Iraqi News Early Tuesday AM 9-6-22

Iraqi News Early Tuesday AM 9-6-22

Tlm724 Administrator Bondlady’s Corner

An Economist Reveals The Reasons For The Increase In Central Bank Sales Of The Dollar And Raises Exciting Questions

09/04/2022 68 Earth News/ The economic expert, Manar Al-Obaidi, revealed today, Sunday, the reasons for the increase in the Central Bank's sales of the dollar, while asking questions to several government agencies. Al-Obaidi said in a statement received by Earth News,

“In order to clarify the picture, it is necessary first to understand the mechanism of the foreign currency sale window,” noting that “most of Iraq’s revenues are in US dollars, given that 92% of the Iraqi government’s revenues are from oil sales, and the Iraqi government’s expenses are mostly From the dinar, given that 90% of government expenses are operational expenses (salaries + subsidies + other service expenses).

Al-Obaidi added that “on the basis of these two rules, the government needs to sell the dollar and buy the dinar through the Central Bank, as the Ministry of Finance sold during this year to the Central Bank an amount of 33 billion US dollars to the Central Bank, which has to provide local cash to cover the value of dollar purchases. From the Ministry of Finance in order to cover the needs of the Iraqi government.”

He pointed out that "the sources of the dinar at the Central Bank are:

Local bank deposits of Iraqi dinar

Depositing government institutions from the Iraqi dinar

Dollar sales to the local market through the foreign exchange window, which is the largest part

Issuing and printing additional cash

And he indicated that “in the event that the first and second points are not sufficiently available to the Central Bank, the bank is forced either to

increase dollar sales through the window to cover the dinar, or to

print new cash to cover the need of the Iraqi government,”

explaining that "the Central Bank’s sales of dollars through the currency sale window. Since the beginning of the year, it has reached nearly 28 billion dollars,

meaning that the difference is about 5 billion dollars in favor of the Central Bank, in which the value of cash in dollars increased at the expense of the dinar.

He explained that "the Central Bank is forced to increase its sales of dollars with the increasing demand for the local currency from the Ministry of Finance and in order not to increase its issuance of a new monetary mass that may lead to an increase in inflation as a result of the rise in the monetary mass."

Al-Obaidi pointed out that “the question is not directed to the Central Bank exclusively about the reasons for the rise in dollar sales through the window, but rather the questions are directed to:

Ministry of Finance: What is the need for the increasing demand for the dinar, which means an increase in the Iraqi government's expenditures in the absence of a budget?

The Ministry of Commerce: It was noticed that the import licenses granted by you increased, and in light of them, the demand for buying dollars increased. Does Iraq actually need these imports, in light of which the licenses are granted?

Ministry of Finance, General Customs Authority: With the increase in the value of remittances related to imports and the increase in import licenses granted by the Ministry of Commerce, no significant increase in the Authority’s revenues was observed despite these rises, which means that a large part of the imports enter through unofficial ways and not through your authority https://earthiq.news/archives/136433

The Largest In The History Of Iraq.. Huge Numbers Of Central Bank Sales Of The Dollar For The Past Month

1,681 Economie 09/03/2022 13:05 Today, Saturday, the economist, Nabil Jaafar Al-Marsoumi, revealed frightening figures for the central bank’s dollar sales for the month of August, while the bank sold five billion five hundred and thirty million dollars, which is the largest in the history of Iraq. Al-Marsoumi told (Baghdad Today) that

"four billion six hundred and ninety-six million dollars were documentary credits for the purchase of goods, while the cash sales were eight hundred and thirty-four million dollars,"

explaining that "the oil revenues for the month of August were nine billion seven hundred and eighty-four million dollars."

The bank drained 65% of the oil revenues, and this number is huge.

He added that "when the amounts of opening documents for imports amount to four billion six hundred and ninety-six million dollars, imports of goods and services must be offset by the same amounts,

but what is happening is different, and the evidence is that last year the private sector recorded import of goods and others with an amount that reached 11 billion dollars,

while it was The bank's document sales amounted to $33 billion,"

he added, adding: "This means that an amount of up to 20 billion was bought with goods and entered through illegal outlets or from the Kurdistan region." https://baghdadtoday.news/news/199665/الأكبر-بتأريخ-العراق-أرق

An Economist Reveals The Size Of The Currency Issued By The Iraqi Central

1,126 Economy 09/02/2022 11:57 Baghdad today – Baghdad Today, Friday, the economic expert, Manar Al-Obaidi, measured the size of the currency issued by the Central Bank of Iraq.

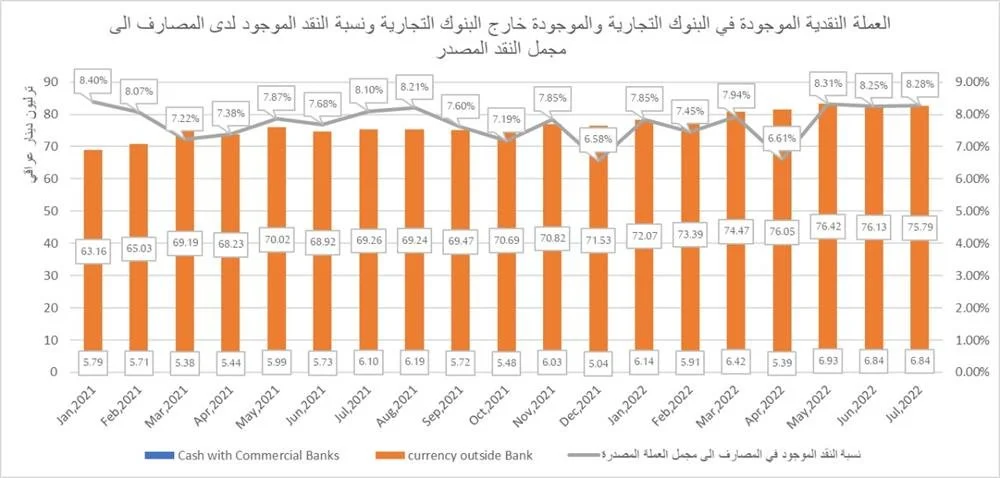

Al-Obaidi said in a statement received (Baghdad Today) that "according to the data of the Central Bank of Iraq, the volume of cash currency issued by the bank is up to 82 trillion Iraqi dinars." He added: "On the other hand, the volume of cash in Iraqi banks does not exceed the barrier of 7 trillion Iraqi dinars only, meaning that more than 75 trillion Iraqi dinars are outside the banking system and it is very difficult to follow up and know its fate, which affects the banking sector and its contribution to the domestic product.

It contributes to an increase in inflation. Al-Obaidi pointed out that "there are 4 main possibilities for this cash away from the banking system, which are:

1 - Iraqis hoard money in their homes without entering it into the banking system

If the number of Iraqis is about 41 million people, and there are more than 9 million of them below the poverty level, according to the data of the Ministry of Planning, and the number of those whose age exceeds the barrier of 16 is among the remaining 30 million, up to 20 million, then the rate of hoarding of money by the Iraqi citizen is about 3.7 million Iraqi dinars.

2- Internal and external commercial transactions with funds from the banking system, and this includes all internal commercial businesses that deal either in cash or through informal financial institutions, and this sector may be the largest holder of these funds.

3 - Foreign institutions hoarding the Iraqi currency for several reasons, including the remote investment in the Iraqi dinar in the hope that its price will rise in the future, or for reasons related to trying to control the local currency in order to pump more currency into the local market, which leads to an increase in inflation, which is a small possibility, but it is possible.

4- Coin damage

It may be that part of the issued currency, especially from small businesses, has been damaged, which means that it is practically out of the currency, but it is still calculated because there is no evidence of its damage.” He pointed out that

"the cash currency issued since the beginning of last year 2021 increased by 19.82%, while the value of the money in the bank did not increase by more than 18%,

meaning that even the issued cash currency, a large part of it does not enter the banking system,"

adding: "Therefore, the The prevailing belief is that the parallel market system and the internal trade market away from the banking system represent larger systems than the banking system, and that the lack of confidence in the banking system and its complexities leads the citizen to hoarding away from the banking sector and keeps the internal merchant away from banking dealings with banks and in order to return this money to the banking system for the possibility of It is necessary to prevent financial transactions and internal transfers away from the banking system, and

it is necessary to increase the confidence of users in banking services and increase deposit rates to gain consumer confidence towards the important banking sector.”

https://baghdadtoday.news/news/199583/خبير-اقتصادي-يكشف-حجم-ال

Al-Kazemi’s Advisor Determines The Size Of The Accumulated Reserves During The First Half Of 2022

Political 2-09-2022, 17:39 Baghdad - INA - Nassar Al-Hajj, the financial advisor to the Prime Minister, Mazhar Muhammad Salih, determined today, Friday, the size of the reserves accumulated during the first half of the current year 2022, while offering a conditional option to employ the surplus financial resources in the absence of the budget. Saleh said, to the Iraqi News Agency (INA), that “the

actual balance of the surpluses achieved from selling oil can only be determined by the end of the current fiscal year, as

estimates (the first half of the current year 2022) indicate the accumulation of public financial reserves of up to 20 billion dollars, and

it cannot be Disposing of it outside what is stipulated in Article 13 of the amended Federal Financial Management Law No. 6 of 2019, i.e. spending at the rate of 1/12 of the total actual current expenditures in the 2021 budget. He added,

"Although the allocations contained in the Emergency Food Security and Development Law No. 2 of 2022 have allocated amounts close to the financial savings achieved in the first half of 2022, what can be expected of financial savings until the end of the current year is perhaps an amount Its balance is between 15-20 billion dollars, in light of the average oil prices in the global market estimated at about $100 per barrel and an export capacity of about 3.3 million barrels of oil per day, in addition to the exchange restrictions and limitations in the aforementioned two laws.”

He continued: "Based on the foregoing, the possible and available option is to employ those surplus financial resources in a (sovereign fund) based on the provisions of Article 19 of the Federal Financial Management Law in force, provided that the legal adaptation that links the establishment of the sovereign fund to the adoption of a law for the general budget is available."

He concluded: "Thus, financial legislation remains the objective basis for all future financial actions."

https://www.ina.iq/164623--2022.html

Central Banks Participate In The Manufacture Of Modern Financial Technologies

Economie Today, 11:40 The Arab Monetary Fund announced, today, Monday, the launch of a training course directed at cadres working in central banks, under the title (Regulatory Frameworks and Legislations for the Industry of Modern Financial Technologies). A statement by the fund stated that

"the course, which will continue until the eighth of this month, is also directed to those concerned with issues of modern financial technologies and the staff working in the capital market authorities and stock exchanges and ministries of finance who are specialized in issues of modern financial technologies."

He added, "It aims to deepen the participants' understanding of the regulatory framework for the modern financial technology industry, as well as discussing many axes,

the most important of which is building an incubating environment and effective national strategies for modern financial technologies and blockchain technologies."

The course reviews some of the different aspects of regulating modern financial technology activities, such as

regulating open financing activities,

alternative financing,

encrypted financial assets and digital contracts,

digital financial services consumer protection frameworks,

cyber security,

data protection frameworks and customer information privacy, and

electronic know-your-customer rules to combat laundering. Funds and financing of the cuticle.

It will also shed light on digital regulatory and supervisory solutions to support the regulatory and supervisory authorities in regulating this industry. https://www.ina.iq/164807--.html

To read more current and reliable Iraqi news please visit BondLady’s Corner: