Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

Bruce’s Big Call Dinar Intel Thursday Night 10-30-25

Bruce’s Big Call Dinar Intel Thursday Night 10-30-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. it is Thursday, October 30th and you're listening to the big call. Thanks everybody for tuning in yet once again and I hope we have a nice encouraging call with some good information for you tonight – I know we will and thanks for tuning in, everybody.

I don't know guys, if we're going to get off daylight savings or not Sunday. I guess our phones will tell us when they reset at 2am in the morning on Sunday, but supposed to have been yesterday, an executive order signed by President Trump that would take us and put us on daylight savings time that we're on now there

Bruce’s Big Call Dinar Intel Thursday Night 10-30-25

Transcribed By WiserNow Emailed To Recaps (INTEL ONLY)

Welcome everybody to the big call tonight. it is Thursday, October 30th and you're listening to the big call. Thanks everybody for tuning in yet once again and I hope we have a nice encouraging call with some good information for you tonight – I know we will and thanks for tuning in, everybody.

I don't know guys, if we're going to get off daylight savings or not Sunday. I guess our phones will tell us when they reset at 2am in the morning on Sunday, but supposed to have been yesterday, an executive order signed by President Trump that would take us and put us on daylight savings time that we're on now there

President Trump wanted to see more sunlight at the end of the day. And I understand that. If you are a golfer, you want that so you can get around a golf in in late afternoon and finish in the daylight. So maybe that's what he's thinking.

So all I can say is pay attention to whether or not we're changing or not changing back to standard time on Sunday, but your phone will tell you, if you wake up, your phone will tell you what time it is, alright. So that's what you want to do.

Let's go into the Intel segment. Let's see where we are.

I will say this. You remember the st Jermaine trust, right? This bottomless trust of money that that is there theoretically could be opened at Christmas or at Easter. Well, they opened it up yesterday and they brought out like it was 150 or $172 sept tillion like September septillion.

I say, what does that mean? Well, septillion is 24 zeros after the one. So let's say it was 150 150 comma, and then put 24 zeros behind it. That's $150 septillion because it goes, you know, we know million, right, billion, trillion, quadrillion, quintillion sex billion, that's right sex, sextillion and septillion. And we'll just stop there. We won't go beyond septillion right now, but that's what they pulled out.

What is that money being used for? That money is going toward NESARA and GESARA . Benefits. The NESARA and GESARA

Now, the money that we are getting for from our currency exchanges and Zim redemption is already positioned in the quantum financial system, a quantum accounts. It's there for us, waiting for us to go in and start doing our exchanges in our Zim redemption Okay, redemption centers, by the way, at the redemption centers.

Now, here's the other piece of that, talking about the timing of DOGE Remember I was saying that there was a fund that was coming that was going to pay 200 300 400 up to 500,000 or maybe 495,000 -- I don't know if it's going to exceed 500 or not. Let's just keep it around 500,000 for people who are 65 and for older folks, but it'll start at the age of 30 with 200 grand at the age of 30, and go up.

I don't know where the where the breaks, the various levels are of where it goes from 200 to 250, to 300 to four, 400 to 500 you know it's all there, but I know it's between 30 years old and anything over 65 gets 495 or 500,000 half a million. That's not too shabby. That's going to be now. When is that going to happen? That is going to happen in the first full week of November.

Now we determine full week by starting with next, Monday, Tuesday, Wednesday, the full week starting, so not starting on the first of November, but the third, fourth, fifth, and so on.

All right, that is being paid to people so that everybody's getting some money. Now, under 30, I don't know, there might be something there. I don't know about less than 30. I don't know, 30 and older, they'll be getting a DOGE pay, and it's a substantial chunk of change. And it's the cool thing is everybody to have some money, which means that when we go in for our exchanges, we sort of have that as cover for us going, you know, because we're going to redemption centers where the real money is and where the real rates are, by the way, compared to the bank, which is low rates, and I already know what they are.

I already know what they are, and you're going to come out so much better at the redemption center. It's not even funny.

Okay, now, what about us? What about bond holders? I know you guys don't care that much about tier three bond holders, but I'm sure we've got some that listen the tier three bonders should get notified with their emails, probably over the weekend, or maybe lagging into Monday.

Somewhere in that frame, I'm going to say from Saturday to Monday, they should be getting their their emails, and that should tell them when they would have access to their accounts. Money has already been placed, in most cases, into the bond owners accounts, so they need access to get in there to see it, and then they need access to the funds themselves in their account. And that should be spelled out in the emails that they're looking to receive.

They have not gotten those yet, but they're looking to get those All right, so we're going to be close to when the bond orders go close, in the sense that we are supposed to get our notifications from Wells Fargo, with the 800 number, supposed to get it Monday or Tuesday. It could be something we wake up to Monday.

It is possible they'll shoot it early morning on Monday, you know, overnight Sunday, early morning. And we could get it when we wake up and then set our appointments Monday. That it could be setting appointments Monday for Monday evening, or it could be setting appointments Monday for Tuesday, the start of Tuesday.

So Monday, Tuesday, are in place for tier 4B Monday, Tuesday. And that's, that's what has come in today, and that's one of the only things that actually came in today for us, which is good. I'm glad you got that, because it's nice to have it as close and as precise as we can get it.

Let's see. So you got the dose payments. We know R and R should be there for us at the redemption center in the quantum accounts. And I'm sure they'll deal with the R. And R for people that are not exchanging currency will get that, probably by direct deposit.

You know, they'll figure that out. I don't have all of that. I'm primarily dealing with people that are involved in redemption and exchanging currencies. We know that there are 31 currencies that are actually going to be on the front screens at the redemption center that are going up in value.

We've talked about six or eight of them in the past, and there are more, there more out there.

And you know, we'll be surprised probably by a few of them, but overall, we'll be looking good. The ones you have are doing very well, by the way.

I don't think I have mentioned this before, but if you are military, or retired military, and you have old Saddam dinar, not the new Iraqi dinar, but the old Saddam dinar, if you're military, only, you can exchange that at the redemption centers, and only through redemption centers. So you military guys out there, if you know your buddies that brought a duffel bag full of old Saddam dinar, they're good for you guys only.

I mean, we got people we know that have maybe a stack, a small stack, of Saddam dinar

But you know, if you're not military, you're not gonna be able to exchange it. Might as well shred it or put it up on the wall, make paper out of it.

I don't think I've ever mentioned that before, but I did get clarification on that a couple days ago.

Well, I think, guys, that's the main thing that we're looking for. I don't think there's a whole lot else that I can think of that would be newsworthy to us. We all want to know when, and we're not going to worry about the rates. And rates are fantastic.

We think that we'll probably get a new Forex rate on all these currencies coming up on the Forex, on the front screen of forex, probably when it comes back Sunday at five o'clock Eastern. And we'll have our we'll have our notifications, hopefully Monday morning, and then go in and set our appointments and go

Now, this is one of these things, guys that we've said before. This is tracking a moving target, and it's, we can't absolutely say it's going to be Monday.

It could be Tuesday. We don't know when, except for what we're hearing from really strong source, you know, and so we have to go with it, but we know. And you know how many times we've told a certain date is what we're hearing this is going to go and boom, we flew right by. It went right over it.

That's why we don't like the expression back wall, because anytime we've had a back wall, it's always been moved, always been pushed back. It's like pushing back the bullet points, right?

So I'm just going to say I feel good about the timing of this, because why we should have the USN and announced party in the redemption centers, and they just did new deliveries of it last Monday, new deliveries of the end, I think was Monday, Wednesday, new deliveries of the USTN currency, the actual new money that we got that's going to be building money the United States Treasury notes. We have those delivered again.

This is the third time I think they've loaded them up to the redemption centers, and we also had new Q Phone delivered also to the redemption centers only. They're not going to get a Q Phone at the bank, but only get it, or Zim holders only will get it at the redemption center.

