Thank you to all the subscribers to our Early Access program…we thank you for your continued support.

We are excited to offer this new service to keep you informed and up-to-date on the latest Dinar and currency news.

FRANK26….10-1-25……..DATE

KTFA

Wednesday Night Video

FRANK26….10-1-25……..DATE

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

KTFA

Wednesday Night Video

FRANK26….10-1-25……..DATE

This video is in Frank’s and his team’s opinion only

Frank’s team is Walkingstick, Eddie in Iraq and guests

Playback Number: 605-313-5163 PIN: 156996#

Countries are Canceling Treasuries for Gold as US Revaluation Panic Grows

Countries are Canceling Treasuries for Gold as US Revaluation Panic Grows

Sean Foo: 9-20-2025

For decades, the US dollar has stood as the undisputed monarch of global finance, its status as the world’s primary reserve currency underpinning stability and shaping international trade. But what if this reign is quietly approaching its twilight?

A compelling video from Sean Foo offers a deep dive into the accelerating “de-dollarization” trend, painting a picture of a world on the cusp of a profound economic shift.

Countries are Canceling Treasuries for Gold as US Revaluation Panic Grows

Sean Foo: 9-20-2025

For decades, the US dollar has stood as the undisputed monarch of global finance, its status as the world’s primary reserve currency underpinning stability and shaping international trade. But what if this reign is quietly approaching its twilight?

A compelling video from Sean Foo offers a deep dive into the accelerating “de-dollarization” trend, painting a picture of a world on the cusp of a profound economic shift.

Sean Foo highlights that the erosion of the dollar’s dominance isn’t a sudden event, but rather the cumulative effect of several powerful forces. Geopolitical tensions, particularly the rising friction between major powers, have incentivized nations to seek alternatives to the dollar-centric system.

Add to this the disruptive force of trade wars – vividly exemplified by the Trump Administration’s tariffs – which have fractured established supply chains and cooled international demand for the dollar.

Simultaneously, persistent fiscal mismanagement within the US, leading to ballooning deficits, has further undermined confidence. When a nation’s financial house isn’t in order, the stability of its currency comes under scrutiny on the global stage.

This isn’t just theoretical; it’s playing out in real-time. China, for instance, is actively spearheading the shift by increasingly conducting its trade and financial transactions in its own currency, the renminbi (RMB), rather than the US dollar.

This move, accelerated by the very trade wars intended to pressure China, demonstrates a strategic pivot away from dollar dependency.

The impact is palpable. The US economy itself is showing signs of instability – think payroll declines, delayed economic data, and increasingly erratic government behavior – all of which erode investor confidence.

The numbers don’t lie: the dollar index plummeted nearly 11% in the first half of 2025, marking its worst performance since the historic collapse of the Bretton Woods system in 1973. This is not merely a dip; it’s a tremor.

Amidst this weakening dollar and a landscape of rising tariffs and projected $2 trillion fiscal deficits in 2025, central banks worldwide are doing something significant. They are actively reducing their holdings of US Treasuries – long considered the world’s safest asset – and conspicuously increasing their gold reserves.

Gold, the ancient store of value, is re-emerging as the preferred safe haven, signaling a historic shift in global financial strategy.

Interestingly, Sean Foo also explores a drastic measure the US government could take: a gold revaluation. Given the vast disparity between the book value and market value of US gold reserves, such a move could unlock nearly $1 trillion in liquidity. This “easy money” could provide short-term relief for US fiscal and monetary policy, fueling inflation-driven GDP growth.

However, this path is fraught with peril. A gold revaluation would be an implicit admission of the dollar’s fragile condition, potentially accelerating its decline.

Furthermore, it could unintentionally strengthen China’s financial position, as China is rumored to hold vast, potentially underreported, gold reserves. The US faces a challenging dilemma: embrace this short-term liquidity and risk undermining the dollar’s long-term status, or avoid it and battle escalating fiscal crises head-on.

The implications of these shifts are profound. We are witnessing a historic recalibration of global reserves, a re-evaluation of dollar holdings, and a resurgence of gold’s role in the new economic landscape. For investors, policymakers, and anyone concerned about the future of money, understanding these dynamics is crucial.

The world is moving on from a singular reliance on the US dollar. The question is no longer if things are changing, but how fast, and what the ultimate destination will be.

Shutdown Or Not, Government Dysfunction = Higher Gold Prices

Shutdown Or Not, Government Dysfunction = Higher Gold Prices

Notes From the Field By James Hickman (Simon Black) September 30, 2025

All eyes are on Washington to see if the government shuts down when the clock strikes midnight tonight.

Funny thing is, most people aren’t really going to care—because all of the “essential” services will keep running. (Which makes you wonder: why do non-essential government services exist on the taxpayer’s dime in the first place?)

But today is also the end of the fiscal year. And based on the data, we can see that the US will end the fiscal year with around $37.5 trillion in debt. That means, for Fiscal Year 2025, the debt will have increased by another $1.8 trillion.

Shutdown Or Not, Government Dysfunction = Higher Gold Prices

Notes From the Field By James Hickman (Simon Black) September 30, 2025

All eyes are on Washington to see if the government shuts down when the clock strikes midnight tonight.

Funny thing is, most people aren’t really going to care—because all of the “essential” services will keep running. (Which makes you wonder: why do non-essential government services exist on the taxpayer’s dime in the first place?)

But today is also the end of the fiscal year. And based on the data, we can see that the US will end the fiscal year with around $37.5 trillion in debt. That means, for Fiscal Year 2025, the debt will have increased by another $1.8 trillion.

Taken as a whole, this is an obvious testament to why foreign governments and central banks are rapidly losing confidence in the US government.

It doesn’t even matter whether the government shuts down tonight— it is the fact that it always comes so close. That Congress can’t even manage to pass a basic budget.

And the “solution” on the table is just another short-term patch— a continuing resolution that keeps the government funded for less than two months, until November 21st.

America looks like exactly what it is: a dysfunctional government that can’t even pass a budget.

Frankly, it’s embarrassing.

On top of that, you’ve got this $37.5 trillion debt growing by leaps and bounds—faster than the US economy and faster than tax revenue.

At a certain point, these foreign governments and central banks, who collectively own trillions upon trillions of dollars worth of US government bonds, start wondering: why should I continue to own these securities? Why continue to lend money to the US government?

They can’t even pass a routine budget, let alone the kind of budget that would actually reassure foreign governments and central banks—a truly controversial one that makes deep, necessary cuts to runaway spending.

Then there’s another problem—one that isn’t new. It started under the Bush administration, Obama elevated it, and Biden perfected it: the weaponization of the US dollar, the financial system, and US Treasury bonds.

This gives foreign governments and central banks obvious concern: if they do something the US doesn’t like, they’re going to be frozen out of the dollar system—out of their Treasury holdings, and out of dollar-denominated assets altogether.

And these are all reasons why we believe, over the long run, gold will continue to march higher: central banks will continue to buy gold as an alternative to US dollars.

Why gold?

It’s an independent asset. It’s not controlled by any government. No country is worried that America will freeze its gold holdings. Millions of troy ounces of bars and bullion stored around the world can’t be frozen with the click of a button.

Gold is universally accepted by every other country and central bank. There’s a global market for it. And it’s an asset class large enough to absorb billions of dollars— or even tens, or hundreds of billions—over time.

You can’t say that about most other asset classes.

Gold has already had an astonishing run—especially this year. But we think that, over the long run, as more foreign central banks allocate an increasing percentage of their strategic reserves into gold instead of dollars, that excess demand will continue to push the gold price much higher.

Gold is like anything else—subject to the laws of supply and demand. Demand for physical gold by governments and central banks around the world has been very strong.

And based on the data we’re seeing, that continues to be the case.

The Chinese central bank has bought another 21 tons of gold this year, marking ten consecutive months of purchases.

And it’s not just China. It’s all over the world— Poland, Turkey, Czech Republic, Kazakhstan and many other countries are buying literal tons of gold.

In fact, 95% of central bank reserve managers said they expect global official gold holdings to increase over the next 12 months, according to the 2025 World Gold Council Central Bank Gold Reserves Survey.

There are, however, short-term price risks. For example, the gold price is also impacted by demand for jewelry, as well as industrial use.

Given current record-high prices, jewelry demand is much weaker.

And that can have an adverse impact on gold prices.

Another factor to consider is supply. At a certain point, mining companies are going to take advantage of these high prices and ratchet up production, eventually resulting in oversupply in the market. That, too, could weigh on gold prices.

But we think these are shorter-term factors that don’t change anything about the long-term driver of gold prices—and that is central bank demand.

What we are seeing literally today— government shutdowns and $1.8 trillion deficits—just underscores how widespread that central bank demand is—and why it simply isn’t going away.

To your freedom, James Hickman Co-Founder, Schiff Sovereign LLC

PS: While gold has hit all time highs, the share prices of many top quality gold producers has lagged far behind. That is starting to change, but there is still opportunity before the gap closes.

Seeds of Wisdom RV and Economics Updates Wednesday Afternoon 10-1-25

Good Afternoon Dinar Recaps,

BRICS Dollar Devaluation Path Strengthens With New Payment Systems

As BRICS builds alternative payment rails and leans on gold reserves, the move toward a multipolar financial order accelerates — with profound geopolitical and economic consequences.

Good Afternoon Dinar Recaps,

BRICS Dollar Devaluation Path Strengthens With New Payment Systems

As BRICS builds alternative payment rails and leans on gold reserves, the move toward a multipolar financial order accelerates — with profound geopolitical and economic consequences.

Payment Infrastructure Advances: Beyond Talk to Action

BRICS is pushing forward with BRICS Pay, a decentralized cross-border payment messaging system designed to bypass Western-controlled networks like SWIFT, allowing member nations to transact in local currencies.

During the Rio de Janeiro deliberations, the bloc proposed a guarantee fund to support local payments and integrate them into BRICS Pay.

These systems aren’t theoretical — they are intended to make dollar-free trade routable, reliable, and scalable across BRICS and select partner states.

De-Dollarization Backed by Gold & Local Currency Trade

🔹 Gold as a Pillar

BRICS nations now hold over 6,000 tons of gold — nearly 20–21% of global central bank reserves. Russia and China lead, owning ~74% of the bloc’s gold reserves.

The gold buffer acts as a shield against sanctions, dollar volatility, and external pressure while anchoring confidence in new payment systems.

🔹 Local Currency Settlement

Trade between BRICS nations increasingly uses national currencies instead of the U.S. dollar, reducing the need for dollar liquidity or FX hedging.

The New Development Bank (NDB) now plans to issue its first Indian rupee-denominated bond, aiming to raise ~$400–$500 million in India, as part of a strategy to internationalize BRICS member currencies.

Challenges & Friction in the Shift

🔹 Institutional & Network Effects

The U.S. dollar remains deeply entrenched in global trade: used in nearly 90% of FX trades and ~48% of SWIFT payments.

De-dollarization faces headwinds: liquidity fragmentation, exchange risk, and the higher cost of managing multiple currency rails.

🔹 Uneven Commitment Among Members

India has publicly stated de-dollarization is “not part of India’s financial agenda”, emphasizing bilateral local-currency trade instead.

Some BRICS members remain wary of overextending—too rapid a shift could destabilize economies, especially those with debt pegged to USD or who still rely heavily on U.S. trade and investment.

How This Fits Into Broader Global Restructuring

🔹 Redistribution of Financial Power

By operating an independent payment network and backing it with gold, BRICS is carving out financial sovereignty zones less subject to U.S. pressure or SWIFT control.

🔹 Erosion of Dollar Leverage

As BRICS transactions move off dollar rails, demand for USD as a settlement, reserve, and liquidity asset may decline — weakening the mechanisms by which the U.S. exerts financial influence.

🔹 Multipolar Payment Networks

Instead of one monolithic financial system, we may see overlapping networks (BRICS Pay, CIPS, mBridge, regional CBDC links), each with their own control nodes, rules, and dominant currencies. The world becomes less unified and more plural in financial architecture.

🔹 Gold & Currency Strategy as Influence Tools

Holding gold gives BRICS credibility; issuing debt in local currencies gives them leverage. These instruments become tools of diplomacy and alignment, not just balance sheet items.

Key Takeaway

BRICS is not just talking about breaking dollar dominance — it is constructing the alternatives. Payment systems, gold reserves, and currency internationalization converge in a push to remake global finance. What once seemed speculative is now engineering realignment of power.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru – BRICS Dollar Devaluation Path Strengthens With New Payment Systems Watcher Guru

InvestingNews – How Would a New BRICS Currency Affect the US Dollar? Investing News Network (INN)

Nestmann – The BRICS De-Dollarization & What It Means for Gold The Nestmann Group

Brasil de Fato – BRICS leaders propose alternative payment system to SWIFT Brasil de Fato

Reuters / News – BRICS-backed NDB plans first rupee-denominated bond Reuters

Wikipedia – BRICS Pay Wikipedia

Carnegie / Policy analyses – Challenges to de-dollarization and structural headwinds CIRSD

Additional academic insight – Geopolitical Tensions & Financial Networks: Strategic Shifts Toward Alternatives arXiv

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

Urgent Breaking News Currency Exchange, IQD Value Increase to 1303

Urgent Breaking News Currency Exchange, IQD Value Increase to 1303

Edu Matrix: 9-30-2025

For years, analysts and investors eyeing exotic currencies have focused on regions struggling with geopolitical instability, searching for the elusive “buy low, sell high” opportunity.

While much of this conversation centers on nations like Iraq, a recent compelling analysis from the Edu Matrix channel shifts the spotlight dramatically to South America, suggesting that Venezuela’s currency could be positioned for a stunning revival.

In a thought-provoking video, Edu Matrix host Sandy Ingram draws a powerful historical parallel, comparing Venezuela’s current state of economic turmoil not to the instability of Iraq, but to the remarkable financial revitalization of Panama in the late 1980s and early 1990s.

Urgent Breaking News Currency Exchange, IQD Value Increase to 1303

Edu Matrix: 9-30-2025

For years, analysts and investors eyeing exotic currencies have focused on regions struggling with geopolitical instability, searching for the elusive “buy low, sell high” opportunity.

While much of this conversation centers on nations like Iraq, a recent compelling analysis from the Edu Matrix channel shifts the spotlight dramatically to South America, suggesting that Venezuela’s currency could be positioned for a stunning revival.

In a thought-provoking video, Edu Matrix host Sandy Ingram draws a powerful historical parallel, comparing Venezuela’s current state of economic turmoil not to the instability of Iraq, but to the remarkable financial revitalization of Panama in the late 1980s and early 1990s.

This isn’t just speculation; it’s an analysis based on economic mechanisms and the critical role of trust in driving currency valuation.

Venezuela’s economy has been ravaged by years of hyperinflation, sanctions, and political paralysis. Yet, Sandy Ingram argues that this exact environment—extreme devaluation coupled with massive underlying assets—is what creates the most asymmetric financial opportunity.

In 1989, following the U.S. arrest of Panamanian leader Manuel Noriega, the country experienced a profound regime change. This political shift had an immediate and immense financial consequence: trust was restored.

Prior to the arrest, citizens and investors had withdrawn significant funds due to instability. Once the political climate stabilized, confidence surged. Sandy Ingram highlights that Panamanians instantly began depositing billions of U.S. dollars back into the country’s banks.

This sudden influx of capital was transformative. It empowered Panama’s central bank, stabilized the financial system, and ignited a rapid economic revival. Crucially, those who had held faith in the nation’s currency during the depths of the crisis were the primary beneficiaries of the subsequent rebound.

Sandy Ingram contrasts this Panamanian success story with the challenges faced by nations like Iraq. While Iraq has experienced periods of stabilization, widespread distrust in its banking system and government has prevented similar massive capital inflows, thus hindering quick, sustained currency stabilization.

Like Panama prior to 1989, Venezuela is currently suffering from a deep crisis of confidence. But the moment a definitive shift in governance or stabilization occurs, the mechanism is expected to mirror the Panamanian experience. Citizens and international investors holding U.S. dollars would likely repatriate capital into the country, depositing funds into the now-trusted banking system.

This sudden, massive capital—measured in billions—would give the central bank the necessary leverage to stabilize the local currency and rapidly spur economic activity.

The foundation of any successful long-term currency rebound is underlying national wealth. In this regard, Venezuela stands apart. Sandy Ingram points out that Venezuela possesses enormous proven oil reserves—reported to be even larger than those in Iraq.

This vast resource base acts as a powerful financial ballast. While political turmoil can suppress the value of the currency, these assets remain fundamental to the country’s long-term viability. As soon as the investment climate improves, these reserves will attract significant foreign direct investment, fueling the currency’s rise.

The Edu Matrix video emphasizes that for investors interested in exotic currencies, the time to conduct research is now, while the Venezuelan currency remains severely undervalued and the economic situation appears darkest.

The investment thesis is clear: Positioning now means buying the currency when the risk is known and priced in, anticipating the potential for a massive, asymmetric payoff once political and banking trust is restored.

This is not a prediction of when a regime shift or stabilization will occur, but an analysis of what will happen financially once it does. If Venezuela follows the Panama blueprint—restored trust leading to massive capital inflow—its currently struggling currency could be one of the most promising exotic currency opportunities available today.

Coffee with MarkZ, joined by Bob Lock. 10/01/2025

Coffee with MarkZ, joined by Bob Lock. 10/01/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning all. Welcome to October….Is this our big month?

Member: And welcome to the 4th quarter of 2025.

Member: Red October... here we come??!!

Coffee with MarkZ, joined by Bob Lock. 10/01/2025

Some highlights by PDK-Not verbatim

MarkZ Disclaimer: Please consider everything on this call as my opinion. People who take notes do not catch everything and its best to watch the video so that you get everything in context. Be sure to consult a professional for any financial decisions

Member: Good Morning all. Welcome to October….Is this our big month?

Member: And welcome to the 4th quarter of 2025.

Member: Red October... here we come??!!

Member: Please tell us some positive news regarding the RV Mark?

Member: Mark – did the bond guy who was told he would be paid in September- get paid?

MZ: No- they didn’t get paid and they have a meeting tomorrow when they expect to be paid. Stay calm until we have somebody freely and openly spending dollars.

Member: I’d be well off if I had a dollar every time you’ve told us to stay calm. LOL I can’t wait for the day I really need to be told that.

Member: The Shanghai Gold Exchange being closed the next 8 days

Member: Mnt Goat (Dinar Guru) As investors in the Iraqi dinar, we just experienced a breakthrough we all have been waiting for, yes waiting for a decade. Most totally overlook what just happened. We read multiple articles since March on the disputes between Baghdad and Kurdistan and SOMO and other oil companies. According to Iraq these disputes are all now solved and the “tripartite” agreement cemented.

Mnt Goat Many ask me how can Iraq afford to pay out billions and billions of US dollar in order to exchange all these dinar investors? If Iraq is selling oil for petro-dollars than why is it so hard to see that our dinar exchanges will be backed by oil. Yes, oil will pay for it. ...So, the U.S. is investing in Iraqi oil. What the US Treasury is going to is loan out the money for our exchanges knowing that later it has guarantees to broker the oil and buy from Iraq at lower than market prices...the U.S. treasury is going to mark up the oil and to bring it to market at market level prices thus resell it to the thirsty world and make a tidy profit. The U.S. will make billions maybe even trillions. This is why they are “fronting” the money for our exchanges.

MZ: That checks out- the “Oil for Dinar” program

MZ: And Banking reforms are being implemented in a big way.

MZ: “ US dollar exchange rate continues to fall in Iraq” this means the dinar is getting stronger and more stable.

Member: Iraq’s stock market rose 46% in one day….IMO- someone over there got new money!!

Member: The meeting will discuss the new financial situation of the Kurdistan Region and expenditures after the IMPLEMENTATION of the tripartite agreement to export oil, (sounds like it done)

MZ: “20 billion barrels of Kirkuk oil fill reserves “ BP (British Petroleum) is talking about how excited they are. They are letting the world know how wealthy Iraq is. It makes sense if you are going to change the value ….you need to Let people know they can support it with commodities and natural resources .

Member: Let’s all put “October is our month” out in the universe!!

Member: With Iraqi elections coming up shortly…..October should be our month if Sudani wants re-elected?

Member: Maybe when Sudani is elected out for not making and keeping his promise… the new Prime Minister will finish the deal. Not sure if that’s what it’s gonna take.

MZ: I think he will finish the RV before he is gone.

Member: If Sudani is making this happen during his term he needs to get it in gear. Early voting starts pretty soon.

Member: I believe Iraqi elections are Nov. 11.

Member: Iraq Independence day is Oct. 3rd.

Member: The RV is taking longer than a snail on a sponsored crawl around the world

Member: Many of us have RV anticipation fatigue…..They need to just “do it”

Member: Still hoping for our “suddenly” to happen.

MZ: I think this will be our month….I am feeling quite excited.

Bob Lock joins the stream today. Please listen to the replay for his opinions and information.

THE CONTENT IN THIS PODCAST IS FOR GENERAL & EDUCATIONAL PURPOSES ONLY&NOT INTENDED TO PROVIDE ANY PROFESSIONAL, FINANCIAL OR LEGAL ADVICE. PLEASE CONSIDER EVERYTHING DISCUSSED IN MARKZ’S OPINION ONLY

FOLLOW MARKZ : TWITTER . https://twitter.com/originalmarkz?s=21. TRUTH SOCIAL . https://truthsocial.com/@theoriginalm...

Mod: MarkZ "Back To Basics" Pre-Recorded Call" for Newbies 10-19-2022 ) https://www.youtube.com/watch?v=37oILmAlptM

MARKZ DAILY LINKS: https://theoriginalmarkz.com/home/

Note from PDK: Please listen to the replay for all the details and entire stream….I do not transcribe political opinions, medical opinions or many guests on this stream……just RV/currency related topics.

ZESTER'S LINK TREE: https://linktr.ee/CrazyCryptonaut

THANKS FOR JOINING. HAVE A BLESSED DAY! SEE YOU ALL TUESDAY THROUGH THURSDAY EVENINGS FOR NEWS @ 7:00 PM EST ~ UNLESS BREAKING NEWS HAPPENS! FROM NOW ON NO MORE NIGHTLY PODCASTS ON MONDAYS AND FRIDAYS

News, Rumors and Opinions Wednesday 10-1-2025

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV excerpts from the Restored Republic via a GCR: Update as of Wed. 1 Oct. 2025

Compiled Wed. 1 Oct. 2025 12:01 am EST by Judy Byington

Summary:

If the latest updates hold true, today is not just the start of a new fiscal quarter—it is the heralded beginning of “Red October,” a month set to redefine global governance, finance, and personal sovereignty.

Note: All intel should be considered as "Rumors" until we receive official announcements ...and “Rates and Dates” could change anytime until we get to the banks/redemption centers.

RV excerpts from the Restored Republic via a GCR: Update as of Wed. 1 Oct. 2025

Compiled Wed. 1 Oct. 2025 12:01 am EST by Judy Byington

Summary:

If the latest updates hold true, today is not just the start of a new fiscal quarter—it is the heralded beginning of “Red October,” a month set to redefine global governance, finance, and personal sovereignty.

As compiled by Judy Byington and supported by numerous independent sources, this Wednesday signals the implementation of massive structural changes that have long been anticipated under the banner of the Restored Republic and Global Currency Reset (GCR).

The long-awaited purge is officially underway.

Today, October 1st, marks a critical pivot point for the operational structure of the United States government. With Congress failing to fund the government, a shutdown is underway—but this is not a typical temporary closure.

Reports suggest this shutdown will be permanent for many offices, with the Office of Management and Budget having already provided agencies with “elimination lists.”

As President Trump reportedly stated, “Many Americans will be happy on Oct. 1, 2025.” This happiness is tied directly to the accompanying shift: the activation of the highly anticipated NESARA/GESARA protocols.

On this pivotal day, the NESARA/GESARA 30+1 Protocols are (allegedly) slated for release. This is not mere reform; it is a systemic purge designed to restore financial control to the people.

While the government shift begins today, the most dramatic financial changes are scheduled to peak later this month, ushering in the gold/asset-backed Quantum Financial System (QFS) and signaling the definitive end of the current fiat economy.

The transition is zero-sum: as the fiat system dies, the Cabal’s SWIFT Global Banking System will cease to function, paving the way for the Quantum technology.

Crucial activity is being reported on the financial infrastructure level, providing compelling evidence that the shift is already in motion.

Reports from late September indicate that SWIFT—the slow, legacy cross-border payment system—is undergoing a radical transformation rather than being eliminated outright.

Over 30 top global banks are (allegedly) uniting to rebuild this system on Blockchain technology.

Amid massive systemic collapse, the Global Currency Reset (GCR) is reportedly moving into its final stages, with active exchanges taking place.

Updates suggest that banks (including Wells Fargo, Chase, HSBC, City Bank, and the Bank of England) have begun paying currency holders in cash, not SKRs.

Sources like TNT Tony indicate agencies are celebrating because “100% of everything has been completed.”

For those holding foreign currency and bonds (Dinar, Dong, Zim), the highest rates are expected via appointments at designated Redemption Centers.

Judy Byington notes her personal expectation that when the EBS goes off with the sound of the Seven Trumpets, cell phones will soon receive critical messages generated from the new Starlink Satellite System. One of these messages should contain information on how to gain a Redemption Center appointment.

The window is open. We await the final signal. Red October is here, bringing the promise of sovereign wealth, erased debt, and a globally restored republic powered by quantum technology.

~~~~~~~~~~~~

Wed. 1 Oct. 2025 President Trump stated, “Many Americans will be happy on Oct. 1 2025.” The day is the beginning of new fiscal year for the US Government, although Congress didn’t fund the government, so today signals a Government shutdown. The Wed. 1 Oct. 2025 government shutdown will be permanent for many offices. The Office of Management and Budget has been telling Agencies to prepare for elimination lists. https://x.com/swisher1776/status/1973093171841163575?t=AlCamMoi8uQZwDy12R_uFg&s=09

Read full post here: https://dinarchronicles.com/2025/10/01/restored-republic-via-a-gcr-update-as-of-october-1-2025/

************

Courtesy of Dinar Guru: https://www.dinarguru.com/

Mnt Goat As investors in the Iraqi dinar, we just experienced a breakthrough we all have been waiting for, yes waiting for a decade. Most totally overlook what just happened. We read multiple articles since March on the disputes between Baghdad and Kurdistan and SOMO and other oil companies. According to Iraq these disputes are all now solved and the “tripartite” agreement cemented. So let me explain further the impact of what just happened... [Post 1 of 2....stay tuned]

Mnt Goat Many ask me how can Iraq afford to pay out billions and billions of US dollar in order to exchange all these dinar investors? If Iraq is selling oil for petro-dollars than why is it so hard to see that our dinar exchanges will be backed by oil. Yes, oil will pay for it. ...So, the U.S. is investing in Iraqi oil. What the US Treasury is going to is loan out the money for our exchanges knowing that later it has guarantees to broker the oil and buy from Iraq at lower than market prices...the U.S. treasury is going to mark up the oil and to bring it to market at market level prices thus resell it to the thirsty world and make a tidy profit. The U.S. will make billions maybe even trillions. This is why they are “fronting” the money for our exchanges. [Post 2 of 2]

************

"If There's A Failure To Deliver Silver - Next Morning the Price Will Be Above $100" - Mike Maloney

9-30-2025

In this urgent silver market update, Mike Maloney dives deep into the potential for a 'failure to deliver' that could catapult silver prices to $80-100 or beyond.

Drawing on historical data from the 1980s hyperbubble and the 2011 peaks, Mike explains why the current bull run—already sustaining above $40 for a record 20+ days—is unlike anything we've seen before.

Key insights include:

How silver's massive cup-and-handle pattern signals explosive momentum.

The impact of global liquidity: Up to $3.5 trillion could chase precious metals, overwhelming supply at current levels.

Why technical indicators like overbought conditions may become irrelevant in a currency or market crisis.

Real risks of overnight price gaps if delivery failures occur, leaving no time to buy in between.

With October's history of market crashes looming, Mike warns we're teetering on a knife's edge.

Whether silver pauses at $50 or surges relentlessly, this analysis equips investors with the fundamentals to navigate what's ahead.

Seeds of Wisdom RV and Economics Updates Wednesday Morning 10-1-25

Good Morning Dinar Recaps,

Day One of a U.S. Government Shutdown — What It Signals for Global Power and Finance

As federal operations grind to a halt, the shockwaves go beyond Washington — this moment may accelerate how capitals, markets, and alliances recalibrate.

Good Morning Dinar Recaps,

Day One of a U.S. Government Shutdown — What It Signals for Global Power and Finance

As federal operations grind to a halt, the shockwaves go beyond Washington — this moment may accelerate how capitals, markets, and alliances recalibrate.

What We Know: Shutdown Begins Amid Deep Political Divide

On October 1, 2025, the U.S. government entered a shutdown after Republicans and Democrats failed to reach agreement on a $1.7 trillion funding package, with healthcare subsidies among the core conflicts.

The shutdown is the 15th since 1981, but this one carries added weight: President Trump is pushing aggressive restructuring of the federal workforce and government programs.

Immediate effects include:

▪️ Federal employees furloughed without pay, while some on administrative leave had already been paid through the end of September.

▪️ Military personnel, research programs, air travel, and social services disrupted or delayed.

▪️ Analysts estimate a $400 million per day cost, spotlighting the economic stakes.

Political Context & Risks

The impasse reflects intense polarization: Republicans frame the shutdown as leverage to force concessions, especially over government size; Democrats call the tactic reckless.

Public opinion is fractured — the political gamble is that no one wants to “lose” by appearing weak.

Longer shutdowns risk eroding confidence: businesses, foreign governments, and markets may begin to question U.S. reliability as a stable economic anchor.

How This Connects to Global Restructuring

🔹 Institutional Fragility & Credibility

When the U.S.—long seen as a bastion of institutional continuity—allows a shutdown to paralyze parts of government, it weakens perceptions of its capacity to govern. That perception shift can shift financial flows, risk assessments, and alliances.

🔹 Capital Flight & Market Volatility

Uncertainty spurs capital movements. Investors may retreat from U.S. treasuries or dollar exposures, pushing them toward alternative safe havens, gold, or non-dollar debt instruments.

🔹 Power Vacuums & Alternative Financial Systems

A distracted U.S. may signal opportunity to China, BRICS, and others to deepen parallel institutions, trade blocs, and currency alternatives while U.S. domestic focus is on internal strife.

🔹 Debt & Fiscal Stress Amplified

Already burdened by a $37.5 trillion national debt, a shutdown reduces revenue, increases borrowing costs, and tightens the margin for maneuver. Other nations watching may accelerate their own strategic alternatives.

Key Takeaway

Day one of the U.S. shutdown is more than a domestic political crisis — it’s a structural stress test of America’s global role. As institutions slow, markets tremble, and credibility cracks, the architecture of global finance and power tilts ever more toward a multipolar future.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Modern Diplomacy – U.S. Government Shutdown Begins Amid Deep Political Divide Modern Diplomacy

(Contextual references from institutional debt trends, global risk assessment, and comparative reaction patterns)

Russia’s Nuclear Technology Playbook for the Global South

By providing reactors, training, and financing, Russia is positioning itself as an energy patron — a role with geopolitical weight and financial leverage in the multipolar era.

Russia’s Strategy in the Global South

Russia is promoting its nuclear technology as a tool for long-term development and energy security, presented as low-carbon, stable power for growing economies.

At the Global Atomic Forum (part of World Atomic Week), President Putin emphasized shifting public attitudes toward nuclear energy and the expanding view of nuclear power as a developmental necessity rather than a niche or controversial option.

Russia’s pitch is holistic: not just building reactors, but offering complete packages—fuel supply, waste management, staff training, financing, and local industry development.

Russia recently formalized a planning agreement with Ethiopia to build a nuclear plant, including roadmap development and technical capacity building.

Challenges and Resistance

🔹 Technical, safety & regulatory hurdles

New nuclear projects require rigorous oversight, often needing alignment with the International Atomic Energy Agency (IAEA) standards. Some partner countries lack regulatory infrastructure.

Public skepticism and concerns about cost overruns, radioactive waste, and nuclear accidents remain major political obstacles.

🔹 Competition & donor dependence

Several global and regional actors—China, France, the U.S.—compete for influence through conventional energy projects (renewables, gas), which may appear safer or more politically acceptable.

Countries relying on Russian nuclear assistance may become dependent on Russian supply chains, maintenance, and economic terms, giving Moscow leverage in diplomacy, trade, or sanctions evasion.

Restructuring Implications & Strategic Alignments

🔹 New Patronage Network

Russia is re-weaving relationships in the Global South by positioning itself as a strategic energy backer. These infrastructure ties often translate into political loyalty and alignment in voting blocs, trade agreements, and financial pacts.

🔹 Financing & Currency Anchors

Nuclear projects cost tens of billions. The financing machinery—loans, guarantees, supply chains—can be aligned with non-USD systems or tied to regional banking structures (e.g. BRICS or state development banks). This shifts capital flows and undermines dollar dominance.

🔹 Legitimacy Through Development

Russia frames its approach as cooperation, not domination. By helping energy-poor states industrialize, it gains moral and diplomatic soft power, contrasting its Western adversaries’ “conditional aid” narratives.

🔹 Energy Security & Geopolitical Leverage

States with shaky grid systems see nuclear power as strategic infrastructure. Russia supplying that infrastructure gives it leverage over energy dependency, supply interruptions, and bilateral influence in conflicts.

🔹 Multipolar Energy Order

As more nations look beyond Western energy firms for support and finance, the architecture of global energy and its financial backbone becomes more plural. Russia’s nuclear push is one axis of this shift.

Why This Matters

Russia’s nuclear diplomacy isn’t just technical or energy policy — it’s part of a reconfiguration of global power and finance. By embedding itself into the energy systems of developing states, Russia secures influence, builds financial dependencies outside Western structures, and accelerates the move toward a more pluralistic global order.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Modern Diplomacy – Russia’s Nuclear Technology Playbook for the Global South Modern Diplomacy

OrePulse – Russia’s Nuclear Energy Advocacy & Partnerships Ore Pulse

Reuters – Russia, Ethiopia sign document calling for construction of nuclear plant Reuters

Chatham House – Russia using Soviet playbook to de-Westernize global order Chatham House

Forbes – Rosatom’s nuclear deals as geopolitical advantage Forbes

CSIS – Reactions in Global South to Russian nuclear threats CSIS

Financial Times – Russia ambitions to lead global nuclear projects Financial Times

Stablecoins Under Fire: U.S. Tokenization Push vs. EU Multi-Issuance Ban Threat

The tug of war over stablecoins in the U.S. and Europe reflects how the next chapter of money is being written — and who will control the rails, rules, and power behind it.

U.S. Moves: Tokenization & Regulatory Softening

The SEC is exploring allowing blockchain-based versions of stocks (tokenized equities) to trade on crypto exchanges, signaling more openness to merging traditional finance with digital finance.

Nasdaq has formally asked the SEC for a rule change to permit regulated exchanges to trade tokenized stocks under equivalent execution and documentation rules.

Separately, SEC staff signaled they will not recommend enforcement action for advisers using state trust companies to custody crypto when certain safeguards are met.

These developments suggest the U.S. is actively pushing the boundary on tokenization and asset digitization — potentially positioning itself as the regulatory anchor for future digital-asset finance.

Europe’s Pushback: Ban on Multi-Issuance Stablecoins

The European Systemic Risk Board (ESRB) recommended a ban on “multi-issuance” stablecoins (i.e. stablecoins issued jointly across borders or jurisdictions) to prevent financial stability risks.

The ESRB flagged concerns about liquidity mismatches: in a stress event, investors may all redeem stablecoins in jurisdictions with stronger protections, straining those reserves.

The European Central Bank (ECB) and other bodies are pushing for strong equivalence regimes so foreign stablecoin issuers must meet EU regulatory standards — particularly around reserve backing, redemption rights, and cross-border operations.

This is part of a broader concern: the EU wants to guard its financial space from unregulated dollar-pegged tokens like USDC or USDT, whose issuers lie mostly beyond EU control.

How These Developments Fit Into Global Restructuring

🔹 Competing Visions for Money & Authority

The U.S. approach leans toward innovation + regulatory clarity, enabling tokenization of assets and digital finance expansion. Europe's approach leans toward caution + containment, particularly for cross-border or non-EU issuance. These contrasting strategies show a struggle over who defines the rules of digital money.

🔹 De-Dollarization & Currency Alternatives

If Europe restricts dollar-pegged stablecoins, it may accelerate adoption of euro-backed digital currencies or stablecoins issued under EU rules — thereby weakening the dominance of dollar-based tokens in European markets.

🔹 Rail Control & Financial Infrastructure

Stablecoin issuance models define who controls the rails: who mints, redeems, oversees reserves, settles cross-border flows. As the U.S. advances tokenization and Europe clamps down on cross-jurisdiction issuance, the contest is over which financial infrastructures will prevail in the new era.

🔹 Sovereignty, Compliance & Risk

Countries will favor stablecoin networks they can regulate, supervise, and audit. Issuers with multi-jurisdiction models may lose access or be forced to fragment operations. This pressures stablecoin companies to localize — reinforcing multipolar financial architectures.

Key Takeaway

The stablecoin battleground isn’t just technical — it’s a frontline in redefining money, power, and financial sovereignty. U.S. regulatory openings and EU tightening are not just policy moves — they are structural shifts that determine who controls the next generation of money systems.

This is not just politics — global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Cointelegraph – SEC weighs plan to allow blockchain-based stock trading Cointelegraph

Cointelegraph – EU watchdog pushes stablecoin ban: Report Cointelegraph

Reuters / news – European banks form company to launch euro stablecoin Reuters

PYMNTS – ECB Seeks Ban on Multi-Issuance Stablecoins PYMNTS.com

FinanceFeeds – EU Regulator Weighs Ban on Circle, Paxos Stablecoins FinanceFeeds

Other references: Nasdaq’s rule change request Cointelegraph; SEC custody openness Cointelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps

What Happens When The Government Shuts Down?

What Happens When The Government Shuts Down?

Raquel Coronell Uribe Tue, September 30, 2025 NBC News

The federal government shut down Wednesday after lawmakers left the Capitol without passing a funding bill. Agencies and departments have issued guidance in recent days on what to expect when the money runs out.

Here’s what will happen during the shutdown.

What Happens When The Government Shuts Down?

Raquel Coronell Uribe Tue, September 30, 2025 NBC News

The federal government shut down Wednesday after lawmakers left the Capitol without passing a funding bill. Agencies and departments have issued guidance in recent days on what to expect when the money runs out.

Here’s what will happen during the shutdown.

How does a shutdown affect the military?

The majority of veteran benefits and military operations will continue to be funded regardless of a shutdown. However, pay for military and civilian workers will be delayed until a funding deal is reached, forcing them to continue their duties without pay.

Military personnel on active duty, including active guard reserves, will continue their duty. However, no new orders may be issued except for extenuating circumstances — such as disaster response or national security. Some National Guard members serving through federal funding could have their orders terminated unless performing an essential duty.

The Department of Veterans Affairs said it expects 97% of its employees to work, though regional offices will be closed. Some death benefits, such as the placement of permanent headstones at VA cemeteries, and ground maintenance, will cease. Also affected will be communication lines, including hotlines, emails, social media and responses to press inquiries.

How is air travel affected?

Air traffic control services will continue, allowing for 13,227 air traffic controllers to work through a shutdown — but without pay until the government is funded again. Other essential activities, such as the certification and oversight of commercial airplanes and engines will continue, as will limited air traffic safety oversight.

However, the Department of Transportation will stop air traffic controller hiring, field training of air traffic controllers, facility security inspections and law enforcement assistance support.

In a letter Monday, a coalition of aviation groups urged Congress to avoid a shutdown, saying funding lapses will hurt the Federal Aviation Administration. The letter cited the furloughing of many FAA employees, and said the ceasing of funding could create backlogs that will create delays in critical FAA services “long after funding resumes.”

“While air traffic controllers, technicians and other excepted aviation safety professionals will continue to work without pay, many of the employees who support them are furloughed, and the programs that the FAA uses to review and address safety events are suspended. To remain the world leader in aviation, we must continue to strive to improve efficiency and further mitigate risk,” the aviation groups wrote.

Will Social Security checks still go out?

Social Security benefits, considered mandatory under law, will continue regardless of a shutdown, so recipients can expect to continue receiving their payments. However, the Social Security Administration could face a furloughed workforce. Fewer workers could mean that processing new Social Security applications could be delayed.

How does the shutdown affect the Department of Health and Human Services?

TO READ MORE: LINK

A Government Shutdown Begins After Talks Break Down

A Government Shutdown Begins After Talks Break Down

Ben Werschkul · Washington Correspondent Updated Wed, October 1, 2025

The first federal government shutdown in years began early Wednesday morning after lawmakers and President Trump stopped negotiations and spent the final hours before the stoppage largely focused on trying to set up the other side to take the political blame.

The victory of gridlock was sealed Tuesday evening when twin Senate votes failed to advance either a Republican bill (even as three members of the Democratic caucus crossed party lines to vote yes) or a Democratic plan. No compromise plan was offered, ensuring the funding lapse.

A Government Shutdown Begins After Talks Break Down

Ben Werschkul · Washington Correspondent Updated Wed, October 1, 2025

The first federal government shutdown in years began early Wednesday morning after lawmakers and President Trump stopped negotiations and spent the final hours before the stoppage largely focused on trying to set up the other side to take the political blame.

The victory of gridlock was sealed Tuesday evening when twin Senate votes failed to advance either a Republican bill (even as three members of the Democratic caucus crossed party lines to vote yes) or a Democratic plan. No compromise plan was offered, ensuring the funding lapse.

The duration of the shutdown has come increasingly into focus as "the question of the hour," as Veda Partners co-founder Henrietta Treyz noted Tuesday. Another round of votes in the Senate were quickly scheduled for Wednesday.

Senate Majority Whip John Barrasso also told reporters that votes could be scheduled throughout the weekend.

The shutdown — the first since a seven-week stoppage during Trump's first term — began at 12:01 a.m. ET as the new fiscal year began. That last shutdown took place in 2018-19 and broke the record for the longest in American history.

Federal agencies will now implement their contingency plans and send hundreds of thousands of government workers home to wait out a stalemate.

Economic effects might be noticeable quickly as government spending largely ceases and economic data gets delayed, starting this Friday with what was scheduled to be a jobs report from the Bureau of Labor Statistics. These impacts could be mitigated if the stoppage ends promptly.

Trump on Tuesday also promised to heighten the potential effects of a shutdown — in part to pressure Democrats — saying "we can do things during the shutdown that are irreversible."

He added later in the day "a lot of good can come down from shutdowns. We can get rid of a lot of things that we didn't want."

The shutdown is also not the only Washington policy focus for investors Wednesday. Markets will also be digesting new tariffs, as promised duties of 100% on a slice of pharmaceutical products and 25% duties on heavy-duty trucks are scheduled to go into effect.

This week also marked the last formal day on the job for government employees who accepted a Department of Government Efficiency program earlier this year called "fork in the road" that induced tens of thousands to leave government service.

Investors trying to make sense of these varied crosscurrents coming from Washington will likely be most attuned to how long this shutdown lasts and whether policymakers can find any off-ramps to end the gridlock.

What a government shutdown is likely to look like

The stalemate could produce unpredictable economic impacts, some of which could be felt quickly and others that could grow with each passing day.

Much of the immediate market focus is on the government's economic data.

The Bureau of Labor Statistics (BLS) is one of the government's main collectors of data and will "completely cease operations," according to its contingency plan, and temporarily go from a workforce of 2,055 to just a single full-time employee.

The agency's fulsome calendar of economic releases will grind to a stop — starting with Friday’s report on employment known within the financial world as the monthly jobs report.

The plan is similar at other sources of government economic data as the Commerce Department is set to cease operations at both the U.S. Census Bureau and Bureau of Economic Analysis.

One new feature around this shutdown that could add more economic uncertainty is a White House promise to consider mass firings if there is no deal.

TO READ MORE: LINK

“Tidbits From TNT” Wednesday Morning 10-1-2025

TNT:

Tishwash: The Pentagon is continuing to reduce its mission in Iraq.

The Pentagon renewed its commitment to reducing its military mission in Iraq, as agreed upon last year, stating that the transition of US-led coalition operations was a result of its success in combating ISIS.

"The US government will continue to coordinate closely with the Iraqi government and coalition members to ensure a credible transition," the Pentagon said in a statement. link

TNT:

Tishwash: The Pentagon is continuing to reduce its mission in Iraq.

The Pentagon renewed its commitment to reducing its military mission in Iraq, as agreed upon last year, stating that the transition of US-led coalition operations was a result of its success in combating ISIS.

"The US government will continue to coordinate closely with the Iraqi government and coalition members to ensure a credible transition," the Pentagon said in a statement. link

************

Tishwash: Rafidain Bank: 81 branches adopt the comprehensive banking system.

Rafidain Bank announced on Tuesday that 81 branches have joined the comprehensive banking system. The bank stated in a statement that "81 branches have joined the comprehensive banking system, following the entry of the Hudhayfah bin Al-Yaman branch and the General Secretariat of the Council of Ministers branch into the integrated electronic service."

He added, "The implementation of a comprehensive banking system is a critical strategic step, as it enables the transition from traditional paper transactions to modern electronic operations, which contributes to increasing operational efficiency, accelerating transaction completion, and enhancing transparency and accuracy in service delivery."

The bank also stated that "the adoption of this system is in line with the latest global banking practices, constitutes a fundamental pillar for improving the quality of services provided to customers, and paves the way for the development of innovative financial products that reflect the digital transformation in the Iraqi banking sector."

The statement also noted that "the integration of branches into the comprehensive banking system will have a direct impact on customers by reducing transaction processing time, reducing error rates, and providing more secure and flexible digital channels, providing customers with an advanced banking experience that meets their daily needs." link

************

Tishwash: Trade: Conferences with Gulf countries to activate the private sector

In line with government plans and programs designed to stimulate the private sector and enhance its role in the country's development plans, the Ministry of Commerce announced its intention to hold conferences with a number of Gulf countries with the aim of developing partnerships with the private sector and maximizing the country's financial resources.

The ministry's official spokesperson, Mohammed Hanoun, told Al-Sabah that the ministry has included in its plans and policies the activation of international economic and trade relations, in addition to launching new memoranda of understanding with a number of countries, particularly the Kingdom of Saudi Arabia, the States of Kuwait and the United Arab Emirates, to enhance cooperation and support the international private sector. He added that the next phase will witness the organization of joint conferences and seminars with these countries, which have expressed their willingness to cooperate with Iraq in this field.

He indicated that these activities will establish clear foundations for formulating policies related to international relations related to the private sector and investments, which will contribute to maximizing the country's resources without placing an additional burden on government budgets.

Hanoun explained that Iraq's recent accession to the World Trade Organization will contribute to the implementation of decisions and laws related to the economy, food security, and support for local products, in line with local market requirements. This is in line with the government's approach to prioritizing the private sector and activating it to work alongside the public sector. He confirmed that his ministry has submitted new draft laws to the House of Representatives that will strengthen international economic and trade relations.

He pointed out that the Ministry has succeeded in automating all its procedures and transitioning to digital work in various fields, particularly those related to the private sector. It has created a new electronic platform called "Al-Tajer" to facilitate the process of registering merchants and obtaining their licenses.

In the same context, the Ministry of Commerce spokesperson revealed that many Gulf investors and businessmen, most notably Kuwait, Saudi Arabia, and the UAE, have expressed their willingness to enter into investment partnerships with Iraq. He explained that digital transformation will be an attractive factor for them, as it will facilitate the formulation of plans and policies, free from complex administrative routine.

He emphasized the importance of electronic platforms, as they will enable transactions to be completed and approvals obtained within record timeframes, enhancing the investment climate while simultaneously providing international companies and investors with a more flexible operating environment. link

****************

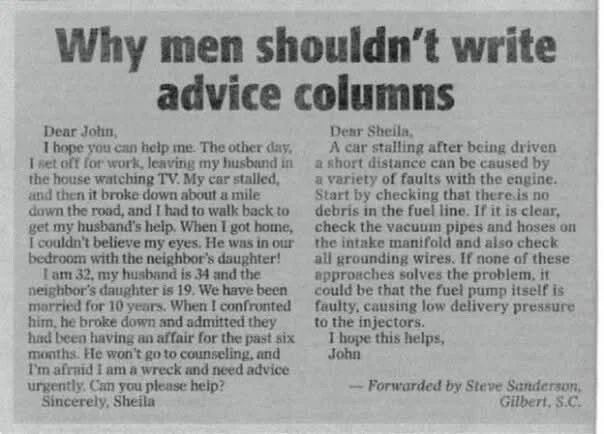

Mot: .. sooooo -- Thats How They Did it!!!!

Mot: They Say - MEN SHOULDN'T WRITE ADVICE COLUMNS!!

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

9-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

MilitiaMan and Crew: IQD News Update--Reassurances - Global Financial Integration

9-30-2025

The Crew: Samson, PompeyPeter, Petra, Daytrader, Sunkissed, GIGI and Militia Man

Follow MM on X == https://x.com/Slashn

Be sure to listen to full video for all the news……..

Seeds of Wisdom RV and Economics Updates Tuesday Evening 9-30-25

Good Evening Dinar Recaps,

Could BRICS Build a Rival to the IMF and World Bank?

As BRICS nations press for financial autonomy, their ambitions to supplant Western institutions may signal a shifting architecture of global finance and power.

Good Evening Dinar Recaps,

Could BRICS Build a Rival to the IMF and World Bank?

As BRICS nations press for financial autonomy, their ambitions to supplant Western institutions may signal a shifting architecture of global finance and power.

Why BRICS Seeks Alternatives to Bretton Woods Institutions

BRICS critics say the IMF and World Bank are Western-dominated, with voting structures, loan conditions, and policy preferences favoring U.S. and European interests.

Loans from those institutions often come with policy strings, governance conditions, structural adjustments, which developing states see as infringing on sovereignty.

In response, BRICS has already built the New Development Bank (NDB) and Contingent Reserve Arrangement (CRA), as alternative financial mechanisms.

What BRICS Face in Building a Rival

🔹 Scale & Capital Constraints

The IMF has resources exceeding $1 trillion, while NDB’s approved loan book is far smaller (circa $30 billion).

Member states compete to have their national currencies used in lending, creating friction in unified currency strategy.

🔹 Institutional Credibility & Network Effects

IMF and World Bank have decades of institutional trust, deep data infrastructure, large global talent pools, and legal frameworks that new institutions must build from scratch.

BRICS success hinges on whether they can offer assistance without harsh conditionality, attracting countries disillusioned with Western institutions.

Recent Signals: Reform and Pushback

In July 2025, BRICS finance ministers made a unified proposal to reform the IMF: reallocating voting quotas to better reflect emerging economies, and challenging European dominance over leadership roles.

Earlier, Russia had urged BRICS to establish its own IMF-style institution as a counter to Western influence.

The CRA (Contingent Reserve Arrangement) is a preexisting framework among BRICS to provide liquidity support, viewed already as a partial competitor to IMF.

How This Could Reshape Global Alignments

🔹 Redistribution of Financial Power

If BRICS can scale its banks and mechanisms, capitals and credit decisions may shift away from Washington, London, and Brussels toward emerging centers in Asia, Africa, and Latin America.

🔹 Alternative Conditions & Sovereignty

Loans without strict Western policy prescriptions would be more attractive to borrowers seeking autonomy. That would shift the bargaining power in global finance toward borrower states and away from donor nations.

🔹 Multipolar Financial Order

A working BRICS rival would encourage blocs like Africa, Latin America, ASEAN, and Middle Eastern states to link with multiple financial systems rather than depending on a single “Western” architecture.

🔹 Accelerated De-Dollarization

As BRICS institutions lend in local currencies and support non-USD denominated systems, reliance on the U.S. dollar for reserves, loans, and trade settlement could weaken in some corridors.

🔹 Network & Legal Ecosystems

For a truly effective rival, BRICS must build legal, data, risk, auditing, regulatory, and governance frameworks — essentially a parallel financial infrastructure.

Why This Matters

The idea of BRICS creating a real rival to IMF/World Bank is more than academic — it is about who controls global credit, who sets financial norms, and where capital flows. As more countries experience the burden of Western conditionality, BRICS’ alternatives grow more attractive. The outcome could be a world where multiple financial centers coexist, each with its own rails, influence, and currencies.

This potential shift underscores a deeper transformation: the restructuring of the global financial world order before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru – Could BRICS Create a Rival to the IMF and World Bank? Watcher Guru

Wikipedia – BRICS Contingent Reserve Arrangement (CRA) Wikipedia

Wikipedia – New Development Bank (NDB) Wikipedia

Reuters – BRICS finance ministers unify on IMF reforms Reuters

Reuters – Russia calls for alternative to IMF Reuters

~~~~~~~~~

Top BRICS Countries With the Highest Gold Reserves in 2025

Gold reserve accumulation by BRICS is more than a financial strategy — it’s a signaling move in the remaking of global monetary influence.

BRICS’ Gold Holdings: Who Leads & Why It Matters

As of 2025, BRICS nations collectively hold over 6,000 metric tons of gold, amounting to roughly 20–21% of global central bank gold reserves.

Russia leads with 2,335.85 tons; China follows closely with 2,298.53 tons.

India ranks third within BRICS at 879.98 tons. Brazil and South Africa hold more modest reserves: 129.65 and 125.47 tons respectively.

Russia and China together control about 74% of BRICS’ gold reserves, giving them disproportionate leverage within the bloc.

Why Gold Is Central to the BRICS Strategy

🔹 Hedge against currency volatility

Gold provides a tangible store of value that is not tied to any one fiat currency. In times of sanctions or dollar weakness, these reserves serve as a stabilizer for national balance sheets.

🔹 Backing for emerging financial vehicles

If BRICS pushes forward on ideas like a common currency, or gold-linked settlement systems, these reserves are the credibility behind those proposals.

🔹 Sign of financial sovereignty

Aggressive accumulation—despite sanctions or geopolitical pressure—signals determination to reduce dependency on Western financial systems.

Broader Impacts & Alignments

🔹 Shifting reserve structure globally

While BRICS is solidifying its gold base, traditional reserve holders (U.S., Europe) still control large gold reserves. The U.S., for example, holds about 8,133.5 tons per World Gold Council/IMF gold data.

That gap remains large, but the rate of increase and redistribution is key: growth among emerging powers changes the marginal influence of gold in global finance.

🔹 Fueling de-dollarization and alternative monetary schemes

As BRICS holds more gold and strengthens alternative infrastructure (e.g. tokenization, blockchain payments, local currency trade), the rationale behind dependence on the U.S. dollar comes under increasing strain.

🔹 Power inside BRICS & candidate alignment

Countries with heavier gold reserves (Russia, China) will have more influence in shaping BRICS policy: who joins, what financial systems are built, how loans and investments flow. Nations seeing opportunities or exclusion may align based on where they see the most leverage.

🔹 Potential for a gold-anchored BRICS currency

There is speculation that BRICS may develop a new common currency, possibly backed by or linked to gold. Such a move would reposition gold from a reserve metal to basis for a functioning cross-border monetary instrument.

Why This Matters

Gold accumulation is not passive — it is a deliberate infrastructural investment in financial autonomy, currency power, and status in a multipolar world. BRICS countries are setting up a foundation for a system less beholden to Western-dominated institutions and the dollar.

This shift is part of a broader re-engineering of global finance: new blocs, new rails, new legitimacy.

This is not just politics — it’s global finance restructuring before our eyes.

@ Newshounds News™ Exclusive

Sources:

Watcher.Guru — Top BRICS Countries With the Highest Gold Reserves in 2025 Watcher Guru

FastBull — BRICS accelerates dedollarization with over 6,000 tons of gold FastBull

Nestmann — The BRICS De-Dollarization & What It Means for Gold The Nestmann Group

InternationalInvestment/Bullion Analytics — Top Gold Reserve Countries in 2025 International Investment

GoldHub / World Gold Council — Central bank gold reserves by country World Gold Council

Reuters — How much gold will China need to diversify reserves? Reuters

Financial Times survey — Central banks plan to boost gold reserves and trim dollar holdings ft.com

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound's News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website

Thank you Dinar Recaps