVE spent decades probing the connection between money and happiness. For instance, a much-cited 2010 study by academics Daniel Kahneman and Angus Deaton found that folks tend to feel happier the more money they make—but only up to a point, which they estimated to be about $75,000 a year.

But using only income to measure the link between money and happiness is incomplete. Another study, entitled “How Your Bank Balance Buys Happiness,” analyzed the connection to people’s “cash on hand.” The researchers found that having more money in checking and savings accounts was associated with higher levels of life satisfaction. But similar to the income studies, so-called liquid wealth appeared to be subject to diminishing returns, with the impact on life satisfaction tapering off as folks have more.

Saving Happiness

Jiab Wasserman

RESEARCHERS HAVE spent decades probing the connection between money and happiness. For instance, a much-cited 2010 study by academics Daniel Kahneman and Angus Deaton found that folks tend to feel happier the more money they make—but only up to a point, which they estimated to be about $75,000 a year.

But using only income to measure the link between money and happiness is incomplete. Another study, entitled “How Your Bank Balance Buys Happiness,” analyzed the connection to people’s “cash on hand.” The researchers found that having more money in checking and savings accounts was associated with higher levels of life satisfaction. But similar to the income studies, so-called liquid wealth appeared to be subject to diminishing returns, with the impact on life satisfaction tapering off as folks have more.

Which brings me to tennis. We recently moved from Granada, Spain, to Alicante, which is about 220 miles to the east and right on the Mediterranean. Alicante has milder weather that’s conducive to outdoor sports all year round, so most apartment complexes have tennis courts. My husband Jim accused me of looking for our new apartment based on the condition of the tennis courts first and the apartment second. Yes, I love playing tennis.

I also have a fondness for tennis analogies. I think saving money is like playing good tennis defense, while making more money is like playing offense. There are plenty of YouTube videos of the best winning shots, but relatively few that focus on the defensive skill that’s needed to keep the ball in play. Playing defense isn’t flashy. Yet Novak Djokovic, arguably the world’s top player, is renowned for his defensive play and for his ability to turn defense into offense.

Along the same lines, making more money, moving up the corporate ladder and building your own business are all exciting. People love to talk about such successes and to show off what this money has bought them, whether it’s the new car or the bigger house. But they never pull out their latest portfolio statement and say, “Look at my balance.” There’s nothing showy about saving money. We often celebrate a pay raise, a promotion or a business success, but we seldom celebrate when we’ve maxed out our 401(k) plan or reached a financial milestone.

In tennis, playing defense is mostly about limiting your mistakes, while waiting for the opportunity to strike. In football, it’s said that “defense wins championships.” Isn’t it the same in life? Progress—and ultimate success—are typically achieved through hundreds of smart, boring, stay-the-course decisions, rather than through flashy gambles.

Indeed, for most people, financial success is more about limiting mistakes and less about striking it big. Limiting mistakes means minimizing expenses by investing in index funds, living within your means, making the most of your 401(k) and so on. Like the turtle, it’s slow and steady that wins the race.

Happiness – It’s a Rat Race Out There!!

32,260,804 views • Nov 24, 2017 • The story of a rodent's unrelenting quest for happiness and fulfillment.

https://www.youtube.com/watch?v=e9dZQelULDk&t=251s

To continue reading, please go to the original article here:

After The Fact

.After The Fact

Feb 8, 2022 by Morgan Housel

Let’s say you exercise an hour a day, seven days a week. Sweat, grunting, the real deal.

Exercising does two things: It makes you hungry and makes you proud. So let’s say after every workout you eat a huge dinner with extra dessert. You know that’s not ideal, but you just accomplished something hard, so it feels justified. After a year of this you haven’t lost any weight, which was your goal. You can’t figure it out. You’re exercising every day. You’re so frustrated.

