.The 5 Secret Levels in the Game of Money

.The 5 Secret Levels in the Game of Money (and How to Beat Them…)

By The Money Wizard August 20, 2019

According to two of the planet’s most brilliant minds – Elon Musk, aka the real life Iron Man, and Neil deGrasse Tyson, a genius astrophysicist and NASA award winner – we’re all living in a simulation.

In other words, everything we see, feel, and experience in this wonderful world around us may all be nothing more than high tech computer code mixed with stunning graphics.

Yeah, I’m not quite sure I buy it either…

That said, the older I get, and the higher my net worth grows, the more I’m convinced of a somewhat similar concept: Money is nothing more than a real life video game.

And not just any game, either. “Money” might as well be the most complex Role Playing Game (RPG) ever developed.

Think about it. We each control a main character (ourselves) who we pilot through a timeline. We make decisions, build skills, and choose battles. As we progress through those pivotal moments, our character is either rewarded with income or penalized by the harsh reality of the system.

Make no mistake, the game of money is filled with levels to beat and bosses to conquer.

The 5 Secret Levels in the Game of Money (and How to Beat Them…)

By The Money Wizard August 20, 2019

According to two of the planet’s most brilliant minds – Elon Musk, aka the real life Iron Man, and Neil deGrasse Tyson, a genius astrophysicist and NASA award winner – we’re all living in a simulation.

In other words, everything we see, feel, and experience in this wonderful world around us may all be nothing more than high tech computer code mixed with stunning graphics.

Yeah, I’m not quite sure I buy it either…

That said, the older I get, and the higher my net worth grows, the more I’m convinced of a somewhat similar concept: Money is nothing more than a real life video game.

And not just any game, either. “Money” might as well be the most complex Role Playing Game (RPG) ever developed.

Think about it. We each control a main character (ourselves) who we pilot through a timeline. We make decisions, build skills, and choose battles. As we progress through those pivotal moments, our character is either rewarded with income or penalized by the harsh reality of the system.

Make no mistake, the game of money is filled with levels to beat and bosses to conquer.

But here’s the part that gets me so excited. By design, the structure of any game means that its prone to a step by step strategy that if followed, can progress beginners into experts.

So, what are the levels of the money game? How do I plan on beating them? And how can you too?

Level 1 – Building An Earnings Base

Level 1 begins how all games start. You choose a path, which sets the course for the rest of the journey.

Start - how to beat the money game

In the game of money, this most often relates to choosing a career field.

Most game players attack this level by strategically choosing a high paying college major.

MBA graduates and CPA holders call this part of the game “building an earnings floor.” With enough credentials behind their names, they all but ensure a specific salary for the rest of their working life.

In a way, I did something similar. By graduating with a degree in Finance and a second degree in Economics for good measure, I’ve essentially “floored” my earnings at entry level finance work.

Given that entry level bankers earn about $50K a year, it’s extremely unlikely my salary would ever drop below this, barring a complete implosion of the financial system. (Which, frighteningly, seems less impossible by the day. Just more reason to keep leveling up!)

Of course, a high paying major isn’t the only way to move on. Even a lower paying degree mixed with a lot of passion can be enough to give you the edge needed to beat this level.

Other game players go a different route entirely – choosing to go to trade school or learning an intangible skill, like sales.

In either case, the goal is always the same – taking care of your base, and then eventually, using that base to springboard into more and more income.

Level 2 – Expanding The Base

This is the part of the game when you’re grinding.

From wikipedia:

‘In video gaming, grinding is performing repetitive tasks, usually for gameplay advantage… The general use of grinding is for “experience points”, or to improve a character’s level.”

Sound familiar?

Those first few years at your career, when you’re:

1. Doing tons of grunt work

2. Building your reputation as a hard worker

3. Schmoozing the bosses and playing office politics

You’re grinding!

To continue reading, please go to the original article at

.What I Learned From Having My Mind Manipulated

.Notes From The Field By Simon Black

September 23, 2019 Las Vegas, Nevada

What I Learned From Having My Mind Manipulated This Weekend

There are few times in life when you have the opportunity to witness a master at work… someone who is truly the best in the world at what they do.

Whether it’s the world’s greatest chef, a champion athlete, a master pianist, or even the guy who holds the world record for being able to recite the first 70,000 digits of Pi, it’s always exciting to see the best at work.

Apollo Robbins is the best in the world at what he does.

Apollo has been called a lot of things: magician, illusionist, mentalist, and even ‘gentleman thief’. But he’s best described as a master of the human mind… and unparalleled expert in manipulating it.

I’ll give you a great example—

Notes From The Field By Simon Black

September 23, 2019 Las Vegas, Nevada

What I Learned From Having My Mind Manipulated This Weekend

There are few times in life when you have the opportunity to witness a master at work… someone who is truly the best in the world at what they do.

Whether it’s the world’s greatest chef, a champion athlete, a master pianist, or even the guy who holds the world record for being able to recite the first 70,000 digits of Pi, it’s always exciting to see the best at work.

Apollo Robbins is the best in the world at what he does.

Apollo has been called a lot of things: magician, illusionist, mentalist, and even ‘gentleman thief’. But he’s best described as a master of the human mind… and unparalleled expert in manipulating it.

I’ll give you a great example—

Apollo was my personal guest at our annual Total Access meetup in Las Vegas over the weekend; and on Friday night during a cocktail reception, he wandered through the crowd performing various tricks to educate and entertain our members.

And in one particular case, I was the Guinea pig.

Apollo asked me to think of any four letter word, as well as the hour and minute of random time of day (like 2:15 or 11:40), and write both of them down on a piece of paper.

Now, there are approximately 5,000 four letter words in the English language, and 720 different timestamps I could have chosen from 12:00 through 11:59.

So between the two, that makes a total of roughly 3.6 million different combinations, meaning Apollo would have had a 0.0000277% chance of guessing both right.

Those odds are so low he had a better chance of being struck by lightning.

Apollo and I started talking about my selections and he asked me if I felt the choices were mine, and mine alone.

I absolutely did. I picked my word. I picked the time. In fact, just to be sure that I wasn’t being manipulated, I chose my word by selecting from random letters.

There was a tree nearby, so I chose a T. A hotel worker was carrying a bottle of water to one of our members, so I picked W. A person standing nearby me was named Steve, so I chose an S. I picked a random vowel (‘A’) and then arranged the letters into a word.

There’s no way Apollo would have known any of those things—where we would have been standing, who would have been nearby, or how I would have even randomly selected my letters. And he acknowledged this later… he had no idea.

As for the random time that I selected, I chose 7:22, based on dialogue in a scene from the movie Pulp Fiction (which was released 25 years ago today).

Again, there’s no way Apollo would have known that. We’d never discussed it, and I don’t think he had even seen the movie.

So I was convinced my choices were 100% mine, and mine alone.

Yet Apollo opened his wallet and pulled out a small, folded photograph of his bedside table.

Sure enough—the photo showed a notepad on his nightstand with a single, four-letter word written on it. And it was the one that I picked.

There was also a clock on the nightstand showing a time of 7:22. And it was seriously spooky.

Most people’s first reaction is to presume that Apollo is some sort of space alien, time traveler, or visitor from an alternate universe.

But he’s none of those things. He’s a practiced master of the human mind, including the ability to manipulate it.

To continue reading, please go to the original article at

.How Much Money Do You Need To Feel Wealthy?

.How Much Money Do You Need To Feel Wealthy?

By RETIREBYFORTY

Last time, I asked – Can YOU become a millionaire? Incredibly, 95% of voters picked yes. That’s awesome, I love it! It really isn’t that hard to become a millionaire in the U.S. if you make at least a median household income of $60,000/year. You just have to commit to saving and you’ll get there.

The point of the previous post was for you to pick yes. Unfortunately, a million dollars doesn’t go as far as it used to. Most people don’t even consider a million dollars wealthy anymore. So how much money do you need to feel wealthy? Let’s check it out.

*This post was originally written in 2013. I’ve updated and expanded it with the latest info. I hope you enjoy this one.

How much money do you need to feel wealthy?

$3 million+ (28%, 555 Votes)

$5 million+ (26%, 529 Votes)

$10 million+ (29%, 579 Votes)

$100 million!!! (7%, 147 Votes)

2-3 times what you have now (3%, 69 Votes)

Total Voters: 2,007

How Much Money Do You Need To Feel Wealthy?

By RETIREBYFORTY

Last time, I asked – Can YOU become a millionaire? Incredibly, 95% of voters picked yes. That’s awesome, I love it! It really isn’t that hard to become a millionaire in the U.S. if you make at least a median household income of $60,000/year. You just have to commit to saving and you’ll get there.

The point of the previous post was for you to pick yes. Unfortunately, a million dollars doesn’t go as far as it used to. Most people don’t even consider a million dollars wealthy anymore. So how much money do you need to feel wealthy? Let’s check it out.

*This post was originally written in 2013. I’ve updated and expanded it with the latest info. I hope you enjoy this one.

How much money do you need to feel wealthy?

$3 million+ (28%, 555 Votes)

$5 million+ (26%, 529 Votes)

$10 million+ (29%, 579 Votes)

$100 million!!! (7%, 147 Votes)

2-3 times what you have now (3%, 69 Votes)

Total Voters: 2,007

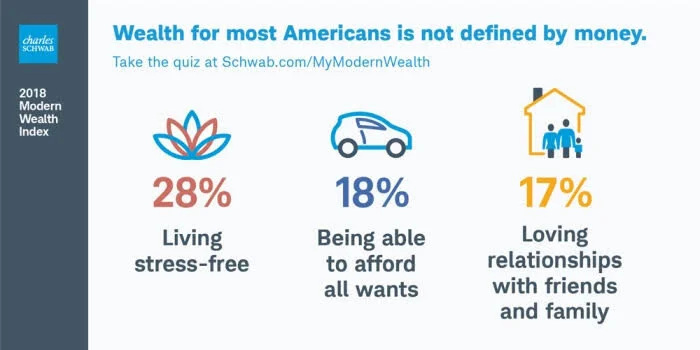

Wealth Isn’t All About Money

Of course, wealth isn’t all about money. Health, relationships, freedom, and happiness are all integral parts of wealth. Money won’t make you feel wealthy if you’re missing some of these. When asked about wealth in Charles Schwab’s 2018 Modern Wealth Index survey, two of the top three answers weren’t related to money.

Wealth Not All About Money

Those things are more difficult to measure, though because they are all subjective. We all have different definitions of happiness. My happiness doesn’t necessarily match yours.

In fact, I think the pursuit of happiness is misguided. We can’t measure those other things, so we’ll just focus on the money today. It’s way easier to figure out net worth than happiness.

When asked to focus on just the money, respondents said it takes $2.4 million to be considered wealthy.

I Don’t Feel Wealthy

Really, $2.4 million? That seems a tad low to me. Our net worth is over that line and I don’t feel rich at all. The problem is the survey is meant to be representative of the US population.

That means most of those surveyed are not millionaires. $2.4 million sounds like a lot of money to regular people, but millionaires don’t consider that wealthy.

Being wealthy is actually a moving target. It turns out most people need twice or more of their current net worth to feel wealthy. If someone is worth $5 million, they would say wealthy means $10 million. That’s pretty funny, isn’t it?

The 2x wealth corollary is pretty much spot on for me. When I wrote this in 2013, our net worth was about $1.5 million. I thought we’d feel wealthy when our net worth reaches $3 million.

Today, I think $3 million is merely comfortable, not wealthy. Like I said, it’s a moving target. However, I’m pretty sure I’ll feel wealthy when we hit $5 million…

UBS Wealth Study

To back up my $5 million = wealthy theory, here is a wealth study from UBS in 2013. It’s a bit older, but investors agreed that wealth isn’t just about having a certain amount of money.

The majority of investors define wealth as having no financial constraints on what they do. But when asked to assign a dollar amount to being wealthy, they say it takes $5 million.

This study targeted investors so the results skewed a bit higher. Investors surveyed were older than 25 years old and have at least $250,000 in investable assets; half have at least $1 million in investable assets. This group is doing a lot better than the average American household.

To continue reading, please go to the original article at

.Can You Become A Millionaire?

.Can You Become A Millionaire?

By RETIREBYFORTY

Recently, I saw a question on Twitter – Can anyone become a millionaire? My gut instinct said yes. I was sure anyone can become a millionaire if they just save and invest consistently. Inflation alone will make the millionaire status much easier to attain in 30 years.

Everyone will make a lot more money so it shouldn’t be that hard. That was my reply. However, there were a few dissenting opinions. I didn’t have any research to back it up so I didn’t argue and let it go.

Today, we’ll take a closer look and see if anyone can really become a millionaire. First, we’ll crank some numbers and then look at the psychological side of this question.

Median income

Let’s look at the average case first to see if they have a chance to become a millionaire. We’ll call our average family the Joneses. The median household income in the US is about $60,000 per year. Median household income means that half of the population makes more than this and half makes less. It’s the middle line.

That’s how much the Joneses make. If the Joneses save and invest consistently, can they become millionaires?

Can You Become A Millionaire?

By RETIREBYFORTY

Recently, I saw a question on Twitter – Can anyone become a millionaire? My gut instinct said yes. I was sure anyone can become a millionaire if they just save and invest consistently. Inflation alone will make the millionaire status much easier to attain in 30 years.

Everyone will make a lot more money so it shouldn’t be that hard. That was my reply. However, there were a few dissenting opinions. I didn’t have any research to back it up so I didn’t argue and let it go.

Today, we’ll take a closer look and see if anyone can really become a millionaire. First, we’ll crank some numbers and then look at the psychological side of this question.

Median income

Let’s look at the average case first to see if they have a chance to become a millionaire. We’ll call our average family the Joneses. The median household income in the US is about $60,000 per year. Median household income means that half of the population makes more than this and half makes less. It’s the middle line.

That’s how much the Joneses make. If the Joneses save and invest consistently, can they become millionaires?

Here are my assumptions

The Joneses will receive a 3% raise every year. This really isn’t much. It’s barely beating inflation, which is around 2%. I assume the Joneses will keep their saving rate steady. When they get any annual raises, they’ll save a bit more.

They’ll invest in the stock market and generate 8% return every year.

I’ll graph it out. We’ll see how long it’ll take the Joneses to reach millionaire status with different saving rates.

Ha! It is as I suspected. The Joneses can become millionaires in 31 years if they religiously save 10% of their income. The more they save, the faster they’ll become a millionaire.

Saving Rate Millionaire in

10% 31 years

20% 23 years

30% 20 years

40% 17 years

50% 15 years

From this table, it looks to me like anyone who makes median income AND is under 30 can easily become a millionaire. Saving 10% really isn’t that difficult at that level of income.

Of course, I recommend saving much more than that in order to achieve financial independence in a reasonable timeframe. You really should aim to save 50% of your income.

To continue reading, please go to the original article at

.The Secret to Building Wealth – Buy Assets

.The Secret to Building Wealth – Buy Assets

By RETIREBYFORTY

The Secret to Building Wealth

The secret to building wealth – Buy Assets and Avoid Liabilities. The first time this became clear to me was when I read Rich Dad Poor Dad by Robert Kiyosaki. The book is an easy read, but it has many flaws*. If you haven’t read it yet, I encourage you to check it out from the library and give it a quick read.

However, you need to take the book with a grain of salt and don’t blindly follow it 100%. You’ll have to separate the good advice from the bad. The biggest takeaway I got from Rich Dad Poor Dad is how to differentiate between assets and liabilities. It turns out, I had it wrong for years.

Once I learned that lesson, building wealth became much smoother. It makes a lot more sense to accumulate assets and avoid liabilities.

The Secret to Building Wealth – Buy Assets

By RETIREBYFORTY

The Secret to Building Wealth

The secret to building wealth – Buy Assets and Avoid Liabilities. The first time this became clear to me was when I read Rich Dad Poor Dad by Robert Kiyosaki. The book is an easy read, but it has many flaws*. If you haven’t read it yet, I encourage you to check it out from the library and give it a quick read.

However, you need to take the book with a grain of salt and don’t blindly follow it 100%. You’ll have to separate the good advice from the bad. The biggest takeaway I got from Rich Dad Poor Dad is how to differentiate between assets and liabilities. It turns out, I had it wrong for years.

Once I learned that lesson, building wealth became much smoother. It makes a lot more sense to accumulate assets and avoid liabilities.

* There are many problems with Rich Dad Poor Dad. Mr. Kiyosaki is a great motivational speaker and salesman. That’s how he made his fortune. His books are designed to sell more books, courses, and seminars. Don’t fall for the seminars!

They are expensive and not very useful. You can learn a lot more for free on the internet and the library. I recommend reading The Millionaire Next Door and Your Money Or Your Life before Rich Dad.

Assets and Liabilities

Like most people, I used to think assets mean anything that has a cash value. However, that’s not the right way to look at it. If you want to become wealthy, you need to think of your household finance as a business. An asset is something that, in the future, can generate cash flow for you. Assets make money. Anything that takes money out of your pocket is a liability.

This was a revelation to me. I used to include our home, car, piano, and other personal belonging in the asset column. That’s the wrong way to look at it. All these things are liabilities. It changes how I think about spending. In my 20s, I felt great when I purchased our BMW convertible because I thought it was an asset. Now I know it’s a liability. That’s why I’ll never buy another luxury car as long as I’m building wealth. Once you think about assets and liabilities this way, it is much easier to build passive income.

Let’s take a look at some “assets.”

House

I’m sure you’ve heard that your home is your biggest asset. Is this really true? When you buy a house, you’ll have to pay the mortgage, property tax, HOA, insurance, utilities, repair and maintenance, yard work, and furnish it. That’s a lot of $$$ going out of your pocket every month.

Sure, the house can appreciate, but would the appreciation be enough to surpass all the expenses? That’s not always true. We purchased our 2 bedroom condo in 2007 and sold it 12 years later. The sale price was was just $1,000 over what we paid in 2007.

Add all the other expenses up and we lost a ton of money from living in that condo. We came out a bit ahead compared to renting, but not by much. Anyway, we all need a place to live and a house is great, but it isn’t really an asset.

A house is good because it forces people to save. A portion of the mortgage payment goes to the principal and you’ll get that back when you sell. We collected $140,000 after we sold our condo.

It’s nice to have a lump sum in the bank. Most people use this as a downpayment for the next home, but we didn’t need it because we moved into our rental duplex. I’ll invest the $140,000 in CrowdStreet and dividend stock.

There is one way to generate some money from your house – rent out the extra rooms! We used to rent out the extra room at our old home to new engineers. This worked out great. They were never home and the rent helped pay our mortgage. Renting out an extra room is even more lucrative today with Airbnb.

Lots of people are making extra money with it. This really depends on your personal situation, though. Most people value their privacy too much to rent out the extra room.

*Update* We moved into our rental duplex. We live in one unit and rent the other one out. It’s been great so far. Our housing expense dropped significantly. This is a really good house hack.

Car

For many people, their car is the second most valuable thing they own (next to the house). A car is a necessity to most people and it costs a lot of money. However, it’s not an asset. It’s even worse than your house because a car depreciates every day and you also need to buy gas.

A car is basically a money pit. How much money do you spend on your car every month? Can you imagine investing that money instead? Most of us need a car to go to work and run errands.

It’s an unavoidable expense almost everybody. However, I don’t think anyone should buy a luxury car unless they are already wealthy. I’ll buy another convertible someday, but it can wait until I’m rich.

Everything else you own

To continue reading, please go to the original article at

.Triggers To Hack Your Life and Money

.20+ Triggers to Hack Your Life & Money

By J. MONEY -

One year ago I picked up a large, 8 cup, water bottle to help force me to drink more water, and after staring at it day in and day out I’m proud to say I’m still going strong and hydrating my body :)

It’s rare stuff like this sticks, but according to my psychology loving friend James Clear, this is the power of “physical triggers.” Items in our life that remind us to do, or think, something specific. Every time I see this large ass bottle sitting on my desk I’m reminded to keep drinking!

We’ve blogged about these triggers before, and how I’m also obsessed with sticky notes which are my all-time favorite triggers (the current one I have on my computer screen simply says “lifestyle” to remind me of why* I blog and work so hard online), but after seeing this email from a new reader of the site, it reminded me to share some others I’ve since come across as well.

Here’s what Janice sent me:

“I love the little games we play with ourselves to motivate. Right now I am working on getting rid of my Starbucks addiction. Every morning that I don’t get one, I drop a $5.00 bill into a big glass jar next to my desk so that I can visually see what I am saving. Silly but effective! Once it is full, I will deposit the money into savings and start over.”

20+ Triggers to Hack Your Life & Money

By J. MONEY -

One year ago I picked up a large, 8 cup, water bottle to help force me to drink more water, and after staring at it day in and day out I’m proud to say I’m still going strong and hydrating my body :)

It’s rare stuff like this sticks, but according to my psychology loving friend James Clear, this is the power of “physical triggers.” Items in our life that remind us to do, or think, something specific. Every time I see this large ass bottle sitting on my desk I’m reminded to keep drinking!

We’ve blogged about these triggers before, and how I’m also obsessed with sticky notes which are my all-time favorite triggers (the current one I have on my computer screen simply says “lifestyle” to remind me of why* I blog and work so hard online), but after seeing this email from a new reader of the site, it reminded me to share some others I’ve since come across as well.

Here’s what Janice sent me:

“I love the little games we play with ourselves to motivate. Right now I am working on getting rid of my Starbucks addiction. Every morning that I don’t get one, I drop a $5.00 bill into a big glass jar next to my desk so that I can visually see what I am saving. Silly but effective! Once it is full, I will deposit the money into savings and start over.”

Nice and simple right? And even though I’m a huge fan of spending money on things that make you happy like especially coffee (so long as it’s budged for and a priority!), the idea here is pretty solid. And can easily be used to curb other splurges as well.

Here are a handful of other money triggers that might help too:

Big thanks to everyone who shared these with me at some point over the past handful of months! Some really REALLY good ones here :)

Password Trigger: “Make your passwords a goal you want to accomplish so every time you log into your laptop, download an app, etc. you’re reminded of a different goal you have set for yourself. BEdebtFREE!2016, DEC15FinishBook, DrinkH20NowJ$ :)” – Heather Stephens

Pile of Crap Trigger: “When I was in credit card debt and realized what I was doing, I piled up all of the crap I bought onto my bed and took a picture of it all. Then I carried that picture in my wallet. Whenever I wanted to buy something I saw that picture and it made me think, “is this just going to end up on the pile of crap that I don’t even use/wear?” It really helped me a lot.” – Jon @ Money Smart Guides

Parking Lot Trigger: “My parking spot at work is a trigger to check my goals before entering the building” – Catina Mount

Savings Graph Trigger: “This kind of physical graph is a very powerful tool to help you achieve any of your goals, having them in front of you every day. I find it way more powerful than digital graphs because it is tangible. The target is to be always on track with the pink line (or above!) if we want to own our home in 3 years. I do update our stash amount every month and this is great to see the black curve trying to keep up with the pink one.” – Mustachian Post

Net Worth Text Message Trigger: “I run a quick net worth calc each afternoon and text the wife the day’s number. It keeps her focused on the goal.” – @Andrew_Dad

Blackberry Trigger: “I have a recurring weekly reminder on my Blackberry that pops up to tell me to “Save Money”. I only set it a few months ago, but it seems to help me stay focused.” – Weenie

Comparison Trigger: “I always have this quote on my computer screen, “Never compare yourself to anyone; you are only comparing your worst to their best.” It really helps me put things into perspective especially after a long hard day. – Christine @ ThePursuitofGreen

Financial Independence Trigger: “Today, I have my financial independence number all over the house. It’s taped to my computer monitor, on my message board on my wall and in my bathroom on the mirror. I see it all the time and it reminds me to keep pushing ahead to reach my goals.” – Jon @ Money Smart Guides

early retirement calculator

To continue reading, please go to the original article at

https://www.budgetsaresexy.com/financial-triggers-grow-your-money/

.The Truth About Rvs

.The Truth About Rvs

By Andrew Zaleski Sep 18, 2019, 8:00am EDT

Illustrations by Zack Rosebrugh

“You’re not going to buy an RV and drive it off the lot and have no hassles”

Deep dives on cities, architecture, design, real estate, and urban planning.

In 2018, Tom and Becky Olesh were living their best lives. They lived permanently aboard the Winnebago motorhome they purchased from a dealer for about $140,000. Crisscrossing the country in a house on wheels was nothing new to the Oleshes; they had spent nearly five years on the road.

And for two decades before that, 78-year-old Tom and 61-year-old Becky had owned all kinds of RVs: tag-along travel trailers, towable camper vans, even diesel motorhomes.

Experienced RV owners well acclimated to the lifestyle, the Oleshes knew what they were doing—which made what happened in their brand new Winnebago that much more of a surprise.

“The suspension was really bad,” Tom says. “Whenever we went over 45 miles per hour on a two-lane road, it was a challenge to keep it on the road.”

The Truth About Rvs

By Andrew Zaleski Sep 18, 2019, 8:00am EDT

Illustrations by Zack Rosebrugh

“You’re not going to buy an RV and drive it off the lot and have no hassles”

Deep dives on cities, architecture, design, real estate, and urban planning.

In 2018, Tom and Becky Olesh were living their best lives. They lived permanently aboard the Winnebago motorhome they purchased from a dealer for about $140,000. Crisscrossing the country in a house on wheels was nothing new to the Oleshes; they had spent nearly five years on the road.

And for two decades before that, 78-year-old Tom and 61-year-old Becky had owned all kinds of RVs: tag-along travel trailers, towable camper vans, even diesel motorhomes.

Curbed on campers, RVs, and more:

Experienced RV owners well acclimated to the lifestyle, the Oleshes knew what they were doing—which made what happened in their brand new Winnebago that much more of a surprise.

“The suspension was really bad,” Tom says. “Whenever we went over 45 miles per hour on a two-lane road, it was a challenge to keep it on the road.”

The trailers and camper vans they used to own tended to bounce up and down as they drove, a symptom of their leaf spring suspension systems, which is why they switched to a motorhome.

Tom and Becky anticipated suspension that more closely mirrored that of an automobile: some bouncing, but certainly less than their previous units. Instead, they shelled out $2,500 to outfit their new RV with additional suspension.

The rule, typically, is don’t buy a new RV. If you buy a new RV, you’re going to be sitting in a dealership for two years getting it fixed.

Not since the years before the Great Recession has the market for recreational vehicles in the U.S. been quite as hot as it is now. In 2017, for the first time in more than 40 years—and for the first time since the main industry group, the Recreation Vehicle Industry Association, has kept track—American RV manufacturers moved more than 500,000 units from their factories to the roughly 2,600 RV dealerships across the country.

Since those record-high production numbers, the overall RV market has cooled a bit. More than 482,000 units were sold last year, which is about 20,000 fewer RVs than in 2017, but still well above the fewer than 170,000 RVs being sold at the peak of last decade’s recession.

Despite shipments of RVs to dealers dropping about 20 percent so far this year compared to 2018, industry professionals remain optimistic about growth and predict shipments will increase in 2020.

But as the Oleshes found when they bought a new motorhome, dueling forces are shaping the current RV market. A buoyant economy coupled with rising interest in the nomadic lifestyle led to a rebound in the RV industry.

The comeback is as much due to millennials as it is to a retiring generation of baby boomers: Of 78.8 million households that hit the great outdoors at least once in 2018, the kids routinely blamed for their poor adulting skills and love of fancy toast made up 41 percent of campers.

At the same time, stories abound—in forums, recall blogs, personal testimonies ,industry publications, and talk radio—of disgruntled owners of RVs who purchased a unit only to immediately about-face the vehicle to a dealership to fix a problem.

“I’ve had people tell me they’ve bought a brand-new RV, drove it off the lot in a rainstorm, and it started leaking,” says Steve Lehto, a consumer protection attorney in Michigan who has handled his fair share of lawsuits for owners of allegedly defective RVs. (There are more than 600,000 views of his “Don’t Buy An RV!” YouTube video.) https://www.youtube.com/watch?v=IP_u2JR51_Y

To continue reading, please go to the original article at

https://www.curbed.com/2019/9/18/20870828/rv-camper-repairs-poor-quality

.To Gift or Not to Gift

.To Gift or Not to Gift

By TRACY CRAIG, FELLOW, ACTEC, AEP®, Partner and Chair of Trusts and Estates Group | Mirick O'Connell September 10, 2019

Sometimes it can be wise (or just pleasurable) to give your assets away while you're still alive.

In estate planning, giving away assets during your lifetime has traditionally been used to help lower estate taxes when you die. However, the federal estate tax exemption amount (the amount under which federal estate taxes do not apply) is currently $11.4 million per person and has been increasing each year due to inflation indexing, so federal estate taxes only apply to 0.1% of people.

The federal exemption amount is scheduled to fall to approximately $6 million (when taking into account future estimated increases for inflation) per person in 2026 (unless Congress changes the law), and even then only about 0.2% of people will be affected.

So, while taking action to avoid federal estate taxes is not necessary for over 99% of the population, there are at least three reasons why gifting may still make sense for you and your family:

To Gift or Not to Gift

By TRACY CRAIG, FELLOW, ACTEC, AEP®, Partner and Chair of Trusts and Estates Group | Mirick O'Connell September 10, 2019

Sometimes it can be wise (or just pleasurable) to give your assets away while you're still alive.

In estate planning, giving away assets during your lifetime has traditionally been used to help lower estate taxes when you die. However, the federal estate tax exemption amount (the amount under which federal estate taxes do not apply) is currently $11.4 million per person and has been increasing each year due to inflation indexing, so federal estate taxes only apply to 0.1% of people.

The federal exemption amount is scheduled to fall to approximately $6 million (when taking into account future estimated increases for inflation) per person in 2026 (unless Congress changes the law), and even then only about 0.2% of people will be affected.

So, while taking action to avoid federal estate taxes is not necessary for over 99% of the population, there are at least three reasons why gifting may still make sense for you and your family:

State Estate Taxes Could Be an Issue for You

While federal estate taxes aren’t a problem for the vast majority of people, state estate taxes are another story. Twelve states and the District of Columbia currently have a state estate tax, and their exemptions are much less generous than the federal limits — with some as low as $1 million. (See 9 States with the Scariest Death Taxes.) In those states, gifting can help reduce the state estate tax.

For example, in Massachusetts, lifetime gifts are not subject to the Massachusetts estate tax. As a result, by making gifts, the value of the assets you own when you pass will be reduced, and the state estate tax will be lowered.

However, before giving away assets to reduce state estate taxes (which are often graduated and never exceed a top rate of 20%), you need to keep in mind the issue of unrealized capital gains and what is known as the “step up in basis.” At death the fair market value of most assets (except most notably retirement accounts) becomes the tax basis of those assets.

Because most assets appreciate during life, the basis of assets is said to “step up” to the fair market value, essentially wiping away all potential capital gains taxes. This is true even if your estate is not large enough to pay any federal estate tax.

When you give away assets, instead of a step up in basis there is a carryover basis, meaning the recipient takes your tax basis. That means, if you paid $10 for your stock and it was worth $100 when you gifted it, a recipient who sold the shares would pay taxes on the $90 of gain.

However, if you don’t sell the stock in your lifetime, the cost basis resets to the value of the stock on the day you die. So, for example, if you had low basis stock, it could make sense to hold the stock until you die if the state estate tax would be lower than the potential capital gains taxes if the asset were sold.

An important consideration here is that in some cases capital gain taxes can be imposed at higher rates than state estate taxes. Federal capital gains tax rates are 0%, 15% or 20% depending on your income and filing status.

There’s also state income tax to consider, plus an additional 3.8% Medicare tax for higher income earners. (For example, in Massachusetts — where the state income tax rate is about 5% for individuals in a high income tax bracket — combined capital gains tax rates can equal almost 30%.)

Therefore, while gifting to save on estate taxes is possible, it should be analyzed carefully to make sure you don’t inadvertently expose yourself or your loved ones to capital gains taxes.

To continue reading, please go to the original article at

https://www.kiplinger.com/article/retirement/T021-C032-S014-to-gift-or-not-to-gift.html

.13 Reasons You'll Regret an RV in Retirement

.13 Reasons You'll Regret an RV in Retirement

By Bob Niedt, Online Editor | August 27, 2019

Many Dinarians talk about buying an RV and doing a lot of traveling after exchanging their Dinars – Here are some informative tips to give consideration to -- Happy Traveling

As you drive toward retirement, dreams of blue highways are giving you that itch to hit the open road. With the kids grown and no job to tie you down, why not sell the house, buy a recreational vehicle and see the country? You wouldn’t be alone.

Approximately 10 million U.S. households own RVs, according to the RV Industry Association, and roughly 1 million Americans are living full-time in them.

But is an RV in retirement right for you? We spoke with retirees who spend much of their time in recreational vehicles for their guidance on the cons of RV living in retirement. Here’s what they had to say about the downsides of life on the road in an RV.

RVs Are Really Expensive

An RV is a big investment, but before you can even set a budget you need to understand the different options on the market.

13 Reasons You'll Regret an RV in Retirement

By Bob Niedt, Online Editor | August 27, 2019

Many Dinarians talk about buying an RV and doing a lot of traveling after exchanging their Dinars – Here are some informative tips to give consideration to -- Happy Traveling

As you drive toward retirement, dreams of blue highways are giving you that itch to hit the open road. With the kids grown and no job to tie you down, why not sell the house, buy a recreational vehicle and see the country? You wouldn’t be alone.

Approximately 10 million U.S. households own RVs, according to the RV Industry Association, and roughly 1 million Americans are living full-time in them.

But is an RV in retirement right for you? We spoke with retirees who spend much of their time in recreational vehicles for their guidance on the cons of RV living in retirement. Here’s what they had to say about the downsides of life on the road in an RV.

RVs Are Really Expensive

An RV is a big investment, but before you can even set a budget you need to understand the different options on the market.

“RVing introduces you to a whole new language,” says Charley Hannagan, who has been RVing with her husband, Joe, since 2014. “The cars that are towed behind motorhomes are ‘toads.’ ‘Sticks and bricks’ refers to a permanent house. ‘Class A’s’ are the bus-like vehicles, ‘Class B’ are vans, ‘Class C’ are the ones that have a truck cab attached to an RV chassis, and ‘fifth wheels’ are the big ones you see pulled by trucks.”

A trailer that’s hauled behind a truck or SUV is the most affordable way to test-drive RV living. A folding trailer, sometimes called a pop-up trailer, can cost as little as $6,000 and go as high as $30,000, according to pricing estimates from both the RV Industry Association and Consumer Reports.

Conventional travel trailers start around $8,000 but can top $100,000 depending on size and amenities. True fifth-wheel trailers that overlap the truck bed run from $18,000 to $160,000.

And then there are motorhomes, which you drive rather than haul. Type A motorhomes, the heaviest and typically the roomiest, begin at $60,000 and climb above $500,000. Type B and Type C motorhomes, smaller and lighter than Type A’s, cost anywhere from $60,000 to $150,000.

“The cost range is extraordinary,” says Nancy Fasoldt, who has been RVing with her husband, Allen, for 12 years. After retiring in 2007, they bought a new 24.5-foot Navion motorhome for $67,000.

They estimate the same RV would cost $106,000 today. Since then they’ve purchased a used 32-foot Wildcat fifth wheel ($20,000); a new 2016 38-foot Highland Ridge fifth wheel ($26,000 after trade-in); and a used Cirrus truck camper ($19,000) that slides into the bed of their pickup.

You'll Spend Even More Money Updating the Decor

This can be especially true if you buy used, but even new RVs can call for immediate upgrades depending on your tastes.

“The most disappointing thing about buying our RV was the décor,” says Charley Hannagan, who owns a 32-foot Jayco Precept Class A motorhome. “I think of it as 1970s old-age home. It was awful. We spent about $2,000 to buy fabric to re-cover the furniture in fabric I liked, to buy melamine dishes that won't break on the road, organizational stuff and sheepskin covers for the front seats.”

The Hannagan’s redecorating extended to the sleeping quarters as well: “We also replaced the mattress on the bed with one of better quality, another $900.”

Your RV Will Depreciate in Value

You might call it your home, but don’t expect your RV to increase in value over time like many traditional “sticks and bricks” houses do.

“With RVs ranging in price from $60,000 to $600,000, it's hard to compare them to a home that's paid off or near being paid off and find financial benefit,” says Margo Armstrong, who’s been RVing for two decades and writes the RV blog Moving On With Margo.

“RVs also depreciate rapidly; when you add in costs for gas, insurance, upkeep, food and the many other expenses of being on the road, traditional vacationing will likely seem to be a better value for your money.”

So don’t expect to recoup your initial investment. However, there is a market for used RVs, or you can trade in your old RV for a new one to offset the sticker price.

To continue reading, please go to the original article at

.How to Complain and Get Results

.How to Complain and Get Results

Making Your Money Last August 29, 2019 From Kiplinger’s Personal Finance

By Pat Mertz Esswein, Associate Editor

Impersonal customer service makes it hard to get help. Here's the script for success.

Taking a complaint to customer service can be maddening. No one wants to deal with endless phone trees, outsourced representatives working from inflexible scripts, automated responses or chatbots.

“Despite saying they provide more ways than ever to contact them, companies are building fortresses around themselves so that no one has to interact with you,” says Christopher Elliott, of Elliott Advocacy, a nonprofit consumer group.

To breach the walls and successfully resolve your complaint, says Elliott, you must use the three p’s: patience, persistence and politeness. Don’t expect an instant fix, and give the company’s complaint process time to work.

Be prepared to tell your tale repeatedly, taking your complaint up the chain of command if necessary. And even if you’re frustrated and furious, make nice. Being polite will help your complaint go to the top of the pile and get you a better response every time.

Here are steps you can take to get the results you want.

How to Complain and Get Results

Making Your Money Last August 29, 2019 From Kiplinger’s Personal Finance

By Pat Mertz Esswein, Associate Editor

Impersonal customer service makes it hard to get help. Here's the script for success.

Taking a complaint to customer service can be maddening. No one wants to deal with endless phone trees, outsourced representatives working from inflexible scripts, automated responses or chatbots.

“Despite saying they provide more ways than ever to contact them, companies are building fortresses around themselves so that no one has to interact with you,” says Christopher Elliott, of Elliott Advocacy, a nonprofit consumer group.

To breach the walls and successfully resolve your complaint, says Elliott, you must use the three p’s: patience, persistence and politeness. Don’t expect an instant fix, and give the company’s complaint process time to work.

Be prepared to tell your tale repeatedly, taking your complaint up the chain of command if necessary. And even if you’re frustrated and furious, make nice. Being polite will help your complaint go to the top of the pile and get you a better response every time.

Here are steps you can take to get the results you want.

Document everything. It’s still called a paper trail, even though much of the information may be digital. For any product or service for which you pay a sizable sum, keep copies of your order confirmations, receipts, contracts, work orders, warranties, service agreements and billing statements.

If you opt to get a receipt by e-mail or text, make sure you receive it and file it. Before you dispose of product packaging, remove enclosed paperwork that may include a warranty and customer-service phone number. Also remove the bar code, which you may need to obtain a replacement item, says Amy Schmitz, a law professor at the University of Missouri.

Keep copies of e-mails and take screenshots of online chats. In your first exchange with customer service, write down the reference number if one is assigned to your case. Recording the call would be ideal.

But if you can’t, take notes, including the date, time, name of the person with whom you spoke, the substance of your conversation and any promises made.

Make your point. It pays to complain as soon as you know you have a problem. The more recent your experience, the greater the weight your complaint will carry. Plus, memories fade, records get buried, and staff changes, says Nelson Santiago, of Consumer Action, a nonprofit consumer advocacy group.

A face-to-face visit with a local seller may quickly fix your problem. But if you’re dealing with an online retailer or a corporate office, you usually must follow its complaint process.

Go to the next level. If you’re not getting results, take your complaint up the corporate ladder. Ask a customer-service rep, “If you can’t help me, who can I call or write who has the authority to help?”

Visit company websites to search for contacts. If the obvious choice (such as “contact us” or “customer service”) isn’t helpful, try clicking on “about us,” “terms and conditions” or “privacy statement.”

On the website of the Better Business Bureau or BBB, search by the company name and look for contact information for owners and executives under “Business Details.” To bypass corporate phone trees, go to www.gethuman.com and search by company for phone numbers and shortcuts to reach a real person.

To continue reading, please go to the original article at

https://www.kiplinger.com/article/credit/T037-C000-S002-how-to-compain-and-get-results.html

.10 Things Rich People Know That You Don't

.10 Things Rich People Know That You Don’t

By Jocelyn Black Hodes

As a financial adviser, I have occasionally found myself feeling envious of certain clients. Not because of their wealth — but because they were disciplined and determined enough to do all the right things that enabled them to accumulate their wealth and, in many cases, retire early.

Despite my expertise, I, like a lot of people, sometimes struggle not to do the wrong things that make being rich, let alone retiring at all, a pipe dream.

Financially responsible and successful people don’t build their wealth by accident — or overnight. Becoming rich takes serious willpower and long-term vision.

You have to be able to keep your eye on the prize of financial freedom, be willing to sacrifice your present wants for the sake of your future and develop good habits to win. Here are 10 habits you can start putting into practice now.

10 Things Rich People Know That You Don’t

By Jocelyn Black Hodes

As a financial adviser, I have occasionally found myself feeling envious of certain clients. Not because of their wealth — but because they were disciplined and determined enough to do all the right things that enabled them to accumulate their wealth and, in many cases, retire early.

Despite my expertise, I, like a lot of people, sometimes struggle not to do the wrong things that make being rich, let alone retiring at all, a pipe dream.

Financially responsible and successful people don’t build their wealth by accident — or overnight. Becoming rich takes serious willpower and long-term vision.

You have to be able to keep your eye on the prize of financial freedom, be willing to sacrifice your present wants for the sake of your future and develop good habits to win. Here are 10 habits you can start putting into practice now.

Start early

As the old saying goes: The early bird catches the worm…or, in this case, gets to retire in style. The sooner you put your money to work, the more time it has to grow.

Earning a paycheck, whether you are self-employed or work for a company, means the opportunity to contribute to an IRA, which you should seize ASAP.

If you’re fortunate enough to get a job with a company that offers a matching contribution to their retirement plan, you need to make it a priority to enroll in the plan as soon as you are eligible. It can be the difference between retiring early and never retiring.

Think about this: If you invested $10,000 and left it to grow for 40 years, assuming an average return per year of 8%, you would end up with over $217,000. But if you waited 10 years and invested $20,000 — twice as much — you would only end up with just over $200,000.

Whatever your situation might be, saving and investing money today is better than waiting until tomorrow. Start now.

Automate

You can be your own worst enemy when it comes to financial success. It’s all too easy to procrastinate and neglect what needs to be done and, meanwhile, give in to temptation and spend more than you should. It’s the perfect recipe for not becoming rich.

The best way to protect yourself from yourself is to automate your savings.

That means setting up recurring transfers on a regular basis from your checking account to your savings and investment accounts (or setting up auto deduction from your paycheck to your employer-sponsored retirement plan).

This way, you force yourself to avoid bad money habits and save what you would likely otherwise spend. If you haven’t already, set aside 15 minutes on your calendar now to do it. Not later, now. Your rich future self will thank you.

********

Maximize Contributions

When it comes to retirement account contributions, you’ve probably been told to start small and then try to increase the amount by at least 1% every year until you max out. If you’ve been procrastinating, then yes, even a small starting contribution is better than none.

The problem is that small efforts can lead to small results. If you want to be rich, you have to save like you mean it. And that means contributing the max amount allowed from the get-go (and at least as much as your employer will match in your 401(k) plan).

This is especially true if you are starting to save later in life and need to play catch up. You might worry that maxing out your contributions will squeeze your cash flow too tightly, but it is easier to get in the habit of spending less if you don’t have that extra to money to spend in the first place. It’s much harder to increasingly scale back your budget year after year to accommodate for increasing contributions.

To continue reading, please go to the original article at

https://www.marketwatch.com/story/10-habits-of-high-net-worth-women-2014-07-02

![start-the-game[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1569413973769-V228BMF8UVW8NVGL0GR5/start-the-game%5B1%5D.jpg)

![savings-graph-trigger[1].jpg](https://images.squarespace-cdn.com/content/v1/5d5222a44813620001d89582/1569168068492-DFLXSALJDKFJTFLROYHN/savings-graph-trigger%5B1%5D.jpg)