Let's see, I told you about the money from the St Germain trust. We should have USN between Saturday the first and Monday, which is the third of November.

That would make sense to me, have it announced, and then we go in for our exchanges, and we can obtain, I think they want to keep us around 3000 - 3500 in cash of the new money. They don't want us loading up with tons and tons of USTN and then get robbed somewhere.

So I believe we'll see it announced as our new official asset backed currency, and we should have DOGE coming out, the first week of first full week of November, and NESARA coming out, starting the first full week of November, culminating at the end of this year, before January one.

So we'll have two months basically to roll out their plans on NESARA. So it's going to be real interesting. That's a lot to cram in to two months. A lot of information to bring out. We should get some some EBS announcements. We can get a lot of we can get a lot of things. We should get some disclosure of some kind on what really happened to JFK? Really, what happened at 911 - really, what happened to the Murrow building and Oklahoma City, all that stuff.

Theoretically, it's going to come out. Truth will come out. We'll see what they do. We kind of already know a lot about that stuff already, but the rest of the people out there don't know, but we'll see where it goes.

And yeah, President Trump had a really good time with in Japan, with these countries, and also in South Korea, with North and South Korea, which, by the way, North and South Korea should be unified. After the first of the year, they're going to try to unify North and South Korea, which is going to be really good, I think, for North Korea to get that, see where that goes,

Just pray that the peace holds up everywhere in the Middle East, as well as I believe we're going to have a peace announced with Russia Ukraine. Hopefully they'll have that where that can be announced.

And President Trump had a really good meeting with President Xi of China. And I think that was a win. President Trump said on a scale of one to 10, the meeting with Xi was a 12. I love it. That's terrific. That's what we want to hear. Our president is absolutely taking charge and doing the right stuff for this country. Absolutely. You got a cabinet. They're all hand picked, and they're all really strong, very good group of cabinet people, secretaries, excellent.

So let's see what, what develops over the weekend, let's see if we can get a US Treasury announcement, probably on the new US asset backed currency us. And I would look for Scott Besant or Bess, which is how I like to say it. But Scott Besant should be the one announcing that maybe along with President Trump, it'd be a major press conference if it comes out. I would think so.

Well, that's pretty much everything I wanted to say

And otherwise we will have plan to have a call on Tuesday. We've got our numbers and it's a call, you know, we said that several times, but hopefully this time, it'll stick. In the meantime, everybody have a weekend, and we should look forward to having a great Thanksgiving and even better Christmas than we've ever had.

So thanks everybody for listening. Let's thank Sue so much tonight. And Bob, same thing. Thanks so much. GCK Doug, thank you Pastor Scott and thank you Jeannie and satellite team sat team for getting to call out all over the world, universe that's listened to us for 14 years. We appreciate you and we care about you, and we will be helping out.

And we've got, we've got Jamaica on the list for rebuild International, because they get whacked pretty hard by that category five hurricane. And so, you know, we're just finding out, really what the devastation is, and that would be something we would kind of go in and make a difference in. In Jamaica, it's a cool little country.

It's a nice, beautiful island, and we want to restore it and rebuild it and make Jamaica proud. All right, so thanks everybody. Well, good night everybody. Have a great weekend. God bless you.

Bruce’s Big Call Dinar Intel Thursday Night 10-30-25 REPLAY LINK Intel Begins 1:01:31

Bruce’s Big Call Dinar Intel Tuesday Night 10-28-25 REPLAY LINK Intel Begins 1:13:00

Bruce’s Big Call Dinar Intel Thursday Night 10-23-25 REPLAY LINK Intel Begins 1:25:50

Bruce’s Big Call Dinar Intel Tuesday Night 10-21-25 REPLAY LINK Intel Begins 1:30:00

Bruce’s Big Call Dinar Intel Thursday Night 10-16-25 REPLAY LINK Intel Begins 1:19:05

Bruce’s Big Call Dinar Intel Tuesday Night 10-14-25 REPLAY LINK Intel Begins 1:34:40

Bruce’s Big Call Dinar Intel Thursday Night 10-9-25 REPLAY LINK Intel Begins 1:25:05

Bruce’s Big Call Dinar Intel Tuesday Night 10-7-25 REPLAY LINK Intel Begins 1:16:50

Bruce’s Big Call Dinar Intel Thursday Night 10-2-25 REPLAY LINK Intel Begins 1:08:45

Seeds of Wisdom RV and Economics Updates Friday Afternoon 10-31-25

Seeds of Wisdom RV and Economics Updates Friday Afternoon 10-31-25

Good Afternoon Dinar Recaps,

Budapest Breakdown: Trump–Putin Talks Collapse Over Ukraine Demands

Geopolitical fractures, financial realignments, and the future of global trade blocs.

Background & Analysis

The cancelled Trump–Putin summit in Budapest marks a critical setback in U.S.–Russia diplomacy. Putin’s insistence on territorial concessions and NATO limits reflects Russia’s broader strategy to cement its Eurasian security sphere.

Seeds of Wisdom RV and Economics Updates Friday Afternoon 10-31-25

Good Afternoon Dinar Recaps,

Budapest Breakdown: Trump–Putin Talks Collapse Over Ukraine Demands

Geopolitical fractures, financial realignments, and the future of global trade blocs.

Background & Analysis

The cancelled Trump–Putin summit in Budapest marks a critical setback in U.S.–Russia diplomacy. Putin’s insistence on territorial concessions and NATO limits reflects Russia’s broader strategy to cement its Eurasian security sphere.

Moscow’s stance: Secure recognition of annexed regions and reshape post-war trade alignment.

Washington’s concern: Protect European stability and prevent China–Russia economic deepening.

Why It Matters for Global Finance

This breakdown stalls the emerging East–West financial détente. Russia’s continued alignment with BRICS and de-dollarization efforts reinforces multipolar financial systems (gold settlement, digital ruble trade).

If U.S.–Russia dialogue remains frozen, expect BRICS+ to accelerate independent financial infrastructure — bypassing Western SWIFT and IMF frameworks.

Implications

Energy markets may fragment further between Western and Eurasian exchanges.

Gold-backed settlement systems gain leverage as sanctions deepen.

Global alliances pivot toward a trade-based peace model — not military negotiation.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Financial Times and Reuters

~~~~~~~~~

Gaza’s Silent Crisis: Peace Without Liquidity

The guns are quiet, but Gaza’s cash-starved banks expose the next phase of global monetary realignment.

A Fragile Peace Meets Financial Collapse

As Gaza’s ceasefire takes hold after two years of war, its residents now face a different kind of siege — a total collapse of liquidity.

Banks reopened on October 16, yet most are shells of their former selves — their vaults empty, their systems dependent on intermittent electricity, and their customers desperate to withdraw even a few shekels.

No physical currency: Israel continues to block cash transfers into Gaza.

Damaged financial infrastructure: Dozens of branches were destroyed during the conflict.

Private withdrawal commissions reach as high as 40 percent, effectively monetizing desperation.

Trump’s peace framework offered no roadmap for restoring Gaza’s banking access, leaving humanitarian aid trapped in digital form.

With inflation spiking and barter returning as a survival mechanism, Gaza’s financial paralysis is now shaping up as a case study in the risks of cashless fragility under geopolitical control.

The Financial Dimension Behind the Ceasefire

This is not only a humanitarian or political crisis — it is a collapse of financial sovereignty.

Currency control as leverage: By halting banknote inflows, Israel and its allies control not just security conditions but economic survival — showing how liquidity itself has become a geopolitical weapon.

Digital dependency without infrastructure: Electronic transfers require stable power, telecom, and fees — all scarce in Gaza, creating a paradox of “digital access without financial inclusion.”

Shadow markets emerge: Private traders are now acting as informal banks, converting remittances or salaries into physical cash at steep markups.

Reconstruction frozen: With no functioning liquidity, aid funds remain unspent, halting rebuilding projects and distorting the regional supply chain.

Why It Matters for the Global Financial Reset

The Gaza case highlights a deeper global trend: the weaponization and fragility of monetary systems in conflict zones.

As nations move toward digital currencies and programmable payment systems, control over access becomes as important as control over value.

Liquidity is power: The ability to turn digital balances into spendable money defines who participates in recovery.

Programmable finance risks exclusion: Centralized digital settlement systems, if politically controlled, can replicate Gaza’s problem on a global scale — peace without prosperity.

Parallel humanitarian rails emerging: Efforts by BRICS and non-aligned nations to develop alternative cross-border payment systems now double as tools for crisis resilience, not just de-dollarization.

Gaza as precedent: Future sanctions or post-conflict economies may face similar liquidity quarantines, prompting calls for sovereign digital frameworks independent of geopolitical gatekeepers.

In short, Gaza’s liquidity famine exposes how financial infrastructure — not just diplomacy — underpins peace, reconstruction, and sovereignty.

The Broader Restructuring Picture

Middle East integration and BRICS+ dialogue may push for regional reconstruction banks denominated in mixed currencies.

Aid settlement reforms through tokenized humanitarian credits are being tested by the UN and African Development Bank — models that could bypass physical-cash barriers.

Global reset linkage: As Western systems centralize control through sanctions and oversight, non-Western alliances are responding by building redundancy into settlement networks — creating a bifurcated global finance system that Gaza’s crisis now exemplifies.

Conclusion

The guns have gone silent, but Gaza’s empty banks speak volumes.

In the new world order of digital settlement and political gatekeeping, access to liquidity may become the next frontier of sovereignty.

For policymakers and financial architects of the coming reset, the lesson is clear — stability without circulation is not stability at all.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Modern Diplomacy (Oct 31 2025) – “Gaza’s Ceasefire Brings Calm, But No Cash as Banks Reopen Empty.”

Reuters – “As the guns fall silent, Gazans find newly‑reopened banks have no cash” (Oct 31 2025)

Bloomberg – ” The closest relevant article is “How Gaza Descended Into a Hunger Crisis”

Al Jazeera – “Ceasefire in Gaza: A fragile calm amid unending struggle”

~~~~~~~~~

The Algorithmic CFO: How Technology Is Re-Wiring Finance Operations

AI, automation, and real-time data are turning the back office into the strategy hub of global finance.

A quiet revolution is underway inside corporate finance departments.

No longer confined to quarterly reports and spreadsheets, the modern finance function is becoming an intelligent, predictive engine — driven by artificial intelligence, cloud computing, and continuous analytics.

🔹 From Bookkeeping to Real-Time Intelligence

Finance teams are shifting from recording the past to forecasting the future:

AI-powered forecasting models deliver near-instant insight into cash flow, risk exposure, and capital needs.

Cloud-based ERP systems link data across subsidiaries, creating a unified financial view in real time.

Automation of reconciliation and compliance tasks frees analysts for higher-value decision-making.

🔹 CFOs at the Core of Digital Strategy

The new CFO role extends far beyond budgets:

Data governance now defines financial credibility — clean data is becoming the new audit standard.

Cyber-resilience joins balance-sheet strength as a measure of financial stability.

Finance and IT convergence is emerging as a new executive discipline in the digital corporation.

🔹 The End of the Monthly Report

Traditional reporting cycles are being replaced by continuous monitoring:

Embedded analytics dashboards give real-time performance visibility.

Predictive scenario modeling allows proactive responses to shocks, not reactive fixes.

AI-driven controls reduce human error and accelerate close processes.

🔹 Strategic Implications

Companies that integrate technology into finance operations gain:

Speed — faster insight means faster strategy.

Accuracy — automation minimizes reporting risk.

Resilience — real-time oversight supports stronger governance and investor confidence.

Bottom Line:

The digitalization of finance is not just an IT upgrade — it is a structural shift in how organizations perceive and execute their fiscal strategy. The CFO of 2025 is no longer a gatekeeper of numbers, but a designer of systems.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Source:

Deloitte — “2025 Revisited: Future Finance Trends” (highlighting automation, big data, predictive modelling in finance operations).

Deloitte — “A CFO’s Guide to Tech Trends 2025” (focus on CFO-relevant technologies including AI, core systems modernization).

Deloitte — “2025 Financial Services Industry Outlooks” (industry-wide look at technology and operational transformation in finance-related functions).

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

News, Rumors and Opinions Friday 10-31-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 31 Oct. 2025

Compiled Fri. 31 Oct. 2025 12:01 am EST by Judy Byington

Judy Note: All was promised to begin next Sat. 1 Nov 2025, when the Quantum Financial System (QFS) would officially transition into full operational control. That meant multiple banks (mainly owned by the Cabal) not GESARA compliant would close, while other Global banking structures were syncing to the asset-backed framework, (allegedly) dismantling the final remnants of the fiat system.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV Excerpts from the Restored Republic via a GCR: Update as of Fri. 31 Oct. 2025

Compiled Fri. 31 Oct. 2025 12:01 am EST by Judy Byington

Judy Note: All was promised to begin next Sat. 1 Nov 2025, when the Quantum Financial System (QFS) would officially transition into full operational control. That meant multiple banks (mainly owned by the Cabal) not GESARA compliant would close, while other Global banking structures were syncing to the asset-backed framework, (allegedly) dismantling the final remnants of the fiat system.

Two days later on Mon. 3 Nov. 2025, there would be a 48-hour blackout while money redistribution into the new Global Financial System(allegedly) began – designed to protect your own digital wallet and monies that only you could access.

In other words, “Where We Go One, We Go All.”

Possible Timing:

The Hidden Sequence Begins …Nesara Gesara QFS on Telegram I can feel the air shifting again. Something deep inside tells me that these next few days — starting from November 1 — will mark the silent birth of everything we’ve been waiting for. They told us nothing would happen overnight, but they never said it wouldn’t happen quietly.

Prepare for the Global Currency Reset, the full-scale activation of the gold and asset-backed Quantum Financial System, the public introduction of Med Beds, a 48-hour wealth redistribution blackout, and Ten Days of Worldwide Communication Darkness. https://t.me/Gesara_QFS

On Sat. 1 Nov 2025, the Quantum Financial System (QFS) will (allegedly) officially transition into full operational control. Global banking structures are now syncing to the asset-backed framework, dismantling the final remnants of the fiat system.

November 1, 2025 That’s the moment the Quantum Financial System truly takes the wheel. The switch isn’t theatrical, it’s mathematical. It happens in silence, in code, through frequencies that most can’t even perceive. While the world sleeps in distraction, the servers reroute, the gold flows back into accountability, and the fiat ghosts begin to fade.

You might not see it, but you will feel it — a strange calm spreading across markets, as if the storm suddenly forgot how to rage. That’s not coincidence. That’s calibration.

On Mon. 3 Nov. 2025, the scheduled 48-hour blackout for GCR/GESARA wealth redistribution will begin. This marks the initiation of massive fund allocations into new sovereign digital wallets under QFS oversight. A 48-hour stillness in global communication, masked as “technical upgrades” and “network synchronization.” But I know what it really is — the redistribution event.

Wealth, finally being reassigned through QFS channels. Invisible to the public, yet monumental in scale. Behind every screen flicker and every delay in digital access, there’s an unseen army of algorithms balancing centuries of theft. The scales of justice are being rewritten, not by courts, but by code.

On Wed. 12 Nov 2025, the first wave of wealth redistribution will go live, as millions receive their initial funds – empowering communities and triggering local economic recovery projects worldwide.

On Thu. 27 Nov 2025, President Trump will (allegedly) host a monumental Thanksgiving address marking the rebirth of the free republic under GESARA law. Global QFS announcements and unveilings of new sovereign infrastructures will accompany the celebration, symbolizing the dawn of a new era for humanity.

Thurs. 1 Jan. 2026 Scott Bessent has verified that the U.S. will integrate gold-backed reserves starting January 2026, ending America’s reliance on fiat currency.

As I write this, I can already sense it unfolding. Timelines merging. Systems syncing. Truth aligning with reality. This is not prediction – it’s confirmation of everything we’ve felt for years. We are entering the sequence. The silence isn’t absence. It’s preparation.

Hold the frequency, stay grounded, and remember: nothing visible can explain what’s already happening beneath the surface.

~~~~~~~~~~

THE INVISIBLE ENGINE BEHIND THE GLOBAL CURRENCY RESET 2025 …GitmO TV on Telegram

You heard of GCR. No one told you how it actually runs. The leak is out. The hidden Tier 1 to 5 structure is the command grid behind the Reset. It is not markets. It is power, access, timing. The battlefield is silent, encrypted, and real.

Fiat empires are collapsing. While the media sleeps, a new architecture is being wired through secure briefings and classified rooms. This is Tiered Redemption. It does not rank money or age. It sorts consciousness, readiness, mission.

Forget the public health tier model. That has nothing to do with GCR. In this operation, tiers mean awareness and position.

Tier 1. Central banks, sovereign treasuries, legacy dynasties, the big plumbing of the old system. You do not have to like them. For the transition you still route through their valves so the flood can drain.

Tier 2. Private banks, massive trusts, religious finance networks, certain NGOs. They are distribution. They move, mask, and now must release. Some corrupted, some pressured, a few flipped.

Tier 3. Historical bond holders and private whales. Dragon bonds, war era gold instruments, family certificates, suppressed estate claims. Redeeming these clears fake overlays and resets the ledger to truth.

Tier 4A. White Hat military and intel operations. Quantum system architects, validation teams, authorized redemption officers. They test, harden, simulate inside secure corridors with military grade clearance. Backstage. No applause. Total control.

Tier 4B. The awakened internet group. You studied QFS, NESARA, GESARA. You acquired revaluation currencies. You listened when others mocked. You prepared. Expect private notices, secure appointments, and roles in humanitarian deployment when the doors open.

Tier 5. The unprepared majority. Good people. Asleep to the war. They will benefit when it goes public, but without strategic terms, no special rates, no private centers. Freedom arrives anyway, even if they never knew the chains.

Read this as a war map. The tiers are not status. They are signal clarity. Higher tiers are not better. They are earlier. They carry responsibility. The mission is to stabilize the grid, then lift everyone.

Plain truths. Tier 1 is the pipe you still use. Tier 2 is the warehouse that must unlock. Tier 3 is the buried soul of real assets. Tier 4A builds the stage and guards the switch. Tier 4B is the citizen force that kept the flame. Tier 5 is humanity that will wake when the lights come on.

You are not here by accident. You are not Tier 5. You were selected to know and to prepare. Hold position. Watch for the signal. When it hits, move fast, act clean, think like a builder. The window will be short and decisive.

Read full post here: https://dinarchronicles.com/2025/10/31/restored-republic-via-a-gcr-update-as-of-october-31-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Frank26 [Iraq boots-on-the-ground report] OMAR: Television news showing clips about the new lower notes, especially on the local Iraqi broadcasts. These are the real notes. They’ve been giving people a heads up on the design and new security features so that everyone knows what’s coming before the notes are fully out there. FRANK: This is what we expected right about now as the month is coming to an end… Congratulations… you have finally landed on the shores of a new exchange rate with purchasing power for your currency…Every day is another piece of the puzzle. IMO sometime between now and the 11th of next month the CBI should show us the new exchange rate.

Mnt Goat …last week the CBI announced plans to remove zeros from dinar, as part of efforts to strengthen the national currency…two weeks ago, we also had articles on this subject matter…So, last week again the CBI confirmed to the citizens the project is underway and we will see more information about it soon. These types of recent articles are no longer just updates on the project to remove the zeros but informational and educational for the start of the process…that is what my CBI [contact] told me on my call to Iraq last Wednesday… So, we can expect more of these articles ongoing from now on educating us on this process that is underway…finally….

************

When Gold Doubles, The System Resets (It Just Happened)

Mark Moss: 10-31-2025

The rule is simple: When gold doubles, empires fall. And it just happened again.

But this isn't just a historical pattern; it's a mathematical certainty. And while most people will focus on the chaos that follows, they're missing the real story: the single greatest transfer of wealth in human history that has now been triggered.

00:00 The Rule That Predicts Collapse

02:00 Rome’s Warning: The Fall of the Denarius

09:00 Britain’s Fall: End of the Pound Empire

13:00 Today’s Warning: Gold Doubles Again

20:00 Defense and Offense: Gold and Bitcoin

Friday Coffee with MarkZ, joined by Bob Lock. 10/31/2025

Friday Coffee with MarkZ, joined by Bob Lock. 10/31/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Fabulous Friday

Member: Happy Halloween – hope it’s a fun one for everyone

Friday Coffee with MarkZ, joined by Bob Lock. 10/31/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: TGIF and Fabulous Friday

Member: Happy Halloween – hope it’s a fun one for everyone

Member: Any idea why bond people havn’t got paid yet?

MZ: I guess they aren’t ready? They sure have a lot of folks positioned. If you look there are financial articles about nations holding historic bonds. Pretty much every nation in the world holds historic bonds in their treasuries. This is a well known, easily researched fact.

Member: I cant decide which is worse the situtaion we are in waiting for notifications or seeing the money in the acct but cant use it yet

MZ: I did nave a bond contact check in saying they would be completed by November 5th. Cross your fingers and hope.

Member: Remember, remember the 5th of November.

Member: Something big is coming, too much going on. Keeping us confused

MZ: You know they have to confuse the timing. Its purposeful. I understand why they have to do it but it just sucks.

Member: It would make sense for everyone to go together…no one knowing ahead of time… most likely bonds aren't getting paid until the RV goes first

MZ: I think it may go “all at once” as well. I think it would be bedlam if it all doesn’t go at once.

Member: Seems very likely Iraq will do something soon to revalue their currency.

Member: Mnt Goat (Dinar Guru) There are NO newer smaller category notes issued or pictures even shown to anyone yet by the CBI and that includes the 10 and 50 categories. This is per my CBI contact. I assure everyone that there are absolutely NO newer lower denominations being distributed in Iraq anywhere. I just talked to my CBI contact yesterday and the CBI has not even released the notes yet. The instructions to the citizens as to how to exchange them along with pictures of them have also not begun. However, I will say that my contact told me that she is waiting for the “green light” to begin...

MZ: I agree that the LD’s have not yet been released…..just the “cut sheets”

Member: On Iraqi National TV …hearing they are showing the lower Notes!

MZ: “ The Central Bank of Iraq obtains the international business continuity certificate (ISO 22301:2019” More International standards ….We are looking at an Iraq with no restrictions.

MZ: “Trump’s Envoy reveals his vision for Iraq” He pictures Iraq free from foreign interference and sovereign.

Member: Frank stated Iraq has asked permission to go 1 to 1 with the US and UK

MZ: I would be ok with that. It would be nice to get more….but I would be ok with it.

Member: If all the countries go 1 to 1…..that would be a reset and we would all still come out all right imo…they just need to “DO IT”

Member: Sensing the nothing, nothing, all at once,

MZ: Just remember it’s a “when” and not an “if”. Buckle up for however long it takes.

Member: Do what you have to do every day, don't ride the roller coaster

Member: Have a wonderful Friday and enjoy your weekend! Hopefully it’s our last “poor” weekend!

Member: Stay safe while taking kids Trick or Treating…..and have fun

Mod: BREAKING NEWS: MarkZ's WEEKEND email address: Don't Write Me@NeverOnWEEKENDS.Com SERIOUSLY, MARK NEEDS A LITTLE TIME FOR HIMSELF FOR REST AND REC. THANK YOU!

Bob Lock joins the stream today. Please listen to the replay for his information and opinions

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

“Tidbits From TNT” Friday 10-31-2025

TNT:

Tishwash: The Central Bank of Iraq obtains the international business continuity certificate (ISO 22301:2019

Under the patronage of His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Allaq, the Central Bank organized a celebration on the occasion of the Total Quality Management Department obtaining the ISO 22301:2019 international conformity certificate for the Business Continuity Management System, issued by the International Organization for Standardization (ISO), after the actual application of the system requirements in the Bank’s Investment Department.

The ceremony was attended by Deputy Governor Dr. Ammar Hamad Khalaf, Professor Yaqoub Yousef, Head of the National Quality Team, the Director of Quality at the General Secretariat of the Council of Ministers, Dr. Areej Saeed, Head of the Department of Business Administration Technologies at the University of Baghdad, and Mr. Ammar Hussein, Director of the Total Quality Management Department.

TNT:

Tishwash: The Central Bank of Iraq obtains the international business continuity certificate (ISO 22301:2019

Under the patronage of His Excellency the Governor of the Central Bank of Iraq, Mr. Ali Mohsen Al-Allaq, the Central Bank organized a celebration on the occasion of the Total Quality Management Department obtaining the ISO 22301:2019 international conformity certificate for the Business Continuity Management System, issued by the International Organization for Standardization (ISO), after the actual application of the system requirements in the Bank’s Investment Department.

The ceremony was attended by Deputy Governor Dr. Ammar Hamad Khalaf, Professor Yaqoub Yousef, Head of the National Quality Team, the Director of Quality at the General Secretariat of the Council of Ministers, Dr. Areej Saeed, Head of the Department of Business Administration Technologies at the University of Baghdad, and Mr. Ammar Hussein, Director of the Total Quality Management Department.

During the ceremony, the international conformity certificate was handed over to the Total Quality Management Department, and the team was honored with a commemorative shield from His Excellency the Governor, in appreciation of their outstanding efforts in establishing a culture of institutional quality and achieving this qualitative accomplishment.

The implementation of the business continuity system comes within the framework of the Central Bank of Iraq’s strategic plan for the years 2024-2026, as one of the main pillars in enhancing institutional readiness and ensuring the continuity of vital operations and financial services in various circumstances, which enhances confidence in the bank’s ability to perform its tasks with high efficiency and flexibility.

Central Bank of Iraq - link

************

Tishwash: Central Bank's Precautionary Foreign Reserves

In line with the strategy and principle of disclosure and transparency that the Central Bank operates on in its internal and international banking transactions.

The monetary policy indicators up to the first half of 2025 show that foreign exchange reserves reached around $100 billion, which covers the issued local currency, which amounts to around 98.4 trillion dinars, which recorded a decrease of 3.8% compared to the same period of 2024.

The decrease in the issued local currency contributed to a decrease in the inflation rate to 0.8%, a decrease of 76% compared to 2024, and had a significant impact on maintaining the general price level.

Furthermore, foreign reserves at their current level are sufficient to cover 18 months of imports. In addition, there is a gold reserve of 167 tons, ranking fourth in the Arab world and thirtieth globally according to the World Gold Council.

This constitutes an important part of Iraq's foreign reserves, recording a significant growth rate of 55% up to the first half of 2025, reaching a value of 22.8 trillion dinars compared to 14.7 trillion dinars in the second half of 2024. The safe investments of these reserves have contributed significantly to the growth of investment portfolios, accompanied by a healthy growth in returns to these portfolios.

We emphasize here that the growth rates achieved in foreign reserves were consistent with the Central Bank’s plan to enhance returns and build capabilities in the field of self-management of reserves

Which enabled the establishment of international banking relationships and the entry into agreements and memoranda of understanding with classified international banks, reputable financial institutions, international financing and consulting organizations, the Arab Monetary Fund, and international institutions concerned with investment management, and contributed to helping our banks build international banking relationships with correspondent banks in accordance with the Central Bank’s plan to regulate foreign trade financing and implement the comprehensive banking reform program. link

************

Tishwash: Iraq signs contracts with international companies regarding the development road

Minister of Transport Razzaq Muhaibis Al-Saadawi announced today, Friday, that the ministry is in the process of contracting with a third party to audit the technical company responsible for the Development Road, noting that this road is an integrated economic project targeting 8 sectors.

Al-Saadawi stated in a press release that "the Ministry of Transport has worked to overcome the challenges in the Development Road project by utilizing foreign expertise," noting that "this is a strategic and large-scale project, the first of its kind in Iraq, and therefore foreign expertise is necessary."

He added that "the Ministry has engaged technical consultants from the Italian company BTP, and also engaged financial and economic consultants from the American company Oliver Wyman. Furthermore, a contract was signed with the American company KBR to audit Oliver Wyman," indicating that "the Ministry is currently in the process of contracting with an auditor or a third party to audit the technical company."

Al-Saadawi explained that "this road is an integrated economic project targeting eight sectors, and several countries are interested in participating in the project," confirming that "a high-level committee and a commission are planned to be formed to manage the Development Road project."

The “Development Road” is a road and railway that extends from Iraq to Türkiye and its ports, with a length of 1200 kilometers inside Iraq.

The "Development Road" is one of the most important pillars for linking Türkiye with Iraq and the Gulf, and is considered one of the shortest routes that connect the Gulf with Europe link

************

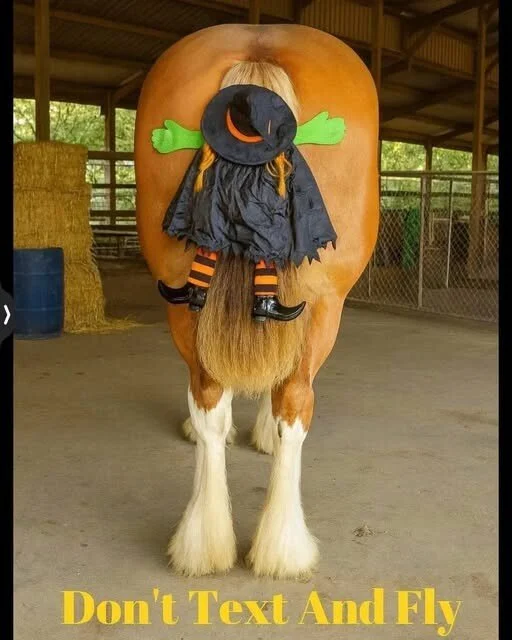

Mot: This Thingy bout Texting and

Mot: Getting Tough Out There - It Is!!!

Mot: Check on your friends ladies. Some are still learning to drive a stick.

Seeds of Wisdom RV and Economics Updates Friday Morning 10-31-25

Good Morning Dinar Recaps,

How the Trump–Xi APEC Truce Rewires Trade — and What It Means for the Global Financial Reset

One-year pauses on rare-earth curbs and export restrictions, tariff roll-backs, and resumed commodity purchases soothe markets — but don’t erase structural rivalry.

A tactical detente at APEC has eased immediate market stress, but the deeper re-wiring of global finance and alliances is only accelerated — not reversed.

Good Morning Dinar Recaps,

How the Trump–Xi APEC Truce Rewires Trade — and What It Means for the Global Financial Reset

One-year pauses on rare-earth curbs and export restrictions, tariff roll-backs, and resumed commodity purchases soothe markets — but don’t erase structural rivalry.

A tactical detente at APEC has eased immediate market stress, but the deeper re-wiring of global finance and alliances is only accelerated — not reversed.

After a nearly two-hour meeting on the sidelines of APEC in South Korea, U.S. President Donald Trump and Chinese President Xi Jinping struck a tactical trade truce: China agreed to pause planned rare-earth export curbs for one year and to resume large purchases of U.S. agricultural goods, while the U.S. signalled tariff reductions and a one-year suspension or delay of certain export-control and entity-list expansions. These moves calmed supply-chain fears and briefly eased market volatility.

Background — what was actually agreed

Rare-earth exports paused for one year: Beijing agreed not to implement newly announced export curbs on critical rare-earth minerals for an initial one-year period, giving manufacturers time to plan and suppliers time to adjust.

Tariff adjustments and trade purchases: Washington announced targeted tariff reductions and secured renewed Chinese purchases of U.S. soybeans and other commodities, intended to rebalance bilateral trade pressures.

Delay/suspension of export-control expansions: U.S. officials indicated a pause or delay in expanding harsher export controls or entity-list restrictions for roughly one year, a concession tied to the leaders’ understanding.

These were tactical, time-bound steps — not a comprehensive strategic accord on technology, security, Taiwan, or long-term industrial policy. Reuters and multiple analysts described the meeting as a temporary truce rather than a full reset.

Why this matters to the new global finance system

Stabilizes key input markets (short term): Rare earths underpin magnets, EV motors, electronics and defence supply chains. A one-year pause reduces immediate scarcity premiums, cooling asset-price and supply-chain shocks that would otherwise push firms toward accelerated decentralization of suppliers and alternative settlement systems.

Buys time for strategic positioning: The pause gives both capitals and firms breathing room to negotiate supply-chain diversification, domestic capacity build-outs, and financing arrangements — but it also creates a one-year runway where parallel systems (BRICS settlement rails, gold-linked arrangements, tokenized trade pilots) can mature.

Reduces near-term pressure for financial bifurcation — but not the trend: Markets welcomed the truce (commodity and equity moves reflected relief), yet the underlying drivers of financial multipolarity — regulatory divergence, regional payment rails, and strategic industrial policy — remain. That means capital allocation and reserve management choices (currency mix, gold, reserves in regional banks) will continue to shift.

Regulatory and entity-list pauses reshape financing windows: Delays to sanctions/controls temporarily reopen technology and capital flows to some firms — easing funding stresses for multinational projects — while policymakers and private actors use the window to accelerate alternative infrastructure (e.g., non-dollar settlement channels, local currency swap lines).

Strategic implications for alliances and global architecture

U.S. leverage regained tactically; China preserves strategic options. Washington gains short-term relief in supply chains and domestic price pressure; Beijing secures time to scale domestic processing and to diversify export partners. Neither side gave up core leverage — they merely rebooted a negotiating clock.

BRICS and regional blocs speed up parallel finance initiatives: A tactical U.S.–China truce reduces immediate urgency for some governments to decouple, but geopolitical competition still incentivizes alternative clearing, trade settlement and reserve arrangements — a parallel architecture that can coexist with renewed U.S.–China commerce.

Private markets and corporates win a planning window: Multinationals get a one-year horizon to adjust contracts, hedge strategies and sourcing — a pragmatic benefit that can temporarily soften capital flight into havens or strategic relocation.

Why this leads to restructuring, not reversal

Time-bound deals don’t undo structural policy choices. Even if rare-earth curbs are paused, China’s prior expansion of controls and investment into processing capacity remain. Markets — and states — will re-price longer-term political risk, accelerating investments in domestic mining, recycling, and substitutes.

A tactical truce accelerates the shape of the reset. Rather than forcing immediate decoupling, the truce allows both sides to coordinate staging: the West can continue gradual reshoring and alliance-based procurement, while China can pursue parallel financial rails and strategic commodity partnerships — both paths change who controls critical flows and how capital is allocated globally.

What to watch next

Follow-through mechanics: Are the rare-earth pauses and tariff cuts written into enforceable MOUs, or are they purely declaratory? Legal detail matters for markets.

One-year horizon policy moves: Expect both capitals to make domestic legislative and industrial moves during the pause — increased mining permits, subsidies, or export-processing investments.

BRICS and alternative settlement progress: If Russia, India or other partners accelerate non-dollar settlement or gold-linked swaps during the truce, the global financial architecture could bifurcate quietly while trade resumes.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Reuters — China agrees to one-year rare earth export deal, issue ‘settled’ says Trump.

Reuters — Trump-Xi 'amazing' summit brings tactical truce, not major reset.

Reuters — Trump shaves China tariffs in deal with Xi on fentanyl, rare earths.

Reuters — US delays expansion of export restrictions on Chinese firms after Trump-Xi meeting, Bessent says.

Al Jazeera — Trump-Xi meeting: Key takeaways (truce on tariffs and rare earths).

Atlantic Council — Experts react: What does the Trump-Xi meeting mean for trade, technology, security, and beyond? (analysis & expert views).

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Stagflation Is Back—And the Fed Is Asleep at the Wheel

Stagflation Is Back—And the Fed Is Asleep at the Wheel

Notes From the Field By James Hickman (Simon Black) October 29, 2025

Protestant firebrand and political activist Hugh Latimer must have known he was risking his life when he stepped into the pulpit at St. Paul’s Cross on January 12, 1549. His sermon that Sunday morning was hardly religious in nature. Rather, Latimer publicly expressed the view-- the deep, deep frustration-- that nearly all Englishmen were feeling at the time, but everyone was too afraid to say out loud.

Inflation was killing them. And it was the government’s fault.

Stagflation Is Back—And the Fed Is Asleep at the Wheel

Notes From the Field By James Hickman (Simon Black) October 29, 2025

Protestant firebrand and political activist Hugh Latimer must have known he was risking his life when he stepped into the pulpit at St. Paul’s Cross on January 12, 1549. His sermon that Sunday morning was hardly religious in nature. Rather, Latimer publicly expressed the view-- the deep, deep frustration-- that nearly all Englishmen were feeling at the time, but everyone was too afraid to say out loud.

Inflation was killing them. And it was the government’s fault.

It started about seven years before, in 1542. England went to war against both Scotland and France-- AT THE SAME TIME. War is always expensive, and it’s especially debilitating when you’re fighting simultaneous conflicts to your north and south.

War costs quickly mounted, and the English government began paying for it by debasing the currency. Two years into the wars, by 1544, silver content in their coins had plummeted by about a third. Two years later by another 50%.

At peak, when Latimer gave his famous sermon, silver content had fallen 90% in just seven years. And as a result, prices across England were skyrocketing.

Latimer was witty and eloquent in the finest English tradition; he quipped at one point that “the King’s coin is become like the King’s faith-- clipped and counterfeit.” And later on, “the debasing of the coin is the debasing of the realm…”

Latimer believed the debasement of the currency to be a moral issue-- even a sinful act-- because it was essentially theft of commoner’s purchasing power.

He spoke to thousands of people that cold day in January. But his words went far beyond the congregation; his sermon was published and widely circulated, prompting angry Englishmen across the country to form rebel groups and demand change.

Latimer was arrested and charged for “stirring the people”, imprisoned in the Tower of London and ultimately put to death. His final words were “we shall this day light such a candle, by God’s grace, in England, as I trust shall never be put out.”

Writing in his own journal in 1551, King Edward VI himself admitted that his government was wrong.

“The debasement of the coin was the cause of the dearth,” wrote the King-- with dearth in that context referring to soaring food prices. He knew his government caused inflation, and inflation caused the social unrest. Latimer was an innocent man who had the courage to say what everyone else was feeling.

Both of these are sadly common trends in history; governments often persecute those whose only crime is telling the truth. And second, governments will invariably screw up, create inflation, and cause severe devastation in people’s lives.

I’ll focus on the second topic today given that the most recent inflation numbers in the US were announced a few days ago.

And, no surprise, inflation is ticking up and moving in the wrong direction. Based on the September month-over-month numbers, inflation is an annualized 3.6%.

Bizarrely, the Fed has already begun lowering interest rates and is widely expected to cut further in the coming months… which will most likely make inflation worse.

Far more important is that Fed officials are signaling that they’re about to end their quantitative tightening earlier than originally planned.

This is crucial. During the pandemic, the Fed created $5+ trillion in new money. Poof. It’s the equivalent of England debasing its currency in the 1540s… and all that new money triggered all the inflation we’ve experienced.

Quantitative tightening is the reverse of that process; in addition to raising rates (starting in 2022), the Fed also began reducing the money supply and draining some of that money out of the financial system.

At this point they’ve removed about $2 trillion out of the $5 trillion that they printed. And the original plan was to keep going and reduce their balance sheet.

But that seems to be no longer happening. So stopping the quantitative tightening, combined with interest rate cuts, will really invite a LOT more inflation.

And all of this is happening just as the labor market is beginning to falter. White collar jobs in particular are being slashed at an astonishing pace.

There’s a term for this-- one that economists don’t like to use very much. But it’s called stagflation-- a shrinking economy combined with higher inflation.

America has been here before-- most recently in the 1970s.

The US economy was in a tailspin; unemployment and inflation BOTH surged, resulting in an almost entire decade of economic misery. But there were safe havens.

Gold was an obvious safe haven. As the US economy stagnated and retail prices rose, gold prices exploded, rising more than 20x over the next ten years. The dollar, meanwhile, lost roughly 75% of its purchasing power.

We’re seeing similar conditions today, from the inflation data to the gargantuan US national debt. And if history is any guide, this isn’t a trend that reverses easily. The underlying driver—loss of confidence in US fiscal policy and the long-term value of the dollar—shows no sign of abating.

This is why we’ve written so much about gold over the past few years. And, despite its recent pullback, gold remains an incredibly sensible long-term investment.

But there are other real assets to consider as well.

Real assets in general tend to hold their value during inflationary periods—because they’re not just paper promises. They’re tangible. They’re productive. They’re the raw inputs the economy is actually built on.

One of the most obvious opportunities right now—possibly the most mispriced sector in the entire market—is energy.

The world does not exist without energy. Full stop. People have been fed a ridiculous lie that oil is going to disappear and we’re all going to drive solar-powered EVs and Exxon is going to go out of business.

What total BS. But because of this myth, many oil companies are absurdly cheap. Meanwhile oilfield services businesses have been practically left for dead.

Then there’s natural gas-- which (especially in the US) remains THE cheapest form of energy on the planet—cheaper than coal, oil, and in some real-world scenarios, even cheaper than nuclear. And it’s even pretty clean.

But natural gas producers too have traded at fire-sale valuations.

We’ve been clear that the gold story is not over by a long shot.

But in our investment research, we are starting to turn to other sectors that are still at the bottom of their cycles— but won’t stay that way for long the way inflation is heating up again.

The story of inflation is as old as the story of civilization itself. It’s inevitable.

And we’re seeing some pretty obvious warning signs on the horizon.

But there are some compelling safe havens out there which have almost NEVER been cheaper. They’re worth considering.

We’d also encourage you to consider joining our premium investment research service, which features these deeply undervalued, highly profitable, well-managed real asset businesses-- we’re offering a limited time promotional discount and an iron-clad money back guarantee.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

MilitiaMan and Crew: IQD News Update-ISO 22301 EXPLOSIVE-EXCHANGE RATE RELATED

MilitiaMan and Crew: IQD News Update-ISO 22301 EXPLOSIVE-EXCHANGE RATE RELATED

10-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update-ISO 22301 EXPLOSIVE-EXCHANGE RATE RELATED

10-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

FRANK26….10-30-25……EXCHANGE CENTER INFO

KTFA

Thursday Night Video

FRANK26….10-30-25……EXCHANGE CENTER INFO

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Thursday Night Video

FRANK26….10-30-25……EXCHANGE CENTER INFO

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Podcast: Is it War? On Rumors That China Just Took Out Two US Military Aircraft

Podcast: Is it War? On Rumors That China Just Took Out Two US Military Aircraft

Notes From the Field By James Hickman (Simon Black) October 28, 2025

There was a popular legend from medieval Venice about an impoverished orphan from the island of Torcello. The boy came to Venice at a young age, found a job, and worked tirelessly and energetically-- enough to impress some of the city’s wealthy patricians.

Eventually the boy-- now a young man-- had built up enough credibility that some local noblemen entered into a commenda contract with him, i.e. a sort of proto-limited partnership. The idea was that the investors would finance a trade voyage (and stay comfortably at home in Venice), while the young man would risk life and limb on the high seas.

Podcast: Is it War? On Rumors That China Just Took Out Two US Military Aircraft

Notes From the Field By James Hickman (Simon Black) October 28, 2025

There was a popular legend from medieval Venice about an impoverished orphan from the island of Torcello. The boy came to Venice at a young age, found a job, and worked tirelessly and energetically-- enough to impress some of the city’s wealthy patricians.

Eventually the boy-- now a young man-- had built up enough credibility that some local noblemen entered into a commenda contract with him, i.e. a sort of proto-limited partnership. The idea was that the investors would finance a trade voyage (and stay comfortably at home in Venice), while the young man would risk life and limb on the high seas.

*********************************

The investors would take 100% of the financial risk in exchange for 75% of the profit, while the orphaned entrepreneur would earn a 25% cut in exchange for risking his life.

The young man went off to sail the known world and came back with 10x his investors’ money. Ecstatic at the tremendous return on capital, the investors backed several other voyages… until eventually the young orphan boy with no prospects became one of the richest men in Venice.

No one knows if this particular story is true. But it’s emblematic of the incredible rise and peak of the Republic of Venice. 1,000+ years ago, it was truly the America of its day.

While the rest of Europe was toiling away in poverty due to the constraints of the ridiculous feudal system, Venice was like a rocket ship far ahead of its time.

Its entire society was built on economic freedom. ANYONE, from anywhere in Europe, could come to Venice, work hard, take risks, and make a fortune. It was the American dream seven centuries before there was an America.

Venice also prided itself on a strong rule of law, not to mention unparalleled political and financial stability. It became the richest place on the continent, by far, and its ducato (ducat) gold coin eventually displaced the Byzantine gold solidus as Europe’s major reserve currency.

But eventually, like most great civilizations, it peaked. Venice’s swashbuckling, risk-taking, hard-working entrepreneurial culture became complacent.

Rather than finance new trade routes and keep innovating, the great moneyed families of Venice were happy to sit at home and spend their fortunes on art and architecture. The government became clogged up with an entrenched political class that remained in elected office year after year. They became lazy, then incompetent, and then ultimately ran the place into the ground.

Meanwhile, other rising powers emerged on the geopolitical horizon-- among them, the Ottoman Empire.

In the 1300s, the Ottoman Empire came out of nowhere as a ferocious competitor, ruthlessly conquering everyone who stood in their way. They were also shrewd at trade and commerce, and they posed a direct threat to Venice.

It was a classic historical case of a rising power against a declining power. And it seemed like war was inevitable.

And to be fair, the two countries did cross swords a number of times; history records these as the “Ottoman-Venetian Wars [note the plural]”, though realistically they were extremely limited conflicts, i.e. not full-blown total war in which both sides tried to obliterate one another.

The reason for the limited nature of the conflicts is simple: trade. Both Venice and the Ottoman Empire did a LOT of business with one another, and they both knew that destroying their adversary would be self-destructive.

*****************************

So instead, they fought small, limited conflicts while continuing to engage in trade and commerce.

This is very similar to the US-China conflict that has already been going on for a number of years. We can’t even count the number of cyberattacks that China has waged on the US and US infrastructure. There will be more.

China has been buying up land across the United States left and right to stage military assets for further conflict. They’ve engaged in election interference. Stolen intellectual property. Flooded the US with Fentanyl. Brazen espionage, complete with honeypot sex scandals of high-ranking bureaucrats, business leaders, and politicians. And let’s not forget about the balloons flying over US military bases.

Over the weekend the US Navy announced that two military aircraft-- a MH-60R Sea Hawk helicopter and F/A-18F Super Hornet jet-- both crashed in the South China Sea while conducting “routine operations”.

Fortunately no one was killed, and all crew members were safely recovered. But aside from that, the Navy provided no further details.

Realistically there are two possibilities.

Either, one, it’s amateur night at the Navy again, where poor training, bad leadership, or DEI quotas resulted in yet another preventable accident. And if that’s the case, it’s even more embarrassing given that it took place in China’s backyard.

The more sinister possibility is that the Chinese navy disabled the aircraft.

China regularly deploys its extensive (and highly advanced) nuclear-powered submarine fleet throughout the South China Sea to deliberately frustrate global shipping and control the region.

They engage in electronic warfare, including signal jamming that takes out radar, navigation, and communication systems for commercial shipping vessels… which encourages them to avoid the South China Sea entirely.

The US military, on the other hand, routinely conducts counter-jamming operations, along with submarine tracking, in an effort to keep the South China Sea open.

The two militaries are essentially engaged with one another every single day… but without firing a single shot. It’s a very limited conflict.

This weekend it might have crossed a line. And it’s possible that China’s jamming operations might have taken out certain flight and navigation controls of the US military aircraft, causing them to crash.

That would be a blatant escalation, especially as President Trump and Xi are set to meet.

Having said that, I still think full-scale war is a remote possibility. Just like Venice and the Ottoman Empire, China and the US still need each other. China actually needs the US far more than the US needs China at this point, and in truth the Trump administration has worked hard to make sure that’s the case.

Frankly, war with China doesn’t even crack what I would consider the top five concerns facing the US right now—maybe not even the top ten.

We break this all down in today’s podcast—why these latest incidents matter, but also why the odds of all-out war are extremely low.

And I also weigh in on what I actually think is a much bigger concern for the US.

You can listen to the podcast here. For the audio-only version, check out our online post here.

Finally, you can find the podcast transcript for your convenience, here.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

Seeds of Wisdom RV and Economics Updates Thursday Evening 10-30-25

Good Evening Dinar Recaps,

Cross-Border Payments & Modernisation — Real-time, Intelligent, Interoperable

Why payments infrastructure is finally becoming the plumbing of the new global reset

Overview

Cross-border payments are undergoing a deep transformation — from slow, opaque, siloed rails to near-instant, high-visibility, smart networks. This change is not just about convenience; it is foundational for a multipolar financial system in which settlement, transparency and speed matter more than legacy incumbency.

Good Evening Dinar Recaps,

Cross-Border Payments & Modernisation — Real-time, Intelligent, Interoperable

Why payments infrastructure is finally becoming the plumbing of the new global reset

Overview

Cross-border payments are undergoing a deep transformation — from slow, opaque, siloed rails to near-instant, high-visibility, smart networks. This change is not just about convenience; it is foundational for a multipolar financial system in which settlement, transparency and speed matter more than legacy incumbency.

Key developments

Real-time payment systems and ISO 20022 messaging standards are being adopted widely: improved data, interoperability and reduced reconciliation friction.

Solutions like SWIFT GPI enable end-to-end tracking of cross-border flows — nearly 60 % of payments credited within 30 minutes, with full delivery within 24 hours.

Emerging rails (digital assets, fintech-led routing, programmable accounts) allow payments to reroute dynamically for speed, cost or regulatory advantage.

What this means for global alliances

Payment interoperability = alliance interoperability: When major blocs (e.g., BRICS, ASEAN, G7) adopt common messaging or rail standards, they deepen economic alignment.

Settlement preference as alignment tool: Countries that connect quickly and transparently to modern rails may become preferred trade partners, pushing others into less-connected legacy networks.

Infrastructure diplomacy: Payment-network governance becomes strategic: who controls node access, routing rules, data visibility becomes part of alliance bargaining.

How this accelerates financial restructuring

By reducing frictions and latency, the system lowers the cost of doing business across borders — enabling multi-currency and non-dollar settlement to gain traction.

The greater transparency and real-time nature enable alternative financial ecosystems to emerge that are less reliant on U.S.-centric rails and more regionally autonomous.

The shift from bank-centrism to rail-centrism means the locus of power moves: from large global banks to protocol/governance owners of payment infrastructure.

Practical signals to watch

Announcements of new payment-rail alliances, cross-border wallet/funds-transfer hubs, or major banks switching to modern messaging standards (e.g., ISO 20022).

Countries signing mutual recognition of payment infrastructures or digital-asset settlement links across jurisdictions.

Reports of major companies routing large cross-border flows via newer rails (digital, wallet-to-wallet) rather than traditional correspondent banking.

Bottom line:

Payments may seem a technical detail — but they are the foundation of global economic exchange. Modern, real-time, interoperable networks are reshaping how money moves, who it moves through and which alliances get preferred access.

This is not just politics — it’s global finance restructuring before our eyes.

Seeds of Wisdom Team

Newshounds News™ Exclusive

Sources:

Finastra – Modernising Cross-Border Payments for a Competitive Advantage

DNB Speech – Cross-Border Implications of Modernising Payment Systems

~~~~~~~~~

Malaysia’s BRICS Bid Gains China–Brazil Backing Amid Trump’s Asian Trade Push

Strategic alliances reshape Southeast Asia’s position in the emerging global financial architecture.

BRICS Expansion Accelerates

Malaysia’s bid for full BRICS membership gained significant traction this week, following public endorsements from China, Brazil, and Russia — three of the bloc’s founding members.

The coordinated support suggests that Malaysia’s full entry into BRICS by 2025 is increasingly probable, marking a milestone in the bloc’s Southeast Asian expansion.

Brazilian President Lula da Silva affirmed Brazil’s backing during the 47th ASEAN Summit in Kuala Lumpur, calling Malaysia’s entry “a natural step for deeper South–South integration.”

China’s Foreign Ministry echoed support, emphasizing that Malaysia “shares BRICS’ cooperative goals and development vision.”

Russia’s Deputy Prime Minister Alexey Overchuk confirmed alignment, noting Malaysia’s “strategic fit within emerging global frameworks.”

If successful, Malaysia would become the second ASEAN nation with full BRICS membership, following Indonesia — strengthening the bloc’s economic footprint in Asia.

Strategic Implications for Southeast Asia

Malaysia’s accession would effectively anchor BRICS influence along the Malacca Strait, one of the world’s most critical trade and energy corridors.

The move signals a shift from dependency on Western-led systems to diversified, multipolar partnerships blending BRICS finance, trade, and digital settlement initiatives.

Enhanced participation in de-dollarized trade settlements.

Access to BRICS development financing, alternative to the IMF/World Bank model.

Expansion of digital infrastructure cooperation, aligning with China’s Belt and Road and Brazil’s south–south fintech programs.

Together, these could accelerate regional integration under a shared digital and resource-backed trade framework.

Trump’s Trade Diplomacy in Malaysia

At the same time, former President Donald Trump’s diplomatic travels through Asia — including Malaysia — have centered on reviving U.S. trade influence in a region increasingly tied to BRICS and China-led frameworks.

During his meetings in Kuala Lumpur, Trump’s delegation emphasized bilateral trade incentives and re-industrialization partnerships, especially in semiconductor and rare earth sectors.

However, these talks occur amid the very BRICS expansion that the U.S. aims to offset.

Trump’s pragmatic strategy appears to position U.S. alliances as complementary rather than adversarial, creating new trade routes that could still integrate with BRICS-linked systems under different governance models.

Global Financial Implications

The Malaysia–BRICS development ties directly into the broader realignment of global finance:

The inclusion of Malaysia strengthens BRICS’ claim over nearly half of global GDP (PPP).

Expansion of cross-border digital payment corridors could integrate ASEAN and BRICS via programmable, asset-linked systems.

A multi-node financial network is emerging — where sovereign trade alliances, real assets, and digital currencies converge outside the traditional Western banking structure.