The name for this is “food compensation,” and it’s wily foe. In his book The Body, Bill Bryson writes:

One study in America found that people overestimate the number of calories they burned in a workout by a factor of four. They also then consumed, on average, about twice as many calories as they had just burned off … the fact is, you can quickly undo a lot of exercise by eating a lot of food, and most of us do.

After The Fact

Feb 8, 2022 by Morgan Housel

Let’s say you exercise an hour a day, seven days a week. Sweat, grunting, the real deal.

Exercising does two things: It makes you hungry and makes you proud. So let’s say after every workout you eat a huge dinner with extra dessert. You know that’s not ideal, but you just accomplished something hard, so it feels justified. After a year of this you haven’t lost any weight, which was your goal. You can’t figure it out. You’re exercising every day. You’re so frustrated.

The name for this is “food compensation,” and it’s wily foe. In his book The Body, Bill Bryson writes:

One study in America found that people overestimate the number of calories they burned in a workout by a factor of four. They also then consumed, on average, about twice as many calories as they had just burned off … the fact is, you can quickly undo a lot of exercise by eating a lot of food, and most of us do.

You can’t measure the benefit of exercise just by tracking how much you work out. It’s the gap between your workout and avoiding offsetting its benefits after the fact that makes all the difference.

And isn’t building wealth the same?

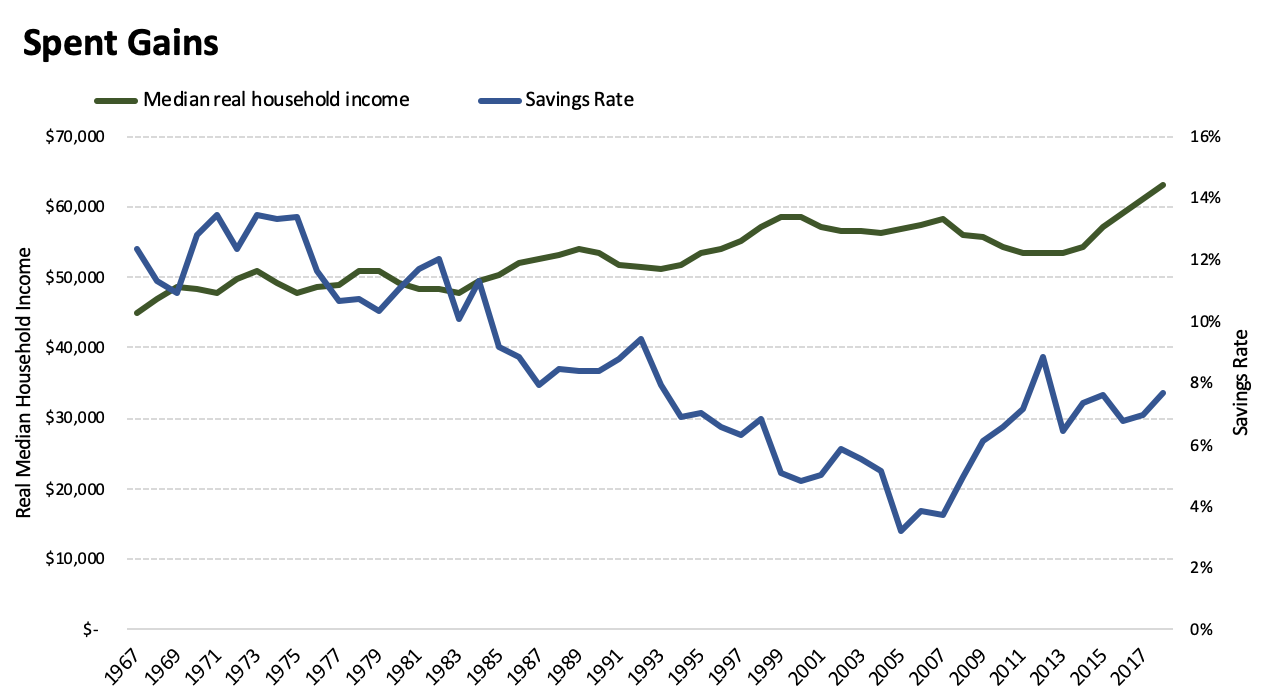

Here’s a short story of what happened over the last 50 years: Median inflation-adjusted incomes doubled and the savings rate was nearly cut in the half:

Source: Federal Reserve, Bureau of Labor Statistics.

The typical American family is earning more than ever before. But for many it probably doesn’t feel like that – at least as much as it should – because all of the income gains and then some have been offset with higher spending.

You could say higher spending is the goal. But all new luxuries become necessities in due time as expectations reset. I suspect part of the reason people don’t feel better off is because financial progress is better measured by wealth, not income. And wealth is just the accumulation of income you haven’t spent.

So a lot of people are the financial equivalent of the exerciser who burns 500 calories then immediately offsets it with dessert and is frustrated by the lack of progress despite working so hard.

To continue reading, please go to the original article here:

10 Mistakes That Deplete Your Wealth

.10 Mistakes That Deplete Your Wealth

Cynthia Measom Fri, February 18, 2022

Proper planning is crucial when it comes to your finances -- not only for the decisions that can affect your wealth now but also for those that will influence your bottom line long term. But knowing how to make the best financial decisions isn't innate. And if you don't fully understand how to manage your finances, you're likely to make mistakes that can take your net worth from well-cushioned to barely getting by -- or force yourself to stay stuck in a constant financial struggle.

The good news is that the longer you have until your target retirement date, the easier it will be to recover from financial blunders, but what if you could avoid money pitfalls altogether? Take a look at these 10 mistakes that deplete your wealth so you can sidestep them and achieve personal financial freedom.

10 Mistakes That Deplete Your Wealth

Cynthia Measom Fri, February 18, 2022

Proper planning is crucial when it comes to your finances -- not only for the decisions that can affect your wealth now but also for those that will influence your bottom line long term. But knowing how to make the best financial decisions isn't innate. And if you don't fully understand how to manage your finances, you're likely to make mistakes that can take your net worth from well-cushioned to barely getting by -- or force yourself to stay stuck in a constant financial struggle.

The good news is that the longer you have until your target retirement date, the easier it will be to recover from financial blunders, but what if you could avoid money pitfalls altogether? Take a look at these 10 mistakes that deplete your wealth so you can sidestep them and achieve personal financial freedom.

Proper planning is crucial when it comes to your finances -- not only for the decisions that can affect your wealth now but also for those that will influence your bottom line long term. But knowing how to make the best financial decisions isn't innate. And if you don't fully understand how to manage your finances, you're likely to make mistakes that can take your net worth from well-cushioned to barely getting by -- or force yourself to stay stuck in a constant financial struggle.

The good news is that the longer you have until your target retirement date, the easier it will be to recover from financial blunders, but what if you could avoid money pitfalls altogether? Take a look at these 10 mistakes that deplete your wealth so you can sidestep them and achieve personal financial freedom.

Investing Blindly

Brian Stivers, investment advisor and founder of Stivers Financial Services, said that one of the biggest mistakes that depletes wealth is investing in areas you have no experience in or don't truly understand.

"The media and internet are filled with fringe investments that promise great wealth with little risk," he said. "Yet, many of these are extremely aggressive and have a substantial downside. It is important for those who are accumulating wealth or have already accumulated wealth to make sure they fully understand the risk involved in any new investment and how that investment works. For most investors, it makes more sense to stay with traditional investment strategies that are easy to understand and have a long track record of success."

Making Investments Based on Emotion

"Investing is emotional given the fact that money is at stake, but investors must control those emotions and aim to act on reason and rationality," said Jason Dall'Acqua, CFP(r) and president of Crest Wealth Advisors.

"Unfortunately, people tend to make investment decisions that are against their own best interests strictly for emotional reasons. The most common example is chasing trends, which results in buying high or being panic-stricken during a market decline, which results in selling low. These decisions can have a significant negative impact on long-term investment returns."

To continue reading, please go to the original article here:

What Is A Multicurrency Account, And Should You Get One?

.What Is A Multicurrency Account, And Should You Get One?

Spencer Tierney Tue, February 15, 2022,

You might need a more global account for certain banking needs. That’s where a multicurrency account comes in. How it works, and other options that may work better for you

The minute you use your U.S. debit card or bank account abroad, your wallet may feel the impact. You may incur foreign transaction and ATM fees. Or your bank may decline debit card purchases if it doesn’t know you’re traveling. If you live or have close connections outside the U.S., you might need a more global account for certain banking needs. That’s where a multicurrency account comes in. Here’s how it works and how to know if one’s right for you.

What Is A Multicurrency Account, And Should You Get One?

Spencer Tierney Tue, February 15, 2022,

You might need a more global account for certain banking needs. That’s where a multicurrency account comes in. How it works, and other options that may work better for you

The minute you use your U.S. debit card or bank account abroad, your wallet may feel the impact. You may incur foreign transaction and ATM fees. Or your bank may decline debit card purchases if it doesn’t know you’re traveling. If you live or have close connections outside the U.S., you might need a more global account for certain banking needs. That’s where a multicurrency account comes in. Here’s how it works and how to know if one’s right for you.

What is a multicurrency account?

A multicurrency account is typically an account at a bank or financial tech firm that lets you spend, receive and hold multiple currencies. It can work like an international checking account with multiple subaccounts, each with a different currency. This lets you manage payments in a foreign currency instead of opening a new bank account overseas.

“Credit cards and multicurrency accounts allow you to spend as a local, but only multicurrency accounts allow you to quickly transfer and receive money,” says Leyla Beriker, product owner of U.S. payments at Revolut.

Most multicurrency accounts — also called foreign currency accounts — are reserved for businesses and high net worth individuals through international or private banking services at banks such as Citibank C, -0.07% and HSBC HSBC, -0.69%. Two notable exceptions are Wise WPLCF, -0.74% and Revolut, two fintech companies that offer multicurrency accounts for the general public and businesses.

When to choose a multicurrency account

1. You live or work outside the U.S.

A multicurrency account can be an easy way to avoid currency conversions every time you make a transaction. This removes the uncertainty in cost from constant exchange rate fluctuations.

To continue reading, please go to the original article here:

Where To Invest Your Money When Inflation Is High — and What Investments To Avoid

.Where To Invest Your Money When Inflation Is High — and What Investments To Avoid

Vance Cariaga Mon, February 14, 2022

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

Where To Invest Your Money When Inflation Is High — and What Investments To Avoid

Vance Cariaga Mon, February 14, 2022

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

As the BBC reported in May 2021, consumer prices in the U.S. rose 4.2% during the 12 months ending in April, which was the biggest increase since September 2008. Higher prices for cars and food drove much of the increase. When prices push higher, your money doesn’t go as far — especially for those on fixed incomes, like retirees. Rising prices also bring the threat of higher interest rates, which tend to drag down equities, CNBC reported.

So where should you put your money?

First off, if you have investments in stocks, don’t start panicking just yet. It’s still too early to know if the U.S. is headed for an extended period of inflation or if the current situation is a temporary blip caused by COVID-19 restrictions and lockdowns.

Moreover, financial experts point out that historically, stocks tend to do well even during periods of inflation. CNBC referenced comments from Steve Hanke, a professor of applied economics at Johns Hopkins University, who said the average annual return on stocks between 1990 and 2017 was 11%. Even when you factor in the cost of inflation, the average annual return was 8%.

Before looking at the best investments during inflation, it’s a good idea to know which ones to avoid. Experts interviewed by CNBC say you should shy away from long-term bonds and certificates of deposit, because buying them during periods of inflation means you might miss out on higher rates later. Short- to intermediate-term bonds are a better choice.

You might also want to avoid growth stocks, which are companies with above-average expected earnings, during inflation. Alex Doll, president of Anfield Wealth Management in Cleveland, told CNBC that growth stocks “tend to perform worse because they expect to earn the bulk of their cash flow in the future. And as inflation increases, those future cash flows are worth less.”

In terms of investments that make good hedges against inflation, Business Insider listed the following:

To continue reading, please go to the original article here:

https://finance.yahoo.com/news/where-invest-money-inflation-high-200001918.html

Where To Invest Your Money When Inflation Is High — and What Investments To Avoid

.Where To Invest Your Money When Inflation Is High — and What Investments To Avoid

Vance Cariaga Mon, February 14, 2022

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

Where To Invest Your Money When Inflation Is High — and What Investments To Avoid

Vance Cariaga Mon, February 14, 2022

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

Inflation fears in the United States have many Americans thinking about how to protect their money against rising prices and higher costs of living. This requires strategizing on which investments to gravitate toward — and which to avoid.

As the BBC reported in May 2021, consumer prices in the U.S. rose 4.2% during the 12 months ending in April, which was the biggest increase since September 2008. Higher prices for cars and food drove much of the increase.

When prices push higher, your money doesn’t go as far — especially for those on fixed incomes, like retirees. Rising prices also bring the threat of higher interest rates, which tend to drag down equities, CNBC reported.

So where should you put your money?

First off, if you have investments in stocks, don’t start panicking just yet. It’s still too early to know if the U.S. is headed for an extended period of inflation or if the current situation is a temporary blip caused by COVID-19 restrictions and lockdowns.

Moreover, financial experts point out that historically, stocks tend to do well even during periods of inflation. CNBC referenced comments from Steve Hanke, a professor of applied economics at Johns Hopkins University, who said the average annual return on stocks between 1990 and 2017 was 11%. Even when you factor in the cost of inflation, the average annual return was 8%.

Before looking at the best investments during inflation, it’s a good idea to know which ones to avoid. Experts interviewed by CNBC say you should shy away from long-term bonds and certificates of deposit, because buying them during periods of inflation means you might miss out on higher rates later. Short- to intermediate-term bonds are a better choice.

To continue reading, please go to the original article here:

https://finance.yahoo.com/news/where-invest-money-inflation-high-200001918.html

One Of The Best Pieces Of Advice I Ever Heard

.One Of The Best Pieces Of Advice I Ever Heard

Notes From The Field By Simon Black February 15, 2022

Thursday, November 29, 2001 felt like any other day in Argentina. People woke up, went to work, and lived their lives. There was nothing really unusual about that day, everything seemed fine. Sure, Argentina’s economy had been in a severe recession for three years, so life was difficult. But it was still normal. By the end of the day, however, a major bank run had started in the country, and life changed forever.

For years, up to that point, Argentina had pegged its currency at a 1:1 rate to the US dollar; this meant that anyone holding local currency could freely convert their Argentine pesos to US dollars. The government’s goal behind this scheme was to reign in inflation and demonstrate that their currency was strong. And it worked for a few years.

One Of The Best Pieces Of Advice I Ever Heard

Notes From The Field By Simon Black February 15, 2022

Thursday, November 29, 2001 felt like any other day in Argentina. People woke up, went to work, and lived their lives. There was nothing really unusual about that day, everything seemed fine. Sure, Argentina’s economy had been in a severe recession for three years, so life was difficult. But it was still normal. By the end of the day, however, a major bank run had started in the country, and life changed forever.

For years, up to that point, Argentina had pegged its currency at a 1:1 rate to the US dollar; this meant that anyone holding local currency could freely convert their Argentine pesos to US dollars. The government’s goal behind this scheme was to reign in inflation and demonstrate that their currency was strong. And it worked for a few years.

But eventually the convertibility became unsustainable. As more and more businesses and individuals converted their pesos into dollars, the government started running out of dollars.

So they went into debt.

Argentina’s government borrowed a mountain of US dollars from foreign investors, solely to maintain this artificial exchange rate. Nearly every dollar they borrowed was almost immediately exchanged for pesos, forcing the government to borrow even more dollars.

By November 2001 the situation reached its crisis moment; large depositors became spooked that the heavily indebted government was about to break the unsustainable exchange rate and devalue the peso. So they started withdrawing their money and converting into dollars.

Panic quickly set in. The next day, Friday November 30th, everyone in the country was rushing to get their money out and convert to dollars.

Then it happened: the next morning, on Saturday December 1st, the government announced that they were freezing every bank account in the country in order to stop the panic.

Needless to say the bank freeze had the opposite effect. People went out into the streets to riot like never before. Workers went on strike. Looting and crime rates soared. Grocery store shelves emptied out.

The government quickly deployed federal forces to quell violence and restore order, but the ‘mostly peaceful’ protests continued.

By December 20th the situation was so untenable that the President resigned from office and was forced to escape the capital by helicopter.

The new President almost immediately defaulted on Argentina’s $132 billion national debt, and then devalued peso.

The whole episode took less than five weeks-- from November 29, when everything still felt ‘normal’, to early January 2002 when they had blood in the streets, looting, empty grocery shelves, frozen bank accounts, debt default, and a currency crisis.

My friend Marco was there for it. Originally from Argentina, Marco was studying at Harvard at the time, but he flew back to Buenos Aires to help his family.

He once told me a story about how he went with his father to the bank in December 2001, after the national freeze. Marco’s dad was holding his life’s savings in physical cash US dollars inside a safety deposit box at the bank.

They had to bribe a guard to let them in and access the box; Marco and his dad then stuffed bricks of cash down their pants, then escaped by making their way past the violent mob outside.

It’s not a situation anyone ever expects to find themselves in. Again, it had only been a few days prior that everything still felt normal. But then the unthinkable happened.

This shouldn’t be so far-fetched anymore. The last few years should have taught all of us that absolutely anything can happen. And just because something hasn’t happened yet doesn’t mean that it won’t happen.

Marco recently told me the best piece of advice his dad ever gave him. He said, “Son, learn English… and know how to swim. Because by the time you’re going to really need those skills, it will be too late.”

That’s incredible advice. But I would add to that list-- Have a Plan B! Because by the time you need one, it will be too late.

Marco’s father did have a Plan B; he was smart enough to realize that the exchange rate wouldn’t last, and that the government would freeze everyone’s bank account. So he held his savings in US dollar cash.

The flaw, of course, was that the money was still held inside of a bank building, in a safety deposit box. They were lucky to have been able to bribe their way into the bank.

A great Plan B covers a lot of ground. It ensures that, no matter what happens or doesn’t happen next, you’ll be in a position of strength. Critically-- a Plan B is NOT the same as having a bunker mentality.

I know there are a lot of people who are deeply concerned about the risks in the world and the astonishing erosion of individual liberty. And it’s natural that stressing out over those risks can prompt an emotional reaction, often resulting in a bunker mentality where people feel like they need to prepare for the end of the world.

The emotional response is understandable. But, rationally, the world is not coming to an end. And when you have a bunker mentality, you end up spending a lot of time, money, and energy wallowing in negativity and preparing for a very specific scenario that is extremely unlikely.

A bunker mentality is like having a REALLY expensive insurance policy on your home that will pay you out $1 BILLION… but only if your home gets struck by lightening.

Sure, if your house is struck by lightening you’ll clean up. But that specific insurance policy costs you a lot of money and misses 99.99999% of other potential risks.

A great Plan B, on the other hand, enables you to go on living your life with a lot more confidence that your risk exposure is greatly reduced across the board.

For example, if you’re concerned what our public health dictators will do the next time a new virus pops up, you might consider having a second residency in a country that’s more respectful to individual freedom. (You could even have a third, fourth, fifth, etc. residency to increase your options.)

If you’re concerned about the privacy, control, and censorship from Big Tech companies, you can stop using them. There are dozens of different options to set up your digital life in a way that reduces or eliminates Big Tech’s dominance over you.

And sure, if you’re concerned about thinning grocery store shelves and ongoing supply chain dysfunction, it doesn’t hurt to have some extra nonperishable food and water at home. Or even a small generator. But if those risks never really play out, you won’t be worse off for having taken those steps.

If the supply chain magically clears up, you won’t be worse off for having some extra food in your pantry, or tending a small garden. If the Big Tech companies suddenly embrace Free Speech, you won’t be worse off securing your data from them.

And you’ll hardly be worse off having another option where you and your family have the right to live, work, and visit whenever you want.

That’s the key difference in what makes a great Plan B: you’re not planning for the end of the world, or even a specific outcome. It’s about taking a rational view of obvious risks, and finding sensible, cost-effective ways to mitigate them.

And it’s definitely something you want to have as soon as possible. Because, just like knowing how to swim, by the time you need it, it will be too late.

Simon Black, Founder, SovereignMan.com

https://www.sovereignman.com/trends/one-of-the-best-pieces-of-advice-i-ever-heard-34643/

FEAR AND GREED

.FEAR AND GREED

Financial planning, Investment by Robert Lockie

Whenever somebody asks me why the stock market fell in value, I have a simple response. On that day, there were more sellers than buyers. If they ask why there were more sellers than buyers, I respond that there was more fear than greed.

Fear and greed are the two competing emotions which govern the behaviour of market participants and this applies regardless of the economic fundamentals which underpin the long-term performance of any investment. Uncertainty, whether economic, political or stock market, has always been with us and always will be as the future is unknown.

FEAR AND GREED

Financial planning, Investment by Robert Lockie

Whenever somebody asks me why the stock market fell in value, I have a simple response. On that day, there were more sellers than buyers. If they ask why there were more sellers than buyers, I respond that there was more fear than greed.

Fear and greed are the two competing emotions which govern the behaviour of market participants and this applies regardless of the economic fundamentals which underpin the long-term performance of any investment. Uncertainty, whether economic, political or stock market, has always been with us and always will be as the future is unknown.

Meanwhile, investors and other market participants are prone to various psychological biases and they must manage these in the context of such a background. The last couple of years remind us that even when the fundamentals look unfavourable, market prices can diverge significantly from this and produce strong returns.

In such circumstances, where substantial segments of the economy have effectively been shut down yet market returns have been positive, investors must have felt something of a conflict between their fear and greed. Failure to manage these forces effectively can have a material long-term impact on the decisions that they make and consequently their long-term financial security. A couple of examples may serve to illustrate this point.

Availability Bias

Availability bias is a phenomenon whereby people base their perception of risk on examples which they can easily recall when a subject is raised. For example, try asking someone how they would view the construction of a nuclear power plant near to their home. Most would recall one or more of the nuclear plant disasters of varying severity such as Fukushima, Chernobyl, Three Mile Island or Windscale.

The prospect of a radioactive leak occurring on the other side of their fence unsurprisingly is something which they prefer to avoid. Although (or maybe because) leaks of radioactive material are uncommon, when they do occur they feature as major news items and therefore attract a lot of attention.

Yet despite this nuclear power stations are generally reliable and produce no emissions of the greenhouse gases to which fossil fuel plants are prone. With the world moving towards greener sources of energy, a focus on such aspects might be thought to favour nuclear over traditional energy sources. However, the principal concern of many over nuclear energy is the safety aspect.

It may therefore come as a surprise to see that even with the fatalities from Fukushima and Chernobyl, as well as those from further upstream in the extraction and processing functions, the death rate from nuclear energy is among the lowest for power generation routes, being comparable with wind.

To continue reading, please go to the original article here: